Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CAMBIUM LEARNING GROUP, INC. | abcd-8k_20160812.htm |

Real Progress for Every Student Investor Presentation August 2016 Exhibit 99.1

Forward Looking Statements and Non GAAP Financial Measures Forward-Looking Statements Some of the statements contained herein constitute forward-looking statements. These statements relate to future events, including the future financial performance of Cambium Learning Group, Inc., and involve known and unknown risks, uncertainties, and other factors that may cause the markets, actual results, levels of activity, performance, or achievements of Cambium Learning Group, Inc., to be materially different from any actual future results, levels of activity, performance, or achievements. These risks and other factors you should consider include, but are not limited to, the ability to successfully attract and retain a broad customer base for current and future products, changes in customer demands or industry standards, success of ongoing product development, maintaining acceptable margins, the ability to control costs, K–12 enrollment and demographic trends, the level of educational funding, the impact of federal, state, and local regulatory requirements on the business of the company, the loss of key personnel, the impact of competition, the uncertainty of general economic conditions and financial market performance, and those other risks and uncertainties listed under the heading “RISK FACTORS” in Cambium Learning Group, Inc.’s Form 10-K and other reports filed with the Securities and Exchange Commission. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “projects,” “intends,” “prospects,” or “priorities,” or the negative of such terms, or other comparable terminology. These statements are only predictions. Actual events or results may differ materially. Cambium Learning Group, Inc., does not assume or undertake any obligation to update the information contained in this press release, and expressly disclaims any obligation to do so, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures Bookings, EBITDA, Adjusted EBITDA, and Cash Income are not prepared in accordance with GAAP and may be different from similarly named, non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. The Company believes that these non-GAAP measures provide useful information to investors because they reflect the underlying performance of the ongoing operations of the Company and provide investors with a view of the Company’s operations from management’s perspective. Adjusted EBITDA and Cash Income remove significant purchase accounting, non-operational, or certain non-cash items from earnings. The Company uses Bookings, Adjusted EBITDA, and Cash Income to monitor and evaluate the operating performance of the Company and as the basis to set and measure progress toward performance targets, which directly affect compensation for employees and executives. The Company generally uses these non-GAAP measures as measures of operating performance and not as measures of the Company’s liquidity. The Company’s presentation of Bookings, EBITDA, Adjusted EBITDA, and Cash Income should not be construed as an indication that our future results will be unaffected by unusual, non-operational, or non-cash items.

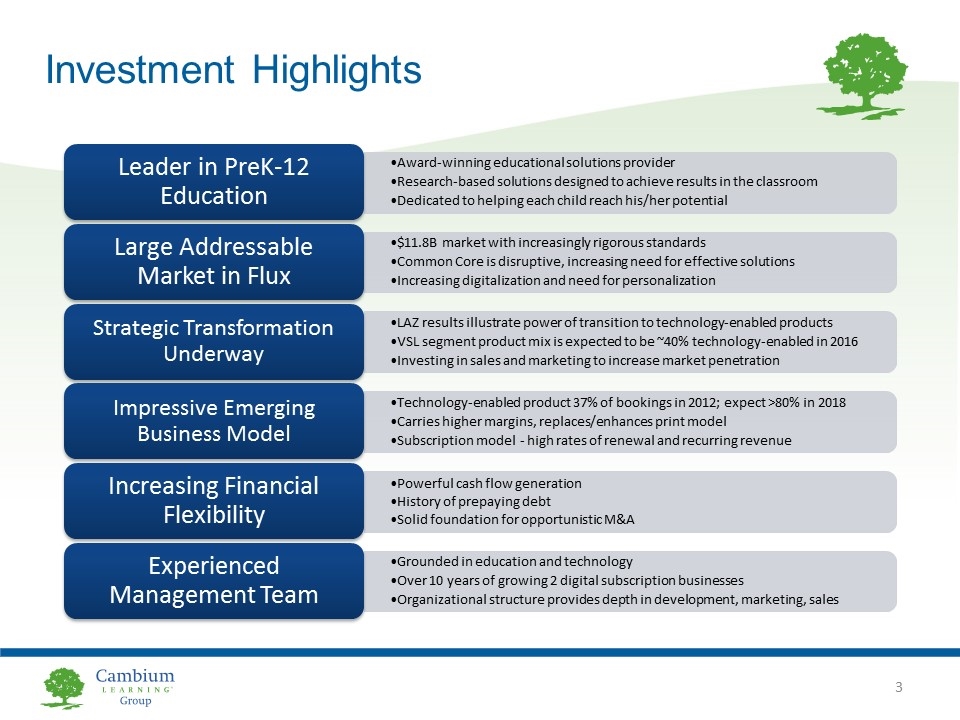

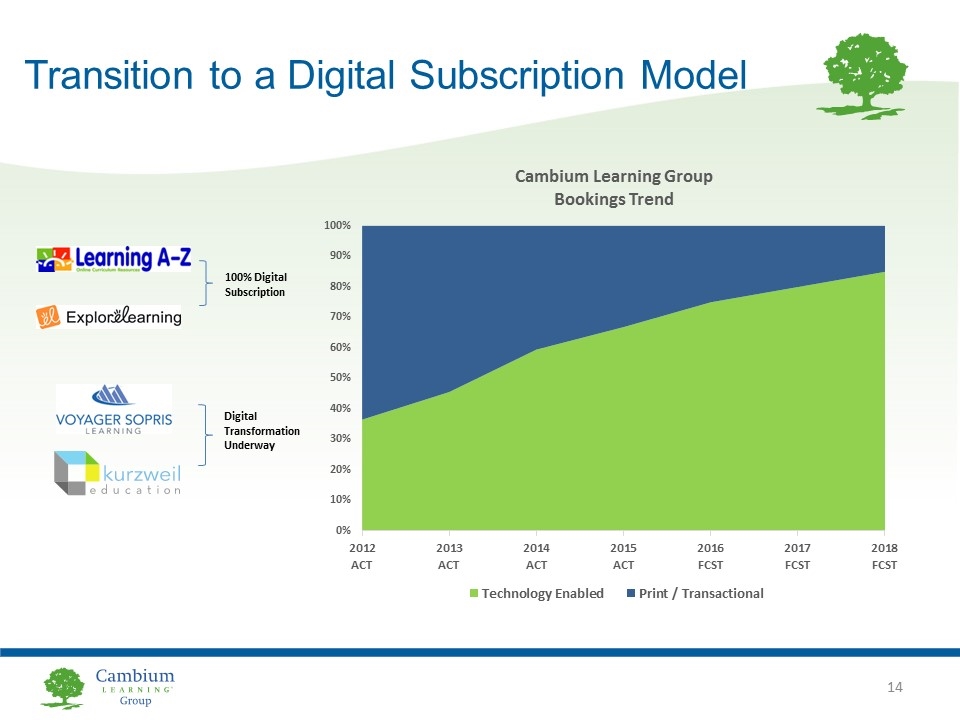

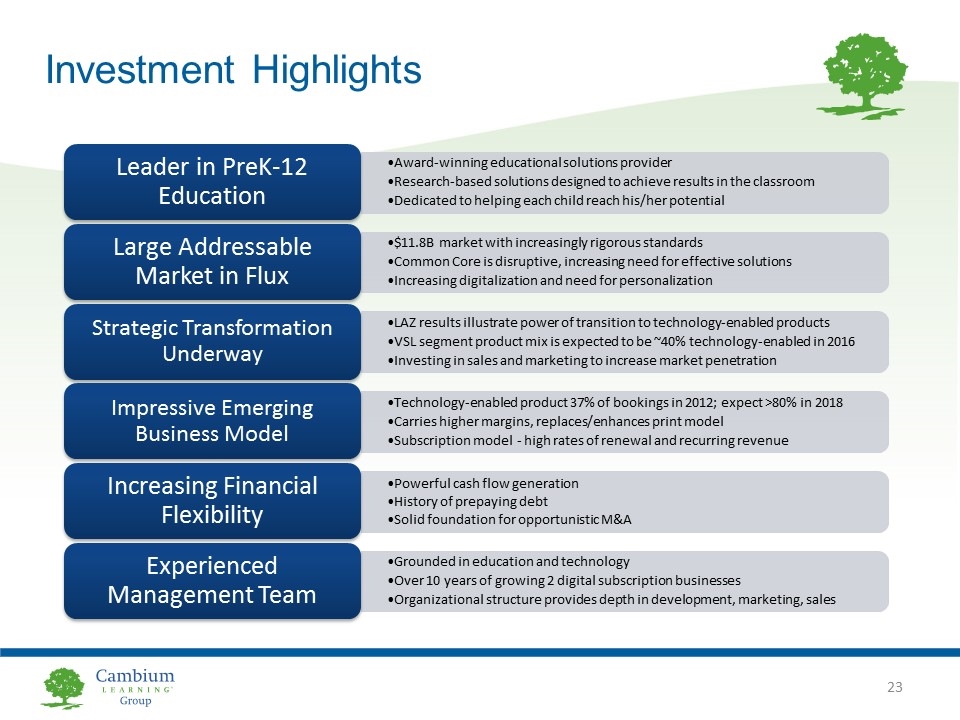

Investment Highlights Leader in PreK-12 Education Award-winning educational solutions provider Large Addressable Market in Flux Common Core is disruptive, increasing need for effective solutions Strategic Transformation Underway LAZ results illustrate power of transition to technology-enabled products Impressive Emerging Business Model Increasing Financial Flexibility Carries higher margins, replaces/enhances print model Powerful cash flow generation Experienced Management Team Grounded in education and technology VSL segment product mix is expected to be ~40% technology-enabled in 2016 Research-based solutions designed to achieve results in the classroom Investing in sales and marketing to increase market penetration Increasing digitalization and need for personalization History of prepaying debt Solid foundation for opportunistic M&A Subscription model - high rates of renewal and recurring revenue $11.8B market with increasingly rigorous standards Technology-enabled product 37% of bookings in 2012; expect >80% in 2018 Over 10 years of growing 2 digital subscription businesses Dedicated to helping each child reach his/her potential Organizational structure provides depth in development, marketing, sales

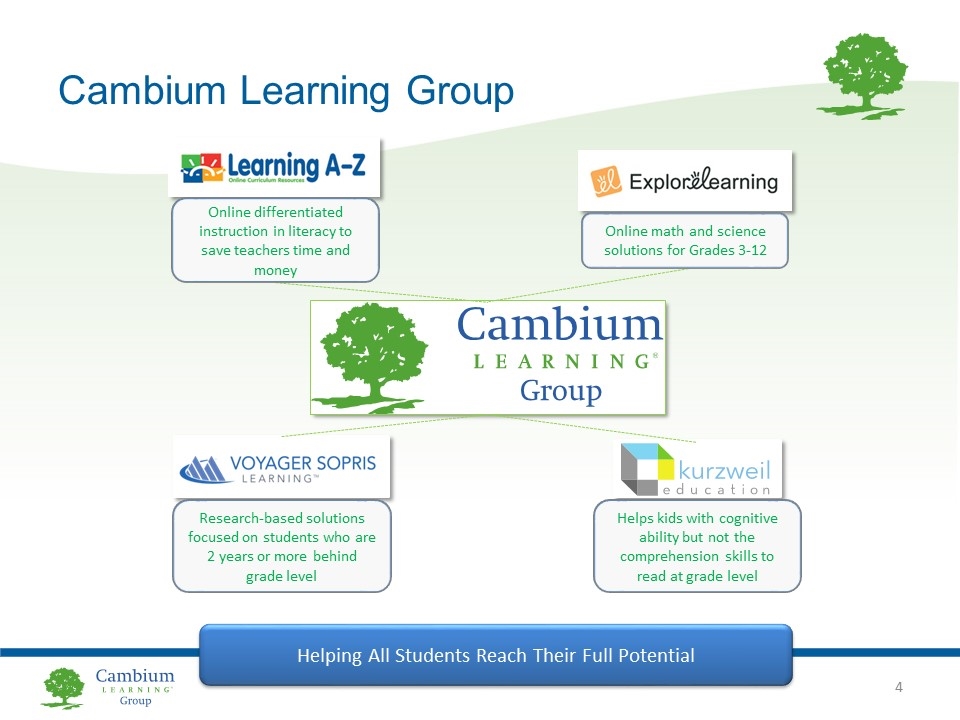

Cambium Learning Group Helping All Students Reach Their Full Potential Online differentiated instruction in literacy to save teachers time and money Online math and science solutions for Grades 3-12 Research-based solutions focused on students who are 2 years or more behind grade level Helps kids with cognitive ability but not the comprehension skills to read at grade level

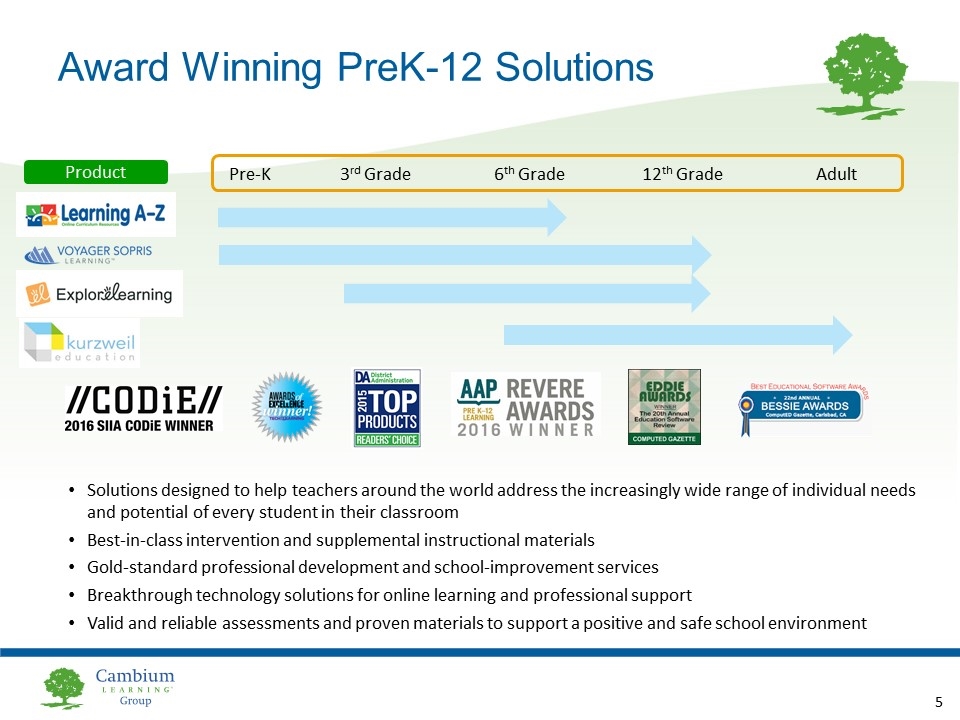

Award Winning PreK-12 Solutions Solutions designed to help teachers around the world address the increasingly wide range of individual needs and potential of every student in their classroom Best-in-class intervention and supplemental instructional materials Gold-standard professional development and school-improvement services Breakthrough technology solutions for online learning and professional support Valid and reliable assessments and proven materials to support a positive and safe school environment Product Pre-K 3rd Grade 6th Grade 12th Grade Adult

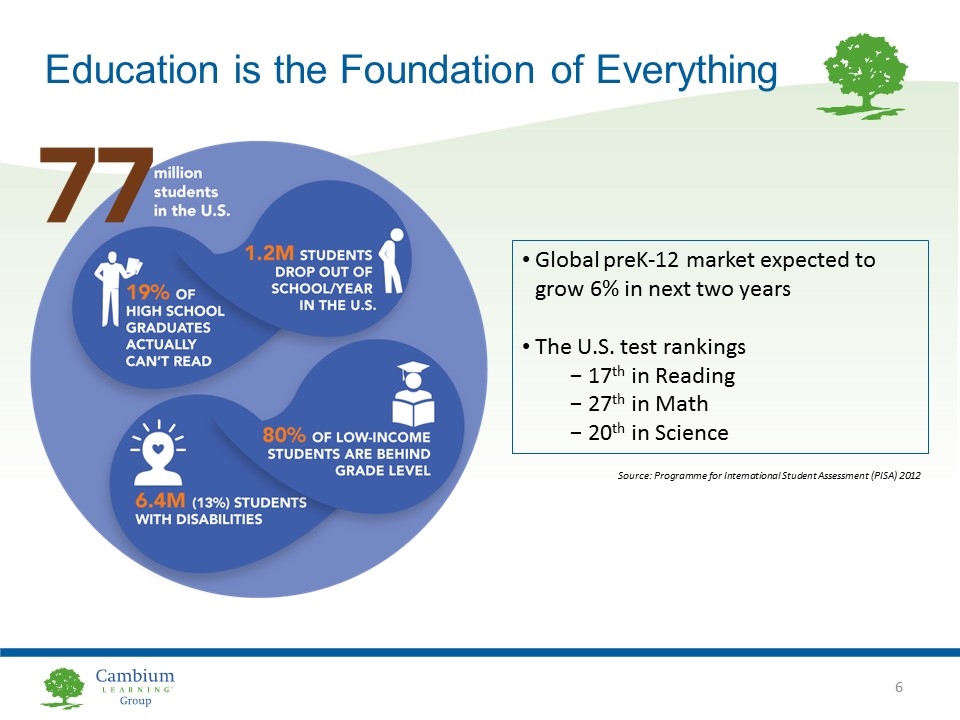

Education is the Foundation of Everything Global preK-12 market expected to grow 6% in next two years The U.S. test rankings 17th in Reading 27th in Math 20th in Science million students in the U.S. Source: Programme for International Student Assessment (PISA) 2012

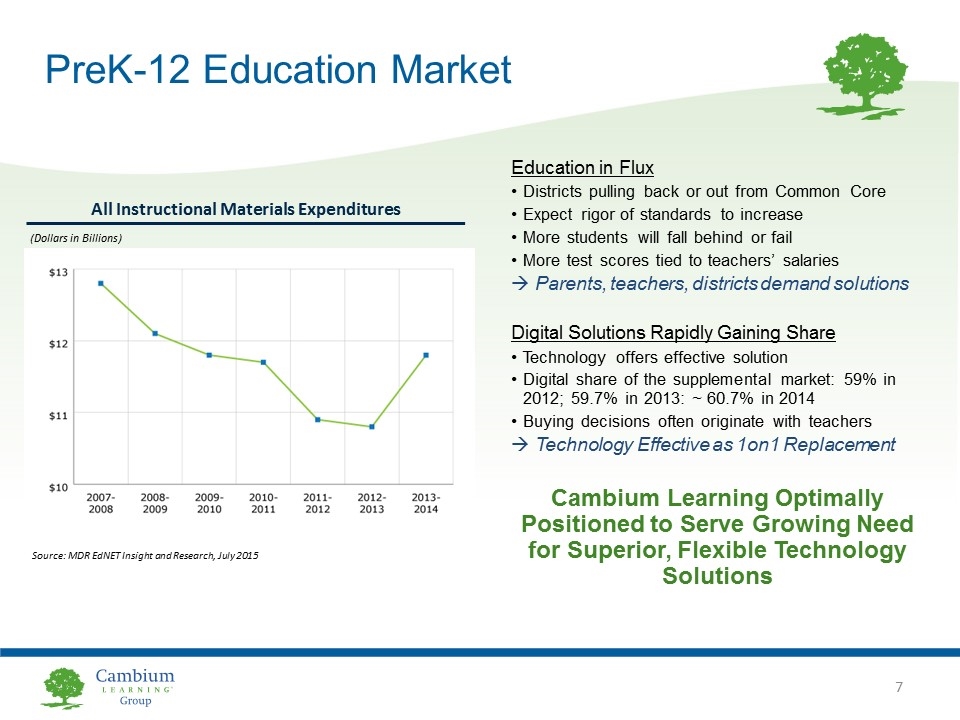

PreK-12 Education Market Education in Flux Districts pulling back or out from Common Core Expect rigor of standards to increase More students will fall behind or fail More test scores tied to teachers’ salaries Parents, teachers, districts demand solutions Digital Solutions Rapidly Gaining Share Technology offers effective solution Digital share of the supplemental market: 59% in 2012; 59.7% in 2013: ~ 60.7% in 2014 Buying decisions often originate with teachers Technology Effective as 1on1 Replacement Cambium Learning Optimally Positioned to Serve Growing Need for Superior, Flexible Technology Solutions All Instructional Materials Expenditures Source: MDR EdNET Insight and Research, July 2015 (Dollars in Billions)

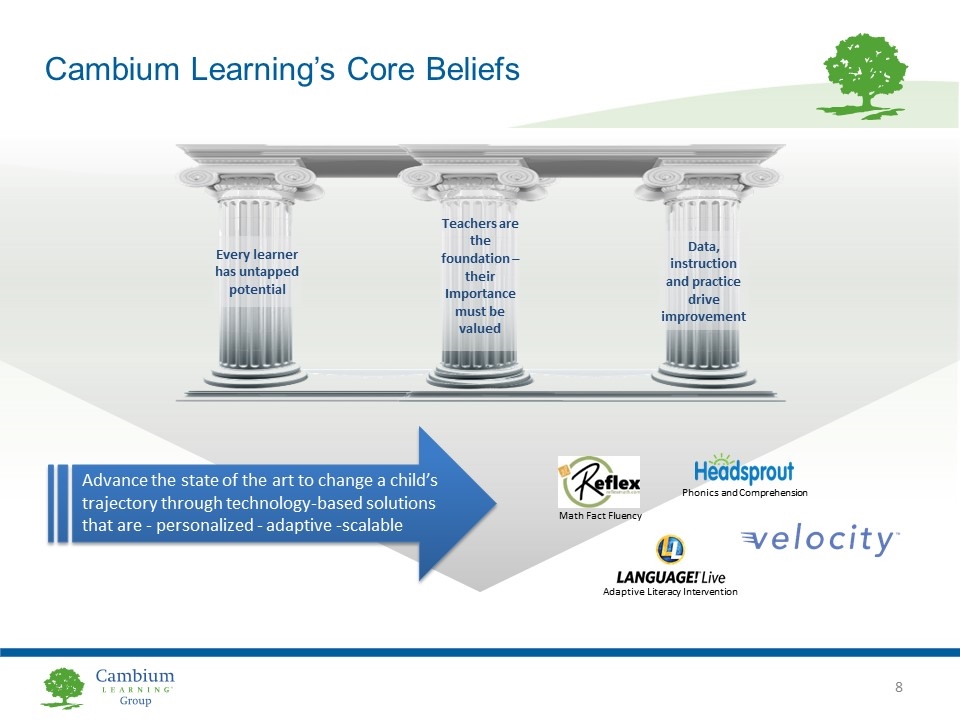

Cambium Learning’s Core Beliefs Every learner has untapped potential Data, instruction and practice drive improvement Teachers are the foundation – their Importance must be valued Phonics and Comprehension Math Fact Fluency Adaptive Literacy Intervention Advance the state of the art to change a child’s trajectory through technology-based solutions that are - personalized - adaptive -scalable

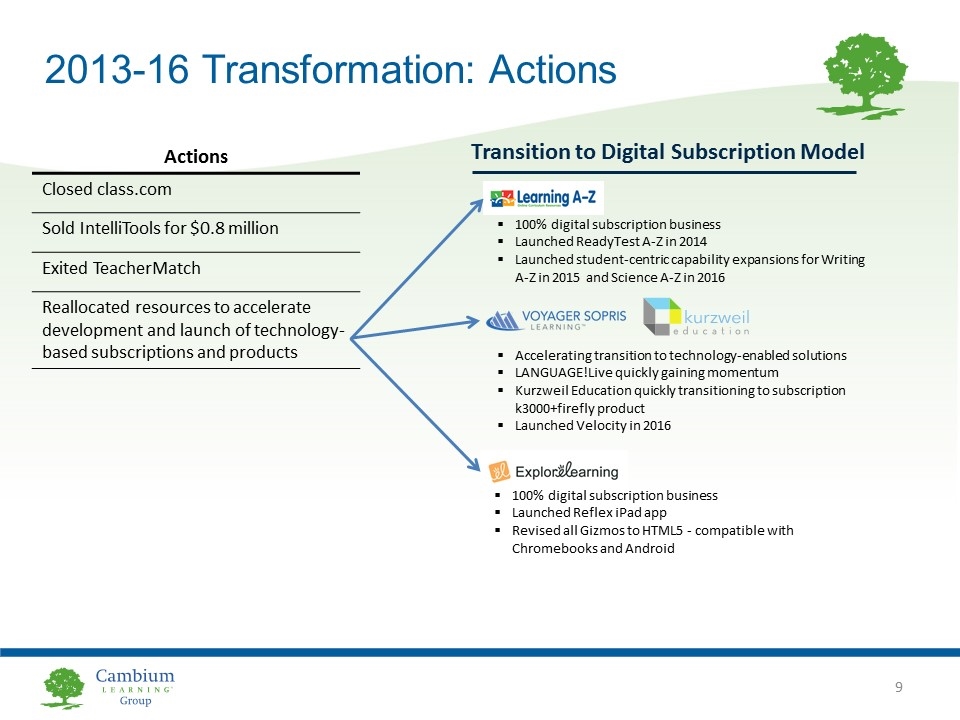

2013-16 Transformation: Actions Accelerating transition to technology-enabled solutions LANGUAGE!Live quickly gaining momentum Kurzweil Education quickly transitioning to subscription k3000+firefly product Launched Velocity in 2016 100% digital subscription business Launched Reflex iPad app Revised all Gizmos to HTML5 - compatible with Chromebooks and Android 100% digital subscription business Launched ReadyTest A-Z in 2014 Launched student-centric capability expansions for Writing A-Z in 2015 and Science A-Z in 2016 Transition to Digital Subscription Model Actions Closed class.com Sold IntelliTools for $0.8 million Exited TeacherMatch Reallocated resources to accelerate development and launch of technology-based subscriptions and products

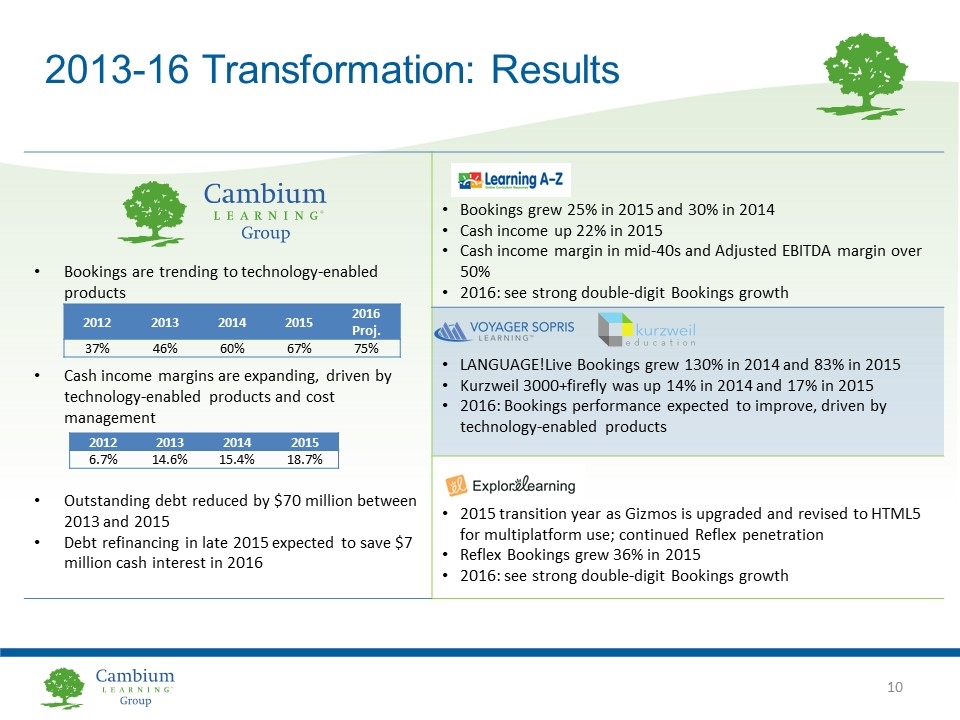

2013-16 Transformation: Results Bookings are trending to technology-enabled products Cash income margins are expanding, driven by technology-enabled products and cost management Outstanding debt reduced by $70 million between 2013 and 2015 Debt refinancing in late 2015 expected to save $7 million cash interest in 2016 Bookings grew 25% in 2015 and 30% in 2014 Cash income up 22% in 2015 Cash income margin in mid-40s and Adjusted EBITDA margin over 50% 2016: see strong double-digit Bookings growth LANGUAGE!Live Bookings grew 130% in 2014 and 83% in 2015 Kurzweil 3000+firefly was up 14% in 2014 and 17% in 2015 2016: Bookings performance expected to improve, driven by technology-enabled products 2015 transition year as Gizmos is upgraded and revised to HTML5 for multiplatform use; continued Reflex penetration Reflex Bookings grew 36% in 2015 2016: see strong double-digit Bookings growth 2012 2013 2014 2015 2016 Proj. 37% 46% 60% 67% 75% 2012 2013 2014 2015 6.7% 14.6% 15.4% 18.7%

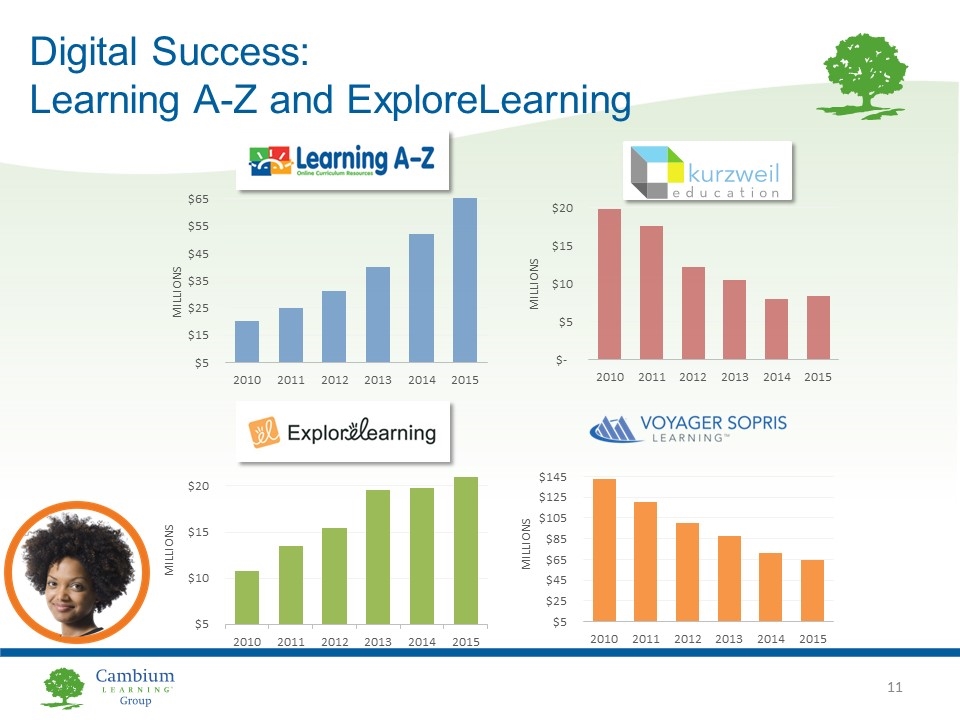

Digital Success: Learning A-Z and ExploreLearning

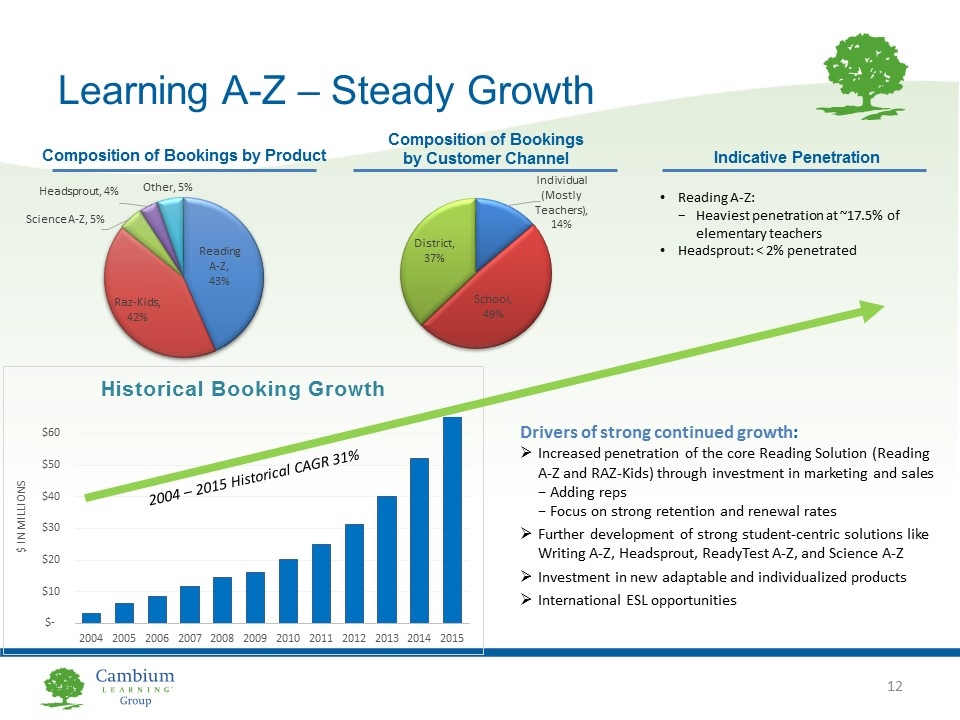

Learning A-Z – Steady Growth Composition of Bookings by Product Indicative Penetration Reading A-Z: Heaviest penetration at ~17.5% of elementary teachers Headsprout: < 2% penetrated Composition of Bookings by Customer Channel Drivers of strong continued growth: Increased penetration of the core Reading Solution (Reading A-Z and RAZ-Kids) through investment in marketing and sales Adding reps Focus on strong retention and renewal rates Further development of strong student-centric solutions like Writing A-Z, Headsprout, ReadyTest A-Z, and Science A-Z Investment in new adaptable and individualized products International ESL opportunities 2004 – 2015 Historical CAGR 31%

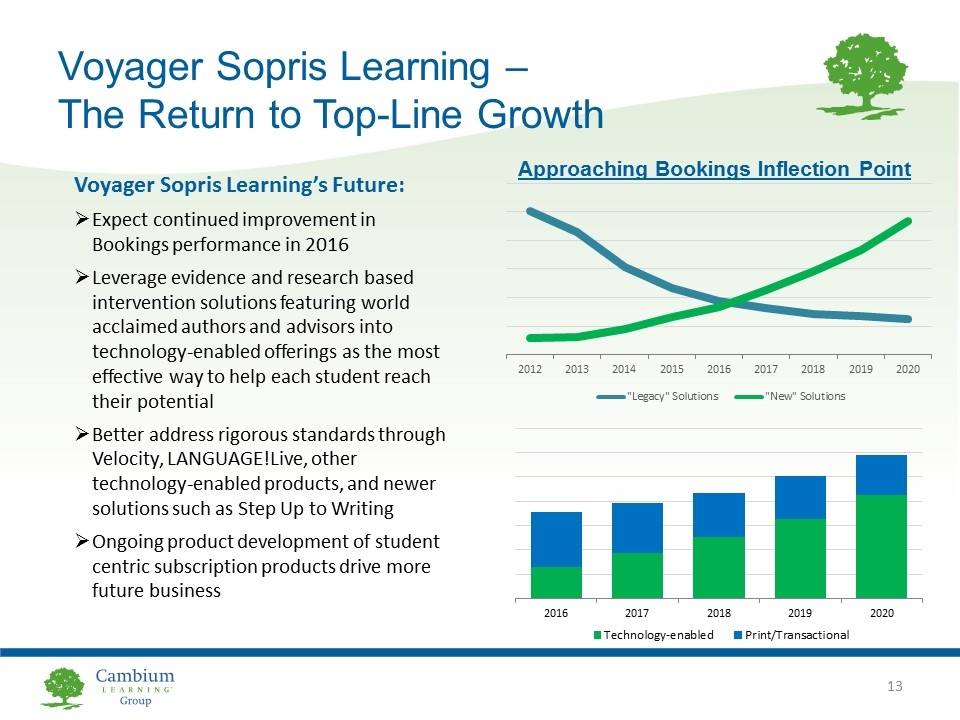

Voyager Sopris Learning – The Return to Top-Line Growth Voyager Sopris Learning’s Future: Expect continued improvement in Bookings performance in 2016 Leverage evidence and research based intervention solutions featuring world acclaimed authors and advisors into technology-enabled offerings as the most effective way to help each student reach their potential Better address rigorous standards through Velocity, LANGUAGE!Live, other technology-enabled products, and newer solutions such as Step Up to Writing Ongoing product development of student centric subscription products drive more future business Approaching Bookings Inflection Point

100% Digital Subscription Digital Transformation Underway Transition to a Digital Subscription Model

MAJOR COMPETITORS WHY WE WIN Saves teachers time and money One-stop library of literary resources Research-based solutions World acclaimed authors and advisors Powerfully effective solutions Source: Company management. Cambium’s Competitive Positioning Open Source Materials Gizmos – interactive exploration is the most effective method for understanding and retaining difficult concepts Reflex – the world’s best tool to help students gain automaticity, perform better on high stakes tests, and have fun

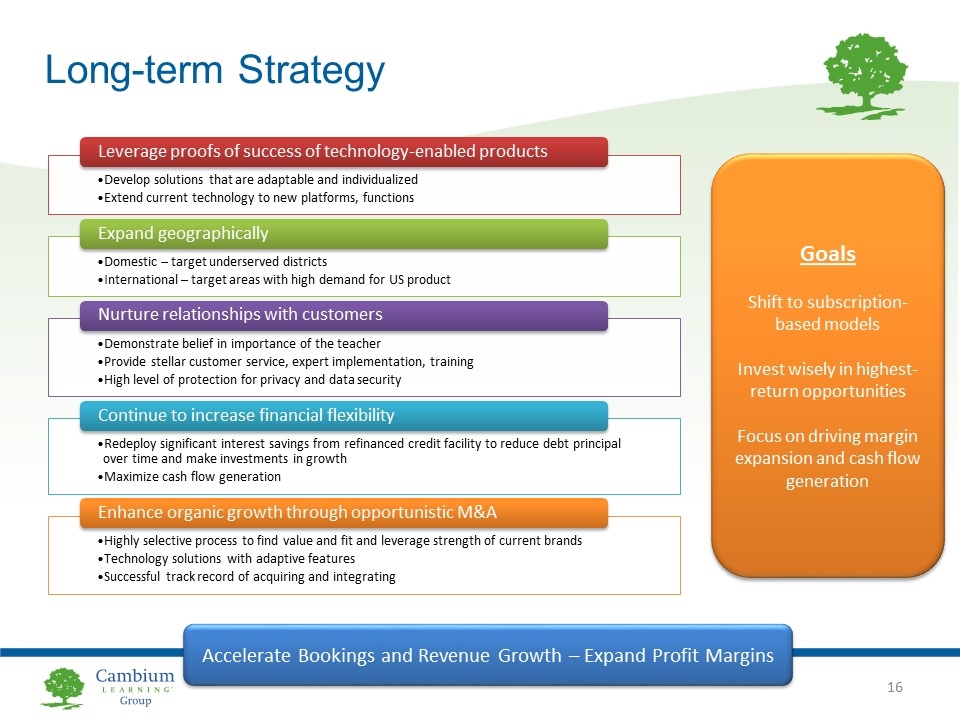

Long-term Strategy Accelerate Bookings and Revenue Growth – Expand Profit Margins Goals Shift to subscription-based models Invest wisely in highest-return opportunities Focus on driving margin expansion and cash flow generation Expand geographically Continue to increase financial flexibility Leverage proofs of success of technology-enabled products Enhance organic growth through opportunistic M&A Develop solutions that are adaptable and individualized Domestic – target underserved districts Redeploy significant interest savings from refinanced credit facility to reduce debt principal over time and make investments in growth Maximize cash flow generation Technology solutions with adaptive features Nurture relationships with customers Demonstrate belief in importance of the teacher Provide stellar customer service, expert implementation, training Successful track record of acquiring and integrating Highly selective process to find value and fit and leverage strength of current brands Extend current technology to new platforms, functions International – target areas with high demand for US product High level of protection for privacy and data security

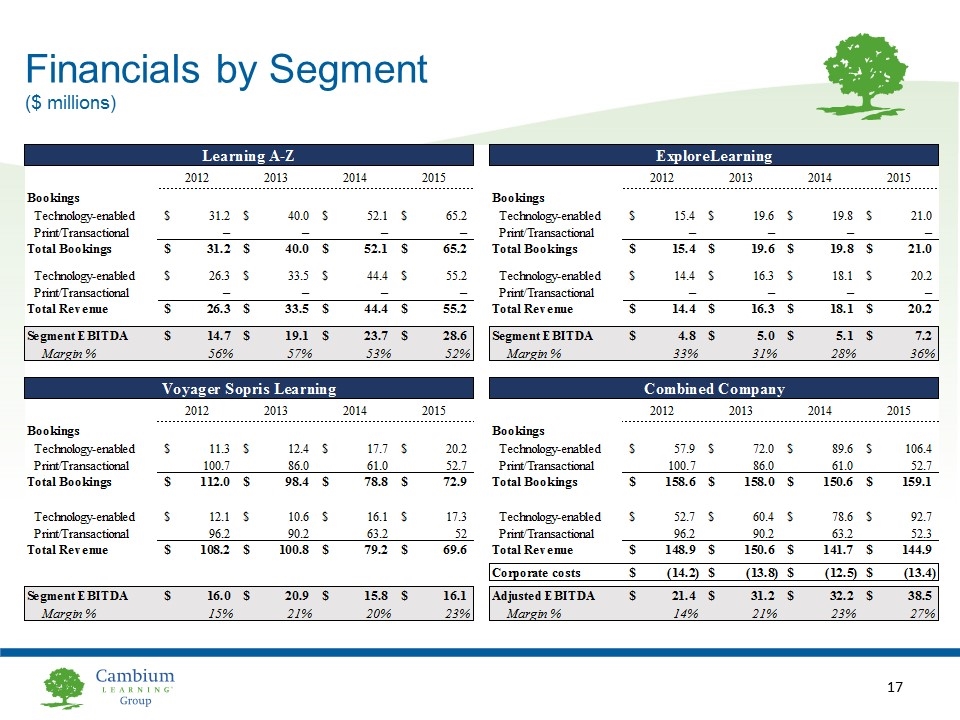

Financials by Segment ($ millions)

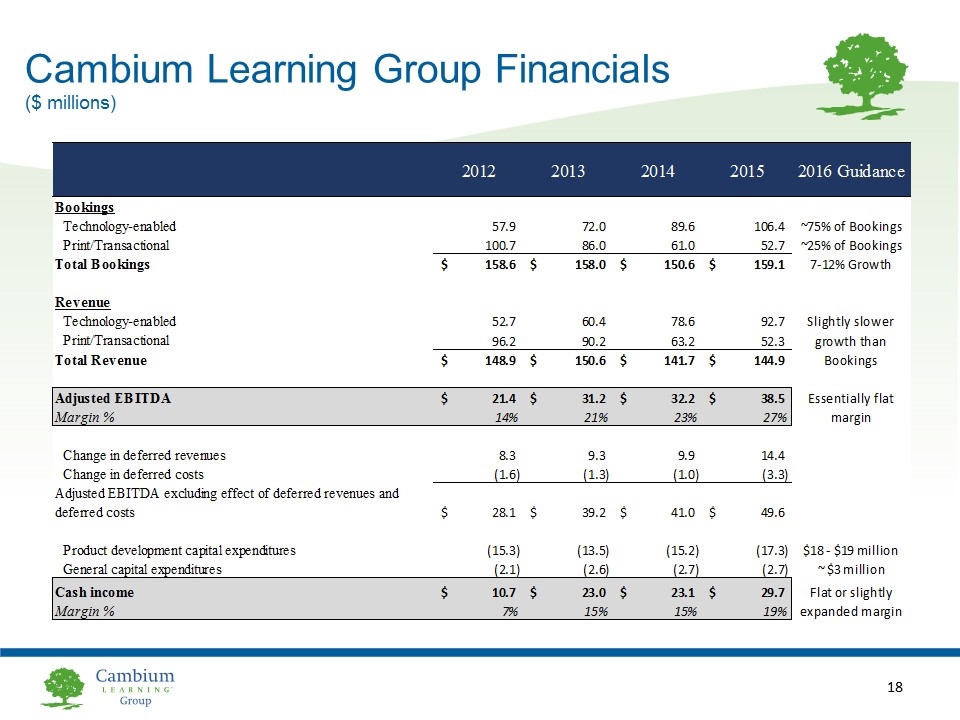

Cambium Learning Group Financials ($ millions)

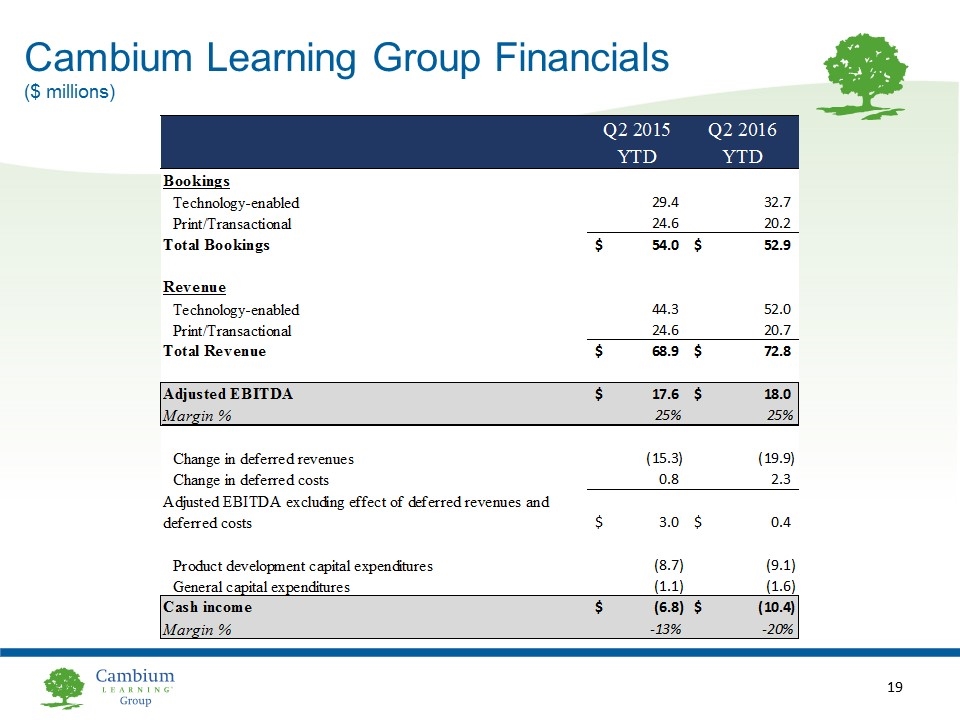

Cambium Learning Group Financials ($ millions)

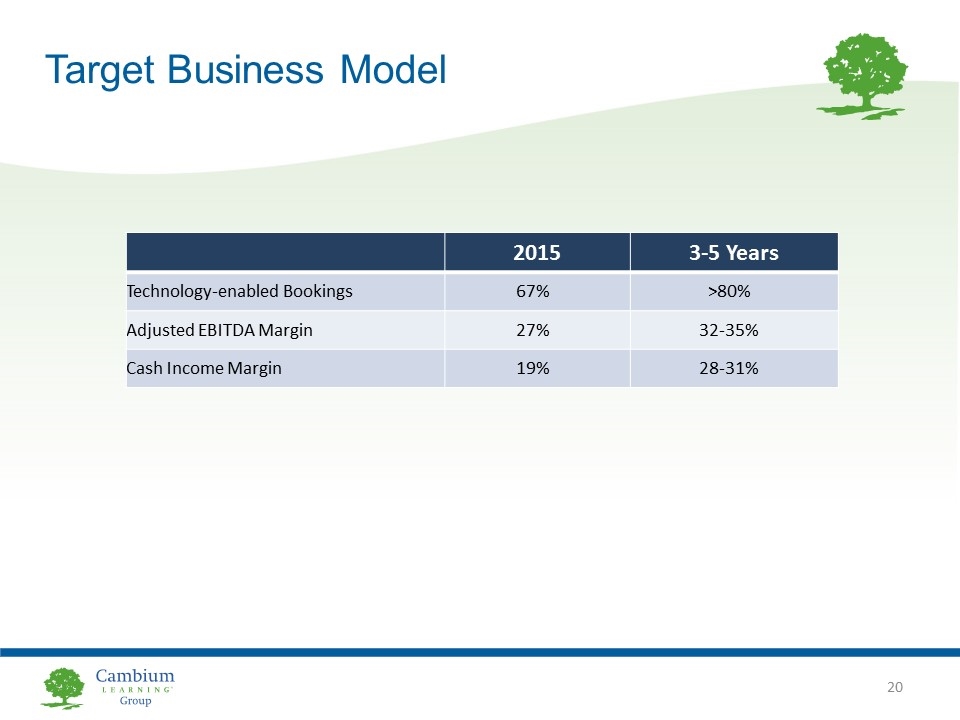

Target Business Model 2015 3-5 Years Technology-enabled Bookings 67% >80% Adjusted EBITDA Margin 27% 32-35% Cash Income Margin 19% 28-31%

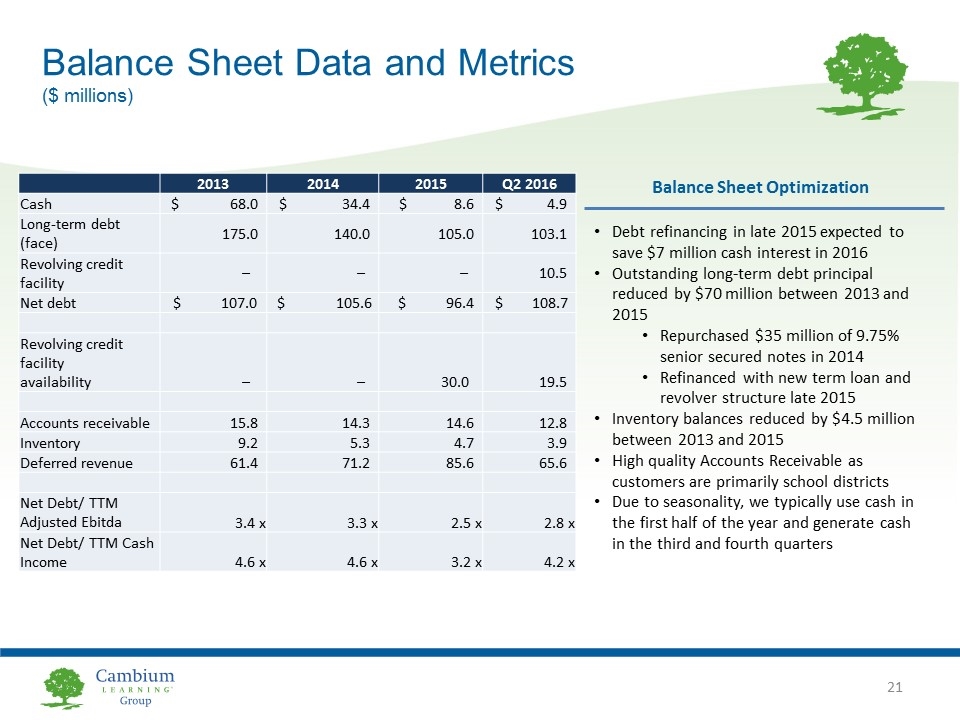

Balance Sheet Data and Metrics ($ millions) Balance Sheet Optimization Debt refinancing in late 2015 expected to save $7 million cash interest in 2016 Outstanding long-term debt principal reduced by $70 million between 2013 and 2015 Repurchased $35 million of 9.75% senior secured notes in 2014 Refinanced with new term loan and revolver structure late 2015 Inventory balances reduced by $4.5 million between 2013 and 2015 High quality Accounts Receivable as customers are primarily school districts Due to seasonality, we typically use cash in the first half of the year and generate cash in the third and fourth quarters 2013 2014 2015 Q2 2016 Cash $ 68.0 $ 34.4 $ 8.6 $ 4.9 Long-term debt (face) 175.0 140.0 105.0 103.1 Revolving credit facility – – – 10.5 Net debt $ 107.0 $ 105.6 $ 96.4 $ 108.7 Revolving credit facility availability – – 30.0 19.5 Accounts receivable 15.8 14.3 14.6 12.8 Inventory 9.2 5.3 4.7 3.9 Deferred revenue 61.4 71.2 85.6 65.6 Net Debt/ TTM Adjusted Ebitda 3.4 x 3.3 x 2.5 x 2.8 x Net Debt/ TTM Cash Income 4.6 x 4.6 x 3.2 x 4.2 x

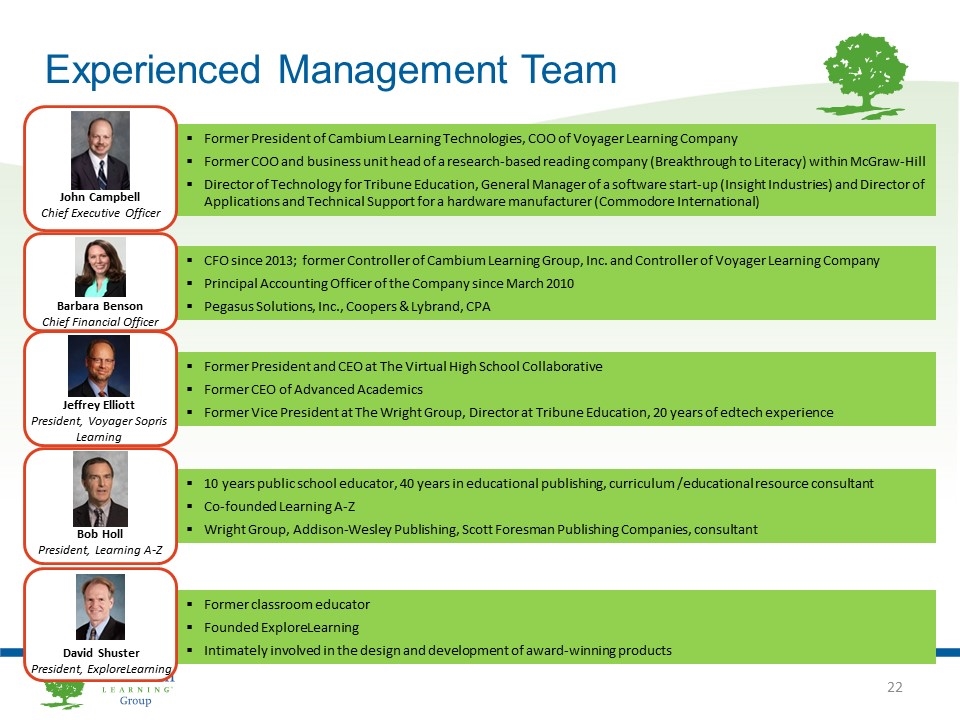

Experienced Management Team Former President of Cambium Learning Technologies, COO of Voyager Learning Company Former COO and business unit head of a research-based reading company (Breakthrough to Literacy) within McGraw-Hill Director of Technology for Tribune Education, General Manager of a software start-up (Insight Industries) and Director of Applications and Technical Support for a hardware manufacturer (Commodore International) John Campbell Chief Executive Officer CFO since 2013; former Controller of Cambium Learning Group, Inc. and Controller of Voyager Learning Company Principal Accounting Officer of the Company since March 2010 Pegasus Solutions, Inc., Coopers & Lybrand, CPA Barbara Benson Chief Financial Officer Former President and CEO at The Virtual High School Collaborative Former CEO of Advanced Academics Former Vice President at The Wright Group, Director at Tribune Education, 20 years of edtech experience Jeffrey Elliott President, Voyager Sopris Learning 10 years public school educator, 40 years in educational publishing, curriculum /educational resource consultant Co-founded Learning A-Z Wright Group, Addison-Wesley Publishing, Scott Foresman Publishing Companies, consultant Bob Holl President, Learning A-Z Former classroom educator Founded ExploreLearning Intimately involved in the design and development of award-winning products David Shuster President, ExploreLearning

Investment Highlights Leader in PreK-12 Education Award-winning educational solutions provider Large Addressable Market in Flux Common Core is disruptive, increasing need for effective solutions Strategic Transformation Underway LAZ results illustrate power of transition to technology-enabled products Impressive Emerging Business Model Increasing Financial Flexibility Carries higher margins, replaces/enhances print model Powerful cash flow generation Experienced Management Team Grounded in education and technology VSL segment product mix is expected to be ~40% technology-enabled in 2016 Research-based solutions designed to achieve results in the classroom Investing in sales and marketing to increase market penetration Increasing digitalization and need for personalization History of prepaying debt Solid foundation for opportunistic M&A Subscription model - high rates of renewal and recurring revenue $11.8B market with increasingly rigorous standards Technology-enabled product 37% of bookings in 2012; expect >80% in 2018 Over 10 years of growing 2 digital subscription businesses Dedicated to helping each child reach his/her potential Organizational structure provides depth in development, marketing, sales

Appendix

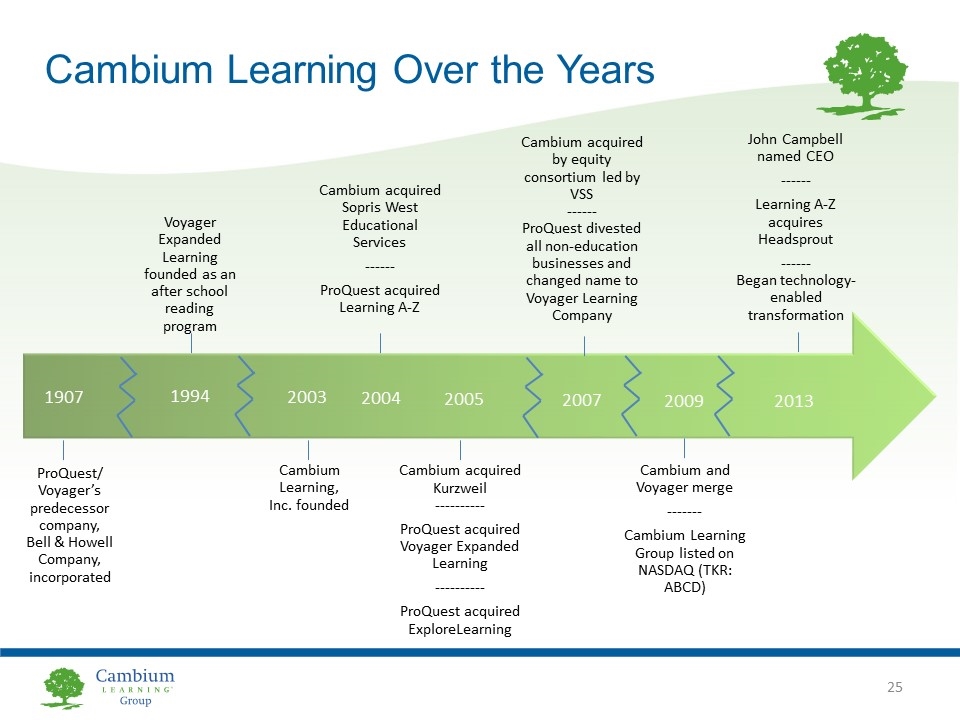

Cambium Learning Over the Years ProQuest/ Voyager’s predecessor company, Bell & Howell Company, incorporated Voyager Expanded Learning founded as an after school reading program Cambium Learning, Inc. founded Cambium acquired Sopris West Educational Services ------ ProQuest acquired Learning A-Z Cambium acquired Kurzweil ---------- ProQuest acquired Voyager Expanded Learning ---------- ProQuest acquired ExploreLearning Cambium acquired by equity consortium led by VSS ------ ProQuest divested all non-education businesses and changed name to Voyager Learning Company Cambium and Voyager merge ------- Cambium Learning Group listed on NASDAQ (TKR: ABCD) John Campbell named CEO ------ Learning A-Z acquires Headsprout ------ Began technology-enabled transformation 1907 1994 2003 2004 2005 2007 2009 2013

Non-GAAP Financial Measures Non-GAAP Financial Measures Bookings, EBITDA, Adjusted EBITDA, and Cash Income are not prepared in accordance with GAAP and may be different from similarly named, non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. The Company believes that these non-GAAP measures provide useful information to investors because they reflect the underlying performance of the ongoing operations of the Company and provide investors with a view of the Company’s operations from management’s perspective. Adjusted EBITDA and Cash Income remove significant purchase accounting, non-operational, or certain non-cash items from earnings. The Company uses Bookings, Adjusted EBITDA and Cash Income to monitor and evaluate the operating performance of the Company and as the basis to set and measure progress toward performance targets, which directly affect compensation for employees and executives. The Company generally uses these non-GAAP measures as measures of operating performance and not as measures of the Company’s liquidity. The Company’s presentation of Bookings, EBITDA, Adjusted EBITDA, and Cash Income should not be construed as an indication that our future results will be unaffected by unusual, non-operational, or non-cash items.

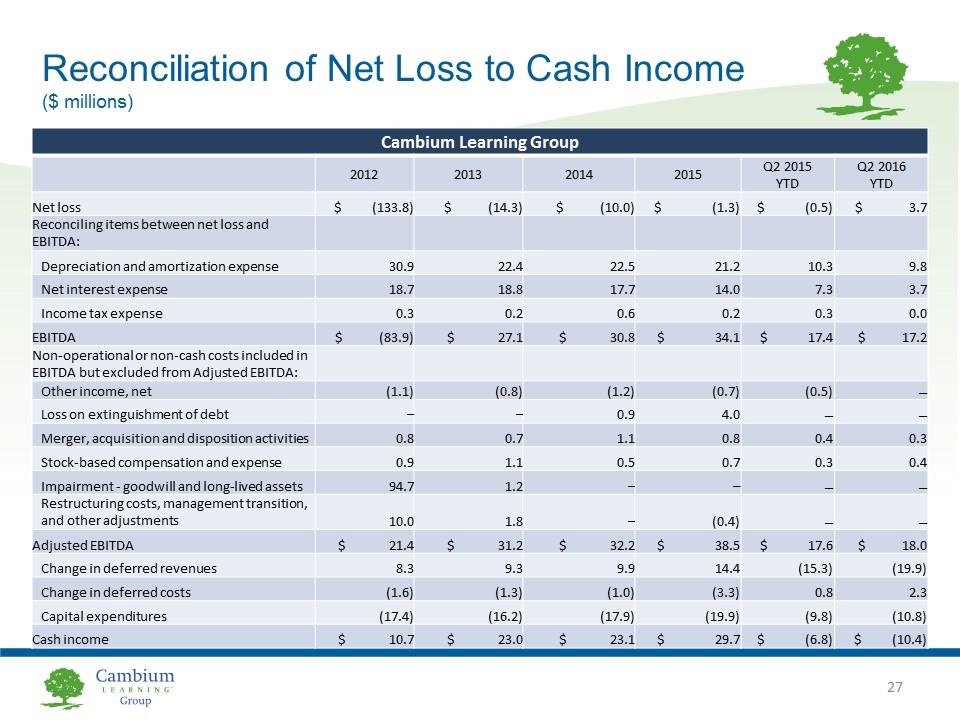

Reconciliation of Net Loss to Cash Income ($ millions) Cambium Learning Group 2012 2013 2014 2015 Q2 2015 YTD Q2 2016 YTD Net loss $ (133.8) $ (14.3) $ (10.0) $ (1.3) $ (0.5) $ 3.7 Reconciling items between net loss and EBITDA: Depreciation and amortization expense 30.9 22.4 22.5 21.2 10.3 9.8 Net interest expense 18.7 18.8 17.7 14.0 7.3 3.7 Income tax expense 0.3 0.2 0.6 0.2 0.3 0.0 EBITDA $ (83.9) $ 27.1 $ 30.8 $ 34.1 $ 17.4 $ 17.2 Non-operational or non-cash costs included in EBITDA but excluded from Adjusted EBITDA: Other income, net (1.1) (0.8) (1.2) (0.7) (0.5) – Loss on extinguishment of debt – – 0.9 4.0 – – Merger, acquisition and disposition activities 0.8 0.7 1.1 0.8 0.4 0.3 Stock-based compensation and expense 0.9 1.1 0.5 0.7 0.3 0.4 Impairment - goodwill and long-lived assets 94.7 1.2 – – – – Restructuring costs, management transition, and other adjustments 10.0 1.8 – (0.4) – – Adjusted EBITDA $ 21.4 $ 31.2 $ 32.2 $ 38.5 $ 17.6 $ 18.0 Change in deferred revenues 8.3 9.3 9.9 14.4 (15.3) (19.9) Change in deferred costs (1.6) (1.3) (1.0) (3.3) 0.8 2.3 Capital expenditures (17.4) (16.2) (17.9) (19.9) (9.8) (10.8) Cash income $ 10.7 $ 23.0 $ 23.1 $ 29.7 $ (6.8) $ (10.4)

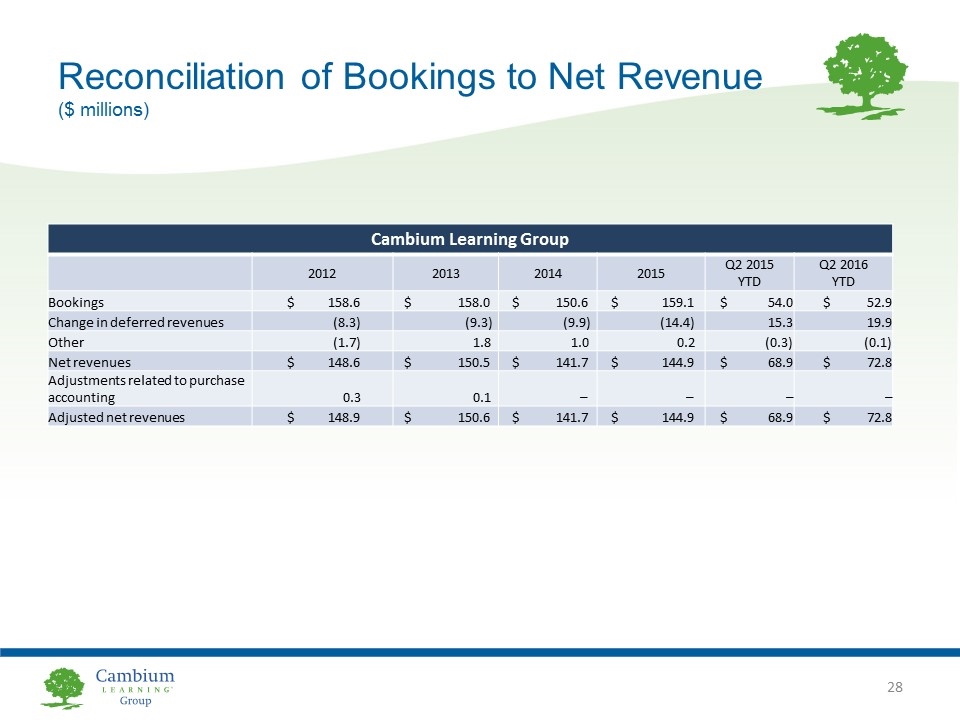

Reconciliation of Bookings to Net Revenue ($ millions) Cambium Learning Group 2012 2013 2014 2015 Q2 2015 YTD Q2 2016 YTD Bookings $ 158.6 $ 158.0 $ 150.6 $ 159.1 $ 54.0 $ 52.9 Change in deferred revenues (8.3) (9.3) (9.9) (14.4) 15.3 19.9 Other (1.7) 1.8 1.0 0.2 (0.3) (0.1) Net revenues $ 148.6 $ 150.5 $ 141.7 $ 144.9 $ 68.9 $ 72.8 Adjustments related to purchase accounting 0.3 0.1 – – – – Adjusted net revenues $ 148.9 $ 150.6 $ 141.7 $ 144.9 $ 68.9 $ 72.8