Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BOSTON OMAHA Corp | boston8k08192016.htm |

Exhibit 99.1

BOSTON OMAHA CORPORATION

292 Newbury Street, Suite 333

Boston, MA 02115

To the Stockholders of Boston Omaha Corporation:

The 2016 Annual Meeting of Stockholders of Boston Omaha Corporation, a Delaware corporation (the "Company" or "we", "our" or "us"), will be held at 1415 – The Meeting Place, 1415 Harney Street, Omaha, Nebraska 68102 on September 30, 2016 beginning at 4:00 p.m. local time. The purpose of the meeting is to consider and act upon the following matters, as more fully described in the Proxy Statement accompanying this Notice:

|

1.

|

To elect four (4) directors of the Company to serve a term of one (1) year or until their successors are duly elected and qualified;

|

|

2.

|

To ratify the selection by our Board of Directors (the "Board") of the firm of MaloneBailey, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016;

|

|

3.

|

To conduct a non-binding advisory vote to approve the compensation of the named executive officers;

|

|

4.

5.

|

To conduct a non-binding advisory vote on the frequency of the advisory vote on the compensation of the named executive officers; and

To transact such other business as may properly come before the Annual Meeting or any adjournment or postponements of the Annual Meeting.

|

Only stockholders of record at the close of business on July 1, 2016 are entitled to notice of and to vote at the 2016 Annual Meeting of Stockholders of the Company, or the Annual Meeting, or any adjournment thereof. A list of such stockholders will be available for examination by any stockholder at the Annual Meeting, and at the office of the secretary of the Company, 292 Newbury Street, Suite 333, Boston, Massachusetts 02115, for a period of ten (10) days prior to the Annual Meeting. The Company's Board of Directors recommends that you vote "For" for each of the first three proposals and "Three Years" on the fourth proposal.

Whether or not you intend to attend the meeting in person, please ensure that your shares of the Company's common stock are present and voted at the meeting by submitting your instructions by telephone, the Internet, or in writing by completing, signing, dating and returning the enclosed proxy card to our transfer agent in the enclosed, self-addressed envelope, which requires no postage if mailed in the United States. Directions to the Annual Meeting are available by calling us at (857) 256-0079.

By Order of the Board of Directors,

Alex B. Rozek

Co-Chairman of the Board of Directors

Boston, Massachusetts

August 19, 2016

Boston Omaha Corporation

292 Newbury Street, Suite 333

Boston, Massachusetts 02115

Boston, Massachusetts 02115

PROXY STATEMENT FOR THE

2016 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Q: Who is soliciting my proxy?

A: The Board.

Q: Where and when is the Annual Meeting?

| A: | The Annual Meeting will be held at 1415 – The Meeting Place, 1415 Harney Street, Omaha, Nebraska 68102, on September 30, 2016 at 4:00 p.m. local time. |

Q: Who can vote at the Annual Meeting?

| A: | All stockholders of record at the close of business on July 1, 2016 (the "Record Date"), will be entitled to notice of and to vote at the Annual Meeting. If on that date your shares were registered directly in your name with our transfer agent, Colonial Stock Transfer Co, Inc., then you are a shareholder of record. As a shareholder of record, you may vote in person at the meeting or vote by proxy. If on that date your shares were held in an account at a brokerage firm, bank, dealer or similar organization, then you are the beneficial owner of shares held in "street name" and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent. As of the close of business on the Record Date, 5,841,417 of Common Stock and 1,055,560 shares of Class A common stock were outstanding. |

Q: What constitutes a quorum for the meeting?

| A: | A quorum is required for stockholders to conduct business at the Annual Meeting. The holders of capital stock representing a majority in voting power of the stock issued and outstanding and entitled to vote thereat, present in person or by remote communication, or represented by proxy, shall constitute a quorum. On the Record Date there were 6,896,977 shares of our capital stock outstanding, consisting of 5,841,417 of Common Stock and 1,055,560 shares of Class A common stock. Shares present, in person or by proxy, including shares as to which authority to vote on any proposal is withheld, shares abstaining as to any proposal, and broker non-votes (where a broker submits a properly executed proxy but does not have authority to vote a customer's shares) on any proposal will be considered present at the meeting for purposes of establishing a quorum for the transaction of business at the meeting. Each of these categories will be tabulated separately. |

Q: What am I voting on?

A: You are voting on the following proposals:

| 1. | To elect four (4) directors of the Company to serve a term of one (1) year or until their successors are duly elected and qualified; |

| 2. | To ratify the selection by the Board of the firm of MaloneBailey, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; |

| 3. | A non-binding vote to approve executive officer compensation; and |

| 4. | A non-binding vote to on the frequency of the advisory vote on the compensation of the named executive officers. |

Q: How many votes do I have?

| A: | Each share of our Common Stock is entitled to one vote on matters brought before the Annual Meeting. Each share of our Class A common stock is entitled to 10 votes on matters brought before the Annual Meeting. |

| Q: | How are votes counted? |

With respect to PROPOSAL 1 (Election of Directors), votes may be cast "FOR" or "WITHHOLD" authority to vote for each of the nominees for the Board. If you vote "WITHHOLD" authority to vote with respect to one or more director nominees, your vote will have no effect on the election of such nominees. Broker non-votes will have no effect on the election of nominees.

With respect to PROPOSAL 2 (Ratification of Auditors), you may vote "FOR," "AGAINST" or "ABSTAIN." If you "ABSTAIN" from voting with respect to this proposal, your vote will have the same effect as a vote "AGAINST" the proposal. Broker non-votes will have no effect on the vote for this proposal.

With respect to PROPOSAL 3 (Advisory Vote on Executive Compensation), you may vote "FOR", "AGAINST" or "ABSTAIN" the Company's proposal regarding compensation for named executive officers. If you abstain from voting on Proposal 3, your vote will have no effect on the outcome of the vote on the proposal. Broker non-votes will have no effect on the vote for Proposal 3.

With respect to PROPOSAL 4 (Advisory Vote on the Frequency of Advisory Votes on Executive Compensation), you may vote "ONE YEAR", "TWO YEARS" or "THREE YEARS" for the frequency of shareholder advisory votes on this proposal regarding the frequency of advisory votes on the compensation of named executive officers. If you abstain from voting on Proposal 4, your vote will have no effect on the outcome of the vote on the proposal. Broker non-votes will have no effect on the vote for Proposal 4.

Q: How many votes are required to approve each item?

With respect to PROPOSAL 1 (Election of Directors), Directors shall be elected by a plurality of the votes cast (meaning that the four director nominees who receive the highest number of shares voted "for" their election are elected). "Withhold" votes and broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on the election of nominees.

With respect to PROPOSAL 2 (Ratification of Auditors), ratification of the selection of auditors requires the affirmative vote of the holders of a majority of the outstanding shares of common stock and Class A common stock, voting together (meaning that of the outstanding shares of common stock, a majority of them must be voted "FOR" the proposal for it to be approved). Abstentions and broker non-votes will have the effect of a vote "AGAINST" this proposal.

With respect to PROPOSAL 3 (Advisory Vote on Executive Compensation), approval of the resolution requires the affirmative vote of the holders of a majority of the outstanding shares of common stock and Class A common stock, voting together must be voted "FOR" the proposal for it to be approved). Abstentions and broker non-votes will have the effect of a vote "AGAINST" this proposal.

With respect to Proposal 4 (Advisory Vote on the Frequency of Advisory Votes on Executive Compensation), the selection of one, two or three years shall be based on the proposal which receives the greatest number of votes. "Withhold" votes and broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on the selection of the frequency on which advisory votes shall be conducted on approving compensation of named executive officers.

Q: My shares are held in the "street name." Will my broker vote my shares?

| A: | If you hold your shares in "street name," your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. If you do not give your broker or nominee specific instructions on such a matter, your shares may not be voted. Shares of capital stock represented by "broker non-votes" will, however, be counted in determining whether there is a quorum. |

Q: How does the Board recommend that I vote on the proposals?

| A: | The Board recommends that you vote "FOR ALL NOMINEES" on Proposal 1, to elect four (4) directors of the Company to serve a term of one (1) year or until their successors are duly elected and qualified. |

The Board recommends that you vote "FOR" on Proposal 2, to ratify the selection by our Board of MaloneBailey, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.

The Board recommends that you vote "FOR" on Proposal 3, to provide an advisory vote approving compensation for named executive officers.

The Board recommends that you vote "THREE YEARS" on Proposal 4, to provide an advisory vote on the frequency of advisory votes approving compensation for named executive officers.

Q: What should I do now?

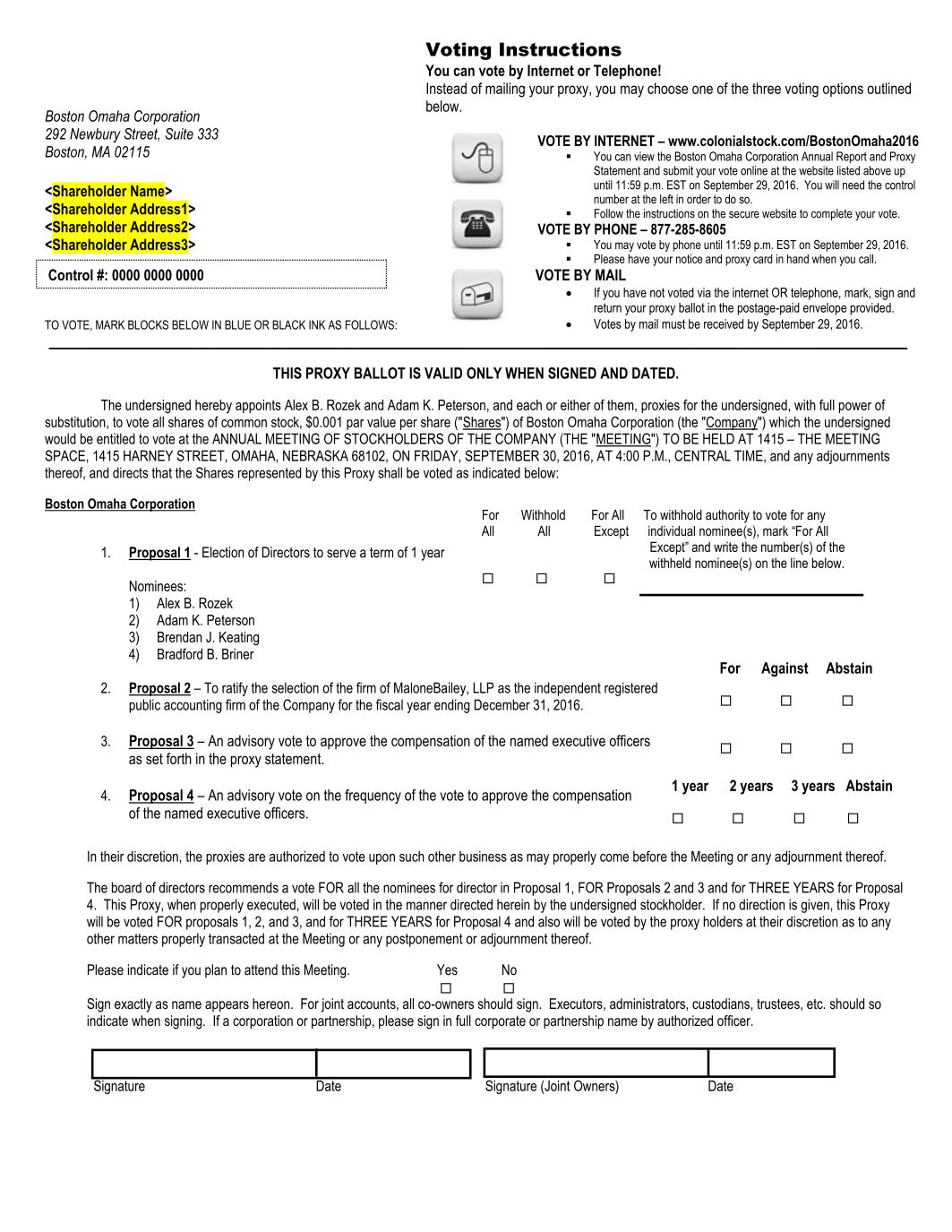

| A: | Carefully read this document and determine how you want to vote. Stockholders may deliver their proxies either electronically over the internet as outlined on the Proxy or by requesting, completing and submitting a properly signed paper proxy card. If you properly fill in your proxy card and send it to us in time to vote, your proxy (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not make specific choices, your proxy will vote your shares as recommended by the Board. |

Q: Can I change my vote after I have mailed my signed proxy card?

| A: | Yes. You can change your vote in one of three ways, at any time before your proxy is voted at the Annual Meeting, by (a) revoking your proxy by written notice to our Corporate Secretary stating that you would like to revoke your proxy, (b) completing and submitting a new proxy card bearing a later date, or (c) attending the Annual Meeting and voting in person. |

Q: Who will bear the cost of this solicitation?

| A: | The Company will pay for the cost of soliciting proxies and may reimburse brokerage firms and others for their expenses in forwarding solicitation material. Solicitation will be made primarily through the use of the mail but our directors and officers may, without additional compensation, solicit proxies personally by telephone, e-mail or fax. |

Q: Whom should I contact with questions?

| A: | If you have any questions or if you need additional copies of this Proxy Statement or the enclosed proxy card, or if you have other questions about the proposals or how to vote your shares, you may contact us at Boston Omaha Corporation, 292 Newbury Street, Suite 333, Boston, Massachusetts 02115, telephone number (857) 256-0079 or by email at contact@bostonomaha.com. |

GENERAL INFORMATION ABOUT THE MEETING

The close of business on July 1, 2016 has been fixed as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting. On that date, the Company's outstanding voting securities consisted of 6,896,977 shares of our capital stock outstanding, consisting of 5,841,417 of Common Stock and 1,055,560 shares of Class A common stock.

Magnolia Capital Fund, LP and Boulderado Partners, LLC, who together control a majority of all of the Company's Common Stock and Class A common stock, will cast each of their votes "FOR" (i) the election of each of the Board's four nominees to serve as directors of the Company until the 2017 Annual Meeting of Stockholders, or until their successors are elected and qualified, (ii) the ratification of the selection by the Board of the firm of MaloneBailey, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016, (iii) approval of a non-binding vote to approve executive officer compensation, and (iv) the approval of a non-binding vote once every three years at the annual meeting of stockholders of an advisory vote on the compensation of the named executive officers.

Holders of a majority of the Company's outstanding securities entitled to vote must be present, in person or by proxy, at the Annual Meeting in order to have the required quorum for the transaction of business. If the shares present, in person or by proxy, at the Annual Meeting do not constitute the required quorum, the Annual Meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum. If a broker, bank or other nominee holds your shares, you will receive instructions from them that you must follow in order to have your shares voted.

Shares that are voted "FOR," "AGAINST," "WITHHOLD AUTHORITY" or "ABSTAIN" will be treated as being present at the Annual Meeting for purposes of establishing a quorum. Accordingly, if you have returned a valid proxy or attend the Annual Meeting in person, your shares will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the Annual Meeting. Broker "non-votes" (i.e., votes from shares held of record by brokers as to which the beneficial owners have given no voting instructions) will also be counted as present for purposes of determining the presence of a quorum.

The Proxy Materials are available at https://www.colonialstock.com/BostonOmaha2016. [Enter the 12-digit control number located on the proxy card.]

If you wish to receive a paper or email copy of the proxy card to complete and mail to the Company in time for the Annual Meeting, you may request one at any time on or before September 15, 2016. You may vote your shares over the Internet or by telephone in the manner provided on the website indicated on the proxy card you receive by completing and returning the proxy card, or by attending the Annual Meeting and voting in person. Votes provided over the Internet or by telephone must be received by 11:59 p.m. Eastern Daylight Time on September 29, 2016.

Whether or not you are able to attend the Annual Meeting, the Company urges you to submit your proxy, which is solicited by the Board. You are urged to give instructions as to how to vote your shares. All properly executed proxies delivered pursuant to this solicitation and not properly revoked will be voted at the Annual Meeting in accordance with the directions given.

We are not aware of any matters to be presented other than those described in this Proxy Statement. If any matters not described in the Proxy Statement are properly presented at the Annual Meeting, the persons designated in the enclosed proxy, or the Proxy Agents, will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned, the Proxy Agents can vote your shares on the new meeting date as well, unless you have revoked your proxy.

We do not expect representatives from our public accounting firm to be present at the Company's Annual Meeting in 2016.

The costs of this solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement and the proxy card will be borne by the Company. The Company will request brokerage houses and other nominees, custodians and fiduciaries to forward soliciting material to beneficial owners of the Company's voting securities. The Company may reimburse brokerage firms and other persons representing beneficial owners for their expenses in forwarding solicitation materials to beneficial owners. Proxies may also be solicited by certain of the Company's directors, officers and regular employees, without additional compensation, either personally or by telephone or facsimile. Except as described above, the Company does not intend to solicit proxies other than by mail.

Our website address is included several times in this Proxy Statement as a textual reference only and the information in the website is not incorporated by reference into this Proxy Statement.

PROPOSAL 1

ELECTION OF DIRECTORS

General

Subject to the rights of holders of any Class A common stock to elect directors, the number of directors of the Company is established by the Board. The Board currently consists of four directors.

At the Annual Meeting, all nominees are to be elected for one-year terms to serve until the Company's 2017 Annual Meeting of Stockholders, or until their successors are elected and qualified. The Board has selected as nominees the following four individuals, all of whom are current directors of the Company: Alex B. Rozek, Adam K. Peterson, Brendan J. Keating and Bradford B. Briner for election as directors at the Annual Meeting.

The Board knows of no reason why the nominees would be unable or unwilling to serve, but if any such nominee should, for any reason, be unable or unwilling to serve, the proxies will be voted for the election of such other person to the office of director as the Board may recommend in the place of such nominee.

Recommendation of the Board

The Board unanimously recommends that you vote "FOR" the election of each of the Board's four nominees to serve as directors of the Company until the 2017 Annual Meeting of Stockholders, or until their successors are elected and qualified.

Voting Information

Proxies solicited by the Board will, unless otherwise directed, be voted to elect the nominees proposed by the Board. A stockholder submitting a proxy may vote for the nominees for election to the Board or may withhold his or her vote from such nominees. Each stockholder will be entitled to one (1) vote for each share of capital stock held by the stockholder on the Record Date. Directors are elected by a plurality of votes, and, therefore, if a quorum is present and voting, the four nominees receiving the highest number of affirmative votes will be elected to the Board. Abstentions and broker non-votes, while included for the purpose of determining the presence of a quorum at the Annual Meeting, will have no effect on the vote. The Proxy Agents will vote your shares "FOR" the nominees unless instructions to the contrary are indicated in the enclosed proxy.

The following table sets forth the directors of the Company who are also nominees for director.

|

Name

|

Age

|

Director Since

|

Term Expires

|

Position(s)

|

|||||||||

|

Alex B. Rozek

|

37

|

2015

|

2017

|

President, Co-Chairman of the Board and Co-Chief Executive Officer

|

|||||||||

|

Adam K. Peterson

|

34

|

2015

|

2017

|

Executive Vice President, Co-Chairman of the Board and Co-Chief Executive Officer

|

|||||||||

|

Brendan J. Keating

|

34

|

2016

|

2017

|

Director

|

|||||||||

|

Bradford B. Briner

|

39

|

2016

|

2017

|

Director

|

|||||||||

Nominees and Incumbent Directors

Set forth below are the names of the persons nominated as directors and incumbent directors, their ages, their offices in the Company, if any, their principal occupations or employment for the past five years, the length of their tenure as directors and the names of other public companies in which they currently hold directorships or have held directorships during the past five years. We have also presented information below regarding each director's specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a director.

Nominees for Director

Alex B. Rozek has been Co-Chairperson of our Board of Directors, Co-Chief Executive Officer and President since February 12, 2015, when he became a member of our Board of Directors. Since July 2007, Mr. Rozek has served as the Manager of Boulderado Group, LLC, which is the investment manager of Boulderado Partners, LLC, a private investment partnership. From 2004 to 2007, Mr. Rozek served as an analyst for Water Street Capital and Friedman Billings Ramsey Group. Mr. Rozek graduated with a B.S. in Biology and a Minor in Chemistry from the University of North Carolina.

Our Board has determined that Mr. Rozek's 12 years' experience in investments and financial analysis qualifies him to be a member of the Board in light of the Company's business and structure.

Adam K. Peterson has been Co-Chairperson of our Board of Directors since February 12, 2015, when he became a member of our Board of Directors. Since June 2014, Mr. Peterson has served as the Manager of The Magnolia Group, LLC, an SEC registered investment advisor and the general partner of Magnolia Capital Fund, LP. From June 2006 through August 2014, Mr. Peterson served as the Chief Investment Officer of Magnolia Capital Partners, LLC and related entities, a family investment office. From May 2004 through June 2006, Mr. Peterson was a financial analyst for Peter Kiewit Sons, Inc. Mr. Peterson graduated with a B.S. in Finance from Creighton University.

Our Board has determined that Mr. Peterson's 12 years' experience in investments and financial analysis qualifies him to be a member of the Board in light of the Company's business and structure.

Brendan J. Keating has since August 2015 been Manager and CEO of Logic Commercial Real Estate, LLC ("Logic"), a company based in Las Vegas, Nevada and formed in 2015 which provides commercial property brokerage and property management services. A trust controlled by members of Mr. Keating's family owns a majority of the membership interest in Logic Commercial Real Estate, LLC. From 2005 to 2015, Mr. Keating was employed at The Equity Group, a company providing services to the commercial real estate market in brokerage, investment, management, development, consulting, tax appeal and facility maintenance services. Mr. Keating served as a principal of The Equity Group from 2007 to 2015. Mr. Keating has a B.S. in Finance and Entrepreneurship from Creighton University.

Our Board has determined that Mr. Keating's 12 years' experience in commercial real estate brokerage, investment and management services qualifies him to be a member of the Board in light of the Company's business and structure.

Bradford B. Briner has since February 2012 been Director of Real Assets for Willett Advisors, LLC, focusing on management of real estate and natural resources investments for the Bloomberg Family and Foundation. From 2002 to 2012, Mr. Briner served as a Managing Director for Morgan Creek Capital Management, for which he managed the private investments business of a large asset manager. Mr. Briner received an M.B.A., with Distinction, from the Harvard Business School, and a B.A. degree in Economics with distinction from the University of North Carolina at Chapel Hill.

Our Board has determined that Mr. Briner's 14 years' experience in private investment management qualifies him to be a member of the Board in light of the Company's business and structure.

There are no family relationships among current members of our Board or executive officers.

Committees and Director Selection

Because of our current size of business operations and the lack of a trading market for our securities, we have not needed and have not implemented extensive corporate governance procedures. We will adopt such procedures when management believes that the benefit of adopting them is justifiable in view of the cost of adopting them and as the same may be required if our securities are listed for trading.

Our Board has not established any standing committees, including an Audit Committee, Compensation Committee or a Nominating Committee. The Board as a whole undertakes the functions of those committees. Our Board believes that its decision not to establish any standing committees has been appropriate due to our current size of business operations. The Board expects to establish one or more of the preceding committees whenever it believes that doing so would benefit us and as the same may be required if our securities are listed for trading.

Our full Board now serves as our Audit Committee. Our Board has determined that while each of Alex Rozek and Adam Peterson have the financial background to qualify as an "Board financial expert," as such term is defined by rules of the U.S. Securities and Exchange Commission, they do not otherwise qualify as they are not "independent" directors.

Because we do not have a standing nominating committee, our full Board is responsible for identifying new candidates for nomination to the Board. We have not adopted a policy that permits shareholders to recommend candidates for election as directors or a process for shareholders to send communications to the Board. Our Board believes that its decision not to establish the preceding policy and process has been appropriate due to our current size of business operations. The Board expects to establish such a policy and such a process whenever it believes that doing so would benefit us.

Because we do not have a standing compensation committee, our full Board will undertake the functions of a compensation committee if any executive officer and director compensation is considered in the immediate future. We do not now have any processes and procedures for the consideration and determination of executive and director compensation.

Code of Ethics

We have adopted a code of ethics that applies to our Co-Chief Executive Officers, Principal Executive Officer, Principal Accounting Officer, Controller and persons performing similar functions within our company.

Director Compensation

None of our Directors is compensated for his role as a Director of our Company. We reimburse all of our directors for reasonable travel and other expenses incurred in attending Board and committee meetings. Each of Messrs. Rozek and Peterson receive compensation as officers of our Company.

Compensation Committee Interlocks and Insider Participation

The following executive officers serve as a member of the Board of an entity that has one or more of its executive officers serving as a member of our Board:

An entity controlled by Mr. Keating serves as the Manager of Logic. Mr. Keating and Mr. Peterson serve as the Managers of The Aligned Group, LLC, which serves as the Manager of TAG SW 1, LLC ("TAG").

EXECUTIVE OFFICERS

The following table sets forth information regarding our executive officers as of July 1, 2016:

|

Name

|

Age

|

Position(s)

|

|||

|

Alex B. Rozek

|

37

|

President, Co-Chairman of the Board and Co-Chief Executive Officer

|

|||

|

Adam K. Peterson

|

34

|

Executive Vice President, Co-Chairman of the Board and Co-Chief Executive Officer

|

|||

|

Jeffrey C. Piermont

|

35

|

Chief Administrative Officer, Interim Chief Financial Officer and Treasurer

|

|||

|

Sean B. Cash

|

47

|

President, Link Holdings, LLC

|

|||

|

Michael J. Scholl

|

48

|

President, General Indemnity Group, LLC

|

|||

In addition to the biographical information for Mr. Rozek and Mr. Peterson, which is set forth above under "Election of Directors," set forth below is certain biographical information about our other executive officers. Our executive officers are elected by, and serve at the discretion of, our board of directors.

Jeffrey C. Piermont has served as our Chief Administrative Officer, Interim Chief Financial Officer and Treasurer since May 2015. Mr. Piermont serves as President and Chief Operating Officer of Boulderado Group, LLC, a position he had held since June 2010. Mr. Piermont previously served as an Investment Professional at Alternative Investment Management from November 2006 through May 2010. Mr. Piermont received his B.S. in Finance and Accounting at Syracuse University.

Sean B. Cash, age 45, has served as the President of Link Holdings, LLC, the holding company for our various billboard business, since its inception in June 2015. From October 2012 through June 2015, Mr. Cash served as Chief Marketing Officer for Pixius Communications, a provider of high speed wireless Internet and managed services technology provider in Kansas. From April 2010 through October 2012, Mr. Cash served as President of LED Ventures, which provided management, business development, sales and marketing strategies, and financial resources for the purpose of developing and managing digital billboards nationwide. From 1996 through 2010, Mr. Cash held a number of senior marketing roles in advertising and food supply businesses. Mr. Cash received his B.S. from the University of Kansas and his MBA from Webster University. Mr. Cash also serves as an adjunct professor of marketing at Friends University.

Michael J. Scholl has served as President of General Indemnity Group, LLC, our wholly owned subsidiary, since October 2015.He previously served as Senior Vice President of Allied Public Risk from May 2014 through October 2015, as Chief Operating Officer of American Public Risk from November 2013 through May 2014, Vice President of Business Development at Commercial Deposit Insurance Agency from August 2012 through November 2013 and as a Vice President of Brown & Brown, a public risk underwriting firm, from August 2002 through November 2009. Mr. Scholl received his B.A. and B.S. in Statistics, Business and Economics from the University of Miami and an M.S. in Statistics from Purdue University.

Executive Compensation.

The following table sets forth information with respect to the compensation of our executive officers for the Company's last completed fiscal year as none of our officers were employed by us prior to 2015:

|

Name and principal position

|

Year

|

Salary ($)

|

Bonus ($)

|

All other

compensation ($)

|

Total ($)

|

||||||||||||

|

Alex B. Rozek(1)

|

2015

|

$

|

9,230

|

-

|

-

|

$

|

9,230

|

||||||||||

|

Co-Chief Executive Officer and

President

|

|

||||||||||||||||

|

(Principal Executive Officer)

|

|

||||||||||||||||

|

|

|

||||||||||||||||

|

Adam K. Peterson (1)

|

2015

|

$

|

9,858

|

-

|

-

|

$

|

9,858

|

||||||||||

|

Co-Chief Executive Officer

and Executive Vice President

|

|

||||||||||||||||

|

Jeffrey C. Piermont (2)

|

2015

|

$

|

14,787

|

-

|

-

|

$

|

14,787

|

||||||||||

|

Chief Administrative Officer,

|

|

||||||||||||||||

|

Interim Chief Financial

|

|

||||||||||||||||

|

Officer and Treasurer

|

|

||||||||||||||||

|

|

|

||||||||||||||||

|

Michael J. Scholl (3)

|

2015

|

$

|

51,915

|

-

|

$

|

51,915

|

|||||||||||

|

President of General Indemnity

Group, LLC

|

|||||||||||||||||

(1) Mr. Rozek and Mr. Peterson salary in 2015 was based on an annual base salary at the rate of $23,600 per year. Each of Messrs. Rozek and Peterson's salaries commenced on August 13, 2015.

(2) Mr. Piermont's base salary for fiscal 2015 was based on an annual base salary of $23,600 per year. Mr. Piermont's salary commenced on May 15, 2015.

(3) Mr. Scholl receives an annual base salary at the rate of $250,000 per year. Mr. Scholl commenced employment with us on October 13, 2015.

Outstanding Equity Awards at Fiscal Year-End

We had no outstanding equity awards at December 31, 2015. We do not currently have any equity incentive plans established and, as a result, none of our officers and directors is a party to any equity incentive plan.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth as of July 1, 2016 certain information with respect to the beneficial ownership of our common stock by (i) each person known by us to own beneficially more than 5% of our outstanding shares of common stock, (ii) each of our directors, (iii) each of our named executive officers and (iv) all directors and executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting and investment power with respect to shares. Unless otherwise indicated below, to our knowledge, all persons named in the table have sole voting and investment power with respect to their shares of common stock, except to the extent authority is shared under applicable law. Unless otherwise indicated, the address of each person named in the table is c/o Boston Omaha Corporation, 292 Newbury Street, Suite 333, Boston, Massachusetts 02115.

|

Name of

Beneficial owner

|

Title of

Class of Stock

|

Amount and

Nature of

Beneficial Ownership

|

Percentage of

Outstanding

Class of Stock

|

Percentage of Aggregate Voting Power of

Class A Common Stock and Common Stock (1)

|

Percentage of Aggregate Economic Interest of

Class A Common Stock and Common Stock(2)

|

|

Magnolia Capital Fund, L.P. (3)

|

Class A

Common

|

580,558

|

50%

|

||

|

Common

|

3,893,623

|

66.66%

|

55.57%

|

63.89%

|

|

|

Boulderado Partners, LLC (4)

|

Class A

Common

|

580,558

|

50%

|

||

|

Common

|

726,876

|

12.44%

|

37.43%

|

18.673%

|

|

|

Adam K. Peterson (3)(5)

|

Class A

Common

|

580,558

|

50%

|

||

|

Common

|

3,893,623

|

66.66%

|

55.57%

|

63.89%

|

|

|

Alex B. Rozek (4)(6)

|

Class A

Common

|

580,558

|

50%

|

||

|

Common

|

726,876

|

12.44%

|

37.43%

|

18.67%

|

|

|

Bradford C. Briner

|

0

|

*

|

*

|

*

|

|

|

Brendan J. Keating (7)

|

Common

|

35,000

|

*

|

*

|

*

|

|

Jeffrey C. Piermont

|

Common

|

4,925

|

*

|

*

|

*

|

|

Sean B. Cash

|

0

|

*

|

*

|

*

|

|

|

Michael J. Scholl

|

0

|

*

|

*

|

*

|

|

|

All directors and officers as a group (4 persons)

|

Class A Common

|

1,161,116

|

100%

|

||

|

Common

|

4,660,424

|

79.78%

|

93.23%

|

83.17%

|

_______________________

* Less than 1%

(1) The percent of Percentage of Aggregate Voting Power of Class A common stock and Common Stock reflects that each share of Class A common stock has 10 votes for each share of common stock and assumes all outstanding, Class A common stock warrants are exercised.

(2) The percent of aggregate economic interest is based on both our Class A common stock and common stock combined. The Class A common stock converts to common stock on a 1:1 basis.

(3) Includes warrants to purchase 52,778 shares of our Class A common stock.

(4) Includes warrants to purchase 52,778 shares of our Class A common stock.

(5) Represents current amount of shares and warrants owned by Magnolia Capital Fund, LP. Mr. Peterson serves as the manager of the general partner of Magnolia Capital Fund, LP.

(6) Represents current amount of shares and warrants owned by Boulderado Partners, LLC. Mr. Rozek serves as the manager of Boulderado Capital, LLC, the manager of Boulderado Partners, LLC.

(7) Represents shares of common stock held by a trust established for the benefit of Mr. Keating and members of his family.

Certain Relationships, Employment Contracts, Related Transactions, and Director Independence.

Rozek and Peterson Employment Agreements

On August 1, 2015, we entered into employment agreements with each of Alex B. Rozek and Adam K. Peterson. Mr. Rozek and Mr. Peterson each serve as our Co-Chief Executive Officer. Each of the employment agreements has a one-year term, with automatic successive one-year renewal terms unless we or the executive decline to renew the agreement. Each of the employment agreements provides for a base salary at $23,600 per year through December 31, 2015, and an annualized base salary of $275,000 for calendar year 2016. However, each of these agreements has been amended to delay an increase in the base salary from $23,600 until such time as approved by the Board, which is not expected to occur prior to January 1, 2017. Each of the employment agreements also provides for certain severance payments to the executives in the event their employment is terminated by us without "cause" or if the executive terminates his employment for "good reason."

Each of Messrs. Rozek and Peterson participate in a management incentive bonus plan (the "MIBP"), effective as of August 1, 2015, under which participants of such plan are eligible to receive cash bonus awards based on achievement by the company of certain net growth target objectives. Each of Alex B. Rozek and Adam K. Peterson are eligible to participate in the management incentive bonus plan pursuant to their respective employment agreements. The MIBP provides for a bonus pool, determined on an annual basis by the compensation committee of the Board, equal to up to 20% of the amount by which our stockholders' equity for the applicable fiscal year (excluding increases or decreases in stockholders' equity resulting from purchases or redemptions of our securities) exceeds 106% of our stockholders' equity for the preceding fiscal year.

In the event that either Mr. Rozek or Mr. Peterson's employment is terminated without cause or if either elects to terminate his employment for "Good Reason", he is entitled to receive severance payments equal to the amounts which would have been payable to him under the MIBP if he had remained with us through the remainder of the fiscal year in which his employment terminated multiplied by a fraction equal to the number of days during the fiscal year that the Executive remained employed by us divided by 365. If the Executive becomes our full-time employee, severance payments also will include an amount equal to four months base salary for each full 12 month period Executive is employed by us commencing August 1, 2015, except that in no event shall severance payments exceed the then current base salary on a monthly basis multiplied by 12.

Boulderado and Magnolia Investments

On February 13, 2015, Boulderado and Magnolia acquired from Richard Church, the former President and former sole member of our Board, approximately 95% of our issued and outstanding shares. Mr. Church also sold to each of Boulderado and Magnolia a 50% interest in a promissory note issued by us to Mr. Church in the principal amount of $298,224. Mr. Church also conveyed to each of Boulderado and Magnolia a 50% interest in another promissory note issued by us to Mr. Church in the principal amount of $100,000. Finally, Mr. Church retained a non-recourse promissory note issued by Ananda Holding, LLC ("Ananda"), our wholly-owned subsidiary, in the principal amount of $135,494 (the "Ananda Note"). These debt instruments, which in their principal amounts total $533,718, replaced all prior debt instruments issued by us to Mr. Church.

In addition to the two notes payable sold to Boulderado and Magnolia in the aggregate original principal amounts of $100,000 and $298,224, on April 10, 2015, we issued notes payable to Boulderado and Magnolia in the principal amount of $100,000 each, bearing interest at 5% per annum and due March 31, 2016. The notes were payable in cash or any or all of the promissory notes could be converted to shares of common stock. The conversion could not occur until we raised $1,000,000 in gross proceeds from one or a series of equity offerings. The conversion price was to be equal to 80% of the price paid by investors in the financing for identical securities. On June 19, 2015, Boulderado and Magnolia converted their notes payable, together with accrued interest of $932 each, into 12,616 shares of Class A common stock and 1,262 warrants each. The warrants are for the purchase of Class A common stock exercisable at a price of $8 per share, are exercisable at any time and expire on June 18, 2025.

On June 19, 2015, and in connection with the acquisition of certain outdoor billboard assets of Bell Media, LLC, we entered into subscription agreements with each of Boulderado and Magnolia, whereby each of Boulderado and Magnolia purchased 500,000 shares of our newly established Class A common stock at a purchase price of $10.00 per share, resulting in gross proceeds to us of $10,000,000. Each of Boulderado and Magnolia also extinguished all principal and interest due under two promissory notes, each in the principal amount of $149,112, assigned to us on February 13, 2015 from Richard Church, the original holder of the notes. As a result of this note extinguishment, each of Boulderado and Magnolia received 15,164 additional shares of Class A common stock. At the same time, Boulderado and Magnolia also converted all sums due under the $100,000 convertible promissory notes we issued to each of them on April 10, 2015, such that each of Boulderado and Magnolia received 12,616 shares of Class A common stock at a conversion price of $8.00 per share. In addition, each of Boulderado and Magnolia received warrants to purchase one share of Class A common stock at a price of $10.00 per share for each 10 shares of Class A common stock purchased, resulting in each of Boulderado and Magnolia receiving warrants to purchase 52,778 shares of Class A common stock. These warrants are exercisable at any time on or before June 18, 2025. Each of the two holders of these warrants are entitled to purchase 51,516 shares of Class A common stock at an exercise price of $10.00 per share and 1,262 shares of Class A common stock at an exercise price of $8.00 per share.

Each of Boulderado and Magnolia agreed as part of the Voting and First Refusal Agreement also entered into on June 19, 2015 to elect as the Class A Directors each of Alex B. Rozek, as a nominee of Boulderado and Adam Peterson, as a nominee of Magnolia. In the event of (a) the death of a Class A Director, (b) the incapacitation of a Class A Director as a result of illness or accident, which makes it reasonably unlikely that the Class A Director will be able to perform his normal duties for the Company for a period of ninety (90) days, or (c) a change of control of Boulderado or Magnolia, then the Class A stockholder which nominated such dead or incapacitated Class A Director, or the Class A stockholder undergoing such change of control, shall convert all of such Class A common stock into shares of our Common Stock, in accordance with the procedures set forth in the Amended and Restated Certificate of Incorporation. The Voting and First Refusal Agreement also provides each of us and the other parties to the Voting Agreement with the right of first refusal to purchase the Class A common stock proposed to be sold by the other holder of Class A common stock. The holders of record of the shares of Class A common stock, exclusively and as a separate class, shall be entitled to elect two directors to our Board (the "Class A Directors"), which number of Class A Directors may be reduced pursuant to the terms and conditions of the Voting and First Refusal. Any Class A Director may be removed without cause by, and only by, the affirmative vote of the holders of eighty percent (80%) of the shares of Class A common stock exclusively and as a separate class, given either at a special meeting of such stockholders duly called for that purpose or pursuant to a written consent of such stockholders. Matters requiring the unanimous approval of the Class A Directors are described in our Annual Report on Form 10-K.

On July 22, 2015, we entered into subscription agreements with each of Boulderado and Magnolia whereby Boulderado purchased 250,000 shares of our common stock and Magnolia purchased 1,200,000 shares of our common stock, each at a purchase price of $10.00 per share, resulting in gross proceeds to us of $14,500,000.

During September 2015, Ananda made a distribution to its members. Our share of the distribution was $32,000 and was distributed directly to Mr. Church as a principal payment on the Ananda Note, reducing the outstanding principal balance to $103,494. On December 31, 2015, we transferred our interest in Ananda to Mr. Church in full satisfaction of our note payable in the principal amount of $103,494 and accrued interest of $6,437. In connection with the transfer of its interest in Ananda, we were released in early 2016 from our limited guaranty of Ananda's mortgage note payable.

In January 2016, we commenced our 2016 Financing. As of the Record Date, we have received investments totaling approximately $41,863,303.78 from 33 investors, including investments of approximately $26,053,000 from Magnolia and approximately $3,500,000 from Boulderado. Each holder of our common stock who is an accredited investor is eligible to participate in a rights offering of common stock, which ends on August 31, 2016. Under the terms of the rights offering, each of our stockholders may participate based on his, her or its proportionate ownership of common stock prior to the commencement of the 2016 Financing and will have the right to purchase common stock at a price of $10.15 per share of common stock. Boulderado and Magnolia will not participate further in the rights offering.

On February 29, 2016, Boulderado and Magnolia converted the remaining promissory note in the principal amount of $100,000, together with accrued interest in the amount of $6,028 into 10,446 shares of our common stock.

Real Estate Investments and Addition of Mr. Keating to the Board

On December 7, 2015, we acquired a 30% ownership position in Logic, which provides brokerage and management services for commercial real estate. Brendan J. Keating holds a controlling interest in Logic and subsequently joined our Board of Directors in February 2016. We paid $195,000 for our ownership position in Logic. On December 8, 2015, we acquired a 15% interest in TAG, a Nevada limited liability company, whose business is to invest in retail centers. As of December 31, 2015, TAG had acquired investments in two retail centers located in Las Vegas, Nevada. Our equity contribution was $97,500. In addition to our equity interest in TAG, Logic manages both the brokerage and property management services of the assets owned by TAG and is compensated for such services. The Aligned Group, LLC, an entity owned by each of Mr. Keating, Mr. Peterson and an entity controlled by Mr. Peterson, is the Manager of TAG. No asset management fees or carry fees are charged to TAG by The Aligned Group, LLC.

Director Independence

Our Board currently consists of Messrs. Rozek, Peterson, Keating and Briner. Currently, we consider Mr. Briner to be the only "independent" director, as Messrs. Rozek and Peterson have a direct employment relationship with us and Mr. Keating serves as the chief executive officer of a company in which we currently own a 30% equity stake. Over time, we expect to adopt a policy that a majority of our Board shall be "independent" in accordance with NASDAQ rules including, in the judgment of the Board, the requirement that such directors have no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us). The Board has adopted the following standards to assist it in determining whether a director has a material relationship with us. Under these standards, a director will not be considered to have a material relationship with us if he or she is not:

(a) a director who is, or during the past three years was, employed by us, other than prior employment as an interim executive officer (provided the interim employment did not last longer than one year);

(b) a director who accepted or has an immediate family member who accepted any compensation from us in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence, other than the following:

(i) compensation for board or board committee service;

(ii) compensation paid to an immediate family member who is our employee (other than an executive officer);

(iii) compensation received for former service as an interim executive officer (provided the interim employment did not last longer than one year); or

(iv) benefits under a tax-qualified retirement plan, or non-discretionary compensation;

(d) a director who is an immediate family member of an individual who is, or at any time during the past three years was, employed by us as an executive officer;

(e) a director who is, or has an immediate family member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which we made, or from which we received, payments (other than those arising solely from investments in our securities or payments under non-discretionary charitable contribution matching programs) that exceed 5% of the organization's consolidated gross revenues for that year, or $200,000, whichever is more, in any of the most recent three fiscal years; or

(f) a director who is, or has an immediate family member who is, a current partner of our outside auditor, or was a partner or employee of our outside auditor who worked on our audit at any time during any of the past three years.

Ownership of a significant amount of our stock, by itself, does not constitute a material relationship. For relationships not covered by these standards, the determination of whether a material relationship exists shall be made by the other members of the Board who are independent (as defined above).

PROPOSAL 2

RATIFY APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board has selected MaloneBailey, LLP as the Company's independent auditors for the fiscal year ending December 31, 2016. During the 2014 and 2015 fiscal year, MaloneBailey, LLP served as the Company's independent auditors. Although the Company is not required to seek stockholder ratification of this selection, the Company has decided to provide its stockholders with the opportunity to do so. If this proposal is not approved by our stockholders at the 2016 Annual Meeting of Stockholders, the Board will reconsider the selection of MaloneBailey, LLP. Even if the selection of MaloneBailey, LLP is ratified, the Board in its discretion may select a different firm of independent auditors at any time during the year if it determines that such a change would be in the best interest of the Company and its stockholders.

Vote Required

The affirmative vote of the holders of a majority in voting power of the shares of the Company's capital stock present in person or represented by proxy at the Annual Meeting and voting for the proposal is required to approve the proposal to ratify the appointment of MaloneBailey, LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2016.

Recommendation of the Board

The Board unanimously recommends that you vote "FOR" the ratification of the appointment of MaloneBailey, LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2016.

Fees Paid to Principal Accountants

Our independent auditor during Fiscal 2015 and Fiscal 2014 was MaloneBailey, LLP. During Fiscal 2015 and Fiscal 2014, the aggregate fees that we paid to our independent auditors for professional services were as follows:

|

Year Ended December 31

|

||||||||

|

|

2015

|

2014

|

||||||

|

Audit Fees (1)

|

$

|

96,000

|

$

|

23,500

|

||||

|

Audit-Related Fees

|

$

|

60,000

|

$

|

-0-

|

||||

|

Tax Fees

|

$

|

-0-

|

$

|

-0-

|

||||

|

All Other Fees

|

$

|

-0-

|

$

|

-0-

|

||||

(1) Fees for audit services include fees associated with the annual audit and the review of our quarterly reports on Form 10-Q.

Audit Fees. The audit fees consist of aggregate fees billed for professional services rendered by the audit of our consolidated financial statements and review of the interim consolidated financial statements included in quarterly reports.

Audit-Related Fees. The audit-related fees consist of aggregate fees billed for assurance and related services reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under "Audit Fees".

Tax Fees. Tax fees consist of aggregate fees billed for professional services for tax compliance, tax advice and tax planning. These services included assistance regarding federal and state tax compliance, and tax audit defense.

All Other Fees. There were no other fees billed for professional services rendered by MaloneBailey, LLP in the fiscal years ending December 31, 2014 and December 31, 2015.

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm.

We do not have an audit committee, but our entire Board functions as such. Our Board pre-approves all audit and permissible non-audit services provided by our independent registered public accounting firm. These services may include audit services, audit-related services and tax services, as well as specifically designated non-audit services that, in the opinion of the Board, will not impair the independence of the independent registered public accounting firm. Our Board annually reviews the audit and permissible non-audit services performed by our independent registered public accounting firm, and reviews and approves the fees charged by it. Our Board has considered the role of our independent registered public accounting firm in providing tax and audit services and other permissible non-audit services to us and has concluded that the provision of such services was compatible with the maintenance of the independence of our independent registered public accounting firm in the conduct of its auditing functions.

Changes in Independent Registered Accounting Firm.

None.

PROPOSAL 3

NON-BINDING ADVISORY PROPOSAL REGARDING EXECUTIVE COMPENSATION.

We are providing our stockholders with the opportunity to cast a non-binding advisory vote on the compensation of our named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion beginning on page 12 of this Proxy Statement. We believe that it is appropriate to seek the views of our stockholders on the design and effectiveness of the Company's executive compensation program.

Our executive compensation policy is intended to further our interests, as well as those of our stockholders, by encouraging growth of our business through securing, retaining and motivating executives of a high caliber who possess the skills necessary for our development and growth. We believe that it achieves these goals by offering competitive base salaries to the named executive officers and offering the named executive officers cash bonus incentives based on the growth in the book value of our company (other than due to increases resulting from the sale of our securities).

Our board of directors encourages our stockholders to approve the following resolution:

RESOLVED, that the compensation paid to the Company's named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion is hereby APPROVED.

As an advisory vote, this proposal is not binding upon the Company. However, the Compensation Committee, which is responsible for designing and administering our executive compensation program, values the opinions expressed by stockholders in their vote on this proposal, and therefore will take such vote into consideration when evaluating our compensation programs and practices applicable to the named executive officers.

Vote Required

This vote is advisory and not binding on the Company. The affirmative vote of the holders of a majority of the outstanding shares of our common stock represented in person or by proxy at the Annual Meeting is required to approve Proposal 4 to approve the compensation paid to our named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion.

Board Recommendation

The Board unanimously recommends that you vote "FOR" the approval of the non-binding advisory proposal regarding executive compensation.

PROPOSAL 4

NON-BINDING ADVISORY PROPOSAL REGARDING FREQUENCY OF VOTE ON EXECUTIVE COMPENSATION

We are seeking the input of our stockholders on the frequency with which the Company will hold a non-binding advisory vote on the compensation of our named executive officers. In voting on this Proposal 4, stockholders may indicate their preference as to whether the advisory vote on the compensation of our named executive officers should occur (a) once every one year, (b) once every two years or (c) once every three years.

It is the opinion of the board of directors that the frequency of the non-binding, advisory stockholder vote on the compensation of our named executive officers should be once every three years. The board of directors views the way we compensate our named executive officers as an essential part of our strategy to maximize our performance and deliver enhanced value to our stockholders. Our board of directors believes that a vote every three years will permit the Company to focus on developing compensation practices that are in the best long-term interests of our stockholders, while simultaneously giving stockholders the time frame they need to fully evaluate the design and effectiveness of those practices. The board of directors believes that a more frequent advisory vote could have the unintended consequence of causing the Company to focus on the short-term impact of its compensation practices to the possible detriment of the long-term performance of the Company.

Stockholders may cast a vote on the preferred voting frequency by selecting the option of one year, two years, three years, or abstain when voting in response to the resolution set forth below:

RESOLVED, that the Company hold a stockholder advisory vote to approve the compensation of the Company's named executive officers as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion, with a frequency of once every one year, two years or three years, whichever receives the highest number of votes cast with respect to this resolution.

The board of directors believes that an advisory vote on named executive officer compensation is the most effective way for stockholders to communicate with the Company about its compensation objectives, policies and practices, and it looks forward to receiving the input of the Company's stockholders on the frequency with which such a vote should be held.

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of the Company's common stock represented in person or by proxy at the Annual Meeting is required to approve the selection of three years for the frequency of the advisory vote on named executive officer compensation.

This vote is advisory and not binding on the Company. The board of directors may decide, after considering the results of this vote that it is in the best interests of the stockholders to hold the advisory vote on named executive officer compensation with a different frequency than the option selected by the stockholders.

Board Recommendation

The Board unanimously recommends that you vote for the option "THREE YEARS" for the frequency of the advisory vote on executive compensation.

ANNUAL REPORT ON FORM 10-K

WE WILL FURNISH WITHOUT CHARGE TO EACH PERSON WHOSE PROXY IS BEING SOLICITED, UPON WRITTEN REQUEST OF ANY SUCH PERSON, A COPY OF OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015, AS FILED WITH THE SEC, INCLUDING THE FINANCIAL STATEMENTS AND A LIST OF EXHIBITS TO SUCH FORM 10-K. WE WILL FURNISH TO ANY SUCH PERSON ANY EXHIBIT DESCRIBED IN THE LIST ACCOMPANYING THE FORM 10-K UPON THE ADVANCE PAYMENT OF REASONABLE FEES. REQUESTS FOR A COPY OF THE FORM 10-K AND/OR ANY EXHIBIT(S) SHOULD BE DIRECTED TO THE CO-CHIEF EXECUTIVE OFFICER OF BOSTON OMAHA CORPORATION, 292 NEWBURY STREET, SUITE 333 BOSTON, MASSACHUSETTS 02115. YOUR REQUEST MUST CONTAIN A REPRESENTATION THAT, AS OF JULY 1, 2016, YOU WERE A BENEFICIAL OWNER OF SHARES ENTITLED TO VOTE AT THE 2016 ANNUAL MEETING OF STOCKHOLDERS.

OTHER MATTERS

The Board does not intend to bring any matters before the Annual Meeting other than as stated in this Proxy Statement and is not aware that any other matters will be presented for action at the Annual Meeting. Should any other matters be properly presented, the Proxy Agents will vote the proxy with respect thereto in accordance with their best judgment, pursuant to the discretionary authority granted by the proxy.

Copies of the Company's recent reports on Form 10-K and Form 10-Q as filed with the SEC will be promptly provided to stockholders without charge upon written or oral request to Alex B. Rozek, Co-Chief Executive Officer, 292 Newbury Street, Suite 333 Boston, Massachusetts 02115, telephone number (857) 256-0079. Copies of our reports are also posted on our website at www.bostonomaha.com.

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for annual reports and Proxy Statements with respect to two or more security holders sharing the same address by delivering a single annual report and Proxy Statement addressed to those security holders. This process, which is commonly referred to as "householding", potentially means extra convenience for security holders and cost savings for companies.

Brokers with account holders who are the Company's stockholders may be "householding" our proxy materials. A single annual report and Proxy Statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or us that they will be "householding" communications to your address, "householding" will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in "householding" and would prefer to receive a separate annual report and Proxy Statement or, if you think that you are eligible for "householding" and would like to request a single copy of the annual report and Proxy Statement for all of the security holders sharing your same address, please notify your broker and direct your request to Alex B. Rozek, Co-Chief Executive Officer, 292 Newbury Street, Suite 333 Boston, Massachusetts 02115, telephone number (857) 256-0079.