Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - XpresSpa Group, Inc. | v446257_ex99-1.htm |

| EX-10.2 - EXHIBIT 10.2 - XpresSpa Group, Inc. | v446257_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - XpresSpa Group, Inc. | v446257_ex10-1.htm |

| EX-3.1 - EXHIBIT 3.1 - XpresSpa Group, Inc. | v446257_ex3-1.htm |

| EX-2.1 - EXHIBIT 2.1 - XpresSpa Group, Inc. | v446257_ex2-1.htm |

| 8-K - FORM 8-K - XpresSpa Group, Inc. | v446257_8k.htm |

Exhibit 99.2

XPRESSPA ACQUISITION AUGUST 8 , 2016

SAFE HARBOR STATEMENT This presentation includes forward - looking statements, which may be identified by words such as "believes," "expects," "anticipa tes," "estimates," "projects," "intends," "should," "seeks," "future," "continue," or the negative of such terms, or other comparable terminology. Forward - looking stateme nts are statements that are not historical facts. Such forward - looking statements are subject to risks and uncertainties, which could cause actual results to differ mater ially from the forward - looking statements contained herein. Statements in this presentation regarding the proposed merger between FORM and XpresSpa ; the expected timetable for completing the transaction; the potential value created by the proposed merger for FORM's stockholders and XpresSpa’s equity holders; the potential of FORM’s business after completion of the merger; the ability to raise capital to fund FHS’s operations and business plan; the continued listing of FORM's securities on the Nasdaq Capital Market; market acceptance of FORM products; the collective ability to protect intellectual property rights; competition from other providers and products; FO RM’s management and board of directors after completion of the merger; and any other statements about FORM's or XpresSpa’s management teams' future expectations, beliefs, goals, plans, revenues or prospects constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Ther e are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward - looking statements, including, bu t not limited to: the risk that FORM and XpresSpa may not be able to complete the proposed transaction; the inability to realize the potential value created by the proposed me rg er for FORM’s stockholders; FORM's inability to maintain the listing of its securities on the Nasdaq Capital Market after completion of the merger; the potential lack of market acceptance of FORM's products; FORM’s inability to monetize and recoup FORM’s investment with respect to assets and other businesses that that we hav e acquired or will acquire in the future; general economic conditions and level of information technology and consumer electronics spending; unexpected trends in the m obi le phone and telecom computing industries; the potential loss of one or more of FORM’s significant Original Equipment Manufacturer (“OEM”) suppliers, the po ten tial lack of market acceptance of FORM’s products; market acceptance, quality, pricing, availability and useful life of FORM’s products and services, as well as the mix of FORM’s products and services sold; potential competition from other providers and products; FORM’s inability to license and monetize FORM’s patents, including th e outcome of litigation; FORM’s inability to develop and introduce new products and/or develop new intellectual property; FORM’s inability to protect FORM’s intellectua l p roperty rights; new legislation, regulations or court rulings related to enforcing patents, that could harm FORM’s business and operating results; FORM’s inability to ret ain key members of its management team; and other risks and uncertainties and other factors discussed from time to time in our filings with the Securities and Exchange C omm ission ("SEC"), including FORM’s Annual Report on Form 10 - K for the year ended December 31, 2015 filed with the SEC on March 10, 2016. Investors and stockholders are a lso urged to read the risk factors set forth in the proxy statement/prospectus carefully when they are available. FORM expressly disclaims any obligation to publicl y u pdate any forward - looking statements contained herein, whether as a result of new information, future events or otherwise, except as required by law. Trademark Usage FORM Holdings, the FORM Holdings logo, and other FORM Holdings trademarks, service marks, and designs are registered or unregistered trademarks of FORM Holdings Corp . and its subsidiaries in the United States and in foreign countries . This presentation contains trade names, trademarks and service marks of other companies . All such trade names, trademarks and service marks of other companies are property of their respective owners . FORM Holdings Corp . does not intend its use or display of other parties’ trade names, trademarks and service marks to imply a relationship with, or endorsement or sponsorship of or by, such other parties . 1

FORM HOLDINGS OVERVIEW ▪ We are a diversified holding company focused on acquiring revenue generating businesses that would benefit from: ≻ Additional capital ≻ Rebranding ≻ Restructuring ≻ Implementation of best practices ≻ Talent recruiting ≻ Marketing, PR & visibility ▪ We are industry agnostic ▪ We only look at businesses with: ≻ Disconnect between the private and public market valuations ≻ Clear trajectory to scale to annual revenues in excess of $100 million ▪ We seek to mitigate risk by: ≻ Looking for additional outside sources of capital ≻ Isolating debt to the subsidiary level ≻ Using public equity for acquisitions as opposed to cash on hand SYMBOL FH EXCHANGE NASDAQ MARKET CAPITALIZATION $30 million 1 AVERAGE TRADING VOLUME 183,365 (3 month) 1 52 WEEK RANGE $1.55 – 2.57 1 CASH $24.3 million 1 AUDITOR CohnReznick LLP CORPORATE HEADQUARTERS New York, NY CORPORATE EMPLOYEES 10 SUBSIDIARY EMPLOYEES 32 2 1 As of August 8, 2016

100% GROUP MOBILE Provider of rugged, mobile and field - use computing products ▪ Acquired in Fall 2015 ▪ Revenue is expected to increase 200% year - over - year ▪ Implemented operational improvements and rebranding ▪ Expanded product offerings and geographic coverage 100% FLI CHARGE Fast, powerful and easy to use wireless charging ▪ Acquired Fall 2015 ▪ Rebranded company and designed consumer product line ▪ Launched consumer product line in June 2016 ▪ Existing partnerships and licensees in education, hospitality and aftermarket transportation 8.5% INFOMEDIA Customer relationship management and monetization technologies ▪ Leading provider of CRM and monetization technologies to mobile carriers and device OEMs ▪ Anticipated 2016 revenue of $75 million+ ▪ Best in class player in mobile payments ▪ Ranked in the 15th Annual Sunday Times Hiscox Tech Track 100 100% VRINGO IP Engaged in the monetization of intellectual property ▪ Portfolio of 600+ technology patents ▪ Active licensing pipeline 100% 1 XPRESSPA Airport terminal spa and wellness retail store ▪ FORM Holdings announced definitive agreement on August 8, 2016 ▪ Acquisition expected to close in Q4 2016 BUSINESS UNITS 1 P ending completion of acquisition 3

ACQUISITION

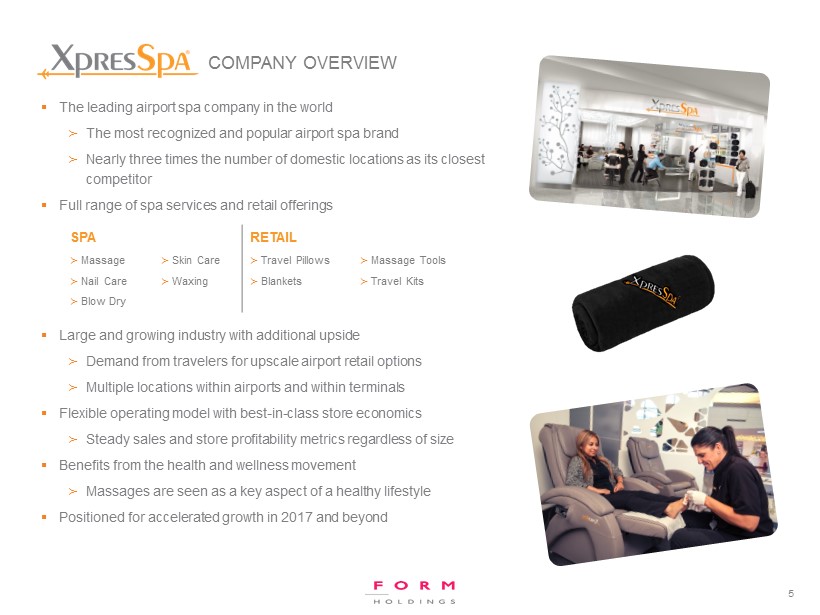

▪ The leading airport spa company in the world ≻ The most recognized and popular airport spa brand ≻ Nearly three times the number of domestic locations as its closest competitor ▪ Full range of spa services and retail offerings ▪ Large and growing industry with additional upside ≻ Demand from travelers for upscale airport retail options ≻ Multiple locations within airports and within terminals ▪ Flexible operating model with best - in - class store economics ≻ Steady sales and store profitability metrics regardless of size ▪ Benefits from the health and wellness movement ≻ Massages are seen as a key aspect of a healthy lifestyle ▪ Positioned for accelerated growth in 2017 and beyond COMPANY OVERVIEW 5 SPA RETAIL ≻ Massage ≻ Nail Care ≻ Blow Dry ≻ Skin Care ≻ Waxing ≻ Travel Pillows ≻ Blankets ≻ Massage Tools ≻ Travel Kits

6 OPERATIONAL HIGHLIGHTS ESTABLISHED PRESENCE WITH UNMATCHED SCALE ▪ XpresSpa meets the growing demand for upscale airport retail concepts ▪ 51 total locations in 21 airports ≻ 42 Stores, 9 Kiosks ≻ 47 domestic locations in 19 airports ▪ Nearly 3x the number of domestic locations vs. next largest competitor GROWING REVENUE AND VOLUME ▪ Current run rate implies year - over - year growth ≻ $38.8 million sales in 2015, $20.5 million sales YTD (6/30/16) ▪ More than $7.5 million in store - level contributions & over 20% store - level margin in 2015 ▪ Average Sales per location ≻ $944,000 per Store ≻ $699,000 per Kiosk ▪ 25 RFPs for new locations in the next 12 months MANAGEMENT EXPERTISE ▪ CEO with 30+ years of experience in luxury retail joined on June 1, 2016

▪ 51 locations in many of the largest and most desirable airport hubs in the world ≻ 47 locations in the United States ▪ 6 targeted openings in 2016, including three locations that have already opened DOMINANT, ESTABLISHED AIRPORT PRESENCE NATIONWIDE AIRPORT STORE KIOSK TOTAL Atlanta (ATL) 2 - 2 Amsterdam (AMS) 1 3 - 3 Chicago O’Hare (CHI) 1 - 1 Dallas (DFW) 3 2 5 Denver (DEN) 2 - 2 Dubai (DXB) 1 - 1 Houston (HOU) 1 - 1 Las Vegas (LAS) 2 1 3 Los Angeles (LAX) 1 1 2 Miami (MIA) 1 - 1 Minneapolis (MSP) 2 1 3 New York (JFK) 6 1 7 New York (LGA) 1 - 1 Orlando (MCO) 3 1 4 Philadelphia (PHI) 3 - 3 Pittsburgh (PIT) 1 - 1 Raleigh - Durham (RDU) 1 - 1 Salt Lake City (SLC) 2 3 - 3 San Francisco (SFO) 4 - 4 Santa Ana (SNA) 1 1 2 Washington DC (DCA) - 1 1 TOTAL 42 9 51 1 Amsterdam location is licensed 2 Includes location in Delta lounge Potential Location Existing Location 7

51 36 9 5 47 16 9 5 0 10 20 30 40 50 60 U.S. & International Locations U.S. Locations Only 51 LOCAITONS IN MANY OF THE LARGEST AND MOST DESIRABLE HUB AIRPORTS IN THE WORLD, 47 IN THE UNITED STATES UNDISPUTED LEADER IN AIRPORT MASSAGE SERVICES 8 2.9x larger than closest competitors in the U.S. BE RELAX* MASSAGE BAR* TERMINAL GETAWAY* * Based on respective company websites as of August 8, 2016

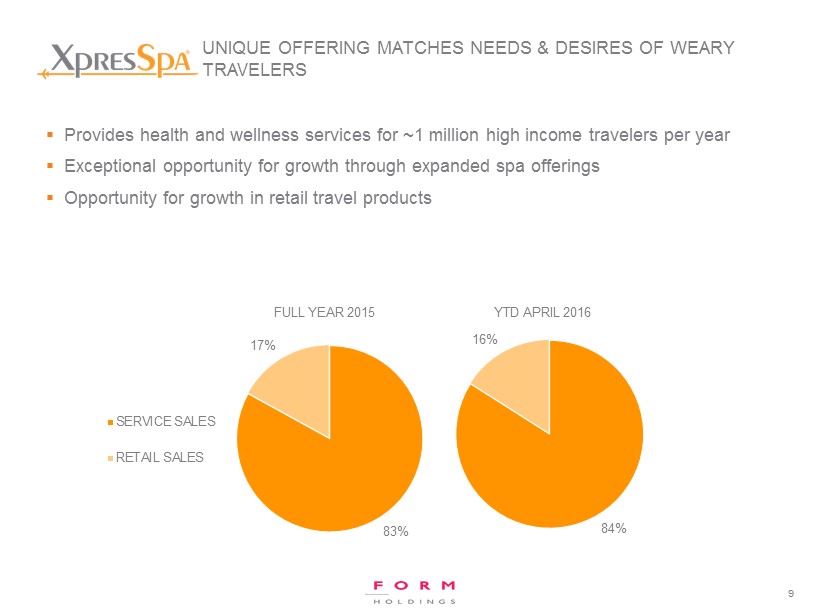

83% 17% FULL YEAR 2015 SERVICE SALES RETAIL SALES ▪ Provides health and wellness services for ~1 million high income travelers per year ▪ Exceptional opportunity for growth through expanded spa offerings ▪ Opportunity for growth in retail travel products UNIQUE OFFERING MATCHES NEEDS & DESIRES OF WEARY TRAVELERS 84% 16% YTD APRIL 2016 9

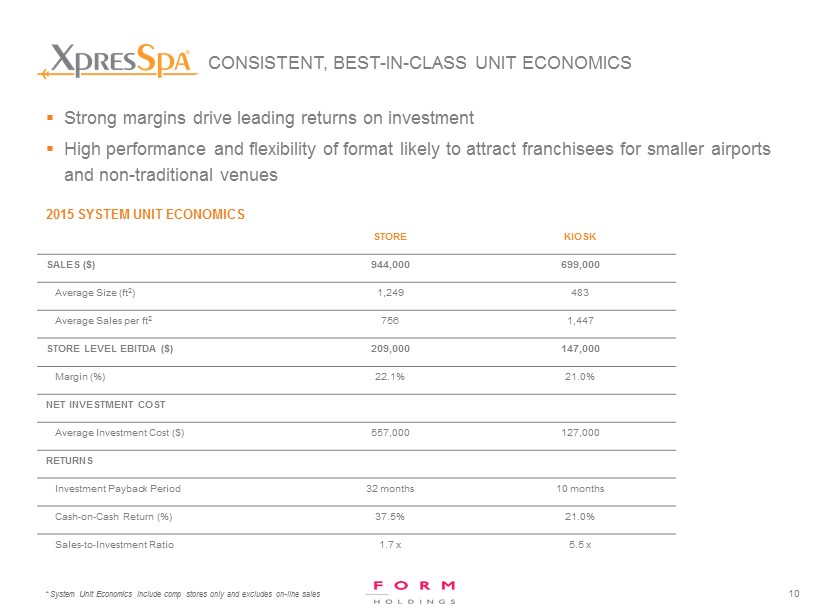

▪ Strong margins drive leading returns on investment ▪ High performance and flexibility of format likely to attract franchisees for smaller airports and non - traditional venues CONSISTENT, BEST - IN - CLASS UNIT ECONOMICS * System Unit Economics include comp stores only and excludes on - line sales 2015 SYSTEM UNIT ECONOMICS STORE KIOSK SALES ($) 944,000 699,000 Average Size (ft 2 ) 1,249 483 Average Sales per ft 2 756 1,447 STORE LEVEL EBITDA ($) 209,000 147,000 Margin (%) 22.1% 21.0% NET INVESTMENT COST Average Investment Cost ($) 557,000 127,000 RETURNS Investment Payback Period 32 months 10 months Cash - on - Cash Return (%) 37.5% 21.0% Sales - to - Investment Ratio 1.7 x 5.5 x 10

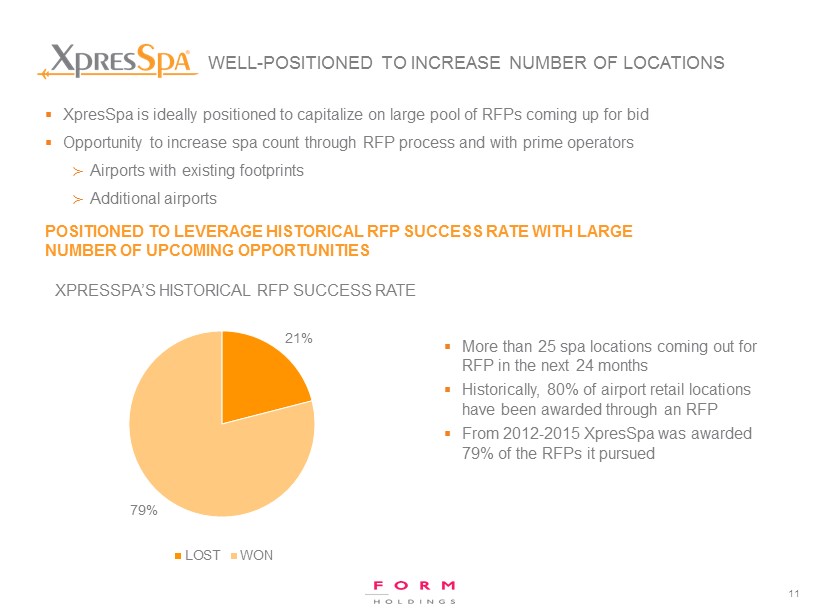

21% 79% LOST WON ▪ XpresSpa is ideally positioned to capitalize on large pool of RFPs coming up for bid ▪ Opportunity to increase spa count through RFP process and with prime operators ≻ Airports with existing footprints ≻ Additional airports WELL - POSITIONED TO INCREASE NUMBER OF LOCATIONS POSITIONED TO LEVERAGE HISTORICAL RFP SUCCESS RATE WITH LARGE NUMBER OF UPCOMING OPPORTUNITIES 11 ▪ More than 25 spa locations coming out for RFP in the next 24 months ▪ Historically, 80% of airport retail locations have been awarded through an RFP ▪ From 2012 - 2015 XpresSpa was awarded 79% of the RFPs it pursued XPRESSPA’S HISTORICAL RFP SUCCESS RATE

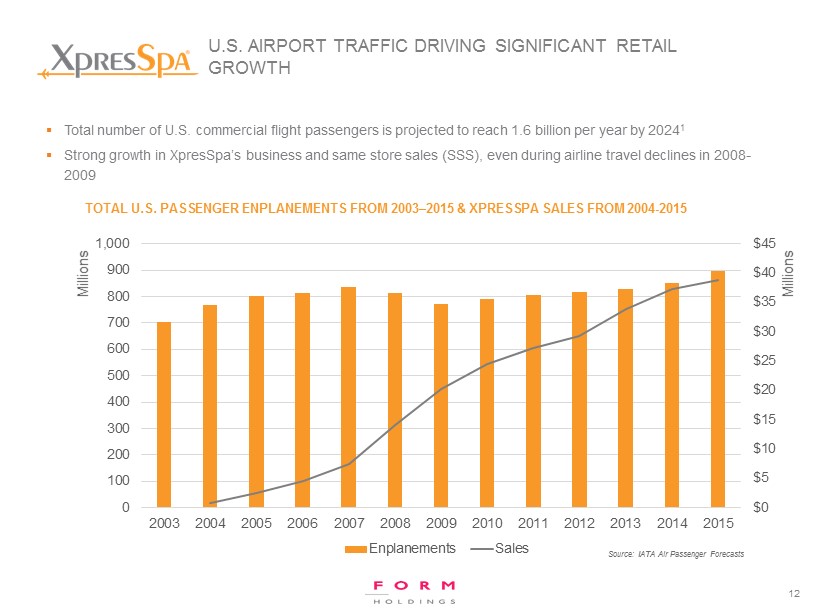

▪ Total number of U.S. commercial flight passengers is projected to reach 1.6 billion per year by 2024 1 ▪ Strong growth in XpresSpa’s business and same store sales (SSS), even during airline travel declines in 2008 - 2009 U.S. AIRPORT TRAFFIC DRIVING SIGNIFICANT RETAIL GROWTH Source: IATA Air Passenger Forecasts TOTAL U.S. PASSENGER ENPLANEMENTS FROM 2003 – 2015 & XPRESSPA SALES FROM 2004 - 2015 12 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 0 100 200 300 400 500 600 700 800 900 1,000 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Millions Millions Enplanements Sales

▪ Increased travel security and screening has driven innovation and growth in airport retail ≻ Travelers typically spend ~ 65 minutes in the airport after going through security 1 ▪ Premium concepts like XpresSpa are suited for typical traveler demographic ≻ 54% of travelers have a household income (HHI) > $75,000 2 , and frequent fliers (18% of travelers) have a HHI > $ 100,000 3 ≻ ~ 70 % of purchases occur on impulse because these affluent customers are bored, rushed, and stressed 4 GROWING TRAVELER DEMANDS FOR PREMIUM CONCESSIONS 1 Global Onboard Partners, 2007 2 Arbitgron , 2004 3 Airport World Magazine, 2016 4 Airport Revenue News 5 New Market Research & Micro Market Monitor 13 0 2 4 6 8 10 12 2015 2016 2017 2018 2019 2020 Billions AIRPORT RETAIL SPENDING ON PACE TO GROW AT A 19% CAGR, FROM $4.2 BILLION IN 2015 TO $9.9 BILLION IN 2020 5

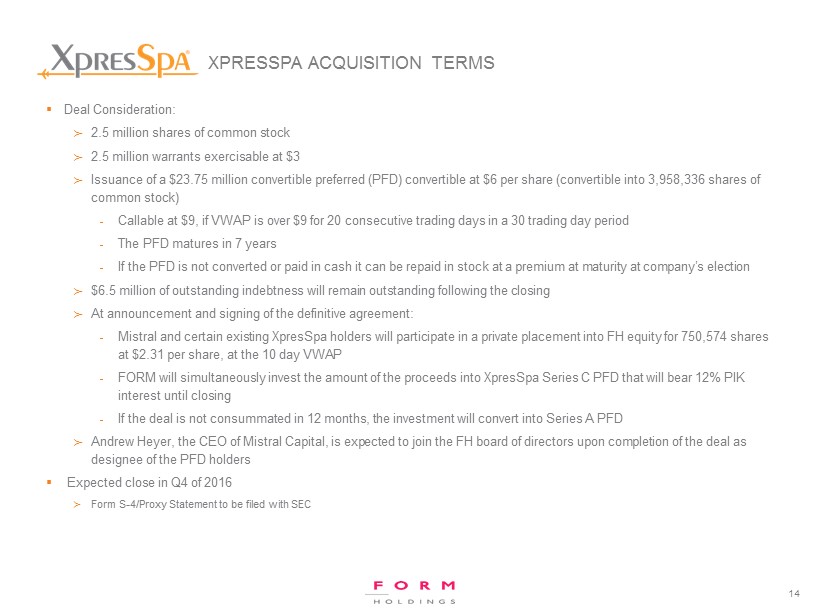

▪ Deal Consideration: ≻ 2.5 million shares of common stock ≻ 2.5 million warrants exercisable at $3 ≻ Issuance of a $23.75 million convertible preferred (PFD) convertible at $6 per share (convertible into 3,958,336 shares of common stock) - Callable at $9, if VWAP is over $9 for 20 consecutive trading days in a 30 trading day period - The PFD matures in 7 years - If the PFD is not converted or paid in cash it can be repaid in stock at a premium at maturity at company’s election ≻ $6.5 million of outstanding indebtness will remain outstanding following the closing ≻ At announcement and signing of the definitive agreement: - Mistral and certain existing XpresSpa holders will participate in a private placement into FH equity for 750,574 shares at $2.31 per share, at the 10 day VWAP - FORM will simultaneously invest the amount of the proceeds into XpresSpa Series C PFD that will bear 12% PIK interest until closing - If the deal is not consummated in 12 months, the investment will convert into Series A PFD ≻ Andrew Heyer, the CEO of Mistral Capital, is expected to join the FH board of directors upon completion of the deal as designee of the PFD holders ▪ Expected close in Q4 of 2016 ≻ Form S - 4/Proxy Statement to be filed with SEC XPRESSPA ACQUISITION TERMS 14

FORMER VICE PRESIDENT & GENERAL MANAGER Repositioned and expanded Luxury Retail including the Ilori Optical, Optical Shops of Aspen and Persol retail stores 2013 - 2016 FORMER SENIOR VICE PRESIDENT & GENERAL MANAGER Responsible for the $400 million North America multi - channel business consisting of 240 retail stores, 2,000 plus wholesale doors, and a growing direct and interactive business 2007 - 2012 FORMER CHIEF OPERATING OFFICER Oversaw merchandising, marketing, finance, store operations, planning/ allocation, real estate and visual/store design. 2001 - 2007 FORMER PRESIDENT Managed more than 500 staff across 85 retail stores with an operating budget of $47 million. 1999 - 2001 FORMER VICE PRESIDENT & DIRECTOR OF STORES Increased comparative store sales by 9%. Directly responsible for stores' organization, corporate communications, marketing, visual merchandising, real estate and construction 1993 - 1999 15 CEO WITH EXTENSIVE EXPERIENCE JOINED IN JUNE 2016 ED JANKOWSKI CEO

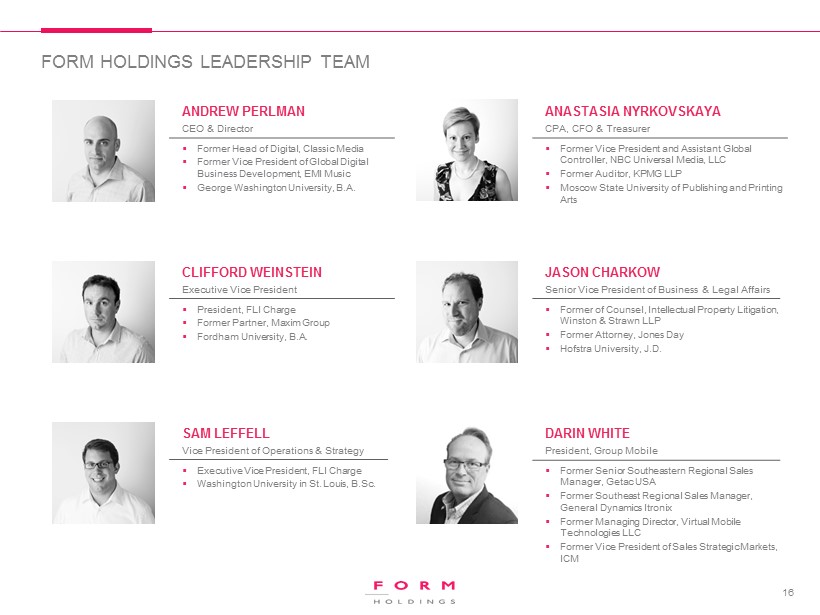

FORM HOLDINGS LEADERSHIP TEAM 16 ANDREW PERLMAN CEO & Director ▪ Former Head of Digital, Classic Media ▪ Former Vice President of Global Digital Business Development, EMI Music ▪ George Washington University, B.A. ANASTASIA NYRKOVSKAYA CPA, CFO & Treasurer ▪ Former Vice President and Assistant Global Controller, NBC Universal Media, LLC ▪ Former Auditor, KPMG LLP ▪ Moscow State University of Publishing and Printing Arts JASON CHARKOW Senior Vice President of Business & Legal Affairs ▪ Former of Counsel, Intellectual Property Litigation, Winston & Strawn LLP ▪ Former Attorney, Jones Day ▪ Hofstra University, J.D. CLIFFORD WEINSTEIN Executive Vice President ▪ President, FLI Charge ▪ Former Partner, Maxim Group ▪ Fordham University, B.A. SAM LEFFELL Vice President of Operations & Strategy ▪ Executive Vice President, FLI Charge ▪ Washington University in St. Louis, B.Sc. DARIN WHITE President, Group Mobile ▪ Former Senior Southeastern Regional Sales Manager, Getac USA ▪ Former Southeast Regional Sales Manager, General Dynamics Itronix ▪ Former Managing Director, Virtual Mobile Technologies LLC ▪ Former Vice President of Sales Strategic Markets, ICM

FORM HOLDINGS BOARD OF DIRECTORS 17 JOHN ENGELMAN Director ▪ Co - head International TV & DreamWorks Classics, DreamWorks Animation ▪ Co - founder, Boomerang Media ▪ Founder & CEO, Classic Media ▪ Former CEO, Broadway Video ▪ Harvard College, B.A.; Harvard Law School, J.D. DONALD STOUT Director ▪ Co - founder, NTP Inc. ▪ Partner, Antonelli Terry Stout & Kraus LLP ▪ Former patent examiner, USPTO ▪ Pennsylvania State University, B.S.; George Washington University, J.D. BRUCE BERNSTEIN Director & Chair of Compensation Committee ▪ President, Rockmore Capital, LLC ▪ Former Co - President, Omicron Capital, LP ▪ Former President, Fortis Investments Inc. ▪ Current Board Member, Summit Digital Health ▪ City University of New York (Baruch), B.B.A. RICHARD ABBE Director ▪ Co - Founder, Principal, Managing Partner & Co - Chief Investment Officer, Iroquois Capital Management LLC ▪ Co - Founder & Former Chief Investment Officer, Vertical Ventures LLC ▪ Former Senior Managing Director & Member of the Board of Directors, Gruntal & Company ANDREW PERLMAN CEO & Director ▪ Former Head of Digital, Classic Media ▪ Former VP of Global Digital Business Development, EMI Music ▪ George Washington University, B.A. SALVATORE GIARDINA Director & Chair of Audit Committee ▪ CFO Pragma Weeden Holdings LLC ▪ Former SVP & CFO, G - Trade Services & ConvergEx Global Markets ▪ Former EVP, CFO & Controller, Ladenburg Thalmann & Co., Inc. ▪ Current Director & Audit Committee Chair, National Holdings Corporation ANDREW HEYER Director Nominee ▪ Managing Partner & CEO, Mistral Equity Partners ▪ Founder & Partner, Trimaran Capital Partners ▪ Vice Chairman, CIBC World Markets ▪ Founder & Partner, The Argosy Group ▪ Managing Director, Drexel Burnham Lambert ▪ University of Pennsylvania, B.S.; The Wharton School, M.B.A

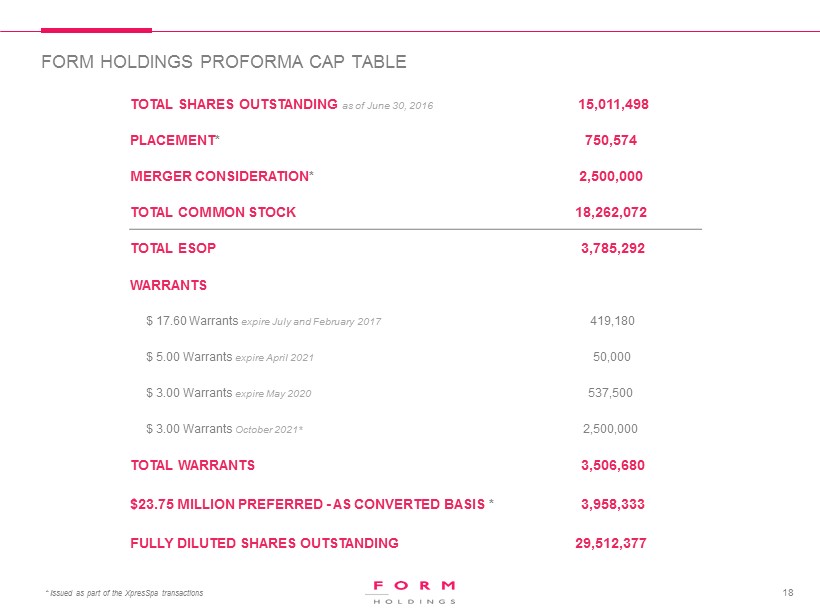

FORM HOLDINGS PROFORMA CAP TABLE TOTAL SHARES OUTSTANDING as of June 30, 2016 15,011,498 PLACEMENT * 750,574 MERGER CONSIDERATION * 2,500,000 TOTAL COMMON STOCK 18,262,072 TOTAL ESOP 3,785,292 WARRANTS $ 17.60 Warrants expire July and February 2017 419,180 $ 5.00 Warrants expire April 2021 50,000 $ 3.00 Warrants expire May 2020 537,500 $ 3.00 Warrants October 2021* 2,500,000 TOTAL WARRANTS 3,506,680 $23.75 MILLION PREFERRED - AS CONVERTED BASIS * 3,958,333 FULLY DILUTED SHARES OUTSTANDING 29,512,377 18 * Issued as part of the XpresSpa transactions

CONTACT INFORMATION Cliff Weinstein Executive Vice President Office: 646.532.6777 CWeinstein@FORMHoldings.com FORM Holdings Corp. 780 3rd Avenue, 12 th Floor New York, NY 10017 For more information, please contact: