Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TEGNA INC | d237118d8k.htm |

| EX-99.1 - EX-99.1 - TEGNA INC | d237118dex991.htm |

Exhibit 99.2 Unlocking Shareholder Value Through Creation of Two Leading Companies July 2016 September 7, 2016

1Forward-Looking Statements Any statements contained in this communication that do not describe historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements may include statements with respect to TEGNA’s potential separation of Cars.com from TEGNA and the distribution of Cars.com shares to TEGNA’s shareholders, the expected financial and operational results of TEGNA and Cars.com after the separation and distribution, the evaluation of strategic alternatives for CareerBuilder, and changes to TEGNA’s management. Any forward-looking statements contained herein are based on our management’s current beliefs and expectations, but are subject to a number of risks, uncertainties and changes in circumstances, which may cause actual results or company actions to differ materially from what is expressed or implied by these statements. Such risks, uncertainties and changes in circumstances include, but are not limited to: uncertainties as to the timing of the spin-off or whether it will be completed, the failure to satisfy any conditions to complete the spin-off, the expected tax treatment of the spin-off, the impact of the spin-off on the businesses of TEGNA and Cars.com, and uncertainties as to the results of the evaluation of strategic alternatives for CareerBuilder, whether such evaluation will result in a transaction, and the failure to achieve anticipated benefits of any such potential transaction. Economic, competitive, governmental, technological and other factors and risks that may affect TEGNA’s operations or financial results are discussed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, and in subsequent filings with the U.S. Securities and Exchange Commission. We disclaim any obligation to update these forward-looking statements other than as required by law.

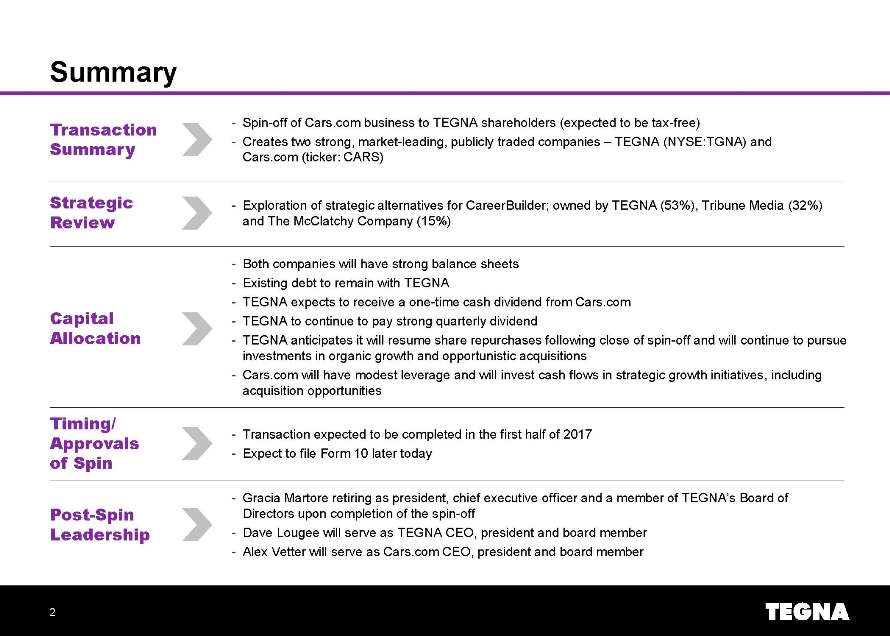

2 Summary Transaction Summary Spin-off of Cars.com business to TEGNA shareholders (expected to be tax-free) Creates two strong, market-leading, publicly traded companies –TEGNA (NYSE:TGNA) andCars.com (ticker: CARS) Post-Spin Leadership Gracia Martore retiring as president, chief executive officer and a member of TEGNA’s Board of Directors upon completion of the spin-off Dave Lougee will serve as TEGNA CEO, president and board member Alex Vetter will serve as Cars.com CEO, president and board member Strategic Review Exploration of strategic alternatives for CareerBuilder; owned by TEGNA (53%), Tribune Media (32%) and The McClatchy Company (15%) Capital Allocation Both companies will have strong balance sheets Existing debt to remain with TEGNA TEGNA expects to receive a one-time cash dividend from Cars.com TEGNA to continue to pay strong quarterly dividend TEGNA anticipates it will resume share repurchases following close of spin-off and will continue to pursue investments in organic growth and opportunistic acquisitions Cars.com will have modest leverage and will invest cash flows in strategic growth initiatives, including acquisition opportunities Timing/ Approvals of Spin Transaction expected to be completed in the first half of 2017 Expect to file Form 10 later today

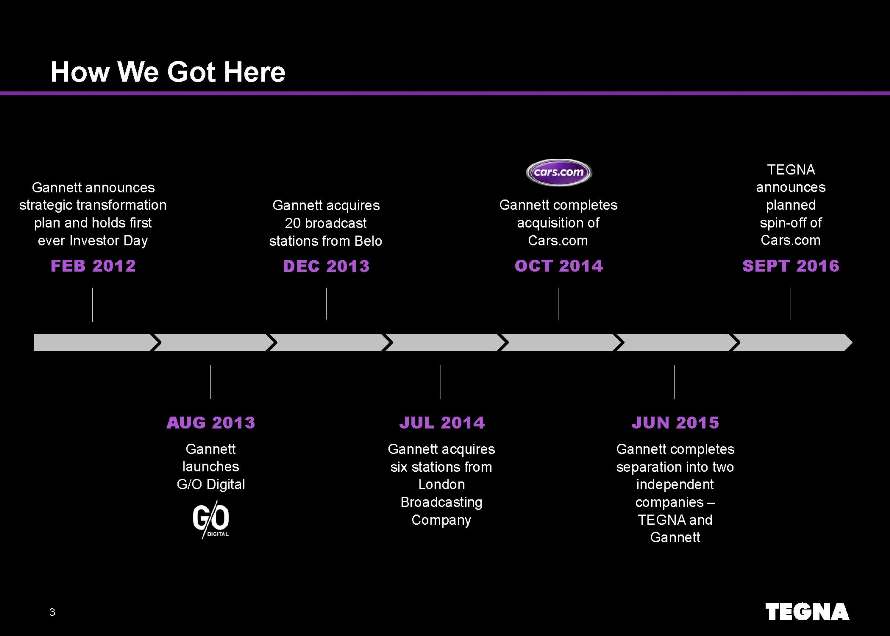

3 How We Got Here AUG 2013 Gannett launches G/O Digital JUL 2014 Gannett acquires six stations from London Broadcasting Company JUN 2015 Gannett completes separation into two independent companies –TEGNA and Gannett Gannett acquires 20 broadcast stations from Belo DEC 2013 Gannett announces strategic transformation plan and holds first ever Investor Day FEB 2012 Gannett completes acquisition of Cars.com OCT 2014 TEGNA announces planned spin-off of Cars.com SEPT 2016

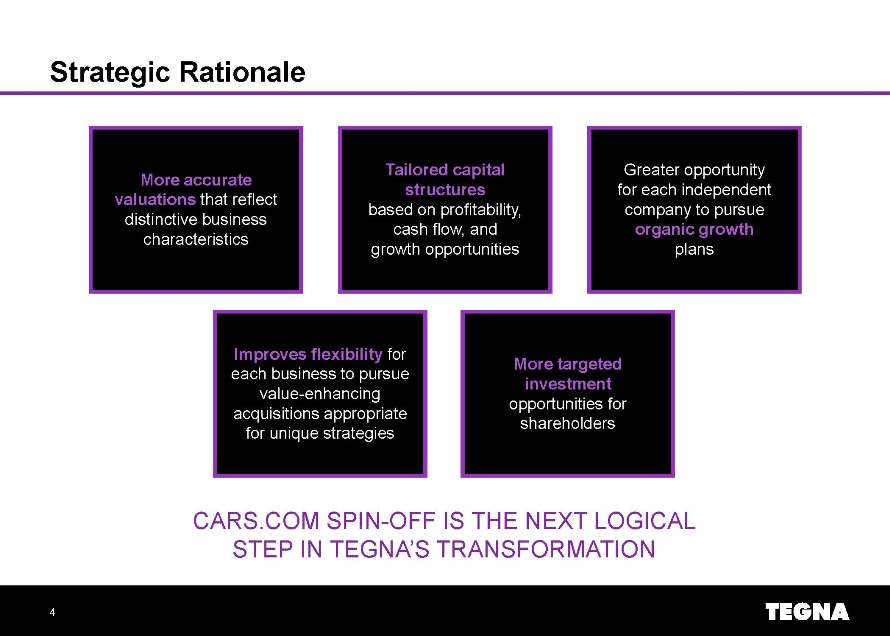

4Strategic Rationale Tailored capital structures based on profitability, cash flow, and growth opportunities Greater opportunity for each independent company to pursue organic growth plans Improves flexibility for each business to pursue value-enhancing acquisitions appropriate for unique strategies More targeted investment opportunities for shareholders More accurate valuations that reflect distinctive business characteristics CARS.COM SPIN-OFF IS THE NEXT LOGICAL STEP IN TEGNA’S TRANSFORMATION

5High Valuations For Cars.com Peer Group High valuations globally in capital markets and M&A transactions Digital auto-related companies with business models and market positions similar to Cars.com consistently trade at high multiples Market leaders are valued at mid-to-high teens forward EBITDA multiples Valuations high across geographic regions Rewarded by the market for growth opportunities Strong public market valuations have been validated by M&A market EBITDA multiples paid for companies listed below range from mid-teens to low-twenties ThomaBravo reached an agreement to acquire TRADER Corporation in July 2016 for $1.2bn XIO Group acquired J.D. Power in April 2016 for $1.1bn IHS acquired CarProof in December 2015 for $460mm Cox Enterprises acquired DealerTrackin June 2015 for $4.5bn

6 Creating Two Industry Leaders 46TV stations Strongest balance sheet among peers Strong cash flow generation Proven M&A track record local marketing solutions Highly attractive advertising vertical A leader in time on-site for automotive mobile and desktop Rapidly growing, consolidating sector with high valuations Strong EBITDA and revenue growth Top online automotive marketplace for consumers, dealers and OEMs 36Mhouseholds or ~1/3 of U.S. market Largest independent owner of affiliates in top 25 markets 35Mmonthly visits

7 CareerBuilder Strategic Review Global leader in human capital solutions –industry’s most comprehensive, integrated offering ANY TRANSACTION PROCEEDS EXPECTED TO PROVIDE FURTHER FINANCIAL FLEXIBILITY FOR TEGNA 1 3 +14 million unique visitors per month 4 Continued successful transition to fast-growing, higher margin SaaS business 5 Operates in more than 60 markets worldwide 2 Leading online job site in the U.S. 6 Positions TEGNA and Cars.com as pure-plays

8Two Exceptional CEOs Alex Vetter One of the original members of Cars.com management Named chief executive officer and president in 2014 Has grown Cars.com to approximately 1,300 employees serving every local market in the U.S. On the boards of several digital technology companies, including RepairPal.com, a leading automotive marketplace for service and repair Dave Lougee Currently serves as president of TEGNA Media Joined Gannett as President of Broadcasting in 2007 9 years with Belo in various roles Inducted into Broadcasting & Cable Hall of Fame in 2015 Awarded First Amendment Leadership Award by RTDNF Serves on a number of industry boards, including Joint board chairman of the National Association of Broadcasters (NAB)

9Industry Leading Portfolio

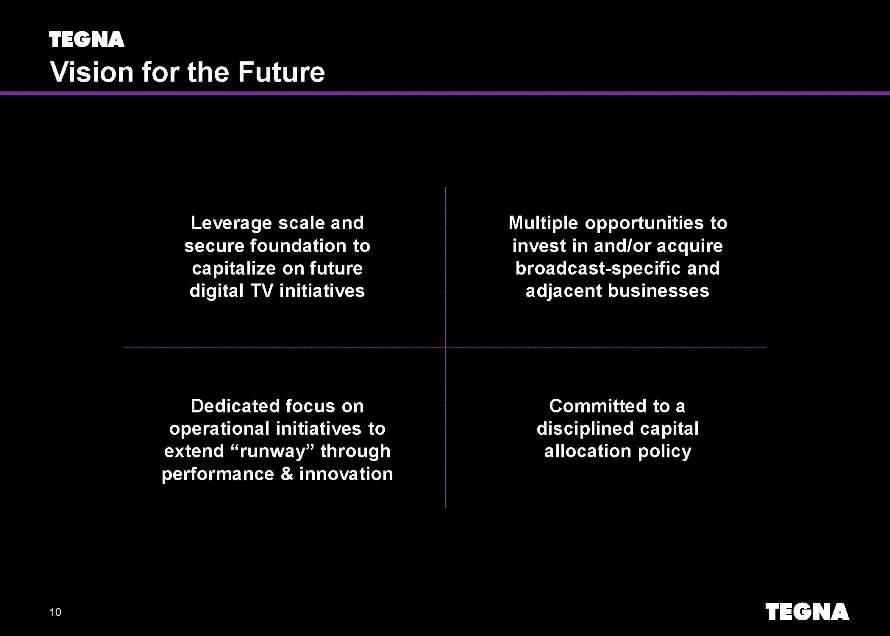

10 Vision for the Future Multiple opportunities to invest in and/or acquire broadcast-specific and adjacent businesses Dedicated focus on operational initiatives to extend “runway” through performance & innovation Committed to a disciplined capital allocation policy Leverage scale and secure foundation to capitalize on future digital TV initiatives

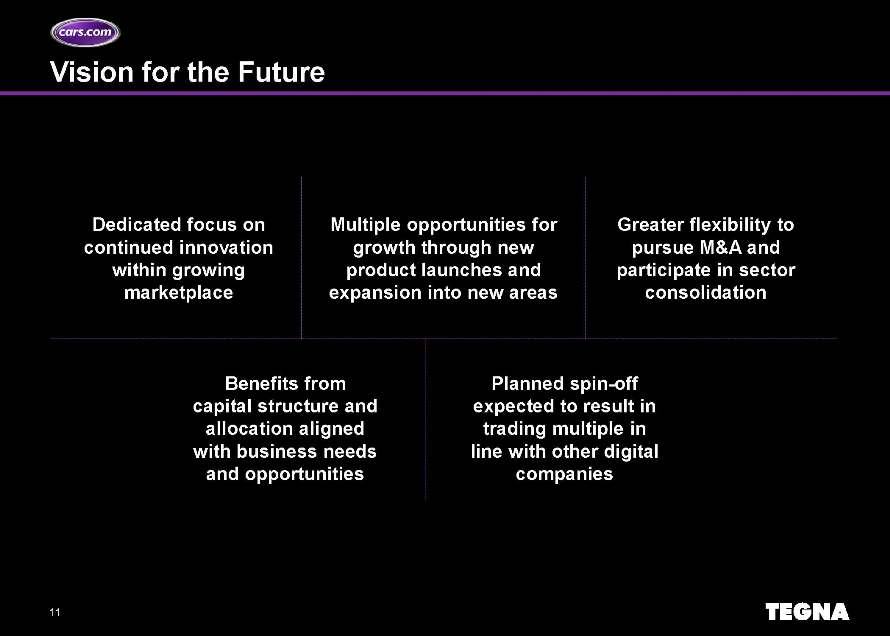

11 Vision for the Future Greater flexibility to pursue M&A and participate in sector consolidation Benefits from capital structure and allocation aligned with business needs and opportunities Dedicated focus on continued innovation within growing marketplace Planned spin-off expected to result in trading multiple in line with other digital companies Multiple opportunities for growth through new product launches and expansion into new areas

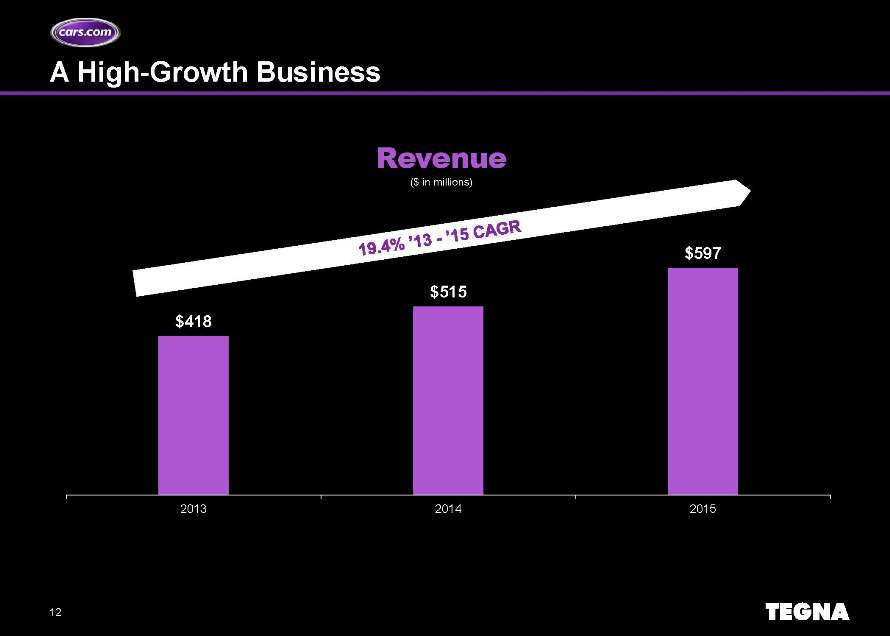

12 A High-Growth Business ($ in millions) Revenue $418 $515 $597 2013 2014 2015

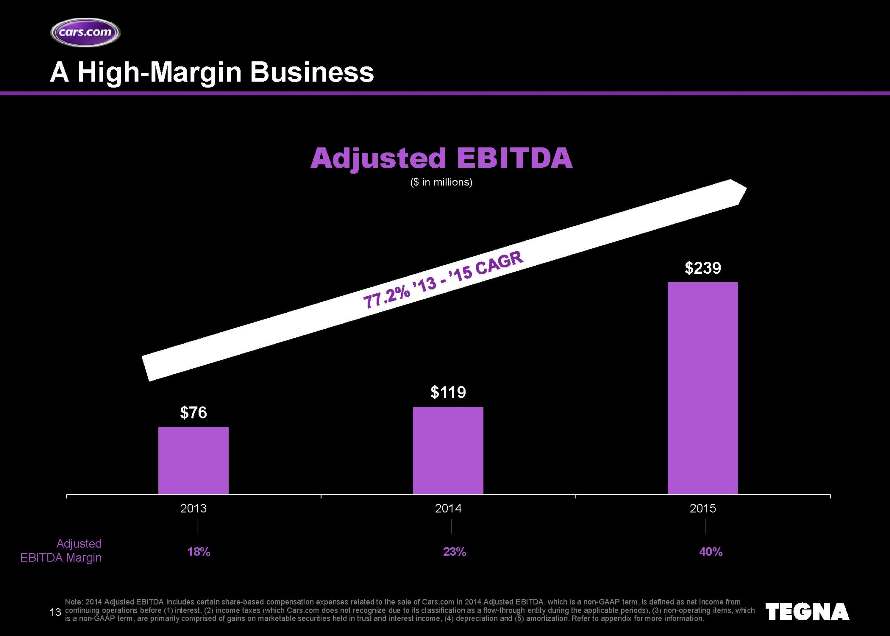

13 A High-Margin Business $76 $119 $239 2013 2014 201518% 23% 40%

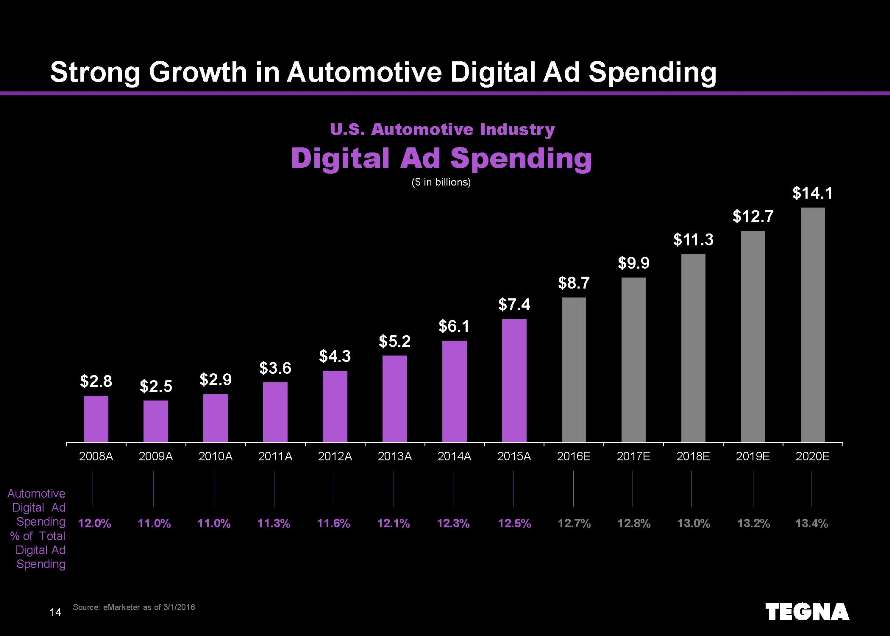

14 Strong Growth in Automotive Digital Ad Spending $2.8 $2.5 $2.9 $3.6 $4.3 $5.2 $6.1 $7.4 $8.7 $9.9 $11.3 $12.7 $14.1 2008A 2009A 2010A 2011A 2012A 2013A 2014A 2015A 2016E 2017E 2018E 2019E 2020E U.S. Automotive Industry 12.0% Digital Ad Spending Automotive Digital Ad Spending % of Total Digital Ad Spending 13.4% 13.2% 13.0% 12.8% 12.7% 12.5% 12.3% 12.1% 11.6% 11.3% 11.0% 11.0% ($ in billions) Source: eMarketeras of 3/1/2016

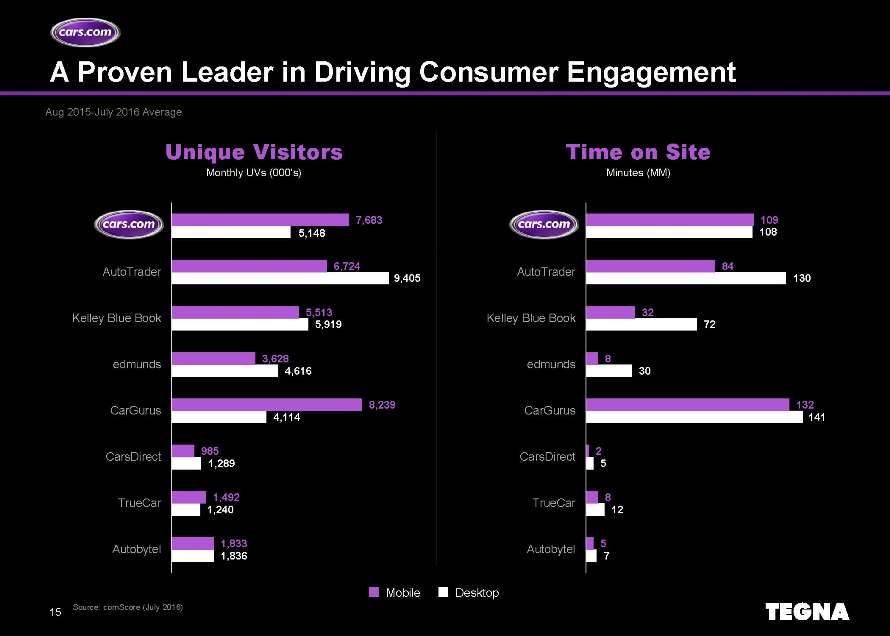

15 A Proven Leader in Driving Consumer Engagement Unique Visitors Monthly UVs (000’s) Time on Site Minutes (MM) Mobile Desktop 7 12 5 141 30 72 130 108 5 8 2 132 8 32 84 109 Autobytel TrueCar CarsDirect CarGurus edmunds Kelley Blue Book AutoTrader cars.com 1,836 1,240 1,289 4,114 4,616 5,919 5,148 1,833 1,492 985 8,239 3,628 5,513 6,724 7,683 Autobytel TrueCar CarsDirect CarGurus edmunds Kelley Blue Book AutoTrader cars.com Aug 2015-July 2016 Average 9,405 Source: comScore (July 2016)

16 Financial Highlights –Spin-Off Transaction Both companies will have strong balance sheets and tailored capital return policies Expected to result in increased growth and appropriate market valuations Existing debt to remain with TEGNA TEGNA expects to receive a one-time cash dividend from Cars.com immediately prior to the spin-off that will be used to maintain TEGNA’s strong credit rating TEGNA to continue to pay strong dividend TEGNA plans to resume share repurchases following close of spin-off Cars.com not expected to pay dividend initially –cash flow will be focused on investment in growth initiatives Spin-off expected to be tax-free to TEGNA shareholders

17 Key Takeaways Logical next step in successful ongoing transformation of TEGNA 1 Creates two industry-leading companies of substantial scale 2 Financially & strategically compelling transactions unlock significant shareholder value 3 Both companies will have strong, flexible balance sheets and capital structures tailored to their individual businesses 4 Cars.com is in an exceptional position in highly valued digital automotive sector –unique investment opportunity for investors 5 Exploration of strategic alternatives for CareerBuilder expected to provide further financial flexibility for TEGNA 6

Q&A

Appendix

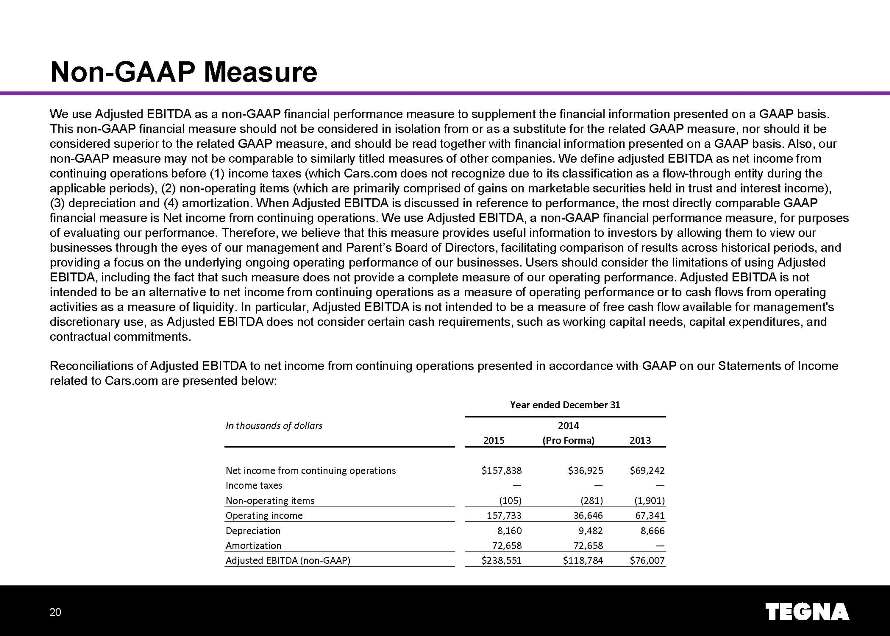

20 Non-GAAP Measure We use Adjusted EBITDA as a non-GAAP financial performance measure to supplement the financial information presented on a GAAP basis. This non-GAAP financial measure should not be considered in isolation from or as a substitute for the related GAAP measure, nor should it be considered superior to the related GAAP measure, and should be read together with financial information presented on a GAAP basis. Also, our non-GAAP measure may not be comparable to similarly titled measures of other companies. We define adjusted EBITDA as net income from continuing operations before (1) income taxes (which Cars.com does not recognize due to its classification as a flow-through entity during the applicable periods), (2) non-operating items (which are primarily comprised of gains on marketable securities held in trust and interest income), (3) depreciation and (4) amortization. When Adjusted EBITDA is discussed in reference to performance, the most directly comparable GAAP financial measure is Net income from continuing operations. We use Adjusted EBITDA, a non-GAAP financial performance measure, for purposes of evaluating our performance. Therefore, we believe that this measure provides useful information to investors by allowing themto view our businesses through the eyes of our management and Parent’s Board of Directors, facilitating comparison of results across historical periods, and providing a focus on the underlying ongoing operating performance of our businesses. Users should consider the limitations ofusing Adjusted EBITDA, including the fact that such measure does not provide a complete measure of our operating performance. Adjusted EBITDA is not intended to be an alternative to net income from continuing operations as a measure of operating performance or to cash flowsfrom operating activities as a measure of liquidity. In particular, Adjusted EBITDA is not intended to be a measure of free cash flow availablefor management’s discretionary use, as Adjusted EBITDA does not consider certain cash requirements, such as working capital needs, capital expenditures, and contractual commitments.Reconciliations of Adjusted EBITDA to net income from continuing operations presented in accordance with GAAP on our Statements of Income related to Cars.com are presented below:Year ended December 31 In thousands of dollars 2014 2015 (Pro Forma) 2013 Net income from continuing operations $157,838 $36,925 $69,242 Income taxes — — — Non-operating items (105) (281) (1,901) Operating income 157,733 36,646 67,341 Depreciation 8,160 9,482 8,666 Amortization 72,658 72,658 — Adjusted EBITDA (non-GAAP) $238,551 $118,784 $76,007