Attached files

| file | filename |

|---|---|

| 8-K - 2018 GRC 8-K - EDISON INTERNATIONAL | eix-sceform8xkregrcfiling.htm |

September 1, 2016

2018 SCE General Rate Case Overview

September 1, 2016 1

Forward-Looking Statements

Statements contained in this presentation about future performance, including, without limitation,

operating results, capital expenditures, rate base growth, dividend policy, financial outlook, and other

statements that are not purely historical, are forward-looking statements. These forward-looking

statements reflect our current expectations; however, such statements involve risks and uncertainties.

Actual results could differ materially from current expectations. These forward-looking statements

represent our expectations only as of the date of this presentation, and Edison International assumes

no duty to update them to reflect new information, events or circumstances. Important factors that

could cause different results include, but are not limited to the:

• ability of SCE to recover its costs in a timely manner from its customers through regulated rates,

including regulatory assets related to San Onofre and proposed spending on grid modernization;

• decisions and other actions by the CPUC, the FERC, the NRC and other regulatory authorities,

including the determinations of authorized rates of return or return on equity, approval of proposed

spending on grid modernization, the outcome of San Onofre CPUC proceedings and delays in

regulatory actions;

• risks inherent in the construction of transmission and distribution infrastructure replacement and

expansion projects, including those related to project site identification, public opposition,

environmental mitigation, construction, permitting, power curtailment costs (payments due under

power contracts in the event there is insufficient transmission to enable acceptance of power

delivery), and governmental approvals; and

• risks associated with the retirement and decommissioning of nuclear generating facilities.

Other important factors are discussed under the headings “Risk Factors” and “Management’s

Discussion and Analysis” in Edison International’s Form 10-K, most recent Form 10-Q, and other reports

filed with the Securities and Exchange Commission, which are available on our website:

www.edisoninvestor.com. These filings also provide additional information on historical and other

factual data contained in this presentation.

September 1, 2016 2

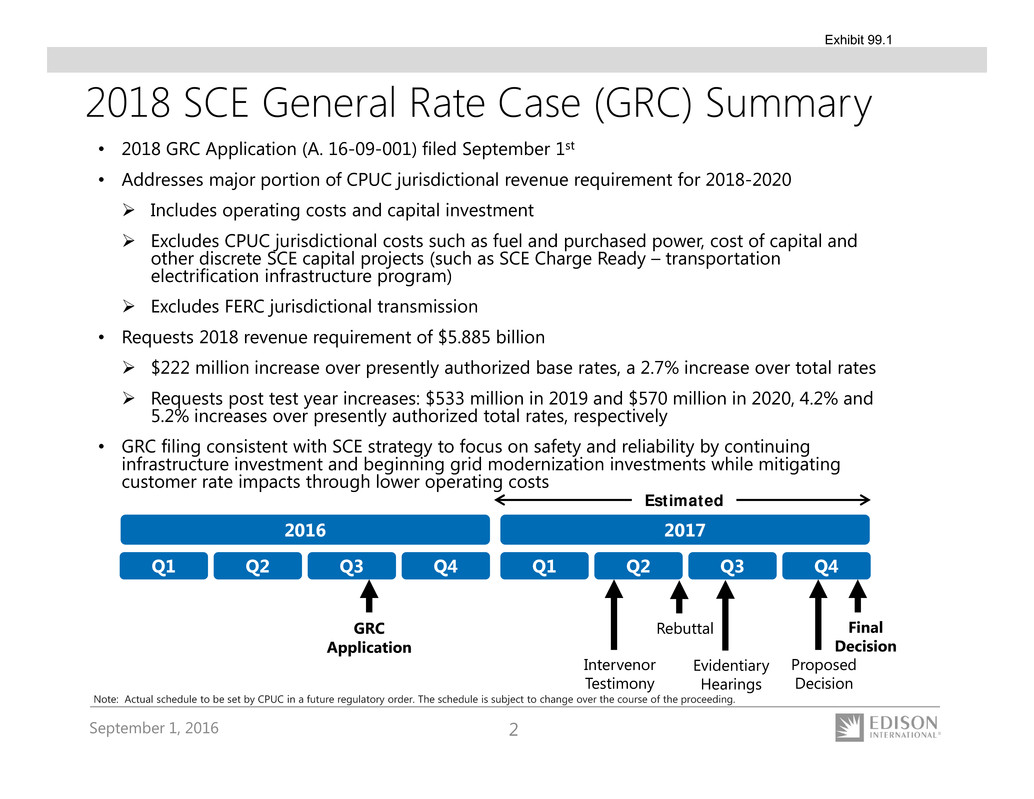

• 2018 GRC Application (A. 16-09-001) filed September 1st

• Addresses major portion of CPUC jurisdictional revenue requirement for 2018-2020

Includes operating costs and capital investment

Excludes CPUC jurisdictional costs such as fuel and purchased power, cost of capital and

other discrete SCE capital projects (such as SCE Charge Ready – transportation

electrification infrastructure program)

Excludes FERC jurisdictional transmission

• Requests 2018 revenue requirement of $5.885 billion

$222 million increase over presently authorized base rates, a 2.7% increase over total rates

Requests post test year increases: $533 million in 2019 and $570 million in 2020, 4.2% and

5.2% increases over presently authorized total rates, respectively

• GRC filing consistent with SCE strategy to focus on safety and reliability by continuing

infrastructure investment and beginning grid modernization investments while mitigating

customer rate impacts through lower operating costs

GRC

Application

Rebuttal Final

Decision

2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Estimated

Intervenor

Testimony

Proposed

Decision

2018 SCE General Rate Case (GRC) Summary

Evidentiary

Hearings

Note: Actual schedule to be set by CPUC in a future regulatory order. The schedule is subject to change over the course of the proceeding.

September 1, 2016 3

• Capital expenditures include $2.1 billion of

proposed grid modernization capital to

support improved safety and reliability and

increased levels of distributed energy

resources (DER)

Requested approval to establish a

memorandum account to facilitate $210

million of grid modernization capital

expenditures in 2016-2017; these

expenditures support 2018 GRC grid

modernization capital request

May need to evaluate grid modernization

capital plan if memorandum account is

not approved

• Need to increase depreciation expense to

reflect updated cost of removal estimates1

Limiting cost of removal request to

mitigate customer rate impact beginning

with $84 million increase in 2018

Further increases will likely be required

over multiple GRC cycles

Items Carried Over from 2015 GRC New Items from 2018 GRC

• Requests continuation of Tax Accounting

Memorandum Account (TAMA) to adjust

revenues annually for over and

undercollection of specified tax items

• Forecasting over $85 million in 2018 O&M

savings from Operational Excellence

initiatives

• Requests recovery for short-term incentive

compensation plans for full-time employees

($41 million disallowance in 2015 GRC

decision)

• Requests continuation of pole loading

capital recovery through balancing account

1. Cost of removal is the cost to remove existing equipment that is being replaced

2018 SCE GRC Summary (cont.)

September 1, 2016 4

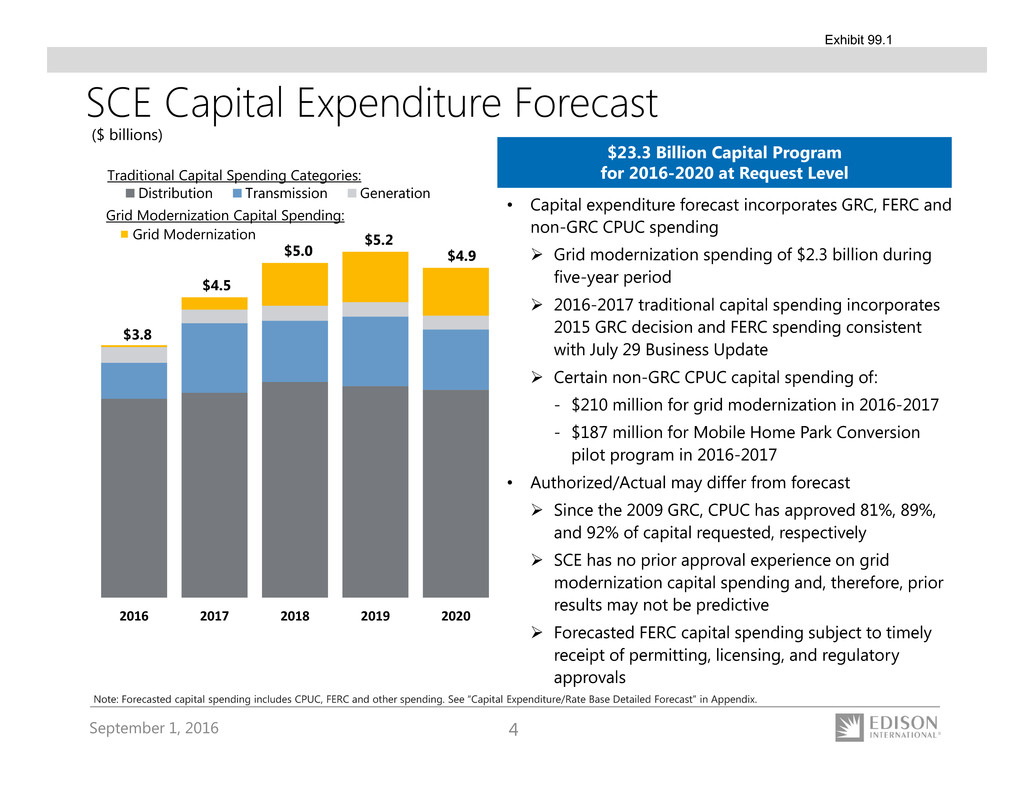

SCE Capital Expenditure Forecast

Note: Forecasted capital spending includes CPUC, FERC and other spending. See “Capital Expenditure/Rate Base Detailed Forecast” in Appendix.

($ billions)

$3.8

$4.5

$5.0

$5.2

$4.9

2016 2017 2018 2019 2020

Distribution Transmission Generation

Traditional Capital Spending Categories:

Grid Modernization Capital Spending:

Grid Modernization

$23.3 Billion Capital Program

for 2016-2020 at Request Level

• Capital expenditure forecast incorporates GRC, FERC and

non-GRC CPUC spending

Grid modernization spending of $2.3 billion during

five-year period

2016-2017 traditional capital spending incorporates

2015 GRC decision and FERC spending consistent

with July 29 Business Update

Certain non-GRC CPUC capital spending of:

- $210 million for grid modernization in 2016-2017

- $187 million for Mobile Home Park Conversion

pilot program in 2016-2017

• Authorized/Actual may differ from forecast

Since the 2009 GRC, CPUC has approved 81%, 89%,

and 92% of capital requested, respectively

SCE has no prior approval experience on grid

modernization capital spending and, therefore, prior

results may not be predictive

Forecasted FERC capital spending subject to timely

receipt of permitting, licensing, and regulatory

approvals

September 1, 2016 5

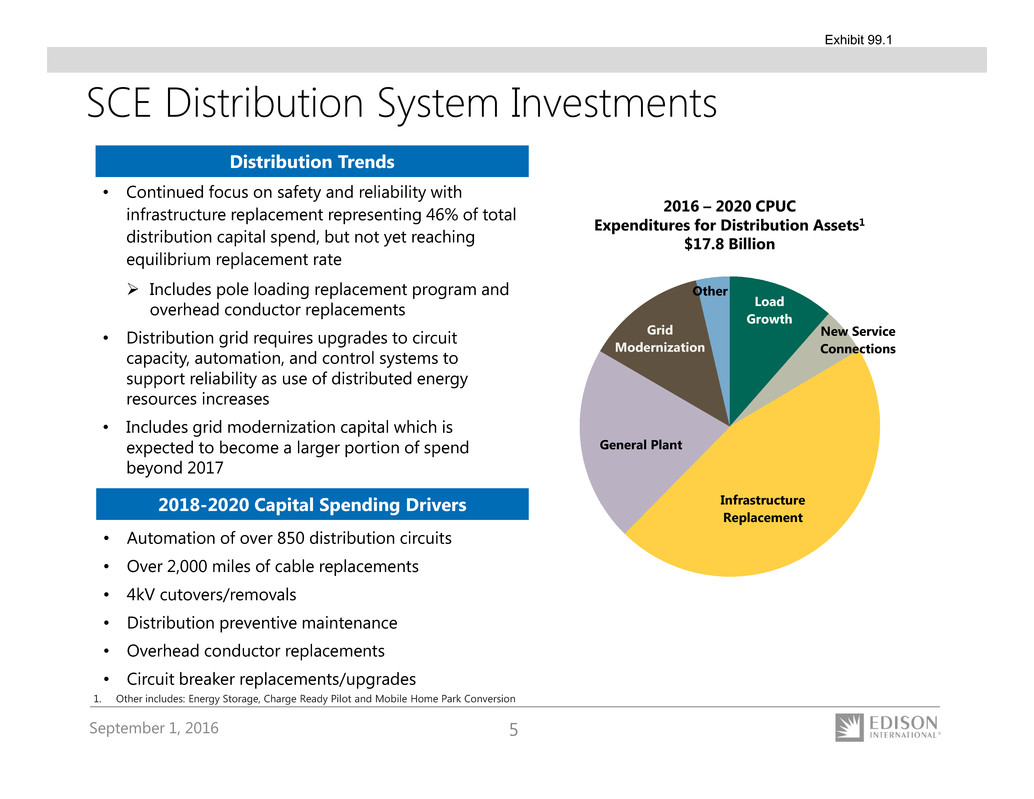

SCE Distribution System Investments

1. Other includes: Energy Storage, Charge Ready Pilot and Mobile Home Park Conversion

Distribution Trends

• Continued focus on safety and reliability with

infrastructure replacement representing 46% of total

distribution capital spend, but not yet reaching

equilibrium replacement rate

Includes pole loading replacement program and

overhead conductor replacements

• Distribution grid requires upgrades to circuit

capacity, automation, and control systems to

support reliability as use of distributed energy

resources increases

• Includes grid modernization capital which is

expected to become a larger portion of spend

beyond 2017

2016 – 2020 CPUC

Expenditures for Distribution Assets1

$17.8 Billion

2018-2020 Capital Spending Drivers

• Automation of over 850 distribution circuits

• Over 2,000 miles of cable replacements

• 4kV cutovers/removals

• Distribution preventive maintenance

• Overhead conductor replacements

• Circuit breaker replacements/upgrades

Load

Growth

New Service

Connections

Infrastructure

Replacement

General Plant

Grid

Modernization

Other

September 1, 2016 6

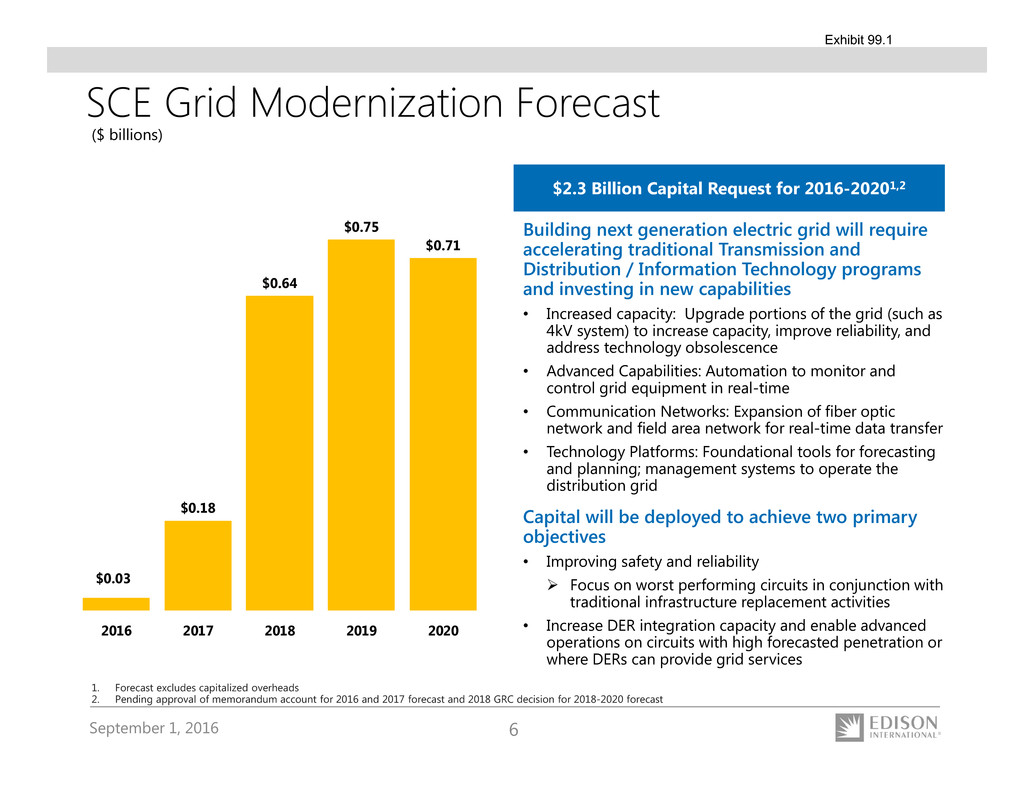

$0.03

$0.18

$0.64

$0.75

$0.71

2016 2017 2018 2019 2020

Building next generation electric grid will require

accelerating traditional Transmission and

Distribution / Information Technology programs

and investing in new capabilities

• Increased capacity: Upgrade portions of the grid (such as

4kV system) to increase capacity, improve reliability, and

address technology obsolescence

• Advanced Capabilities: Automation to monitor and

control grid equipment in real-time

• Communication Networks: Expansion of fiber optic

network and field area network for real-time data transfer

• Technology Platforms: Foundational tools for forecasting

and planning; management systems to operate the

distribution grid

Capital will be deployed to achieve two primary

objectives

• Improving safety and reliability

Focus on worst performing circuits in conjunction with

traditional infrastructure replacement activities

• Increase DER integration capacity and enable advanced

operations on circuits with high forecasted penetration or

where DERs can provide grid services

1. Forecast excludes capitalized overheads

2. Pending approval of memorandum account for 2016 and 2017 forecast and 2018 GRC decision for 2018-2020 forecast

SCE Grid Modernization Forecast

($ billions)

$2.3 Billion Capital Request for 2016-20201,2

September 1, 2016 7

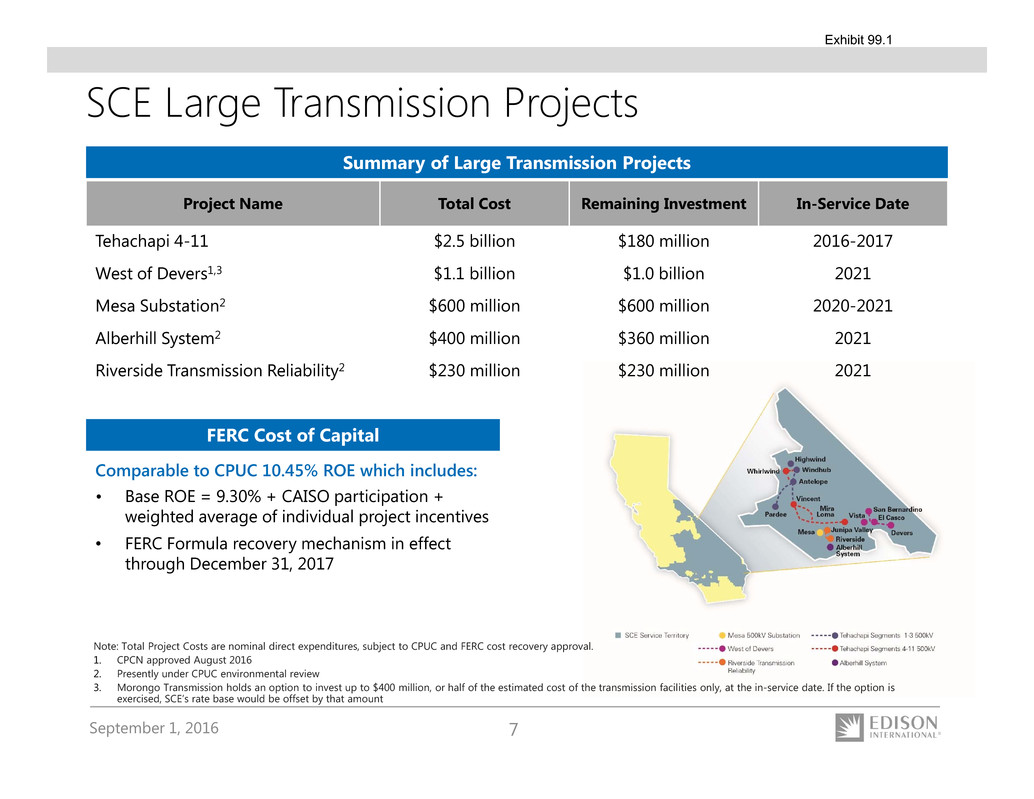

SCE Large Transmission Projects

Note: Total Project Costs are nominal direct expenditures, subject to CPUC and FERC cost recovery approval.

1. CPCN approved August 2016

2. Presently under CPUC environmental review

3. Morongo Transmission holds an option to invest up to $400 million, or half of the estimated cost of the transmission facilities only, at the in-service date. If the option is

exercised, SCE’s rate base would be offset by that amount

FERC Cost of Capital

Comparable to CPUC 10.45% ROE which includes:

• Base ROE = 9.30% + CAISO participation +

weighted average of individual project incentives

• FERC Formula recovery mechanism in effect

through December 31, 2017

Summary of Large Transmission Projects

Project Name Total Cost Remaining Investment In-Service Date

Tehachapi 4-11 $2.5 billion $180 million 2016-2017

West of Devers1,3 $1.1 billion $1.0 billion 2021

Mesa Substation2 $600 million $600 million 2020-2021

Alberhill System2 $400 million $360 million 2021

Riverside Transmission Reliability2 $230 million $230 million 2021

September 1, 2016 8

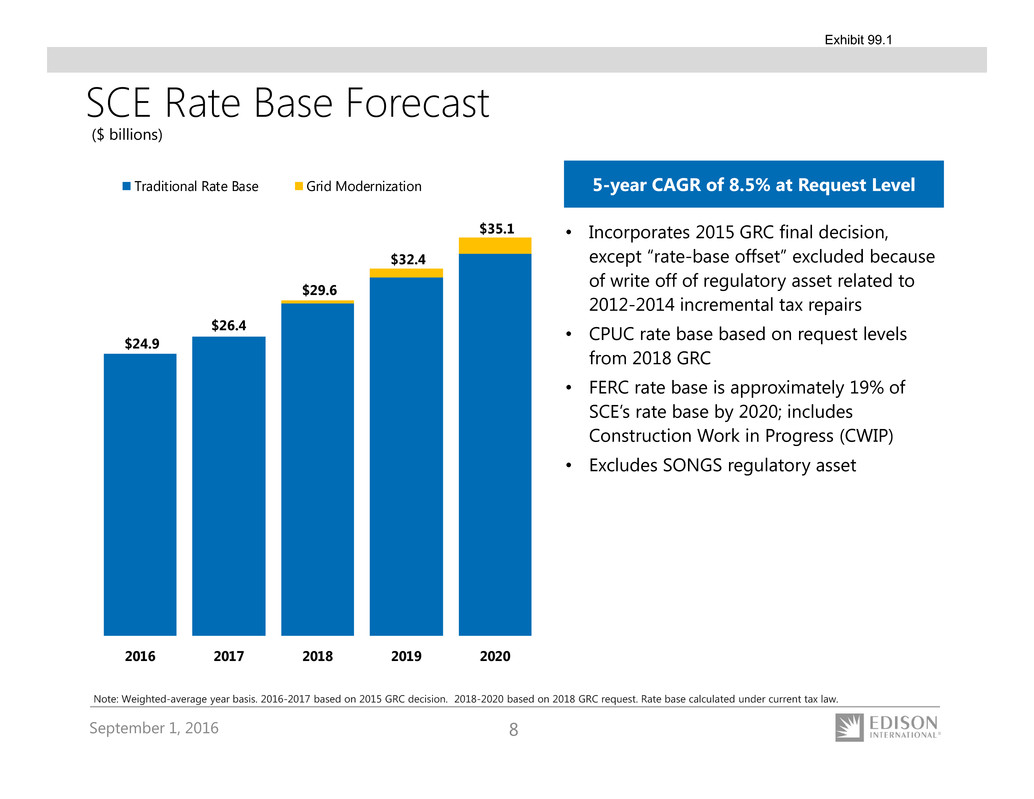

SCE Rate Base Forecast

• Incorporates 2015 GRC final decision,

except “rate-base offset” excluded because

of write off of regulatory asset related to

2012-2014 incremental tax repairs

• CPUC rate base based on request levels

from 2018 GRC

• FERC rate base is approximately 19% of

SCE’s rate base by 2020; includes

Construction Work in Progress (CWIP)

• Excludes SONGS regulatory asset

($ billions)

Note: Weighted-average year basis. 2016-2017 based on 2015 GRC decision. 2018-2020 based on 2018 GRC request. Rate base calculated under current tax law.

5-year CAGR of 8.5% at Request Level

$24.9

$26.4

$29.6

$32.4

$35.1

2016 2017 2018 2019 2020

Traditional Rate Base Grid Modernization

September 1, 2016 9

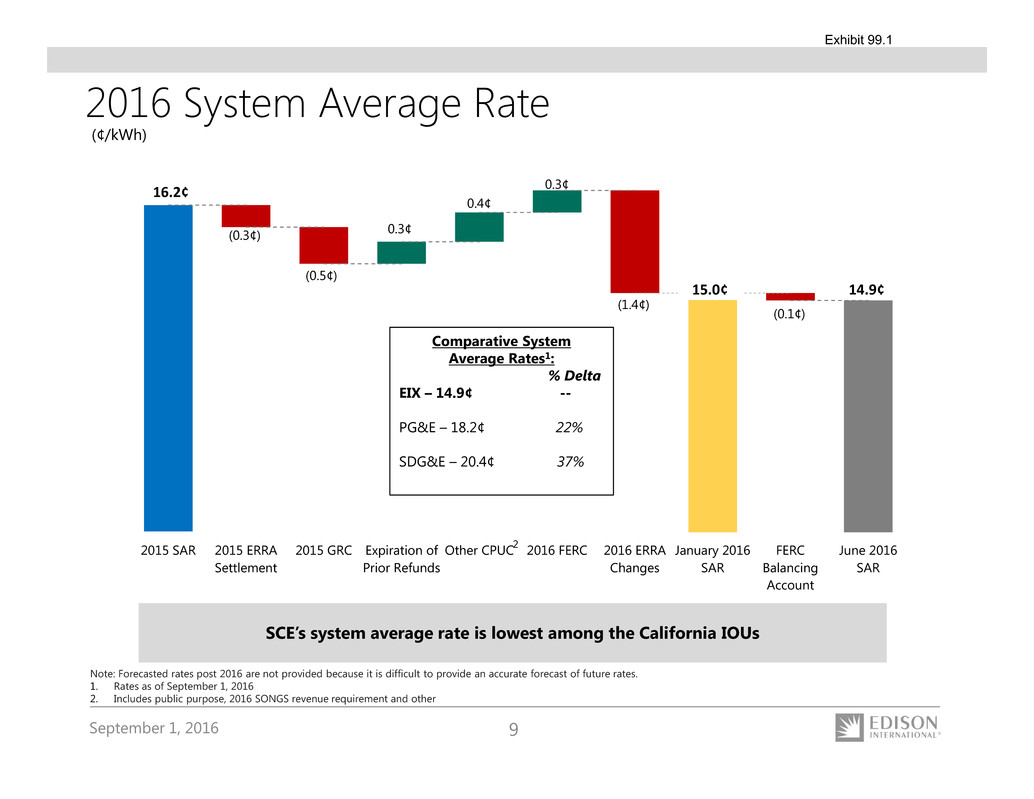

(0.3¢)

(0.5¢)

(1.4¢)

(0.1¢)

0.3¢

0.4¢

0.3¢

2015 SAR 2015 ERRA

Settlement

2015 GRC Expiration of

Prior Refunds

Other CPUC 2016 FERC 2016 ERRA

Changes

January 2016

SAR

FERC

Balancing

Account

June 2016

SAR

16.2¢

14.9¢15.0¢

2016 System Average Rate

SCE’s system average rate is lowest among the California IOUs

(¢/kWh)

2

Comparative System

Average Rates1:

% Delta

EIX – 14.9¢ --

PG&E – 18.2¢ 22%

SDG&E – 20.4¢ 37%

Note: Forecasted rates post 2016 are not provided because it is difficult to provide an accurate forecast of future rates.

1. Rates as of September 1, 2016

2. Includes public purpose, 2016 SONGS revenue requirement and other

September 1, 2016 10

Appendix

September 1, 2016 11

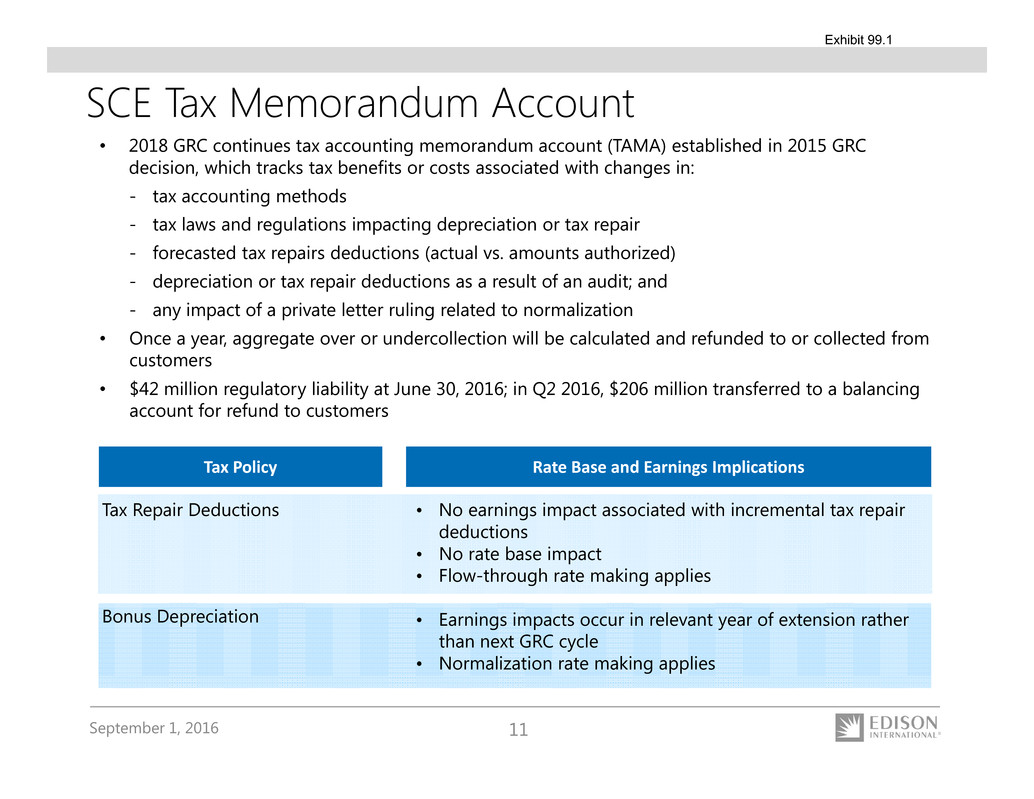

SCE Tax Memorandum Account

• 2018 GRC continues tax accounting memorandum account (TAMA) established in 2015 GRC

decision, which tracks tax benefits or costs associated with changes in:

- tax accounting methods

- tax laws and regulations impacting depreciation or tax repair

- forecasted tax repairs deductions (actual vs. amounts authorized)

- depreciation or tax repair deductions as a result of an audit; and

- any impact of a private letter ruling related to normalization

• Once a year, aggregate over or undercollection will be calculated and refunded to or collected from

customers

• $42 million regulatory liability at June 30, 2016; in Q2 2016, $206 million transferred to a balancing

account for refund to customers

Tax Repair Deductions

Bonus Depreciation

• No earnings impact associated with incremental tax repair

deductions

• No rate base impact

• Flow-through rate making applies

• Earnings impacts occur in relevant year of extension rather

than next GRC cycle

• Normalization rate making applies

Tax Policy Rate Base and Earnings Implications

September 1, 2016 12

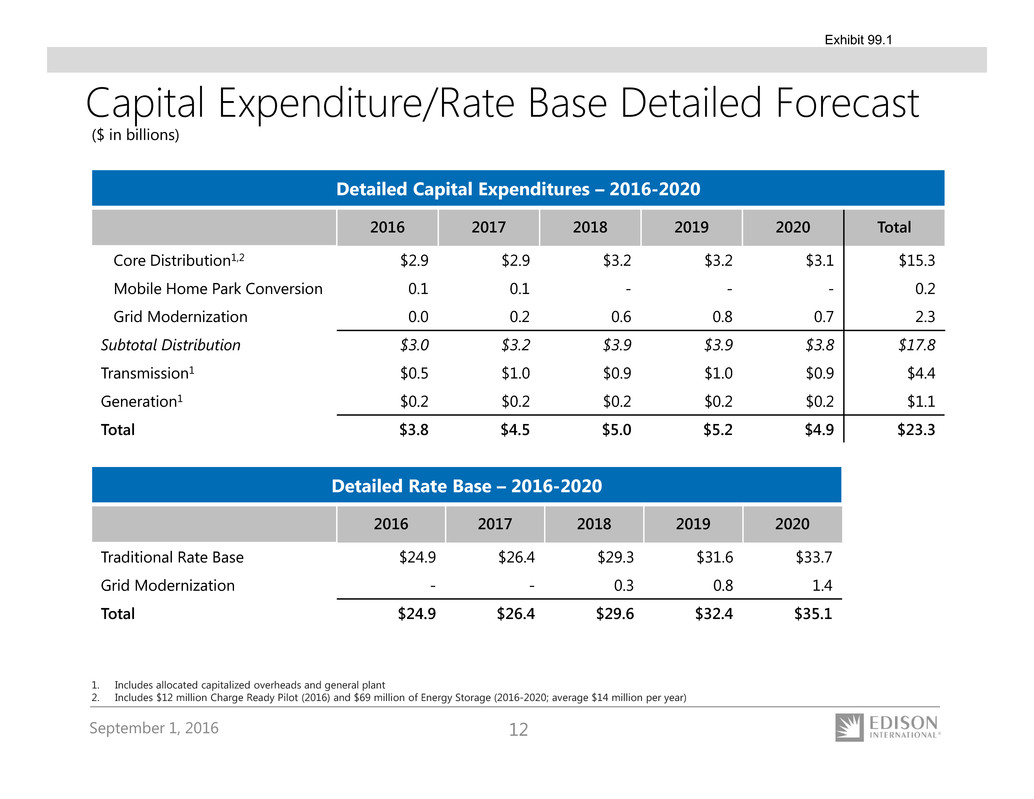

Detailed Capital Expenditures – 2016-2020

2016 2017 2018 2019 2020 Total

Core Distribution1,2 $2.9 $2.9 $3.2 $3.2 $3.1 $15.3

Mobile Home Park Conversion 0.1 0.1 - - - 0.2

Grid Modernization 0.0 0.2 0.6 0.8 0.7 2.3

Subtotal Distribution $3.0 $3.2 $3.9 $3.9 $3.8 $17.8

Transmission1 $0.5 $1.0 $0.9 $1.0 $0.9 $4.4

Generation1 $0.2 $0.2 $0.2 $0.2 $0.2 $1.1

Total $3.8 $4.5 $5.0 $5.2 $4.9 $23.3

Capital Expenditure/Rate Base Detailed Forecast

Detailed Rate Base – 2016-2020

2016 2017 2018 2019 2020

Traditional Rate Base $24.9 $26.4 $29.3 $31.6 $33.7

Grid Modernization - - 0.3 0.8 1.4

Total $24.9 $26.4 $29.6 $32.4 $35.1

1. Includes allocated capitalized overheads and general plant

2. Includes $12 million Charge Ready Pilot (2016) and $69 million of Energy Storage (2016-2020; average $14 million per year)

($ in billions)