Attached files

| file | filename |

|---|---|

| EX-99.3 - TRUEBLUE INVESTOR PRESENTATION - TrueBlue, Inc. | investorroadshowpresenta.htm |

| 8-K - TRUEBLUE FORM 8-K - TrueBlue, Inc. | tbi2016q2pressrelease.htm |

| EX-99.1 - TRUEBLUE Q2 2016 PRESS RELEASE - TrueBlue, Inc. | tbi2016q2pressreleaseexhib.htm |

www.TrueBlue.com

www.TrueBlue.com

Forward-Looking Statements

Certain statements made by us in this presentation that are not historical facts or that relate to future plans, events or

performances are forward-looking statements that reflect management’s current outlook for future periods, including statements

regarding future financial performance. These forward-looking statements are based upon our current expectations, and our actual

results may differ materially from those described or contemplated in the forward–looking statements. Factors that may cause our

actual results to differ materially from those contained in the forward-looking statements, include without limitation the following: 1)

national and global economic conditions, including the impact of changes in national and global credit markets and other changes

that affect our customers; 2) our ability to continue to attract and retain customers and maintain profit margins in the face of new

and existing competition; 3) new laws and regulations that could have a materially adverse effect on our operations and financial

results; 4) increased costs and collateral requirements in connection with our insurance obligations, including workers’

compensation insurance; 5) our continuing ability to comply with the financial covenants of our credit agreement; 6) our ability to

attract and retain qualified employees in key positions or to find temporary and permanent employees with the right skills to fulfill

the needs of our customers; 7) our ability to successfully complete and integrate acquisitions that we may make; and 8) other risks

described in our most recent filings with the Securities and Exchange Commission.

Use of estimates and forecasts:

Any references made to fiscal 2016 are based on management guidance issued July 20, 2016, and are included for informational

purposes only. We assume no obligation to update or revise any forward-looking statement, whether as a result of new

information, future events, or otherwise, except as required by law. Any other reference to future financial estimates are included

for informational purposes only and subject to risk factors discussed in our most recent filings with the Securities Exchange

Commission.

Financial Comparisons

All comparisons are to prior year periods unless stated otherwise.

www.TrueBlue.com

Q2 2016 Highlights

Total revenue growth 7%, low end of our prior outlook

Organic revenue decline of 1%

Continued organic softness in Staffing Services segment

Strong results in Managed Services segment

Net loss of $64M included a non-cash impairment charge of $80

million, net of tax1

Goodwill and intangible assets primarily related to the reduced scope of

services with our largest customer reported by TrueBlue in April 2016

Adjusted EBITDA2 $37 million, above the high end of prior outlook

Cost management actions producing favorable results in both segments

1 Equivalent to $1.91 per diluted share. Pre-tax impairment was $99 million, $67 million within the Staff Management reporting unit related to the reduced scope of services with our largest customer, $32 million related to outlook

changes in the PlaneTechs and HRX reporting units reflecting recent economic and industry conditions.

2 See Appendix for definitions of non-GAAP financial terms.

www.TrueBlue.com

Financial Summary

Excluding company’s largest customer, organic revenue growth was 2%

Pricing and cost management actions position company to improve future

Adjusted EBITDA margin

Amounts in millions, except for earnings per share Q2 2016 Change

Revenue $673 +7% (-1% organic)

Net loss $64 NM

Net loss Per Share $1.53 NM

Adjusted Earnings Per Share1 $0.51 Flat

Adjusted EBITDA

% Margin

$37

5.5%

Flat

-50bps

1 See Appendix for definitions of non-GAAP financial terms.

www.TrueBlue.com

Gross Margin and SG&A Bridges

24.2%

25.3%

0.8% 0.4%

0.1%

Q2 2015 Acquisitions Revenue Mix Bill/Pay & Other Q2 2016

$,118

$,136

$,10 $,8

Q2 2015 Acquisitions Organic Business Q2 2016

SG&A

Amounts in millions

Gross Margin

www.TrueBlue.com

Staffing Services Segment1

Excluding the company’s largest customer, organic revenue grew 1%

Positive results from price increases with new and existing customers

Disciplined cost management across the business, 9 branches

consolidated

Amounts in millions Q2 2016 Change

Revenue $626 +4% (-2% organic)

Adjusted EBITDA $35 -11%

Adjusted EBITDA Margin 5.6% -90bps

1 Staffing Services includes all contingent labor businesses.

www.TrueBlue.com

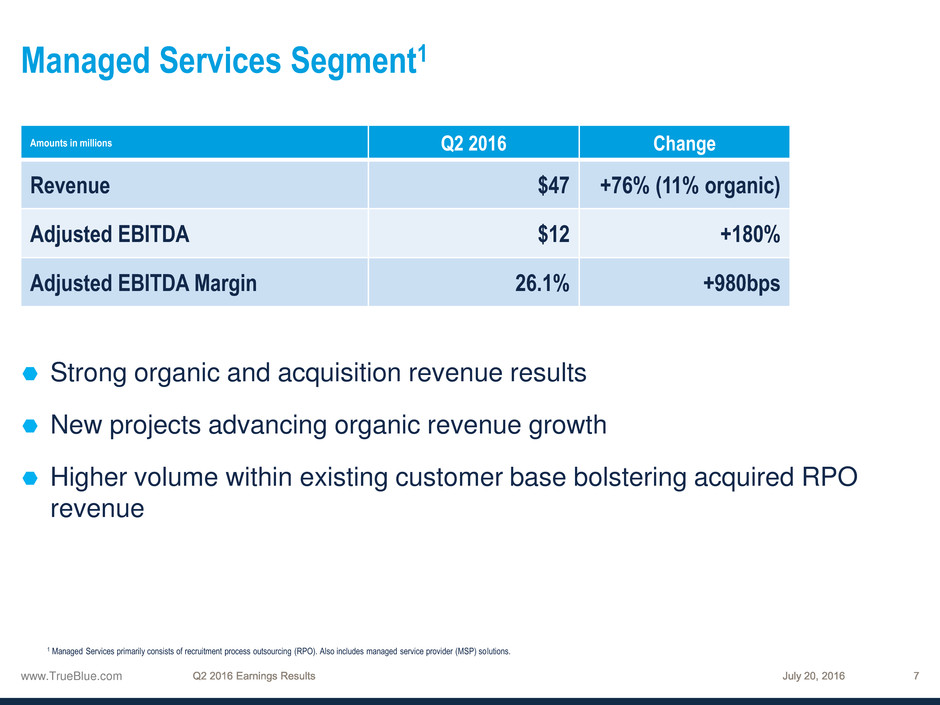

Managed Services Segment1

Strong organic and acquisition revenue results

New projects advancing organic revenue growth

Higher volume within existing customer base bolstering acquired RPO

revenue

Amounts in millions Q2 2016 Change

Revenue $47 +76% (11% organic)

Adjusted EBITDA $12 +180%

Adjusted EBITDA Margin 26.1% +980bps

1 Managed Services primarily consists of recruitment process outsourcing (RPO). Also includes managed service provider (MSP) solutions.

www.TrueBlue.com

$180

$216

$128

$202

$246

$150

2014 2015 Q2 2016

Net Debt Cash

$101

$77

$126

$21

$30

$22 $123

$107

$148

2014 2015 Q2 2016

Borrowing Availability Cash

Debt and Liquidity Highlights

30% 31%

24%

2014 2015 Q2 2016

Total Debt

Liquidity

Debt to Total

Capital

Amounts in millions

Amounts in millions

Note: Balances as of fiscal period end. Figures on this page may not sum due to rounding.

www.TrueBlue.com

www.TrueBlue.com

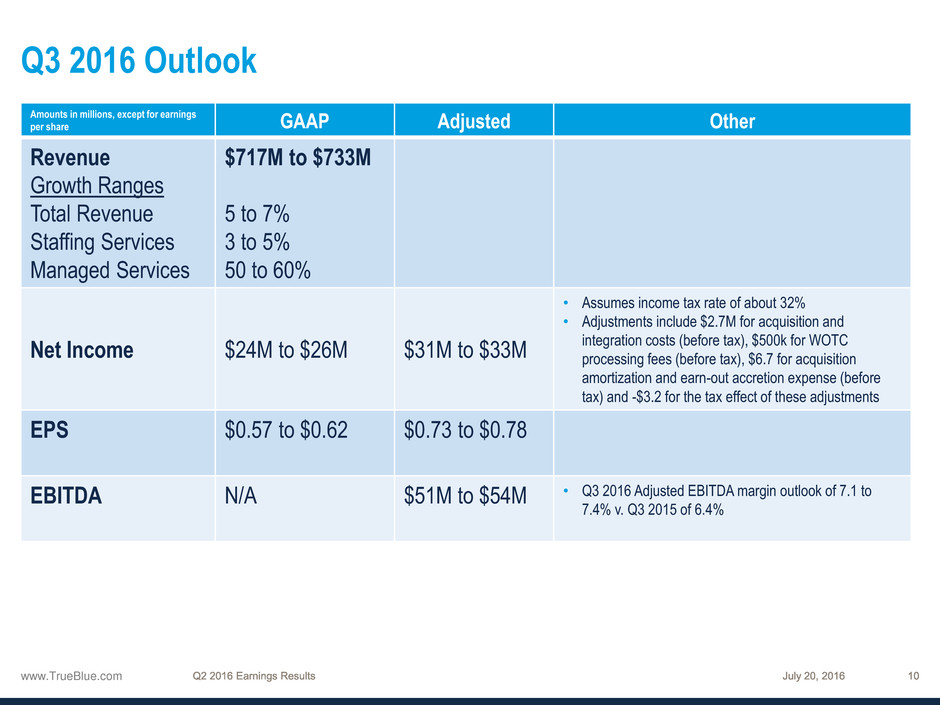

Q3 2016 Outlook

Amounts in millions, except for earnings

per share GAAP Adjusted Other

Revenue

Growth Ranges

Total Revenue

Staffing Services

Managed Services

$717M to $733M

5 to 7%

3 to 5%

50 to 60%

Net Income $24M to $26M $31M to $33M

• Assumes income tax rate of about 32%

• Adjustments include $2.7M for acquisition and

integration costs (before tax), $500k for WOTC

processing fees (before tax), $6.7 for acquisition

amortization and earn-out accretion expense (before

tax) and -$3.2 for the tax effect of these adjustments

EPS

$0.57 to $0.62

$0.73 to $0.78

EBITDA

N/A

$51M to $54M

• Q3 2016 Adjusted EBITDA margin outlook of 7.1 to

7.4% v. Q3 2015 of 6.4%

www.TrueBlue.com

www.TrueBlue.com

Non-GAAP Terms and Definitions

EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA excludes interest, taxes, depreciation and amortization,

and goodwill and intangible asset impairment charges from net income. Adjusted EBITDA further excludes from EBITDA costs

related to acquisition and integration, and Work Opportunity Tax Credit third-party processing fees. EBITDA and Adjusted EBITDA

are key measures used by management to evaluate performance. EBITDA and Adjusted EBITDA should not be considered

measures of financial performance in isolation or as an alternative to Income from operations in the Consolidated Statements of

Operations in accordance with GAAP, and may not be comparable to similarly titled measures of other companies.

Adjusted net income is a non-GAAP financial measure which excludes from Net income (loss) costs related to acquisition and

integration, amortization of intangible assets of acquired businesses, accretion expense related to acquisition earn-out, goodwill

and intangible asset impairment charges, and Work Opportunity Tax Credit third-party processing fees, tax effect of each

adjustment to GAAP net income (loss), and adjusts income taxes to the expected ongoing effective tax rate. Adjusted net income

should not be considered a measure of financial performance in isolation or as an alternative to net income (loss) in the

Consolidated Statements of Operations in accordance with GAAP, and may not be comparable to similarly titled measures of other

companies.

Adjusted net income per diluted share is a non-GAAP financial measure which excludes from net income (loss) on a per diluted

share basis costs related to goodwill and intangible asset impairment charges, acquisition and integration, Work Opportunity Tax

Credit third-party processing fees, amortization of intangibles of acquired businesses, accretion expense related to acquisition

earn-out, tax effect of each adjustment to GAAP net income (loss), and adjusts income taxes to the expected ongoing effective tax

rate. Adjusted net income per diluted share is a key measure used by management to evaluate performance and communicate

comparable results. Adjusted net income per diluted share should not be considered a measure of financial performance in

isolation or as an alternative to net income per diluted share in the Consolidated Statements of Operations in accordance with

GAAP, and may not be comparable to similarly titled measures of other companies.

See “Financials” in the Investors section of our web site at www.trueblue.com for a full reconciliation of non-GAAP financial

measures to GAAP financial results.

July 20, 2016