Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hospitality Investors Trust, Inc. | v448459_8k.htm |

Exhibit 99.1

2 nd Quarter 2016 Webinar Series

Second Quarter 2016 Investor Presentation Platform Advisor To Investment Programs

American Realty Capital Hospitality Trust, Inc. 3 IMPORTANT INFORMATION Risk Factors Investing in our common stock involves a high degree of risk . See the section entitled “Risk Factors” in our most recent Annual Report on Form 10 - K for a discussion of the risks which should be considered in connection with our Company . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the Risk Factors at the end of this presentation and the Company’s Annual Report on Form 10 - K for a more complete list of risk factors, as well as a discussion of risks and uncertainties that could cause actual results to differ materially from our forward - looking statements. Additional Information AR Global Investments, LLC (“AR Global”) is the successor to AR Capital LLC’s (“AR Capital”) business and AR Global and AR Capital are companies under common control. Our Company continues to be indirectly advised by AR Capital through AR Capital’s indirect ownership and control of American Realty Capital Hospitality Advisors, LLC.

American Realty Capital Hospitality Trust, Inc. 4 ▪ Hospitality Trust owns select - service and full - service hotels that are: ▪ Affiliated with premium national brands such as Hilton, Marriott and Hyatt ▪ Operated by highly - ranked and experienced management companies ▪ Located in strong U.S. markets with diverse demand generators ▪ Well - maintained, with brand - mandated reinvestment expected to further drive hotel performance ▪ Market leaders with attractive rates, occupancies and cash flows ▪ Purchased at a discount to replacement cost ▪ The target holding period of this offering is 3 - 6 years from the close of the initial offering. Capital Preservation Capital Appreciation Hospitality Trust seeks to provide: INVESTMENT STRATEGY

American Realty Capital Hospitality Trust, Inc. 5 REPRESENTATIVE PORTFOLIO

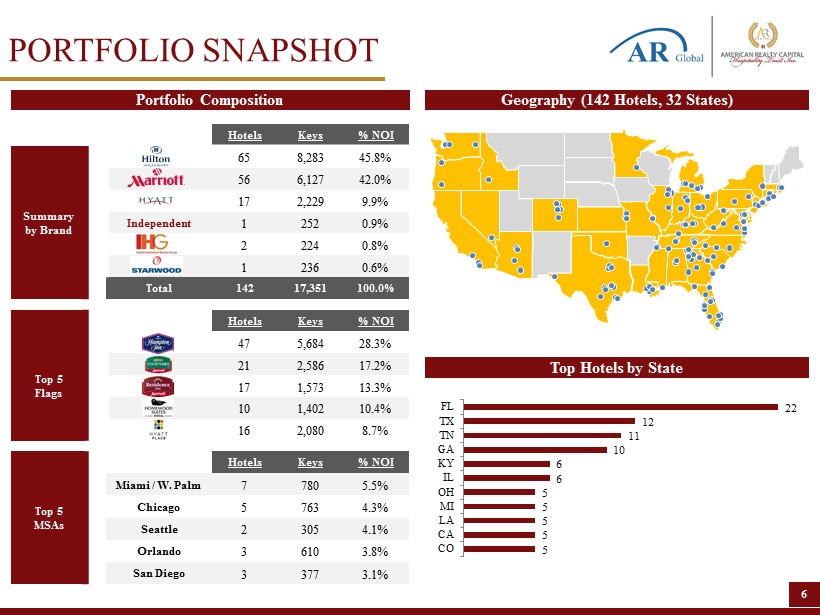

American Realty Capital Hospitality Trust, Inc. 6 Hotels Keys % NOI Summary by Brand 65 8,283 45.8% 56 6,127 42.0% 17 2,229 9.9% Independent 1 252 0.9% 2 224 0.8% 1 236 0.6% Total 142 17,351 100.0% Hotels Keys % NOI Top 5 Flags 47 5,684 28.3% 21 2,586 17.2% 17 1,573 13.3% 10 1,402 10.4% 16 2,080 8.7% Top 5 MSAs Hotels Keys % NOI Miami / W. Palm 7 780 5.5% Chicago 5 763 4.3% Seattle 2 305 4.1% Orlando 3 610 3.8% San Diego 3 377 3.1% Portfolio Composition Geography (142 Hotels, 32 States) Top Hotels by State 22 12 11 10 6 6 5 5 5 5 5 FL TX TN GA KY IL OH MI LA CA CO PORTFOLIO SNAPSHOT

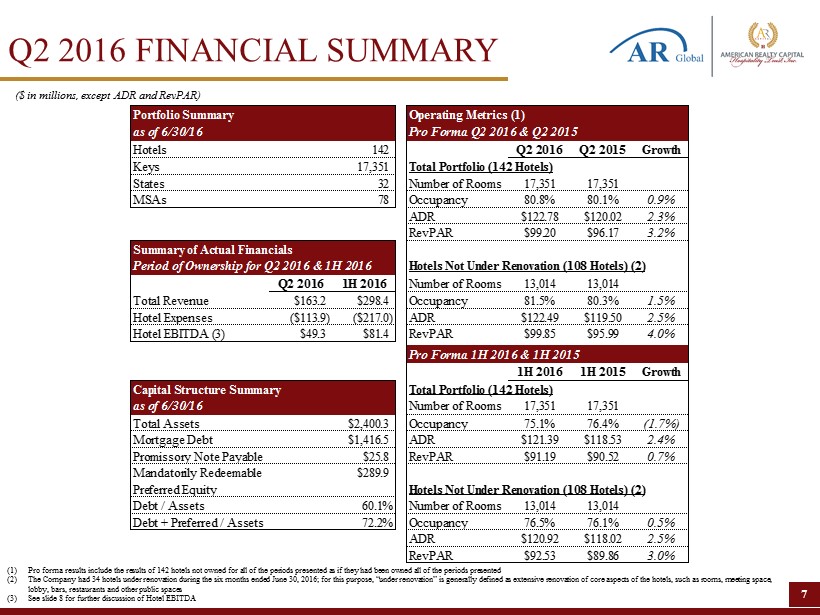

American Realty Capital Hospitality Trust, Inc. 7 ($ in millions, except ADR and RevPAR) (1) Pro forma results include the results of 142 hotels not owned for all of the periods presented as if they had been owned all of the periods presented (2) The Company had 34 hotels under renovation during the six months ended June 30, 2016; for this purpose, “under renovation” is ge nerally defined as extensive renovation of core aspects of the hotels, such as rooms, meeting space, lobby, bars, restaurants and other public spaces (3) See slide 8 for further discussion of Hotel EBITDA Q2 2016 FINANCIAL SUMMARY Portfolio Summary Operating Metrics (1) as of 6/30/16 Pro Forma Q2 2016 & Q2 2015 Hotels 142 Q2 2016 Q2 2015 Growth Keys 17,351 Total Portfolio (142 Hotels) States 32 Number of Rooms 17,351 17,351 MSAs 78 Occupancy 80.8% 80.1% 0.9% ADR $122.78 $120.02 2.3% RevPAR $99.20 $96.17 3.2% Summary of Actual Financials Period of Ownership for Q2 2016 & 1H 2016 Hotels Not Under Renovation (108 Hotels) (2) Q2 2016 1H 2016 Number of Rooms 13,014 13,014 Total Revenue $163.2 $298.4 Occupancy 81.5% 80.3% 1.5% Hotel Expenses ($113.9) ($217.0) ADR $122.49 $119.50 2.5% Hotel EBITDA (3) $49.3 $81.4 RevPAR $99.85 $95.99 4.0% Pro Forma 1H 2016 & 1H 2015 1H 2016 1H 2015 Growth Capital Structure Summary Total Portfolio (142 Hotels) as of 6/30/16 Number of Rooms 17,351 17,351 Total Assets $2,400.3 Occupancy 75.1% 76.4% (1.7%) Mortgage Debt $1,416.5 ADR $121.39 $118.53 2.4% Promissory Note Payable $25.8 RevPAR $91.19 $90.52 0.7% Mandatorily Redeemable $289.9 Preferred Equity Hotels Not Under Renovation (108 Hotels) (2) Debt / Assets 60.1% Number of Rooms 13,014 13,014 Debt + Preferred / Assets 72.2% Occupancy 76.5% 76.1% 0.5% ADR $120.92 $118.02 2.5% RevPAR $92.53 $89.86 3.0%

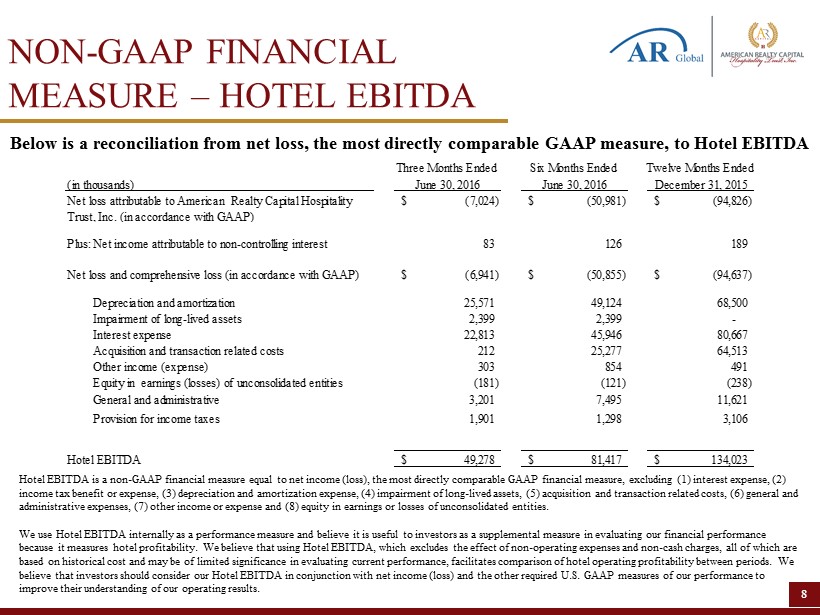

American Realty Capital Hospitality Trust, Inc. 8 Below is a reconciliation from net loss, the most directly comparable GAAP measure, to Hotel EBITDA Hotel EBITDA is a non - GAAP financial measure equal to net income (loss), the most directly comparable GAAP financial measure, ex cluding (1) interest expense, (2) income tax benefit or expense, (3) depreciation and amortization expense, (4) impairment of long - lived assets, (5) acquisition a nd transaction related costs, (6) general and administrative expenses, (7) other income or expense and (8) equity in earnings or losses of unconsolidated entities. We use Hotel EBITDA internally as a performance measure and believe it is useful to investors as a supplemental measure in ev alu ating our financial performance because it measures hotel profitability. We believe that using Hotel EBITDA, which excludes the effect of non - operating expense s and non - cash charges, all of which are based on historical cost and may be of limited significance in evaluating current performance, facilitates comparison of hote l o perating profitability between periods. We believe that investors should consider our Hotel EBITDA in conjunction with net income (loss) and the other required U.S. GAA P m easures of our performance to improve their understanding of our operating results. NON - GAAP FINANCIAL MEASURE – HOTEL EBITDA Three Months Ended Six Months Ended Twelve Months Ended (in thousands) June 30, 2016 June 30, 2016 December 31, 2015 (7,024)$ (50,981)$ (94,826)$ Plus: Net income attributable to non-controlling interest 83 126 189 Net loss and comprehensive loss (in accordance with GAAP) (6,941)$ (50,855)$ (94,637)$ Depreciation and amortization 25,571 49,124 68,500 Impairment of long-lived assets 2,399 2,399 - Interest expense 22,813 45,946 80,667 Acquisition and transaction related costs 212 25,277 64,513 Other income (expense) 303 854 491 Equity in earnings (losses) of unconsolidated entities (181) (121) (238) General and administrative 3,201 7,495 11,621 Provision for income taxes 1,901 1,298 3,106 Hotel EBITDA 49,278$ 81,417$ 134,023$ Net loss attributable to American Realty Capital Hospitality Trust, Inc. (in accordance with GAAP)

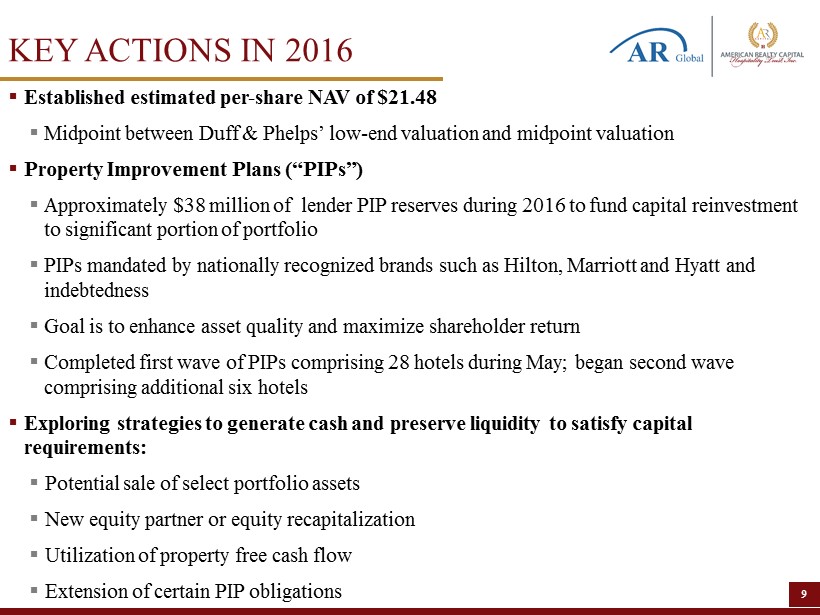

American Realty Capital Hospitality Trust, Inc. 9 ▪ Established estimated per - share NAV of $21.48 ▪ Midpoint between Duff & Phelps’ low - end valuation and midpoint valuation ▪ Property Improvement Plans (“PIPs”) ▪ Approximately $38 million of lender PIP reserves during 2016 to fund capital reinvestment to significant portion of portfolio ▪ PIPs mandated by nationally recognized brands such as Hilton, Marriott and Hyatt and indebtedness ▪ Goal is to enhance asset quality and maximize shareholder return ▪ Completed first wave of PIPs comprising 28 hotels during May; began second wave comprising additional six hotels ▪ Exploring strategies to generate cash and preserve liquidity to satisfy capital requirements: ▪ Potential sale of select portfolio assets ▪ New equity partner or equity recapitalization ▪ Utilization of property free cash flow ▪ Extension of certain PIP obligations KEY ACTIONS IN 2016

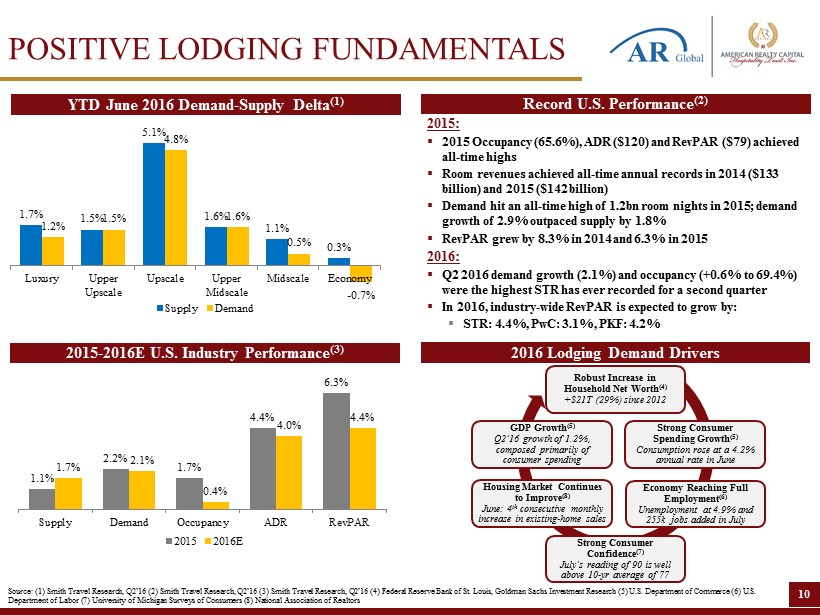

American Realty Capital Hospitality Trust, Inc. 10 2015 - 2016E U.S. Industry Performance (3) Record U.S. Performance (2) YTD June 2016 Demand - Supply Delta (1) 2016 Lodging Demand Drivers 2015: ▪ 2015 Occupancy (65.6%), ADR ($120) and RevPAR ($79) achieved all - time highs ▪ Room revenues achieved all - time annual records in 2014 ($133 billion) and 2015 ($142 billion) ▪ Demand hit an all - time high of 1.2bn room nights in 2015; demand growth of 2.9% outpaced supply by 1.8% ▪ RevPAR grew by 8.3% in 2014 and 6.3% in 2015 2016: ▪ Q2 2016 demand growth (2.1%) and occupancy (+0.6% to 69.4%) were the highest STR has ever recorded for a second quarter ▪ In 2016, industry - wide RevPAR is expected to grow by: ▪ STR: 4.4%, PwC: 3.1%, PKF: 4.2% Robust Increase in Household Net Worth (4) +$21T (29%) since 2012 Strong Consumer Spending Growth (5) Consumption rose at a 4.2% annual rate in June Economy Reaching Full Employment (6) Unemployment at 4.9% and 255k jobs added in July Strong Consumer Confidence (7) July’s reading of 90 is well above 10 - yr average of 77 Housing Market Continues to Improve (8) June: 4 th consecutive monthly increase in existing - home sales GDP Growth (5) Q2’16 growth of 1.2%, composed primarily of consumer spending Source: (1) Smith Travel Research, Q2’16 (2) Smith Travel Research, Q2’16 (3) Smith Travel Research, Q2’16 (4) Federal Reserv e B ank of St. Louis, Goldman Sachs Investment Research (5) U.S. Department of Commerce (6) U.S. Department of Labor (7) University of Michigan Surveys of Consumers (8) National Association of Realtors POSITIVE LODGING FUNDAMENTALS 1.1% 2.2% 1.7% 4.4% 6.3% 1.7% 2.1% 0.4% 4.0% 4.4% Supply Demand Occupancy ADR RevPAR 2015 2016E 1.7% 1.5% 5.1% 1.6% 1.1% 0.3% 1.2% 1.5% 4.8% 1.6% 0.5% - 0.7% Luxury Upper Upscale Upscale Upper Midscale Midscale Economy Supply Demand

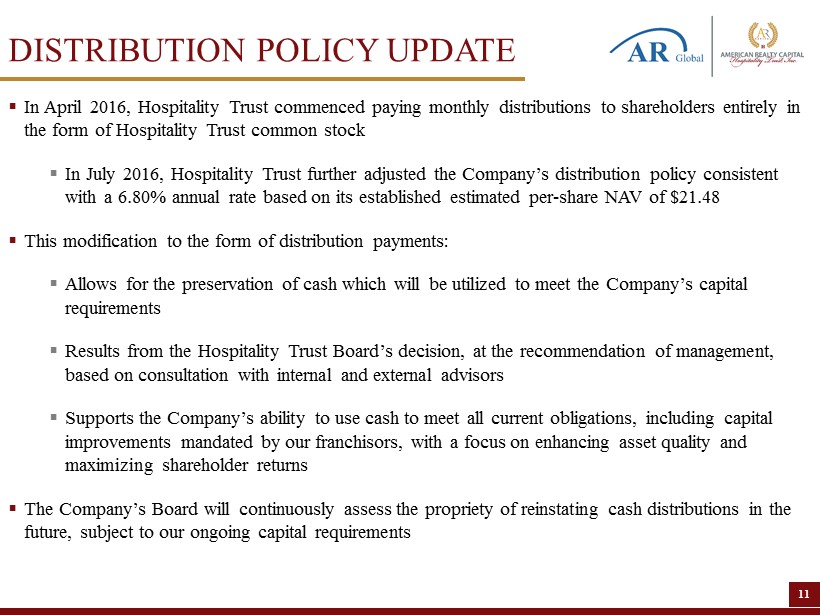

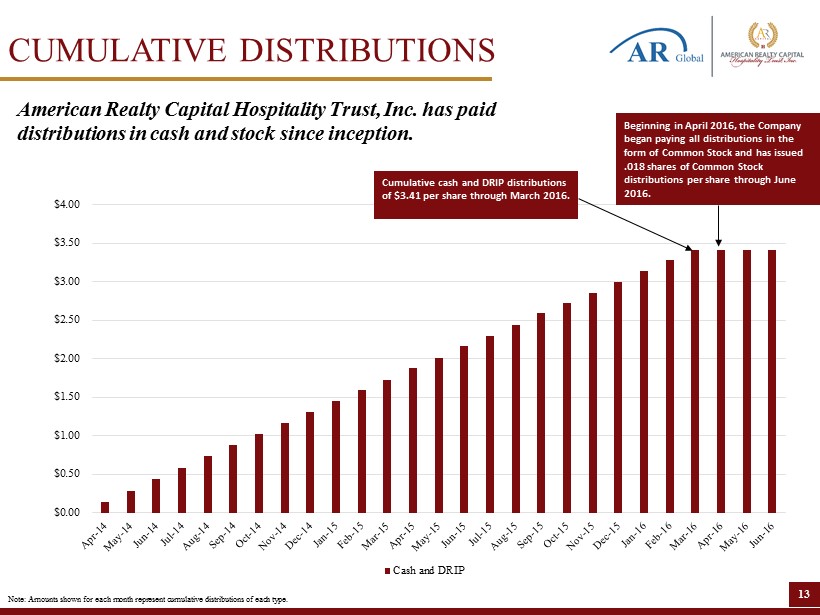

American Realty Capital Hospitality Trust, Inc. 11 ▪ In April 2016, Hospitality Trust commenced paying monthly distributions to shareholders entirely in the form of Hospitality Trust common stock ▪ In July 2016, Hospitality Trust further adjusted the Company’s distribution policy consistent with a 6.80% annual rate based on its established estimated per - share NAV of $21.48 ▪ This modification to the form of distribution payments: ▪ Allows for the preservation of cash which will be utilized to meet the Company’s capital requirements ▪ Results from the Hospitality Trust Board’s decision, at the recommendation of management, based on consultation with internal and external advisors ▪ Supports the Company’s ability to use cash to meet all current obligations, including capital improvements mandated by our franchisors, with a focus on enhancing asset quality and maximizing shareholder returns ▪ The Company’s Board will continuously assess the propriety of reinstating cash distributions in the future, subject to our ongoing capital requirements DISTRIBUTION POLICY UPDATE

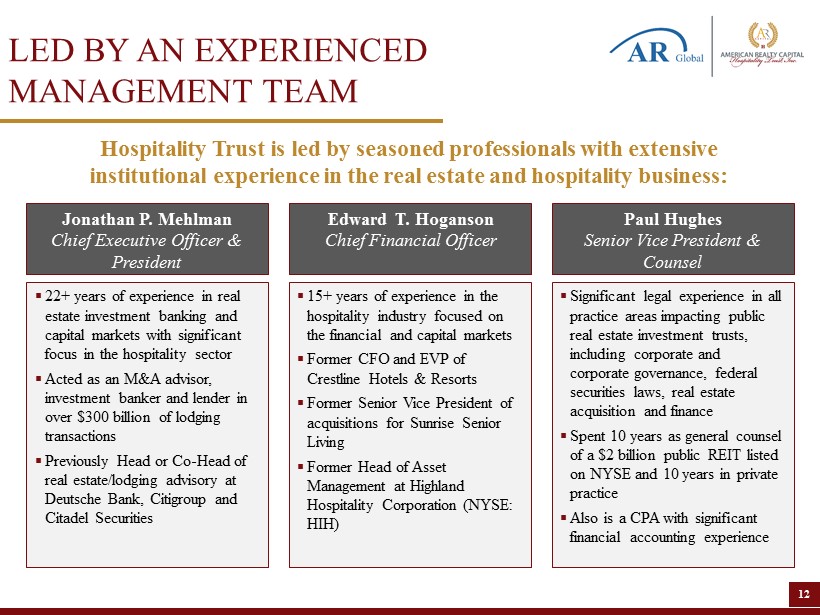

American Realty Capital Hospitality Trust, Inc. 12 Hospitality Trust is led by seasoned professionals with extensive institutional experience in the real estate and hospitality business: Jonathan P. Mehlman Chief Executive Officer & President Paul Hughes Senior Vice President & Counsel Edward T. Hoganson Chief Financial Officer ▪ 22+ years of experience in real estate investment banking and capital markets with significant focus in the hospitality sector ▪ Acted as an M&A advisor, investment banker and lender in over $300 billion of lodging transactions ▪ Previously Head or Co - Head of real estate/lodging advisory at Deutsche Bank, Citigroup and Citadel Securities ▪ Significant legal experience in all practice areas impacting public real estate investment trusts, including corporate and corporate governance, federal securities laws, real estate acquisition and finance ▪ Spent 10 years as general counsel of a $2 billion public REIT listed on NYSE and 10 years in private practice ▪ Also is a CPA with significant financial accounting experience ▪ 15+ years of experience in the hospitality industry focused on the financial and capital markets ▪ Former CFO and EVP of Crestline Hotels & Resorts ▪ Former Senior Vice President of acquisitions for Sunrise Senior Living ▪ Former Head of Asset Management at Highland Hospitality Corporation (NYSE: HIH) LED BY AN EXPERIENCED MANAGEMENT TEAM

American Realty Capital Hospitality Trust, Inc. 13 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 Cash and DRIP Cumulative cash and DRIP distributions of $3.41 per share through March 2016. CUMULATIVE DISTRIBUTIONS American Realty Capital Hospitality Trust, Inc. has paid distributions in cash and stock since inception. Note: Amounts shown for each month represent cumulative distributions of each type. Beginning in April 2016, the Company began paying all distributions in the form of Common Stock and has issued .018 shares of Common Stock distributions per share through June 2016.

American Realty Capital Hospitality Trust, Inc. 14 See ‘‘Risk Factors’’ beginning on page 7 of the Company’s 2015 Form 10 - K for a discussion of the risks that should be considered in connection with your investment in our common stock, including : • All of our executive officers are also officers, managers and/or holders of a direct or indirect controlling interest in American Realty Capital Hospitality Advisors, LLC (the "Advisor") or other entities affiliated with AR Capital, LLC (“AR Capital”), the parent of our sponsor, American Realty Capital IX, LLC (the "Sponsor"), and AR Global Investments, LLC, the successor to AR Capital’s business (“AR Global”) . As a result, our executive officers, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by our Advisor's compensation arrangements with us . These conflicts could result in unanticipated actions . • We suspended our initial public offering of common stock (our "IPO" or our "Offering") on November 15 , 2015 , effective as of December 31 , 2015 . Prior to the suspension of our IPO, we depended, and expected to continue to depend, in substantial part on proceeds from our IPO to meet our major capital requirements . Because we do not expect we will resume our IPO, we will require funds in addition to operating cash flow and cash on hand to meet our capital requirements, including payments due on our outstanding indebtedness . • Because we require funds in addition to our operating cash flow and cash on hand to meet our capital requirements, beginning with distributions payable with respect to April 2016 we began paying distributions to our stockholders in shares of common stock instead of cash . There can be no assurance that we will continue to pay distributions in shares of common stock or resume paying distributions in cash in the future . Our ability to make future cash distributions will depend on our future cash flows and may be dependent on our ability to obtain additional liquidity on favorable terms . • We are evaluating a variety of alternatives for obtaining additional liquidity, but there can be no assurance that we will be successful in obtaining sufficient proceeds from any of these pursuits to meet our capital requirements . RISK FACTORS

American Realty Capital Hospitality Trust, Inc. 15 • All of the properties we own are hotels, and we are subject to risks inherent in the hospitality industry . • We will require additional debt or equity financing to complete our pending acquisition of eight hotels for an aggregate purchase price of $ 77 . 2 million (the “Pending Acquisition”) from Summit Hotel OP, LP, the operating partnership of Summit Hotel Properties, Inc . (collectively, “Summit”), and there can be no assurance that such additional capital will be available on favorable terms, or at all . Any failure to complete our Pending Acquisition could cause us to default under the agreement and forfeit a $ 7 . 5 million deposit . • Because our IPO has raised substantially less proceeds than expected, we will not be able to make additional investments unless we are able to identify additional debt or equity capital on favorable terms and our ability to achieve our original investment objectives has been adversely affected . • No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid . • Increases in interest rates could increase the amount of our debt payments . • We have incurred substantial indebtedness, which may limit our future operational and financial flexibility . • We are obligated to pay fees to our Advisor and its affiliates, which may be substantial . • We may fail to realize the expected benefits of our acquisitions of hotels within the anticipated timeframe or at all and we may incur unexpected costs . • We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit markets of the United States from time to time . • Our failure to qualify or to continue to qualify to be treated as a real estate investment trust for U . S . federal income tax purposes ("REIT") which would result in higher taxes, may adversely affect operations and cash available for distributions . RISK FACTORS

ARCHospitalityReit.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com