Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WhiteHorse Finance, Inc. | v442250_8k.htm |

Exhibit 99.1

Investor Presentation June 2016 WhiteHorse Finance, Inc. NASDAQ: WHF

1 References in this presentation to “WHF”, “we”, “us”, “our” and “the Company” refer to WhiteHorse Finance, Inc. Some of the statements in this presentation constitute forward - looking statements, which relate to future events or the Company’s fut ure performance or financial condition. The forward - looking statements contained in this presentation involve risks and uncertainti es, including statements as to: the Company’s future operating results; changes in political, economic or industry conditions, the interest r ate environment or conditions affecting the financial and capital markets, which could result in changes to the value of the Company’s assets; t he Company’s business prospects and the prospects of its prospective portfolio companies; the impact of investments that the Company expec ts to make; the impact of increased competition; the Company’s contractual arrangements and relationships with third parties; the dependence of the Company’s future success on the general economy and its impact on the industries in which the Company invests; the ability of the Compa ny’ s prospective portfolio companies to achieve their objectives; the relative and absolute performance of the Company’s investment adviser; t he Company’s expected financings and investments; the adequacy of the Company’s cash resources and working capital; the timing of cash flo ws, if any, from the operations of the Company’s prospective portfolio companies; and the impact of future acquisitions and divestitures. Such forward - looking statements may include statements preceded by, followed by or that otherwise include the words “may,” “migh t,” “will,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan” or si milar words. The Company has based the forward - looking statements included in this presentation on information available to us on the date of this presentation, and the Company assumes no obligation to update any such forward - looking statements. Actual results could differ materially from those implied or expressed in the Company’s forward - looking statements for any reason, and future results could differ materiall y from historical performance. Although the Company undertakes no obligation to revise or update any forward - looking statements, whether as a res ult of new information, future events or otherwise, you are advised to consult any additional disclosures that are made directly to you or through reports that the Company in the future may file with the Securities and Exchange Commission, including annual reports on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K. For a further discussion of factors that could cause the Company’s future results to differ materially from any forward - looking statements, see the section entitled “Risk Factors” in the annual report on Form 10 - K. Forward Looking Statements

2 WhiteHorse Finance Snapshot Company / Ticker: WhiteHorse Finance, Inc. / NASDAQ: WHF (“WhiteHorse Finance” or the “Company”) : Current Share Price: $10.91 (1 ) : Market Cap: $200MM (1 ) : Price / Book: 0.82x (1)(2) Portfolio Fair Value: $417MM (2 ) : Current Dividend Yield: 13.0% ( 1 ) ; consistent quarterly dividends of $0.355 per share since IPO : (1) As of June 8, 2016 (2) As of March 31, 2016 External Manager: Affiliate of H.I.G. Capital, LLC (“H.I.G. Capital” or “H.I.G.”)

3 WhiteHorse Finance Overview Investment Strategy ▪ Generate attractive risk - adjusted returns through debt investments in performing small - cap companies ▪ Primarily target directly originated senior secured loans sourced through H.I.G.’s deal flow network ▪ Opportunistically invest in credits where the Company possesses an advantage through H.I.G. Capital Externally Managed by H.I.G. Capital ▪ Leading global alternative asset manager focused on the small - cap market with close to $20Bn under management (1) ▪ Substantial scale and resources to support the Company’s activities - ~310 investment professionals (90 dedicated to debt investing ) ▪ Extensive investing experience built over the past 20 years across multiple market cycles Unique Deal Sourcing Network ▪ Consistent, “off market” deal flow generated through H.I.G.’s proprietary sourcing network ▪ Over 1,000 opportunities reviewed and approximately $670MM invested since December 2012 IPO ▪ All ~310 H.I.G. investment professionals active in sourcing opportunities Secure Investment Portfolio ▪ ~95% of the portfolio is composed of senior secured loans ▪ Portfolio has significant downside protection with meaningful value coverage ▪ Diligently structured with tight covenants and broad lender rights Note: As of March 31, 2016 unless otherwise noted (1) Based on total capital commitments to funds managed by H.I.G. Capital and its affiliates

Note: As of March 31, 2016 (1) Based on total capital commitments to funds managed by H.I.G. Capital and its affiliates 4 H.I.G. Capital Overview ▪ Leading global alternative asset manager focused on the small - cap market, defined as companies with $50MM to $350MM of enterprise value − Founded in 1993; ~$20Bn of capital under management (1) ▪ Differentiated, value - added strategy and deep experience in the small - cap segment of the market have resulted in what we believe is a superior track record ▪ Broad investment capabilities across sectors, capital structures, and investment styles, with a focus on smaller, complex situations ▪ Investment activities include: − Leveraged Buyouts − Credit − Growth Capital − Real Estate ▪ ~310 investment professionals located in thirteen offices across North America, South America and Europe ▪ “Institutionalized” management structure and processes with strong financial staff, controls , legal, compliance , IT support, and risk management procedures in place Investment Approach Global Footprint Miami New York Boston Chicago San Francisco Dallas Rio de Janeiro London Madrid Milan Hamburg Paris Atlanta

5 H.I.G. Capital Platform Overview ▪ Small - Cap Buyouts ▪ Middle Market Buyouts Leveraged Buyouts ▪ Venture Capital ▪ Bio - Tech ▪ Growth Equity Growth Equity ▪ CLOs / Structured Credit ▪ Senior Loan Funds AUM: $8.6Bn Real Estate ▪ Opportunistic equity and debt investments across all property types ▪ Special situation investments H.I.G. Capital Family of Funds ▪ H.I.G. manages ~$20Bn of capital under management (1) through a number of highly interconnected and synergistic strategies primarily focused on the small - cap market ▪ WhiteHorse Finance sits within H.I.G’s credit platform, with $8.6Bn of capital under management and 90 dedicated credit investment professionals Credit ▪ Direct Originations ▪ Senior Secured Loans ▪ Special Situation Credits ▪ Distressed Investments (1) Based on total capital commitments to funds managed by H.I.G. Capital and its affiliates

6 Small - Cap Market Overview Unstructured and Inefficient Market ▪ Sourcing small - cap lending opportunities requires access to an extensive network of relationships in the small - business community (as opposed to the established investment banking sources for larger companies) Specialized Lending Requirements ▪ As a result of small - cap companies having limited resources to facilitate a financing process, there is an opportunity to create an informational advantage through a more rigorous due diligence and underwriting process Credit Supply / Demand Imbalance ▪ We believe commercial banks, investment banks, CLOs and hedge funds have reduced small - cap lending efforts to focus on larger, more liquid asset classes ▪ Demand for debt financing from small - cap companies remains strong as these companies continue to require credit to refinance existing debt, to support growth initiatives and to finance acquisitions

7 Self - Originated Small - Cap Broadly Syndicated and Secondary Market Value Add for Investors ▪ Proprietary deals with limited competition, generally resulting in above market risk - return dynamics ▪ Larger, more liquid investments; competition among a large number of participants often drives down yields Number of Lenders ▪ Sole lender in most transactions ▪ Large number of lenders in syndicated transactions; less influence over process Due Diligence ▪ Direct access to management allows for more thorough diligence process to create potential informational advantages ▪ Limited access to management and owners/ sponsors at underwriting stage Terms/ Credit Metrics ▪ Moderate leverage levels, favorable lender terms ▪ Market process and equity sponsor influence often lead to more borrower - friendly terms Financial Covenants ▪ Control over documentation, resulting in tight operational and financial covenants ▪ Documentation controlled by agent; competitive market dynamics can result in less stringent covenant packages Monitoring ▪ Lead monitoring process, able to take quick action if any issues arise ▪ Often limited to predetermined compliance package; access to company controlled by the agent Compelling Small - Cap Lending Opportunities ▪ With access to H.I.G. Capital’s sourcing network, the Company is able to capitalize on more attractive self - originated small - cap transactions Directly originated loans to small - cap companies typically generate more attractive risk - adjusted returns relative to larger, broadly syndicated credits

8 WhiteHorse Finance Portfolio Composition ▪ Self - originated, proprietary transactions sourced through H.I.G.’s deal flow network − “Off market” opportunities primarily to non - sponsored, small - cap companies − Compelling risk - adjusted returns resulting from limited competition Direct Originations ▪ Short - term investments may be traded into or out of the portfolio opportunistically, depending on market conditions and the level of capital deployment. Transitory ▪ Includes credits in which the Company derives an advantage from H.I.G. other than sourcing, including: − Former H.I.G. portfolio companies − Credits previously owned by affiliated H.I.G. funds ▪ Generally larger , more liquid investments Club Deals / Syndications Fair Value: Number of Companies: Avg. Investment Size: $417.2MM 31 $11.0MM As of March 31, 2016

Health Care Facilities 13% Specialized Consumer Services 4% Broadcasting 4% Data Processing & Outsourced Services 9% Department Stores 2% Research & Consulting Services 3% Specialized Finance 5% Other 9% Distributors 2% Consumer Finance 14% Advertising 11% Electronic Equipment & Instruments 2% Oil & Gas Exploration & Production 2% Diversified Support Services 9% Food Retail 6% Other Diversified Financial Services 4% Call Protection 74% Hard Call Protection 19% No Protection 26% Soft Call Protection 55% Floating 97% Fixed 3% Senior Secured 95% Structured Products 5% Equity <1% 9 WhiteHorse Finance Portfolio Investment Characteristics Investments by Sector Investments by Type As of March 31, 2016; based on fair value of investments; numbers may not add due to rounding Yield Protection Call Protection 95% of the portfolio secured 97% of floating loans have LIBOR floors 74% of portfolio has call protection Highly diversified portfolio with significant downside protection Mitigates non - credit (interest rate and reinvestment) risks

10 Updates / Developments since December 2012 IPO Investment Portfolio Activity: ▪ Approximately $670MM of capital invested across ~60 new and existing portfolio companies ▪ Investment portfolio of $417.2MM across 31 companies as of March 31, 2016 ▪ ~95% of the portfolio is composed of senior secured loans, underwritten to conservative leverage ratios with meaningful value coverage Highlights from inception through Q1 2016: ▪ Only one loan on non - accrual; no credit losses ▪ Paid consistent quarterly distribution of $0.355 per share since IPO ▪ Granted Co - investment Exemptive Relief Order by the SEC Note: As of March 31, 2016 unless otherwise indicated IPO/ Financing: ▪ Raised $45MM through a public rights offering in November 2015 ▪ Raised $30MM publicly traded Senior Notes in July 2013 ▪ Extended maturity and lowered interest rate on the Unsecured Term Loan ▪ Increased size and flexibility on the Revolving Credit Facility

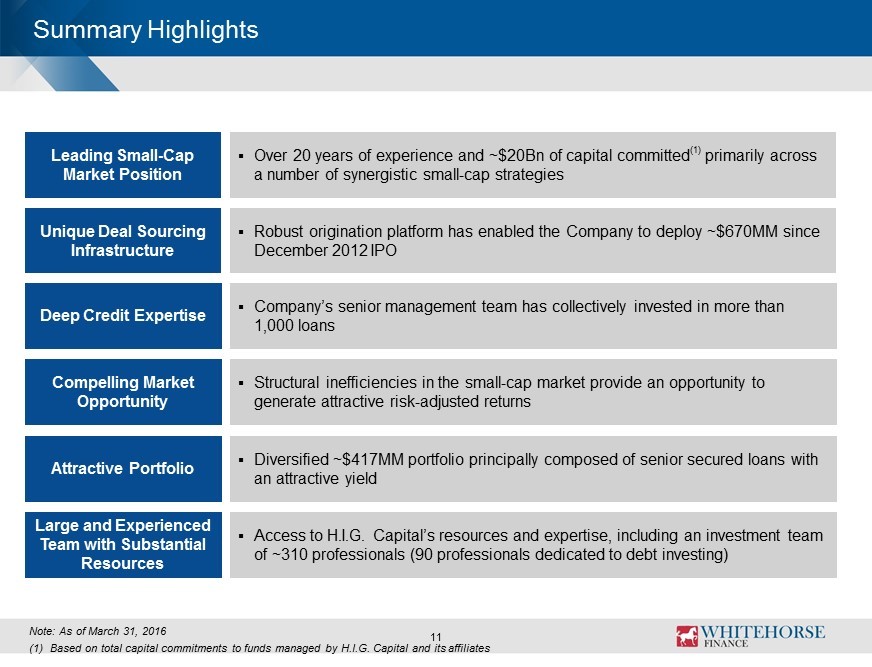

11 Summary Highlights Leading Small - Cap Market Position ▪ Over 20 years of experience and ~$20Bn of capital committed (1) primarily across a number of synergistic small - cap strategies Unique Deal Sourcing Infrastructure ▪ Robust origination platform has enabled the Company to deploy ~$670MM since December 2012 IPO Deep Credit Expertise ▪ Company’s senior management team has collectively invested in more than 1,000 loans Compelling Market Opportunity ▪ Structural inefficiencies in the small - cap market provide an opportunity to generate attractive risk - adjusted returns Attractive Portfolio ▪ Diversified ~$417MM portfolio principally composed of senior secured loans with an attractive yield Large and Experienced Team with Substantial Resources ▪ Access to H.I.G. Capital’s resources and expertise, including an investment team of ~310 professionals (90 professionals dedicated to debt investing) Note: As of March 31, 2016 (1) Based on total capital commitments to funds managed by H.I.G. Capital and its affiliates

12 Appendix

13 Historical Quarterly Operating Highlights (USD amounts in millions, except per share data) Q2 15 (unaudited) Q3 15 (unaudited) Q4 15 (unaudited) Q1 16 (unaudited) Total Investment Income 12.2$ 11.7$ 11.9$ 13.4$ Expenses Interest Expenses 1.7 1.7 1.7 1.9 Accelerated Amortization related to Refinancing - - 3.2 - Base Management Fees 2.1 2.1 2.2 2.3 Incentive Management Fees 1.5 1.4 0.1 1.7 Other Expenses 1.0 0.8 0.8 0.7 Total Expenses 6.3 6.0 8.0 6.6 Net Investment Income 5.9 5.7 3.9 6.8 Net Realized and Unrealized Gain / (Loss) (0.1) (4.3) (18.7) (1.3) Net Increase in Net Assets from Operations 5.8$ 1.4$ (14.8)$ 5.5$ Per Share Net Investment Income (NII) 0.39$ 0.38$ 0.24$ 0.37$ Core Net Investment Income (1) 0.39$ 0.38$ 0.35$ 0.37$ Net Realized and Unrealized Gain / (Loss) (0.01)$ (0.28)$ (1.14)$ (0.07)$ Earnings 0.38$ 0.10$ (0.91)$ 0.30$ Dividends Declared 0.36$ 0.36$ 0.36$ 0.36$ NII Dividend Coverage 111% 106% 67% 104% (1) Core net investment income is a non - GAAP financial measure. The Company believes that core net investment income provides us eful information to investors and management because it reflects the Company's financial performance excluding the net impact of costs associated with the refinancing of the Company’s revolving cre dit facility. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP . Core net investment income adds back non - recurring, non - cash net credit facility refinancing costs of $0.11 per share to NII of $0.24 per share.

14 Historical Quarterly Balance Sheet Highlights (USD amounts in millions, except per share data) Q2 15 (unaudited) Q3 15 (unaudited) Q4 15 (audited) Q1 16 (unaudited) Assets Investments at Fair Value 387.5$ 376.1$ 415.3$ 417.2$ Cash and Equivalents (1) 27.3 25.9 22.8 21.1 Other Assets 7.5 7.1 7.1 7.8 Total Assets 422.3$ 409.1$ 445.2$ 446.1$ Liabilities Debt 185.5$ 173.5$ 187.0$ 190.0$ Other Liabilities 11.6 14.2 14.1 13.0 Total Liabilities 197.1 187.7 201.1 203.0 Total Net Assets 225.2 221.4 244.1 243.1 Total Liabilities and Net Assets 422.3$ 409.1$ 445.2$ 446.1$ Net Asset Value per Share 15.03$ 14.77$ 13.33$ 13.28$ Leverage Ratio 0.82x 0.78x 0.77x 0.78x Net Leverage Ratio (2) 0.70x 0.68x 0.68x 0.69x (1) Includes restricted cash (2) Net leverage ratio is defined as debt outstanding plus any amounts payable for investments purchased less cash and equivalents (including restricted cash) less any receivables for

15 WhiteHorse Finance – Senior Team Bios Title Years of Experience Highlights John Bolduc ▪ Chairman of the Board ▪ Member of the Investment Committee 25 ▪ Leads H.I.G. Capital’s c redit platform ▪ Previous experience at Bain & Company and Chemed Corporation Stuart Aronson ▪ Chief Executive Officer ▪ Member of the Investment Committee 29 ▪ Leads H.I.G. Capital’s direct lending strategy ▪ Previously held various positions with GE Sponsor Finance and was an officer of the GE Company Gerhard Lombard ▪ Chief Financial Officer, Treasurer 16 ▪ Former Chief Accounting Officer of Churchill Financial Group ▪ Previously worked at Ernst & Young for over 10 years Sami Mnaymneh ▪ Member of the Investment Committee 29 ▪ Co - founding Partner of H.I.G. Capital ▪ Former Managing Director at The Blackstone Group ▪ Vice President in the Mergers & Acquisitions group at Morgan Stanley Anthony Tamer ▪ Member of the Investment Committee 31 ▪ Co - founding Partner of H.I.G. Capital ▪ Former Partner at Bain & Company ▪ Previously held marketing, engineering and manufacturing positions at Hewlett - Packard and Sprint Corporation Jay Carvell ▪ Member of the Investment Committee 15 ▪ Founding partner of WhiteHorse Capital, a leading credit investor and manager of CLOs (certain assets acquired by H.I.G. Capital in 2011) ▪ Previously held various positions with Highland Capital Management and PricewaterhouseCoopers LLP Brian Schwartz ▪ Member of the Investment Committee 23 ▪ Executive Managing Director and co - head of H.I.G. Capital’s Middle Market funds ▪ Previous experience at PepsiCo and Dillon, Read and Co. Pankaj Gupta ▪ Member of the Investment Committee 16 ▪ Managing Director with H.I.G. Capital’s credit platform ▪ Former co - head of the Credit and Sponsor Finance group at American Capital Javier Casillas ▪ Member of the Investment Committee 14 ▪ Managing Director with H.I.G. Capital’s credit platform ▪ Previously held various positions with JP Morgan and ING Chris Paldino ▪ Member of the Investment Committee 15 ▪ Managing Director with H.I.G. Capital’s credit platform ▪ Previously held various positions with Spire Capital Partners and Salomon Smith Barney