Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - EMMIS COMMUNICATIONS CORP | emmsex991070716.htm |

| 8-K - 8-K - EMMIS COMMUNICATIONS CORP | emms8k07072016.htm |

Emmis Communications

Annual Meeting of Shareholders

July 7, 2016

10:00 a.m.

2

• Note: Certain statements in this presentation constitute “forward-

looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements

of the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Reference is made to the company’s

Annual Report on Form 10-K and other public documents filed with

the Securities and Exchange Commission for additional information

concerning such risks and uncertainties.

• Additional disclosure related to non-GAAP financial measures can

be found under the Investors tab on our website, www.emmis.com.

3

Emmis Overview

Headquartered in Indianapolis, IN, Emmis is a publicly traded

radio broadcasting communications company (NASDAQ: EMMS).

The Company was incorporated in 1979 and went public in 1994

Emmis operates one of the 10 largest radio portfolios in the US

(based on number of listeners)

- Owns 19 FM and 4 AM radio stations in New York, Los

Angeles, St. Louis, Austin (has 50.1% controlling interest)

Indianapolis and Terre Haute, IN

Includes 2 largest hip-hop stations in the world based in

New York City (Hot 97) and Los Angeles (Power 106)

Includes WBLS, the most listened to urban station in the US

- One of the FM radio stations in New York is operated pursuant

to a Local Marketing Agreement (“LMA”) with ESPN / Disney

The radio division of Emmis accounts for approximately 73% of

revenues and substantially all of the Company’s station operating

income

In addition to owning and operating radio stations, the Company

owns NextRadio®, leading city / regional publications and is

majority owner of a dynamic pricing business (Digonex)

Company overview Radio market statistics

Publishing portfolio summary

Source: Miller Kaplan; Terre Haute revenue share is Company estimate

Note: One of the above stations in New York is operated under LMA with ESPN

Source: Publisher’s Statement as of 12/31/2015

Revenue

share AM FM Total

Los Angeles, CA 1 5% - 1 1

New York, NY 2 10% 1 3 4

St. Louis, MO 21 22% - 4 4

Austin, TX 31 41% 1 5 6

Indianapolis, IN 38 33% 1 3 4

Terre Haute, IN 229 41% 1 3 4

Total 4 19 23

Market name

Market

rank

Stations

Monthly Paid &

Verified Circulation

Monthly Paid &

Verified Circulation

Texas Monthly 297,600 Orange Coast 52,800

Los Angeles 138,000 Indianapolis Monthly 40,100

Atlanta 71,000 Cincinnati 36,500

Total 636,000

4

Radio Industry – Unparalleled Reach

Radio has

surpassed

broadcast television

as the #1 reach

medium in the

United States

Source: Nielsen Q1 2016

5

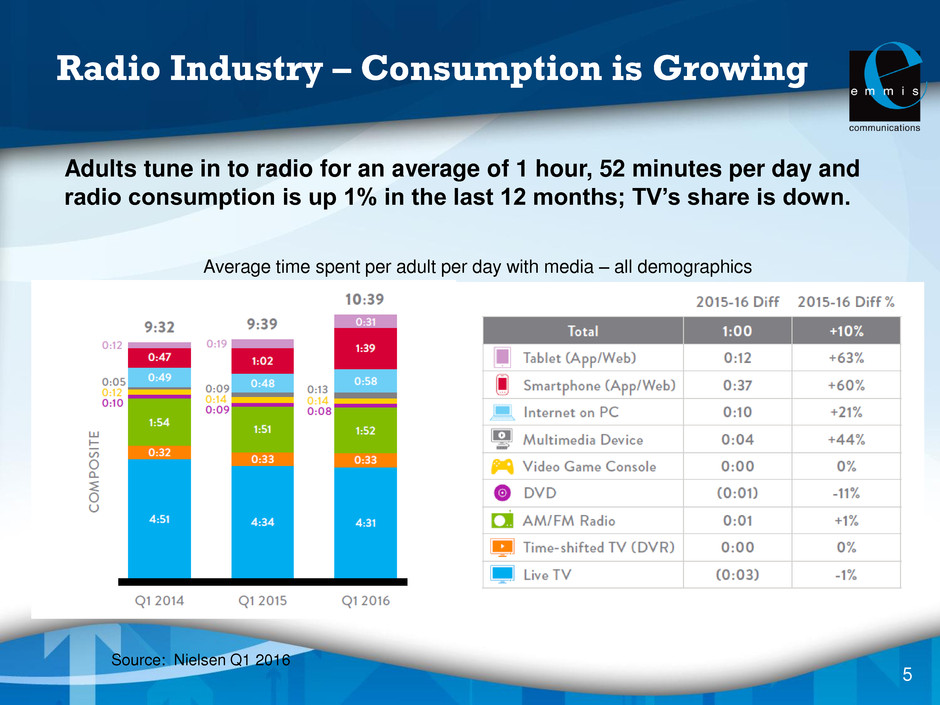

Radio Industry – Consumption is Growing

Source: Nielsen Q1 2016

Average time spent per adult per day with media – all demographics

Adults tune in to radio for an average of 1 hour, 52 minutes per day and

radio consumption is up 1% in the last 12 months; TV’s share is down.

6

Radio Industry’s Value

• Nielsen’s ROI studies highlight

radio’s effectiveness

Average ROI of 6:1 and as high

as 23:1

• Radio has the lowest CPM of all

major media ($13)

Magazines ($17), Cable ($18),

Digital ($20), Newspapers ($27),

TV ($30)

• Perception of streaming providers

doesn’t align with reality

AM/FM’s share of audio listening

is 9x larger than Pandora and

17x larger than Spotify

7

Emmis Radio Market Summary

FY16 Radio Net Revenues

100% = $143.5 million

FY16 Radio Station Operating Income

100% = $38.3 million

Note: Excludes 98.7FM in NY. Reflects 50.1% of Austin radio stations

New York + Los Angeles represent approximately 55% of our radio net

revenues and 64% of our radio SOI

35%

20%

17%

15%

11%

2%

0%

5%

10%

15%

20%

25%

30%

35%

40%

NY LA Ind STL Austin TH

35%

29%

14% 13%

9%

0%

0%

5%

10%

15%

20%

25%

30%

35%

40%

NY LA Austin Ind STL TH

8

Streak of outperforming markets derailed by new

competition in Los Angeles; other markets continue

to outperform

Year ended 2/28(29) Emmis revenue growth Market revenue growth

2016

-4.6%

(ex-LA -2.0%)

-1.5%

(ex-LA -2.5%)

2015

+1.6%

-3.7%

2014

+4.9%

+2.7%

2013

+3.3%

-1.2%

20121

+4.0%

+0.6%

20111

+6.7%

+4.5%

Emmis versus the market

Emmis wins!

By 2%

Emmis wins!

By 4%

Emmis wins!

By 3%

Emmis wins!

By 2%

Superior strategy and execution leading to consistently better results

Source: Miller Kaplan

1 Excludes WRKS now operated under LMA with ESPN as WEPN-FM

LA format change causes first

miss in 6 years; ex-LA, Emmis

narrowly beats markets.

Emmis wins!

By 5%

9

New York Update

FY16 NY market revenue summary

National +3%

Local -5%

Network/NTR +6%

Digital -3%

Total revenues -3%

Emmis total NY revenues -5%

New York Market Revenue Summary

Q1 FY17 NY market revenue summary

National +21%

Local +1%

Network/NTR +1%

Digital -1%

Total revenues +4%

Emmis total NY revenues +11%

• Disappointing performance in fiscal 2016 led to management changes in

January 2016. Improving market, coupled with better cluster

performance, bodes well for fiscal 2017.

• Ratings remain strong at Hot97 and WBLS. Poor weather for our largest

outdoor concert, Summer Jam, is a temporary setback for June’s results.

10

Los Angeles Update

FY16 LA market revenue summary

National flat

Local -2%

Network/NTR +9%

Digital +1%

Total revenues flat

Emmis total LA revenues -14%

Los Angeles Market Revenue Summary

Q1 FY17 LA market revenue summary

National -8%

Local +6%

Network/NTR +5%

Digital +14%

Total revenues +3%

Emmis total LA revenues -19%

• The revenue impact from the new format competitor was most pronounced

beginning in August 2015 (KPWR was down 5% in a down 2% market from

March-July 2015 before revenue declines accelerated).

• We expect the revenue declines we are currently experiencing to abate in Q3 of

this fiscal year.

• Our ratings are beginning to rebound and we are beating our competitor in the

key 18-34 demographic; marketing campaign underway to create further

separation in the ratings.

11

Austin, Indianapolis & St. Louis Update

• Grew market share in Indianapolis and St. Louis in fiscal 2016 as well as Q1 of

fiscal 2017

• Maintained 40%+ market share in Austin, but market was weaker in fiscal 2016

as compared to recent years

• Ratings in St. Louis are very strong as KPNT and KSHE hold the #1 ratings

position in every major demographic.

• Market revenues have improved from FY16 to Q1FY17 in all three markets.

12

January 2016 Expense Reductions

In response to difficult market conditions and company-specific challenges in New York and LA, we

implemented a cost reduction plan in January 2016 to yield approximately $7.5 million of savings in

fiscal 2017. We are using a portion of these savings to invest in our businesses and a portion to

improve EBITDA.

Radio

($5.3 million)

Publishing

($1.5 million)

Corporate

($0.7 million)

Increase marketing for WQHT,

WBLS and KPWR to grow ratings.

Increase investment in NextRadio

Stabilize EBITDA

January

2016

Cuts

FY 2017

Uses

13

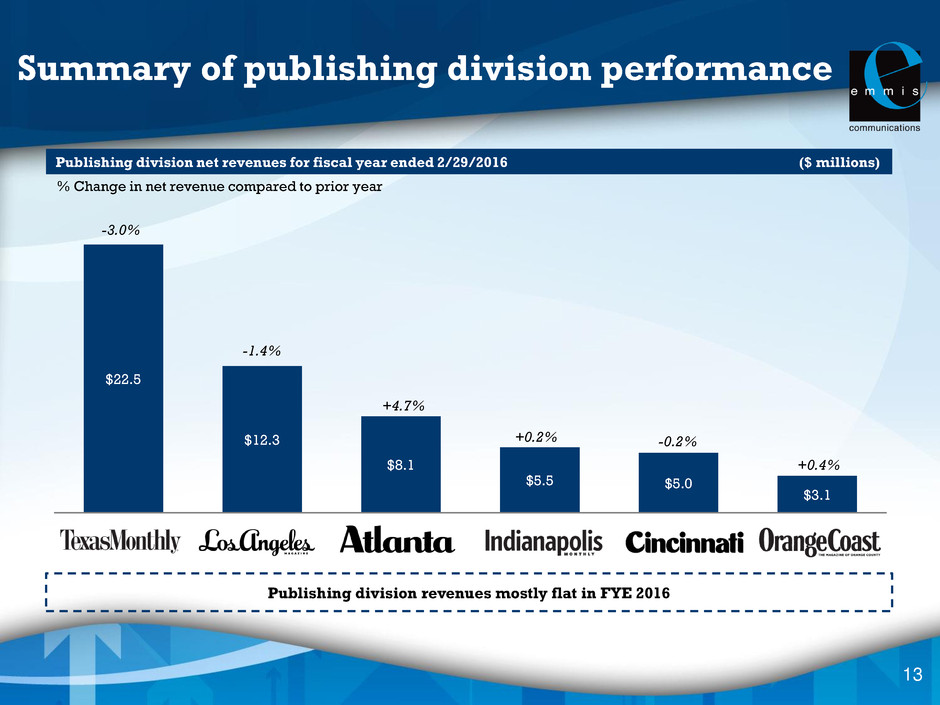

Summary of publishing division performance

Publishing division revenues mostly flat in FYE 2016

$22.5

$12.3

$8.1

$5.5 $5.0

$3.1

Texas Los Angeles Atlanta Indianapolis Cincinnati Orange Coast

Publishing division net revenues for fiscal year ended 2/29/2016 ($ millions)

+0.4%

+0.2% -0.2%

+4.7%

-1.4%

-3.0%

% Change in net revenue compared to prior year

14

Offers dynamic pricing solutions to

help clients optimize revenues given

supply and demand conditions

Emmis acquired majority control in

June 2014

Targeted sectors primarily include

zoos, aquariums, theme parks, seated

venues, and cultural institutions.

Emerging Technologies: NextRadio and

Digonex

Emmis owns 100% of the NextRadio smartphone application

Started with single Sprint phone in 2013. Now on every major

wireless carrier, including #1 selling phone for 2016 (Samsung

Galaxy S7 and S7 Edge).

NextRadio has the potential to change consumer and advertiser

perceptions and it gives the radio industry a new revenue stream.

- Emmis would benefit both as a radio operator and as owner of

NextRadio

15

NextRadio Product

NextRadio is…

FM Radio on your Smartphone

NOT Internet Streaming

Intuitive Live Guide

Artist/program/commercial visuals

Station feedback

Real-time interactivity

Enabled by TagStation® – cloud-

based content delivery application

software for broadcasters

16

NextRadio Data Attribution

NextRadio is able to pinpoint listeners and provide insights about the behavior

of those listeners for advertisers. This level of measurement has never existed

in broadcast radio until now. The chart below shows the location of some

NextRadio listeners during the Indianapolis 500.

17

NextRadio - Carrier and Handset Update

NextRadio Supported Smartphone Sales in the US

D

ec-1

4

Ja

n

-1

5

F

e

b-1

5

M

ar

-1

5

A

pr

-1

5

M

ay-1

5

J

u

n

-1

5

J

u

l-

1

5

A

u

g

-1

5

S

e

p

-1

5

O

c

t-

1

5

N

ov-1

5

D

ec-1

5

Ja

n

-1

6

F

e

b-1

6

M

ar

-1

6

A

pr

-1

6

M

ay-1

6

Ju

n

-1

6

Ju

l-

1

6

A

u

g

-1

6

S

e

p

-1

6

O

c

t-

1

6

N

ov-1

6

D

ec-1

6

Ja

n

-1

7

F

e

b-1

7

M

ar

-1

7

A

pr

-1

7

M

ay-1

7

Ju

n

-1

7

Ju

l-

1

7

A

u

g

-1

7

S

e

p

-1

7

O

c

t-

1

7

N

ov-1

7

D

ec-1

7

Sprint/Boost/Virgin AT&T/Cricket T-Mobile Blu Preload US Cellular Verizon Other

130M

120M

110M

100M

90M

80M

70M

60M

50M

40M

30M

20M

10M

0

60 million

enabled

devices

by 2016

year end

121 million

enabled

devices

by 2017

year end

18

NextRadio Product – International

• FM radio broadcasting technology is the same around the world.

• NextRadio is working with broadcasters across North and South America to

bring NextRadio to international markets.

Product is live in Google Playstore for Peru and Canada

Launch in Mexico is planned for August. Great discussions with large

carriers in Mexico

Ongoing discussions in Colombia and other LATAM countries

• NextRadio is also having exploratory discussions with European and

Australian broadcasters.

• NextRadio licenses its technology to these international broadcasters for a fee

and shares in the new revenue streams created by the interactive ecosystem.

19

Financial Overview

• EBITDA in excess of

cash interest by

approximately $20

million

• FY17 Uses: CapEx

($3.5 million), debt

principal amortization

payments ($9.2

million), and

investments to

accelerate growth of

NextRadio ($7

million).

Exclude Exclude Emmis

Emmis NY SPV Digonex Ex-Nonrecourse

($ in millions) 5/31/16 (Nonrecourse) (Nonrecourse) 5/31/16

LTM Adjusted EBITDA (1) $40.9 ($9.4) $2.1 $33.6

Cash 4.7 (1.0) (0.5) 3.2

Debt: Rate

Revolver L + 600 9.0 -- -- 9.0

Senior Term Loans L + 600 176.6 -- -- 176.6

Nonrecourse debt - NY 4.10% 64.1 (64.1) -- --

Nonrecourse debt - Digonex 5.00% 4.9 -- (4.9) --

Total Debt Balance $254.6 ($64.1) ($4.9) $185.6

Cash Interest Expense $16.2 ($2.6) ($0.2) $13.3

Total Interest Expense $16.2 $13.3

Total Net Debt / Adjusted EBITDA 6.1x 5.4x

(1) Based on definition in the Company's Credit Agreement. Excludes NextRadio losses, severance charges,

49.9% of Austin EBITDA, barter activity and other noncash items.

20

Compelling free cash flow yield

valuation

The summary below excludes the operations of 98.7FM in New York, which is operated pursuant to an LMA

with Disney/ESPN, but makes no adjustments for Digonex losses, NextRadio losses, or severance

expenses in the LTM period.

LTM 5/31/2016 EBITDA (See appendix for reconciliation) 24,305 Excludes 98.7FM LMA in NY

Less: Capital expenditures (3,369)

Less: Cash Interest expense (13,297) Excludes 98.7FM LMA in NY

LTM 5/31/2016 Free Cash Flow 7,639

Diluted shares outstanding 47,295

Free cash flow/share 0.16$

Price 7/5/2016 0.75$

FCF Yield 21.5%

Appendix

22

EBITDA Reconciliation

LTM 5/31/2016

Trailing twelve-months operating income from continuing operations 20,660$

Plus: Depreciation and amortization 5,679

Plus: Noncash compensation 3,656

Plus: Impairment loss 9,499

Plus: Loss on disposal of assets 56

Less: 49.9% of Austin radio EBITDA (Minority Interest) (5,816)

EBITDA, including New York SPV EBITDA 33,734$

Less: 98.7FM New York LMA LTM EBITDA (9,429)

EBITDA, excluding New York SPV EBITDA 24,305$

Adjusted EBITDA:

EBITDA, excluding New York SPV EBITDA 24,305$

Plus: Digonex LTM losses 2,086

Plus: NextRadio/TagStation LTM losses 4,977

Plus: Severance and contract termination expenses 2,439

Plus/Less: Other (240)

Adjusted EBITDA (Credit Agreement Definition): 33,567$

Emmis Communications

Annual Meeting of Shareholders

July 7, 2016

10:00 a.m.