Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PACIFIC SUNWEAR OF CALIFORNIA INC | d224441d8k.htm |

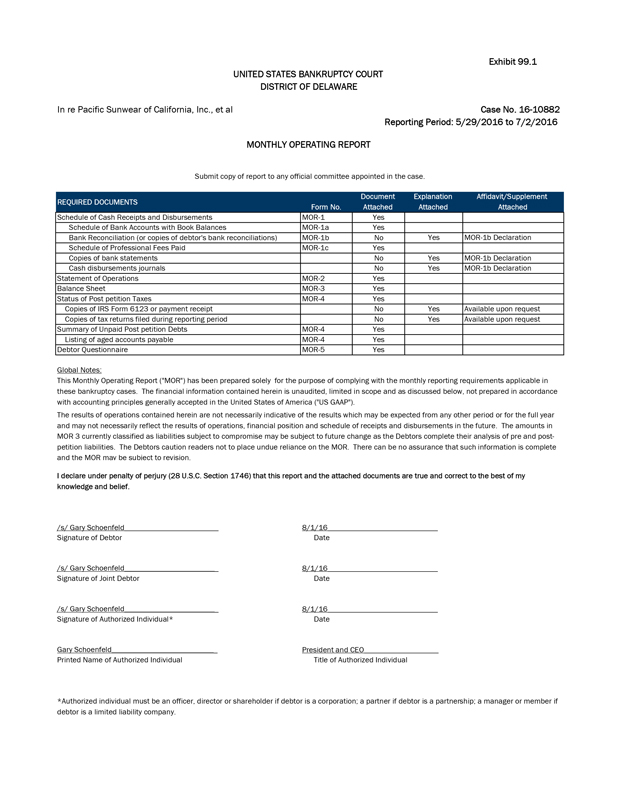

Exhibit 99.1

UNITED STATES BANKRUPTCY COURT

DISTRICT OF DELAWARE

| In re Pacific Sunwear of California, Inc., et al | Case No. 16-10882 | |

| Reporting Period: 5/29/2016 to 7/2/2016 |

MONTHLY OPERATING REPORT

Submit copy

of report to any official committee appointed in the case.

| REQUIRED DOCUMENTS | Form No. |

Document Attached |

Explanation Attached |

Affidavit/Supplement Attached | ||||

| Schedule of Cash Receipts and Disbursements | MOR-1 | Yes | ||||||

| Schedule of Bank Accounts with Book Balances | MOR-1a | Yes | ||||||

| Bank Reconciliation (or copies of debtor’s bank reconciliations) | MOR-1b | No | Yes | MOR-1b Declaration | ||||

| Schedule of Professional Fees Paid | MOR-1c | Yes | ||||||

| Copies of bank statements | No | Yes | MOR-1b Declaration | |||||

| Cash disbursements journals | No | Yes | MOR-1b Declaration | |||||

| Statement of Operations | MOR-2 | Yes | ||||||

| Balance Sheet | MOR-3 | Yes | ||||||

| Status of Post petition Taxes | MOR-4 | Yes | ||||||

| Copies of IRS Form 6123 or payment receipt | No | Yes | Available upon request | |||||

| Copies of tax returns filed during reporting period | No | Yes | Available upon request | |||||

| Summary of Unpaid Post petition Debts | MOR-4 | Yes | ||||||

| Listing of aged accounts payable | MOR-4 | Yes | ||||||

| Debtor Questionnaire | MOR-5 | Yes |

Global Notes:

This Monthly Operating Report

(“MOR”) has been prepared solely for the purpose of complying with the monthly reporting requirements applicable in these bankruptcy cases. The financial information contained herein is unaudited, limited in scope and as discussed

below, not prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”).

The results of operations

contained herein are not necessarily indicative of the results which may be expected from any other period or for the full year and may not necessarily reflect the results of operations, financial position and schedule of receipts and disbursements

in the future. The amounts in MOR 3 currently classified as liabilities subject to compromise may be subject to future change as the Debtors complete their analysis of pre and post-petition liabilities. The Debtors caution readers not to place undue

reliance on the MOR. There can be no assurance that such information is complete and the MOR may be subject to revision.

I declare under penalty of perjury (28

U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief.

| /s/ Gary Schoenfeld | 8/1/16 | |||

| Signature of Debtor | Date | |||

| /s/ Gary Schoenfeld | 8/1/16 | |||

| Signature of Joint Debtor | Date | |||

| /s/ Gary Schoenfeld | 8/1/16 | |||

| Signature of Authorized Individual* | Date | |||

| Gary Schoenfeld | President and CEO | |||

| Printed Name of Authorized Individual | Title of Authorized Individual |

| * | Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. |

1

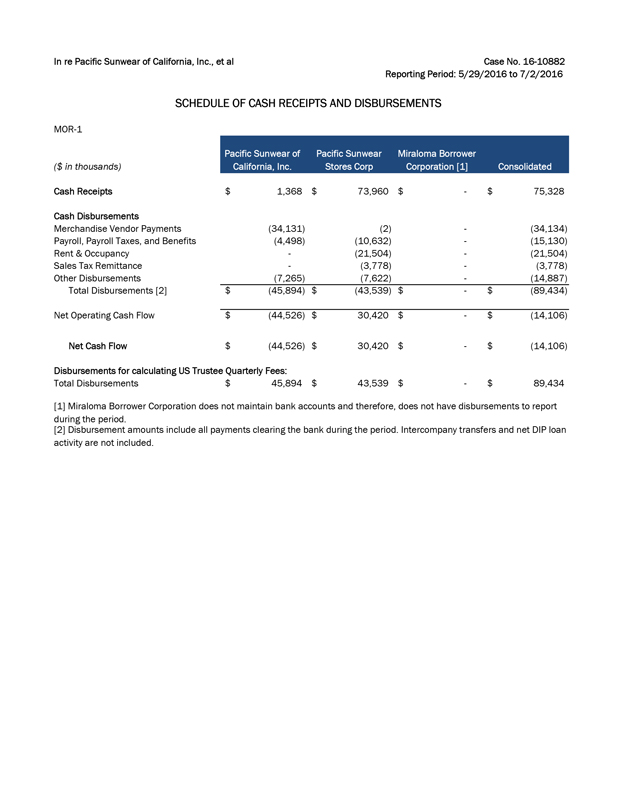

| In re Pacific Sunwear of California, Inc., et al | Case No. 16-10882 | |

| Reporting Period: 5/29/2016 to 7/2/2016 |

SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS

MOR-1

| ($ in thousands) | Pacific Sunwear of California, Inc. | Pacific Sunwear Stores Corp | Miraloma Borrower Corporation [1] | Consolidated | ||||

| Cash Receipts | $1,368 | $73,960 | $— | $75,328 | ||||

| Cash Disbursements | ||||||||

| Merchandise Vendor Payments | (34,131) | (2) | — | (34,134) | ||||

| Payroll, Payroll Taxes, and Benefits | (4,498) | (10,632) | — | (15,130) | ||||

| Rent & Occupancy | — | (21,504) | — | (21,504) | ||||

| Sales Tax Remittance | — | (3,778) | — | (3,778) | ||||

| Other Disbursements | (7,265) | (7,622) | — | (14,887) | ||||

| Total Disbursements [2] | $(45,894) | $(43,539) | $— | $(89,434) | ||||

| Net Operating Cash Flow | $(44,526) | $30,420 | $— | $(14,106) | ||||

| Net Cash Flow | $(44,526) | $30,420 | $— | $(14,106) | ||||

| Disbursements for calculating US Trustee Quarterly Fees: | ||||||||

| Total Disbursements | $45,894 | $43,539 | $— | $89,434 | ||||

| [1] | Miraloma Borrower Corporation does not maintain bank accounts and therefore, does not have disbursements to report during the period. |

| [2] | Disbursement amounts include all payments clearing the bank during the period. Intercompany transfers and net DIP loan activity are not included. |

2

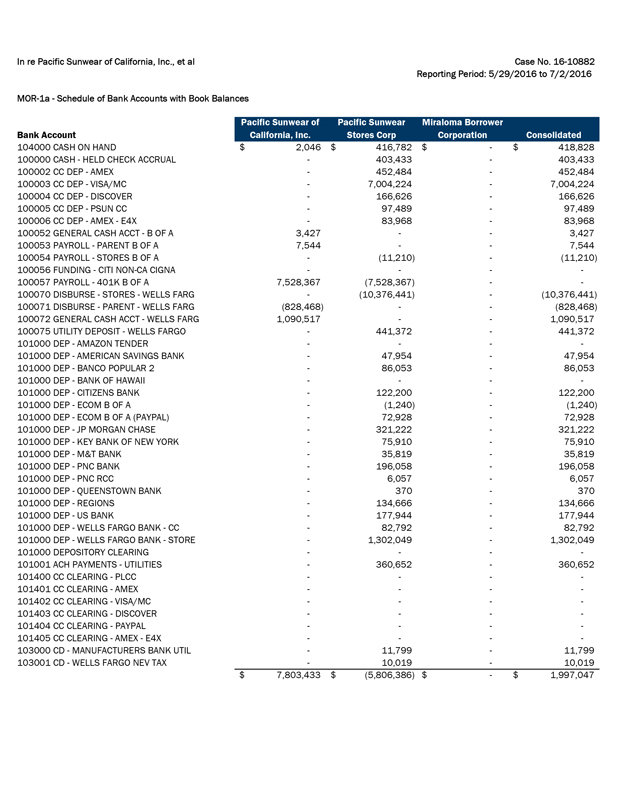

| In re Pacific Sunwear of California, Inc., et al | Case No. 16-10882 | |

| Reporting Period: 5/29/2016 to 7/2/2016 |

MOR-1a - Schedule of Bank Accounts with Book Balances

| Bank Account | Pacific Sunwear of California, Inc. |

Pacific Sunwear Stores Corp |

Miraloma Borrower Corporation |

Consolidated | ||||||||||||

| 104000 CASH ON HAND | $ | 2,046 | $ | 416,782 | $ | — | $ | 418,828 | ||||||||

| 100000 CASH - HELD CHECK ACCRUAL | — | 403,433 | — | 403,433 | ||||||||||||

| 100002 CC DEP - AMEX | — | 452,484 | — | 452,484 | ||||||||||||

| 100003 CC DEP - VISA/MC | — | 7,004,224 | — | 7,004,224 | ||||||||||||

| 100004 CC DEP - DISCOVER | — | 166,626 | — | 166,626 | ||||||||||||

| 100005 CC DEP - PSUN CC | — | 97,489 | — | 97,489 | ||||||||||||

| 100006 CC DEP - AMEX - E4X | — | 83,968 | — | 83,968 | ||||||||||||

| 100052 GENERAL CASH ACCT - B OF A | 3,427 | — | — | 3,427 | ||||||||||||

| 100053 PAYROLL - PARENT B OF A | 7,544 | — | — | 7,544 | ||||||||||||

| 100054 PAYROLL - STORES B OF A | — | (11,210 | ) | — | (11,210 | ) | ||||||||||

| 100056 FUNDING - CITI NON-CA CIGNA | — | — | — | — | ||||||||||||

| 100057 PAYROLL - 401K B OF A | 7,528,367 | (7,528,367 | ) | — | — | |||||||||||

| 100070 DISBURSE - STORES - WELLS FARG | — | (10,376,441 | ) | — | (10,376,441 | ) | ||||||||||

| 100071 DISBURSE - PARENT - WELLS FARG | (828,468 | ) | — | — | (828,468 | ) | ||||||||||

| 100072 GENERAL CASH ACCT - WELLS FARG | 1,090,517 | — | — | 1,090,517 | ||||||||||||

| 100075 UTILITY DEPOSIT - WELLS FARGO | — | 441,372 | — | 441,372 | ||||||||||||

| 101000 DEP - AMAZON TENDER | — | — | — | — | ||||||||||||

| 101000 DEP - AMERICAN SAVINGS BANK | — | 47,954 | — | 47,954 | ||||||||||||

| 101000 DEP - BANCO POPULAR 2 | — | 86,053 | — | 86,053 | ||||||||||||

| 101000 DEP - BANK OF HAWAII | — | — | — | — | ||||||||||||

| 101000 DEP - CITIZENS BANK | — | 122,200 | — | 122,200 | ||||||||||||

| 101000 DEP - ECOM B OF A | — | (1,240 | ) | — | (1,240 | ) | ||||||||||

| 101000 DEP - ECOM B OF A (PAYPAL) | — | 72,928 | — | 72,928 | ||||||||||||

| 101000 DEP - JP MORGAN CHASE | — | 321,222 | — | 321,222 | ||||||||||||

| 101000 DEP - KEY BANK OF NEW YORK | — | 75,910 | — | 75,910 | ||||||||||||

| 101000 DEP - M&T BANK | — | 35,819 | — | 35,819 | ||||||||||||

| 101000 DEP - PNC BANK | — | 196,058 | — | 196,058 | ||||||||||||

| 101000 DEP - PNC RCC | — | 6,057 | — | 6,057 | ||||||||||||

| 101000 DEP - QUEENSTOWN BANK | — | 370 | — | 370 | ||||||||||||

| 101000 DEP - REGIONS | — | 134,666 | — | 134,666 | ||||||||||||

| 101000 DEP - US BANK | — | 177,944 | — | 177,944 | ||||||||||||

| 101000 DEP - WELLS FARGO BANK - CC | — | 82,792 | — | 82,792 | ||||||||||||

| 101000 DEP - WELLS FARGO BANK - STORE | — | 1,302,049 | — | 1,302,049 | ||||||||||||

| 101000 DEPOSITORY CLEARING | — | — | — | — | ||||||||||||

| 101001 ACH PAYMENTS - UTILITIES | — | 360,652 | — | 360,652 | ||||||||||||

| 101400 CC CLEARING - PLCC | — | — | — | — | ||||||||||||

| 101401 CC CLEARING - AMEX | — | — | — | — | ||||||||||||

| 101402 CC CLEARING - VISA/MC | — | — | — | — | ||||||||||||

| 101403 CC CLEARING - DISCOVER | — | — | — | — | ||||||||||||

| 101404 CC CLEARING - PAYPAL | — | — | — | — | ||||||||||||

| 101405 CC CLEARING - AMEX - E4X | — | — | — | — | ||||||||||||

| 103000 CD - MANUFACTURERS BANK UTIL | — | 11,799 | — | 11,799 | ||||||||||||

| 103001 CD - WELLS FARGO NEV TAX | — | 10,019 | — | 10,019 | ||||||||||||

| $ | 7,803,433 | $ | (5,806,386 | ) | $ | — | $ | 1,997,047 | ||||||||

3

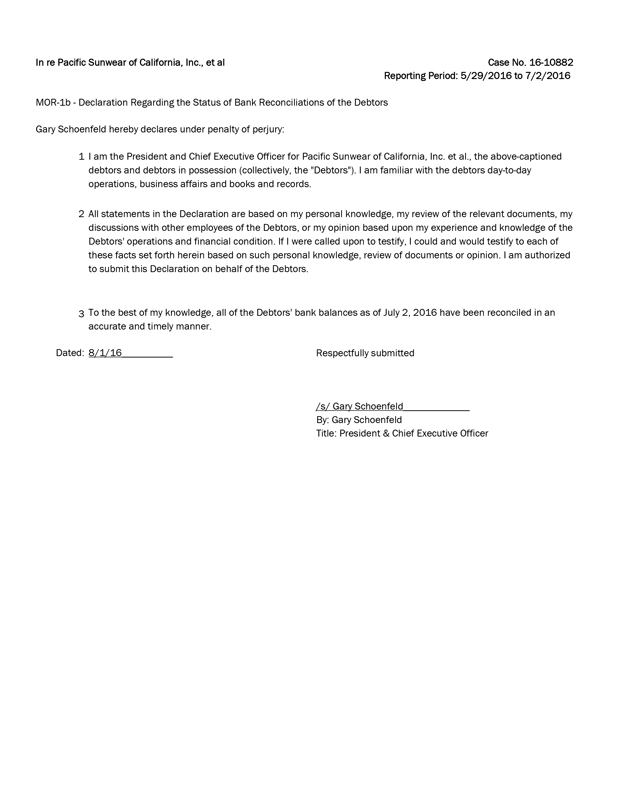

| In re Pacific Sunwear of California, Inc., et al | Case No. 16-10882 | |

| Reporting Period: 5/29/2016 to 7/2/2016 |

MOR-1b - Declaration Regarding the Status of Bank Reconciliations of the Debtors

Gary Schoenfeld hereby declares under penalty of perjury:

| 1 | I am the President and Chief Executive Officer for Pacific Sunwear of California, Inc. et al., the above-captioned debtors and debtors in possession (collectively, the “Debtors”). I am familiar with the debtors day-to-day operations, business affairs and books and records. |

| 2 | All statements in the Declaration are based on my personal knowledge, my review of the relevant documents, my discussions with other employees of the Debtors, or my opinion based upon my experience and knowledge of the Debtors’ operations and financial condition. If I were called upon to testify, I could and would testify to each of these facts set forth herein based on such personal knowledge, review of documents or opinion. I am authorized to submit this Declaration on behalf of the Debtors. |

| 3 | To the best of my knowledge, all of the Debtors’ bank balances as of July 2, 2016 have been reconciled in an accurate and timely manner. |

| Dated: | 8/1/16 | Respectfully submitted | ||||||||

| /s/ Gary Schoenfeld | ||||||||||

| By: | Gary Schoenfeld | |||||||||

| Title: | President & Chief Executive Officer | |||||||||

4

| In re Pacific Sunwear of California, Inc., et al | Case No. 16-10882 | |

| Reporting Period: 5/29/2016 to 7/2/2016 |

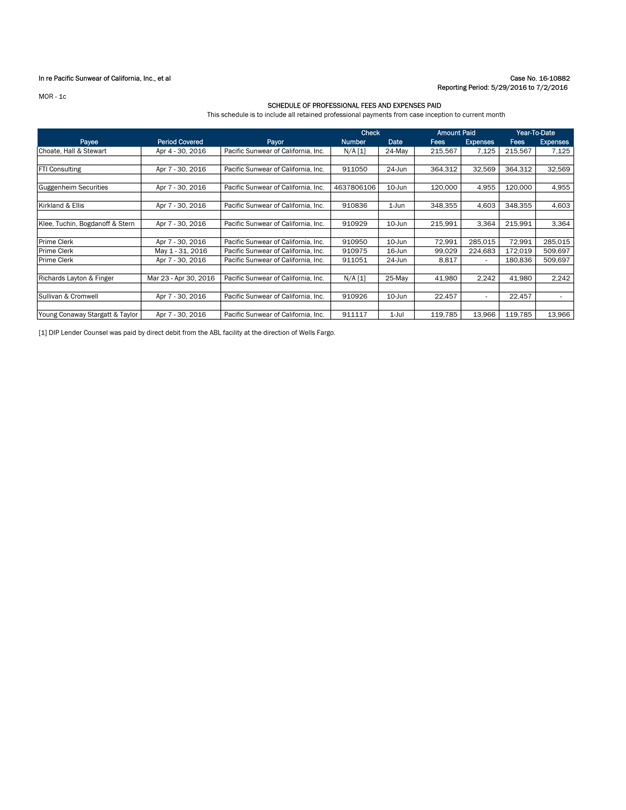

MOR - 1c

SCHEDULE OF PROFESSIONAL

FEES AND EXPENSES PAID

This schedule is to include all retained professional payments from case inception to current month

| Check | Amount Paid | Year-To-Date | ||||||||||||||||||||||

| Payee | Period Covered | Payor | Number | Date | Fees | Expenses | Fees | Expenses | ||||||||||||||||

| Choate, Hall & Stewart | Apr 4 - 30, 2016 | Pacific Sunwear of California, Inc. | N/A [1] | 24-May | 215,567 | 7,125 | 215,567 | 7,125 | ||||||||||||||||

| FTI Consulting | Apr 7 - 30, 2016 | Pacific Sunwear of California, Inc. | 911050 | 24-Jun | 364,312 | 32,569 | 364,312 | 32,569 | ||||||||||||||||

| Guggenheim Securities | Apr 7 - 30, 2016 | Pacific Sunwear of California, Inc. | 4637806106 | 10-Jun | 120,000 | 4,955 | 120,000 | 4,955 | ||||||||||||||||

| Kirkland & Ellis | Apr 7 - 30, 2016 | Pacific Sunwear of California, Inc. | 910836 | 1-Jun | 348,355 | 4,603 | 348,355 | 4,603 | ||||||||||||||||

| Klee, Tuchin, Bogdanoff & Stern | Apr 7 - 30, 2016 | Pacific Sunwear of California, Inc. | 910929 | 10-Jun | 215,991 | 3,364 | 215,991 | 3,364 | ||||||||||||||||

| Prime Clerk | Apr 7 - 30, 2016 | Pacific Sunwear of California, Inc. | 910950 | 10-Jun | 72,991 | 285,015 | 72,991 | 285,015 | ||||||||||||||||

| Prime Clerk | May 1 - 31, 2016 | Pacific Sunwear of California, Inc. | 910975 | 16-Jun | 99,029 | 224,683 | 172,019 | 509,697 | ||||||||||||||||

| Prime Clerk | Apr 7 - 30, 2016 | Pacific Sunwear of California, Inc. | 911051 | 24-Jun | 8,817 | — | 180,836 | 509,697 | ||||||||||||||||

| Richards Layton & Finger | Mar 23 - Apr 30, 2016 | Pacific Sunwear of California, Inc. | N/A [1] | 25-May | 41,980 | 2,242 | 41,980 | 2,242 | ||||||||||||||||

| Sullivan & Cromwell | Apr 7 - 30, 2016 | Pacific Sunwear of California, Inc. | 910926 | 10-Jun | 22,457 | — | 22,457 | — | ||||||||||||||||

| Young Conaway Stargatt & Taylor | Apr 7 - 30, 2016 | Pacific Sunwear of California, Inc. | 911117 | 1-Jul | 119,785 | 13,966 | 119,785 | 13,966 | ||||||||||||||||

| [1] DIP Lender Counsel was paid by direct debit from the ABL facility at the direction of Wells Fargo. | ||||||||||||||||||||||||

5

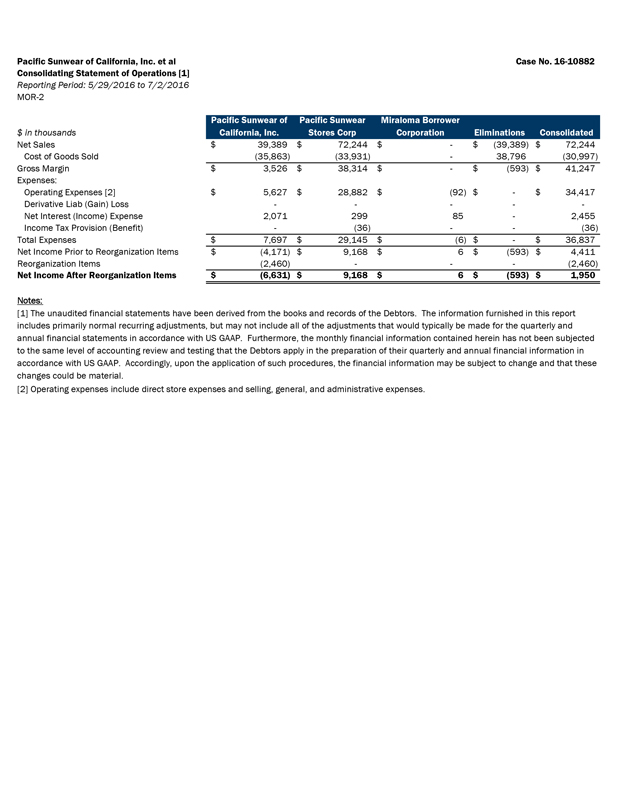

| Pacific Sunwear of California, Inc. et al | Case No. 16-10882 |

| Consolidating Statement of Operations [1] | ||

| Reporting Period: 5/29/2016 to 7/2/2016 | ||

| MOR-2 |

| $ in thousands | Pacific Sunwear of California, Inc. |

Pacific Sunwear Stores Corp |

Miraloma Borrower Corporation |

Eliminations | Consolidated | |||||||||||||||

| Net Sales | $ | 39,389 | $ | 72,244 | $ | — | $ | (39,389 | ) | $ | 72,244 | |||||||||

| Cost of Goods Sold | (35,863 | ) | (33,931 | ) | — | 38,796 | (30,997 | ) | ||||||||||||

| Gross Margin | $ | 3,526 | $ | 38,314 | $ | — | $ | (593 | ) | $ | 41,247 | |||||||||

| Expenses: | ||||||||||||||||||||

| Operating Expenses [2] | $ | 5,627 | $ | 28,882 | $ | (92 | ) | $ | — | $ | 34,417 | |||||||||

| Derivative Liab (Gain) Loss | — | — | — | — | — | |||||||||||||||

| Net Interest (Income) Expense | 2,071 | 299 | 85 | — | 2,455 | |||||||||||||||

| Income Tax Provision (Benefit) | — | (36 | ) | — | — | (36 | ) | |||||||||||||

| Total Expenses | $ | 7,697 | $ | 29,145 | $ | (6 | ) | $ | — | $ | 36,837 | |||||||||

| Net Income Prior to Reorganization Items | $ | (4,171 | ) | $ | 9,168 | $ | 6 | $ | (593 | ) | $ | 4,411 | ||||||||

| Reorganization Items | (2,460 | ) | — | — | — | (2,460 | ) | |||||||||||||

| Net Income After Reorganization Items | $ | (6,631 | ) | $ | 9,168 | $ | 6 | $ | (593 | ) | $ | 1,950 | ||||||||

Notes:

| [1] | The unaudited financial statements have been derived from the books and records of the Debtors. The information furnished in this report includes primarily normal recurring adjustments, but may not include all of the adjustments that would typically be made for the quarterly and annual financial statements in accordance with US GAAP. Furthermore, the monthly financial information contained herein has not been subjected to the same level of accounting review and testing that the Debtors apply in the preparation of their quarterly and annual financial information in accordance with US GAAP. Accordingly, upon the application of such procedures, the financial information may be subject to change and that these changes could be material. |

| [2] | Operating expenses include direct store expenses and selling, general, and administrative expenses. |

6

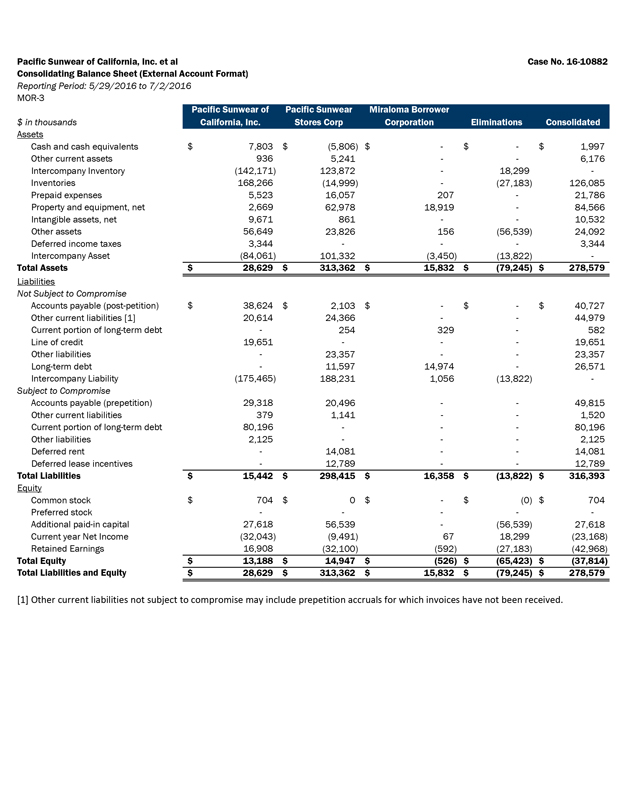

| Pacific Sunwear of California, Inc. et al | Case No. 16-10882 |

| Consolidating Balance Sheet (External Account Format) | ||

| Reporting Period: 5/29/2016 to 7/2/2016 | ||

| MOR-3 |

| $ in thousands | Pacific Sunwear of California, Inc. |

Pacific Sunwear Stores Corp |

Miraloma Borrower Corporation |

Eliminations | Consolidated | |||||||||||||||

| Assets | ||||||||||||||||||||

| Cash and cash equivalents | $ | 7,803 | $ | (5,806 | ) | $ | — | $ | — | $ | 1,997 | |||||||||

| Other current assets | 936 | 5,241 | — | — | 6,176 | |||||||||||||||

| Intercompany Inventory | (142,171 | ) | 123,872 | — | 18,299 | — | ||||||||||||||

| Inventories | 168,266 | (14,999 | ) | — | (27,183 | ) | 126,085 | |||||||||||||

| Prepaid expenses | 5,523 | 16,057 | 207 | — | 21,786 | |||||||||||||||

| Property and equipment, net | 2,669 | 62,978 | 18,919 | — | 84,566 | |||||||||||||||

| Intangible assets, net | 9,671 | 861 | — | — | 10,532 | |||||||||||||||

| Other assets | 56,649 | 23,826 | 156 | (56,539 | ) | 24,092 | ||||||||||||||

| Deferred income taxes | 3,344 | — | — | — | 3,344 | |||||||||||||||

| Intercompany Asset | (84,061 | ) | 101,332 | (3,450 | ) | (13,822 | ) | — | ||||||||||||

| Total Assets | $ | 28,629 | $ | 313,362 | $ | 15,832 | $ | (79,245 | ) | $ | 278,579 | |||||||||

| Liabilities | ||||||||||||||||||||

| Not Subject to Compromise | ||||||||||||||||||||

| Accounts payable (post-petition) | $ | 38,624 | $ | 2,103 | $ | — | $ | — | $ | 40,727 | ||||||||||

| Other current liabilities [1] | 20,614 | 24,366 | — | — | 44,979 | |||||||||||||||

| Current portion of long-term debt | — | 254 | 329 | — | 582 | |||||||||||||||

| Line of credit | 19,651 | — | — | — | 19,651 | |||||||||||||||

| Other liabilities | — | 23,357 | — | — | 23,357 | |||||||||||||||

| Long-term debt | — | 11,597 | 14,974 | — | 26,571 | |||||||||||||||

| Intercompany Liability | (175,465 | ) | 188,231 | 1,056 | (13,822 | ) | — | |||||||||||||

| Subject to Compromise | ||||||||||||||||||||

| Accounts payable (prepetition) | 29,318 | 20,496 | — | — | 49,815 | |||||||||||||||

| Other current liabilities | 379 | 1,141 | — | — | 1,520 | |||||||||||||||

| Current portion of long-term debt | 80,196 | — | — | — | 80,196 | |||||||||||||||

| Other liabilities | 2,125 | — | — | — | 2,125 | |||||||||||||||

| Deferred rent | — | 14,081 | — | — | 14,081 | |||||||||||||||

| Deferred lease incentives | — | 12,789 | — | — | 12,789 | |||||||||||||||

| Total Liabilities | $ | 15,442 | $ | 298,415 | $ | 16,358 | $ | (13,822 | ) | $ | 316,393 | |||||||||

| Equity | ||||||||||||||||||||

| Common stock | $ | 704 | $ | 0 | $ | — | $ | (0 | ) | $ | 704 | |||||||||

| Preferred stock | — | — | — | — | — | |||||||||||||||

| Additional paid-in capital | 27,618 | 56,539 | — | (56,539 | ) | 27,618 | ||||||||||||||

| Current year Net Income | (32,043 | ) | (9,491 | ) | 67 | 18,299 | (23,168 | ) | ||||||||||||

| Retained Earnings | 16,908 | (32,100 | ) | (592 | ) | (27,183 | ) | (42,968 | ) | |||||||||||

| Total Equity | $ | 13,188 | $ | 14,947 | $ | (526 | ) | $ | (65,423 | ) | $ | (37,814 | ) | |||||||

| Total Liabilities and Equity | $ | 28,629 | $ | 313,362 | $ | 15,832 | $ | (79,245 | ) | $ | 278,579 | |||||||||

| [1] | Other current liabilities not subject to compromise may include prepetition accruals for which invoices have not been received. |

7

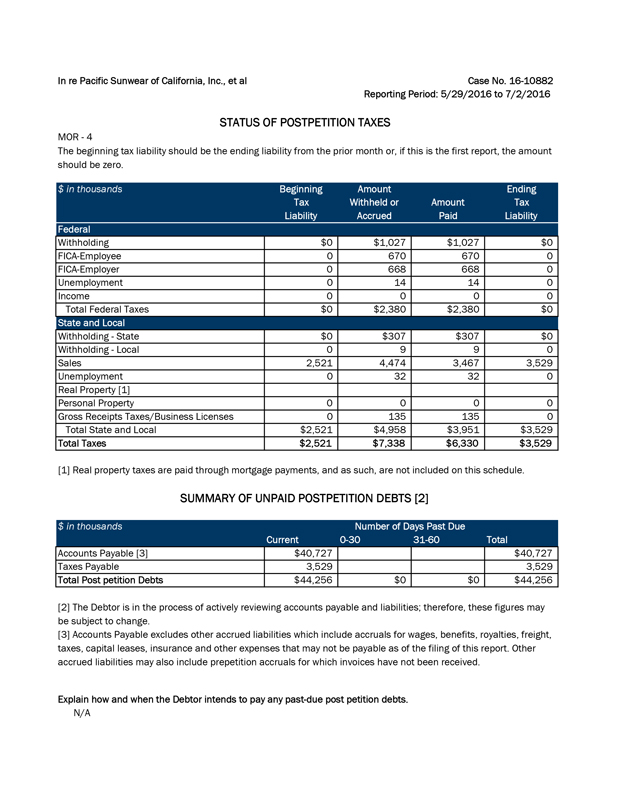

| In re Pacific Sunwear of California, Inc., et al | Case No. 16-10882 | |

| Reporting Period: 5/29/2016 to 7/2/2016 |

STATUS OF POSTPETITION TAXES

MOR -

4

The beginning tax liability should be the ending liability from the prior month or, if this is the first report, the amount should be zero.

| $ in thousands | Beginning Tax Liability |

Amount Withheld or Accrued |

Amount Paid |

Ending Tax Liability |

||||||||||||

| Federal | ||||||||||||||||

| Withholding | $ | 0 | $ | 1,027 | $ | 1,027 | $ | 0 | ||||||||

| FICA-Employee | 0 | 670 | 670 | 0 | ||||||||||||

| FICA-Employer | 0 | 668 | 668 | 0 | ||||||||||||

| Unemployment | 0 | 14 | 14 | 0 | ||||||||||||

| Income | 0 | 0 | 0 | 0 | ||||||||||||

| Total Federal Taxes | $ | 0 | $ | 2,380 | $ | 2,380 | $ | 0 | ||||||||

| State and Local | ||||||||||||||||

| Withholding - State | $ | 0 | $ | 307 | $ | 307 | $ | 0 | ||||||||

| Withholding - Local | 0 | 9 | 9 | 0 | ||||||||||||

| Sales | 2,521 | 4,474 | 3,467 | 3,529 | ||||||||||||

| Unemployment | 0 | 32 | 32 | 0 | ||||||||||||

| Real Property [1] | ||||||||||||||||

| Personal Property | 0 | 0 | 0 | 0 | ||||||||||||

| Gross Receipts Taxes/Business Licenses | 0 | 135 | 135 | 0 | ||||||||||||

| Total State and Local | $ | 2,521 | $ | 4,958 | $ | 3,951 | $ | 3,529 | ||||||||

| Total Taxes | $ | 2,521 | $ | 7,338 | $ | 6,330 | $ | 3,529 | ||||||||

| [1] | Real property taxes are paid through mortgage payments, and as such, are not included on this schedule. |

SUMMARY OF UNPAID POSTPETITION DEBTS [2]

| $ in thousands | Number of Days Past Due | |||||||||||||||

| Current | 0-30 | 31-60 | Total | |||||||||||||

| Accounts Payable [3] | $ | 40,727 | $ | 40,727 | ||||||||||||

| Taxes Payable | 3,529 | 3,529 | ||||||||||||||

| Total Post petition Debts | $ | 44,256 | $ | 0 | $ | 0 | $ | 44,256 | ||||||||

| [2] | The Debtor is in the process of actively reviewing accounts payable and liabilities; therefore, these figures may be subject to change. |

| [3] | Accounts Payable excludes other accrued liabilities which include accruals for wages, benefits, royalties, freight, taxes, capital leases, insurance and other expenses that may not be payable as of the filing of this report. Other accrued liabilities may also include prepetition accruals for which invoices have not been received. |

Explain how and when the Debtor intends to pay any past-due post petition debts.

N/A

8

| In re Pacific Sunwear of California, Inc., et al | Case No. 16-10882 | |

| Reporting Period: 5/29/2016 to 7/2/2016 |

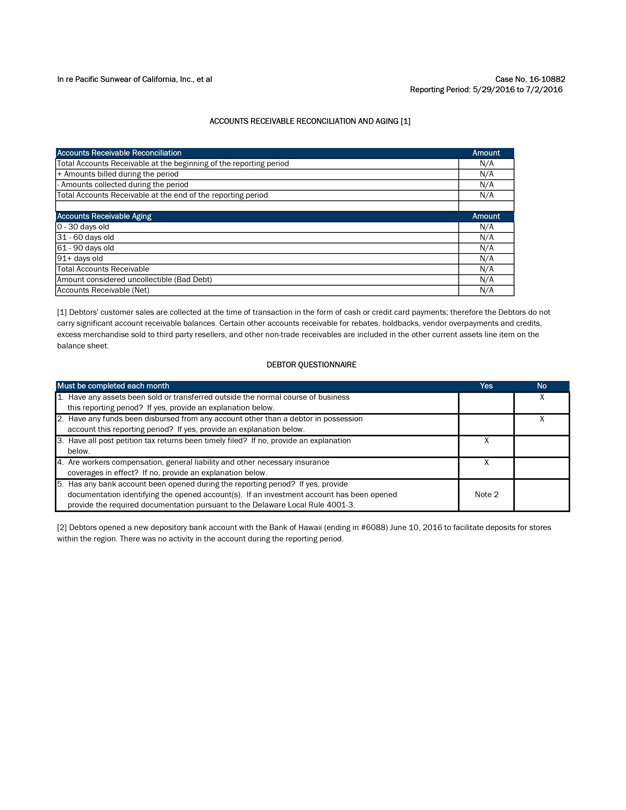

ACCOUNTS RECEIVABLE RECONCILIATION AND AGING [1]

| Accounts Receivable Reconciliation | Amount | |

| Total Accounts Receivable at the beginning of the reporting period | N/A | |

| + Amounts billed during the period | N/A | |

| - Amounts collected during the period | N/A | |

| Total Accounts Receivable at the end of the reporting period | N/A | |

| Accounts Receivable Aging | Amount | |

| 0 - 30 days old | N/A | |

| 31 - 60 days old | N/A | |

| 61 - 90 days old | N/A | |

| 91+ days old | N/A | |

| Total Accounts Receivable | N/A | |

| Amount considered uncollectible (Bad Debt) | N/A | |

| Accounts Receivable (Net) | N/A | |

| [1] | Debtors’ customer sales are collected at the time of transaction in the form of cash or credit card payments; therefore the Debtors do not carry significant account receivable balances. Certain other accounts receivable for rebates, holdbacks, vendor overpayments and credits, excess merchandise sold to third party resellers, and other non-trade receivables are included in the other current assets line item on the balance sheet. |

DEBTOR QUESTIONNAIRE

| Must be completed each month | Yes | No | ||||

| 1. | Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. | X | ||||

| 2. | Have any funds been disbursed from any account other than a debtor in possession account this reporting period? If yes, provide an explanation below. | X | ||||

| 3. | Have all post petition tax returns been timely filed? If no, provide an explanation below. | X | ||||

| 4. | Are workers compensation, general liability and other necessary insurance coverages in effect? If no, provide an explanation below. | X | ||||

| 5. | Has any bank account been opened during the reporting period? If yes, provide documentation identifying the opened account(s). If an investment account has been opened provide the required documentation pursuant to the Delaware Local Rule 4001-3. | Note 2 | ||||

| [2] | Debtors opened a new depository bank account with the Bank of Hawaii (ending in #6088) June 10, 2016 to facilitate deposits for stores within the region. There was no activity in the account during the reporting period. |

9