Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OLIN Corp | form8k2016outlookslides.htm |

Second Quarter 2016 Update

July 22, 2016

TM

Exhibit 99.1

Forward-Looking Statements

This communication includes forward-looking statements. These statements relate to analyses and other information that are

based on management’s beliefs, certain assumptions made by management, forecasts of future results, and current expectations,

estimates and projections about the markets and economy in which we and our various segments operate. These statements may

include statements regarding our recent acquisition of the U.S. chlor alkali and downstream derivatives businesses, the expected

benefits and synergies of the transaction, and future opportunities for the combined company following the transaction. The

statements contained in this communication that are not statements of historical fact may include forward-looking statements

that involve a number of risks and uncertainties.

We have used the words “anticipate,” “intend,” “may,” “expect,” “believe,” “should,” “plan,” “project,” “estimate,” “forecast,”

“optimistic,” and variations of such words and similar expressions in this communication to identify such forward-looking

statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions,

which are difficult to predict and many of which are beyond our control.

Therefore, actual outcomes and results may differ materially from those matters expressed or implied in such forward-looking

statements. Factors that could cause or contribute to such differences include, but are not limited to: factors relating to the

possibility that Olin may be unable to achieve expected synergies and operating efficiencies in connection with the transaction

within the expected time-frames or at all; the integration of the acquired chlorine products businesses being more difficult, time-

consuming or costly than expected; the effect of any changes resulting from the transaction in customer, supplier and other

business relationships; general market perception of the transaction; exposure to lawsuits and contingencies associated with the

acquired chlorine products business; the ability to attract and retain key personnel; prevailing market conditions; changes in

economic and financial conditions of our chlorine products business; uncertainties and matters beyond the control of

management; and the other risks detailed in Olin’s Form 10-K for the fiscal year ended December 31, 2015 and Olin’s Form 10-Q

for the quarter ended March 31, 2016. The forward-looking statements should be considered in light of these factors. In addition,

other risks and uncertainties not presently known to Olin or that Olin considers immaterial could affect the accuracy of our

forward-looking statements. The reader is cautioned not to rely unduly on these forward-looking statements. Olin undertakes no

obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise.

1

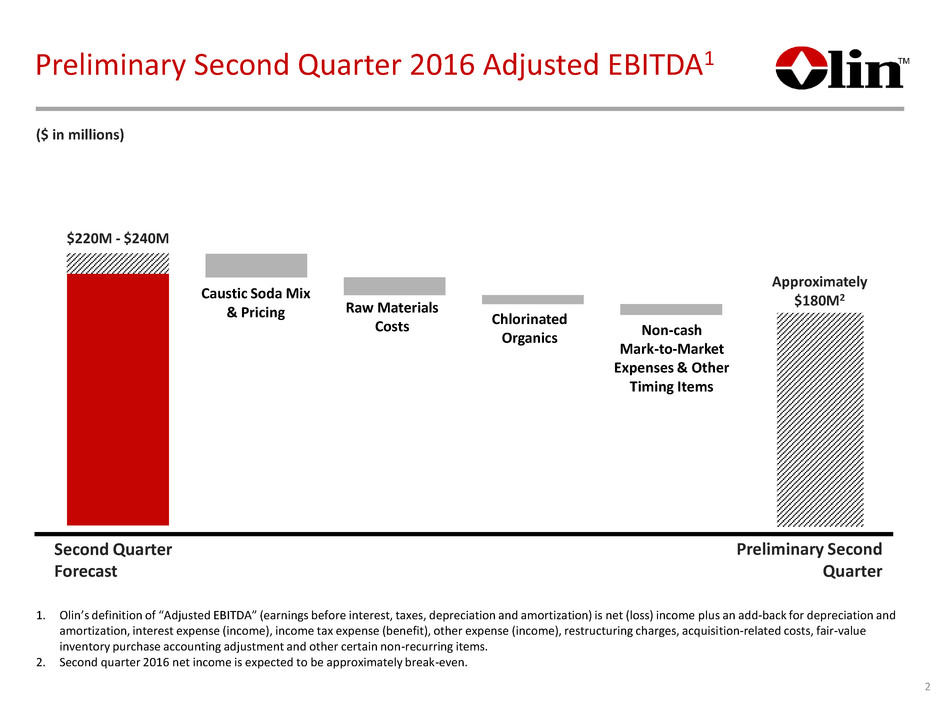

Preliminary Second Quarter 2016 Adjusted EBITDA1

($ in millions)

Second Quarter

Forecast

Preliminary Second

Quarter

$220M - $240M

Approximately

$180M2 Caustic Soda Mix

& Pricing Raw Materials

Costs

Chlorinated

Organics

Non-cash

Mark-to-Market

Expenses & Other

Timing Items

2

1. Olin’s definition of “Adjusted EBITDA” (earnings before interest, taxes, depreciation and amortization) is net (loss) income plus an add-back for depreciation and

amortization, interest expense (income), income tax expense (benefit), other expense (income), restructuring charges, acquisition-related costs, fair-value

inventory purchase accounting adjustment and other certain non-recurring items.

2. Second quarter 2016 net income is expected to be approximately break-even.

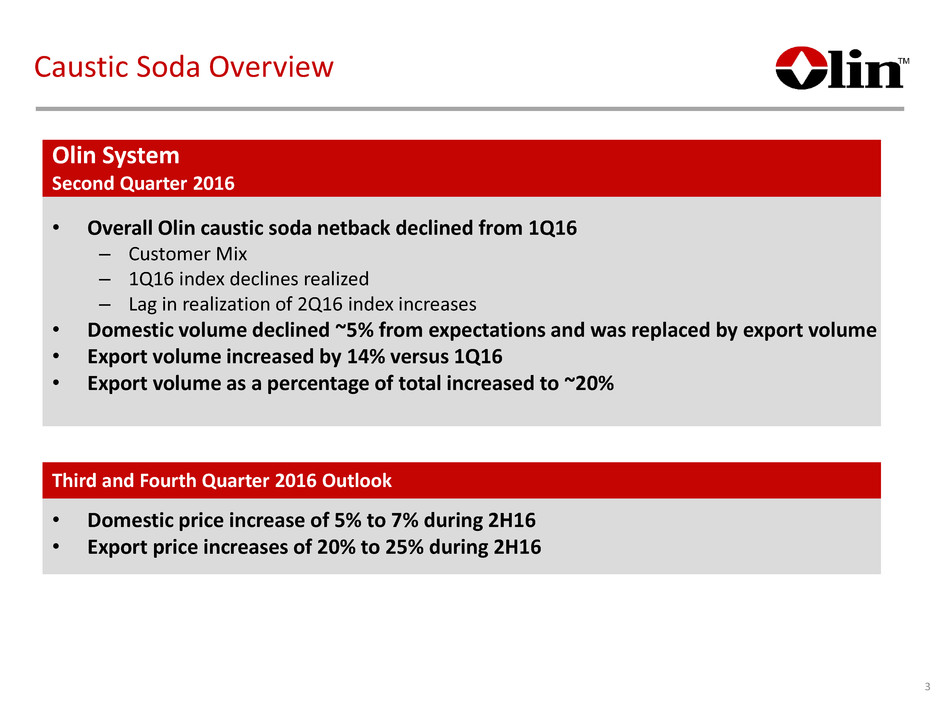

Olin System

Second Quarter 2016

• Overall Olin caustic soda netback declined from 1Q16

– Customer Mix

– 1Q16 index declines realized

– Lag in realization of 2Q16 index increases

• Domestic volume declined ~5% from expectations and was replaced by export volume

• Export volume increased by 14% versus 1Q16

• Export volume as a percentage of total increased to ~20%

• Domestic price increase of 5% to 7% during 2H16

• Export price increases of 20% to 25% during 2H16

Third and Fourth Quarter 2016 Outlook

Caustic Soda Overview

3

Ethylene Dichloride Export Pricing

12/31/15 IHS Forecast

6/30/16 IHS Forecast

• Low oil prices have

made Naphtha-based

PVC more competitive

• Downward trend in

international vinyl

prices has pressured

EDC export pricing

• Result is lower than

expected recovery in

EDC pricing

• $0.01 per pound price

change equates to

~$20 million in annual

Adjusted EBITDA

4

Average EDC Price 2000-2015 = $0.14

Chlorinated Organics

• Overall chlorinated organics volumes projected to be ~10% lower than

2016 expectations

5

• North American and European refrigerants customers negatively impacted

by softer demand and increased imports from China

• North American packaging and agriculture demand also below

expectations

• Lower demand has led to pricing pressure across product portfolio

$1.5 billion +

FY 2016 Forecast

$840 – $900 million

Chlor Alkali Mid-Cycle

EDC Price Recovery

Continued Epoxy Improvement

Synergies

Adjusted EBITDA Potential: Mid-Cycle

6

End slide

TM

7