Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DNIB UNWIND, INC. | d254410d8k.htm |

Exhibit 99.1

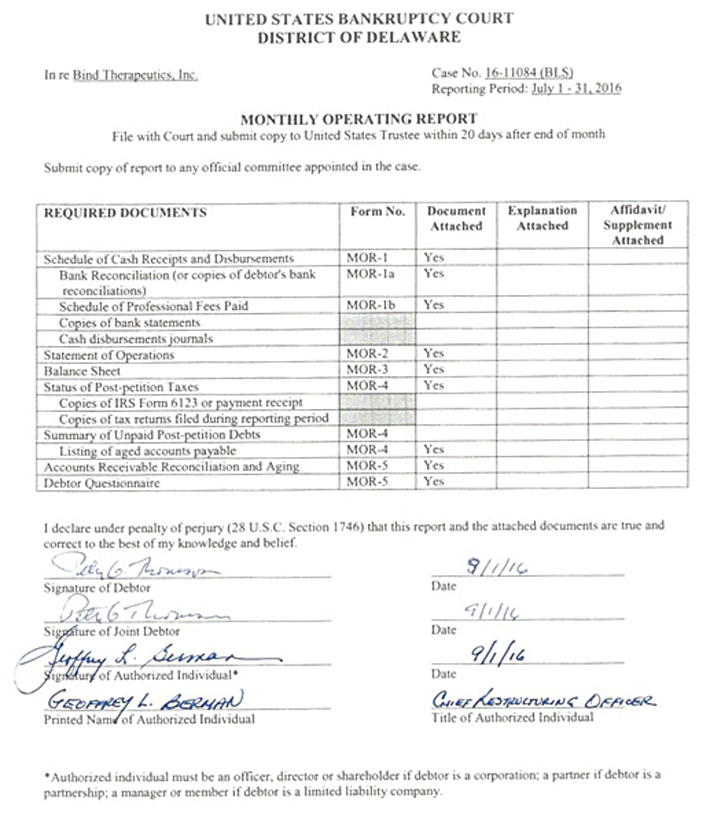

UNITED STATES BANKRUPTCY COURT

DISTRICT OF

DELAWARE

In re Bind Therapeutics, Inc.

Case No 16-11084 (BLS)

Reporting Period: July 1 - 31, 2016

MONTHLY OPERATING REPORT

File with Court and submit copy to United States Trustee within 20 days after end of month

Submit copy of report to any official committee appointed in the case

REQUIRED DOCUMENTS Form No. Document Attached Explanation Attached Affidavit/ Supplement Attached

Schedule of Cash Receipts and Disbursements MOR-1 Yes

Bank Reconciliation (or copies of

debtor’s bank reconciliations) MOR-1a Yes

Schedule of Professional Fees Paid MOR-1b Yes

Copies of bank statements

Cash disbursements journals

Statement of Operations MOR-2 Yes

Balance Sheet MOR-3 Yes

Status of Post-petition Taxes MOR-4 Yes

Copies of IRS Form 6123 or payment receipt

Copies of tax returns filed during reporting period

Summary of Unpaid Post-petition Debts

MOR-4

Listing of aged accounts payable MOR-4 Yes

Accounts Receivable

Reconciliation and Aging MOR-5 Yes

Debtor Questionnaire MOR-5 Yes

1 declare

under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief.

Signature of Debtor Date 9/1/16

Signature of Joint Debtor Date 9/1/16

Signature of Authorized Individual* Date 9/1/16

Printed Name of Authorized

Individual Title of Authorized Individual

* Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a

partnership; a manager or member if debtor is a limited liability company.

| In re Bind Therapeutics, Inc. | Case No. 16-11084 (BLS) | |

| Debtor | Reporting Period: July 31, 2016 |

SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS

Amounts reported should be per the debtor’s books, not the bank statement. The beginning cash should be the ending cash from the prior month or, if this is the first report, the amount should be the balance on the date the petition was filled. The amounts reported in the “CURRENT MONTH - ACTUAL” column must equal the sum of the four bank account columns. The amounts reported in the “PROJECTED” columns should be taken from the SMALL BUSINESS INITIAL REPORT (FORM IR-1). Attach copies of the bank statements and the cash disbursements journal. The total disbursements listed in the disbursements journal must equal the total disbursements reported on this page. A bank reconciliation must be attached for each account. [See MOR-1 (CONT)]

| BANK ACCOUNTS | CURRENT MONTH | CUMULATIVE FILING TO DATE | ||||||||||||||||||||||||||

| OPER. | PAYROLL | TAX | OTHER | ACTUAL | PROJECTED | ACTUAL |

PROJECTED | |||||||||||||||||||||

| CASH BEGINNING OF MONTH |

6,514,214.49 | — | — | — | 6,514,214.49 | |||||||||||||||||||||||

| RECEIPTS | ||||||||||||||||||||||||||||

| CASH SALES |

||||||||||||||||||||||||||||

| ACCOUNTS RECEIVABLE |

||||||||||||||||||||||||||||

| LOANS AND ADVANCES |

||||||||||||||||||||||||||||

| SALE OF ASSETS |

||||||||||||||||||||||||||||

| OTHER (INVESTMENT INCOME) |

0.31 | 0.31 | ||||||||||||||||||||||||||

| TRANSFERS (FROM DIP ACCTS) |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| TOTAL RECEIPTS |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| DISBURSEMENTS | ||||||||||||||||||||||||||||

| NET PAYROLL |

349,497.28 | 349,497.28 | ||||||||||||||||||||||||||

| PAYROLL TAXES |

232,063.68 | 232,063.68 | ||||||||||||||||||||||||||

| SALES, USE & OTHER TAXES |

||||||||||||||||||||||||||||

| INVENTORY PURCHASES |

||||||||||||||||||||||||||||

| SECURED RENTAL/LEASES |

218.94 | 218.94 | ||||||||||||||||||||||||||

| INSURANCE |

61,961.34 | 61,961.34 | ||||||||||||||||||||||||||

| ADMINISTRATIVE |

131,515.10 | 131,515.10 | ||||||||||||||||||||||||||

| SELLING |

||||||||||||||||||||||||||||

| OTHER (RESEARCH AND DEV.) |

409,571.39 | 409,571.39 | ||||||||||||||||||||||||||

| OTHER (REPAY HERCULES DEBT) |

541,334.30 | 541,334.30 | ||||||||||||||||||||||||||

| OWNER DRAW* |

||||||||||||||||||||||||||||

| TRANSFERS (TO DIP ACCTS) |

||||||||||||||||||||||||||||

| PROFESSIONAL FEES |

446,108.25 | 446,108.25 | ||||||||||||||||||||||||||

| U.S. TRUSTEE QUARTERLY FEES |

||||||||||||||||||||||||||||

| COURT COSTS |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| TOTAL DISBURSEMENTS |

2,172,269.97 | 2,172,269.97 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| NET CASH FLOW |

2,172,269.66 | 2,172,269.66 | ||||||||||||||||||||||||||

| (RECEIPTS LESS DISBURSEMENTS) |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| CASH - END OF MONTH |

4,341,944.52 | 4,341,944.52 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| * | COMPENSATION TO SOLE PROPRIETORS FOR SERVICES RENDERED TO BANKRUPTCY ESTATE |

THE FOLLOWING SECTION MUST BE COMPLETED

| DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES (FROM CURRENT MONTH ACTUAL COLUMN) |

| |||

| TOTAL DISBURSEMENTS |

$ | 2,172,269.97 | ||

| LESS: TRANSFERS TO DEBTOR IN POSSESSION ACCOUNTS |

$ | |||

| PLUS: ESTATE DISBURSEMENTS MADE BY OUTSIDE SOURCES (i.e. from escrow accounts) |

$ | |||

|

|

|

|||

| TOTAL DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES |

$ | 2,172,269.97 | ||

|

|

|

|||

BIND Therapeutics et al.

MOR 1a - Schedule of Disbursements By Legal Entity

Reporting Period: July 1, 2016 - July 31, 2016

| Case No. |

Entity |

July 1-31, 2016 | ||||

| 16-11084 |

BIND Therapeutics, Inc. |

(2,172,269.97 | ) | |||

| 16-11085 |

BIND Biosciences Security Corp. |

— | ||||

|

|

|

|||||

| Total |

(2,172,269.97 | ) | ||||

|

|

|

|||||

BIND Therapeutics et al.

MOR 1a - Bank Reconciliation

Reporting Period: July 1-31, 2016

| Case No. |

Entity |

Bank Acct # |

7/31/16 Book Balance |

(+/-) Outstanding Checks |

(+/-) Outstanding ACH |

(+/-) Outstanding Other |

7/31/16 Bank Balance |

Bank |

Description | |||||||||||||||||||

| 16-11084 | BIND Therapeutics, Inc. |

4235 | 4,340,214.68 | 148,266.86 | — | — | 4,488,481.54 | Comerica |

Operating Account | |||||||||||||||||||

| 16-11084 | BIND Therapeutics, Inc. |

4896 | 559,665.16 | — | — | — | 559,665.16 | Comerica |

Restricted Cash | |||||||||||||||||||

| 16-11084 | BIND Therapeutics, Inc. |

6013 | 477.69 | — | — | — | 477.69 | Comerica |

Money Market | |||||||||||||||||||

| 16-11084 | BIND Therapeutics, Inc. |

4120 | 1,182.07 | — | — | — | 1,182.07 | Capital Advisors Group |

Investment Account | |||||||||||||||||||

| 16-11085 | BIND Biosciences Security Corp. |

4121 | 70.08 | — | — | — | 70.08 | Capital Advisors Group |

Investment Account | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| TOTAL | 4,901,609.68 | 148,266.86 | — | — | 5,049,876.54 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| In re Bind Therapeutics, Inc. | Case No. 16-11084 (BLS) | |

| Debtor | Reporting Period: July 1-31, 2016 |

SCHEDULE OF PROFESSIONAL FEES AND EXPENSES PAID

This schedule is to include all retained professional payments from case inception to current month.

| Check | Amount Paid | Year-To-Date | ||||||||||||||||||||||||||||||||

| Payee |

Period Covered |

Amount Covered |

Payor | Number | Date | Fees | Expenses | Fees | Expenses | |||||||||||||||||||||||||

|

*The following payments were made via escrow / retainer account as noted at the bottom:

|

| |||||||||||||||||||||||||||||||||

| Richards, Layton, Finger |

May 1-31, 2016 |

|

Bind Therapeutics, Inc. (via escrow) |

|

Wire | 7/18/16 | $ | 88,911.60 | $ | 7,259.75 | $ | 124,509.60 | $ | 11,791.81 | ||||||||||||||||||||

| Prime Clerk |

May 1 – June 30, 2016 |

|

Bind Therapeutics, Inc. (via escrow) |

|

wire | 7/19/16 | $ | 48,689.50 | $ | 44,499.70 | $ | 54,761.50 | $ | 44,545.92 | ||||||||||||||||||||

| Latham & Watkins |

May 1 – May 31, 2016 |

|

Bind Therapeutics, Inc. (via escrow) |

|

wire | 7/19/16 | $ | 757,066.80 | $ | 37,875.37 | $ | 1,782,443.3 | $ | 40,266.53 | ||||||||||||||||||||

*Note: Richards, Layton, Finger manages the escrow account for Bankruptcy professionals, including RLF, Latham & Watkins and Prime Clerk.

| In re Bind Therapeutics, Inc. | Case No. 16-11084 (BLS) | |

| Reporting Period: July 1-31, 2016 |

Income Statement

| YTD May | YTD June | YTD July | ||||||||||

| Partnership Revenue |

$ | 1,872,593.21 | $ | 6,355,862.42 | $ | 11,580,738.39 | ||||||

|

|

|

|

|

|

|

|||||||

| Total Revenue |

||||||||||||

| R&D |

||||||||||||

| Salary & Benefits |

$ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

| Base Salaries |

$ | 3,749,448.44 | $ | 4,286,235.76 | $ | 4,564,607.58 | ||||||

| Contracted Labor |

$ | 212,714.93 | $ | 224,112.68 | $ | 239,732.18 | ||||||

| Payroll Taxes |

$ | 342,632.11 | $ | 370,042.28 | $ | 382,450.94 | ||||||

| Group Health |

$ | 291,502.04 | $ | 358,550.02 | $ | 386,095.92 | ||||||

| Vacation Expense (accrual adj) |

$ | 31,150.00 | $ | 19,150.00 | $ | 19,150.00 | ||||||

| Bonus Expense |

($ | 449,408.00 | ) | ($ | 449,408.00 | ) | ($ | 449,408.00 | ) | |||

|

|

|

|

|

|

|

|||||||

| Total Salary & Benefits |

$ | 4,178,039.52 | $ | 4,808,682.74 | $ | 5,142,628.62 | ||||||

| R&D Consulting |

$ | 78,822.31 | $ | 83,710.63 | $ | 118,014.44 | ||||||

| Depreciation Expense R&D |

$ | 1,086,326.15 | $ | 1,295,135.34 | $ | 1,458,766.36 | ||||||

| Dues, Subscriptions, & Journals R&D |

$ | 177,972.18 | $ | 210,031.39 | $ | 298,573.47 | ||||||

| Conferences |

$ | 20,022.00 | $ | 20,022.00 | $ | 20,022.00 | ||||||

| Travel |

$ | 237,285.24 | $ | 272,782.20 | $ | 239,325.75 | ||||||

| Meals & Entertainment |

$ | 20,203.57 | $ | 25,631.96 | $ | 25,836.36 | ||||||

| External R&D |

||||||||||||

| External R&D |

$ | 447,156.57 | $ | 431,171.37 | $ | 479,149.18 | ||||||

| Pharmacology |

$ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

| Raw Materials |

$ | 646,271.95 | $ | 647,001.95 | $ | 647,211.95 | ||||||

| GLP Tox Study |

$ | 5,198.49 | $ | 5,198.49 | $ | 5,198.49 | ||||||

| GMP Manufacture |

$ | 2,535,783.30 | $ | 2,750,164.16 | $ | 2,410,598.54 | ||||||

| Analytical Activity |

$ | 212,863.78 | $ | 210,918.60 | $ | 194,839.60 | ||||||

| Clinical Trial |

$ | 5,049,986.31 | $ | 5,177,551.62 | $ | 5,302,954.84 | ||||||

|

|

|

|

|

|

|

|||||||

| Total External R&D |

$ | 8,897,260.40 | $ | 9,222,006.19 | $ | 9,039,952.60 | ||||||

| Lab Expense |

$ | 140,725.10 | $ | 151,808.81 | $ | 151,808.81 | ||||||

| Lab Supplies |

$ | 980,813.08 | $ | 1,129,264.96 | $ | 1,154,742.66 | ||||||

| Lab Equipment Lease Expense |

$ | 13,629.95 | $ | 13,629.95 | $ | 21,965.58 | ||||||

| Licenses, Permits, Safety |

$ | 50.00 | $ | 4,050.00 | $ | 4,050.00 | ||||||

| MIT Fees |

$ | 99,193.53 | $ | 124,204.61 | $ | 144,443.28 | ||||||

| Other In License Fees |

$ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

| Facility Allocation In from G&A |

$ | 1,210,729.34 | $ | 1,454,036.32 | $ | 1,306,078.45 | ||||||

| R&D Stock Compensation-EE |

$ | 208,917.00 | $ | 396,242.00 | $ | 396,242.00 | ||||||

| R&D Stock Compensation-Consulta |

$ | 18,337.00 | $ | 30,654.00 | $ | 30,654.00 | ||||||

|

|

|

|

|

|

|

|||||||

| Total Other R&D |

$ | 2,672,395.00 | $ | 3,303,890.65 | $ | 3,209,984.78 | ||||||

|

|

|

|

|

|

|

|||||||

| Total R&D |

$ | 17,368,326.37 | $ | 19,241,893.10 | $ | 19,553,104.38 | ||||||

| Charges to NIST / RUSSIA Ops |

$ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

| NIST Salaries & Benefits |

$ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

|

|

|

|

|

|

|

|||||||

| Other Russian Expenses |

$ | 720.72 | $ | 720.72 | $ | 720.72 | ||||||

|

|

|

|

|

|

|

|||||||

| Total NIST GRANT / Russia Charges |

$ | 720.72 | $ | 720.72 | $ | 720.72 | ||||||

| Total R&D |

$ | 17,369,047.09 | $ | 19,242,613.82 | $ | 19,553,825.10 | ||||||

| G&A |

||||||||||||

| Salaries & Benefits |

||||||||||||

| Salary & Benefits |

$ | 10,626.00 | $ | 12,296.00 | $ | 13,000.01 | ||||||

| Base Salaries |

$ | 1,276,755.79 | $ | 1,531,591.19 | $ | 1,809,963.02 | ||||||

| Contracted Labor |

$ | 120,998.45 | $ | 183,459.20 | $ | 218,981.70 | ||||||

| Payroll Taxes |

$ | 121,903.10 | $ | 131,573.74 | $ | 143,982.39 | ||||||

| Group Health |

$ | 71,875.51 | $ | 89,637.50 | $ | 117,183.40 | ||||||

| Vacation Expense (accrual adj) |

$ | 35,000.00 | $ | 29,000.00 | $ | 29,000.00 | ||||||

| Bonus Expense |

($ | 416,911.00 | ) | ($ | 416,911.00 | ) | ($ | 416,911.00 | ) | |||

|

|

|

|

|

|

|

|||||||

| Total G&A Salaries & Benefits |

$ | 1,220,247.85 | $ | 1,560,646.63 | $ | 1,915,199.52 | ||||||

| G&A Consulting |

$ | 677,964.59 | $ | 859,840.74 | $ | 829,857.66 | ||||||

| Depreciation Expense G&A |

$ | 229,446.67 | $ | 275,184.90 | $ | 362,404.02 | ||||||

| Dues, Subscriptions, & Journals R&D |

$ | 157,033.43 | $ | 173,391.23 | $ | 238,639.76 | ||||||

| Conferences |

$ | 7,717.33 | $ | 7,717.33 | $ | 7,717.33 | ||||||

| BOD Fees |

$ | 166,161.29 | $ | 198,786.29 | $ | 198,786.29 | ||||||

| Facility Expense |

||||||||||||

| Rent |

$ | 1,041,396.11 | $ | 1,254,061.39 | $ | 397,524.01 | ||||||

| Operating Expense |

$ | 595,160.94 | $ | 713,479.63 | $ | 673,479.63 | ||||||

| Free Rent Adjustment (GAAP) |

($ | 72,577.75 | ) | ($ | 89,127.18 | ) | $ | 58,451.45 | ||||

| Tenant Improvement - AMORT’N |

($ | 204,899.95 | ) | ($ | 245,879.94 | ) | $ | 196,855.94 | ||||

| Rent Parking and Transportation |

$ | 44,080.00 | $ | 51,890.00 | $ | 59,700.00 | ||||||

| RENT - 114 Commonwealth Ave |

$ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

| Repairs & Maintenance |

$ | 84,493.33 | $ | 96,494.50 | $ | 98,991.63 | ||||||

| Moving Expense |

$ | 25,759.00 | $ | 36,627.00 | $ | 36,627.00 | ||||||

| Facility Alloction Out to R&D |

($ | 1,210,729.34 | ) | ($ | 1,454,036.32 | ) | ($ | 1,306,078.45 | ) | |||

|

|

|

|

|

|

|

|||||||

| Total Facility Expense |

$ | 302,682.34 | $ | 363,509.08 | $ | 215,551.21 | ||||||

| Legal |

$ | 2,903,791.91 | $ | 3,403,427.51 | $ | 3,853,709.51 | ||||||

| Legal Patent |

$ | 538,893.69 | $ | 539,145.50 | $ | 589,188.92 | ||||||

| Insurance |

$ | 75,087.20 | $ | 80,654.48 | $ | 156,735.47 | ||||||

| Insurance - D&O |

$ | 298,283.35 | $ | 357,940.02 | $ | 656,223.33 | ||||||

| Bank Service Charge |

$ | 9,348.12 | $ | 9,741.90 | $ | 9,741.97 | ||||||

| Audit and Valuation Fees |

$ | 259,617.00 | $ | 295,450.00 | $ | 200,450.00 | ||||||

| Office Expense & Supplies |

||||||||||||

| Office Expense & Supplies |

$ | 46,409.91 | $ | 51,699.98 | $ | 57,018.86 | ||||||

| Kitchen Supplies |

$ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

| Computer Supplies |

$ | 19,035.27 | $ | 18,174.70 | $ | 18,174.70 | ||||||

| Office Equipment Lease |

$ | 5,724.45 | $ | 6,649.20 | $ | 8,011.83 | ||||||

|

|

|

|

|

|

|

|||||||

| Total Office Expense & Supplies |

$ | 71,169.63 | $ | 76,523.88 | $ | 83,205.39 | ||||||

| P/R, Marketing & Website |

$ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

| Recruiting |

||||||||||||

| Recruiting |

$ | 1,207.00 | $ | 1,207.00 | $ | 1,207.00 | ||||||

|

|

|

|

|

|

|

|||||||

| Total Recruiting |

$ | 1,207.00 | $ | 1,207.00 | $ | 1,207.00 | ||||||

| Postage |

$ | 32,449.80 | $ | 36,005.35 | $ | 37,657.55 | ||||||

| Printing & Stationery |

$ | 41,819.26 | $ | 66,819.93 | $ | 73,252.90 | ||||||

| State & Local Tax |

$ | 114,514.49 | $ | 137,414.49 | $ | 138,617.95 | ||||||

| Telephone & Internet |

$ | 26,601.14 | $ | 30,739.01 | $ | 32,636.47 | ||||||

| Travel |

||||||||||||

| Travel |

$ | 57,121.90 | $ | 66,348.85 | $ | 57,339.12 | ||||||

| Meals & Entertainment |

$ | 32,290.65 | $ | 40,071.58 | $ | 57,750.46 | ||||||

|

|

|

|

|

|

|

|||||||

| Total Travel |

$ | 89,412.55 | $ | 106,420.43 | $ | 115,089.58 | ||||||

| Training |

$ | 6,494.82 | $ | 6,494.82 | $ | 6,494.82 | ||||||

| Unallowed Expenses |

$ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

|

|

|

|

|

|

|

|||||||

| G&A Stock Compensation-EE |

$ | 185,558.00 | $ | 332,580.00 | $ | 332,580.00 | ||||||

| G&A Stock Compensation-Consulta |

$ | 155,353.00 | $ | 241,521.00 | $ | 241,521.00 | ||||||

|

|

|

|

|

|

|

|||||||

| Total G&A |

$ | 7,570,854.46 | $ | 9,161,161.52 | $ | 10,296,467.65 | ||||||

|

|

|

|

|

|

|

|||||||

| Total Expenses |

$ | 24,939,901.55 | $ | 28,403,775.34 | $ | 29,850,292.75 | ||||||

|

|

|

|

|

|

|

|||||||

| Net Ordinary Income |

($ | 23,067,308.34 | ) | ($ | 22,047,912.92 | ) | ($ | 18,269,554.36 | ) | |||

| Other Income |

||||||||||||

| Interest Income |

$ | 28,445.98 | $ | 28,514.98 | $ | 28,586.39 | ||||||

| Other Income |

($ | 205,364.65 | ) | ($ | 205,364.65 | ) | ($ | 205,364.65 | ) | |||

|

|

|

|

|

|

|

|||||||

| Total Other Income |

($ | 176,918.67 | ) | ($ | 176,849.67 | ) | ($ | 176,778.26 | ) | |||

| Other Expense |

||||||||||||

| Interest Expenses |

$ | 1,144,320.00 | $ | 1,168,494.74 | $ | 1,229,951.52 | ||||||

| Interest Expense - Warrants |

($ | 1,099,000.00 | ) | ($ | 2,612,224.25 | ) | ($ | 2,612,224.25 | ) | |||

|

|

|

|

|

|

|

|||||||

| Total Other Expense |

$ | 45,320.00 | ($ | 1,443,729.51 | ) | ($ | 1,382,272.73 | ) | ||||

| Net Other Income (Expense) |

($ | 222,238.67 | ) | $ | 1,266,879.84 | $ | 1,205,494.47 | |||||

| NET INCOME (LOSS) |

($ | 23,289,547.01 | ) | ($ | 20,781,033.08 | ) | ($ | 17,064,059.89 | ) | |||

|

|

|

|

|

|

|

|||||||

| In re Bind Therapeutics, Inc. | Case No. 16-11084 (BLS) | |

| Reporting Period: July 31, 2016 |

Balance Sheet

| May | June | July | ||||||||||||

| ASSETS |

||||||||||||||

| Current Assets |

||||||||||||||

| Checking/Savings |

||||||||||||||

| Cash |

1000 | 70.08 | 1,251.93 | 1,252.15 | ||||||||||

| Cash-Operating |

1002 | 8,583,197.23 | 6,512,484.89 | 4,340,214.68 | ||||||||||

| Cash-MM |

1003 | 477.65 | 477.67 | 477.69 | ||||||||||

| Total Cash and cash equivalents |

8,583,744.96 | 6,514,214.49 | 4,341,944.52 | |||||||||||

| Accounts Receivable |

||||||||||||||

| Accounts Receivables |

1100 | 831,757.28 | 4,095,902.99 | 4,612,438.36 | ||||||||||

| Total Account Receivable |

831,757.28 | 4,095,902.99 | 4,612,438.36 | |||||||||||

| Other Current Assets |

||||||||||||||

| Prepaid Expense |

1200 | 1,933,509.78 | 1,942,597.64 | 1,091,874.63 | ||||||||||

| Prepaid Clinical |

1202 | 620,610.68 | 718,910.71 | 1,500,000.00 | ||||||||||

| Other Receivables |

1205 | 1,181.94 | 0.21 | 0.21 | ||||||||||

| Other Current Assets |

1210 | 95,496.68 | — | — | ||||||||||

| Total Other Current Assets |

2,650,799.08 | 2,661,508.56 | 2,591,874.84 | |||||||||||

| Short-term Investments |

1220 | — | — | — | ||||||||||

| Total Current Assets |

12,066,301.32 | 13,271,626.04 | 11,546,257.72 | |||||||||||

| Fixed Assets |

||||||||||||||

| Lab Equipment -Capital Lease |

1325 | 74,553.96 | 74,553.96 | 74,553.96 | ||||||||||

| Tenant LeaseHold Improvements |

(1360 TO 1361) | 2,383,033.30 | 2,383,033.30 | 2,383,033.30 | ||||||||||

| Computer Equipment |

1300 | 172,636.59 | 172,636.59 | 172,636.59 | ||||||||||

| Furniture & Fixtures |

1310 | 92,107.97 | 92,107.97 | 92,107.97 | ||||||||||

| Lab Equipment |

1320 | 11,625,033.30 | 11,625,033.30 | 11,625,033.30 | ||||||||||

| Leasehold Improvements |

1350 | 2,319,570.32 | 2,319,570.32 | 2,319,570.32 | ||||||||||

| Assets Not Yet in Service |

1385 | 0.40 | 0.40 | 0.40 | ||||||||||

| Accumulated Depreciation |

1390 | (8,042,159.53 | ) | (8,296,706.95 | ) | (8,547,557.09 | ) | |||||||

| Total Fixed Assets |

8,624,776.31 | 8,370,228.89 | 8,119,378.75 | |||||||||||

| Other Assets |

||||||||||||||

| Investments-Securities Corp. |

1600 | (46,060.51 | ) | (46,060.51 | ) | (46,060.51 | ) | |||||||

| Investment in Sub - BIND (RUS) |

1610 | 11,069,998.00 | 11,069,998.00 | 11,069,998.00 | ||||||||||

| Restricted Cash |

1700 | 559,525.27 | 559,594.06 | 559,665.16 | ||||||||||

| Total Other Assets |

11,583,462.76 | 11,583,531.55 | 11,583,602.65 | |||||||||||

| TOTAL ASSETS |

32,274,540.39 | 33,225,386.48 | 31,249,239.12 | |||||||||||

| LIABILITIES & EQUITY |

||||||||||||||

| Current Liabilities |

||||||||||||||

| Accounts Payable |

||||||||||||||

| Accounts Payable |

2000 | 6,116,563.28 | 6,518,247.15 | 7,443,755.65 | ||||||||||

| BIND Credit Cards |

2010 | 16,408.37 | 16,408.37 | 16,408.37 | ||||||||||

| Accrued Purchases |

2005 | 260,660.72 | 299,519.45 | 302,314.89 | ||||||||||

| Total Accounts Payable |

6,393,632.37 | 6,834,174.97 | 7,762,478.91 | |||||||||||

| Other Current Liabilities |

||||||||||||||

| Deferred Revenue |

2150 | 2,854,982.79 | 3,166,921.28 | — | ||||||||||

| Deferred Rent-ST |

2220 | 647,843.92 | 590,314.50 | — | ||||||||||

| VC Loan - St |

2260 | 8,151,323.54 | 8,339,466.91 | 7,859,589.39 | ||||||||||

| FSA Withholding |

2015 | 14,876.76 | 12,919.81 | 5,027.94 | ||||||||||

| Accrued Expense |

2100 | 1,565,750.01 | 1,201,750.01 | 915,750.01 | ||||||||||

| Accrued Clinical |

2105 | 958,999.65 | 1,360,299.68 | 1,360,299.68 | ||||||||||

| Accrued Manufacturing |

2107 | 1,643,000.00 | 1,059,000.00 | 600,000.00 | ||||||||||

| Accrued Bonus |

2109 | — | — | — | ||||||||||

| Accrued Vacation |

2111 | 311,000.00 | 293,000.00 | 293,000.00 | ||||||||||

| Accrued G&A Consulting |

2113 | 37,666.00 | 15,000.00 | 20,000.00 | ||||||||||

| Accrued Taxes |

2117 | 397,300.00 | 420,200.00 | 420,200.00 | ||||||||||

| 401K Withheld |

2110 | — | — | — | ||||||||||

| Accrued Legal |

2119 | 1,577,000.00 | 1,599,500.00 | 1,599,500.00 | ||||||||||

| Accrued Audit |

2121 | 134,167.00 | 170,000.00 | 75,000.00 | ||||||||||

| Payroll Liabilities |

2200 | 0.02 | — | — | ||||||||||

| Total Other Current Liabilities |

18,293,909.69 | 18,228,372.19 | 13,148,367.02 | |||||||||||

| Total Current Liabilities |

24,687,542.06 | 25,062,547.16 | 20,910,845.93 | |||||||||||

| Long Term Liabilities |

||||||||||||||

| Warrant Liability |

2245 | 1,795,000.00 | 140,000.00 | 140,000.00 | ||||||||||

| Deferred Rent-LT |

2500 | — | — | — | ||||||||||

| Deferred Revenue-LT |

2530 | 2,251,924.26 | 1,541,419.32 | — | ||||||||||

| VC Loan |

2600 | — | — | — | ||||||||||

| VC Loan back end fee amort |

2610 | — | — | — | ||||||||||

| Total Long Term Liabilities |

4,046,924.26 | 1,681,419.32 | 140,000.00 | |||||||||||

| Total Liabilities |

28,734,466.32 | 26,743,966.48 | 21,050,845.93 | |||||||||||

| Equity |

||||||||||||||

| Opening Balance Equity |

3000 | (54,910.87 | ) | (54,910.87 | ) | (54,910.87 | ) | |||||||

| Common Stock |

3100 | 2,081.47 | 2,081.47 | 2,081.47 | ||||||||||

| Paid in Capital |

3200 | 194,898,702.05 | 195,331,534.05 | 195,331,534.05 | ||||||||||

| Unrealized Gains/Loss on Investments |

3210 | — | — | — | ||||||||||

| Retained Earnings |

(3900 TO 3901) | (168,016,251.57 | ) | (168,016,251.57 | ) | (168,016,251.57 | ) | |||||||

| Net Income |

(4000 TO 9900) | (23,289,547.01 | ) | (20,781,033.08 | ) | (17,064,059.89 | ) | |||||||

| Total Equity |

3,540,074.07 | 6,481,420.00 | 10,198,393.19 | |||||||||||

| TOTAL LIABILITIES & EQUITY |

32,274,540.39 | 33,225,386.48 | 31,249,239.12 | |||||||||||

| In re BIND Therapeutics, Inc. | Case No. 16-11084 (BLS) | |

| Debtor | Reporting Period: July 31, 2016 |

STATUS OF POSTPETITION TAXES

The beginning tax liability should be the ending liability from the prior month or, if this is the first report, the amount should be zero. Attach photocopies of IRS Form 6123 or payment receipt to verify payment or deposit of federal payroll taxes.

Attach photocopies of any tax returns filed during the reporting period.

| Federal |

Beginning Tax Liability | Amount Withheld or Accrued | Amount Paid | Date Paid | Check No. or EFT |

Ending Tax Liability | ||||||||||||||

| Withholding |

— | 101,611.42 | 101,611.42 | 7/15 & 7/31 | Wire | — | ||||||||||||||

| FICA-Employee |

— | 24,817.27 | 24,817.27 | 7/15 & 7/31 | Wire | — | ||||||||||||||

| FICA-Employer |

— | 24,817.31 | 24,817.31 | 7/15 & 7/31 | Wire | — | ||||||||||||||

| Unemployment |

— | — | — | |||||||||||||||||

| Income |

— | — | — | |||||||||||||||||

| Other: Medicare surtax |

— | 743.60 | 743.60 | 7/15 & 7/31 | Wire | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Federal Taxes |

— | 151,989.60 | 151,989.60 | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| State and Local |

||||||||||||||||||||

| Withholding |

— | 25,561.21 | 25,561.21 | 7/15 & 7/31 | Wire | — | ||||||||||||||

| Sales |

— | — | — | |||||||||||||||||

| Excise |

— | |||||||||||||||||||

| Unemployment |

— | — | — | |||||||||||||||||

| Real Property |

— | |||||||||||||||||||

| Personal Property |

142,200.00 | — | — | 142,200.00 | ||||||||||||||||

| Other: DE Franchise Tax |

90,000.00 | — | — | 90,000.00 | ||||||||||||||||

| Other: BIND-RUS |

250,000.00 | — | 250,000.00 | |||||||||||||||||

| Other: E&Y |

10,000.00 | — | 10,000.00 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total State and Local |

492,200.00 | 25,561.21 | 25,561.21 | 492,200.00 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Taxes |

492,200.00 | 177,550.81 | 177,550.81 | 492,200.00 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

SUMMARY OF UNPAID POSTPETITION DEBTS

Attach aged listing of accounts payable.

| Number of Days Past Due | ||||||||||||||||||||||||

| Current | 0-30 | 31-60 | 61-90 | >90 | Total | |||||||||||||||||||

| Accounts Payable |

28,647 | — | 28,647 | |||||||||||||||||||||

| Wages Payable |

— | |||||||||||||||||||||||

| Taxes Payable |

— | |||||||||||||||||||||||

| Rent/Leases-Building |

— | |||||||||||||||||||||||

| Rent/Leases-Equipment |

— | |||||||||||||||||||||||

| Secured debt |

— | |||||||||||||||||||||||

| Professional fees |

45,643 | 58,731 | 104,375 | |||||||||||||||||||||

| Amounts due to insiders |

— | |||||||||||||||||||||||

| Other: Biology/Chemistry |

— | |||||||||||||||||||||||

| Other: Mfg |

— | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Postpetition debts: |

74,291 | 58,731 | — | — | — | 133,022 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Explain how and when the Debtor intends to pay any past-due postpetition debts.

Payments for post-petition debts will be paid in the normal course of business per the budget submitted to the Court; Professional fees will follow the process for Ordinary Course Professionals. * “Insider” is defined in 11 U.S.C. Section 101(31).

| In re BIND THERAPEUTICS, INC. | Case No. 16-11084 (BLS) | |

| Debtor | Reporting Period: July 31, 2016 |

ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

| Accounts Receivable Reconciliation |

Amount | |||||||

| Total Accounts Receivable at the beginning of the reporting period |

$ | 4,095,902.99 | ||||||

| + Amounts billed during the period |

$ | 516,535.37 | ||||||

| - Amounts collected during the period |

||||||||

|

|

|

|

|

|||||

| Total Accounts Receivable at the end of the reporting period |

$ | 4,612,438.36 | ||||||

|

|

|

|

|

|||||

| Accounts Receivable Aging |

Amount | |||||||

| 0 - 30 days old |

$ | 516,535.37 | ||||||

| 31 - 60 days old |

$ | 4,073,607.03 | ||||||

| 61 - 90 days old |

$ | 22,295.96 | ||||||

| 91+ days old |

||||||||

|

|

|

|

|

|||||

| Total Accounts Receivable |

||||||||

|

|

|

|

|

|||||

| Amount considered uncollectible (Bad Debt) |

||||||||

|

|

|

|

|

|||||

| Accounts Receivable (Net) |

$ | 4,612,438.36 | ||||||

|

|

|

|

|

|||||

DEBTOR QUESTIONNAIRE

| Must be completed each month |

Yes |

No | ||||

| 1. | Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. | X | ||||

| 2. | Have any funds been disbursed from any account other than a debtor in possession account this reporting period? If yes, provide an explanation below. | X | ||||

| 3. | Have all postpetition tax returns been timely filed? If no, provide an explanation below. | X | ||||

| 4. | Are workers compensation, general liability and other necessary insurance coverages in effect? If no, provide an explanation below. | X | ||||

| 5. | Has any bank account been opened during the reporting period? If yes, provide documentation identifying the opened account(s). If an investment account has been opened provide the required documentation pursuant to the Delaware Local Rule 4001-3. | X | ||||

NOTE: CALENDAR YE 2015 INCOME TAX RETURNS ARE ON EXTENSION.