Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - JONES LANG LASALLE INC | exhibit311-jllq22016.htm |

| 10-Q - 10-Q - JONES LANG LASALLE INC | jll-2016630x10qq2.htm |

| EX-32.1 - CERTIFICATION OF CHIEF EXCUTIVE AND FINANCIAL OFFICERS - JONES LANG LASALLE INC | exhibit321-jllq22016.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - JONES LANG LASALLE INC | exhibit312-jllq22016.htm |

| EX-10.5 - EXHIBIT 10.5 - JONES LANG LASALLE INC | ex105jllq2201610q.htm |

| EX-10.4 - EXHIBIT 10.4 - JONES LANG LASALLE INC | ex104jllq2201610q.htm |

- 1 -

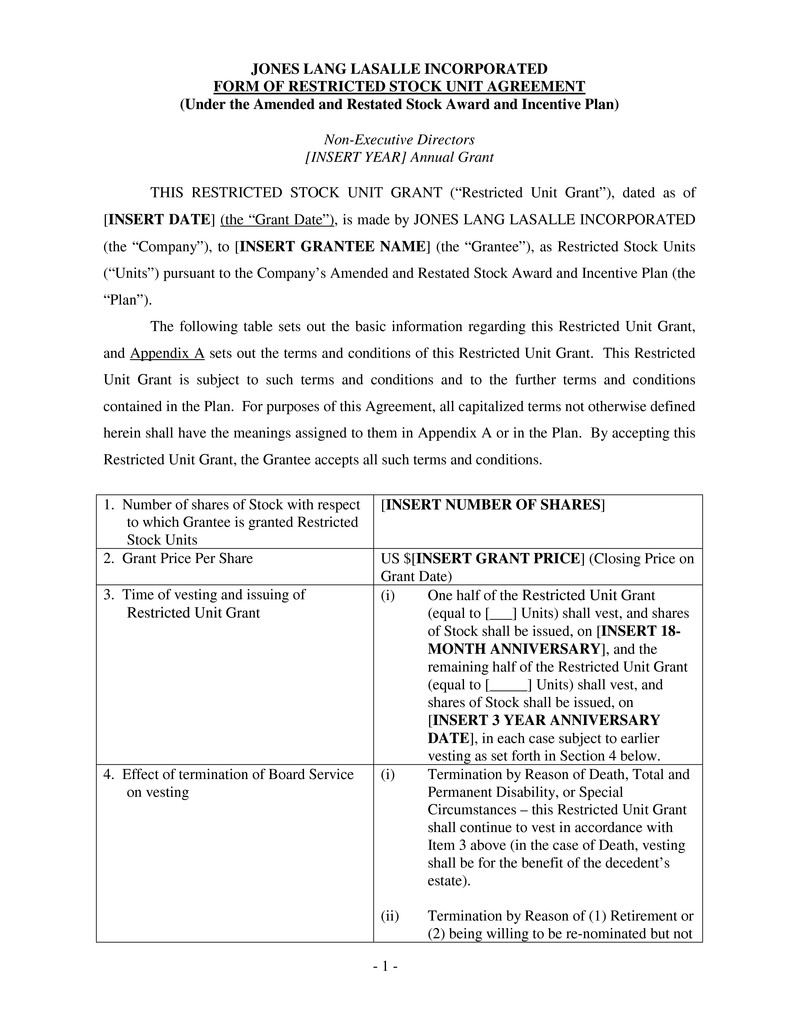

JONES LANG LASALLE INCORPORATED

FORM OF RESTRICTED STOCK UNIT AGREEMENT

(Under the Amended and Restated Stock Award and Incentive Plan)

Non-Executive Directors

[INSERT YEAR] Annual Grant

THIS RESTRICTED STOCK UNIT GRANT (“Restricted Unit Grant”), dated as of

[INSERT DATE] (the “Grant Date”), is made by JONES LANG LASALLE INCORPORATED

(the “Company”), to [INSERT GRANTEE NAME] (the “Grantee”), as Restricted Stock Units

(“Units”) pursuant to the Company’s Amended and Restated Stock Award and Incentive Plan (the

“Plan”).

The following table sets out the basic information regarding this Restricted Unit Grant,

and Appendix A sets out the terms and conditions of this Restricted Unit Grant. This Restricted

Unit Grant is subject to such terms and conditions and to the further terms and conditions

contained in the Plan. For purposes of this Agreement, all capitalized terms not otherwise defined

herein shall have the meanings assigned to them in Appendix A or in the Plan. By accepting this

Restricted Unit Grant, the Grantee accepts all such terms and conditions.

1. Number of shares of Stock with respect

to which Grantee is granted Restricted

Stock Units

[INSERT NUMBER OF SHARES]

2. Grant Price Per Share US $[INSERT GRANT PRICE] (Closing Price on

Grant Date)

3. Time of vesting and issuing of

Restricted Unit Grant

(i) One half of the Restricted Unit Grant

(equal to [___] Units) shall vest, and shares

of Stock shall be issued, on [INSERT 18-

MONTH ANNIVERSARY], and the

remaining half of the Restricted Unit Grant

(equal to [_____] Units) shall vest, and

shares of Stock shall be issued, on

[INSERT 3 YEAR ANNIVERSARY

DATE], in each case subject to earlier

vesting as set forth in Section 4 below.

4. Effect of termination of Board Service

on vesting

(i) Termination by Reason of Death, Total and

Permanent Disability, or Special

Circumstances – this Restricted Unit Grant

shall continue to vest in accordance with

Item 3 above (in the case of Death, vesting

shall be for the benefit of the decedent’s

estate).

(ii) Termination by Reason of (1) Retirement or

(2) being willing to be re-nominated but not

-2-

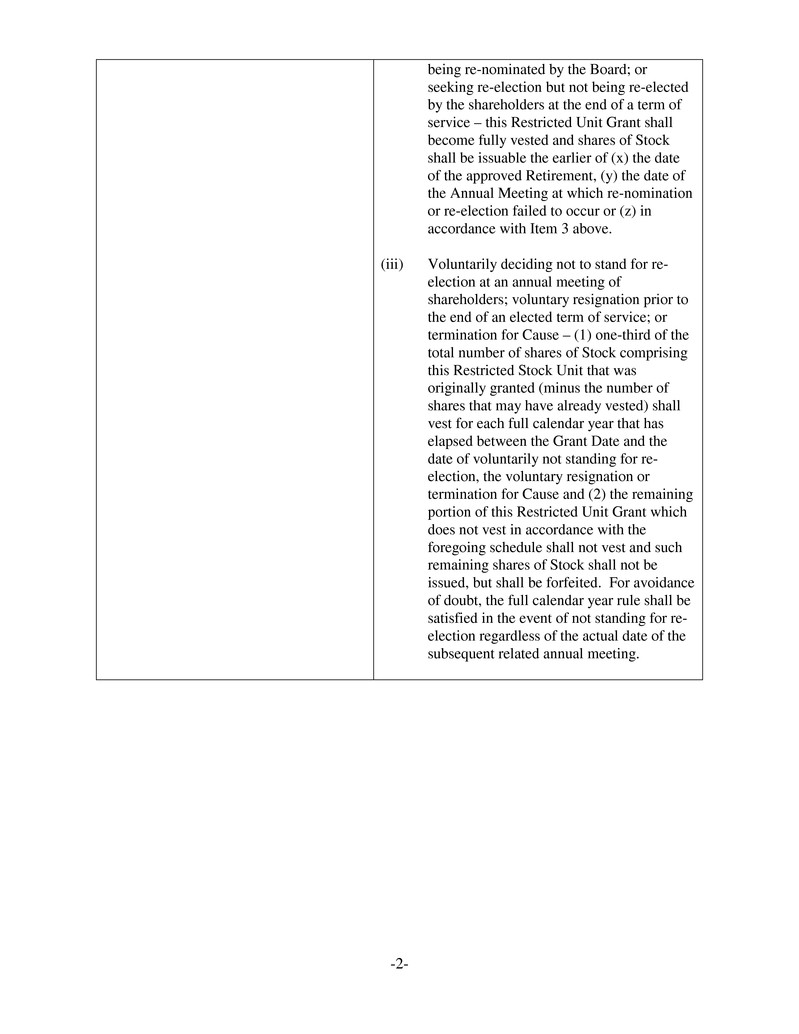

being re-nominated by the Board; or

seeking re-election but not being re-elected

by the shareholders at the end of a term of

service – this Restricted Unit Grant shall

become fully vested and shares of Stock

shall be issuable the earlier of (x) the date

of the approved Retirement, (y) the date of

the Annual Meeting at which re-nomination

or re-election failed to occur or (z) in

accordance with Item 3 above.

(iii) Voluntarily deciding not to stand for re-

election at an annual meeting of

shareholders; voluntary resignation prior to

the end of an elected term of service; or

termination for Cause – (1) one-third of the

total number of shares of Stock comprising

this Restricted Stock Unit that was

originally granted (minus the number of

shares that may have already vested) shall

vest for each full calendar year that has

elapsed between the Grant Date and the

date of voluntarily not standing for re-

election, the voluntary resignation or

termination for Cause and (2) the remaining

portion of this Restricted Unit Grant which

does not vest in accordance with the

foregoing schedule shall not vest and such

remaining shares of Stock shall not be

issued, but shall be forfeited. For avoidance

of doubt, the full calendar year rule shall be

satisfied in the event of not standing for re-

election regardless of the actual date of the

subsequent related annual meeting.

-3-

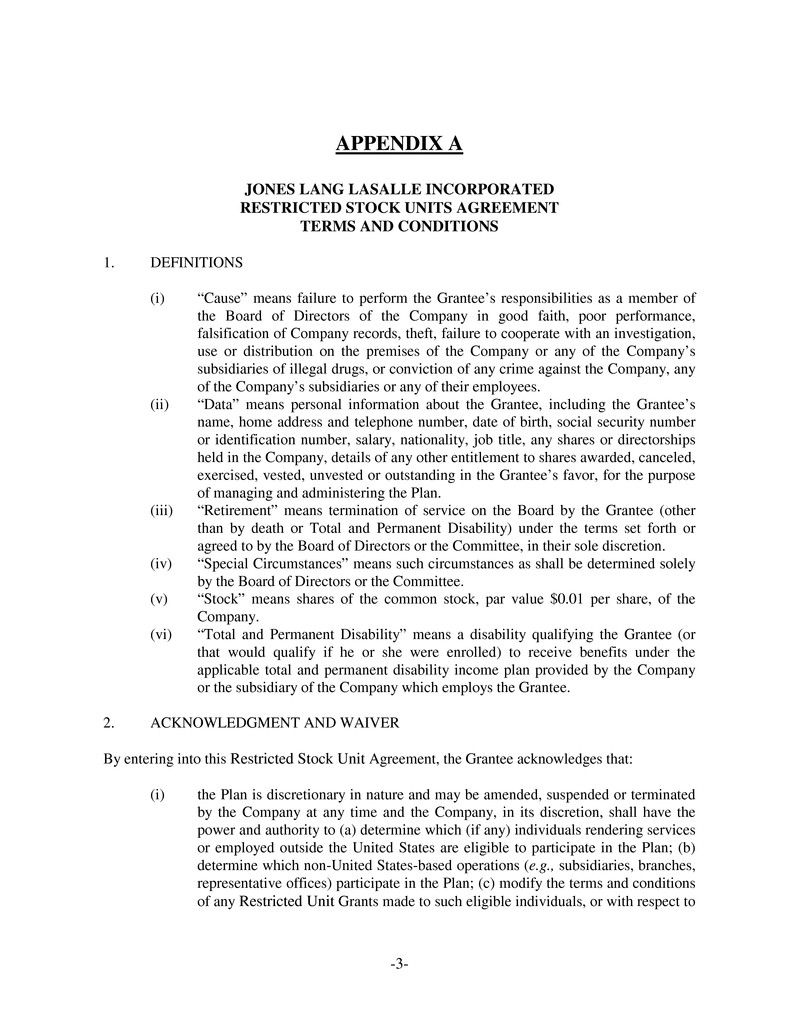

APPENDIX A

JONES LANG LASALLE INCORPORATED

RESTRICTED STOCK UNITS AGREEMENT

TERMS AND CONDITIONS

1. DEFINITIONS

(i) “Cause” means failure to perform the Grantee’s responsibilities as a member of

the Board of Directors of the Company in good faith, poor performance,

falsification of Company records, theft, failure to cooperate with an investigation,

use or distribution on the premises of the Company or any of the Company’s

subsidiaries of illegal drugs, or conviction of any crime against the Company, any

of the Company’s subsidiaries or any of their employees.

(ii) “Data” means personal information about the Grantee, including the Grantee’s

name, home address and telephone number, date of birth, social security number

or identification number, salary, nationality, job title, any shares or directorships

held in the Company, details of any other entitlement to shares awarded, canceled,

exercised, vested, unvested or outstanding in the Grantee’s favor, for the purpose

of managing and administering the Plan.

(iii) “Retirement” means termination of service on the Board by the Grantee (other

than by death or Total and Permanent Disability) under the terms set forth or

agreed to by the Board of Directors or the Committee, in their sole discretion.

(iv) “Special Circumstances” means such circumstances as shall be determined solely

by the Board of Directors or the Committee.

(v) “Stock” means shares of the common stock, par value $0.01 per share, of the

Company.

(vi) “Total and Permanent Disability” means a disability qualifying the Grantee (or

that would qualify if he or she were enrolled) to receive benefits under the

applicable total and permanent disability income plan provided by the Company

or the subsidiary of the Company which employs the Grantee.

2. ACKNOWLEDGMENT AND WAIVER

By entering into this Restricted Stock Unit Agreement, the Grantee acknowledges that:

(i) the Plan is discretionary in nature and may be amended, suspended or terminated

by the Company at any time and the Company, in its discretion, shall have the

power and authority to (a) determine which (if any) individuals rendering services

or employed outside the United States are eligible to participate in the Plan; (b)

determine which non-United States-based operations (e.g., subsidiaries, branches,

representative offices) participate in the Plan; (c) modify the terms and conditions

of any Restricted Unit Grants made to such eligible individuals, or with respect to

-4-

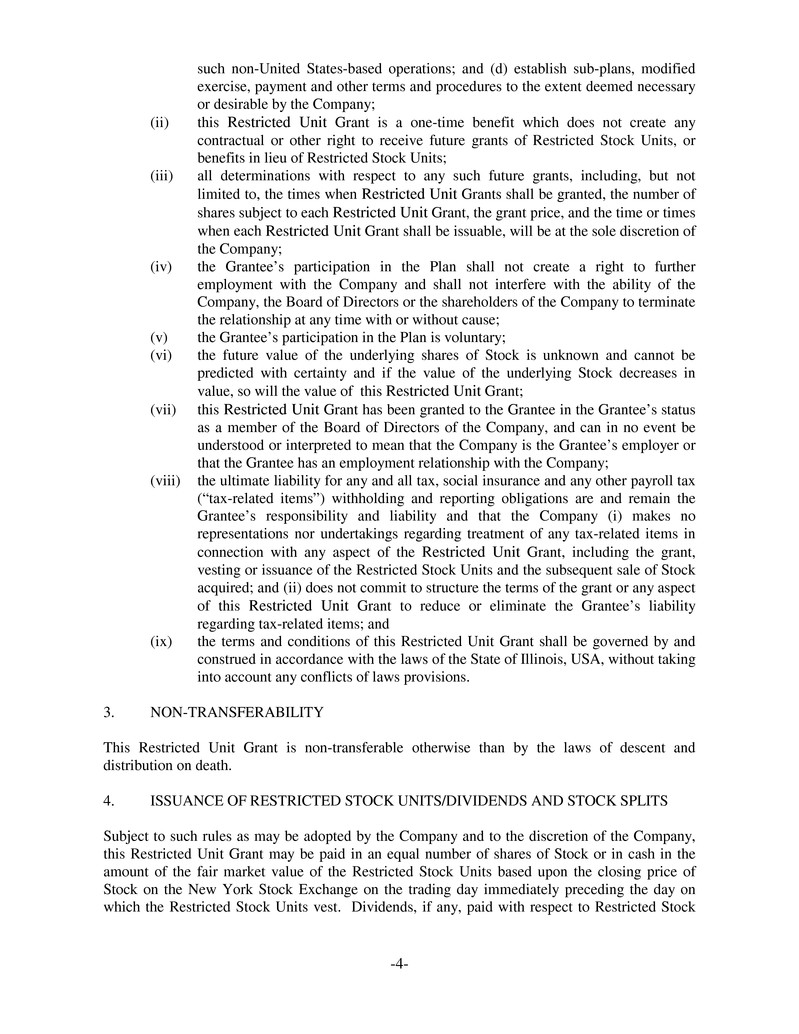

such non-United States-based operations; and (d) establish sub-plans, modified

exercise, payment and other terms and procedures to the extent deemed necessary

or desirable by the Company;

(ii) this Restricted Unit Grant is a one-time benefit which does not create any

contractual or other right to receive future grants of Restricted Stock Units, or

benefits in lieu of Restricted Stock Units;

(iii) all determinations with respect to any such future grants, including, but not

limited to, the times when Restricted Unit Grants shall be granted, the number of

shares subject to each Restricted Unit Grant, the grant price, and the time or times

when each Restricted Unit Grant shall be issuable, will be at the sole discretion of

the Company;

(iv) the Grantee’s participation in the Plan shall not create a right to further

employment with the Company and shall not interfere with the ability of the

Company, the Board of Directors or the shareholders of the Company to terminate

the relationship at any time with or without cause;

(v) the Grantee’s participation in the Plan is voluntary;

(vi) the future value of the underlying shares of Stock is unknown and cannot be

predicted with certainty and if the value of the underlying Stock decreases in

value, so will the value of this Restricted Unit Grant;

(vii) this Restricted Unit Grant has been granted to the Grantee in the Grantee’s status

as a member of the Board of Directors of the Company, and can in no event be

understood or interpreted to mean that the Company is the Grantee’s employer or

that the Grantee has an employment relationship with the Company;

(viii) the ultimate liability for any and all tax, social insurance and any other payroll tax

(“tax-related items”) withholding and reporting obligations are and remain the

Grantee’s responsibility and liability and that the Company (i) makes no

representations nor undertakings regarding treatment of any tax-related items in

connection with any aspect of the Restricted Unit Grant, including the grant,

vesting or issuance of the Restricted Stock Units and the subsequent sale of Stock

acquired; and (ii) does not commit to structure the terms of the grant or any aspect

of this Restricted Unit Grant to reduce or eliminate the Grantee’s liability

regarding tax-related items; and

(ix) the terms and conditions of this Restricted Unit Grant shall be governed by and

construed in accordance with the laws of the State of Illinois, USA, without taking

into account any conflicts of laws provisions.

3. NON-TRANSFERABILITY

This Restricted Unit Grant is non-transferable otherwise than by the laws of descent and

distribution on death.

4. ISSUANCE OF RESTRICTED STOCK UNITS/DIVIDENDS AND STOCK SPLITS

Subject to such rules as may be adopted by the Company and to the discretion of the Company,

this Restricted Unit Grant may be paid in an equal number of shares of Stock or in cash in the

amount of the fair market value of the Restricted Stock Units based upon the closing price of

Stock on the New York Stock Exchange on the trading day immediately preceding the day on

which the Restricted Stock Units vest. Dividends, if any, paid with respect to Restricted Stock

-5-

Units prior to vesting may be paid in cash or, in the Company’s discretion, may be reinvested in

additional Restricted Stock Units having the same vesting date, and additional Restricted Stock

Units will be received by the Grantee in the case of a Stock split or Stock dividend.

5. DATA PRIVACY CONSENT

The Grantee consents to the collection, use and transfer of Data as described in this paragraph.

The Grantee understands that the Company and/or its Subsidiaries will transfer Data amongst

themselves as necessary for the purpose of implementation, administration and management

of the Grantee’s participation in the Plan or any other plan of the Company (through this

Restricted Unit Grant and any other award which may have been or be in the future granted

under the Plan or any such other plan), and that the Company and/or any of its Subsidiaries

may each further transfer Data to any third parties assisting the Company in the

implementation, administration and management of the Plan or any other plan of the

Company. The Grantee understands that these recipients may be located in the European

Economic Area, or elsewhere, such as the United States or Canada. The Grantee authorizes

them to receive, possess, use, retain and transfer the Data, in electronic or other form, for the

purposes of implementing, administering and managing the Grantee’s participation in the Plan

or any other plan of the Company (through this Restricted Unit Grant and any other award

which may have been or be in the future granted under the Plan or any such other plan),

including any requisite transfer to a broker or other third party with whom the Grantee may

elect to deposit any Stock acquired upon issuance of Stock in accordance with this Restricted

Unit Grant or any other award and such Data as may be required for the administration of the

Plan or any other plan of the Company and/or the subsequent holding of Stock on his or her

behalf. The Grantee understands that he or she may, at any time, view Data, require any

necessary amendments to it or withdraw the consents herein in writing by contacting his or her

local Human Resources representative. Withdrawal of consent may, however, affect

Grantee’s ability to realize benefits from this Restricted Unit Grant or other awards.