Attached files

| file | filename |

|---|---|

| 8-K - 8-K 09012016 - TIFFANY & CO | a8-k09012016.htm |

EXHIBIT 10.37

PPN: 886547 E*5 | ||||

TIFFANY & CO.

NOTE PURCHASE AGREEMENT |

Dated as of August 26, 2016

¥10,000,000,000 Principal Amount of 0.78% Senior Notes Due August 26, 2026

DB1/ 87639059.10 | ||||

TABLE OF CONTENTS

Page | ||||

1. | AUTHORIZATION OF NOTES | 1 | ||

2. | SALE AND PURCHASE OF NOTES | 1 | ||

3. | CLOSING | 2 | ||

4. | CONDITIONS TO CLOSING | 2 | ||

4.1. | Representations and Warranties | 2 | ||

4.2. | Performance; No Default | 2 | ||

4.3. | Compliance Certificates | 3 | ||

4.4. | Opinions of Counsel | 3 | ||

4.5. | Purchase Permitted By Applicable Law, etc. | 3 | ||

4.6 | Payment of Fees | 4 | ||

4.7. | Private Placement Numbers | 4 | ||

4.8. | Changes in Corporate Structure | 4 | ||

4.9. | Funding Instructions | 4 | ||

4.10. | Proceedings and Documents | 4 | ||

5. | REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 4 | ||

5.1. | Organization; Power and Authority | 4 | ||

5.2. | Authorization, etc. | 5 | ||

5.3 | Disclosure | 5 | ||

5.4 | Organization and Ownership of Shares of Subsidiaries; Affiliates | 5 | ||

5.5. | Financial Statements | 6 | ||

5.6. | Compliance with Laws, Other Instruments, etc. | 6 | ||

5.7. | Governmental Authorizations, etc. | 7 | ||

5.8 | Litigation; Observance of Agreements, Statutes and Orders | 7 | ||

5.9 | Taxes | 7 | ||

5.10. | Title to Property; Leases | 8 | ||

5.11. | Licenses, Permits, etc. | 8 | ||

5.12. | Compliance with ERISA | 8 | ||

5.13. | Private Offering by the Company | 10 | ||

5.14. | Use of Proceeds; Margin Regulations | 10 | ||

5.15. | Existing Indebtedness; Future Liens | 10 | ||

5.16. | Foreign Assets Control Regulations, Etc. | 11 | ||

5.17. | Status under Certain Statutes | 12 | ||

5.18. | Environmental Matters | 12 | ||

5.19. | Pari Passu Ranking | 12 | ||

6. | REPRESENTATIONS OF THE PURCHASERS | 12 | ||

6.1. | Purchase for Investment | 12 | ||

6.2. | Source of Funds | 13 | ||

6.3. | Denomination of Notes | 14 | ||

i | ||

DB1/ 87639059.10 | ||

TABLE OF CONTENTS

(continued)

Page | ||||

7. | INFORMATION AS TO THE COMPANY | 15 | ||

7.1. | Financial and Business Information | 15 | ||

7.2. | Officer’s Certificate | 18 | ||

7.3. | Inspection | 19 | ||

8. | PAYMENT OF THE NOTES | 19 | ||

8.1. | Required Principal Prepayments; Payment at Maturity | 19 | ||

8.2. | Optional Prepayments with Make-Whole Amount | 20 | ||

8.3. | Allocation of Partial Prepayments | 20 | ||

8.4. | Maturity; Surrender, etc. | 20 | ||

8.5. | No Other Optional Prepayments or Purchase of Notes | 20 | ||

8.6. | Make-Whole Amount and Modified Make-Whole Amount | 21 | ||

8.7. | Prepayment for Tax Reasons | 22 | ||

9. | AFFIRMATIVE COVENANTS | 24 | ||

9.1. | Compliance with Law | 24 | ||

9.2. | Insurance | 24 | ||

9.3. | Maintenance of Properties | 25 | ||

9.4. | Payment of Taxes and Claims | 25 | ||

9.5. | Corporate Existence, etc. | 25 | ||

9.6. | Subsequent Guarantors | 25 | ||

10. | NEGATIVE COVENANTS | 26 | ||

10.1. | Transactions with Affiliates | 26 | ||

10.2. | Line of Business | 27 | ||

10.3. | Limitation on Debt | 27 | ||

10.4. | Liens | 28 | ||

10.5. | Merger, Consolidation, etc. | 31 | ||

10.6. | Sale of Assets | 32 | ||

10.7. | Most Favored Lender Status | 36 | ||

10.8. | Terrorism Sanctions Regulations | 37 | ||

11. | EVENTS OF DEFAULT | 37 | ||

12. | REMEDIES ON DEFAULT, ETC. | 40 | ||

12.1. | Acceleration | 40 | ||

12.2. | Other Remedies | 41 | ||

12.3. | Rescission | 41 | ||

12.4. | No Waivers or Election of Remedies, Expenses, etc. | 42 | ||

13. | TAX INDEMNIFICATION; FATCA INFORMATION | 42 | ||

13.1. | Tax Indemnification | 42 | ||

13.2. | FATCA Information | 46 | ||

ii | ||

DB1/ 87639059.10 | ||

TABLE OF CONTENTS

(continued)

Page | ||||

14. | REGISTRATION; EXCHANGE; SUBSTITUTION OF NOTES | 47 | ||

14.1. | Registration of Notes | 47 | ||

14.2. | Transfer and Exchange of Notes | 47 | ||

14.3. | Replacement of Notes | 48 | ||

15. | PAYMENTS ON NOTES | 48 | ||

15.1. | Place of Payment | 48 | ||

15.2. | Home Office Payment | 48 | ||

16. | EXPENSES, ETC. | 49 | ||

16.1. | Transaction Expenses | 49 | ||

16.2. | Currency Rate Indemnity | 49 | ||

16.3. | Survival | 50 | ||

17. | SURVIVAL OF REPRESENTATIONS AND WARRANTIES; ENTIRE AGREEMENT | 50 | ||

18. | AMENDMENT AND WAIVER | 51 | ||

18.1. | Requirements | 51 | ||

18.2. | Solicitation of Holders of Notes | 51 | ||

18.3. | Binding Effect, etc. | 52 | ||

18.4. | Notes held by Company, etc. | 52 | ||

19. | NOTICES | 52 | ||

20. | REPRODUCTION OF DOCUMENTS | 53 | ||

21. | CONFIDENTIAL INFORMATION | 53 | ||

22. | SUBSTITUTION OF PURCHASER | 55 | ||

23. | MISCELLANEOUS | 55 | ||

23.1. | Successors and Assigns | 55 | ||

23.2. | Payments Due on Non-Business Days | 55 | ||

23.3. | Severability | 55 | ||

23.4. | Construction | 56 | ||

23.5. | Counterparts | 56 | ||

23.6. | Governing Law | 56 | ||

iii | ||

DB1/ 87639059.10 | ||

Schedules and Exhibits | |||

Schedule A | -- | Information Relating to Purchasers | |

Schedule B | -- | Defined Terms | |

Schedule 3 | -- | Payment Instructions | |

Schedule 4.8 | -- | Changes in Corporate Structure | |

Schedule 5.3 | -- | Disclosure | |

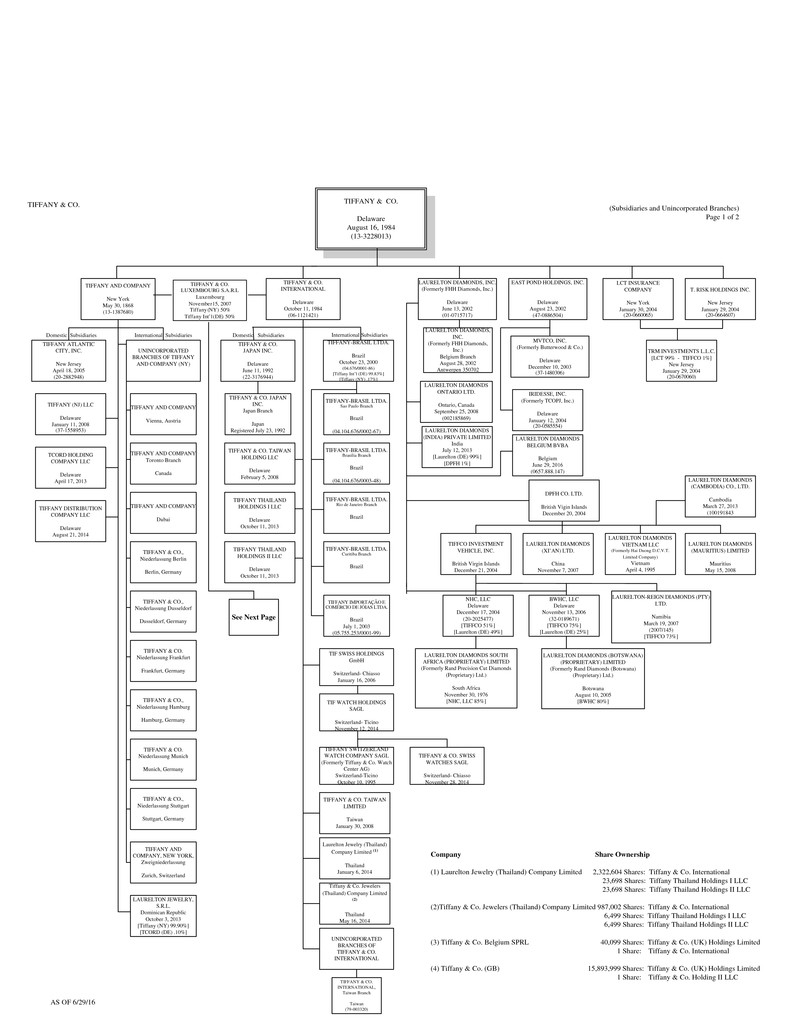

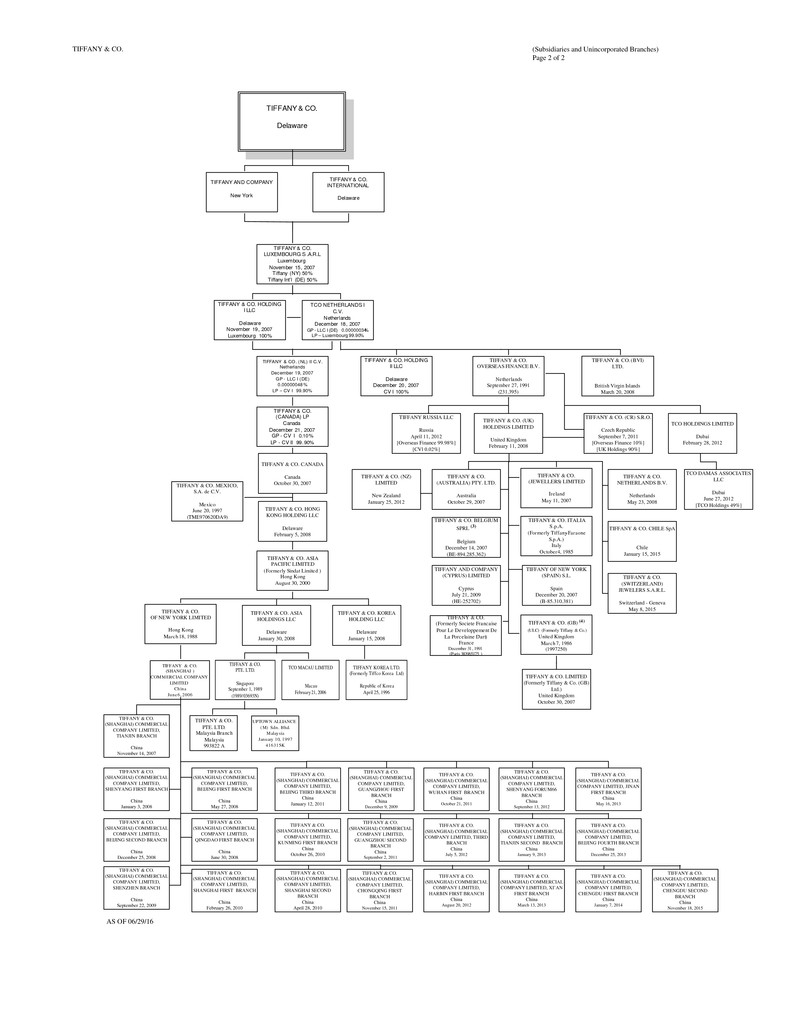

Schedule 5.4 | -- | Subsidiaries and Affiliates of the Company and Ownership of Subsidiary Stock | |

Schedule 5.5 | -- | Financial Statements | |

Schedule 5.15 | -- | Existing Indebtedness and Liens | |

Schedule 10.3 | -- | Exclusions from Priority Debt | |

Schedule 10.7 | -- | Incorporated Provisions | |

Exhibit A | -- | Form of 0.78% Senior Notes due August 26, 2026 | |

Exhibit 4.4(a) | -- | Form of Opinion of Counsel for the Company - Notes | |

Exhibit 4.4(b) | -- | Form of Opinion of Associate General Counsel for the Company - Notes | |

Exhibit 4.4(c) | -- | Form of Opinion of Special Counsel for Purchasers | |

Exhibit 9.6 | -- | Form of Guaranty Agreement | |

iv | ||

DB1/ 87639059.10 | ||

TIFFANY & CO.

727 Fifth Avenue

New York, New York 10022

¥10,000,000,000 0.78% Senior Notes due August 26, 2026

Dated as of August 26, 2016

Separately addressed to each of the Purchasers

listed on the attached Schedule A

Ladies and Gentlemen:

TIFFANY & CO., a Delaware corporation (together with its successors and assigns that become a party hereto pursuant to Section 10.5(c)), the “Company”), agrees with each Purchaser as follows:

1. | AUTHORIZATION OF NOTES. |

The Company will authorize the issue of its senior promissory notes (the “Notes”) in the aggregate principal amount of ¥10,000,000,000, to be dated the date of issue thereof, to mature August 26, 2026, to bear interest on the unpaid balance thereof from the date thereof until the principal thereof shall have become due and payable at the rate of 0.78% per annum, and on overdue principal, Make-Whole Amount or Modified Make-Whole Amount, as applicable, and interest at the rate specified therein, and to be substantially in the form of Exhibit A attached hereto. The terms “Note” and “Notes” as used herein shall include each Note delivered pursuant to any provision of this Agreement and each Note delivered in substitution or exchange for any such Note pursuant to any such provision.

Certain capitalized terms used in this Agreement are defined in Schedule B; references to a “Schedule” or an “Exhibit” are, unless otherwise specified, to a Schedule or an Exhibit attached to this Agreement; and references to a “Section” are, unless otherwise specified, references to a Section of this Agreement.

2. | SALE AND PURCHASE OF NOTES. |

(a)Subject to the terms and conditions of this Agreement, the Company will issue and sell to the Purchasers and the Purchasers will purchase from the Company, at the Closing Day provided for in Section 3, Notes in the principal amounts specified below its name in Schedule A at the purchase price of 100% of the principal amount thereof. The obligations of the Purchasers are several and not joint obligations and no Purchaser shall have any obligation under this Agreement or any liability to any Person for the performance or non-performance by any other Purchaser hereunder. The Company may, but will not be obligated to, issue and sell any of the Notes unless the Purchasers purchase an aggregate of ¥10,000,000,000 of Notes.

DB1/ 87639059.10 | ||

(b)The Company will pay to each Purchaser in immediately available funds a fee on the Closing Day in an amount equal to 0.10% of the aggregate principal amount of Notes sold to such Purchaser on the Closing Day. Such fee shall be paid to such Purchaser in Yen by wire transfer of immediately available funds to such Purchaser’s account designated on Schedule A.

3. | CLOSING. |

The sale and purchase of the Notes to be purchased by the Purchasers shall occur at the offices of Morgan, Lewis & Bockius LLP, 101 Park Avenue, New York, New York 10178, at 11:00 a.m., Tokyo time, at a closing (the “Closing”; the date of such closing herein referred to as the “Closing Day”) on August 26, 2016, or at such later time on such date or on such other Business Day thereafter as may be agreed upon by the Company and the Purchasers. At the Closing, the Company will deliver to each Purchaser the Notes to be purchased by such Purchaser in the form of a single Note (or such greater number of Notes in denominations of at least ¥230,000,000 as such Purchaser may request), dated the Closing Day and registered in the name of such Purchaser (or in the name of its nominee), as indicated in Schedule A, against payment by federal funds wire transfer in immediately available funds of the amount of the purchase price therefor as directed by the Company in Schedule 3. If, at the Closing, the Company shall fail to tender such Notes to any Purchaser as provided above in this Section 3, or any of the conditions specified in Section 4 shall not have been fulfilled to such Purchaser’s satisfaction, such Purchaser shall, at its election, be relieved of all further obligations under this Agreement, without thereby waiving any rights it may have by reason of such failure or such nonfulfillment.

4. | CONDITIONS TO CLOSING. |

The obligation of each Purchaser to purchase and pay for the Notes to be sold to such Purchaser on the Closing Day is subject to the fulfillment to its satisfaction, prior to or on the Closing Day, of the following conditions:

4.1. Representations and Warranties.

The representations and warranties of the Company in this Agreement shall be correct when made and as of the Closing Day.

4.2. Performance; No Default.

The Company shall have performed and complied with all agreements and conditions contained in this Agreement required to be performed or complied with by it prior to or on the Closing Day, and, after giving effect to the issue and sale of the Notes (and the application of the proceeds thereof as contemplated by this Agreement), no Default or Event of Default shall have occurred and be continuing.

2 | ||

DB1/ 87639059.10 | ||

4.3. Compliance Certificates.

(a)Officer’s Certificate. The Company shall have delivered to such Purchaser an Officer’s Certificate, dated the Closing Day, certifying that the conditions specified in Sections 4.1, 4.2 and 4.8 have been fulfilled.

(b)Secretary’s Certificate. The Company shall have delivered to such Purchaser a certificate, signed on its behalf by its Secretary or one of its Assistant Secretaries, dated the Closing Day, certifying as to (i) the resolutions attached thereto and other corporate proceedings relating to the authorization, execution and delivery of the applicable Notes and this Agreement and (ii) the Company’s organizational documents as then in effect.

4.4. Opinions of Counsel.

Such Purchaser shall have received opinions in form and substance reasonably satisfactory to such Purchaser, dated the Closing Day, from

(a)Gibson, Dunn & Crutcher LLP, counsel for the Company, substantially in the form set out in Exhibit 4.4(a) and covering such other matters incident to the transactions contemplated hereby as such Purchaser or its counsel may reasonably request (and the Company hereby instructs such counsel to deliver such opinion to such Purchaser), and

(b)John C. Duffy, Associate General Counsel of the Company, substantially in the form set out in Exhibit 4.4(b) and covering such other matters incident to the transactions contemplated hereby as such Purchaser or its counsel may reasonably request (and the Company hereby instructs such counsel to deliver such opinion to such Purchaser), and

(c)Morgan, Lewis & Bockius LLP, special counsel to the Purchasers, substantially in the form set out in Exhibit 4.4(c) and covering such other matters incident to the transactions contemplated hereby as such Purchaser may reasonably request.

4.5. Purchase Permitted By Applicable Law, etc.

On the Closing Day, such Purchaser’s purchase of the Notes shall (a) be permitted by the laws and regulations of each jurisdiction to which such Purchaser is subject, without recourse to provisions (such as section 1405(a)(8) of the New York Insurance Law) permitting limited investments by insurance companies without restriction as to the character of the particular investment, (b) not violate any applicable law or regulation (including, without limitation, Regulation T, U or X of the Board of Governors of the Federal Reserve System) and (c) not subject such Purchaser to any tax, penalty or liability under or pursuant to any applicable law or regulation. If requested by such Purchaser, such Purchaser shall have received an Officer’s Certificate certifying as to such matters of fact as such Purchaser may reasonably specify to enable such Purchaser to determine whether such purchase is so permitted.

3 | ||

DB1/ 87639059.10 | ||

4.6. Payment of Fees.

The Company shall have paid to such Purchaser the fees due to such Purchaser pursuant to Section 2(b). Without limiting the provisions of Section 16.1, the Company shall also have paid on or before the Closing Day the reasonable fees, charges and disbursements of such Purchaser’s special counsel referred to in Section 4.4(c) to the extent reflected in a statement of such counsel rendered to the Company at least one Business Day prior to the Closing Day.

4.7. Private Placement Numbers.

A Private Placement Number issued by Standard & Poor’s CUSIP Service Bureau (in cooperation with the SVO) shall have been obtained for the Notes issued on the Closing Day.

4.8. Changes in Corporate Structure.

Except as specified in Schedule 4.8 or permitted pursuant to this Agreement, the Company shall not have changed its jurisdiction of incorporation or been a party to any merger or consolidation or shall have succeeded to all or any substantial part of the liabilities of any other entity, at any time following the date of the most recent financial statements referred to in Schedule 5.5.

4.9. Funding Instructions.

At least one Business Day prior to the Closing Day, each Purchaser shall have received written instructions signed by a Responsible Officer on letterhead of the Company confirming the information specified in Schedule 3 including (i) the name and address of the transferee bank, (ii) such transferee bank’s ABA number/Swift Code/IBAN and (iii) the account name and number into which the purchase price for the Notes is to be deposited.

4.10. Proceedings and Documents.

All corporate and other proceedings in connection with the transactions contemplated by this Agreement and all documents and instruments incident to such transactions shall be satisfactory to such Purchaser and its special counsel, and such Purchaser and its special counsel shall have received all such counterpart originals or certified or other copies of such documents as such Purchaser or its special counsel may reasonably request.

5. | REPRESENTATIONS AND WARRANTIES OF THE COMPANY. |

The Company represents and warrants to each Purchaser that:

5.1. Organization; Power and Authority.

The Company is a corporation duly organized, validly existing and in good standing under the laws of its jurisdiction of incorporation, and is duly qualified as a foreign corporation and is in good standing in each jurisdiction in which such qualification is required by law, other than those jurisdictions as to which the failure to be so qualified or in good standing would not,

4 | ||

DB1/ 87639059.10 | ||

individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. The Company has the corporate power and authority to own or hold under lease the properties it purports to own or hold under lease, to transact the business it transacts and proposes to transact, to execute and deliver the Financing Documents to which it is a party and to perform the provisions thereof.

5.2. Authorization, etc.

This Agreement and the Notes have been duly authorized by all necessary corporate action on the part of the Company, and this Agreement constitutes, and upon execution and delivery thereof, each Note will constitute, a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as may be limited by (a) applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and (b) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

5.3. Disclosure.

The Company’s Annual Report on Form 10-K for the Fiscal Year ended January 31, 2016, the Company’s Proxy Statement dated April 8, 2016, the Company’s Quarterly Report on Form 10-Q for the Fiscal Quarter ended July 31, 2016, and the Company’s Current Reports on Form 8-K dated May 13, 2016, May 19, 2016, May 26, 2016, June 2, 2016 and July 15, 2016, together with the documents, certificates or other writings delivered to the Purchasers by or on behalf of the Company in connection with the transactions contemplated by the Financing Documents and the financial statements listed in Schedule 5.5 (collectively referred to as the “Disclosure Documents”), taken as a whole, fairly describe, in all material respects, the general nature of the business and principal properties of the Company and its Subsidiaries as of the Closing Day. The Financing Documents and the Disclosure Documents, taken as a whole, do not contain any untrue statement of a material fact or omit to state any material fact necessary to make the statements herein or therein not misleading in light of the circumstances under which they were made. Except as disclosed in the Disclosure Documents or as expressly disclosed in Schedule 5.3, since July 31, 2016, there has been no change in the financial condition, operations, business, properties or prospects of the Company or any Subsidiary except changes that individually or in the aggregate would not reasonably be expected to have a Material Adverse Effect. There is no fact known to the Company that would reasonably be expected to have a Material Adverse Effect that has not been set forth herein or in the Disclosure Documents, as supplemented or amended, delivered or to be delivered to each Purchaser.

5.4. Organization and Ownership of Shares of Subsidiaries; Affiliates.

(a)Schedule 5.4 contains (except as noted therein) complete and correct lists of (i) the Company’s Subsidiaries, showing, as to each Subsidiary, the correct name thereof, the jurisdiction of its organization, and, if less than 100%, the percentage of shares of each class of its Capital Stock outstanding owned by the Company and each other Subsidiary, and (ii) the Company’s Affiliates, other than Subsidiaries.

5 | ||

DB1/ 87639059.10 | ||

(b)All of the outstanding shares of Capital Stock of each Subsidiary shown in Schedule 5.4 as being owned by the Company or its Subsidiaries have been validly issued, are fully paid and nonassessable and are owned by the Company or another Subsidiary free and clear of any Lien (except as otherwise disclosed in Schedule 5.4).

(c)Each Subsidiary identified in Schedule 5.4 is a corporation or other legal entity duly organized, validly existing and in good standing under the laws of its jurisdiction of organization, and is duly qualified as a foreign corporation or other legal entity and is in good standing in each jurisdiction in which such qualification is required by law, other than those jurisdictions as to which the failure to be so qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. Each such Subsidiary has the corporate or other power and authority to own or hold under lease the properties it purports to own or hold under lease, to transact the business it transacts and proposes to transact, to execute and deliver the Financing Documents to which it is a party and to perform its obligations thereunder.

(d)No Subsidiary is a party to, or otherwise subject to any legal restriction or any agreement (other than the agreements listed in Schedule 5.4 and customary limitations imposed by corporate law statutes) restricting the ability of such Subsidiary to pay dividends out of profits or make any other similar distributions of profits to the Company or any of its Subsidiaries that owns outstanding shares of Capital Stock of such Subsidiary.

5.5. Financial Statements.

The Company has delivered to each Purchaser copies of the consolidated financial statements of the Company and its Subsidiaries listed in Schedule 5.5; provided that posting on its official website or delivery of copies of the Company’s Annual Report on Form 10-K or Quarterly Report on Form 10-Q, as applicable (including copies of each exhibit filed therewith), prepared in compliance with the requirements therefor and filed with the Securities and Exchange Commission shall be deemed to satisfy the requirements of this Section 5.5 so long as such Report includes each of the consolidated financial statements referred to above. All of said consolidated financial statements (including, in each case, the related schedules and notes) fairly present in all material respects the consolidated financial position of the Company and its Subsidiaries as of the respective dates specified in such Schedule and the consolidated results of their operations and cash flows for the respective periods so specified and have been prepared in accordance with GAAP consistently applied throughout the periods involved except as set forth in the notes thereto (subject, in the case of any interim financial statements, to normal year-end adjustments).

5.6. Compliance with Laws, Other Instruments, etc.

The execution, delivery and performance by the Company of this Agreement and the Notes will not:

(a)contravene, result in any breach of, or constitute a default under, or result in the creation of any Lien in respect of any property of the Company or any of its

6 | ||

DB1/ 87639059.10 | ||

Subsidiaries under, any indenture, mortgage, deed of trust, loan, purchase or credit agreement, lease, corporate charter or by-laws, shareholders agreement or any other agreement or instrument to which the Company or any of its Subsidiaries is bound or by which the Company or any of its Subsidiaries or any of their respective properties may be bound or affected,

(b)conflict with or result in a breach of any of the terms, conditions or provisions of any order, judgment, decree, or ruling of any court, arbitrator or Governmental Authority applicable to the Company or any of its Subsidiaries, or

(c)violate any provision of any statute or other rule or regulation of any Governmental Authority applicable to the Company or any of its Subsidiaries.

5.7. Governmental Authorizations, etc.

No consent, approval or authorization of, or registration, filing or declaration with, any Governmental Authority is required to be obtained by the Company in connection with the execution, delivery or performance by the Company of this Agreement or the Notes.

5.8. Litigation; Observance of Agreements, Statutes and Orders.

(a)There are no actions, suits or proceedings pending or, to the knowledge of the Company, threatened against or affecting the Company or any of its Subsidiaries or any property of the Company or any of its Subsidiaries in any court or before any arbitrator of any kind or before or by any Governmental Authority that, individually or in the aggregate, would reasonably be expected to have a Material Adverse Effect.

(b)Neither the Company nor any Subsidiary thereof is (i) in default under any term of any agreement or instrument to which it is a party or by which it is bound, (ii) in violation of any order, judgment, decree or ruling of any court, arbitrator or Governmental Authority or (iii) in violation of any applicable law, ordinance, rule or regulation of any Governmental Authority (including, without limitation, Environmental Laws, the USA PATRIOT Act or any of the other laws and regulations that are referred to in Section 5.16), which default or violation, individually or in the aggregate, would reasonably be expected to have a Material Adverse Effect.

5.9. Taxes.

The Company and its Subsidiaries have filed all material tax returns that are required to have been filed by them in any jurisdiction, and have paid all taxes shown to be due and payable on such returns and all other taxes and assessments levied upon them or their properties, assets, income or franchises, to the extent such taxes and assessments have become due and payable and before they have become delinquent, except for any taxes and assessments (a) the amount of which is not individually or in the aggregate Material or (b) the amount, applicability or validity of which is currently being contested in good faith by appropriate proceedings and with respect to which the Company or a Subsidiary, as the case may be, has established adequate reserves in accordance with GAAP. The Company knows of no basis for any other tax or assessment that

7 | ||

DB1/ 87639059.10 | ||

would reasonably be expected to have a Material Adverse Effect. The charges, accruals and reserves on the books of the Company and its Subsidiaries in respect of Federal, state or other taxes for all fiscal periods are adequate. As of the Closing Day, the U.S. Federal income tax liabilities of the Company and its Subsidiaries have been paid for all taxable years up to and including the fiscal year ended January 31, 2016.

5.10. Title to Property; Leases.

The Company and its Subsidiaries have good and sufficient title to their respective properties that individually or in the aggregate are Material, including all such properties reflected in the most recent audited balance sheet referred to in Section 5.5 or purported to have been acquired by the Company or any Subsidiary after said date (except as sold or otherwise disposed of in the ordinary course of business), in each case free and clear of Liens prohibited by this Agreement. All leases that individually or in the aggregate are Material are valid and subsisting and are in full force and effect in all material respects.

5.11. Licenses, Permits, etc.

(a)The Company and its Subsidiaries own or possess all licenses, permits, franchises, authorizations, patents, copyrights, service marks, trademarks and trade names, or rights thereto, that individually or in the aggregate are Material, without known conflict with the rights of others;

(b)to the best knowledge of the Company, no product or practice of the Company or any of its Subsidiaries infringes in any material respect any license, permit, franchise, authorization, patent, copyright, service mark, trademark, trade name or other right owned by any other Person; and

(c)to the best knowledge of the Company, there is no Material violation by any Person of any right of the Company or any of its Subsidiaries with respect to any patent, copyright, service mark, trademark, trade name or other intellectual property right owned or used by the Company or any of its Subsidiaries.

5.12. Compliance with ERISA.

(a)The Company and each ERISA Affiliate have operated and administered each Plan in compliance with all applicable laws except for such instances of noncompliance as have not resulted in and would not reasonably be expected to result in a Material Adverse Effect. Neither the Company nor any ERISA Affiliate has incurred any liability pursuant to Title I or IV of ERISA or the penalty or excise tax provisions of the Code relating to employee benefit plans (as defined in section 3 of ERISA), and no event, transaction or condition has occurred or exists that could reasonably be expected to result in the incurrence of any such liability by the Company or any ERISA Affiliate, or in the imposition of any Lien on any of the rights, properties or assets of the Company or any ERISA Affiliate, in either case pursuant to Title I or IV of ERISA or to section 430(k) of the Code or to any such penalty or excise tax provisions under the Code or federal law or section 4068 of ERISA or by the granting of a security interest in

8 | ||

DB1/ 87639059.10 | ||

connection with the amendment of a Plan, other than such liabilities or Liens as would not be individually or in the aggregate Material.

(b)The amounts under each of the Plans (other than Multiemployer Plans) that are “defined benefit plans,” as defined in Section 3(35) of ERISA, that are benefit obligations, and the fair value of plan assets under each such Plan, are set forth in Note N to the Company’s audited financial statements included in the Company’s Annual Report on Form 10-K for the most recently completed fiscal year and have been prepared in accordance with FASB Accounting Standards Codification Topic 715-30. The term “benefit liabilities” has the meaning specified in section 4001 of ERISA and the terms “current value” and “present value” have the meaning specified in section 3 of ERISA.

(c)The Company and its ERISA Affiliates have not incurred withdrawal liabilities (and are not subject to contingent withdrawal liabilities) under section 4201 or 4204 of ERISA in respect of Multiemployer Plans that individually or in the aggregate are Material.

(d)Note N to the Company’s audited financial statements included in the Company’s Annual Report on Form 10-K for the most recently completed fiscal year sets forth the expected postretirement benefit obligations of the Company and its Subsidiaries determined as of the last day of the Company’s most recently ended fiscal year for which audited financial statements are available in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 715-60, without regard to liabilities attributable to continuation coverage mandated by section 4980B of the Code.

(e)The execution and delivery of this Agreement and the issuance and sale of the Notes hereunder will not involve any transaction that is subject to the prohibitions of section 406 of ERISA or in connection with which a tax could be imposed pursuant to section 4975(c)(1)(A)-(D) of the Code. The representation by the Company in the first sentence of this Section 5.12(e) is made in reliance upon and subject to the accuracy of each Purchaser’s representation in Section 6.2 as to the Sources used to pay the purchase price of the Notes to be purchased by such Purchaser.

(f)[Reserved.]

(g)All Foreign Pension Plans have been established, operated, administered and maintained in compliance with all laws, regulations and orders applicable thereto except for such failures to comply, in the aggregate for all such failures, that would not reasonably be expected to have a Material Adverse Effect. All premiums, contributions and any other amounts required by applicable Foreign Pension Plan documents or applicable laws have been paid or accrued as required, except for premiums, contributions and amounts that, in the aggregate for all such obligations, would not reasonably be expected to have a Material Adverse Effect.

9 | ||

DB1/ 87639059.10 | ||

5.13. Private Offering by the Company.

Neither the Company nor anyone acting on its behalf has offered the Notes or any similar securities (within six months of the date of the first offer of the Notes) for sale to, or solicited any offer to buy any of the same from, or otherwise approached or negotiated in respect thereof with, any Person other than the Purchasers, each of which has been offered the Notes at a private sale for investment. Neither the Company nor anyone acting on its behalf has taken, or will take, any action that would subject the issuance or sale of the Notes to the registration requirements of section 5 of the Securities Act or to the registration requirements of any securities or blue sky laws of any applicable jurisdiction or of the Financial Instruments and Exchange Act.

5.14. Use of Proceeds; Margin Regulations.

The Company will apply the proceeds of the sale of the Notes (a) to repay in full the ¥10,000,000,000 1.72% Senior Notes due September 1, 2016 outstanding under that certain Note Purchase Agreement dated as of September 1, 2010, by and among the Company and the holders of such notes, and (b) for general corporate purposes. No part of the proceeds from the sale of the Notes hereunder will be used, directly or indirectly, for the purpose of buying or carrying any margin stock within the meaning of Regulation U of the Board of Governors of the Federal Reserve System (12 CFR 221), or for the purpose of buying or carrying or trading in any securities under such circumstances as to involve the Company in a violation of Regulation X of said Board (12 CFR 224) or to involve any broker or dealer in a violation of Regulation T of said Board (12 CFR 220). Margin stock does not constitute more than 25% of the value of the consolidated assets of the Company and its Subsidiaries and the Company does not have any present intention that margin stock will constitute more than 25% of the value of such assets. As used in this Section, the terms “margin stock” and “purpose of buying or carrying” shall have the meanings assigned to them in said Regulation U.

5.15. Existing Indebtedness; Future Liens.

(a)Except as described therein, Schedule 5.15 sets forth a complete and correct list of all outstanding Indebtedness of the Company and its Subsidiaries as of the dates specified in such Schedule (and specifying, as to each item of such Indebtedness, the collateral, if any, securing such Indebtedness), since which date there has been no Material change in the amounts, interest rates, sinking funds, installment payments or maturities of the Indebtedness of the Company or its Subsidiaries. Neither the Company nor any Subsidiary is in default and no waiver of default is currently in effect, in the payment of any principal or interest on any Indebtedness of the Company or such Subsidiary and no event or condition exists with respect to any Indebtedness of the Company or any Subsidiary that would permit (or that with notice or the lapse of time, or both, would permit) one or more Persons to cause such Indebtedness to become due and payable before its stated maturity or before its regularly scheduled dates of payment.

(b)Except as disclosed in Schedule 5.15, neither the Company nor any Subsidiary has agreed or consented to cause or permit in the future (upon the happening

10 | ||

DB1/ 87639059.10 | ||

of a contingency or otherwise) any of its property, whether now owned or hereafter acquired, to be subject to a Lien not permitted by Section 10.4.

5.16. Foreign Assets Control Regulations, Etc.

(a)Neither the Company nor any Controlled Entity (i) is (A) a Person whose name appears on the list of Specially Designated Nationals and Blocked Persons published by the Office of Foreign Assets Control, U.S. Department of Treasury (“OFAC”) (an “OFAC Listed Person”) or (B) a department, agency or instrumentality of, or is otherwise controlled by or acting on behalf of, directly or indirectly, (x) any OFAC Listed Person or (y) any Person, entity, organization, foreign country or regime that is subject to any OFAC Sanctions Program (each OFAC Listed Person and each other Person, entity, organization and government of a country described in clause (B), a “Blocked Person”), or (ii) has been notified that its name appears or may in the future appear on a State Sanctions List or that it is a target of sanctions imposed by the United Nations or the European Union.

(b)No part of the proceeds from the sale of the Notes hereunder constitutes or will constitute funds obtained on behalf of any Blocked Person or will otherwise be used, directly by the Company or indirectly through any Controlled Entity, (i) in connection with any investment in, or any other transaction with, any Blocked Person, or (ii) for any purpose that would cause any Purchaser to be in violation of any U.S. Economic Sanctions Laws.

(c)To the Company’s actual knowledge after making due inquiry, neither the Company nor any Controlled Entity (i) is under investigation by any Governmental Authority for, or has been charged with, or convicted of, (A) money laundering, drug trafficking, terrorist-related activities or other money laundering predicate crimes under any applicable law (collectively, “Anti-Money Laundering Laws”), or (B) violating any applicable U.S. Economic Sanctions Laws, (ii) has been assessed civil penalties under any Anti-Money Laundering Laws or U.S. Economic Sanctions Laws or (iii) has had any of its funds seized or forfeited in an action under any Anti-Money Laundering Laws. The Company has taken reasonable measures appropriate to the circumstances (in any event as required by applicable law) to ensure that the Company and each Controlled Entity is and will continue to be in compliance with all applicable current and future Anti-Money Laundering Laws.

(d)No part of the proceeds from the sale of the Notes hereunder will be used, directly or indirectly, for any improper payments to any governmental official or employee, political party, official of a political party, candidate for political office, official of any public international organization or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in each case in violation of any applicable anti-corruption laws or regulations.

11 | ||

DB1/ 87639059.10 | ||

5.17. Status under Certain Statutes.

Neither the Company nor any Subsidiary is subject to regulation under the Investment Company Act of 1940, as amended, the Public Utility Holding Company Act of 2005, as amended, the ICC Termination Act of 1995, as amended, or the Federal Power Act, as amended.

5.18. Environmental Matters.

Neither the Company nor any Subsidiary has knowledge of any claim or has received any notice of any claim, and no proceeding has been instituted raising any claim against the Company or any of its Subsidiaries or any of their respective real properties now or formerly owned, leased or operated by any of them or other assets, alleging any damage to the environment or violation of any Environmental Laws, except, in each case, such as would not reasonably be expected to result in a Material Adverse Effect. Except as otherwise disclosed to each Purchaser in writing,

(a)neither the Company nor any Subsidiary has knowledge of any facts which would give rise to any claim, public or private, of violation of Environmental Laws or damage to the environment emanating from, occurring on or in any way related to real properties now or formerly owned, leased or operated by any of them or to other assets or their use, except, in each case, such as would not reasonably be expected to result in a Material Adverse Effect;

(b)neither the Company nor any of its Subsidiaries has stored any Hazardous Materials on real properties now or formerly owned, leased or operated by any of them or disposed of any Hazardous Materials in a manner contrary to any Environmental Laws in each case in any manner that would reasonably be expected to result in a Material Adverse Effect; and

(c)all buildings on all real properties now owned, leased or operated by the Company or any of its Subsidiaries are in compliance with applicable Environmental Laws, except where failure to comply would not reasonably be expected to result in a Material Adverse Effect.

5.19. Pari Passu Ranking.

The obligations of the Company under this Agreement rank at least pari passu in right of payment with the Company’s Indebtedness obligations under the Credit Agreement and the Other Tiffany Note Agreements.

6. | REPRESENTATIONS OF THE PURCHASERS. |

6.1. Purchase for Investment.

Each Purchaser severally represents that it is purchasing the Notes for its own account or for one or more separate accounts maintained by such Purchaser or for the account of one or more pension or trust funds and not with a view to the distribution thereof, provided that the

12 | ||

DB1/ 87639059.10 | ||

disposition of such Purchaser’s property or their property shall at all times be within such Purchaser’s or their control. Each Purchaser understands that the Notes have not been registered under the Securities Act (or, to the extent applicable, the Financial Instruments and Exchange Act) and may be resold only if registered pursuant to the provisions of the Securities Act (or, to the extent applicable, the Financial Instruments and Exchange Act), or if an exemption from registration is available, except under circumstances where neither such registration nor such an exemption is required by law, and that the Company is not required to register the Notes.

6.2. Source of Funds.

Each Purchaser severally represents that at least one of the following statements is an accurate representation as to each source of funds (a “Source”) to be used by such Purchaser to pay the purchase price of the Notes to be purchased by such Purchaser hereunder:

(a)the Source is an “insurance company general account” (as the term is defined in the United States Department of Labor’s Prohibited Transaction Exemption (“PTE”) 95-60) in respect of which the reserves and liabilities (as defined by the annual statement for life insurance companies approved by the NAIC (the “NAIC Annual Statement”)) for the general account contract(s) held by or on behalf of any employee benefit plan together with the amount of the reserves and liabilities for the general account contract(s) held by or on behalf of any other employee benefit plans maintained by the same employer (or affiliate thereof as defined in PTE 95-60) or by the same employee organization in the general account do not exceed 10% of the total reserves and liabilities of the general account (exclusive of separate account liabilities) plus surplus as set forth in the NAIC Annual Statement filed with such Purchaser’s state of domicile; or

(b)the Source is a separate account that is maintained solely in connection with such Purchaser’s fixed contractual obligations under which the amounts payable, or credited, to any employee benefit plan (or its related trust) that has any interest in such separate account (or to any participant or beneficiary of such plan (including any annuitant)) are not affected in any manner by the investment performance of the separate account; or

(c)the Source is either (i) an insurance company pooled separate account, within the meaning of PTE 90-1 or (ii) a bank collective investment fund, within the meaning of the PTE 91-38 and, except as disclosed by such Purchaser to the Company in writing pursuant to this clause (c), no employee benefit plan or group of plans maintained by the same employer or employee organization beneficially owns more than 10% of all assets allocated to such pooled separate account or collective investment fund; or

(d)the Source constitutes assets of an “investment fund” (within the meaning of Part VI of PTE 84-14 (the “QPAM Exemption”)) managed by a “qualified professional asset manager” or “QPAM” (within the meaning of Part VI of the QPAM Exemption), no employee benefit plan’s assets that are managed by the QPAM in such investment fund, when combined with the assets of all other employee benefit plans established or maintained by the same employer or by an affiliate (within the meaning of

13 | ||

DB1/ 87639059.10 | ||

Part VI(c)(1) of the QPAM Exemption) of such employer or by the same employee organization and managed by such QPAM, represent more than 20% of the total client assets managed by such QPAM, the conditions of Part I(c) and (g) of the QPAM Exemption are satisfied, neither the QPAM nor a person controlling or controlled by the QPAM maintains an ownership interest in the Company that would cause the QPAM and the Company to be “related” within the meaning of Part VI(h) of the QPAM Exemption and (i) the identity of such QPAM and (ii) the names of any employee benefit plans whose assets in the investment fund, when combined with the assets of all other employee benefit plans established or maintained by the same employer or by an affiliate (within the meaning of Part VI(c)(1) of the QPAM Exemption) of such employer or by the same employee organization, represent 10% or more of the assets of such investment fund, have been disclosed to the Company in writing pursuant to this clause (d); or

(e)the Source constitutes assets of a “plan(s)” (within the meaning of Part IV(h) of PTE 96-23 (the “INHAM Exemption”)) managed by an “in-house asset manager” or “INHAM” (within the meaning of Part IV(a) of the INHAM Exemption), the conditions of Part I(a), (g) and (h) of the INHAM Exemption are satisfied, neither the INHAM nor a person controlling or controlled by the INHAM (applying the definition of “control” in Part IV(d)(3) of the INHAM Exemption) owns a 10% or more interest in the Company and (i) the identity of such INHAM and (ii) the name(s) of the employee benefit plan(s) whose assets constitute the Source have been disclosed to the Company in writing pursuant to this clause (e); or

(f)the Source is a governmental plan; or

(g)the Source is one or more employee benefit plans, or a separate account or trust fund comprised of one or more employee benefit plans, each of which has been identified to the Company in writing pursuant to this paragraph (g); or

(h)the Source does not include assets of any employee benefit plan, other than a plan exempt from the coverage of ERISA.

As used in this Section 6.2, the terms “employee benefit plan”, “governmental plan” and “separate account” shall have the respective meanings assigned to such terms in section 3 of ERISA.

6.3. Denomination of Notes.

Each Purchaser hereby acknowledges that the Company has notified such Purchaser that the solicitation for newly issued securities relating to the Notes falls under the category described in Article 2, Paragraph 3, Item 2(iii) of the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948) (the “Financial Instruments and Exchange Act”) as an offering of Notes pursuant to a private placement limited to Qualified Institutional Investors only (which Notes may only be transferred to other Qualified Institutional Investors) (the “QII Private Placement”) and, therefore, the registration under the provisions of Article 4, Paragraph 1 of the Financial Instruments and Exchange Act has not been made for such solicitation for newly issued securities.

14 | ||

DB1/ 87639059.10 | ||

Each Purchaser acknowledges that no securities registration statement for a public offering has been filed or will be filed under the provisions of Article 4, Paragraph 1 of the Financial Instruments and Exchange Act. Based on the foregoing, any transfer of Notes by a Purchaser shall: (a) be made only to another “Qualified Institutional Investor” (as such term is defined in Article 2, Paragraph 3, Item 1 of the Financial Instruments and Exchange Act and Article 10, Paragraph 1 of the Cabinet Office Ordinance on Definitions provided in Article 2 of the Financial Instruments and Exchange Act of Japan (Cabinet Office Ordinance No. 14 of 1993, as amended) and (b) include written notification from the transferor to the transferee that (i) the Notes were offered in Japan under the QII Private Placement and no securities registration statement has been filed or will be filed under Article 4, Paragraph (1) of the Financial Instruments and Exchange Act and (ii) the Notes may only be transferred to another Qualified Institutional Investor.

7. | INFORMATION AS TO THE COMPANY. |

7.1. Financial and Business Information.

The Company shall deliver to each holder of Notes that is an Institutional Investor:

(a)Quarterly Statements -- within 60 days after the end of each quarterly fiscal period in each fiscal year of the Company (other than the last quarterly fiscal period of each such fiscal year), duplicate copies of,

(i)a consolidated balance sheet of the Company and its Subsidiaries as at the end of such quarter, and

(ii)consolidated statements of earnings, stockholders’ equity and cash flows of the Company and its Subsidiaries, for such quarter and (in the case of the second and third quarters) for the portion of the fiscal year ending with such quarter,

setting forth in each case in comparative form the figures for the corresponding periods in the previous fiscal year, all in reasonable detail, prepared in accordance with GAAP applicable to quarterly financial statements generally, and certified on behalf of the Company by a Senior Financial Officer as fairly presenting, in all material respects, the consolidated financial position of the companies being reported on and their consolidated results of operations and cash flows, subject to changes resulting from year-end adjustments, provided that posting on its official website or delivery within the time period specified above of copies of the Company’s Quarterly Report on Form 10-Q (including copies of each exhibit filed therewith) prepared in compliance with the requirements therefor and filed with the Securities and Exchange Commission shall be deemed to satisfy the requirements of this Section 7.1(a) so long as such Report includes each of the financial statements (and the comparative historical figures) referred to above, provided, however, that any such report or document as contemplated by this Section 7.1(a) which has been posted to the Company’s official website with general access rights for the public shall be deemed to have been delivered to the

15 | ||

DB1/ 87639059.10 | ||

holders of Notes as contemplated by this Section 7.1(a) so long as the Company has provided each holder of Notes prior notice, by electronic mail to the electronic address provided by such holder of Notes, of such posting;

(b)Annual Statements -- within 120 days after the end of each fiscal year of the Company, duplicate copies of,

(i)a consolidated balance sheet of the Company and its Subsidiaries, as at the end of such year, and

(ii)consolidated statements of earnings, stockholders’ equity and cash flows of the Company and its Subsidiaries, for such year,

setting forth in each case in comparative form the figures for the previous fiscal year, all in reasonable detail, prepared in accordance with GAAP, and accompanied by

(A)an opinion thereon of independent certified public accountants of recognized national standing, which opinion shall state that such financial statements present fairly, in all material respects, the consolidated financial position of the companies being reported upon and their consolidated results of operations and cash flows and have been prepared in conformity with GAAP, and that the examination of such accountants in connection with such financial statements has been made in accordance with generally accepted auditing standards, and that such audit provides a reasonable basis for such opinion in the circumstances, and

(B)a certificate of such accountants stating that they have reviewed this Agreement and stating further whether, in making their audit, they have become aware of any condition or event that then constitutes a Default or an Event of Default, and, if they are aware that any such condition or event then exists, specifying the nature and period of the existence thereof (it being understood that such accountants shall not be liable, directly or indirectly, for any failure to obtain knowledge of any Default or Event of Default unless such accountants should have obtained knowledge thereof in making an audit in accordance with generally accepted auditing standards or did not make such an audit),

provided that posting on its official website or delivery within the time period specified above of the Company’s Annual Report on Form 10-K (including copies of each exhibit filed therewith) for such fiscal year prepared in accordance with the requirements therefor and filed with the Securities and Exchange Commission, together with the accountant’s certificate described in clause (B) above, shall be deemed to satisfy the requirements of this Section 7.1(b), so long as such Report includes each of the financial statements (and the comparative historical figures) referred to above, provided, however, that any such report or document as contemplated by this Section 7.1(b) which has been posted to the Company’s official website with general access rights for the public shall be deemed to

16 | ||

DB1/ 87639059.10 | ||

have been delivered to the holders of Notes as contemplated by this Section 7.1(b) so long as the Company has provided each holder of Notes prior notice, by electronic mail to the electronic address provided by such holder of Notes, of such posting;

(c)SEC and Other Reports -- promptly upon their becoming available, one copy of (i) each financial statement, annual report (including, without limitation, the Company’s annual report to shareholders, if any, prepared pursuant to Rule 14a-3 under the Exchange Act), notice or proxy statement sent by the Company or any Subsidiary to public securities holders generally, and (ii) each regular or periodic report, each registration statement (without exhibits except as expressly requested by such holder), and each prospectus and all amendments thereto filed by the Company or any Subsidiary with the Securities and Exchange Commission and of all press releases and other statements made available generally by the Company or any Subsidiary to the public concerning developments that are Material, provided that posting on its official website of any such report or document shall be deemed to satisfy the requirements of this Section 7.1(c), provided, however, that any such report or document as contemplated by this Section 7.1(c) which has been posted to the Company’s official website with general access rights for the public shall be deemed to have been delivered to the holders of Notes as contemplated by this Section 7.1(c) so long as the Company has provided each holder of Notes prior notice, by electronic mail to the electronic address provided by such holder of Notes, of such posting;

(d)Notice of Default or Event of Default -- promptly, and in any event within five days after a Responsible Officer becoming aware of the existence of any Default or Event of Default or that any Person has given any notice or taken any action with respect to a claimed default hereunder or that any Person has given any notice or taken any action with respect to a claimed default of the type referred to in Section 11(f), a written notice specifying the nature and period of existence thereof and what action the Company is taking or proposes to take with respect thereto;

(e)ERISA Matters -- promptly, and in any event within five days after a Responsible Officer becoming aware of any of the following, a written notice setting forth the nature thereof and the action, if any, that the Company or an ERISA Affiliate proposes to take with respect thereto:

(i)with respect to any Plan, any reportable event, as defined in section 4043(c) of ERISA and the regulations thereunder, for which notice thereof has not been waived pursuant to such regulations as in effect on the Closing Day; or

(ii)the taking by the PBGC of steps to institute, or the threatening by the PBGC of the institution of, proceedings under section 4042 of ERISA for the termination of, or the appointment of a trustee to administer, any Plan, or the receipt by the Company or any ERISA Affiliate of a notice from a Multiemployer Plan that such action has been taken by the PBGC with respect to such Multiemployer Plan; or

17 | ||

DB1/ 87639059.10 | ||

(iii)any event, transaction or condition that could result in the incurrence of any liability by the Company or any ERISA Affiliate pursuant to Title I or IV of ERISA or the penalty or excise tax provisions of the Code relating to employee benefit plans, or in the imposition of any Lien on any of the rights, properties or assets of the Company or any ERISA Affiliate pursuant to Title I or IV of ERISA or such penalty or excise tax provisions, if such liability or Lien, taken together with any other such liabilities or Liens then existing, would reasonably be expected to have a Material Adverse Effect;

(f)Notices from Governmental Authority -- promptly, and in any event within 30 days of receipt thereof, copies of any notice to the Company or any Subsidiary from any Federal or state Governmental Authority relating to any order, ruling, statute or other law or regulation that would reasonably be expected to have a Material Adverse Effect; and

(g)Requested Information -- with reasonable promptness, such other data and information relating to the business, operations, affairs, financial condition, assets or properties of the Company or any of its Subsidiaries or relating to the ability of the Company to perform its obligations hereunder and under the Notes as from time to time may be reasonably requested by any such holder of Notes, or such information regarding the Company required to satisfy the requirements of 17 C.F.R. §230.144A, as amended from time to time, in connection with any contemplated transfer of the Notes.

7.2. Officer’s Certificate.

Each set of financial statements delivered to a holder of Notes pursuant to Section 7.1(a) or Section 7.1(b) hereof shall be accompanied by an Officer’s Certificate signed by a Senior Financial Officer setting forth:

(a)Covenant Compliance -- the information (including detailed calculations) required in order to establish whether the Company was in compliance with the requirements of Sections 10.3 through 10.6, inclusive, and each Incorporated Provision which is a financial covenant or otherwise makes reference to the financial condition or results of operations of any one or more of the Company or any Subsidiary (including any provision that limits or measures indebtedness, interest expense, fixed charges, total assets, net worth or stockholders equity of the Company and its Subsidiaries) during the quarterly or annual period covered by the statements then being furnished (including with respect to each such Section, where applicable, the calculations of the maximum or minimum amount, covenant basket amount, ratio or percentage, as the case may be, permissible under the terms of such Sections, and the calculation of the amount, ratio or percentage then in existence).

(b)Event of Default -- a statement that such officer has reviewed the relevant terms hereof and has made, or caused to be made, under his or her supervision, a review of the transactions and conditions of the Company and its Subsidiaries from the beginning of the quarterly or annual period covered by the statements then being

18 | ||

DB1/ 87639059.10 | ||

furnished to the date of the certificate and that such review has not disclosed the existence during such period of any condition or event that constitutes a Default or an Event of Default or, if any such condition or event existed or exists (including, without limitation, any such event or condition resulting from the failure of the Company or any Subsidiary to comply with any Environmental Law), specifying the nature and period of existence thereof and what action the Company shall have taken or proposes to take with respect thereto.

(c)Subsidiary Guarantors -- setting forth a list of all Subsidiaries that are Guarantors and certifying that each Subsidiary that is required to be a Guarantor pursuant to Section 9.6 is a Guarantor, in each case, as of the date of such Officer’s Certificate.

7.3. Inspection.

The Company shall permit the representatives of each holder of Notes that is an Institutional Investor:

(a)No Default -- if no Default or Event of Default then exists, at the expense of such holder and upon reasonable prior notice to the Company, to visit the principal executive office of the Company, to discuss the affairs, finances and accounts of the Company and its Subsidiaries with the Company’s officers, and (with the consent of the Company, which consent will not be unreasonably withheld) its independent public accountants, and (with the consent of the Company, which consent will not be unreasonably withheld) to visit the other offices and properties of the Company and each Subsidiary, all at such reasonable times and as often as may be reasonably requested in writing; and

(b)Default -- if a Default or Event of Default then exists, at the expense of the Company, to visit and inspect any of the offices or properties of the Company and any Subsidiary, to examine all their respective books of account, records, reports and other papers, to make copies and extracts therefrom, and to discuss their respective affairs, finances and accounts with their respective officers and independent public accountants (and by this provision the Company authorizes said accountants to discuss the affairs, finances and accounts of the Company and its Subsidiaries), all at such times and as often as may be requested.

8. PAYMENT OF THE NOTES.

8.1. Required Principal Prepayments; Payment at Maturity.

There are no required prepayments of principal in respect of the Notes. The entire principal amount of the Notes outstanding on August 26, 2026, together with all accrued and unpaid interest thereon, shall be due and payable on such date.

19 | ||

DB1/ 87639059.10 | ||

8.2. Optional Prepayments with Make-Whole Amount.

The Company may, at its option, upon notice as provided below, prepay at any time all, or from time to time any part of, the Notes (but if in part, in integral multiples of ¥50,000,000 and in an amount not less than ¥500,000,000 or such lesser amount as shall then be outstanding), at 100% of the principal amount so prepaid, together with accrued unpaid interest on such amount, plus the Make-Whole Amount determined for the prepayment date with respect to such principal amount. The Company will give each holder of Notes written notice of each optional prepayment under this Section 8.2 not less than 30 days and not more than 60 days prior to the date fixed for such prepayment. Each such notice shall specify such prepayment date (which shall be a Business Day), the aggregate principal amount of the Notes to be prepaid on such date, the principal amount of each Note held by such holder to be prepaid (determined in accordance with Section 8.3), and the interest to be paid on the prepayment date with respect to such principal amount being prepaid, and shall be accompanied by an Officer’s Certificate signed by a Senior Financial Officer as to the estimated Make-Whole Amount due in connection with such prepayment (calculated as if the date of such notice were the date of the prepayment), setting forth the details of such computation. Two Business Days prior to such prepayment, the Company shall deliver to each holder of Notes to be prepaid an Officer’s Certificate signed by a Senior Financial Officer specifying the calculation of such Make-Whole Amount as of the specified prepayment date.

8.3. Allocation of Partial Prepayments.

In the case of each partial optional prepayment of any Notes, the principal amount of the Notes to be prepaid shall be allocated among all of the Notes at the time outstanding in proportion, as nearly as practicable, to the respective unpaid principal amounts thereof not theretofore called for prepayment.

8.4. Maturity; Surrender, etc.

In the case of each prepayment of Notes pursuant to this Section 8, the principal amount of each Note to be prepaid shall mature and become due and payable on the date fixed for such prepayment, together with interest on such principal amount accrued to such date and the applicable Make-Whole Amount or Modified Make-Whole Amount, if any. From and after such date, unless the Company shall fail to pay such principal amount when so due and payable, together with the interest and Make-Whole Amount or Modified Make-Whole Amount, if any, as aforesaid, interest on such principal amount shall cease to accrue. Any Note paid or prepaid in full shall be surrendered to the Company and cancelled and shall not be reissued, and no Note shall be issued in lieu of any prepaid principal amount of any Note.

8.5. No Other Optional Prepayments or Purchase of Notes.

The Company will not, and will not permit any Affiliate to, prepay (whether directly or indirectly by purchase, redemption or other acquisition) any of the outstanding Notes except upon the payment or prepayment of the Notes in accordance with the terms of this Section 8. The Company will promptly cancel all Notes acquired by it or any Affiliate pursuant to any

20 | ||

DB1/ 87639059.10 | ||

payment, prepayment or purchase of Notes pursuant to any provision of this Section 8 and no Notes may be issued in substitution or exchange for any such Notes.

8.6. Make-Whole Amount and Modified Make-Whole Amount.

The terms “Make-Whole Amount” and “Modified Make-Whole Amount” mean, with respect to any Note, an amount equal to the excess, if any, of the Discounted Value of the Remaining Scheduled Payments with respect to the Called Principal of such Note over the amount of such Called Principal, provided that neither the Make-Whole Amount nor the Modified Make-Whole Amount may in any event be less than zero. For the purposes of determining the Make-Whole Amount and/or Modified Make-Whole Amount with respect to any Note, the following terms have the following meanings:

“Called Principal” means the principal of such Note that is to be prepaid pursuant to Section 8.2 or Section 8.7 or has become or is declared to be immediately due and payable pursuant to Section 12.1, as the context requires.

“Discounted Value” means, with respect to the Called Principal of such Note, the amount obtained by discounting all Remaining Scheduled Payments with respect to such Called Principal from their respective scheduled due dates to the Settlement Date with respect to such Called Principal, in accordance with accepted financial practice and at a discount factor (applied on the same periodic basis as that on which interest on the Note is payable) equal to the Reinvestment Yield with respect to such Called Principal.

“Recognized Yen Market Maker” means any financial institution that makes regular markets in Japanese Government Bonds and Japanese Government Bond-based securities and financial products, as shall be agreed between the Required Holders and the Company or, following the occurrence and continuance of an Event of Default, as reasonably determined by the Required Holders.

“Reinvestment Yield” means, with respect to the Called Principal of such Note, the sum of (i) 0.50% per annum (in the case of a computation of the Make-Whole Amount) or (ii) 1.00% per annum (in the case of a computation of the Modified Make-Whole Amount), plus the yield to maturity implied by (i) the yields reported as of 10:00 A.M. (New York City time) on the second Business Day preceding the Settlement Date with respect to such Called Principal, on the display designated as Bloomberg Financial Markets News Screen BTMM-JN (or such other display as may replace such Bloomberg Financial Markets News Screen) for the most recently issued actively traded Japanese Government Bonds having a maturity equal to the Remaining Average Life of such Called Principal as of such Settlement Date, or (ii) if such yields are not reported as of such time or the yields reported as of such time are not ascertainable (including by way of interpolation), the average of the yields for such securities as determined by two Recognized Yen Market Makers.

In the case of each determination under clause (i) or (ii), as the case may be, of the preceding paragraph, such implied yield will be determined, if necessary, by (a) converting Japanese Government Bond quotations to bond equivalent yields in

21 | ||

DB1/ 87639059.10 | ||

accordance with accepted financial practice and (b) interpolating linearly between (1) the actively traded Japanese Government Bonds with the maturity closest to and greater than such Remaining Average Life and (2) the applicable actively traded Japanese Government Bonds with the maturity closest to and less than such Remaining Average Life. The Reinvestment Yield shall be rounded to the number of decimal places as appears in the interest rate of such Note.

“Remaining Average Life” means, with respect to any Called Principal or such Note, the number of years obtained by dividing (i) such Called Principal into (ii) the sum of the products obtained by multiplying (a) the principal component of each Remaining Scheduled Payment with respect to such Called Principal by (b) the number of years, computed on the basis of a 360-day year comprised of twelve 30-day months and calculated to two decimal places, that will elapse between the Settlement Date with respect to such Called Principal and the scheduled due date of such Remaining Scheduled Payment.

“Remaining Scheduled Payments” means, with respect to the Called Principal of such Note, all payments of such Called Principal and interest thereon that would be due after the Settlement Date with respect to such Called Principal if no payment of such Called Principal were made prior to its scheduled due date, provided that if such Settlement Date is not a date on which an interest payment is due to be made under the terms of such Note, then the amount of the next succeeding scheduled interest payment will be reduced by the amount of interest accrued to such Settlement Date and required to be paid on such Settlement Date pursuant to Section 8.2, 8.7 or Section 12.1.

“Settlement Date” means, with respect to the Called Principal of such Note, the date on which such Called Principal is to be prepaid pursuant to Section 8.2 or has become or is declared to be immediately due and payable pursuant to Section 12.1, as the context requires.

8.7. Prepayment for Tax Reasons.

(a)If at any time as a result of a Change in Tax Law (as defined below) the Company is or becomes obligated to make any Additional Payments (as defined below) in respect of any payment of interest on account of any of the Notes in an aggregate amount for all affected Notes equal to 5.00% or more of the aggregate amount of such interest payment on account of all of the Notes, the Company may give the holders of all affected Notes irrevocable written notice (each, a “Tax Prepayment Notice”) of the prepayment of such affected Notes on a specified prepayment date (which shall be a Business Day not less than 15 days nor more than 60 days after the date of such notice) and the circumstances giving rise to the obligation of the Company to make any Additional Payments and the amount thereof and stating that all of the affected Notes shall be prepaid on the date of such prepayment at 100% of the principal amount so prepaid together with interest accrued thereon to the date of such prepayment plus an amount equal to the Modified Make-Whole Amount for each such Note, except in the case of an affected Note if the holder of such Note shall, by written notice given to the

22 | ||

DB1/ 87639059.10 | ||

Company no more than 10 days after receipt of the Tax Prepayment Notice, reject such prepayment of such Note (each, a “Rejection Notice”). Such Tax Prepayment Notice shall be accompanied by a certificate of a Senior Financial Officer as to the estimated Modified Make-Whole Amount due in connection with such prepayment (calculated as if the date of such notice were the date of the prepayment), setting forth the details of such computation. The form of Rejection Notice shall also accompany the Tax Prepayment Notice and shall state with respect to each Note covered thereby that execution and delivery thereof by the holder of such Note shall operate as a permanent waiver of such holder’s right to receive the Additional Payments arising as a result of the circumstances described in the Tax Prepayment Notice in respect of all future payments of interest on such Note (but not of such holder’s right to receive any Additional Payments that arise out of circumstances not described in the Tax Prepayment Notice or which exceed the amount of the Additional Payment described in the Tax Prepayment Notice), which waiver shall be binding upon all subsequent transferees of such Note. The Tax Prepayment Notice having been given as aforesaid to each holder of the affected Notes, the principal amount of such Notes together with interest accrued thereon to the date of such prepayment plus the Modified Make-Whole Amount shall become due and payable on such prepayment date, except in the case of Notes the holders of which shall timely give a Rejection Notice as aforesaid. Two Business Days prior to such prepayment, the Company shall deliver to each holder of a Note being so prepaid a certificate of a Senior Financial Officer specifying the calculation of such Modified Make-Whole Amount as of such prepayment date.

(b)No prepayment of the Notes pursuant to this Section 8.7 shall affect the obligation of the Company to pay Additional Payments in respect of any payment made on or prior to the date of such prepayment. For purposes of this Section 8.7, any holder of more than one affected Note may act separately with respect to each affected Note so held (with the effect that a holder of more than one affected Note may accept such offer with respect to one or more affected Notes so held and reject such offer with respect to one or more other affected Notes so held).

(c)The Company may not offer to prepay or prepay Notes pursuant to this Section 8.7 (i) if a Default or Event of Default then exists, (ii) until the Company shall have, in the good faith discretion of the Company, taken commercially reasonable steps, if any are available, to mitigate the requirement to make the related Additional Payments or (iii) if the obligation to make such Additional Payments directly results or resulted from actions taken by the Company or any Subsidiary (other than actions required to be taken under applicable law), and any Tax Prepayment Notice given pursuant to this Section 8.7 shall certify to the foregoing and describe such mitigation steps, if any.

(d)For purposes of this Section 8.7: “Additional Payments” means additional amounts required to be paid to a holder of any Note pursuant to Section 13 by reason of a Change in Tax Law; and a “Change in Tax Law” means (individually or collectively with one or more prior changes other than changes described in a Rejection Notice) (i) the adoption or taking effect of, or an amendment to, or change in, any law, treaty, rule or regulation of the Taxing Jurisdiction after the Closing Day, or an amendment to, or

23 | ||

DB1/ 87639059.10 | ||

change in, an official interpretation or application of such law, treaty, rule or regulation after the Closing Day, which adoption, amendment or change is in force and continuing and meets the opinion and certification requirements described below or (ii) in the case of any other jurisdiction that becomes a Taxing Jurisdiction after the Closing Day, the adoption or taking effect of, or an amendment to, or change in, any law, treaty, rule or regulation of such jurisdiction, or an amendment to, or change in, an official interpretation or application of such law, treaty, rule or regulation, in any case after such jurisdiction shall have become a Taxing Jurisdiction, which adoption, amendment or change is in force and continuing and meets such opinion and certification requirements. No such amendment or change shall constitute a Change in Tax Law unless the same would in the opinion of the Company (which shall be evidenced by an Officer’s Certificate of the Company and supported by a written opinion of counsel having recognized expertise in the field of taxation in the relevant Taxing Jurisdiction, both of which shall be delivered to all holders of the Notes prior to or concurrently with the Tax Prepayment Notice in respect of such Change in Tax Law) affect the deduction or require the withholding of any Tax imposed by such Taxing Jurisdiction on any payment payable on the Notes.

9. AFFIRMATIVE COVENANTS.

The Company covenants that so long as any of the Notes are outstanding:

9.1. Compliance with Law.