Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - AMC ENTERTAINMENT HOLDINGS, INC. | amc-20160801ex9920fc61d.htm |

| 8-K - 8-K - AMC ENTERTAINMENT HOLDINGS, INC. | amc-20160801x8k.htm |

FOR IMMEDIATE RELEASE

AMC Entertainment Holdings, Inc. Announces

Second Quarter 2016 Results

LEAWOOD, KANSAS - (August 1, 2016) -- AMC Entertainment Holdings, Inc. (“AMC” or “the Company”), one of the world’s leading theatrical exhibition companies and an industry leader in innovation and operational excellence, today reported results for the second quarter ended June 30, 2016.

Highlights for the second quarter 2016 include the following:

|

· |

Total revenues were $764.0 million compared to total revenues of $821.1 million for the three months ended June 30, 2015. |

|

· |

Admissions revenues were $481.2 million compared to $533.4 million for the same period a year ago. Average ticket price was $9.63 compared to $9.91 for the same period a year ago. |

|

· |

Food and beverage revenues were $243.5 million, compared to $250.5 million for the quarter ended June 30, 2015. Food and beverage revenues per patron increased 4.7% to an all-time high record of $4.87. This quarter marks nine of the last ten quarters AMC has set an all-time high record in food and beverage per patron. |

|

· |

Net earnings were $24.0 million and diluted earnings per share (“diluted EPS”) were $0.24 compared to $43.9 million and $0.45, respectively, for the three months ended June 30, 2015. |

|

· |

Adjusted diluted earnings per share (1) were $0.24 compared to $0.48 for the three months ended June 30, 2015. Included in adjusted diluted earnings per share for the three months ended June 30, 2016 was approximately $5.5 million of merger and acquisition costs. |

|

· |

Adjusted EBITDA(1) was $129.6 million compared to $157.8 million for the three months ended June 30, 2015. Adjusted EBITDA Margin (1) for the second quarter was 17.0% compared to 19.2%, for the same period a year ago. |

|

· |

Adjusted Free Cash Flow(1) for the quarter ended June 30, 2016 was $40.8 million compared to $68.8 million for the quarter ended June 30, 2015. |

"It would ordinarily be difficult to be pleased with a quarter in which a lackluster film slate caused us to share in the industrywide box office revenue decline that was down domestically some 10.7% per screen year-over-year. However, we are encouraged that this trend has already reversed itself with industry box office revenues up more than 7% as of July 29th, and a potentially record setting film slate being close at hand for calendar year 2017," said Adam Aron, AMC Chief Executive Officer and President.

Aron added, "However, of far greater importance in our view, things that were within our control tell a much different story for AMC. We made progress at AMC in the second quarter in four significant ways. First, our theatre renovations featuring recliner seats, premium large format auditoriums and a refreshed overall decor continued to lead the industry enhancing our appeal to consumers. Second, thanks to continuing our innovation of the AMC theatre experience, food and beverage revenues per patron were an all-time record for us. Third, we wholly revamped our already popular AMC Stubs® loyalty program, and tested it in 40 theatres in 6 markets. The test was so successful that we have already rolled out the new program nationally across our entire network. Moviegoers are signing up to enroll in the new AMC Stubs® loyalty program at a rate 2 to 3 times than that for the previous program, and the number of our total active members is already up approximately 20% in just a few short months. We believe membership should continue to increase at a brisk pace, and this augers brightly for AMC's future. And fourth, our executives and staff worked tirelessly to put us in a position to announce in July our acquisition of Odeon & UCI Cinemas in Europe as well as a new merger agreement with Carmike Cinemas here in the United States. When either of these acquisitions close, AMC then becomes overnight the largest movie exhibitor in the world. Taken together, this level of activity and progress is almost breathtaking, enabling AMC to be uniquely positioned to deliver additional value to our guests, associates and shareholders."

Highlights for the six months ended June 30, 2016 include the following:

|

· |

AMC set all-time high records for the six months ended June 30th period for all revenue segments: total revenues, admissions revenues, food and beverage revenues and other revenues. |

|

· |

Total revenues increased 3.8% to $1,530.0 million compared to total revenues of $1,474.2 million for the six months ended June 30, 2015. |

|

· |

Admissions revenues grew 1.2% to $963.8 million compared to $952.1 million for the six months ended June 30, 2015. Average ticket price was $9.52 compared to $9.66 for the six months ended June 30, 2015 and attendance grew 2.7% to more than 101 million guests. |

|

· |

Food and beverage revenues increased 8.1% to $487.7 million, compared to $451.0 million for the six months ended June 30, 2015. Food and beverage revenues per patron increased 5.2% to a new six month record of $4.82. |

|

· |

Net earnings increased 4.4% to $52.3 million and diluted earnings per share grew 3.9% to $0.53 compared to $50.1 million and $0.51, respectively, for the six months ended June 30, 2015. |

|

· |

Adjusted diluted earnings per share (1) increased 18.6% to $0.51 compared to the six months ended June 30, 2015. Included in adjusted diluted earnings per share for the six months ended June 30, 2016 was approximately $10.2 million of merger and acquisition costs. |

|

· |

Adjusted EBITDA(1) grew 0.9% to $276.0 million compared to $273.5 million and Adjusted EBITDA Margin(1) was 18.0%, compared to 18.5% for the six months ended June 30, 2015. |

|

· |

Adjusted EBITDA(1) for the six months ended June 30, 2015, benefited from an $18.1 million gain related to the termination of a post-retirement health benefit plan which caused our net periodic benefit costs to be much lower than normal in the prior year. The gain was recorded as a reduction of general and administrative: other expense. Excluding this gain in the prior year period, Adjusted EBITDA growth, year-over-year for the six months ended June 30, 2016, would have shown an improvement of approximately 8.1%, and Adjusted EBITDA Margin improvement of 70 basis points from 17.3% to 18.0%. |

|

· |

Adjusted Free Cash Flow(1) for the six months ended June 30, 2016 increased approximately $25.0 million, or 28.4%, to $112.9 million compared to $87.9 million for the six months ended June 30, 2015. |

|

(1) |

(Reconciliations and definitions of non-GAAP financial measures are provided in the financial schedules accompanying this press release.) |

CFO Commentary

Commentary on the quarter by Craig Ramsey, AMC's executive vice president and chief financial officer, is available at http://investor.amctheatres.com

Dividend

On April 27, 2016, the Company declared a regular quarterly dividend of $0.20 per share for the quarter ended March 31, 2016, which was paid on June 20, 2016, to shareholders of record as of June 6, 2016. The total dividends paid in the second quarter of 2016 were approximately $19.7 million.

On July 25, 2016, the Company declared a regular quarterly dividend of $0.20 per share for the quarter ended June 30, 2016, which is payable on September 19, 2016, to shareholders of record on September 6, 2016.

Acquisitions

Odeon & UCI Cinemas Group: As previously announced on July 12, 2016, AMC entered into a definitive agreement to acquire the equity of the largest theatre exhibitor in Europe, London-based Odeon & UCI Cinemas Group from private equity firm, Terra Firma in a transaction valued at approximately £921 million (including approximately £14 million of employee incentive costs), comprised of £500 million for the equity, 75% in cash and 25% in stock consideration, subject to lock-ups, and the assumption of £407 million of net debt as of March 31, 2016 to be simultaneously refinanced at closing. Assuming the transaction closes December 31, 2016 and a GBP/USD exchange rate of 1.30 the transaction is valued at approximately $1,199 million under UK GAAP. The transaction is expected to produce annual cost synergies of approximately $10 million. The transaction is expected to be completed in the fourth quarter of 2016, subject to antitrust clearance by the European Commission and consultation with the European Works Council.

Carmike Cinemas, Inc. (NASDAQ: CKEC): As previously announced on July 25, 2016, AMC has entered into an amended and restated merger agreement to acquire all of the outstanding shares of Carmike Cinemas, Inc. (NASDAQ: CKEC) (“Carmike”) for $33.06 per share, representing an approximate 32% premium to Carmike’s March 3, 2016, closing stock price. The revised offer provides an additional $3.06 per share or 10.2% more than the previous offer. Carmike stockholders can elect to receive $33.06 in cash or 1.0819 AMC shares per Carmike share, subject to a customary proration mechanism to achieve an aggregate consideration mix of 70% cash and 30% in shares of AMC stock. The transaction is valued at approximately $1.2 billion, including the assumption of Carmike’s net indebtedness, based on the closing trading price of AMC’s common stock on the New York Stock Exchange on July 22, 2016.

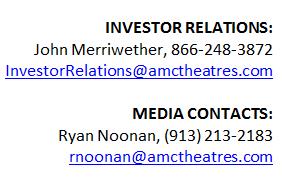

Conference Call / Webcast Information

The Company will host a conference call via webcast for investors and other interested parties beginning at 7:30 a.m. CT/8:30 a.m. ET on Monday, August 1, 2016. To listen to the conference call via the internet, please visit the investor relations section of the AMC website at www.investor.amctheatres.com for a link to the webcast. Investors and interested parties should go to the website at least 15 minutes prior to the call to register, and/or download and install any necessary audio software.

Participants may also listen to the call by dialing (877) 407-3982, or (201) 493-6780 for international participants.

A podcast and archive of the webcast will be available on the Company’s website after the call for a limited time.

About AMC Entertainment Holdings, Inc.

AMC (NYSE:AMC) is the guest experience leader with 386 locations and 5,334 screens located primarily in the United States. AMC has propelled innovation in the theatrical exhibition industry and continues today by delivering more comfort and convenience, enhanced food & beverage, greater engagement and loyalty, premium sight & sound, and targeted programming. AMC operates the most productive theatres in the country’s top markets, including No. 1 market share in the top three markets (NY, LA, Chicago). www.amctheatres.com.

Website Information

This press release, along with other news about AMC, is available at www.amctheatres.com . We routinely post information that may be important to investors in the Investor Relations section of our

website, www.investor.amctheatres.com. We use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD, and we encourage investors to consult that section of our website regularly for important information about AMC. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document. Investors interested in automatically receiving news and information when posted to our website can also visit www.investor.amctheatres.com to sign up for E-mail Alerts.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “plan,” “estimate,” “will,” “would,” “project,” “maintain,” “intend,” “expect,” “anticipate,” “strategy,” “future,” “likely,” “may,” “should,” “believe,” “continue,” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Similarly, statements made herein and elsewhere regarding the pending acquisitions of Odeon & UCI and Carmike Cinemas (collectively “the targets”) are also forward-looking statements, including statements regarding the anticipated closing date of the acquisitions, the source and structure of financing, management’s statements about effect of the acquisitions on AMC’s future business, operations and financial performance and AMC’s ability to successfully integrate the targets into its operations. These forward-looking statements are based on information available at the time the statements are made and/or managements’ good faith belief as of that time with respect to future events, and are subject to risks, trends, uncertainties and other facts that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks, trends, uncertainties and facts include, but are not limited to, risks related to: the parties’ ability to satisfy closing conditions in the anticipated time frame or at all; obtaining regulatory approval, including the risk that any approval may be on terms, or subject to conditions, that are not anticipated; obtaining the Carmike stockholders approval for the Carmike transaction; the possibility that these acquisitions do not close, including in circumstances in which AMC would be obligated to pay a termination fee or other damages or expenses; related to financing these transactions, including AMC’s ability to finance the transactions on acceptable terms and to issue equity at favorable prices; responses of activist stockholders to the transactions; AMC’s ability to realize expected benefits and synergies from the acquisitions; AMC’s effective implementation, and customer acceptance, of its marketing strategies; disruption from the proposed transactions- making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on transaction-related issues; the negative effects of this announcement or the consummation of the proposed acquisitions- on the market price of AMC’s common stock; unexpected costs, charges or expenses relating to the acquisitions; unknown liabilities; litigation and/or regulatory actions related to the proposed transactions; AMC’s significant indebtedness, including the indebtedness incurred to acquire the targets; execution risks related to the integration of Starplex Cinemas into our business; our ability to achieve expected synergies and performance from our acquisition of Starplex Cinemas; AMC’s ability to utilize net operating loss carry-forwards to reduce future tax liability; increased competition in the geographic areas in which we operate and from alternative film-delivery methods and other forms of entertainment; continued effectiveness of AMC’s strategic Initiatives; the impact of shorter theatrical exclusive release windows; our ability to attract and retain senior executives and other key personnel; the impact of governmental regulation, including anti-trust investigations concerning potentially anticompetitive conduct, including film clearances and participation in certain joint ventures; unexpected delays and costs related to our optimization of our theatre circuit; failure, unavailability or security breaches of our information systems; operating a business in markets AMC is unfamiliar with; the United Kingdom’s exit from the European Union; and other business effects, including the effects of industry, market, economic, political or regulatory conditions, future exchange or interest rates, changes

in tax laws, regulations, rates and policies; and risks, trends, uncertainties and other facts discussed in the reports AMC has filed with the SEC. Should one or more of these risks, trends, uncertainties or facts materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by the forward-looking statements contained herein. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. For a detailed discussion of risks, trends and uncertainties facing AMC, see the section entitled “Risk Factors” in AMC’s Annual Report on Form 10-K, filed with the SEC on March 8, 2016, and the risks, trends and uncertainties identified in their other public filings. AMC does not intend, and undertakes no duty, to update any information contained herein to reflect future events or circumstances, except as required by applicable law.

(Tables follow)

AMC Entertainment Holdings, Inc.

Consolidated Statements of Operations

For the Fiscal Periods Ended 6/30/16 and 6/30/15

(dollars in thousands, except per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended |

|

6 Months Ended |

||||||||

|

|

|

June 30, |

|

June 30, |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

||||

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

Admissions |

|

$ |

481,234 |

|

$ |

533,382 |

|

$ |

963,808 |

|

$ |

952,076 |

|

Food and beverage |

|

|

243,546 |

|

|

250,516 |

|

|

487,698 |

|

|

451,040 |

|

Other theatre |

|

|

39,182 |

|

|

37,181 |

|

|

78,473 |

|

|

71,087 |

|

Total revenues |

|

|

763,962 |

|

|

821,079 |

|

|

1,529,979 |

|

|

1,474,203 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Film exhibition costs |

|

|

262,940 |

|

|

295,416 |

|

|

525,294 |

|

|

518,504 |

|

Food and beverage costs |

|

|

34,100 |

|

|

35,807 |

|

|

68,065 |

|

|

64,315 |

|

Operating expense |

|

|

200,026 |

|

|

205,414 |

|

|

402,339 |

|

|

392,672 |

|

Rent |

|

|

122,819 |

|

|

115,022 |

|

|

247,403 |

|

|

232,943 |

|

General and administrative: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Merger, acquisition and transaction costs |

|

|

5,548 |

|

|

261 |

|

|

10,152 |

|

|

1,839 |

|

Other |

|

|

20,634 |

|

|

17,737 |

|

|

39,150 |

|

|

22,678 |

|

Depreciation and amortization |

|

|

62,291 |

|

|

57,249 |

|

|

122,721 |

|

|

115,026 |

|

Operating costs and expenses |

|

|

708,358 |

|

|

726,906 |

|

|

1,415,124 |

|

|

1,347,977 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

55,604 |

|

|

94,173 |

|

|

114,855 |

|

|

126,226 |

|

Other expense (income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense |

|

|

(110) |

|

|

9,273 |

|

|

(84) |

|

|

9,273 |

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate borrowings |

|

|

24,888 |

|

|

24,717 |

|

|

49,755 |

|

|

50,796 |

|

Capital and financing lease obligations |

|

|

2,147 |

|

|

2,331 |

|

|

4,342 |

|

|

4,704 |

|

Equity in earnings of non-consolidated entities |

|

|

(11,849) |

|

|

(9,362) |

|

|

(16,113) |

|

|

(10,686) |

|

Investment (income) loss |

|

|

176 |

|

|

(59) |

|

|

(9,778) |

|

|

(5,202) |

|

Total other expense |

|

|

15,252 |

|

|

26,900 |

|

|

28,122 |

|

|

48,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before income taxes |

|

|

40,352 |

|

|

67,273 |

|

|

86,733 |

|

|

77,341 |

|

Income tax provision |

|

|

16,385 |

|

|

23,350 |

|

|

34,475 |

|

|

27,280 |

|

Net Earnings |

|

$ |

23,967 |

|

$ |

43,923 |

|

$ |

52,258 |

|

$ |

50,061 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$ |

0.24 |

|

$ |

0.45 |

|

$ |

0.53 |

|

$ |

0.51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted earnings per share (1) |

|

$ |

0.24 |

|

$ |

0.48 |

|

$ |

0.51 |

|

$ |

0.43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average shares outstanding diluted |

|

|

98,304 |

|

|

98,037 |

|

|

98,237 |

|

|

97,987 |

Balance Sheet Data (at period end):

(dollars in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

As of |

|

As of |

||

|

|

|

June 30, |

|

December 31, |

||

|

|

|

2016 |

|

2015 |

||

|

Cash and equivalents |

|

$ |

93,316 |

|

$ |

211,250 |

|

Corporate borrowings |

|

|

1,834,970 |

|

|

1,912,793 |

|

Other long-term liabilities |

|

|

492,393 |

|

|

462,626 |

|

Capital and financing lease obligations |

|

|

97,665 |

|

|

101,864 |

|

Stockholders' equity |

|

|

1,552,846 |

|

|

1,538,703 |

|

Total assets |

|

|

4,948,541 |

|

|

5,088,317 |

Other Data:

(in thousands, except operating data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended |

|

6 Months Ended |

||||||||

|

|

|

June 30, |

|

June 30, |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

||||

|

Net cash provided by operating activities |

|

$ |

111,077 |

|

$ |

171,352 |

|

$ |

133,948 |

|

$ |

192,915 |

|

Capital expenditures |

|

$ |

(82,668) |

|

$ |

(74,167) |

|

$ |

140,325 |

|

$ |

(143,757) |

|

Screen additions |

|

|

— |

|

|

12 |

|

|

12 |

|

|

12 |

|

Screen acquisitions |

|

|

11 |

|

|

32 |

|

|

11 |

|

|

40 |

|

Screen dispositions |

|

|

— |

|

|

— |

|

|

38 |

|

|

— |

|

Construction openings (closures), net |

|

|

(57) |

|

|

28 |

|

|

(77) |

|

|

32 |

|

Average screens-continuing operations |

|

|

5,282 |

|

|

4,943 |

|

|

5,298 |

|

|

4,914 |

|

Number of screens operated |

|

|

5,334 |

|

|

5,031 |

|

|

5,334 |

|

|

5,031 |

|

Number of theatres operated |

|

|

386 |

|

|

350 |

|

|

386 |

|

|

350 |

|

Screens per theatre |

|

|

13.8 |

|

|

14.4 |

|

|

13.8 |

|

|

14.4 |

|

Attendance (in thousands) |

|

|

49,996 |

|

|

53,818 |

|

|

101,241 |

|

|

98,576 |

Reconciliation of Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share:

(dollars in thousands, except per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended |

|

6 Months Ended |

||||||||

|

|

|

June 30, |

|

June 30, |

||||||||

|

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings: |

|

$ |

23,967 |

|

$ |

43,923 |

|

$ |

52,258 |

|

$ |

50,061 |

|

Net periodic benefit credit related to the termination |

|

|

|

|

|

|

|

|

|

|

|

|

|

of post-retirement plan |

|

|

— |

|

|

— |

|

|

|

|

|

(18,118) |

|

Loss on redemption of 9.75% Senior |

|

|

|

|

|

|

|

|

|

|

|

|

|

Subordinated Notes due 2020 |

|

|

— |

|

|

9,273 |

|

|

|

|

|

9,273 |

|

Gain on sale Real D |

|

|

— |

|

|

— |

|

|

(3,008) |

|

|

|

|

Discrete tax benefit recorded in income tax provision |

|

|

— |

|

|

(2,900) |

|

|

— |

|

|

(2,900) |

|

Income tax effects of pre-tax adjustments above |

|

|

— |

|

|

(3,616) |

|

|

1,173 |

|

|

3,450 |

|

Net Earnings, excluding benefit related to termination |

|

|

|

|

|

|

|

|

|

|

|

|

|

of post-retirement plan, loss on redemption of Notes due |

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 and gain on sale of Real D, discrete tax benefit, |

|

|

|

|

|

|

|

|

|

|

|

|

|

and related tax effects of adjustments |

|

$ |

23,967 |

|

$ |

46,680 |

|

$ |

50,423 |

|

$ |

41,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average shares outstanding, diluted |

|

|

98,304 |

|

|

98,037 |

|

|

98,237 |

|

|

97,987 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted earnings per share (1) |

|

$ |

0.24 |

|

$ |

0.48 |

|

$ |

0.51 |

|

$ |

0.43 |

|

Diluted Earnings per share |

|

$ |

0.24 |

|

$ |

0.45 |

|

$ |

0.53 |

|

$ |

0.51 |

Reconciliation of Adjusted EBITDA:

(dollars in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended |

|

6 Months Ended |

||||||||

|

|

|

June 30, |

|

June 30, |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

||||

|

Net Earnings |

|

$ |

23,967 |

|

$ |

43,923 |

|

$ |

52,258 |

|

$ |

50,061 |

|

Plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision |

|

|

16,385 |

|

|

23,350 |

|

|

34,475 |

|

|

27,280 |

|

Interest expense |

|

|

27,035 |

|

|

27,048 |

|

|

54,097 |

|

|

55,500 |

|

Depreciation and amortization |

|

|

62,291 |

|

|

57,249 |

|

|

122,721 |

|

|

115,026 |

|

Certain operating expenses (3) |

|

|

3,838 |

|

|

3,350 |

|

|

7,240 |

|

|

7,414 |

|

Equity in earnings of non-consolidated entities |

|

|

(11,849) |

|

|

(9,362) |

|

|

(16,113) |

|

|

(10,686) |

|

Cash distributions from non-consolidated entities |

|

|

590 |

|

|

1,285 |

|

|

18,271 |

|

|

15,771 |

|

Investment (income) loss |

|

|

176 |

|

|

(59) |

|

|

(9,778) |

|

|

(5,202) |

|

Other expense (4) |

|

|

(110) |

|

|

9,273 |

|

|

(84) |

|

|

9,273 |

|

General and administrative expense-unallocated: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Merger, acquisition and transaction costs |

|

|

5,548 |

|

|

261 |

|

|

10,152 |

|

|

1,839 |

|

Stock-based compensation expense (5) |

|

|

1,717 |

|

|

1,439 |

|

|

2,804 |

|

|

7,178 |

|

Adjusted EBITDA (2) |

|

$ |

129,588 |

|

$ |

157,757 |

|

$ |

276,043 |

|

$ |

273,454 |

|

Adjusted EBITDA Margin (6) |

|

|

17.0% |

|

|

19.2% |

|

|

18.0% |

|

|

18.5% |

Reconciliation of Adjusted Free Cash Flow:

(dollars in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended |

|

6 Months Ended |

||||||||

|

|

|

June 30, |

|

June 30, |

||||||||

|

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings |

|

$ |

23,967 |

|

$ |

43,923 |

|

$ |

52,258 |

|

$ |

50,061 |

|

Plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision |

|

|

16,385 |

|

|

23,350 |

|

|

34,475 |

|

|

27,280 |

|

Interest expense |

|

|

27,035 |

|

|

27,048 |

|

|

54,097 |

|

|

55,500 |

|

Depreciation and amortization |

|

|

62,291 |

|

|

57,249 |

|

|

122,721 |

|

|

115,026 |

|

Certain operating expenses (3) |

|

|

3,838 |

|

|

3,350 |

|

|

7,240 |

|

|

7,414 |

|

Equity in earnings of non-consolidated entities |

|

|

(11,849) |

|

|

(9,362) |

|

|

(16,113) |

|

|

(10,686) |

|

Cash distributions from non-consolidated entities |

|

|

590 |

|

|

1,285 |

|

|

18,271 |

|

|

15,771 |

|

Investment (income) loss |

|

|

176 |

|

|

(59) |

|

|

(9,778) |

|

|

(5,202) |

|

Other expense (4) |

|

|

(110) |

|

|

9,273 |

|

|

(84) |

|

|

9,273 |

|

General and administrative expense-unallocated: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Merger, acquisition and transaction costs |

|

|

5,548 |

|

|

261 |

|

|

10,152 |

|

|

1,839 |

|

Stock-based compensation expense (5) |

|

|

1,717 |

|

|

1,439 |

|

|

2,804 |

|

|

7,178 |

|

Minus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash distributions from non-consolidated entities |

|

|

590 |

|

|

1,285 |

|

|

18,271 |

|

|

15,771 |

|

Income taxes paid, net of refunds |

|

|

3,284 |

|

|

(1,635) |

|

|

4,090 |

|

|

(1,130) |

|

Cash interest expense |

|

|

25,569 |

|

|

27,394 |

|

|

51,383 |

|

|

56,718 |

|

Capital expenditures (excluding change in |

|

|

|

|

|

|

|

|

|

|

|

|

|

construction payables) |

|

|

82,569 |

|

|

70,823 |

|

|

128,680 |

|

|

130,207 |

|

Landlord contributions |

|

|

(27,537) |

|

|

(12,726) |

|

|

(47,846) |

|

|

(23,717) |

|

Principal payments under Term Loan |

|

|

2,201 |

|

|

1,937 |

|

|

4,403 |

|

|

3,875 |

|

Principal payments under capital and financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

lease obligations |

|

|

2,123 |

|

|

1,940 |

|

|

4,199 |

|

|

3,826 |

|

Adjusted Free Cash Flow (7) |

|

$ |

40,789 |

|

$ |

68,739 |

|

$ |

112,863 |

|

$ |

87,904 |

|

(1) |

Adjusted diluted earnings per share is diluted earnings per share excluding a non-recurring postretirement net periodic benefit credit in the prior year, a loss on redemption of our 9.75% Senior Subordinated Notes due 2020 in the prior year quarter and year, a gain on sale of our investments in Real D during the current year, a discrete tax benefit recorded in income tax provision during the prior year quarter and year and the related tax effects of those adjustments. We have included adjusted diluted earnings per share because we believe it provides investors with additional useful information on our performance and is used by management to assess our performance. We have calculated the tax effects of the pre-tax adjustments described above using our effective Federal and State income tax rate for current and deferred income taxes which is reflective of our estimated annual GAAP income tax rate forecast adjusted to account for items excluded from GAAP income. Adjusted diluted earnings per share is a non-GAAP financial measure and should not be used as an alternative to diluted earnings per share, and may not be comparable to similarly titled measures reported by other companies. |

|

(2) |

We present Adjusted EBITDA as a supplemental measure of our performance. We define Adjusted EBITDA as net earnings plus (i) income tax provision, (ii) interest expense and (iii) depreciation and amortization, as further adjusted to eliminate the impact of certain items that we do not consider indicative of our ongoing operating performance and to include any cash distributions of earnings from our equity method investees. These further adjustments are itemized above. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Adjusted EBITDA, you should be aware that in the future |

we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Adjusted EBITDA is a non-GAAP financial measure and should not be construed as an alternative to net earnings as an indicator of operating performance or as an alternative to cash flow provided by operating activities as a measure of liquidity (as determined in accordance with U.S. GAAP). Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. We have included Adjusted EBITDA because we believe it provides management and investors with additional information to measure our performance, estimate our value and evaluate our ability to service debt. |

Adjusted EBITDA has important limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under U.S. GAAP. For example,

Adjusted EBITDA:

|

· |

does not reflect our capital expenditures, future requirements for capital expenditures or contractual commitments; |

|

· |

does not reflect changes in, or cash requirements for, our working capital needs; |

|

· |

does not reflect the significant interest expenses, or the cash requirements necessary to service interest or principal payments, on our debt; |

|

· |

excludes income tax payments that represent a reduction in cash available to us; and |

|

· |

does not reflect any cash requirements for the assets being depreciated and amortized that may have to be replaced in the future. |

|

(3) |

Amounts represent preopening expense related to temporarily closed screens under renovation, theatre and other closure expense for the permanent closure of screens including the related accretion of interest, non-cash deferred digital equipment rent expense, and disposition of assets and other non-operating gains or losses included in operating expenses. We have excluded these items as they are non-cash in nature, include components of interest cost for the time value of money or are non-operating in nature. |

|

(4) |

Other expense for the prior year quarter and prior year related to the cash tender offer and redemption of the 9.75% Senior Subordinated Notes due 2020. We exclude other expense and income related to financing activities as the amounts are similar to interest expense or income and are non-operating in nature. |

|

(5) |

Non-cash expense included in General and Administrative: Other |

|

(6) |

We define Adjusted EBITDA Margin as Adjusted EBITDA divided by Total Revenues. |

|

(7) |

We use Adjusted Free Cash Flow as a performance measure in our internal evaluation of operating effectiveness and in making decisions regarding the allocation of resources. Adjusted Free Cash Flow is a non-GAAP financial measure and should not be construed as an alternative to net earnings as an indicator of operating performance or as an alternative to cash flow provided by operating activities as a measure of liquidity (as determined in accordance with U.S. GAAP). We define Adjusted Free Cash Flow as Adjusted EBITDA minus the sum of cash distributions from non-consolidated entities, cash taxes, cash interest, capital expenditures (excluding change in construction payables) net of landlord contributions, mandatory payments of principal under any credit facility and payments under capital lease obligations and financing lease obligations as further described in the table below. We make adjustments to Adjusted EBITDA for certain cash requirements to determine amounts available for general capital purposes from our operations. Adjusted Free Cash Flow may not be comparable to similarly titled measures reported by other companies or other similar measures of cash flow. We have included Adjusted Free Cash Flow as we believe it provides a useful measure of funds available for general capital purposes from our operations, and because it is used by management to evaluate the performance of our Company. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended |

|

6 Months Ended |

||||||||

|

|

|

June 30, |

|

June 30, |

||||||||

|

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

||||

|

Adjusted EBITDA |

|

$ |

129,588 |

|

$ |

157,757 |

|

$ |

276,043 |

|

$ |

273,454 |

|

Minus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash distributions from non-consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

entities |

|

|

590 |

|

|

1,285 |

|

|

18,271 |

|

|

15,771 |

|

Income taxes paid, net of refunds |

|

|

3,284 |

|

|

(1,635) |

|

|

4,090 |

|

|

(1,130) |

|

Cash interest expense |

|

|

25,569 |

|

|

27,394 |

|

|

51,383 |

|

|

56,718 |

|

Capital expenditures (excluding change in |

|

|

|

|

|

|

|

|

|

|

|

|

|

construction payables) |

|

|

82,569 |

|

|

70,823 |

|

|

128,680 |

|

|

130,207 |

|

Landlord contributions |

|

|

(27,537) |

|

|

(12,726) |

|

|

(47,846) |

|

|

(23,717) |

|

Principal payments under Term Loan |

|

|

2,201 |

|

|

1,937 |

|

|

4,403 |

|

|

3,875 |

|

Principal payments under capital and financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

lease obligations |

|

|

2,123 |

|

|

1,940 |

|

|

4,199 |

|

|

3,826 |

|

Adjusted Free Cash Flow |

|

$ |

40,789 |

|

$ |

68,739 |

|

$ |

112,863 |

|

$ |

87,904 |

###