UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported) June 21, 2016

TECH FOUNDRY VENTURES, INC.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 005-89438 | 46-5152859 | ||

| (State

or other jurisdiction of incorporation) |

(Commission

File number) |

(IRS

Employer Identification No.) |

316 California Ave., Suite 543, Reno, NV 89509

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code (888) 909-5548

(Former name or former address, if changed since last report.)

Copies to:

Brunson Chandler Jones, PLLC

175 South Main Street, Suite 1410

Salt Lake City, Utah 84111

Phone: (801) 303-5730

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Current Report on form 8-K (this “Report”) contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “seeks,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Such statements may include, but are not limited to, information related to: anticipated operating results; relationships with our customers; consumer demand; financial resources and condition; changes in revenues; cost of sales; selling, general and administrative expenses; interest expense; legal proceedings and claims.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this Report. You should read this Report and the documents that we reference and filed as exhibits to this Report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Exploration Agreement with Option to Form a Joint Venture

As previously disclosed on Form 8-K, on December 17, 2015, the Company entered into a definitive agreement (the “Agreement”) with Nevada Canyon Gold Corporation, a Nevada corporation (“NCG”), to acquire all of NCG’s rights, titles and interests in and into an exploration agreement with an option to form a joint venture with Walker River Resources Corp., a Canadian public company (“Walker River” or “WRR”), dated September 15, 2015. WRR owns a 100% undivided interest in and to the Lapon Canyon Gold Property, containing the Lapon Canyon claims, which is the subject of the Agreement.

The Agreement does not grant the Company an interest in or to the Lapon Canyon claims, or any equity interest in WRR, but rather, grants the Company the right to earn up to an undivided 50% interest in the Lapon Canyon claims by incurring expenditures of $500,000 (over a two-year period) in exploration expenses in a work program established and operated by WRR on the Lapon Canyon claims. Thereafter, the Agreement grants the Company an option to enter into a joint venture with WRR for further exploration and development of the Lapon Canyon claims. The Agreement also grants the Company the first right of refusal to acquire an additional 20% interest in the Lapon Canyon claims by the expenditure of additional funds and performance of additional tasks, all related to the joint venture.

The foregoing descriptions of the terms of the Agreement are qualified in its entirety by reference to the provisions of the agreement filed as Exhibit 2.1 to this Report, which is incorporated by reference herein.

Private Placement Offering

On June 21, 2016, the Company exceeded the minimum offering requirements of a Private Placement Memorandum for a minimum of $100,000 and a maximum of $500,000 at $0.10 per share (the “Offering”) to accredited investors (the “Purchasers”). Pursuant to Rule 506 of Regulation D of the Securities and Exchange Act of 1934, we have issued to the Purchasers a total of 3,750,000 shares of $0.001 par value restricted common stock for proceeds of $375,000 to date.

The Private Placement Memorandum was offered on a best efforts basis with no underwriter and the Company’s management has fully identified Purchasers and will limit subscriptions to existing Purchasers of the remaining balance of 1,250,000 shares up to the maximum of 5,000,000 shares of restricted common stock, though we cannot guarantee that this number will be met. No registration rights were provided. The Uses of Proceeds of the offering are (i) to exercise the option for the joint venture and to finalize the Joint Venture Agreement as described in the Agreement, (ii) to continue exploration activities on the Lapon Canyon Project and (iii) continue our current business operations.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

Reference is made to the disclosure set forth under Item 1.01 of this Report, which disclosure is incorporated herein by reference.

On June 21, 2016, following the successful completion of the minimum offering amount under our Private Placement Memorandum, we will have the ability to fund a portion of the Agreement and the option for a joint venture as described in Item 1.01, Accordingly, we believe the majority of our operations as a Company will organically shift and evolve to focus on this new business opportunity in Nevada through the exploration of the Lapon Canyon Project. Management will continue to pursue management and consulting services opportunities though such efforts may significantly decrease. Because of the transformative nature of our business, the Company is electing to providing additional disclosures and business descriptions relating to the exploration and mining industry (as defined hereinafter) and the Lapon Canyon Project specifically.

For organizational purposes, the information included in this Item 2.01 below is as specified in Form 10.

Item 1. Business

Business Overview

Tech Foundry Ventures Inc. (“TFVI”) acquired Nevada Canyon Gold’s (“NCG”) Exploration Agreement with Option to form a Joint Venture with Walker River Resources Corp. (TSX.V:WRR) on its wholly-owned Lapon Canyon Gold Project (“Lapon Canyon Project” or “LCP”), located approximately 40 miles southeast of Yerington, Nevada. Hereinafter, the companies are referred to as “TFVI”, “NCG,” “Company” or “NCG/TFVI” interchangeably. TFVI has an option to acquire an initial 25% of the LCP for US$250,000 paid towards exploration expenses within a one-year period of entering into this Exploration Agreement. TFVI has an option to acquire an additional 25% for an additional US$250,000 of exploration expenses on or before the second anniversary of the Exploration Agreement. Following TFVI’s acquisition of up to 50% of the LCP, a 50/50 joint venture will be formed between Walker River and TFVI to conduct further mining activities on LCP, assuming the exploration results and other business variables warrant such further activities, of which there can be no assurance.

After earn-in of a 50% interest and formation of the joint venture, Walker River will grant TFVI a Right of First Refusal (“ROFR”) for two years to earn an additional 20% in the Lapon project by completing the following: an equity investment of US$1,000,000 in Walker River; funding and delivering a complete scoping study on the project; and carrying US$500,000 of post-scoping joint venture expenditures pertaining to WRR. TFVI could accelerate any of the above earn-in periods at its option. Walker River is the operator of all of the exploration activities on the Property during the Company’s earn-in period.

Business Opportunity

We are an exploration stage Company. We have only recently begun our exploration operations and have not generated or realized any revenues from these additional business operations.

If we find mineralized material of sufficient quantity and grade that justifies further detailed exploration and if our direct Offering is successful, then we will be able to obtain additional necessary permits from the U.S. Bureau of Land Management (“BLM”), and continue detailed exploration activities on the Property in furtherance of our business plan. At the present time, we have made arrangements to raise the additional funds required to do advanced exploration but not to place our Property into production. If we need additional cash and cannot raise it, we will either have to suspend activities until we do raise the cash, or cease activities entirely. Other than as described in this paragraph, we have no financing plans.

Even if we complete our current exploration programs and are successful in identifying a mineralized deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit, called a reserve.

We will be conducting exploration of the Property with what we anticipate is sufficient funding for approximately one year of operations. Our exploration program is explained in as much detail as possible in the business section of this Form 8-K. We are not going to buy or sell any significant equipment during the next twelve months. If we find mineralized materials in the Property, we have no intention to develop the reserves ourselves, but rather, will attempt to find a mining operations company to whom we can sell the property or with whom we can enter into a business arrangement to put the ore deposit into operation.

We do not intend to hire employees at this time. All of the work on the Property will be conducted by Walker River. They will be responsible for surveying, geology, engineering, exploration, and excavation, and we will be responsible for paying all of the expenses incurred in such activities. Walker River will be solely responsible for conducting the exploration stage operations, and we will pay the expense of such operations, all devoted to exploration. Once we have paid $250,000 in exploration expenses, we will have earned our 25% in the Lapon Canyon Project, and once we have paid an additional $250,000, we will have earned an additional 25% interest, for a total 50% in the Lapon Canyon Project.

One of our directors will be present on the Property as a representative for the Company during most exploration operations. If we hire an independent geologist, he/she will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Mineral property exploration is typically conducted in phases. We intend to follow our consultant’s recommendations and begin drilling to determine if there is sufficient mineralization on the property to warrant continued exploration and development activities. We estimate the cost of the drilling, shipping samples, as well as geological mapping, rock chip sampling, grid establishment, hiring geologists, and soil sampling, to be approximately $500,000, which is the amount we expect to pay in order to acquire a 50% interest in the Lapon Project.

After the completion of the first phase of the exploration program, we will review the results and conclusions and evaluate the advisability of additional exploration work on the Property.

If we are unable to complete any phase of exploration because we don’t have enough money, we will cease activities until we raise more money. If we cannot or do not raise more money, we will cease activities. If we cease activities, we have no plans for any other business activity.

Industry Overview

Walker River Resources Corp. acquired the Lapon Canyon project following site visits and research into the geology and history of work on the property.

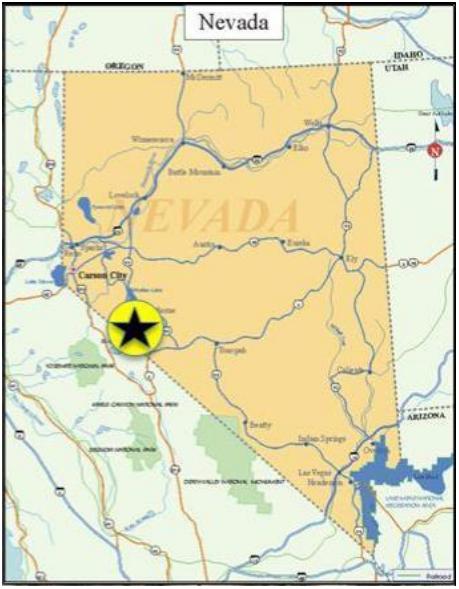

Location Image of Lapon Canyon Project:

Location

The Lapon project consists of 36 claims (Sleeper claims 1–36) comprising 720 acres situated in the Wassuk Range (Mt. Grant Mining District), approximately 40 miles southeast of Yerington, Nevada. The property is easily accessible by a well-maintained secondary state road to the Lapon Canyon road, which is generally a 15% grade canyon road. A state grid power transmission line passes within two miles of the property. An ample source of water exists (for drilling and other activities) in several locations on the Property.

The Company believes that the 36-claim block at Lapon Canyon is too small to support a viable mining operation, and additional claims will be needed for a mining company to consider a venture involving the Lapon Canyon property. The identification and acquisition of additional claims will cost additional funds for location and annual claim payments, as well as for exploration. The Company has not identified any possible additional claims, nor has the Company identified a source of additional financing to acquire or explore any such claims, assuming additional claims can be identified and acquired, of which there can be no assurance.

If initial exploration results are successful, we will seek to acquire additional claims where the mineralization is extending.

In our due diligence and Walker River’s Exploration Program over the last two years, it was determined that the exploration target is dipping to the west, away from the portion of the mining claims adjacent to military lands and, thus, the portion of such mining claims adjacent to military lands has no bearing on any of our future exploration plans.

Mining Claims

The subject claims of our Exploration Agreement are recorded in Mineral County, Nevada, in the name of Walker River. The following are the serial numbers of the recorded claims. The mining claims are in good standing.

| CLAIMS | BLM SERIAL NUMBER | LOCATION DATE | ||

| Sleeper 1-3 | 699414-416 | February 16, 1994 | ||

| Sleeper 4-10 | 699417-423 | February 26, 1994 | ||

| Sleeper 11-12 | 699424-424 | March 3, 1994 | ||

| Sleeper 13-14 | 708229-230 | September 9, 1994 | ||

| Sleeper 15 | 7088231 | September 14, 1994 | ||

| Sleeper 16-18 | 708232-234 | September 9, 1994 | ||

| Sleeper 19 | 708235 | September 9, 1994 | ||

| Sleeper 20 through 28 | NMC 1008338 through NMC 1008345 | May 31, 2009 | ||

| Sleeper 29 through 36 | NMC 100846 through NMC 1008352 | June 1, 2009 |

The unpatented mining claims comprising the Lapon Canyon Project occupy public lands administered by the BLM and are subject to the ultimate title of the United States. The claims have been filed with both the BLM and Mineral County, Nevada as required by law.

There is an annual BLM fee that must be paid in order to continue to maintain ownership interest in the claims. The fee must be paid on or before September 1st of each year. If we miss the payment, we could lose our interest in the claims. The BLM charges $155 annually per 20-acre claim.

Surface use for mining purposes on unpatented mining claims is guaranteed by the Mining Law of 1872. Notice must be given to the BLM prior to drilling. This is accomplished by filing a notice of intent. This is required as long as the disturbance is less than 5 acres. If it exceeds 5 acres, we would need to file a plan of operation. Reclamation bonds are also required prior to any disturbance, whether it is under a notice of intent, or plan of operation. The project area is not known to contain any culturally or environmentally sensitive resources.

Annual payments to maintain the validity and right to use the mining claims are the responsibility of Walker River, and its failure to maintain the mining claims in good standing could result in our loss of our entire investment.

Sleeper Claim locations in Mineral County, Nevada

Geological Setting

The Property is underlain by Mesozoic to Tertiary intrusive rocks, near a contact with earlier Mesozoic volcanic, sedimentary, and intrusive rocks. Later Cretaceous quartz monzonite porphyry and diorites intrude this pile.

Mineralization and Past History

Small-scale, high-grade underground mining began on the property in 1914. The mine area, near the top of the Lapon Canyon, at what is today the Lapon Rose Zone, was extremely difficult to access. Work was fairly extensive, with the development of over 2000 feet of levels, sub levels, and raise, from two adits. A two-stamp mill was installed.

In 1964, H. Nylene, drove a 230-foot adit 300 vertical feet below the old workings, following a drill hole that reported a high-grade result. Mill construction began at this location, with the installation of ball mills, water tanks, conveyors, and so on. However, the work was not completed. In 1990, Teck briefly carried out trenching and minor drilling at the upper adit of the old mine working.

District Geologic Setting

Based on public information available from the Nevada Bureau of Mines, Nevada is dominated by two striking structural features: (1) the basin and range structure which covers most of the northern and central parts of the state and (2) Walker Lane shear zone, a 50-mile wide structure along the southwestern border with California. The location of the Lapon property lies within Mesozoic to Tertiary intrusive rocks near a contact with Mesozoic volcanic, sedimentary and intrusive rocks. It is in the center of the Walker Lane shear zone of NW trending strike-slip faults. The belt Cretaceous intrusives are mainly quartz monzonite; granodiorite and minor diorite. The basin and range structure consists of a series of northerly to northeasterly trending mountain ranges and valleys. The ranges are bounded by normal and strike-slip faults. The Walker Lane shear zone, features a complex northwesterly – striking zone of strike-slip faults and intrusions. The Walker Lane structural corridor extends in a southeast direction from Reno, Nevada and within this trend, numerous gold, silver, and copper mines are located.

The Property is located within the Walker Lane structural corridor, a 50-mile wide structure that extends in a southeast direction from Reno, Nevada towards Las Vegas, Nevada along the southwestern border with California. Numerous gold, silver, and copper mines are located within the Walker Lane structural corridor. The Property location lies within Mesozoic to Tertiary intrusive rocks near a contact with earlier Mesozoic volcanic, sedimentary and intrusive rocks Later Cretaceous quartz monzonite porphyry and diorites intrude this pile. It is in the center of the Walker Lane shear zone of NW trending strike-slip faults. The belt Cretaceous intrusives are mainly quartz monzonite; granodiorite and minor diorite. The basin and range structure consists of a series of northerly to north-easterly trending mountain ranges and valleys. The ranges are bounded by normal and strike-slip faults. The Walker Lane shear zone, features a complex north-westerly striking zone of strike-slip faults and intrusions.

Legislation

We are in compliance with all material mining and environmental legislation and regulations applicable to our activities and hold a valid mineral property license. At this time, we cannot anticipate the impact that recent developments will have on our planned or future operations. Changes to current laws in the jurisdiction in which we operate may entail additional costs and increase our financing requirements. Potential changes are unpredictable and any additional environmental, technical or other substantive requirements may render our planned exploration activities futile or uneconomical and lead to the failure of our business.

Market, Customers and Distribution Methods

Although there can be no assurance as to their performance, large and well-capitalized markets are readily available throughout the world for all metals, including precious metals, as is a very sophisticated futures market for the pricing and delivery of future production. The price for metals is affected by a number of global factors, including economic strength and resultant demand for metals for production, fluctuating supplies, mining activities and production by others in the industry, and new and/or reduced uses for subject metals.

The mining industry is highly speculative and very high-risk. As such, mining activities involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Few mining projects actually become operating mines.

The mining industry is subject to a number of factors, including intense industry competition, high susceptibility to economic conditions (such as price of metal, foreign currency exchange rates, and capital and operating costs), and political conditions (which could affect such things as import and export regulations, and foreign ownership restrictions). Furthermore, mining activities are subject to all hazards incidental to mineral exploration, development and production, any of which could result in work stoppages, damage to or loss of property and equipment, and possible environmental damage. Hazards such as unusual or unexpected geological formations and other conditions are also involved in mineral exploration and development.

Competition

The mineral exploration industry is highly competitive. We are a new and pre-exploration stage Company and have a weak competitive position in the industry. We compete with junior and senior mineral exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration Property throughout the world together with the equipment, labor and materials required to operate on those Property. Competition for the acquisition of mineral exploration interests is intense with many mineral exploration leases or concessions available in a competitive bidding process in which we may lack the technological information or expertise available to other bidders.

Many of the mineral exploration companies with which we compete for financing and acquisition of mineral exploration property have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration property. This advantage could enable our competitors to acquire mineral exploration property of greater quality and interest to prospective investors, who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration interests or explore and develop our current or future mineral exploration property.

We also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our acquisition or exploration programs if investors perceive that investments in our competitors are more attractive based on the merit of their mineral exploration property or the price of the investment opportunity. In addition, we compete with both junior and senior mineral exploration companies for available resources, including, but not limited to, professional geologists, land specialists, engineers, camp staff, helicopters, float planes, mineral exploration supplies and drill rigs.

General competitive conditions may be substantially affected by various forms of energy legislation and/or regulation introduced from time to time by the governments of the Republic of the Philippines, the United States, and other countries, as well as factors beyond our control, including international political conditions and supply and demand for mineral exploration.

In the face of competition, we may not be successful in acquiring, exploring or developing profitable gold or mineral property or interests, and we cannot give any assurance that suitable gold or mineral property or interests will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the gold or mineral industry by:

| ● | keeping our costs low; | |

| ● | relying on the strength of our management’s contacts; and | |

| ● | using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities. |

Exploration Program

A detailed exploration program, to be carried out solely by our joint venture partner, Walker River, and funded exclusively by us, is described below.

Capital Investment

The Company believes that the maximum gross proceeds of this Offering, in the amount of $500,000, will allow the Company to achieve the following:

| ● | Earn an initial 50% interest in the Lapon Canyon Project’s Option Agreement; and | |

| ● | Form a joint venture on the Lapon Canyon Project and, based on favorable results from our exploration program and drill results, enable us to make a determination as to whether we should exercise our Right of First Refusal to purchase an additional 20% interest in the Lapon Canyon Project. |

Using the funds derived from the Offering, and assuming a maximum subscription, of which there can be no assurance, a detailed exploration program will be implemented, as follows:

Phase 1

1. Road Improvements – Other than initial geological reconnaissance, road improvement should precede any other work, in order to facilitate movement of equipment and personnel to the property.

2. Underground Rehabilitation – This should be aimed particularly at Adit C, located on the Sleeper 10 claim, which would make it possible to drill both into the sublevel area and up into potential mineralization. It would also provide possible access to the sublevels for mapping and sampling. If safely feasible, then Adits A & B, also located on the Sleeper 10 claim, should also be accessed.

3. Geological Mapping – All accessible parts of the underground working should be mapped and sampled. In mapping, rock type and alteration of structural elements should be noted.

4. Geochemical Surveying – A geochemical soil survey and mapping should be conducted over the potentially mineralized area to the east of the underground workings. If results are favorable, some test drilling should follow.

Phase Two

5. Drilling – On the basis of knowledge gained from Part 2 of Recommendations, drilling should be done with a track-mounted drill with reverse circulation capabilities. A total of 6,000 meters (20,000 feet) is recommended for surface drill holes.

A cost estimate for the proposed two-phase program is presented in the following section. The program is expected to take about twelve months to complete.

COST ESTIMATES

Phase 1

| 1. | Geology, Sampling | |||||||

| Geologist 10 days @ $600/day | $ | 6,000 | ||||||

| Technician 10 days @ $350/day | $ | 3,500 | ||||||

| 2. | Site rehab adit access and safety | $ | 5,000 | |||||

| 3. | Room and Board | $ | 3,000 | |||||

| 4. | Vehicle | $ | 1,500 | |||||

| 5. | Misc. supplies | $ | 3,000 | |||||

| 6. | Contingencies | $ | 2,000 | |||||

| TOTAL | $ | 24,000 |

Phase 2

| 1. | Road maintenance safety | $ | 20,000 | |||||

| 2. | Water sumps site prep | $ | 10,000 | |||||

| 3. | Drilling 10,000 feet @ $30/foot | $ | 300,000 | |||||

| 4. | Geologist 50 days @ $660/day | $ | 30,000 | |||||

| 5. | Technician 50 days @ $350/day | $ | 17,500 | |||||

| 6. | Assaying | $ | 15,000 | |||||

| 7. | Room board | $ | 12,500 | |||||

| 8. | Vehicle | $ | 10,000 | |||||

| 9. | Misc. supplies | $ | 10,000 | |||||

| 10. | Contingencies | $ | 51,000 | |||||

| TOTAL | $ | 476,000 |

TOTAL ESTIMATED COSTS OF PHASES 1 & 2 – $500,000

We intend that the drilling program will first drill, log, and sample certain portions of the Property our consultants deem to be of interest and potential. These samples would provide an initial evaluation point for determining the gross economic potential of the given mineralized area. The second phase would be to drill, log, and sample additional borings to define the lateral extent and apparent mineral content over the given mineralized areas. This would provide a gross determination on the potential minable materials and the overall economic grade.

Local Resources and Infrastructure

Nevada has long been state with an active mining industry and is well accustomed to mining activities. Mineral County has a long history of mining and that activity has remained a significant economic element for the County. There are a number of active and inactive mining projects in the region.

Yerington is the nearest community to the claims, but all lodging, casual labor, supplies for exploration, heavy equipment and operators are anticipated to be available from Yerington or Las Vegas, Nevada. Major support for mine development and operation is available in Las Vegas.

Apart from exploration and mining, the principal land use in the area is agriculture, recreation and tourism.

Mineralization Estimate

No estimates of mineralization exist for the Sleeper claims.

Compliance with Government Regulation

Both Federal and Nevada laws govern work on the claims. Title to mineral claims are issued and administered by the BLM and any work on the property must comply with all provisions under the BLM surface management regulations. A mineral claim acquires the right to the minerals, which were available at the time of location and as defined in the Mining Act of 1872. There are no surface rights included, but the titleholder has the right to use the surface of the claim for mining purposes only.

Regulations

BLM regulates surface management on mining activity conducted on lands administered by the BLM. All mining activities require reasonable reclamation. The lowest level of mining activity, “casual use,” is designed for the miner or weekend prospector who creates only negligible surface disturbance (for example, activities that do not involve the use of earth-moving equipment or explosives may be considered casual use).

The second level of activity, where surface disturbance is five acres or less per year, requires a notice advising the BLM of the anticipated work 15 days prior to commencement. This notice needs to be filed with the appropriate field office. No approval is needed although bonding is required. State agencies need to be notified to assure that their requirements are met.

For operations involving more than five acres, a detailed plan of operation must be filed with the appropriate BLM field office. Bonding is required to ensure proper reclamation.

Our drill program will involve less than five acres, so at the time we raise the money to start the drilling, we will not need to submit a plan of operation to the BLM. Walker River has obtained the initial bonding, so this cost is not included as part of our use of proceeds. If we decide that the drilling has positive results, we would then submit a plan of operation. If the plan is approved, the BLM will likely require us to post additional bonding to cover the cost of any remediation. The cost of remediation work will vary according to the degree of physical disturbance. As mentioned above, we will have to sustain the cost of reclamation and environmental remediation for all exploration and other work undertaken. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended first phase of the exploration program. Because there is presently no information on the size, tenor, or quality of any mineral resource at this time, it is impossible to assess the impact of any capital expenditures on earnings or our competitive position in the event a potential mineral deposit is discovered.

If we enter into substantial exploration, the cost of complying with permit and regulatory environment laws will be greater than in our initial phase because the impact on the project area is greater. Permits and regulations will control all aspects of any program if the project continues to that stage because of the potential impact on the environment. We may be required to conduct an environmental review process, including preparation of an environmental impact statement (EIS) if we determine to proceed with a substantial project. An EIS is not required to proceed until we submit a plan of operation.

Environmental Factors

We will have to sustain the cost of reclamation and environmental remediation for all work undertaken that causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back to its original state as much as possible. Other potential pollution or damage must be cleaned up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remedy any environmental damage caused, such as refilling trenches after sampling and cleaning up fuel spills. Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended three phases described above. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

Exploration

There have been exploration activities conducted on the Property in the past, including some initial drilling conducted by the Company and Walker River, wherein mineralization was successfully identified. There is also evidence of historic drilling and other mining activities. The Company is uncertain as to the quality or results of such activities and, instead, intends to rely on its own drilling results.

Competitive Factors

The mining industry is fragmented, and there are many mineral prospectors and producers, small and large. We do not compete with anyone with respect to the Claim. That is because there is no competition for the exploration or removal of minerals from the Property. We will either find gold or other valuable metals on the Property, or not. If we do not find valuable metals, we will cease or suspend operations.

Geographical/Access Challenges

We do not expect any major challenges in accessing the Property during the initial exploration stages. Except for the 15% grade road in.

Environmental Factors

We will also have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills. Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended phases described above. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

Glossary of Mining Terms:

| Auriferous | refers to gold (AU) or gold equivalents (AUEQ). |

| Basalt | a hard rock of varied mineral content; volcanic in origin, it makes up much of the Earth’s crust. |

| Copper | a chemical element with the symbol Cu (Latin: cuprum) and atomic number 29. It is a ductile metal with very high thermal and electrical conductivity. Pure copper is rather soft and malleable, and a freshly-exposed surface has a pinkish or peachy color. |

| Cretaceous age | a geological period and system from 145 to 65 million years ago. |

| Crystalline | a solid material, whose constituent atoms, molecules, or ions are arranged in an orderly repeating pattern extending in all three spatial dimensions; ie. crystals. |

| Diorite | an intrusive igneous rock composed principally of the silicate minerals plagioclase feldspar (typically andesine), biotite, hornblende, and/or pyroxene. The chemical composition of diorite is intermediate, between that of mafic gabbro and felsic granite. |

| Dolerite | A fine-grained basaltic rock. |

| Extrusive | the mode of igneous volcanic rock formation in which hot magma from inside the Earth flows out (extrudes) onto the surface as lava or explodes violently into the atmosphere to fall back as pyroclastics or tuff. This is opposed to intrusive rock formation, in which magma does not reach the surface. The main effect of extrusion is that the magma can cool much more quickly in the open air or under seawater, and there is little time for the growth of crystals. Often, a residual portion of the matrix fails to crystallize at all, instead becoming an interstitial natural glass or obsidian. |

| Fault | a break in the continuity of a body of rock. It is accompanied by a movement on one side of the break or the other so that what were once parts of one continuous rock stratum or vein are now separated. The amount of displacement of the parts may range from a few inches to thousands of feet. |

| Feldspar | any of a large group of rock-forming minerals that, together, make up about 60% of the earth’s outer crust. The feldspars are all aluminum silicates of the alkali metals sodium, potassium, calcium and barium. Feldspars are the principal constituents of igneous and plutonic rocks. |

| Fold | a curve or bend of a planar structure such as rock strata, bedding planes, foliation, or cleavage. |

| Foliation | A general term for a planar arrangement of textural or structural features in any type of rock; esp., the planar structure that results from flattening of the constituent grains of a metamorphic rock. |

| Formation | a distinct layer of sedimentary rock of similar composition. |

| Gabbro | a group of dark-colored, basic intrusive igneous rocks composed principally of basic plagioclase (commonly labradorite or bytownite) and clinopyroxene (augite), with or without olivine and orthopyroxene; also, any member of that group. It is the approximate intrusive equivalent of basalt. Apatite and magnetite or ilmenite are common accessory minerals. |

| Gold | chemical element with the symbol Au (from Latin: aurum, “shining dawn”) and an atomic number of 79. It has been a highly sought-after precious metal for coinage, jewelry, and other arts since the beginning of recorded history. The metal occurs as nuggets or grains in rocks, in veins and in alluvial deposits. Gold is dense, soft, shiny and the most malleable and ductile pure metal known. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Gold is one of the coinage metals and has served as a symbol of wealth and a store of value throughout history. Gold standards have provided a basis for monetary policies. It also has been linked to a variety of symbolisms and ideologies. |

| Granite | highly felsic igneous plutonic rock, typically light in color; rough plutonic equivalent of rhyolite. Granite is actually quite rare in the U.S.; often the term is applied to any quartz- bearing plutonic rock. |

| Granodiorite | a group of coarse-grained plutonic rocks intermediate in composition between quartz diorite and quartz monzonite, and potassium feldspar, with biotite, hornblende, or more rarely, pyroxene, as the mafic component. |

| Granulite | fine to medium–grained metamorphic rocks that have experienced high temperatures of metamorphism, composed mainly of feldspars sometimes associated with quartz and anhydrous ferromagnesian minerals, with granoblastic texture and gneissose to massive structure. They are of particular interest to geologists because many granulites represent samples of the deep continental crust. Some granulites experienced decompression from deep in the Earth to shallower crustal levels at high temperature; others cooled while remaining at depth in the Earth. |

| Hydrothermal | creation of rock with fluid at high temperatures. |

| Igneous | resulting from, or produced by, the action of great heat; with rocks, it could also mean formed from lava/magma; granite and basalt are igneous rocks. |

| Intrusions | masses of igneous rock that, while molten, were forced into other rocks. |

| Intrusive | intrusions are one of the two ways igneous rock can form; the other is extrusive, that is, a volcanic eruption or similar event. Technically speaking, an intrusion is any formation of intrusive igneous rock; rock formed from magma that cools and solidifies within the crust of the planet. |

| Metamorphic | the mineralogical, chemical, and structural adjustment of solid rocks to physical and chemical conditions that have generally been imposed at depth below the surface zones of weathering and cementation, and that differ from the conditions under which the rocks in question originated. |

| Metasediment | a metamorphosed sedimentary rock. |

| Monzonite | an intermediate igneous intrusive rock composed of approximately equal amounts of sodic to intermediate plagioclase and orthoclase feldspars with minor amounts of hornblende, biotite and other minerals. |

| Ore | the natural occurring mineral from which a mineral or minerals of economic value can be extracted profitable or to satisfy social or political objectives. |

| Oxides | a chemical compound containing at least one oxygen atom as well as at least one other element. Most of the Earth’s crust consists of oxides. Oxides result when elements are oxidized by oxygen in air. |

| Placers | an accumulation of valuable minerals formed by deposition of dense mineral phases in a trap site. |

| Porphyry | an hard igneous rock consisting of large-grained crystals such as feldspar or quartz dispersed in a fine-grained feldspathic matrix or groundmass. The larger crystals are called phenocrysts. |

| Precious metals | a rare, naturally occurring metallic chemical element of high economic value, which is not radioactive (excluding natural polonium, radium, actinium and protactinium). Chemically, the precious metals are less reactive than most elements, have high lustre, are softer or more ductile, and have higher melting points than other metals. Historically, precious metals were important as currency, but are now regarded mainly as investment and industrial commodities. Gold, silver, platinum, and palladium each have an ISO 4217 currency code. |

| Production | a “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. |

| Pyrite | a yellow iron sulphide mineral of little value and referred to as “fool’s gold”. |

| Quartz | a common rock-forming mineral consisting of silicon and oxygen. |

| Quartzite | a hard metamorphic rock which was originally sandstone. Sandstone is converted into quartzite through heating and pressure usually related to tectonic compression within orogenic belts. Pure quartzite is usually white to grey, though quartzites often occur in various shades of pink and red due to varying amounts of iron oxide. Other colors, such as yellow and orange, are due to other mineral impurities. |

| Reserve | the term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination |

| Sedimentary | types of rock that are formed by the deposition and subsequent cementation of that material at the Earth’s surface and within bodies of water. Sedimentation is the collective name for processes that cause mineral and/or organic particles (detritus) to settle in place. |

| Shear | a form of strain resulting from stresses that cause or tend to cause contiguous parts of a body of rock to slide relatively to each other in a direction parallel to their plane of contact. |

| Stockwork | a complex system of structurally controlled or randomly oriented veins. Stockworks are common in many ore deposit types and especially notable in greisens. They are also referred to as stringer zones. |

| Sulphides | an anion of sulfur in its lowest oxidation number of −2. Sulfide is also a slightly archaic term for thioethers, a common type of organosulfur compound that are well known for their bad odors. |

| Telluride | a compound of a metal with tellurium; metal salts of tellurane. Any organic compound of general formula R 2 Te (R not = H), the tellurium analogues of ethers. Another name for sylvanite. |

| Tonalite | an igneous, plutonic (intrusive) rock, of felsic composition, with phaneritic texture. Feldspar is present as plagioclase (typically oligoclase or andesine) with 10% or less alkali feldspar. Quartz is present as more than 20% of the rock. Amphiboles and pyroxenes are common accessory minerals. |

| Vein | a thin, sheet-like body of hydrothermal mineralization, principally quartz. |

Intellectual Property

None.

Government Regulation

The U.S. Government requires the Company to follow International Traffic in Arms Regulations (ITAR) compliant procedures for defense articles, defense services or related technical data. ITAR is a set of United States government regulations that controls the export and import of defense-related articles and services. These regulations mandate that information and materials pertaining to defense and military related technologies only be shared with U.S. Persons unless authorization from the Department of State is received or a special exemption is used.

Facilities

The Lapon Canyon Project will utilize the facilities of Walker River for the foreseeable future.

Employees

Our only direct employee is our chief executive officer.

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this Report.

We are not a Company that engages in hands-on mining activities and must, therefore, rely on Walker River to conduct all such activities, especially those related to exploration.

Our anticipated future dependence upon Walker River to conduct the mining exploration activities in a professional manner, all seeking to establish data supporting the presence of valuable ores in sufficient qualities and quantities to make the Property viable as a target for a mining production Company to purchase the Property or enter into a form of agreement with Walker River and us. The Company and Walker River may need to enter into additional agreements for the exploration activities. There can be no assurance that our partners or we can do so on favorable terms, if at all.

We will rely on Walker River to perform all exploration work on the Property.

A management committee consisting of one Walker River representative and one of our representatives will be formed, with Walker River having discretion to act in accordance with its judgment in the event of any failure of the two committee members to agree on any issue. In the event that Walker River does not exercise skill and competence in the conduct of its operations, or fails to performs satisfactory quality of mining activities, in a timely manner and at an acceptable cost, our interests in the Exploration Agreement and Property may be negatively impacted.

No known ore reserves.

The probability of a mining claim having the necessary quantity and quality of ores to result in a profitable mining operation is uncertain and our claims, even with large investments by us, may never generate a profit.

Mineral deposit estimates are imprecise and subject to error.

Mineral deposit estimation calculations when made may prove unreliable. Assumptions made regarding the supporting data may prove inaccurate and unforeseen events may lead to further inaccuracies. Sample variability, mining and processing adjustments, environmental changes, metal price fluctuations, and law and regulation changes are all factors that could lead to deviances from any original estimations. We have no known ore reserves. Despite future investment in exploration activities, there is no guarantee we will locate a commercially viable ore deposit or reserve. Most exploration projects do not result in discovery of commercially viable and mineable ore deposits. With little capital available, we will have to limit our exploration, which decreases the chances of finding a commercially viable ore body. Even if potentially promising mineralization is identified, the Lapon Canyon Project may not be put into production due to many factors, including high extraction costs, low gold prices, or inadequate amount and reduced recovery rates. If the exploration activities do not suggest a commercially successful prospect, then we may altogether abandon plans to pursue efforts to develop the property.

Our future operations may be adversely affected by future governmental and environmental regulations and permitting.

Environmental regulations may negatively affect the progression of operations and these regulations may become stricter in the future. In the U.S., all mining is regulated by federal and state government agencies. Obtaining licenses and permits from these agencies as well as an environmental impact study for each mining property must be completed before starting mining activities. These are expensive and affect the timing of operations. Pollution can be anticipated with mining activities. If we are unable to comply with current or future regulations, this may expose us to fines, penalties and litigation that could cause our business to fail.

Further, the laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the U.S. or Nevada may be changed, applied or interpreted in a manner which will fundamentally alter the ability for us to carry on our business.

The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitably.

Risks Related to Our Business

Our operations are subject to permitting requirements which could require us to delay, suspend or terminate our operations on our mining property.

Our planned exploration activities on the Lapon Canyon Project, and other property we may acquire, require permits from the BLM, and other governmental agencies. We may be unable to obtain these permits in a timely manner, on reasonable terms or at all. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration of the Lapon Canyon Project will be adversely affected. We have no current plans to acquire any other property.

Our exploration activities may not be commercially successful, which could lead us to abandon our plans to seek a mining production company to develop or purchase our Property, and thereby lose the investment we made in the Property.

Our long-term success depends on our ability to identify commercially viable and mineable mineral deposits on the Lapon Canyon Project. Upon identifying these deposits we will determine whether any such deposits can be developed into a commercially viable mining operation. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of exploration is determined in part by the following factors:

| ● | the identification of potential silver and/or gold mineralization based on evaluation of the host rock, alteration, structure, geochemistry and proper sampling; | |

| ● | availability of government-granted operation permits; | |

| ● | the quality of our management and our geological and technical expertise; and | |

| ● | the capital available for exploration. |

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral deposits. The decision to abandon our Lapon Project may have an adverse effect on the market value of our securities and the ability to raise future financing. We cannot assure you that we will discover or acquire any mineralized material in sufficient quantities on any of our Property to justify commercial operations, or that we will be able to find a mining operator who is willing and able to enter into a business venture with us.

Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and there are no assurances that our exploration activities will result in identification of commercially viable quantities and qualities of mineable ores.

Our estimated operating and exploration costs for the Lapon Canyon Project are based on limited information available to us that we believe to be accurate. However, costs for labor, regulatory compliance, energy, mine and plant equipment and materials needed for exploration may significantly fluctuate. In light of these factors, actual costs related to our proposed budgeted exploration costs may exceed any estimates we may make. We do not have an operating history upon which we can base estimates of future operating costs related to Lapon Canyon Project, and we intend to rely upon our future economic feasibility of the Project and any estimates that may be contained therein. Studies derive estimates of cash operating costs based upon, among other things:

| ● | anticipated tonnage, grades and metallurgical characteristics of the material to be mined and processed; | |

| ● | anticipated recovery rates of gold and other metals from the material; | |

| ● | cash operating costs of comparable facilities and equipment; and | |

| ● | anticipated climatic conditions and availability of water. |

Capital and operating costs, production and economic returns, and other estimates contained in feasibility studies may differ significantly from actual costs, and there can be no assurance that our actual capital and operating costs will not be higher than anticipated or disclosed.

A shortage of critical equipment, supplies, and resources could adversely affect our exploration activities.

We are dependent on the availability of certain equipment, supplies and resources for Walker River to carry out our mining exploration activities, including input commodities, drilling equipment and skilled labor. A shortage in the market for any of these factors could cause unanticipated cost increases and delays in delivery times, which could in turn adversely impact exploration schedules and costs.

Historical production at the Lapon Canyon Project may not be indicative of the potential for future development.

The Lapon Canyon Project is not in commercial production, and, since acquiring our interests, we have never recorded any revenues from commercial production at the Property. You should not rely on the fact that there were limited historical mining operations in the mining district surrounding our Property as an indication that we will ever find commercially mineable quantities and qualities of mineral ores on our Property or have future successful commercial operations on our Property. In fact, based on the information available to us, none of the historical mining operations were successful.

We currently do not have sufficient funds, nor do we intend in our proposed operations, to bring the Property into commercial operation or production, and we expect that we will require additional financing in the future.

We are an exploration stage Company and do not currently have any proposed plans or sufficient capital for sustained operations, specifically those that include the mining, processing and production of minerals from any ores which may be identified during our exploration activities. We expect that the proceeds from this Offering will be used to begin drilling and on geological studies of the Lapon Canyon Project. Our future financing needs may be substantial if we encounter unexpected costs or delays at this early stage of exploration of the Property.

Failure to obtain sufficient financing through this Offering may result in the delay or indefinite postponement of exploration, drilling or other mining activities at the Lapon Canyon Project. Furthermore, even if we raise sufficient additional capital, there can be no assurance that we will achieve success in our exploration activities. In addition, any future equity offering will further dilute your equity interest in the Company and any future debt financing will require us to dedicate a portion of our cash flow, if any, to payments on indebtedness and will limit our flexibility in planning for or reacting to changes in our business.

We are strictly an exploration Company and have no intent or plans to engage in operations involving the mining, processing and/or production of minerals from orders, if any, which we may discover on our property during our exploration activities. In the event our exploration operations determine that we have ores which may warrant further mining operations, it is our intent to seek to identify a mining production company to purchase or option our interests in the Property, and enter into some type of business arrangement with that company relating to our Property.

If the development of one or more claims included in our Lapon Project is found to be economically feasible, such claims will be subject to all of the risks associated with establishing new mining operations.

If the development of one or more of our mining claims included in our Lapon Project is found to be economically feasible, and we are able to enter into a business arrangement with a mining company that engages in mining operations and production, such development will require obtaining permits and financing, and the construction and operation of mines, processing plants and related infrastructure. As a result, the project will be subject to all of the risks associated with establishing new mining operations, including:

| ● | the timing and cost, which can be considerable, of the construction of mining and processing facilities and related infrastructure; | |

| ● | the availability and cost of skilled labor, mining equipment and principal supplies needed for operations, including explosives, fuels, chemical reagents, water, power, equipment parts and lubricants; | |

| ● | the availability and cost of appropriate smelting and refining arrangements; | |

| ● | the need to obtain necessary environmental and other governmental approvals and permits and the timing of the receipt of those approvals and permits; | |

| ● | the availability of funds to finance construction and development activities; | |

| ● | industrial accidents; | |

| ● | mine failures, shaft failures or equipment failures; | |

| ● | natural phenomena such as inclement weather conditions, floods, droughts, rock slides and seismic activity; | |

| ● | unusual or unexpected geological and metallurgic conditions; | |

| ● | exchange rate and commodity price fluctuations; | |

| ● | high rates of inflation; | |

| ● | potential opposition from non-governmental organizations, environmental groups or local groups, which may delay or prevent development activities; and | |

| ● | restrictions or regulations imposed by governmental or regulatory authorities. |

The costs, timing and complexities of developing our projects may be greater than anticipated. Cost estimates may increase significantly as more detailed engineering work is completed on a project. It is common in mining operations to experience unexpected costs, problems and delays during construction, development and mine start-up. We cannot provide assurance that activities will result in profitable mining operations at our mineral Property, or that our Company will derive financial benefits from such operations. Any one or more of these events identified above could have a material adverse effect on any revenues we may anticipate receiving from the Lapon Project

Our operations involve significant risks and hazards inherent to the mining industry.

Our exploration operations will involve the operation of large pieces of drilling and other heavy equipment. Hazards such as fire, explosion, floods, structural collapses, industrial accidents, unusual or unexpected geological conditions, ground control problems, cave-ins, flooding and mechanical equipment failure are inherent risks in our operations. Hazards inherent to the mining industry can cause injuries or death to employees, contractors or other persons at our mineral Property, severe damage to and destruction of our property, plant and equipment and mineral Property, and contamination of, or damage to, the environment, and can result in the suspension of our exploration activities and any future development and production activities. While the Company aims to maintain best safety practices as part of its culture, safety measures implemented by us may not be successful in preventing or mitigating future accidents.

In addition, from time to time we may be subject to governmental investigations and claims and litigation filed on behalf of persons who are harmed while at our Property or otherwise in connection with our operations. To the extent that we are subject to personal injury or other claims or lawsuits in the future, it may not be possible to predict the ultimate outcome of these claims and lawsuits due to the nature of personal injury litigation. Similarly, if we are subject to governmental investigations or proceedings, we may incur significant penalties and fines, and enforcement actions against us could result in the closing of certain of our mining operations. If claims and lawsuits or governmental investigations or proceedings are ultimately resolved against us, it could have a material adverse effect on our financial performance, financial position and results of operations. Also, if we conduct mining operations on property without the appropriate licenses and approvals, we could incur liability or our operations could be suspended.

The mining industry is very competitive.

Much of our competition is from larger, established mining companies with greater liquidity, greater access to credit and other financial resources, newer or more efficient equipment, lower cost structures, more effective risk management policies and procedures and/or a greater ability than us to withstand losses. Our competitors may be able to respond more quickly to new laws or regulations or emerging technologies, or devote greater resources to the expansion or efficiency of their operations than we can. In addition, current and potential competitors may make strategic acquisitions or establish cooperative relationships among themselves or with third parties. Accordingly, it is possible that new competitors or alliances among current and new competitors may emerge and gain significant market share to our detriment. We may not be able to compete successfully against current and future competitors, and any failure to do so could have a material adverse effect on our business, financial condition or results of operations.

We are subject to inherent mining hazards and risks that may result in future financial obligations.

Risks and hazards associated with the mining industry may adversely affect our proposed operations and include political and social risks, industrial accidents, labor disputes, inability to retain necessary personnel or equipment, environmental hazards, unexpected geologic formations, cave-ins, landslides, flooding and monsoons, fires, explosions, power outages, processing problems. Personal injury and death could result as well as property damage, delays in mining, environmental damage, legal liability and monetary loss. We may not be able to obtain insurance to cover these risks at economically reasonable premiums. We do not carry any sort of insurance and may have difficulties obtaining such once operations start, as insurance is generally sparse and cost prohibitive.

Our financial performance depends on the successful operation of our proposed exploration activities on the Property, which are subject to various operational risks.

There is no assurance the Company will be successful in its proposed mining activities. Our financial performance depends on the successful operation of our proposed exploration activities, which are being conducted by Walker River and paid for by us. The cost of operation and maintenance and the results of our proposed activities may be adversely affected by a variety of factors, including the following:

| ● | regular and unexpected maintenance and replacement expenditures; | |

| ● | shutdowns due to the breakdown or failure of our equipment; | |

| ● | labor disputes; | |

| ● | the presence of hazardous materials on our planned project sites; | |

| ● | catastrophic events such as fires, explosions, earthquakes, landslides, floods, releases of hazardous materials, severe storms or similar occurrences affecting our proposed exploration activities; and | |

| ● | unforeseen results and problems inherent in mining and exploration activities. |

Any of these events could significantly increase the expenses incurred in our planned exploration and could materially and adversely affect our business, financial condition, future results and cash flow, if any.

Our proposed exploration is subject to substantial risks, including:

| ● | unanticipated cost increases; | |

| ● | shortages and inconsistent qualities of equipment, material and labor; | |

| ● | work stoppages; | |

| ● | inability to obtain permits and other regulatory matters; and | |

| ● | failure by key suppliers, component manufacturers and vendors to timely and properly perform. |

Any one of these risks, or other unanticipated factors, could give rise to delays and cost overruns. There can be no assurance that the Company will ever successfully complete its proposed exploration, or become profitable.

We are unable to predict when we expect positive cash flow from future operations with any certainty. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business.

We do not expect to forecast positive cash flow from future operations in the near term. Completion of the exploration, permitting, and other work required before determining that a mineral deposit can be placed into production can take over ten years in the best of circumstances. There is no assurance that actual cash requirements will not exceed our estimates. In particular, additional capital may be required in the event that:

| ● | drilling, exploration and completion costs for our Lapon Canyon Project increase beyond our expectations; or | |

| ● | we encounter greater costs associated with general and administrative expenses or other costs. |

The occurrence of any of the aforementioned events could adversely affect our ability to meet our business plans.

We will depend almost exclusively on outside capital to pay for the continued exploration and development of our Property. Such outside capital may include the sale of additional stock and/or commercial borrowing. We can provide no assurances that any financing will be successfully completed.

Capital may not continue to be available if and when necessary to meet continuing development costs or, if capital is available, there is no guarantee it will be available on terms acceptable to us. The issuance of additional equity securities by us would result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease future operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

As our Property is in the pre-exploration stage, there can be no assurance that we will identify commercially viable qualities and quantities of mineralization on our Property.

Exploration for mineral ores is subject to a number of risk factors. Few properties that are explored are ultimately developed into producing mines. Our Property is only in the pre-exploration stage and is without any identified ores. We may not establish commercially viable quantities and qualities of ores on our Lapon Canyon Project (or on any future property we may acquire) and, even if we do, there is no guarantee that we will be able to interest a third-party mining company to enter into a business arrangement, which could cause our business to fail.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims, we will not be able to earn profits or continue future proposed operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will most likely fail.

If our exploration costs are higher than anticipated, our exploration activities will be adversely affected.

We are currently planning to commence exploration of our Property on the basis of estimated exploration costs. If our exploration costs are greater than anticipated, then we will not be able to carry out all planned exploration of the Property. Factors that could cause exploration costs to increase include adverse weather conditions, difficult terrain, and shortages of qualified personnel.

The price of gold is volatile and a decrease in gold prices could cause us to incur losses.

We will be exploring primarily for gold on our Property. The profitability of gold exploration and production is directly related to the prevailing market price for gold. The market prices of metals, including the gold market, fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the gold market from the time exploration is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to explore for gold at a time when the price of gold or other related mineral make such exploration economically feasible and, subsequently, incur losses because prices have decreased. For example, since reaching an all-time high during 2011, the gold futures market has declined and further decline is possible. Adverse fluctuations of metals market prices or the continued decline in the gold market, generally, may force us to curtail or cease our business operations.

Changes in the market price of gold, silver and other metals, which in the past has fluctuated widely, will affect the profitability of our operations and financial condition.

Our profitability and long-term viability depend, in large part, upon the market price of gold, copper, silver and other metals and minerals which may be produced from our mineral Property, and from which we may derive revenues under any agreement that we may enter into with a Company that conducts mining operations on our Property. The market price of gold and other metals is volatile and is impacted by numerous factors beyond our control, including:

| ● | sales by central banks and other holders, speculators and producers of gold and other metals in response to any of the below factors. | |

| ● | the relative strength of the U.S. dollar and certain other currencies; | |

| ● | interest rates; | |

| ● | global or regional political, financial, or economic conditions; | |

| ● | supply and demand for jewelry and industrial products containing metals; and | |

| ● | expectations with respect to the rate of inflation; |

A material decrease in the market price of gold and other metals could affect the commercial viability of our Property and any of our future anticipated development and production assumptions, if any. Lower gold prices could also adversely affect our ability to finance future development at all of our mining Property, all of which would have a material adverse effect on our financial condition and results of operations. There can be no assurance that the market price of gold and other metals will remain at current levels or that such prices will improve.

Our securities must be considered highly speculative, generally because of the nature of our business and the pre-exploration-stage of our business.