Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 5, 2016

CHINA LENDING CORPORATION

(Exact name of registrant as specified in its charter)

| British Virgin Islands | 001-36664 | 98-1192662 | ||

| (State

or other jurisdiction of incorporation) |

(Commission File Number) | (IRS

Employer Identification No.) |

11th Floor, Satellite Building 473 Satellite Road Economic Technological Development Zone Urumqi, Xinjiang, China |

830000 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number including area code: +86 991-3072247

DT Asia Investments Limited

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

TABLE OF CONTENTS

| Page No. | ||

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 3 | |

| EXPLANATORY NOTE | 4 | |

| Item 1.01. | Entry into a Material Definitive Agreement. | 5 |

| Item 2.01. | Completion of Acquisition of Disposition of Assets. | 5 |

| THE SHARE EXCHANGE AND RELATED TRANSACTIONS | 5 | |

| DESCRIPTION OF BUSINESS | 10 | |

| DESCRIPTION OF PROPERTIES | 25 | |

| RISK FACTORS | 26 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 54 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 74 | |

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 75 | |

| EXECUTIVE COMPENSATION | 81 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 84 | |

| MARKET PRICE OF AND DIVIDENDS ON COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 90 | |

| DESCRIPTION OF SECURITIES | 91 | |

| LEGAL PROCEEDINGS | 97 | |

| INDEMNIFICATION OF DIRECTORS AND OFFICERS | 98 | |

| Item 3.01. | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. | 99 |

| Item 3.02. | Unregistered Sales of Equity Securities. | 99 |

| Item 5.01. | Changes in Control of Registrant. | 100 |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. | 100 |

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. | 100 |

| Item 5.05. | Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics. | 100 |

| Item 5.06. | Change in Shell Company Status. | 100 |

| Item 5.07. | Submission of Matters to a Vote of Security Holders. | 100 |

| Item 9.01. | Financial Statements and Exhibits. | 101 |

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report (the “Report”) contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Plan of Operations,” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the accuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation:

| ● | Market acceptance of our products and services; |

| ● | Competition from existing products or new products that may emerge; |

| ● | The implementation of our business model and strategic plans for our business and our products; |

| ● | Estimates of our future revenue, expenses, capital requirements and our need for financing; |

| ● | Our financial performance; |

| ● | Current and future government regulations; |

| ● | Developments relating to our competitors; and |

| ● | Other risks and uncertainties, including those listed under the section title “Risk Factors.” |

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise, except as required by law.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the SEC.

| 3 |

China Lending Corporation, a British Virgin Islands corporation (“China Lending Corporation” or the “Company,” formerly DT Asia Investments Limited) was incorporated in the British Virgin Islands as a company with limited liability on April 8, 2014. The Company was formed for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation, or contractual control arrangement with, purchasing all or substantially all of the assets of, or engaging in any other similar business combination with one or more businesses or entities.

On July 6, 2016 (the “Closing Date”), we consummated the transaction contemplated by a Share Exchange Agreement (the “Share Exchange Agreement”) dated January 11, 2016, by and among DT Asia Investments Limited (“DT Asia”), Adrie Global Holdings Limited, a business company incorporated in the British Virgin Islands with limited liability (“Adrie”), each of Adrie’s shareholders (collectively, the “Sellers”), DT Asia’s sponsor, DeTiger Holdings Limited, in the capacity as the representative for DT Asia’s shareholders prior to the closing of the Business Combination (defined below) (the “DT Representative”), and Li Jingping in the capacity as the representative for the Sellers (the “Seller Representative”), pursuant to which DT Asia acquired from the Sellers all of the issued and outstanding equity interests of Adrie in exchange for 20,000,000 ordinary shares of DT Asia (the “Business Combination”). As a result of the Business Combination, the Sellers, as the former shareholders of Adrie, became the controlling shareholders of the Company and Adrie became a subsidiary of the Company. The Share Exchange was accounted for as a reverse merger effected by a share exchange, wherein Adrie is considered the acquirer for accounting and financial reporting purposes.

As a result of the Business Combination, DT Asia will continue the existing business operations of Adrie as a publicly traded company under the name “China Lending Corporation.”

In accordance with “reverse merger” or “reverse acquisition” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the Business Combination will be replaced with the historical financial statements of Adrie in all future filings with the U.S. Securities and Exchange Commission (“SEC”).

As used in this Report henceforward, unless otherwise stated or the context clearly indicates otherwise, the terms the “Company,” the “Registrant,” “we,” “us” and “our” refer to China Lending Corporation, giving effect to the Business Combination.

This Report contains summaries of the material terms of various agreements executed in connection with the Business Combination described herein. The summaries of these agreements are subject to, and are qualified in their entirety by, reference to these agreements, which are filed as exhibits hereto and incorporated herein by reference.

Prior to the Business Combination, we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended). As a result of the Business Combination, we have ceased to be a “shell company.” The information contained in this Report, together with the information contained in our Annual Report on Form 10-K for the fiscal year ended March 31, 2016 and Current Reports on Form 8-K, as filed with the SEC, constitute the current “Form 10 information” necessary to satisfy the conditions contained in Rule 144(i)(2) under the Securities Act of 1933, as amended (the “Securities Act”).

| 4 |

| Item 1.01. | Entry into a Material Definitive Agreement. |

The information contained in Item 2.01 below relating to the various agreements described therein is incorporated herein by reference.

| Item 2.01. | Completion of Acquisition of Disposition of Assets. |

THE SHARE EXCHANGE AND RELATED TRANSACTIONS

The Share Exchange

On January 11, 2016, DT Asia entered into a Share Exchange Agreement with Adrie, the Sellers, the DT Representative, and the Seller Representative, pursuant to which DT Asia effected an acquisition of Adrie and its subsidiaries, including certain wholly foreign-owned enterprises registered in China which contractually control Urumqi Feng Hui Direct Lending Limited, a registered company in Xinjiang China (Adrie and its controlled entities, collectively, the “China Lending Group”) by acquiring from the Sellers all outstanding equity interests of Adrie (the “Business Combination”). The Business Combination closed on July 6, 2016 and pursuant to the terms of the Share Exchange Agreement, Adrie became a wholly-owned subsidiary of the Company.

Pursuant to the Business Combination, we acquired the business of the China Lending Group, which is to engage in the business of providing loan facilities to micro, small and medium sized enterprises (“MSMEs”) and sole proprietors in the Xinjiang Uyghur Autonomous Region (“Xinjiang Province”) of the People’s Republic of China (“PRC” or “China”). As a result, we have ceased to be a shell company.

At the closing of the Business Combination, pursuant to the Share Exchange Agreement, Adrie’s 20,000,000 shares of capital stock issued and outstanding immediately prior to the closing of the Business Combination were exchanged for an aggregate of 20,000,000 of our ordinary shares (the “Exchange Shares”), with 8,000,000 of the Exchange Shares (the “Escrow Shares”) being held in escrow and subject to forfeiture (along with dividends and other earnings otherwise payable with respect to such Escrow Shares) in the event that we fail to meet certain minimum financial performance targets or in the event that the DT Representative successfully brings an indemnification claim under the Share Exchange Agreement on behalf of DT Asia’s pre-Business Combination shareholders.

The Share Exchange Agreement contains customary representations and warranties, pre- and post-closing covenants of each party and customary closing conditions. In consummating the Business Combination, the parties to the Share Exchange Agreement waived certain closing conditions, including, but not limited to the wavier of (i) the $12 million PIPE investment condition which required that DT Asia shall have completed the PIPE Offering for at least $12 million and (ii) the $10 million minimum closing proceeds condition which required that upon the closing of the Business Combination and after giving effect to the completion of the redemptions of the ordinary shares and the PIPE Offering, there would be at least $10 million in closing proceeds. Breaches of the representations and warranties are subject to indemnification claims and, other than claims based on fraud, willful misconduct or intentional misrepresentations, are limited to the value of the Escrow Shares.

The Business Combination will be treated as a “reverse acquisition” of the Company for financial accounting purposes, Adrie will be considered the acquirer for accounting purposes, and the historical financial statements of DT Asia before the Business Combination will be replaced with the historical financial statements of Adrie and its consolidated entities before the Business Combination in all future filings with the SEC.

| 5 |

The issuance of our ordinary shares to holders of Adrie’s capital stock in connection with the Business Combination has not been registered under the Securities Act, in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering, and Regulation D and/or Regulation S promulgated by the SEC under that section. The Exchange Shares may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirement.

The foregoing description of the Share Exchange Agreement does not purport to be complete and is qualified in its entirety by reference to the Share Exchange Agreement, a copy of which is filed herewith as Exhibit 2.1 and is incorporated herein by reference. There are representations and warranties contained in the Share Exchange Agreement which were made by the parties to each other as of specific dates. The assertions embodied in these representations and warranties were made solely for purposes of the Share Exchange Agreement and may be subject to important qualifications and limitations agreed to by the parties in connection with negotiating their terms. Moreover, certain representations and warranties may not be accurate or complete as of any specified date because they are subject to a contractual standard of materiality that is different from certain standards generally applicable to shareholders or were used for the purpose of allocating risk between the parties rather than establishing matters as facts. Based on the foregoing reasons, investors should not rely on the representations and warranties as statements of factual information.

Registration Rights Agreement

On July 6, 2016 and in connection with the Business Combination, DT Asia entered into a Registration Rights Agreement with the Sellers and the DT Representative (the “Registration Rights Agreement”). Under the Registration Rights Agreement, the Sellers will hold registration rights that will obligate the Company to register for resale under the Securities Act, all or any portion of the Exchange Shares so long as such shares are not then restricted under the Lock-Up Agreement (defined below). Sellers holding a majority-in-interest of all Exchange Shares then issued and outstanding will be entitled under the Registration Rights Agreement to make a written demand for registration under the Securities Act of all or part of the their Exchange Shares, so long as such shares are not then restricted under the Lock-Up Agreement. Subject to certain exceptions, if any time after the closing of the Business Combination, the Company proposes to file a registration statement under the Securities Act with respect to its securities, under the Registration Rights Agreement, the Company shall give notice to the Sellers as to the proposed filing and offer the Sellers holding Exchange Shares an opportunity to register the sale of such number of Exchange Shares as requested by the Sellers in writing. In addition, subject to certain exceptions, Sellers holding Exchange Shares will be entitled under the Registration Rights Agreement to request in writing that the Company register the resale of any or all of such Exchange Shares on Form S-3 and any similar short-form registration that may be available at such time.

Under the Registration Rights Agreement, the Company will agree to indemnify the Sellers and certain persons or entities related to the Sellers such as their officers, directors, employees, agents and representatives against any losses or damages resulting from any untrue statement or omission of a material fact in any registration statement or prospectus pursuant to which they sell Exchange Shares, unless such liability arose from their misstatement or omission, and the Sellers including registrable securities in any registration statement or prospectus will agree to indemnify the Company and certain persons or entities related to the Company such as its officers and directors and underwriters against all losses caused by their misstatements or omissions in those documents.

| 6 |

The foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the Registration Rights Agreement, a copy of which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

Lock-Up Agreement

On July 6, 2016 and in connection with the Business Combination, the Sellers entered into a Lock-Up Agreement with DT Asia and the DT Representative (the “Lock-Up Agreement”). Under the Lock-Up Agreement, each Seller agrees that such Seller will not, from the closing of the Business Combination until the first anniversary of the closing (or if earlier, the date on which the Company consummates a liquidation, merger, share exchange or other similar transaction with an unaffiliated third party that results in all of the Company’s shareholders having the right to exchange either equity holdings in us for cash, securities or other property), (i) sell, offer to sell, contract or agree to sell, hypothecate, pledge, grant any option to purchase or otherwise dispose of or agree to dispose of, directly or indirectly, or establish or increase a put equivalent position or liquidate or decrease a call equivalent position within the meaning of Section 16 of the Exchange Act with respect to any of its Exchange Shares, (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any of its Exchange Shares, in cash or otherwise, or (iii) publicly announce any intention to effect any transaction specified in clause (i) or (ii). Each Seller further agrees that the Escrow Shares will continue to be subject to such transfer restrictions until they are released from the escrow account. However, each Seller will be allowed to transfer any of its Exchange Shares (other than the Escrow Shares while they are held in the escrow account) by gift, will or intestate succession or to any affiliate, stockholder, members, party or trust beneficiary, provided in each such case that the transferee thereof agrees to be bound by the restrictions set forth in the Lock-up Agreement. Additionally, each Seller will be allowed to pledge its Exchange Shares (other than the Escrow Shares while they are held in the escrow account) to an unaffiliated third party as a guarantee to secure borrowings made by such third party to Adrie or any of its subsidiaries or and variable interest entities.

The foregoing description of the Lock-Up Agreement does not purport to be complete and is qualified in its entirety by reference to the Lock-Up Agreement, a copy of which is filed herewith as Exhibit 10.2 and is incorporated herein by reference.

Non-Competition and Non-Solicitation Agreement

On July 6, 2016 and in connection with the Business Combination, certain Sellers and individuals associated with such Sellers that are involved in the management of the Company (together with such Seller referred to as the “Subject Parties”) entered into Non-Competition and Non-Solicitation Agreements (the “Non-Competition and Non-Solicitation Agreements”) in favor of the Company, Adrie and their respective successors, affiliates and subsidiaries and variable interest entities (referred to as the “Covered Parties”). Under the Non-Competition and Non-Solicitation Agreements, for a period from the closing of the Business Combination to four years thereafter (or if later, the date on which the Subject Parties, their respective affiliates or any of their respective officers, directors or employees are no longer directors, officers, managers or employees of Adrie or its subsidiaries or variable interest entities), each Subject Party and its affiliates will not, without the Company’s prior written consent, anywhere in the PRC directly or indirectly engage in (or own, manage, finance or control, or become engaged or serve as an officer, director, employee, member, partner, agent, consultant, advisor or representative of, an entity that engages in) the business of directly or indirectly providing non-bank micro-credit and small and mid-size business lending in the PRC (the “Business”). However, the Subject Parties and their respective affiliates are permitted under the Non-Competition and Non-Solicitation Agreements to own passive portfolio company investments in a competitor, so long as the Subject Parties and their affiliates and their respective shareholders, directors, officer, managers and employees who were involved with the business of Adrie and its subsidiaries and variable interest entities are not involved in the management or control of such competitor. Additionally, family members and associates of Subject Parties are permitted to continue their existing activities as specified in the agreement, even if competitive, as long as the Subject Parties are not involved in the management or control of such competitor. Under the Non-Competition and Non-Solicitation Agreements, during such restricted period, the Subject Parties also will not, without the Company’s prior written consent, (i) solicit or hire the Covered Parties’ employees, consultants or independent contractors as of the closing (or during the year prior to the closing) or otherwise interfere with the Covered Parties’ relationships with such persons, (ii) solicit or divert the Covered Parties’ customers as of the closing (or during the year prior to the closing) relating to the Business or otherwise interfere with the Covered Parties’ contractual relationships with such persons, or (iii) interfere with or disrupt any Covered Parties’ vendors, suppliers, distributors, agents or other service providers for a purpose competitive with a Covered Party as it relates to the Business. The Subject Parties also agree in each Non-Competition and Non-Solicitation Agreement to not disparage the Covered Parties and to keep confidential and not use the confidential information of the Covered Parties.

| 7 |

The foregoing description of the Form Non-Competition and Non-Solicitation Agreement does not purport to be complete and is qualified in its entirety by reference to the Form Non-Competition and Non-Solicitation Agreement, a copy of which is filed herewith as Exhibit 10.3 and is incorporated herein by reference.

Escrow Agreement

On July 6, 2016 and in connection with the Business Combination, the Company and the Seller Representative (on behalf of the Sellers) entered into an Escrow Agreement (the “Escrow Agreement”) with Continental Stock Transfer & Trust Company (the “Escrow Agent”). Pursuant to the Escrow Agreement, Escrow Agent will hold the Escrow Shares in a segregated escrow account, to be held and disbursed as agreed to in the Share Exchange Agreement. The DT Representative will have the sole right to act on behalf of the Company under the Escrow Agreement. The Company and the Seller Representative (on behalf of the Sellers) will split half of the Escrow Agent’s fees, costs, expenses and indemnification obligations.

The foregoing description of the Escrow Agreement does not purport to be complete and is qualified in its entirety by reference to the Escrow Agreement, a copy of which is filed herewith as Exhibit 10.4 and is incorporated herein by reference.

Departure and Appointment of Directors and Officers

Upon the closing of the Business Combination, all of our incumbent directors, except Jason Kon Man Wong, resigned from their position as directors, and Mr. Alain Vincent Fontaine, Ms. Qi Wen, Ms. Li Jingping and Mr. Si Shen were appointed to the Board of Directors of the Company (the “Board”). Mr. Si Shen will serve as a Class I director, Ms. Qi Wen and Ms. Li Jingping will serve as Class II directors and Mr. Jason Kon Man Wong and Mr. Alain Vincent Fontaine will serve as Class III directors. The member of Class I will serve as a director until our annual meeting in 2017, members of Class II will serve as directors until our annual meeting in 2018 and members of Class III will serve as directors until our annual meeting in 2019.

Also, upon closing of the Business Combination, our President and Chief Executive Officer, Stephen Cannon, resigned from these positions and Ms. Li Jingping was appointed as our President and Chief Executive Officer by the Board.

| 8 |

Accounting Treatment; Change of Control

The Business Combination is being accounted for as a “reverse acquisition,” and Adrie is deemed to be the acquirer. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Business Combination will be those of Adrie and its consolidated subsidiaries and will be recorded at the historical cost basis of Adrie, and the consolidated financial statements after consummation of the Business Combination will include the assets and liabilities of Adrie, historical operations of Adrie, and operations of the Company and its subsidiaries from the Closing Date of the Business Combination.

As a result of the issuance of the Exchange Shares pursuant to the Business Combination, a change of control of the Company occurred as of the Closing Date. Except as described in this Report, no arrangements or understandings exist among present or former controlling shareholders with respect to the election of members of our Board and, to our knowledge, no other arrangements exist that might result in a change of control of the Company.

We continue to be a “smaller reporting company,” as defined under the Exchange Act, following the Business Combination. We believe that, as a result of the Business Combination, we have ceased to be a “shell company” (as that term is defined in Rule 12b-2 under the Exchange Act).

| 9 |

Immediately following the Business Combination, the business of China Lending Group is to engage in providing loan facilities to micro, small and medium sized enterprises (“MSMEs”) and sole proprietors in the Xinjiang Uyghur Autonomous Region (“Xinjiang Province”) of the People’s Republic of China (“PRC” or “China”).

Corporate Information

As described above, we were incorporated in the British Virgin Islands in April 2014. The Company was formed for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation, or contractual control arrangement with, purchasing all or substantially all of the assets of, or engaging in any other similar business combination with one or more businesses or entities. Since incorporation and prior to the Business Combination, we were a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act).

As a result of the Business Combination, we acquired the business of China Lending Group and have ceased to be a shell company. China Lending Group commenced operations as a British Virgin Islands company in 2014.

As of July 6, 2016, our authorized and issued capital stock consisted of 22,132,474 ordinary shares, 715,000 Series A Convertible Preferred Shares, 6,852,835 public warrants, 2,387,126 Sponsor warrants, 6,852,835 public rights, 319,119 private rights held by our Sponsor, 7,228 public units and 33,134 private units held by EarlyBirdCapital, Inc. (“EarlyBird”). Our ordinary shares and warrants will begin trading on the Nasdaq Capital Market under the symbols “CLDC” and “CLDCW,” respectively, on or around July 12, 2016.

Our principal executive offices are located at 11th Floor, Satellite Building, 473 Satellite Road, Economic Technological Development Zone, Urumqi, Xinjiang, China. Our telephone number is +86 991-3072247. Our website address is chinalending.com. The information contained on our website is not incorporated by reference into this Current Report on Form 8-K.

| 10 |

Corporate History and Structure of our PRC Operation

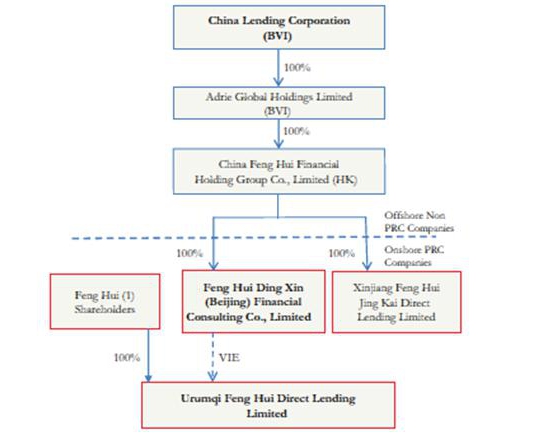

Corporate Organization Chart

The following is an organizational chart setting forth our corporate structure, immediately following the Business Combination:

| 11 |

(1) Below is a list of the current shareholders of Feng Hui:

| Record Holder | Ownership Percentage | Beneficial Owner* | Beneficial Ownership in Record Holder | |||||||||

| 1 | Xinjiang Pu Zhao Technology Development Co., Ltd. | 20.0000 | % | Qi Wen | 77.4 | % | ||||||

| 2 | Xinjiang Nolde Equity Investment limited Partnership | 5.0000 | % | Feng Shuangping | 33.00 | % | ||||||

| Qi Wen | 33.00 | % | ||||||||||

| Li Jingping | 34.00 | % | ||||||||||

| 3 | Xinjiang Huajun Energy Saving Equipment Co., Ltd. | 10.0000 | % | Li Jingping | 80.00 | % | ||||||

| 4 | Xinjiang Shuangcheng Equity Investment Co., Ltd. | 5.0000 | % | Feng Mengshi | 90.00 | % | ||||||

| 5 | Xinjiang Yongji Commercial and Trade Co., Ltd. | 5.0000 | % | Zheng Yongde | 49.00 | % | ||||||

| Shi Xiaofang | 51.00 | % | ||||||||||

| 6 | Xinjiang Shenghe Dairy Co., Ltd. | 10.0000 | % | Yang Yali | 45.00 | % | ||||||

| Yang Yaping | 45.00 | % | ||||||||||

| 7 | Xinjiang Reide Lighting Co., Ltd. | 10.0000 | % | Liang Zandong | 99.00 | % | ||||||

| 8 | Xinjiang Xinruihongcheng Commercial and Trade Co., Ltd. | 5.0000 | % | Pan Chunju | 50.00 | % | ||||||

| Wang Qing | 50.00 | % | ||||||||||

| 9 | Xinjiang Pu Yuan Logistics Co., Ltd. | 4.6000 | % | Xinjiang Pu Zhao Technology Development Co., Ltd. (refer to No.1) | 70.00 | % | ||||||

| 10 | Li Jingping | 7.2500 | % | |||||||||

| 11 | Ma Shiyao | 1.6667 | % | |||||||||

| 12 | Li Yuanqing | 0.3333 | % | |||||||||

| 13 | Qi Wen | 8.8167 | % | |||||||||

| 14 | Guo Xiaoyan | 0.6666 | % | |||||||||

| 15 | Zhang Jianfeng | 1.6667 | % | |||||||||

| 16 | Chen Hong | 5.0000 | % | |||||||||

| Total | 100.0000 | % | ||||||||||

| * | Beneficial owners of 30% or more of applicable record holders, where record holder is not an individual |

| 12 |

History

Adrie is a limited liability company organized in 2014 under the laws of the British Virgin Islands and after the Business Combination is a direct, wholly-owned subsidiary of the Company. Adrie is a holding company that has no operations and no assets other than its ownership of China Feng Hui Financial Holding Group Co., Limited (“Feng Hui Financial Group”).

Feng Hui Financial Group is a limited liability company organized in 2015 under the laws of the Hong Kong Special Administrative Region of the PRC. It is the wholly owned subsidiary of Adrie. Feng Hui Financial Group is a holding company that has no operations and no assets other than its ownership of Feng Hui Ding Xin (Beijing) Financial Consulting Co., Limited (“Consulting”) and Xinjian Feng Hui Jing Kai Direct Lending Limited (“XWFOE”).

Consulting is a limited liability company organized in 2015 under the laws of the PRC. Consulting is a wholly-owned subsidiary of Feng Hui Financial Group with the business purposes of providing risk management-related financial consulting services to XWFOE and Urumqi Feng Hui Direct Lending Limited (“Feng Hui” and together with XWFOE, the “Lending Companies”) and to third-party direct lending companies in China and to enter into certain agreements with Feng Hui and its shareholders pursuant to which Consulting provides certain services to Feng Hui.

XWFOE is a limited liability company organized in 2015 under the laws of the PRC with the approval of the Financial Office of Xinjiang Provincial Government. XWFOE is a wholly-owned subsidiary of Feng Hui Financial Group with the business purposes of providing direct loans to MSMEs and sole-proprietors in Xinjiang Province. XWFOE has not yet conducted any operating activities.

Feng Hui is a limited liability company organized in 2009 under the laws of the PRC with the approval of Financial Office of Xinjiang Province Government and is engaged in providing direct loans to MSMEs and sole proprietors in Xinjiang Province. Feng Hui is owned by 16 shareholders, nine of which are legal persons and the remainder of which are natural persons. Feng Hui and its shareholders entered into certain variable interest entity contracts with Consulting pursuant to which the profits of Feng Hui are paid to Consulting, and in connection with entering into such contracts, Feng Hui is contractually controlled by Consulting.

The Lending Companies

As noted above, Adrie’s wholly-owned subsidiary XWFOE and consolidated variable interest entity, Feng Hui, are each licensed to provide direct loans to MSMEs and sole proprietors in Xinjiang Province, including Urumqi, the province’s capital and financial and commercial hub. While Feng Hui has operated as a direct lender since 2009, XWFOE was established in 2015 and its direct lending authority was not effective, and did not commence operations, until the closing of the Business Combination and net proceeds were injected as registered capital into XWFOE.

Both of the Lending Companies are consolidated into China Lending Group for financial reporting purposes, and China Lending Group intends to operate the two parallel direct lending services under the “Feng Hui” and “Jing Kai” brand names. Each Lending Company is an independent business entity and has its own management, employees, assets and office facilities. Although both of the Lending Companies are in the direct lending industry, their business models and focuses are different: while Feng Hui will continue to grow through traditional direct lending services, XWFOE will emphasize more on financial innovation, including supply chain finance.

| 13 |

Feng Hui currently engages in both the traditional direct lending business and financial innovation, such as supply chain finance in which Feng Hui provides financing for suppliers purchasing inventory from distributors. During 2015, Feng Hui originated loans to supply chain finance accounts constituting 24.94% of total loans originated. However, Feng Hui’s practice of supply chain finance has been limited to certain industries, primarily the tire industry, and has not expanded into other vertical industrial networks due to maximum leverage constraints. Feng Hui is a PRC domestic company whose lending capacity is constrained by the regulatory leverage ceiling of 1.5 times; therefore its current business has already saturated its lending capacity. During 2015, the monthly average fund utilization (cash or cash equivalent/loan receivables) of Feng Hui reached 98.5%, and it came to 99.8% for the first three months of 2016.

The Company believes that supply chain finance offers substantial market potential and intends, through XWFOE, to devote more attention to supply chain finance in new and various industries following the consummation of the Business Combination. The Company believes that XWFOE’s operations will not significantly overlap or cannibalize the traditional lending business of Feng Hui, because XWFOE will focus its operations on supply chain finance in industries in which Feng Hui is not currently operating and because the overall unmet MSME demand for loans. In 2014, the estimated loan shortage for MSMEs reached over $4.9 trillion in China, based on the data from China’s National Bureau of Statistics.

Substantially all of the money available after the Business Combination will be contributed to XWFOE’s registered capital. As shareholders of the pre-Business Combination DT Asia redeemed approximately 96% of the maximum of number of ordinary shares in connection with the Business Combination, the amount of net closing proceeds resulting from the Business Combination will not allow the Company to proceed on its preferred timeline; however, the Company still intends to implement its financial innovation strategy, but initially starting with a smaller scale. In preparation for such implementation, the Company has already established a research division, with several financial experts, to conduct research and development on financial innovation products beyond supply chain finance.

Consulting

As noted above, Adrie’s wholly-owned subsidiary, Consulting, is licensed to provide financial consulting services such as loan origination criteria, risk assessment and loan monitoring in several major metropolitan areas in China. Consulting was organized in Beijing having a branch company in Urumqi, Xiangjiang in the second quarter of 2015 and started operations as of August 1, 2015. Since its inception through March 31, 2016, Consulting has provided consulting services to 164 clients.

Consulting established its proprietary big data credit risk analytics (“CRA”) platform in the first quarter of 2016 to provide credit rating and risk management solutions to clients within the Company as well as other players in the industry.

Contractual Arrangements between Consulting, Feng Hui, and Feng Hui’s Shareholders

Consulting, Feng Hui and/or Feng Hui’s shareholders have executed the following agreements and instruments, pursuant to which the Company, through its subsidiary Consulting, controls Feng Hui: Equity Pledge Agreement, Exclusive Business Cooperation Agreement, Exclusive Purchase Option Agreement and Power of Attorney (the “VIE Agreements”). Each of the VIE Agreements is described below and became effective upon its execution.

| 14 |

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Feng Hui and Consulting, Consulting provides Feng Hui with comprehensive business support, technical services and consulting services relating to its day-to-day business operations and management, on an exclusive basis.

For services rendered to Feng Hui by Consulting under this agreement, Consulting is entitled to collect a service fee calculated based on the complexity, required time, contents and commercial value of the consulting services provided by Consulting. Consulting will calculate and sum up the service fees and correspondingly issue a notice to Feng Hui. Feng Hui will pay such service fees to the bank accounts as designated by Consulting within 10 working days from the receipt of such notice.

The Exclusive Business Cooperation Agreement shall remain in effect for five years unless it is terminated by Consulting at its discretion with 30-days prior notice. Feng Hui does not have the right to terminate the Exclusive Business Cooperation Agreement unilaterally. Consulting may at its discretion unilaterally extend the term of the Exclusive Business Cooperation Agreement.

The foregoing description of the Exclusive Business Cooperation Agreement does not purport to be complete and is qualified in its entirety by reference to the Exclusive Business Cooperation Agreement, a copy of which is filed herewith as Exhibit 10.5 and is incorporated herein by reference.

Equity Pledge Agreement

Under the Equity Pledge Agreement between the Feng Hui shareholders and Consulting, the 16 Feng Hui shareholders pledged all of their equity interests in Feng Hui to Consulting to guarantee the secured indebtedness caused by failure of performance of Feng Hui’s and the Feng Hui shareholders’ obligations under the Exclusive Business Cooperation Agreement, Exclusive Purchase Option Agreement and Power of Attorney. Under the terms of the Equity Pledge Agreement, any dividend or bonus received by Feng Hui in respect of the Pledged Equity shall be deposited into an account designated by Consulting. The Feng Hui shareholders also agreed that upon occurrence of any event of default, as set forth in the Equity Pledge Agreement, Consulting is entitled to dispose of the pledged equity interest in accordance with applicable PRC laws. The Feng Hui shareholders further agreed not to dispose of the pledged equity interests or take any actions that would prejudice Consulting’s interest.

The Equity Pledge Agreement shall be effective until all obligations under the other VIE Agreements have been performed by Feng Hui, when the VIE Agreements are terminated or when the secured indebtedness has been satisfied in full.

The foregoing description of the Equity Pledge Agreement does not purport to be complete and is qualified in its entirety by reference to the Equity Pledge Agreement, a copy of which is filed herewith as Exhibit 10.6 and is incorporated herein by reference.

Exclusive Purchase Option Agreement

Under the Exclusive Purchase Option Agreement, the Feng Hui shareholders irrevocably granted Consulting (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, part or all of their equity interests in Feng Hui. The option price is equal to the lowest price permissible by PRC laws.

The Exclusive Purchase Option Agreement will remain effective for a term of five years and may be renewed at Consulting’s discretion.

| 15 |

The foregoing description of the Exclusive Purchase Option Agreement does not purport to be complete and is qualified in its entirety by reference to the Exclusive Purchase Option Agreement, a copy of which is filed herewith as Exhibit 10.7 and is incorporated herein by reference.

Power of Attorney

Under the Power of Attorney, each Feng Hui shareholder authorized Consulting to act on the shareholder’s behalf as his, her or its exclusive agent and attorney with respect to all rights as a shareholder of Feng Hui, under PRC laws and the Articles of Association of Feng Hui, including but not limited to attending shareholder meetings and voting to approve the sale or transfer or pledge or disposition of shares in part or in whole or to designate and appoint the legal representative, directors, and supervisors of Feng Hui. When Consulting executes such shareholders’ rights, it should obtain all the current Consulting directors’ approval by the resolution of board of directors.

The Power of Attorney shall be continuously valid with respect to each Feng Hui shareholder from the date of execution of the Power of Attorney, so long as such Feng Hui shareholder is a shareholder of Feng Hui. Consulting is entitled to terminate the Power of Attorney unilaterally at its discretion by the written notice to Feng Hui.

In the opinion of our PRC counsel, DeHeng Law Office, these contractual arrangements are valid, binding and enforceable under current PRC laws. There are substantial uncertainties regarding the interpretation and application of current or future PRC laws and regulations. See “Risk Factors--Risks Related to the Company’s Corporate Structure” below.

The foregoing description of the Power of Attorney does not purport to be complete and is qualified in its entirety by reference to the Power of Attorney, a copy of which is filed herewith as Exhibit 10.8 and is incorporated herein by reference.

Our Business

Immediately following the consummation of the Business Combination, the business of China Lending Group became our business. With Adrie formed as a non-operational holding company, the China Lending Group is a PRC-based group of companies specializing in providing loan facilities to MSMEs and sole proprietors in Xinjiang Province.

Most of our customers are MSMEs and individual proprietors located in Urumqi, Xinjiang Province. Our customers are involved in the commerce, energy and mining, real estate, agriculture and husbandry, services and manufacturing industries, in particular, loans to the commerce and service industry accounts for 37.80% and 35.86% of total amount of loans originated by the Company during the first three months of 2016 and 2015, respectively.

| 16 |

The loan origination distribution of customers during the first three months of 2016 is summarized below:

| Number of loans | Percentage | Loan Amount (in ‘000) | Percentage | |||||||||||

| Commerce & Service | 46 | 42.59 | % | $ | 31,456 | 37.80 | % | |||||||

| Supply Chain Finance | 36 | 33.33 | % | 31,643 | 38.02 | % | ||||||||

| Manufacturing | 8 | 7.41 | % | 4,717 | 5.67 | % | ||||||||

| Real Estate | 3 | 2.78 | % | 4,663 | 5.60 | % | ||||||||

| Agriculture | 5 | 4.63 | % | 7,122 | 8.56 | % | ||||||||

| Energy and Mining | 2 | 1.85 | % | 3,058 | 3.67 | % | ||||||||

| Consumer Credit | 8 | 7.41 | % | 563 | 0.68 | % | ||||||||

| 108 | 100.00 | % | $ | 83,221 | 100.00 | % | ||||||||

The loan origination distribution of customers during 2015 is summarized below:

| Number of loans | Percentage | Loan Amount (in ‘000) | Percentage | |||||||||||

| Commerce & Service | 108 | 39.56 | % | $ | 85,114 | 35.86 | % | |||||||

| Supply Chain Finance | 59 | 21.61 | % | 58,803 | 24.77 | % | ||||||||

| Manufacturing | 41 | 15.02 | % | 37,632 | 15.85 | % | ||||||||

| Real Estate | 23 | 8.43 | % | 22,788 | 9.60 | % | ||||||||

| Agriculture | 9 | 3.30 | % | 14,451 | 6.09 | % | ||||||||

| Energy and Mining | 5 | 1.83 | % | 5,438 | 2.29 | % | ||||||||

| Consumer Credit | 15 | 5.49 | % | 1,036 | 0.44 | % | ||||||||

| Other | 13 | 4.76 | % | 12,110 | 5.10 | % | ||||||||

| 273 | 100.00 | % | $ | 237,372 | 100.00 | % | ||||||||

We make loans to borrowers solely to provide short-term working capital, and not for long-term investments or fixed asset purchases. The table below summarizes the types of businesses to which we lend within each industry category, as well as the unique risks to lending within each industry.

| Industry | Type of Enterprises | Particular Risks Associated with Industry | ||

| Commerce | Wholesale and retail of various merchandises, such as steel products, automobiles, medical apparatus and instruments, construction materials, cotton products, tomato products, etc. | ● Borrower market share within its own industry determines its competitiveness, and as a result, its cash flows and the ability to pay interests and principal. Feng Hui is more willing to make loans to those borrowers covering large market share within their own industries. Therefore, it relies on Feng Hui’s ability to obtain true and accurate information about each borrower’s market share.

● Whether borrowers’ merchandise is salable and easy to sell will impact borrowers’ cash flows and repayment abilities. | ||

| Service | Information technology/science and technology services; property realtors; bidding services; media; hospitality and restaurants; transportation, and leasing service; etc. | Borrower market share within its own industry directly determines its competitiveness, and as a result, its cash flows and the ability to pay interests and principal. Feng Hui is more willing to make loans to those borrowers covering a large market share within their own industries. Therefore, it relies on Feng Hui’s ability to obtain true and accurate information about each borrower’s market share. |

| 17 |

| Supply Chain Finance | Production and distribution of small, medium and large tires | The strength and goodwill of distributors (who usually make repurchase commitments) is very important. In the event that a borrower has difficulties in sales and thus defaults in making payments, the distributor will repurchase any unsold merchandise so that the due amounts may be paid to the lender. | ||

| Manufacturing | Vehicle manufacturing; asphalt production; glass manufacturing, agricultural equipment manufacturing; alcohol processing; construction; ceramics processing; tungsten production; new material production; textile; etc. | The gross profit margin of manufacturing industries is low, so it is important to clearly establish the approved use of loan proceeds. If the loan is used for long-term production or investments, then the borrowing cost is too high for a borrower to sustain operations in the long run. We only make loans for short-term working capital operation purposes. | ||

| Real Estate | Property developers | ● Risks associated with identifying and controlling the ratio between the borrower’s own funds and borrowed funds (their leverage ratio).

● Whether the borrower’s inventory of real estates are salable and easy to sell.

● It requires Feng Hui to closely watch the borrower’s sales situation and cash flows. | ||

| Agricultural | Cotton processing & sales; agricultural food processing industry; dairy products; fruit processing; agricultural science and technology; tomato sales; etc. | ● Price of products are correlated with domestic and international commodity prices and price indices.

● These industries are subject to weather and natural disasters.

● Price of agricultural products are tightly related to the production and sales in the previous year. Therefore, it requires Feng Hui to make correct judgment on production volume and inventory of the previous production cycle. | ||

| Mineral and Energy | Coal mining and washing; oil and gas; ferrous metal mining and dressing; non-ferrous metal mining and dressing; non-metallic mining and mineral sales; etc. | ● Price of products are correlated with domestic and international commodity prices and price indices.

● Feng Hui requires that a borrower obtain a mineral exploration license and mining license.

● Feng Hui has to confirm whether the borrower is really conducting mining business, or whether it has sold mining licenses to a third party. In the latter case, the borrower’s ability to make repayment cannot be guaranteed. | ||

| Others | Transportation; education; fashion; environmental protection; etc. | Feng Hui has to identify and control specific risks associated with lending within different industries. |

| 18 |

Business Strategies

The Company intends to implement three primary strategies to expand and grow the size of its businesses: (i) increase the Lending Companies’ lending capacity through the cash generated from operations (after any dividends) and through increases in XWFOE’s registered capital by the Business Combination; (ii) diversify the Company’s portfolio of financial services by expanding the business into financial consulting and risk management services, and Internet financing in Xinjiang Province and other cities of China; and (iii) expand the Company’s geographic coverage to Beijing, Shanghai, Shenzhen and other financial cities through the establishment of branch offices or mergers and acquisitions.

Risk Management Consulting Service

Regardless of the type of product, risk management is always the core of business and the key to success. The Company has set up Consulting to provide independent risk management consulting services to the direct lending market and further to other microfinance markets. We believe that Feng Hui’s unique risk management mechanism can become a new profit growth point for our business expansion.

1. Other Direct Lenders Provide a Pool of Potential Customers. The Company believes that most direct lending companies in the PRC do not conduct risk management well, which is demonstrated by their results. Direct lending companies grew rapidly in recent years, but such growth brings greater risk. Nearly 20% of direct lending companies in the PRC suffered net losses from January 2014 to November 2014 according to a report by Economic Information Daily. The default rate of some companies located in East China and the Pearl River Delta exceeded 5% or higher during that period of 2014. We believe that there is a need and demand for the risk management expertise and services that Consulting provides.

2. The Changing Microfinance Industry Provides Additional Opportunities. Default risk also impacted the rapidly growing online finance industry in the PRC. With the development of the Internet, big data and cloud computing, online finance has experienced explosive growth in the PRC in recent years. Peer-to-Peer (“P2P”) platforms are very typical in online finance. There were only 50 P2P platforms before 2012, but by the end of December 31, 2015, the number had increased to 3,491. In the explosive development, most platforms ignored risk management, while over 25% of platforms are problematic platforms (platforms with one or more of the following problems: (1) platform operators absconding with investor money; (2) high non-performing loan ratios and illiquidity, resulting in difficulties for investors wishing to withdraw funds; (3) bankruptcy; or (4) under economic crime investigation). An area of microfinance that has moved in the other direction is financial guarantees. Financial guarantee companies used to be regarded as the bridge between creditors and borrowers. Since 2005 to 2012, the amount of companies increased from less than 3,000 to over 8,500. More and more guarantee companies went bankrupt since the middle of 2014. Nearly 90% of companies in Wenzhou and a half in Sichuan, Xinjiang and Henan stopped doing business since 2014. Most companies didn’t do well in risk management and the default rate was pretty high are the reason of collapse. With the rapid changes in the industry and the resulting influx of new companies, we believe there are many potential customers with a great need for Consulting’s services.

3. First Step in Planned National Expansion. Consulting is an important part, and the first step, of our strategy to expand nationally. Such expansion will mitigate our dependency on the Xinjiang Province’s economy and the risk that political and policy development in Xinjiang might adversely affect our business. We also believe that a national platform with offices in a variety of regions will help us attract managers, employees and other talent.

| 19 |

The Company intends that Consulting will provide risk management consulting services to our strategic partners and not our direct competitors, minimizing the risk of conflicts of interest. We believe that Consulting’s risk management services provides a new growth driver for our businesses and will generates increased revenues. Further, we expect offering these services will increase our partners’ dependency on the Company, and as a result, will enhance our influence, through Consulting, in the non-banking finance industry. As a result, we believe that the positive impacts to the Company from delivering risk management services should far outweigh the negative impact from any related conflicts of interest.

Internet Financing

Recently, Internet financing, particularly P2P lending, has developed rapidly in China. P2P lending can provide a fast, convenient asset management and financing platform for the lender and the borrower. The number of P2P platforms has increased from 10 in 2010 to 3,491 by the end of 2015, and annual P2P lending has increased from RMB 504 million to RMB 157.7 billion (313 times) in the last four years, with an average compound annual growth rate of 216%.

The biggest advantage of typical online P2P lending platforms in China is that they attract idle funds, thereby providing additional sources of liquidity to direct lending companies, while minimizing operating costs, breaking through geographic restrictions, and increasing competition and thereby reducing interest rates. In addition to the fastest growing P2P lending platforms, such as LendingClub, there are also internet banking service providers that leverage Internet technologies to provide online banking services (such as Bofi and Simple). Due to the smaller and more vulnerable capital base of such lenders’ as compared with commercial banks, their business models focus on targeted customers, i.e., individuals or small- or micro-enterprises. As the Lending Companies target those same groups (at the small end of their customer base), the Company believes this will provide it with advantageous knowledge about such potential borrowers. The strengths of online financing platforms in terms of their diversified capital sources, combined with the customer bases and risk management abilities of Lending Companies, are expected to create a rapid growth in both industries. Given that the business models are different between traditional direct lending and a peer-to-peer platform, our peer-to-peer platform will take the current risk management practice as a reference, and build its own risk management system based on characteristics of peer-to-peer platform operations.

The Company has a comprehensive plan to expand its operation into the online financing market, particularly establishing a P2P lending platform. It has completed the necessary strategic and technical preparations for such an expansion. We will implement the online financing business strategies by means of merger and acquisition. By virtue of our premium customer base and the leading risk management ability, we believe that we will be able to succeed in the online financing market.

The Company intends to commence its peer-to-peer practice within the next couple of years through either establishing platforms on its own or through acquisition. We are targeting the creation of our peer-to-peer platform at a time when we anticipate the regulatory framework governing the micro-credit lending industry is under development by the PRC government.

The ability of Feng Hui and XWFOE to engage in peer-to-peer lending through subsidiaries as well as the registrations and requirements for Consulting under the Interim Provisions (Draft for Comments) are subject to change. It is unclear whether Feng Hui or XWFOE will be able to engage in peer-to-peer lending through subsidiaries under final provisions or what requirements and approvals will be required of Consulting and what obstacles, if any, the Company, as a whole, may face in starting its peer-to-peer lending program. The Company plans to enter the peer-to-peer lending business in approximately two years through either organic growth or through acquisition of peer-to-peer platforms. We will first market in Xinjiang, in which we hope to achieve substantial market share, while promoting the platform to other cities and areas across China, ultimately establishing a nationwide peer-to-peer internet financing system.

| 20 |

Intellectual Property

The Company owns and has the right to use the domain name “chinalending.com”. The Company’s subsidiary, Feng Hui, owns and has the right to use the domain name “fhxd.net” and is in the process of registering a trademark.

Competition

The Company faces competition in the direct lending industry, and the Company believes that the direct lending industry is becoming more competitive as this industry matures and begins to consolidate. The Company competes with traditional financial institutions, other direct lending companies, other microfinance companies, including P2P lenders, and some cash-rich state-owned companies or individuals that lend to MSMEs. Some of these competitors have larger and more established borrower bases and substantially greater financial, marketing and other resources than the we have. In addition, peer-to-peer lending platforms are rapidly growing in China and may provide highly competitive interest rates to customers due to lower overhead, and in some cases, lower required returns by the lenders. For example, large internet companies such as Tencent Holdings Ltd. and Alibaba Holding Ltd. have formed financial services affiliates such as online-only banks and P2P lending services which have been greatly capitalized and rapidly developed. As a result, we could lose market share and our revenues could decline, thereby adversely affecting our earnings and potential for growth.

Government Regulation

The Company’s operations are subject to extensive and complex state, provincial and local laws, rules and regulations. The Lending Companies are supervised by a variety of provincial and local government authorities, including the Finance Offices of Xinjiang Provincial Government and Urumqi Government, CBRC, PBOC, local tax bureau, local Administration of Industry and Commerce, local Bureau of Finance, local Administration of Foreign Exchange and local employment departments.

Summaries of Certain Key PRC Laws

Below are summaries of the material terms of Circular 23, Xinjiang Temporary Regulation for Microcredit Companies applicable to the Lending Companies’ businesses.

Circular 23

Circular 23 divides “microcredit companies” into two categories: a “limited liability company” or a “joint stock limited company” that consists of equity interests held by private parties, including individuals, corporate entities and other organizations. The shareholders of a microcredit company shall meet the minimum requirement set by applicable laws. A limited liability company shall be established with capital contributions from no more than 50 shareholders; while a joint stock limited company shall have 2-200 promoters, more than 50% of whom shall domicile in the PRC. The promoters are the shareholders after the incorporation of the company. The source of registered capital of a microcredit company shall be true and legal. All the registered capital shall be fully paid in cash by the capital contributors or the promoters. The registered capital of a limited liability company shall be no less than RMB 5,000,000 and the registered capital of a joint stock limited company shall be no less than RMB 10,000,000.

Circular 23 also provides that the sources of funds of a microcredit company shall be limited to the capital contributions paid by its shareholders, profit from operations, monetary donations, and loans provided by no more than two banking financial institutions. Pursuant to applicable laws, administrative rules and regulations, the outstanding loans owed by a microcredit company to banking financial institutions shall not exceed 50% of its net assets. The interest rate and the terms for such loans shall be determined based on arms-length negotiations between the company and the financial institutions and such interest rate shall be determined using the “Shanghai inter-bank borrowing interest rate” for the same period as prime rate plus basis points.

| 21 |

Circular 23 also states that a provincial government that is able to clearly specify an authority-in-charge (finance office or relevant government organs) to be in charge of the supervision and administration of microcredit companies and is willing to assume the responsibilities for the risk management of microcredit companies may, within its own province, develop a pilot program relating to the establishment of microcredit companies. A microcredit company shall abide by all applicable laws and shall not conduct any illegal fund-raising in any form. In the event an illegal fund-raising activity is conducted within the provincial territory, it shall be handled by the local government at the provincial level. Other activities in violation of the laws or the administrative rules and regulations will be fined by local authorities or prosecuted in the event a criminal offense has been committed.

Xinjiang Province Temporary Regulation for Microcredit Companies

Xinjiang Province Temporary Regulation for Microcredit Companies provides for general rules with respect to the establishment and business operation of microcredit companies in Xinjiang Province. It includes the following material terms:

1. Approval of Establishment. The establishment of microcredit companies in Xinjiang Province shall be approved by the Financial Office of Xinjiang Provincial Government.

2. Shareholders. The number of shareholders of a limited liability company that is a microcredit lender in Xinjiang Province shall not exceed 50. The individual shareholders shall comply with laws, have good credibility and have no civil or criminal record indicating violation of laws and serious discredit. The enterprise legal persons shareholders shall, among other things, be registered to the competent Administration of Industry and Commerce and maintain the legal status without any record of its operations in violation of any laws and regulations materially. Moreover, the amount of equity interests invested by a microcredit company’s enterprise legal persons shareholder shall not exceed 50% of net assets according to the combined financial statements of the enterprise legal persons shareholder. The capital contributed by shareholders for equity interest shall be legitimate self-owned capital.

3. Capital. The registered capital of a microcredit limited liability company in Xinjiang Province shall be no less than RMB 5 million. The registered capital must be paid in cash.

4. Articles of Association. The microcredit company shall adopt Articles of Association of the organizations in accordance with the Company Law of the PRC.

5. Business premises. A microcredit company shall have no less than one business operating premise in the administrative level of county or below.

6. Shareholding Assignment. The promoters’ equity interests shall not be transferred within one year after the incorporation of the microcredit company. The equity interests held by a director or senior executive shall not be transferred during his or her term of service.

7. Sources of Funds. The microcredit company shall be funded by capital contribution, donation, reserves, funds from banking financial institutions and other sources approved by the state and the Xinjiang Government. The number of banking financial institutions from which the Company borrows shall not exceed two and the aggregate amount borrowed shall be not more than 50% of the net assets of the microcredit company (the “Bank Borrowing Rule”).

| 22 |

8. Business. The microcredit company shall observe the following principles: (a) the loan balance for an individual borrower shall not exceed 5% of the net assets of the microcredit company (the “5% Loan Cap”); (b) the microcredit company shall not provide any loan to its shareholders, directors or senior executives; (c) the loan interest rate shall not exceed the ceiling rate set by the judicial authority, and shall not be lower than 0.9 times of benchmarking rate set by the PBOC.

9. Reserves. A microcredit company shall accrue the provision for sufficient bad debt reserve and ensure that the loan loss reserve adequacy ratio (the ratio of the actual loan loss reserve to the reserve for loans that should be in place) is higher than 100% to cover all exposures.

10. Employees. A microcredit company shall have employees who have relevant expertise and professional experiences and qualified senior executives. The number of qualified senior executives shall be no less than two.

11. Liabilities. If any of the following circumstances occurs with respect to a microcredit company, the local county or city government is authorized to order the company to correct the misbehaviors under a limited period, and may impose the criminal liability upon the responsible persons:

(a) Conducting merger, division or other amendment matters and failing to complete the registration properly with the Financial Office of Xinjiang Government;

(b) Failing to observe the 5% Loan Cap or the Bank Borrowing Rule described above;

(c) Issuing loans with the interest rates which are in violation of relevant regulations;

(d) Failing to observe the above reserves requirements;

(e) Carrying out new businesses without approval;

(f) Providing any false or misleading financial report, financial statements or other statistical documents; or

(g) Otherwise violating the laws and regulations of the state and the Xinjiang Government.

Additionally, if a microcredit company is deemed to have solicited funds from the general public directly or indirectly or otherwise unlawfully raised funds, the Financial Office of Xinjiang Government may cancel the qualification of the microcredit company and the responsible persons may face criminal liability by the judicial authorities.

Urumqi Temporary Regulation for Microcredit Companies

The Urumqi Temporary Regulation for Microcredit Companies requires that registered capital of a microcredit limited liability company shall be no less than RMB 50 million, and the registered capital of a microcredit joint stock limited company shall be no less than RMB 100 million. Generally under the regulation, the principal promoter’s capital contribution to an Urumqi microcredit company must be 10% to 20% of the total registered capital of the company, the capital contribution of one of the other shareholders shall be lower than 10% of the total capital contribution and total capital contributions by related shareholders may not exceed 40% of the total registered capital. However, Urumqi authorities may waive that restriction and has done so in approving XWFOE’s license.

| 23 |

Regulation for P2P Companies

Currently, the PRC government has not promulgated any specific rules, laws or regulations to specially regulate the peer-to-peer lending service industry. On July 18, 2015 the PBOC together with nine other PRC regulatory agencies jointly issued a series of policy measures applicable to the online peer-to-peer lending service industry titled the Guidelines on Promoting the Healthy Development of Internet Finance, or the Guidelines. The Guidelines introduced formally for the first time the regulatory framework and basic principles for administering the peer-to-peer lending service industry in China. On December 28, 2015, the China Banking Regulatory Commission together with other PRC regulatory agencies jointly issued the Interim Provisions on Online Peer-to-peer Lending Information Agencies Service (Draft for Comments), or the Interim Provisions (Draft for Comments).

According to the Interim Provisions (Draft for Comments), Consulting is not prohibited from directly engaging in peer-to-peer lending, but it must follow an application process that requires registration with several distinct PRC departments and agencies. First, it must obtain a business license from its local industrial and commercial bureau. Second, it must register with its local financial supervision department. Finally, it must register with its communication department (and obtain a telecommunication business license, if applicable).

Currently under PRC law, Feng Hui and XWFOE, each of which is a micro-credit company, are prohibited from directly engaging in peer-to-peer lending. Under the Interim Provisions (Draft for Comments), Feng Hui and XWFOE can only engage in peer-to-peer lending through subsidiaries, and the final provisions governing the subsidiaries’ ability to conduct peer-to-peer lending have not yet been promulgated.

Employees

As of March 31, 2016, the Company has 30 full time employees and one senior advisor. Among them, 14 employees are employed by Feng Hui, 14 employees are employed by the Consulting, one employee is employed by XWFOE, one employee is employed by Feng Hui Financial Group, and the senior advisor has a consulting agreement with Feng Hui. Feng Hui, Consulting and XWFOE have executed employment contracts with all of its employees in accordance with PRC Labor Law and Labor Contract Law. These contracts comply with PRC law. The employment contract with Feng Hui Financial Group complies with the laws of Hong Kong, Special Administrative Region. There are no collective bargaining contracts covering any of its employees. The Company believes its relationship with its employees is satisfactory.

Legal Proceedings

The Company is not and has not been involved in any material legal proceedings, other than ordinary litigation incidental to its business. Although no assurances can be given about the final outcome of pending legal proceedings, at the present time management does not believe that the resolution or outcome of any of the Company’s pending legal proceedings will have a material adverse effect on its financial condition, liquidity or results of operations.

There is no proceedings in which any of the Company’s directors, officers or any of their respective affiliates, or any beneficial shareholder of more than five percent of voting securities, is an adverse party or has a material interest adverse to the Company’s interest.

| 24 |

DESCRIPTION OF PROPERTIES

The Company leases approximately 1,500 square feet of office space at Floor 9th, No. 473, Weixing Road, Urumqi Economic and Technology Development Zone, Urumqi, Xinjiang Province, China. The lease agreement is with Zhengxin Financing Guarantee Co., Ltd. on a rent-free basis with a three-year term starting from December 1, 2014. This address is the location of the registered office of Feng Hui.

The Company leases approximately 800 square feet of office space at Floor 8th, No. 473, Weixing Road, Urumqi Economic and Technology Development Zone, Urumqi, Xinjiang Province, China. The lease agreement is with Lang Kun Properties Co., Ltd. on a rent-free basis with a three-year term starting from June 1, 2015. This address is the location of the registered office of XWFOE.

| 25 |

RISK FACTORS

The following risk factors apply to the business and operations of the Company. These risk factors are not exhaustive and investors are encouraged to perform their own investigation with respect to the business, financial condition and prospects of the Company. You should carefully consider the following risk factors in addition to the other information included in this Report, including matters addressed in the section entitled “Cautionary Statement Regarding Forward-Looking Statements.” We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business. The following discussion should be read in conjunction with the financial statements and notes to the financial statements attached hereto.

Risks Factors Relating to the Company’s Business and Operations

The limited operating history of Feng Hui and the lack of an operating history of XWFOE and Consulting make it difficult to evaluate their business and prospects.

Feng Hui commenced operations in June 2009 and has a limited operating history. Since inception through December 31, 2015, the Company has built a portfolio of an aggregate of approximately $897 million of direct loans to 1,473 borrowers. For the years ended December 31, 2015 and 2014, the Company generated approximately $28.2 million and $18.8 million of revenue with $14.1 million and $11.3 million of net income, respectively. However the Company’s growth rate since 2009 may not be indicative of future performance. XWFOE and Consulting were formed in the second quarter of 2015, XWFOE has not commenced operations, and Consulting commenced operations in August 2015.

After the Business Combination, the Company may not be able to achieve similar results or grow at the same rate as China Lending Group has in the past. It is also difficult to evaluate our prospects, as the Company may not have sufficient experience in addressing the risks to which companies operating in new and rapidly evolving markets such as the direct lending industry may be exposed. After the Business Combination, the Company will continue to encounter risks and difficulties that companies at a similar stage of development frequently experience, including the potential failure to:

| ● | obtain sufficient working capital and increase its registered capital to support expansion of its loan portfolios; |

| ● | comply with any changes in the laws and regulations of the PRC or local province that may affect its lending operations; |

| ● | expand its customer base; |

| ● | maintain adequate control of default risks and expenses allowing it to realize anticipated revenue growth; |

| ● | implement its customer development, risk management consulting Internet-based lending and national growth and acquisition strategies and plans and adapt and modify them as needed; |

| ● | integrate any future acquisitions; and |

| ● | anticipate and adapt to changing conditions in the Chinese lending industry resulting from changes in government regulations, mergers and acquisitions involving its competitors, and other significant competitive and market dynamics. |

If the Company is unable to address any or all of the foregoing risks, its business may be materially and adversely affected.

| 26 |

The Lending Companies’ current operations in China are geographically limited to Xinjiang Province.