Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERCULES OFFSHORE, INC. | d226091d8k.htm |

Exhibit 99.1

UNITED STATES BANKRUPTCY COURT

DISTRICT OF DELAWARE

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MONTHLY OPERATING REPORT

File with Court and submit copy to United States Trustee within 20 days after end of month.

| REQUIRED DOCUMENTS |

Form No. |

Document Attached |

Explanation Attached | |||

| Schedule of Cash Receipts and Disbursements | MOR-1 | Yes | ||||

| Bank Reconciliation (or copies of debtor’s bank reconciliations) | MOR-1 (CON’T) | Yes | ||||

| Schedule of Professional Fees Paid | MOR-lb | Yes | ||||

| Copies of bank statements |

No | Note 1 | ||||

| Cash disbursements journals |

No | Note 1 | ||||

| Statement of Operations | MOR-2 | Yes | ||||

| Balance Sheet | MOR-3 | Yes | ||||

| Status of Post-petition Taxes | No | Note 2 | ||||

| Copies of IRS Form 6123 or payment receipt |

No | Note 1 | ||||

| Copies of tax returns filed during reporting period |

No | Note 1 | ||||

| Summary of Unpaid Post-petition Debts | MOR-4 | Yes | ||||

| Listing of Aged Accounts Payable |

MOR-4 | Yes | ||||

| Accounts Receivable Reconciliation and Aging | MOR-5 | Yes | ||||

| Debtor Questionnaire | MOR-5 | Yes |

| (1) | Due to the system constraints and/or the volume of the records, no attachment is provided, but is available to the UST upon request. |

| (2) | The Company is current on all tax payments. |

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief.

|

Signature of Debtor |

Date | |

|

Signature of Joint Debtor |

Date | |

| /s/ Troy Carson |

7/20/2016 | |

| Signature of Authorized Individual* | Date | |

| Troy Carson |

Chief Financial Officer | |

| Printed Name of Authorized Individual | Title of Authorized Individual |

| * | Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-1: SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS

HERCULES OFFSHORE, INC., ET AL. DEBTOR

| Current Month | Cumulative Filing to Date | |||||||||||||||

| Actual | Projected1 | Actual | Projected1 | |||||||||||||

| Beginning Cash |

$ | 207,705,799 | $ | 208,311,591 | $ | 207,705,799 | $ | 208,311,591 | ||||||||

| RECEIPTS |

||||||||||||||||

| Total Receipts |

3,496,749 | 3,295,533 | 3,496,749 | 3,295,533 | ||||||||||||

| DISBURSEMENTS |

||||||||||||||||

| Personnel Costs |

6,209,626 | 7,674,498 | 6,209,626 | 7,674,498 | ||||||||||||

| Premises Rents |

195,923 | 256,100 | 195,923 | 256,100 | ||||||||||||

| Insurance |

171,578 | 832,500 | 171,578 | 832,500 | ||||||||||||

| Taxes |

5,801 | 81,893 | 5,801 | 81,893 | ||||||||||||

| Utilities |

100,227 | 99,125 | 100,227 | 99,125 | ||||||||||||

| Vendors and Others |

961,564 | 3,366,533 | 961,564 | 3,366,533 | ||||||||||||

| Professional Fees |

59,931 | — | 59,931 | — | ||||||||||||

| U.S. Trustee Quarterly Fees |

— | — | — | — | ||||||||||||

| Adequate Protection Debt and Assurance |

42,792,898 | 42,717,441 | 42,792,898 | 42,717,441 | ||||||||||||

| Total Disbursements |

50,497,546 | 55,028,089 | 50,497,546 | 55,028,089 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Cash Flow |

(47,000,797 | ) | (51,732,556 | ) | (47,000,797 | ) | (51,732,556 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ending Cash2 |

$ | 160,705,001 | $ | 156,579,035 | $ | 160,705,001 | $ | 156,579,035 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES3

| Hercules Offshore, Inc. |

$ | 19,937,059 | ||

| Cliffs Drilling Company |

1,253,912 | |||

| Cliffs Drilling Trinidad L.L.C. |

— | |||

| FDT LLC |

— | |||

| FDT Holdings LLC |

— | |||

| Hercules Drilling Company, LLC |

2,102,166 | |||

| Hercules Offshore Services LLC |

5,283,697 | |||

| Hercules Offshore Liftboat Company LLC |

— | |||

| HERO Holdings, Inc. |

4,640,729 | |||

| SD Drilling LLC |

10,474,061 | |||

| THE Offshore Drilling Company |

6,691,078 | |||

| THE Onshore Drilling Company |

— | |||

| TODCO Americas Inc. |

114,845 | |||

| TODCO International Inc. |

— | |||

|

|

|

|||

| TOTAL DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES |

$ | 50,497,546 | ||

|

|

|

| (1) | Projected amounts are based on the forecasted weekly activity for the week ending 6/11 through the week ending 7/2 from the 13-week cash flow forecast filed in the Cash Collateral Motion. |

| (2) | Ending Cash balance excludes petty cash and collateral accounts. |

| (3) | A majority of disbursements are made from centralized payroll and accounts payable bank accounts. Pro-rated amounts were allocated to the debtor entities based on percentage of expenses over the period. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-1a: BANK RECONCILIATIONS

| Legal Entity1 |

Bank Name |

Account Function |

Account# | USD Balance as of 6/30 | ||||||

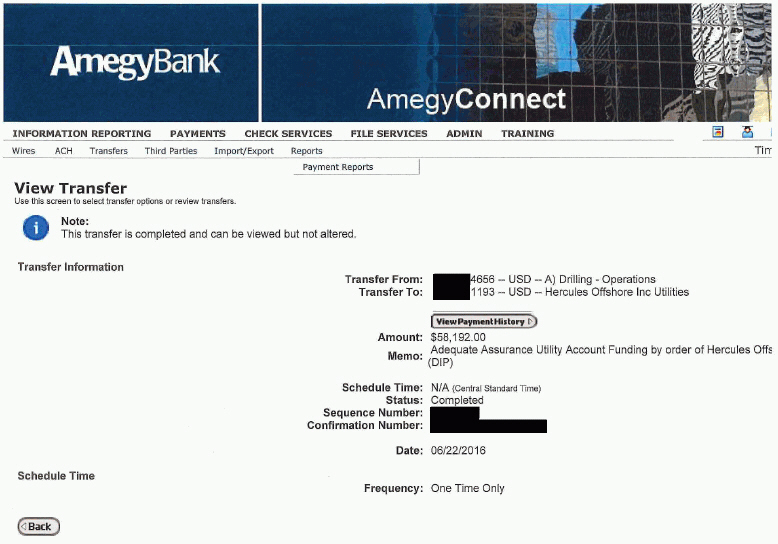

| Hercules Offshore, Inc. |

Amegy Bank of Texas, N.A. | Operating Account | ****2838 | — | ||||||

| Hercules Offshore, Inc. |

Amegy Bank of Texas, N.A. | Flexible Spending Claims | ****7288 | — | ||||||

| Hercules Offshore, Inc. |

Amegy Bank of Texas, N.A. | Singapore Operating Account | ****0935 | — | ||||||

| Hercules Offshore, Inc. |

HSBC | Checking Account | ****2845 | 5,184,687 | ||||||

| Hercules Offshore, Inc. |

HSBC | Investment Account | ****1393 | 50,241,834 | ||||||

| Hercules Offshore, Inc. |

Amegy Bank of Texas, N.A. | Hercules Offshore Inc. Utilities | ****1193 (New) | 58,192 | ||||||

| Cliffs Drilling Company |

Amegy Bank of Texas, N.A. | Operating Account | ****1649 | — | ||||||

| Cliffs Drilling Company |

HSBC | Local Operations | ****1001 | 13,845 | ||||||

| Hercules Drilling Company, LLC |

Amegy Bank of Texas, N.A, | Operating Account | ****4656 | 15,207,567 | ||||||

| Hercules Drilling Company, LLC |

Amegy Bank of Texas, N.A. | Payables | ****5850 | — | ||||||

| Hercules Drilling Company, LLC |

Amegy Bank of Texas, N.A. | Cayman Investment Sweep Account | ****4656 | 1,503 | ||||||

| Hercules Drilling Company, LLC |

Amegy Bank of Texas, N.A. | Money Market Investment Account | ****8200 | — | ||||||

| Hercules Drilling Company, LLC |

Amegy Bank of Texas, N.A. | Cayman Self Directed Investment Account | ****2321 | — | ||||||

| Hercules Drilling Company, LLC |

Capital One Bank | Investment Account | ****7684 | 65,171,673 | ||||||

| Hercules Drilling Company, LLC |

Comerica Bank | Investment Account | ****8881 | 25,176,764 | ||||||

| Hercules Offshore Services LLC |

Amegy Bank of Texas, N.A. | Payroll Account | ****5069 | — | ||||||

| TODCO Americas Inc. |

Amegy Bank of Texas, N.A. | Operating Account | ****8930 | — | ||||||

Notes:

| (1) | Includes only Debtor entity bank accounts |

I attest that each of the Debtors’ corporate bank accounts is reconciled to monthly bank statements. The Company’s standard practice is to ensure that each corporate bank account is reconciled to monthly bank statements for each fiscal month within 30 days after month end. See above listing of each of the Debtors’ bank accounts and the book balance of the account as of the end of the fiscal month covered by this report.

| /s/ Troy Carson |

Troy Carson | |||

| Authorized Representative | Printed Name of Authorized Representative |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-1a: BANK RECONCILIATIONS

| Legal Entity Bank Name |

Hercules Offshore, Inc. HSBC ****2845 |

Hercules Offshore, Inc. HSBC ****1393 |

Hercules Offshore, Inc. Amegy Bank of Texas, N.A. ****1193 |

Cliffs Drilling Company HSBC ****1001 |

Hercules Drilling Company, LLC Amegy Bank of Texas, N.A. ****4656 |

|||||||||||||||||||||||||

| Balance Per Books |

$ | 5,184,687 | $ | 50,241,834 | $ | 58,192 | $ | 13,845 | $ | 15,207,567 | ||||||||||||||||||||

| Bank Balance |

$ | 5,184,687 | $ | 50,241,834 | $ | 58,192 | $ | 13,845 | $ | 15,207,567 | ||||||||||||||||||||

| (+) Deposits In Transit |

— | — | — | — | — | |||||||||||||||||||||||||

| (-) Outstanding Checks |

— | — | — | — | — | |||||||||||||||||||||||||

| Other |

— | — | — | — | — | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Adjusted Bank Balance |

$ | 5,184,687 | $ | 50,241,834 | $ | 58,192 | $ | 13,845 | $ | 15,207,567 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Deposits In Transit |

Date | Amount | Date | Amount | Date | Amount | Date | Amount | Date | Amount | ||||||||||||||||||||

| $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Deposits In Transit |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Outstanding Checks |

Date | Amount | Date | Amount | Date | Amount | Date | Amount | Date | Amount | ||||||||||||||||||||

| $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Outstanding Checks |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Other |

Date | Amount | Date | Amount | Date | Amount | Date | Amount | Date | Amount | ||||||||||||||||||||

| $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Other |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-1a: BANK RECONCILIATIONS

| Legal Entity Bank Name Account # |

Hercules Drilling Company, LLC Amegy Bank of Texas, N.A. ****4656 |

Hercules Drilling Company, LLC Capital One Bank ****7684 |

Hercules Drilling Company, LLC Comerica Bank ****8881 |

Hercules Drilling Company, LLC Amegy Bank of Texas, N.A.1 ****5850 |

Hercules Offshore Services LLC Amegy Bank of Texas, N.A.1 ****5069 |

|||||||||||||||||||||||||

| Balance Per Books |

$ | 1,503 | $ | 65,171,673 | $ | 25,176,764 | $ | (346,595 | ) | $ | (4,469 | ) | ||||||||||||||||||

| Bank Balance |

$ | 1,503 | $ | 65,171,673 | $ | 25,176,764 | $ | — | $ | — | ||||||||||||||||||||

| (+) Deposits In Transit |

— | — | — | — | — | |||||||||||||||||||||||||

| (-) Outstanding Checks |

— | — | — | 346,595 | 4,469 | |||||||||||||||||||||||||

| Other |

— | — | — | — | — | |||||||||||||||||||||||||

| Adjusted Bank Balance |

$ | 1,503 | $ | 65,171,673 | $ | 25,176,764 | $ | (346,595 | ) | $ | (4,469 | ) | ||||||||||||||||||

| Deposits In Transit |

Date | Amount | Date | Amount | Date | Amount | Date | Amount | Date | Amount | ||||||||||||||||||||

| $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| Total Deposits In Transit |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||

| Outstanding Checks2 |

Date | Amount | Date | Amount | Date | Amount | Date | Amount | Date | Amount | ||||||||||||||||||||

| Total Outstanding Checks |

$ | — | $ | — | $ | — | $ | 346,595 | $ | 4,469 | ||||||||||||||||||||

| Other |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| — | — | — | — | — | ||||||||||||||||||||||||||

| Total Other |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||

| (1) | The negative book balance in accounts ****5850 and ****5069 are due to those accounts being ZBA accounts in the Amegy bank account structure noted in the Cash Management Motion. As checks clear these bank accounts, funds are made available to those accounts to process checks presented for payment. |

| (2) | Outstanding checks are available to the UST upon request. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-1b: SCHEDULE OF PROFESSIONAL FEES AND EXPENSES PAID

| Check | Amount Paid | Year-To-Date | ||||||||||||||||||||||||||||||||||

| Payee |

Period Covered | Amount Approved | Payor | Number | Date | Fees | Expenses | Fees | Expenses | |||||||||||||||||||||||||||

| None |

None | None | None | None | None | None | None | None | None | |||||||||||||||||||||||||||

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

The Consolidated Debtor Entities

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | 4,608,214 | $ | 4,608,214 | ||||

| Total Revenue |

4,608,214 | 4,608,214 | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

3,586,630 | 3,586,630 | ||||||

| Depreciation & Amortization |

688,607 | 688,607 | ||||||

| General & Administrative |

5,116,251 | 5,116,251 | ||||||

| Total Operating Expenses |

9,391,487 | 9,391,487 | ||||||

|

|

|

|

|

|||||

| Operating Income |

(4,783,274 | ) | (4,783,274 | ) | ||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

(59,583 | ) | (59,583 | ) | ||||

| Interest Expense |

130,227,782 | 130,227,782 | ||||||

| Income Taxes (Benefit) |

(5,435,176 | ) | (5,435,176 | ) | ||||

| Total Other Income and Expenses |

124,733,022 | 124,733,022 | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | (129,516,296 | ) | $ | (129,516,296 | ) | ||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

Hercules Offshore, Inc.

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | 205,137 | $ | 205,137 | ||||

| Total Revenue |

205,137 | 205,137 | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

(42,836 | ) | (42,836 | ) | ||||

| Depreciation & Amortization |

58,333 | 58,333 | ||||||

| General & Administrative |

3,692,379 | 3,692,379 | ||||||

| Total Operating Expenses |

3,707,876 | 3,707,876 | ||||||

|

|

|

|

|

|||||

| Operating Income |

(3,502,739 | ) | (3,502,739 | ) | ||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

(46,308 | ) | (46,308 | ) | ||||

| Interest Expense |

129,610,791 | 129,610,791 | ||||||

| Income Taxes (Benefit) |

(4,053,243 | ) | (4,053,243 | ) | ||||

| Total Other Income and Expenses |

125,511,241 | 125,511,241 | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | (129,013,980 | ) | $ | (129,013,980 | ) | ||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

Cliffs Drilling Company

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | — | $ | — | ||||

| Total Revenue |

— | — | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

209,309 | 209,309 | ||||||

| Depreciation & Amortization |

— | — | ||||||

| General & Administrative |

23,893 | 23,893 | ||||||

| Total Operating Expenses |

233,201 | 233,201 | ||||||

|

|

|

|

|

|||||

| Operating Income |

(233,201 | ) | (233,201 | ) | ||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

670 | 670 | ||||||

| Interest Expense |

— | — | ||||||

| Income Taxes (Benefit) |

(1,158,886 | ) | (1,158,886 | ) | ||||

| Total Other Income and Expenses |

(1,158,216 | ) | (1,158,216 | ) | ||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | 925,015 | $ | 925,015 | ||||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

Cliffs Drilling Trinidad L.L.C.

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | — | $ | — | ||||

| Total Revenue |

— | — | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

— | — | ||||||

| Depreciation & Amortization |

— | — | ||||||

| General & Administrative |

— | — | ||||||

| Total Operating Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Operating Income |

— | — | ||||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

— | — | ||||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

FDT LLC

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | — | $ | — | ||||

| Total Revenue |

— | — | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

— | — | ||||||

| Depreciation & Amortization |

— | — | ||||||

| General & Administrative |

— | — | ||||||

| Total Operating Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Operating Income |

— | — | ||||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

— | — | ||||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

FDT Holdings LLC

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | — | $ | — | ||||

| Total Revenue |

— | — | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

— | — | ||||||

| Depreciation & Amortization |

— | — | ||||||

| General & Administrative |

— | — | ||||||

| Total Operating Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Operating Income |

— | — | ||||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

— | — | ||||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

Hercules Drilling Company, LLC

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | — | $ | — | ||||

| Total Revenue |

— | — | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

(101,960 | ) | (101,960 | ) | ||||

| Depreciation & Amortization |

221,776 | 221,776 | ||||||

| General & Administrative |

271,143 | 271,143 | ||||||

| Total Operating Expenses |

390,959 | 390,959 | ||||||

|

|

|

|

|

|||||

| Operating Income |

(390,959 | ) | (390,959 | ) | ||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

(13,946 | ) | (13,946 | ) | ||||

| Interest Expense |

(75,750 | ) | (75,750 | ) | ||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

(89,696 | ) | (89,696 | ) | ||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | (301,263 | ) | $ | (301,263 | ) | ||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

Hercules Offshore Services LLC

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | 1,292,845 | $ | 1,292,845 | ||||

| Total Revenue |

1,292,845 | 1,292,845 | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

841,740 | 841,740 | ||||||

| Depreciation & Amortization |

140,917 | 140,917 | ||||||

| General & Administrative |

— | — | ||||||

| Total Operating Expenses |

982,657 | 982,657 | ||||||

|

|

|

|

|

|||||

| Operating Income |

310,188 | 310,188 | ||||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

— | — | ||||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | 310,188 | $ | 310,188 | ||||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

Hercules Offshore Liftboat Company LLC

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | — | $ | — | ||||

| Total Revenue |

— | — | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

— | — | ||||||

| Depreciation & Amortization |

— | — | ||||||

| General & Administrative |

— | — | ||||||

| Total Operating Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Operating Income |

— | — | ||||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

— | — | ||||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

HERO Holdings, Inc.

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | — | $ | — | ||||

| Total Revenue |

— | — | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

— | — | ||||||

| Depreciation & Amortization |

— | — | ||||||

| General & Administrative |

863,078 | 863,078 | ||||||

| Total Operating Expenses |

863,078 | 863,078 | ||||||

|

|

|

|

|

|||||

| Operating Income |

(863,078 | ) | (863,078 | ) | ||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

692,740 | 692,740 | ||||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

692,740 | 692,740 | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | (1,555,818 | ) | $ | (1,555,818 | ) | ||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

SD Drilling LLC

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | 1,548,292 | $ | 1,548,292 | ||||

| Total Revenue |

1,548,292 | 1,548,292 | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

1,736,320 | 1,736,320 | ||||||

| Depreciation & Amortization |

211,636 | 211,636 | ||||||

| General & Administrative |

— | — | ||||||

| Total Operating Expenses |

1,947,956 | 1,947,956 | ||||||

|

|

|

|

|

|||||

| Operating Income |

(399,664 | ) | (399,664 | ) | ||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

(7,000 | ) | (7,000 | ) | ||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

(7,000 | ) | (7,000 | ) | ||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | (392,664 | ) | $ | (392,664 | ) | ||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

THE Offshore Drilling Company

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | 1,561,939 | $ | 1,561,939 | ||||

| Total Revenue |

1,561,939 | 1,561,939 | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

922,698 | 922,698 | ||||||

| Depreciation & Amortization |

55,944 | 55,944 | ||||||

| General & Administrative |

265,758 | 265,758 | ||||||

| Total Operating Expenses |

1,244,401 | 1,244,401 | ||||||

|

|

|

|

|

|||||

| Operating Income |

317,538 | 317,538 | ||||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

— | — | ||||||

| Income Taxes (Benefit) |

(223,047 | ) | — | |||||

| Total Other Income and Expenses |

(223,047 | ) | — | |||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | 540,586 | $ | 317,538 | ||||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

THE Onshore Drilling Company

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | — | $ | — | ||||

| Total Revenue |

— | — | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

— | — | ||||||

| Depreciation & Amortization |

— | — | ||||||

| General & Administrative |

— | — | ||||||

| Total Operating Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Operating Income |

— | — | ||||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

— | — | ||||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

TODCO Americas Inc.

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | — | $ | — | ||||

| Total Revenue |

— | — | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

21,359 | 21,359 | ||||||

| Depreciation & Amortization |

— | — | ||||||

| General & Administrative |

— | — | ||||||

| Total Operating Expenses |

21,359 | 21,359 | ||||||

|

|

|

|

|

|||||

| Operating Income |

(21,359 | ) | (21,359 | ) | ||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

7,000 | 7,000 | ||||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

7,000 | 7,000 | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | (28,359 | ) | $ | (28,359 | ) | ||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-2: STATEMENT OF OPERATIONS

(Income Statement)

TODCO International Inc.

| REVENUES |

Month1 | Cumulative Filing to Date1 |

||||||

| Revenue |

$ | — | $ | — | ||||

| Total Revenue |

— | — | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES |

||||||||

| Operating Cost & Expenses |

— | — | ||||||

| Depreciation & Amortization |

— | — | ||||||

| General & Administrative |

— | — | ||||||

| Total Operating Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Operating Income |

— | — | ||||||

|

|

|

|

|

|||||

| OTHER INCOME AND EXPENSES |

||||||||

| Other (Income)/Expenses, Net |

— | — | ||||||

| Interest Expense |

— | — | ||||||

| Income Taxes (Benefit) |

— | — | ||||||

| Total Other Income and Expenses |

— | — | ||||||

|

|

|

|

|

|||||

| Net Profit/(Loss) |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| (1) | The Company did not close the books on the petition date, and therefore the values represent the period June 1 - June 30. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-3: BALANCE SHEET

The Consolidated Debtor Entities

| ASSETS CURRENT ASSETS |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Cash |

$ | 160,705,001 | $ | 217,684,724 | ||||

| Restricted Cash |

1,000,000 | 1,000,000 | ||||||

| Accounts Receivable – Trade |

11,112,224 | 9,217,001 | ||||||

| Accounts Receivable – Other |

122,367 | 119,087 | ||||||

| Due to/from Affiliates |

(390,437,258 | ) | (394,727,811 | ) | ||||

| Deposits |

— | — | ||||||

| Prepaid & Other |

10,412,713 | 9,927,381 | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

(207,084,953 | ) | (156,779,618 | ) | ||||

|

|

|

|

|

|||||

| PROPERTY, PLANT & EQUIPMENT |

||||||||

| Net Property, Plant & Equipment |

87,036,128 | 87,666,226 | ||||||

| OTHER ASSETS |

||||||||

| Investment in/from Affiliates |

1,724,702,689 | 1,724,702,689 | ||||||

| Notes Receivable – Affiliates |

959,514,329 | 959,514,329 | ||||||

| Other Assets |

5,919,147 | 6,022,792 | ||||||

| Total Other Assets |

2,690,136,165 | 2,690,239,810 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 2,570,087,340 | $ | 2,621,126,418 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Accounts Payable |

$ | 13,864,805 | $ | 16,526,907 | ||||

| Accrued Liabilities |

21,847,229 | 24,374,275 | ||||||

| Interest Payable |

— | — | ||||||

| Taxes Payable |

(1,008,185 | ) | 113,230 | |||||

| Other Current Liabilities |

90,000 | 11,785,000 | ||||||

| Current portion of Long-Term Debt |

— | — | ||||||

| Deferred Income Taxes |

(0 | ) | 4,055,000 | |||||

| Notes Payable—Affiliates |

499,814,329 | 499,814,329 | ||||||

| Other Liabilities |

1,821,295 | 1,831,842 | ||||||

|

|

|

|

|

|||||

| Total Liabilities Not Subject to Compromise |

536,429,473 | 558,500,583 | ||||||

|

|

|

|

|

|||||

| LIABILITIES SUBJECT TO COMPROMISE1 |

||||||||

| Total Liabilities Subject to Compromise |

347,883,958 | 247,377,323 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

884,313,431 | 805,877,906 | ||||||

|

|

|

|

|

|||||

| SHAREHOLDERS EQUITY |

||||||||

| Common Stock |

200,041 | 200,041 | ||||||

| Additional Paid-in-Capital |

1,681,587,480 | 1,681,545,787 | ||||||

| Contributed Capital |

138,844,823 | 138,844,823 | ||||||

| Treasury Stock |

(325,548 | ) | (325,548 | ) | ||||

| Retained Earning – Prior Year |

(22,848,912 | ) | (22,848,912 | ) | ||||

| Net Income |

(111,683,974 | ) | 17,832,321 | |||||

|

|

|

|

|

|||||

| Net Shareholders Equity |

1,685,773,910 | 1,815,248,512 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders Equity |

$ | 2,570,087,340 | $ | 2,621,126,418 | ||||

|

|

|

|

|

|||||

| (1) | The all-trade motion authorizes the payment of all trade payables in normal course, and therefore only the Senior Notes and Interest Payable have been included in Liabilities subject to compromise. Additionally, Liabilities subject to compromise include the estimated make whole payment amounts. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-3: BALANCE SHEET

Hercules Offshore, Inc.

| ASSETS CURRENT ASSETS |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Cash |

$ | 55,484,713 | $ | 55,408,393 | ||||

| Restricted Cash |

— | |||||||

| Accounts Receivable – Trade |

3,700,137 | 3,696,647 | ||||||

| Accounts Receivable – Other |

110,027 | 110,027 | ||||||

| Due to/from Affiliates |

(557,847,818 | ) | (509,789,774 | ) | ||||

| Deposits |

— | |||||||

| Prepaid & Other |

3,474,336 | 2,323,250 | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

(495,078,606 | ) | (448,251,458 | ) | ||||

|

|

|

|

|

|||||

| PROPERTY, PLANT & EQUIPMENT |

||||||||

| Net Property, Plant & Equipment |

— | — | ||||||

| OTHER ASSETS |

||||||||

| Investment in/from Affiliates |

756,424,589 | 756,424,589 | ||||||

| Notes Receivable – Affiliates |

864,514,329 | 864,514,329 | ||||||

| Other Assets |

5,919,147 | 6,022,792 | ||||||

| Total Other Assets |

1,626,858,065 | 1,626,961,710 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 1,131,779,460 | $ | 1,178,710,252 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Accounts Payable |

$ | 4,715,689 | $ | 6,954,544 | ||||

| Accrued Liabilities |

1,613,040 | 1,381,516 | ||||||

| Interest Payable |

— | — | ||||||

| Taxes Payable |

(305,298 | ) | (307,775 | ) | ||||

| Other Current Liabilities |

— | 11,695,000 | ||||||

| Current portion of Long-Term Debt |

— | — | ||||||

| Deferred Income Taxes |

0 | 4,055,000 | ||||||

| Notes Payable—Affiliates |

— | — | ||||||

| Other Liabilities |

1,821,295 | 1,831,842 | ||||||

|

|

|

|

|

|||||

| Total Liabilities Not Subject to Compromise |

7,844,726 | 25,610,127 | ||||||

|

|

|

|

|

|||||

| LIABILITIES SUBJECT TO COMPROMISE1 |

||||||||

| Total Liabilities Subject to Compromise |

343,685,517 | 243,878,622 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

351,530,244 | 269,488,750 | ||||||

|

|

|

|

|

|||||

| SHAREHOLDERS EQUITY |

||||||||

| Common Stock |

200,000 | 200,000 | ||||||

| Additional Paid-in-Capital |

587,981,206 | 587,939,513 | ||||||

| Contributed Capital |

— | — | ||||||

| Treasury Stock |

(325,548 | ) | (325,548 | ) | ||||

| Retained Earning – Prior Year |

298,364,810 | 298,364,810 | ||||||

| Net Income |

(105,971,252 | ) | 23,042,728 | |||||

|

|

|

|

|

|||||

| Net Shareholders Equity |

780,249,216 | 909,221,503 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders Equity |

$ | 1,131,779,460 | $ | 1,178,710,252 | ||||

|

|

|

|

|

|||||

| (1) | The all-trade motion authorizes the payment of all trade payables in normal course, and therefore only the Senior Notes and Interest Payable have been included in Liabilities subject to compromise. Additionally, Liabilities subject to compromise include the estimated make whole payment amounts. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-3: BALANCE SHEET

Cliffs Drilling Company

| ASSETS CURRENT ASSETS |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Cash |

$ | 13,845 | $ | 14,060 | ||||

| Restricted Cash |

1,000,000 | 1,000,000 | ||||||

| Accounts Receivable – Trade |

(460,950 | ) | (460,950 | ) | ||||

| Accounts Receivable – Other |

— | — | ||||||

| Due to/from Affiliates |

87,434,486 | 87,536,987 | ||||||

| Deposits |

— | — | ||||||

| Prepaid & Other |

851,626 | 936,711 | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

88,839,006 | 89,026,807 | ||||||

|

|

|

|

|

|||||

| PROPERTY, PLANT & EQUIPMENT |

||||||||

| Net Property, Plant & Equipment |

1,000,000 | 1,000,000 | ||||||

| OTHER ASSETS |

||||||||

| Investment in/from Affiliates |

3,499,897 | 3,499,897 | ||||||

| Notes Receivable – Affiliates |

— | — | ||||||

| Other Assets |

— | — | ||||||

| Total Other Assets |

3,499,897 | 3,499,897 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 93,338,904 | $ | 93,526,704 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Accounts Payable |

$ | 1,205,380 | $ | 1,161,311 | ||||

| Accrued Liabilities |

50,487 | 48,485 | ||||||

| Interest Payable |

— | — | ||||||

| Taxes Payable |

123,151 | 1,282,037 | ||||||

| Other Current Liabilities |

— | — | ||||||

| Current portion of Long-Term Debt |

— | — | ||||||

| Deferred Income Taxes |

(1 | ) | (1 | ) | ||||

| Notes Payable—Affiliates |

— | — | ||||||

| Other Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities Not Subject to Compromise |

1,379,018 | 2,491,833 | ||||||

|

|

|

|

|

|||||

| LIABILITIES SUBJECT TO COMPROMISE1 |

||||||||

| Total Liabilities Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

1,379,018 | 2,491,833 | ||||||

|

|

|

|

|

|||||

| SHAREHOLDERS EQUITY |

||||||||

| Common Stock |

10 | 10 | ||||||

| Additional Paid-in-Capital |

210,903,996 | 210,903,996 | ||||||

| Contributed Capital |

— | — | ||||||

| Treasury Stock |

— | — | ||||||

| Retained Earning – Prior Year |

(118,718,232 | ) | (118,718,232 | ) | ||||

| Net Income |

(225,888 | ) | (1,150,902 | ) | ||||

|

|

|

|

|

|||||

| Net Shareholders Equity |

91,959,886 | 91,034,872 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders Equity |

$ | 93,338,904 | $ | 93,526,704 | ||||

|

|

|

|

|

|||||

| (1) | The all-trade motion authorizes the payment of all trade payables in normal course, and therefore only the Senior Notes and Interest Payable have been included in Liabilities subject to compromise. Additionally, Liabilities subject to compromise include the estimated make whole payment amounts. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-3: BALANCE SHEET

Cliffs Drilling Trinidad L.L.C.

| ASSETS CURRENT ASSETS |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Cash |

$ | — | $ | — | ||||

| Restricted Cash |

— | — | ||||||

| Accounts Receivable – Trade |

— | — | ||||||

| Accounts Receivable – Other |

— | — | ||||||

| Due to/from Affiliates |

(299 | ) | (299 | ) | ||||

| Deposits |

— | — | ||||||

| Prepaid & Other |

— | — | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

(299 | ) | (299 | ) | ||||

|

|

|

|

|

|||||

| PROPERTY, PLANT & EQUIPMENT |

||||||||

| Net Property, Plant & Equipment |

— | — | ||||||

| OTHER ASSETS |

||||||||

| Investment in/from Affiliates |

1,144 | 1,144 | ||||||

| Notes Receivable – Affiliates |

— | — | ||||||

| Other Assets |

— | — | ||||||

| Total Other Assets |

1,144 | 1,144 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 845 | $ | 845 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Accounts Payable |

$ | — | $ | — | ||||

| Accrued Liabilities |

— | — | ||||||

| Interest Payable |

— | — | ||||||

| Taxes Payable |

— | — | ||||||

| Other Current Liabilities |

— | — | ||||||

| Current portion of Long-Term Debt |

— | — | ||||||

| Deferred Income Taxes |

— | — | ||||||

| Notes Payable—Affiliates |

— | — | ||||||

| Other Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities Not Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| LIABILITIES SUBJECT TO COMPROMISE1 |

||||||||

| Total Liabilities Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| SHAREHOLDERS EQUITY |

||||||||

| Common Stock |

— | — | ||||||

| Additional Paid-in-Capital |

— | — | ||||||

| Contributed Capital |

9,360 | 9,360 | ||||||

| Treasury Stock |

— | — | ||||||

| Retained Earning – Prior Year |

(8,515 | ) | (8,515 | ) | ||||

| Net Income |

— | — | ||||||

|

|

|

|

|

|||||

| Net Shareholders Equity |

845 | 845 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders Equity |

$ | 845 | $ | 845 | ||||

|

|

|

|

|

|||||

| (1) | The all-trade motion authorizes the payment of all trade payables in normal course, and therefore only the Senior Notes and Interest Payable have been included in Liabilities subject to compromise. Additionally, Liabilities subject to compromise include the estimated make whole payment amounts. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-3: BALANCE SHEET

FDT LLC

| ASSETS CURRENT ASSETS |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Cash |

$ | — | $ | — | ||||

| Restricted Cash |

— | — | ||||||

| Accounts Receivable – Trade |

— | — | ||||||

| Accounts Receivable – Other |

— | — | ||||||

| Due to/from Affiliates |

— | — | ||||||

| Deposits |

— | — | ||||||

| Prepaid & Other |

— | — | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

— | — | ||||||

|

|

|

|

|

|||||

| PROPERTY, PLANT & EQUIPMENT |

||||||||

| Net Property, Plant & Equipment |

— | — | ||||||

| OTHER ASSETS |

||||||||

| Investment in/from Affiliates |

— | — | ||||||

| Notes Receivable – Affiliates |

— | — | ||||||

| Other Assets |

— | — | ||||||

| Total Other Assets |

— | — | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Accounts Payable |

$ | — | $ | — | ||||

| Accrued Liabilities |

— | — | ||||||

| Interest Payable |

— | — | ||||||

| Taxes Payable |

— | — | ||||||

| Other Current Liabilities |

— | — | ||||||

| Current portion of Long-Term Debt |

— | — | ||||||

| Deferred Income Taxes |

— | — | ||||||

| Notes Payable—Affiliates |

— | — | ||||||

| Other Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities Not Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| LIABILITIES SUBJECT TO COMPROMISE1 |

||||||||

| Total Liabilities Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| SHAREHOLDERS EQUITY |

||||||||

| Common Stock |

— | — | ||||||

| Additional Paid-in-Capital |

— | — | ||||||

| Contributed Capital |

— | — | ||||||

| Treasury Stock |

— | — | ||||||

| Retained Earning – Prior Year |

— | — | ||||||

| Net Income |

— | — | ||||||

|

|

|

|

|

|||||

| Net Shareholders Equity |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders Equity |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| (1) | The all-trade motion authorizes the payment of all trade payables in normal course, and therefore only the Senior Notes and Interest Payable have been included in Liabilities subject to compromise. Additionally, Liabilities subject to compromise include the estimated make whole payment amounts. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-3: BALANCE SHEET

FDT Holdings LLC

| ASSETS CURRENT ASSETS |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Cash |

$ | — | $ | — | ||||

| Restricted Cash |

— | — | ||||||

| Accounts Receivable – Trade |

— | — | ||||||

| Accounts Receivable – Other |

— | — | ||||||

| Due to/from Affiliates |

— | — | ||||||

| Deposits |

— | — | ||||||

| Prepaid & Other |

— | — | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

— | — | ||||||

|

|

|

|

|

|||||

| PROPERTY, PLANT & EQUIPMENT |

||||||||

| Net Property, Plant & Equipment |

— | — | ||||||

| OTHER ASSETS |

||||||||

| Investment in/from Affiliates |

— | — | ||||||

| Notes Receivable – Affiliates |

— | — | ||||||

| Other Assets |

— | — | ||||||

| Total Other Assets |

— | — | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Accounts Payable |

$ | — | $ | — | ||||

| Accrued Liabilities |

— | — | ||||||

| Interest Payable |

— | — | ||||||

| Taxes Payable |

— | — | ||||||

| Other Current Liabilities |

— | — | ||||||

| Current portion of Long-Term Debt |

— | — | ||||||

| Deferred Income Taxes |

— | — | ||||||

| Notes Payable—Affiliates |

— | — | ||||||

| Other Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities Not Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| LIABILITIES SUBJECT TO COMPROMISE1 |

||||||||

| Total Liabilities Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| SHAREHOLDERS EQUITY |

||||||||

| Common Stock |

— | — | ||||||

| Additional Paid-in-Capital |

— | — | ||||||

| Contributed Capital |

— | — | ||||||

| Treasury Stock |

— | — | ||||||

| Retained Earning – Prior Year |

— | — | ||||||

| Net Income |

— | — | ||||||

|

|

|

|

|

|||||

| Net Shareholders Equity |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders Equity |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| (1) | The all-trade motion authorizes the payment of all trade payables in normal course, and therefore only the Senior Notes and Interest Payable have been included in Liabilities subject to compromise. Additionally, Liabilities subject to compromise include the estimated make whole payment amounts. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-3: BALANCE SHEET

Hercules Drilling Company, LLC

| ASSETS CURRENT ASSETS |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Cash |

$ | 105,210,912 | $ | 162,264,792 | ||||

| Restricted Cash |

— | — | ||||||

| Accounts Receivable – Trade |

— | — | ||||||

| Accounts Receivable – Other |

38 | 34 | ||||||

| Due to/from Affiliates |

(3,419,592 | ) | (59,108,055 | ) | ||||

| Deposits |

— | — | ||||||

| Prepaid & Other |

856,800 | 914,397 | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

102,648,158 | 104,071,168 | ||||||

|

|

|

|

|

|||||

| PROPERTY, PLANT & EQUIPMENT |

||||||||

| Net Property, Plant & Equipment |

10,571,776 | 10,793,552 | ||||||

| OTHER ASSETS |

||||||||

| Investment in/from Affiliates |

— | — | ||||||

| Notes Receivable – Affiliates |

90,000,000 | 90,000,000 | ||||||

| Other Assets |

— | — | ||||||

| Total Other Assets |

90,000,000 | 90,000,000 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 203,219,934 | $ | 204,864,721 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Accounts Payable |

$ | 1,345,769 | $ | 1,270,472 | ||||

| Accrued Liabilities |

19,416,644 | 20,835,465 | ||||||

| Interest Payable |

— | — | ||||||

| Taxes Payable |

(389,633 | ) | (389,633 | ) | ||||

| Other Current Liabilities |

90,000 | 90,000 | ||||||

| Current portion of Long-Term Debt |

— | — | ||||||

| Deferred Income Taxes |

— | — | ||||||

| Notes Payable—Affiliates |

— | — | ||||||

| Other Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities Not Subject to Compromise |

20,462,780 | 21,806,303 | ||||||

|

|

|

|

|

|||||

| LIABILITIES SUBJECT TO COMPROMISE1 |

||||||||

| Total Liabilities Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

20,462,780 | 21,806,303 | ||||||

|

|

|

|

|

|||||

| SHAREHOLDERS EQUITY |

||||||||

| Common Stock |

— | — | ||||||

| Additional Paid-in-Capital |

— | — | ||||||

| Contributed Capital |

— | — | ||||||

| Treasury Stock |

— | — | ||||||

| Retained Earning – Prior Year |

181,789,741 | 181,789,741 | ||||||

| Net Income |

967,413 | 1,268,676 | ||||||

|

|

|

|

|

|||||

| Net Shareholders Equity |

182,757,154 | 183,058,417 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders Equity |

$ | 203,219,934 | $ | 204,864,721 | ||||

|

|

|

|

|

|||||

| (1) | The all-trade motion authorizes the payment of all trade payables in normal course, and therefore only the Senior Notes and Interest Payable have been included in Liabilities subject to compromise. Additionally, Liabilities subject to compromise include the estimated make whole payment amounts. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-3: BALANCE SHEET

Hercules Offshore Services LLC

| ASSETS CURRENT ASSETS |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Cash |

$ | (4,469 | ) | $ | (2,521 | ) | ||

| Restricted Cash |

— | — | ||||||

| Accounts Receivable – Trade |

2,006,285 | 1,082,562 | ||||||

| Accounts Receivable – Other |

(2,297 | ) | 2,435 | |||||

| Due to/from Affiliates |

17,770,152 | 20,348,276 | ||||||

| Deposits |

— | — | ||||||

| Prepaid & Other |

880,425 | 968,467 | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

20,650,096 | 22,399,219 | ||||||

|

|

|

|

|

|||||

| PROPERTY, PLANT & EQUIPMENT |

||||||||

| Net Property, Plant & Equipment |

25,600,850 | 25,741,767 | ||||||

| OTHER ASSETS |

||||||||

| Investment in/from Affiliates |

483,802,329 | 483,802,329 | ||||||

| Notes Receivable – Affiliates |

— | — | ||||||

| Other Assets |

— | — | ||||||

| Total Other Assets |

483,802,329 | 483,802,329 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 530,053,274 | $ | 531,943,314 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Accounts Payable |

$ | 1,145,737 | $ | 1,489,552 | ||||

| Accrued Liabilities |

(681,673 | ) | 1,174,739 | |||||

| Interest Payable |

— | — | ||||||

| Taxes Payable |

— | — | ||||||

| Other Current Liabilities |

— | — | ||||||

| Current portion of Long-Term Debt |

— | — | ||||||

| Deferred Income Taxes |

— | — | ||||||

| Notes Payable - Affiliates |

— | — | ||||||

| Other Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities Not Subject to Compromise |

464,063 | 2,664,291 | ||||||

|

|

|

|

|

|||||

| LIABILITIES SUBJECT TO COMPROMISE1 |

||||||||

| Total Liabilities Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

464,063 | 2,664,291 | ||||||

|

|

|

|

|

|||||

| SHAREHOLDERS EQUITY |

||||||||

| Common Stock |

— | — | ||||||

| Additional Paid-in-Capital |

265,099,970 | 265,099,970 | ||||||

| Contributed Capital |

65,545,741 | 65,545,741 | ||||||

| Treasury Stock |

— | — | ||||||

| Retained Earning – Prior Year |

201,796,230 | 201,796,230 | ||||||

| Net Income |

(2,852,730 | ) | (3,162,918 | ) | ||||

| Net Shareholders Equity |

529,589,211 | 529,279,023 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders Equity |

$ | 530,053,274 | $ | 531,943,314 | ||||

|

|

|

|

|

|||||

| (1) | The all-trade motion authorizes the payment of all trade payables in normal course, and therefore only the Senior Notes and Interest Payable have been included in Liabilities subject to compromise. Additionally, Liabilities subject to compromise include the estimated make whole payment amounts. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-3: BALANCE SHEET

Hercules Offshore Liftboat Company LLC

| ASSETS CURRENT ASSETS |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Cash |

$ | — | $ | — | ||||

| Restricted Cash |

— | — | ||||||

| Accounts Receivable – Trade |

— | — | ||||||

| Accounts Receivable – Other |

— | — | ||||||

| Due to/from Affiliates |

— | — | ||||||

| Deposits |

— | — | ||||||

| Prepaid & Other |

— | — | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

— | — | ||||||

|

|

|

|

|

|||||

| PROPERTY, PLANT & EQUIPMENT |

||||||||

| Net Property, Plant & Equipment |

— | — | ||||||

| OTHER ASSETS |

||||||||

| Investment in/from Affiliates |

— | — | ||||||

| Notes Receivable – Affiliates |

— | — | ||||||

| Other Assets |

— | — | ||||||

| Total Other Assets |

— | — | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Accounts Payable |

$ | — | $ | — | ||||

| Accrued Liabilities |

— | — | ||||||

| Interest Payable |

— | — | ||||||

| Taxes Payable |

— | — | ||||||

| Other Current Liabilities |

— | — | ||||||

| Current portion of Long-Term Debt |

— | — | ||||||

| Deferred Income Taxes |

— | — | ||||||

| Notes Payable - Affiliates |

— | — | ||||||

| Other Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities Not Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| LIABILITIES SUBJECT TO COMPROMISE1 |

||||||||

| Total Liabilities Subject to Compromise |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

— | — | ||||||

|

|

|

|

|

|||||

| SHAREHOLDERS EQUITY |

||||||||

| Common Stock |

— | — | ||||||

| Additional Paid-in-Capital |

— | — | ||||||

| Contributed Capital |

— | — | ||||||

| Treasury Stock |

— | — | ||||||

| Retained Earning – Prior Year |

— | — | ||||||

| Net Income |

— | — | ||||||

| Net Shareholders Equity |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders Equity |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| (1) | The all-trade motion authorizes the payment of all trade payables in normal course, and therefore only the Senior Notes and Interest Payable have been included in Liabilities subject to compromise. Additionally, Liabilities subject to compromise include the estimated make whole payment amounts. |

| (2) | The balance sheets and statements of operations included in the Monthly Operating Report are unaudited and subject to adjustment, including year-end adjustments and any audit-related adjustments. |

| In re | HERCULES OFFSHORE, INC., ET AL. DEBTOR |

Case No. | 16-11385 | |||

| Debtor | Reporting Period: | JUN. 5 - JUN. 30, 2016 |

MOR-3: BALANCE SHEET

HERO Holdings, Inc.

| ASSETS CURRENT ASSETS |

Book Value at End of Current Reporting Month |

Book Value on 5/31/16 |

||||||

| Cash |

$ | — | $ | — | ||||

| Restricted Cash |

— | — | ||||||

| Accounts Receivable – Trade |

— | — | ||||||

| Accounts Receivable – Other |

— | — | ||||||

| Due to/from Affiliates |

16,880,323 | 17,741,246 | ||||||

| Deposits |

— | — | ||||||

| Prepaid & Other |

(0 | ) | (0 | ) | ||||

|

|

|

|

|

|||||

| Total Current Assets |

16,880,323 | 17,741,246 | ||||||

|

|

|

|

|

|||||

| PROPERTY, PLANT & EQUIPMENT |

||||||||

| Net Property, Plant & Equipment |

— | — | ||||||

| OTHER ASSETS |

||||||||

| Investment in/from Affiliates |

480,974,730 | 480,974,730 | ||||||

| Notes Receivable – Affiliates |

— | |||||||

| Other Assets |

— | |||||||

| Total Other Assets |

480,974,730 | 480,974,730 | ||||||

|

|

|

|

|

|||||