Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - British Cambridge, Inc. | exhibit101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 2, 2016

|

British Cambridge, Inc.

|

| (Exact name of registrant as specified in its charter) |

| Delaware |

333-207947

|

37-1801552 | ||

| (state or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| Ground Floor, Unit D, Belvedere Tower San Miguel Avenue, Ortigas Center Pasig City, Philippines | 1605 | |

| (address of principal executive offices) | (zip code) |

| Telephone: (+63) 2 650 6565 |

| (registrant’s telephone number, including area code) |

| Not Applicable |

| (former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

-1-

Item 2.01 Disposition of Asset(s).

The “Company” refers to British Cambridge, Inc.

On September 2, 2016 at a meeting of our majority shareholders and board of directors a motion was presented and resolved to sell the comprehensive rights to the Company’s online education platform to British Cambridge College, including any propriety code. British Cambridge College is considered a related party and is in part owned by both our CEO Teodoro G. Bondoc Jr. and President Hatadi Shapiro Supaat. The consideration British Cambridge College paid for the platform to the Company was $35,000.

During the three month period ended June 30, 2016 British Cambridge College paid us $35,000 in advance payments to be put toward the lease of our online education platform. Because we have sold the online education platform to them we have agreed that the advance payments will be considered as the monetary consideration in the above transaction. As a result there was no physical exchange of cash regarding the above transaction.

The lease agreement executed on August 1, 2016 between the two aforementioned parties is now terminated.

The above description of the material terms of the aforementioned agreement is simply a summary and should be read in its entirety. It is included herein as exhibit 10.1 of this Form 8-K.

Item 8.01 Other Events.

As described below the nature of our business and operations have changed. We have adopted a new businesses plan. As a result we have included below a description of our new plan moving forward including the industry we will operate in, and any applicable risk factors that relate to our new course of business. It should be noted that at this time all of our officers and directors will remain in their respective positions with the Company.

Industry Overview

The global consulting industry has a total value of around $250 billion and is one of the most substantial markets within the larger professional services industry. As the global economy fluctuates, so too does the consulting industry. In any economy experiencing growth, higher revenues and budgets, this creates a setting in which companies are more willing to spend their revenue on consultation services. Of course that also means that when countries experience and economic downturn this alters their spending behavior and typically results in cutting down on their consultation budgets.

Despite the close link between the consulting industry and a country’s economy, it is notable that between the 1970s up to the 1990s the global consulting market grew every single year, despite two recession periods. However, in 2002 and later between 2009 and 2011 the consultation industry contracted due to global financial crises.

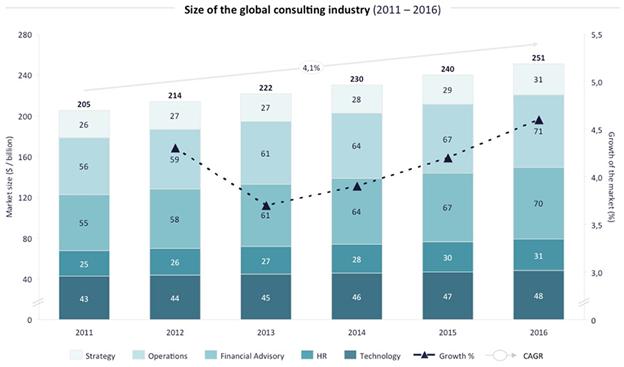

According to http://www.consultancy.uk/consulting-industry/global the consulting industry was valued at around $205 billion, and since then the market has grown with an average Compound Annual Growth Rate (CAGR) of 4.1% to a value of $251 billion in 2016. For many years globalization, consolidation, developments in laws and legislation, efficiency and technology have acted as the main growth drivers of the global consulting industry. More recently, digital and business model disruption has surfaced as the driving factor behind growth, in particular in the more mature markets.

Relevant data regarding how many consulting firms offer comparable services, I.E., assist in taking a Company public onto a recognized exchange, are incredibly difficult to come by because the range of services consultants offer can vary so broadly and can fluctuate on a case by case basis. Many consultants tailor their services to each individual client and thereby if going public is ideal for their client then they will attempt to assist in that process. However, in addition to general consulting there are certain subsections of the industry which are noteworthy.

The five main branches of the consulting industry are: strategy, operations, financial advisory, human resources, and technology. Strategy consulting, also termed boardroom consulting, focuses on ‘big picture’ consultation services which are typically provided to executives, members of the board of directors, etc. Operations relates to the day to day running and operations of a company, and human resources relates directly to its namesake. Financial consulting is built on an analytic foundation and can cover a wide range of topics relating to a company’s finances. Technology consulting is increasingly important as technology continues to evolve and industry professionals find their skills in higher demand.

General consulting can cover some of, or all, of the branches of consultation and is rather difficult to quantify. While we believe that our services can fit into several of the aforementioned branches it may be more accurate to state that we provide general consultation services. This puts us directly into competition with tens of thousands of other companies, and as the industry continues to evolve and grow the competition for the growing market share will only become stronger.

Business Plan

We, British Cambridge, Inc. have changed the nature of our business and operations from marketing our online education platform ‘British Cambridge College’ to business consulting. Specifically, we aim to provide small businesses with consulting services relating to going public on the Over-the-Counter (OTC) Marketplace, a United States Financial Listing Platform, and may evaluate assisting companies to go public on other, as of this time, unidentified exchanges. From time to time, upon request, we may also assist our clients in becoming SEC Reporting via a Form 10, an S-1 Registration Statement or other comparable Registration Statement.

We will charge a flat fee for our business consulting services depending upon the consulting service that is being requested. As of this point in time, the fees we intend to charge prospective clients are undecided, however they will likely be determined on a case by case basis. The determination of our fees can vary based on a number of factors including, but not limited to, the size of the client’s Company, the amount of time each project is likely to take, the difficulty inherent in every project, etc.

We will not be offering our clients investment or legal advice, nor do we anticipate that we will be conducting any SEC filings on behalf of our clients. Our primary focus is on connecting our clients to reputable service providers in the United States that can assist our client’s in going public, becoming SEC Reporting, or assisting with other related services. Upon connecting our clients with these service providers we will oversee their operations in order to ensure that they are carrying out their tasks in a reasonable amount of time and providing work that lives up to our standards.

We anticipate that our services will extend to assisting our clients by providing the communication link between their company and the U.S. Service providers. As an example, we may provide services relating to bettering our clients’ business plans and other material necessary for a U.S. service provider in order to complete their services.

Additionally, we may offer advice and consultation to any of our clients who are seeking to conduct mergers and acquisitions. As before, our advisory and consultancy services should not be misconstrued as providing legal or investment advice to our clients.

Going forward we will use Company revenue and available cash to fund our operations. We may also seek to acquire and maintain equity in some of our clients’ companies seeking to go public on various exchanges in lieu of full cash payments. Our initial focus will be on businesses located in the Philippines, where our Company is currently located, however we do have future unidentified plans to expand into other areas in Asia. At this time we do not have a definitive marketing plans. We do however, have a website that is in development which will showcase the services we will offer to our clients. We believe that the website will be completed in the next few months.

-2-

Risk Factors

Due to the fact that we have changed the nature of our business, there is the possibility that we may be unsuccessful in carrying out our new business plan.

There is the possibility that we may be unsuccessful in carrying out our new business plan. We may never become profitable. If we cannot generate revenues via our new business plan, shareholders’ investments in us may be negatively impacted.

Current shareholders may decide to liquidate their investment in us due to the change of our business plan. This may cause a disruption in the desirability and/or value of our common stock.

Given that we have received investments during a point in time in which we were marketing an online education platform, and we have subsequently changed our business plan to offer consulting services, it is possible that our existing shareholders may lose faith or interest in the Company. As a result, investors may choose to liquidate their shares in our Company, thereby causing a disruption in our common stock’s desirability and potentially its value.

At present we have not finalized the pricing for our services, and as such our revenue may differ from what we anticipate.

Given the fact that we do not have any definitive prices set for our services it is difficult to evaluate exactly how much revenue we can expect. Additionally, we plan to price our services on a case by case scenario based upon the clients we begin to work with. Until we have commenced our new operations for at least several months it will be difficult for us to evaluate or predict any generated revenue accurately. As such, any investment in our company would be a material risk because if we are unsuccessful in generating the revenue we anticipate we may have to change our course of action, or, in a worst case scenario, cease operations entirely.

We do not currently have a fully developed marketing plan, and as such we may not generate as much revenue as we anticipate.

Presently, we do not have a definitive marketing plan to acquire clients. We may initially utilize personal connections of our Officers and Directors to generate leads, but we cannot guarantee that will result in anything. It will take us time to develop a concrete marketing plan, and in the interim we will likely not be generating significant revenue or, in a worst case scenario, any revenue at all. This could result in a partial or complete loss of any investment in our Company.

Due to the fact that we are entering a highly competitive industry, and we will be competing against companies with greater resources and an established network, we may have a difficult time penetrating the market.

Our new competitors have been in the consultation business for far longer than we have. They also have an existing client base, relevant company history, greater capital resources, an established brand, and any number of other factors. We may have a difficult time gaining the market share we are seeking. We will need to devote significant effort in the future to ensure that we can compete with established competitors successfully, and that we can generate and retain clients when competing against these other companies. In the event that we are not able to compete successfully, we may be forced to change our business plan and or scale down our operations.

We rely on third parties to fully take our future clients public onto the OTC Marketplace, or to potentially provide other services, and if there is any issue at all with the services these third parties provide then we may be adversely effected.

There are aspects of the process of getting trading on the OTC Marketplace that we do not have the applicable licenses/certifications to carry out, and additionally we may seek third party assistance for some or all of the parts of the process. As a result, this will make it more difficult for us to monitor and control all aspects of the process. While we have every intention to monitor these third parties, who we do not yet have any solid relationships with, we cannot guarantee with absolute certainty that the quality of their work, their timeline, or any number of other factors will live up to our expectations. In the event that thee third parties produce substandard work we may be forced to identify alternative third parties or, in a worst case scenario in which we cannot find any third parties to work with, we may be forced to alter our business strategy or cease operations entirely.

While we will make every effort to assist our future clients there may be some situations in which a project will become untenable due to a refusal to provide required information.

In the event that we have a client in the future who refuses to provide us, or a service provider we connect them with, the material needed to add certain disclosures into a document, we may be forced to suspend or cease the project entirely. There are aspects of going public that require certain filings with particular disclosures that are derived from information provided by the client (Company), and if they are unwilling or unable to provide this information this could hinder or halt the process from moving forward.

In the event that a client is performing any unlawful actions, such as fraud, theft, etc. we will be unable to work with them and complete their project.

As part of the process to go public certain information, such as financial information, is required in order to provide a factual analysis of the company in question. In the event that it comes to light that a future client of ours is conducting any kind of unlawful behavior we will be forced to cease all work for the client and may be required to contact the appropriate third parties. This would, of course, render us unable to complete our intended project on behalf of that particular client.

Our Officers and Directors have limited experience working with clients and service providers in an effort to assist a client in becoming trading on the OTC Marketplace or any other US trading platform.

Our Officers and Directors have limited experience relating to taking a company public on the OTC Marketplace, or any US Stock Exchange for that matter. Due to this fact, they may be forced to rely on outside industry professionals in order to assist them in learning all of the information required in order to take a company public. While our Officers and Directors fully believe they have the capability to carry out our new business activities, we understand that there can be no guarantees based on their history. In the event that our Officers and Directors find themselves unable to complete the services described in our new business plan then we may be forced to change our business plan and or scale down our operations.

-3-

ITEM 9.01. Financial Statements and Exhibits.

- None

- Exhibits

| NUMBER | EXHIBIT |

| 10.1 | Agreement between British Cambridge Inc. and British Cambridge College |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

British Cambridge, Inc.

Dated: September 2, 2016

| By: | /s/ Teodoro G. Bondoc Jr. | |

| Teodoro G. Bondoc Jr., Chief Executive Officer (Principal Executive Officer), Director |

-4-