Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - COMERICA INC /NEW/ | gearupfactsheet.htm |

| EX-99.1 - EXHIBIT 99.1 - COMERICA INC /NEW/ | cma-20160630ex991.htm |

| 8-K - 8-K - COMERICA INC /NEW/ | cma-20160630form8k.htm |

Comerica Incorporated

Second Quarter 2016Financial Review

July 19, 2016

Safe Harbor Statement

Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,” “outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,” “outcome,” “continue,” “remain,” “maintain,” “on course,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, including the GEAR Up initiative, and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries as well as estimates of the economic benefits of the GEAR Up initiative, estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences are changes in general economic, political or industry conditions; changes in monetary and fiscal policies, including changes in interest rates; changes in regulation or oversight; Comerica's ability to maintain adequate sources of funding and liquidity; the effects of more stringent capital or liquidity requirements; declines or other changes in the businesses or industries of Comerica's customers, in particular the energy industry; unfavorable developments concerning credit quality; operational difficulties, failure of technology infrastructure or information security incidents; reliance on other companies to provide certain key components of business infrastructure; factors impacting noninterest expenses which are beyond Comerica's control; changes in the financial markets, including fluctuations in interest rates and their impact on deposit pricing; reductions in Comerica's credit rating; whether Comerica may achieve opportunities for revenue enhancements and efficiency improvements under the GEAR Up initiative, or changes in the scope or assumptions underlying the GEAR Up initiative; the interdependence of financial service companies; the implementation of Comerica's strategies and business initiatives; damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; changes in customer behavior; any future strategic acquisitions or divestitures; management's ability to maintain and expand customer relationships; management's ability to retain key officers and employees; the impact of legal and regulatory proceedings or determinations; the effectiveness of methods of reducing risk exposures; the effects of terrorist activities and other hostilities; the effects of catastrophic events including, but not limited to, hurricanes, tornadoes, earthquakes, fires, droughts and floods; changes in accounting standards and the critical nature of Comerica's accounting policies. Comerica cautions that the foregoing list of factors is not exclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 12 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2015 and “Item 1A. Risk Factors” beginning on page 54 of Comerica’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 2

Completed initial comprehensive, diagnostic review

Key actions identified to date: over 20 work streams

Implementation underway

Identified additional ~$230MM in annual pre-tax income in FY18

Efficiency ratio ≤60% by FYE18

Driving to a double-digit return on equity (ROE)

2Q16 $53MM

2H16 ~$35MM-$55MM

Total: ~$140MM-$160MM through FY18

Provide quarterly updates on progress

Executive management owns initiative

GEAR Up: Growth in Efficiency And RevenueDrive for enhanced shareholder value

Process

Targets

Restructuring Charges1

Accountability

3

6/30/16 ● Pre-tax $ ● Estimates & outlook as of 7/19/16 ● 1Restructuring charges related to actions identified to date

GEAR Up: Growth in Efficiency and Revenue Initial Financial Targets

Driving to Double-Digit Return on Equity (ROE)

Initial revenue & expense opportunities contribute ~200 bps to ROE which drives ROE well-above peer average1

Management review underway to identify further opportunities in 2017 & beyond

Continued active capital management

~$30MM

FY17

Low 60%range

FY18

Revenue Enhancements

Expense Reductions

Efficiency Ratio

~$230MM Additional Annual Pre-Tax Income in FY18

≤60%

~$160MM

~$70MM

~$110MM

Income

Efficiency Ratio

ReturnonEquity

4

6/30/16 ● Pre-tax $ ● Estimates & outlook as of 7/19/16 ● For illustrative purposes; not drawn to scale ● 1Based on FY15 peer group ROE

Business growth, net of investments

Efficiency Ratio

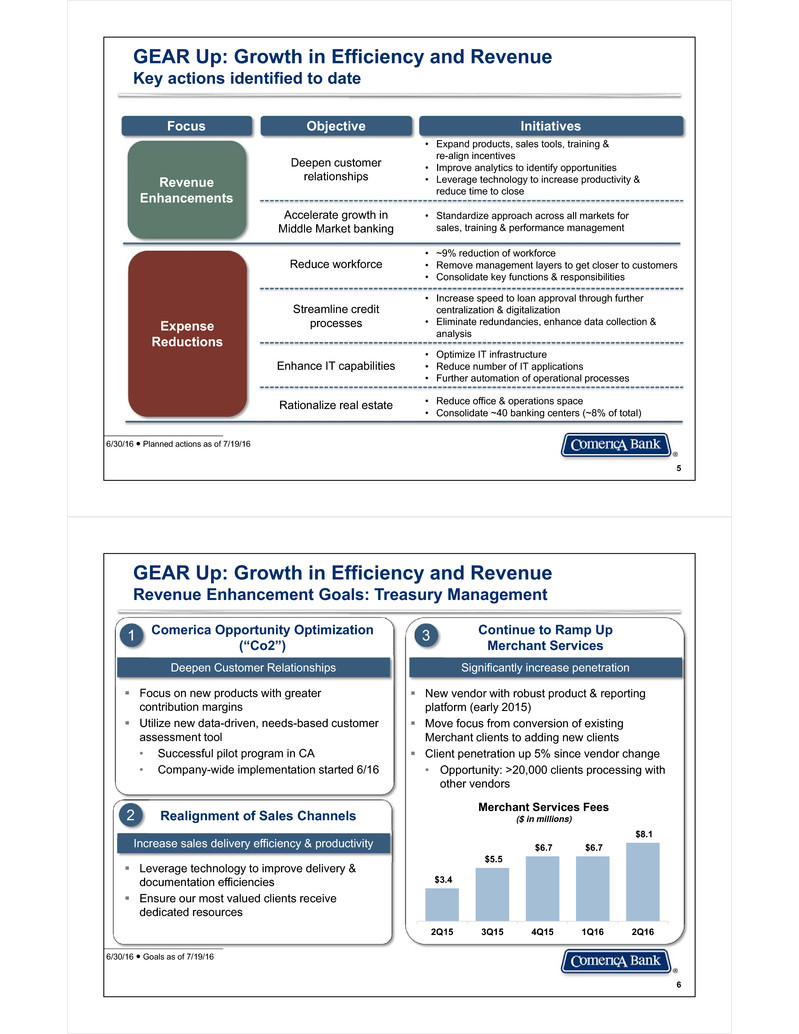

GEAR Up: Growth in Efficiency and Revenue Key actions identified to date

6/30/16 ● Planned actions as of 7/19/16

Focus

Deepen customer relationships

Expense Reductions

• ~9% reduction of workforce• Remove management layers to get closer to customers• Consolidate key functions & responsibilities

Objective Initiatives

• Expand products, sales tools, training & re-align incentives• Improve analytics to identify opportunities• Leverage technology to increase productivity & reduce time to close

• Standardize approach across all markets for sales, training & performance managementAccelerate growth in Middle Market banking

Revenue Enhancements

Reduce workforce

Streamline credit processes

Enhance IT capabilities

Rationalize real estate

• Increase speed to loan approval through further centralization & digitalization• Eliminate redundancies, enhance data collection & analysis

• Optimize IT infrastructure • Reduce number of IT applications • Further automation of operational processes

• Reduce office & operations space • Consolidate ~40 banking centers (~8% of total)

5

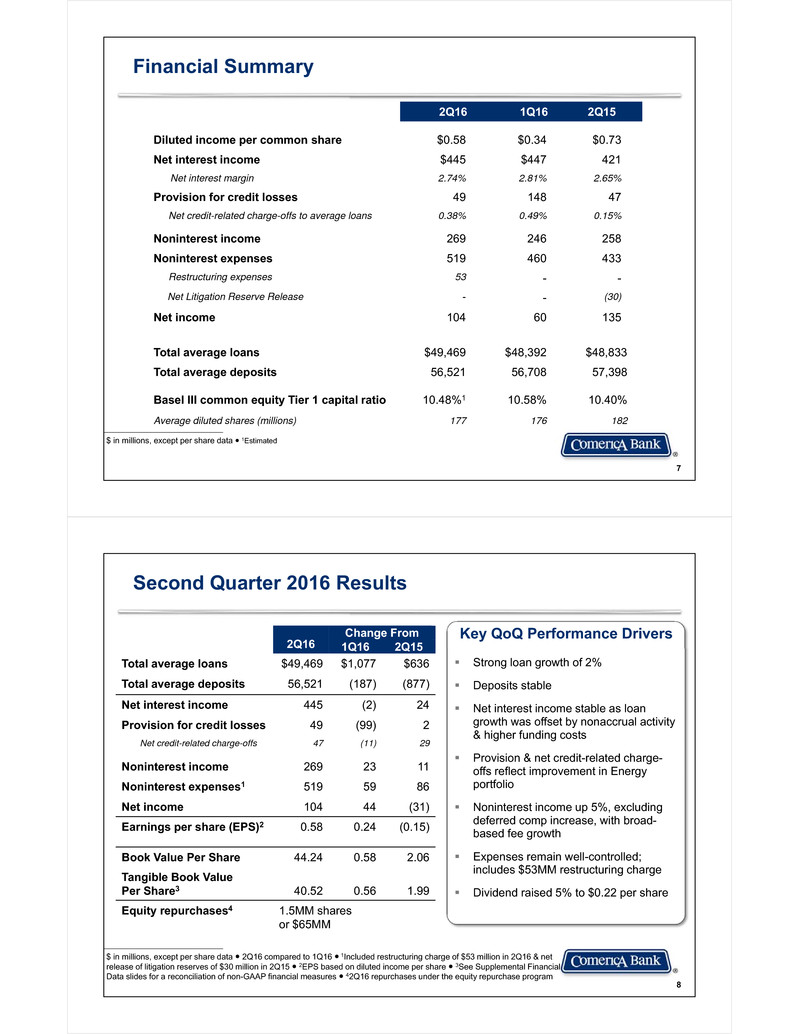

Focus on new products with greater contribution margins

Utilize new data-driven, needs-based customer assessment tool• Successful pilot program in CA • Company-wide implementation started 6/16

Leverage technology to improve delivery & documentation efficiencies

Ensure our most valued clients receive dedicated resources

Comerica Opportunity Optimization(“Co2”)

Realignment of Sales Channels

GEAR Up: Growth in Efficiency and Revenue Revenue Enhancement Goals: Treasury Management

New vendor with robust product & reporting platform (early 2015)

Move focus from conversion of existing Merchant clients to adding new clients

Client penetration up 5% since vendor change• Opportunity: >20,000 clients processing with other vendors

Continue to Ramp Up Merchant Services

Deepen Customer Relationships

$3.4

$5.5 $6.7 $6.7

$8.1

2Q15 3Q15 4Q15 1Q16 2Q16

Increase sales delivery efficiency & productivity

Significantly increase penetration

1

2

3

6/30/16 ● Goals as of 7/19/16

Merchant Services Fees ($ in millions)

6

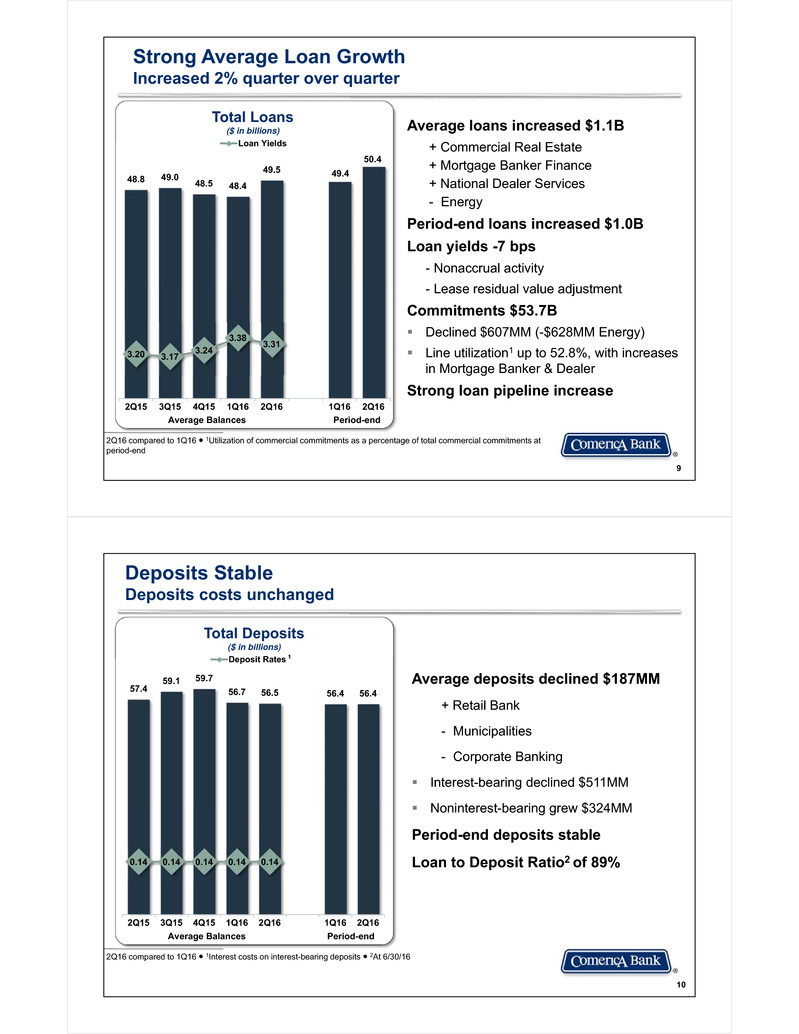

Financial Summary

2Q16 1Q16 2Q15

Diluted income per common share $0.58 $0.34 $0.73

Net interest income $445 $447 421

Net interest margin 2.74% 2.81% 2.65%

Provision for credit losses 49 148 47

Net credit-related charge-offs to average loans 0.38% 0.49% 0.15%

Noninterest income 269 246 258

Noninterest expenses 519 460 433

Restructuring expenses 53 - -

Net Litigation Reserve Release - - (30)

Net income 104 60 135

Total average loans $49,469 $48,392 $48,833

Total average deposits 56,521 56,708 57,398

Basel III common equity Tier 1 capital ratio 10.48%1 10.58% 10.40%

Average diluted shares (millions) 177 176 182

$ in millions, except per share data ● 1Estimated

7

Second Quarter 2016 Results

$ in millions, except per share data ● 2Q16 compared to 1Q16 ● 1Included restructuring charge of $53 million in 2Q16 & net release of litigation reserves of $30 million in 2Q15 ● 2EPS based on diluted income per share ● 3See Supplemental FinancialData slides for a reconciliation of non-GAAP financial measures ● 42Q16 repurchases under the equity repurchase program

2Q16 Change From1Q16 2Q15Total average loans $49,469 $1,077 $636

Total average deposits 56,521 (187) (877)

Net interest income 445 (2) 24

Provision for credit losses 49 (99) 2

Net credit-related charge-offs 47 (11) 29

Noninterest income 269 23 11

Noninterest expenses1 519 59 86

Net income 104 44 (31)

Earnings per share (EPS)2 0.58 0.24 (0.15)

Book Value Per Share 44.24 0.58 2.06

Tangible Book Value Per Share3 40.52 0.56 1.99

Equity repurchases4 1.5MM sharesor $65MM

Key QoQ Performance Drivers

Strong loan growth of 2%

Deposits stable

Net interest income stable as loan growth was offset by nonaccrual activity & higher funding costs

Provision & net credit-related charge-offs reflect improvement in Energy portfolio

Noninterest income up 5%, excluding deferred comp increase, with broad-based fee growth

Expenses remain well-controlled; includes $53MM restructuring charge

Dividend raised 5% to $0.22 per share

8

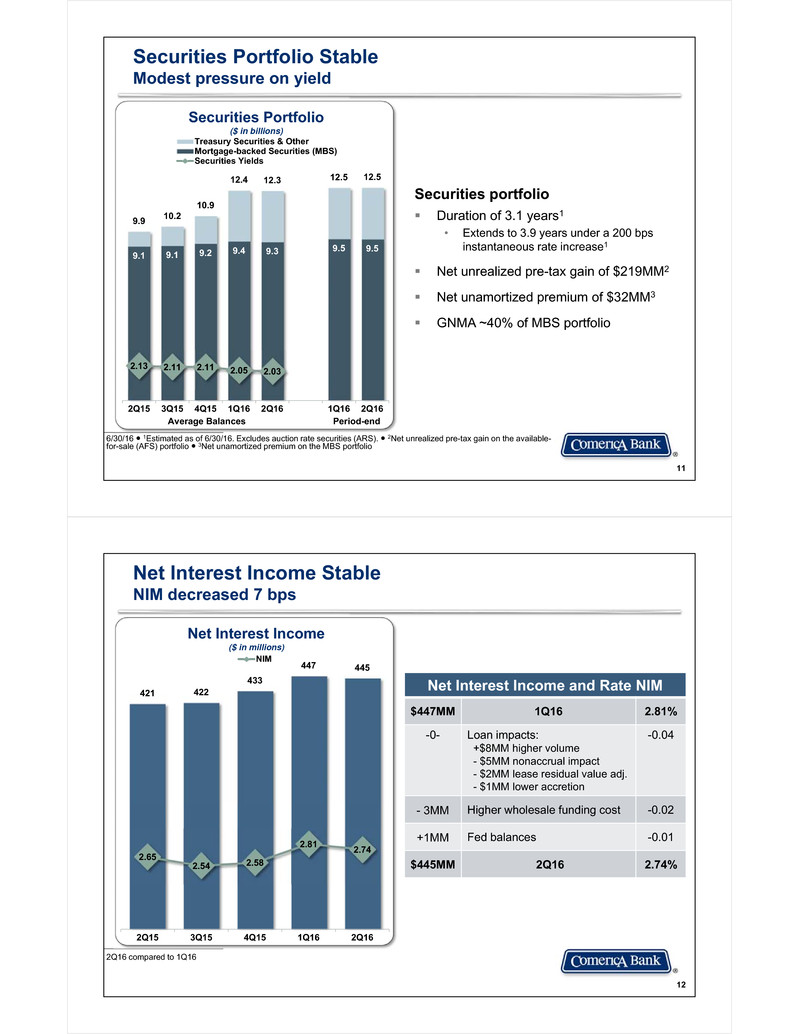

Strong Average Loan Growth Increased 2% quarter over quarter

2Q16 compared to 1Q16 ● 1Utilization of commercial commitments as a percentage of total commercial commitments at period-end

Total Loans($ in billions)

48.8 49.0 48.5 48.4

49.5 49.4 50.4

3.20 3.17 3.24

3.38 3.31

2Q15 3Q15 4Q15 1Q16 2Q16 1Q16 2Q16

Loan Yields

Average Balances Period-end

Average loans increased $1.1B

+ Commercial Real Estate+ Mortgage Banker Finance+ National Dealer Services - EnergyPeriod-end loans increased $1.0BLoan yields -7 bps

- Nonaccrual activity - Lease residual value adjustmentCommitments $53.7B

Declined $607MM (-$628MM Energy)

Line utilization1 up to 52.8%, with increases in Mortgage Banker & DealerStrong loan pipeline increase

9

Deposits StableDeposits costs unchanged

2Q16 compared to 1Q16 ● 1Interest costs on interest-bearing deposits ● 2At 6/30/16

Average Balances Period-end

Total Deposits($ in billions)

57.4 59.1 59.7 56.7 56.5 56.4 56.4

0.14 0.14 0.14 0.14 0.14

2Q15 3Q15 4Q15 1Q16 2Q16 1Q16 2Q16

Deposit Rates 1

10

Average deposits declined $187MM

+ Retail Bank

- Municipalities

- Corporate Banking

Interest-bearing declined $511MM

Noninterest-bearing grew $324MM

Period-end deposits stable

Loan to Deposit Ratio2 of 89%

Securities Portfolio($ in billions)

6/30/16 ● 1Estimated as of 6/30/16. Excludes auction rate securities (ARS). ● 2Net unrealized pre-tax gain on the available-for-sale (AFS) portfolio ● 3Net unamortized premium on the MBS portfolio

9.1 9.1 9.2 9.4 9.3 9.5 9.5

9.9 10.2

10.9

12.4 12.3 12.5 12.5

2.13 2.11 2.11 2.05 2.03

2Q15 3Q15 4Q15 1Q16 2Q16 1Q16 2Q16

Treasury Securities & OtherMortgage-backed Securities (MBS)Securities Yields

Average Balances Period-end

Securities Portfolio StableModest pressure on yield

11

Securities portfolio

Duration of 3.1 years1• Extends to 3.9 years under a 200 bps instantaneous rate increase1

Net unrealized pre-tax gain of $219MM2

Net unamortized premium of $32MM3

GNMA ~40% of MBS portfolio

Net Interest Income($ in millions)

Net Interest Income StableNIM decreased 7 bps

2Q16 compared to 1Q16

421 422 433

447 445

2.65 2.54 2.58

2.81 2.74

2Q15 3Q15 4Q15 1Q16 2Q16

NIM

Net Interest Income and Rate NIM

$447MM 1Q16 2.81%

-0- Loan impacts:+$8MM higher volume- $5MM nonaccrual impact- $2MM lease residual value adj.- $1MM lower accretion

-0.04

- 3MM Higher wholesale funding cost -0.02

+1MM Fed balances -0.01

$445MM 2Q16 2.74%

12

349 357 367 681 605

2,361 2,898

3,193 3,928 3,551

4.7 5.9 6.5

8.0 7.0

2Q15 3Q15 4Q15 1Q16 2Q16

NALsCriticized as a % of Total Loans

Criticized Loans2($ in millions)

Credit Quality Reflects Improvement in EnergyEnergy business line reserve allocation1 now over 8%

6/30/16 ●1Bank's entire allowance is available to cover any & all losses. Allocation of allowance for energy loans reflects ourrobust allowance methodology which contains quantitative and qualitative components ● 2Criticized loans are consistent withregulatory defined Special Mention, Substandard, Doubtful & Loss loan classifications ● 3Net credit-related charge-offs

Allowance for Credit Losses($ in millions)

668 670 679 770 772

1.24 1.27 1.29

1.47 1.45

2Q15 3Q15 4Q15 1Q16 2Q16

Allowance for Loan Losses as a % of total loans

$ in millions Ex-Energy TotalTotal loans $47,639 $50,380% of total 95% 100%

Criticized2 1,999 3,551Ratio 4.2% 7.0%Q/Q change (96) (377)

Nonaccrual 259 605Ratio 0.5% 1.2%Q/Q change 1 (76)

Net charge-offs3 15 47Ratio 0.13% 0.38%

$ in millions Loans Criticized NAL 2Q16 NCO3

E&P $1,911 $1,239 $307 $8

Midstream 467 79 12 9

Services 363 234 27 15

Total Energy $2,741 $1,552 $346 $32

Q/Q change (356) (281) (77) (10)

Energy Credit Metrics

Portfolio Credit Metrics

13

Noninterest Income HigherCustomer-driven fees increased 5%

2Q16 compared to 1Q16

258 262 268 246

269

2Q15 3Q15 4Q15 1Q16 2Q16

Noninterest Income ($ in millions)

14

Noninterest income increased $23MM

+ $ 3MM Card fees

+ $ 3MM Fiduciary income

+ $ 3MM Customer derivative income

+ $ 2MM Commercial lending fees

+ $1MM Brokerage fees

+ $1MM Foreign Exchange income

+$10MM Deferred comp (Other noninterest income; offset in noninterest expense)

Noninterest Expenses Well-ControlledIncludes restructuring costs of $53MM

2Q16 compared to 1Q16

Noninterest expenses up $59MM

+ $53MM Restructuring expense

- $1MM Salaries and Benefits

+ $10MM Deferred comp (offset in noninterest income)+ Annual merit+ Seasonal 401k contribution+ Incentives tied to revenue growth- Annual stock compensation- Seasonal payroll taxes

+ $5MM Outside processing fees

+ $3MM FDIC insurance premiums

+ $2MM Advertising

- $8MM Gain on sale of leased assets(other noninterest expenses)

53

433

459

484

460

519

2Q15 3Q15 4Q15 1Q16 2Q16

Restructuring

Noninterest Expenses($ in millions)

15

Active Capital ManagementReceived ‘no objection’ for 2016 Capital Plan

1Shares & warrants repurchased under equity repurchase program ● 2Paid July 1, 2016, to common stock shareholders of record on June 15, 2016 ● 3See Supplemental Financial Data slides for a reconciliation of non-GAAP financial measures

● 4LTM = last twelve months

2016 CCAR Capital Plan

Equity repurchases up to $440 million (3Q16-2Q17)

Consider dividend increase at next Board Meeting

Pace of buyback linked to capital position, financial performance & market conditions2015 CCAR Plan Completed

6.4MM shares & 0.5MM warrants for $290MM1(2Q15-2Q16)

2Q16: 1.5MM shares for $65MM Dividend increased 5% to $0.22/share2

$31.40 $33.36 $35.64

$37.72 $39.33 $40.52$34.79 $39.86

$39.22 $41.35 $43.03 $44.24

2011 2012 2013 2014 2015 2Q16

Tangible Book Value Book Value

Book Value Per Share3 Dividends Per Share Growth

0.40

0.55

0.68 0.79

0.83 0.85

2011 2012 2013 2014 2015 LTM2Q16

197 188 182 179 176 174

2011 2012 2013 2014 2015 2Q16

Common Shares Outstanding(in millions)

4

16

Why is Comerica Asset Sensitive?

6/30/16 ● 1Estimated outlook as of 7/19/16 based on calculations derived from sensitivity results shown in slide 22 ● 2As of 5/31/16

Interest Rate Sensitivity Significant upside in rising rate scenario

Additional Annual Net Interest Income1Estimated Increase From Movement in Fed Rates

Deposit Beta

($ in millions) 0% 25% 50% 75%

+25 bps ~$85 ~$70 ~$55 ~$40

+50 bps ~170 ~140 ~105 ~75

+100 bps ~345 ~280 ~215 ~150

~$90MM expected benefit to FY16 from 12/15 rate rise, if deposit prices remain at current levels Predominately floating rate loans • <2% have floors2

Fixed rate securities < 20% of earning assets

Large non-maturity deposit base

Abnormally low interest rate environment

Fixed Rate~10% Libor-Based~70%Prime-Based~20%

Loan Portfolio ($ in billions, Period-end)

Total $50.4

17

Outlook as of 7/19/16

FY16 compared to FY15

Average loans Modest growth, in line with GDP growth • Continued decline in Energy more than offset by increases in most remaining businesses• Seasonality in National Dealer, Mortgage Banker & Middle Market to impact second half of year

Net interest income

Higher• Benefit from December 2015 rise in short-term rates• Loan growth & larger securities portfolio

Provision Higher, reflecting 1Q16 reserve build for Energy• Continued solid credit quality in the remainder of portfolio• Net charge-offs 35-45 bps (formerly 45-55 bps)• Additional reserve changes dependent on developments in the oil & gas sector

Noninterest income

Modest growth• Continued focus on cross-sell opportunities, including card, fiduciary & brokerage services• Offset by lower market driven fees, including commercial lending fees (primarily energy related) investment banking, derivatives & warrant income • Benefits from GEAR Up expected to begin in early 2017

Noninterest expenses

Higher, with $90MM-$110MM in restructuring expense• GEAR Up expense savings of ~$20MM • Increase in outside processing in line with growing revenue• Increase in FDIC expense in part related to regulatory surcharge • Typical inflationary pressures (merit raises, occupancy, etc.)• FY15 benefitted from $33MM legal reserve release which is offset by lower pension expense

Income Taxes ~30% of pre-tax income

Management 2016 Outlook Assuming continuation of current economic & low rate environment

18

Appendix

19

Loans by Business and Market

Average $ in billions ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets

Middle Market: Serving companies with revenues generally between $20-$500MM

Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM

Small Business: Serving companies with revenues generally under $20MM

By Line of Business 2Q16 1Q16 2Q15

Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services

$12.72.96.50.73.30.9

$12.83.16.20.73.30.9

$13.53.46.00.63.00.9

Total Middle Market $27.0 $27.0 $27.4

Corporate BankingUS BankingInternational 2.41.8 2.41.7 2.61.8

Mortgage Banker Finance 2.1 1.7 2.1

Commercial Real Estate 5.3 4.8 4.2

BUSINESS BANK $38.6 $37.6 $38.1

Small Business 3.9 3.9 3.9

Retail Banking 2.0 1.9 1.9

RETAIL BANK $5.9 $5.8 $5.8

Private Banking 5.0 5.0 4.9

WEALTH MANAGEMENT 5.0 5.0 $4.9

TOTAL $49.5 $48.4 $48.8

By Market 2Q16 1Q16 2Q15

Michigan $12.7 $12.8 $13.3

California 17.7 17.3 16.4

Texas 10.8 10.8 11.2

Other Markets1 8.3 7.5 7.9

TOTAL $49.5 $48.4 $48.8

20

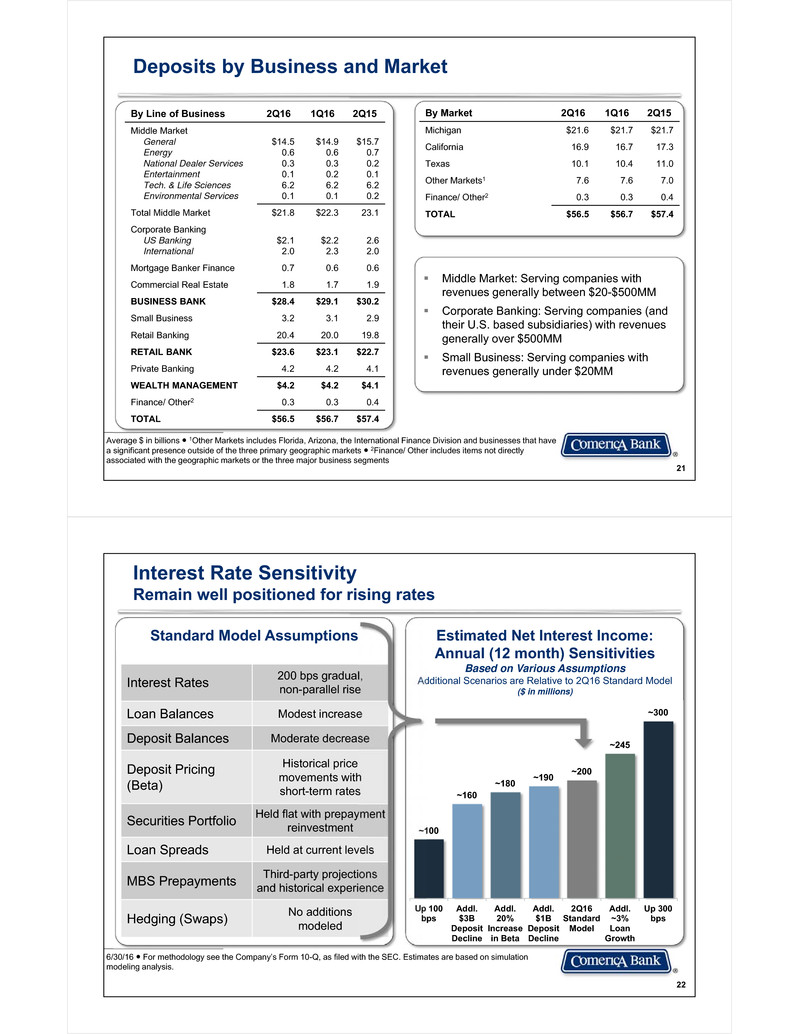

Deposits by Business and Market

Average $ in billions ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets ● 2Finance/ Other includes items not directly associated with the geographic markets or the three major business segments

Middle Market: Serving companies with revenues generally between $20-$500MM

Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM

Small Business: Serving companies with revenues generally under $20MM

By Line of Business 2Q16 1Q16 2Q15

Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services

$14.50.60.30.16.20.1

$14.90.60.30.26.20.1

$15.70.70.20.16.20.2

Total Middle Market $21.8 $22.3 23.1

Corporate BankingUS BankingInternational $2.12.0 $2.22.3 2.62.0

Mortgage Banker Finance 0.7 0.6 0.6

Commercial Real Estate 1.8 1.7 1.9

BUSINESS BANK $28.4 $29.1 $30.2

Small Business 3.2 3.1 2.9

Retail Banking 20.4 20.0 19.8

RETAIL BANK $23.6 $23.1 $22.7

Private Banking 4.2 4.2 4.1

WEALTH MANAGEMENT $4.2 $4.2 $4.1

Finance/ Other2 0.3 0.3 0.4

TOTAL $56.5 $56.7 $57.4

By Market 2Q16 1Q16 2Q15

Michigan $21.6 $21.7 $21.7

California 16.9 16.7 17.3

Texas 10.1 10.4 11.0

Other Markets1 7.6 7.6 7.0

Finance/ Other2 0.3 0.3 0.4

TOTAL $56.5 $56.7 $57.4

21

Interest Rate SensitivityRemain well positioned for rising rates

6/30/16 ● For methodology see the Company’s Form 10-Q, as filed with the SEC. Estimates are based on simulation modeling analysis.

Estimated Net Interest Income: Annual (12 month) SensitivitiesBased on Various AssumptionsAdditional Scenarios are Relative to 2Q16 Standard Model($ in millions)

~100

~160 ~180

~190 ~200

~245

~300

Up 100bps Addl.$3BDepositDecline

Addl.20%Increasein Beta

Addl.$1BDepositDecline

2Q16StandardModel

Addl.~3%LoanGrowth

Up 300bps

0.1

Interest Rates 200 bps gradual, non-parallel rise

Loan Balances Modest increase

Deposit Balances Moderate decrease

Deposit Pricing (Beta)

Historical price movements with short-term rates

Securities Portfolio Held flat with prepayment reinvestment

Loan Spreads Held at current levels

MBS Prepayments Third-party projections and historical experience

Hedging (Swaps) No additions modeled

Standard Model Assumptions

22

Multifamily48%

Retail11%

Commercial11%

Office7%

Single Family7% Multi use4%

Land Carry5%

Other7%

Dallas 35%

Houston 28%

Austin 24%

San Antonio7%

Other 6%

Commercial Real Estate Line of BusinessLong history of working with well established, proven developers

6/30/16 ● 1Excludes CRE line of business loans not secured by real estate ● 2Includes CRE line of business loans not secured by real estate

CRE by Property Type1($ in millions; Period-end)

Michigan6% California45%

Texas31%Florida1%

Other17%

CRE by Market1($ in millions; Period-end, based on location of property)

Total$4,433

Total$4,433

Total$1,368($ in millions; Period-end) 1Q16 2Q16Real Estate Construction $1,946 38% $2,197 40%Commercial Mortgages 2,168 42% 2,236 41%$4,114 80% $4,433 81%Commercial & Other2 1,023 20% 1,079 19%Total $5,137 100% $5,512 100%

CRE by Loan Type

23

Energy Line of Business & Energy-relatedGranular, contracting portfolios

6/30/16 ● 1As of 7/12/16 ● 2Commitments totaling ~$220MM ● 3Energy-related loans in other businesses that have a sizable portion of their revenue related to energy or could be otherwise disproportionately negatively impacted by prolonged low oil and gas prices ● 4Net credit-related charge-offs

Natural Gas 13% Oil40%

463 481 479 509 467530 513 480 426 363

2,316 2,249 2,111 2,162 1,911

3,309 3,243 3,070 3,097 2,741

2Q15 3Q15 4Q15 1Q16 2Q16

Midstream Services Exploration & Production

Energy Line of Business Loans ($ in millions; Period-end)

Mixed18%

6,624 6,541 6,134 5,573 4,945

48% 48% 49% 54% 54%

2Q15 3Q15 4Q15 1Q16 2Q16

Total Commitments Utilization Rate

Energy Line of Business

Maintain granular portfolio: ~200 customers

E&P companies

Spring redeterminations 88% complete1

Borrowing bases declined ~22% on average

Collateral deficiencies: 10 relationships2totaling ~$47MM

Energy-related3

~100 customers

~55% in Texas Middle Market Lending

$ in millions 4Q15 1Q16 2Q16Total loans $624 $534 $489

Criticized 187 185 182

Nonaccrual 29 33 36

Net charge-offs4 7 3 1

24

6/30/16 ● 1Source: Mortgage Bankers Association (MBA) Mortgage Finance Forecast as of 6/20/16 ● 2$ in billions ● 3Based on MBA annual mortgage origination estimates

614 9

23

1,53

5

1,48

3

1,50

7 1,99

6 2,09

4

1,73

7

1,81

5

1,60

5

1,10

9

886 1,

319 1,5

95

1,39

7

1,39

9 2,

089 2,13

6

1,74

2

1,67

4 2,14

5

200300

400500

600700

800900

2Q1

1

3Q1

1

4Q1

1

1Q1

2

2Q1

2

3Q1

2

4Q1

2

1Q1

3

2Q1

3

3Q1

3

4Q1

3

1Q1

4

2Q1

4

3Q1

4

4Q1

4

1Q1

5

2Q1

5

3Q1

5

4Q1

5

1Q1

6

2Q1

6

Actual MBAMortgageOriginationVolumes

Average Loans($ in millions)

Mortgage Banker Finance50 Years experience with reputation for consistent, reliable approach

MBA Mortgage Originations Forecast1($ in billions)

461 426 405 350

510 460

343 295 380

2Q15Actual 3Q15Actual 4Q15Actual 1Q16Actual 2Q16 3Q16 4Q16 1Q17 2Q17

Purchase Refinance

1,2

Provide warehouse financing: bridge from residential mortgage origination to sale to end market

Extensive backroom provides collateral monitoring and customer service

Focus on full banking relationships

Granular portfolio with 100+ relationships

Market share more than doubled over past six years3

Underlying mortgages are typically related to home purchases as opposed to refinancesAs of 2Q16: • Comerica: ~75% purchase • Industry: 54% purchase1

Strong credit quality• No charge-offs since 2010

25

National Dealer Services65+ years of floor plan lending

Toyota/Lexus16%

Honda/Acura 14%

Ford 11%

GM 8%

Chrysler 10%

Mercedes 3%

Nissan/ Infiniti 6%

Other European 11%

Other Asian 12%

Other19%

Franchise Distribution(Based on period-end loan outstandings)

Geographic DispersionCalifornia 65% Texas 7%Michigan 18% Other 10%

Average Loans($ in billions)

Top tier strategy

Focus on “Mega Dealer” (five or more dealerships in group)

Strong credit quality

Robust monitoring of company inventory and performance

1.7 1.3 1.5 1.9 2.3 2.3 2.5 2.8 3.1 2.9 3.2 3.2 3.5 3.2 3.4 3.5 3.6 3.5 3.7 3.8 4.0

3.6 3.1 3.4

3.8 4.

3 4.3 4.6

4.9 5.1

4.9 5.

3 5.3 5.7

5.5 5.7

5.9 6.0

6.0 6.2

6.2 6.5

2Q1

1

3Q1

1

4Q1

1

1Q1

2

2Q1

2

3Q1

2

4Q1

2

1Q1

3

2Q1

3

3Q1

3

4Q1

3

1Q1

4

2Q1

4

3Q1

4

4Q1

4

1Q1

5

2Q1

5

3Q1

5

4Q1

5

1Q1

6

2Q1

6

Floor Plan

Total $6.6B

6/30/16 ● 1Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck, recreational vehicles, and non-floor plan loans)

26

0.3 0.4 0.6 1.1 1.4 1.4

1.8 2.0

2.5 3.1

3.3 3.3

2012 2013 2014 2015 1Q16 2Q16

Equity Fund Services

Technology and Life Sciences20+ Years experience provides competitive advantage

Technology & Life Sciences Avg. Loans($ in billions)

Customer Segment Overview(based on period-end loans)

Strong relationships with top-tier investors

Granular portfolio: ~800 customers (including ~190 customers in Equity Fund Services)

Closely monitor cash balances

Numerous verticals, many with concentration limits• Ad tech ● Cyber security• Software ● Life sciences

Net Charge-off Ratio1(In basis points)

Total $3.3B 57 61

89 108 86

45

2012 2013 2014 2015 1Q16 2Q16

Early Stage~10%

Growth~25%

Late Stage~20%

Equity Fund Services~40%

Leveraged Finance~5%

l .2

6/30/16 ● 1TLS net charge-offs to avg. TLS loans

27

Shared National Credit (SNC) Relationships

At 6/30/16 ● SNCs are not a line of business. The balances shown above are included in the line of business balances.

● SNCs are facilities greater than $20 million shared by three or more federally supervised financial institutions which are reviewed by regulatory authorities at the agent bank level

SNC loans stable over 1Q16

SNC relationships included in business line balances

Approximately 740 borrowers

Comerica is agent for approx. 20%

Strategy: Pursue full relationships with ancillary business

Adhere to same credit underwriting standards as rest of loan book

Period-end Loans($ in billions)

Commercial Real Estate$1.0 9%

Corporate Banking$2.3 22%

General$2.0 19%

National Dealer Services$0.5 5%

Energy$2.6 25%

Entertainment$0.3 3%

Environmental Services$0.3 3%

Tech. & Life Sciences$1.0 9%

Mortgage Banker$0.6 5%

= Total Middle Market (64%)

Total$10.6

28

Equity$7.7 11%

Interest-Bearing Deposits$27.8 40%

Noninterest-Bearing Deposits$28.6 41%

Wholesale Debt$5.9 8%

Funding and Maturity Profile

3/31/16 ● 12026 maturity ● 2Face value at maturity

Wholesale debt markets

Federal Home Loan Bank of Dallas• $2.8B outstanding1• $3.2B remaining borrowing capacity

Brokered deposits• $-0-outstanding

Fed funds/ Repo markets

Multiple Funding Sources

Debt Profile by Maturity2($ in millions)

650 500 350

4,225

2016 2017 2019 2020+

Subordinated NotesSenior NotesFHLB Advance

Funding ProfileAt June 30, 2016($ in billions)

1

29

Senior Unsecured/Long-Term Issuer Rating Moody’s S&P Fitch

BB&T A2 A- A+

Cullen Frost A3 A- --

M&T Bank A3 A- A

BOK Financial Corporation A3 BBB+ A

Comerica A3 BBB+ A

Huntington Baa1 BBB A-

Fifth Third Baa1 BBB+ A

KeyCorp Baa1 BBB+ A-

SunTrust Baa1 BBB+ A-

First Horizon National Corp Baa3 BB+ BBB-

Regions Financial Baa3 BBB BBB

Zions Bancorporation Ba1 BBB- BBB-

U.S. Bancorp A1 A+ AA

Wells Fargo & Company A2 A AA-

PNC Financial Services Group A3 A- A+

JP Morgan A3 A- A+

Bank of America Baa1 BBB+ A

Holding Company Debt Rating

As of 7/14/16 ● Source: SNL Financial ● Debt Ratings are not a recommendation to buy, sell, or hold securities

Pee

r Ba

nks

Larg

e Ba

nks

30

The tangible common equity ratio removes preferred stock and the effect of intangible assets from capital and the effect of intangible assets from total assets. Tangible common equity per share of common stock removes the effect of intangible assets from common shareholders equity per share of common stock.● The Corporation believes these measurements are meaningful measures of capital adequacy used by investors, regulators, management and others to evaluate the adequacy of common equity and to compare against other companies in the industry

Supplemental Financial DataReconciliation of non-GAAP financial measures with financial measures defined by GAAP ($ in millions)

6/30/16 3/31/16 12/31/15 06/30/15 12/31/14 12/31/13 12/31/12 12/31/11Common shareholders’ equityLess: GoodwillLess: Other intangible assets

$7,69463512

$7,64463513

$7,56063514

$7,52363515

$7,40263515

$7,15063517

$6,93963522

$6,86563532

Tangible common equity $7,047 $6,966 $6,911 $6,873 $6,752 $6,498 $6,282 $6,198

Total assetsLess: GoodwillLess: Other intangible assets

$71,28063512

$69,00763513

$71,87763514

$69,94563515

$69,18663515

$65,22463517

$65,06663522

$61,00563532

Tangible assets $70,633 $68,359 $71,228 $69,295 $68,536 $64,572 $64,409 $60,338Common equity ratio 10.79% 11.08% 10.52% 10.76 10.70% 10.97% 10.67% 11.26%Tangible common equity ratio 9.98 10.23 9.70 9.92 9.85 10.07 9.76 10.27

Common shareholders’ equity $7,694 $7,644 $7,560 $7,523 $7,402 $7,150 $6,939 $6,865Tangible common equity 7,047 6,996 6,911 6,873 6,752 6,498 6,282 6,198Shares of common stock outstanding (in millions) 174 175 176 178 179 182 188 197Common shareholders’ equity per share of common stock $44.24 $43.66 $43.03 $42.18 $41.35 $39.22 $36.86 $34.79Tangible common equity per share of common stock 40.52 39.96 39.33 38.53 37.72 35.64 33.36 31.40

31

32