Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bristow Group Inc | brs8k7122016.htm |

1

Investor Presentation - London

Bristow Group Inc.

July 12, 2016

2

Forward-looking statements

Statements contained in this presentation that state the Company’s or management’s intentions, hopes, beliefs,

expectations or predictions of the future are forward-looking statements. These forward-looking statements

include statements regarding earnings guidance and earnings growth, expected contract revenue, capital

deployment strategy, operational and capital performance, impact of new contracts, cost reduction initiatives,

capex deferral, shareholder return, liquidity, market and industry conditions. It is important to note that the

Company’s actual results could differ materially from those projected in such forward-looking statements. Risks

and uncertainties include, without limitation: fluctuations in the demand for our services; fluctuations in worldwide

prices of and supply and demand for oil and natural gas; fluctuations in levels of oil and natural gas production,

exploration and development activities; the impact of competition; actions by clients and suppliers; the risk of

reductions in spending on helicopter services by governmental agencies; changes in tax and other laws and

regulations; changes in foreign exchange rates and controls; risks associated with international operations;

operating risks inherent in our business, including the possibility of declining safety performance; general

economic conditions including the capital and credit markets; our ability to obtain financing; the risk of grounding

of segments of our fleet for extended periods of time or indefinitely; our ability to re-deploy our aircraft to regions

with greater demand; our ability to acquire additional aircraft and dispose of older aircraft through sales into the

aftermarket; the possibility that we do not achieve the anticipated benefit of our fleet investment and Operational

Excellence programs; availability of employees with the necessary skills; and political instability, war or acts of

terrorism in any of the countries in which we operate. Additional information concerning factors that could cause

actual results to differ materially from those in the forward-looking statements is contained from time to time in the

Company’s SEC filings, including but not limited to the Company’s annual report on Form 10-K for the fiscal year

ended March 31, 2016. Bristow Group Inc. disclaims any intention or obligation to revise any forward-looking

statements, including financial estimates, whether as a result of new information, future events or otherwise.

3

• BRS stock price1 $11.41/share with a market cap

~$400 million

• 343 aircraft (162 LACE)2 with ~4,800

employees3

• Major markets are Australia, Brazil, Canada,

Nigeria, Norway, Trinidad, U.K., U.S. Gulf of

Mexico

• Our services are delivered in four regions:

Europe Caspian (ECR)

Africa (AFR)

Asia Pacific (APR)

Americas (AMR)

• Europe Caspian includes U.K. SAR and

Eastern; Asia Pacific includes Airnorth

• Significant joint ventures in Brazil (Líder) and

Canada (Cougar)

• Successful launch of $2.5 billion revenue U.K.

SAR contract (not tied to oil and gas)

Bristow transports crews for oil

and gas companies and provides

search and rescue services for

them and governments alike

Bristow is a leader in industrial aviation services for oil

and gas, Search and Rescue (SAR) and fixed wing

1) Based on NYSE stock price as of June 30, 2016

2) FMV of 100 LACE owned commercial aircraft is ~$2.1 billion

3) As of March 31, 2016

4

0.42

0.27 0.31 0.26 0.23

0.37

FY11 FY12 FY13 FY14 FY15 FY16

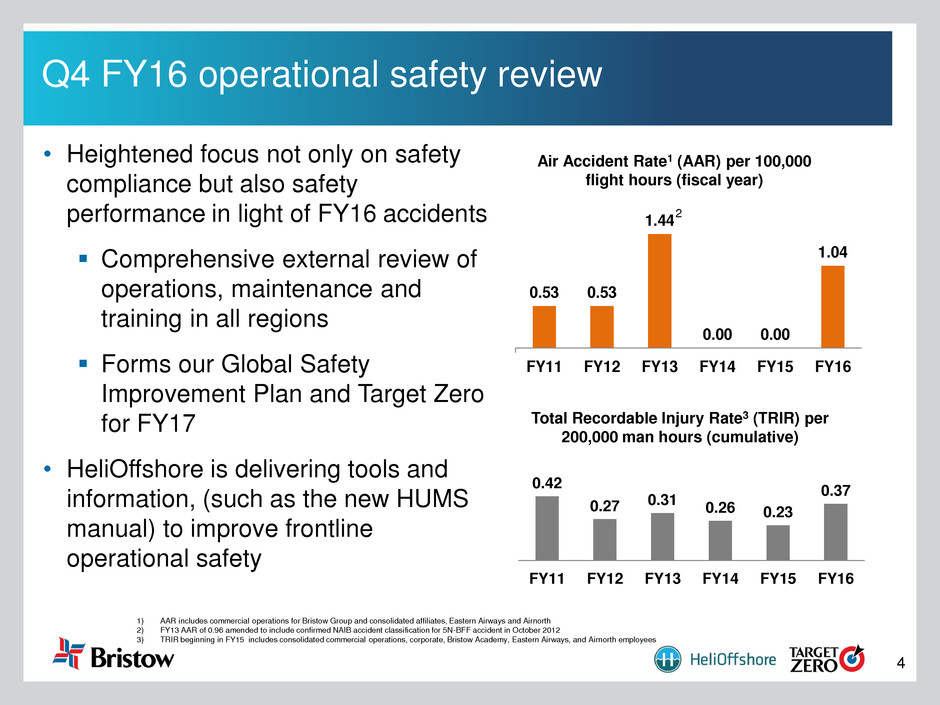

Q4 FY16 operational safety review

1) AAR includes commercial operations for Bristow Group and consolidated affiliates, Eastern Airways and Airnorth

2) FY13 AAR of 0.96 amended to include confirmed NAIB accident classification for 5N-BFF accident in October 2012

3) TRIR beginning in FY15 includes consolidated commercial operations, corporate, Bristow Academy, Eastern Airways, and Airnorth employees

Total Recordable Injury Rate3 (TRIR) per

200,000 man hours (cumulative)

• Heightened focus not only on safety

compliance but also safety

performance in light of FY16 accidents

Comprehensive external review of

operations, maintenance and

training in all regions

Forms our Global Safety

Improvement Plan and Target Zero

for FY17

• HeliOffshore is delivering tools and

information, (such as the new HUMS

manual) to improve frontline

operational safety

0.53 0.53

1.44

0.00 0.00

1.04

FY11 FY12 FY13 FY14 FY15 FY16

Air Accident Rate1 (AAR) per 100,000

flight hours (fiscal year)

2

5

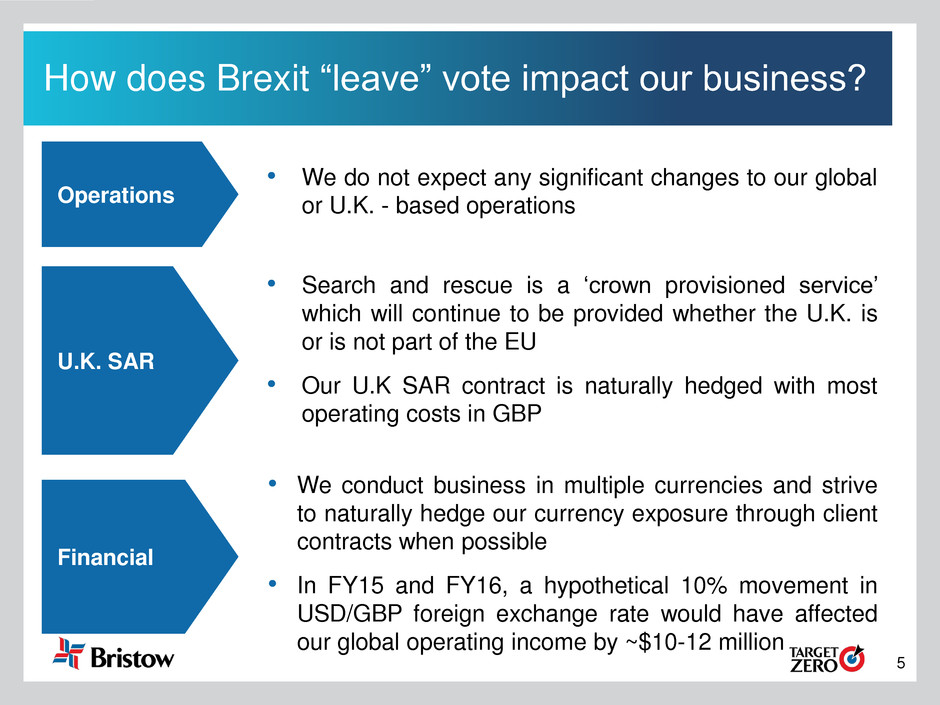

How does Brexit “leave” vote impact our business?

• We conduct business in multiple currencies and strive

to naturally hedge our currency exposure through client

contracts when possible

• In FY15 and FY16, a hypothetical 10% movement in

USD/GBP foreign exchange rate would have affected

our global operating income by ~$10-12 million

Operations

• We do not expect any significant changes to our global

or U.K. - based operations

U.K. SAR

• Search and rescue is a ‘crown provisioned service’

which will continue to be provided whether the U.K. is

or is not part of the EU

• Our U.K SAR contract is naturally hedged with most

operating costs in GBP

Financial

6

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

FY14 FY15 FY16

U.K. SAR Fixed wing

Oil and gas

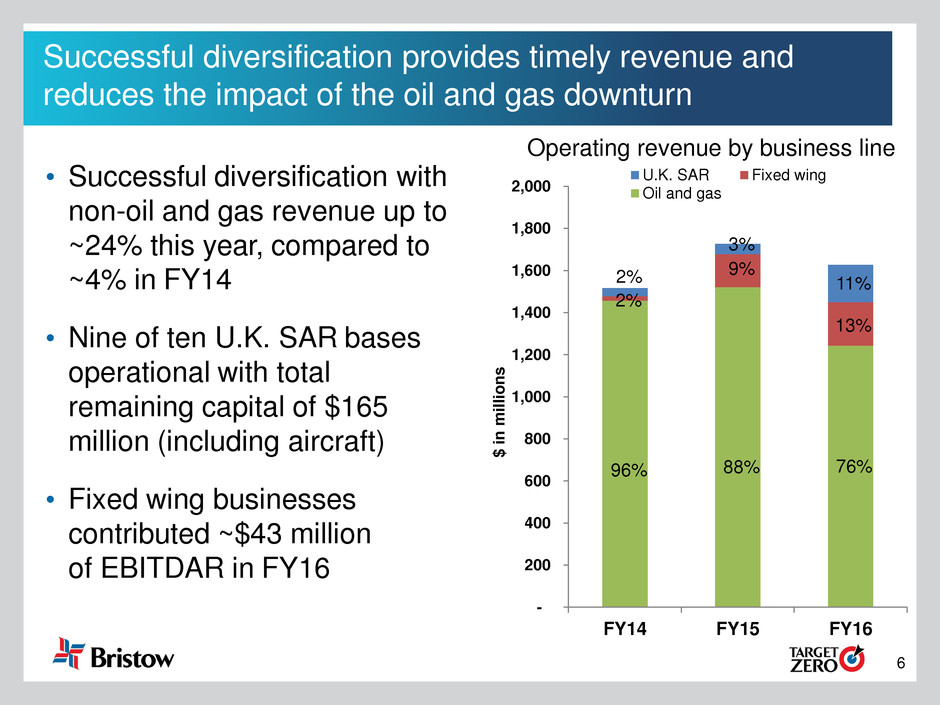

Successful diversification provides timely revenue and

reduces the impact of the oil and gas downturn

96%

2%

88%

9%

3%

Operating revenue by business line

$

in

mil

lion

s

2%

76%

13%

11%

• Successful diversification with

non-oil and gas revenue up to

~24% this year, compared to

~4% in FY14

• Nine of ten U.K. SAR bases

operational with total

remaining capital of $165

million (including aircraft)

• Fixed wing businesses

contributed ~$43 million

of EBITDAR in FY16

7

• U.K. SAR contract is ~10 years in

term with an option for a two-year

extension by the U.K. government

• Expected operating revenue and

adjusted EBITDAR for the ~10 year

contract term of $2.5 billion and

$1.1 billion, respectively

• Anticipated U.K. SAR EBITDAR

margins in the mid-40% range

• Recent certification of AW189 full

deicing protection allows us to

proceed with delivering the

contracted solution of 11 S-92s and

11 AW189s

U.K. SAR is a key element in our diversification

strategy providing stable non-oil and gas cash flow

8

267

232 253

116

0

50

100

150

200

250

300

FY13 FY14 FY15 FY16

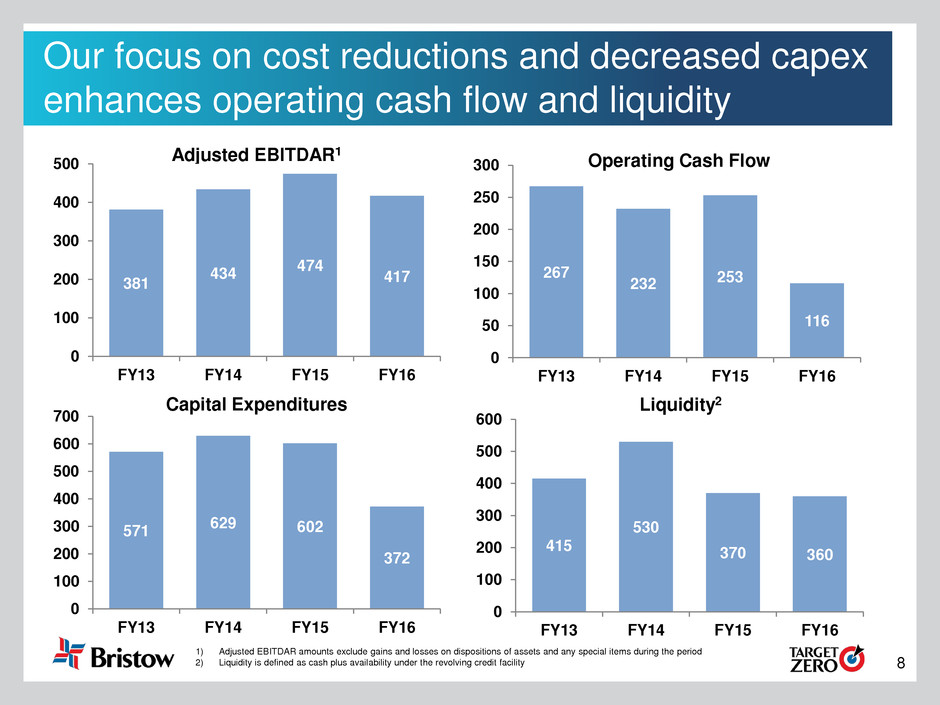

Our focus on cost reductions and decreased capex

enhances operating cash flow and liquidity

1) Adjusted EBITDAR amounts exclude gains and losses on dispositions of assets and any special items during the period

2) Liquidity is defined as cash plus availability under the revolving credit facility

Adjusted EBITDAR1 Operating Cash Flow

Capital Expenditures Liquidity2

381

434

474

417

0

100

200

300

400

500

FY13 FY14 FY15 FY16571

629 602

372

0

100

200

300

400

5

600

700

FY13 FY14 FY15 FY16

415

530

370 360

0

100

200

30

40

5

60

FY13 FY14 FY15 FY16

9

Improving liquidity through strong operating cash

flow and lower capital spend

Total liquidity

$

i

n

m

il

li

o

n

s

$299

$360

• Cost reductions and capital

efficiency initiatives improve

liquidity as market remains

difficult

• Capital deferrals, dividend

reduction and execution of

three AW139 sale-

leasebacks improved

liquidity ahead of FY17

• Declining FY17 capex

requirements as U.K. SAR

implementation completes

and discussions with OEMs

continue

167

255

132

105

100

150

200

250

300

350

400

Q3 FY16 Q4 FY16

Undrawn borrowing capacity Cash

10

We are in control of our future with improvements

to safety and financial strength underway

• Continued cash flow optimization through capital deferral, prior

dividend reduction, and working capital management

• Execution of successful FY16 cost cutting initiatives that

continue into FY17 to make Bristow more competitive

• Global opportunities for new contracts and market share

gains are being pursued evidenced by several recent wins

FY17

action

plan

Financial

and

operational

flexibility

• Amended bank covenants in order to provide financial flexibility

through the oil and gas downturn

• Replaced existing leverage ratio with senior secured leverage ratio

and replaced existing interest coverage ratio with current ratio

• Other identified measures to maintain margins include efficiencies

with our OEM and other partners including capex deferral

11

Cash flow, asset values and mission critical nature

underpin strong investment thesis

• Leading global helicopter service provider to the offshore energy

industry

• Historical record of safe operations and renewed emphasis on safety

culture

• Focus on the production segment of the energy value chain continues to

provide more revenue stability compared to other OFS sectors

• U.K. SAR contract not tied to oil and gas will generate significant stable

revenue and cash flow

• Fixed wing businesses have helped offset pressure from the oil industry

downturn

• Ability to defer capex and further reduce capital needs in support of

liquidity enhancing efforts

• Ba3 / BB- corporate credit rating and Ba2 / BB secured debt rating

12

Appendix

13

1) LACE count based on aircraft types specified in original contract

U.K. SAR

• Two additional bases began operating on

contract in January 2016, bringing the total to

nine of ten operational (including two GAP

SAR bases)

• Tenth and final base expected to begin

operations in April 2017

• Final GAP SAR base will transition to full SAR

contract in July 2017

• 22 new technology SAR helicopters – 11 SAR

S-92s and 11 SAR AW189s following recent

certification of icing protection on the AW189

$ in millions GAP SAR U.K. SAR Total

Operating revenue $43 $135 $177

Adjusted EBITDAR $18 $82 $100

LACE (on contract)1 4 14 18

LACE rate $10.7 $9.6 $9.8

Total U.K. SAR - FY16

14

H225 Fleet Update

• On Friday April 29, 2016, during a flight returning from an offshore

platform in Norway, an accident occurred involving another operator’s

H225LP resulting in 13 fatalities

• Both the U.K. CAA and the Norway CAA issued safety directives

requiring operators to suspend all operations of H225 aircraft

• Bristow currently is not flying a total of 27 H225s globally: 13 H225

helicopters in the U.K., five H225 in Norway and nine H225 aircraft in

Australia

• Bristow has increased utilization of other in-region aircraft including

idle S-92 aircraft and has moved, or is moving, available aircraft to

minimize or eliminate the impact to our clients

• It is too early to determine the positive or negative financial impact

15

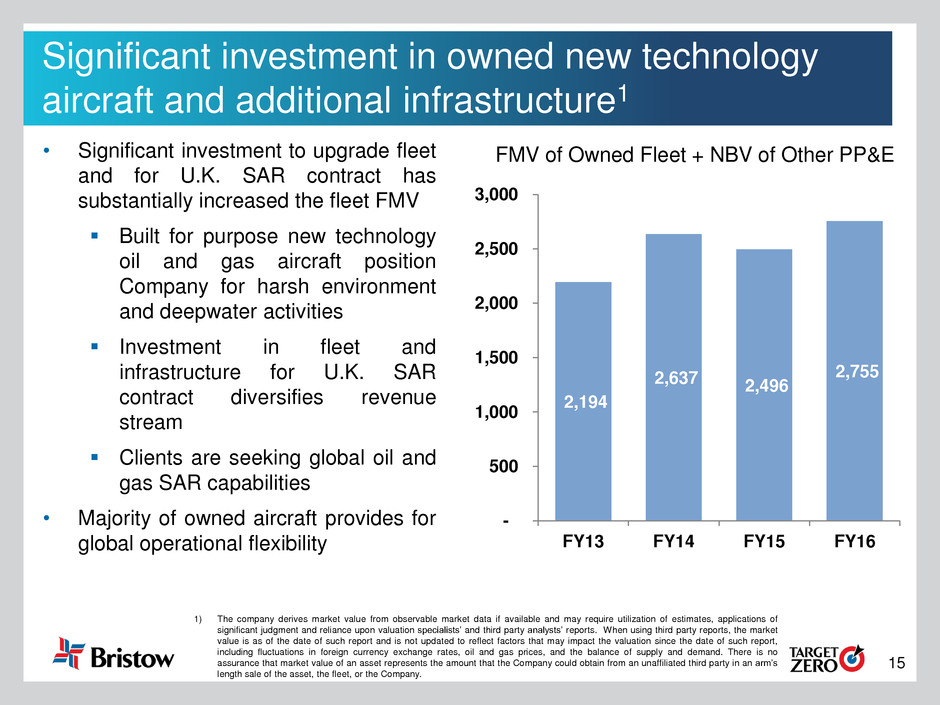

Significant investment in owned new technology

aircraft and additional infrastructure1

• Significant investment to upgrade fleet

and for U.K. SAR contract has

substantially increased the fleet FMV

Built for purpose new technology

oil and gas aircraft position

Company for harsh environment

and deepwater activities

Investment in fleet and

infrastructure for U.K. SAR

contract diversifies revenue

stream

Clients are seeking global oil and

gas SAR capabilities

• Majority of owned aircraft provides for

global operational flexibility

1) The company derives market value from observable market data if available and may require utilization of estimates, applications of

significant judgment and reliance upon valuation specialists’ and third party analysts’ reports. When using third party reports, the market

value is as of the date of such report and is not updated to reflect factors that may impact the valuation since the date of such report,

including fluctuations in foreign currency exchange rates, oil and gas prices, and the balance of supply and demand. There is no

assurance that market value of an asset represents the amount that the Company could obtain from an unaffiliated third party in an arm’s

length sale of the asset, the fleet, or the Company.

FMV of Owned Fleet + NBV of Other PP&E

2,194

2,637 2,496

2,755

-

500

1,000

1,500

2,000

2,500

3,000

FY13 FY14 FY15 FY16

16

286

50 66 60

109

55

58

-

50

100

150

200

250

300

350

FY16A FY17E FY18E FY19E FY20E+

$ in

mi

llio

ns

U.K. SAR Oil and gas aircraft

Bristow has meaningfully reduced projected capex

to enhance financial flexibility

Non-SAR aircraft capex is primarily dedicated to 17 H175 aircraft to be

delivered in FY18 and beyond

Total annual aircraft capex commitments

105

124

17

Bank financial covenants

$ in millions March 31, 2016

Term loan $336

Term loan credit facility 200

Revolving credit facility 144

Covenant PV of leases 604

Letters of credit (secured) 1

Total covenant debt $1,285

TTM Adj EBITDAR $417

Non-cash stock comp expense 21

Cash proceeds from assets sales (max: $20M) 17

Non-cash FX impact 20

Other adjustments 22

TTM Covenant EBITDAR $498

Senior secured leverage ratio actual 2.58x

Senior secured leverage ratio maximum 4.25x

Senior secured leverage ratio

$ in millions March 31, 2016

Total current assets $593

Less: assets HFS (44)

Revolver availability less $25M 230

Total covenant current assets $780

Total current liabilities $393

Le s: Term loan maturity in current assets -

Total covenant current liabilities $393

Covenent current ratio actual 1.99x

Covenent current ratio minimum 1.00x

Current ratio

18

Bristow has the flexibility to reduce our fixed lease costs in

future years without interrupting operations or current revenue

• Modern fleet (average age ~8 years) of 162 LACE aircraft requires limited

ongoing renewal capital investment

• Our mix of owned and leased aircraft gives us the option to return leased

aircraft at expiry; reducing annual fixed cash costs while meeting demand with

owned fleet and committed orders

$2

$20

$45

$76

5

14

23

38

0

5

10

15

20

25

30

35

40

$-

$10

$20

$30

$40

$50

$60

$70

$80

FY17 FY18 FY19 FY20

$ in

millio

ns

Cumulative Rent Savings Cumulative LACE Roll Off

LACE Count

19

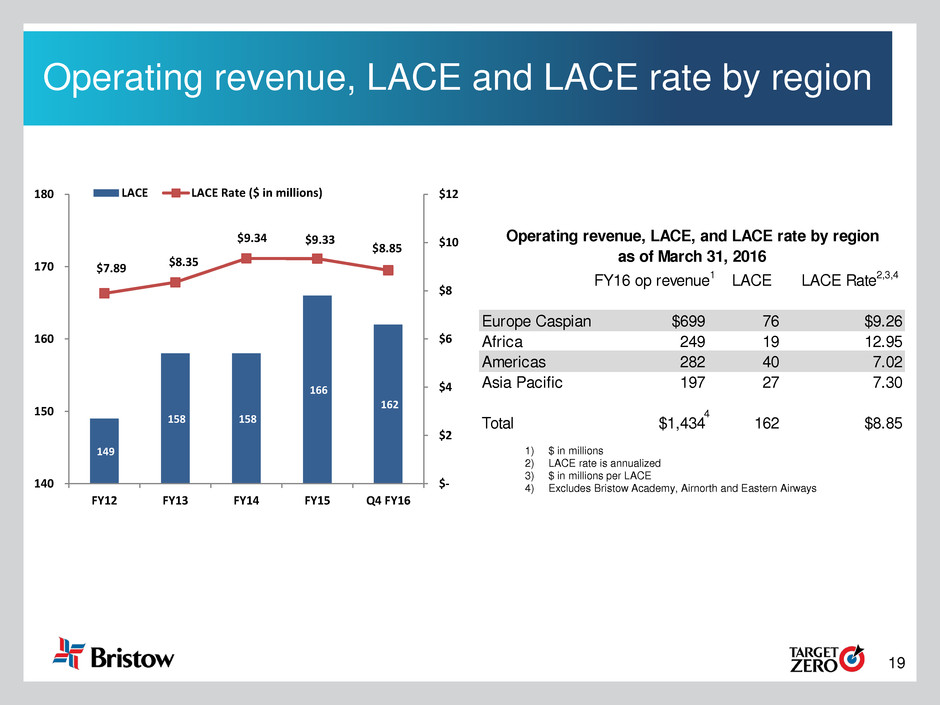

FY16 op revenue1 LACE LACE Rate2,3,4

Europe Caspian $699 76 $9.26

Africa 249 19 12.95

Americas 282 40 7.02

Asia Pacific 197 27 7.30

Total $1,434 162 $8.85

as of March 31, 2016

Operating revenue, LACE, and LACE rate by region

Operating revenue, LACE and LACE rate by region

4

1) $ in millions

2) LACE rate is annualized

3) $ in millions per LACE

4) Excludes Bristow Academy, Airnorth and Eastern Airways

149

158 158

166

162

$7.89 $8.35

$9.34 $9.33

$8.85

$-

$2

$4

$6

$8

$10

$12

140

150

160

170

180

FY12 FY13 FY14 FY15 Q4 FY16

LACE LACE Rate ($ in millions)

20

Historical LACE by region

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Europe Caspian 48 46 52 56 58 60 60 57 62 68 70 72

Africa 23 23 21 21 21 22 23 24 24 24 22 21

Americas 48 46 53 52 51 48 48 47 47 45 46 45

Asia Pacific 29 28 28 30 30 30 34 30 31 29 31 29

Consolidated 147 142 154 158 161 160 165 158 163 166 168 166

Q1 Q2 Q3 Q4

Europe Caspian 74 76 76 76

Africa 22 20 19 19

Americas 41 41 41 40

Asia Pacific 27 27 26 27

Consolidated 164 163 163 162

FY13 FY14 FY15

LACE

FY16

21

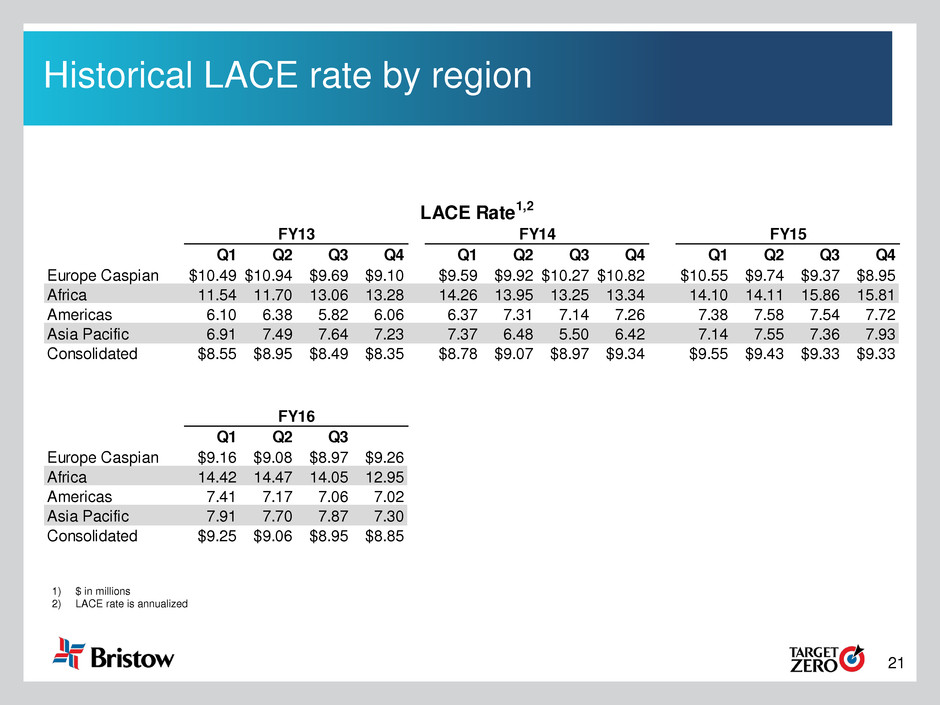

Historical LACE rate by region

1) $ in millions

2) LACE rate is annualized

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Europe Caspian $10.49 $10.94 $9.69 $9.10 $9.59 $9.92 $10.27 $10.82 $10.55 $9.74 $9.37 $8.95

Africa 11.54 11.70 13.06 13.28 14.26 13.95 13.25 13.34 14.10 14.11 15.86 15.81

Americas 6.10 6.38 5.82 6.06 6.37 7.31 7.14 7.26 7.38 7.58 7.54 7.72

Asia Pacific 6.91 7.49 7.64 7.23 7.37 6.48 5.50 6.42 7.14 7.55 7.36 7.93

Consolidated $8.55 $8.95 $8.49 $8.35 $8.78 $9.07 $8.97 $9.34 $9.55 $9.43 $9.33 $9.33

Q1 Q2 Q3

Europe Caspian $9.16 $9.08 $8.97 $9.26

Africa 14.42 14.47 14.05 12.95

Americas 7.41 7.17 7.06 7.02

Asia Pacific 7.91 7.70 7.87 7.30

Consolidated $9.25 $9.06 $8.95 $8.85

FY13 FY14 FY15

LACE Rate1,2

FY16

22

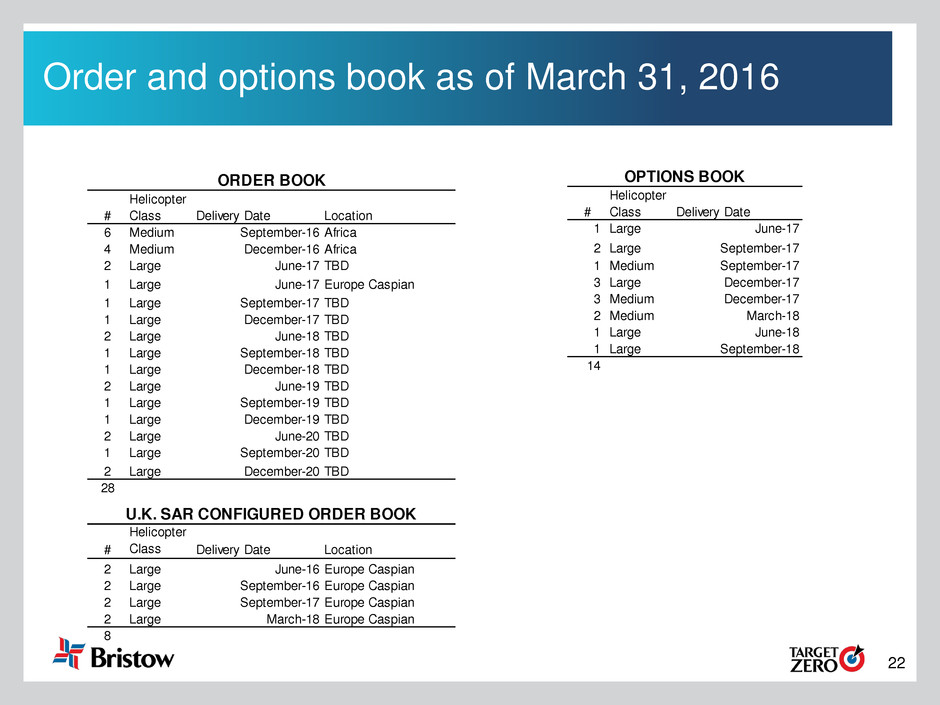

Order and options book as of March 31, 2016

#

Helicopter

Class Delivery Date Location

2 Large June-16 Europe Caspian

2 Large September-16 Europe Caspian

2 Large September-17 Europe Caspian

2 Large March-18 Europe Caspian

8

U.K. SAR CONFIGURED ORDER BOOK

#

Helicopter

Class Delivery Date Location

6 Medium September-16 Africa

4 Medium December-16 Africa

2 Large June-17 TBD

1 Large June-17 Europe Caspian

1 Large September-17 TBD

1 Large December-17 TBD

2 Large June-18 TBD

1 Large September-18 TBD

1 Large December-18 TBD

2 Large June-19 TBD

1 Large September-19 TBD

1 Large December-19 TBD

2 Large June-20 TBD

1 Large September-20 TBD

2 Large December-20 TBD

28

ORDER BOOK

#

Helicopter

Class Delivery Date

1 Larg June-17

2 Large September-17

1 Medium September-17

3 Large December-17

3 Medium December-17

2 Medium March-18

1 Large June-18

1 Large September-18

14

OPTIONS BOOK

23

Adjusted EBITDAR margin trend by region

Adjusted EBITDAR excludes special items and asset dispositions and margin is calculated by taking adjusted EBITDAR divided by operating revenue

Q1 Q2 Q3 Q4 Full Year Q1 Q2 Q3 Q4 Full Year

Europe Caspian 32.0% 34.4% 39.2% 35.8% 35.4% 30.4% 35.3% 35.6% 37.8% 35.0%

Africa 31.5% 26.5% 35.0% 32.0% 31.4% 34.1% 30.1% 31.7% 36.6% 33.3%

Americas 28.5% 28.3% 38.0% 40.0% 33.9% 42.5% 35.7% 37.4% 38.4% 38.1%

Asia Pacific 34.1% 36.6% 34.2% 28.7% 33.3% 25.0% 23.3% 17.4% 28.3% 23.8%

Consolidated 26.3% 26.1% 31.5% 29.4% 28.3% 28.5% 28.7% 27.0% 30.4% 28.6%

Q1 Q2 Q3 Q4 Full Year Q1 Q2 Q3 Q4 Full Year

Europe Caspian 34.1% 33.5% 32.8% 30.9% 32.9% 32.0% 32.5% 34.3% 29.9% 32.1%

Africa 25.9% 30.7% 34.5% 48.6% 34.7% 29.4% 31.3% 29.4% 14.9% 27.2%

Americas 44.7% 31.5% 37.6% 40.8% 38.7% 41.8% 10.0% 49.8% 25.1% 32.0%

Asia Pacific 23.5% 22.7% 24.5% 29.2% 25.2% 22.8% 22.7% 24.6% 26.6% 24.0%

Consolidated 29.2% 25.4% 25.3% 30.2% 27.4% 27.5% 22.1% 29.6% 23.1% 25.6%

FY16

FY14FY13

FY15

24

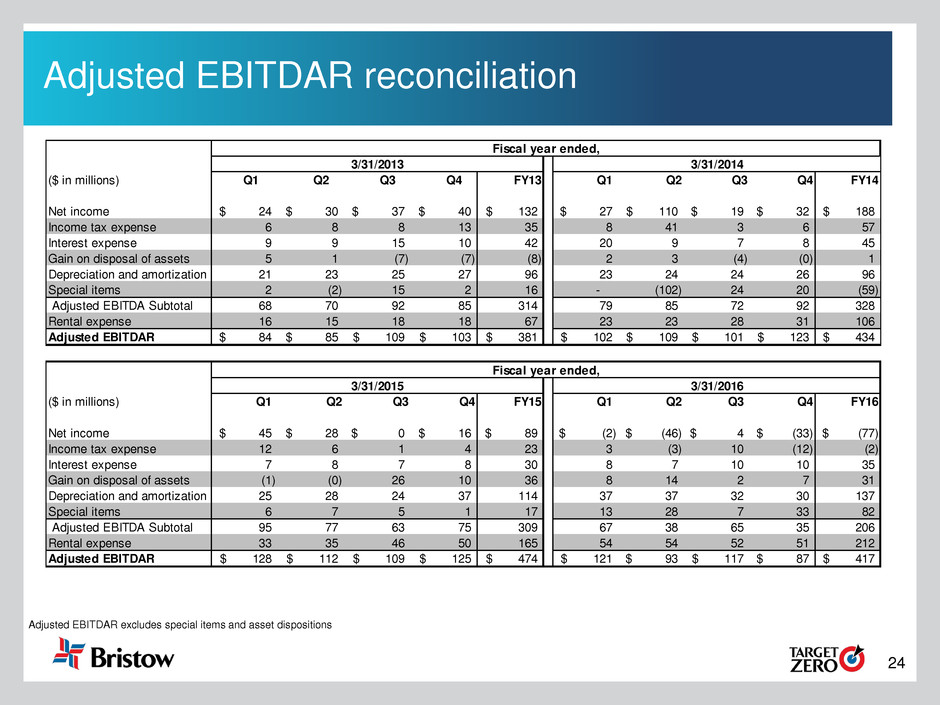

Adjusted EBITDAR reconciliation

Adjusted EBITDAR excludes special items and asset dispositions

($ in millions) Q1 Q2 Q3 Q4 FY13 Q1 Q2 Q3 Q4 FY14

Net income 24$ 30$ 37$ 40$ 132$ 27$ 110$ 19$ 32$ 188$

Income tax expense 6 8 8 13 35 8 41 3 6 57

Interest expense 9 9 15 10 42 20 9 7 8 45

Gain on disposal of assets 5 1 (7) (7) (8) 2 3 (4) (0) 1

Depreciation and amortization 21 23 25 27 96 23 24 24 26 96

Special items 2 (2) 15 2 16 - (102) 24 20 (59)

Adjusted EBITDA Subtotal 68 70 92 85 314 79 85 72 92 328

Rental expense 16 15 18 18 67 23 23 28 31 106

Adjusted EBITDAR 84$ 85$ 109$ 103$ 381$ 102$ 109$ 101$ 123$ 434$

($ in millions) Q1 Q2 Q3 Q4 FY15 Q1 Q2 Q3 Q4 FY16

Net income 45$ 28$ 0$ 16$ 89$ (2)$ (46)$ 4$ (33)$ (77)$

Income tax expense 12 6 1 4 23 3 (3) 10 (12) (2)

Interest expense 7 8 7 8 30 8 7 10 10 35

Gain on disposal of assets (1) (0) 26 10 36 8 14 2 7 31

Depreciation and amortization 25 28 24 37 114 37 37 32 30 137

Special items 6 7 5 1 17 13 28 7 33 82

Adjusted EBITDA Subtotal 95 77 63 75 309 67 38 65 35 206

Rental expense 33 35 46 50 165 54 54 52 51 212

Adjusted EBITDAR 128$ 112$ 109$ 125$ 474$ 121$ 93$ 117$ 87$ 417$

Fiscal year ended,

3/31/2013 3/31/2014

3/31/2015

Fiscal year ended,

3/31/2016

25

GAAP reconciliation

1) See information about special items in the earnings release for Q4 FY16

2) These amounts are presented after applying the appropriate tax effect to each item and dividing by the weighted average shares outstanding during the related period to calculate the earnings

per share impact

2016 2015 2016 2015

Adjusted EBITDAR $86,645 $126,330 $417,363 $473,824

Gain (loss) on disposal of assets (6,837) (10,255) (30,693) (35,849)

Special items1 (33,311) (925) (82,063) (17,132)

Depreciation and amortization (29,959) (37,129) (136,812) (114,293)

Rent expense (51,345) (49,928) (211,840) (164,767)

Interest expense (10,183) (7,895) (35,186) (30,310)

Provision for income taxes 11,582 (4,390) 2,082 (22,766)

Net income ($33,408) $15,808 ($77,149) $88,707

Adjusted net income $4,716 $31,804 $51,308 $133,963

Gain (loss) on disposal of assets2 (3,659) (8,087) (22,028) (28,528)

Special items1,2 (26,312) (8,640) (101,722) (21,135)

Net income (loss) attributable to Bristow Group ($25,255) $15,077 ($72,442) $84,300

Adjusted diluted earnings per share $0.13 $0.91 $1.45 $3.77

Gain (loss) on disposal of assets2 (0.10) (0.23) (0.62) (0.80)

Special items1,2 (0.74) (0.25) (2.92) (0.59)

Diluted earnings (loss) per share ($0.72) $0.43 ($2.12) $2.37

Three months ended

March 31,

12 months ended

March 31,

(In thousands, except per share amounts)

26

Adjusted EBITDAR excludes gains and losses on dispositions of assets

Total leverage reconciliation

Debt Investment Capital Leverage

(a) (b) (c) = (a) + (b) (a) / (c)

(in millions)

As of March 31, 2016 1,140.9$ 1,503.3$ 2,644.2$ 43.1%

Adjust for:

Unfunded pension liability 70.1 70.1

NPV of lease obligations @ 6% 578.3 578.3

Letters of credit 11.7 11.7

Adjusted 1,801.0$ (d) 1,503.3$ 3,304$ 54.5%

Calculation of debt to adjusted EBITDAR multiple

TTM Adjusted EBITDAR1:

Q4 FY16 417.4$ (e)

= (d) / (e) 4.32:1

27

Bristow Group Inc. (NYSE: BRS)

2103 City West Blvd., 4th Floor

Houston, Texas 77042

t 713.267.7600

f 713.267.7620

bristowgroup.com

Contact us