Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Buscar Co | cgld_ex321.htm |

| EX-31.1 - CERTIFICATION - Buscar Co | cgld_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACTOF 1934 |

For the quarterly period ended June 30, 2016

¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to ____________

Commission File Number: 000-55659

BUSCAR COMPANY |

(Exact Name of Registrant as Specified in its Charter) |

Nevada | 68-0681435 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

4325 Glencoe Ave Ste C9-9903

Marina Del Rey, CA 90292

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number including area code: (661) 418-7842

N/A |

Former name, former address, and former fiscal year, if changed since last report |

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Larger accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of August 19, 2016, there were 15,521,321 shares of the issuer's common stock, $0.00001 par value per share, outstanding.

BUSCAR COMPANY

FORM 10-Q

FOR THE PERIOD ENDED JUNE 30, 2016

PAGE | |||

| 3 | |||

Management's Discussion and Analysis of Financial Condition and Results of Operations. | 10 | ||

| 15 | |||

| 15 | |||

| 16 | |||

| 16 | |||

Unregistered Sales of Equity Securities and Use of Proceeds. | 16 | ||

| 16 | |||

| 16 | |||

| 16 | |||

| 16 | |||

| 17 | |||

| 2 |

PART I – FINANCIAL INFORMATION

ITEM 1. CONDENSED FINANCIAL STATEMENTS.

BUSCAR COMPANY.

Condensed Consolidated Balance Sheets

|

| June 30, |

|

| March, 31 |

| ||

|

| 2016 |

|

| 2016 |

| ||

|

| (unaudited) |

|

|

|

| ||

ASSETS | ||||||||

|

|

|

|

|

|

| ||

CURRENT ASSETS |

|

|

|

|

|

| ||

Cash |

| $ | 1,874 |

|

| $ | - |

|

Total Current Assets |

|

| 1,874 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

Thoroughbreds, net |

|

| 54,508 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

| $ | 56,382 |

|

| $ | - |

|

|

|

|

|

|

|

|

|

|

LIABILITIES & STOCKHOLDERS' DEFICIT | ||||||||

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Due to related parties |

| $ | 70,669 |

|

| $ | 40,171 |

|

Accrued liabilities |

|

| 485 |

|

|

| 5,485 |

|

Contingent liabilities |

|

| 177,270 |

|

|

| 177,270 |

|

Total Current Liabilities |

|

| 248,424 |

|

|

| 222,926 |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

| $ | 248,424 |

|

| $ | 222,926 |

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' DEFICIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, par value $0.00001; authorized 50,000,000 shares authorized; |

|

|

|

|

|

|

|

|

Series A preferred stock, $0.00001 par value, 10,000,000 shares designated; 8,000,000 shares issued and outstanding at June 30, 2016 and March 31, 2016, respectively |

|

| 80 |

|

|

| 80 |

|

Series B preferred stock, $0.00001 par value, 10,000,000 shares designated; 10,000,000 and 0 shares issued and outstanding at June 30, 2016 and March 31, 2016, respectively |

|

| 100 |

|

|

| - |

|

Common stock, $0.00001 par value, 500,000,000 shares authorized; 381,321 and 372,375 shares issued and outstanding at June 30, 2016 and March 31, 2016, respectively |

|

| 4 |

|

|

| 4 |

|

Additional paid-in capital |

|

| 15,608,281 |

|

|

| 15,038,381 |

|

Accumulated deficit |

|

| (15,800,507 | ) |

|

| (15,261,391 | ) |

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS' DEFICIT |

| $ | (192,042 | ) |

| $ | (222,926 | ) |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT |

| $ | 56,382 |

|

| $ | - |

|

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

| 3 |

BUSCAR COMPANY.

Condensed Consolidated Statements of Operations

(unaudited)

|

| Three Months Ended June 30, |

| |||||

|

| 2016 |

|

| 2015 |

| ||

Costs and expenses: |

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

Management and consulting fees |

| $ | 525,000 |

|

| $ | 126,746 |

|

General and administrative |

|

| 14,116 |

|

|

| 30,656 |

|

Total expenses |

|

| 539,116 |

|

|

| 157,402 |

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

| (539,116 | ) |

|

| (157,402 | ) |

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

| (539,116 | ) |

|

| (157,402 | ) |

Provision for income taxes |

|

| - |

|

|

| - |

|

Net loss |

| $ | (539,116 | ) |

| $ | (157,402 | ) |

|

|

|

|

|

|

|

|

|

Net loss per common share: Basic and diluted |

| $ | (1.43 | ) |

| $ | (2.54 | ) |

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: Basic and diluted |

|

| 377,245 |

|

|

| 61,944 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

| 4 |

BUSCAR COMPANY.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

| Three Months Ended June 30, |

| |||||

|

| 2016 |

|

| 2015 |

| ||

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

| ||

Net loss |

| $ | (539,116 | ) |

| $ | (157,402 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

Stock based compensation |

|

| 525,000 |

|

|

| 132,000 |

|

Depreciation |

|

| 1,750 |

|

|

| - |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accrued liability |

|

| (5,000 | ) |

|

| 30,656 |

|

Due to related parties |

|

| - |

|

|

| (5,254 | ) |

Net Cash Used in Operating Activities |

|

| (17,366 | ) |

|

| - |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

Purchase of thoroughbreds |

|

| (56,258 | ) |

|

| - |

|

Net cash used in Investing Activities |

|

| (56,258 | ) |

|

| - |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

Common stock issued |

|

| 45,000 |

|

|

| - |

|

Loan from related party, net |

|

| 124,178 |

|

|

| - |

|

Repayments of loans from related party |

|

| (93,680 | ) |

|

|

|

|

Net cash provided by Financing Activities |

|

| 75,498 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

Net cash increase for period |

|

| 1,874 |

|

|

| - |

|

Cash at beginning of period |

|

| - |

|

|

| - |

|

Cash at end of period |

| $ | 1,874 |

|

| $ | - |

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

Cash paid for income taxes |

| $ | - |

|

| $ | - |

|

Cash paid for interest |

| $ | - |

|

| $ | - |

|

|

|

|

|

|

|

|

|

|

NON CASH INVESTING AND FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

Series B Preferred shares issued to CEO |

| $ | 100 |

|

| $ | - |

|

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

| 5 |

Buscar Company

Notes to Unaudited Condensed Consolidated Financial Statements

Note 1 – Business

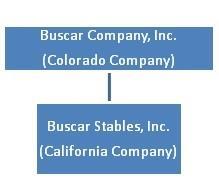

Buscar Company. ("Buscar", "we", "us", "our", the "Company") was incorporated in Nevada as Cascade Springs Ltd. on January 19, 2010. In 2012, we amended our Articles of Incorporation to change our name to Colorado Gold Mines, Inc. On June 18, 2014, changed our name to Buscar Oil, Inc. On May 19, 2015, the Company changed it's name to Buscar Company. On April 22, 2016, Buscar incorporated a wholly-owned California subsidiary, Buscar Stables, Inc. ("Buscar Stables"). Buscar is domiciled in the state of Colorado, and its corporate headquarters are located in Los Angeles, CA. The Company selected March 31 as its fiscal year end.

The Company's primary business is the breeding and selling of thoroughbreds, through its wholly owned subsidiary Buscar Stables. The Company will breed in California. The Company expects that it will need to raise $5,500,000 to fully execute its breeding program. The breeding program consists of the Company acquiring broodmares and paying stud fees to farms who own the studs. The breeding season typically runs from February through May. Under the rules of racing, every foal (a baby thoroughbred) is given a birthday of January 1 of the year of its birth regardless of its actual date of birth. The Company will generate revenue from its breeding operations through the sale of the foals and purse winnings from the foals the Company keeps. While the Company is building its breeding operations, the Company will own and manage thoroughbreds that will race in allowance or stakes races. This will allow the Company to begin to develop relationships with other owners and trainers for the benefit of its breeding operations.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation of Interim FinancialStatements

The accompanying interim unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and in accordance with the instructions to Form 10-Q and Article 8 of Regulation S-X. In our opinion, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results for the three months ended June 30, 2016 are not necessarily indicative of the results that may be expected for the year ending March 31, 2017. Notes to the interim unaudited condensed consolidated financial statements that would substantially duplicate the disclosures contained in the audited consolidated financial statements for fiscal year ended March 31, 2016 have been omitted. This report should be read in conjunction with the audited consolidated financial statements and the footnotes thereto for the fiscal year ended March 31, 2016 included in the Company's Form 10-K as filed with the Securities and Exchange Commission on July 15, 2016.

Consolidation Policy

For June 30, 2016, the unaudited condensed consolidated financial statements of the Company include the accounts of the Company and its wholly owned subsidiary, Buscar Stables, Inc. All significant intercompany balances and transactions have been eliminated in consolidation.

Thoroughbreds

The Company depreciates thoroughbreds via straight-line depreciation over its useful life of 3 years.

The thoroughbreds are stated at the lower of cost or market value. The cost was deemed to be the best evidence of market value and the company's thoroughbreds were therefore stated at cost. Costs of maintaining horses prior to maturity and entered into a race or disposition are capitalized as an additional costs of the horse. When a horse is sold or otherwise disposed of, the cost and associated accumulated depreciation are removed from the accounts and the resulting gain or loss is recognized in the statement of operations.

| 6 |

The company evaluates the recoverability of its Long Term Assets in accordance with ASC topic 360, which requires recognition of impairments of long lived assets in the event an indication of impairment exists and the net book value of such assets exceeds the expected future value net cash flows attainable to such assets. The Company did not recognize any impairment losses for any periods presented.

|

| June 30, 2016 |

|

| March 31, 2016 |

| ||

Thoroughbreds |

| $ | 56,258 |

|

| $ | - |

|

Accumulated depreciation |

|

| (1,750 | ) |

|

| - |

|

Thoroughbreds - net |

|

| 54,508 |

|

|

| - |

|

Thoroughbred Revenue Recognition

The company pursues opportunities to realize revenues from a principal activity: breeding the thoroughbreds. It is the company's policy that revenues and gains will be recognized in accordance with ASC Topic 605-10-25, "Revenue Recognition." Under ASC Topic 605-10-25, revenue earning activities such as selling the horses and the company has substantially accomplished all it must do to be entitled to the benefits represented by the revenue. Gains or losses from the sale of the horses are recognized when the horse is sold, and the cost and associated accumulated depreciation are removed from the accounts and the resulting gain or loss is recognized in the statement of operations.

Recent Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Note 3 – Going Concern

These unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which assumes that the Company will be able to meet its obligations and continue its operations for its next fiscal year. Realization values may be substantially different from carrying values as shown and these unaudited condensed consolidated financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Company be unable to continue as a going concern. At June 30, 2016, the Company had not yet achieved profitable operations, has accumulated losses of $15,800,507 since its inception, has a working capital deficiency of $246,550 and expects to incur further losses in the development of its business, all of which raise substantial doubt about the Company's ability to continue as a going concern. The Company's ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has no formal plan in place to address this concern but considers that the Company will be able to obtain additional funds by equity financing and/or related party advances, however there is no assurance of additional funding being available or on terms acceptable to the Company.

| 7 |

Note 4 – Due to Related Parties

During the three months ended June 30, 2016, the Company borrowed a total amount of $124,178 from WB Partners, LLC, which is owned by a shareholder of the Company and repaid $86,180 for payments of operating expenses and purchase of thoroughbreds. As of June 30, 2016, the Company recorded due to WB Partners, LLC of $64,798.

During the three months ended June 30, 2016, the Company repaid $7,500 to a shareholder, who is also a former officer of the Company. As of June 30, 2016, the Company recorded due to shareholder of $5,871 for payments of operating expense on behalf of the Company.

As of June 30, 2016 and March 31, 2016, the Company owed due to related parties $70,669 and $40,171, respectively.

Note 5 – Commitments and Contingencies

As of June 30, 2016, the Company had a total of $248,424 of outstanding liabilities. As of this date, the Company recognized $177,270 of outstanding liabilities related to previous Company directors, Robert Sawatsky and Kelly Fielder. The Company's legal counsel believes that the outstanding liabilities are expected to be paid back to the previous Company directors, Robert Sawatsky and Kelly Fielder, who had originally loaned money to the Company. However, there has been no resolution of this event.

Note 6 – Equity

Preferred Stock

The Company has authorized 50,000,000 preferred shares with a par value of $0.00001 per share. Board of Directors are authorized to divide the authorized shares of Preferred Stock into one or more series, each of which shall be so designated as to distinguish the shares thereof from the shares of all other series and classes.

Series A Preferred Stock

The Company has designated 10,000,000 preferred shares of Series A Preferred Stock with a par value of $0.00001 per share. As at June 30, 2016 and March 31, 2016, the Company had 8,000,000 shares of Series A Preferred Stock issued and outstanding.

Series B Preferred Stock

The Company has designated 10,000,000 preferred shares of Series B Preferred Stock with a par value of $0.00001 per share.

During the three months ended June 30, 2016, 10,000,000 shares of Series B Preferred Stock were issued to our CEO for the par value as there is no stated value.

| 8 |

As at June 30, 2016 and March 31, 2016, the Company had 10,000,000 and 0 shares of Series B Preferred Stock issued and outstanding, respectively.

Common Stock

The Company has authorized 500,000,000 shares of common stock with a par value of $0.00001 per share.

During the three months ended June 30, 2016, the Company issued common shares, as follows:

· | 7,500 shares for services, with a fair value of $525,000 as compensation |

|

|

· | 643 shares were sold for cash for a consideration of $45,000 |

|

|

· | 803 shares for rounding up adjustment of reverse split. |

As of June 30, 2016 and March 31, 2016, the Company had 381,321 and 372,375 shares of common stock issued and outstanding, respectively.

Note 7 – Subsequent events

Subsequent to June 30, 2016, the Company issued 1,140,000 shares of common stock for services.

Subsequent to June 30, 2016, an aggregate of 14,000,000 common shares were issued for the conversion of 35,000 shares of Series B Preferred Stock, owned by our CEO.

| 9 |

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The discussion and analysis of our financial condition and results of operations are based on our financial statements, which we have prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported revenues and expenses during the reporting periods. On an ongoing basis, we evaluate estimates and judgments, including those described in greater detail below. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

As used in this "Management's Discussion and Analysis of Financial Condition and Results of Operation," except where the context otherwise requires, the term "we," "us," or "our," refers to the business of Buscar Company.

Critical Accounting Policies and Estimates

Our significant accounting policies are described in the notes to our accompanying financial statements.

Pursuant to the JOBS Act of 2012, as an emerging growth company, we can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC.

We have elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the standard for the private company. This may make comparison of our financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

Although we are still evaluating the JOBS Act, it currently intends to take advantage of some or all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an "emerging growth company". We have elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b) of the JOBS Act. Among other things, this means that our independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of our internal control over financial reporting so long as it qualifies as an emerging growth company, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an emerging growth company, we may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers that would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate us. As a result, investor confidence in us and the market price of our common stock may be adversely affected.

Use of Estimates

Financial statements prepared in accordance with U.S. GAAP require management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Among other things, management makes estimates relating to the fair value of financial instruments and the valuation allowance related to deferred income tax assets. Actual results could differ from those estimates.

| 10 |

Stock-Based Compensation

We periodically issue stock options and warrants to employees and non-employees in non-capital raising transactions for services and for financing costs. We account for stock option and warrant grants issued and vesting to employees based on Financial Accounting Standards Board (FASB) ASC Topic 718, "Compensation - Stock Compensation", whereas the award is measured at its fair value at the date of grant and is amortized ratably over the service period. We account for stock option and warrant grants issued and vesting to non-employees in accordance with ASC Topic 505, "Equity", whereas the value of the stock compensation is based upon the measurement date as determined at either (a) the date at which a performance commitment is reached, or (b) at the date at which the necessary performance to earn the equity instruments is complete.

Results of Operations and Financial Condition for the three-months ended June 30, 2016 and 2015

|

| Three Months Ended June 30, |

|

|

|

|

|

| ||||||||

|

| 2016 |

|

| 2015 |

|

| Change |

|

| % |

| ||||

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Management and consulting fees |

| $ | 525,000 |

|

| $ | 126,746 |

|

| $ | 398,254 |

|

|

| 314 | % |

General and administrative |

|

| 14,116 |

|

|

| 30,656 |

|

|

| (16,540 | ) |

| (54%) |

| |

Total expenses |

|

| 539,116 |

|

|

| 157,402 |

|

|

| 381,714 |

|

|

| 243 | % |

|

|

|

|

|

|

|

|

|

|

| - |

|

|

| - |

|

Loss from operations |

|

| (539,116 | ) |

|

| (157,402 | ) |

|

| (381,714 | ) |

|

| 243 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

| (539,116 | ) |

|

| (157,402 | ) |

|

| (381,714 | ) |

|

| 243 | % |

Provision for income taxes |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

Net loss |

| $ | (539,116 | ) |

| $ | (157,402 | ) |

| $ | (381,714 | ) |

|

| 243 | % |

We have not generated any revenues as of June 30, 2016.

Operating expense increase to $539,116 from $157,402 for the periods ended June 30, 2016 and 2015, respectively. The increase in operating expenses is primarily due to the increase in management and consulting fees that resulted from stock issuances.

There is no assurance that we will ever be profitable. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result should we be unable to continue as a going concern.

| 11 |

Liquidity and Capital Resources

|

| June 30, |

|

| March 31, |

|

|

|

|

|

| |||||

|

| 2016 |

|

| 2016 |

|

| Change |

|

| % |

| ||||

Cash |

| $ | 1,874 |

|

| $ | - |

|

| $ | 1,874 |

|

|

| - |

|

Total Assets |

| $ | 56,382 |

|

| $ | - |

|

| $ | 56,382 |

|

|

| - |

|

Total Liabilities |

| $ | 248,424 |

|

| $ | 222,926 |

|

| $ | 25,498 |

|

|

| 11 | % |

Stockholders' Deficit |

| $ | (192,042 | ) |

| $ | (222,926 | ) |

| $ | 30,884 |

|

| (14 | )% | |

|

| Three Months Ended June 30, |

|

|

| |||||||

|

| 2016 |

|

| 2015 |

|

| Change |

| |||

Cash Flows used in Operating Activities |

| $ | (17,366 | ) |

| $ | - |

|

| $ | (17,366 | ) |

Cash Flows used in Investing Activities |

|

| (56,258 | ) |

|

| - |

|

|

| (56,258 | ) |

Cash Flows from Financing Activities |

|

| 75,498 |

|

|

| - |

|

|

| 75,498 |

|

Net Decrease in Cash During the Year |

| $ | 1,874 |

|

| $ | - |

|

| $ | 1,874 |

|

As of June 30, 2016 and 2015, we had cash of $1,874 and $0, respectively. Our cash position is insufficient and as such we plan to raise additional debt and equity financing to meet our obligations as they become due.

During the three months ended June 30, 2016, cash used in operating activities was $17,366. This was primarily the result of our net loss of $539,116 and a decrease in accrued liability of $5,000, offset by stock based compensation of $525,000 and depreciation of $1,750. During the three months ended June 30, 2015, cash used in operating activities was $0. This was primarily the result of our net loss of $157,402 and a decrease in due to related party of $5,254, offset by an increase in accrued liability of $30,656 and share based compensation of $132,000.

During the three months ended June 30, 2016, cash used in investing activities was $56,258. The Company purchased minority interest in two horses and a majority interest in a third horse, for a total of $56,258. During the three months ended June 30, 2015, cash used in investing activities was $0.

During the three months ended June 30, 2016, cash provided by financing activities amounted to $75,498. The Company received cash from issuance of common stock of $45,000 and loans from related party of $124,178 and repaid loans from related party of $93,680. During the three months ended June 30, 2015, cash provided by financing activities amounted to $0.

Off-Balance Sheet Arrangements

We did not have any off balance sheet arrangements as of June 30, 2016.

Timing needs for Funding

Immediate needs (current through December 2016)

$1,375,000: This capital is intended to be used to claim the 5-6 broodmares. The $1,375,000 is broken down as follows: $600,000 to acquire broodmares, $375,000 for stud fees, $141,000 for reserve for fees associated with the thoroughbreds acquired (i.e. training and vet) and $250,000 in working capital. The Company expects the monthly costs of the care of thoroughbreds to be approximately $5,000 per month. The Company's reserve of $141,000 for the thoroughbred's monthly costs.

| 12 |

The Company expects its on-going monthly expenses directly associated to the thoroughbreds in its breeding division to be approximately $10 to $17 per day for each broodmare.

The expenses directly associated to each thoroughbred acquired are $10-$17 per day depending on the trainer and the vet needs of each thoroughbred. The Company's current monthly burn rate is between $18,000 – 20,000 per month, which includes approximately $2,000 for training fees associated with the Company's thoroughbreds, $15,000 is general corporate expenses and approximately $2,000 associated with being a reporting company. The Company's monthly burn rate consists of the direct costs of the thoroughbreds the Company has acquired (such as training and vet fees) and the expected on-going general expenses of the Company (such as filing fees, audits and general administrative expenses).

The company has included the $141,000 reserve since the Company expects it will take approximately 12-24 months from the date a broodmare is acquired before revenue may be generated from sale of foal, depending if the foal is sold as a yearling or 2-year-old. The Company expects to begin generating revenue within 12 -24 months of the acquisition of the broodmare as such the on-going monthly burn rate should be covered by the revenue generated from the sale of foals. However, there is no guarantee that the Company's revenue would be able to cover the Company's monthly burn rate.

If the Company's revenue is not sufficient to cover the monthly burn rate, the Company would be required to raise additional funds to cover those expenses. The Company will not know the amount that would be required to be raised to cover the monthly burn rate until the Company is able to determine what its monthly revenue is.

If the Company's revenue is not sufficient to cover the monthly burn rate and the Company cannot raise additional funds to cover those expenses, then the Company would have to sell its broodmares. This may require the Company to sell its thoroughbreds for less than the Company purchased.

Short-term needs (January through December 2017)

$3,000,000: This capital is intended to be used to claim the 13-15 broodmares. The $3,000,000 is broken down as follows: $1,500,000 to acquire broodmares, $975,000 for stud fees, $275,000 for reserve for fees associated with the thoroughbreds acquires (i.e. training and vet) and $250,000 in working capital. The Company expects the monthly costs of the thoroughbreds to be approximately $5,000 per month. The Company's reserve of $275,000 for the monthly costs is intended for the expenses for the broodmares acquired.

The Company expects its on-going monthly expenses directly associated to the thoroughbreds in its breeding division to be approximately $10 to $17 per day for each broodmare.

The expenses directly associated to each thoroughbred acquired are $10-$17 per day depending on the trainer and the vet needs of each thoroughbred. The Company's current monthly burn rate is between $18,000 – 20,000 per month, which includes approximately $2,000 for training fees associated with the Company's thoroughbreds, $15,000 is general corporate expenses and approximately $2,000 associated with being a reporting company. The Company's monthly burn rate consists of the direct costs of the thoroughbreds the Company has acquired (such as training and vet fees) and the expected on-going general expenses of the Company (such as filing fees, audits and general administrative expenses).

The Company has included the $275,000 reserve since the Company expects it will take approximately 12-24 months from the date a broodmare is acquired before revenue may be generated from sale of foal, depending if the foal is sold as a yearling or 2-year-old. The Company expects to begin generating revenue within 12 -24 months of the acquisition of the broodmare as such the on-going monthly burn rate should be covered by the revenue generated from the sale of foals. However, there is no guarantee that the Company's revenue would be able to cover the Company's monthly burn rate.

If the Company's revenue is not sufficient to cover the monthly burn rate, the Company would be required to raise additional funds to cover those expenses. The Company will not know the amount that would be required to be raised to cover the monthly burn rate until the Company is able to determine what its monthly revenue is.

| 13 |

If the Company's revenue is not sufficient to cover the monthly burn rate and the Company cannot raise additional funds to cover those expenses, then the Company would have to sell its broodmares. This may require the Company to sell its thoroughbreds for less than the Company purchased.

Long-term needs (January through December 2018)

$5,500,000: This capital is intended to be used to claim the 30-40 broodmares. The $5,500,000 is broken down as follows: $2,700,000 to acquire broodmares, $2,000,000 for stud fees, $450,000 for reserve for fees associated with the thoroughbreds acquires (i.e. training and vet) and $250,000 in working capital. The Company expects the monthly costs of the thoroughbreds to be approximately $5,000 per month. The Company's reserve of $450,000 for the monthly costs is intended for the expenses for the broodmares acquired.

The Company expects its on-going monthly expenses directly associated to the thoroughbreds in its breeding division to be approximately $10 to $17 per day for each broodmare.

The expenses directly associated to each thoroughbred acquired are $10-$17 per day depending on the trainer and the vet needs of each thoroughbred. The Company's current monthly burn rate is between $18,000 – 20,000 per month, which includes approximately $2,000 for training fees associated with the Company's thoroughbreds, $15,000 is general corporate expenses and approximately $2,000 associated with being a reporting company. The Company's monthly burn rate consists of the direct costs of the thoroughbreds the Company has acquired (such as training and vet fees) and the expected on-going general expenses of the Company (such as filing fees, audits and general administrative expenses).

The Company has included the $450,000 reserve since the Company expects it will take approximately 12-24 months from the date a broodmare is acquired before revenue may be generated from sale of foal, depending if the foal is sold as a yearling or 2-year-old. The Company expects to begin generating revenue within 12 -24 months of the acquisition of the broodmare as such the on-going monthly burn rate should be covered by the revenue generated from the sale of foals. However, there is no guarantee that the Company's revenue would be able to cover the Company's monthly burn rate.

If the Company's revenue is not sufficient to cover the monthly burn rate, the Company would be required to raise additional funds to cover those expenses. The Company will not know the amount that would be required to be raised to cover the monthly burn rate until the Company is able to determine what its monthly revenue is.

If the Company's revenue is not sufficient to cover the monthly burn rate and the Company cannot raise additional funds to cover those expenses, then the Company would have to sell its broodmares. This may require the Company to sell its thoroughbreds for less than the Company purchased.

Dividend Policy

The Company has not paid dividends on its Common Stock in the past. The Company has decided to distribute at least 16% of its net purse winnings that the Company's thoroughbreds generate. However, our ability to pay dividends is subject to limitations imposed by Nevada law. Pursuant to Nevada Revised Statute 78.288, dividends may be paid to the extent that a corporation's assets exceed it liabilities and it is able to pay its debts as they become due in the usual course of business.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive exploration activities. For these reasons our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern.

| 14 |

Accounting and Audit Plan

In the next twelve months, we anticipate spending approximately $20,000 - $30,000 to pay for our accounting and audit requirements.

Off-balance sheet arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company, as a smaller reporting company, as defined by Rule 229.10(f)(1), is not required to provide the information required by this Item.

ITEM 4. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

An evaluation was carried out under the supervision and with the participation of our management, including our Principal Executive Officer and Principal Financial Officer, of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this report on Form 10-Q. Disclosure controls and procedures are procedures designed with the objective of ensuring that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934, such as this Form 10-Q, is recorded, processed, summarized and reported, within the time period specified in the Securities and Exchange Commission's rules and forms, and that such information is accumulated and is communicated to our management, including our Principal Executive Officer and Principal Financial Officer, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure. Based on that evaluation, our management concluded that, as of June 30, 2016, our disclosure controls and procedures were not effective.

Significant Deficiencies in Disclosure Controls And Procedures

The Company is a small organization with limited personnel. The Company was unable to implement an effective system of disclosure controls and procedures as of the evaluation date. Nevertheless, management believes that this Report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statement made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this Report.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting during the quarter ended June 30, 2016, that materially affected or are reasonably likely to materially affect our internal control over financial reporting.

| 15 |

None.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

The above statement notwithstanding, shareholders and prospective investors should be aware that certain risks exist with respect to the Company and its business, including those risk factors contained in our most recent Registration Statements on Form S-1 and Form 10, as amended. These risks include, among others: limited assets, lack of significant revenues and only losses since inception, industry risks, dependence on third party manufacturers/suppliers and the need for additional capital. The Company's management is aware of these risks and has established the minimum controls and procedures to insure adequate risk assessment and execution to reduce loss exposure.

ITEM 2. UNREGISTERED SALE OF EQUITY SECURITIES AND USE OF PROCEEDS

No unregistered securities where issued during the three months ending June 30, 2016.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

There was no other information during the quarter ended June 30, 2016 that was not previously disclosed in our filings during that period.

Exhibit No. | Description | |

Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | ||

Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| 16 |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this amended report to be signed on its behalf by the undersigned thereunto duly authorized.

BUSCAR COMPANY | |||

By: | /s/ Anastasia Shishova | ||

August 22, 2016 | Anastasia Shishova | ||

CEO | |||

17 |