Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - AMERICAN REALTY CAPITAL - RETAIL CENTERS OF AMERICA, INC. | v448424_ex2-1.htm |

| EX-99.1 - EXHIBIT 99.1 - AMERICAN REALTY CAPITAL - RETAIL CENTERS OF AMERICA, INC. | v448424_ex99-1.htm |

| EX-3.1 - EXHIBIT 3.1 - AMERICAN REALTY CAPITAL - RETAIL CENTERS OF AMERICA, INC. | v448424_ex3-1.htm |

| 8-K - 8-K - AMERICAN REALTY CAPITAL - RETAIL CENTERS OF AMERICA, INC. | v448424_8k.htm |

Exhibit 99.2

American Realty Capital – Retail Centers of America Agrees to be Acquired by American Finance Trust

A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC . 2 Risk Factors The proposed acquisition and investing in our common stock involves a high degree of risk . See the section entitled “Risk Factors” in the most recent Annual Report on Form 10 - K for a discussion of the risks which should be considered in connection with our company and the discussion of Risk Factors at the end of this presentation . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and our company’s most recent Annual Report on Form 10 - K or Quarterly Report on Form 10 - Q for a more complete list of risk factors, as well as a discussion of forward - looking statements. IMPORTANT INFORMATION

Additional Information About the Proposed Transaction and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, American Realty Capital – Retail Centers of America, Inc. (“RCA”) and American Finance Trust, Inc. (“AFIN”) intend to file relevant materials with the Securities and Exchange Commission (“SEC”), including a joint proxy statement/prospectus. BOTH RCA AND AFIN STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors may obtain free copies of the proxy statement/prospectus and other relevant documents filed by RCA and AFIN with the SEC (if and when they become available) through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by RCA and AFIN with the SEC are also available free of charge on AFIN’s website at www.americanfinancetrust.com and copies of the documents filed by RCA with the SEC are available free of charge on RCA’s website at www.retailcentersofamerica.com . RCA and AFIN and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from both companies’ stockholders in respect of the proposed transaction. Information regarding RCA’s directors and executive officers can be found in RCA’s definitive proxy statement filed with the SEC on April 29, 2016. Information regarding AFIN's directors and executive officers can be found in AFIN's definitive proxy statement filed with the SEC on April 29, 2016. Additional information regarding the interests of such potential participants will be included in the joint proxy statement and other relevant documents filed with the SEC in connection with the proposed transaction if and when they become available. These documents are available free of charge on the SEC’s website and from RCA and AFIN, as applicable, using the sources indicated above. DISCLOSURE 3 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

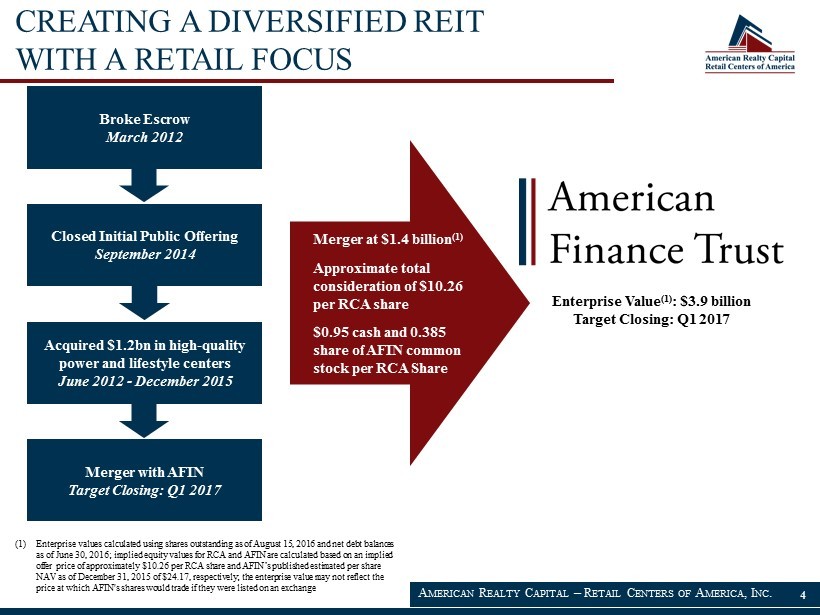

(1) Enterprise values calculated using shares outstanding as of August 15, 2016 and net debt balances as of June 30, 2016; implied equity values for RCA and AFIN are calculated based on an implied offer price of approximately $10.26 per RCA share and AFIN’s published estimated per share NAV as of December 31, 2015 of $ 24.17, respectively; the enterprise value may not reflect the price at which AFIN's shares would trade if they were listed on an exchange 4 CREATING A DIVERSIFIED REIT WITH A RETAIL FOCUS A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC . Broke Escrow March 2012 Closed Initial Public Offering September 2014 Acquired $1.2bn in high - quality power and lifestyle centers June 2012 - December 2015 Merger with AFIN Target Closing: Q1 2017 Merger at $1.4 billion (1) Approximate total consideration of $10.26 per RCA share $0.95 cash and 0.385 share of AFIN common stock per RCA Share Enterprise Value (1) : $3.9 billion Target Closing: Q1 2017

AFIN to acquire RCA in a merger worth $1.4 b illion (1) • Total Consideration: Approximately $10.26 per RCA share • 0.385 Conversion Ratio: Based on AFIN’s published estimated per share NAV as of December 31, 2015 of $24.17 , each share of RCA common stock owned would be exchanged for approximately $9.31 of AFIN stock • Cash Consideration: $0.95 of cash consideration per RCA share • Enhanced Portfolio: Diversification of property type, asset class, tenant base, and geography is expected to strengthen the safety of distributions to shareholders and lowers market cycle risk • Cost Savings: Meaningful c ost savings from G&A synergies and elimination of duplicative costs and functions Strong shareholder p rotections • RCA has been granted a 45 - day Go - Shop period to solicit a superior offer Maintains distribution rate while providing additional cash payment to RCA shareholders • As part of the transaction, RCA shareholders will receive $0.95 in cash per RCA share • Post transaction, RCA shareholders will continue to receive a distribution in the amount of $0.64 per converted RCA share (2 ) Closing expected Q1 2017 • Subject to RCA and AFIN shareholder vote • Subject to customary closing conditions (1) Inclusive of net debt as of June 30, 2016 and share count as of August 15, 2016 (2) Based on exchange ratio of 0.385 and AFIN’s annualized daily distribution SUMMARY OF TRANSACTION 5 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

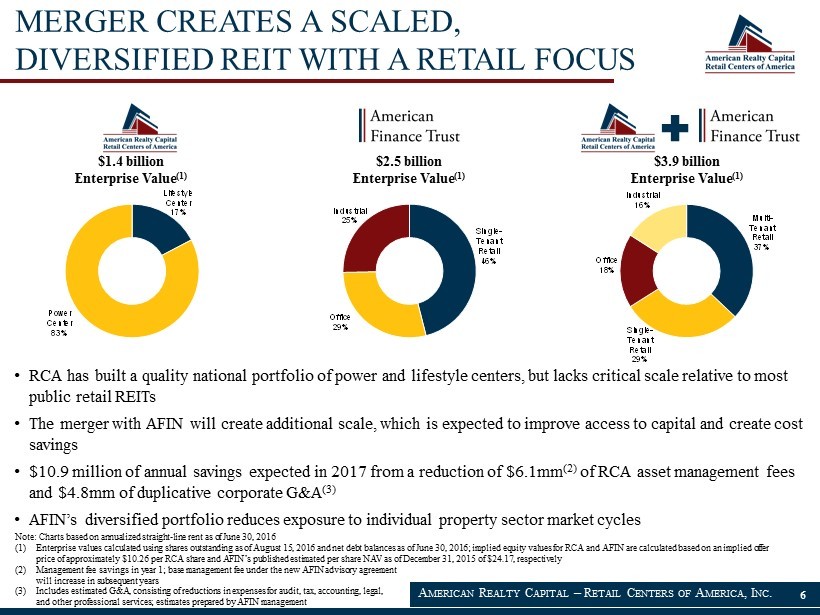

Single - Tenant Retail 46% Office 29% Industrial 25% Lifestyle Center 17% Power Center 83% MERGER CREATES A SCALED, DIVERSIFIED REIT WITH A RETAIL FOCUS Multi - Tenant Retail 37% Single - Tenant Retail 29% Office 18% Industrial 16% Note: Charts based on annualized straight - line rent as of June 30, 2016 (1) Enterprise values calculated using shares outstanding as of August 15, 2016 and net debt balances as of June 30, 2016; implie d e quity values for RCA and AFIN are calculated based on an implied offer price of approximately $10.26 per RCA share and AFIN’s published estimated per share NAV as of December 31, 2015 of $24.17, respectively (2) Management fee savings in year 1; base management fee under the new AFIN advisory agreement will increase in subsequent years (3) Includes estimated G&A, consisting of reductions in expenses for audit, tax, accounting, legal, and other professional services; estimates prepared by AFIN management $1.4 billion Enterprise V alue (1) $2.5 billion Enterprise Value (1) $3.9 billion Enterprise Value (1) 6 • RCA has built a quality national portfolio of power and lifestyle centers, but lacks critical scale relative to most public retail REITs • The merger with AFIN will create additional scale , which is expected to improve access to capital and create cost savings • $10.9 million of annual savings expected in 2017 from a reduction of $6.1mm (2) of RCA asset management fees and $4.8mm of duplicative corporate G&A (3) • AFIN’s diversified portfolio reduces exposure to individual property sector market cycles A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

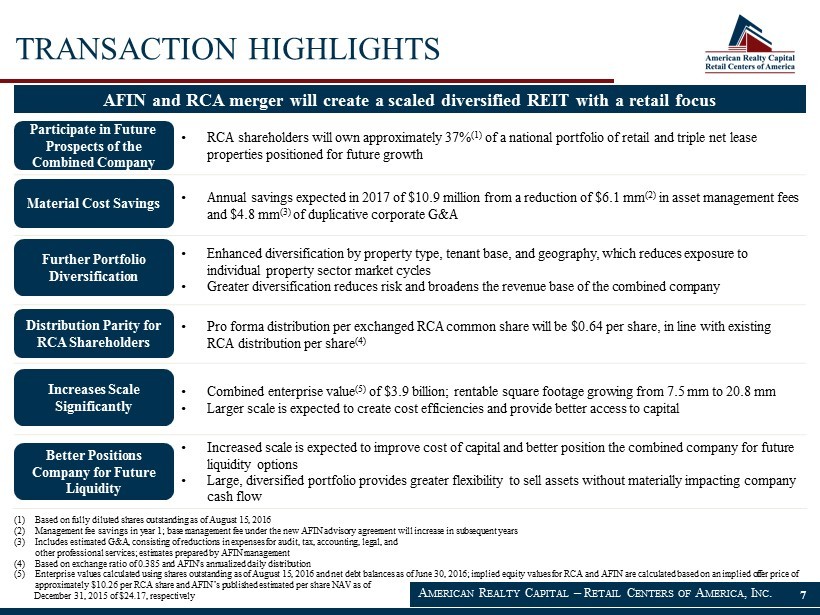

• RCA shareholders will own approximately 37% (1) of a national portfolio of retail and triple net lease properties positioned for future growth • Annual savings expected in 2017 of $10.9 million from a reduction of $6.1 mm (2) in asset management fees and $4.8 mm (3) of duplicative corporate G&A • Enhanced diversification by property type, tenant base, and geography, which reduces exposure to individual property sector market cycles • Greater diversification reduces risk and broadens the revenue base of the combined company • Pro forma distribution per exchanged RCA common share will be $0.64 per share, in line with existing RCA distribution per share (4) • Combined enterprise value (5) of $3.9 billion; rentable square footage growing from 7.5 mm to 20.8 mm • Larger scale is expected to create cost efficiencies and provide better access to capital • Increased scale is expected to improve cost of capital and better position the combined company for future liquidity options • Large, diversified portfolio provides greater flexibility to sell assets without materially impacting company cash flow TRANSACTION HIGHLIGHTS 7 AFIN and RCA merger will create a scaled diversified REIT with a retail focus Better Positions Company for Future Liquidity Further Portfolio Diversification Increases Scale Significantly Participate in Future Prospects of the Combined Company Material Cost Savings Distribution Parity for RCA Shareholders A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC . (1) Based on fully diluted shares outstanding as of August 15, 2016 (2) Management fee savings in year 1; base management fee under the new AFIN advisory agreement will increase in subsequent years (3) Includes estimated G&A, consisting of reductions in expenses for audit, tax, accounting, legal, and other professional services; estimates prepared by AFIN management (4) Based on exchange ratio of 0.385 and AFIN's annualized daily distribution (5) Enterprise values calculated using shares outstanding as of August 15, 2016 and net debt balances as of June 30, 2016; implied equity values for RCA and AFIN are calculated based on an implied offer price of approximately $10.26 per RCA share and AFIN’s published estimated per share NAV as of December 31, 2015 of $24.17, respectively

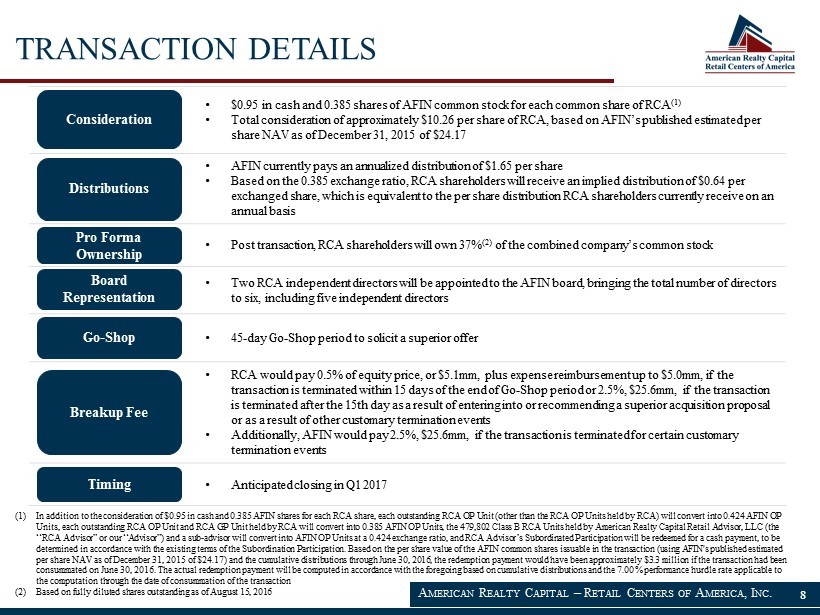

• $0.95 in cash and 0.385 shares of AFIN common stock for each common share of RCA (1) • Total consideration of approximately $10.26 per share of RCA, based on AFIN’s published estimated per share NAV as of December 31, 2015 of $24.17 • AFIN currently pays an annualized distribution of $1.65 per share • Based on the 0.385 exchange ratio, RCA shareholders will receive an implied distribution of $0.64 per exchanged share, which is equivalent to the per share distribution RCA shareholders currently receive on an annual basis • Post transaction, RCA shareholders will own 37% (2) of the combined company’s common stock • Two RCA independent directors will be appointed to the AFIN board, bringing the total number of directors to six, including five independent directors • 45 - day Go - Shop period to solicit a superior offer • RCA would pay 0.5% of equity price, or $5.1mm, plus expense reimbursement up to $5.0mm, if the transaction is terminated within 15 days of the end of Go - Shop period or 2.5%, $25.6mm, if the transaction is terminated after the 15th day as a result of entering into or recommending a superior acquisition proposal or as a result of other customary termination events • Additionally, AFIN would pay 2.5%, $25.6mm, if the transaction is terminated for certain customary termination events • Anticipated closing in Q1 2017 Consideration Board Representation Distributions Pro Forma Ownership Go - Shop Breakup Fee Timing (1) In addition to the consideration of $0.95 in cash and 0.385 AFIN shares for each RCA share, each outstanding RCA OP Unit (oth er than the RCA OP Units held by RCA) will convert into 0.424 AFIN OP Units, each outstanding RCA OP Unit and RCA GP Unit held by RCA will convert into 0.385 AFIN OP Units, the 479,802 Class B RC A U nits held by American Realty Capital Retail Advisor, LLC (the “RCA Advisor” or our “Advisor”) and a sub - advisor will convert into AFIN OP Units at a 0.424 exchange ratio, and RCA Advisor’s S ubordinated Participation will be redeemed for a cash payment, to be determined in accordance with the existing terms of the Subordination Participation. Based on the per share value of the AFIN co mmon shares issuable in the transaction (using AFIN's published estimated per share NAV as of December 31, 2015 of $24.17) and the cumulative distributions through June 30, 2016, the redemption payme nt would have been approximately $3.3 million if the transaction had been consummated on June 30, 2016. The actual redemption payment will be computed in accordance with the foregoing based on cumula tiv e distributions and the 7.00 % performance hurdle rate applicable to the computation through the date of consummation of the transaction (2) Based on fully diluted shares outstanding as of August 15, 2016 TRANSACTION DETAILS 8 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

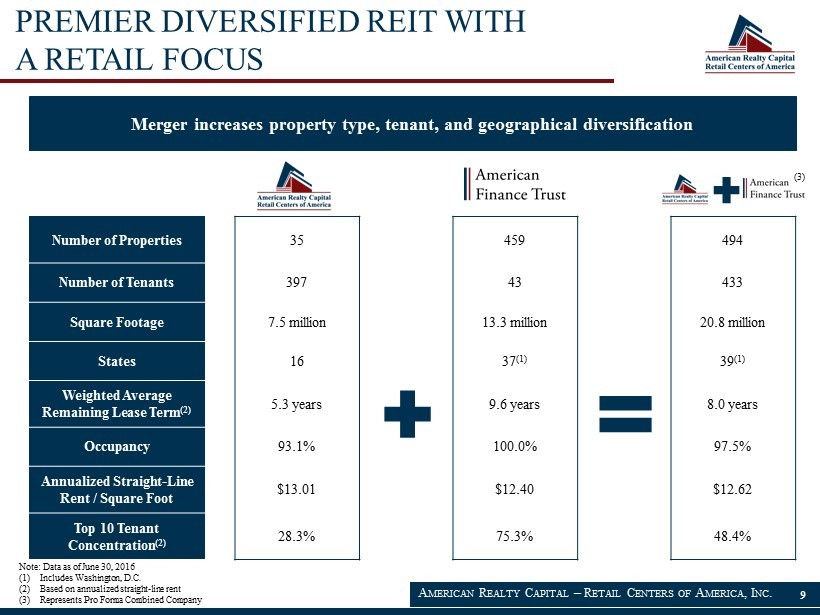

Number of Properties 35 459 494 Number of Tenants 397 43 433 Square Footage 7.5 million 13.3 million 20.8 million States 16 37 (1) 39 (1) Weighted Average Remaining Lease Term (2) 5.3 years 9.6 years 8.0 years O ccupancy 93.1% 100.0% 97.5% Annualized Straight - Line Rent / Square Foot $13.01 $12.40 $12.62 Top 10 Tenant Concentration (2) 28.3% 75.3% 48.4% Merger increases property type, tenant, and geographical diversification Note: Data as of June 30, 2016 (1) Includes Washington, D.C. (2) Based on annualized straight - line rent (3) Represents Pro Forma C ombined C ompany PREMIER DIVERSIFIED REIT WITH A RETAIL FOCUS 9 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC . (3)

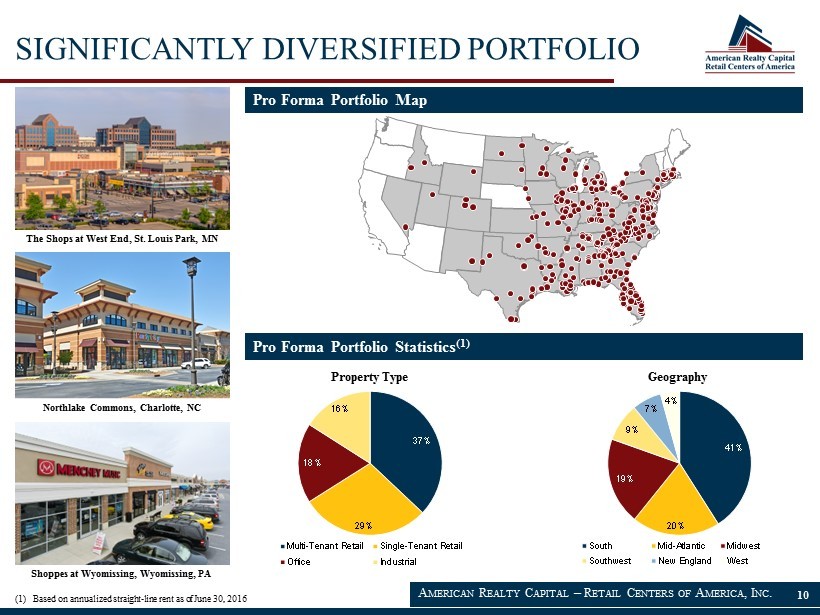

41% 20% 19% 9% 7% 4% South Mid-Atlantic Midwest Southwest New England West (1) Based on annualized straight - line rent as of June 30, 2016 SIGNIFICANTLY DIVERSIFIED PORTFOLIO 37% 29% 18% 16% Multi-Tenant Retail Single-Tenant Retail Office Industrial Pro Forma Portfolio Map Pro Forma Portfolio Statistics (1) Property Type Geography 10 Shops at West End – Multi - Tenant Retail A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC . TBU Pending Advisor Comments Northlake Commons, Charlotte, NC Shoppes at Wyomissing, Wyomissing, PA The Shops at West End, St. Louis Park, MN

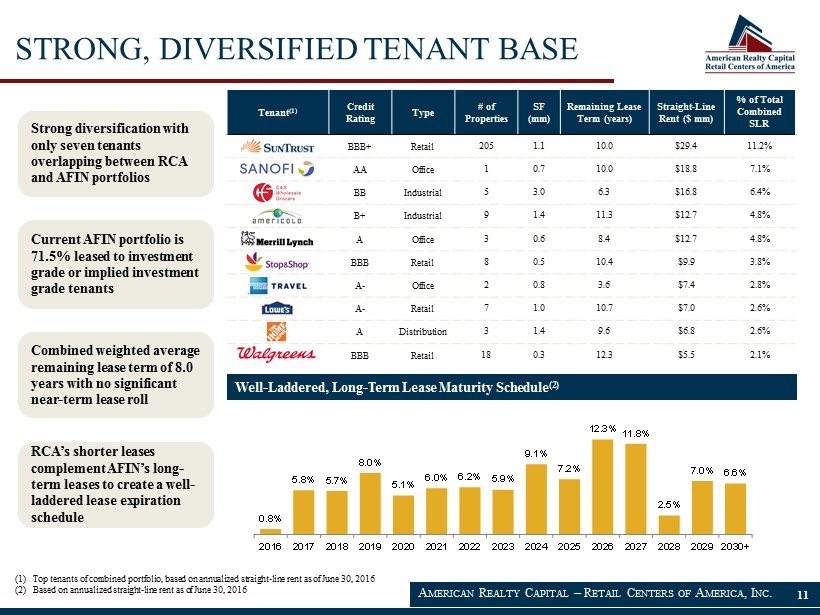

Tenant (1) Credit Rating Type # of Properties SF (mm) Remaining Lease Term (years) Straight - Line Rent ($ mm) % of Total Combined SLR BBB+ Retail 205 1.1 10.0 $29.4 11.2% AA Office 1 0.7 10.0 $18.8 7.1% BB Industrial 5 3.0 6.3 $16.8 6.4% B+ Industrial 9 1.4 11.3 $12.7 4.8% A Office 3 0.6 8.4 $12.7 4.8% BBB Retail 8 0.5 10.4 $9.9 3.8% A - Office 2 0.8 3.6 $7.4 2.8% A - Retail 7 1.0 10.7 $7.0 2.6% A Distribution 3 1.4 9.6 $6.8 2.6% BBB Retail 18 0.3 12.3 $5.5 2.1% Current AFIN portfolio is 71.5% leased to investment grade or implied investment grade tenants Well - Laddered, Long - Term Lease Maturity Schedule (2) Strong diversification with only seven tenants overlapping between RCA and AFIN portfolios Combined weighted average remaining lease term of 8.0 years with no significant near - term lease roll RCA’s shorter leases complement AFIN’s long - term leases to create a well - laddered lease expiration schedule STRONG, DIVERSIFIED TENANT BASE 0.8% 5.8% 5.7% 8.0% 5.1% 6.0% 6.2% 5.9% 9.1% 7.2% 12.3% 11.8% 2.5% 7.0% 6.6% 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030+ 11 (1) Top tenants of combined portfolio, based on annualized straight - line rent as of June 30, 2016 (2) Based on annualized straight - line rent as of June 30, 2016 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

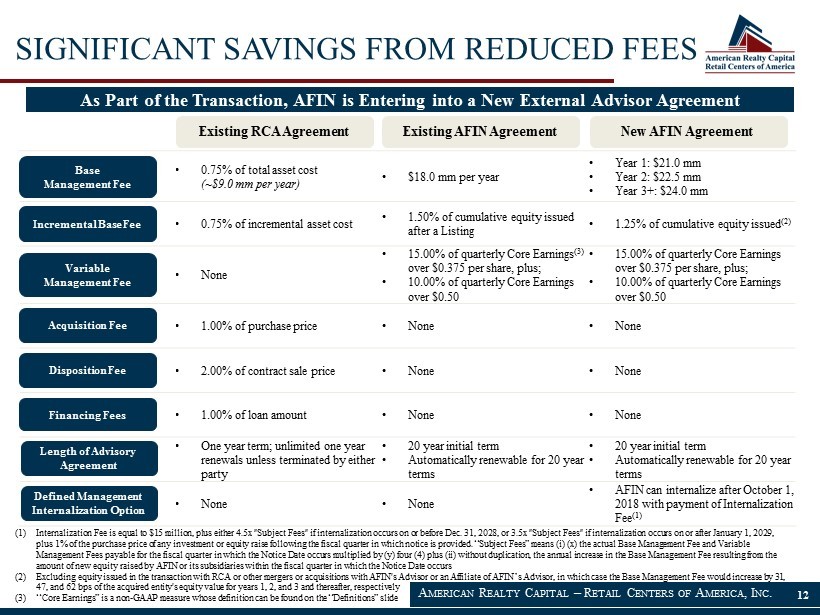

(1) Internalization Fee is equal to $15 million, plus either 4.5x "Subject Fees" if internalization occurs on or before Dec. 31, 202 8, or 3.5x "Subject Fees" if internalization occurs on or after January 1, 2029, plus 1% of the purchase price of any investment or equity raise following the fiscal quarter in which notice is provided. “Su bje ct Fees” means ( i ) (x) the actual Base Management Fee and Variable Management Fees payable for the fiscal quarter in which the Notice Date occurs multiplied by (y) four (4 ) plus (ii) without duplication, the annual increase in the Base Management Fee resulting from the amount of new equity raised by AFIN or its subsidiaries within the fiscal quarter in which the Notice Date occurs (2) Excluding equity issued in the transaction with RCA or other mergers or acquisitions with AFIN's Advisor or an Affiliate of AFIN’s Advisor , in which case the Base Management Fee would increase by 31, 47, and 62 bps of the acquired entity's equity value for years 1, 2, and 3 and thereafter, respectively (3) “Core Earnings” is a non - GAAP measure whose definition can be found on the “Definitions” slide SIGNIFICANT SAVINGS FROM REDUCED FEES As Part of the Transaction, AFIN is Entering into a New External Advisor Agreement • 0.75% of total asset cost (~$9.0 mm per year) • $18.0 mm per year • Year 1: $21.0 mm • Year 2: $22.5 mm • Year 3+: $24.0 mm • 0.75% of incremental asset cost • 1.50% of cumulative equity issued after a Listing • 1.25% of cumulativ e equity issued (2) • None • 15.00% of quarterly Core Earnings (3) over $0.375 per share, plus; • 10.00% of quarterly Core Earnings over $0.50 • 15.00% of quarterly Core Earnings over $0.375 per share, plus; • 10.00% of quarterly Core Earnings over $0.50 • 1.00% of purchase price • None • None • 2.00% of contract sale price • None • None • 1.00% of loan amount • None • None • One year term; unlimited one year renewals unless terminated by either party • 20 year initial term • Automatically renewable for 20 year terms • 20 year initial term • Automatically renewable for 20 year terms • None • None • AFIN can internalize after October 1 , 2018 with payment of Internalization Fee (1) Variable Management Fee Disposition Fee Acquisition Fee Base Management Fee Financing Fees Incremental Base Fee Existing RCA Agreement Existing AFIN Agreement New AFIN Agreement Defined Management Internalization Option Length of Advisory Agreement 12 12 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

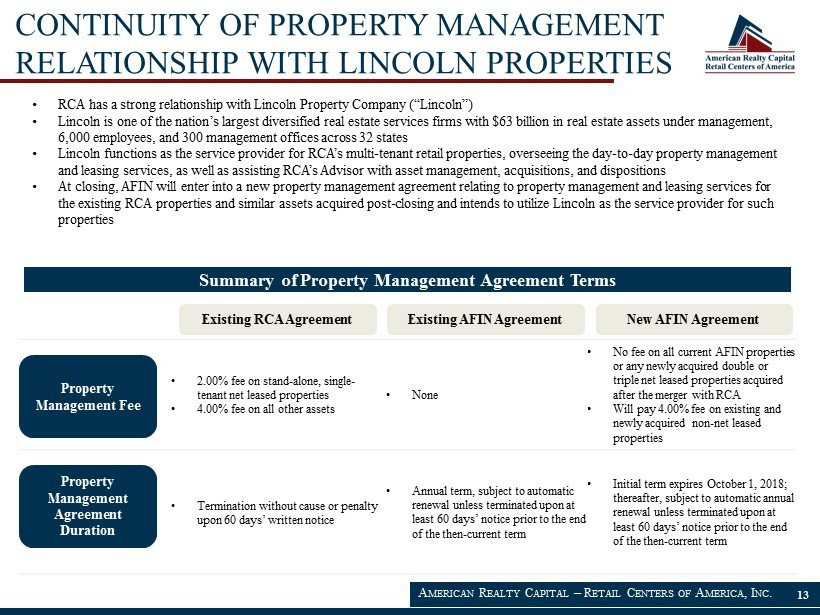

• 2.00% fee on stand - alone, single - tenant net leased properties • 4.00% fee on all other assets • None • No fee on all current AFIN properties or any newly acquired double or triple net leased properties acquired after the merger with RCA • Will pay 4.00% fee on existing and newly acquired non - net leased properties • Termination without cause or penalty upon 60 days’ written notice • Annual term, subject to automatic renewal unless terminated upon at least 60 days’ notice prior to the end of the then - current term • Initial term expires October 1, 2018; thereafter, subject to automatic annual renewal unless terminated upon at least 60 days’ notice prior to the end of the then - current term Property Management Fee Property Management Agreement Duration Existing RCA Agreement Existing AFIN Agreement New AFIN Agreement 13 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC . CONTINUITY OF PROPERTY MANAGEMENT RELATIONSHIP WITH LINCOLN PROPERTIES • RCA has a strong relationship with Lincoln Property Company (“Lincoln”) • Lincoln is one of the nation’s largest diversified real estate services firms with $63 billion in real estate assets under ma nag ement, 6,000 employees, and 300 management offices across 32 states • Lincoln functions as the service provider for RCA’s multi - tenant retail properties, overseeing the day - to - day property management and leasing services, as well as assisting RCA’s Advisor with asset management, acquisitions, and dispositions • At closing, AFIN will enter into a new property management agreement relating to property management and leasing services for the existing RCA properties and similar assets acquired post - closing and intends to utilize Lincoln as the service provider for such properties Summary of Property Management Agreement Terms

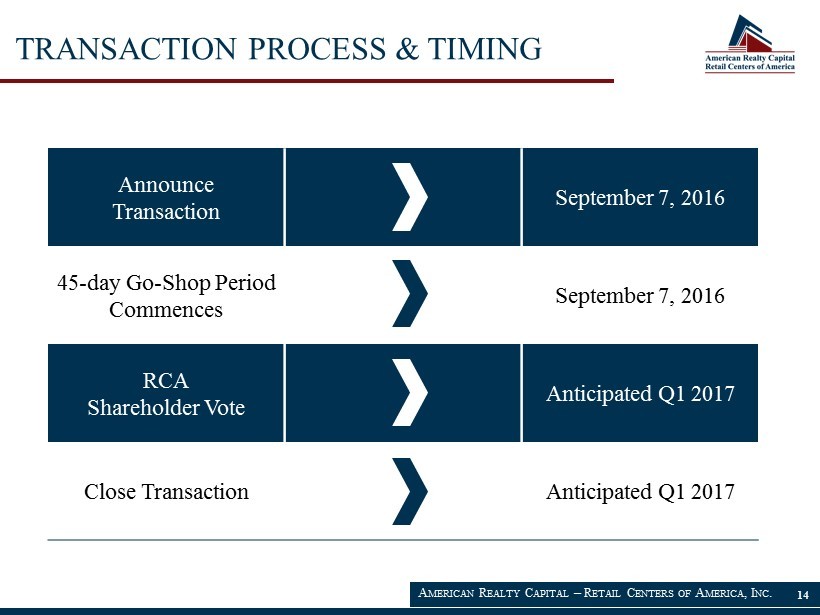

TRANSACTION PROCESS & TIMING Announce Transaction September 7, 2016 45 - day Go - Shop Period Commences September 7 , 2016 RCA Shareholder Vote Anticipated Q1 2017 Close Transaction Anticipated Q1 2017 14 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

SIGNIFICANT BENEFITS FOR RCA SHAREHOLDERS 15 x Increased scale is expected to provide better access to capital markets x Large, diversified portfolio broadens the revenue base of the combined company x Cost savings and synergies x Maintains distribution parity x Better positioned for future liquidity options A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC . Walgreens, Pine Bluff, AR L.A. Fitness, Houston, TX American Express Travel Related Services, Greensboro, NC

This presentation includes estimated projections of future operating results. These projections were not prepared in accordance with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of financial projections. This information is not fact and should not be relied upon as being necessarily indicative of future results; the projections were prepared in good faith by management and are based on numerous assumptions that may prove to be wrong. Important factors that may affect actual results and cause the projections to not be achieved include, but are not limited to, risks and uncertainties relating to the company and other factors described in the “Risk Factors” section of RCA’s Annual Report on Form 10 - K filed with the SEC on March 11, 2016, RCA’s Quarterly Reports on Form 10 - Q filed for the quarters ended March 31, 2016 and June 30, 2016 filed on May 13, 2016 and August 12, 2016, respectively, in the “Risk Factors” section of AFIN’s Annual Report on Form 10 - K filed with the SEC on March 16, 2016, AFIN’s Quarterly Reports on Form 10 - Q filed for the quarters ended March 31, 2016 and June 30, 2016 filed on May 13, 2016 and August 11, 2016, respectively, in RCA’s and AFIN’s future filings with the SEC. The projections also reflect assumptions as to certain business decisions that are subject to change. As a result, actual results may differ materially from those contained in the estimates. Accordingly, there can be no assurance that the estimates will be realized. This presentation also contains estimates and information concerning our industry, including market position, market size, and growth rates of the markets in which we participate, that are based on industry publications and reports. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the “Risk Factors” section of the Company’s Annual Report on Form 10 - K filed with the SEC on March 11, 2016, the Quarterly Reports on Form 10 - Q filed for the quarters ended March 31, 2016 and June 30, 2016 filed on May 13, 2016 and August 12, 2016, respectively, and in future filings with the SEC. These and other factors could cause results to differ materially from those expressed in these publications and reports . PROJECTIONS 16 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31, 2015 and our Quarterly Reports on Form 10 - Q filed from time to time. The following are some of the risks and uncertainties relating to us and the proposed transaction, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements: • All of our executive officers are also officers, managers or holders of a direct or indirect controlling interest in American Realty Capital Retail Advisor, LLC or other entities under common control with AR Global Investments, LLC (“AR Global”) . As a result, our executive officers, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by our Advisor’s compensation arrangements with us and other investment programs advised by affiliates of our sponsor and conflicts in allocating time among these entities and us, which could negatively impact our operating results. • The merger and related transactions are subject to certain conditions, including approval by stockholders of RCA and AFIN. • The merger is conditioned on AFIN’s common stock being authorized for listing, but the merger agreement does not require that AFIN’s common stock begin trading upon closing. There can be no assurance that our or AFIN’s common stock will be listed. No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid. • AFIN’s net asset value represents AFIN’s estimate of the value of its assets and does not necessarily represent the amount a third party would pay for AFIN’s assets or the price at which AFIN’s shares would trade if they were listed on an exchange or were actively traded by brokers. • Failure to complete the merger could negatively impact the value of RCA common stock, and the future business and financial results of RCA. POTENTIAL RISKS 17 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

• The pendency of the merger could adversely affect the business and operations of RCA and AFIN. • If the merger is not consummated by March 6, 2017 (or April 21, 2017, if the joint proxy statement/prospectus is not declared effective before January 6, 2017), either RCA or AFIN may terminate the merger agreement. • We depend on tenants for our rental revenue and, accordingly, our rental revenue is dependent upon the success and economic viability of our tenants. • Our tenants may not achieve our rental rate incentives and our expenses could be greater, which may impact our results of operations. • We have not generated, and in the future may not generate, operating cash flows sufficient to cover 100% of our distributions, and, as such, we may be forced to source distributions from borrowings, which may be at unfavorable rates, or depend on our Advisor to waive reimbursement of certain expenses or fees. There is no assurance that our Advisor will waive reimbursement of expenses or fees . • We may be unable to pay or maintain cash distributions at the current rate or increase distributions over time. • We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates. • We are subject to risks associated with any dislocation or liquidity disruptions that may exist or occur in the credit markets of the United States of America. • We may fail to continue to qualify to be treated as a real estate investment trust for U.S. federal income tax purposes, which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and our cash available for distributions. • We may be deemed by regulators to be an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and thus subject to regulation under the Investment Company Act. POTENTIAL RISKS (CONT’D) 18 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

Certain statements made in this presentation are “forward - looking statements” (as defined in Section 21E of the Securities Exchange Act of 1934), which reflect the expectations of RCA and AFIN regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”) between RCA and AFIN, among others, will be consummated, the new combined company’s plans, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to the combined company, including regarding future distributions and market valuations, and other statements that are not historical facts . The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements: the ability to obtain regulatory approvals for the transaction and the approval by AFIN's and RCA’s stockholders of the transactions contemplated in the Merger Agreement; market volatility; unexpected costs or unexpected liabilities that may arise from the transaction, whether or not consummated; the inability to retain key personnel; continuation or deterioration of current market conditions; future regulatory or legislative actions that could adversely affect the companies; and the business plans of the tenants of the respective parties. Additional factors that may affect future results are contained in RCA’s and AFIN’s filings with the SEC, which are available at the SEC’s website at www.sec.gov. RCA and AFIN disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise. FORWARD LOOKING STATEMENTS 19 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

• Core Earnings • Core Earnings, as defined in the existing AFIN advisory agreement and the new AFIN advisory agreement, means the net income (loss), computed in accordance with GAAP, excluding ( i ) non - cash equity compensation expense, (ii) the Variable Management Fee, (iii) acquisition and transaction related fees and expenses, (iv) financing related fees and expenses, (v) depreciation and amortization , ( vi) realized gains and losses on the sale of assets, (vii) any unrealized gains or losses or other non - cash items that are included in net income (loss) for the applicable reporting period, regardless of whether such items are included in other comprehensive income or loss, or in net income, (viii) one - time events pursuant to changes in GAAP and certain non - cash charges, (ix) impairment losses on real estate related investments and other than temporary impairment of securities, (x) amortization of deferred financing costs, (xi) amortization of tenant inducements, (xii) amortization of straight - line rent, ( xiii) amortization of market lease intangibles, (xiv) provision for loan losses and (xv) other non - recurring revenue and expenses, in each case after discussions between the Advisor to AFIN and the independent directors of AFIN and approved by a majority of the independent d irectors of AFIN. DEFINITIONS 20 A MERICAN R EALTY C APITAL – R ETAIL C ENTERS OF A MERICA , I NC .

▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com American Realty Capital – Retail Centers of America www.RetailCentersofAmerica.com