Attached files

| file | filename |

|---|---|

| 8-K - 8-K 9/8/16 INVESTOR PRESENTATION - APARTMENT INVESTMENT & MANAGEMENT CO | a9816investorpresentation8.htm |

1

INVESTOR PRESENTATION

SEPTEMBER 2016

Preserve at Marin, Corte Madera, CA

2

AIMCO VALUE CREATION

Economic income: year-over-year NAV growth plus annual

dividend

2015 Economic Income: $5.28 per share*

14% Return on Beginning-of-Year NAV

$3.10

Property Operations

Aimco's 2015 Same Store

NOI growth of 5.6%

created ~$3.00 of NAV per

share.

$0.50

Redevelopment

Annual investment

of $200 - $300M, at

value creation

averaging 25 - 35%

of investment.

Adds $0.50 to NAV

per share annually.

$0.50

Balance Sheet

Each year, Aimco

funds from retained

earnings ~$80M of

property debt

amortization,

adding $0.50 to

NAV per share.

$1.18

Annual Dividend

Cash dividends per

share up 13% to

$1.18.

* Represents the sum of a) the year-over-year change in consensus NAV as reported by KeyBanc Capital Markets and b) cash dividends per share paid by Aimco

during 2015.

3

STRATEGIC AREAS OF FOCUS

REDEVELOPMENT

• Redevelopment is a core business activity

• Robust pipeline of redevelopment opportunities within existing portfolio

• Occasional development when warranted by risk-adjusted returns

• Above-average property operating results over cycle

• Above-average resident retention

• Peer-leading expense control

PROPERTY

OPERATIONS

• Diversified across markets and price points to reduce volatility in revenue

• Disciplined capital recycling to upgrade portfolio

• Peer-leading growth in average revenue per apartment home

PORTFOLIO

MANAGEMENT

• Quantity of leverage in line with peers and declining

• Quality of leverage superior to peers

• $1.7 billion unencumbered asset pool provides financial flexibility

• Rated investment grade by S&P and by Fitch

BALANCE SHEET

• Focus on ownership and operation of apartment communities

• Add value through operational excellence and redevelopment

• Live our values, foster a culture of success and work collaboratively

every day to achieve our goals

BUSINESS

& CULTURE

4

PROPERTY OPERATIONS STRATEGY

STRATEGY PROVIDES FOR

• Greater NOI contribution: Renewal lease rate increases are generally

higher than new lease rate increases; renewals avoid costs associated

with turnover: higher vacancy, refurbishment, and marketing.

• More predictable operating results: Renewal lease rate increases

are less volatile; operating costs more predictable.

PRODUCE ABOVE-AVERAGE

OPERATING RESULTS

• Focus on customer satisfaction,

resident retention, and superior

cost control.

5

STRONG OPERATING PERFORMANCE

Revenue Growth Guidance: We remain on track to achieve our 2016 revenue growth guidance of 4.5% to 5.0%.

• With strong rent growth already embedded in our transacted leases, approximately 75% of the revenue growth

for the balance of the year is locked in based on August YTD revenue growth at 4.6%, an acceleration of 10

bps over June YTD at 4.5% and an acceleration of 20 bps over the August YTD revenue growth in the prior

year.

• For the remainder of 2016, we expect occupancy to increase by 30 to 60 bps based on a substantially lower

number of lease expirations, and we expect renewal lease rates of 4.0% to 5.0%. At the mid-points of these

two ranges, we achieve the low-end of our guidance range with new lease rates of (1.2%) and the high-end

with new lease rates of 4.75%.

(1) Aimco measures changes in Same Store rental rates by comparing, on a lease-by-lease basis, the rate on a newly executed lease to the rate on the expiring lease for

that same apartment. Newly executed leases are classified either as a new lease, where a vacant apartment is leased to a new customer, or as a renewal. Results are

for Aimco's 2Q 2016 Same Store portfolio.

6

(1) Peer group consists of AvalonBay, Camden, Equity Residential, Essex, MAA, Post Properties and UDR. Source for peer information: Bank of America Merrill Lynch.

(2) Source: SNL Financial. Peer group consists of AvalonBay, Camden, Equity Residential, Essex, MAA, Post Properties and UDR.

(3) Source: Company reports. Individual market peers vary based on geographic exposure.

• Focus on customer satisfaction and resident retention: From 2011 through 2015, Aimco turnover averaged 47%

compared to the peer average of 53%(1).

• Aimco receives ~90,000 customer surveys every year: Customer satisfaction has averaged more than 4.0 (on a 1

to 5 scale) for the past eleven quarters and was 4.20 during 2Q 2016.

• Solid NOI performance: From 2005 through 2015, the compound annual growth rate for Aimco’s Same Store

property NOI of 4.1% is consistent with the public apartment REIT average.

(2)

• At the market level, Aimco's Same Store operating results are above-average across price points and quality grades.

• Approximately 60% of Aimco's Q2 2016 Same Store NOI was earned in markets where Aimco competes with two or more other public

apartment REITs.

• Q2 YTD, Aimco was number one or two in Same Store Revenue growth in all but two of these eight common markets.

(3)

STRONG OPERATING PERFORMANCE (CONT.)

Q2 2016 Q2 YTD Q2 YTD

Aimco Asset

Quality

Same Store

Revenue

Same Store

Revenue

Same Store

NOI

Atlanta A 1 of 4 1 of 4 1 of 4

B y Area B 1 of 5 1 of 5 1 of 5

Bosto C+ 1 of 4 1 of 4 1 of 4

Greater DC C+ 1 of 6 2 of 6 4 of 6

Greater LA A 6 of 6 5 of 6 5 of 6

New York B 1 of 4 2 of 4 1 of 4

San Diego B 4 of 5 4 of 5 4 of 5

Seattle A 1 of 5 1 of 5 1 of 5

7

PEER-LEADING EXPENSE CONTROL

• Focus on efficient operations: Over the past three years, the compound annual growth rate

for Aimco's property operating expenses before taxes, insurance, and utilities ("COE") is 0.8%

and over the last nine years, the compound annual growth rate for Aimco's COE is negative

0.2%.

• Centralize: moving administrative tasks to the Shared Service Center reduces cost and

allows site teams to focus on sales and service.

• Standardize: reduce complexity, increase purchasing volume discounts.

• Invest: focus on total lifecycle costs and invest in more durable materials such as plank

flooring instead of carpet and granite countertops instead of laminate.

* Peer group consists of AvalonBay, Camden, Equity Residential, Essex, MAA, Post Properties and UDR. Peer 2016E is based on the most recent company guidance.

Data Sources: SNL Financial, company reports.

95

100

105

110

115

2012 2013 2014 2015 2016E

Same Store Expense Growth

2013 - 2016E

CAGR

3.2% Peer Avg*

2.3% Aimco

1.3% Aimco COE

8

• The 2016 and 2017 Aimco plan includes the lease-up of three newly-constructed

communities, which communities are projected to make a neutral contribution to NOI in

2016, and to contribute $0.12 per share to 2017 NOI.

• The lease-up at Vivo, located in Cambridge, MA, was completed in 2Q 2016, two months

ahead of schedule and at rates 2% above underwriting.

• Leasing at One Canal and Indigo is progressing in accordance with plan.

LEASE-UP COMMUNITIES

Schedule

Total Apt.

Homes

% Leased as

of 9/5/2016

Initial

Occupancy

Stabilized

Occupancy

Stabilized

NOI

Stabilized

Revenue per

Apt. Home

Commercial

Revenue

ONE CANAL,

BOSTON

310 59% 2Q 2016 3Q 2017 4Q 2018 $ 3,865 $1.1M

INDIGO,

BAY AREA

463 35% 3Q 2016 3Q 2017 4Q 2018 $ 4,130 -

9

REDEVELOPMENT STRATEGY

BUY RIGHT

• Own and operate real estate in special locations

where land value appreciates faster than buildings

depreciate

• Higher rent growth markets support strategic

redevelopment opportunities

REDEVELOP WITHIN PORTFOLIO

• Reposition existing operating properties through

phased redevelopment

• Vacate smaller properties on a select basis

• Take advantage of opportunities to increase

density through development of existing vacant

land or zoning modifications

10

REDEVELOPMENT VALUE CREATION

NOI STABILIZED

Redevelopment projects(1)

Net investment

5

$612M

OCCUPANCY

STABILIZED

Redevelopment projects

Net investment

2

$138M

UNDER

CONSTRUCTION

Redevelopment projects

Estimated net investment

3

$236M

TOTAL / WEIGHTED

AVERAGE

Communities

Net investment

Actual / projected value creation as a % of net investment

10

$986M

35%

• During the last three years, Aimco completed seven redevelopments

located in high-quality locations in: the Bay Area; La Jolla, CA; west Los

Angeles; downtown Seattle; and suburban Chicago. Aimco currently has

three major redevelopment projects in process in Philadelphia and Los

Angeles.

(1) Previously completed redevelopment phases at The Palazzo at Park La Brea are NOI stabilized. The current phase, including the renovation of 389 apartment

homes, is under construction.

11

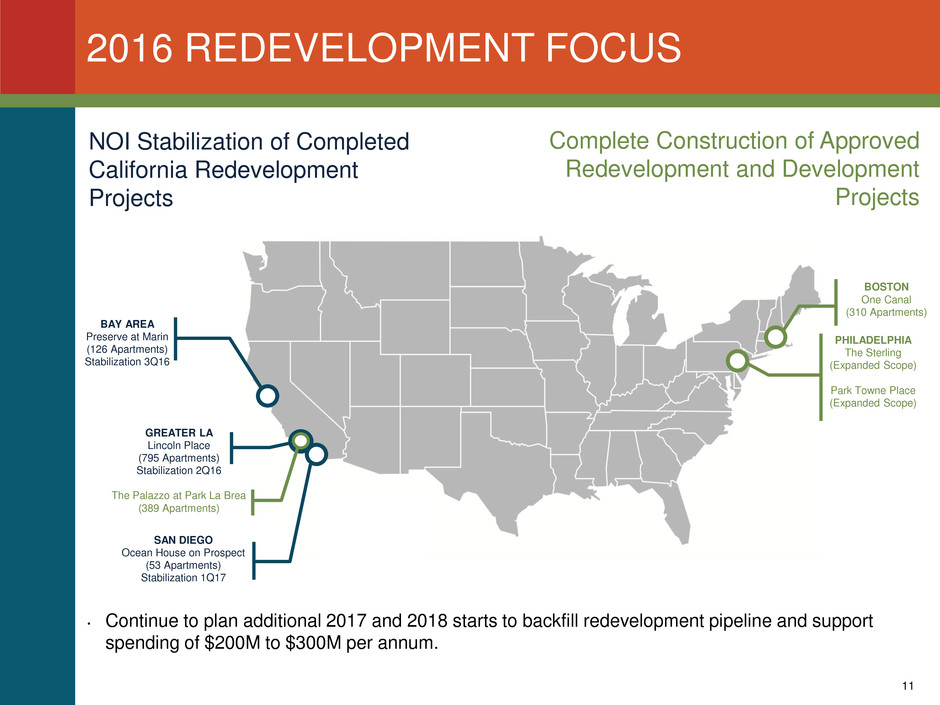

2016 REDEVELOPMENT FOCUS

NOI Stabilization of Completed

California Redevelopment

Projects

BAY AREA

Preserve at Marin

(126 Apartments)

Stabilization 3Q16

PHILADELPHIA

The Sterling

(Expanded Scope)

Park Towne Place

(Expanded Scope)

GREATER LA

Lincoln Place

(795 Apartments)

Stabilization 2Q16

The Palazzo at Park La Brea

(389 Apartments)

BOSTON

One Canal

(310 Apartments)

SAN DIEGO

Ocean House on Prospect

(53 Apartments)

Stabilization 1Q17

Complete Construction of Approved

Redevelopment and Development

Projects

• Continue to plan additional 2017 and 2018 starts to backfill redevelopment pipeline and support

spending of $200M to $300M per annum.

12

BAY AREA

707 Leahy

Preserve At Marin

Saybrook Pointe

CHICAGO

100 Forest Place

Evanston Place

Yorktown Apartments

MIAMI

Bay Parc Plaza

Flamingo South Beach

Yacht Club at Brickell

PHILADELPHIA

Park Towne Place

(Expanded Scope)

DENVER

21 Fitzsimons

Boston Lofts

Eastpointe

Township at Highlands

GREATER LA

3400 Avenue of the Arts

Palazzo East

Palazzo West

Villas at Park La Brea

MINNEAPOLIS

Calhoun Beach Club

GREATER DC

Foxchase

Merrill House

Shenandoah Crossing

SAN DIEGO

Mariner’s Cove

WHAT’S NEXT FOR REDEVELOPMENT?

REDEVELOPMENT MENU

The menu shown above is representative of the properties whose redevelopment is being considered. Actual redevelopment projects and their scope may differ

materially from the above.

13

PORTFOLIO STRATEGY

To continuously upgrade our portfolio through redevelopment, property

upgrades, acquisitions, and limited development activity.

• We do this through a strict paired-trade discipline with:

• DISPOSITION of 5-10% of our portfolio annually, primarily from

submarkets with lower revenue growth prospects; and

• REINVESTMENT of these proceeds in communities in target submarkets

with above-average revenue growth prospects.

• We maintain sufficient geographic and price point DIVERSIFICATION to limit

volatility and concentration risk, while focusing investment in higher rent

growth, higher-margin submarkets.

• We offer a product that ATTRACTS highly qualified residents with positive

prospects for income growth and the ability and willingness to pay for high

quality communities and service.

14

PORTFOLIO STRATEGY EXECUTION

• Aimco targets the disposition of 5-10% of our portfolio annually. On average,

during the last three years, we have disposed of 5% of our portfolio annually.

• We fund redevelopment, development and property upgrades from the sale

of 2-3% of assets each year (~$250-$350M) and fund selective acquisitions

with additional sales up to the 5-10% target, only if opportunities are

identified that are financially accretive and improve portfolio quality. Aimco is

cautious about acquisitions in the current environment where accretive

opportunities are limited.

$ Millions 2013 2014 2015

Total/

Wt. Avg.

PROPERTY

SALES

Gross proceeds

% of Portfolio

Net proceeds

$406

4%

$203

$689

7%

$435

$386

4%

$226

$1,481

5%

$867

USE OF

PROCEEDS

Redevelopment/development

Property upgrades

Acquisitions

Decrease/(increase) in leverage

Total

$194

39

54

119

$406

$229

50

349

61

$689

$233

49

129

(25)

$386

$656

138

532

155

$1,481

15

• Aimco's portfolio management activities have resulted in a significant improvement in portfolio

quality.

• Over the last three years, Aimco has exited: Dallas; Daytona Beach; Detroit; Fort Wayne, IN; Grand

Rapids, MI; Houston; Jacksonville; Lexington, MD; Naples, Orlando, Palm Beach, Tampa, FL; and

Phoenix.

• Through market rent growth and disciplined capital recycling, we expect revenue per apartment

home to approximate $1,950 at 2016 year-end and $2,050 at 2017 year-end.

PORTFOLIO TRANSFORMATION

(1) Aimco defines asset quality as follows: "A" quality assets are those with rents greater than 125% of local market average; "B" quality assets are those with rents

90% to 125% of local market average; and "C+" quality assets are those with rents greater than $1,100 per month but less than 90% of local market average. The

table above illustrates Aimco's Conventional portfolio quality based on market data for 4Q 2012 and 1Q 2016. Average revenue per apartment home figures are

for 2Q 2016.

(2) Assumes capital replacements of $1,200 per apartment home per year.

Year-End

2012

Quarter-End

6/30/2016

% Change

FOOTPRINT

Communities 175 137 - 22%

Apartment Homes 55,879 38,841 - 30%

% NOI in Target Markets 85% 91% + 7%

QUALITY(1)

Revenue per Apartment Home $ 1,362 $ 1,900 + 40%

Percentage A (Rev/Home $2,386) 34% 51% + 50%

Percentage B (Rev/Home $1,719) 35% 37% + 6%

Percentage C+ (Rev/Home $1,546) 21% 12% - 43%

Percentage C 10% - - 100%

PROFITABILITY

NOI Margin 64% 67% + 6%

Free Cash Flow Margin(2) 56% 62% + 11%

16

TODAY'S PORTFOLIO

• Aimco emphasizes diversification by geography and by price point.

• The nature of a diversified portfolio is that generally some markets accelerate while

other markets decelerate.

• Using blended lease rate growth for Q2 2016, roughly 45% of our target markets

accelerated, 45% decelerated with the remainder about flat on a weighted basis.

Aimco defines asset quality as follows: "A" quality assets are those with rents greater than 125% of local market average; "B" quality assets are those with rents 90% to 125% of local

market average; "C+" quality assets are those with rents less than 90% of local market average, and with rents greater than $1,100 per month; and "C" quality assets are those with

rents less than 90% of local market average and with rents less than $1,100 per month. The chart above illustrates Aimco's Conventional Property portfolio quality based on 1Q 2016

data.

A Quality 51%

B Quality 37%

C+ Quality 12%

Geographic Diversification

(% Conv. NOI)

Coastal California 35%

Mid Atlantic 22%

Northeast 16%

Sunbelt 9%

Miami 9%

Chicago 7%

Other 2%

17

DEMAND FOR RENTALS

The structure of the U.S. population supports continued strong demand for apartments.

• Historically, 64% of people aged 20 to 34 have opted for rental housing(1).

• If this propensity to rent continues, this age cohort would add 650k people to the rental population

over the next 10 years.

• Historically, about 21% of people over the age of 55 have opted for rental housing(1).

• If this propensity to rent continues, this age cohort would add 3.8M people to the rental

population over the next 10 years.

-0.3

-0.2

-0.1

0.0

0.1

0.2

0.3

0.4

0.5

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Mi

llio

ns

Impact of Baby Boomer and Echo Boomer Population

Change on Potential New Renters

Aged > 55 Aged 20 - 34

(1) Source: Green Street Advisors

(2) Source: Population forecast by Moody's Economy.com

(2)

18

DEMAND FOR RENTALS (CONT.)

Source: AxioMetrics. Market level data as of 2Q 2016.

• Job growth also contributes to the predictable demand for apartment homes.

• Forecasted 2017 job growth in Aimco markets generally outpaces supply growth.

2017 Supply and Jobs

Supply

Growth

Job

Growth Variance

Miami 1.13% 2.11% 0.98%

Greater DC 1.85% 2.45% 0.60%

Greater LA 1.07% 1.65% 0.58%

Chicago 0.92% 1.39% 0.47%

San Diego 1.18% 1.57% 0.39%

Atlanta 2.07% 2.42% 0.35%

Bay Area 1.93% 2.26% 0.33%

Greater New York 1.62% 1.75% 0.13%

Boston 1.52% 1.64% 0.12%

Philadelphia 1.78% 1.31% -0.47%

Denver 2.49% 1.73% -0.76%

Seattle 2.78% 1.96% -0.82%

19

AIMCO EXPOSURE TO NEW SUPPLY

(1) Source: MPF Research. Data as of 2Q 2016.

(2) Based on submarket data for deliveries in the next twelve months as a percentage of existing stock, available from MPF Research. This research covers 95% of Aimco

conventional apartment homes . The balance of Aimco conventional apartment homes are located in Manhattan and New Jersey for which MPF research is not

available. The Manhattan apartment homes have average rents of $2,589, and the New Jersey apartment homes have average rents of $1,495, both well below the

new supply rents.

• Nationwide, completions as a percentage of existing inventory in the next twelve months are projected to be 2.3%. This compares

to 1.6% for the two previous twelve month periods.(1)

• New supply generally impacts rent growth when completions are greater than 2% of existing inventory.

• However, new supply is typically delivered at the highest rents in the market, putting competitive pressure primarily on existing

high-rent “A” communities.

• Aimco emphasizes price point and submarket diversification to mitigate the impact of new supply. As a result 95% of Aimco

conventional apartment homes are located in seventy-eight submarkets tracked by MPF with the following new supply profile: (2)

• In fifteen submarkets (13% GAV), there is no new supply;

• In fifteen submarkets (19% GAV), new supply is less than 1%;

• In eighteen submarkets (23% GAV), new supply is more than 1% but less than 2%; and

• In thirty submarkets (38% GAV), new supply is more than 2%.

• In the submarkets where supply is greater than 2%, Aimco GAV is allocated 2% to “C+”, 14% to “B”, and 22% to “A” price point

communities.

• As a result of Aimco diversification, Aimco exposure to competitive new supply is primarily limited to its “A” price point

communities in submarkets with more than 2% supply growth…or approximately 22% of Aimco GAV. This exposure is mitigated

in some of these submarkets where the pace of job growth is greater than supply growth and in other submarkets, where Aimco’s

“A” rents are substantially lower than the rents charged by new supply.

20

HIGH QUALITY BALANCE SHEET

• During the last three years, Aimco has reduced leverage and added financial

flexibility by creating an unencumbered pool of assets. Both S&P and Fitch

rate the Aimco balance sheet "investment grade.”

• In 3Q 2016, Aimco closed two fixed rate, amortizing, non-recourse property

loans with ten year terms at 150 and 129 basis points above the ten year

Treasury rate.

• Year-to-date, REITs having an investment grade rating of BBB- have issued

ten year bonds at 215 to 378 basis points above the ten year Treasury rate.

Year-End

2012

Quarter-End

6/30/2016 % Change

DEBT TO EBITDA 7.5x 6.4x - 15%

DEBT AND PREFERRED EQUITY TO EBITDA 7.8x 6.8x - 13%

VALUE OF UNENCUMBERED ASSETS $0.0B $1.7B + 100%

21

• Aimco Debt and Preferred Equity to EBITDA of 6.8x reflects outstanding

balances at 06/30/2016, but overstates the refunding risk of our leverage.

• Our property debt balances at maturity are more than $800 million lower than

2Q 2016 balances due to principal amortization paid from retained earnings.

HIGH QUALITY BALANCE SHEET

(1) Peer group consists of AvalonBay, Camden, Equity Residential, Essex, MAA, Post Properties and UDR. Peer weighted average computed by Aimco based on

6/30/2016 debt and preferred equity balances, less cash, cash equivalents and restricted cash, divided by last twelve months recurring EBITDA, all as reported by

SNL Financial. Balances are adjusted to reflect company share of unconsolidated debt and NOI. For Aimco, leverage represents Aimco's share of property debt,

preferred equity and any balance on the revolving credit facility, reduced by Aimco's share of cash, cash equivalents, restricted cash and investments in a

securitization trust that holds Aimco property loans. See further information in Aimco's 2Q 2016 Earnings Release.

(2) Refunding Risk is lower than Total Leverage because property debt balances are reduced by scheduled amortization funded from retained earnings and because

perpetual preferred equity is not subject to mandatory refunding.

Property debt

amortization,

Perpetual Preferred

Equity

Total Leverage / LTM EBITDA as of June 30, 2016

(1)

Refunding Risk

(2)

5.4x

6.8x

5.0x

Peer Wt. Avg. Aimco Aimco Based on

Balances Due at

Maturity

22

• Looking ahead: We expect the quantum of leverage to remain fairly constant over the

next several years and that our leverage ratios will improve due to NOI growth in our same

store portfolio and the earn-in from stabilization of redevelopments and lease-up

properties.

• Exposure to interest rates: Aimco has limited near-term exposure to changes in interest

rates due to the long duration and fixed rates of its leverage. If Aimco refinances maturing

property loans at today's interest rates, it would result in an annual increase to AFFO per

share of approximately $0.05 for each of the next few years.

• Exposure to capital markets: Aimco’s planned capital activities for the two years 2016

and 2017 included: (i) selling $625M - $725M in properties ($315M sold to date); (ii) the

refinancing of $575M of maturing property debt with average LTVs at maturity of 30%

($20M refinanced to date); and (iii) placing approximately $145M of new property debt

($145M placed). The two-year funding activities are on target and one-third complete.

Year-End

2015

Year-End

2017

Forecast

%

Change

DEBT TO EBITDA 6.4x ~ 5.9x - 8%

DEBT AND PREFERRED EQUITY TO EBITDA 6.8x ~ 6.3x - 7%

VALUE OF UNENCUMBERED ASSETS $1.8B $2.1B + 17%

FOCUS ON REDUCING LEVERAGE

23

Integrity

Respect

Collaboration Customer

Focus

Performance

Our Vision

To be the best owner and

operator of apartment

communities, inspired by a

talented team committed to

exceptional customer service,

strong financial performance,

and outstanding corporate

citizenship.

Aimco Cares

Through the Aimco

Cares philanthropic

program, Aimco team

members have

contributed tens of

Top Work Place

In 2016, Aimco was again

recognized by the Denver

Post as a Top Work Place

based on independent

surveys of ~300 team

members.

thousands of volunteer hours to hundreds of non-profit

organizations; the annual Aimco Cares Charity Golf

Classic has raised more than $3 million for patriotic and

educational causes; and Aimco has awarded more than

500 college scholarships to help team members with

the cost of their child's higher education.

WE LIVE OUR VALUES

2013 2014 2015 2016

WE LIVE OUR ALUE

24

AIMCO SENIOR LEADERSHIP TEAM

Terry is a life-long entrepreneur focused on business, politics and

family. Terry has been an active real estate investor for more than

45 years, serving four REITs as CEO. Through the Considine

Companies, Terry has invested in real estate, television

broadcasting, convenience stores, environmental services, and

venture capital. Terry contributed his apartment business to the

formation of Aimco, led the Aimco IPO in 1994, and has served

as Aimco Chairman/CEO since that time. Terry has also been

active in politics, elected twice to the Colorado Senate and

holding leadership roles in numerous campaigns and political

organizations. He is a director of the Lynde and Harry Bradley

Foundation in Milwaukee, Wisconsin and Intrepid Potash (NYSE:

IPI) in Denver, Colorado. Terry has been married for 40 years to

his wife Betsy. Together, they are actively involved in education

reform and also ranching in western Colorado. Most of all, they

enjoy three adult children, their spouses, and two remarkable

grandchildren.

TERRY CONSIDINE

Chairman of the Board &

Chief Executive Officer

25

AIMCO SENIOR LEADERSHIP TEAM

Paul was promoted to Executive Vice President and Chief

Financial Officer in September 2015. He joined Aimco in 2008 as

Senior Vice President and Chief Accounting Officer. Prior to

joining Aimco, from October 2007 to March 2008, Paul served as

Chief Financial Officer of APRO Residential Fund. Prior to that,

from May 2005 to September 2007, Paul served as Chief

Financial Officer of America First Apartment Investors, Inc., then

a publicly traded company. From 1996 to 2005, Paul was with the

firm of Deloitte & Touche, LLP serving in numerous roles. Paul is

a certified public accountant.

PAUL BELDIN

Executive Vice President &

Chief Financial Officer

26

AIMCO SENIOR LEADERSHIP TEAM

John was appointed Executive Vice President and Chief

Investment Officer in July 2013. He joined Aimco as Senior Vice

President - Development in June 2006. John is responsible for

portfolio management, including dispositions, acquisitions and

capital investments. Prior to joining the Company, John spent

over 20 years with Prologis, Inc. and Catellus Development

Corporation in a variety of executive positions, including those

with responsibility for transactions, fund management, asset

management, leasing, and operations. John and his wife Sheri

have nine children, live in Littleton, Colorado, and are anxiously

engaged in all the excitement that comes with a big family.

JOHN E. BEZZANT

Executive Vice President &

Chief Investment Officer

27

AIMCO SENIOR LEADERSHIP TEAM

Lisa has served as Executive Vice President, General Counsel and

Secretary since 2007. Lisa is responsible for Aimco's legal functions and

has executive responsibility for insurance and risk management, human

resources, regulatory compliance, commercial and ancillary income, and

asset quality and service. Lisa has also served as Chairman of the Aimco

Investment Committee since November 2014. She joined Aimco in July

2002 as Vice President, Assistant General Counsel and Assistant

Secretary and was promoted to Senior Vice President in July 2004. Prior

to joining Aimco, Lisa was engaged in the private practice of law at

Hogan & Hartson LLP (now Hogan Lovells), with an emphasis on public

and private transactional work, public equity offerings and venture capital

financing. Prior to private practice, she spent two years as a Federal

judicial law clerk. Lisa earned her degree in Public Policy from Stanford

University and earned her law degree from Harvard Law School. She

serves on the Board of Trustees of the Rose Community Foundation and

is actively involved in the Denver community. Lisa and her husband, Rich,

have one son.

LISA R. COHN

Executive Vice President, General Counsel,

Secretary and Investment Committee Chairman

28

AIMCO SENIOR LEADERSHIP TEAM

Miles was promoted to Executive Vice President and Chief

Administrative Officer in December 2007. He is responsible for

administration, government relations, communications, and

special projects, and chairs the Senior Leadership Team. Miles

joined Aimco in August 2001 as Executive Vice President,

General Counsel and Secretary. Prior to joining the Company, he

practiced law in Denver, Colorado since 1970 and served as

president of both the Colorado Bar Association and the Denver

Bar Association. For over ten years he was recognized in "Best

Lawyers in America" and in 2001 was the Denver Business

Journal's "Law Executive of the Year." He served with the First

Infantry Division in Vietnam in 1969, where he was awarded the

Bronze Star, the Air Medal and the Army Commendation Medal.

Miles has been a trustee of Trinity University since 2005 and

serves on the board of directors of the Colorado Open Golf

Foundation. He is married to Jan Cortez, and they have four

children and five grandchildren. He is an avid tennis player and

golfer, and speaks Spanish.

MILES CORTEZ

Executive Vice President &

Chief Administrative Officer

29

AIMCO SENIOR LEADERSHIP TEAM

Patti was promoted to Executive Vice President - Securities and

Debt in February 2003 and added Treasurer in January 2005.

Patti assumed responsibility for Redevelopment activities in

November 2014. She is responsible for debt financing activities,

including property debt and corporate financings, and she

oversees all Treasury, LIHTC and joint ventures. Patti joined

Aimco in February 1997 as Vice President-Tenders, Securities

and Debt and was promoted to Senior Vice President - Securities

and Debt in January 2000. Prior to joining Aimco, Patti was with

Hanover Capital from 1996-1997. From 1993-1995 she was Vice

Chairman, Senior Vice President and Co-Founder of CapSource

Funding Corp. Patti was a Group Vice President with Duff &

Phelps Rating Company from 1987 to 1993 and a commercial

real estate appraiser with American Appraisal for three years.

Patti and her husband Bill have two boys. In her spare time she

enjoys skiing, biking, and swimming.

PATTI FIELDING

Executive Vice President,

Redevelopment & Treasurer

30

AIMCO SENIOR LEADERSHIP TEAM

Keith was born in Pittsburgh, Pennsylvania and is a diehard

Steelers fan. In 1976, his family moved to Southern California

where he quickly acclimated to the beautiful beaches and took up

his passion for surfing. Keith is married to his wonderful wife Leyla,

and they have two beautiful children and now reside in Colorado.

Keith began his career in the multifamily real estate business in

1992 as a leasing consultant and onsite manager, where he

learned the day-to-day operations and cultivated a keen connection

to onsite teams. He joined Aimco in March 2002 as a Regional

Manager and in March 2006 was promoted to Regional Vice

President - Property Operations for California. In September 2008,

Keith was appointed Area Vice President - Property Operations for

the western United States. In January 2011, Keith was promoted to

Executive Vice President - Property Operations heading our

national operations.

KEITH M. KIMMEL

Executive Vice President - Property

Operations

31

FORWARD LOOKING STATEMENTS &

OTHER INFORMATION

This presentation contains forward-looking statements within the meaning of the federal securities laws, including, without limitation, statements regarding

projected results and specifically forecasts of: 3Q and full year 2016 results, including but not limited to: Pro forma FFO and selected components thereof; AFFO;

Aimco redevelopment and development investments, timelines and Net Operating Income contribution; Aimco acquisition and lease-up timelines and Net

Operating Income contribution; expectations regarding sales of Aimco apartment communities and the use of proceeds thereof; and Aimco liquidity and leverage

metrics.

These forward-looking statements are based on management's judgment as of this date, which is subject to risks and uncertainties. Risks and uncertainties

include, but are not limited to: Aimco's ability to maintain current or meet projected occupancy, rental rate and property operating results; the effect of acquisitions,

dispositions, redevelopments and developments; Aimco's ability to meet budgeted costs and timelines, and achieve budgeted rental rates related to Aimco

developments and redevelopments; Aimco's ability to meet timelines and budgeted rental rates related to Aimco lease-up properties; and Aimco's ability to comply

with debt covenants, including financial coverage ratios.

Actual results may differ materially from those described in these forward-looking statements and, in addition, will be affected by a variety of risks and factors,

some of which are beyond the control of Aimco, including, without limitation: real estate risks, including fluctuations in real estate values and the general economic

climate in the markets in which Aimco operates and competition for residents in such markets; national and local economic conditions, including the pace of job

growth and the level of unemployment; the amount, location and quality of competitive new housing supply; financing risks, including the availability and cost of

capital markets' financing and the risk that Aimco's cash flows from operations may be insufficient to meet required payments of principal and interest; the risk that

Aimco's earnings may not be sufficient to maintain compliance with debt covenants; the terms of governmental regulations that affect Aimco and interpretations of

those regulations; the competitive environment in which Aimco operates; the timing of acquisitions, dispositions, redevelopments and developments; insurance

risk, including the cost of insurance; natural disasters and severe weather such as hurricanes; litigation, including costs associated with prosecuting or defending

claims and any adverse outcomes; energy costs; and possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary

remediation of contamination of apartment communities presently or previously owned by Aimco. In addition, Aimco's current and continuing qualification as a real

estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code and depends on its ability to meet the

various requirements imposed by the Internal Revenue Code, through actual operating results, distribution levels and diversity of stock ownership.

Readers should carefully review Aimco's financial statements and the notes thereto, as well as the section entitled "Risk Factors" in Item 1A of Aimco's Annual

Report on Form 10-K for the year ended December 31, 2015, and the other documents Aimco files from time to time with the Securities and Exchange

Commission.

These forward-looking statements reflect management's judgment as of this date, and Aimco assumes no obligation to revise or update them to reflect future

events or circumstances. This press release does not constitute an offer of securities for sale.

Glossary & Reconciliations of Non-GAAP Financial and Operating Measures

Financial and operating measures discussed in this document include certain financial measures used by Aimco management, some of which are measures not

defined under accounting principles generally accepted in the United States, or GAAP. These measures are defined in the Glossary included in Aimco's 2Q 2016

Earnings Release dated July 28, 2016. Where appropriate, the non-GAAP financial measures for Aimco's 2016 results and guidance included within this

document have been reconciled to the most comparable GAAP measures within Aimco's 2Q 2016 Earnings Release referenced above.