Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Thompson Creek Metals Co Inc. | pressreleaseq22016.htm |

| 8-K - 8-K - Thompson Creek Metals Co Inc. | a8-kq22016.htm |

Second Quarter 2016 Financial Results

Investor Conference Call

August 9, 2016

TSX: TCM OTCQX: TCPTF

2

Webcast Information

Webcast:

This Webcast can be accessed on the Thompson Creek Metals Company website

under the Events Section: www.thompsoncreekmetals.com

Q&A Instructions:

If you would like to ask a question, please press star 1 on your telephone keypad.

If you’re using a speakerphone, please make sure your mute function is turned off

to allow your signal to reach the operator.

3

Cautionary Statement

Certain statements in this release are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and applicable

Canadian securities legislation, and are intended to be covered by the safe harbors provided by these regulations. All statements other than

statements of historical fact set forth or incorporated herein by reference are forward-looking statements. These forward-looking statements

may, in some cases, be identified by the use of terms such as "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "future,"

"opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Our forward-looking

statements may include, without limitation, statements with respect to: future financial or operating performance of the Company or its

subsidiaries and its projects; future liquidity; the proposed arrangement with Centerra Gold Inc., including, but not limited to, the timing,

expectations and risks associated with the proposed arrangement; our ability to access financing arrangements and our ability to refinance or

reduce debt on favorable terms or at all; future inventory, production, sales, payments from customers, cash costs, capital expenditures and

exploration expenditures; future earnings and operating results; expected mining and concentrate grades and recoveries; estimates of mineral

reserves and mineral resources, including estimated mine life and annual production; expectations regarding the optimization of Mount Milligan

Mine and construction of a permanent secondary crushing circuit, including timing and cost of construction and the effects of secondary

crushing; future concentrate shipment dates and shipment sizes; future operating plans and goals, including expected financial and operating

results of the molybdenum business; expected costs, including any severance costs; personnel decisions, including reductions in work force;

future copper, gold, and molybdenum prices; and future foreign exchange rates.

Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to

have a reasonable basis. However, our forward-looking statements are based on current expectations and assumptions that are subject to risks

and uncertainties, which may cause actual results to differ materially from future results expressed, projected or implied by those forward-

looking statements. Important factors that could cause actual results and events to differ from those described in such forward-looking

statements can be found in the section entitled "Risk Factors" in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other

documents filed on EDGAR at www.sec.gov and on SEDAR at www.sedar.com. Although we have attempted to identify those material factors

that could cause actual results or events to differ from those described in such forward-looking statements, there may be other factors, currently

unknown to us or deemed immaterial at the present time that could cause results or events to differ from those anticipated, estimated or

intended. Many of these factors are beyond our ability to control or predict. Given these uncertainties, the reader is cautioned not to place undue

reliance on our forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as

a result of new information, future events or otherwise.

4

Overview

Jacques Perron

President and Chief Executive Officer

5

Improving Safety Performance

Company All Incident Recordable Rate (AIRR)1

1

Includes Lost Time and Reportable Incidents.

2.60

2.25

1.40

2.48 2.46

0.67

1.71

0.00

1.00

2.00

3.00

4.00

5.00

6.00

7.00

2010 2011 2012 2013 2014 2015 YTD 2016

Thompson Creek Metals Company U.S. Metals Manufacturing AIRR Average

Surface Metals Mining U.S. AIRR Average Mining Association British Columbia AIRR Average

6

Q216 Achievements

Ended the quarter with ~ $130 million of working capital, including ~ $120 million

of cash

Molybdenum business generated net cash flow of ~ $3 million

Payable production

Copper ~ 15 million pounds

Gold ~ 46,000 ounces

Achieved unit cash cost of $0.37

1

per pound of copper produced on a by-

product basis net of gold credits, a decrease of 23% from Q215

Completed four copper and gold concentrate shipments

Construction of the Mount Milligan permanent secondary crushing circuit

proceeded as planned and remained on schedule

1 Please refer to Appendix for non-GAAP reconciliation.

7

Financial Review

Pam Saxton

Executive Vice President and Chief Financial Officer

8

Selected Financial Results

24

41

49

68

$0

$10

$20

$30

$40

$50

$60

$70

Q216 Q115 H116 H115

Non-GAAP EBITDA

129 134

226

257

$0

$50

$100

$150

$200

$250

$300

Q216 Q215 H116 H115

Revenue

[millions US$, except per share data]

1 Please refer to Appendix for GAAP net income and reconciliation.

(4)

12

4

17

-$6

-$1

$4

$9

$14

$19

Q216 Q215 H116 H115

Operating (loss) Income

6

24

(9)

19

-$15

-$5

$5

$15

$25

Q216 Q215 H116 H115

Operating Cash Flow (Drain)

(27)

(14)

(46)

(28)

-$60

-$50

-$40

-$30

-$20

-$10

$0

$10

$20

Q216 Q215 H116 H115

Non-GAAP Adjusted Net Loss1

(28)

0.3

7

(87)

-$100

-$80

-$60

-$40

-$20

$0

$20

$40

Q216 Q215 H116 H115

Net (loss) Income

9

Three Months Ended

6/30/16 6/30/15

Six Months Ended

6/30/16 6/30/15

Cash Generated (Used) from Operations 6.3

23.9

(9.4)

18.6

Cash (Used) in Investing Activities (19.3) (9.9) (35.2) (16.7)

Cash (Used) in Financing Activities (6.5) (41.1) (12.7) (55.4)

Effect of Exchange Rate Changes on Cash 0.1 -- 0.2 (1.0)

Decrease in Cash and Cash Equivalents (19.4) (27.1) (57.1) (54.5)

Cash and Cash Equivalents, beginning of period 139.1 238.2 176.8 265.6

Cash and Cash Equivalents, end of period 119.7 211.1 119.7 211.1

Summary of Statement of Cash Flows

[US$ in millions]

10

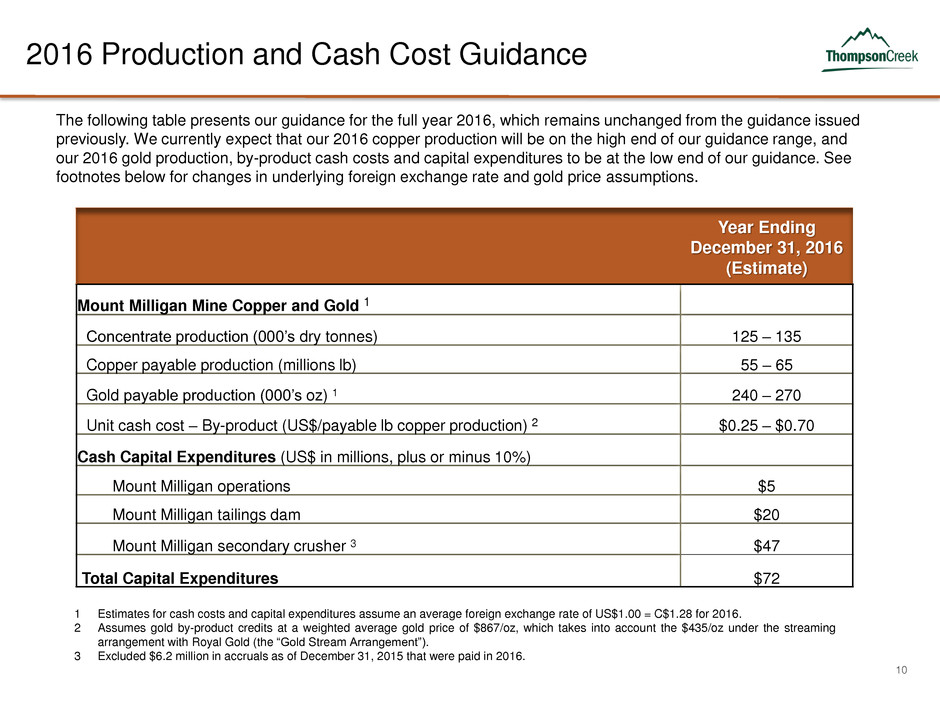

2016 Production and Cash Cost Guidance

Year Ending

December 31, 2016

(Estimate)

Mount Milligan Mine Copper and Gold 1

Concentrate production (000’s dry tonnes) 125 – 135

Copper payable production (millions lb) 55 – 65

Gold payable production (000’s oz) 1 240 – 270

Unit cash cost – By-product (US$/payable lb copper production) 2 $0.25 – $0.70

Cash Capital Expenditures (US$ in millions, plus or minus 10%)

Mount Milligan operations $5

Mount Milligan tailings dam $20

Mount Milligan secondary crusher 3 $47

Total Capital Expenditures $72

1 Estimates for cash costs and capital expenditures assume an average foreign exchange rate of US$1.00 = C$1.28 for 2016.

2 Assumes gold by-product credits at a weighted average gold price of $867/oz, which takes into account the $435/oz under the streaming

arrangement with Royal Gold (the “Gold Stream Arrangement”).

3 Excluded $6.2 million in accruals as of December 31, 2015 that were paid in 2016.

The following table presents our guidance for the full year 2016, which remains unchanged from the guidance issued

previously. We currently expect that our 2016 copper production will be on the high end of our guidance range, and

our 2016 gold production, by-product cash costs and capital expenditures to be at the low end of our guidance. See

footnotes below for changes in underlying foreign exchange rate and gold price assumptions.

11

Sales Summary,

Operations Review and

Key Messages

Jacques Perron

President and Chief Executive Officer

12

35.3 36.0

H116 H115

Copper (Cu) Sales

1 Please refer to Appendix for non-GAAP reconciliation.

20.3 21.2

Q216 Q215

Cu Sales

(millions lbs)

Average Realized Sales Price1

(US$/lb)

Cu Sales

(millions lbs)

Average Realized Sales Price1

(US$/lb)

$37.6

$49.3

Q216 Q215

$65.7

$81.5

H116 H115

$2.16

$2.56

H116 H115

Cu Revenue

(millions US$)

Cu Revenue

(millions US$)

$2.15

$2.63

Q216 Q215

Three Months Ended June 30 Six Months Ended June 30

13

$92.3

H116 H115

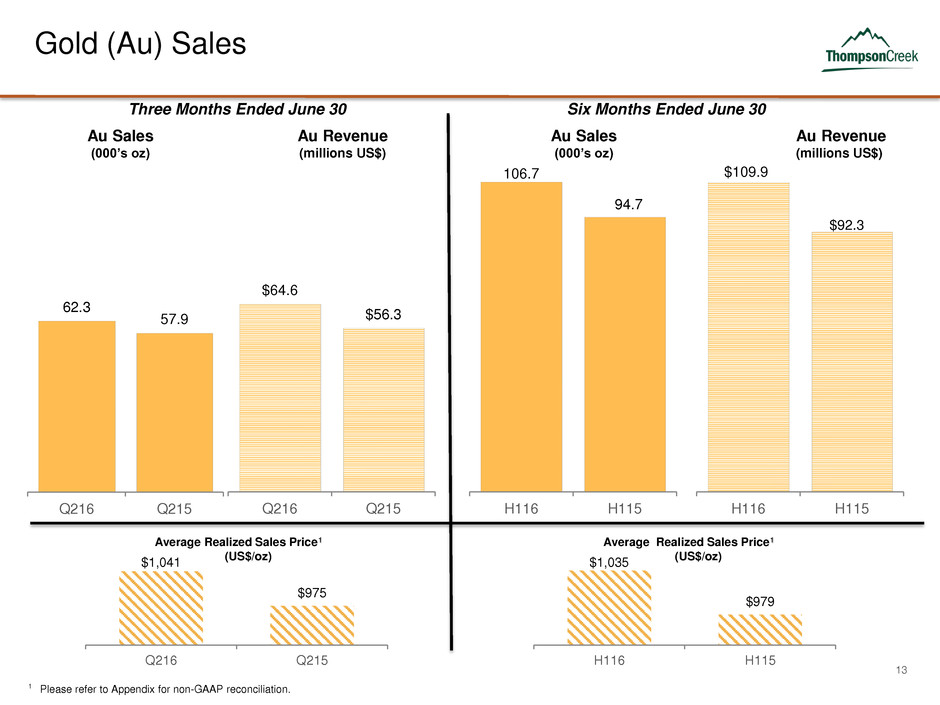

Gold (Au) Sales

1 Please refer to Appendix for non-GAAP reconciliation.

62.3

57.9

Q216 Q215

Au Sales

(000’s oz)

Average Realized Sales Price1

(US$/oz)

Au Sales

(000’s oz)

Average Realized Sales Price1

(US$/oz)

$64.6

$56.3

Q216 Q215

$1,035

$979

H116 H115

Au Revenue

(millions US$)

Au Revenue

(millions US$)

$1,041

$975

Q216 Q215

Three Months Ended June 30 Six Months Ended June 30

106.7

94.7

H116 H115

$109.9

14

Molybdenum Sales

Total Sales

Tolling, Calcining and Other

$22.3 $20.9

$41.9

$63.7

$4.2

$7.6 $8.6

$19.6

Q216 Q215 H116 H115

3.0

2.3

6.1

6.5

Q216 Q215 H116 H115

Avg Realized

Mo Price/Lb.

$6.92 $9.73

Mo Sales Volumes

[US$ in millions] [millions of pounds]

$7.38 $9.23

1

2

1 Roasted Molybdenum concentrate sourced from third parties

2 Includes inventory produced from our mines during 2014, in addition to third party sourced production.

1

2

15

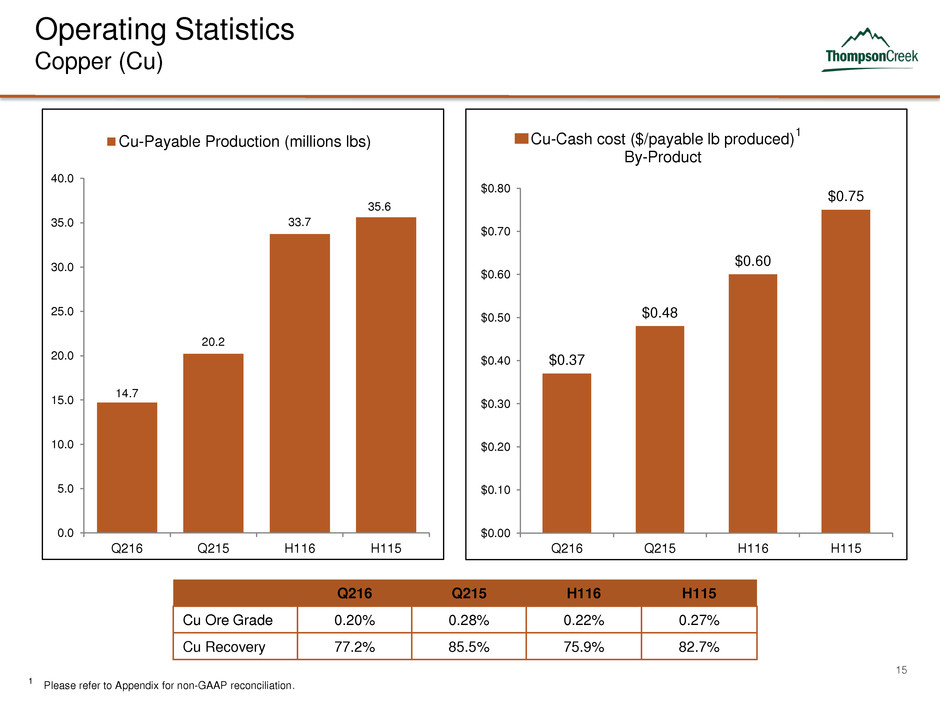

Operating Statistics

Copper (Cu)

1 Please refer to Appendix for non-GAAP reconciliation.

14.7

20.2

33.7

35.6

0.0

5.0

10.0

15.0

20.0

25.0

30.0

35.0

40.0

Q216 Q215 H116 H115

Cu-Payable Production (millions lbs)

$0.37

$0.48

$0.60

$0.75

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

Q216 Q215 H116 H115

Cu-Cash cost ($/payable lb produced)

By-Product

1

Q216 Q215 H116 H115

Cu Ore Grade 0.20% 0.28% 0.22% 0.27%

Cu Recovery 77.2% 85.5% 75.9% 82.7%

16

Operating Statistics

Gold (Au)

1 Please refer to Appendix for non-GAAP reconciliation.

46.4

59.9

99.7

106.0

0.0

20.0

40.0

60.0

80.0

100.0

Q216 Q215 H116 H115

Au-Payable Production (000's oz)

$728

$434

$618

$462

-$50

$50

$150

$250

$350

$450

$550

$650

$750

Q216 Q215 H116 H115

Au-Cash cost ($/payable oz produced)

Co-Product

1

Q216 Q215 H116 H115

Au Ore Grade (g/tonne) 0.54 0.65 0.55 0.64

Au Recovery 60.4% 72.7% 59.8% 70.0%

17

Key Messages

Continuous optimization of Mount Milligan Mine

Permanent secondary crushing circuit

• Construction and commissioning expected to be completed by year-end 2016

• Total capex expected to be less than $60 million, inclusive of ~ $22 million

incurred during the first half of 2016 and ~ $15 million incurred in 2015

• Q316 scheduled shutdown equivalent to 8 production days for tie in of the new

conveyor

• Once completed and commissioned, average daily mill throughput is expected

to increase to 62,500 tpd and above

Continuous enhancements to Mount Milligan mill to better process increased

throughput and to achieve increases in recoveries

Molybdenum business is expected to generate sufficient revenue in 2016 to

substantially cover care and maintenance costs and maintain option value of assets

Previously announced transaction with Centerra Gold is expected to close in the

second half of 2016

18

Thompson Creek and Centerra

Proposed Transaction

Jacques Perron

President and Chief Executive Officer

19

Transaction

Summary

Total transaction value of ~US$1.1 Billion:

• Purchase of TCM shares outstanding ~US$140MM(1)

• Redemption of TCM bonds at the call price plus accrued and unpaid interest (US$889MM)(2)

• Assumption of TCM capital leases (US$40MM) as of June 30, 2016

Result of Robust

Process

• Extensive process conducted by the Company and its advisors to evaluate all available alternatives to address its high debt level

amid a challenging commodity price environment

• Parallel process was run evaluating restructuring / refinancing and M&A alternatives

• Extensive strategic review process whereby over 100 qualified strategic and financial parties were invited to participate

Consideration

• Each existing TCM share outstanding at closing will be exchanged for 0.0988 Centerra shares pursuant to a plan of arrangement

providing TCM shareholders with an approximate 8% interest in Centerra

• The Exchange Ratio implies a premium of 33% to Thompson Creek common shares based on each company’s 20-day volume

weighted average price on the TSX for the period ending July 4, 2016

• In connection with the closing of arrangement, the Company’s 9.75% secured notes due 2017, 7.375% unsecured notes due 2018,

and 12.5% unsecured notes due 2019 will be redeemed for cash in accordance with the indenture terms

Financing

Redemption of

TCM Notes

The redemption of TCM’s notes will be financed by Centerra with a combination of:

• Equity Offering: Net proceeds from a C$195MM bought deal subscription receipt financing by Centerra

• New Credit Facilities: US$300MM drawdown of the new US$325MM credit facility provided by Scotiabank to Centerra(3)

• Use of Cash on Hand: Balance of approximately US$435MM will be financed by cash on hand at Thompson Creek and Centerra

Conditions

• Thompson Creek shareholder approval (66⅔% of votes cast)

• Customary regulatory and court approvals

Governance

• Centerra’s leadership will lead the combined company

• Appointment of one current member of the TCM board of directors to the Centerra board

Other • Customary non-solicitation covenants and a termination fee is payable in customary circumstances

Closing • Expected to close in the second half of 2016

1. Calculated based on the closing price of Centerra’s shares on the TSX as of July 4, 2016

2. Assumes redemption date of September 30, 2016

3. Pursuant to a commitment letter from Scotiabank dated June 13, 2016 and subject to the terms and conditions contained therein

Transaction Summary

20

Mount Milligan and Kumtor: Two Flagship Gold Assets

Mount Milligan

2016E

Guidance

Gold Production (koz) 240-270

Copper Production (Mlbs) 55-65

Remaining Reserve Life (years) (1) 22 years

Gold Copper

P&P Reserves (1) 5.69Moz 2,185Mlbs

Grade 0.349g/t 0.196%

Proposed Amended Royal Gold

Stream (4)

35% @

US$435/oz

18.75% @ 15%

of spot Cu price

Source: Centerra’s public filings on SEDAR, including the Kumtor Mine NI 43-101 Technical Report (March 20, 2015); and TCM’s public filings on SEDAR and EDGAR, including its

Form 10-K for the year ended December 31, 2015.

1. See Note i on slide 24.

2. See Note ii on slide 24.

3. See Note iii on slide 24.

4. Source: Centerra’s public filings on SEDAR.

Kumtor

2015

2016E

Guidance

Gold Production (koz) 521 500-530

Adjusted Operating Costs (US$/oz) (2) $326 $369-$391

Growth Capital (US$MM) (2) $14 $33

Projected Asset Life (years) +10

P&P Reserves (Moz) (3) 5.6

Au Grade (g/t) 2.5

M&I Resource (Moz) (3) 2.6

Au Grade (g/t) 2.7

22 years of production from existing P&P reserves (1)

5.7 million gold reserve ounces (1)

Low cost, long life production

Stable, mining-friendly jurisdiction

Restructured stream to provide additional gold upside

+19 years of uninterrupted profitable production

Over 10M ounces produced since 1997

5.6M ounces remaining in P&P reserves (3)

Low cost, long life production

High-grade underground opportunity

21

Closing Remarks

Jacques Perron

President and Chief Executive Officer

22

OTCQX: TCPTF TSX:TCM

Thompson Creek Metals Company

www.thompsoncreekmetals.com

Pamela Solly

Director, Investor Relations

and Corporate Responsibility

Phone (303) 762-3526

Email psolly@tcrk.com

23

Appendix

24

(i) The mineral reserve estimates for Mount Milligan Mine are as of December 31, 2015 and were prepared by Robert Clifford, Thompson Creek’s Director of Mine

Engineering, who is a Qualified Person under NI 43-101. The mineral reserve estimates were prepared using an ultimate open pit design optimized at spot metal prices

of $2.95/lb copper, $1,250/oz gold, an exchange rate of US$1.00/C$1.10, a cut-off grade of 0.176% copper equivalent and takes into consideration metallurgical

recoveries, concentrate grades, transportation costs, smelter treatment charges and royalty and streaming arrangements in determining economic viability. The mineral

reserve estimates are based on the cost assumptions included in the NI 43-101 technical report entitled "NI 43-101 Technical Report-Mount Milligan Mine-Northern

Central British Columbia" dated January 21, 2015 and filed on SEDAR on January 21, 2015. Mill recoveries vary by rock type and region but average 85.0% copper and

71.5% gold. Anticipated losses resulting from beneficiation average approximately 4.5% copper and 2.5% gold.

(ii) Adjusted operating costs, all-in costs and all-in costs - including taxes as well as sustaining capital, growth capital, average realized gold price per ounce and cost of

sales per ounce sold are non-GAAP measures and are discussed under “Non-GAAP Measures” in the Company’s annual MD&A filed on SEDAR.

(iii) The mineral reserves at Kumtor have been estimated based on a gold price of US$1,200 per ounce, as at December 31, 2015. The open pit reserves and resources

at Kumtor are estimated based on a cut-off grade of 0.85 grams of gold per tonne for the Central Pit and 1.0 grams of gold per tonne for the Southwest and Sarytor

deposits. Open Pit resources at Kumtor are constrained by a pit shell developed using a gold price of US$1,450 per ounce. Mineral resources are in addition to reserves.

Mineral resources do not have demonstrated economic viability. Further information including key assumptions, parameters and methods used to estimate mineral

resources and reserves, as well as legal, political, environmental and other risks are described in Centerra’s 2015 Annual Information Form dated March 31, 2016 filed

on SEDAR.

Notes to mineral properties slides

Notes Regarding Mineral Properties

25

Non-GAAP EBITDA Reconciliation Last Twelve Months

1 Includes gain (loss) from debt extinguishment

2 Certain prior year reclassifications were made to DD&A to conform with current year presentation.

(US$ in millions)

Three Months

Ended

June 30, 2016

Three Months

Ended

June 30, 2015

Six Months

Ended

June 30, 2015

Six Months

Ended

June 30, 2015

Net income (loss) (27.9) 0.3 7.2 (86.9)

(Interest income)/expense, net 20.4 25.4 41.4 47.6

Tax expense (benefit) 0.6 5.1 8.1 (11.6)

DD&A 1 29.1 26.8 48.9 46.8

Accretion 0.6 0.6 1.2 1.2

(Gain) loss on foreign exchange 1.4 (16.9) (58.0) 71.3

Non-GAAP EBITDA 24.2 41.3 48.8 68.4

Non-GAAP EBITDA

26

Non-GAAP Reconciliation

Adjusted Net Income (Loss)

(US$ in millions, except per share amounts)

Three Months Ended June 30, Six Months Ended June 30,

2016 2015 2016 2015

Net (loss) income $ (27.9 ) $ 0.3 $ 7.2 $ (86.9 )

Add (Deduct):

Loss (gain) on foreign exchange (1) 1.4 (17.2 ) (59.2 ) 72.6

Tax (benefit) expense on foreign exchange (gain) loss (0.4 ) 3.4 5.8 (13.4 )

Non-GAAP adjusted net loss $ (26.9 ) $ (13.5 ) $ (46.2 ) $ (27.7 )

Net (loss) income per share

Basic $ (0.13 ) $ 0.00 $ 0.03 $ (0.40 )

Diluted $ (0.13 ) $ 0.00 $ 0.03 $ (0.40 )

Adjusted net (loss) income per share

Basic $ (0.13 ) $ (0.06 ) $ (0.21 ) $ (0.13 )

Diluted $ (0.13 ) $ (0.06 ) $ (0.21 ) $ (0.13 )

Weighted-average shares

Basic 221.7 218.0 222.4 216.2

Diluted 221.7 218.0 222.4 216.2

(1) Included a foreign exchange gain of nil and $1.2 million presented in income and mining tax expense (benefit) on the Condensed Consolidated

Statements of Operations for the three and six months ended June 30, 2016, respectively. Included a foreign exchange gain of $0.3 million and a

foreign exchange loss of $1.3 million presented in income and mining tax expense (benefit) on the Condensed Consolidated Statements of Operations

for the three and six months ended June 30, 2015, respectively.

Non-GAAP Reconciliation

27

Non-GAAP Reconciliation

Copper-Gold Operations Non-GAAP Cash Cost

(US$ in millions)

(1) Mining, milling and on-site general and administration costs. Mining includes all stripping costs but excludes costs capitalized related to the construction of

the tailings dam. Stripping costs that provide access to mineral reserves that will be produced in future periods are expensed as incurred under US GAAP.

(2) Silver sales are reflected as a credit to operating costs.

Three Months Ended Six Months Ended

Reconciliation to amounts reported below (US$ in millions) Jun 30 2016 Jun 30 2015 Jun 30 2016 Jun 30 2015

Copper-Gold segment US GAAP operating expenses $ 61.9 $ 49.6 $ 97.9 $ 83.4

Adjustments:

Direct costs $ 8.6 $ 8.4 $ 15.0 $ 14.9

Changes in inventory (11.8 ) (1.8 ) (0.3 ) 5.2

Silver by-product credits (2) 1.7 1.2 2.7 2.4

Non cash costs and other 0.4 (0.2 ) 0.2 (0.4 )

Non-GAAP cash costs $ 60.8 $ 57.2 $ 115.5 $ 105.5

Three Months Ended Six Months Ended

Non-GAAP cash costs (US$ in millions) Jun 30 2016 Jun 30 2015 Jun 30 2016 Jun 30 2015

Direct mining costs (1) $ 48.1 $ 45.0 $ 92.9 $ 82.4

Truck and rail transportation and warehousing costs 4.1 3.8 7.6 8.2

Costs reflected in inventory and operations costs $ 52.2 $ 48.8 $ 100.5 $ 90.6

Refining and treatment costs 6.4 6.6 11.0 11.1

Ocean freight and insurance costs 2.2 1.8 4.0 3.8

Direct costs reflected in revenue and selling and marketing costs $ 8.6 $ 8.4 $ 15.0 $ 14.9

Non-GAAP cash costs $ 60.8 $ 57.2 $ 115.5 $ 105.5

28

By-Product

(US$ in millions, except pounds and per pound amounts)

Non-GAAP Reconciliation Copper-Gold

Operations By-Product Unit Cost Per Pound Produced

Three Months Ended Six Months Ended

June 30,

2016

June 30,

2015

June 30,

2016

June 30,

2015

Copper payable production (000's lbs) 14,687

20,159

33,749

35,564

Non-GAAP cash cost $ 60.8

$ 57.2

$ 115.5

$ 105.5

Less by-product credits

Gold sales (1) 64.9

$ 56.5

110.4

$ 92.7

Gold sales related to deferred portion of Gold Stream Arrangement (2) (11.4 ) (10.0 ) (18.0 ) (16.4 )

Net gold by-product credits $ 53.5

$ 46.5

$ 92.4

$ 76.3

Silver by-product credits (3) 1.7

1.3

2.7

2.5

Total by-product credits $ 55.2

$ 47.8

$ 95.1

$ 78.8

Non-GAAP cash cost net of by-product credits $ 5.6

$ 9.4

$ 20.4

$ 26.7

Non-GAAP cash cost per pound, on a by-product basis $ 0.37

$ 0.48

$ 0.60

$ 0.75

(1) Excluded refining and treatment charges.

(2) The three and six months ended June 30, 2016 included a $1.5 million reduction related to five provisional invoices from 2015. The decrease resulted from

a downward revision to the rate at which the deferred revenue liability resulting from the Gold Stream Arrangement was amortized. This rate is calculated

based on the remaining deferred revenue liability and total ounces of refined gold owed to Royal Gold.

(3) Silver sales are reflected as a credit to operating costs.

29

Co- Product

(US$ in millions, except pounds, ounces and per unit amounts)

Non-GAAP Reconciliation

Copper-Gold Operations Co-Product Costs

Three Months Ended Six Months Ended

June 30,

2016

June 30,

2015

June 30,

2016

June 30,

2015

Copper payable production (000’s lbs) 14,687

20,159

33,749

35,564

Gold payable production in Cu eq. (000’s lbs) (1) 17,880

17,317

37,818

31,399

Payable production (000’s lbs) 32,567

37,476

71,567

66,963

Non-GAAP cash cost allocated to Copper 27.0

$ 30.8

53.8

$ 56.0

Non-GAAP cash cost per pound, on a co-product basis 1.84

$ 1.55

1.59

$ 1.59

Non-GAAP cash cost allocated to Gold $ 33.8

$ 26.4

$ 61.7

$ 49.5

Gold payable production (ounces) 46,383

59,917

99,712

106,036

Non-GAAP cash cost per ounce, on a co-product basis $ 728

$ 434

$ 618

$ 462

(1) Gold has been converted from payable ounces to thousands of copper equivalent pounds by using the gold production for the periods presented,

using a gold price of $824 and $795 per ounce for the three months ended June 30, 2016 and June 30, 2015, respectively, (adjusted for the Royal

Gold price of $435 per ounce) and a copper price of $2.14 and $2.75 per pound for the three months ended June 30, 2016 and June 30, 2015,

respectively.

30

Non-GAAP Reconciliation

Copper-Gold Operations Average Realized Sales Prices

(US$ in millions, except pounds, ounces and per unit amounts)

Three Months Ended Six Months Ended

Average Realized Sale Price for Copper June 30, 2016 June 30, 2015 June 30, 2016 June 30, 2015

Copper sales reconciliation ($)

Copper sales, excluding adjustments $ 43.9 $ 58.4 $ 76.0 $ 96.7

Final pricing adjustments 0.5 1.6 (1.9 ) (5.7 )

Mark-to-market adjustments (0.7 ) (4.3 ) 2.1 1.2

Copper sales, net of adjustments 43.7 55.7 76.2 92.2

Less Refining and treatment costs 6.1 6.4 10.5 10.7

Copper sales $ 37.6 $ 49.3 $ 65.7 $ 81.5

Pounds of Copper sold (000's lb) 20,309 21,195 35,271 35,986

Average realized sales price for Copper on a per pound basis

Copper sales excluding adjustments $ 2.16 $ 2.76 $ 2.15 $ 2.69

Final pricing adjustments 0.02 0.08 $ (0.05 ) $ (0.16 )

Mark-to-market adjustments (0.03 ) (0.21 ) $ 0.06 $ 0.03

Average realized Copper sales price per pound sold $ 2.15 $ 2.63 $ 2.16 $ 2.56

Average Realized Sales Price

31

Non-GAAP Reconciliation (continued)

Copper-Gold Operations Average Realized Sales Prices

(US$ in millions, except pounds, ounces and per unit amounts)

(1) The six months ended June 30, 2016 reflect a $1.5 million reduction related to five provisional invoices from 2015. The decrease resulted from a downward

revision of $27/oz. to the rate at which the deferred revenue liability resulting from the Gold Stream Arrangement was amortized. This rate is calculated based

on the remaining deferred revenue liability and total ounces of refined gold owed to Royal Gold.

Three Months Ended June 30, Six Months Ended June 30,

Average Realized Sales Price for Gold 2016 2015 2016 2015

Gold sales reconciliation ($)

Gold sales related to cash portion of Gold Stream Arrangement $ 14.1 $ 13.1 $ 24.1 $ 21.4

Gold sales related to deferred portion of Gold Stream Arrangement(1) 11.4 10.0 18.0 16.4

Gold sales under Gold Stream Arrangement 25.5 23.1 42.1 37.8

TCM share of gold sales to MTM Customers 38.1

34.0

64.3

55.2

Final pricing adjustments 0.8 (1.1 ) 1.4 (0.4 )

Mark-to-market adjustments 0.5 0.4 2.6 —

Gold sales TCM Share 39.4 33.3 68.3 54.8

Gold sales, net of adjustments 64.9

56.4

110.4

92.6

Less Refining and treatment costs 0.3 0.1 0.5 0.3

Gold sales 64.6 56.3 109.9 92.3

Ounces of gold sold to Royal Gold 32,294

30,070

55,373

49,224

TCM share of ounces of gold sold to MTM customers 30,020 27,850 51,332 45,446

Total ounces of Gold sold 62,314 57,920 106,705 94,670

Average realized sales price for Gold on a per ounce basis

Gold sales related to cash portion of Gold Stream Arrangement $ 435 $ 435 $ 435 $ 435

Gold sales related to deferred portion of Gold Stream Arrangement 351 334 324 334

Average realized sales price per ounce sold to Royal Gold $ 786 $ 769 $ 759 $ 769

TCM share of gold sales to MTM Customers $ 1,269

$ 1,221

1,253

1,215

Final pricing adjustments 27 (39 ) 27 (10 )

Mark-to-market adjustments 19 15 52 —

Average realized sales price per ounce sold for TCM share $ 1,315 $ 1,197 $ 1,332 $ 1,205

Average realized sales price per ounce sold $ 1,041

$ 975

$ 1,035

$ 979