Attached files

| file | filename |

|---|---|

| 8-K - HOWARD BANCORP, INC. 8-K - Howard Bancorp Inc | a51414710.htm |

Exhibit 99.1

0 Investor PresentationSeptember 2016 CONFIDENTIAL

Forward-Looking Statements This presentation contains statements that are forward-looking, as that term is defined by the Private Securities Litigation Reform Act of 1995 or the Securities and Exchange Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors created thereby. All forward-looking statements are based on current expectations regarding important risk factors, including but not limited to real estate values, local and national economic conditions, the impact of interest rates on financing and the successful completion and deployment of proceeds from the capital raises as well as the successful completion and integration of mergers and acquisitions. Accordingly, actual results may differ from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by the Company or any other person that results expressed therein will be achieved. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

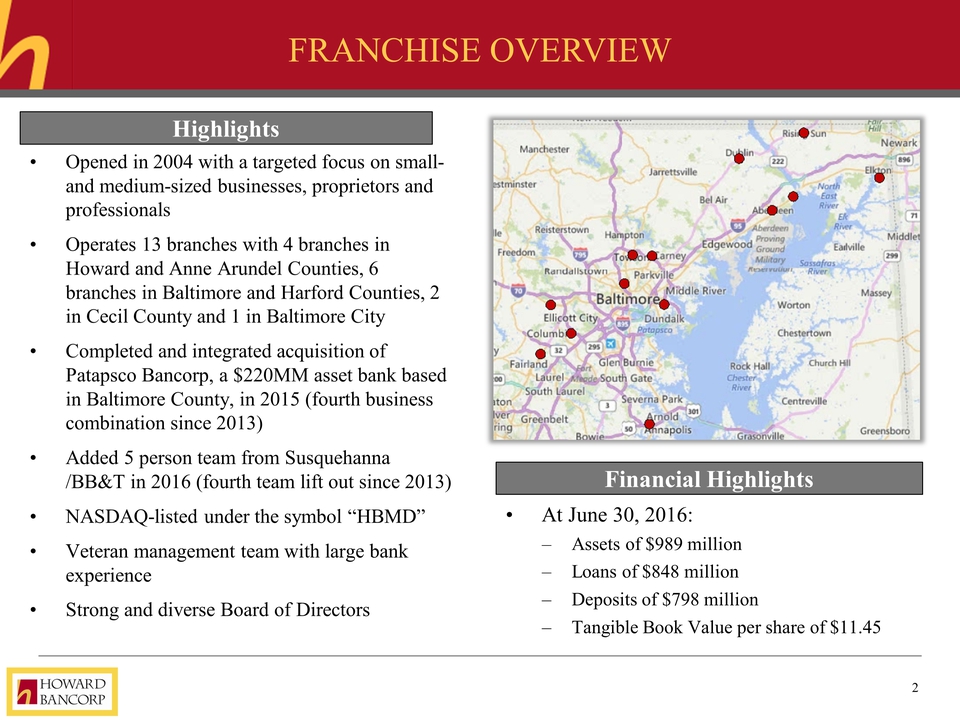

Franchise Overview Opened in 2004 with a targeted focus on small- and medium-sized businesses, proprietors and professionals Operates 13 branches with 4 branches in Howard and Anne Arundel Counties, 6 branches in Baltimore and Harford Counties, 2 in Cecil County and 1 in Baltimore City Completed and integrated acquisition of Patapsco Bancorp, a $220MM asset bank based in Baltimore County, in 2015 (fourth business combination since 2013)Added 5 person team from Susquehanna /BB&T in 2016 (fourth team lift out since 2013) NASDAQ-listed under the symbol “HBMD” Veteran management team with large bank experience Strong and diverse Board of Directors At June 30, 2016: Assets of $989 million Loans of $848 million Deposits of $798 million Tangible Book Value per share of $11.45 Highlights Financial Highlights

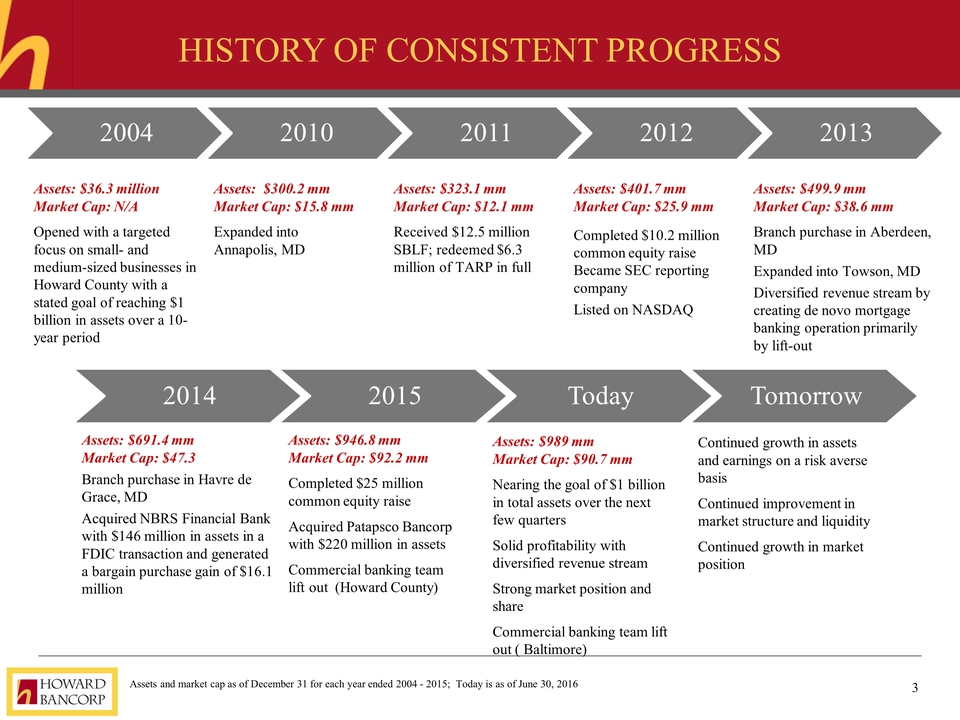

History of Consistent Progress 2004 2010 2011 2012 2013 Assets: $36.3 million Market Cap: N/A Opened with a targeted focus on small- and medium-sized businesses in Howard County with a stated goal of reaching $1 billion in assets over a 10-year period Assets: $300.2 mm Market Cap: $15.8 mm Expanded into Annapolis, MD Assets: $323.1 mm Market Cap: $12.1 mm Received $12.5 million SBLF; redeemed $6.3 million of TARP in full Assets: $401.7 mm Market Cap: $25.9 mm Completed $10.2 million common equity raise Became SEC reporting company Listed on NASDAQ Assets: $499.9 mm Market Cap: $38.6 mm Branch purchase in Aberdeen, MD Expanded into Towson, MD Diversified revenue stream by creating de novo mortgage banking operation primarily by lift-out 2014 2015 Today Tomorrow Assets: $691.4 mm Market Cap: $47.3Branch purchase in Havre de Grace, MD Acquired NBRS Financial Bank with $146 million in assets in a FDIC transaction and generated a bargain purchase gain of $16.1 million Assets: $946.8 mm Market Cap: $92.2 mm Completed $25 million common equity raise Acquired Patapsco Bancorp with $220 million in assets Commercial banking team lift out (Howard County) Assets: $989 mm Market Cap: $90.7 mm Nearing the goal of $1 billion in total assets over the next few quarters Solid profitability with diversified revenue stream Strong market position and share Commercial banking team lift out ( Baltimore) Continued growth in assets and earnings on a risk averse basis Continued improvement in market structure and liquidity Continued growth in market position Assets and market cap as of December 31 for each year ended 2004 - 2015; Today is as of June 30, 2016

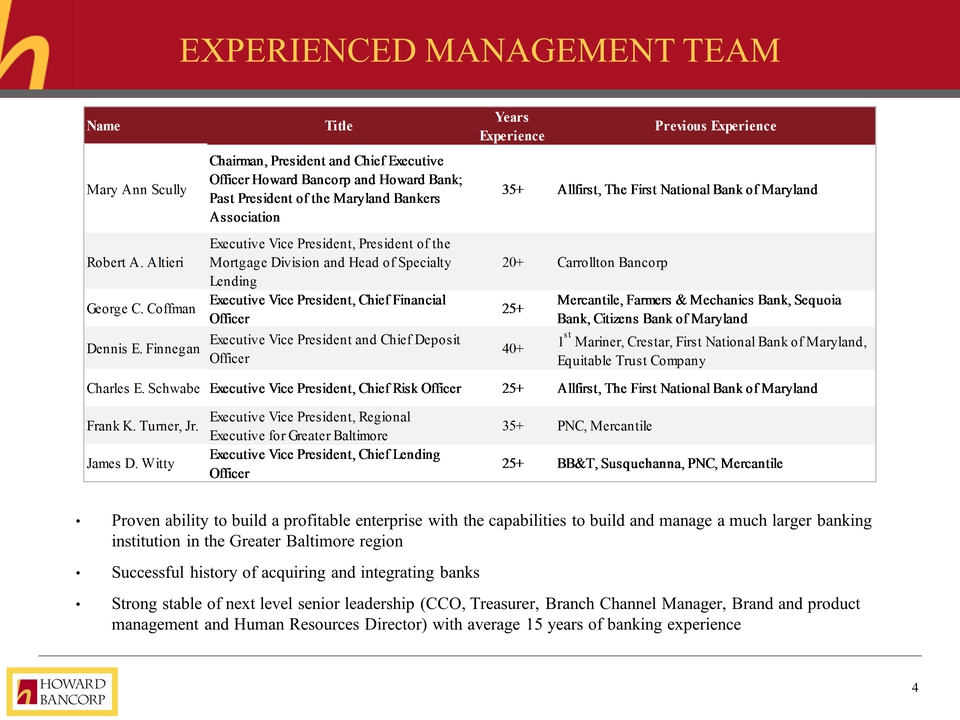

Experienced Management Team Proven ability to build a profitable enterprise with the capabilities to build and manage a much larger banking institution in the Greater Baltimore region Successful history of acquiring and integrating banks Strong stable of next level senior leadership (CCO, Treasurer, Branch Channel Manager, Brand and product management and Human Resources Director) with average 15 years of banking experience Mary Ann Scully Chairman, President and Chief Executive Officer Howard Bancorp and Howard Bank; Past President of the Maryland Bankers Association 35+ Allfirst, The First National Bank of Maryland Robert A. Altieri Executive Vice President, President of the Mortgage Division and Head of Specialty Lending 20+ Carrollton Bancorp George C. Coffman Executive Vice President, Chief Financial Officer 25+ Mercantile, Farmers & Mechanics Bank, Sequoia Bank, Citizens Bank of Maryland Dennis E. Finnegan Executive Vice President and Chief Deposit Officer 40+ 1st Mariner, Crestar, First National Bank of Maryland, Equitable Trust Company Charles E. Schwabe Executive Vice President, Chief Risk Officer 25+ Allfirst, The First National Bank of Maryland Frank K. Turner, Jr. Executive Vice President, Regional Executive for Greater Baltimore 35+ PNC, Mercantile James D. Witty Executive Vice President, Chief Lending Officer 25+ BB&T, Susquehanna, PNC, Mercantile

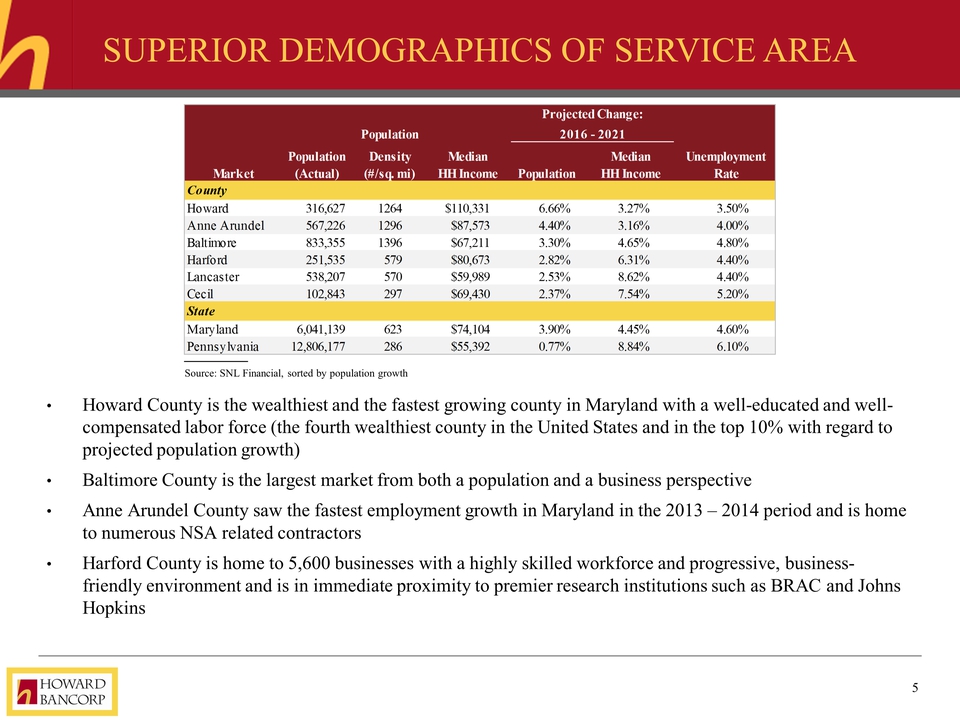

Superior Demographics of Service Area Howard County is the wealthiest and the fastest growing county in Maryland with a well-educated and well-compensated labor force (the fourth wealthiest county in the United States and in the top 10% with regard to projected population growth)Baltimore County is the largest market from both a population and a business perspective Anne Arundel County saw the fastest employment growth in Maryland in the 2013 – 2014 period and is home to numerous NSA related contractors Harford County is home to 5,600 businesses with a highly skilled workforce and progressive, business-friendly environment and is in immediate proximity to premier research institutions such as BRAC and Johns Hopkins Source: SNL Financial, sorted by population growth Market Population (Actual) Population Density (#/sq.mi) Median HH Income Population Median HH Income Unemployment Rate Projected Change: 2016 – 2021 County State Howard 316,627 1264 $110,331 6.66% 3.27% 3.50% Anne Arundel 567,226 1296 $87,573 4.40% 3.16% 4.00% Baltimore 833,355 1396 $67,211 3.30% 4.65% 4.80% Hartford 251,535 579 $80,673 2.82% 6.31% 4.40% Lancaster 538,207 570 $59,989 2.53% 8.62% 4.40% Cecil 102,843 297 $69,430 2.37% 7.54% 5.20% State Maryland 6,041,139 623 $74,104 3.90% 4.45% 4.60% Pennsylvania 12,806,177 286 $55,392 0.77% 8.84% 6.10%

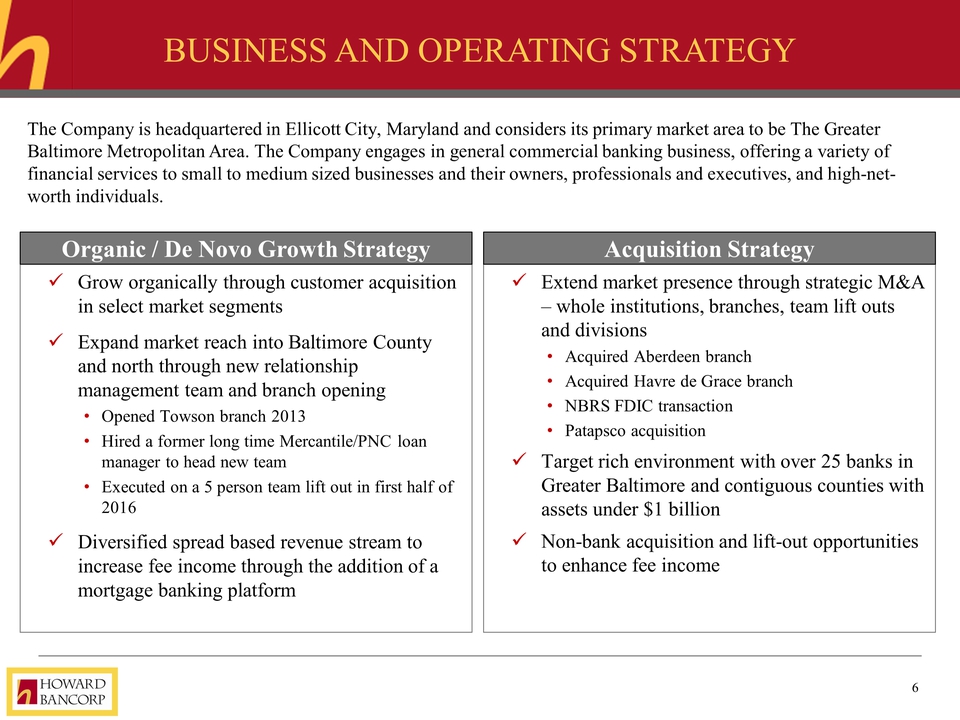

Business and Operating Strategy Grow organically through customer acquisition in select market segments Expand market reach into Baltimore County and north through new relationship management team and branch opening Opened Towson branch 2013 Hired a former long time Mercantile/PNC loan manager to head new team Executed on a 5 person team lift out in first half of 2016 Diversified spread based revenue stream to increase fee income through the addition of a mortgage banking platform Extend market presence through strategic M&A – whole institutions, branches, team lift outs and divisions Acquired Aberdeen branch Acquired Havre de Grace branch NBRS FDIC transaction Patapsco acquisition Target rich environment with over 25 banks in Greater Baltimore and contiguous counties with assets under $1 billion Non-bank acquisition and lift-out opportunities to enhance fee income Organic / De Novo Growth Strategy Acquisition Strategy The Company is headquartered in Ellicott City, Maryland and considers its primary market area to be The Greater Baltimore Metropolitan Area. The Company engages in general commercial banking business, offering a variety of financial services to small to medium sized businesses and their owners, professionals and executives, and high-net-worth individuals.

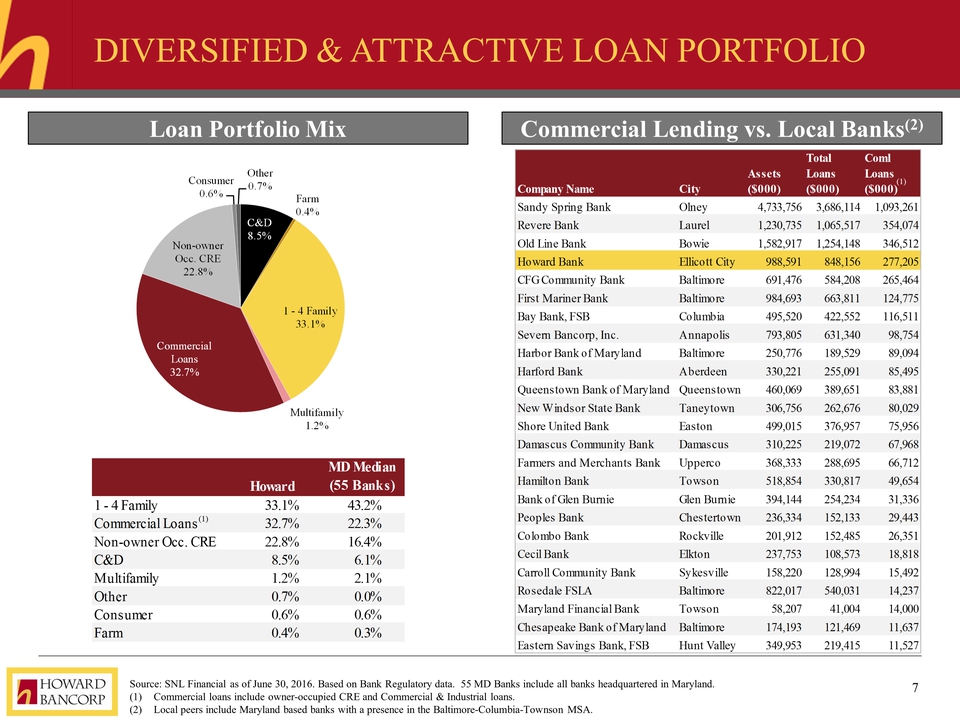

Diversified & Attractive Loan Portfolio Source: SNL Financial as of June 30, 2016. Based on Bank Regulatory data. 55 MD Banks include all banks headquartered in Maryland. Commercial loans include owner-occupied CRE and Commercial & Industrial loans. Local peers include Maryland based banks with a presence in the Baltimore-Columbia-Townson MSA. Loan Portfolio Mix Commercial Lending vs. Local Banks (2) (1) (1) Loan Portfolio Mix Consumer Other Farm 1-4 Family Multifamily Commercial Loans Non-owner Occ. CRE 0.6% 0.7% 8.5% 0.4% 33.1% 1.2% 32.7% 22.8% Howard MD Median (55 Banks) 1-4 Family 33.1% 43.2% Commercial Loans 32.7% 22.3% Non-owner Occ. CRE 22.8% 16.4% C&D 8.5% 6.1% Multifamily 1.2% 2.1% Other 0.7% 0.0% Consumer 0.6% 0.6% Farm 0.4% 0.3% Company Name City Assets ($000) Total Loans ($000) Coml Loans ($000) Sandy Spring Bank Olney 4,733,756 3,686,114 1,093,261 Revere Bank Laurel 1,230,735 1,065,517 354,074 Old Line Bank Bowie 1,582,917 1,254,148 346,512 Howard Bank Ellicott City 988,591 848,156 277,205 CFG Community Bank Baltimore 691,476 584,208 265,464 First Mariner Bank Baltimore 984,693 663,811 124,775 Bay Bank, FSB Columbia 495,520 422,552 116,511 Seven Bancorp, Inc. Annapolis 793,805 631,340 98,754 Harbor Bank of Maryland Baltimore 250,776 189,529 89,094 Harford Bank Aberdeen 330,221 255,091 85,495 Queenstown Bank of Maryland Queenstown 460,069 389,651 83,881 New Windsor State Bank Taneytown 306,756 262,676 80,029 Shore United Bank Easton 499,015 376,957 75,956 Damascus Community Bank Damascus 310,225 219,072 67,968 Farmers and Merchants Bank Upperco 368,333 288,695 66,712 Hamilton Bank Towson 518,854 330,817 49,654 Bank of Glen Burnie Glen Burnie 394,144 254,234 31,336 Peoples Bank Chestertown 236,334 152,133 29,443 Colombo Bank Rockville 201,912 152,485 26,351 Cecil Bank Elkton 237,753 108,573 18,818 Carroll Community Bank Sykesville 158,220 128,994 15,492 Rosedale FSLA Baltimore 822,017 540,031 14,237 Maryland Financial Bank Towson 58,207 41,004 14,000 Chesapeake Bank of Maryland Baltimore 174,193 121,469 11,637 Eastern Savings Bank, FSB Hunt Valley 349,953 219,415 11,527

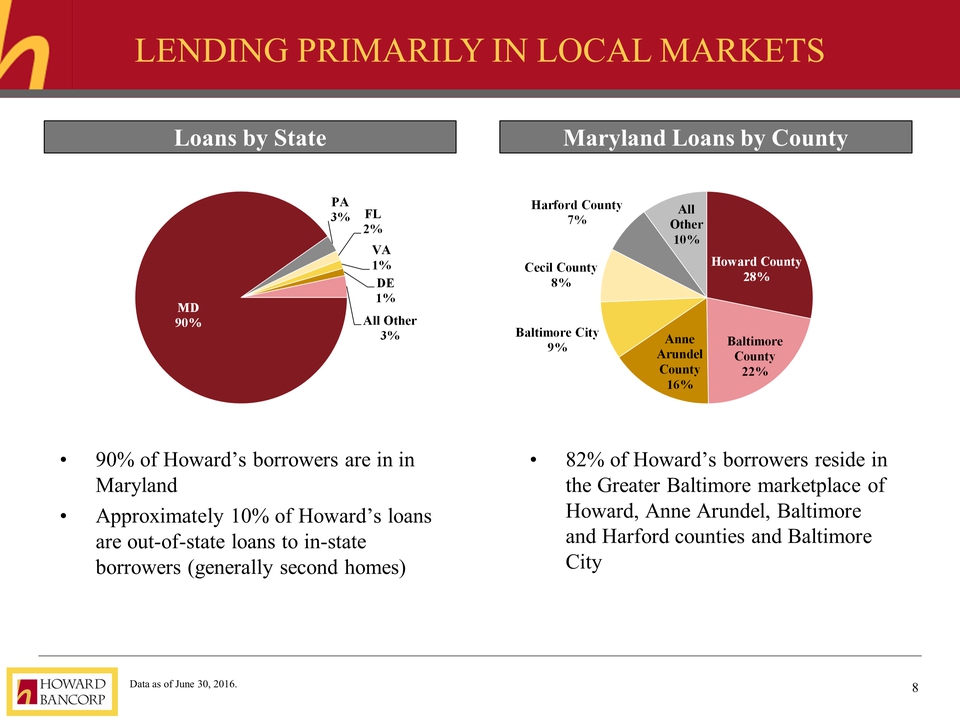

Lending Primarily in Local Markets 90% of Howard’s borrowers are in in Maryland Approximately 10% of Howard’s loans are out-of-state loans to in-state borrowers (generally second homes) 82% of Howard’s borrowers reside in the Greater Baltimore marketplace of Howard, Anne Arundel, Baltimore and Harford counties and Baltimore City Loans by State Maryland Loans by County Data as of June 30, 2016. PA 3% FL 2% VA 1% DE 1% All other 3% MD 90% Harford County 7% Cecil County 8% Baltimore City 9% All Other 10% Anne Arundel County 16% Howard County 28% Baltimore County 22%

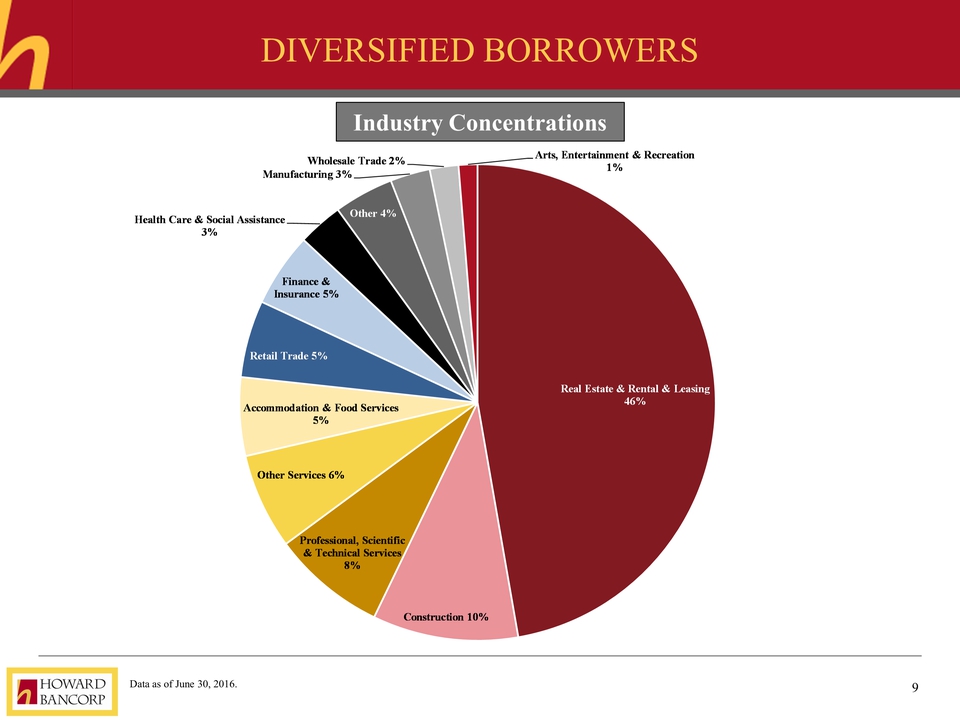

Diversified Borrowers Industry Concentrations Data as of June 30, 2016. Wholesale Trade 2% Manufacturing 3% Arts, Entertainment & Recreation 1% Other 4% Real Estate & Rental & Leasing 46% Construction 10% Professional, Scientific & Technical Services 8% Other Services 6% Accommodation & Food Services 5% Retail Trade 5% Finance & Insurance 5% Health Care & Social Assistance 3%

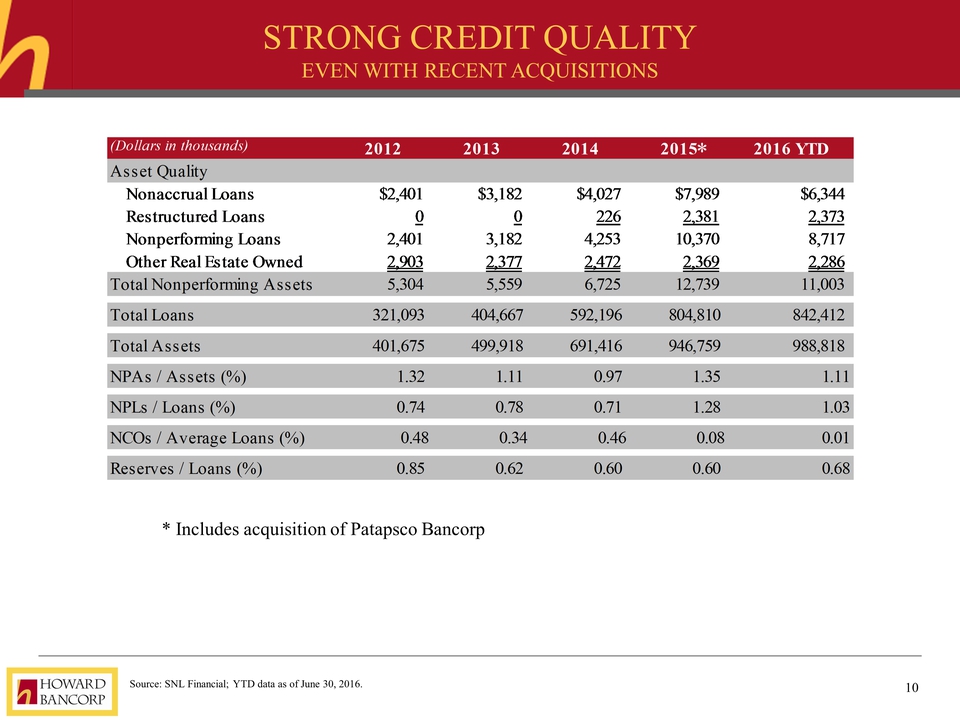

Strong Credit Quality Even with Recent Acquisitions (Dollars in thousands) 2012 2013 2014 2015* 2016 YTD Asset Quality Nonaccrual Loans Restructured Loans Nonperforming Loans Other Real Estate Owned Total Nonperforming Assets Total Loans Total Assets NPAs/Assets % NPLs/Loans (%) NCOs/Average Loans (5) Reserves/Loans (%) $2,401 0 2,401 2,903 5,304 321,093 401,675 1.32 0.74 0.48 0.85 $3,182 0 3,182 2,377 5,559 404,667 499,918 1.11 0.78 0.34 0.62 $4,027 226 4,253 2,472 6,725 592,196 691,416 0.97 0.71 0.46 0.60 $7,989 2,381 10,370 2,369 12,739 804,810 946,759 1.35 1.28 0.08 0.60 $6,344 2,373 8,717 2,286 11,003 842,412 988,818 1.11 1.03 0.01 0.68 * Includes acquisition of Patapsco Bancorp Source: SNL Financial; YTD data as of June 30, 2016.

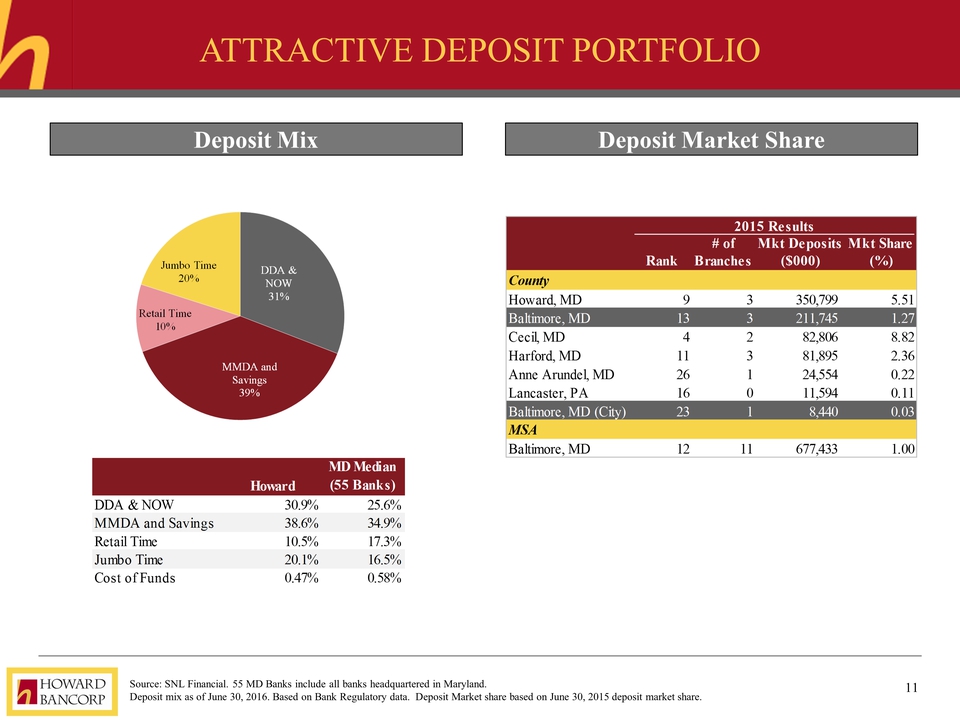

Attractive Deposit Portfolio Deposit Mix Source: SNL Financial. 55 MD Banks include all banks headquartered in Maryland. Deposit mix as of June 30, 2016. Based on Bank Regulatory data. Deposit Market share based on June 30, 2015 deposit market share. Deposit Market Share Jumbo Time 20% DDA & NOW 31% MMDA and Savings 39% Retail Time 10% DDA & NOW MMDA and Savings Retail Time Jumbo Time Cost of Funds Howard MD Median (55 Banks) 30.9% 38.6% 10.5% 20.1% 0.47% 25.6% 34.9% 17.3% 16.5% 0.58% 2015 Results Rank # of Branches Mrk Deposits ($000) Mrk Share (%) County Howard, MD Baltimore, MD Harford, MD Anne Arundel, MD Lancaster, PA Baltimore, MD (City) MSA Baltimore, MD 9 13 4 11 26 16 23 12 3 3 2 3 1 0 1 11 350,799 211,745 82,806 81,895 24,554 11,594 8,440 677,433 5.51 1.27 8.82 2.36 0.22 0.11 0.03 1.00

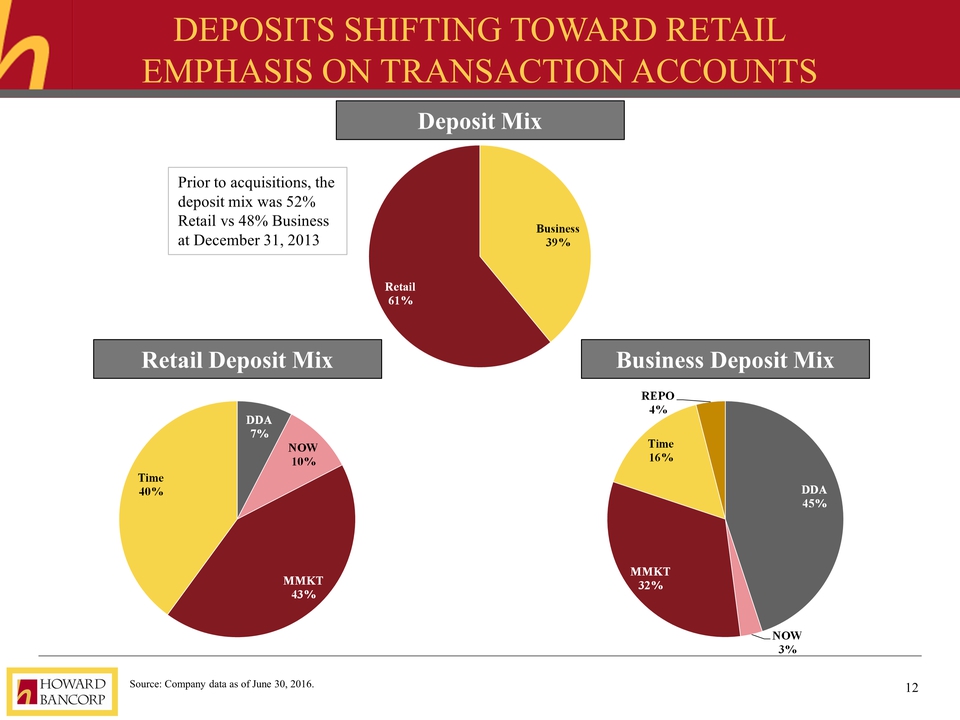

Deposits Shifting Toward Retail Emphasis On Transaction Accounts Source: Company data as of June 30, 2016. Deposit Mix Retail Deposit Mix Business Deposit Mix Prior to acquisitions, the deposit mix was 52% Retail vs 48% Business at December 31, 2013 Time 40% DDA 7% NOW 10% MMKT 43% Retail 61% Business 39% REPO 4% Time 16% MMKT 32% NOW 3% DDA 45%

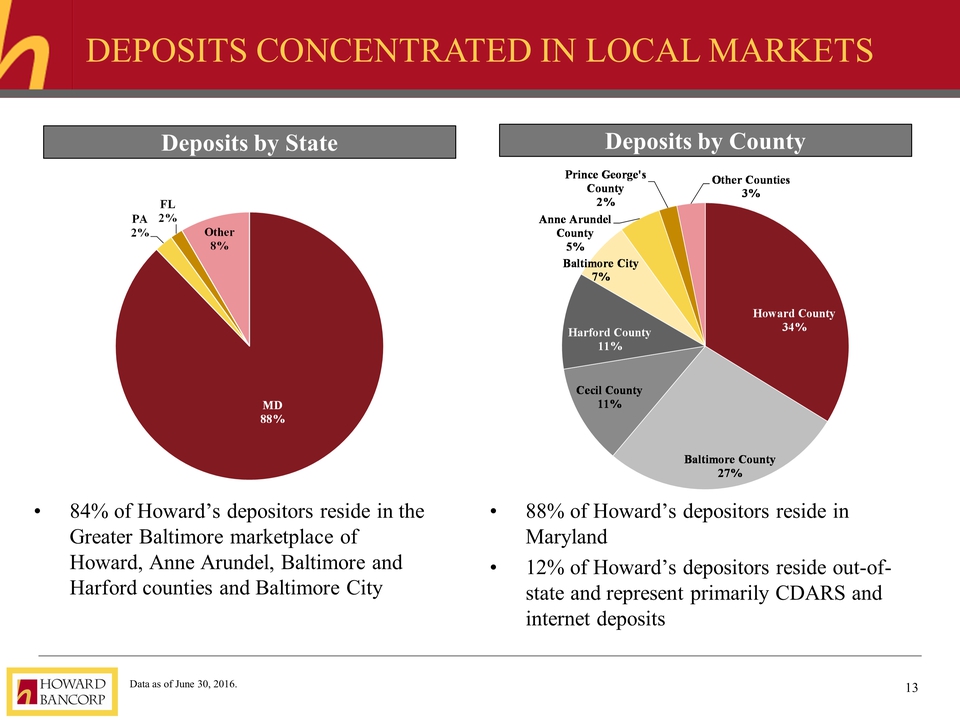

Deposits Concentrated in Local Markets 88% of Howard’s depositors reside in Maryland 12% of Howard’s depositors reside out-of-state and represent primarily CDARS and internet deposits 84% of Howard’s depositors reside in the Greater Baltimore marketplace of Howard, Anne Arundel, Baltimore and Harford counties and Baltimore City Deposits by State Deposits by County Data as of June 30, 2016. Prince George’s County 2% Other Counties 3% Howard County 34% Baltimore County 27% Cecil County 11% Harford County 11% Baltimore City 7% Anne Arundel County 5%

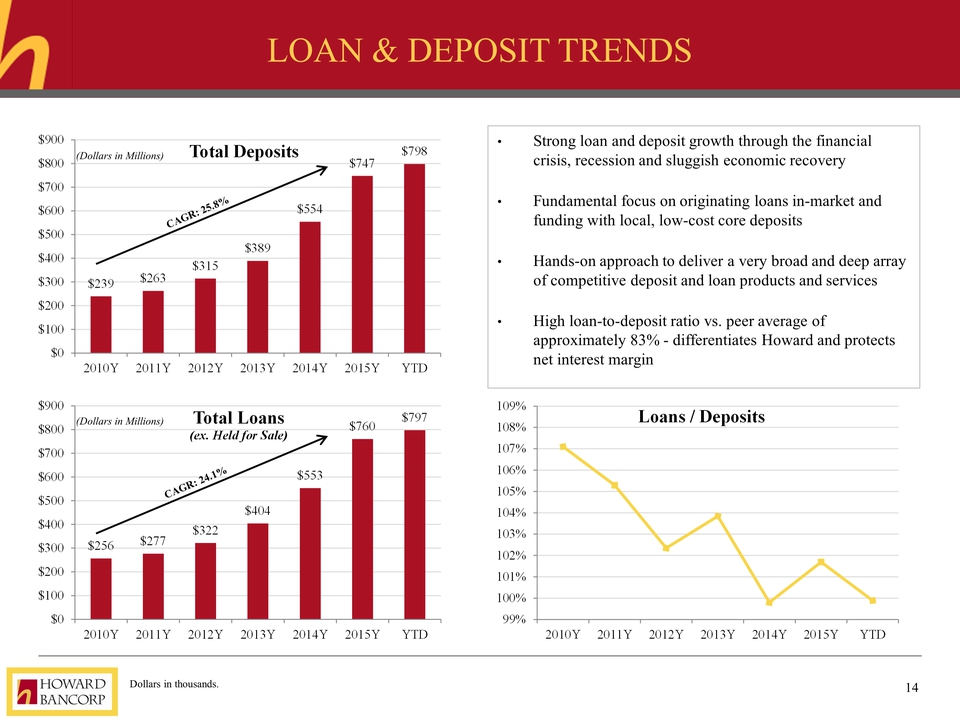

Loan & Deposit Trends Strong loan and deposit growth through the financial crisis, recession and sluggish economic recovery Fundamental focus on originating loans in-market and funding with local, low-cost core deposits Hands-on approach to deliver a very broad and deep array of competitive deposit and loan products and services High loan-to-deposit ratio vs. peer average of approximately 83% - differentiates Howard and protects net interest margin Dollars in thousands. (Dollars in Millions) (Dollars in Millions) CAGR: 25.8% CAGR: 24.1% $900 $800 $700 $600 $500 $400 $300 $200 $100 $0 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y YTD $239 $263 $389 $554 $747 $798 Total Deposits total Loans (ex. Held for Sale) $256 $277 $322 $404 $553 $760 $797 109% 108% 107% 106% 105% 104% 103% 102% 101% 100% 99% Loans/Deposits

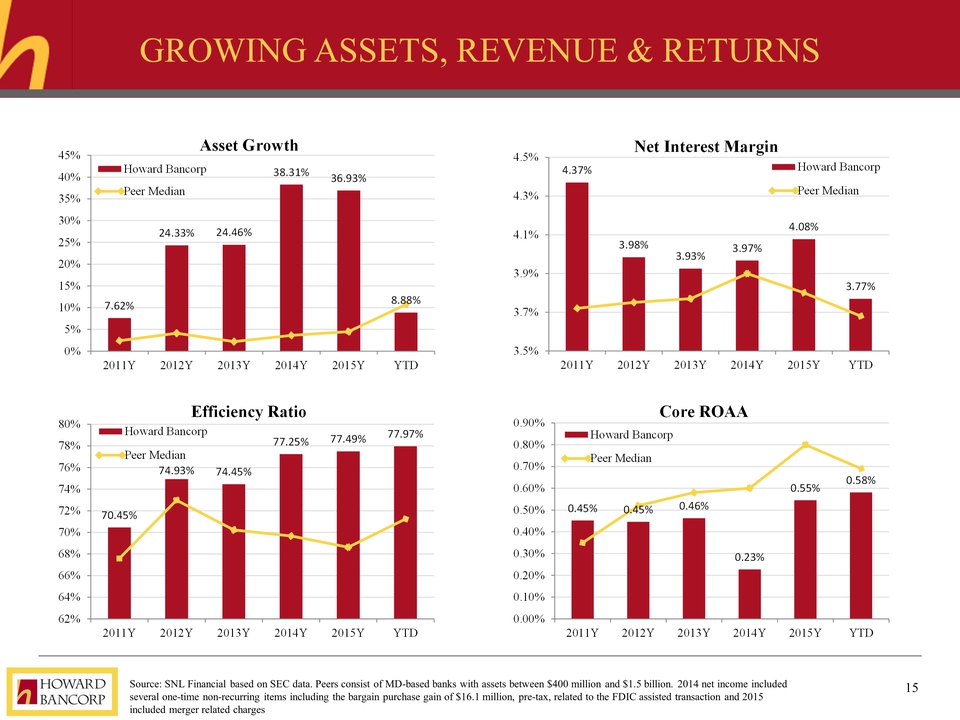

Growing Assets, Revenue & Returns Source: SNL Financial based on SEC data. Peers consist of MD-based banks with assets between $400 million and $1.5 billion. 2014 net income included several one-time non-recurring items including the bargain purchase gain of $16.1 million, pre-tax, related to the FDIC assisted transaction and 2015 included merger related charges Asset Growth Net Interest Margin Efficiency Ratio Core ROAA Howard Bancorp Peer Median 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% 2011Y 2012Y 2013Y 2014Y 2015Y YTD 7.62% 24.33% 24.46% 38.31% 36.93% 8.88% 4.5% 4.3% 4.1% 3.9% 3.7% 3.5% 4.37% 3.98% 3.93% 3.97% 4.08% 3.77% 80% 78% 76% 74% 72% 70% 68% 66% 64% 62% 70.45% 74.93% 74.45% 77.25% 77.49% 77.97% 0.905 0.80% 0.70% 0.60% 0.50% 0.40% 0.30% 0.20% 0.10% 0.00% 0.45% 0.45% 0.46% 0.23% 0.55% 0.58%

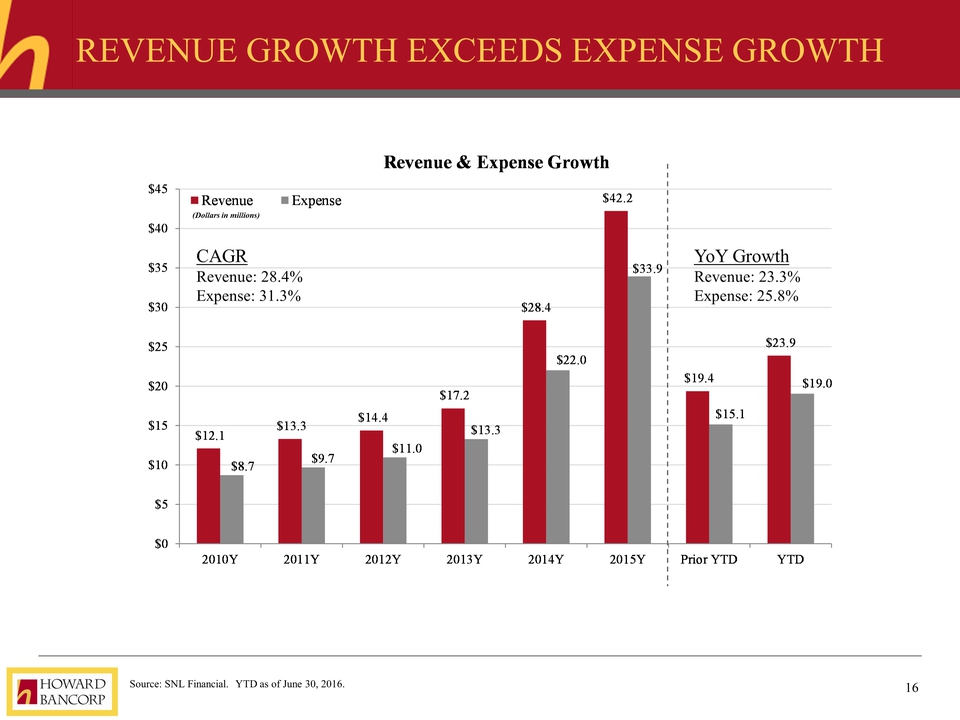

Revenue Growth Exceeds Expense Growth Source: SNL Financial. YTD as of June 30, 2016. CAGR Revenue: 28.4% Expense: 31.3% (Dollars in millions) YoY Growth Revenue: 23.3% Expense: 25.8% Revenue & Expense Growth $45 $40 $35 $30 $25 $20 $15 $10 $5 $0 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y Prior YTD YTD $12.1 $8.7 $13.3 $9.7 $14.4 $11.0 $17.2 $13.3 $28.4 $22.0 $42.2 $33.9 $19.4 $15.1 $23.9 $19.0

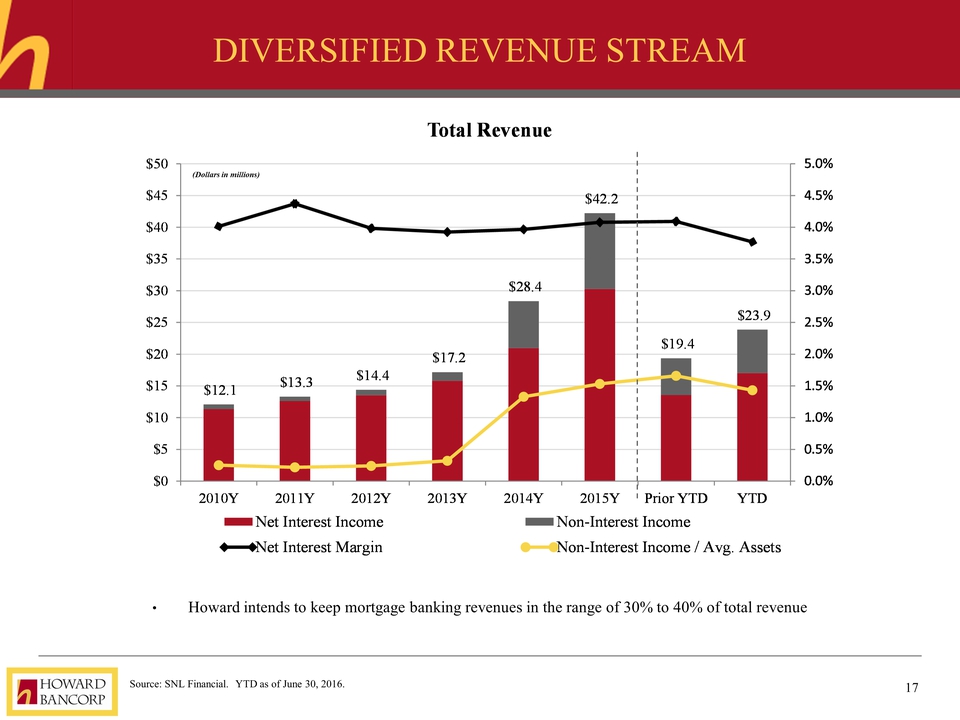

Diversified Revenue Stream (Dollars in millions) Source: SNL Financial. YTD as of June 30, 2016. Howard intends to keep mortgage banking revenues in the range of 30% to 40% of total revenue $50 $45 $40 $35 $30 $25 $20 $15 $5 $0 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y Prior YTD YTD 5.0% 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% Net Interest Income Net Interest Margin Non-Interest Income Non-Interest Income/Avg. Assets $12.1 $13.3 $14.4 $17.2 $28.4 $42.2 $19.4 $23.9

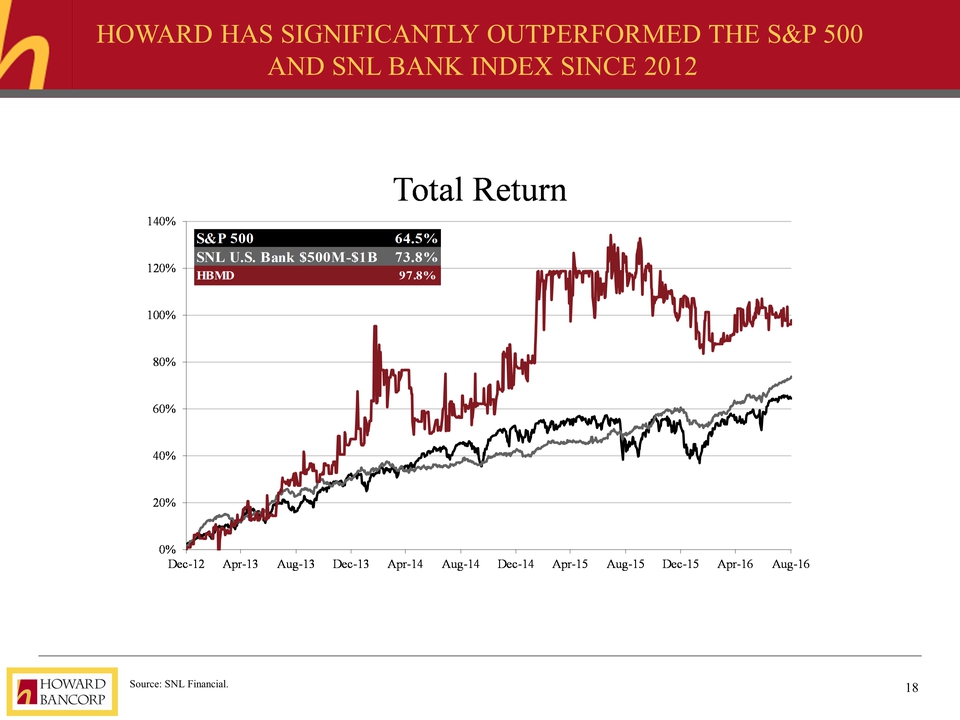

Howard has Significantly Outperformed the S&P 500 and SNL Bank Index Since 2012 Source: SNL Financial. Total Return S&P 500 64.5% SNL U.S. Bank $500M-$1B 73.8% HBMD 97.8% 140% 120% 100% 80% 60% 40% 20% 0% Dec-12 Apr-13 Aug-13 Dec-13 Apr-14 Aug-14 Dec-14 Apr-15 Aug-15 Dec-15 Apr-16 Agu-16

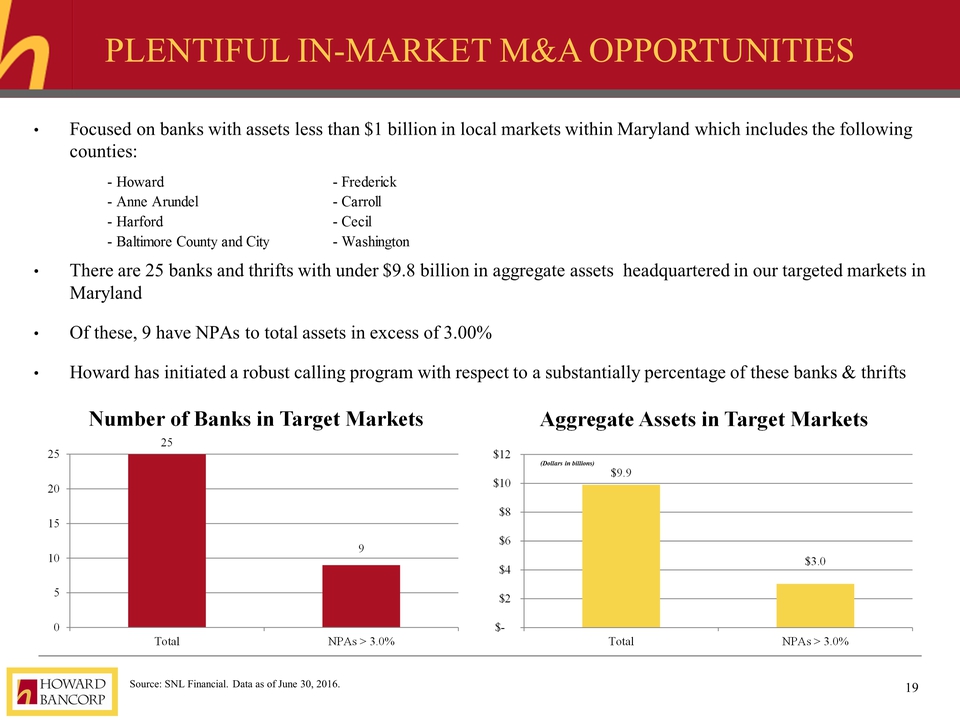

Plentiful in-market M&A Opportunities Source: SNL Financial. Data as of June 30, 2016. (Dollars in billions) Focused on banks with assets less than $1 billion in local markets within Maryland which includes the following counties: There are 25 banks and thrifts with under $9.8 billion in aggregate assets headquartered in our targeted markets in Maryland Of these, 9 have NPAs to total assets in excess of 3.00% Howard has initiated a robust calling program with respect to a substantially percentage of these banks & thrifts Howard Anne Arundel Harford Baltimore County and City Frederick Carroll Cecil Washington Number of Banks in Target Markets Aggregate Assets in Target Markets 25 20 15 10 5 0 Total NPAs > 3.0% 25 9 $12 $10 $8 $6 $4 $2 $- $9.9 43.0

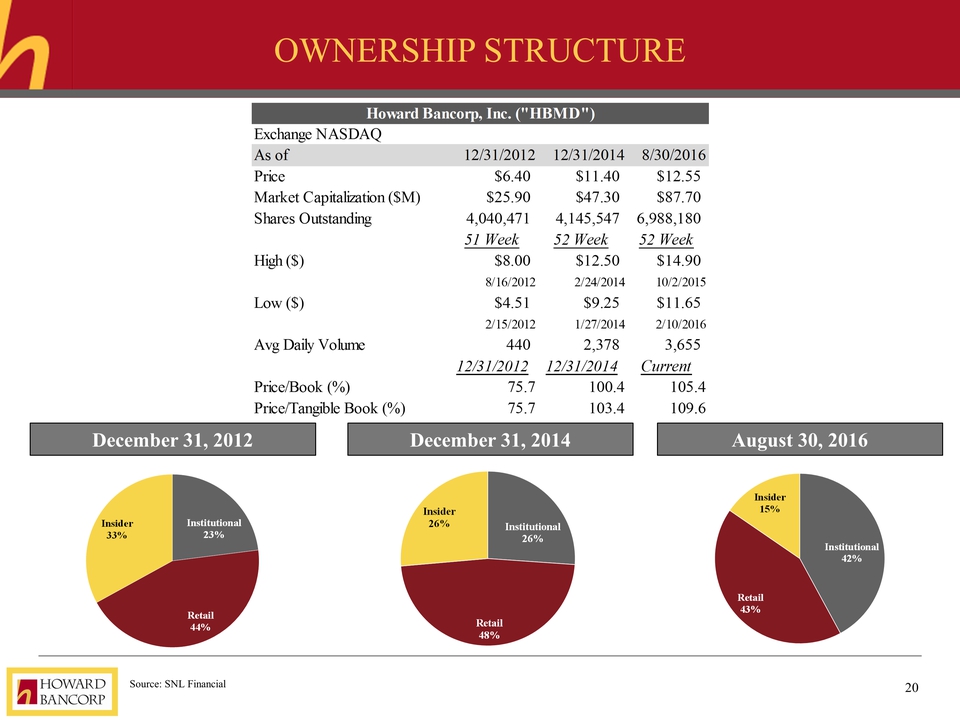

Source: SNL Financial Ownership Structure December 31, 2012 December 31, 2014 August 30, 2016 Howard Bancorp, Inc. (“HBMD”) Exchange NASDAQ AS of Price Market Capitalization ($M) Shares Outstanding High ($) Low ($) Avg Daily Volume Price/Book (%) Price/Tagline Book (%) 12/31/2013 12/31/2014 8/30/2016 $6.40 $25.90 4,040,471 51 week 48.00 8/16/2012 $4.51 2/15/2012 440 12/31/2012 75.7 75.7 $11.40 $47.30 4,145,547 52 week $12.50 2/24/2014 $9.25 1/27/2014 2,378 12/31/2014 100.4 103.4 $12.55 $87.70 6,988,180 52 week $14.90 10/2/2015 $11.65 2/10/2016 3,655 Current 105.4 109.6 December 31, 2012 Insider 33% Institutional 23% Retail 44% December 31, 2014 Insider 26% Institutional 26% Retail 48% August 30, 2016 Insider 15% Institutional 42% Retail 43%

Source: SNL Financial. Data as of 9/1/2016. Top 20 Institutional Owners Institutional Holder Position Shares Out (%) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 EJF Capital LLC T. Rowe Price Group Inc. Stieven Capital Advisors LP Endeavour Capital Advisors Inc. Manulife Asset Management (US) LLC Emerald Advisers Inc Hilton Capital Management LLC SunTrust Banks Inc. High Tower Advisors LLC FJ Capital Management LLC ATEC Profit Sharing Plan Geode Capital Management LLC Context BH Capital Management LP AllianceBernstein LP PNC Financial Services Group Inc. Goldman Sachs Group Inc. BancFunds Co. LLC myCIO Wealth Partners LLC Morgan Stanley Sandy Spring Bank Top 20 Institutional Owners Remaining Institutional Owners Total Institutional Ownership 675,587 595,317 387,704 273,162 264,722 262,499 201,765 58,630 47,344 32,000 20,600 18,478 18,188 17,801 17,500 16,640 11,187 9,000 3,070 1,800 2,932,994 6,788 2,939,782 9.67 8.52 5.55 3.91 3.79 3.76 2.89 0.84 0.68 0.46 0.29 0.26 0.26 0.25 0.25 0.24 0.16 0.13 0.04 0.03 41.98 0.08 42.06

Strong & Diverse Board of Directors M&A and Strategic – Head of Global Corporate practice of large international law firm and others with M&A experience Banking: Regulatory – Former and Present members of regional board of Federal Reserve Bank of Maryland and Former member of the Richmond Federal Reserve Bank board Banking: Operations – Former Founders, Chairmen and Board Members of a number of regional financial institutions Technology – Senior executive managers of software solution and IT service firms Accounting – Former senior partners and other senior accounting professionals of both national and regional accounting firms with diverse financial, tax accounting and employee benefits experience Legal – Former and practicing multidisciplinary lawyers from both national and regional law firms Governance – several members who served or advised both small- and mid-cap public company boards with corporate governance and public company policies, procedures and processes awareness and experience Strong Regional Business Affiliations – Members of the regional business community with strong relationships who provide us with referrals and introductions to new customers, as well as, information on the regional business and economic environment and knowledge of real estate and real estate development in our market areas Individual Board Member Information – More information on each director can be found on our website at www.howardbank.com

Investment highlights HBMD has consistently and successfully executed on its business model since its inception and is now one of the leading community banks headquartered in the greater Baltimore market Operating in one of the most attractive and wealthiest counties in the US Experienced management team with strong ties to the local market and conservative risk profile Strong asset quality history with minimal charge-off experience driven by conservative credit culture Attractive and diversified loan portfolio Strong core deposit franchise with 23% non-interest bearing accounts Good core profitability with growing fee based revenue streams Balance of inside ownership growing institutional holders, both legacy and acquired retail holders that are well aligned with all stakeholders Proven acquirer with successful integration and achievement of acquisition related cost savings Employer of choice in the local market with many high profile hires and team lift outs