Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - Heyu Leisure Holidays Corp | v444509_ex32.htm |

| EX-31 - EXHIBIT 31 - Heyu Leisure Holidays Corp | v444509_ex31.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) | |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR | |

| 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-55068

HEYU LEISURE HOLIDAYS CORPORATION

(Exact name of registrant as specified in its charter)

CLOUD RUN ACQUISITION CORPORATION

(Former Name of Registrant as Specified in its Charter)

| Delaware | 46-3601223 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

Westwood Business Center

611 South Main Street

Grapevine, Texas 76051

(Address of principal executive offices) (zip code)

Registrant's telephone number, including area code: (+86) 592 504 9622

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $.0001 par value per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer", "non-accelerated filer", and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer ¨ | Accelerated filer | ¨ |

| Non-accelerated filer ¨ | Smaller reporting company | x |

| (do not check if smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

$ 0

Indicate the number of shares outstanding of each of the registrant's classes of common stock as of the latest practicable date.

| Class | Outstanding at |

| July 15, 2016 | |

| Common Stock, par value $0.0001 | 60,001,000 |

| Documents incorporated by reference: | None |

HEYU LEISURE HOLIDYS CORPORATION

FORM 10-K ANNUAL REPORT

FOR THE YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

2

| Item 1. | Business |

Heyu Leisure Holidays Corporation (formerly Cloud Run Acquisition Corporation) ("Heyu" or the "Company") was incorporated on July 2, 2013 under the laws of the State of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions. The Company will attempt to locate and negotiate with a business entity for the combination of that target company with Heyu Leisure Holidays Corporation. The combination will normally take the form of a merger, stock-for-stock exchange or stock-for-assets exchange. In most instances the target company will wish to structure the business combination to be within the definition of a tax-free reorganization under Section 351 or Section 368 of the Internal Revenue Code of 1986, as amended. The Company has been formed to provide a method for a foreign or domestic private company to become a reporting company with a class of securities registered under the Securities Exchange Act of 1934.

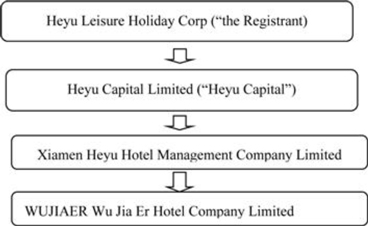

On February 9, 2015, Heyu Leisure Holiday Corp. (“Heyu Leisure” or the “Group” or the “Registrant” ) merged with Heyu Capital Ltd (“Heyu Capital”), a corporation existing under the laws of Hong Kong (Special Administrative Region of the PRC). Pursuant to the merger, the Registrant acquired all of the outstanding common shares of Heyu Capital through the issuance of common shares of the Registrant to the shareholders of Heyu Capital.

As a result of the Merger and pursuant to the Resolution, Heyu Capital has become a wholly-owned subsidiary of the Registrant and the Registrant issued shares of its common stock to shareholders of Heyu Capital at a rate of 1,000 shares of the Registrant’s common stock for all Heyu Capital common share. Immediately prior to the Merger, the Registrant had 60,000,000 shares of common stock outstanding.

Following the Merger, the Registrant has 60,001,000 shares of common stock outstanding after the share exchange and the issuance of 1,000 common shares to the shareholder of Heyu Capital.

The following diagram illustrates our corporate and ownership structure, the place of formation and the ownership interests of our subsidiaries as of December 31, 2015.

CURRENT ACTIVITIES

The Registrant specializes in managing and operating hotel chains in China via selected mergers, acquisitions and joint ventures, with a focus on providing a full range of services to its hotels and amenities to their guests.

The Registrant plans to establish hotel chains synonymous with in-house leisure, and to meet the needs of business and recreational travelers alike. To achieve this goal, the Registrant intends to be among the first budget hotels in the world to offer a wide variety of mobile office options in each of its hotels, including conference facilities, audio/video equipment, Internet access and staff that can help plan and conduct guests’ meetings.

3

The Registrant also plans to offer select complimentary beverages and other services to hotel guests. The Registrant will also offer memberships for Heyu Hotel leisure clubs. Club members will be entitled to complimentary drinks, food and other services when they visit club facilities.

As of December 31, 2015, the Company had sustained a net loss of $1,027,932 and had an accumulated deficit of $6,039,956.

The Company's independent auditors have issued a report raising substantial doubt about the Company's ability to continue as a going concern. At present, the Company has no operations and the continuation of the Company as a going concern is dependent upon financial support from its stockholders, its ability to obtain necessary equity financing to continue operations and/or to successfully locate and negotiate with a business entity for a business combination that would provide a basis of possible operations.

There is no assurance that the Company will ever be profitable.

| Item 1A. | Risk Factors |

The Registrant has generated revenues, but limited profits, to date.

The Registrant has generated limited profits to date. The business model of the Registrant involves significant costs, resulting in a low margin on revenues. Coupling this fact with operating expenses incurred by the Registrant, the Registrant has only generated a small amount of total profits in the past. The Registrant hopes that as its business expands via selected mergers, acquisitions and joint ventures that the scale of the enterprise would result in a higher gross margin and net margin.

No assurance of success in operations.

There is no assurance that the Registrant’s exploration or development activities will be successful. Moreover, there is no assurance that any of the Registrant’s operations will have any ability to realize profits.

The Registrant is an early-stage company with a limited operating history, and as such, any prospective investor may have difficulty in assessing the Registrant’s profitability or performance.

Because the Registrant is an early-stage company with a limited operating history, it could be difficult for any investor to assess the performance of the Registrant or to determine whether the Registrant will meet its projected business plan. The Registrant has limited financial results upon which an investor may judge its potential. As a company still in the early stages of its life, the Registrant may in the future experience under-capitalization, shortages, setbacks and many of the problems, delays and expenses encountered by any early-stage business. An investor will be required to make an investment decision based solely on the Registrant management’s history, its projected operations in light of the risks, the limited operations and financial results of the Registrant to date, and any expenses and uncertainties that may be encountered by one engaging in the Registrant’s industry.

The Registrant expects to incur additional expenses and may ultimately never be profitable.

The Registrant is an early-stage company and has a limited history of its operations. The Registrant will need to continue generating revenue in order to maintain sustained profitability. Ultimately, in spite of the Registrant’s best or reasonable efforts, the Registrant may have difficulty in generating revenues or remaining profitable.

The Registrant’s officers and directors beneficially own a majority of the Registrant’s common stock and, as a result, can exercise control over stockholder and corporate actions.

The officers and directors of the Registrant currently beneficially own approximately 79% of the Registrant’s outstanding common stock. As such, they will be able to control most matters requiring approval by stockholders, including the election of directors and approval of significant corporate transactions. This concentration of ownership may also have the effect of delaying or preventing a change in control, which in turn could have a material adverse effect on the market price of the Registrant’s common stock or prevent stockholders from realizing a premium over the market price for their Shares.

The Registrant depends on its management team to manage its business effectively.

The Registrant's future success is dependent in large part upon its ability to understand and develop the business plan and to attract and retain highly skilled management, operational and executive personnel. In particular, due to the relatively early stage of the Registrant's business, its future success is highly dependent on its officers, to provide the necessary experience and background to execute the Registrant's business plan. The loss of any officer’s services could impede, particularly initially as the Registrant builds a record and reputation, its ability to develop its objectives, and as such would negatively impact the Registrant's possible overall development.

4

The Registrant’s Management possesses no prior experience managing a public company and the Registrant does not currently possess effective disclosure controls and procedures adequate for a public company.

Based upon their respective evaluation, the Registrant’s Managing Director and Officers have concluded that, as of December 31, 2014, the existing disclosure controls and procedures of the Registrant were not effective. Disclosure controls and procedures means controls and other procedures that are designed to ensure that information required to be disclosed by the Registrant in the reports it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by the Registrant in the reports that it files or submits under the Exchange Act is accumulated and communicated to management, including the Managing Director, principal executive and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

The Registrant has engaged outside accounting and finance advisors to assist the Registrant in better implementing effective disclosure controls and procedures.

The Registrant’s business may be sensitive to Chinese economic conditions. A severe or prolonged downturn in the Chinese could materially and adversely affect our revenues and results of hotel operations.

The Registrant operates primarily in China within the Chinese domestic business travel and leisure industry. Accordingly, the Registrant’s financial results have been, and are expected to continue to be, affected by developments in the Chinese economy and travel industry. The travel industry is directly related to general economic trends and is highly sensitive to business and personal discretionary spending levels. Travel industry growth may decline during general economic downturns. In 2008, China was affected by the disruptions to financial markets. Although the Chinese economy recovered in 2010 and remained relatively stable in 2011 and 2012, the growth rate of China’s GDP decreased in 2013 and 2014, and it is uncertain whether this economic downturn will continue into 2015 and beyond. A prolonged downturn in the Chinese economy could erode consumer confidence, which could result in changes to consumer spending patterns for travel and lodging-related products and services.

China’s economic growth rate may materially decline in the future, which may adversely effects the Registrant’s financial condition and results of operations. Risk of a material downturn in China’s economic growth rate is based on several current or emerging factors including: (i) overinvestment by the government and businesses and excessive credit offered by banks; (ii) a rudimentary monetary policy; (iii) excessive privileges to state-owned enterprises at the expense of private enterprises; (iv) the dwindling supply of surplus labor; (v) a decrease in exports due to weaker overseas demand; and (vi) failure to boost domestic consumption.

If the Registrant is unable to generate sufficient cash, it may find it necessary to curtail acquisition and operational activities.

The Registrant’s business plan hinges on its ability to acquire, develop, market and commercialize hotels, in China. If the Registrant is unable secure external sources of funding from investors or fund raising in the capital market to acquire, develop, market and/or commercialize hotels, it would not be able to proceed with its business plan or successfully develop its planned operations at all.

The Registrant may face significant competition from companies that serve its industries.

The hotel and hospitality industry is subject to intense competition. The Registrant’s principal competitors in this industry will include major hospitality chains, smaller hotel chains, independent and local hotel owners and other well-established and recognized brands. The Registrant would be competing for individual guests, group reservations and conference business. Much of the competition for these customers is based on brand name recognition and reputation, as well as location, room rates, property size and availability of rooms, quality of the accommodations and amenities, and customer satisfaction. The Registrant’s competitors may have greater financial and marketing resources which would allow them to improve their properties and expand and improve their marketing efforts in ways that could affect the Registrant’s ability to effectively compete for guests. If the Registrant is unable to compete successfully, its financial performance may be adversely affected.

The Registrant is subject to the potential factors of market and customer changes.

The business of the Registrant is susceptible to rapidly changing preferences of the marketplace and its customers. The needs of customers are subject to constant change. Although the Registrant intends to carry out its plan of acquiring and operating hotels to satisfy changing customer demands in the marketplace, there can be no assurance that funds for such expenditures will be available or that the Registrant's competition will not develop similar or superior capabilities or that the Registrant will be successful in its internal efforts. The future success of the Registrant will depend in part on its ability to respond effectively to rapidly changing trends, industry standards and customer requirements by adapting its visions of potential hotels and leisure properties for purchase and improving the features and experience offered by these properties.

5

Insurance that the Registrant possesses is not necessarily sufficient to satisfy all potential claims that may arise against the Registrant or its officers and directors.

There is no assurance that insurance coverage that the Registrant possesses would be adequate to satisfy any potential claims made against the Registrant, its officers and directors, or its business operations. Any such liability which might arise could be substantial and may exceed the assets of the Registrant. The certificate of incorporation and by-laws of the Registrant provide for indemnification of officers and directors to the fullest extent permitted under Delaware law. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons, it is the opinion of the Securities and Exchange Commission that such indemnification is against public policy, as expressed in the Act, and is therefore, unenforceable.

Intellectual property and/or trade secret protection may be inadequate.

The Registrant holds limited intellectual property rights in China. The Registrant has not applied for intellectual property or trade secret protection in any aspect of its business in the United States. There can be no assurance that the Registrant can obtain effective protection against unauthorized duplication or the introduction of substantially similar solutions and services. The Registrant may choose to apply for additional intellectual property protection in the future; however, there can be no guarantee that intellectual property rights will adequately protect the Registrant or its business and operations.

There has been no prior public market for the Registrant’s securities and the lack of such a market may make resale of the stock difficult.

No prior public market has existed for the Registrant’s securities and the Registrant cannot assure any investor that a market will develop subsequent to this offering. An investor must be fully aware of the long-term nature of an investment in the Registrant. The Registrant intends to apply for quotation of its common stock on the OTC Bulletin Board as soon as possible which may be while this offering is still in process. However, the Registrant does not know if it will be successful in such application, how long such application will take, or, that if successful, that a market for the common stock will ever develop or continue on the OTC Bulletin Board. If for any reason the common stock is not listed on the OTC Bulletin Board or a public trading market does not otherwise develop, investors in the offering may have difficulty selling their common stock should they desire to do so. If the Registrant is not successful in its application for quotation on the OTC Bulletin Board, it will apply to have its securities quoted by the Pink OTC Markets, Inc., real-time quotation service for over-the-counter equities.

The offering price of the Shares has been arbitrarily determined by the Registrant and such offering should not be used by an investor as an indicator of the fair market value of the Shares.

Currently there is no public market for the Registrant’s common stock. The offering price for the Shares has been arbitrarily determined by the Registrant and does not necessarily bear any direct relationship to the assets, operations, book or other established criteria of value of the Registrant. Thus an investor should be aware that the offering price does not reflect the fair market price of the Shares.

The Registrant may complete a primary public offering (or private placement) for Shares in parallel with or immediately following this offering.

The Registrant may conduct a primary public offering (or private placement) for Shares to raise proceeds for the Registrant. Such an offering may be conducted in parallel with or immediately following this offering. Sales of additional Shares will dilute the percentage ownership of shareholders in the Registrant.

The Registrant has authorized the issuance of preferred stock with certain preferences.

The board of directors of the Registrant is authorized to issue up to 20,000,000 shares of $0.0001 par value preferred stock. The board of directors has the power to establish the dividend rates, liquidation preferences, and voting rights of any series of preferred stock, and these rights may be superior to the rights of holders of the Shares. The board of directors may also establish redemption and conversion terms and privileges with respect to any shares of preferred stock. Any such preferences may operate to the detriment of the rights of the holders of the Shares, and further, could be used by the board of directors as a device to prevent a change in control of the Registrant. No such preferred shares or preferences have been issued to date, but such shares or preferences may be issued at a later time, subject to the sole discretion of the board of directors.

The Registrant does not intend to pay dividends to its stockholders, so investors will not receive any return on investment in the Registrant prior to selling their interest in it.

The Registrant does not project paying dividends but anticipates that it will retain future earnings for funding the Registrant’s growth and development. Therefore, investors should not expect the Registrant to pay dividends in the foreseeable future. As a result, investors will not receive any return on their investment prior to selling their Shares in the Registrant, if and when a market for such Shares develops. Furthermore, even if a market for the Registrant’s securities does develop, there is no guarantee that the market price for the shares would be equal to or more than the initial per share investment price paid by any investor. There is a possibility that the Shares could lose all or a significant portion of their value from the initial price paid in this offering.

6

The Registrant’s stock may be considered a penny stock and any investment in the Registrant’s stock will be considered a high-risk investment and subject to restrictions on marketability.

If the Shares commence trading, the trading price of the Registrant's common stock may be below $5.00 per share. If the price of the common stock is below such level, trading in its common stock would be subject to the requirements of certain rules promulgated under the Securities Exchange Act of 1934, as amended. These rules require additional disclosure by broker-dealers in connection with any trades generally involving any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Such rules require the delivery, before any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith, and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors (generally institutions). For these types of transactions, the broker-dealer must determine the suitability of the penny stock for the purchaser and receive the purchaser’s written consent to the transactions before sale. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in the Registrant’s common stock which could impact the liquidity of the Registrant’s common stock.

The Registrant's election not to opt out of JOBS Act extended accounting transition period may not make its financial statements easily comparable to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the Registrant can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Registrant has elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, the Registrant, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Registrant's financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

The recently enacted JOBS Act will also allow the Registrant to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies. The Registrant meets the definition of an emerging growth company and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Act and certain disclosure requirements of the Dodd- Frank Act relating to compensation of its chief executive officer;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934 and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Registrant Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Registrant is still evaluating the JOBS Act, it currently intends to take advantage of some or all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Registrant has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b) of the JOBS Act. Among other things, this means that the Registrant's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Registrant's internal control over financial reporting so long as it qualifies as an emerging growth company, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an emerging growth company, the Registrant may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers that would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Registrant. As a result, investor confidence in the Registrant and the market price of its common stock may be adversely affected.

Shares of common stock in the Registrant may be subject to resale restrictions imposed by Rule 144 of the Securities and Exchange Commission

The shares of common stock held by current shareholders are considered “restricted securities” subject to the limitations of Rule 144 under the Securities Act. In general, securities may be sold pursuant to Rule 144 after being fully-paid and held for more than 12 months. Shares purchased in this Offering may be subject to Rule 144 resale restrictions, and accordingly, investors may be subject to such resale limitations.

7

Reliance upon Rule 144 to sell securities may be unavailable to the Registrant, due to its previous status as a shell company, and if Rule 144 is not available (pursuant to Rule 144(i)), certain shares of common stock may have no ability for sale or transfer until the Registrant is allowed to rely upon Rule 144 of the Securities and Exchange Commission

Rule 144 establishes specific criteria for determining whether a person is not engaged in a distribution of securities. Among other things, Rule 144 creates a safe harbor whereby a person satisfying the applicable conditions of the Rule 144 safe harbor is deemed not to be engaged in a distribution of the securities and therefore not an underwriter of the securities. If a purchaser of securities is unable to rely upon Rule 144 to sell securities (due to Rule 144(i)), then the securities must be registered or another exemption from registration must be found in order for the distribution of securities to be made. In the event that the securities are not registered or another exemption is not found, a purchaser of securities may not be able to sell or transfer the shares of common stock in the Registrant until such time as the Registrant is able rely upon Rule 144.

Pursuant to Rule 144(i), reliance upon Rule 144 is typically available for the resale of restricted or unrestricted securities that were initially issued by a reporting or non-reporting shell company (or an issuer that has been at any time previously a reporting or non-reporting shell company) only if the following conditions are met:

| · | The issuer of the securities that was formerly a reporting or non-reporting shell company has ceased to be a shell company; |

| · | The issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934; |

| · | The issuer of the securities has filed all reports and material required to be filed under Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding 12 months (or for such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and |

| · | At least one year has elapsed from the time that the issuer filed current Form 10 type information with the Commission reflecting its status as an entity that is not a shell company. |

| Item 1B | Unresolved Staff Comments |

None.

| Item 2. | Properties |

The Registrant currently leases two offices:

1) Xiamen Office 13D Alishan Plaza, Block No 2, Lvling Road, Siming District, Xiamen City, Fujian Province, 361000, China. The Registrant and its subsidiaries are currently leasing this property. The lease was commenced and used from August, 2014 and is set to expire September 30, 2015. The office is an area of 264.42 square meters. The Registrant and its subsidiaries pay a monthly rental rate of RMB 13221 (approximately $2,156). Upon executing the lease, the Registrant paid the landlord a performance guarantee in the amount of RMB 13,221 (approximately $2,156) or one month’s rent.

2) Hong Kong Virtual Office17/F, Wheelock House, 20 Pedder Street, Central, Hong Kong. The leased this office on November 1, 2014 for a team of six (6) months and is set to expire 31 December, 2015. The Registrant has paid the full lease amount of HKD 4,798 (approximately $620) for six months. The Registrant is currently in the midst of reviewing the new office tenancy, which is estimated the monthly rental of HKD 80,000 (approximately $10,322) located at Kowloon, Hong Kong with the area of 2,500 square feet.

As of December 31, 2015, the Registrant had only one leased hotel with the area of 3,000 square meters in operation, namely Wujiaer Hotel, which is located at 4F, Lotus Building, No 194 Jiahe Road, Siming District, Xiamen, China. Under lease arrangement, the company pays a quarterly rental rate of RMB 420,000 (approximately $67,740). The lease was signed October 1, 2013 for a term of ten years and is set to expire September 30, 2025.

| Item 3. | Legal Proceedings |

There is no litigation pending or threatened by or against the Company.

| Item 4. | Mine Safety Disclosures. |

Not applicable.

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

There is currently no public market for the Company's securities.

The Company may wish to cause the Company's common stock to trade in one or more United States securities markets. The Company anticipates that it will take the steps required for such admission to quotation following the business combination or at some later time.

8

At such time as it qualifies, the Company may choose to apply for quotation of its securities on the OTC Bulletin Board.

The OTC Bulletin Board is a dealer-driven quotation service. Unlike the Nasdaq Stock Market, companies cannot directly apply to be quoted on the OTC Bulletin Board, only market makers can initiate quotes, and quoted companies do not have to meet any quantitative financial requirements. Any equity security of a reporting company not listed on the Nasdaq Stock Market or on a national securities exchange is eligible.

Currently, there is no trading market for the securities of the Registrant. The Registrant intends to work with market-makers for its securities that will apply for quotation of its common stock on the OTC Bulletin Board. However, the Registrant does not know if any such application will be made and whether it will be successful if made, how long such application will take, or, that if successful, that a market for the common stock will ever develop or continue on the OTC Bulletin Board. There can be no assurance that the Registrant will qualify for quotation of its securities on the OTC Bulletin Board. See “RISK FACTORS”

Since inception, the Company has sold securities which were not registered as follows:

| Shares Owned | ||||||||

| Name | Number | Percentage | ||||||

| Ban Siong Ang | 46,389,604 | 77 | % | |||||

| Tiang Lee Ng | 4,272,419 | 7 | % | |||||

| Hooi Pheng Ang | 254,569 | * | ||||||

| Teik Kui Ang | 651,854 | * | ||||||

| Xin Chen | 109,354 | * | ||||||

| Tek Mun Chin | 340,000 | * | ||||||

| ShuHui Dai | 257,416 | * | ||||||

| XieMing Fan | 66,000 | * | ||||||

| HaiBin Gao | 80,000 | * | ||||||

| Boon Hong Haw | 2,000,000 | 3.3 | % | |||||

| JianShu Huang | 60,000 | * | ||||||

| QingQiang Li | 42,854 | * | ||||||

| EnYu Lin | 70,000 | * | ||||||

| FenJin Lin | 40,000 | * | ||||||

| Wee Lee Sim | 60,000 | * | ||||||

| Swiss Teo Swee Kiong | 103,064 | * | ||||||

| Guan Chuan Tan | 300,000 | * | ||||||

| Hang Kiang Tan | 60,000 | * | ||||||

| Hung Seng Tan | 1,484,423 | 2.5 | % | |||||

| Hup Teong Tan | 90,000 | * | ||||||

| Kwee Huwa Tan | 349,550 | * | ||||||

| Lan Tan | 78,209 | * | ||||||

| Lee Hiang Tan | 97,355 | * | ||||||

| XiaoDi Rao | 153,709 | * | ||||||

| ShuYing Wang | 105,354 | * | ||||||

| MeiMei Weng | 147,355 | * | ||||||

| Kean Heong Wong | 76,203 | * | ||||||

| XiuHua Xian | 200,000 | * | ||||||

| MeiJiao Xu | 166,354 | * | ||||||

| ZhuEn Xu | 50,000 | * | ||||||

| TaoYing Yang | 241,098 | * | ||||||

| ZhenYu Zeng | 180,354 | * | ||||||

| DeZhao Zhang | 100,000 | * | ||||||

| XiuMei Zheng | 525,355 | * | ||||||

| BingRen Zhong | 408,387 | * | ||||||

| MeiYun Zhong | 119,064 | * | ||||||

| WenJin Zhong | 121,354 | * | ||||||

| XingEn Zhong | 84,710 | * | ||||||

| XingHua Zhong | 65,032 | * | ||||||

* Less than 1%

9

| Item 6. | Selected Financial Data. |

There is no selected financial data required to be filed for a smaller reporting company.

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

Heyu Leisure Holidays Corporation (the "Company") was incorporated on July 2, 2013 under the laws of the State of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions.

In addition to a change in control of its management and shareholders, the Company's operations to date have been limited to issuing shares and filing a registration statement on Form 10 pursuant to the Securities Exchange Act of 1934. The Company was formed to provide a method for a foreign or domestic private company to become a reporting company with a class of securities registered under the Securities Exchange Act of 1934.

On September 30, 2013, the Company registered its common stock on a Form 10 registration statement filed pursuant to the Securities Exchange Act of 1934 (the "Exchange Act") and Rule 12(g) thereof which became automatically effective 60 days thereafter.

The Company files with the Securities and Exchange Commission periodic and current reports under Rule 13(a) of the Exchange Act, including quarterly reports on Form 10-Q and annual reports Form 10-K.

The Company entered into an agreement with Tiber Creek Corporation of which the former president of the Company is the president and controlling shareholder. Tiber Creek Corporation assists companies to become public reporting companies and for the preparation and filing of a registration statement pursuant to the Securities Act of 1933, and the introduction to brokers and market makers.

On January 13, 2014, the following events occurred which resulted in a change of control of the Company:

10

The Company redeemed an aggregate of 20,000,000 of the then 20,000,000 shares of outstanding stock at a redemption price of $.0001 per share for an aggregate redemption price of $2,000.

James Cassidy and James McKillop, both directors of the Company and the then president and vice president, respectively, resigned such directorships and all offices of the Company. Neither Messrs. Cassidy nor McKillop retain any shares of the Company's common stock.

Ban Siong Ang was named as the director of the Company and serves as its Chief Executive Officer.

On January 14, the Company issued 1,000,000 shares of its common stock at par representing 100% of the then total outstanding 1,000,000 shares of common stock.

On August 8, 2014, the Company issued additional 59,000,000 shares of its common stock at par. Accordingly, the total outstanding of common stock is 60,000,000 shares as at 30 September 2014.

Hung Seng Tan is appointed as the Executive Director and Guan Chuan Tan is appointed as the Director of the Company during the period. Ban Siong Ang is appointed as Managing Director and serves as Chief Executive Officer subsequent to the appointment of new Directors.

On February 9, 2015, Heyu Leisure Holiday Corp. (“Heyu Leisure” or the “Company” or the “Registrant”) merged with Heyu Capital Ltd (“Heyu Capital”), a corporation existing under the laws of Hong Kong (Special Administrative Region of the PRC). Pursuant to the merger, the Company acquired all of the outstanding common shares of Heyu Capital through the issuance of common shares of the Company to the shareholders of Heyu Capital.

As a result of the Merger and pursuant to the Resolution, Heyu Capital has become a wholly-owned subsidiary of the Company and the Company issued shares of its common stock to shareholders of Heyu Capital at a rate of 1,000 shares of the Registrant’s common stock for all Heyu Capital common share. Immediately prior to the Merger, the Registrant had 60,000,000 shares of common stock outstanding.

Following the Merger, the Company has 60,001,000 shares of common stock outstanding after the share exchange and the issuance of 1,000 common shares to the shareholder of Heyu Capital.

Results of Operations for the years ended December 31, 2015 and December 31, 2014

| For the years ended, | ||||||||

| 2015 | 2014 | |||||||

| Revenue | $ | 329,514 | $ | 306,882 | ||||

| Cost of revenue | (486,296 | ) | (424,501 | ) | ||||

| Operating expenses | (873,429 | ) | (2,966,080 | ) | ||||

The revenue increased from $306,882 to $329,514 from the years ended December 31, 2014 to December 31 2015. These increases resulted primarily from the increase of hotel room occupancy rate during the period.

The operating expenses decreased from $2,966,080 to $873,429 from years ended December 31, 2014 to December 31 2015. There was consultant fee payments to consultant related to the share listing and project fee in previous year. However, no such payments incurred in 2015 and resulted in decrease in operating costs.

Liquidity and Capital Resources

Working Capital

As at December 31, | As at December 31, | |||||||

| Total current assets | $ | 208,702 | $ | 236,708 | ||||

| Total current liabilities | 1,430,946 | 592,714 | ||||||

| Working capital (deficit) | (1,222,244 | ) | (356,006 | ) | ||||

As of December 31, 2015 and December 31, 2014, total current assets were $208,702 and $236,708 respectively. The decrease is mainly due to decrease in cash and cash equivalent as a result of payment of hotel daily operating expenses.

As of December 31, 2015 and December 31, 2014, total current liabilities were $1,430,946 and $592,714 respectively. The increase is mainly from the advances from shareholder, which paid for daily hotel operation expenses and staff salaries during the period.

11

The Company had negative working capital of $1,222,244 and an accumulated deficit of $ 6,042,235 as of December 31, 2015.

Cash Flows

| For the year ended December 31, 2015 | For the year ended December 31, 2014 | |||||||

| Net cash (used in) operating activities | $ | (780,493 | ) | $ | (2,678,265 | ) | ||

| Net cash (used in) investing activities | (102,365 | ) | (725,817 | ) | ||||

| Net cash provided by financing activities | ||||||||

| 820,680 | 3,003,037 | |||||||

| Effect of exchange rate changes on cash and cash equivalent | 3,286 | 7,977 | ||||||

| Net change in cash | (56,892 | ) | (393,069 | ) | ||||

For years ended December 31, 2014 to December 31 2015, we spent $2,678,265 and $780, 493 in operating activities. The decrease in our expenditures on operating activities was primarily due to the payment to consultant in relation to the potential project acquisition and share listing expenses in prior period. However, there is no such expense incurred and therefore decrease in operating expenses during 2015.

For years ended December 31 2014 to December 31 2015, the cash used in investing activities was $ 725,817 and $102,365 respectively. The decrease was due to we spent $598,545 in purchasing Wujiaer hotel in 2014. There is no such activity incurred in 2015.

For years ended December 31, 2014 to December 31 2015, $3,003,037 and $820,680 were provided by financing activities, the decrease is mainly from the lesser capital contribution from shareholder during the year.

Business

The Company was incorporated on July 2, 2013 under the laws of the State of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions. The Company has been in the developmental stage since inception.

The Company intends to operate and manage budget hotels chains in China. The Company intends that it will develop its business plan through the acquisition or business combination with an existing private company in China or otherwise through growth and development of its projects.

The Company may develop its operations by marketing and internal growth and/or by effecting a business combination with an operating company in the field. The Company anticipates that if it enters such a business combination it would likely take the form of a merger. It is anticipated that such private company will bring with it to such merger key operating business activities and a business plan. As of the date of this Report, no agreements have been executed to effect any business combination.

A combination will normally take the form of a merger, stock-for-stock exchange or stock-for-assets exchange. The Company may wish to structure the business combination to be within the definition of a tax-free reorganization under Section 351 or Section 368 of the Internal Revenue Code of 1986, as amended.

On February 9, 2015, Heyu Leisure Holiday Corp. (“Heyu Leisure” or the “Company”) merged with Heyu Capital Ltd (“Heyu Capital”), a corporation existing under the laws of Hong Kong (Special Administrative Region of the PRC). Pursuant to the merger, the Registrant acquired all of the outstanding common shares of Heyu Capital through the issuance of common shares of the Registrant to the shareholders of Heyu Capital.

The Company's independent auditors have issued a report raising substantial doubt about the Company's ability to continue as a going concern. At present, the Company has no operations and the continuation of the Company as a going concern is dependent upon financial support from its stockholders, its ability to obtain necessary equity financing to continue operations and/or to successfully locate and negotiate with a business entity for a business combination that would provide a basis of possible operations.

12

| ITEM 7A. | Quantitative and Qualitative Disclosures about Market Risk |

Not applicable for smaller reporting companies

| Item 8. | Financial Statements and Supplementary Data |

The financial statements for the year ended December 31, 2014 and 2015 are attached hereto.

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

There were no disagreements with the Company's accountants on accounting or financial disclosure for the period covered by this report.

| Item 9A. | Controls and Procedures |

Disclosure Controls and Procedures

We maintain disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are designed to ensure that information required to be disclosed in our reports under the Exchange Act, is recorded, processed, summarized and reported within the time periods specified in the Commission's rules and forms, and that such information is accumulated and communicated to our management, including our principal executive officer and our principal financial and accounting officer, as appropriate, to allow timely decisions regarding required disclosure.

We carried out an evaluation under the supervision and with the participation of our management, including our principal executive officer and principal financial and accounting officer, of the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Exchange Act) as of the end of the period covered by this Annual Report. Based on this evaluation, we concluded that our disclosure controls and procedures were effective as of December 31, 2015.

Internal Control Over Financial Reporting

Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that:

| · | pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets |

| · | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and |

| · | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Changes in Internal Control Over Financial Reporting

There have been no changes in the Company's internal controls over financial reporting during its fourth fiscal quarter that have materially affected, or are reasonably likely to materially affect, its internal control over financial reporting.

13

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting during the year ended December 31, 2015 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Management's Report on Internal Control Over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting in accordance with the Rule 13a-15 of the Securities Exchange Act of 1934. The Company's president and its principal financial and accounting officer conducted an evaluation of the effectiveness of the Company's internal control over financial reporting as of December 31, 2015, based on the criteria establish in Internal Control Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management concluded that the Company's internal control over financial reporting was effective as of December 31, 2015, based on the those criteria. A control system can provide only reasonably, not absolute, assurance that the objectives of the control system are met and no evaluation of controls can provide absolute assurance that all control issues have been detected.

Anton & Chia LLP, the independent registered public accounting firm, has not issued an attestation report on the effectiveness of the internal control over financial reporting.

| Item 10. | Directors, Executive Officers, and Corporate Governance |

The Directors and Officers of the Company are as follows:

| Name | Age | Position | Year Commenced | |||

| Boon Hong Haw | 46 | Chairman of the Board cum Independent | ||||

| Non-executive Director | 2014 | |||||

| Ban Siong Ang | 40 | CEO,Group Managing Director and interim CFO | 2014 | |||

| Hung Seng Tan | 53 | Executive Director | 2014 | |||

| Guan Chuan Tan | 48 | Director | 2014 | |||

| Kean Tat Che | 32 | Chief Financial Officer | 2014 | |||

| (Resigned on November 13, 2015) | ||||||

| Timi Ecimovic | 73 | Non-executive Director | 2014 | |||

| Mei Yun Zhong | 39 | Non-executive Director | 2014 | |||

| Stephan Truly Busch | 65 | Non-executive Director | 2014 | |||

| Kwee Huwa Tan | 50 | Non-executive Director | 2014 | |||

| Shanmuga Ratnam | 58 | Independent Non-executive Director | 2014 | |||

| M. Shahid Siddiqi | 72 | Independent Non-executive Director | 2014 | |||

| Hakikur Rahman | 57 | Independent Non-executive Director | 2014 | |||

| Lay Hoon Ong | 42 | Independent Non-executive Director | 2014 |

Boon Hong Haw

Boon Hong Haw was appointed as a Chairman cum Independent Non-Executive Director of the Registrant in 2014. Also serves as one of the Finance, Audit, Remuneration and Risk Management Board Committee member of HEYU Group of Companies in 2014.

14

Mr Haw is a Business Consultant and Professor in Corporate Social Responsibility for Ansted University since September 1999.He has developed many successful portfolios for public listed companies, private limited companies, business enterprise, NGOs to World Organization, Institutions and government agencies in various countries through encouraging these entities to cultivating Corporate and Individuals Social Responsibility practices.

Mr. Haw is one of the Internationally well-known Environmentalists, Educationalists, Social Scientists, Strategic planners, authors, Peace Sustainable Makers and Consultant/Specialist on International Business & Entrepreneurial Development, leadership, Corporate Social & Sustainable Responsibilities, Financial & Economic, Management, Marketing, Cross-Cultural Resource, Human Rights and the creative management of change. Also he is an intellectual luminary of great repute and a human dynamo of hard work and unstinted service. Mr Haw individual qualifications and skills that led to the conclusion that he should serve as a Chairman and Audit and Finance Committee include his extensive and broad experience in the Hotel industry gained through his years of consultancy positions of increasing responsibility in operations, corporate planning, mergers and acquisition. He has no conflict of interest in any business arrangement involving the Registrant. He has had no convictions for any offences within the past ten years.

Ban Siong Ang

Mr. Ban Siong Ang was appointed as a Group CEO and Managing Director of the Registrant in 2014. He also served as interim CFO prior to the joining of new CFO.

He graduated from University of Southern Queensland, Australia in 1998 and completed his Doctor of Business Administration from Ansted University in 2011. Upon his graduation from Australia, he started his career and worked as Senior Officer in Bursa Malaysia Depository Sdn Bhd (formerly known as Kuala Lumpur Stock Exchange) between 1998 to2004. From 2004 to 2009, he served as Director and principal consultant for Golden Design Renovation and Construction Sdn Bhd. Between 2010 and 2011, he served as General Manager and Directors for E-World Films Production Limited, Big Mine (Hong Kong) Private Limited and Asia Morgan Foundation Financial Ltd. In 2012, he founded Heyu Group of Companies in China, Hong Kong and Malaysia. Heyu Group of Companies are engaged in Leisure and Hotels management, Club membership, Biotechnology, Finance and Investment, Food & Beverage, Brand Franchising, Advance Entertainment Technology, Event Management, Property Development and Management, land & real estate property development, etc.

He is responsible in the formulation and implementation of the HEYU Group’s corporate strategies as well as in charge of the corporate finance and investment management aspects of the Group due to his acute knowledge with rich experience, strong commitment, innovative and dynamic personality. He obtained few Professional Institution Fellowship recognitions from the United Kingdom and also as a member of “The Academic Council on the United Nations System (ACUNS)” in Canada.

In view of Mr. Ang humanitarian contributions, he was certified as ASRIA CSR-CAP in recognizing his outstanding contributions to establish, promote and protect humanity, Peace, Culture Human resource development and Education for the well-being of human society through volunteerism. He was also bestowed the Royal Orders from the State of Pahang in Malaysia.

Hung Seng Tan

Mr. Hung Seng Tan was appointed as an Executive Director of the Registrant in 2014. In July 2007, he graduated from Ansted University and possessed Bachelor degree in Civil Engineering.

Between March 1980 and February 1984, he worked at Hotels and Restaurants in the United States of America.

In June 1984, he started his own business venture in Malaysia and served as Managing Director in Mesin Engineering Sdn Bhd in the field of quarry construction and trading business. Mr Tan is a prominent hand on specialist in town with 30 year experience in the quarry business (River and Marine sand exploratory) and also in earthworks construction project to which he has completed few important infrastructure projects in Malaysia since 1984. Presently, he sits on the Directors of Mesin Engineering Sdn Bhd and Hung Seng Constructions Sdn Bhd in Malaysia since 1984.

Mr. Tan’s individual qualifications and skills that led to the conclusion that he should serve as a director and co-founder of Heyu Group of companies to oversee on hotel business, property development and risk management.

Guan Chuan Tan

Guan Chuan Tan was appointed as a Director of the Registrant in 2014. He possesses a Bachelor and Master in Business Administration from Ansted University. He has engaged in restaurant and property industry for over 30 years.

In 1998, he formed Lava Group and started his first Japanese Food Restaurant- Sushi Sam in Texas City, Texas. In 2002, he set up a Japanese and Thailand Style Restaurant- Lava Grill in Texas. In 2008, he served as Executive Director of Aniseed Group to take charge of culinary and food development. Besides that, he also expanded his business in China and started up a Vietnamese Restaurant in Shanghai, China. In 2010, he expanded another Asian style restaurant, named Lava 10, in another city of Texas. He also serve as CEO of Buddhist Temple at Dallas, Texas since 2008.

He does not have any family relationship with any directors and/or major shareholder of HEYU Group of Companies, nor any conflict of interest in any business arrangement involving the Registrant. He has had no convictions for any offenses within the past ten years.

15

Timi Ecimovic

Timi Ecimovic was appointed as a Non-Executive Director of the Registrant in 2014. He was the Ex-Chairman of the World Thinkers’ Forum cum one of the chapter’s founding members of the World Thinkers’ Panel on the Sustainable Future of Humankind (WTP-SFH) in China. He started his career as veterinary surgeon with Agriculture Institute, Nova Gorica and Ihan between 1966 and 1969. In 1969, he worked as Adviser for development of Veterinary drugs in Krka Pharmaceutical Company. Between 1970 and 1972, he held the position of Regional Veterinary Officer in Ministry of Agriculture, Dar-es-Salaam, Tanzania. From 1972 to 1975, he worked as Regional Sales and Marketing Manager in Krka Pharmaceutical Company, Slovenia. Between 1975 and 1979, he served as Financial adviser in Ljubljanska Bank for industrial co-operation and joint venture affairs. In 1981, he served as General Manager in Danjub Chemical company at Enugu in Nigeria. From 1982 to 1986, he served as Sales Manager in Emona Ipko. He started his own company namely TJE Business Advisory Centre and served for Manager between 1987 and 1993. In 1993, he worked as independent researcher registered with Ministry of Science and Technology at Ljubljana in Slovenia. From 1995 until present, he is the Director of SEM Institute for Climate change and free-lance lecturer for the climate change system, nature, space and environment protection.

He has more than 300 professional publications including 20 books, several book chapters in the field of Environmental Sciences, Physics of the Nature, System thinking, Climate Change System, Corporate and Individual Social Responsibility, etc. Also he is the Chair of ASRIA’s CSR-CAP, Professor cum Program Director of Ansted University’s School of Environmental Sciences, Ex-Head of SEM Institute for Climate Change, active member of the European Academy of Sciences and Arts, was an International Consultant Socio-Economic and Sport Fishing for The Food and Agriculture Organization of the United Nations (UN FAO) in Rome, Italy. He received the public certificate The Citizen of the Earth XXI, 2012.

Mr. Timi Ecimovic has been nominated by many institutions in the world for the Nobel Prize in Physics. He has been serving as Chairman for the World Thinkers’ Forum, The Chancellor of the World Philosophical Forum University, and many of his activities have been broadcasted via various media channels through press, magazines, journals TV shows and radio presentations including Kaleidoscope of the United Nations Children’s Fund (UNICEF). He is author of environmental sciences and sustainable development cum sustainable future of humankind resources books as well as listed in Who’s who publications as Global Studies Encyclopedic Directory, and Encyclopedic Directory of Known Slovenians. He does not have any family relationship with any directors and/or major shareholder of HEYU Group of Companies, nor any conflict of interest in any business arrangement involving the Registrant. He has had no convictions for any offences in his whole life until now.

Mei Yun Zhong

Ms. Zhong was appointed as a Non-Executive Director cum Nomination Committee member of the Registrant in 2014. From 1996 to 2000, she started her career as surgical nurse in Fuzhou General Hospital of Nanjing Military Region in China. Subsequently, she worked as Regional Agent for China Life Insurance between 2000 and 2002. From 2003 to present, she working as healthcare Regional Sales agent and Manager in New Era Guo Zeng Inc in China.

In 2013, she received her Bachelor Degree of Business Administration from Ansted University. In view of her strong interest in doing business with good leadership skill, she was appointed Non-Executive Director in 2014. She does not have any family relationship with any directors and/or major shareholder of HEYU Group of Companies, nor any conflict of interest in any business arrangement involving the Registrant. She has had no convictions for any offences within the past ten years.

Stephan Truly Busch

Stephan Truly Busch was appointed as a Non-Executive Director cum Nomination Committee member of the Registrant in 2014. He has been in the teaching profession for over 40 years at different German schools in Germany. He is a well-known English teacher in Germany, also fluent in German, Bosnian, Croatian and Serbian languages. He started his career as translator/ interpreter with Energeoinvest Sarajevo between 1970 and 1973. From 1973 to present, he is working as the teacher of English and German at Wolfen buettel School in Germany. He also served as Evaluation consultant for Europe in California University FCE from 2011 until now.

He completed his Doctor of Education at Ansted University and serves as an Evaluation expert for European credentials. He has also managed several soccer teams throughout Germany. He does not have any family relationship with any directors and/or major shareholder of HEYU Group of Companies, nor any conflict of interest in any business arrangement involving the Registrant. He has had no convictions for any offences within the past ten years.

Kwee Huwa Tan

Kwee Huwa Tan was appointed as a Non-Executive Director cum Nomination Committee member of the Registrant in 2014. In 2014, she received her Bachelor of Business Administration from Ansted University. She does have 25 years of experience in beauty care business. Presently she is the Principal Consultant for HEYU Healthcare division in the aspect of beauty and cosmetology.

In 2000, she established Slynn International Beauty Group and working as Director until now, which is integrating scientific research, marketing, training and professional beauty in business territories covering mainland China, Southeast Asia, Europe, America and China Taiwan region. She has been enthusiastic about public welfare, involving social welfare activities and contribution diligently.

She does not have any family relationship with any directors and/or major shareholder of HEYU Group of Companies, nor any conflict of interest in any business arrangement involving the Registrant. She has had no convictions for any offences within the past ten years.

Shanmuga Ratnam,

Shanmuga Ratnam was appointed as an Independent Non-Executive Director cum the Finance, Audit, Remuneration and Risk Management Board Committee member of HEYU LEISURE HOLIDAYS CORPORATION in 2014. He is retired since 2009 and was formerly a banker who served as head of department in the FOREX exchange for 25 years in a financial institution in Malaysia.

16

A well-known personality in his chosen profession, Mr. Ratnam is Ansted University Doctorate Alumni cum Honorary Advisory Council member in Malaysia. Also he obtained few Professional Institution Fellowship recognitions from the United Kingdom and travels extensively to various countries to serve as an invited speaker.

He does not have any family relationship with any directors and/or major shareholder of HEYU Group of Companies, nor any conflict of interest in any business arrangement involving the Registrant. He has had no convictions for any offences within the past ten years.

M. Shahid Siddiqi

M. Shahid Siddiqi was appointed as an Independent Non-Executive Director of the Registrant in 2014. He is one of the founding members of the World Thinkers’ Panel on the Sustainable Future of Humankind (WTP-SFH). He is a Notary Public in the State of California, United States, since 2009. He has been a Board of Advisor cum Professor in Business & Accounting for Ansted University University since March 1999. He is a retired Tax Consultant in the United States and Canada since November 2007. Besides that, he also served as president/CEO, Avon Income Tax Services since October 1990. In 1980, he was Deputy Governor for American Biographical Institute Research Association.

He does not have any family relationship with any directors and/or major shareholder of HEYU Group of Companies, nor any conflict of interest in any business arrangement involving the Registrant. He has had no convictions for any offences within the past ten years.

Hakikur Rahman

Md. Hakikur Rahman was appointed as an Independent Non-Executive Director of the Registrant in 2014. He is specialized in the field of Computer Engineering. He is Ansted University Doctorate alumni cum Honorary Advisory Council member. Also he is a trained and qualified Electrical & Electronics Engineer and has been serving as faculty members for various Universities in Portugal and Bangladesh. He is the Chief Editor of the Advances in Knowledge Communities and Social Networks (AKCSN) Book series and International Journal of Information and Communication technology for Human Development (IJICTHD);

He started his career as National Project Coordinator with Sustainable Development Networking Foundation (UNDP) in Bangladesh in December 1999, subsequently being promoted to executive Director in January 2007. Between November 2008 and November 2013, he served as Post-Doctoral Researcher in the University of Minho, Portugal to conduct research in the field of knowledge management and organizational learning. From April 2014 to the present, he is working as Director (Academic Services) in the Institute of Computer Management Science, responsible for the preparation of course materials and manuals for personnel from Government and Non-Government organization. He has contributed over 45 book chapters, authored/edited about 20 books and published more than 100 articles/papers on ICT for Development (e.g. knowledge management, e-governance, e-learning, data mining applications and Internet governance).

He does not have any family relationship with any directors and/or major shareholder of HEYU Group of Companies, nor any conflict of interest in any business arrangement involving the Registrant. He has had no convictions for any offences within the past ten years.

Lay Hoon Ong

Ms. Lay Hoon Ong, was appointed as an Independent Non-Executive Director of the Registrant in 2014. She has 20 years of experience in directing business administrative and accounting aspects in the field of Education Institution, Publication, Insurance, Business Consultancy, Manufacturing and Industrial Services. Although this kind of task is considered extremely challenging but she never stopped learning the new approaches and improve herself along the journey as a dedicated Administrative Management Director. In view of her international voluntary contributions for many successful conference event projects, she was awarded an Honorary Doctorate degree BALKAN Academy of Science, Technology and Management in Sofia, Bulgaria in 2005. In addition, she also sits on the Directors of several private limited companies in Malaysia.

She started her career as an Insurance Financial Planner with SimeAxa Assurance Berhad between December 1993 and July 1999. Between September 1999 and August 2003, she was the Deputy Director for Ansted Asia Regional Service Center to overseeing and managing international projects in Asia and the United Kingdom. Between September 2003 and August 2010, she served as Director cum Shareholder for Best Team Industrial Services. From September 2010 to the present, she serves as Director cum Shareholder for Best Team Manufacturing and Trading Sdn. Bhd to overseeing and directing Administrative and Account Department of Best Team Group of Companies.

17

She has no conflict of interest in any business arrangement involving the Registrant. She has had no convictions for any offences within the past ten years.

Director Independence

Pursuant to Rule 4200 of The NASDAQ Stock Market one of the definitions of an independent director is a person other than an executive officer or employee of a company. The Registrant's board of directors has reviewed the materiality of any relationship that each of the directors has with the Registrant, either directly or indirectly. Based on this review, the board currently has five independent directors.

Committees and Terms

The Board of Directors (the “Board”) has established two committees, which are the Finance, Audit and Risk Management committee and nominations committee. The Registrant has adopted a charter for each of the board committees. Each committee’s members and functions are described below.

Finance, Audit and Risk Management Committee

Our audit committee consists of four directors, namely Mr. Shanmuga Ratnam, Mr Boon Hong Haw, Mr Ban Siong Ang and Mr Hung Seng Tan. Our board of directors has determined that Mr. Shanmuga Ratnam is qualified as an audit committee financial expert within the meaning of the SEC regulations. The audit committee oversees our accounting and financial reporting processes and the audits of the financial statements of our company. The audit committee is responsible for, among other things:

· selecting the independent auditors and pre-approving all auditing and non-auditing services permitted to be performed by the independent auditors;

· setting clear hiring policies for employees or former employees of the independent auditors;

· reviewing with the independent auditors any audit problems or difficulties and management’s response;

· reviewing and approving all proposed related-party transactions;

· discussing the annual audited financial statements with management and the independent auditors;

· discussing with management and the independent auditors major issues regarding accounting principles and financial statement presentations;

· reviewing reports prepared by management or the independent auditors relating to significant financial reporting issues and judgments;

· reviewing with management and the independent auditors related-party transactions and off-balance sheet transactions and structures;

· reviewing with management and the independent auditors the effect of regulatory and accounting initiatives and actions;

· reviewing policies with respect to risk assessment and risk management;

· reviewing our disclosure controls and procedures and internal control over financial reporting;

· timely reviewing reports from the independent auditors regarding all critical accounting policies and practices to be used by our company, all alternative treatments of financial information within GAAP that have been discussed with management and all other material written communications between the independent auditors and management;

· establishing procedures for the receipt, retention and treatment of complaints received from our employees regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters;

· annually reviewing and reassessing the adequacy of our audit committee charter;

· such other matters that are specifically delegated to our audit committee by our board of directors from time to time; and

· meeting separately, periodically, with management, the internal auditors and the independent auditors.

Nomination Committee

Our Nomination committee consists of Ms. Kwee Huwa Tan, Mr. Truly Bush and Ms. Mei Yun Zhong. The nomination committee is responsible for, among other things:

· Making recommendations as to the size, composition, structure, operations, performance and effectiveness of the Board;

· Overseeing the Company’s chief executive officer (“CEO”) succession planning process

· Conducting an annual review of the Company’s CEO and non-independent chairman, if any;

· Developing and recommending to the Board a set of corporate governance principles, including independence standards; and

· taking a leadership role in shaping the corporate governance of the Company.

18

| Item 11. | Executive Compensation |

| Aggregate | ||||||||||||||||||||||||||||||||||||

| Annual | Annual | Accrued | All | Annual | ||||||||||||||||||||||||||||||||

| Earned | Payments | Salary Since | Stock and | Compensation | Other | Compensation | ||||||||||||||||||||||||||||||

| Name/Position | Year | Salary | Made | Inception | Bonus | Options | Plans | Compensation | Total | |||||||||||||||||||||||||||

| Boon Hong Haw Chairman | 2015 | $ | 120,000 | $ | 0 | $ | 120,000 | $ | 0 | - | - | - | $ | 120,000 | ||||||||||||||||||||||

| 2014 | $ | 120,000 | $ | 0 | $ | 120,000 | $ | 0 | - | - | - | $ | 120,000 | |||||||||||||||||||||||

| Ban Siong Ang | 2015 | $ | 180,000 | $ | 0 | $ | 180,000 | $ | 0 | - | - | - | $ | 180,000 | ||||||||||||||||||||||

| CEO and | 2014 | $ | 180,000 | $ | 0 | $ | 180,000 | $ | 0 | - | - | - | $ | 180,000 | ||||||||||||||||||||||

| Group Managing Director | ||||||||||||||||||||||||||||||||||||

| Hung Seng Tan | 2015 | $ | 72,000 | $ | 0 | $ | 72,000 | $ | 0 | - | - | - | $ | 72,000 | ||||||||||||||||||||||

| Executive Director | 2014 | $ | 72,000 | $ | 0 | $ | 72,000 | $ | 0 | - | - | - | $ | 72,000 | ||||||||||||||||||||||

| Guan Chuan Tan | 2015 | $ | 24,000 | $ | 0 | $ | 24,000 | $ | 0 | - | - | - | $ | 24,000 | ||||||||||||||||||||||

| Director | 2014 | $ | 24,000 | $ | 0 | $ | 24,000 | $ | 0 | - | - | - | $ | 24,000 | ||||||||||||||||||||||

| Kean Tat Che | 2015 | $ | 72,000 | $ | 0 | $ | 72,000 | $ | 0 | - | - | - | $ | 72,000 | ||||||||||||||||||||||

| Former Chief Financial Officer Resigned on November 13, 2015 | 2014 | $ | 72,000 | $ | 0 | $ | 72,000 | $ | 0 | - | - | - | $ | 72,000 | ||||||||||||||||||||||

The Board of Directors may allocate salaries and benefits to the officers in its sole discretion. No officer is subject to a compensation plan or arrangement that results from his or her resignation, retirement, or any other termination of employment with the Registrant or from a change in control of the company or a change in his or her responsibilities following a change in control. The members of the Board of Directors may receive, if the Board so decides, a fixed fee and reimbursement of expenses, for attendance at each regular or special meeting of the Board, although no such program has been adopted to date. The Registrant currently has no retirement, pension, or profit-sharing plan covering its officers and directors; however, the Registrant plans to implement certain such benefits after sufficient funds are realized or raised by the Registrant (see “Anticipated Officer and Director Remuneration” below.)

Employment Agreements

The Registrant enters into and maintains customary employment agreements with each of its officers and employees.

The employees receive health insurance benefits. The Registrant provides the health insurance coverage to all Registrant staff after a probation period.

The Registrant also offers an Employee Provident Fund as a provision of retirement funds. All Registrant staff are entitled to participate in this fund after a probation period. The contribution of the Employee Provident Fund is from Employer and Employee. The Registrant will match up to five percent of the Employee’s salary towards a contribution.

The Registrant also provides a food allowance. The food allowance is provided to the hotel staff only, of up to RMB 10.00 per working shift.