Attached files

| file | filename |

|---|---|

| EX-99.2 - 2Q SLIDE PRESENTATION - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | earningspresentation2q16.htm |

| 8-K - 2Q16 EARNINGS RELEASE - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | a2q20168-kcoverpage.htm |

ZIONS BANCORPORATION

Press Release – Page 1

July 26, 2016

Zions Bancorporation One South Main Salt Lake City, UT 84133 July 26, 2016 www.zionsbancorporation.com |  |

Second Quarter 2016 Financial Results: FOR IMMEDIATE RELEASE

Investor and Media Contact: James Abbott (801) 844-7637

Zions Bancorporation Reports: 2Q16 Net Earnings1 of $91 million, diluted EPS of $0.44 compared to 1Q16 Net Earnings1 of $79 million, diluted EPS of $0.38, and 2Q15 Net Earnings1 of $(1.1) million, diluted EPS of $(0.01) | |||||

SECOND QUARTER RESULTS

$0.44 | $91 million | 6.31% | 11.9% | 3.39% | 64.5% | |||||

Earnings per diluted common share | Net Earnings 1 | Tangible return on average tangible common equity 2 | Common Equity Tier 1 2 | Net interest margin (“NIM”) | Efficiency ratio 2 | |||||

HIGHLIGHTS | |

Net Interest Income and Net Interest Margin | • Net interest income was $465 million for 2Q16, up 3% from 1Q16 and up 10% from 2Q15• NIM up 4 bps to 3.39% from 3.35% in 1Q16 and up 21 bps from 3.18% in 2Q15 |

Operating Performance 3 | • Adjusted pre-provision net revenue ("PPNR")2 was $211 million for 2Q16, up 16% from 1Q16 and up 32% from 2Q15• Efficiency ratio2 of 64.5% for 2Q16, an improvement of 399 bps from 1Q16• Adjusted noninterest expense2 of $384 million in 2Q16 compared to $396 million in 1Q16• Customer-related fees in 2Q16 increased 5% from 1Q16 |

Loans and Credit Quality | • Net loans and leases increased $1.1 billion, or 2.6%, from 1Q16 (10.5% annualized)• Nonperforming assets were 1.30% of loans and leases, down from 1.33% in 1Q16• Provision for credit losses was $30 million, compared to $36 million in 1Q16• Net charge-offs were $38 million in 2Q16, compared to $36 million in 1Q16 |

Oil and Gas-Related Exposure | • Net charge-offs for oil and gas loans were $37 million in 2Q16, compared to $36 million in 1Q16• Oil and gas portfolio allowance continued to exceed 8% of the portfolio• Criticized oil and gas-related loans remained stable at 38% of the oil and gas-related loans |

1 Net Earnings is net earnings applicable to common shareholders.

2 For information on non-GAAP financial measures see pages 15-17.

3 Included in these non-GAAP financial measures are the key metrics to which Zions announced it would hold itself accountable in its June 1, 2015 efficiency initiative, and to which executive compensation is tied.

CEO COMMENTARY |

Harris H. Simmons, Chairman and CEO, commented, “We are pleased with the Company’s positive momentum, as evidenced most notably by the continued strong improvement in pre-provision net revenue which increased 32% in the second quarter from the same prior year period. As anticipated, the strong performance is coming from loan growth, which came from diverse geographies and product types, and well-controlled expenses. We are focused on increasing both the return on and the return of capital. Accordingly, we announced a one-third increase in our dividend, and the commencement at the earliest opportunity of a share repurchase program expected to total $180 million over the next four quarters.” |

OPERATING PERFORMANCE2 |

- more -

ZIONS BANCORPORATION

Press Release – Page 2

July 26, 2016

The percent change amounts presented in the following tables are calculated on amounts in thousands rather than millions.

RESULTS OF OPERATIONS

Net Interest Income | ||||||||||||||||||||||||||

2Q16 - 1Q16 | 2Q16 - 2Q15 | |||||||||||||||||||||||||

(In millions) | 2Q16 | 1Q16 | 2Q15 | $ | % | $ | % | |||||||||||||||||||

Interest and fees on loans | $ | 434 | $ | 421 | $ | 421 | $ | 13 | 3 | % | $ | 13 | 3 | % | ||||||||||||

Interest on money market investments | 6 | 7 | 6 | (1 | ) | (21 | ) | — | (4 | ) | ||||||||||||||||

Interest on securities | 47 | 47 | 28 | — | 1 | 19 | 65 | |||||||||||||||||||

Total interest income | 487 | 475 | 455 | 12 | 3 | 32 | 7 | |||||||||||||||||||

Interest on deposits | 12 | 12 | 12 | — | — | — | (4 | ) | ||||||||||||||||||

Interest on short and long-term borrowings | 10 | 10 | 19 | — | — | (9 | ) | (47 | ) | |||||||||||||||||

Interest expense | 22 | 22 | 31 | — | — | (9 | ) | (30 | ) | |||||||||||||||||

Net interest income | $ | 465 | $ | 453 | $ | 424 | $ | 12 | 3 | $ | 41 | 10 | ||||||||||||||

Net interest income increased to $465 million in the second quarter of 2016 from $453 million in the first quarter of 2016. The net interest margin increased to 3.39% in the second quarter of 2016, compared to 3.35% in the first quarter of 2016. The Company continues to change its mix of interest-earning assets as average money market investments declined in the second quarter of 2016 by $1.1 billion, much of which was deployed into loans and term investment securities. Average loans and leases held for investment increased in the second quarter of 2016 by $1.1 billion and average securities increased $876 million. The increase in net interest income was due to a $13 million increase in interest and fees on loans resulting from solid loan growth across all segments in recent quarters. Although the average amount of investment securities increased, the interest income on securities was stable with the prior quarter primarily due to elevated prepayments and the corresponding reduction in portfolio yield.

Noninterest Income | ||||||||||||||||||||||||||

2Q16 - 1Q16 | 2Q16 - 2Q15 | |||||||||||||||||||||||||

(In millions) | 2Q16 | 1Q16 | 2Q15 | $ | % | $ | % | |||||||||||||||||||

Service charges and fees on deposit accounts | $ | 42 | $ | 41 | $ | 42 | $ | 1 | 2 | % | $ | — | 1 | % | ||||||||||||

Other service charges, commissions and fees | 52 | 49 | 47 | 3 | 5 | 5 | 11 | |||||||||||||||||||

Wealth management income | 9 | 8 | 8 | 1 | 10 | 1 | 8 | |||||||||||||||||||

Loan sales and servicing income | 10 | 8 | 8 | 2 | 28 | 2 | 21 | |||||||||||||||||||

Capital markets and foreign exchange | 5 | 6 | 7 | (1 | ) | (20 | ) | (2 | ) | (38 | ) | |||||||||||||||

Customer-related fees | 118 | 112 | 112 | 6 | 5 | 6 | 5 | |||||||||||||||||||

Dividends and other investment income | 6 | 5 | 9 | 1 | 34 | (3 | ) | (33 | ) | |||||||||||||||||

Fair value and nonhedge derivative income (loss) | (2 | ) | (3 | ) | 2 | 1 | 26 | (4 | ) | (204 | ) | |||||||||||||||

Other | 4 | 3 | (128 | ) | 1 | 63 | 132 | 103 | ||||||||||||||||||

Total noninterest income | $ | 126 | $ | 117 | $ | (5 | ) | $ | 9 | 8 | $ | 131 | (2,785 | ) | ||||||||||||

Total noninterest income for the second quarter of 2016 was $126 million, compared to $117 million for the first quarter of 2016. The improvement in total noninterest income during the quarter was primarily due to customer-related fees, which increased in the second quarter of 2016 by 5% compared to the prior quarter and prior year

- more -

ZIONS BANCORPORATION

Press Release – Page 3

July 26, 2016

period. Additionally, equity securities gains increased primarily due to a $2 million increase in the market value of the Company’s SBIC investments.

Noninterest Expense | ||||||||||||||||||||||||||

2Q16 - 1Q16 | 2Q16 - 2Q15 | |||||||||||||||||||||||||

(In millions) | 2Q16 | 1Q16 | 2Q15 | $ | % | $ | % | |||||||||||||||||||

Salaries and employee benefits | $ | 241 | $ | 258 | $ | 251 | $ | (17 | ) | (7 | )% | $ | (10 | ) | (4 | )% | ||||||||||

Occupancy, net | 30 | 30 | 30 | — | (1 | ) | — | (2 | ) | |||||||||||||||||

Furniture, equipment and software | 30 | 32 | 31 | (2 | ) | (5 | ) | (1 | ) | (2 | ) | |||||||||||||||

Credit-related expense | 6 | 6 | 8 | — | (1 | ) | (2 | ) | (28 | ) | ||||||||||||||||

Provision for unfunded lending commitments | (4 | ) | (6 | ) | (2 | ) | 2 | 27 | (2 | ) | (83 | ) | ||||||||||||||

Professional and legal services | 12 | 11 | 13 | 1 | 7 | (1 | ) | (7 | ) | |||||||||||||||||

Advertising | 5 | 6 | 7 | (1 | ) | (6 | ) | (2 | ) | (19 | ) | |||||||||||||||

FDIC premiums | 10 | 7 | 9 | 3 | 34 | 1 | 11 | |||||||||||||||||||

Amortization of core deposit and other intangibles | 2 | 2 | 2 | — | (2 | ) | — | (15 | ) | |||||||||||||||||

Other | 50 | 50 | 50 | — | 1 | — | (1 | ) | ||||||||||||||||||

Total noninterest expense | $ | 382 | $ | 396 | $ | 399 | $ | (14 | ) | (4 | ) | $ | (17 | ) | (4 | ) | ||||||||||

Adjusted noninterest expense 1 | $ | 384 | $ | 396 | $ | 395 | $ | (12 | ) | (3 | )% | $ | (11 | ) | (3 | )% | ||||||||||

1 | For information on non-GAAP financial measures see pages 15-17. |

The Company continued to make meaningful progress with its corporate restructuring and cost initiatives during the quarter. Noninterest expense for the second quarter of 2016 was $382 million, compared to $396 million for the first quarter of 2016, and $399 million for the second quarter of 2015. The decrease in total noninterest expense from the first quarter of 2016 was primarily due to a decrease of $17 million in salaries and employee benefits, which was predominantly a result of $13 million of seasonal increases that occurred during the first quarter related to the accrual for annual restricted stock awards and payroll taxes, in addition to a $3 million decline in severance. For more information on adjusted noninterest expense measures used to determine the Company’s efficiency ratio, see pages 15-17.

BALANCE SHEET ANALYSIS

Loans and Leases | ||||||||||||||||||||||||||

2Q16 - 1Q16 | 2Q16 - 2Q15 | |||||||||||||||||||||||||

(In millions) | 2Q16 | 1Q16 | 2Q15 | $ | % | $ | % | |||||||||||||||||||

Loans held for sale | $ | 147 | $ | 109 | $ | 152 | $ | 38 | 35 | % | $ | (5 | ) | (4 | )% | |||||||||||

Loans and leases, net of unearned income and fees | 42,501 | 41,418 | 40,024 | 1,083 | 3 | 2,477 | 6 | |||||||||||||||||||

Less allowance for loan losses | 608 | 612 | 609 | (4 | ) | (1 | ) | (1 | ) | — | ||||||||||||||||

Loans held for investment, net of allowance | $ | 41,893 | $ | 40,806 | $ | 39,415 | $ | 1,087 | 3 | $ | 2,478 | 6 | ||||||||||||||

Loans and leases, net of unearned income and fees, increased $1.1 billion, or 2.6% (10.5% on an annualized basis based on second quarter growth) to $42.5 billion at June 30, 2016 from $41.4 billion at March 31, 2016. Average loans and leases held for investment of $42.1 billion during the second quarter of 2016 increased from $41.0 billion during the first quarter of 2016. The increase in loans was widespread across products and geography, with

- more -

ZIONS BANCORPORATION

Press Release – Page 4

July 26, 2016

particular strength in commercial real estate term, 1-4 family residential (which includes the purchase of $104 million of loans), and commercial and industrial loans. Unfunded lending commitments were $18.5 billion at June 30, 2016, compared to $18.2 billion at March 31, 2016.

Oil and Gas-Related Exposure1 | ||||||||||||||||||||||||||

2Q16 - 1Q16 | 2Q16 - 2Q15 | |||||||||||||||||||||||||

(In millions) | 2Q16 | 1Q16 | 2Q15 | $ | % | $ | % | |||||||||||||||||||

Loans and leases | ||||||||||||||||||||||||||

Upstream – exploration and production | $ | 831 | $ | 859 | $ | 954 | $ | (28 | ) | (3 | )% | $ | (123 | ) | (13 | )% | ||||||||||

Midstream – marketing and transportation | 658 | 649 | 589 | 9 | 1 | 69 | 12 | |||||||||||||||||||

Downstream – refining | 131 | 129 | 131 | 2 | 2 | — | — | |||||||||||||||||||

Other non-services | 45 | 43 | 75 | 2 | 5 | (30 | ) | (40 | ) | |||||||||||||||||

Oilfield services | 712 | 734 | 879 | (22 | ) | (3 | ) | (167 | ) | (19 | ) | |||||||||||||||

Oil and gas service manufacturing | 193 | 229 | 255 | (36 | ) | (16 | ) | (62 | ) | (24 | ) | |||||||||||||||

Total loan and lease balances 2 | 2,570 | 2,643 | 2,883 | (73 | ) | (3 | ) | (313 | ) | (11 | ) | |||||||||||||||

Unfunded lending commitments | 1,823 | 2,021 | 2,385 | (198 | ) | (10 | ) | (562 | ) | (24 | ) | |||||||||||||||

Total oil and gas credit exposure | $ | 4,393 | $ | 4,664 | $ | 5,268 | $ | (271 | ) | (6 | ) | $ | (875 | ) | (17 | ) | ||||||||||

Private equity investments | $ | 6 | $ | 12 | $ | 18 | $ | (6 | ) | (50 | ) | $ | (12 | ) | (67 | ) | ||||||||||

Credit quality measures 2 | ||||||||||||||||||||||||||

Criticized loan ratio | 37.8 | % | 37.5 | % | 20.3 | % | ||||||||||||||||||||

Classified loan ratio | 31.5 | % | 26.9 | % | 11.3 | % | ||||||||||||||||||||

Nonaccrual loan ratio | 11.1 | % | 10.8 | % | 2.3 | % | ||||||||||||||||||||

Current nonaccrual loan ratio | 89.2 | % | 90.6 | % | 87.9 | % | ||||||||||||||||||||

Net charge-off ratio, annualized 3 | 5.8 | % | 5.4 | % | — | % | ||||||||||||||||||||

1 | Because many borrowers operate in multiple businesses, judgment has been applied in characterizing a borrower as oil and gas-related, including a particular segment of oil and gas-related activity, e.g., upstream or downstream; typically, 50% of revenues coming from the oil and gas sector is used as a guide. |

2 Total loan and lease balances and the credit quality measures do not include $13 million of oil and gas loans held for sale.

3 | Calculated as the ratio of annualized net charge-offs for each respective period to loan balances at each period end. |

During the second quarter of 2016, oil and gas-related loans decreased $73 million, or 3%, and total oil and gas credit exposure decreased by $271 million, or 6%. Oil and gas services (oilfield services and oil and gas service manufacturing) decreased $58 million, or 6%, from the first quarter of 2016, and $229 million, or 20%, from the second quarter of 2015. Unfunded lending commitments decreased by $198 million, primarily in the oilfield services and oil and gas service manufacturing portfolios. Consistent with management’s expectations, the majority of loan downgrades in the second quarter of 2016 reflected deterioration in the financial condition of companies in the oilfield services and the exploration and production portfolios. Oil and gas-related loan net charge-offs were $37 million in the second quarter of 2016 and were predominantly in the oilfield services portfolio, compared to $36 million in the first quarter of 2016. Nonaccrual and criticized oil and gas-related loan ratios remained relatively flat from the first quarter of 2016. Approximately 89% of oil and gas-related nonaccruing loans were current as to principal and interest payments as of June 30, 2016, similar to the 91% reported as of March 31, 2016. The allowance for credit losses related to oil and gas-related loans remained more than 8% for the second quarter of 2016.

- more -

ZIONS BANCORPORATION

Press Release – Page 5

July 26, 2016

Asset Quality | ||||||||||||||||||||||||||

2Q16 - 1Q16 | 2Q16 - 2Q15 | |||||||||||||||||||||||||

(In millions) | 2Q16 | 1Q16 | 2Q15 | bps | bps | |||||||||||||||||||||

Ratio of nonperforming assets to loans and leases and other real estate owned | 1.30 | % | 1.33 | % | 0.96 | % | (3 | ) | 34 | |||||||||||||||||

Annualized ratio of net loan and lease charge-offs to average loans | 0.36 | 0.35 | 0.11 | 1 | 25 | |||||||||||||||||||||

Ratio of total allowance for credit losses to loans and leases outstanding | 1.58 | 1.64 | 1.72 | (6 | ) | (14 | ) | |||||||||||||||||||

$ | % | $ | % | |||||||||||||||||||||||

Classified loans | $ | 1,610 | $ | 1,532 | $ | 1,293 | $ | 78 | 5 | % | $ | 317 | 25 | % | ||||||||||||

Provision for credit losses | 30 | 36 | (2 | ) | (6 | ) | (17 | ) | 32 | 1,818 | ||||||||||||||||

Asset quality for the total portfolio remained strong and was generally stable when compared to the prior quarter. Nonperforming assets were $556 million at June 30, 2016, compared to $552 million at March 31, 2016, and classified loans increased 5% to $1.6 billion at June 30, 2016, from $1.5 billion at March 31, 2016. The ratio of nonperforming assets to loans and leases and other real estate owned decreased to 1.30% at June 30, 2016, compared to 1.33% at March 31, 2016. The allowance for credit losses decreased to $673 million at June 30, 2016 from $681 million at March 31, 2016, which was 1.58% and 1.64% of loans and leases, respectively.

Total net charge-offs were $38 million in the second quarter of 2016, or an annualized 0.36% of average loans, compared to $36 million, or an annualized 0.35% of average loans, in the first quarter of 2016. Only $1 million of net charge-offs were attributed to loans outside of the oil and gas portfolio. Additionally, classified loans outside of the oil and gas portfolio decreased by 3% in the second quarter of 2016, compared to the first quarter. The Company provided $30 million for credit losses during the second quarter of 2016, compared to $36 million during the first quarter of 2016. The decrease of $4 million in the allowance for loan losses reflected continued strong credit quality. The reserve for unfunded lending commitments declined by $4 million as a result of improved credit quality assessments related to these obligations.

Deposits | ||||||||||||||||||||||||||

2Q16 - 1Q16 | 2Q16 - 2Q15 | |||||||||||||||||||||||||

(In millions) | 2Q16 | 1Q16 | 2Q15 | $ | % | $ | % | |||||||||||||||||||

Noninterest-bearing demand | $ | 22,276 | $ | 21,872 | $ | 21,558 | $ | 404 | 2 | % | $ | 718 | 3 | % | ||||||||||||

Interest-bearing: | ||||||||||||||||||||||||||

Savings and money market | 25,541 | 25,724 | 24,744 | (183 | ) | (1 | ) | 797 | 3 | |||||||||||||||||

Time | 2,336 | 2,072 | 2,263 | 264 | 13 | 73 | 3 | |||||||||||||||||||

Foreign | 118 | 220 | 372 | (102 | ) | (46 | ) | (254 | ) | (68 | ) | |||||||||||||||

Total deposits | $ | 50,271 | $ | 49,888 | $ | 48,937 | $ | 383 | 1 | $ | 1,334 | 3 | ||||||||||||||

Total deposits increased to $50.3 billion at June 30, 2016, compared to $49.9 billion at March 31, 2016. Average total deposits increased $396 million to $50.0 billion for the second quarter of 2016, compared to $49.6 billion for

- more -

ZIONS BANCORPORATION

Press Release – Page 6

July 26, 2016

the first quarter of 2016. Average noninterest bearing deposits were generally stable at $21.8 billion for the second quarter of 2016, compared to $21.9 billion for the first quarter of 2016, and were 44% of average total deposits.

Shareholders’ Equity | ||||||||||||||||||||||||||

2Q16 - 1Q16 | 2Q16 - 2Q15 | |||||||||||||||||||||||||

(In millions) | 2Q16 | 1Q16 | 2Q15 | $ | % | $ | % | |||||||||||||||||||

Shareholders’ equity: | ||||||||||||||||||||||||||

Preferred Stock | $ | 709 | $ | 828 | $ | 1,004 | $ | (119 | ) | (14 | )% | $ | (295 | ) | (29 | )% | ||||||||||

Common Stock | 4,783 | 4,779 | 4,738 | 4 | — | 45 | 1 | |||||||||||||||||||

Retained earnings | 2,110 | 2,031 | 1,823 | 79 | 4 | 287 | 16 | |||||||||||||||||||

Accumulated other comprehensive income (loss) | 24 | (12 | ) | (35 | ) | 36 | 303 | 59 | 167 | |||||||||||||||||

Total shareholders' equity | $ | 7,626 | $ | 7,626 | $ | 7,530 | $ | — | — | $ | 96 | 1 | ||||||||||||||

The Company’s preferred stock decreased by $119 million in the second quarter of 2016 as a result of the tender offer the Company completed during the quarter to purchase $27 million of its Series I preferred stock, $59 million of its Series J preferred stock, and $33 million of its Series G preferred stock for an aggregate cash payment of $127 million. The total one-time reduction to net earnings applicable to common shareholders associated with the preferred stock redemption was $10 million. Preferred dividends are expected to be $10.4 million for the third quarter of 2016 and first quarter of 2017 and are expected to be $12.4 million for the fourth quarter of 2016 and the second quarter of 2017.

Accumulated other comprehensive income (loss) increased to $24 million from $(12) million primarily as a result of improvement in the fair value of the Company’s available-for-sale securities portfolio due largely to changes in the interest rate environment.

Tangible book value per common share increased to $28.72 at June 30, 2016, compared to $28.20 at March 31, 2016. The estimated Basel III common equity tier 1 (“CET1”) capital ratio was 11.94% at June 30, 2016, compared to 12.13% at March 31, 2016; Basel III capital ratios are based on the applicable phase-in periods, however, the fully phased-in ratio was not substantially different.

On June 29, the Board of Governors of the Federal Reserve System notified Zions that the Federal Reserve did not object to Zions’ board-approved 2016 capital plan. Zions’ capital plan for the period spanning July 1, 2016 through June 30, 2017 include the following capital actions:

• | The increase of the common dividend to $0.08 per share per quarter |

• | Up to $180 million of common stock repurchases |

• | Up to $144 million of preferred equity redemption |

On July 22, 2016, the Company announced that its board of directors declared a regular quarterly dividend of $0.08 per common share and authorized the commencement of its stock buyback program, including $45 million expected in the third quarter of 2016.

- more -

ZIONS BANCORPORATION

Press Release – Page 7

July 26, 2016

Supplemental Presentation and Conference Call

Zions has posted a supplemental presentation to its website, which will be used to discuss these second quarter results at 5:30 p.m. ET this afternoon (July 26, 2016). Media representatives, analysts, investors, and the public are invited to join this discussion by calling 253-237-1247 (domestic and international) and entering the passcode 43431070, or via on-demand webcast. A link to the webcast will be available on the Zions Bancorporation website at zionsbancorporation.com. The webcast of the conference call will also be archived and available for 30 days.

About Zions Bancorporation

Zions Bancorporation is one of the nation’s premier financial services companies with total assets of approximately $60 billion. Zions operates under local management teams and unique brands in 11 western and southwestern states: Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. The company is a national leader in Small Business Administration lending and public finance advisory services, and is a consistent top recipient of numerous Greenwich Excellence awards in banking. In addition, Zions is included in the S&P 500 and NASDAQ Financial 100 indices. Investor information and links to local banking brands can be accessed at zionsbancorporation.com.

Forward-Looking Information

Statements in this press release that are based on other than historical data or that express the Company’s expectations regarding future events or determinations are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Statements based on historical data are not intended and should not be understood to indicate the Company’s expectations regarding future events. Forward-looking statements provide current expectations or forecasts or intentions regarding future events or determinations. These forward-looking statements are not guarantees of future performance or determinations, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those presented, either expressed or implied, in this press release. Factors that could cause actual results to differ materially from those expressed in the forward-looking statements include the actual amount and duration of declines in the price of oil and gas, our ability to meet our efficiency and noninterest expense goals, as well as other factors discussed in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”) and available at the SEC’s Internet site (http://www.sec.gov).

Except as required by law, the Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments.

- more -

ZIONS BANCORPORATION

Press Release – Page 8

July 26, 2016

FINANCIAL HIGHLIGHTS

(Unaudited)

Three Months Ended | |||||||||||||||||||

(In thousands, except share, per share, and ratio data) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | ||||||||||||||

BALANCE SHEET 1 | |||||||||||||||||||

Loans held for investment, net of allowance | $ | 41,893,230 | $ | 40,806,291 | $ | 40,043,494 | $ | 39,516,683 | $ | 39,414,609 | |||||||||

Total assets | 59,642,992 | 59,179,913 | 59,664,543 | 58,405,718 | 58,360,005 | ||||||||||||||

Deposits | 50,270,921 | 49,887,857 | 50,374,091 | 48,920,147 | 48,937,124 | ||||||||||||||

Total shareholders’ equity | 7,626,383 | 7,625,737 | 7,507,519 | 7,638,095 | 7,530,175 | ||||||||||||||

STATEMENT OF INCOME | |||||||||||||||||||

Net earnings (loss) applicable to common shareholders | 90,647 | 78,777 | 88,197 | 84,238 | (1,100 | ) | |||||||||||||

Net interest income | $ | 464,849 | $ | 452,842 | $ | 448,833 | $ | 425,377 | $ | 423,704 | |||||||||

Taxable-equivalent net interest income | 470,913 | 458,242 | 453,780 | 429,782 | 428,015 | ||||||||||||||

Total noninterest income | 125,717 | 116,761 | 118,641 | 125,944 | (4,682 | ) | |||||||||||||

Total noninterest expense | 381,894 | 395,573 | 397,353 | 391,280 | 398,997 | ||||||||||||||

Adjusted pre-provision net revenue 2 | 211,472 | 182,124 | 174,013 | 171,204 | 160,417 | ||||||||||||||

Provision for loan losses | 34,492 | 42,145 | 22,701 | 18,262 | 566 | ||||||||||||||

Provision for unfunded lending commitments | (4,246 | ) | (5,812 | ) | (6,551 | ) | 1,428 | (2,326 | ) | ||||||||||

Provision for credit losses | 30,246 | 36,333 | 16,150 | 19,690 | (1,760 | ) | |||||||||||||

PER COMMON SHARE | |||||||||||||||||||

Net earnings (loss) per diluted common share | $ | 0.44 | $ | 0.38 | $ | 0.43 | $ | 0.41 | $ | (0.01 | ) | ||||||||

Dividends | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | ||||||||||||||

Book value per common share 1 | 33.72 | 33.23 | 32.67 | 32.47 | 32.03 | ||||||||||||||

Tangible book value per common share 1, 2 | 28.72 | 28.20 | 27.63 | 27.42 | 26.95 | ||||||||||||||

SELECTED RATIOS AND OTHER DATA | |||||||||||||||||||

Return on average assets | 0.77 | % | 0.62 | % | 0.68 | % | 0.69 | % | 0.10 | % | |||||||||

Return on average common equity | 5.30 | % | 4.67 | % | 5.17 | % | 5.02 | % | (0.07 | )% | |||||||||

Tangible return on average tangible common equity 2 | 6.31 | % | 5.59 | % | 6.20 | % | 6.05 | % | 0.03 | % | |||||||||

Net interest margin | 3.39 | % | 3.35 | % | 3.23 | % | 3.11 | % | 3.18 | % | |||||||||

Efficiency ratio 2 | 64.5 | % | 68.5 | % | 69.6 | % | 69.1 | % | 71.1 | % | |||||||||

Effective tax rate | 34.6 | % | 31.4 | % | 30.5 | % | 28.8 | % | 28.3 | % | |||||||||

Ratio of nonperforming assets to loans and leases and other real estate owned | 1.30 | % | 1.33 | % | 0.87 | % | 0.92 | % | 0.96 | % | |||||||||

Annualized ratio of net loan and lease charge-offs to average loans | 0.36 | % | 0.35 | % | 0.13 | % | 0.31 | % | 0.11 | % | |||||||||

Ratio of total allowance for credit losses to loans and leases outstanding 1 | 1.58 | % | 1.64 | % | 1.68 | % | 1.69 | % | 1.72 | % | |||||||||

Full-time equivalent employees | 10,064 | 10,092 | 10,200 | 10,219 | 10,265 | ||||||||||||||

CAPITAL RATIOS 1 | |||||||||||||||||||

Tangible common equity ratio | 10.05 | % | 9.92 | % | 9.63 | % | 9.76 | % | 9.58 | % | |||||||||

Basel III: 3 | |||||||||||||||||||

Common equity tier 1 capital | 11.94 | % | 12.13 | % | 12.22 | % | 12.16 | % | 12.00 | % | |||||||||

Tier 1 leverage | 11.25 | % | 11.44 | % | 11.26 | % | 11.63 | % | 11.65 | % | |||||||||

Tier 1 risk-based capital | 13.39 | % | 13.87 | % | 14.08 | % | 14.41 | % | 14.26 | % | |||||||||

Total risk-based capital | 15.47 | % | 15.97 | % | 16.12 | % | 16.46 | % | 16.32 | % | |||||||||

Risk-weighted assets | 49,150,140 | 47,695,790 | 46,747,245 | 46,313,188 | 46,179,545 | ||||||||||||||

Weighted average common and common-equivalent shares outstanding | 204,536,196 | 204,095,529 | 204,276,930 | 204,154,880 | 202,887,762 | ||||||||||||||

Common shares outstanding 1 | 205,103,566 | 204,543,707 | 204,417,093 | 204,278,594 | 203,740,914 | ||||||||||||||

1 | At period end. |

2 | For information on non-GAAP financial measures see pages 15-17. |

- more -

ZIONS BANCORPORATION

Press Release – Page 9

July 26, 2016

3 | Basel III capital ratios became effective January 1, 2015 and are based on the applicable phase-in periods. Current period ratios and amounts represent estimates. |

- more -

ZIONS BANCORPORATION

Press Release – Page 10

July 26, 2016

CONSOLIDATED BALANCE SHEETS

(In thousands, except shares) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | ||||||||||||||

(Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||||

ASSETS | |||||||||||||||||||

Cash and due from banks | $ | 560,262 | $ | 517,803 | $ | 798,319 | $ | 602,694 | $ | 758,238 | |||||||||

Money market investments: | |||||||||||||||||||

Interest-bearing deposits | 2,154,959 | 3,039,090 | 6,108,124 | 6,558,678 | 7,661,311 | ||||||||||||||

Federal funds sold and security resell agreements | 620,469 | 1,587,212 | 619,758 | 1,325,501 | 1,404,246 | ||||||||||||||

Investment securities: | |||||||||||||||||||

Held-to-maturity, at adjusted cost (approximate fair value $720,991, $636,484, $552,088, $553,088, and $578,327) | 713,392 | 631,646 | 545,648 | 544,168 | 570,869 | ||||||||||||||

Available-for-sale, at fair value | 9,477,089 | 8,701,885 | 7,643,116 | 6,000,011 | 4,652,415 | ||||||||||||||

Trading account, at fair value | 118,775 | 65,838 | 48,168 | 73,521 | 74,519 | ||||||||||||||

10,309,256 | 9,399,369 | 8,236,932 | 6,617,700 | 5,297,803 | |||||||||||||||

Loans held for sale | 146,512 | 108,764 | 149,880 | 139,122 | 152,448 | ||||||||||||||

Loans and leases, net of unearned income and fees | 42,501,575 | 41,418,185 | 40,649,542 | 40,113,123 | 40,023,984 | ||||||||||||||

Less allowance for loan losses | 608,345 | 611,894 | 606,048 | 596,440 | 609,375 | ||||||||||||||

Loans held for investment, net of allowance | 41,893,230 | 40,806,291 | 40,043,494 | 39,516,683 | 39,414,609 | ||||||||||||||

Other noninterest-bearing investments | 850,578 | 855,813 | 848,144 | 851,225 | 863,443 | ||||||||||||||

Premises and equipment, net | 955,540 | 925,430 | 905,462 | 873,800 | 856,577 | ||||||||||||||

Goodwill | 1,014,129 | 1,014,129 | 1,014,129 | 1,014,129 | 1,014,129 | ||||||||||||||

Core deposit and other intangibles | 12,281 | 14,259 | 16,272 | 18,546 | 20,843 | ||||||||||||||

Other real estate owned | 8,354 | 10,411 | 7,092 | 12,799 | 13,269 | ||||||||||||||

Other assets | 1,117,422 | 901,342 | 916,937 | 874,841 | 903,089 | ||||||||||||||

$ | 59,642,992 | $ | 59,179,913 | $ | 59,664,543 | $ | 58,405,718 | $ | 58,360,005 | ||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||||||

Deposits: | |||||||||||||||||||

Noninterest-bearing demand | $ | 22,276,600 | $ | 21,872,274 | $ | 22,276,664 | $ | 21,572,022 | $ | 21,557,584 | |||||||||

Interest-bearing: | |||||||||||||||||||

Savings and money market | 25,540,525 | 25,723,996 | 25,672,356 | 24,690,359 | 24,744,288 | ||||||||||||||

Time | 2,336,088 | 2,071,688 | 2,130,680 | 2,216,206 | 2,263,146 | ||||||||||||||

Foreign | 117,708 | 219,899 | 294,391 | 441,560 | 372,106 | ||||||||||||||

50,270,921 | 49,887,857 | 50,374,091 | 48,920,147 | 48,937,124 | |||||||||||||||

Federal funds and other short-term borrowings | 270,255 | 232,188 | 346,987 | 272,391 | 227,124 | ||||||||||||||

Long-term debt | 698,712 | 802,448 | 812,366 | 939,543 | 1,045,484 | ||||||||||||||

Reserve for unfunded lending commitments | 64,780 | 69,026 | 74,838 | 81,389 | 79,961 | ||||||||||||||

Other liabilities | 711,941 | 562,657 | 548,742 | 554,153 | 540,137 | ||||||||||||||

Total liabilities | 52,016,609 | 51,554,176 | 52,157,024 | 50,767,623 | 50,829,830 | ||||||||||||||

Shareholders’ equity: | |||||||||||||||||||

Preferred stock, without par value, authorized 4,400,000 shares | 709,601 | 828,490 | 828,490 | 1,004,159 | 1,004,032 | ||||||||||||||

Common stock, without par value; authorized 350,000,000 shares; issued and outstanding 205,103,566, 204,543,707, 204,417,093, 204,278,594, and 203,740,914 shares | 4,783,061 | 4,777,630 | 4,766,731 | 4,756,288 | 4,738,272 | ||||||||||||||

Retained earnings | 2,110,069 | 2,031,270 | 1,966,910 | 1,894,623 | 1,823,043 | ||||||||||||||

Accumulated other comprehensive income (loss) | 23,652 | (11,653 | ) | (54,612 | ) | (16,975 | ) | (35,172 | ) | ||||||||||

Total shareholders’ equity | 7,626,383 | 7,625,737 | 7,507,519 | 7,638,095 | 7,530,175 | ||||||||||||||

$ | 59,642,992 | $ | 59,179,913 | $ | 59,664,543 | $ | 58,405,718 | $ | 58,360,005 | ||||||||||

- more -

ZIONS BANCORPORATION

Press Release – Page 11

July 26, 2016

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

Three Months Ended | |||||||||||||||||||

(In thousands, except per share amounts) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | ||||||||||||||

Interest income: | |||||||||||||||||||

Interest and fees on loans | $ | 433,743 | $ | 420,508 | $ | 429,842 | $ | 419,981 | $ | 420,642 | |||||||||

Interest on money market investments | 5,564 | 7,029 | 6,144 | 6,018 | 5,785 | ||||||||||||||

Interest on securities | 47,645 | 47,364 | 37,573 | 30,231 | 28,809 | ||||||||||||||

Total interest income | 486,952 | 474,901 | 473,559 | 456,230 | 455,236 | ||||||||||||||

Interest expense: | |||||||||||||||||||

Interest on deposits | 11,869 | 11,845 | 12,377 | 12,542 | 12,321 | ||||||||||||||

Interest on short- and long-term borrowings | 10,234 | 10,214 | 12,349 | 18,311 | 19,211 | ||||||||||||||

Total interest expense | 22,103 | 22,059 | 24,726 | 30,853 | 31,532 | ||||||||||||||

Net interest income | 464,849 | 452,842 | 448,833 | 425,377 | 423,704 | ||||||||||||||

Provision for loan losses | 34,492 | 42,145 | 22,701 | 18,262 | 566 | ||||||||||||||

Net interest income after provision for loan losses | 430,357 | 410,697 | 426,132 | 407,115 | 423,138 | ||||||||||||||

Noninterest income: | |||||||||||||||||||

Service charges and fees on deposit accounts | 42,108 | 41,261 | 42,445 | 43,196 | 41,616 | ||||||||||||||

Other service charges, commissions and fees | 51,906 | 49,474 | 49,335 | 47,968 | 46,602 | ||||||||||||||

Wealth management income | 8,788 | 7,954 | 7,953 | 7,496 | 8,160 | ||||||||||||||

Loan sales and servicing income | 10,178 | 7,979 | 6,915 | 7,728 | 8,382 | ||||||||||||||

Capital markets and foreign exchange | 4,545 | 5,667 | 6,255 | 6,624 | 7,275 | ||||||||||||||

Dividends and other investment income | 6,226 | 4,639 | 2,986 | 8,449 | 9,343 | ||||||||||||||

Fair value and nonhedge derivative income (loss) | (1,910 | ) | (2,585 | ) | 688 | (1,555 | ) | 1,844 | |||||||||||

Equity securities gains (losses), net | 2,709 | (550 | ) | 53 | 3,630 | 4,839 | |||||||||||||

Fixed income securities gains (losses), net | 25 | 28 | (7 | ) | (53 | ) | (138,436 | ) | |||||||||||

Other | 1,142 | 2,894 | 2,018 | 2,461 | 5,693 | ||||||||||||||

Total noninterest income | 125,717 | 116,761 | 118,641 | 125,944 | (4,682 | ) | |||||||||||||

Noninterest expense: | |||||||||||||||||||

Salaries and employee benefits | 241,341 | 258,338 | 236,037 | 242,023 | 251,133 | ||||||||||||||

Occupancy, net | 29,621 | 29,779 | 30,618 | 29,477 | 30,095 | ||||||||||||||

Furniture, equipment and software | 30,550 | 32,015 | 31,820 | 30,416 | 31,247 | ||||||||||||||

Other real estate expense | (527 | ) | (1,329 | ) | (536 | ) | (40 | ) | (445 | ) | |||||||||

Credit-related expense | 5,845 | 5,934 | 7,582 | 6,914 | 8,106 | ||||||||||||||

Provision for unfunded lending commitments | (4,246 | ) | (5,812 | ) | (6,551 | ) | 1,428 | (2,326 | ) | ||||||||||

Professional and legal services | 12,229 | 11,471 | 13,129 | 12,699 | 13,110 | ||||||||||||||

Advertising | 5,268 | 5,628 | 5,692 | 6,136 | 6,511 | ||||||||||||||

FDIC premiums | 9,580 | 7,154 | 9,194 | 8,500 | 8,609 | ||||||||||||||

Amortization of core deposit and other intangibles | 1,979 | 2,014 | 2,273 | 2,298 | 2,318 | ||||||||||||||

Debt extinguishment cost | 106 | 247 | 135 | — | 2,395 | ||||||||||||||

Other | 50,148 | 50,134 | 67,960 | 51,429 | 48,244 | ||||||||||||||

Total noninterest expense | 381,894 | 395,573 | 397,353 | 391,280 | 398,997 | ||||||||||||||

Income before income taxes | 174,180 | 131,885 | 147,420 | 141,779 | 19,459 | ||||||||||||||

Income taxes | 60,231 | 41,448 | 44,933 | 40,780 | 5,499 | ||||||||||||||

Net income | 113,949 | 90,437 | 102,487 | 100,999 | 13,960 | ||||||||||||||

Preferred stock dividends | (13,543 | ) | (11,660 | ) | (14,290 | ) | (16,761 | ) | (15,060 | ) | |||||||||

Preferred stock redemption | (9,759 | ) | — | — | — | — | |||||||||||||

Net earnings (loss) applicable to common shareholders | $ | 90,647 | $ | 78,777 | $ | 88,197 | $ | 84,238 | $ | (1,100 | ) | ||||||||

Weighted average common shares outstanding during the period: | |||||||||||||||||||

Basic shares | 204,236 | 203,967 | 203,884 | 203,668 | 202,888 | ||||||||||||||

Diluted shares | 204,536 | 204,096 | 204,277 | 204,155 | 202,888 | ||||||||||||||

Net earnings (loss) per common share: | |||||||||||||||||||

Basic | $ | 0.44 | $ | 0.38 | $ | 0.43 | $ | 0.41 | $ | (0.01 | ) | ||||||||

Diluted | 0.44 | 0.38 | 0.43 | 0.41 | (0.01 | ) | |||||||||||||

- more -

ZIONS BANCORPORATION

Press Release – Page 12

July 26, 2016

Loan Balances Held for Investment by Portfolio Type

(Unaudited)

(In millions) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | ||||||||||||||||||||||||

Commercial: | |||||||||||||||||||||||||||||

Commercial and industrial | $ | 13,757 | $ | 13,590 | $ | 13,211 | $ | 13,035 | $ | 13,111 | |||||||||||||||||||

Leasing | 426 | 437 | 442 | 427 | 402 | ||||||||||||||||||||||||

Owner occupied | 6,989 | 7,022 | 7,150 | 7,141 | 7,277 | ||||||||||||||||||||||||

Municipal | 756 | 696 | 676 | 600 | 589 | ||||||||||||||||||||||||

Total commercial | 21,928 | 21,745 | 21,479 | 21,203 | 21,379 | ||||||||||||||||||||||||

Commercial real estate: | |||||||||||||||||||||||||||||

Construction and land development | 2,088 | 1,968 | 1,842 | 2,214 | 2,062 | ||||||||||||||||||||||||

Term | 9,230 | 8,826 | 8,514 | 8,089 | 8,058 | ||||||||||||||||||||||||

Total commercial real estate | 11,318 | 10,794 | 10,356 | 10,303 | 10,120 | ||||||||||||||||||||||||

Consumer: | |||||||||||||||||||||||||||||

Home equity credit line | 2,507 | 2,433 | 2,417 | 2,347 | 2,348 | ||||||||||||||||||||||||

1-4 family residential | 5,680 | 5,418 | 5,382 | 5,269 | 5,194 | ||||||||||||||||||||||||

Construction and other consumer real estate | 419 | 401 | 385 | 370 | 372 | ||||||||||||||||||||||||

Bankcard and other revolving plans | 460 | 439 | 444 | 428 | 409 | ||||||||||||||||||||||||

Other | 189 | 188 | 187 | 193 | 202 | ||||||||||||||||||||||||

Total consumer | 9,255 | 8,879 | 8,815 | 8,607 | 8,525 | ||||||||||||||||||||||||

Loans and leases, net of unearned income and fees | $ | 42,501 | $ | 41,418 | $ | 40,650 | $ | 40,113 | $ | 40,024 | |||||||||||||||||||

Nonperforming Assets

(Unaudited)

(Amounts in thousands) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | ||||||||||||||

Nonaccrual loans | $ | 547,402 | $ | 541,768 | $ | 349,860 | $ | 359,272 | $ | 372,830 | |||||||||

Other real estate owned | 8,354 | 10,411 | 7,092 | 12,799 | 13,269 | ||||||||||||||

Total nonperforming assets | $ | 555,756 | $ | 552,179 | $ | 356,952 | $ | 372,071 | $ | 386,099 | |||||||||

Ratio of nonperforming assets to loans1 and leases and other real estate owned | 1.30 | % | 1.33 | % | 0.87 | % | 0.92 | % | 0.96 | % | |||||||||

Accruing loans past due 90 days or more | $ | 28,994 | $ | 37,202 | $ | 32,024 | $ | 34,857 | $ | 27,204 | |||||||||

Ratio of accruing loans past due 90 days or more to loans1 and leases | 0.07 | % | 0.09 | % | 0.08 | % | 0.09 | % | 0.07 | % | |||||||||

Nonaccrual loans and accruing loans past due 90 days or more | $ | 576,396 | $ | 578,970 | $ | 381,884 | $ | 394,129 | $ | 400,034 | |||||||||

Ratio of nonaccrual loans and accruing loans past due 90 days or more to loans1 and leases | 1.35 | % | 1.39 | % | 0.94 | % | 0.98 | % | 1.00 | % | |||||||||

Accruing loans past due 30-89 days | $ | 132,522 | $ | 100,341 | $ | 121,732 | $ | 118,361 | $ | 124,955 | |||||||||

Restructured loans included in nonaccrual loans | 143,379 | 132,524 | 103,004 | 108,387 | 118,358 | ||||||||||||||

Restructured loans on accrual | 171,854 | 195,482 | 194,084 | 178,136 | 180,146 | ||||||||||||||

Classified loans | 1,610,263 | 1,532,052 | 1,368,022 | 1,322,924 | 1,292,980 | ||||||||||||||

1 Includes loans held for sale.

- more -

ZIONS BANCORPORATION

Press Release – Page 13

July 26, 2016

Allowance for Credit Losses

(Unaudited)

Three Months Ended | |||||||||||||||||||

(Amounts in thousands) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | ||||||||||||||

Allowance for Loan Losses | |||||||||||||||||||

Balance at beginning of period | $ | 611,894 | $ | 606,048 | $ | 596,440 | $ | 609,375 | $ | 620,013 | |||||||||

Add: | |||||||||||||||||||

Provision for losses | 34,492 | 42,145 | 22,701 | 18,262 | 566 | ||||||||||||||

Adjustment for FDIC-supported/PCI loans | — | — | 5 | — | 38 | ||||||||||||||

Deduct: | |||||||||||||||||||

Gross loan and lease charge-offs | (57,629 | ) | (48,110 | ) | (45,334 | ) | (42,359 | ) | (31,048 | ) | |||||||||

Recoveries | 19,588 | 11,811 | 32,236 | 11,162 | 19,806 | ||||||||||||||

Net loan and lease (charge-offs) recoveries | (38,041 | ) | (36,299 | ) | (13,098 | ) | (31,197 | ) | (11,242 | ) | |||||||||

Balance at end of period | $ | 608,345 | $ | 611,894 | $ | 606,048 | $ | 596,440 | $ | 609,375 | |||||||||

Ratio of allowance for loan losses to loans and leases, at period end | 1.43 | % | 1.48 | % | 1.49 | % | 1.49 | % | 1.52 | % | |||||||||

Ratio of allowance for loan losses to nonperforming loans, at period end | 111 | % | 113 | % | 173 | % | 166 | % | 163 | % | |||||||||

Annualized ratio of net loan and lease charge-offs to average loans | 0.36 | % | 0.35 | % | 0.13 | % | 0.31 | % | 0.11 | % | |||||||||

Reserve for Unfunded Lending Commitments | |||||||||||||||||||

Balance at beginning of period | $ | 69,026 | $ | 74,838 | $ | 81,389 | $ | 79,961 | $ | 82,287 | |||||||||

Provision charged (credited) to earnings | (4,246 | ) | (5,812 | ) | (6,551 | ) | 1,428 | (2,326 | ) | ||||||||||

Balance at end of period | $ | 64,780 | $ | 69,026 | $ | 74,838 | $ | 81,389 | $ | 79,961 | |||||||||

Total Allowance for Credit Losses | |||||||||||||||||||

Allowance for loan losses | $ | 608,345 | $ | 611,894 | $ | 606,048 | $ | 596,440 | $ | 609,375 | |||||||||

Reserve for unfunded lending commitments | 64,780 | 69,026 | 74,838 | 81,389 | 79,961 | ||||||||||||||

Total allowance for credit losses | $ | 673,125 | $ | 680,920 | $ | 680,886 | $ | 677,829 | $ | 689,336 | |||||||||

Ratio of total allowance for credit losses to loans and leases outstanding, at period end | 1.58 | % | 1.64 | % | 1.68 | % | 1.69 | % | 1.72 | % | |||||||||

- more -

ZIONS BANCORPORATION

Press Release – Page 14

July 26, 2016

Nonaccrual Loans by Portfolio Type

(Unaudited)

(In millions) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | ||||||||||||||||||||||||

Loans held for sale | $ | 13 | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||

Commercial: | |||||||||||||||||||||||||||||

Commercial and industrial | $ | 341 | $ | 356 | $ | 164 | $ | 167 | $ | 165 | |||||||||||||||||||

Leasing | 14 | 14 | 4 | — | — | ||||||||||||||||||||||||

Owner occupied | 69 | 74 | 74 | 77 | 89 | ||||||||||||||||||||||||

Municipal | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||

Total commercial | 425 | 445 | 243 | 245 | 255 | ||||||||||||||||||||||||

Commercial real estate: | |||||||||||||||||||||||||||||

Construction and land development | 5 | 6 | 7 | 15 | 20 | ||||||||||||||||||||||||

Term | 51 | 33 | 40 | 39 | 44 | ||||||||||||||||||||||||

Total commercial real estate | 56 | 39 | 47 | 54 | 64 | ||||||||||||||||||||||||

Consumer: | |||||||||||||||||||||||||||||

Home equity credit line | 12 | 11 | 8 | 10 | 9 | ||||||||||||||||||||||||

1-4 family residential | 39 | 44 | 50 | 48 | 43 | ||||||||||||||||||||||||

Construction and other consumer real estate | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||

Bankcard and other revolving plans | 1 | 2 | 1 | 1 | 1 | ||||||||||||||||||||||||

Other | — | — | — | — | — | ||||||||||||||||||||||||

Total consumer | 53 | 58 | 60 | 60 | 54 | ||||||||||||||||||||||||

Total nonaccrual loans | $ | 547 | $ | 542 | $ | 350 | $ | 359 | $ | 373 | |||||||||||||||||||

Net Charge-Offs by Portfolio Type

(Unaudited)

Three Months Ended | |||||||||||||||||||||||||||||

(In millions) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | ||||||||||||||||||||||||

Commercial: | |||||||||||||||||||||||||||||

Commercial and industrial | $ | 32 | $ | 37 | $ | 18 | $ | 30 | $ | 13 | |||||||||||||||||||

Leasing | — | — | — | — | — | ||||||||||||||||||||||||

Owner occupied | — | (1 | ) | — | 3 | (3 | ) | ||||||||||||||||||||||

Municipal | — | — | — | — | — | ||||||||||||||||||||||||

Total commercial | 32 | 36 | 18 | 33 | 10 | ||||||||||||||||||||||||

Commercial real estate: | |||||||||||||||||||||||||||||

Construction and land development | (1 | ) | (2 | ) | (2 | ) | (2 | ) | (1 | ) | |||||||||||||||||||

Term | 7 | — | (4 | ) | (1 | ) | 2 | ||||||||||||||||||||||

Total commercial real estate | 6 | (2 | ) | (6 | ) | (3 | ) | 1 | |||||||||||||||||||||

Consumer: | |||||||||||||||||||||||||||||

Home equity credit line | — | 1 | (1 | ) | 1 | — | |||||||||||||||||||||||

1-4 family residential | (1 | ) | 1 | 1 | — | — | |||||||||||||||||||||||

Construction and other consumer real estate | — | — | (1 | ) | (1 | ) | — | ||||||||||||||||||||||

Bankcard and other revolving plans | 1 | — | 2 | — | 1 | ||||||||||||||||||||||||

Other | — | — | — | 1 | (1 | ) | |||||||||||||||||||||||

Total consumer loans | — | 2 | 1 | 1 | — | ||||||||||||||||||||||||

Total net charge-offs (recoveries) | $ | 38 | $ | 36 | $ | 13 | $ | 31 | $ | 11 | |||||||||||||||||||

- more -

ZIONS BANCORPORATION

Press Release – Page 15

July 26, 2016

CONSOLIDATED AVERAGE BALANCE SHEETS, YIELDS AND RATES

(Unaudited)

Three Months Ended | ||||||||||||||||||||

June 30, 2016 | March 31, 2016 | June 30, 2015 | ||||||||||||||||||

(In thousands) | Average balance | Average yield/rate 1 | Average balance | Average yield/rate 1 | Average balance | Average yield/rate 1 | ||||||||||||||

ASSETS | ||||||||||||||||||||

Money market investments | $ | 4,045,333 | 0.55 | % | $ | 5,122,483 | 0.55 | % | $ | 8,414,602 | 0.28 | % | ||||||||

Securities: | ||||||||||||||||||||

Held-to-maturity | 669,372 | 4.46 | % | 562,040 | 4.86 | % | 583,349 | 5.06 | % | |||||||||||

Available-for-sale | 8,852,688 | 1.93 | % | 8,108,708 | 2.11 | % | 4,585,760 | 1.99 | % | |||||||||||

Trading account | 78,479 | 3.88 | % | 53,367 | 3.56 | % | 76,706 | 3.19 | % | |||||||||||

Total securities | 9,600,539 | 2.13 | % | 8,724,115 | 2.30 | % | 5,245,815 | 2.35 | % | |||||||||||

Loans held for sale | 126,045 | 3.52 | % | 140,423 | 3.95 | % | 115,377 | 3.48 | % | |||||||||||

Loans held for investment 2: | ||||||||||||||||||||

Commercial | 21,934,114 | 4.20 | % | 21,624,134 | 4.20 | % | 21,527,723 | 4.22 | % | |||||||||||

Commercial real estate | 11,169,157 | 4.31 | % | 10,555,869 | 4.23 | % | 10,089,092 | 4.47 | % | |||||||||||

Consumer | 9,004,845 | 3.88 | % | 8,822,899 | 3.90 | % | 8,514,519 | 3.91 | % | |||||||||||

Total loans held for investment | 42,108,116 | 4.16 | % | 41,002,902 | 4.14 | % | 40,131,334 | 4.22 | % | |||||||||||

Total interest-earning assets | 55,880,033 | 3.55 | % | 54,989,923 | 3.51 | % | 53,907,128 | 3.42 | % | |||||||||||

Cash and due from banks | 520,769 | 727,577 | 591,347 | |||||||||||||||||

Allowance for loan losses | (606,228 | ) | (600,216 | ) | (621,348 | ) | ||||||||||||||

Goodwill | 1,014,129 | 1,014,129 | 1,014,129 | |||||||||||||||||

Core deposit and other intangibles | 13,527 | 15,379 | 22,135 | |||||||||||||||||

Other assets | 2,723,529 | 2,679,525 | 2,558,514 | |||||||||||||||||

Total assets | $ | 59,545,759 | $ | 58,826,317 | $ | 57,471,905 | ||||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||||||||

Interest-bearing deposits: | ||||||||||||||||||||

Savings and money market | $ | 25,779,999 | 0.14 | % | $ | 25,350,037 | 0.15 | % | $ | 24,514,516 | 0.16 | % | ||||||||

Time | 2,192,366 | 0.46 | % | 2,087,698 | 0.44 | % | 2,300,593 | 0.43 | % | |||||||||||

Foreign | 138,583 | 0.28 | % | 235,331 | 0.26 | % | 325,640 | 0.14 | % | |||||||||||

Total interest-bearing deposits | 28,110,948 | 0.17 | % | 27,673,066 | 0.17 | % | 27,140,749 | 0.18 | % | |||||||||||

Borrowed funds: | ||||||||||||||||||||

Federal funds and other short-term borrowings | 546,707 | 0.24 | % | 267,431 | 0.18 | % | 214,287 | 0.14 | % | |||||||||||

Long-term debt | 790,103 | 5.05 | % | 809,123 | 5.02 | % | 1,076,178 | 7.13 | % | |||||||||||

Total borrowed funds | 1,336,810 | 3.08 | % | 1,076,554 | 3.82 | % | 1,290,465 | 5.97 | % | |||||||||||

Total interest-bearing liabilities | 29,447,758 | 0.30 | % | 28,749,620 | 0.31 | % | 28,431,214 | 0.44 | % | |||||||||||

Noninterest-bearing deposits | 21,839,395 | 21,881,777 | 20,984,073 | |||||||||||||||||

Other liabilities | 596,697 | 579,453 | 559,722 | |||||||||||||||||

Total liabilities | 51,883,850 | 51,210,850 | 49,975,009 | |||||||||||||||||

Shareholders’ equity: | ||||||||||||||||||||

Preferred equity | 778,844 | 828,490 | 1,004,031 | |||||||||||||||||

Common equity | 6,883,065 | 6,786,977 | 6,492,865 | |||||||||||||||||

Total shareholders’ equity | 7,661,909 | 7,615,467 | 7,496,896 | |||||||||||||||||

Total liabilities and shareholders’ equity | $ | 59,545,759 | $ | 58,826,317 | $ | 57,471,905 | ||||||||||||||

Spread on average interest-bearing funds | 3.25 | % | 3.20 | % | 2.98 | % | ||||||||||||||

Net yield on interest-earning assets | 3.39 | % | 3.35 | % | 3.18 | % | ||||||||||||||

1 Taxable-equivalent rates used where applicable.

2 Net of unearned income and fees, net of related costs. Loans include nonaccrual and restructured loans.

- more -

ZIONS BANCORPORATION

Press Release – Page 16

July 26, 2016

GAAP to Non-GAAP Reconciliations

(Unaudited)

(In thousands, except per share amounts) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | |||||||||||||||

Tangible Book Value per Common Share | ||||||||||||||||||||

Total shareholders’ equity (GAAP) | $ | 7,626,383 | $ | 7,625,737 | $ | 7,507,519 | $ | 7,638,095 | $ | 7,530,175 | ||||||||||

Preferred stock | (709,601 | ) | (828,490 | ) | (828,490 | ) | (1,004,159 | ) | (1,004,032 | ) | ||||||||||

Goodwill | (1,014,129 | ) | (1,014,129 | ) | (1,014,129 | ) | (1,014,129 | ) | (1,014,129 | ) | ||||||||||

Core deposit and other intangibles | (12,281 | ) | (14,259 | ) | (16,272 | ) | (18,546 | ) | (20,843 | ) | ||||||||||

Tangible common equity (non-GAAP) | (a) | $ | 5,890,372 | $ | 5,768,859 | $ | 5,648,628 | $ | 5,601,261 | $ | 5,491,171 | |||||||||

Common shares outstanding | (b) | 205,104 | 204,544 | 204,417 | 204,279 | 203,741 | ||||||||||||||

Tangible book value per common share (non-GAAP) | (a/b) | $ | 28.72 | $ | 28.20 | $ | 27.63 | $ | 27.42 | $ | 26.95 | |||||||||

Three Months Ended | ||||||||||||||||||||

(Dollar amounts in thousands) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | |||||||||||||||

Tangible Return on Average Tangible Common Equity | ||||||||||||||||||||

Net earnings (loss) applicable to common shareholders (GAAP) | $ | 90,647 | $ | 78,777 | $ | 88,197 | $ | 84,238 | $ | (1,100 | ) | |||||||||

Adjustments, net of tax: | ||||||||||||||||||||

Amortization of core deposit and other intangibles | 1,227 | 1,249 | 1,446 | 1,461 | 1,472 | |||||||||||||||

Net earnings applicable to common shareholders, excluding the effects of the adjustments, net of tax (non-GAAP) | (a) | $ | 91,874 | $ | 80,026 | $ | 89,643 | $ | 85,699 | $ | 372 | |||||||||

Average common equity (GAAP) | $ | 6,883,065 | $ | 6,786,977 | $ | 6,765,737 | $ | 6,655,513 | $ | 6,492,865 | ||||||||||

Average goodwill | (1,014,129 | ) | (1,014,129 | ) | (1,014,129 | ) | (1,014,129 | ) | (1,014,129 | ) | ||||||||||

Average core deposit and other intangibles | (13,527 | ) | (15,379 | ) | (17,453 | ) | (19,726 | ) | (22,135 | ) | ||||||||||

Average tangible common equity (non-GAAP) | (b) | $ | 5,855,409 | $ | 5,757,469 | $ | 5,734,155 | $ | 5,621,658 | $ | 5,456,601 | |||||||||

Number of days in quarter | (c) | 91 | 91 | 92 | 92 | 91 | ||||||||||||||

Number of days in year | (d) | 366 | 366 | 365 | 365 | 365 | ||||||||||||||

Tangible return on average tangible common equity (non-GAAP) | (a/b/c*d) | 6.31 | % | 5.59 | % | 6.20 | % | 6.05 | % | 0.03 | % | |||||||||

- more -

ZIONS BANCORPORATION

Press Release – Page 17

July 26, 2016

Three Months Ended | ||||||||||||||||||||

(Dollar amounts in thousands) | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | |||||||||||||||

Efficiency Ratio | ||||||||||||||||||||

Noninterest expense (GAAP) 1 | (a) | $ | 381,894 | $ | 395,573 | $ | 397,353 | $ | 391,280 | $ | 398,997 | |||||||||

Adjustments: | ||||||||||||||||||||

Severance costs | 201 | 3,471 | 3,581 | 3,464 | 1,707 | |||||||||||||||

Other real estate expense | (527 | ) | (1,329 | ) | (536 | ) | (40 | ) | (445 | ) | ||||||||||

Provision for unfunded lending commitments | (4,246 | ) | (5,812 | ) | (6,551 | ) | 1,428 | (2,326 | ) | |||||||||||

Debt extinguishment cost | 106 | 247 | 135 | — | 2,395 | |||||||||||||||

Amortization of core deposit and other intangibles | 1,979 | 2,014 | 2,273 | 2,298 | 2,318 | |||||||||||||||

Restructuring costs | 47 | 996 | 777 | 1,630 | 679 | |||||||||||||||

Total adjustments | (b) | (2,440 | ) | (413 | ) | (321 | ) | 8,780 | 4,328 | |||||||||||

Adjusted noninterest expense (non-GAAP) | (a-b)=(c) | $ | 384,334 | $ | 395,986 | $ | 397,674 | $ | 382,500 | $ | 394,669 | |||||||||

Taxable-equivalent net interest income (GAAP) | (d) | $ | 470,913 | $ | 458,242 | $ | 453,780 | $ | 429,782 | $ | 428,015 | |||||||||

Noninterest income (GAAP) 1 | (e) | 125,717 | 116,761 | 118,641 | 125,944 | (4,682 | ) | |||||||||||||

Combined income | (d+e)=(f) | 596,630 | 575,003 | 572,421 | 555,726 | 423,333 | ||||||||||||||

Adjustments: | ||||||||||||||||||||

Fair value and nonhedge derivative income (loss) | (1,910 | ) | (2,585 | ) | 688 | (1,555 | ) | 1,844 | ||||||||||||

Equity securities gains (losses), net | 2,709 | (550 | ) | 53 | 3,630 | 4,839 | ||||||||||||||

Fixed income securities gains (losses), net | 25 | 28 | (7 | ) | (53 | ) | (138,436 | ) | ||||||||||||

Total adjustments | (g) | 824 | (3,107 | ) | 734 | 2,022 | (131,753 | ) | ||||||||||||

Adjusted taxable-equivalent revenue (non-GAAP) | (f-g)=(h) | $ | 595,806 | $ | 578,110 | $ | 571,687 | $ | 553,704 | $ | 555,086 | |||||||||

Adjusted pre-provision net revenue (PPNR) | (h-c) | $ | 211,472 | $ | 182,124 | $ | 174,013 | $ | 171,204 | $ | 160,417 | |||||||||

Efficiency ratio 1 | (c/h) | 64.5 | % | 68.5 | % | 69.6 | % | 69.1 | % | 71.1 | % | |||||||||

1In the first quarter of 2016, to be consistent with industry practice, the Company reclassified its bankcard rewards expense from “Other” noninterest expense to “Other service charges, commissions and fees” in noninterest income in order to offset this expense against the associated revenue. Prior period amounts have been reclassified to reflect this change.

# # #

ZIONS BANCORPORATION

Press Release – Page 18

July 26, 2016

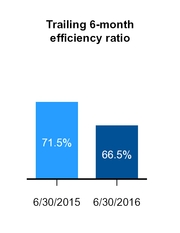

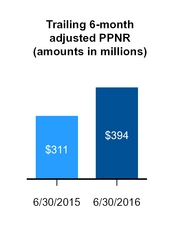

Six Months Ended | ||||||||

(Dollar amounts in thousands) | June 30, 2016 | June 30, 2015 | ||||||

Efficiency Ratio | ||||||||

Noninterest expense (GAAP) 1 | (a) | $ | 777,467 | $ | 791,974 | |||

Adjustments: | ||||||||

Severance costs | 3,672 | 3,960 | ||||||

Other real estate expense | (1,856 | ) | (71 | ) | ||||

Provision for unfunded lending commitments | (10,058 | ) | (1,115 | ) | ||||

Debt extinguishment cost | 353 | 2,395 | ||||||

Amortization of core deposit and other intangibles | 3,993 | 4,676 | ||||||

Restructuring costs | 1,043 | 1,445 | ||||||

Total adjustments | (b) | (2,853 | ) | 11,290 | ||||

Adjusted noninterest expense (non-GAAP) | (a-b)=(c) | $ | 780,320 | $ | 780,684 | |||

Taxable-equivalent net interest income (GAAP) | (d) | $ | 929,155 | $ | 849,596 | |||

Noninterest income (GAAP) 1 | (e) | 242,478 | 112,656 | |||||

Combined income | (d+e)=(f) | 1,171,633 | 962,252 | |||||

Adjustments: | ||||||||

Fair value and nonhedge derivative income (loss) | (4,495 | ) | 756 | |||||

Equity securities gains (losses), net | 2,159 | 8,192 | ||||||

Fixed income securities gains (losses), net | 53 | (138,675 | ) | |||||

Total adjustments | (g) | (2,283 | ) | (129,727 | ) | |||

Adjusted taxable-equivalent revenue (non-GAAP) | (f-g)=(h) | $ | 1,173,916 | $ | 1,091,979 | |||

Adjusted pre-provision net revenue (PPNR) | (h-c)=(i) | $ | 393,596 | $ | 311,295 | |||

Efficiency ratio 1 | (c/h) | 66.5 | % | 71.5 | % | |||

1In the first quarter of 2016, to be consistent with industry practice, the Company reclassified its bankcard rewards expense from “Other” noninterest expense to “Other service charges, commissions and fees” in noninterest income in order to offset this expense against the associated revenue. Prior period amounts have been reclassified to reflect this change.

This press release presents the non-GAAP financial measures previously shown. The adjustments to reconcile from the applicable GAAP financial measures to the non-GAAP financial measures are included where applicable in financial results presented in accordance with GAAP. The Company considers these adjustments to be relevant to ongoing operating results.

The Company believes that excluding the amounts associated with these adjustments to present the non-GAAP financial measures provides a meaningful base for period-to-period and company-to-company comparisons, which will assist regulators, investors, and analysts in analyzing the operating results or financial position of the Company and in predicting future performance. These non-GAAP financial measures are used by management to assess the performance of the Company’s business or its financial position for evaluating bank reporting segment performance, for presentations of Company performance to investors, and for other reasons as may be requested by investors and analysts. The Company further believes that presenting these non-GAAP financial measures will permit investors and analysts to assess the performance of the Company on the same basis as that applied by management.

Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied, and are not audited. Although non-GAAP financial measures are frequently used by stakeholders to evaluate a company, they have limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of results reported under GAAP.

- more -