Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - EOG RESOURCES INC | d251549dex991.htm |

| 8-K - 8-K - EOG RESOURCES INC | d251549d8k.htm |

NYSE Stock Symbol:EOG Common Dividend:$0.67 Basic Shares Outstanding:551 Million Internet Address: http://www.eogresources.com Investor Relations Contacts Cedric W. Burgher, SVP Investor and Public Relations (713) 571-4658, cburgher@eogresources.com David J. Streit, Director IR (713) 571-4902, dstreit@eogresources.com Kimberly M. Ehmer, Manager IR (713) 571-4676, kehmer@eogresources.com Yates Transaction Exhibit 99.2

Copyright; Assumption of Risk: Copyright 2016. This presentation and the contents of this presentation have been copyrighted by EOG Resources, Inc. (EOG). All rights reserved. Copying of the presentation is forbidden without the prior written consent of EOG. Information in this presentation is provided “as is” without warranty of any kind, either express or implied, including but not limited to the implied warranties of merchantability, fitness for a particular purpose and the timeliness of the information. You assume all risk in using the information. In no event shall EOG or its representatives be liable for any special, indirect or consequential damages resulting from the use of the information. Cautionary Notice Regarding Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements herein, other than statements of historical fact, including, among others, statements regarding EOG’s projections and expectations with respect to the future operations of the combined company, the future drilling activities and production growth in respect of the acquired Yates acreage, the returns and performance to be achieved from the combined company’s assets, EOG’s business strategy, plans and objectives in respect of the acquired Yates acreage and the anticipated closing date of the transaction described herein, are forward-looking statements. Forward-looking statements are not guarantees of performance. Although EOG believes the expectations reflected in its forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Moreover, EOG's forward-looking statements may be affected by known, unknown or currently unforeseen risks, events or circumstances that may be outside EOG's control. Important factors that could cause EOG's actual results to differ materially from the expectations reflected in EOG's forward-looking statements are enumerated in EOG’s most recent Quarterly Reports on Form 10-Q filed with the United States Securities and Exchange Commission (SEC); see the sections entitled “Information Regarding Forward-Looking Statements” therein. Also, see “Risk Factors” on pages 13 through 21 of EOG's Annual Report on Form 10-K for the fiscal year ended December 31, 2015 filed with the SEC for a discussion of certain risk factors that affect or may affect EOG’s business, financial position and results of operations. You should not place any undue reliance on any of EOG's forward-looking statements. EOG's forward-looking statements speak only as of the date made, and EOG undertakes no obligation, other than as required by applicable law, to update or revise its forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise. Reconciliation and calculation schedules for EOG non-GAAP financial measures can be found on the EOG website at www.eogresources.com. Oil and Gas Reserves: The United States Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose not only “proved” reserves (i.e., quantities of oil and gas that are estimated to be recoverable with a high degree of confidence), but also “probable” reserves (i.e., quantities of oil and gas that are as likely as not to be recovered) as well as “possible” reserves (i.e., additional quantities of oil and gas that might be recovered, but with a lower probability than probable reserves). Statements of reserves are only estimates and may not correspond to the ultimate quantities of oil and gas recovered. Any reserve estimates provided in this presentation that are not specifically designated as being estimates of proved reserves may include "potential" reserves and/or other estimated reserves not necessarily calculated in accordance with, or contemplated by, the SEC’s latest reserve reporting guidelines. Investors are urged to consider closely the disclosure in EOG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, available from EOG at P.O. Box 4362, Houston, Texas 77210-4362 (Attn: Investor Relations). You can also obtain this report from the SEC by calling 1-800-SEC-0330 or from the SEC's website at www.sec.gov.

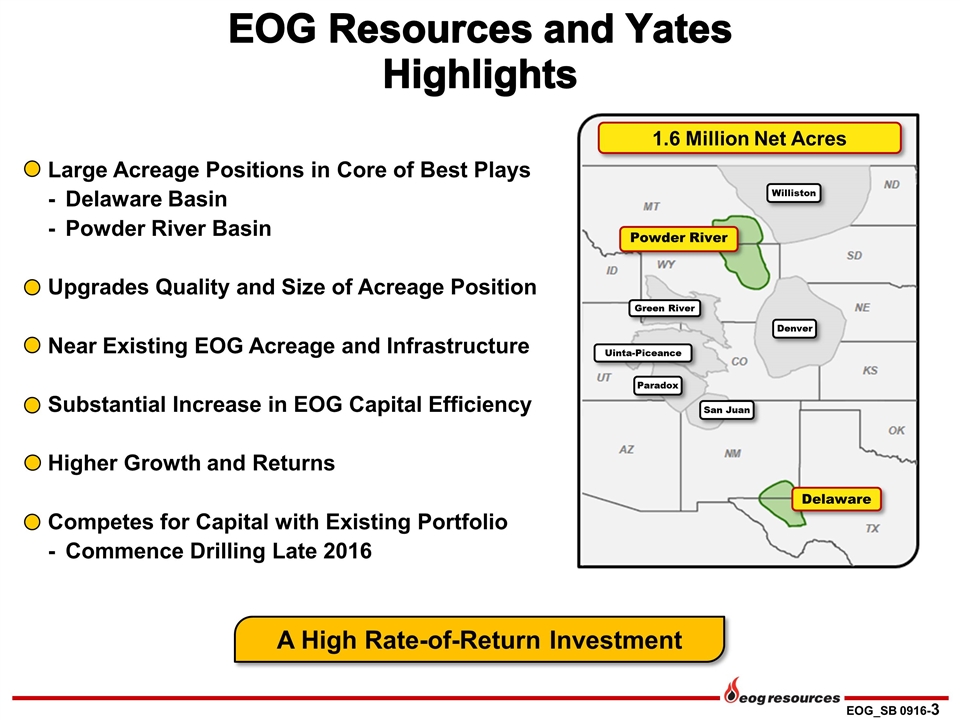

EOG Resources and Yates Highlights Large Acreage Positions in Core of Best Plays -Delaware Basin -Powder River Basin Upgrades Quality and Size of Acreage Position Near Existing EOG Acreage and Infrastructure Substantial Increase in EOG Capital Efficiency Higher Growth and Returns Competes for Capital with Existing Portfolio -Commence Drilling Late 2016 A High Rate-of-Return Investment Williston Powder River Denver Green River Uinta-Piceance Paradox San Juan Delaware 1.6 Million Net Acres

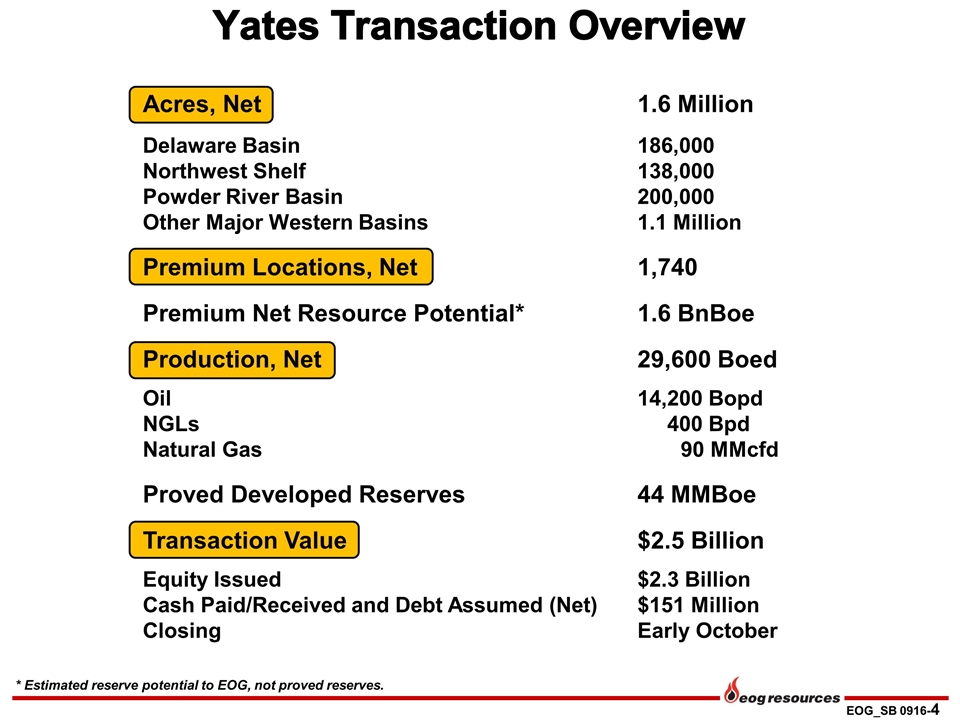

* Estimated reserve potential to EOG, not proved reserves. Yates Transaction Overview Acres, Net1.6 Million Delaware Basin 186,000 Northwest Shelf 138,000 Powder River Basin200,000 Other Major Western Basins1.1 Million Premium Locations, Net 1,740 Premium Net Resource Potential*1.6 BnBoe Production, Net29,600 Boed Oil 14,200 Bopd NGLs 400 Bpd Natural Gas 90 MMcfd Proved Developed Reserves 44 MMBoe Transaction Value$2.5 Billion Equity Issued$2.3 Billion Cash Paid/Received and Debt Assumed(Net)$151 Million Closing Early October

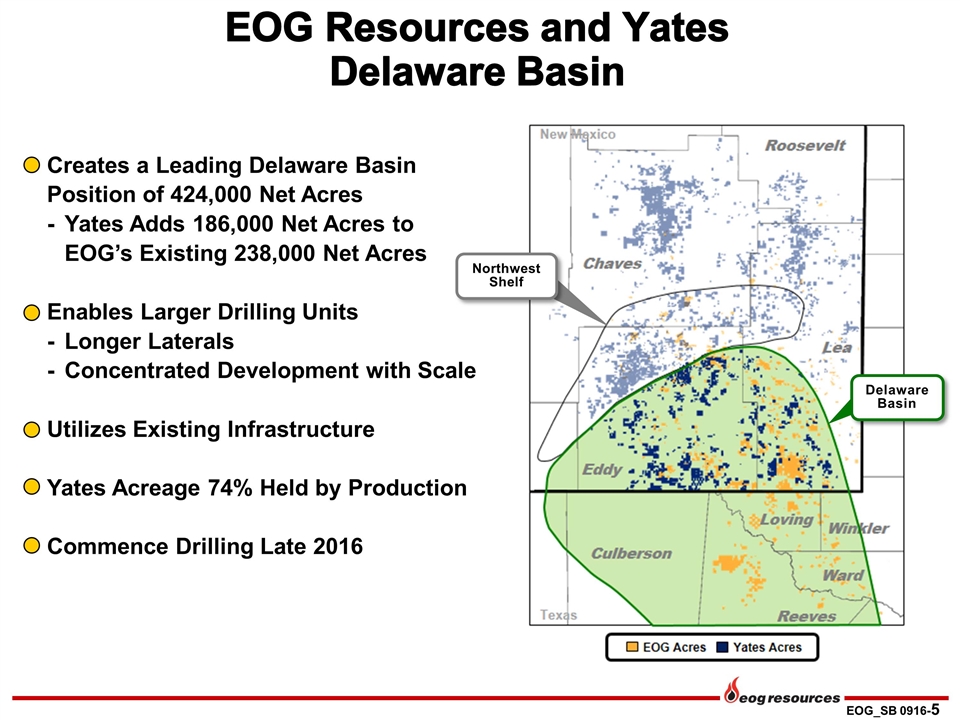

EOG Resources and Yates Delaware Basin Creates a Leading Delaware Basin Position of 424,000 Net Acres -Yates Adds 186,000 Net Acres to EOG’s Existing 238,000 Net Acres Enables Larger Drilling Units -Longer Laterals -Concentrated Development with Scale Utilizes Existing Infrastructure Yates Acreage 74% Held by Production Commence Drilling Late 2016 Delaware Basin Northwest Shelf

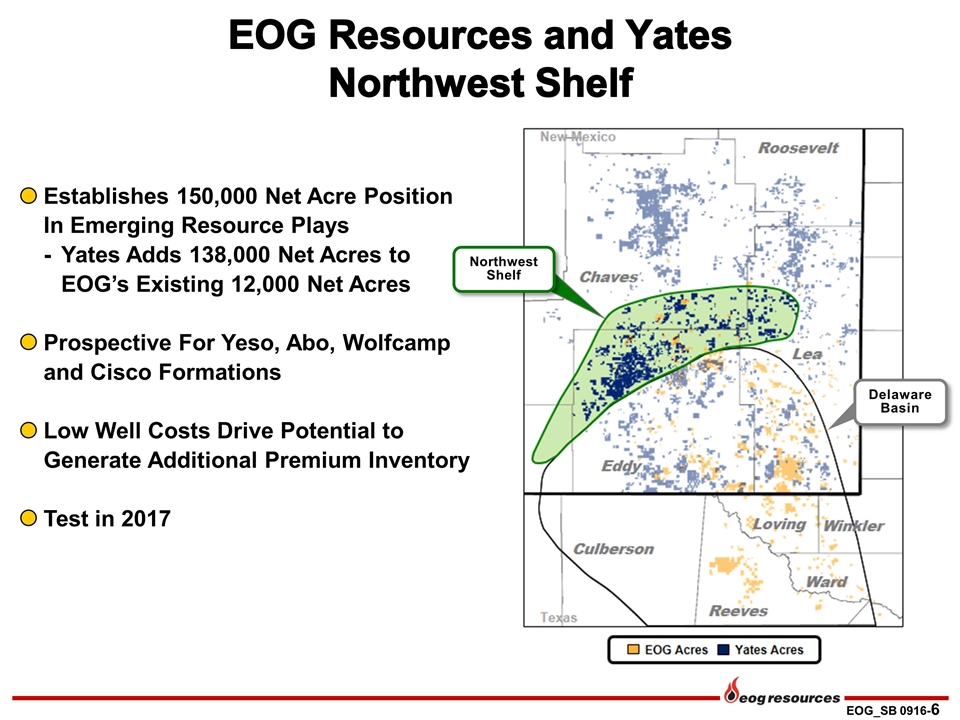

EOG Resources and Yates Northwest Shelf Establishes 150,000 Net Acre Position In Emerging Resource Plays -Yates Adds 138,000 Net Acres to EOG’s Existing 12,000 Net Acres Prospective For Yeso, Abo, Wolfcamp and Cisco Formations Low Well Costs Drive Potential to Generate Additional Premium Inventory Test in 2017 Delaware Basin Northwest Shelf

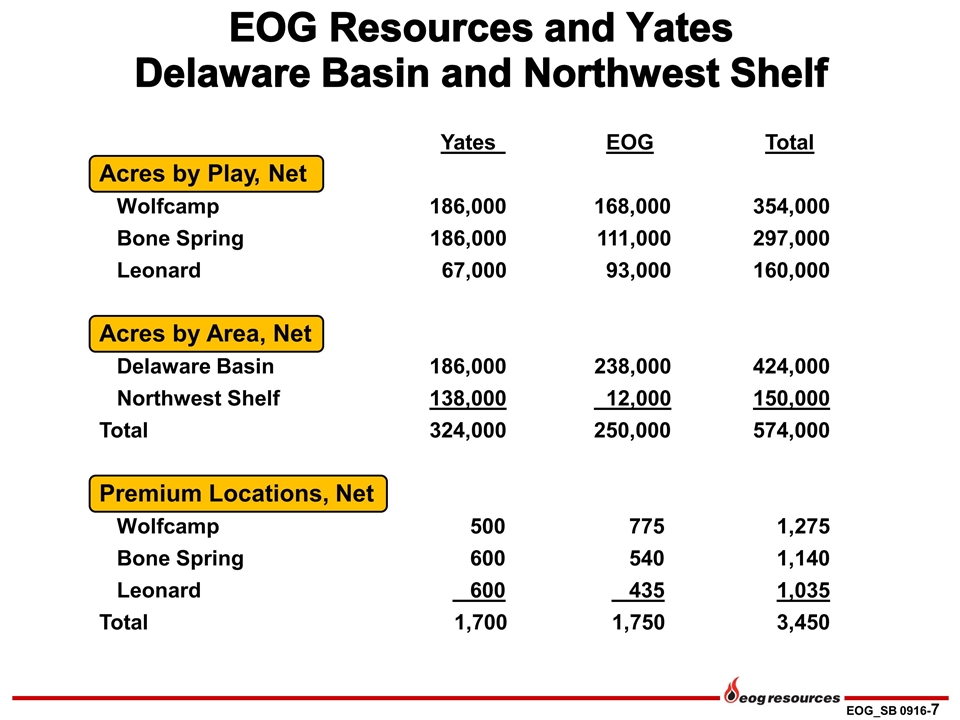

EOG Resources and Yates Delaware Basin and Northwest Shelf Yates EOG Total Acres by Play, Net Wolfcamp 186,000168,000354,000 Bone Spring 186,000 111,000 297,000 Leonard 67,000 93,000 160,000 Acres by Area, Net Delaware Basin 186,000 238,000 424,000 Northwest Shelf 138,000 12,000 150,000 Total 324,000 250,000 574,000 Premium Locations, Net Wolfcamp 500775 1,275 Bone Spring 600 540 1,140 Leonard 600 435 1,035 Total 1,700 1,750 3,450

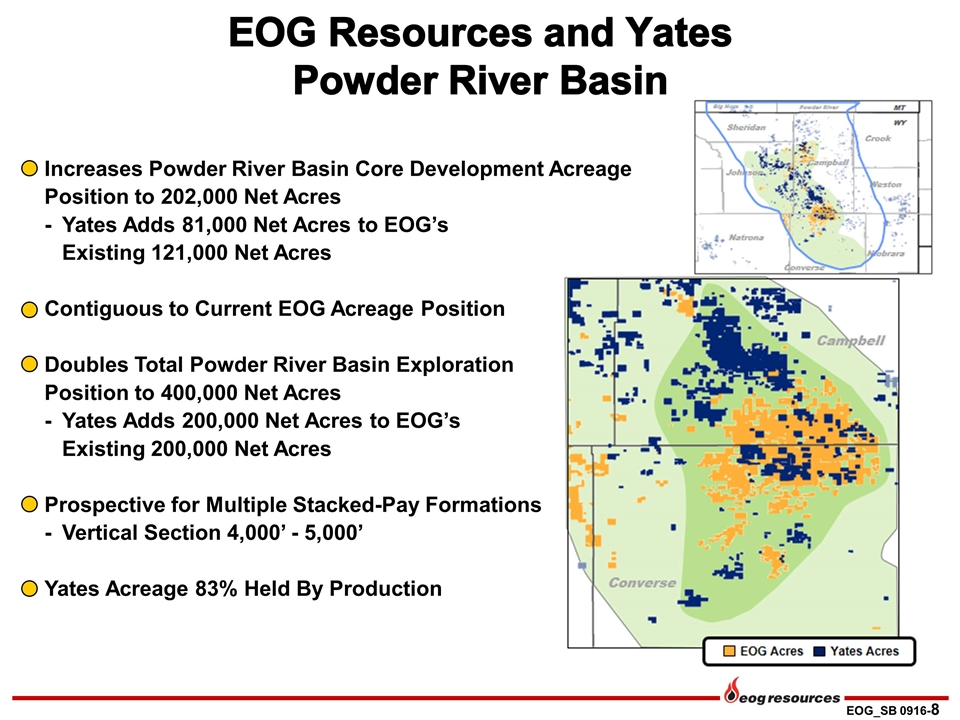

EOG Resources and Yates Powder River Basin Increases Powder River Basin Core Development Acreage Position to 202,000 Net Acres -Yates Adds 81,000 Net Acres to EOG’s Existing 121,000 Net Acres Contiguous to Current EOG Acreage Position Doubles Total Powder River Basin Exploration Position to 400,000 Net Acres -Yates Adds 200,000 Net Acres to EOG’s Existing 200,000 Net Acres Prospective for Multiple Stacked-Pay Formations -Vertical Section 4,000’ - 5,000’ Yates Acreage 83% Held By Production

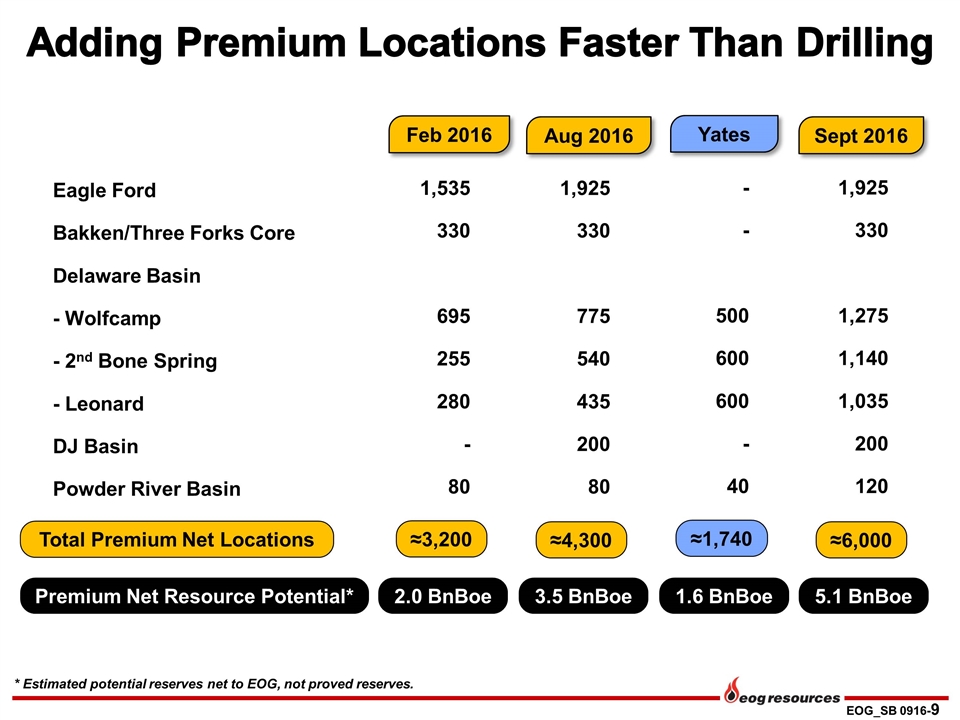

Adding Premium Locations Faster Than Drilling Aug 2016 ≈3,200 Feb 2016 Eagle Ford Bakken/Three Forks Core Delaware Basin - Wolfcamp - 2nd Bone Spring - Leonard DJ Basin Powder River Basin 1,535 330 695 255 280 - 80 1,925 330 775 540 435 200 80 ≈4,300 Total Premium Net Locations Yates - - 500 600 600 - 40 ≈1,740 2.0 BnBoe 3.5 BnBoe Premium Net Resource Potential* * Estimated potential reserves net to EOG, not proved reserves. 1.6 BnBoe Sept 2016 ≈6,000 5.1 BnBoe 1,925 330 1,275 1,140 1,035 200 120