Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EAGLE PHARMACEUTICALS, INC. | a8-k081016.htm |

August 2016

Corporate Overview

2

Forward Looking Statements

• This presentation contains forward-looking information within the meaning of the Private Securities Litigation Reform Act of 1995, as

amended, and other securities laws. Forward-looking statements are statements that are not historical facts. Words such as “will,”,

“determined”, “confirming”, “underway,” ramping up,” “agreement,” “allows,” “well positioned,” “expect,” “may,” “intends,” “anticipate(s),”

“plan,” “enables,” “potentially,” “look forward,” “on track,” and similar expressions are intended to identify forward-looking statements. These

statements include, but are not limited to, statements regarding future events including, but not limited to: the continued commercial

performance of our marketed products, including BENDEKA, which is marketed by our partner Cephalon, and RYANODEX, which we

market ourselves as well as our ability to replicate our marketing successes for our other product candidates either through joint or direct

marketing efforts; the lack of a need for human safety and efficacy data for the submission of an NDA for Ryanodex and the adequacy of the

regulatory pathway to complete an NDA submission; the Company’s share repurchase authorization and timing and ability to repurchase

shares of the Company’s common stock under a share repurchase program; the business path forward for the Company beyond 2020; the

label expansions of Ryanodex for EHS patients and for the treatment of ecstasy and methamphetamine intoxication; the strength of the

Company’s cash position and the ability to optimize the deployment of capital and take advantage of market opportunities; the potential of the

Company’s pipeline to drive value beyond 2020; the contribution of the Ryanodex portfolio to the Company’s growth; the timing of Ryanodex

for EHS entering the market; and the advancement of the Company’s product candidates through the development process and the ability to

access significant new markets. All of such statements are subject to certain risks and uncertainties, many of which are difficult to predict and

generally beyond Eagle’s control, that could cause actual results to differ materially from those expressed in, or implied or projected by, the

forward-looking information and statements. Such risks include, but are not limited to: whether our animal studies will support the safety and

efficacy of Ryanodex for the treatment of EHS and ecstasy and methamphetamine intoxication; whether the FDA will ultimately approve

Ryanodex for these indications; whether the Company will adequately evaluate and respond to the FDA’s Complete Response Letter on RTU

bivalirudin; fluctuations in the trading volume and market price of shares of the Company's common stock, general business and market

conditions and management's determination of alternative needs and uses of the Company's cash resources which may affect the Company's

share repurchase program; the success of our commercial relationship with Teva and the parties’ ability to work effectively together; whether

Eagle and Teva will successfully perform their respective obligations under the license agreement; difficulties or delays in manufacturing; the

availability and pricing of third party sourced products and materials; the outcome of litigation involving any of our products or that may have

an impact on any of our products, successful compliance with FDA and other governmental regulations applicable to product approvals,

manufacturing facilities, products and/or businesses; general economic conditions; the strength and enforceability of our intellectual property

rights or the rights of third parties; competition from other pharmaceutical and biotechnology companies; the timing of product launches; the

successful marketing of our products; the risks inherent in the early stages of drug development and in conducting clinical trials; and other

factors that are discussed in Eagle’s Annual Report on Form 10-K for the year ended December 31, 2015, and its other filings with the U.S.

Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements that speak

only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward-looking statements to reflect events or

circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

3

About Eagle Pharmaceuticals

Fully commercial specialty pharmaceutical company

focused on hospitals and infusion centers

• Developing & commercializing injectable products that improve upon existing

formulations

• 5 products in-market delivering profits

• Key driver of profit through 2019

• Bendeka: line extension developed for Teva to replace Treanda

• 80% market share of ~$750mm market since Q1 2016 launch

• 20% royalty (~$125-$150mm annually) through 2019

• Next big product: Ryanodex

• Approved and selling in niche market to treat malignant hyperthermia

• Large worldwide market opportunity in treating Exertional Heat Stroke

• Expect to file NDA shortly

• Potential to treat brain hyperthermia in ecstasy and methamphetamine intoxication

• 125K ER cases annually in US alone

• Exciting additional pipeline programs

• Solid financial position: profitable, growing cash position, no debt

• Confident in future: purchased Ryanodex royalty obligation and authorized $75mm

stock buyback

4

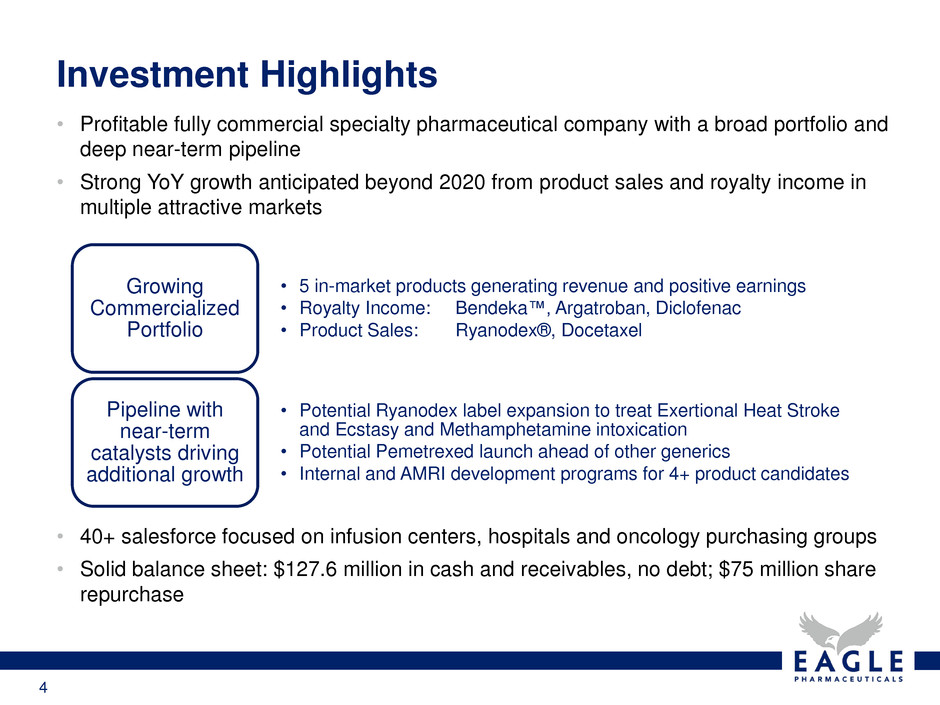

• Profitable fully commercial specialty pharmaceutical company with a broad portfolio and

deep near-term pipeline

• Strong YoY growth anticipated beyond 2020 from product sales and royalty income in

multiple attractive markets

• 40+ salesforce focused on infusion centers, hospitals and oncology purchasing groups

• Solid balance sheet: $127.6 million in cash and receivables, no debt; $75 million share

repurchase

Investment Highlights

• 5 in-market products generating revenue and positive earnings

• Royalty Income: Bendeka™, Argatroban, Diclofenac

• Product Sales: Ryanodex®, Docetaxel

Growing

Commercialized

Portfolio

• Potential Ryanodex label expansion to treat Exertional Heat Stroke

and Ecstasy and Methamphetamine intoxication

• Potential Pemetrexed launch ahead of other generics

• Internal and AMRI development programs for 4+ product candidates

Pipeline with

near-term

catalysts driving

additional growth

5

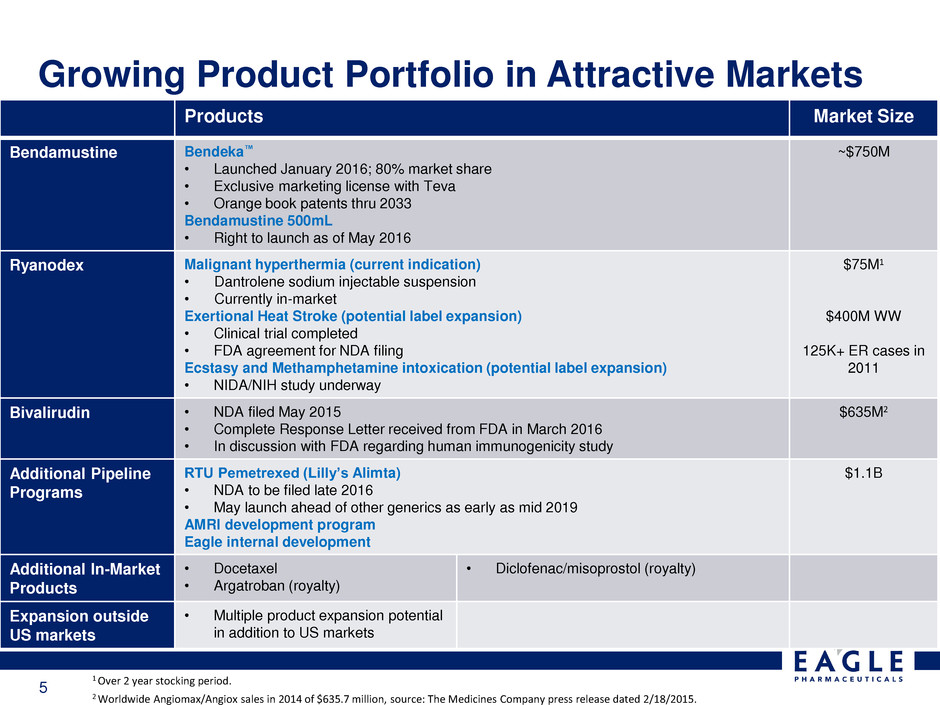

Growing Product Portfolio in Attractive Markets

Mkt Size: $XX

Products Market Size

Bendamustine Bendeka™

• Launched January 2016; 80% market share

• Exclusive marketing license with Teva

• Orange book patents thru 2033

Bendamustine 500mL

• Right to launch as of May 2016

~$750M

Ryanodex Malignant hyperthermia (current indication)

• Dantrolene sodium injectable suspension

• Currently in-market

Exertional Heat Stroke (potential label expansion)

• Clinical trial completed

• FDA agreement for NDA filing

Ecstasy and Methamphetamine intoxication (potential label expansion)

• NIDA/NIH study underway

$75M1

$400M WW

125K+ ER cases in

2011

Bivalirudin • NDA filed May 2015

• Complete Response Letter received from FDA in March 2016

• In discussion with FDA regarding human immunogenicity study

$635M2

Additional Pipeline

Programs

RTU Pemetrexed (Lilly’s Alimta)

• NDA to be filed late 2016

• May launch ahead of other generics as early as mid 2019

AMRI development program

Eagle internal development

$1.1B

Additional In-Market

Products

• Docetaxel

• Argatroban (royalty)

• Diclofenac/misoprostol (royalty)

Expansion outside

US markets

• Multiple product expansion potential

in addition to US markets

1 Over 2 year stocking period.

2 Worldwide Angiomax/Angiox sales in 2014 of $635.7 million, source: The Medicines Company press release dated 2/18/2015.

6

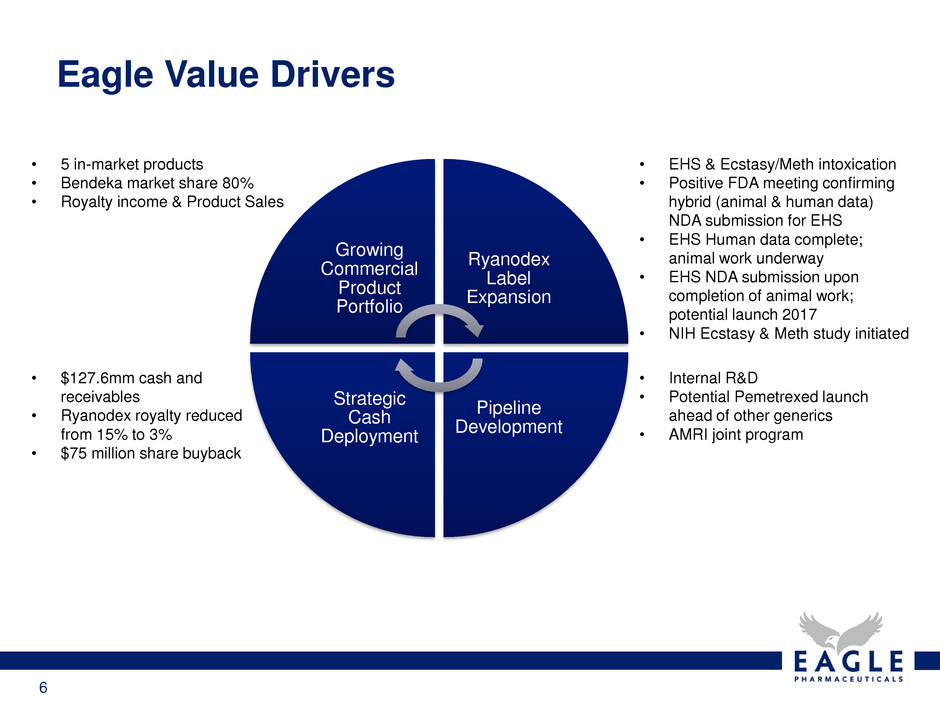

Eagle Value Drivers

Growing

Commercial

Product

Portfolio

Ryanodex

Label

Expansion

Pipeline

Development

Strategic

Cash

Deployment

• EHS & Ecstasy/Meth intoxication

• Positive FDA meeting confirming

hybrid (animal & human data)

NDA submission for EHS

• EHS Human data complete;

animal work underway

• EHS NDA submission upon

completion of animal work;

potential launch 2017

• NIH Ecstasy & Meth study initiated

• 5 in-market products

• Bendeka market share 80%

• Royalty income & Product Sales

• Internal R&D

• Potential Pemetrexed launch

ahead of other generics

• AMRI joint program

• $127.6mm cash and

receivables

• Ryanodex royalty reduced

from 15% to 3%

• $75 million share buyback

7

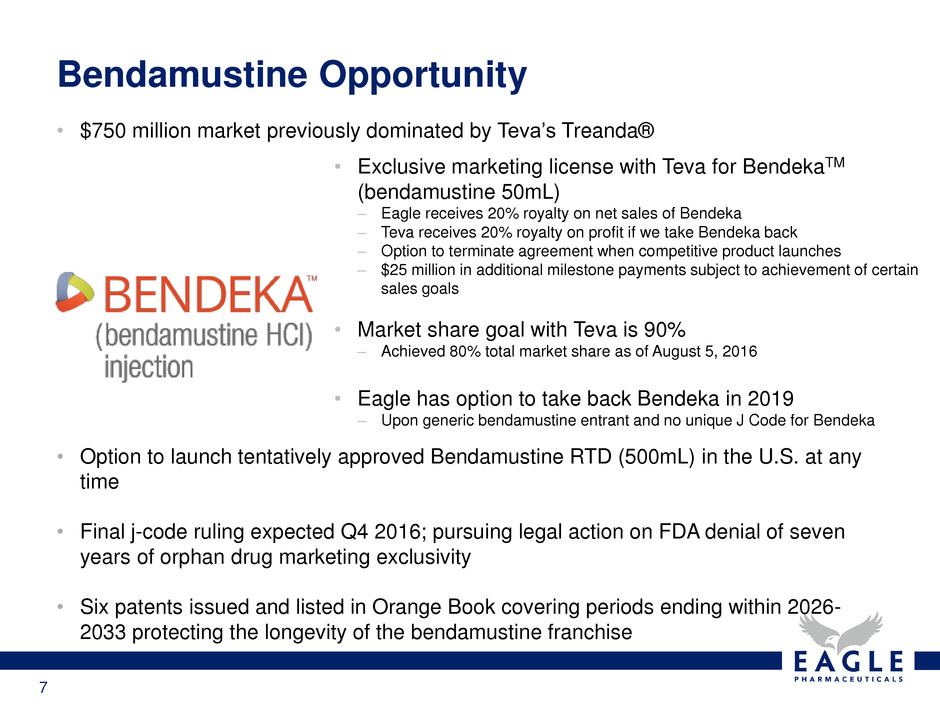

• $750 million market previously dominated by Teva’s Treanda®

• Option to launch tentatively approved Bendamustine RTD (500mL) in the U.S. at any

time

• Final j-code ruling expected Q4 2016; pursuing legal action on FDA denial of seven

years of orphan drug marketing exclusivity

• Six patents issued and listed in Orange Book covering periods ending within 2026-

2033 protecting the longevity of the bendamustine franchise

Bendamustine Opportunity

• Exclusive marketing license with Teva for BendekaTM

(bendamustine 50mL)

– Eagle receives 20% royalty on net sales of Bendeka

– Teva receives 20% royalty on profit if we take Bendeka back

– Option to terminate agreement when competitive product launches

– $25 million in additional milestone payments subject to achievement of certain

sales goals

• Market share goal with Teva is 90%

– Achieved 80% total market share as of August 5, 2016

• Eagle has option to take back Bendeka in 2019

– Upon generic bendamustine entrant and no unique J Code for Bendeka

8

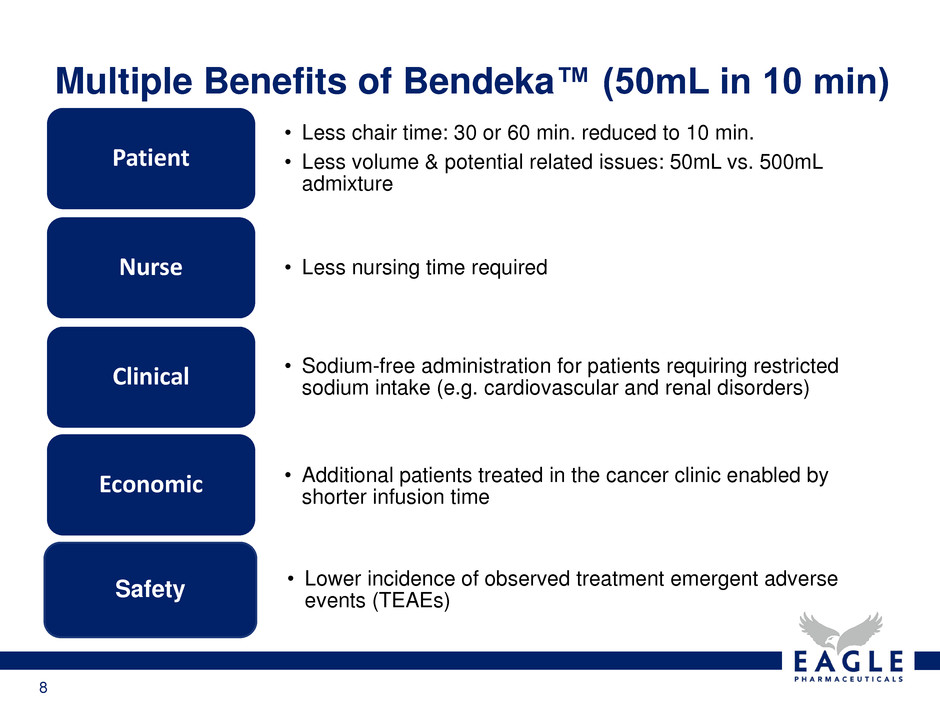

Multiple Benefits of Bendeka™ (50mL in 10 min)

• Less chair time: 30 or 60 min. reduced to 10 min.

• Less volume & potential related issues: 50mL vs. 500mL

admixture

Patient

• Less nursing time requiredNurse

• Sodium-free administration for patients requiring restricted

sodium intake (e.g. cardiovascular and renal disorders)Clinical

• Additional patients treated in the cancer clinic enabled by

shorter infusion time

Economic

• Lower incidence of observed treatment emergent adverse

events (TEAEs)Safety

9

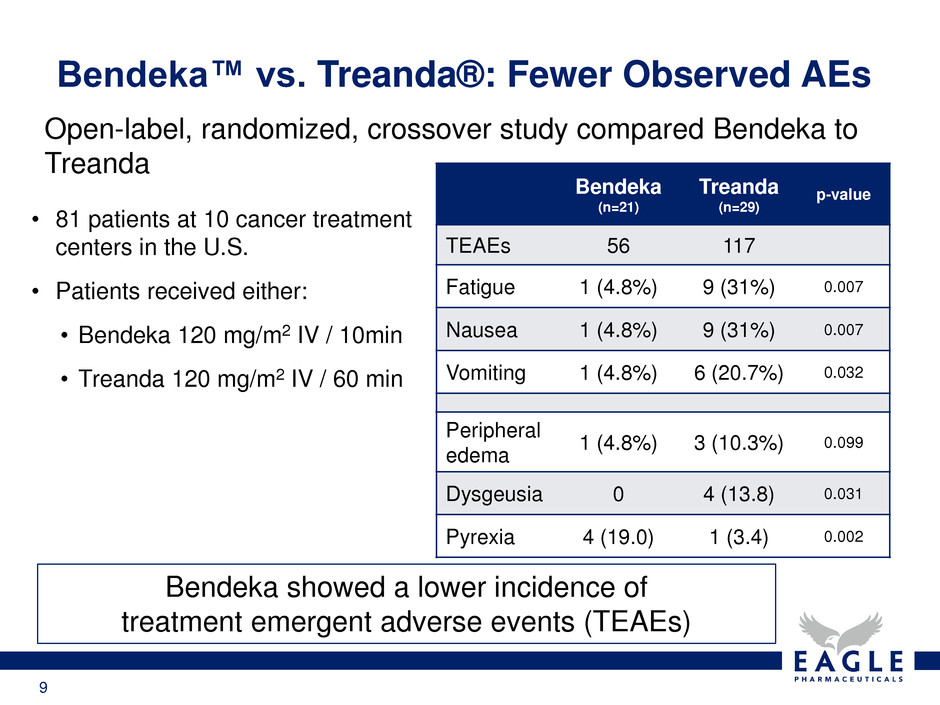

Bendeka showed a lower incidence of

treatment emergent adverse events (TEAEs)

Bendeka™ vs. Treanda®: Fewer Observed AEs

Open-label, randomized, crossover study compared Bendeka to

Treanda

Bendeka

(n=21)

Treanda

(n=29)

p-value

TEAEs 56 117

Fatigue 1 (4.8%) 9 (31%) 0.007

Nausea 1 (4.8%) 9 (31%) 0.007

Vomiting 1 (4.8%) 6 (20.7%) 0.032

Peripheral

edema

1 (4.8%) 3 (10.3%) 0.099

Dysgeusia 0 4 (13.8) 0.031

Pyrexia 4 (19.0) 1 (3.4) 0.002

• 81 patients at 10 cancer treatment

centers in the U.S.

• Patients received either:

• Bendeka 120 mg/m2 IV / 10min

• Treanda 120 mg/m2 IV / 60 min

10

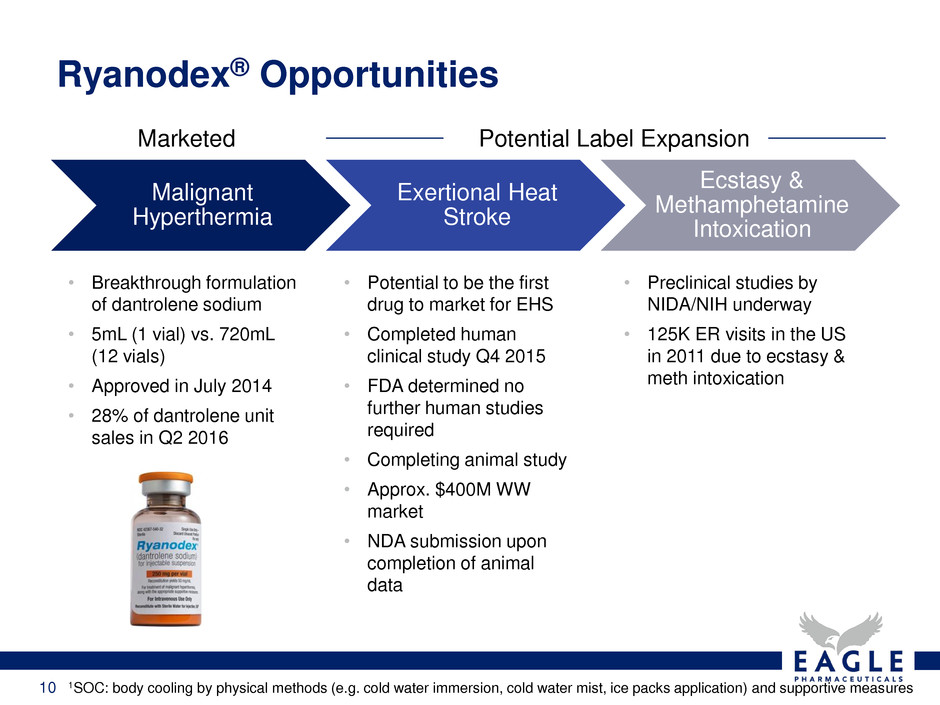

Ryanodex® Opportunities

1SOC: body cooling by physical methods (e.g. cold water immersion, cold water mist, ice packs application) and supportive measures

Malignant

Hyperthermia

Exertional Heat

Stroke

Ecstasy &

Methamphetamine

Intoxication

• Breakthrough formulation

of dantrolene sodium

• 5mL (1 vial) vs. 720mL

(12 vials)

• Approved in July 2014

• 28% of dantrolene unit

sales in Q2 2016

Marketed Potential Label Expansion

• Potential to be the first

drug to market for EHS

• Completed human

clinical study Q4 2015

• FDA determined no

further human studies

required

• Completing animal study

• Approx. $400M WW

market

• NDA submission upon

completion of animal

data

• Preclinical studies by

NIDA/NIH underway

• 125K ER visits in the US

in 2011 due to ecstasy &

meth intoxication

11

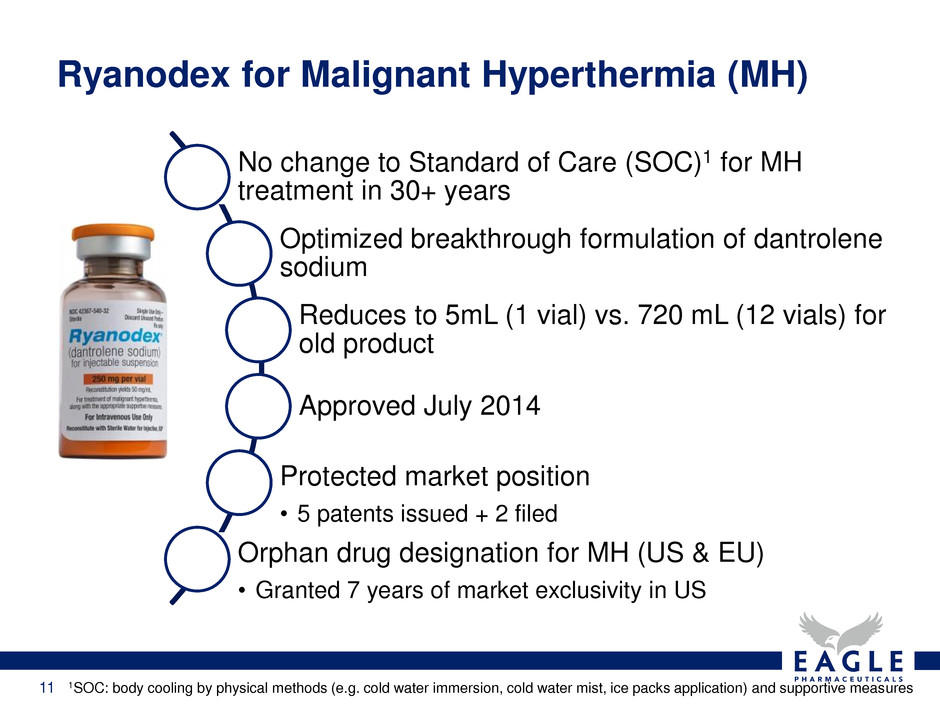

Ryanodex for Malignant Hyperthermia (MH)

1SOC: body cooling by physical methods (e.g. cold water immersion, cold water mist, ice packs application) and supportive measures

No change to Standard of Care (SOC)1 for MH

treatment in 30+ years

Optimized breakthrough formulation of dantrolene

sodium

Reduces to 5mL (1 vial) vs. 720 mL (12 vials) for

old product

Approved July 2014

Protected market position

• 5 patents issued + 2 filed

Orphan drug designation for MH (US & EU)

• Granted 7 years of market exclusivity in US

12

• Exertional Heat Stroke (EHS) unmet medical need

‒ Sudden, unpredictable and life-threatening condition

‒ Patient population impacted: military, student athletes, athletes,

construction workers, migrant workers, and firemen

‒ A leading cause of student athlete death (US) & non-combat military deaths

‒ Similarities to MH

• Potential for Ryanodex to be first to market for EHS

– Granted fast track and orphan drug designation

– Human study completed; animal study underway

– Potential for 7 years of exclusivity

• $400 million worldwide market

Ryanodex for EHS

13

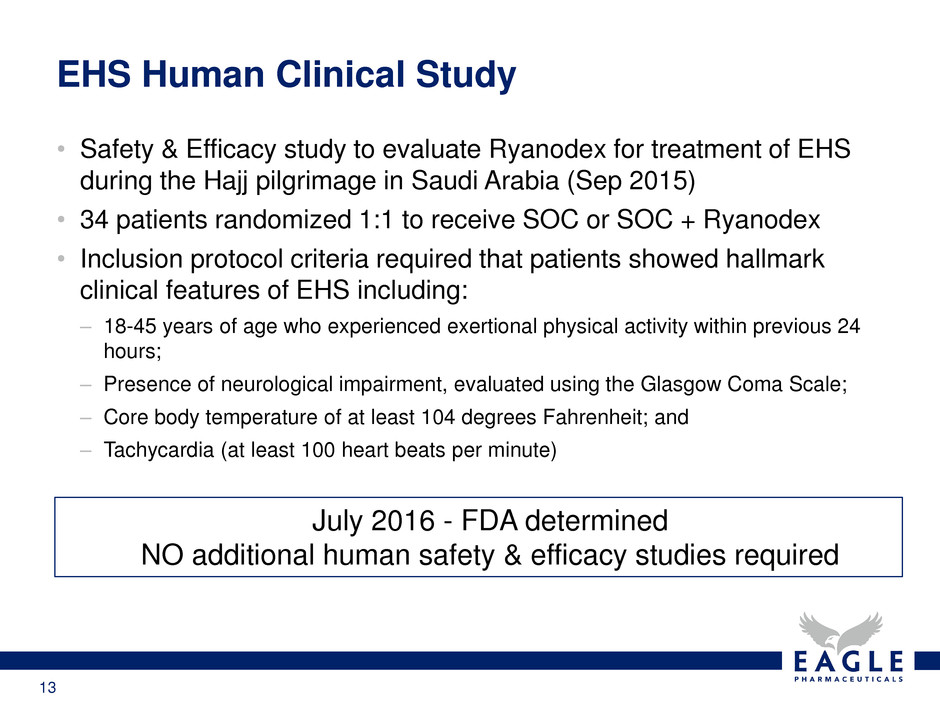

• Safety & Efficacy study to evaluate Ryanodex for treatment of EHS

during the Hajj pilgrimage in Saudi Arabia (Sep 2015)

• 34 patients randomized 1:1 to receive SOC or SOC + Ryanodex

• Inclusion protocol criteria required that patients showed hallmark

clinical features of EHS including:

– 18-45 years of age who experienced exertional physical activity within previous 24

hours;

– Presence of neurological impairment, evaluated using the Glasgow Coma Scale;

– Core body temperature of at least 104 degrees Fahrenheit; and

– Tachycardia (at least 100 heart beats per minute)

EHS Human Clinical Study

July 2016 - FDA determined

NO additional human safety & efficacy studies required

14

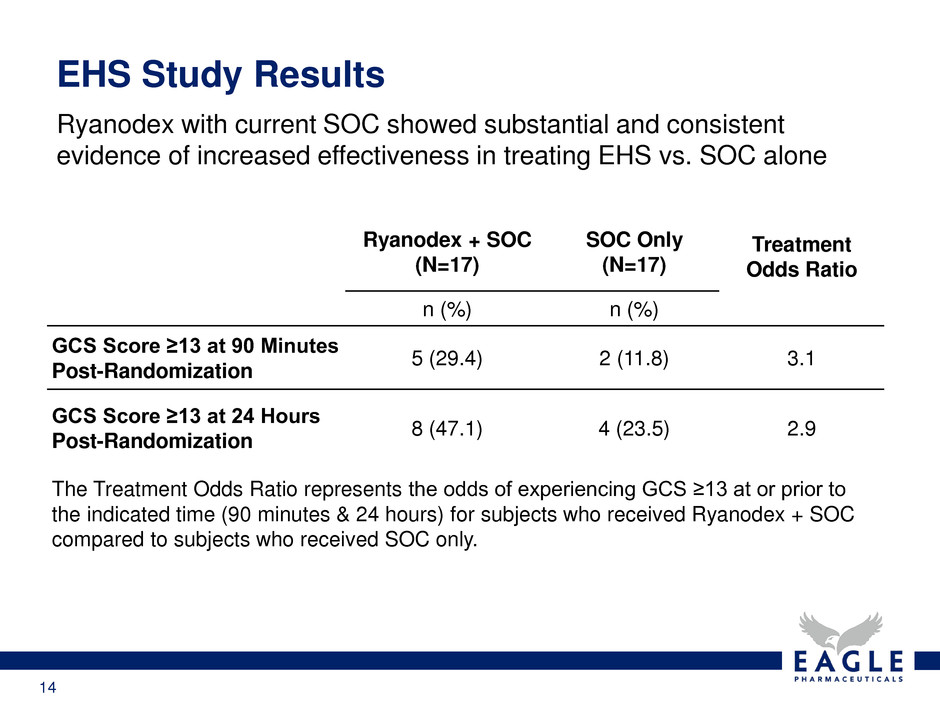

Ryanodex with current SOC showed substantial and consistent

evidence of increased effectiveness in treating EHS vs. SOC alone

EHS Study Results

Ryanodex + SOC

(N=17)

SOC Only

(N=17)

Treatment

Odds Ratio

n (%) n (%)

GCS Score ≥13 at 90 Minutes

Post-Randomization

5 (29.4) 2 (11.8) 3.1

GCS Score ≥13 at 24 Hours

Post-Randomization

8 (47.1) 4 (23.5) 2.9

The Treatment Odds Ratio represents the odds of experiencing GCS ≥13 at or prior to

the indicated time (90 minutes & 24 hours) for subjects who received Ryanodex + SOC

compared to subjects who received SOC only.

15

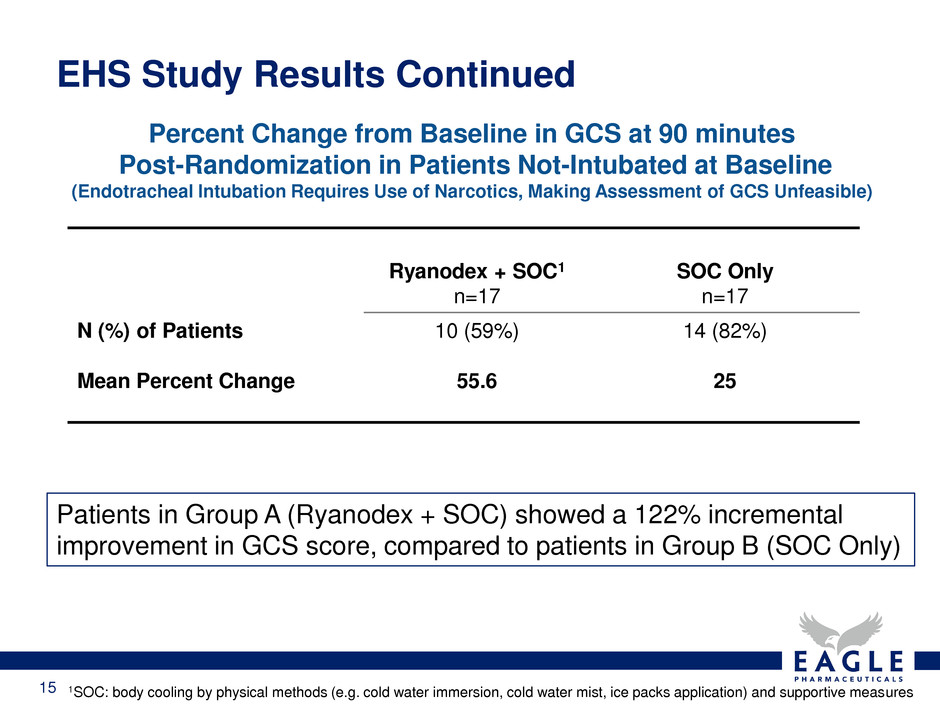

Ryanodex + SOC1

n=17

SOC Only

n=17

N (%) of Patients

Mean Percent Change

10 (59%)

55.6

14 (82%)

25

Percent Change from Baseline in GCS at 90 minutes

Post-Randomization in Patients Not-Intubated at Baseline

(Endotracheal Intubation Requires Use of Narcotics, Making Assessment of GCS Unfeasible)

Patients in Group A (Ryanodex + SOC) showed a 122% incremental

improvement in GCS score, compared to patients in Group B (SOC Only)

1SOC: body cooling by physical methods (e.g. cold water immersion, cold water mist, ice packs application) and supportive measures

EHS Study Results Continued

16

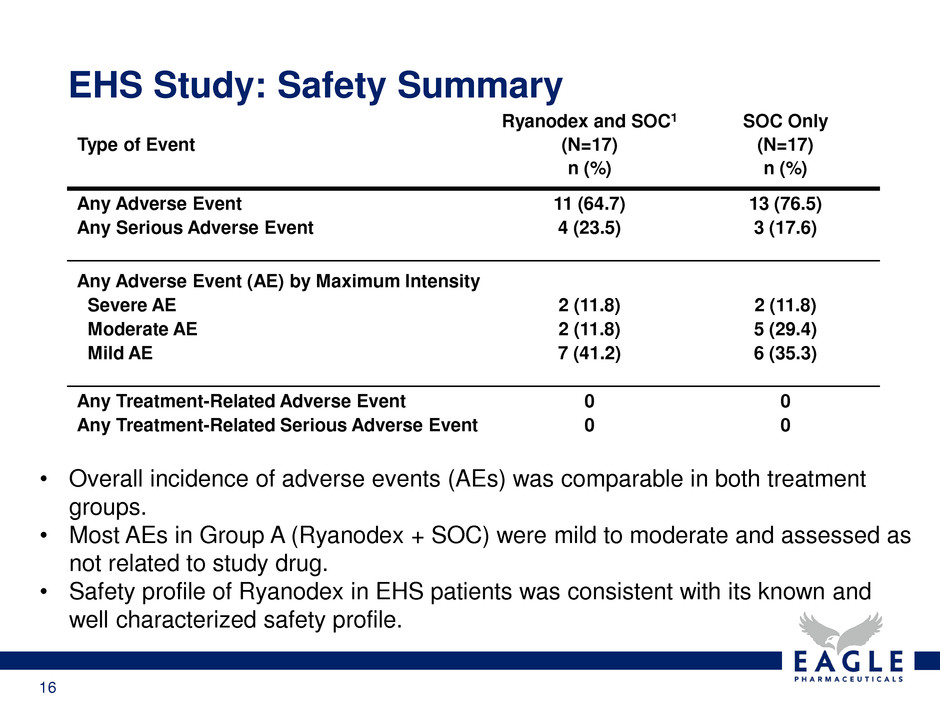

EHS Study: Safety Summary

• Overall incidence of adverse events (AEs) was comparable in both treatment

groups.

• Most AEs in Group A (Ryanodex + SOC) were mild to moderate and assessed as

not related to study drug.

• Safety profile of Ryanodex in EHS patients was consistent with its known and

well characterized safety profile.

Type of Event

Ryanodex and SOC1

(N=17)

n (%)

SOC Only

(N=17)

n (%)

Any Adverse Event 11 (64.7) 13 (76.5)

Any Serious Adverse Event 4 (23.5) 3 (17.6)

Any Adverse Event (AE) by Maximum Intensity

Severe AE 2 (11.8) 2 (11.8)

Moderate AE 2 (11.8) 5 (29.4)

Mild AE 7 (41.2) 6 (35.3)

Any Treatment-Related Adverse Event 0 0

Any Treatment-Related Serious Adverse Event 0 0

17

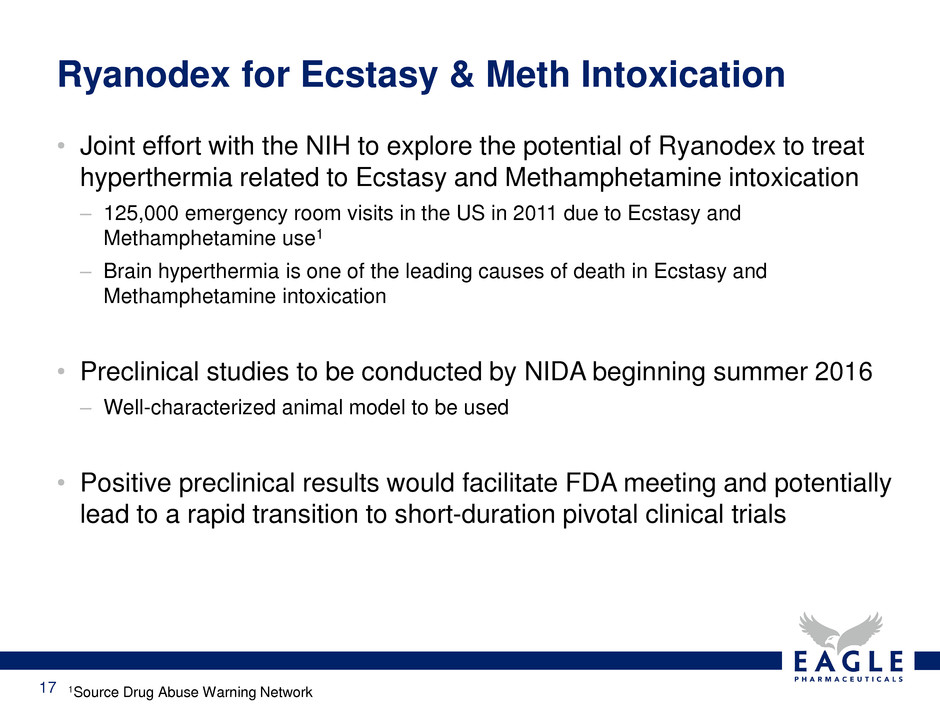

• Joint effort with the NIH to explore the potential of Ryanodex to treat

hyperthermia related to Ecstasy and Methamphetamine intoxication

– 125,000 emergency room visits in the US in 2011 due to Ecstasy and

Methamphetamine use1

– Brain hyperthermia is one of the leading causes of death in Ecstasy and

Methamphetamine intoxication

• Preclinical studies to be conducted by NIDA beginning summer 2016

– Well-characterized animal model to be used

• Positive preclinical results would facilitate FDA meeting and potentially

lead to a rapid transition to short-duration pivotal clinical trials

Ryanodex for Ecstasy & Meth Intoxication

1Source Drug Abuse Warning Network

18

• Lilly’s Alimta patent infringement lawsuit win should prevent current

ANDA filers from launching until May 24, 2022

• Eagle plans to file Pemetrexed RTU NDA in late 2016

• Registration batches have been produced

• We believe our patent position may enable us to bring the product to

market as early as Q4 2017

• 30 month stay to expire 1st half of 2019

• $1.1B market opportunity1

Pemetrexed

1 Alimta® (pemetrexed) (Eli Lilly & Co.). Source: Eli Lilly & Co. Q2 2016 earnings for MAT 12 mos ending 6/30/13: (U.S. sales)

19

RTU Bivalirudin Opportunity

• Complete Response Letter received March 2016

• In discussions with FDA regarding human study

1 Angiomax® (bivalirudin) / Angiox® (bivalirudin) (The Medicines Company)

20

Building Pipeline for Long Term Growth

• Ryanodex for the treatment of Ecstasy and Methamphetamine

intoxication

• AMRI Development Program

• Joint development program for several new product candidates

• AMRI to provide drug development and manufacturing once approved

by the FDA

• Eagle responsible clinical trials, regulatory submissions, and

commercial distribution in the U.S.

• New NDA under development targeted to reduce number of

injections of $400M branded product in a growing market

• Undisclosed next project

21

Strategic Cash Deployment

• $127.6 million in cash and receivables as of June 30, 2016

• Focused on prudent deployment of cash on behalf of shareholders

• Ryanodex royalty

• Reduced royalty obligation from 15% to 3%

• $15 million in cash

• Share repurchase

• Board authorized $75 million share buyback program

• Completed over time at market price

22

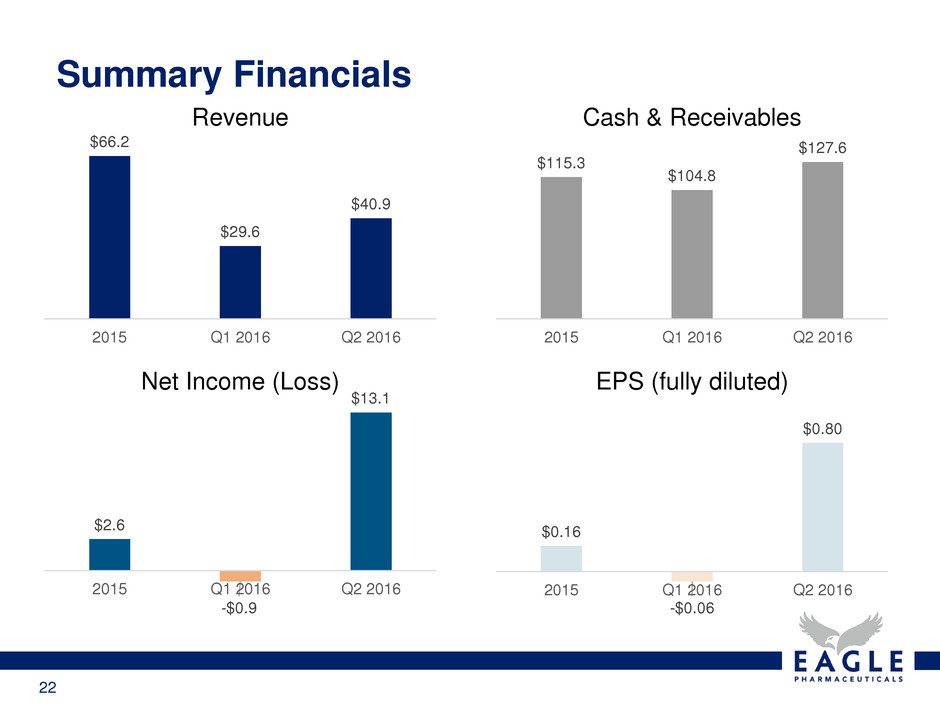

$66.2

$29.6

$40.9

2015 Q1 2016 Q2 2016

Revenue

Summary Financials

$115.3

$104.8

$127.6

2015 Q1 2016 Q2 2016

Cash & Receivables

$2.6

-$0.9

$13.1

2015 Q1 2016 Q2 2016

Net Income (Loss)

$0.16

-$0.06

$0.80

2015 Q1 2016 Q2 2016

EPS (fully diluted)

23

Why Eagle? Why Now?

• Fully commercial specialty pharmaceutical company with 5 in-market products

• Bendeka expected to deliver steady royalty stream driving near term profitability

• 80% market share (and growing) of $750mm market

• 20% royalty (~$125-$150mm+ annually) through 2019

• Next big product: Ryanodex

• Selling in niche market to treat malignant hyperthermia

• Large market opportunity in treating Exertional Heat Stroke

• Expect to file NDA shortly

• Potential to treat brain hyperthermia in ecstasy and methamphetamine intoxication

• 125K ER cases annually in the US

• Exciting additional pipeline programs

• Profitable, growing cash position, no debt

• Confident in future

• Purchased Ryanodex royalty obligation

• Authorized $75mm stock buyback