Attached files

| file | filename |

|---|---|

| EX-4.1 - EX-4.1 - TESARO, Inc. | tsro-20160630ex41a212a80.htm |

| 10-Q - 10-Q - TESARO, Inc. | tsro-20160630x10q.htm |

| EX-32.2 - EX-32.2 - TESARO, Inc. | tsro-20160630ex322af6edd.htm |

| EX-32.1 - EX-32.1 - TESARO, Inc. | tsro-20160630ex321017805.htm |

| EX-31.2 - EX-31.2 - TESARO, Inc. | tsro-20160630ex3124750dd.htm |

| EX-31.1 - EX-31.1 - TESARO, Inc. | tsro-20160630ex3110d60f3.htm |

| EX-10.3 - EX-10.3 - TESARO, Inc. | tsro-20160630ex103eb9aec.htm |

| EX-10.2 - EX-10.2 - TESARO, Inc. | tsro-20160630ex102442380.htm |

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

COLLABORATION AND LICENSE AGREEMENT

BY AND BETWEEN

TESARO, INC.

AND

JANSSEN BIOTECH, INC.

TABLE OF CONTENTS

|

|

Page |

|

Article 1 DEFINITIONS |

1 |

|

|

|

|

Article 2 GOVERNANCE |

22 |

|

|

|

|

2.1 Joint Steering Committee |

22 |

|

2.2 Joint Development Committee |

25 |

|

2.3 Joint Commercialization Committee |

28 |

|

2.4 Joint Manufacturing Committee |

30 |

|

2.5 Joint Finance Committee |

31 |

|

2.6 Committee Membership and Operations |

33 |

|

2.7 Additional Subcommittees |

35 |

|

2.8 Authority |

35 |

|

2.9 Alliance Managers |

35 |

|

2.10 Compliance with Merger Control Laws |

35 |

|

|

|

|

Article 3 LICENSES |

36 |

|

|

|

|

3.1 Licenses to Company |

36 |

|

3.2 License to TESARO |

39 |

|

3.3 [***] |

40 |

|

3.4 Retained Rights |

41 |

|

3.5 No Implied Licenses |

41 |

|

3.6 [***] |

41 |

|

|

|

|

Article 4 DEVELOPMENT |

43 |

|

|

|

|

4.1 General |

43 |

|

4.2 Development Activities |

43 |

|

4.3 Development Diligence Obligations |

47 |

|

4.4 Compliance with Law |

48 |

|

4.5 Records |

48 |

|

4.6 Subcontracting |

49 |

|

4.7 Audits |

49 |

|

|

|

|

Article 5 REGULATORY RESPONSIBILITIES |

49 |

|

|

|

|

5.1 General |

49 |

|

5.2 Regulatory Activities – General |

50 |

|

5.3 INDs and Marketing Approvals |

51 |

|

5.4 Interactions with Regulatory Authorities |

57 |

|

5.5 Sharing of Regulatory Documentation |

58 |

|

5.6 Rights of Reference |

58 |

|

5.7 Adverse Event Reporting and Safety Data Exchange |

60 |

|

5.8 Medical Affairs |

60 |

|

5.9 Recalls and Voluntary Withdrawals |

62 |

|

5.10 Subcontracting |

63 |

|

|

|

|

Article 6 COMMERCIALIZATION |

64 |

|

|

|

|

6.1 General |

64 |

|

6.2 Commercialization Activities |

64 |

|

6.3 Commercialization Diligence Obligations |

67 |

|

6.4 Registration & Distribution Option |

67 |

|

6.5 Trademarks; Product Packaging |

68 |

|

6.6 Transparency Reporting |

68 |

|

6.7 Compliance with Law |

69 |

|

6.8 Advertising and Promotional Materials |

69 |

|

6.9 Subcontracting |

69 |

|

6.10 [***] |

69 |

|

|

|

|

Article 7 MANUFACTURING |

70 |

|

|

|

|

7.1 Single Agent Products |

70 |

|

7.2 Fixed Dose Combination Products |

71 |

|

7.3 API Supply |

71 |

|

7.4 Joint Manufacturing Committee |

73 |

|

7.5 Compliance with Law |

74 |

|

7.6 Subcontracting; Audit Rights |

74 |

|

7.7 Supply Shortages |

75 |

|

|

|

|

Article 8 CONSIDERATION |

75 |

|

|

|

|

8.1 Upfront Payment |

75 |

|

8.2 Milestone Payments |

76 |

|

8.3 Single Agent Alliance Payments |

80 |

|

8.4 Company Royalty Obligations |

82 |

|

8.5 Royalty Term |

86 |

|

8.6 Royalty Rate Reduction |

87 |

|

8.7 Manner of Royalty Payment |

87 |

|

8.8 Currency |

88 |

|

8.9 Third Party Financial Obligations |

89 |

|

8.10 Taxes |

92 |

|

8.11 Audit |

93 |

|

8.12 [***] |

94 |

|

Confidential |

ii |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

|

8.13 Other TESARO Invoices to Company |

95 |

|

8.14 Invoices |

95 |

|

8.15 Late Payment |

95 |

|

|

|

|

Article 9 INTELLECTUAL PROPERTY MATTERS |

95 |

|

|

|

|

9.1 Ownership of Inventions |

95 |

|

9.2 Disclosure of Inventions |

96 |

|

9.3 Prosecution of Patents |

96 |

|

9.4 Patent Term Extensions in the Territory |

98 |

|

9.5 Infringement of Patents by Third Parties |

99 |

|

9.6 Infringement of Third Party Rights in the Territory |

101 |

|

9.7 Patent Oppositions and Other Proceedings |

103 |

|

|

|

|

Article 10 REPRESENTATIONS, WARRANTIES AND COVENANTS |

104 |

|

|

|

|

10.1 Mutual Representations, Warranties and Covenants |

104 |

|

10.2 Additional Representations and Warranties of TESARO |

105 |

|

10.3 Additional Representations and Warranties of Company |

109 |

|

10.4 Merck License Agreement |

109 |

|

10.5 Certain Compliance Matters |

109 |

|

10.6 No Other Representations or Warranties |

110 |

|

|

|

|

Article 11 CONFIDENTIALITY |

110 |

|

|

|

|

11.1 Nondisclosure and Nonuse |

110 |

|

11.2 Exceptions |

111 |

|

11.3 Authorized Disclosure |

112 |

|

11.4 Terms of this Agreement |

112 |

|

11.5 Publicity |

113 |

|

11.6 Securities Filings |

113 |

|

11.7 Relationship to Confidentiality Agreement and Merck License Agreement |

113 |

|

11.8 Equitable Relief |

114 |

|

11.9 Publications |

114 |

|

11.10 Return of Confidential Information |

114 |

|

|

|

|

Article 12 TERM AND TERMINATION |

114 |

|

|

|

|

12.1 Term |

114 |

|

12.2 Termination upon Termination of the Merck License Agreement or Either AstraZeneca License Agreement |

114 |

|

12.3 Unilateral Termination by Company |

114 |

|

12.4 Termination for Material Breach |

114 |

|

12.5 Termination by Company for Safety Reasons |

115 |

|

Confidential |

iii |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

|

12.6 [Reserved.] |

115 |

|

12.7 Termination for Bankruptcy |

115 |

|

12.8 [***] |

117 |

|

12.9 Effects of Termination |

117 |

|

12.10 Remedies |

121 |

|

12.11 Survival |

121 |

|

|

|

|

Article 13 DISPUTE RESOLUTION |

121 |

|

|

|

|

13.1 Exclusive Dispute Resolution Mechanism |

121 |

|

13.2 Resolution by Executive Officers |

121 |

|

13.3 Arbitration |

122 |

|

13.4 Provisional Remedies |

123 |

|

13.5 Confidentiality |

123 |

|

|

|

|

Article 14 INDEMNIFICATION |

123 |

|

|

|

|

14.1 Indemnification by Company |

123 |

|

14.2 Indemnification by TESARO |

125 |

|

14.3 Indemnification Procedures |

126 |

|

14.4 Insurance |

129 |

|

14.5 Limitation of Liability |

129 |

|

|

|

|

Article 15 MISCELLANEOUS |

129 |

|

|

|

|

15.1 Notices |

129 |

|

15.2 Governing Law |

130 |

|

15.3 [***] |

131 |

|

15.4 Assignment |

132 |

|

15.5 Designation of Affiliates |

132 |

|

15.6 Relationship of the Parties |

133 |

|

15.7 Force Majeure |

133 |

|

15.8 Entire Agreement; Amendments |

133 |

|

15.9 Severability |

133 |

|

15.10 English Language |

134 |

|

15.11 Waiver and Non-Exclusion of Remedies |

134 |

|

15.12 Further Assurance |

134 |

|

15.13 Headings |

134 |

|

15.14 Construction |

134 |

|

15.15 Counterparts |

135 |

|

Confidential |

iv |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

LIST OF EXHIBITS

|

Exhibit 1.63 |

Initial Compound |

|

Exhibit 1.69 |

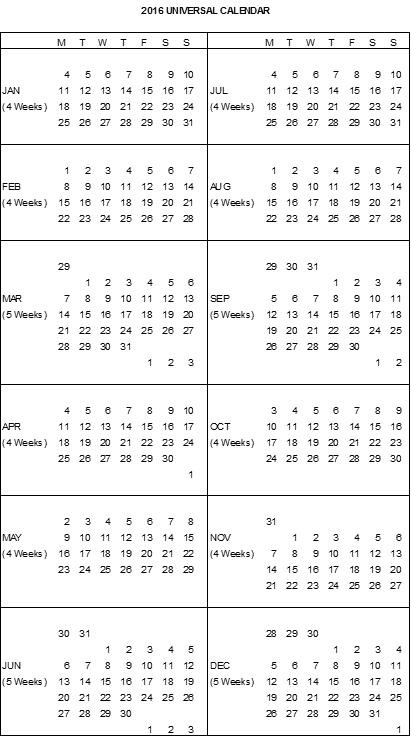

2016 Johnson & Johnson Universal Calendar |

|

Exhibit 1.117 |

TESARO Patents |

|

Exhibit 4.2(c) |

TESARO Development Plan |

|

Exhibit 4.2(f) |

TESARO INDs |

|

Exhibit 4.2(h) |

Example of Third Party Development Report |

|

Exhibit 5.5(a) |

Regulatory Documentation relating to Initial Compound and Initial Product |

|

Exhibit 7.1(a) |

Company Supply Requirements and Timeline |

|

Exhibit 8.2(d) |

Merck Milestone Payments |

|

Exhibit 8.3 |

Alliance Payments |

|

Exhibit 8.4(b)(i)(1) |

Pass-through Merck Royalty |

|

Attachment 1 to Exhibit 8.4(b)(i)(1) |

Merck Compound Patent Rights |

|

Exhibit 8.4(b)(i)(2) |

Pass-through AstraZeneca Royalties |

|

[***] |

[***] |

|

[***] |

[***] |

|

Summary of Economic Transfers between the Parties |

|

|

Exhibit 10.2(j) |

TESARO Disclosure of Certain Development Activities |

|

Exhibit 10.4 |

Merck License Agreement Provisions |

|

Exhibit 10.5 |

Compliance with Laws |

|

Exhibit 11.5 |

Press Release |

|

Confidential |

v |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

COLLABORATION AND LICENSE AGREEMENT

THIS COLLABORATION AND LICENSE AGREEMENT (“Agreement”) is entered into as of April 5, 2016 (the “Effective Date”), by and between JANSSEN BIOTECH, INC., a Pennsylvania corporation, having its principal place of business at 800/850 Ridgeview Drive, Horsham, PA 19044 (hereinafter “Company”) and TESARO, INC., a Delaware corporation having its principal place of business at 1000 Winter Street, Suite 3300, Waltham, MA 02451 (“TESARO”). Company and TESARO are sometimes referred to herein individually as a “Party” and collectively as the “Parties”.

WHEREAS, TESARO is currently developing a small molecule poly ADP ribose polymerase (PARP) inhibitor, Niraparib, for certain cancer indications (including breast cancer and ovarian cancer);

WHEREAS, Company desires to obtain, and TESARO desires to grant to Company, a worldwide (excluding Japan), exclusive license to develop and commercialize Niraparib for prostate cancer indications, subject to the terms and conditions of this Agreement; and

WHEREAS, TESARO and Company desire to collaborate with respect to the development, manufacture and commercialization of Niraparib as set forth in this Agreement.

NOW, THEREFORE, in consideration of the foregoing and the premises and conditions set forth herein, the Parties agree as follows:

1.1“Acquirer” means any Third Party that is an acquirer in any Change of Control transaction and any of such Third Party’s Affiliates.

1.2“Affiliate” means, with respect to a particular Person and a particular time, another Person that controls, is controlled by or is under common control with such first Person at any such time during the Term. For the purposes of this definition, the word “control” (including, with correlative meaning, the terms “controlled by” or “under the common control with”) means the actual power, either directly or indirectly through one or more intermediaries, to direct or cause the direction of the management and policies of a Person, whether by the ownership of fifty percent (50%) or more of the voting stock of such Person, by contract, or otherwise.

1.3“Affordable Basis” means making a product available to patients at the lowest cost possible. For clarification, Affordable Basis is satisfied if a Party sells such product for no more than [***]. In determining Affordable Basis, the Parties recognize that, to the extent that a Party engages a Third Party in the commercialization of a product on an Affordable Basis, such Third Party shall be entitled to [***]; provided that the applicable Party uses Commercially Reasonable Efforts to minimize such Third Party profits.

1.4“Alliance Manager” means the person appointed by each Party from within its respective organization to coordinate and facilitate the communication, interaction and cooperation of the Parties pursuant to this Agreement.

1.5“ANDA” means an abbreviated new drug application submitted to the FDA pursuant to 21 U.S.C. § 355(j), and all amendments and supplements thereto

1.6“Applicable Law” means all applicable statutes, ordinances, regulations, rules or orders of any kind whatsoever of any Governmental Authority, including the FFDCA, 21 U.S.C. §301 et seq., U.S. Patent Act (35 U.S.C. §1 et seq.), Federal False Claims Act (31 U.S.C. §3729 et seq.), the Anti-Kickback Statute (42 U.S.C. §1320a-7b et seq.), Directive 2001/83/EC of the European Parliament and of the Council of 6 November 2001 on the Community code relating to medicinal products for human use, Directive 2001/20/EC on the approximation of the laws, regulations and administrative provisions of the EU member states relating to the implementation of good clinical practice in the conduct of clinical trials on medicinal products for human use, Commission Directive 2005/28/EC of 8 April 2005 laying down principles and detailed guidelines for good clinical practice as regards investigational medicinal products for human use and related guidance, Directive 95/46/EC on the protection of individuals with regard to the processing of personal data and on the free movement of such data, the related national implementing laws and regulations of the EU member states, provisions of the national laws and industry and professionals codes of EU member states governing anti-bribery and anti-kickback practices, all as amended from time to time, together with any rules, regulations, and compliance guidance promulgated thereunder.

1.7“AstraZeneca” means AstraZeneca UK Limited or any assignee of such entity under the AstraZeneca License Agreements.

1.8“AstraZeneca License Agreements” means, collectively, (a) the Patent License Agreement, dated October 4, 2012, between TESARO and AstraZeneca, relating to certain intellectual property licensed to AstraZeneca by the Institute of Cancer Research (the “AstraZeneca-ICR License Agreement”), and (b) the Patent License Agreement, dated October 4, 2012, between TESARO and AstraZeneca, relating to certain intellectual property licensed to AstraZeneca by the University of Sheffield (the “AstraZeneca-Sheffield License Agreement”), in each case ((a) and (b)), including all amendments thereto.

1.9“AstraZeneca Patents” means the “Licensed Patents” as such term is defined in each of the AstraZeneca License Agreements.

1.10“Business Day” means a day other than Saturday, Sunday or any other day on which banking institutions in New York, New York are closed for business.

1.11“Calendar Quarter” means a financial quarter based on the Johnson & Johnson Universal Calendar; provided, however, that the first Calendar Quarter for the first Calendar Year extends from the Effective Date to the end of the then-current Calendar Quarter and the last

|

Confidential |

2 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

Calendar Quarter extends from the first day of such Calendar Quarter until the effective date of the termination or expiration of this Agreement.

1.12“Calendar Year” means a year based on the Johnson & Johnson Universal Calendar for that year. The last Calendar Year of the Term begins on the first day of the Johnson & Johnson Universal Calendar Year for the year during which termination or expiration of this Agreement will occur, and the last day of such Calendar Year will be the effective date of such termination or expiration.

1.13“Centralized Approval Procedure” means, to the extent compulsory or permitted for the Marketing Approval of a pharmaceutical product in Iceland, Liechtenstein, Norway or any country in the European Union, the procedure administrated by the EMA which results in a single Marketing Approval granted by the European Commission (excluding any pricing or reimbursement approval) that is valid in all countries in the European Union and following recognition, Iceland, Liechtenstein and Norway.

1.14“Change of Control” shall occur if: (a) any Third Party acquires directly or indirectly the beneficial ownership of any voting security of a Party, or if the percentage ownership of such person or entity in the voting securities of a Party is increased through stock redemption, cancellation or other recapitalization, and immediately after such acquisition or increase such Third Party is, directly or indirectly, the beneficial owner of voting securities representing more than fifty percent (50%) of the total voting power of all of the then outstanding voting securities of a Party; (b) a merger, consolidation, recapitalization or reorganization of a Party is consummated, other than any such transaction, which would result in stockholders or equity holders of such Party immediately prior to such transaction, owning, directly or indirectly, at least fifty percent (50%) of the outstanding securities of the surviving entity (or its parent entity) immediately following such transaction; (c) the stockholders or equity holders of a Party approve a plan of complete liquidation of such Party, or an agreement for the sale or disposition by such Party of all or substantially all of such Party’s assets, other than pursuant to a transaction described above or to an Affiliate; (d) individuals who, as of the date hereof, constitute the Board of Directors of a Party (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board of Directors of such Party (provided, however, that any individual becoming a director subsequent to the date hereof whose election, or nomination for election by such Party’s shareholders, was recommended or approved by a vote of at least a majority of the directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board); or (e) the sale or transfer to a Third Party of all or substantially all of such Party’s assets is effected.

1.15“Clinical Data” means any and all data (anonymized, to the extent required by Applicable Law or relevant contracts) generated from any Clinical Trial, or from testing or analysis of subjects or samples from a Clinical Trial (e.g., in vitro testing of tissue samples from subjects enrolled in a Clinical Trial), including raw data, any top-line results reports, and the final clinical study report from such Clinical Trial.

|

Confidential |

3 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

1.16“Clinical Trials” means a Phase 1 Trial, Phase 2 Trial, Phase 2/3 Trial, Phase 3 Trial or Phase 4 Trial, as applicable.

1.17“CMC Development” means the Development activities related to the composition, manufacture, and specification of the drug substance and the drug product intended to assure the proper identification, quality, purity and strength of the drug, including, but not limited to: test method development and stability testing, process development, drug substance development, process validation, process scale-up, formulation development, delivery system development, quality assurance and quality control development.

1.18“Co-Packaged Product” means any product containing, in a single package or container and intended for coordinated sale or use, two (2) or more separate products as components, one (1) of which is a Product and the other one (1) or more are for preventative, therapeutic, or diagnostic use.

1.19“Combination Product” means any Product containing as a single formulation, two or more active pharmaceutical ingredients (each, an “API”) as components, including (i) a Compound and (ii) one or more other APIs.

1.20“Combination Use” means the use of a Single Agent Product in combination with at least one other product that is not a Product for the diagnosis, treatment or prevention of any indication, where such Single Agent Product and other product are packaged and sold separately.

1.21“Commercialization” means any activities directed to marketing, promoting and/or Distributing a pharmaceutical product. When used as a verb, “Commercialize” means to engage in Commercialization activities.

1.22“Commercially Reasonable Efforts” means, with respect to the efforts and resources to be expended, or activities to be undertaken, by a Party or its Affiliate with respect to any objective or activity to be undertaken hereunder, reasonable efforts and resources intended in good faith to accomplish such objective or activity as such Party would normally use to accomplish a similar objective or activity under similar circumstances, it being understood and agreed that, with respect to the Development, Manufacture, seeking and obtaining Marketing Approval, or Commercialization of a Compound or Product, such efforts and resources shall be consistent with those efforts and resources normally used by a Party under similar circumstances for similar compounds or products to which it has similar rights, which compound or product, as applicable, is at a similar stage in its development or product life and is of similar market potential, taking into account all commercial, scientific, economic and other factors (not including payments due to a Party hereunder), including: (a) issues of efficacy, safety, and expected and actual approved labeling; (b) the expected and actual competitiveness of alternative products sold by Third Parties in the marketplace; (c) the expected and actual product profile of the Compound or Product; (d) the expected and actual patent and other proprietary position of the Compound or Product; (e) the likelihood of Marketing Approval of the Product given the regulatory structure involved, including the likelihood of obtaining regulatory exclusivity; (f) the ability to formulate and Develop Combination Products; and (g) the market penetration, actual

|

Confidential |

4 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

profitability and the return on investment potential of the Product, including pricing and reimbursement status achieved or likely to be achieved and expected and actual Third Party costs. Additionally, neither Party shall take into account the Alliance Payments, royalties or milestone payments due to the other Party under this Agreement in connection with its use of Commercially Reasonable Efforts. To the extent that the performance of a Party’s obligations hereunder is adversely affected by the other Party’s failure to perform its obligations hereunder, the impact of such performance failure will be taken into account in determining whether such first Party has used Commercially Reasonable Efforts to perform its affected obligations.

1.23“Company Field” means the diagnosis, treatment or prevention of prostate cancer in humans.

1.24“Company Know-How” means any Know-How Controlled by Company or its Affiliates during the Term that is used by Company or any of its Affiliates or (sub)licensees to Exploit the Compounds or Single Agent Products in the Company Field in the Company Territory, but excluding any such Know-How to the extent that it (a) is used to Exploit a Compound due to its incorporation or use as part of a Combination Product, and (b) is not necessary or useful for the Exploitation of Compounds as Single Agent Products.

1.25“Company Net Sales” means, with respect to any Product sold by Company or any of its Affiliates, licensees or sublicensees, the gross amounts invoiced on sales of such Product by Company or any of its Affiliates, licensees or sublicensees to a Third Party purchaser in an arms-length transaction, less the following customary deductions, determined in accordance with GAAP and internal policies and actually taken, paid, accrued or allocated based on good faith estimates:

(a) trade, cash and/or quantity discounts, allowances, and credits, excluding commissions for commercialization;

(b) excise taxes, use taxes, tariffs, sales taxes and customs duties, and/or other government taxes imposed on the sale of Product (including VAT, but only to the extent that such VAT taxes are not reimbursable or refundable), specifically excluding, for clarity, any income taxes assessed against the income arising from such sale;

(c) outbound freight, shipment and insurance costs to the extent included in the price and separately itemized on the invoice price;

(d) [***], cash rebates payable to, or the impact of reimbursement caps established by, a governmental authority (or agent thereof) pursuant to governmental regulations by reason of any national or local health insurance program or similar program, including government levied fees as a result of healthcare reform policies;

|

Confidential |

5 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

(e) retroactive price reductions, credits or allowances actually granted upon rejections or returns of Product, including for recalls or damaged goods, or billing errors and reserves for returns;

(f) rebates, chargebacks, administrative fees and discounts (or equivalent thereof) payable to managed health care organizations, group purchasing organizations, pharmacy benefit managers (or equivalent thereof), specialty pharmacy providers, federal, state/provincial, local or other governments, or their agencies or purchasers, reimbursers, or trade customers;

(g) amounts payable to patients through co-pay assistance cards or similar forms of rebate directly related to the prescribing of the Product; and

(h) any invoiced amounts which are not collected by Company or its Affiliates, including bad debts.

All aforementioned deductions shall only be allowable to the extent they are commercially reasonable and shall be determined, on a country-by-country basis, as incurred in the ordinary course of business in type and amount consistent with Company’s, its Affiliate’s, or Third Party licensee’s or sublicensee’s (as the case may be) business practices consistently applied across its product lines and accounting standards and verifiable based on Company’s and its Affiliates’ sales reporting system.

Sales of a Product by and between Company and its Affiliates, licensees or sublicensees are not sales to Third Parties and shall be excluded from Net Sales calculations for all purposes so long as such Product is subsequently resold to a Third Party end user. Sales of a Product on an Affordable Basis in Developing Countries shall be excluded from Net Sales calculations for purposes of royalty calculations under ARTICLE 8. Any disposition of a Product as free samples, donations, patient assistance, test marketing programs or other similar programs or studies where such Product is supplied free of charge shall not be subject to royalties.

Notwithstanding the foregoing, but subject to Section 3.1(e), with respect to any Combination Product that is sold by Company or any of its Affiliates, licensees or sublicensees, the Net Sales of such Combination Product for the determination of royalties of Combination Products will be calculated by multiplying the Net Sales of such Combination Product (calculated as set forth above) by the fraction 1/A, where A is the total number of separate active pharmaceutical ingredients included in such Combination Product.

1.26“Company Parent” means Johnson & Johnson, a New Jersey corporation.

1.27“Company Patents” means all Patents Controlled by Company or its Affiliates during the Term that are necessary to Exploit Compounds or the Single Agent Products in the Company Field in the Company Territory, but excluding any such Patent to the extent that it (a) Covers such Compound due to its incorporation or use as part of a Combination Product and (b) is not necessary or useful for the Exploitation of Compounds as Single Agent Products.

|

Confidential |

6 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

1.28“Company Technology” means, collectively, the Company Patents and the Company Know-How.

1.29“Company Territory” means worldwide, excluding Japan.

1.30“Compound” means (a) the Initial Compound; (b) the compound licensed to TESARO under the Merck License Agreement and known as MK-2512; or (c) with respect to both (a) and (b), any pharmaceutically acceptable salt, polymorph, crystal form, prodrug or solvate thereof.

1.31“Conducting Party” means the Party that is (or the Party whose Affiliate, licensee or sublicensee is) conducting a Clinical Trial of a Product.

1.32“Confidential Information” means, subject to ARTICLE 11, (a) all non-public or proprietary information disclosed by a Party to the other Party under this Agreement, which may include Know-How; and (b) all other non-public or proprietary information (including Know-How) that is expressly deemed in this Agreement to be Confidential Information of such Party whether or not disclosed by such Party or any of its Affiliates to the other Party or any of its Affiliates; in each case ((a) and (b)) without regard as to whether any of the foregoing is marked “confidential” or “proprietary,” or disclosed in oral, written, graphic, or electronic form. Confidential Information shall include: (a) the terms and conditions of this Agreement; and (b) Confidential Information disclosed by either Party pursuant to the Mutual Non-Disclosure Agreement dated December 29, 2015, between TESARO and Janssen Research & Development LLC, an Affiliate of Company (the “Prior CDA”).

1.33“Control” or “Controlled” means, with respect to any Know-How, Patent, Trademark or other intellectual property right, possession by a Party or[***] any of its Affiliates, of the ability (without taking into account any rights granted by one Party to the other Party under the terms of this Agreement) to grant access, a license or a sublicense to such Know-How, Patent, Trademark or other intellectual property right without violating the terms of any agreement or other arrangement with, or necessitating the consent of, any Third Party, but with respect to TESARO excluding any Know-How, Patent, Trademark or other intellectual property right that comes into the Control of TESARO pursuant to a Change of Control of TESARO, except to the extent and only to the extent that, such Know-How, Patent, Trademark or other intellectual property right is (a) made, conceived or reduced to practice by the Acquirer following a Change of Control through the use of, or reference to, any Know-How, Patent, Trademark or other intellectual property right Controlled by TESARO prior to the Change of Control and the failure of Company to have access to such intellectual property right would prevent Company from exercising its rights under Section 3.1 to Exploit Compounds and Products, as they existed immediately prior to the Change of Control; or (b) actually used by TESARO or its Affiliates, or the Acquirer, to Exploit the Compounds or Products following the consummation of such Change of Control. For clarity, “Control” of a compound by a Party shall mean that such Party Controls Know-How, Patents or other intellectual property rights with respect to such compound.

1.34“Cover” or “Covering” means, with respect to a product, technology, process or method, that, in the absence of ownership of or a license granted under a Valid Claim, the practice or

|

Confidential |

7 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

Exploitation of such product, technology, process or method would infringe such Valid Claim (or, in the case of a Valid Claim that has not yet issued, would infringe such Valid Claim if it were to issue).

1.35“CPR” means the International Institute for Conflict Prevention & Resolution or any successor organization having substantially the same function.

1.36“Critical Observation” means a significant and meaningful GMP deviation or deficiency that requires immediate remediation.

1.37“Currency Hedge Rate” means the Johnson & Johnson currency hedge rate[***]. The Johnson & Johnson currency hedge rate is calculated [***].

1.38“Developing Countries” means those countries defined by the World Bank as either “low income countries” or “lower middle income economies” as of the Effective Date. If, during the Term, countries reported by the World Bank are moved in or out of these designations, the Parties will discuss in good faith the royalty reduction treatment for such countries.

1.39“Development” means all research and non-clinical and clinical drug development activities and processes, including toxicology, pharmacology, project management and other non-clinical efforts, statistical analysis, formulation development, delivery system development, statistical analysis, CMC Development, the performance of Clinical Trials (including the Manufacturing of Compound or Product for use in Clinical Trials) and other activities, reasonably necessary to obtain or maintain Marketing Approval of a pharmaceutical product. When used as a verb, “Develop” means to engage in Development activities.

1.40“Distribution” means offering to sell, selling, distributing, exporting, transporting and other activities associated with the foregoing activities with respect to the distribution of a pharmaceutical product, including inventory management and control, storage, warehousing and distribution, invoicing, collection of sales proceeds, booking of sales, preparation of sales records and reports, customer relations and services and handling of returns. When used as a verb, “Distribute” means to engage in Distribution activities.

1.41“DMF Equivalent” means (a) a Drug Master File (as defined in 21 CFR 314.420) with respect to the U.S.; (b) Module 3 of the Common Technical Document with respect to countries in the EU; or (c) any equivalent of any of the foregoing with respect to any country outside the U.S. or EU.

1.42“Drug Approval Application” means an MAA or NDA.

1.43“EMA” means the European Medicines Agency or any successor agency(ies) or authority having substantially the same function.

|

Confidential |

8 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

1.44“European Commission” means the executive body of the European Union that is responsible, among other things, for granting marketing authorization for medicinal products through the Centralized Approval Procedure.

1.45“European Union” or “EU” means the European Union member states as then-currently constituted; provided, however, that the EU shall always be deemed to include the Major EU Countries. As of the Effective Date, the European Union member states are Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and the United Kingdom.

1.46“Executive Officers” means (a) with respect to Company, either (i) prior to the first Marketing Approval of any Product in the Company Field in the Company Territory, the Global Head of Research and Development (or his or her designee), and (ii) following the first Marketing Approval of any Product in the Company Field in the Company Territory, the President of U.S. oncology commercial operations (or his or her designee), and (b) with respect to TESARO, the Chief Executive Officer (or his or her designee).

1.47“Exploitation” means research, use, practice, Development, Manufacture or Commercialization. When used as a verb, to “Exploit” means to engage in Exploitation activities.

1.48“FDA” means the U.S. Food and Drug Administration and any successor agency(ies) or authority having substantially the same function.

1.49“FFDCA” means the U.S. Federal Food, Drug, and Cosmetic Act (21 U.S.C. §301 et seq.), as amended from time to time.

1.50“Field” means, (a) with respect to Company and its Affiliates and (sub)licensees, the Company Field, and (b) with respect to TESARO and its Affiliates and (sub)licensees, the TESARO Field. References to a “Party’s Field” shall be interpreted accordingly.

1.51“First Commercial Sale” means, on a Product-by-Product and country-by-country basis, the first sale for monetary value of such Product under this Agreement by a Party, its Affiliates, licensees or sublicensees to an end user for use, consumption or resale of such Product in such country in the Company Field after Marketing Approval of such Product in the Company Field has been obtained in such country, where such sale results in a Net Sale. Sale of a Product under this Agreement by a Party to an Affiliate of such Party or a licensee or sublicensee of such Party shall not constitute a First Commercial Sale unless such Affiliate, licensee or sublicensee is the end user of such Product. For the avoidance of doubt, the sale of Product for clinical study purposes, early access programs (such as to provide patients with a Product prior to Marketing Approval pursuant to treatment INDs or protocols, named patient programs or compassionate use programs) or any similar uses shall not constitute a First Commercial Sale.

|

Confidential |

9 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

1.52“Fixed Dose Combination Product” or “FDC” means any Product containing, as a single formulation, two or more APIs as components, including (a) a Compound and (ii) one or more other APIs. For clarity, an FDC is a “Combination Product” hereunder.

1.53“Force Majeure” means any event beyond the reasonable control of the affected Party, which may include embargoes; war or acts of war, including terrorism; insurrections, riots, or civil unrest; strikes, lockouts or other labor disturbances; epidemics, fire, floods, earthquakes or other acts of nature; acts, omissions or delays in acting by any Governmental Authority (other than delays incident to the ordinary course of drug development); and failure of plant or machinery.

1.54“GAAP” means generally accepted accounting principles in the U.S., consistently applied.

1.55“Generic Approval” means, with respect to a pharmaceutical product for which Marketing Approval has been granted in any country or jurisdiction, a subsequent Marketing Approval for another pharmaceutical product in such country or any other country that is granted based upon: (a) reference to an existing Marketing Approval for such pharmaceutical product (or any of its APIs), or to any Regulatory Documentation or Clinical Data underlying such existing Marketing Approval but not including pursuant to a Right of Reference granted under this Agreement; and (b) in the U.S., that pharmaceutical product is approved with an “A” rating under an ANDA, or outside of the U.S., that pharmaceutical product is similarly approved.

1.56“Generic Version” means, with respect to a given pharmaceutical product and a given country or jurisdiction, a version of such pharmaceutical product that: (a) contains the same active pharmaceutical ingredient(s) as such pharmaceutical product (and no other active pharmaceutical ingredient(s)); (b) has the same indication; (c) has the same dosage form and strength; (d) is approved for marketing or sale in such country or jurisdiction pursuant to a Generic Approval; and (e) is sold by a Third Party in such country pursuant to such Generic Approval.

1.57“Good Clinical Practices” or “GCP” means the then-current standards, practices and procedures promulgated or endorsed by the FDA as set forth in 21 C.F.R. Parts 50, 54 and 56 (or any successor statute or regulation), and in the guideline adopted by the International Conference on Harmonization (“ICH”), titled “Guidance for Industry E6 Good Clinical Practice: Consolidated Guidance” (or any successor document), including related regulatory requirements imposed by the FDA and comparable regulatory standards, practices and procedures promulgated by the European Commission or other Regulatory Authority, as they may be updated from time to time.

1.58“Good Laboratory Practices” or “GLP” means the then-current standards, practices and procedures promulgated or endorsed by the FDA as set forth in 21 C.F.R. Part 58 (or any successor statute or regulation), including related regulatory requirements imposed by the FDA and comparable regulatory standards, practices and procedures promulgated by the European

|

Confidential |

10 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

Commission or other Regulatory Authority, as they may be updated from time to time, including applicable guidelines promulgated under the ICH.

1.59“Good Manufacturing Practices” or “GMP” means the then-current good manufacturing practices required by the FFDCA, as amended, and the regulations promulgated thereunder by the FDA at 21 C.F.R. Parts 210 and 211, for the manufacture and testing of pharmaceutical materials, and comparable Applicable Law related to the manufacture and testing of pharmaceutical materials in jurisdictions outside the U.S., including the quality guideline promulgated by the ICH designated ICH Q7A, titled “Q7A Good Manufacturing Practice Guidance for Active Pharmaceutical Ingredients” and the regulations promulgated thereunder, in each case as they may be updated from time to time.

1.60“Governmental Authority” means any multi-national, supra-national, federal, state, local, municipal or other government authority of any nature (including any governmental division, subdivision, department, agency, bureau, branch, office, commission, council, court or other tribunal).

1.61“IND” means (a) an Investigational New Drug application as defined in the FFDCA and applicable regulations promulgated thereunder by the FDA, including 21 C.F.R. Part 312; or (b) a Clinical Trial authorization application or other documentation filed with a Regulatory Authority in any other country or jurisdiction outside the U.S., the filing or becoming effective of which (in the case of (a) or (b)) is necessary to commence or conduct clinical testing of a pharmaceutical product in humans in such country or jurisdiction.

1.62“Indication” means a discrete clinically recognized form of a disease in the Company Field. For purposes of this Agreement, treatment of different subpopulations within a population of patients treated for a particular cancer type/indication or different lines of treatment for the same cancer type/indication shall also be treated as separate Indications (e.g., front-line treatment, relapsed refractory treatment and maintenance treatment of the same disease shall be considered different Indications).

1.63“Initial Compound” means the compound known as Niraparib, as further described in Exhibit 1.63.

1.64“Initial Indications” means [***].

1.65“Initial Product” means the Single Agent Product Developed by TESARO prior to the Effective Date that contains the Initial Compound as its sole active pharmaceutical ingredient.

1.66“International Public Organization” means any of the organizations listed in 8 C.F.R. § 316.20, as amended from time to time.

1.67“Invention” means any invention, discovery or development, whether or not patentable, made, conceived or reduced to practice under this Agreement, whether made, conceived or

|

Confidential |

11 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

reduced to practice solely by, or on behalf of, TESARO, Company, the Parties jointly, or any Affiliate of the same.

1.68“JAA” means any anti-androgen compound Controlled by Company or any of its Affiliates during the Term or a product containing such compound as a sole active pharmaceutical ingredient, as the context requires. For clarity, the term “JAA” does not include any FDC or other Combination Product containing a JAA as a component.

1.69“Johnson & Johnson Universal Calendar” means the universal calendar system used by Company Parent and its Affiliates for internal and external reporting purposes (a copy of which for the year 2016 is attached hereto as Exhibit 1.69 and a copy of which prior to the beginning of each such year for succeeding years shall be provided to TESARO).

1.70“Know-How” means information, inventions, discoveries, formulations, formulas, practices, procedures, processes, methods, knowledge, know-how, trade secrets, technology, techniques, designs, drawings, correspondence, computer programs, documents, apparatus, results, strategies, Regulatory Documentation, information and submissions pertaining to, or made in association with, filings with any Governmental Authority, data (including pharmacological, toxicological, non-clinical data, Clinical Data, analytical and quality control data, manufacturing data and descriptions, market data, financial data or descriptions), devices, assays, chemical formulations, specifications, material, product samples and other samples, physical, chemical and biological materials, and the like, in written, electronic, oral or other tangible or intangible form, whether or not patentable.

1.71“Knowledge” means, as applied to a Party, that such Party shall be deemed to have knowledge of a particular fact or other matter to the extent that a reasonably prudent person with primary responsibility for the applicable subject matter (whether an officer or employee of such Party) knew or should have known of such fact or other matter.

1.72“[***]” means [***].

1.73“[***]” means [***].

1.74“Major EU Countries” means, collectively, France, Germany, Italy, Spain, and the United Kingdom (whether or not such countries are EU member states).

1.75“Major Markets” mean the U.S., Canada and the Major EU Countries.

1.76“[***]” means [***].

1.77“Manufacture” means all activities and processes related to the manufacturing of a pharmaceutical product, or any ingredient thereof, including labeling, packaging, in-process and finished product testing, release of such pharmaceutical product or any component or ingredient thereof, performance of quality assurance activities related to manufacturing and release of such pharmaceutical product, and the performance of ongoing stability tests and regulatory activities

|

Confidential |

12 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

related to any of the foregoing. Where the context so requires, Manufacture shall also include obtaining product from contract manufacturers subject to the terms and conditions of this Agreement. When used as a verb, to “Manufacture” means to engage in Manufacturing activities.

1.78“Manufacturing Costs” means [***]. Costs included will be consistent with the activities outlined in Section 1.77 (the “Manufacture” definition).

1.79“Marketing Approval” means, with respect to a pharmaceutical product and any country or jurisdiction, any and all: (a) Regulatory Approvals that are necessary to market or sell such pharmaceutical product in such country or jurisdiction, including approval of a Drug Approval Application; and (b) pricing and reimbursement approvals that are necessary to obtain before initiating Commercialization of such pharmaceutical product in such country or jurisdiction. For purposes of illustration with respect to the Major EU Countries, the following pricing and reimbursement approvals are examples of those described in clause (b): in France, publication of the reimbursed price level in the official journal and registration on a reimbursement list by or on behalf of Comité Economique des Produits de Santé or Haute Autorité de Santé (or a successor agency); in Italy, publication of reimbursement in the Government’s Official Gazette (by Agenzia Italiana del Farmaco or a successor agency); in Germany, execution of contract with the head association of sick funds (GKV-Spitzenverband, Gesetzlichen Krankenversicherung, or a successor agency); in Spain, authorization by La Comisión Interministerial de Precios de los Medicamentos or La Comisión Nacional para el Uso Racional de los Medicamentos (or a successor agency) for national patient access to reimbursement by or on behalf of a Governmental Authority; and in the United Kingdom, a recommendation by the National Institute for Health and Care Excellence (or a successor agency) to obtain mandatory funding to enable broad market access.

1.80“Marketing Authorization Application” or “MAA” means an application for authorization to market and/or sell a drug product submitted to a Regulatory Authority in any country or jurisdiction other than the U.S., and amendments and supplements thereto, including, with respect to the European Union, a marketing authorization application filed with the EMA pursuant to the Centralized Approval Procedure or with the applicable Regulatory Authority of a country in the European Economic Area with respect to the decentralized procedure, mutual recognition or any national approval procedure.

1.81“Merck” means Merck Sharp & Dohme Corp. or any assignee of such entity under the Merck License Agreement.

1.82“Merck Know-How” has the meaning set forth in the Merck License Agreement.

1.83“Merck License Agreement” means the License Agreement, dated May 22, 2012, between Merck and TESARO, including all amendments thereto.

1.84“Merck Patents” means the “Compound Patent Rights” as such term is defined in the Merck License Agreement.

|

Confidential |

13 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

1.85“Merck Term” means the “Term” of the Merck License Agreement as such term is defined in the Merck License Agreement.

1.86“Merger Control Laws” means all U.S. federal and state, and any foreign, statutes, rules, regulations, orders, administrative and judicial doctrines, and other Applicable Law, relating to antitrust or competition matters, or that are designed or intended to prohibit, restrict or regulate actions having the purpose or effect of monopolization or restraint of trade or lessening of competition.

1.87“Monotherapy Use” means the use of one Single Agent Product alone for the diagnosis, treatment or prevention of any indication.

1.88“NDA” means a new drug application submitted to the FDA pursuant to Section 505(b) of the FFDCA, 21 U.S.C. § 355(b), and all amendments and supplements thereto.

1.89“Net Sales” means (a) with respect to any Product sold by Company or any of its Affiliates, licensees or sublicensees, Company Net Sales and (b) with respect to any Product sold by TESARO or any of its Affiliates, licensees or sublicensees, TESARO Net Sales.

1.90“Orange Book” means, as applicable, the most recent and electronic editions of the Orange Book: Approved Drug Products with Therapeutic Equivalence Evaluations.

1.91“Other TESARO Patents” means TESARO Patents other than the Merck Patents and the AstraZeneca Patents.

1.92“Pass-through Third Party Royalties” means the Pass-through Merck Royalty, the Pass-through AstraZeneca-ICR Royalty and the Pass-through AstraZeneca-Sheffield Royalty.

1.93“Patents” means all: (a) patents, including any utility or design patent; (b) patent applications, including provisionals, substitutions, divisionals, continuations, continuations in-part or renewals; (c) patents of addition, restorations, extensions, supplementary protection certificates, registration or confirmation patents, patents resulting from post-grant proceedings, re-issues and re-examinations; (d) other patents or patent applications claiming priority directly or indirectly to (i) any such specified patent or patent application specified in (a) through (c), or (ii) any patent or patent application from which a patent or patent application specified in (a) through (c) claim direct or indirect priority; (e) inventor’s certificates; and (f) other rights issued from a Governmental Authority similar to any of the foregoing; in each case of (a) through (f), irrespective of whether such patent, patent application or other right arises in the U.S. or any other country or jurisdiction.

1.94“Person” means an individual, sole proprietorship, partnership, limited partnership, limited liability partnership, corporation, limited liability company, business trust, joint stock company, trust, incorporated association, joint venture or similar entity or organization, including a government or political subdivision, department or agency of a government.

|

Confidential |

14 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

1.95“Phase 1 Trial” means a clinical trial of a pharmaceutical product that (a) (i) is a first-in-humans trial on subjects who are patients, (ii) is for the purposes of establishing initial safety, tolerability, pharmacokinetic and pharmacodynamic data for such product, (iii) exposes subjects to such product and (iv) is designed to provide the sponsor of the clinical trial with sufficient data about such product to initiate a Phase 2 Trial; or (b) meets the definition in 21 C.F.R. §312.21(a) or any of its foreign equivalents.

1.96“Phase 2 Trial” means a clinical trial of a pharmaceutical product (a) with the endpoint of evaluating its effectiveness for a particular indication or indications, its short term tolerance and safety, as well as its pharmacokinetic and pharmacodynamic data in patients with the indications under study and is not intended to be pivotal to support Marketing Approval for such product; or (b) that meets the definition in 21 C.F.R. §312.21(b) or any of its foreign equivalents.

1.97“Phase 2/3 Trial” means a Phase 2 Trial involving a sufficient number of subjects that, prior to commencement of the trial or at any other defined point in the trial, satisfies both of the following ((a) and (b)):

(a) such trial is designed to (i) establish that the applicable pharmaceutical product is safe and efficacious for its intended use, and (ii) define and determine warnings, precautions, and adverse reactions that are associated with the pharmaceutical product in the dosage range to be prescribed, which trial is intended to support Marketing Approval for such Product or a similar clinical study prescribed by the FDA; and

(b) such trial is or becomes a registration trial sufficient for filing an application for a Marketing Approval the applicable pharmaceutical product in the U.S., as evidenced by (i) an agreement with or statement from the FDA on a Special Protocol Assessment or equivalent, or (ii) other guidance or minutes issued by the FDA, for such registration trial.

1.98“Phase 3 Trial” means a clinical trial of a pharmaceutical product (a) on a sufficient number of patients, which trial (i) is designed to establish that such product is safe and efficacious for its intended use, (ii) is designed to define warnings, precautions and adverse reactions that are associated with such product in the dosage range to be prescribed, and (iii) is pivotal to support Marketing Approval for such product; or (b) that meets the definition in 21 C.F.R. §312.21(c) or any of its foreign equivalents.

1.99“Phase 4 Trial” means a clinical trial of a pharmaceutical product, possibly including pharmacokinetic studies, which trial (a) is not required to be completed prior to obtaining Marketing Approval for an indication; and (b) either (i) is required by the applicable Regulatory Authority as mandatory to be conducted on or after the Marketing Approval of an indication, or (ii) is conducted voluntarily to enhance scientific knowledge of such product (e.g., providing additional drug profile, safety data or marketing support information, or supporting expansion of product labeling).

|

Confidential |

15 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

1.100“Product” means any pharmaceutical product, including all forms, presentations, strengths, doses and formulations (including any method of delivery), containing a Compound alone or in combination with other APIs. For the sake of clarity, all forms, presentations, doses and formulations of a pharmaceutical product containing a Compound shall be considered the same Product for purposes of this Agreement, so long as each form, presentation, dose and formulation contains the same Compound and same other APIs (and no other Compounds or other APIs).

1.101“Regulatory Approval” means any and all approvals, licenses (including import licenses), registrations or authorizations from any Regulatory Authority that are required under Applicable Law or reasonably necessary to Exploit a pharmaceutical product in any country or jurisdiction for one or more uses, and all amendments and supplements thereto.

1.102“Regulatory Authority” means any applicable Governmental Authority with authority over the Exploitation of a pharmaceutical product in a country or jurisdiction, including (a) in the U.S., the FDA; and (b) in the European Union, the EMA and the European Commission.

1.103“Regulatory Documentation” means, with respect to the Compounds and Products, (a) all applications for Regulatory Approval of any Compound or Product, including Drug Approval Applications; (b) all Regulatory Approvals for any Compound or Product, including INDs and Marketing Approvals; (c) all supporting documents created for, referenced in, submitted to or received from an applicable Regulatory Authority relating to any of the applications or Regulatory Approvals described in clauses (a) or (b), including DMF Equivalents, annual reports, advertising and promotion documents required to be submitted to Regulatory Authorities, adverse event files, complaint files and Manufacturing records; (d) all correspondence made to, made with, or received from any Regulatory Authority (including written correspondence and minutes from meetings, discussions or conferences) relating to any of the foregoing applications, Regulatory Approvals or documents described in clauses (a), (b) or (c), in each case ((a), (b), (c) and (d)), including all Know-How included therein.

1.104“Right of Reference” shall have the meaning set forth in 21 C.F.R. §314.3(b) or equivalents thereto under Applicable Law in countries or jurisdictions outside the U.S.

1.105“Royalty Term” means, on a Product-by-Product and country-by-country basis, the time period beginning with the First Commercial Sale of such Product in such country (or, if earlier with respect to a Prostate-Approved Single Agent Product, the first sale or other transfer of such Product in such country for a use described in clause (B) or (C) of the definition of “Prostate-Approved Single Agent Product” where such sale or transfer results in a Net Sale) and continuing until the later of: (a) the expiration of the last Valid Claim of a TESARO Patent that Covers such Product in such country; or (b) ten (10) years from the First Commercial Sale of such Product in such country.

|

Confidential |

16 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

1.106“Single Agent Product” means (a) any Product that contains a Compound as its sole API and (b) any Product that is deemed to be a Single Agent Product pursuant to Section 3.1(e).

1.107“Supplemental Application” means, with respect to any pharmaceutical product for which a Drug Approval Application has been approved by the applicable Regulatory Authority, an application to supplement or amend such Drug Approval Application to expand the approved label for such pharmaceutical product to include use of such pharmaceutical product for an additional indication.

1.108“Tax” or “Taxes” means any taxes, levies, imposts, duties, charges, assessments or fees of any nature (including any interest thereon).

1.109“Technology Transfer Costs” means internal and external costs incurred by TESARO for the transfer of copies of all tangible embodiments of Know-How necessary for Company’s establishment of Manufacturing capabilities for Compound API as described in the API Supply Agreement. With respect to internal costs, FTEs will be invoiced at an annual rate of $[***] per FTE (i.e., an hourly rate of $[***] per FTE, assuming [***] working days per year and an 8 hour workday). For the avoidance of doubt, Technology Transfer Costs exclude expenses for travel and time spent in general planning meetings. A quarterly budget for TESARO consulting services related to technology transfer will be established and agreed to by the Parties in accordance with the API Supply Agreement. All Technology Transfer Costs will be invoiced according to Section 8.13.

1.110“Territory” means, (i) with respect to Company and its Affiliates and (sub)licensees, the Company Territory, and (ii) with respect to TESARO and its Affiliates and (sub)licensees, the TESARO Territory. References to a “Party’s Territory” shall be interpreted accordingly.

1.111“TESARO Calendar Quarter” means the respective periods of three (3) consecutive calendar months ending on March 31, June 30, September 30 and December 31, for so long as this Agreement is in effect; provided, however, that the first TESARO Calendar Quarter for the first TESARO Calendar Year extends from the Effective Date to the end of the then-current TESARO Calendar Quarter and the last TESARO Calendar Quarter extends from the first day of such TESARO Calendar Quarter until the effective date of the termination or expiration of this Agreement.

1.112“TESARO Calendar Year” means each successive period of twelve (12) months commencing on January 1 and ending on December 31, for so long as this Agreement is in effect. The last TESARO Calendar Year of the Term begins on January 1 for the year during which termination or expiration of this Agreement will occur, and the last day of such TESARO Calendar Year will be the effective date of such termination or expiration.

1.113“TESARO Field” means (a) with respect to Japan, all uses, including the diagnosis, treatment or prevention of any disease in humans, and (b) with respect to any country or jurisdiction outside Japan, all uses outside of the Company Field.

1.114“TESARO Know-How” means all Know-How Controlled by TESARO during the Term that is necessary or useful to Exploit the Compounds or Products in the Company Field in the Company Territory.

|

Confidential |

17 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

1.115“TESARO License Agreements” means (a) the Merck License Agreement, and (b) the AstraZeneca License Agreements.

1.116“TESARO Net Sales” means with respect to any Product, the gross amounts invoiced and included as current period sales of such Product by TESARO or any of its Affiliates or (sub)licensees to a Third Party purchaser in an arm’s-length transaction, less the following customary deductions, to the extent they are actually taken, paid, accrued or allocated based on good faith estimates, all determined in accordance with GAAP and internal policies, consistently applied:

(a) trade and quantity discounts other than early payment cash discounts;

(b) returns, rebates, chargebacks and other allowances;

(c) retroactive price reductions that are actually allowed or granted;

(d) sales commissions paid to Third Party distributors and/or selling agents;

(e) deductions to gross invoice price of Product imposed by Regulatory Authorities or other governmental entities;

(f) the standard inventory cost of devices or delivery systems used for dispensing or administering Product; and

(g) a fixed amount equal to three percent (3%) of the amount invoiced to cover bad debt, early payment cash discounts, transportation and insurance and custom duties.

1.117“TESARO Patents” means all Patents Controlled by TESARO during the Term that are necessary or useful to Exploit the Compounds or Products in the Company Field in the Company Territory. TESARO Patents include, as of the Effective Date, those Patents set forth in Exhibit 1.117, the Merck Patents and AstraZeneca Patents.

1.118“TESARO Technology” means, collectively, the TESARO Patents and the TESARO Know-How.

1.119“TESARO Territory” means worldwide.

1.120“Third Party” means any Person other than (a) Company, (b) TESARO or (c) an Affiliate of either of Company or TESARO.

1.121“Third Party Royalties” means royalties required to be paid by TESARO or its Affiliates on Product sales to Third Parties.

1.122“Trademark” means any word, name, symbol, colour, designation, slogan, catch phrase or device or any combination thereof used or intended to be used in commerce and indicating the

|

Confidential |

18 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

source for a product or service, including any domain name, trademark, trade dress, brand mark, trade name, brand name, logo or business symbol, any registrations of any of the foregoing or any pending applications therefor.

1.123“U.S.” means the United States of America, including its territories and possessions.

1.124“Valid Claim” means either: (a) a claim of an issued and unexpired Patent, to the extent such claim has not been revoked, held invalid or unenforceable by a patent office, court or other Governmental Authority of competent jurisdiction in a final order, from which no further appeal can be taken, and which claim has not been disclaimed, denied or admitted to be invalid or unenforceable through reissue, re-examination or disclaimer or otherwise; or (b) a claim of a patent application that has not been pending for more than seven (7) years from the date of its first priority patent application filing anywhere in the world and that has not been revoked, cancelled, withdrawn, held invalid or abandoned.

Additional Definitions. Each of the following definitions is set forth in the Section of this Agreement indicated below:

|

Section |

|

|

[***] |

[***] |

|

Agreement |

Preamble |

|

Alliance Payments |

8.3(a) |

|

Alliance Payments Report |

Exhibit 8.3 |

|

Annual Alliance Payment Forecast |

8.3(e) |

|

Annual Royalty Payment Forecast |

8.4(c) |

|

API |

1.19 |

|

API Supply Agreement |

7.3(b) |

|

[***] |

[***] |

|

AstraZeneca-ICR License Agreement |

1.8 |

|

AstraZeneca-Sheffield License Agreement |

1.8 |

|

Bankruptcy Laws |

12.7(b) |

|

Blocking Intellectual Property |

8.9(b) |

|

Breaching Party |

12.4(a) |

|

Clinical Supply Agreement |

7.1(a)(ii) |

|

Company |

Preamble |

|

Company Combination Product Net Sales |

8.4(a)(iii) |

|

Company Development Plan |

4.2(c) |

|

Company Field License Agreement |

8.9(b)(i) |

|

Company Indemnitee |

14.2 |

|

Company Infringement Proceeding |

14.1(h) |

|

Company Product Liability Proceeding |

14.1(g) |

|

Company Prostate-Approved Single Agent Product Net Sales |

8.4(a)(ii) |

|

Confidential |

19 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

|

Section |

|

|

Combined Worldwide Prostate-Approved Single Agent Product Net Sales |

8.4(a)(i) |

|

Company Combination Product Net Sales |

8.4(a)(ii) |

|

Company Prostate-Approved Single Agent Product Net Sales |

8.4(a)(iii) |

|

Company Registration Plan |

5.2(c) |

|

Company Regulatory Documentation |

5.6(b) |

|

Company Trademarks |

6.5(a) |

|

[***] |

[***] |

|

[***] |

[***] |

|

Compound API |

7.3(a) |

|

CPR Rules |

13.3 |

|

Cross-Indication License Agreement |

8.9(b)(iii) |

|

Cure Period |

12.4(a) |

|

Deadlocked Committee Matter |

2.1(d) |

|

Defending Party |

14.3(d) |

|

Development Milestone |

8.2(a) |

|

Development Milestone Payment |

8.2(a) |

|

Development Plans |

4.2(c) |

|

Disclosing Party |

11.1(a) |

|

Dispute(s) |

13.1 |

|

[***] |

[***] |

|

Equitable Exceptions |

10.1(b) |

|

Escalation Procedures |

2.1(d)(i) |

|

Effective Date |

Preamble |

|

FATCA |

8.10(a) |

|

First Prostate Use |

Exhibit 8.3 |

|

Good Faith Dispute |

9.4 |

|

ICH |

1.57 |

|

Incremental Tax Cost |

8.10(d) |

|

Indemnification Notice |

14.3(a) |

|

Indemnifying Party |

14.3(a) |

|

Indemnitee |

14.3(a) |

|

Infringement Claim |

9.6(a) |

|

Infringement Recovery |

9.5(c) |

|

Insolvency Event |

12.7(a) |

|

Insolvent Party |

12.7(b) |

|

Joint Committee |

2.6(a) |

|

Joint Inventions |

9.1 |

|

Confidential |

20 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

|

Section |

|

|

Joint Patents |

9.3(e) |

|

JCC |

2.3(a) |

|

JDC |

2.2(a) |

|

JFC |

2.5(a) |

|

JMC |

2.4 |

|

JSC |

2.1(a) |

|

Licensed Patents |

10.2(b) |

|

Losses |

14.1 |

|

Merck Milestone |

8.2(d) |

|

Merck Milestone Payment |

8.2(d) |

|

[***] |

[***] |

|

Milestone Events |

8.2 |

|

Milestone Payments |

8.2 |

|

Monotherapy Registration & Distribution Notice |

5.3(b)(iii) |

|

[***] |

[***] |

|

Non-Insolvent Party |

12.7(b) |

|

Non-Paying Party |

8.10(d) |

|

Notice Indication |

4.3(b) |

|

Objection |

4.2(d)(iii) |

|

Officials |

10.5(b) |

|

Other Included Countries |

Exhibit 8.3 |

|

Party/Parties |

Preamble |

|

Pass-through AstraZeneca-ICR Royalty |

8.4(b)(i)(2) |

|

Pass-through AstraZeneca-Sheffield Royalty |

8.4(b)(i)(2) |

|

Pass-through Merck Royalty |

8.4(b)(i)(1) |

|

Patent Extension(s) |

9.4 |

|

Paying Party |

8.10(d) |

|

Payment |

10.5(b) |

|

[***] |

[***] |

|

Potential Recall Notice |

5.9(a) |

|

Pricing Terms |

6.2(d)(i) |

|

Prior CDA |

1.32 |

|

Proceeding |

14.1 |

|

[***] |

[***] |

|

[***] |

[***] |

|

[***] |

[***] |

|

Promotional Materials |

6.8 |

|

8.4(a)(iv) |

|

|

8.4(a)(v) |

|

Confidential |

21 |

|

[***] INDICATES MATERIAL THAT WAS OMITTED AND FOR WHICH CONFIDENTIAL TREATMENT WAS REQUESTED. ALL SUCH OMITTED MATERIAL WAS FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24b-2 PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

|

Section |

|

|

Prostate Sales Allocation Factor |

Exhibit 8.3 |

|

Protocol |

13.3(b)(iii) |

|

PVA |

5.7(c) |

|

Receiving Party |

11.1(a) |

|

Redactable Information |

4.2(f)(ii) |

|

Related Indemnitees |

14.3(a) |

|

Registration Plans |

5.2(c) |

|

Regulatory Milestone |

8.2(b) |

|

Regulatory Milestone Payment |