Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Global Net Lease, Inc. | v443099_8k.htm |

Exhibit 99.1

July 2016 Brexit Impact Presentation 1

Non - GAAP Definitions Net operating income ("NOI") is a non - GAAP financial measure equal to net income (loss), the most directly comparable GAAP financial measure, less discontinued operations, interest, other income and income from preferred equity investments and investment securities, plus corporate general and administrative expense, acquisition and transaction related expenses, depreciation and amortization, other non cash expenses and interest expense . NOI is adjusted to include our pro rata share of NOI from unconsolidated joint ventures . We use NOI internally as a performance measure and believe NOI provides useful information to investors regarding our financial condition and results of operations because it reflects only those income and expense items that are incurred at the property level . Therefore, we believe NOI is a useful measure for evaluating the operating performance of our real estate assets and to make decisions about resource allocations . Further, we believe NOI is useful to investors as a performance measure because, when compared across periods, NOI reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and acquisition activity on an unlevered basis, providing perspective not immediately apparent from net income . NOI excludes certain components from net income in order to provide results that are more closely related to a property's results of operations . For example, interest expense is not necessarily linked to the operating performance of a real estate asset and is often incurred at the corporate level as opposed to the property level . In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the property level . NOI presented by us may not be comparable to NOI reported by other REITs that define NOI differently . We believe that in order to facilitate a clear understanding of our operating results, NOI should be examined in conjunction with net income (loss) as presented in our consolidated financial statements . NOI should not be considered as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of our liquidity . Annualized net cash flow is NOI on an annualized basis and is based on foreign exchange rates less annualized cash interest expense . Refer to 10 - Q for period ended March 31 , 2016 for detailed information on total GBP debt and interest rates . 2

Overview While the decision of the UK to exit the European Union has had an impact on global financial markets and implications for the UK economy, GNL is well positioned to limit exposure from the impact of Brexit on any of its owned properties in the UK GNL’s management team actively manages currency risk and utilizes hedging strategies to safe guard the portfolio against negative movements in exchange rates As a result of current in place hedges, a 5% reduction in exchange rate between the British Pound (“GBP”) and US Dollar (“USD”) corresponds to less than a 0 .25% reduction in annualized net cash flow for GNL in 2016 (1) UK properties are 100% occupied with long duration leases to mostly investment grade tenants, helping insulate GNL’s portfolio from short to medium term market volatility, economic and political risks Consistency of cash flow generated by these properties No near term lease expirations – first UK lease expires in August 2022 GNL does not own any London - based properties GNL’s portfolio is well - diversified in geography and tenant base, with only 19% of its Q1 2016 annualized net operating income (“NOI”) derived from properties located in the UK; 87% of the NOI from UK based properties is generated by investment grade rated tenants (2) 3 Global Net Lease Inc. (“GNL”) is well positioned to sustain any current volatility in global financial and currency markets related to the United Kingdom’s (“UK”) referendum vote to leave the European Union (1) Based on foreign exchange rates as of March 31, 2016 (2) Actual ratings reflect the tenant rating. Implied ratings are determined using a proprietary Moody’s analytical tool, which compares th e risk metrics of the non - rated company to those of a company with an actual rating. A tenant with a parent that has an investment grade rating is included in implied investment g rad e. Ratings information is as of June 27, 2016, unless otherwise noted.

Actively Managed Hedging Program UK Asset Values are Fully Hedged GNL employs an asset / liability matching program to provide a natural hedge for asset values This program matches asset values to debt levels in local currency This program allows debt and asset values in local currency to move in concert, effectively limiting any impact of currency movements GNL “Locked - In” Pre - Brexit Exchange Rates for 3 Years GNL uses foreign exchange forward contracts to fix the rate on net cash flow generated in GBP As of Q1 2016, 70% of GNL’s 2016 net cash flow from UK properties were hedged to protect against fluctuations in exchange rates between the GBP and USD GNL added FX forwards prior to the Brexit vote on net cash flow through 2019 in order to minimize exchange rate risk GNL’s management team employs a hedging program focused on both the underlying asset values and future net cash flow to minimize risk 4

Brexit Impact on GNL Net Cash Flow % Change in Exchange Rate (1) : GBP / USD Corresponding Spot Rate: GBP / USD % Change Impact to GNL Net Cash Flow 5% 1.368 0.24% 10% 1.296 0.47% 20% 1.152 0.95% (1) Exchange rate as of March 31, 2016 5 As a result of the implemented hedging program and management’s recent actions to mitigate risk, the impact of a 5 % fluctuation in the GBP/USD exchange rate (1) would result in less than a 0.25% reduction in GNL’s annualized net cash flow for 2016

0% 0% 0% 0% 2% 2% 8% 10% 21% 57% Well D iversified Portfolio Global Portfolio Overview Source: All portfolio and financial information derived from unaudited company internal records as of March 31, 2016. Informa tio n shown based on USD equivalent amounts using exchange rates as of March 31, 2016. 1. Actual ratings reflect the tenant rating. Implied ratings are determined using a proprietary Moody’s analytical tool, which c omp ares the risk metrics of the non - rated company to those of a company with an actual rating. A tenant with a parent that has an investment grade rating is included in implied investment grade. Ratings information is as of June 27, 2016, unless otherwise noted. 2. Based on Q1 2016 annualized NOI 3. Based on square feet. 4. Fixed percent or actual increases, or country CPI - indexed increases. x Largely investment - grade tenants x Long duration leases x Diversification by country, tenant and tenant industry x 60% of NOI derived from U.S. assets (2) Lease Expiration Schedule (% of SF Per Year) Weighted Average Lease Term: 11.0 (3) years # of Properties 329 Total Square Feet (mm) 18.7 Number of Tenants 86 Number of Industries 36 Countries 5 Occupancy 100% Weighted Average Remaining Lease Term (3) 11.0 years % of NOI from Investment Grade Tenants (1)(2) 68.7% % of Portfolio NOI from Leases with Contractual Rent Increases (2)(4) 89.3% GNL owns a portfolio of 329 assets diversified across 5 countries, 86 tenants and 36 industries. Key Themes 6 U.S. 60% UK 19% Germany 10% Netherlands 4% Finland 7% Geography (2)

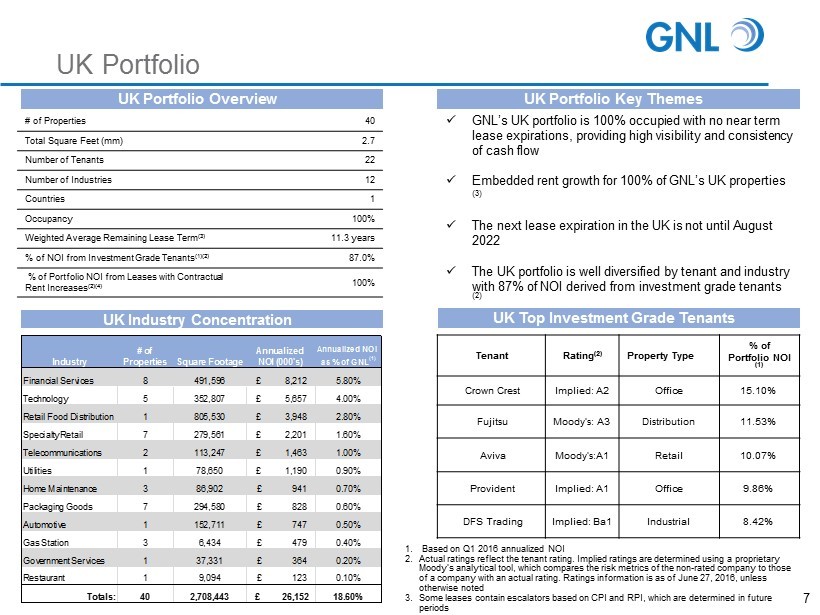

UK Portfolio # of Properties 40 Total Square Feet (mm) 2.7 Number of Tenants 22 Number of Industries 12 Countries 1 Occupancy 100% Weighted Average Remaining Lease Term (3) 11.3 years % of NOI from Investment Grade Tenants (1)(2) 87.0% % of Portfolio NOI from Leases with Contractual Rent Increases (2)(4) 100% UK Portfolio Overview Tenant Rating (2) Property Type % of Portfolio NOI (1) Crown Crest Implied: A2 Office 15.10% Fujitsu Moody’s: A3 Distribution 11.53% Aviva Moody’s:A1 Retail 10.07% Provident Implied: A1 Office 9.86% DFS Trading Implied: Ba1 Industrial 8.42% 7 x GNL’s UK portfolio is 100% occupied with no near term lease expirations, providing high visibility and consistency of cash flow x Embedded rent growth for 100% of GNL’s UK properties (3) x The next lease expiration in the UK is not until August 2022 x The UK portfolio is well diversified by tenant and industry with 87% of NOI derived from investment grade tenants (2) UK Portfolio Key Themes UK Industry Concentration Industry # of Properties Square Footage Annualized NOI (000's) Annualized NOI as % of GNL (1) Financial Services 8 491,596 £ 8,212 5.80% Technology 5 352,807 £ 5,657 4.00% Retail Food Distribution 1 805,530 £ 3,948 2.80% Specialty Retail 7 279,561 £ 2,201 1.60% Telecommunications 2 113,247 £ 1,463 1.00% Utilities 1 78,650 £ 1,190 0.90% Home Maintenance 3 86,902 £ 941 0.70% Packaging Goods 7 294,580 £ 828 0.60% Automotive 1 152,711 £ 747 0.50% Gas Station 3 6,434 £ 479 0.40% Government Services 1 37,331 £ 364 0.20% Restaurant 1 9,094 £ 123 0.10% Totals: 40 2,708,443 £ 26,152 18.60% UK Top Investment Grade Tenants 1. Based on Q1 2016 annualized NOI 2. Actual ratings reflect the tenant rating. Implied ratings are determined using a proprietary Moody’s analytical tool, which compares the risk metrics of the non - rated company to those of a company with an actual rating. Ratings information is as of June 27, 2016, unless otherwise noted 3. Some leases contain escalators based on CPI and RPI, which are determined in future periods

Eurozone Portfolio # of Properties 17 Total Square Feet (mm) 3.8 Number of Tenants 11 Number of Industries 10 Countries 3 Occupancy 100% Weighted Average Remaining Lease Term (3) 10.6 years % of NOI from Investment Grade Tenants (1)(2) 81% % of Portfolio NOI from Leases with Contractual Rent Increases (2)(4) 100% Eurozone Portfolio Overview Tenant Rating (1) Property Type % of Portfolio NOI (1) RWE Baa3 Office 5.3% Finnair Parent: Aaa Industrial 4.4% Metro Tonic Parent: Baa3 Retail 11.6% Achmea S&P: A - Office 6.1% KPN Moody’s: Baa3 Office 5.4% 8 Eurozone Portfolio Key Themes Eurozone Industry Concentration Eurozone Top Investment Grade Tenants x Eurozone portfolio assets are located in major markets of Germany, Finland and the Netherlands x GNL has strategically acquired assets throughout the EU with the intention of mitigating political and economic risk x Investment grade NOI derived from these properties is approximately 81% (2) x Hedging program encompasses currency and interest rate risk of all countries where GNL has acquired properties Industry # of Properties Square Footage Annualized NOI (000's) Annualized NOI as % of GNL (1) Utilities 3 594,415 € 8,566 5.20% Aerospace 4 656,275 € 6,601 4.30% Financial Services 3 826,318 € 6,122 3.90% Discount Retail 1 800,834 € 5,011 2.80% Office Supplies 1 206,331 € 2,038 1.00% Automotive 1 320,102 € 1,958 1.00% Telecommunications 1 133,053 € 1,887 0.70% Hospitality 1 24,283 € 1,146 0.60% Consumer Goods 1 175,675 € 928 0.50% Home Maintenance 1 143,633 € 401 0.50% Totals: 17 3,880,859 € 34,658 20.80% (1) Based on Q1 2016 annualized NOI (2) Actual ratings reflect the tenant rating. Implied ratings are determined using a proprietary Moody’s analytical tool, which compares th e risk metrics of the non - rated company to those of a company with an actual rating. Ratings information is as of June 27, 2016, unless otherwise noted

Conclusions 9 Disciplined investment strategy has GNL well positioned in countries within Europe that will limit the potential impact of political instability by focusing on Western European countries such as Germany, Finland and the Netherlands GNL’s management continues to monitor economic developments from the UK Referendum and utilize hedging strategies to safeguard the portfolio against negative movements in the GBP As a result of current in place hedges, a 5% reduction in exchange rate between GBP and USD corresponds to less than a 0.25 % reduction in annualized net cash flow for GNL in 2016 GNL’s portfolio is well - diversified in terms of geography and tenant base, with 60% of its annualized NOI derived from GNL’s U.S. properties UK properties are 100% occupied with long duration leases to mostly investment grade tenants, helping insulate GNL’s portfolio from short to medium term market volatility, economic and political risks No near term lease expirations – first UK lease expires in August 2022 Rent growth will be driven over the life of GNL’s UK leases through embedded rent escalators

APPENDIX 10

Non - GAAP Measures Reconciliation Amounts in thousands (unaudited) Mar 31, 2016 EBITDA: Net income (loss) $ 6,558 Depreciation and amortization 23,756 Interest expense 10,569 Income tax expense 550 EBITDA $ 41,433 Adjusted EBITDA: Equity based compensation $ 1,044 Acquisition and transaction related (129) Losses (gains) on derivative instruments 349 Losses (gains) on hedges and derivatives deemed ineffective 98 Other (income) expense (9) Adjusted EBITDA $ 42,786 Net Operating Income (NOI): Operating fees to related parties $ 4,817 General and administrative 1,704 NOI $ 49,307 11

Diversification by Geography Total Portfolio Region NOI (1 ) NOI Percent Square Footage Sq. ft. Percent United States $ 117,971 58.2% 12,085 64.5% United Kingdom 38,368 18.9% 2,708 14.5% Germany 19,373 9.6% 1,870 10.0% Finland 14,747 7.3% 1,457 7.8% The Netherlands 8,968 4.4% 554 3.0% US Province 3,212 1.6% 65 0.3% Total $ 202,638 100% 18,740 100% Footnotes: ( 1) NOI is on an annualized basis and is based on foreign currency exchange rates as of March 31, 2016. Amounts in thousands (unaudited) 12