Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - NAVISTAR INTERNATIONAL CORP | d242623dex991.htm |

| EX-10.7 - EX-10.7 - NAVISTAR INTERNATIONAL CORP | d242623dex107.htm |

| EX-10.6 - EX-10.6 - NAVISTAR INTERNATIONAL CORP | d242623dex106.htm |

| EX-10.3 - EX-10.3 - NAVISTAR INTERNATIONAL CORP | d242623dex103.htm |

| EX-10.2 - EX-10.2 - NAVISTAR INTERNATIONAL CORP | d242623dex102.htm |

| EX-10.1 - EX-10.1 - NAVISTAR INTERNATIONAL CORP | d242623dex101.htm |

| 8-K - FORM 8-K - NAVISTAR INTERNATIONAL CORP | d242623d8k.htm |

Volkswagen Truck & Bus and Navistar enter into a strategic alliance September 6, 2016 Exhibit 99.2

Disclaimer The following presentation contains forward-looking statements and information on, inter alia, the scope of the strategic alliance, ways of collaboration regarding the strategic alliance, descriptions of the business strategy of both companies, and expected benefits and synergies of the strategic alliance. These statements and information may be spoken or written and can be recognized by terms such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” or words with similar meaning. These statements and information are based on assumptions relating to the companies' business and operations, the development of the economies in the countries in which either company is active, and the completion of the transactions contemplated by the parties, among others. Volkswagen Truck & Bus and Navistar have made such forward-looking statements on the basis of the information available to them and assumptions they believe to be reasonable. The financial information and financial data included in this presentation are preliminary, unaudited, and may be subject to revision upon completion of both companies’ audit process. The forward-looking statements and information involve significant risks and uncertainties, and actual results may differ materially from those forecast. Such risks and uncertainties include, but are not limited to, the parties inability for any reason to complete any or all of the contemplated transactions described in this presentation, achieve the expected benefits and synergies associated with those transactions, enter into definitive agreements concerning the contemplated license and supply agreements and procurement joint venture, realize anticipated cost savings from the procurement joint venture (including, but not limited to, as a result of any counterparty’s unwillingness to conduct business with the joint venture or take the joint venture’s recommendations), anticipate the outcome of future feasibility studies and collaboration discussions and develop successfully future technologies and products. Further risks and uncertainties may result from Navistar’s adaptations and localizations of VW Truck & Bus’s engines and technology. If any of these or other risks or uncertainties materialize, or if the assumptions underlying any of these statements prove incorrect, the actual results may significantly differ from those expressed or implied by such forward-looking statements and information. Volkswagen Truck & Bus and Navistar will not update the following presentation, particularly not the forward-looking statements. The presentation is valid on the date of publication only.

Troy Clarke President and Chief Executive Officer Andreas Renschler Chief Executive Officer

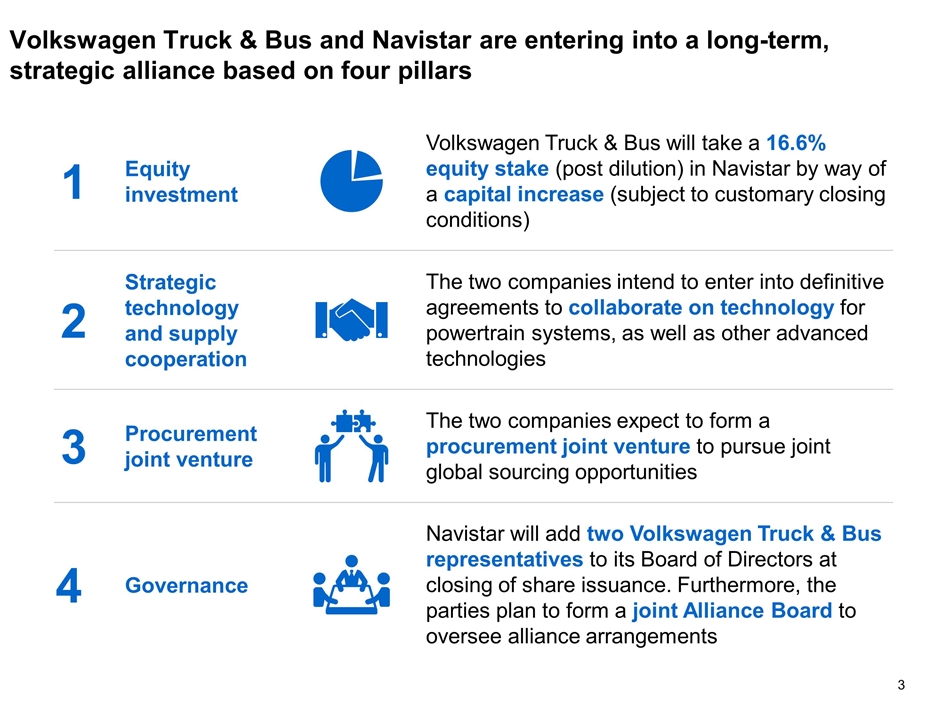

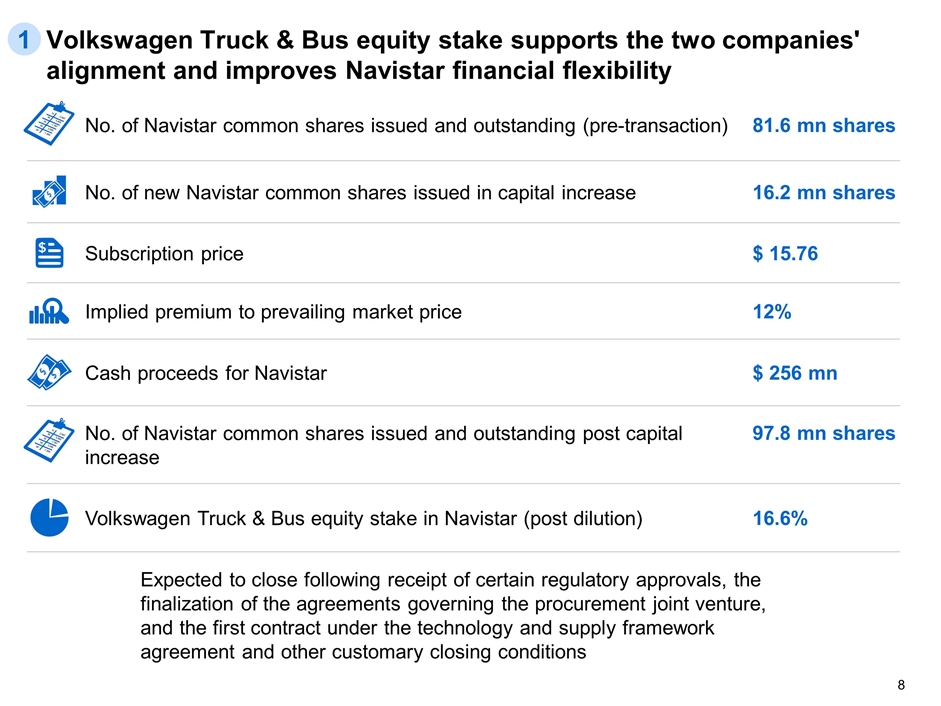

Volkswagen Truck & Bus and Navistar are entering into a long-term, strategic alliance based on four pillars Volkswagen Truck & Bus will take a 16.6% equity stake (post dilution) in Navistar by way of a capital increase (subject to customary closing conditions) Equity investment 1 The two companies intend to enter into definitive agreements to collaborate on technology for powertrain systems, as well as other advanced technologies Strategic technology and supply cooperation 2 The two companies expect to form a procurement joint venture to pursue joint global sourcing opportunities Procurement joint venture 3 Navistar will add two Volkswagen Truck & Bus representatives to its Board of Directors at closing of share issuance. Furthermore, the parties plan to form a joint Alliance Board to oversee alliance arrangements Governance 4

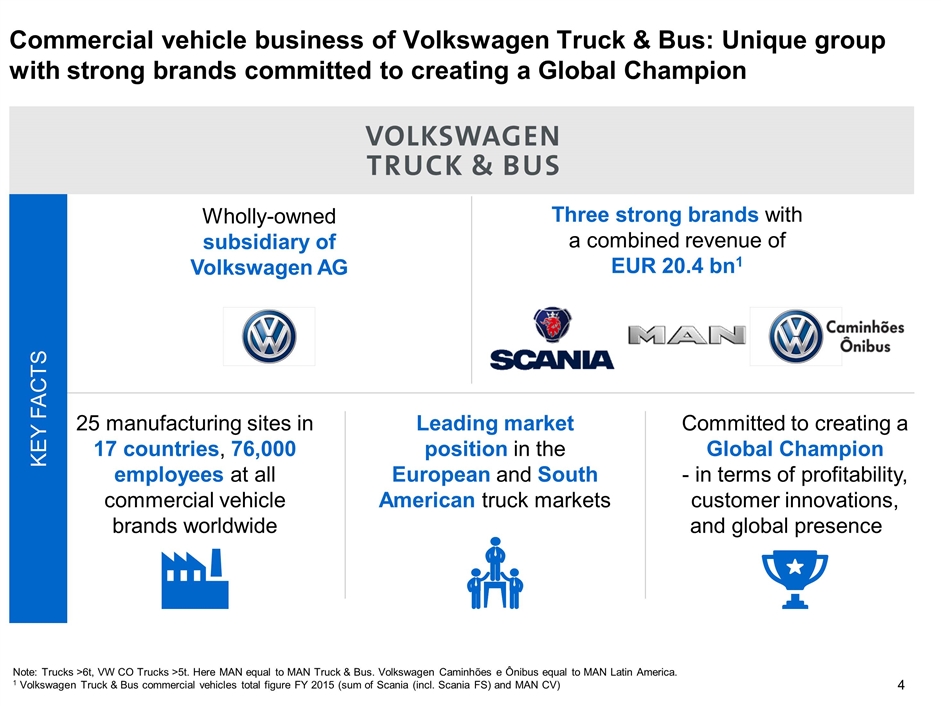

Commercial vehicle business of Volkswagen Truck & Bus: Unique group with strong brands committed to creating a Global Champion Wholly-owned subsidiary of Volkswagen AG 25 manufacturing sites in 17 countries, 76,000 employees at all commercial vehicle brands worldwide Leading market position in the European and South American truck markets Committed to creating a Global Champion - in terms of profitability, customer innovations, and global presence KEY FACTS Three strong brands with a combined revenue of EUR 20.4 bn1 Note: Trucks >6t, VW CO Trucks >5t. Here MAN equal to MAN Truck & Bus. Volkswagen Caminhões e Ônibus equal to MAN Latin America. 1 Volkswagen Truck & Bus commercial vehicles total figure FY 2015 (sum of Scania (incl. Scania FS) and MAN CV)

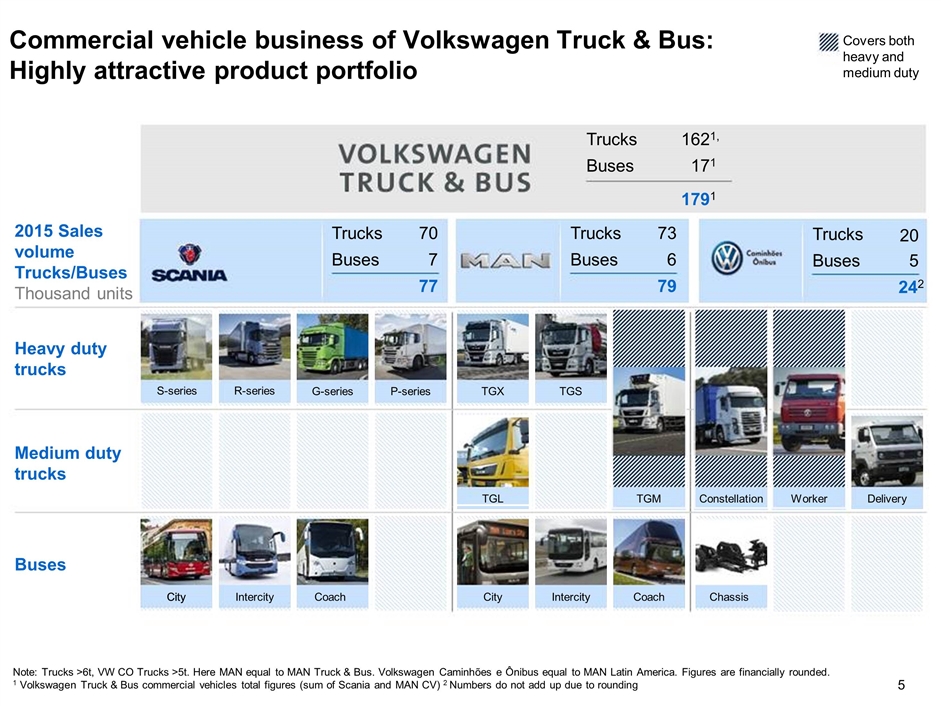

Commercial vehicle business of Volkswagen Truck & Bus: Highly attractive product portfolio Covers both heavy and medium duty Trucks 1621, Buses 171 1791 2015 Sales volume Trucks/Buses Thousand units 20 Trucks Buses 5 242 Trucks Buses 73 6 79 Trucks Buses 70 7 77 TGX TGS P-series G-series R-series S-series Heavy duty trucks Delivery Constellation Worker TGL TGM Medium duty trucks Chassis City Intercity Coach Coach Intercity City City Buses Note: Trucks >6t, VW CO Trucks >5t. Here MAN equal to MAN Truck & Bus. Volkswagen Caminhões e Ônibus equal to MAN Latin America. Figures are financially rounded. 1 Volkswagen Truck & Bus commercial vehicles total figures (sum of Scania and MAN CV) 2 Numbers do not add up due to rounding

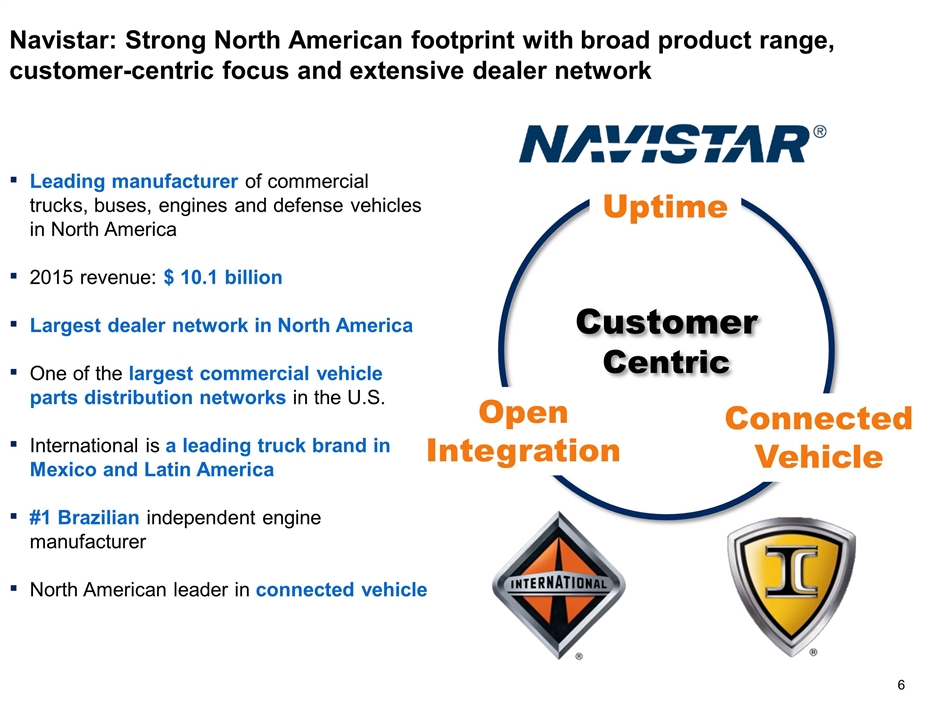

Navistar: Strong North American footprint with broad product range, customer-centric focus and extensive dealer network Leading manufacturer of commercial trucks, buses, engines and defense vehicles in North America 2015 revenue: $ 10.1 billion Largest dealer network in North America One of the largest commercial vehicle parts distribution networks in the U.S. International is a leading truck brand in Mexico and Latin America #1 Brazilian independent engine manufacturer North American leader in connected vehicle Customer Centric Uptime Open Integration Connected Vehicle

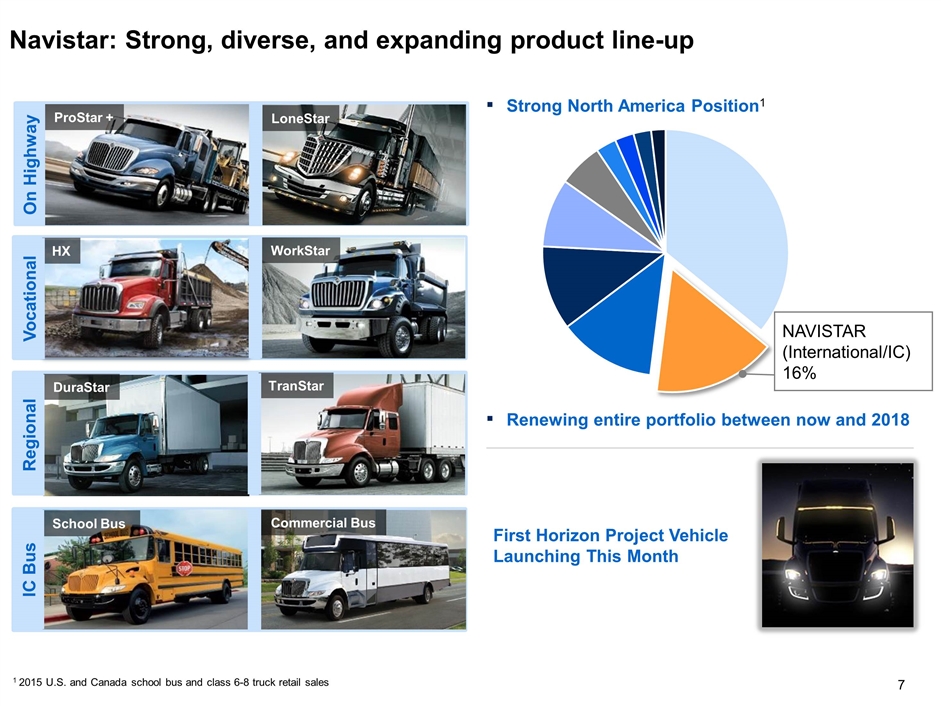

Navistar: Strong, diverse, and expanding product line-up ProStar + TranStar LoneStar DuraStar School Bus WorkStar HX Strong North America Position1 Renewing entire portfolio between now and 2018 Commercial Bus 1 2015 U.S. and Canada school bus and class 6-8 truck retail sales On Highway Vocational Regional IC Bus NAVISTAR (International/IC) 16% First Horizon Project Vehicle Launching This Month

Volkswagen Truck & Bus equity stake supports the two companies' alignment and improves Navistar financial flexibility 1 No. of new Navistar common shares issued in capital increase 16.2 mn shares Implied premium to prevailing market price 12% Subscription price $ 15.76 No. of Navistar common shares issued and outstanding (pre-transaction) 81.6 mn shares 2.687 5.466 -1.367 3.586 -1.989 14 46 36 58 99 Cash proceeds for Navistar $ 256 mn No. of Navistar common shares issued and outstanding post capital increase 97.8 mn shares 2.687 5.466 -1.367 3.586 -1.989 14 46 36 58 99 Volkswagen Truck & Bus equity stake in Navistar (post dilution) 16.6% Expected to close following receipt of certain regulatory approvals, the finalization of the agreements governing the procurement joint venture, and the first contract under the technology and supply framework agreement and other customary closing conditions

Technology collaboration framework will create an opportunity for Volkswagen Truck & Bus and Navistar to enter into definitive agreements to develop high quality powertrain and advanced technology solutions 2 Potential examples: Advanced Driver Assistance Systems “Connected vehicle” solutions Cabin and chassis components Fuel efficiency technologies Powertrain systems Scope Volkswagen Truck & Bus and Navistar expected to jointly develop powertrain related solutions Volkswagen Truck & Bus expected to supply and license the relevant technology to Navistar Navistar expected to localize product where appropriate Volkswagen Truck & Bus and Navistar to pursue collaboration in additional technologies Collaboration could include joint research, development, testing, and production Cooperation Example Planned initial technology collaboration Planned collaboration around future technologies

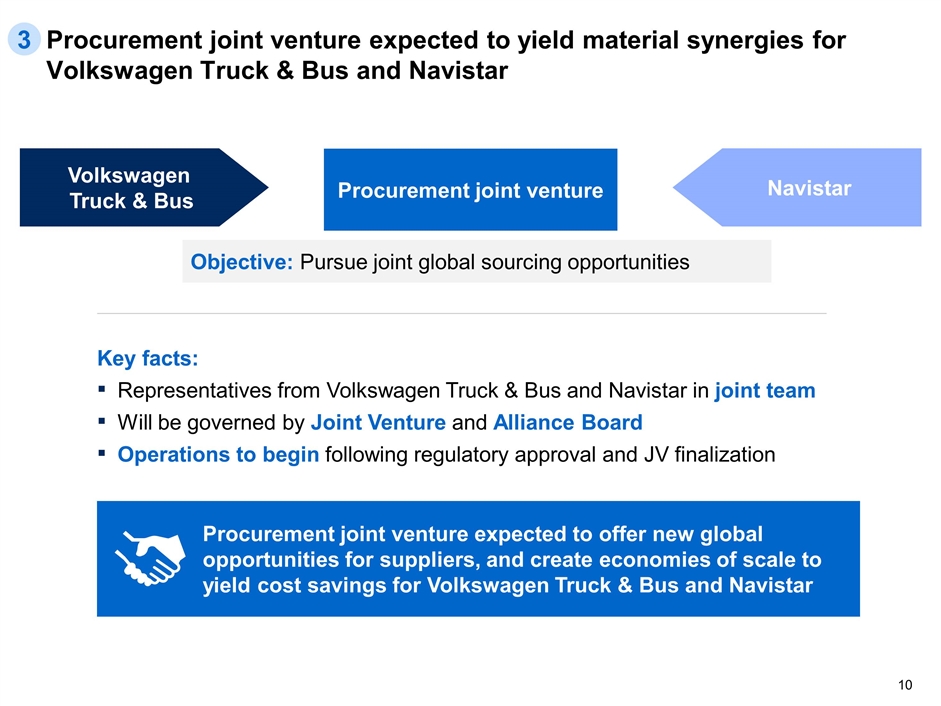

Procurement joint venture expected to yield material synergies for Volkswagen Truck & Bus and Navistar 3 Key facts: Representatives from Volkswagen Truck & Bus and Navistar in joint team Will be governed by Joint Venture and Alliance Board Operations to begin following regulatory approval and JV finalization Procurement joint venture expected to offer new global opportunities for suppliers, and create economies of scale to yield cost savings for Volkswagen Truck & Bus and Navistar Procurement joint venture Volkswagen Truck & Bus Navistar Objective: Pursue joint global sourcing opportunities

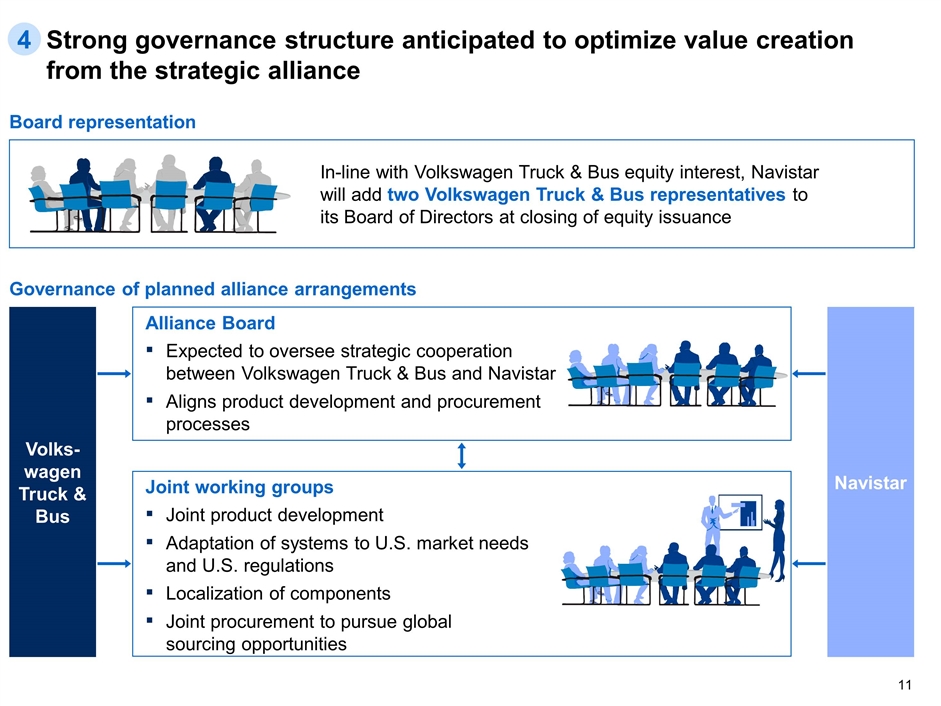

Strong governance structure anticipated to optimize value creation from the strategic alliance Board representation In-line with Volkswagen Truck & Bus equity interest, Navistar will add two Volkswagen Truck & Bus representatives to its Board of Directors at closing of equity issuance Governance of planned alliance arrangements Volks-wagen Truck & Bus Navistar Alliance Board Expected to oversee strategic cooperation between Volkswagen Truck & Bus and Navistar Aligns product development and procurement processes Joint working groups Joint product development Adaptation of systems to U.S. market needs and U.S. regulations Localization of components Joint procurement to pursue global sourcing opportunities 4

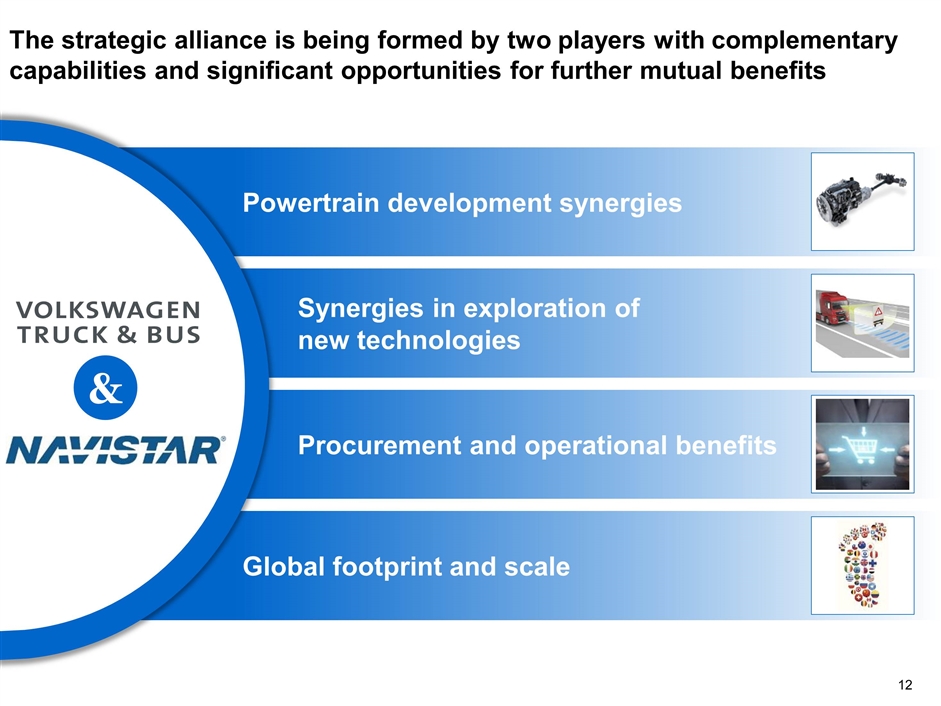

Powertrain development synergies Global footprint and scale Synergies in exploration of new technologies Procurement and operational benefits The strategic alliance is being formed by two players with complementary capabilities and significant opportunities for further mutual benefits &

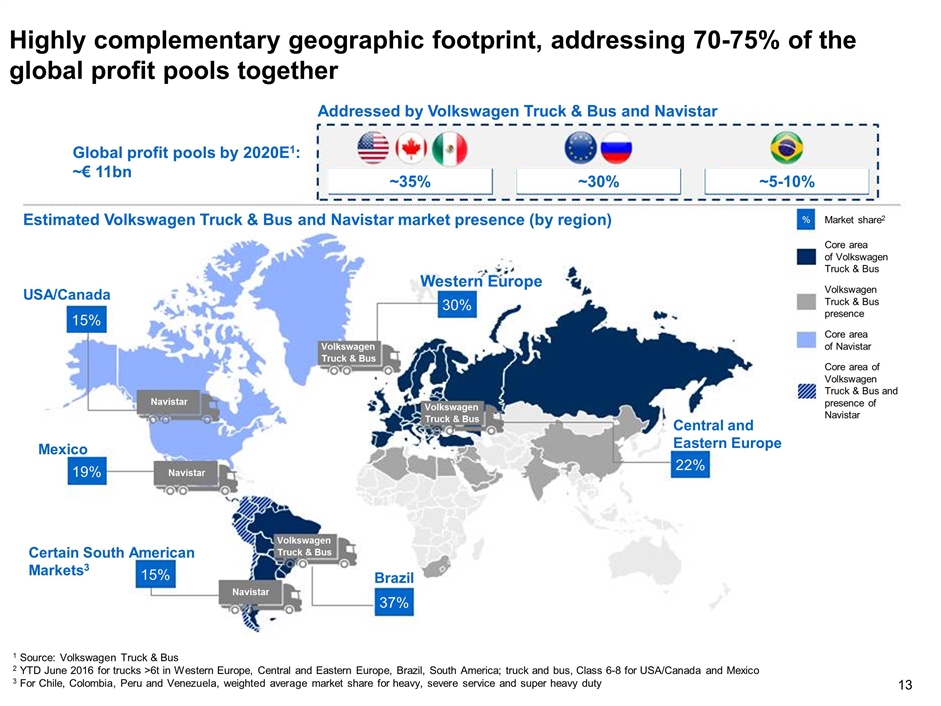

Highly complementary geographic footprint, addressing 70-75% of the global profit pools together 1 Source: Volkswagen Truck & Bus 2 YTD June 2016 for trucks >6t in Western Europe, Central and Eastern Europe, Brazil, South America; truck and bus, Class 6-8 for USA/Canada and Mexico 3 For Chile, Colombia, Peru and Venezuela, weighted average market share for heavy, severe service and super heavy duty Estimated Volkswagen Truck & Bus and Navistar market presence (by region) Western Europe Navistar Brazil USA/Canada Central and Eastern Europe Volkswagen Truck & Bus Mexico Certain South American Markets3 15% 37% 22% 30% Navistar Navistar Volkswagen Truck & Bus Volkswagen Truck & Bus 15% 19% Core area of Volkswagen Truck & Bus Core area of Navistar Volkswagen Truck & Bus presence Market share2 % Core area of Volkswagen Truck & Bus and presence of Navistar Global profit pools by 2020E1: ~€ 11bn ~35% ~30% ~5-10% Addressed by Volkswagen Truck & Bus and Navistar

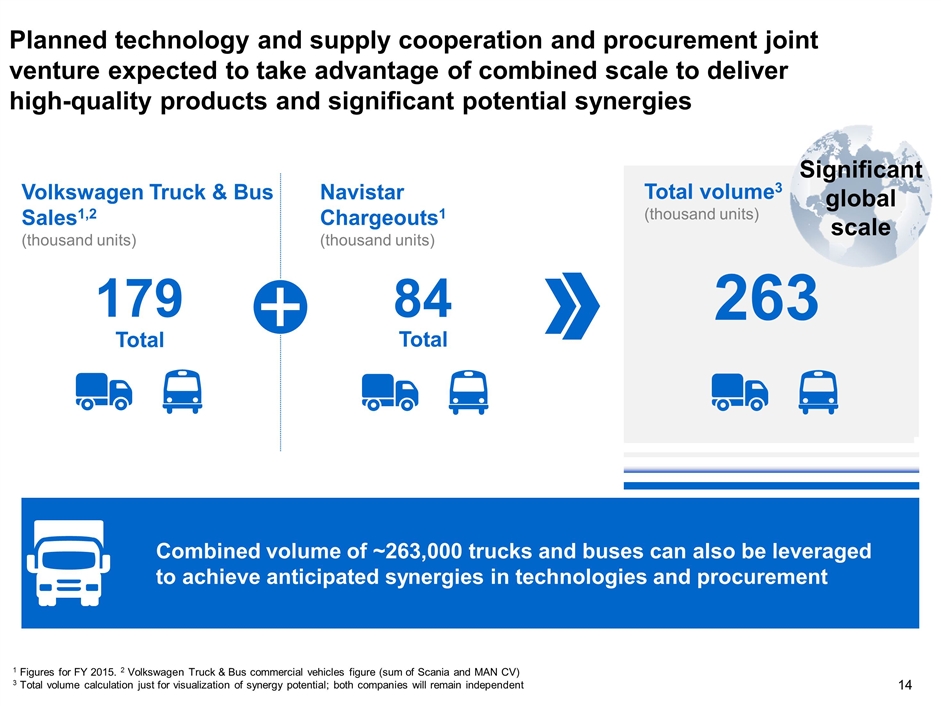

Planned technology and supply cooperation and procurement joint venture expected to take advantage of combined scale to deliver high-quality products and significant potential synergies Combined volume of ~263,000 trucks and buses can also be leveraged to achieve anticipated synergies in technologies and procurement Volkswagen Truck & Bus Sales1,2 (thousand units) Navistar Chargeouts1 (thousand units) Total volume3 (thousand units) 179 84 263 Significant global scale 1 Figures for FY 2015. 2 Volkswagen Truck & Bus commercial vehicles figure (sum of Scania and MAN CV) 3 Total volume calculation just for visualization of synergy potential; both companies will remain independent

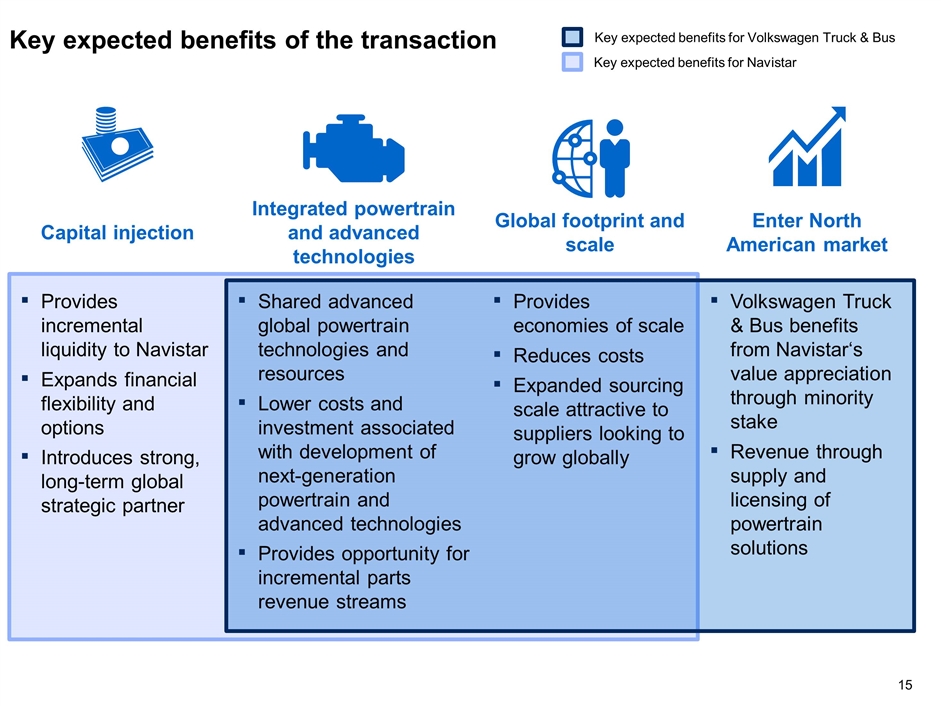

Key expected benefits of the transaction Key expected benefits for Volkswagen Truck & Bus Key expected benefits for Navistar Enter North American market Volkswagen Truck & Bus benefits from Navistar‘s value appreciation through minority stake Revenue through supply and licensing of powertrain solutions Global footprint and scale Provides economies of scale Reduces costs Expanded sourcing scale attractive to suppliers looking to grow globally Capital injection Provides incremental liquidity to Navistar Expands financial flexibility and options Introduces strong, long-term global strategic partner Integrated powertrain and advanced technologies Shared advanced global powertrain technologies and resources Lower costs and investment associated with development of next-generation powertrain and advanced technologies Provides opportunity for incremental parts revenue streams

Q&A session Andreas Renschler Walter Borst Troy Clarke President and Chief Executive Officer Chief Executive Officer Chief Financial Officer Matthias Gründler Chief Financial Officer