Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Seventy Seven Energy Inc. | d22000dex992.htm |

| EX-2.1 - EX-2.1 - Seventy Seven Energy Inc. | d22000dex21.htm |

| 8-K - 8-K - Seventy Seven Energy Inc. | d22000d8k.htm |

Exhibit 99.1

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| In re: | Seventy Seven Finance Inc. et al. |

Case No: | 16-11409 (LSS) | |||||

| Debtors | Jointly Administered |

INITIAL MONTHLY OPERATING REPORT

File report and attachments with the Court and submit a copy to the United States Trustee within 15 days after the order relief.

Certificates of insurance must name United States Trustee as a party to be notified in the event of policy cancellation. Bank accounts and checks must bear the name of the debtor, the case number, and the designation “Debtor in Possession.” Examples of acceptable evidence of Debtor in Possession Bank accounts include voided checks, copy of bank deposit agreement/certificate of authority, signature card, and/or corporate checking resolution.

| REQUIRED DOCUMENTS |

Document Attached |

Explanation Attached | ||

| 12-Month Cash Flow Projection (Form IR-1) |

Yes (1) | No | ||

| Certificates of Insurance: |

Yes (2) | No | ||

| Workers Compensation |

||||

| Property |

||||

| General Liability |

||||

| Vehicle |

||||

| Other: |

||||

| Indentify areas of self-insurance w/ liability caps |

||||

| Evidence of Debtor in Possession Bank Accounts |

Yes (3) | No | ||

| Tax Escrow Account |

||||

| General Operating Account |

||||

| Money Market Account pursuant to Local Rule 4001-3. Refer to |

||||

| http://www.deb.uscourts.gov/ |

||||

| Other: |

||||

| Retainers Paid (Form IR-2) |

Yes | No |

Note(s):

| (1) | See excerpt of DIP motion for Debtors’ 13-Week Cash Flow Projection (Docket #47, filed 06/08/16) |

| (2) | See attached Certificates of Insurance |

| (3) | See excerpt of Cash Management motion for charts of accounts (Docket item #15, entered 06/07/16) |

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the documents attached are true and correct to the best of my knowledge and belief.

| /s/ Cary D. Baetz |

June 22, 2016 | |||

| Signature of Authorized Individual * | Date | |||

| Cary D. Baetz |

Chief Financial Officer | |||

| Name of Authorized Individual | Title of Authorized Individual | |||

| * | Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager if debtor is a limited liability company. |

Exhibit 1 to Initial Operating Report

13-Week Cash Flow

(Docket item #47, filed 06/08/16)

| Seventy Seven Energy Inc. - Company Consolidated 13-Week Cash Flow Forecast As of 6/6/2016 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 1 WE 6-3 |

2 WE 6-10 |

3 WE 6-17 |

4 WE 6-24 |

5 WE 7-1 |

6 WE 7-8 |

7 WE 7-15 |

8 WE 7-22 |

9 WE 7-29 |

10 WE 8-5 |

11 WE 8-12 |

12 WE 8-19 |

13 WE 8-26 |

13 week Total |

||||||||||||||||||||||||||||||||||||||||||

| Begining Book Cash |

$ | 62,672 | $ | 73,676 | $ | 58,414 | $ | 55,210 | $ | 62,585 | $ | 55,337 | $ | 65,724 | $ | 62,348 | $ | 28,022 | $ | 25,771 | $ | 37,263 | $ | 28,768 | $ | 27,871 | $ | 62,672 | ||||||||||||||||||||||||||||

| Cash Receipts |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Customer Cash Receipts |

$ | 22,333 | $ | 12,160 | $ | 10,006 | $ | 12,078 | $ | 8,381 | $ | 19,601 | $ | 12,542 | $ | 4,669 | $ | 8,378 | $ | 19,291 | $ | 6,993 | $ | 6,373 | $ | 6,206 | $ | 149,011 | ||||||||||||||||||||||||||||

| Miscellaneous Cash Receipts |

2,592 | 350 | — | — | 2,130 | — | — | — | 1,275 | — | — | — | — | 6,348 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total Cash Receipts |

$ | 24,926 | $ | 12,510 | $ | 10,006 | $ | 12,078 | $ | 10,511 | $ | 19,601 | $ | 12,542 | $ | 4,669 | $ | 9,654 | $ | 19,291 | $ | 6,993 | $ | 6,373 | $ | 6,206 | $ | 155,359 | ||||||||||||||||||||||||||||

| Operating Cash Disbursements |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Labor Cost |

$ | (6,059 | ) | $ | (285 | ) | $ | (6,023 | ) | $ | (14 | ) | $ | (6,591 | ) | $ | — | $ | (7,188 | ) | $ | — | $ | (5,938 | ) | $ | — | $ | (5,938 | ) | $ | — | $ | (5,938 | ) | $ | (43,974 | ) | ||||||||||||||||||

| Operating Disbursements |

(4,988 | ) | (5,236 | ) | (4,956 | ) | (2,935 | ) | (7,146 | ) | (6,456 | ) | (4,370 | ) | (6,322 | ) | (4,379 | ) | (5,550 | ) | (5,509 | ) | (5,650 | ) | (5,735 | ) | (69,233 | ) | ||||||||||||||||||||||||||||

| Insurance |

(50 | ) | (2,054 | ) | — | — | — | — | — | — | — | — | — | — | — | (2,104 | ) | |||||||||||||||||||||||||||||||||||||||

| Tax |

(305 | ) | — | — | (500 | ) | — | — | — | (500 | ) | — | (7 | ) | — | (500 | ) | — | (1,813 | ) | ||||||||||||||||||||||||||||||||||||

| Capex |

(1,335 | ) | (2,605 | ) | (1,481 | ) | (773 | ) | (2,056 | ) | (1,586 | ) | (3,816 | ) | (1,735 | ) | (1,587 | ) | (1,968 | ) | (1,116 | ) | (1,121 | ) | (1,017 | ) | (22,195 | ) | ||||||||||||||||||||||||||||

| Professional Fees |

(357 | ) | — | (217 | ) | (100 | ) | (185 | ) | — | (13 | ) | (400 | ) | — | (175 | ) | — | — | (400 | ) | (1,847 | ) | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total Operating Cash Disbursements |

$ | (13,095 | ) | $ | (10,180 | ) | $ | (12,678 | ) | $ | (4,322 | ) | $ | (15,978 | ) | $ | (8,041 | ) | $ | (15,387 | ) | $ | (8,957 | ) | $ | (11,904 | ) | $ | (7,700 | ) | $ | (12,563 | ) | $ | (7,270 | ) | $ | (13,090 | ) | $ | (141,166 | ) | ||||||||||||||

| Debt Service |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest |

$ | (100 | ) | $ | — | $ | — | $ | — | $ | (25 | ) | $ | — | $ | — | $ | — | $ | — | $ | (100 | ) | $ | — | $ | — | $ | — | $ | (225 | ) | ||||||||||||||||||||||||

| Amortization |

— | — | — | — | (1,250 | ) | — | — | (15,000 | ) | — | — | — | — | — | (16,250 | ) | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total Debt Service Disbursements |

$ | (100 | ) | $ | — | $ | — | $ | — | $ | (1,275 | ) | $ | — | $ | — | $ | (15,000 | ) | $ | — | $ | (100 | ) | $ | — | $ | — | $ | — | $ | (16,475 | ) | |||||||||||||||||||||||

| Total Operating Disbursements |

$ | (13,195 | ) | $ | (10,180 | ) | $ | (12,678 | ) | $ | (4,322 | ) | $ | (17,253 | ) | $ | (8,041 | ) | $ | (15,387 | ) | $ | (23,957 | ) | $ | (11,904 | ) | $ | (7,800 | ) | $ | (12,563 | ) | $ | (7,270 | ) | $ | (13,090 | ) | $ | (157,641 | ) | ||||||||||||||

| Operating Cash Flow |

$ | 11,731 | $ | 2,329 | $ | (2,672 | ) | $ | 7,756 | $ | (6,742 | ) | $ | 11,559 | $ | (2,845 | ) | $ | (19,288 | ) | $ | (2,250 | ) | $ | 11,491 | $ | (5,570 | ) | $ | (897 | ) | $ | (6,884 | ) | $ | (2,282 | ) | |||||||||||||||||||

| Restructuring Related |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Professional Fees |

$ | (726 | ) | $ | (16,881 | ) | $ | (531 | ) | $ | (381 | ) | $ | (506 | ) | $ | (1,131 | ) | $ | (531 | ) | $ | (4,719 | ) | $ | — | $ | — | $ | (2,925 | ) | $ | — | $ | — | $ | (28,330 | ) | ||||||||||||||||||

| Financing Fees |

— | (517 | ) | — | — | — | (42 | ) | — | (10,320 | ) | — | — | — | — | — | (10,878 | ) | ||||||||||||||||||||||||||||||||||||||

| Utilities Deposit |

— | (194 | ) | — | — | — | — | — | — | — | — | — | — | — | (194 | ) | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total Bankruptcy Related Charges |

$ | (726 | ) | $ | (17,592 | ) | $ | (531 | ) | $ | (381 | ) | $ | (506 | ) | $ | (1,173 | ) | $ | (531 | ) | $ | (15,039 | ) | $ | — | $ | — | $ | (2,925 | ) | $ | — | $ | — | $ | (39,403 | ) | ||||||||||||||||||

| Net Operating Cash Flow (After Restructuring) |

$ | 11,005 | $ | (15,262 | ) | $ | (3,203 | ) | $ | 7,375 | $ | (7,248 | ) | $ | 10,387 | $ | (3,376 | ) | $ | (34,326 | ) | $ | (2,250 | ) | $ | 11,491 | $ | (8,495 | ) | $ | (897 | ) | $ | (6,884 | ) | $ | (41,685 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Ending Book Cash |

$ | 73,676 | $ | 58,414 | $ | 55,210 | $ | 62,585 | $ | 55,337 | $ | 65,724 | $ | 62,348 | $ | 28,022 | $ | 25,771 | $ | 37,263 | $ | 28,768 | $ | 27,871 | $ | 20,986 | $ | 20,986 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Cash & Liquidity |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Beginning Book Cash |

$ | 62,672 | $ | 73,676 | $ | 58,414 | $ | 55,210 | $ | 62,585 | $ | 55,337 | $ | 65,724 | $ | 62,348 | $ | 28,022 | $ | 25,771 | $ | 37,263 | $ | 28,768 | $ | 27,871 | $ | 62,672 | ||||||||||||||||||||||||||||

| Change in Cash |

11,005 | (15,262 | ) | (3,203 | ) | 7,375 | (7,248 | ) | 10,387 | (3,376 | ) | (34,326 | ) | (2,250 | ) | 11,491 | (8,495 | ) | (897 | ) | (6,884 | ) | (41,685 | ) | ||||||||||||||||||||||||||||||||

| Revolver Draw |

— | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Ending Book Cash |

$ | 73,676 | $ | 58,414 | $ | 55,210 | $ | 62,585 | $ | 55,337 | $ | 65,724 | $ | 62,348 | $ | 28,022 | $ | 25,771 | $ | 37,263 | $ | 28,768 | $ | 27,871 | $ | 20,986 | $ | 20,986 | ||||||||||||||||||||||||||||

| Revolver Excess Availability |

$ | 52,870 | $ | 52,870 | $ | 52,329 | $ | 52,329 | $ | 52,329 | $ | 52,329 | $ | 52,329 | $ | 45,096 | $ | 45,096 | $ | 45,096 | $ | 45,096 | $ | 45,742 | $ | 45,742 | $ | 45,742 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total Liquidity |

$ | 126,547 | $ | 111,284 | $ | 107,539 | $ | 114,914 | $ | 107,666 | $ | 118,053 | $ | 114,677 | $ | 73,118 | $ | 70,868 | $ | 82,359 | $ | 73,864 | $ | 73,613 | $ | 66,728 | $ | 66,728 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Short Term Investments |

$ | 3,900 | $ | 3,900 | $ | 3,900 | $ | 3,900 | $ | 1,770 | $ | 1,770 | $ | 1,770 | $ | 1,770 | $ | 495 | $ | 495 | $ | 495 | $ | 495 | $ | 495 | $ | 495 | ||||||||||||||||||||||||||||

| Outstanding Payment Float |

5,077 | 2,003 | 2,474 | 2,575 | 2,525 | 2,301 | 2,010 | 2,456 | 2,567 | 2,386 | 2,634 | 2,319 | 2,545 | 2,545 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Estimated Ending Bank Cash |

$ | 82,654 | $ | 64,317 | $ | 61,584 | $ | 69,060 | $ | 59,632 | $ | 69,795 | $ | 66,128 | $ | 32,248 | $ | 28,833 | $ | 40,143 | $ | 31,896 | $ | 30,684 | $ | 24,026 | $ | 24,026 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

Exhibit 2 to Initial Operating Report

Certificate of Insurance

June 15, 2016

Office of the United States Trustee

844 King Street

Suite 2207

Lockbox 35

Wilmington, DE 19801

| RE: | In re Seventy Seven Energy |

Dear United States Trustee:

The Houston Series of Lockton Companies, LLC (“Lockton”) serves as insurance broker for Seventy Seven Energy and its subsidiaries (collectively “Seventy Seven”) with respect to the policies referenced in Exhibit A (the “Policies”).

During the pendency of Seventy Seven’s Chapter 11 case, Lockton hereby agrees to notify the United States Trustee, at the following address, of any claim made under any of the Policies that Lockton is made aware of:

Office of the United States Trustee

844 King Street

Suite 2207

Lockbox 35

Wilmington, DE 19801

Should you have any questions, please do not hesitate to contact me at 713-458-5283.

Sincerely,

Houston Series of Lockton Companies, LLC

By: Joseph W. Dryden, AVP and Account Executive

LOCKTON COMPANIES

5847 San Felipe, Suite 320 / Houston, TX 77057-3183

713-458-5200 / FAX: 713-458-5299

www.lockton.com

EXHIBIT A

| Type of Coverage | Carrier | Policy Number | Policy Period | |||

| Worker’s Comp & Employer’s Liability - All Other States | Starr Indemnity & Liability Company through Starr Energy | 100 0001410-02 | 6/30/16-9/30/16 | |||

| Worker’s Comp & Employer’s Liability - All Other States | Starr Indemnity & Liability Company through Starr Energy | 100 0001779-01 | 6/30/16-9/30/16 | |||

| Excess Worker’s Comp - Oklahoma | Starr Indemnity & Liability Company through Starr Energy | 100 0001409-02 | 6/30/16-9/30/16 | |||

| Auto Liability | Starr Indemnity & Liability Company through Starr Energy | SISIPCA08298215 | 6/30/15-9/30/16 | |||

| General Liability | National Marine & Fire Ins Co. through Berkshire Hathaway | 42-GLO-100249-02 | 6/30/15-9/30/16 | |||

| Umbrella Liability - $25M | National Marine & Fire Ins Co. through Berkshire Hathaway | 42-UMO-100250-02 | 6/30/15-9/30/16 | |||

| Excess Liability - $25M xs $25M | American Guarantee & Liability Ins Co through Zurich | AEC0173065-01 | 6/30/15-9/30/16 | |||

| Excess Liability - $25M xs $50M | Ironshore Specialty Insurance Company through Ironshore | 2059601 | 6/30/15-9/30/16 | |||

| Excess Liability - $35M xs $75M | Westchester Surplus Lines Insurance Company through Swett & Crawford | G27467337002 | 6/30/15-9/30/16 | |||

| Excess Liability - $25m xs $100M | Berkley Custom through Swett & Crawford | CEX09601105-01 | 6/30/15-9/30/16 | |||

| Excess Liability - $25M xs $125M | North American Specialty Insurance Company through Swiss Re | ECX-1000004-01 | 6/30/15-9/30/16 | |||

| Alesco through Lloyd’s of London: | ||||||

| AEGIS Casualty Consortium, Syndicate 9369 | ||||||

| Navigators Syndicate 1221 | ||||||

| Talbots , Syndicate 1183 | ||||||

| Excess Liability - $50M xs $150M | Apollo Liability Consortium, Syndicate 9984 | B1263EG0106715 | 6/30/15-9/30/16 | |||

| Markel, Syndicate 3000 | ||||||

| Novae, Syndicate 2007 | ||||||

| Chaucer, Syndicate 1084 | ||||||

| BAR, Syndicate 1955 | ||||||

| Non-Owned Aviation | Starnet Insurance Company through Berkley Aviation | BA-15-06-00019 | 6/30/15-9/28/16 | |||

| Contractors Pollution | AIG Specialty Insurance Company through AIG | CPL13015942 | 6/30/15-9/30/16 | |||

| Property | Affiliated FM | GN437 | 6/30/15-10/1/16 | |||

| Contractor’s Equipment | London | B1263EG002814 | 10/1/15-10/1/16 | |||

| Primary D&O Liability ($10M) | U.S. Specialty Insurance Company | 14-MGU-15-A35050 | 6/30/15 –6/30/16 | |||

| Primary D&O Liability ($10M) | U.S. Specialty Insurance Company | 14-MGU-15-A35050 | 6/30/15 –6/30/16 | |||

| 1st Excess D&O Liability ($10M x $10M) | National Union Fire Insurance Company of Pittsburgh, Pa. | 01-421-44-57 | 6/30/15-6/30/16 | |||

| 2nd Excess D&O Liability ($15M x $20M) | XL Specialty Insurance Company | ELU139640-15 | 6/30/15-6/30/16 | |||

| 3rd Excess D&O Liability ($15M x $35M) | Energy Insurance Mutual Limited | 293145-15DO | 6/30/15-6/30/16 | |||

| Type of Coverage | Carrier | Policy Number | Policy Period | |||

| 4th Excess D&O Liability ($5M x $45M) | Beazley Insurance Company, Inc. | V15E6A150201 | 6/30/15-6/30/16 | |||

| 5th Excess D&O Liability – Side A ($10M x $55M) | ACE Bermuda Insurance Ltd. | SSE-2263C | 6/30/15-6/30/16 | |||

| 6th Excess D&O Liability – Side A ($10M x $65M) | Allied World Assurance Company Ltd. | C020439/002 | 6/30/15-6/30/16 | |||

| Primary Fiduciary Liability ($10M) | U.S. Specialty Insurance Company | 14-MGU-15-A35051 | 6/30/15-6/30/16 | |||

| 1st Excess Fiduciary Liability ($10M x $10M) | XL Specialty Insurance Company | ELU139634-15 | 6/30/15-6/30/16 | |||

| 2nd Excess Fiduciary Liability ($10M x $30M) | Freedom Specialty Insurance Company | XMF1501171 | 6/30/15-6/30/16 | |||

| 3rd Excess Fiduciary Liability ($10M x $40M) | Beazley Insurance Company, Inc. | V15E30150201 | 6/30/15-6/30/16 | |||

| Employment Practices Liability | National Union Fire Insurance Company of Pittsburgh, Pa. | 14214455 | 6/30/15-9/30/16 | |||

| Commercial Crime | Great American Insurance Company | SAA 098-82-79-01-00 | 6/30/15-9/30/16 | |||

| Special Crime | Federal Insurance Company | 8240-8875 | 6/30/15-9/30/16 | |||

| Primary D&O Liability ($10M) | XL Specialty Insurance Company | ELU144700-16 | 6/30/16-6/30/17 | |||

| 1st Excess D&O Liability ($10M x $10M) | National Union Fire Insurance Company of Pittsburgh, Pa. | 01-436-21-53 | 6/30/16-6/30/17 | |||

| 2nd Excess D&O Liability ($10M x $20M) | Beazley Insurance Company, Inc. | V15E6A160301 | 6/30/16-6/30/17 | |||

| 3rd Excess D&O Liability ($5M x $30M) | Allied World Assurance Company | 0310-1749 | 6/30/16-6/30/17 | |||

| 4th Excess D&O Liability – Side A ($10M x $35M) | ACE Bermuda Insurance Ltd. | SSE-2481C | 6/30/16-6/30/17 | |||

| 5th Excess D&O Liability – Side A ($10M x $45M) | Allied World Assurance Company Ltd. | C020439/003 | 6/30/16-6/30/17 | |||

| Primary Fiduciary Liability ($10M) | XL Specialty Insurance Company | ELU144702-16 | 6/30/16-6/30/17 | |||

| 1st Excess Fiduciary Liability ($10M x $10M) | National Union Fire Insurance Company of Pittsburgh, Pa. | 01-436-15-45 | 6/30/16-6/30/17 | |||

| 2nd Excess Fiduciary Liability ($10M x $30M) | Freedom Specialty Insurance Company | XMF1601171 | 6/30/16-6/30/17 | |||

| 3rd Excess Fiduciary Liability ($10M x $40M) | Beazley Insurance Company, Inc. | V15E30160301 | 6/30/16-6/30/17 | |||

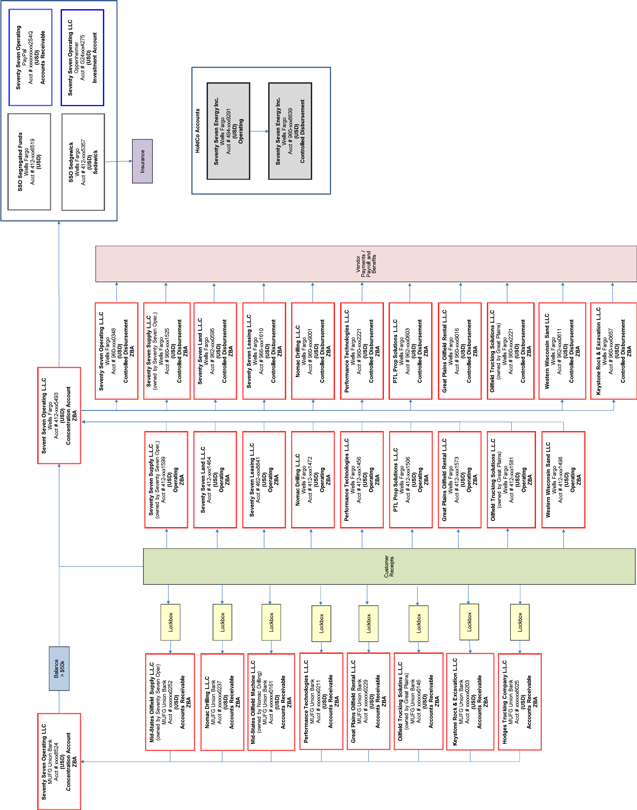

Exhibit 3 to Initial Operating Report

Debtor-in-Possession Bank Accounts

(Docket item #15, filed 06/07/16)

| Order | Account Name | Account Number | Bank/Entity | |||||

| 1010 |

SSE Operating |

4946309291 | Wells Fargo | |||||

| 1011 |

SSE Disbursement |

9600158639 | Wells Fargo | |||||

| 1020 |

SSO Operating |

4127275493 | Wells Fargo | |||||

| 1021 |

SSO Disbursement |

9606000348 | Wells Fargo | |||||

| 1030 |

SSO Segregated Funds |

4122796519 | Wells Fargo | |||||

| 1040 |

SSO Sedewick |

4129615357 | Wells Fargo | |||||

| 1050 |

SSS Operating |

4120001599 | Wells Fargo | |||||

| 1051 |

SSS Disbursement |

9600171525 | Wells Fargo | |||||

| 1060 |

SSL Operating |

4120021464 | Wells Fargo | |||||

| 1061 |

SSL Disbursement |

9622000595 | Wells Fargo | |||||

| 1070 |

SSE Leasing Operting |

4623948841 | Wells Fargo | |||||

| 1071 |

SSE Leasing Disbursement |

9669451610 | Wells Fargo | |||||

| 1080 |

Nomac Operating |

4120021472 | Wells Fargo | |||||

| 1081 |

Nomac Disbursement |

9600099001 | Wells Fargo | |||||

| 1090 |

PTL Disbursement |

9600142221 | Wells Fargo | |||||

| 1100 |

PTL Operating |

4120021456 | Wells Fargo | |||||

| 1101 |

PTL Prop Disbursement |

9622000603 | Wells Fargo | |||||

| 1110 |

PTL Prop Operating |

4120021506 | Wells Fargo | |||||

| 1111 |

Great Plains Operating |

4120001573 | Wells Fargo | |||||

| 1120 |

Great Plains Disbursement |

9600099016 | Wells Fargo | |||||

| 1130 |

OTS Operating |

4120001581 | Wells Fargo | |||||

| 1131 |

OTS Disbursement |

9600153246 | Wells Fargo | |||||

| 1140 |

WWS Operating |

4120021498 | Wells Fargo | |||||

| 1141 |

WWS Disbursement |

9622000611 | Wells Fargo | |||||

| 1151 |

Keystone Rock & Excavation Disbursement |

9600140657 | Wells Fargo | |||||

| 2001 |

Seventy Seven Operating |

0040828524 | Union | |||||

| 2002 |

Mid-States Oilfield Supply |

4171000252 | Union | |||||

| 2003 |

Nomac Drilling |

4171000237 | Union | |||||

| 2004 |

Mid-States Oilfield Machine |

4171000161 | Union | |||||

| 2005 |

Performance Technologies |

4171000211 | Union | |||||

| 2006 |

Great Plains Oilfield Rental |

4171000229 | Union | |||||

| 2007 |

Oilfield Trucking Solutions |

4171000146 | Union | |||||

| 2008 |

Keystone Rock & Excavation Disbursement |

4171000203 | Union | |||||

| 2009 |

Hodges Trucking Company LLC |

0021418025 | Union | |||||

| 3000 |

Seventy Seven Operating LLC |

G241874275 | Oppenheimer | |||||

| 4000 |

Seventy Seven Operating |

6U5RBK8HL2S4Q | PayPal | |||||

| 36 |

||||||||

| In re: | Seventy Seven Finance Inc. et al. |

Case No. | 16-11409 (LSS) | |||||

| Debtor | Jointly Administered |

SCHEDULE OF RETAINERS PAID TO PROFESSIONALS

(This schedule is to include each Professional paid a retainer 1)

| Check | Amount Applied | |||||||||||||||||||||

| Payee |

Date | Number | Name of Payor |

Amount | to Date | Balance | ||||||||||||||||

| Alvarez & Marsal North America LLC |

3/31/16 | Wire/ACH | Seventy Seven Operating LLC | $ | 250,000 | $ | — | $ | 250,000 | |||||||||||||

| Weil Gotshal & Manges LLP |

3/31/16 | Wire/ACH | Seventy Seven Operating LLC | 200,000 | — | 200,000 | ||||||||||||||||

| Schulte Roth & Zabel LLP |

6/6/16 | Wire/ACH | Seventy Seven Operating LLC | 175,000 | — | 175,000 | ||||||||||||||||

| Prime Clerk |

4/7/16 | Wire/ACH | Seventy Seven Operating LLC | 30,000 | — | 30,000 | ||||||||||||||||

| Kurtzman Carson Consultants |

6/6/16 | Wire/ACH | Seventy Seven Operating LLC | 9,500 | — | 9,500 | ||||||||||||||||

| Baker Botts LLP |

3/31/16 | Wire/ACH | Seventy Seven Operating LLC | 1,000,000 | 93,055 | 906,945 | ||||||||||||||||

| Morris, Nichols, Arsht & Tunnell LLP |

4/14/16 | Wire/ACH | Seventy Seven Operating LLC | 118,497 | 31,883 | 86,614 | ||||||||||||||||

| Ernst & Young LLP |

5/24/16 | Wire/ACH | Seventy Seven Operating LLC | 242,000 | — | 242,000 | ||||||||||||||||