Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Multi Packaging Solutions International Ltd | mpsx-20160630ex231374ed7.htm |

| EX-32 - EX-32 - Multi Packaging Solutions International Ltd | mpsx-20160630xex32.htm |

| EX-31.2 - EX-31.2 - Multi Packaging Solutions International Ltd | mpsx-20160630ex312045a94.htm |

| EX-31.1 - EX-31.1 - Multi Packaging Solutions International Ltd | mpsx-20160630ex3116d813a.htm |

| EX-21.1 - EX-21.1 - Multi Packaging Solutions International Ltd | mpsx-20160630ex2115e15fe.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2016

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-37598

Multi Packaging Solutions International Limited

(Exact Name of Registrant as Specified in its Charter)

|

Bermuda |

|

98-1249740 |

|

(State or Other Jurisdiction of |

|

(I.R.S. Employer |

|

Clarendon House, 2 Church Street |

|

HM 11 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(441) 295-5950

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to section 12(b) of the Act:

|

Title of Each Class |

|

Name of exchange on which registered: |

|

Common Shares, par value $1.00 per share |

|

New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to Form 10-K.

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter was $363,359,000.

As of August 15, 2016, there were 77,452,946 common shares, $1.00 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the registrant’s Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

Multi Packaging Solutions International Limited and subsidiaries

Unless the context otherwise requires, all references to “MPS Limited,” the “Company,” “we,” “us” and “our” refer to Multi Packaging Solutions International Limited, a Bermuda exempted company incorporated under the laws of Bermuda on June 19, 2015, together with the entities that became its consolidated subsidiaries on October 7, 2015. The entities that became the consolidated subsidiaries of MPS Limited consist of Multi Packaging Solutions Global Holdings Limited, which we refer to as “MPS Holdings,” and its subsidiaries. On October 7, 2015, MPS Limited became the direct parent company of MPS Holdings through a series of internal reorganizational transactions. We collectively refer to these reorganizational transactions as the “Reorg Transactions.” Unless otherwise indicated, references in this Annual Report to 2016 and 2015 or “fiscal” 2016, 2015 or other years refer to our fiscal year ended June 30 of that year and references to 2017 or “fiscal” 2017 refer to our fiscal year ending June 30, 2017.

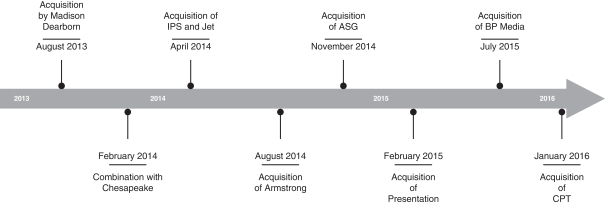

On August 15, 2013, Multi Packaging Solutions, Inc. and its primary shareholder, IPC/Packaging LLC, entered into an Agreement and Plan of Merger to be purchased by Mustang Parent Corp. (“Mustang”), an entity controlled by funds advised by Madison Dearborn. The acquisition of Multi Packaging Solutions, Inc. by Madison Dearborn is referred to as the “Madison Dearborn Transaction.” On November 18, 2013, an investment fund controlled by Madison Dearborn and an investment fund controlled by The Carlyle Group (“Carlyle”) entered into a Combination Agreement, whereby Madison Dearborn contributed 100% of the outstanding equity of Mustang to Chesapeake Finance 2 Limited (“Chesapeake”), in exchange for a 50% equity interest in Chesapeake. The combination transaction between Chesapeake and Mustang was consummated on February 14, 2014 and was accounted for as a reverse acquisition with Chesapeake as the legal acquiror and new parent entity, and Mustang as the legal subsidiary but the accounting acquiror. Subsequently, Chesapeake changed its name to Multi Packaging Solutions Global Holdings Limited.

The financial information prior to the February 14, 2014 completion of the combination reflects that of Mustang and its predecessor.

We are a leading, global provider of value-added specialty packaging solutions, based on sales, focused on high complexity products for the consumer, healthcare and multi-media markets. For fiscal 2016, approximately 47%, 47% and 6% of our net sales came from our North American, European and Asian operating segments, respectively, and approximately 89% of our net sales were derived from our consumer and healthcare end markets. We believe that our core addressable consumer and healthcare end markets encompass attractive, resilient and growing packaging categories, and we believe we are a leader in these end markets across North America and Europe based on sales. Additionally, we believe we have a market-leading position in the multi-media specialty packaging sector based on sales, which accounts for 11% of our net sales in fiscal 2016. We provide our customers with an extensive array of print-based specialty packaging solutions, including premium folding cartons, inserts, labels and rigid packaging across a variety of substrates and finishes, which are complemented by value-added services, including creative design, new product development and customized supply chain solutions. Based on management estimates, we believe the market opportunity across our primary addressable markets is currently in excess of $17 billion of annual sales.

We have long-term customer relationships driven by our global presence, breadth of products, value-added service offering, reputation for operational excellence, innovative packaging solutions and highly experienced management team. We serve a blue chip customer base, including some of the world’s largest companies and the leaders in our target end markets. Our global platform allows us to serve our customers, which include AstraZeneca, Coty, Diageo, Estée Lauder, GlaxoSmithKline, L’Oréal, Mondelēz International, Nestlé, Pernod Ricard, Pfizer and Sony, on both a local and global basis. Our relationships with our top 20 customers exceeds 34 years on average with many of our customers operating under multi-year contracts. No one customer accounted for more than 10% of our net sales for fiscal 2016, fiscal 2015 and the period from August 15, 2013 through June 30, 2014. One customer accounted for approximately 11% of net sales for the period from July 1, 2013 through August 14, 2013. Servicing our customers requires us to meet stringent quality specifications, significant customer service standards and meaningful investment requirements. Our healthcare customers, for example, require exacting standards of manufacturing in order to meet their regulatory requirements, which include strict process controls, site certification, chain of custody product information and strict adherence to print requirements and print quality due to the nature of the use of the product by our customers’ end users. For our consumer customers, we are at the front end of their branding and marketing strategy, enhancing the visual impact at the shelf while also ensuring

1

product integrity and regulatory compliance. We believe our advanced printing and finish effects and designs often help our customers position their products at the premium end of their addressable markets. In addition we provide value-added supply chain services such as vendor managed inventory (“VMI”), specific carton-by-carton scan ability and data which enable the customer to track a product from manufacturer to end user.

We believe we are one of a few companies in the end markets we serve offering a full range of products across multiple geographies, allowing us to provide specialty packaging solutions for customers locally and globally, a capability our customers find valuable in presenting a consistent image of the underlying product. Our global manufacturing footprint consists of 59 manufacturing sites and eight sales offices across North America, Europe and Asia. Our strategically located facilities have enabled us to grow our business by leveraging our customer relationships across multiple geographies and products, and drive incremental growth through our ability to integrate and improve our customers’ supply chains. These solutions highlight our competitive difference and allow us to win new customers and strengthen our existing client relationships through cross-selling opportunities across our unique global platform, with further benefits to be realized from recent acquisitions. Additionally, our global manufacturing footprint is supported by our sales and design teams, which consist of a dedicated research and development group, approximately 100 structural and graphic designers and approximately 200 sales personnel.

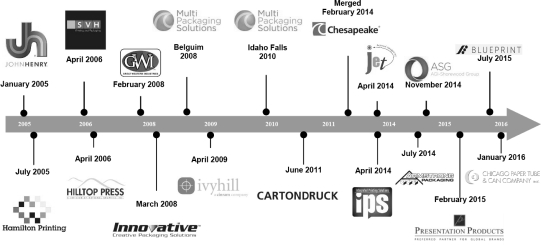

Our History

Since 2005, we have evolved from our initial U.S. platform of five facilities into a global specialty packaging leader, based on sales, in the consumer, healthcare and multi-media end markets. We have completed a total of 16 transactions within our addressable products and markets, with early acquisitions targeted at obtaining and building the necessary technology footprint to serve consumer and pharmaceutical companies. Later acquisitions focused on expanding that platform into complementary products and creating a global footprint capable of meeting all of our customers’ value-added packaging requirements. In 2014, we entered into a transformational merger with Chesapeake (February 2014), acquired ASG (November 2014) and in addition completed six further acquisitions since the Merger, which expanded our global reach and diversified our product and end market profile. We have a successful track record of acquiring strategically relevant companies, establishing and realizing savings and synergy programs and integrating acquired operations and customers into our global platform. Through successful execution and integration of acquired businesses, we have expanded our geographic reach and product and service offering, which has enabled us to better serve our large multinational customers, as well as penetrate new regional and local customers in our key end markets. We have expanded the operating margins of companies we have acquired, achieving our synergy targets and leveraging our platform as evidenced by our accreting EBITDA margins subsequent to each acquisition. Specifically, we estimate that we realized a total of approximately $40 million of synergies from the Chesapeake and ASG transactions.

2

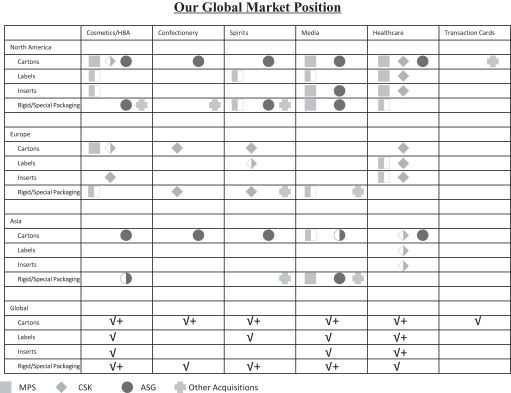

The MPS and Chesapeake platforms are highly complementary. At the time of the merger between the two companies, MPS was predominantly focused on the personal care and generic pharmaceutical end markets within North America. Conversely, Chesapeake was focused on the branded pharmaceutical, confectionary and Scotch whisky end markets in Europe. The combination provides for significant cross-selling opportunities across our global platform.

Note: Partially shaded symbols represent limited presence and fully shaded symbols represent significant presence.

Our Segments

We operate our business along three operating segments, which are grouped on the basis of geography: North America, Europe and Asia. We believe this method of segment reporting reflects both the way its business segments are managed and the way the performance of each segment is evaluated. The three segments consist of similar operating activities as each segment produces similar products. The Company evaluates performance based on several factors, of which the primary financial measure is Adjusted EBITDA. Adjusted EBITDA is defined as segment net income (loss) before income taxes, interest, depreciation, amortization, restructuring, transaction, stock-based compensation and certain other costs that do not related to the segment’s ongoing operations. See Note 19, Segments, in the Notes to Consolidated Financial Statements for additional information about our segments.

3

Net sales for our segments were as follows:

|

|

|

Successor |

|

|

Predecessor |

|

||||||||

|

|

|

Fiscal Year Ended |

|

Period from August |

|

|

Period from July 1 |

|

||||||

|

|

|

June 30, |

|

15, 2013 through |

|

|

2013 through |

|

||||||

|

(amounts in thousands) |

|

2016 |

|

2015 |

|

June 30, 2014 |

|

|

August 14, 2013 |

|

||||

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America * |

|

$ |

784,453 |

|

$ |

737,888 |

|

$ |

452,031 |

|

|

$ |

58,728 |

|

|

Europe |

|

|

785,997 |

|

|

820,391 |

|

|

354,396 |

|

|

|

15,353 |

|

|

Asia |

|

|

90,978 |

|

|

59,361 |

|

|

7,786 |

|

|

|

— |

|

|

Total Net Sales |

|

$ |

1,661,428 |

|

$ |

1,617,640 |

|

$ |

814,213 |

|

|

$ |

74,081 |

|

* Includes net sales in the United States of $695.3 million and $688.2 million for the fiscal years ended June 30, 2016 and 2015, respectively. Substantially all North America sales for the period from August 15, 2013 through June 30, 2014 and the period from July 1, 2013 through August 14, 2013 were generated in the United States.

Our Products

We provide our customers a comprehensive suite of innovative specialty products and services, including premium folding cartons, inserts, labels and rigid packaging. Our packaging solutions utilize a wide variety of substrates (e.g., paper and paperboard, pressure sensitive labels, plastic, foil) and finishes (e.g., UV coatings, film lamination, stamping, embossing). We also employ an array of value-add decorative technologies to create iridescent, holographic, textured and dimensional effects to provide differentiated specialty packaging products to our customers. Our comprehensive solutions, which often include combination or bundled products, and a technologically advanced asset base allow us to win new customers and strengthen our existing client relationships through cross-selling opportunities across our unique global platform.

Premium Folding Cartons

Premium folding cartons are widely used, versatile forms of secondary packaging that our customers utilize to attract consumer attention at the point-of-sale and provide critical product information to end users. Our folding carton offering is targeted at the premium end of the market, utilizes high quality inputs such as solid bleached sulfate, and is manufactured with various features and finishes, including lamination, embossing, foil stamping and windowing. Rigid packaging serves a functional purpose by providing protection to the product throughout the shipping, distribution and merchandising processes. Premium folding cartons accounted for approximately 61%, 61%, 59% and 66% of our consolidated net sales in fiscal 2016, fiscal 2015, the period from August 15, 2013 through June 30, 2014 and the period from July 1, 2013 through August 14, 2013, respectively.

Our premium folding cartons offering plays an important role in our customers’ branding and marketing strategies through influencing purchase decisions at the point-of-sale by conveying an exceptional appearance, shelf presence and impact through the use of specialty graphics, a variety of printed finishes and other creative designs. Additionally, our premium folding cartons offering must adhere to stringent regulatory requirements by playing a key role in our customers’ product safety as well as ensuring product authenticity, accurate product information and product compliance to the end customer. Our premium folding carton customers oftentimes purchase associated labels and inserts. Leveraging cross-selling opportunities is a key strategic initiative of recent acquisitions that we have completed.

Inserts

We provide inserts for all the end markets we serve, with the majority of our net sales in this category being to the healthcare end market. Inserts are of particular importance in the healthcare end market given stringent regulations to ensure the accuracy of product information, although they are also used in non-healthcare markets in which product literature is required to be presented to the end user. Inserts are included either inside a secondary package (e.g., folding carton) or affixed to the outside of a primary package (e.g., bottle). Numerous regulatory bodies, such as the U.S. Food and Drug Administration, the U.S. Department of Agriculture and various trade associations, require an increasing level of product information, including nutritional, performance and other related product disclosures. Providing this increasing

4

amount of information requires larger and, in many instances, more complex inserts. Specific technical equipment is necessary to produce the folded leaflet, which requires significant upfront investment. Evolving regulations require that insert manufacturers stay abreast of new developments and maintain manufacturing equipment and process capabilities necessary to meet strict inspection and quality control standards. Product disclosure requirements change, oftentimes on short notice, due to regulatory oversight. This results in the need for quick reaction and turnaround of production. Oftentimes our ability to be an integral part of our customers’ information management systems allows us to monitor customer demand and limit their exposure to inventory obsolescence when product disclosure changes. Inserts accounted for approximately 13%, 16%, 16% and 12% of our consolidated net sales in fiscal 2016, fiscal 2015, the period from August 15, 2013 through June 30, 2014 and the period from July 1, 2013 through August 14, 2013, respectively.

Labels

Labels are one of the most visible and recognizable packaging components and are used in a wide variety of applications serving as the primary means of identifying products to consumers, while creating shelf appeal and brand recognition for products. Labels also function as a conduit for fulfilling regulatory requirements, communicating product-related information to consumers and contributing to product integrity and security. We supply a broad range of pressure sensitive labels, including single-panel, multi-panel, multi-ply and extended content labels, as well as cut and stack labels. Labels accounted for approximately 8%, 7%, 9% and 10% of our consolidated net sales in fiscal 2016, fiscal 2015, the period from August 15, 2013 through June 30, 2014 and the period from July 1, 2013 through August 14, 2013, respectively.

The majority of our net sales in this category are pressure sensitive labels sold primarily into the healthcare market which, like our inserts, are subject to stringent regulations to ensure the accuracy of product information. Additionally, we supply both pressure sensitive and cut and stack labels to the consumer products markets where decorative labels are utilized to differentiate products at the retail point-of-sale. We employ multiple print technologies with respect to labels, utilizing digital, flexographic and offset printing press technologies to serve our customers globally.

Rigid Packaging

Rigid boxes are commonly used to present ultra-premium products and vary from rigid top load boxes for the high-end spirits market to specialized boxes for perfumes and other luxury products. We historically provided rigid box offerings, oftentimes described as top load box or set up boxes, via strategic outsource suppliers. Consistent with our acquisition strategy to acquire appropriate technologies, we completed two recent strategic acquisitions which added our own internal manufacturing capability for a premium rigid packaging product offering with the addition of customized/high-end rigid boxes. We have a growing presence in rigid packaging and believe this is a meaningful area for growth in the future. Rigid Packaging accounted for approximately 6%, 4%, 1% and 0% of our consolidated net sales in fiscal 2016, fiscal 2015, the period from August 15, 2013 through June 30, 2014 and the period from July 1, 2013 through August 14, 2013, respectively.

Other Consumer Products Packaging

We offer a number of additional printed packaging products, including transaction cards, point-of-purchase displays, brochures, product literature, marketing materials and grower tags and plant stakes for the horticultural market. These products are supplied to various niche markets that require print-based specialty packaging. Our transaction cards and card services offerings are of a particular focus. We provide our customers a comprehensive end-to-end solution for credit, debit, general prepaid reloadable, gift, loyalty, hospitality, insurance and other card-based programs. Our integrated supply chain for cards, carriers, multi-packs and point-of-purchase displays greatly simplifies the development and execution of card programs and drives competitive differentiation. Other consumer products packaging accounted for approximately 12%, 12%, 15% and 12% of our consolidated net sales in fiscal 2016, fiscal 2015, the period from August 15, 2013 through June 30, 2014 and the period from July 1, 2013 through August 14, 2013, respectively.

5

Value-Added Services

We provide a range of value-added services to our customers ranging from collaboration on the initial packaging concept to total management of the supply chain. We work closely with our customers to understand their specific requirements and thereby implement streamlined workflows starting from pre-press through to fulfillment. These valuable service capabilities complement our broad product offering and, when matched with our manufacturing operations, enable us to consistently deliver high quality products and superior service to our customers. Examples of such value-added services include creative design and new product development, for which we have a team of more than 105 structural designers and graphic designers across a number of key locations. We also provide our customers with customized supply chain solutions, including VMI programs. VMI solutions help customers manage production based on actual demand to reduce lead times, minimize inventory, eliminate waste and enhance supply chain security. Our ability to provide on-demand services for our customers via digital print technology has allowed us to reduce our lead times. Shorter lead times provide a distinct advantage in consumer and healthcare-facing industries where companies must move quickly to introduce new products and ramp-up supply in response to market trends and consumer demand. Shorter lead times also limit our customers’ exposure to inventory obsolescence. Our value-added services build entrenched partnerships with customers and allow us to become a more critical part of the supply chain by helping to improve workflow efficiencies and reduce our customers’ total cost of ownership for packaging materials.

|

· |

Digital Workflow: Ability to manage all of a customer’s digital assets for simplified management on a regional or global scale. These digital assets range from artwork and front-end solutions to tracking codes that account for individual items throughout the supply chain and activation codes that scan at retail. |

|

· |

Creative Services: Award-winning creative team with a reputation for innovation and quality, comprised of 25 structural designers and nine graphic designers who provide packaging engineering, 3-D renderings, product animation, prototyping and testing. |

|

· |

Pre-Press Services: Fully staffed, around-the-clock team to provide same day or next day service including full proofing capabilities, artwork enhancement and file correction. |

|

· |

Vendor Managed Inventory: Ability to manage production based on a customer’s actual demand provides numerous benefits, including shorter lead times, reduced physical inventory, waste reduction and increased supply chain security. |

|

· |

Late Stage Customization: Ability to leverage our flexible manufacturing capabilities by printing common graphics on long-run equipment and customizing products on-demand with printed labels or inserts using short-run digital equipment. A proprietary finishing system prints and applies labels and delivers finished cartons on an as needed basis. |

|

· |

Co-Located Facilities: Onsite facilities management provides equipment and staffing for printing and packaging production physically located within a customer’s facility. On-demand packaging capabilities provide numerous customer benefits, including lower inventory levels, reduced obsolescence and cycle time reductions. |

|

· |

Brand Protection / E-Pedigree: We provide brand security through the application of various technologies, including magnetic inks, invisible bar codes and holographic cold foil, to help ensure the traceability and authenticity of our customers’ products. |

|

· |

Environmental Solutions: We have made substantial investments in sustainability and environmentally-friendly products, technologies and manufacturing processes to meet the environmental objectives of our customers. |

6

Our End Markets

Consumer

We produce a full line of specialty print-based packaging products for a wide range of customers in the personal care, spirits, cosmetics and confectionary markets. We focus on the premium end of the market where high-impact graphics, and innovative designs and finishes attract attention and help brands drive “top-of-mind” positioning with consumers at the point-of-purchase. Our scale and financial resources have enabled us to build out a leading global design division which has been at the forefront of our product innovation capabilities. Multinational customers have also increasingly centralized their procurement functions seeking fewer, more strategic partners capable of meeting their consumer packaging needs and consistent marketing image across a range of products, services and geographies. We are well-positioned to benefit from this trend in vendor rationalization by leveraging our ability to deliver a broad range of local solutions while simultaneously providing global coverage to our multinational customers. Consumer end market products accounted for approximately 50%, 50%, 45% and 35% of our consolidated net sales in fiscal 2016, fiscal 2015, the period from August 15, 2013 through June 30, 2014 and the period from July 1, 2013 through August 14, 2013, respectively.

This market is driven by:

|

· |

Shortened product life cycle—Focus on new product introductions with unique packaging designs that promote brand identity and on-shelf differentiation in order to drive growth. In order to achieve the first-mover advantage, personal care companies rely on suppliers able to rapidly design and commercialize these new, high quality packages. |

|

· |

Enhanced product design and brand promotion—Personal care companies have increasing demand for packaging suppliers who are able to offer new technologies and services to promote brand identity, premium positioning and shelf appeal. This trend increasingly favors suppliers with differentiated capabilities, such as finishing technologies for iridescent, holographic, textured and dimensional effects. |

|

· |

Positive demographic trends and increasing health and wellness awareness—The growing and aging population sensitive about preserving a youthful image is driving a positive shift in the consumption patterns of personal care products, including products used to reverse signs of aging, such as anti-wrinkle skin creams, lotions, serums and hair colorants. People are generally tending to take better care of themselves and are willing to pay more for products with perceived benefits. |

|

· |

Increasing disposable premiumization—Individuals have greater capability to purchase higher end consumer products, particularly in developing regions such as Asia and Latin America. Sophisticated packaging solutions allow for better shelf visibility and brand positioning. The propensity to use secondary packaging, such as premium rigid boxes and labeling, is higher in premium type spirits and confections, as it represents one of the principal ways to command higher price points and differentiate products. |

|

· |

Demand for sustainable and intelligent packaging—Increasing consumer focus on environmental issues and recyclability of materials represents an opportunity for advanced high value-add producers to further strengthen market positions. Consumers are increasingly purchasing products that are sustainable and offer recyclable packaging and many companies have embraced this trend, moving towards eco-friendly products. |

Healthcare

Healthcare packaging is used in a wide variety of applications including over-the-counter and prescription pharmaceuticals, medical devices, nutritional and dietary supplements, vitamins and minerals. We offer a full line of print-based packaging products serving the healthcare market, including folding cartons, inserts, labels, outserts and booklets. The healthcare packaging market is characterized by significant technical requirements, recession-resilient demand characteristics and numerous growth opportunities. Healthcare packaging has stringent quality specifications, prerequisite manufacturing standards and evolving regulatory requirements. Product innovation plays a key role in the industry as pharmaceutical manufacturers increasingly incorporate authentication features into packaging to assist in the prevention of counterfeiting. We have developed strong relationships with leading healthcare companies as a result of our high-quality products, expertise in print technologies including digital print technology, excellent customer service and customized

7

supply solutions, and quick response and turnaround times. Through this approach, we believe we have established ourselves as an important supplier to the industry and see significant opportunity for future growth with new and existing customers. Healthcare end market products accounted for approximately 39%, 40%, 41% and 28% of our consolidated net sales in fiscal 2016, fiscal 2015, the period from August 15, 2013 through June 30, 2014 and the period from July 1, 2013 through August 14, 2013, respectively.

This market is driven by:

|

· |

Population demographics—Population growth, an increased focus on chronic diseases and the aging population have increased the market for pharmaceuticals as consumers require a growing number and diversity of prescription and over-the-counter medicines and nutritional supplements, including those that target age-related conditions and illnesses. |

|

· |

Globalization and vendor rationalization—Regulatory pressures and increased product quality requirements have encouraged large multinational pharmaceutical and supplement manufacturers to focus their packaging spend on fewer suppliers that can provide consistent service and product quality on a global basis. We believe this trend favors scale players with the capability to support product launches across multiple products and geographies. We expect vendor rationalization to continue as customers seek to contain costs without sacrificing logistical flexibility and product quality. |

|

· |

Increasing consumer awareness regarding health and wellness—Manufacturers and marketers of nutritional and dietary supplements are continuously introducing and marketing new product offerings in order to appeal to growing consumer awareness regarding health and wellness and preventative medicine. |

|

· |

Growth in drug treatments and availability—The volume of pharmaceutical products available in the market has been expanding for both branded and generic drugs. The demand for generic drugs may accelerate as some branded pharmaceutical products become available in generic formulations after the expiration of patents. While our branded business is set to grow with the overall market, we also expect to benefit from the growth of generic pharmaceuticals. |

|

· |

Evolving regulatory standards and regulations—Regulatory standards to improve security and prevent drug counterfeiting as well as provide greater, more accessible disclosure to patients and healthcare providers create a dynamic regulatory environment that requires creative, value-added packaging solutions. For example, the blister packaging market is expected to benefit from the implementation of U.S. Food and Drug Administration regulations requiring all prescribed pharmaceuticals dispensed in hospitals and nursing homes to be packaged in unit dose formats with barcodes in order to reduce dispensing errors. Overall drug spend is also forecast to grow, given recent government legislation and regulation around the Patient Protection and Affordable Care Act. |

Multi-Media

Our multi-media end market net sales is focused on high quality specialty packaging, which often requires quick response, including commemorative and special editions for home videos, recorded music, video games and software. We produce a full line of printed packaging products for leading multi-media companies including folding cartons, booklets, folders, inserts, cover sheets and slipcases, as well as highly customized, graphical and value-added packaging components. We are one of the largest producers of these products in the North American multi-media end market based on sales. Multi-media end market products accounted for approximately 11%, 10%, 14% and 37% of our consolidated net sales in fiscal 2016, fiscal 2015, the period from August 15, 2013 through June 30, 2014 and the period from July 1, 2013 through August 14, 2013, respectively.

8

This market is characterized by:

|

· |

Digital substitution—We believe the combination of our talented sales executives with longstanding customer relationships and our product and operational excellence has allowed us to generate attractive margins and cash flow despite the decline in multi-media packaging demand. The increasing popularity of digital distribution will continue to erode the shipments of physical music and video game and home video units. See “Risk Factors—Risks Related to Our Business—The impact of electronic media and similar technological changes, including the substitution of physical products for digital content, may continue to adversely affect sales in the multi-media end market.” We believe that through our market-leading positions in the multi-media specialty packaging sector we will be able to continue to execute on profitable and opportunistic multi-media packaging business. Moreover, highly anticipated video game launches, such as Grand Theft Auto, and blockbuster movie releases drive increased demand for gaming and home video, respectively, including higher value-add commemorative editions and box sets, and can generate above average growth and profitability. |

Our Sales and Marketing

We believe we maintain a world class sales and marketing organization with an ability to grow sales with new and existing customers, as well as cross-sell our comprehensive product offerings. The ability to identify and successfully recruit talented sales and marketing executives has contributed to our ability to achieve accelerated growth rates. Each vertical is led by dedicated sales executives who, in collaboration with our executive team, are responsible for maintaining existing relationships and identifying and pursuing a target account list of potential new customers.

We have a proven ability to provide customized solutions that reduce our customers’ total cost for packaging materials. By seeking out customers who would benefit from value-added solutions, we have been able to consistently expand our customer base and maintain longstanding relationships without competing solely on the basis of price.

Our Customers

We have a broad and diversified customer base. We benefit from longstanding relationships with well-recognized customers in each of our core markets. Our relationships with our top 20 customers exceed 34 years on average. No one customer accounted for more than 10% of our net sales for fiscal 2016, fiscal 2015 and the period from August 15, 2013 through June 30, 2014. One customer accounted for approximately 11% of net sales for the period from July 1, 2013 through August 14, 2013.

Our management is highly focused on creating and maintaining strategic partnerships beyond standard transactional customer relationships. Our customer relationships are reinforced by our innovation, consistent high quality products, integrated service offerings, reliable on-time delivery and outstanding customer service.

Our customer relationships are further entrenched by customer audit specifications and regulatory approvals required for packaging suppliers as well as the inherent risk of switching suppliers. Products are typically complex and involve short-run production lengths, while contracts include multiple SKUs with color and design variability. While secondary packaging is a low proportion of end-product cost or price (in healthcare, for example, it is often less than 1% of end-product cost/price), the potential cost of disruption to a packaging line as a result of poor quality products or unstable supply can be significant. Consequentially, end customers are focused on quality and stability of supply.

We maintain multi-year contracts with the majority of our customers with terms of three to four years on average. Consistent with industry practice, we do not typically receive volume commitments from customers, but often have a contractual right to a minimum percentage of a customer’s spend on identified products. We manage the majority of our raw material costs through a combination of market-based pricing and contracted escalators and de-escalators.

9

Our Facilities

We own or lease 59 manufacturing facilities and several dedicated sales and design offices in North America, Europe and Asia. Our facility network is strategically located in close proximity to key customers.

We employ a largely integrated, enterprise-wide approach to management of our facilities and fundamental equipment, which enables us to redeploy plant assets and production processes to match customer and profitability objectives. At the same time, facility level specialization of our manufacturing footprint based on customer needs, substrate capabilities and technological offerings allows us to take advantage of enhanced profitability from efficiencies associated with running larger volumes of consistent products at specific locations. Acquired operations also benefit from this approach as business is optimized across the broader facility network incorporating a process of asset redeployment, facility rationalization and targeted capital investment.

Further, we have invested to ensure our facilities provide the scale, geographic coverage, operational flexibility and security of redundant capabilities that sophisticated customers require. Since our inception in 2005, we have pursued a capital investment program, which we believe has provided us with leading technological and operational capabilities and capacity for continued growth. We completed a capital investment program from fiscal year 2012 through fiscal year 2013 that expanded existing co-located facilities, expanded our Poland facility and consolidated two redundant facilities. As a result, our manufacturing platform is well positioned to support the anticipated ramp-up of production related to our new business pipeline and organic growth. We are able to deliver high quality products and services to our customers by way of the following:

|

· |

Security of Supply—The scale of our multi-site network allows customers to confidently source a large portion of their packaging requirements from us. |

|

· |

Fully-Accredited Sites—All our facilities are registered to ISO9000 standards or are cGMP compliant. Many sites conform to relevant market sector standards such as the Pharmaceutical Code of Practice (PS9000), BRC / IoP, HAACP, ISO14001 and 18001. |

|

· |

Sites Meet Stringent Customer Requirements—Customer audits are undertaken for supplier approval and quality certifications. These demanding audits are accompanied by continually evolving and increasingly stringent regulatory standards and requirements. |

Our Manufacturing

Our manufacturing footprint and dedicated sales force are strategically located in close proximity to our clients, which further enables our ability to manage customers in the region. Through continued capital investment and strategic acquisitions, we have become a leading print-based specialty packaging supplier offering a comprehensive range of technological capabilities to our customers. We have invested in state-of-the-art equipment and are a leader in the three principal specialty printing technologies:

|

· |

Offset lithographic printing—In “offset” printing, rollers apply ink and water to plates which are then transferred to a rubber cylinder that transfers the image onto the paper. The lithographic printing process delivers superior quality graphics and can accommodate a variety of specialty finishes, including foil stamping and embossing. Benefits to offset printing include consistent high image quality and usability on a wide range of printing surfaces. In this process, paper is cut down to sheets (either internally or by outside vendors) and then fed through the printing press. |

|

· |

Flexographic printing—In “flexo” printing, inked rubber or plastic plates with a slightly raised image are rotated on a cylinder which transfers the image directly to the substrate. A versatile printing technology, flexography offers a unique blend of high quality graphics on a wide variety of substrates and supports flexible production requirements. In this process, the presses are web-fed or roll-fed, whereby a large roll of paper or paperboard is fed through the press. |

10

|

· |

Digital printing—Digital printing is ideal for short production runs and on-demand printing. Product concepts and design alternatives can be produced quickly on virtually any substrate. This value-added solution helps customers reduce inventory levels and practically eliminate inventory obsolescence. |

We have also invested in finishing capabilities that utilize a variety of new technologies and equipment, including cutters, folders, gluers and other specialized equipment that we use to create the final product. Our footprint provides redundant and flexible capabilities that enable us to optimize facility loading to most effectively and efficiently service our customers’ needs.

We believe we also have significant available capacity for continued growth by means of our considerable investments in plant infrastructure and information technology systems. Moreover, our core information technology systems are being progressively updated to provide increased functionality and control.

Further contributing to our success is our creative design and product development expertise. Our products are manufactured with various features and finishes, including lamination, stamping, embossing and foil stamping. In addition, we are able to use our extensive decorative technology capabilities to create iridescent, holographic, textured and dimensional effects to provide differentiated packaging to our customers.

While we have undergone a lot of changes, particularly around the perimeter of our business, we are only part of the way through our operational efficiency journey. Going forward, our key areas of operational focus include:

|

· |

Operational performance improvement—Significant savings could be realized if all sites can be brought up to the average group standard efficiency for key processes. Example areas of focus include machine performance improvements, material yield improvements and improved capacity utilization. For instance, we have yet to realize the full benefits of recent capital expenditures in new presses, which have reduced the number of presses required for the same output and led to lower raw material wastage and direct costs. |

|

· |

Additional plant optimization—Addressing underperforming plants with scope for further rationalization. Additionally, benefits from recently completed plant consolidations are still being realized. |

|

· |

Attractive capital projects—Achieving efficiencies from a number of recent capital expenditure projects. Additionally, there are numerous identified capital projects not yet implemented with attractive payback periods. |

|

· |

Procurement—The procurement function has evolved to a more centralized model globally but has largely focused on key, direct spend items and has yet to tackle its broader indirect purchase envelope which has historically been decentralized with a high number of suppliers to drive further savings. |

|

· |

Selling, general and administrative expenses improvement—There has been ongoing focus on reducing selling, general and administrative expenses, for example through further clustering of manufacturing sites, whereby facilities are integrated with common facility management teams as well as shared back office services, to drive cost efficiencies. |

Lean manufacturing

We established lean manufacturing principles and have subsequently implemented lean manufacturing across the entire Company, with eight full-time employees dedicated to the implementation of best practices across the Company through the use of lean manufacturing tools. This discipline includes utilizing value stream mapping to identify opportunities for process improvement. We have realized significant benefits from lean manufacturing initiatives including shorter make-ready times, improved production workflow, faster cycle times, expanded capacity and reduced waste. Lean manufacturing benefits are essential components of our ability to compete and deal with the impacts of employee salary increases and raw material price increases. We maintain one of the key principles of lean manufacturing, continuous operational improvement, at the center of our corporate philosophy. As a reflection of this, we have implemented lean manufacturing at all acquired companies and conduct weekly and monthly calls to share best practices across facilities. We rigorously evaluate our manufacturing footprint on an ongoing basis by measuring several key performance indicators, including

11

downtime, make-ready time and run speed, to identify underperforming facilities and ensure that measures are taken to bring them up to our company-wide manufacturing efficiency standards.

Our Suppliers and Raw Materials

Our largest raw material expenses are related to our major product substrates, including paperboard, paper, sheeted plastic and label stock. We also purchase inks, varnishes, coatings, adhesives and corrugated boxes that are used in the manufacturing process. We have a centralized purchasing function that allows us to leverage our growing scale to achieve competitive material pricing. Further, we have consistently used our scale to lower input costs at acquired businesses.

We utilize a diversified and global sourcing model with the ability to procure each key substrate from a variety of sources. We price non-contractual business based on prevailing raw material costs, which we believe mitigates the impact of rising input prices. All primary materials are available from multiple suppliers and we have not experienced any material disruptions in our ability to procure key inputs. We have been able to effectively manage raw material costs since our founding, including during periods of rapidly escalating commodity prices, either through contractual pass-through mechanisms or transactional business.

Seasonality

Net sales in our end markets are somewhat seasonal, with consumer and multi-media market net sales higher in the first and second quarter of the fiscal year due to the need to satisfy holiday-related packaging needs of our customers. Cash flow in our business is also seasonal, typically with investments in working capital in the first half of the fiscal year which then reverses and provides cash inflows in the second half of the fiscal year.

Research and Development

We employ 13 professionals in Europe and the United States to work on new technological developments and customer-focused solutions. The trademarked technologies employed by MPS were developed internally by MPS, and continue to be refined to provide more value-add to our customers. We also focus on the creation of compliance packaging for the healthcare industry, and we have successfully launched a number of products that are extensively used by our healthcare customers.

Intellectual Property and Licenses

Although our business is not dependent to any significant extent upon any single or related group of intellectual property, we have registered intellectual property in the United States and in a number of foreign jurisdictions. In addition, we have a book of copyrights. Further, we do not believe our licenses to third-party intellectual property are significant to our business other than licenses to commercially available third-party software.

Trademarks

We own or otherwise have rights to the trademarks, service marks, copyrights and trade names used in conjunction with the marketing and sale of our products and services. Our trademarks are protected under applicable intellectual property laws and are our property and the property of our subsidiaries. This Annual Report also contains trademarks, service marks, copyrights and trade names of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Solely for convenience, our trademarks, service marks, trade names and copyrights referred to may appear without the ®,™ or © symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights.

12

Our Employees

As of June 30, 2016, we employed approximately 8,700 people, of which approximately 3,200 are located in North America, 4,500 are located in Europe and 1,000 are located in Asia. The majority of our workforce is non-union; however, we participate in multiple collective bargaining agreements with various unions, which provide specified benefits to certain union employees. Approximately 8% of our employees in North America and approximately 75% of our employees in Europe are members of a union or works council or otherwise covered by labor agreements. The collective bargaining contract agreements with our North American unions are set to expire in 2017, at which time we expect to negotiate a renewal of the agreements.

Health, Safety and Environmental Matters and Governmental Regulation

Our business and facilities are subject to a wide range of federal, state, local and foreign general and industry-specific environmental, health and safety laws and regulations, including those relating to air emissions, wastewater discharges, management and disposal of regulated materials and site remediation. Certain of our operations require environmental permits or other approvals from governmental authorities, and certain of these permits and approvals are subject to expiration, denial, revocation or modification under various circumstances. We are also subject to frequent inspections and monitoring by government enforcement authorities. Compliance with these laws, regulations, permits and approvals is a significant factor in our business. We incur, from time to time, and may incur in the future, significant capital and operating expenditures to achieve and maintain compliance with applicable environmental laws, regulations, permits and approvals. Our failure to comply with applicable environmental laws and regulations or permit or approval requirements could result in substantial civil or criminal fines or penalties or enforcement actions, including regulatory or judicial orders enjoining or curtailing operations or requiring remedial or corrective measures, installation of pollution control equipment or other actions or costs, which could have a material adverse effect on our business, financial condition and operating results.

In addition, as an owner and operator of real estate, we may be responsible under environmental laws and regulations for the investigation, remediation and monitoring, as well as associated costs, expenses and third-party damages, including tort liability and natural resource damages, relating to past or present releases or threats of releases of regulated materials at, on, under or from our properties. Liability under these laws may be imposed without regard to whether we knew of or were responsible for, the presence of those materials on our property, may be joint and several, meaning that the entire liability may be imposed on each party without regard to contribution, and retroactive and may not be limited to the value of the property. In addition, we or others may discover new material environmental liabilities, including liabilities related to third-party owned properties that we or our predecessors formerly owned or operated, or at which we or our predecessors have disposed of, or arranged for the disposal of, certain materials.

We may be involved in administrative or judicial proceedings and inquiries in the future relating to such environmental matters, which could have a material adverse effect on our business, financial condition and operating results.

New environmental laws or regulations (or changes in existing laws or regulations or their enforcement) may be enacted that require significant expenditures by us. If the resulting expenses significantly exceed our expectations, our business, financial condition and operating results could be materially and adversely affected.

We are also subject to various federal, state, local, and foreign requirements concerning safety and health conditions at our manufacturing facilities. We may also be subject to material financial penalties or liabilities for non-compliance with those safety and health requirements, as well as potential business disruption, if any of our facilities or a portion of any facility is required to be temporarily closed as a result of any significant injury or any non-compliance with applicable requirements. Such financial penalties or liabilities or business disruptions could have a material adverse effect on our business, financial condition and operating results.

Our manufacturing facilities are run in compliance with the rules and requirements set forth by the U.S. Food and Drug Administration and the U.S. Occupational Safety and Health Administration. We believe that our manufacturing facilities are in compliance, in all material respects, with these laws and regulations.

We are committed to ensuring that safe operating practices are established, implemented and maintained throughout our organization. In addition, we have instituted active health and safety programs throughout our company.

13

Available Information

The following information can be found, free of charge, on our corporate website at http://www.multipkg.com:

|

· |

our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”); |

|

· |

our policies related to corporate governance, including our Code of Conduct and Business Ethics (“Code of Ethics”) applying to our directors, officers and employees (including our principal executive officer and principal financial and accounting officer) that we have adopted to meet applicable rules and regulations; |

|

· |

the charters of the Audit, Compensation and Nominating and Corporate Governance Committees of our Board of Directors. |

In addition, copies of the Company’s annual report will be made available, free of charge, upon written request.

We intend to satisfy the applicable disclosure requirements regarding amendments to, or waivers from, provisions of our Code of Ethics by posting such information on our website. The information contained on our website or accessible through our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this report.

Our business, operations and financial condition are subject to various risks and uncertainties. The most significant of these risks include those described below; however, there may be additional risks and uncertainties not presently known to us or that we currently consider immaterial. If any of the following risks and uncertainties develop into actual events, our business, financial condition or results of operations could be materially adversely affected. In such case, the trading price of our common shares could decline, and you may lose all or part of your investment. These risk factors should be read in conjunction with the other information in this Annual Report on Form 10-K and in the other documents that we file from time-to-time with the SEC.

We face competition in our markets, which may harm our financial performance and growth prospects.

We operate in a competitive market in which we face competition in each of our product lines from numerous competitors. We compete on the basis of product quality and reliability, breadth of product offering, manufacturing capability and flexibility, delivery times and range, technical capability, product innovation, customer service, price and completeness of order fulfillment. Certain of our competitors may have lower operating costs, greater operational flexibility, greater productive capacity, more financial flexibility and other resources that are greater than ours. We also face competition to a certain extent from companies that produce alternative products including plastic, board, paper, foil-based and other products that we do not currently offer. In addition, changes within the packaging industries, including the consolidation of our competitors, and consolidation of our customers, have occurred and may continue to occur. As a result of the foregoing factors, we may lose customers or be forced to reduce prices, which could have a material adverse effect on our business, financial condition and operating results. In addition, because of the level of fixed costs in our specialty print-based packaging business, our profitability is sensitive to changes in the balance between supply and demand in the specialty print-based packaging market. Competitors with lower operating costs than ours will have a competitive advantage over us with respect to products that are particularly price-sensitive. Increased production capacity within the industry could cause an oversupply resulting in lower prices, which could have a material adverse effect on our business, financial condition and operating results.

14

Our business performance may be impacted by general economic conditions, including downturns in the geographies and target markets that we serve.

The growth of our business and demand for our products is affected by changes in the health of the overall global economy and regional economies. Demand for our products is principally driven by consumer consumption of the products sold in the packages or with the inserts and labels we produce, which is affected by general economic conditions and changes in consumer preferences. Our primary end markets are consumer products, such as personal care, spirits, cosmetics and confectionary products, healthcare products, such as pharmaceuticals, medical devices, nutritional supplements and vitamins, and multi-media products, such as home videos, video games and software. Downturns or periods of economic weakness in these markets could result in decreased demand for our products. In general, our business may be adversely affected by decreases in the overall level of global economic activity, such as decreases in business and consumer spending. In particular, our business could be adversely affected by any economic downturn that results in difficulties for any of our major customers.

We may encounter difficulties in restructuring operations, closing facilities and disposing of assets and facilities.

We have closed facilities, sold assets and otherwise restructured operations in an effort to improve our cost competitiveness and profitability. Some of these activities are ongoing, and there is no guarantee that any such activities will not divert the attention of management or disrupt our operations or achieve the intended cost and operations improvements. These activities, and any future activities we may undertake, could have a material adverse effect on our business, financial condition and operating results.

If we are unable to successfully integrate our acquisitions and identify and integrate future acquisitions, our results of operations could be adversely affected.

We have completed a number of acquisitions, including the transformative combination with Chesapeake. We continue to integrate acquisitions into our business, but may not be able to do so successfully. Furthermore, we may seek to identify and complete additional acquisitions that meet our strategic and financial return criteria. However, there can be no assurance that we will be able to locate suitable targets or acquire them on acceptable terms or, because of limitations imposed by the agreements governing our indebtedness, that we will be able to finance future acquisitions. Acquisitions involve a number of risks, including risks related to:

|

· |

the diversion of management’s attention and resources to the assimilation of the acquired companies and their employees and to the management of expanding operations; |

|

· |

increased costs of integration activities; |

|

· |

disruption of our existing business operations; |

|

· |

the incorporation of acquired products into our current offerings; |

|

· |

problems associated with maintaining relationships with employees and customers of acquired businesses as a result of changes in ownership and management; |

|

· |

the increasing demands on our operational systems resulting from integration of the systems of acquired businesses; |

|

· |

the ability to integrate and implement effective disclosure controls and procedures and internal controls over financial reporting within the allowable timeframe; |

|

· |

possible adverse effects on our reported operating results, particularly during the first several reporting periods after such acquisitions are completed; and |

|

· |

the difficulty of converting acquired companies to our corporate culture and brands. |

We may become responsible for unanticipated liabilities and contingencies that we failed or were unable to discover in the course of performing due diligence in connection with historical acquisitions or any future acquisitions. We have typically required sellers to indemnify us against certain undisclosed liabilities. However, we cannot assure you that indemnification rights we have obtained, or will in the future obtain, will be enforceable, collectible or sufficient in amount, scope or duration to fully offset the possible liabilities associated with the business or property acquired. Any of these liabilities, individually or in the aggregate, could have a material adverse effect on our business, financial condition and results of operations.

15

In addition, we may not be able to successfully integrate future acquisitions without substantial costs, delays or other problems. The costs of such integration could have a material adverse effect on our operating results and financial condition. Although we conduct what we believe to be a prudent level of investigation regarding the businesses we purchase, in light of the circumstances of each transaction, an unavoidable level of risk remains regarding the actual condition of these businesses. Until we actually assume operating control of such businesses and their assets and operations, we may not be able to ascertain the actual value or understand the potential liabilities of the acquired entities and their operations.

We may not realize the growth opportunities and cost savings and synergies that are anticipated from our acquisitions and the other initiatives that we undertake.

The benefits that we expect to achieve as a result of our acquisitions will depend in part on our ability to realize anticipated growth opportunities and cost savings and synergies. Our success in realizing these opportunities and synergies and the timing of this realization depend on the successful integration of the acquired businesses and operations with our business and operations and the adoption of best practices. Even if we are able to integrate these businesses and operations successfully, this integration may not result in the realization of the full benefits of the growth opportunities and synergies we currently expect from this integration within the anticipated timeframe or at all. Accordingly, the benefits from these acquisitions may be offset by unanticipated costs or delays in integrating the companies.

Furthermore, we may not realize all of the cost savings and synergies we expect to achieve from our current strategic initiatives due to a variety of risks, including, but not limited to, difficulties in integrating shared services within our business, higher than expected employee severance or retention costs, higher than expected overhead expenses, delays in the anticipated timing of activities related to our cost savings plans and other unexpected costs associated with operating our business. If we are unable to achieve the cost savings or synergies that we expect to achieve from our strategic initiatives, or if the implementation of these initiatives adversely affect our operations or cost more or take longer to effectuate than we expect, it could adversely affect our business, financial condition and results of operations.

If we cannot effectively anticipate technology trends and develop and market new products to respond to changing customer preferences and regulatory environment, our revenue, earnings and cash flow could be adversely affected.

We are a specialty packaging company serving the consumer, healthcare and multi-media markets. Our success in these markets depends on our ability to offer differentiated solutions to capture market share and grow scale. To enable this, we must continually develop and introduce new products and services in a timely manner to keep pace with technological and regulatory developments and achieve customer acceptance. In addition, the services and products that we provide to customers may not meet the needs of our customers as the business models of our customers evolve. Our customers may decide to decrease their product packaging or forego the packaging of certain products entirely. Regulatory developments can also significantly alter the market for our solutions. For example, a move to electronic distribution of disclaimers and other paperless regimes could negatively impact our healthcare inserts and labels businesses. In addition, it is difficult to successfully predict the products and services our customers will demand. The success of our business depends in part on our ability to identify and respond promptly to changes in customer preferences, expectations and needs. If we do not timely assess and respond to changing customer expectations, preferences and needs, our financial condition, results of operations or cash flows could be adversely affected.

The impact of electronic media and similar technological changes, including the substitution of physical products for digital content, may continue to adversely affect sales in the multi-media end market.

The multi-media landscape is experiencing rapid change due to the impact of electronic media and digital content delivery on the demand for physical products. Improvements in the accessibility and quality of digital media through the online distribution and hosting of media content, pay-per-view and on-demand entertainment services and mobile technologies has resulted, and will likely continue to result, in increased digital substitution by consumers. Ongoing consumer acceptance of such digital media will result in a decrease in demand for physical music, video game and home video units. This will likely in turn decrease the demand for certain of our multi-media packaging solutions and consequently result in reduced pricing for our products, which could adversely affect our business, financial condition and results of operations. For example, our multi-media sales in North America would have declined in each of the two most recent fiscal years if not for the increased sales that resulted from the ASG acquisition.

16

We are affected by seasonality.

Historically, our business experiences some seasonal fluctuations, with a greater portion of our consumer and multi-media sales occurring in the first and second fiscal quarters, reflecting increased demand for our customers’ products during the holiday selling seasons. As a result of this seasonality, any factors negatively affecting us during these periods of any year, including unfavorable economic conditions, could have a material adverse effect on our financial condition and results of operations for the entire year.

Our operations could expose us to significant regulations and compliance expenditures as a result of environmental, health and safety laws.

Our business and facilities are subject to a wide range of federal, state, local and foreign general and industry-specific environmental, health and safety laws and regulations, including those relating to air emissions, wastewater discharges, management and disposal of regulated materials and site remediation. Certain of our operations require environmental permits or other approvals from governmental authorities, and certain of these permits and approvals are subject to expiration, denial, revocation or modification under various circumstances. We are also subject to frequent inspections and monitoring by government enforcement authorities. Compliance with these laws, regulations, permits and approvals is a significant factor in our business. From time to time we incur, and may in the future incur, significant capital and operating expenditures to achieve and maintain compliance with applicable environmental laws, regulations, permits and approvals. Our failure to comply with applicable environmental laws and regulations or permit or approval requirements could result in substantial civil or criminal fines or penalties or enforcement actions, including regulatory or judicial orders enjoining or curtailing operations or requiring remedial or corrective measures, installation of pollution control equipment or other actions or costs, which could have a material adverse effect on our business, financial condition and operating results.

In addition, as an owner and operator of real estate, we may be responsible under environmental laws and regulations for the investigation, remediation and monitoring, as well as associated costs, expenses and third-party damages, including tort liability and natural resource damages, relating to past or present releases or threats of releases of regulated materials at, on, under or from our properties. Liability under these laws may be imposed without regard to whether we knew of or were responsible for the presence of those materials on our property; may be joint and several, meaning that the entire liability may be imposed on each party without regard to contribution; and may be retroactive and may not be limited to the value of the property. In addition, we or others may discover new material environmental liabilities, including liabilities related to third-party owned properties that we or our predecessors formerly owned or operated, or at which we or our predecessors have disposed of, or arranged for the disposal of, certain regulated materials. We may be involved in administrative or judicial proceedings and inquiries in the future relating to such environmental matters, which could have a material adverse effect on our business, financial condition and operating results.

New environmental laws or regulations (or changes in existing laws or regulations or their enforcement) may be enacted that require significant expenditures by us. If the resulting expenses significantly exceed our expectations, our business, financial condition and operating results could be materially and adversely affected.

We are also subject to various federal, state, local and foreign requirements concerning safety and health conditions at our manufacturing facilities. The operation of manufacturing facilities involves many risks, including the failure or substandard performance of equipment, suspension of operations and new governmental statutes, regulations, guidelines and policies. Our and our customers’ operations are also subject to various hazards incidental to the production, use, handling, processing, storage and transportation of certain hazardous materials. These hazards can cause personal injury, severe damage to and destruction of property and equipment and environmental damage. Furthermore, we may become subject to claims with respect to workplace exposure, workers’ compensation and other matters. We may be subject to material financial penalties or liabilities for noncompliance with safety and health requirements, as well as potential business disruption, if any of our facilities or a portion of any facility is required to be temporarily closed as a result of any significant injury or any noncompliance with applicable requirements.

The occurrence of material operational problems, including, but not limited to, the above events, could have a material adverse effect on our business, financial condition and results of operations.

17

A significant part of our business is conducted outside of the United States, exposing us to additional risks that may not exist in the United States, which in turn could cause our business and operating results to suffer.

We have material operations outside of the United States. For fiscal 2016, approximately 58% of our total net sales were generated from sales outside of the United States. Our international operations are subject to risks, including risks related to:

|

· |

foreign currency exchange rate fluctuations, including devaluations; |

|

· |

local political or economic instability, including local inflationary pressures; |

|

· |

restrictive government regulation, including changes in governmental regulation; |

|

· |

changes in import/export duties; |

|

· |

changes in laws and policies, including the laws and policies of the United States, affecting trade and foreign investment; |

|

· |

lack of experience in certain foreign markets; |

|

· |