Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Business Development Corp of America | v448462_8-k.htm |

Exhibit 99.1

2 nd Quarter 2016 Webinar Series

Second Quarter 2016 Investor Presentation Platform Advisor To Investment Programs

Investing in America’s Growth Disclosures 3 This presentation was prepared exclusively for the benefit and use of the Business Development Corporation of America (“BDCA” ) i nvestors to whom it is directly addressed and delivered and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentat ion is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by BDCA employees. Neither this pre sen tation nor any of its contents may be distributed or used for any other purpose without the prior written consent of BDCA Adviser, LLC. BDCA Advisor, LLC is indirectly, wholly - owned by the sponsor, AR Global Investments, LLC The sole purpose of this presentation is to provide investors with an update on BDCA. The description of certain aspects of B DCA herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing sh all be relied upon as a promise or representation as to the future performance of BDCA. This summary is not an offer to sell securities and is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted. This summary is not advice, a recommendation or an offer to enter into any transaction with BDCA or any of their affiliated f und s. There is no guarantee that any of the goals, targets or objectives described in this summary will be achieved. Certain information included in this presentation (including certain information relating to portfolio companies) was derived from third party sources and has not been independently verified and, accordingly, BDCA makes no representation or warranty in respect of this information . The following slides contain summaries of certain financial and statistical information about BDCA . The information contained in this presentation is summary information that is intended to be considered in the context of our SEC filings and other public announcements that we may make, by press release or otherwise, from time to time . We undertake no duty or obligation to publicly update or revise the information contained in this presentation . In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured . You should not view the past performance of BDCA, or information about the market, as indicative of BDCA’s future results . This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of BDCA . The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal, ERISA or tax advice or investment recommendations . Investors should also seek advice from their own independent tax, accounting, financial, ERISA, investment and legal advisors to properly assess the merits and risks associated with their investment in light of their own financial condition and other circumstances . Forward Looking Statements and Risk Factors This presentation contains “forward looking statements” that are subject to risks and uncertainties . Actual outcomes and results could differ materially from those suggested by this presentation due to the impact of many factors beyond the control of BDCA, including those listed in the “Risk Factors” section of our filings with the Securities and Exchange Commission (“SEC”) . Any such forward - looking statements are made pursuant to the safe harbor provisions available under applicable securities laws and BDCA assumes no obligation to update or revise any such forward looking statements . BDCA has based these forward - looking statements on its current expectations and projections about future events . BDCA believes that the expectations and assumptions that have been made with respect to these forward - looking statements are reasonable . However, such expectations and assumptions may prove to be incorrect . A number of factors could lead to results that may differ from those expressed or implied by the forward - looking statements . Given this level of uncertainty, prospective investors should not place undue reliance on any forward - looking statements .

Investing in America’s Growth Investment Thesis 4 ▪ Focused on lending to middle market American businesses ▪ 3 Primary objectives*: - Preserve and protect capital; - Provide attractive and stable cash distributions; and - Increase the value of assets in order to generate capital appreciation BDCA seeks to provide: *There is no guarantee these objectives will be met.

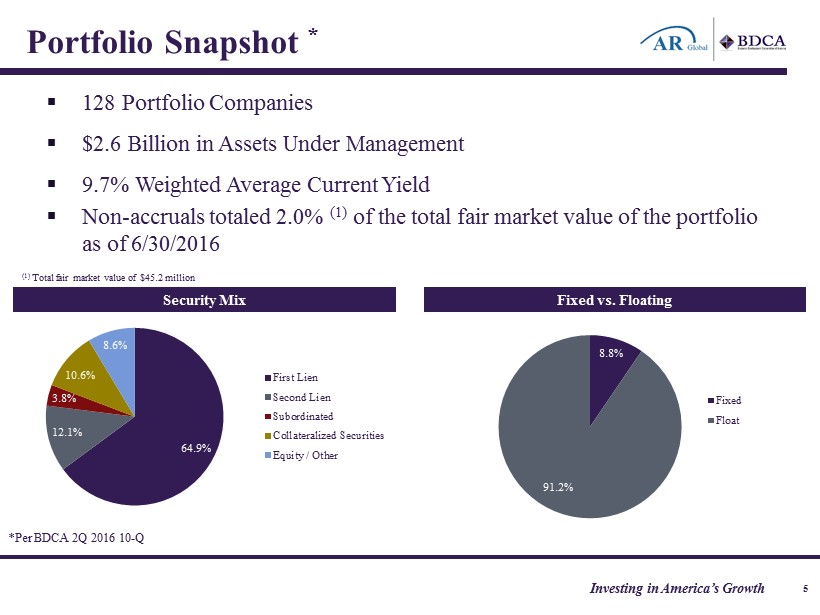

Investing in America’s Growth Portfolio Snapshot * 5 ▪ 128 Portfolio Companies ▪ $2.6 Billion in Assets Under Management ▪ 9.7% Weighted Average Current Yield ▪ Non - accruals totaled 2.0% (1) of the total fair market value of the portfolio as of 6/30/2016 *Per BDCA 2Q 2016 10 - Q Security Mix Fixed vs. Floating 8.8% 91.2% Fixed Float 64.9% 12.1% 3.8% 10.6% 8.6% First Lien Second Lien Subordinated Collateralized Securities Equity / Other (1) Total fair market value of $45.2 million

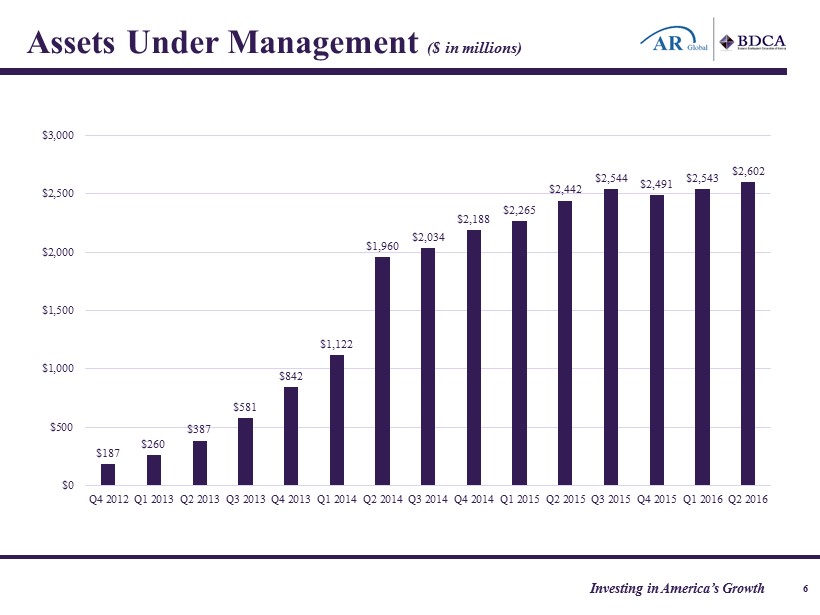

Investing in America’s Growth Assets Under Management ($ in millions) 6 $187 $260 $387 $581 $842 $1,122 $1,960 $2,034 $2,188 $2,265 $2,442 $2,544 $2,491 $2,543 $2,602 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

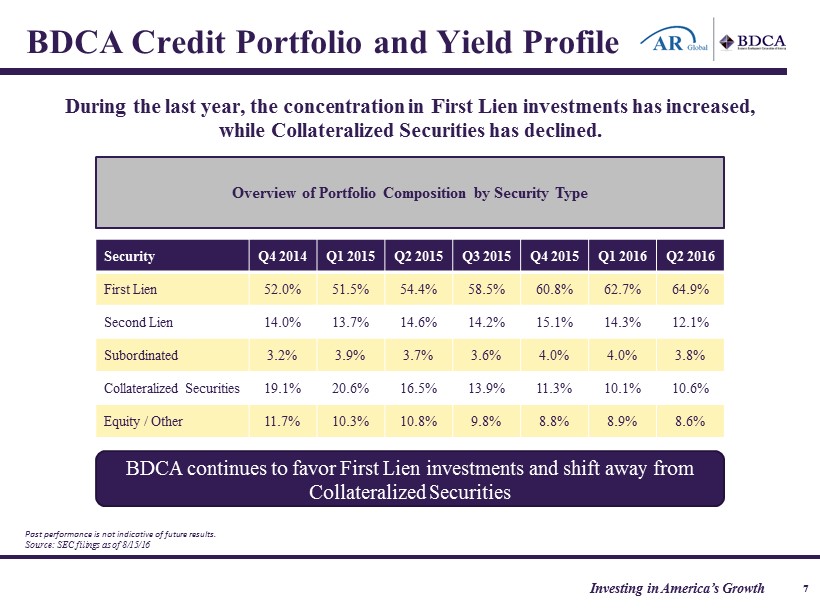

Investing in America’s Growth BDCA Credit Portfolio and Yield Profile 7 Overview of Portfolio Composition by Security Type Security Q4 2014 Q1 20 15 Q2 20 15 Q3 20 15 Q4 20 15 Q1 2016 Q2 2016 First Lien 52.0% 51.5% 54.4% 58.5% 60.8% 62.7% 64.9% Second Lien 14.0% 13.7% 14.6% 14.2% 15.1% 14.3% 12.1% Subordinated 3.2% 3.9% 3.7% 3.6% 4.0% 4.0% 3.8% Collateralized Securities 19.1% 20.6% 16.5% 13.9% 11.3% 10.1% 10.6% Equity / Other 11.7% 10.3% 10.8% 9.8% 8.8% 8.9% 8.6% During the last year, the concentration in First Lien investments has increased, while Collateralized Securities has declined. Past performance is not indicative of future results . Source: SEC filings as of 8/15/16 BDCA continues to favor First Lien investments and shift away from Collateralized Securities

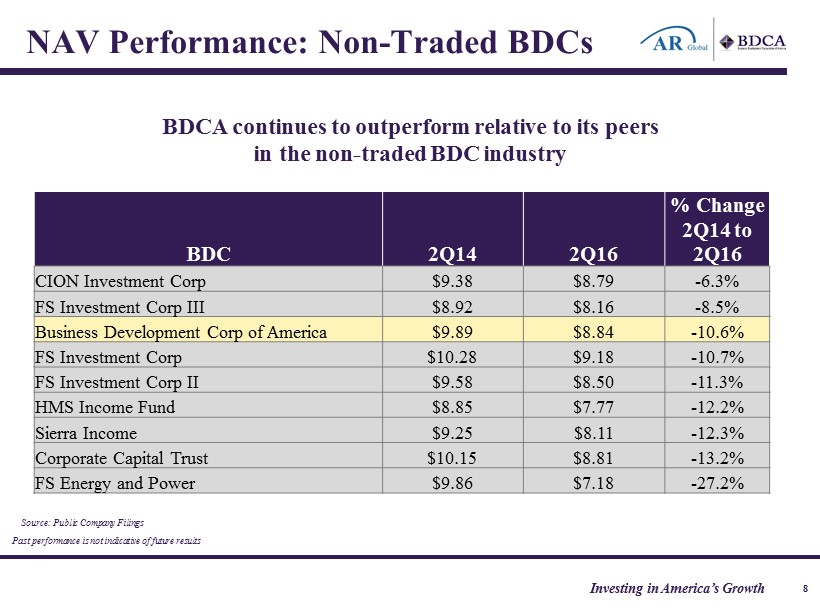

Investing in America’s Growth NAV Performance: Non - Traded BDCs 8 BDCA continues to outperform relative to its peers in the non - traded BDC industry Source: Public Company Filings BDC 2Q14 2Q16 % Change 2Q14 to 2Q16 CION Investment Corp $9.38 $8.79 - 6.3% FS Investment Corp III $8.92 $8.16 - 8.5% Business Development Corp of America $9.89 $8.84 - 10.6% FS Investment Corp $10.28 $9.18 - 10.7% FS Investment Corp II $9.58 $8.50 - 11.3% HMS Income Fund $8.85 $7.77 - 12.2% Sierra Income $9.25 $8.11 - 12.3% Corporate Capital Trust $10.15 $8.81 - 13.2% FS Energy and Power $9.86 $7.18 - 27.2% Past performance is not indicative of future results

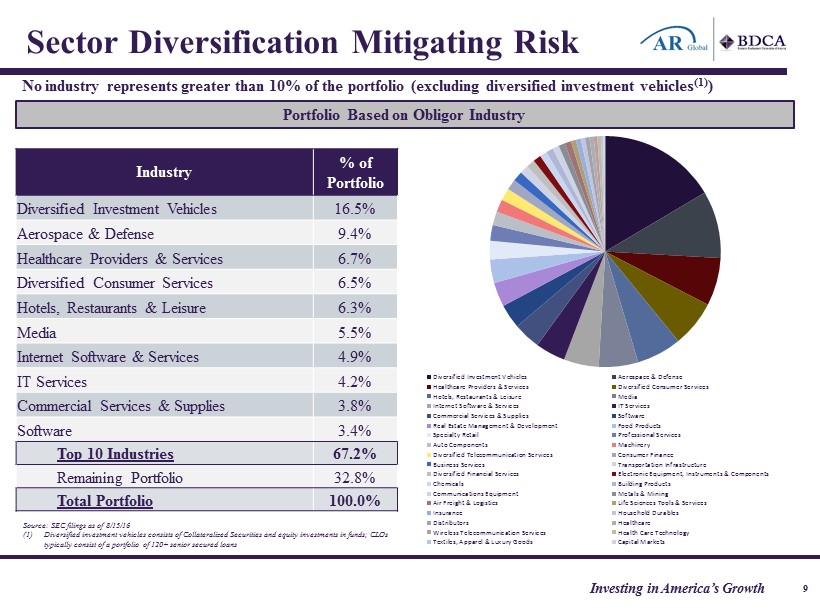

Investing in America’s Growth Sector Diversification Mitigating Risk 9 Industry % of Portfolio Diversified Investment Vehicles 16.5% Aerospace & Defense 9.4% Healthcare Providers & Services 6.7% Diversified Consumer Services 6.5% Hotels, Restaurants & Leisure 6.3% Media 5.5% Internet Software & Services 4.9% IT Services 4.2% Commercial Services & Supplies 3.8% Software 3.4% Top 10 Industries 67.2% Remaining Portfolio 32.8% Total Portfolio 100.0% Source: SEC filings as of 8/15/16 (1) Diversified investment vehicles consists of Collateralized Securities and equity investments in funds; CLOs typically consist of a portfolio of 120+ senior secured loans Diversified Investment Vehicles Aerospace & Defense Healthcare Providers & Services Diversified Consumer Services Hotels, Restaurants & Leisure Media Internet Software & Services IT Services Commercial Services & Supplies Software Real Estate Management & Development Food Products Specialty Retail Professional Services Auto Components Machinery Diversified Telecommunication Services Consumer Finance Business Services Transportation Infrastructure Diversified Financial Services Electronic Equipment, Instruments & Components Chemicals Building Products Communications Equipment Metals & Mining Air Freight & Logistics Life Sciences Tools & Services Insurance Household Durables Distributors Healthcare Wireless Telecommunication Services Health Care Technology Textiles, Apparel & Luxury Goods Capital Markets Portfolio Based on Obligor Industry No industry represents greater than 10% of the portfolio (excluding diversified investment vehicles (1) )

Investing in America’s Growth ▪ Build upon our direct origination leadership position ▪ Continue to deploy / reposition capital ▪ Focus on growing Net Asset Value ▪ Utilize unused balance sheet capacity to increase ROI and dividend coverage 31 Key Initiatives 10

Investing in America’s Growth ▪ BDCA continues to be very selective in evaluating new opportunities in a slow market for deal flow ▪ Focus is on capital preservation and strict underwriting standards ▪ Retreat of commercial banks from the middle market continues to provide BDCs attractive investment opportunities 31 Market Trends 11

Investing in America’s Growth 31 Organizational Depth 12 Peter M. Budko Chief Executive Officer Ira Wishe Deputy CIO Doug Lyons Head of Capital Markets Peter M. Budko Executive Chairman Michael Weil Director Leslie D. Michelson Independent Director Damien Dovi Head of Charlotte Office Randolph C. Read Independent Director Franklin Leong Head of Credit James A. Fisher President Management Team Board of Directors Corinne D. Pankovcin Chief Financial Officer Shiloh Bates Head of Structured Products Edward G. Rendell Independent Director

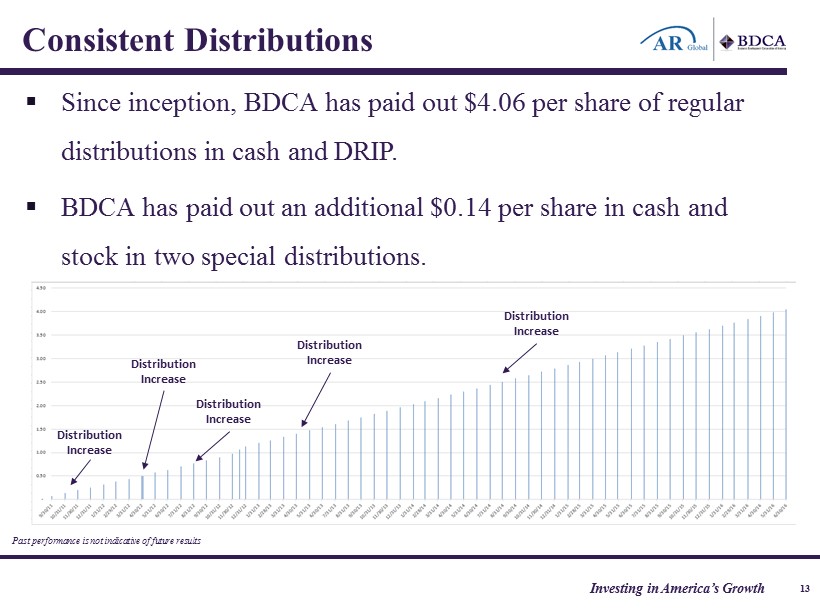

Investing in America’s Growth 31 Consistent Distributions 13 ▪ Since inception, BDCA has paid out $4.06 per share of regular distributions in cash and DRIP. ▪ BDCA has paid out an additional $0.14 per share in cash and stock in two special distributions. Past performance is not indicative of future results Distribution Increase Distribution Increase Distribution Increase Distribution Increase Distribution Increase

Investing in America’s Growth The following is a summary of risk factors for Business Development Corporation of America . Risk Factors 14 • You should not expect to be able to sell your shares regardless of how we perform . • If you are able to sell your shares, you will likely receive less than your purchase price . • Our Adviser and its affiliates, including our officers an some of our directors, will face conflicts of interest caused by compensation arrangements with us and our affiliates, which could result in actions that are not in the best interests of our stockholders . • We do not intend to list our shares on any securities exchange during or for what may be a significant time after the offering period, and we do not expect a secondary market in the shares to develop . • We may borrow funds to make investments . As a result, we would be exposed to the risks of borrowing, also known as leverage, which may be considered a speculative investment technique . Leverage increases the volatility of investments by magnifying the potential for gain and loss on amounts invested, thereby increasing the risks associated with investing in our securities . Moreover, any assets we may acquire with leverage will be subject to management fees payable to our Adviser ; thus our Adviser may have an incentive to increase portfolio leverage in order to earn higher management fees . • Because you will be unable to sell your shares, you will be unable to reduce your exposure in any market downturn . • Our distributions may be funded from any sources of funds available to us, including offering proceeds and borrowings as well as expense support payments from our Adviser that are subject to reimbursement to it, which may constitute a return of capital and reduce the amount of capital available to us for investment . We have not established limits on the amount of funds we may use from available sources to make distributions . The Adviser has no obligation to make expense support payments in the future . Any capital returned to stockholders through distributions will be distributed after payment of fees and expenses . Our Adviser may also waive reimbursements by us for certain expenses paid by it to fund our distributions . The waived reimbursements may be subject to repayment in the future, reducing future distributions to which our stockholders may be entitled .

Investing in America’s Growth www.BDCA.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com