Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - EVIO, INC. | sgby_ex312.htm |

| EX-32.2 - CERTIFICATION - EVIO, INC. | sgby_ex322.htm |

| EX-32.1 - CERTIFICATION - EVIO, INC. | sgby_ex321.htm |

| EX-31.1 - CERTIFICATION - EVIO, INC. | sgby_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended MARCH 31, 2016

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________.

Commission File Number: 000-12350

SIGNAL BAY, INC. |

(Exact name of registrant as specified in its charter) |

Colorado | 47-1890509 | |

(State of Incorporation) | (I.R.S. Employer Identification No.) | |

62930 O. B. Riley Rd, Suite 300, Bend, OR | 97703 | |

(Address of principal executive offices) | (Zip Code) |

(541) 633-4568

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Non-accelerated filer | ¨ |

Accelerated filer | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

Title of Each Class | Outstanding as of June 1, 2016 | |

Common stock, par value $0.0001 per share | 527,400,608 | |

Class A Preferred Stock, par value $0.0001 per share | 1,840,000 | |

Class B Preferred Stock, par value $0.0001 per share | 5,000,000 |

SIGNAL BAY, INC.

FORM 10-Q

March 31, 2016

TABLE OF CONTENTS

Page | |||||

PART I – FINANCIAL INFORMATION | |||||

Item 1. | Financial Statements (Unaudited) | 3 | |||

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 20 | |||

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 27 | |||

Item 4. | Control and Procedures | 27 | |||

PART II – OTHER INFORMATION | |||||

Item 1. | Legal Proceedings | 30 | |||

Item 1A. | Risk Factors | 30 | |||

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 30 | |||

Item 3. | Defaults Upon Senior Securities | 30 | |||

Item 4. | Mine Safety Disclosures | 30 | |||

Item 5. | Other Information | 30 | |||

Item 6. | Exhibits | 32 | |||

| 2 |

PART I – FINANCIAL INFORMATION

ITEM 1 – FINANCIAL STATEMENTS

Signal Bay, Inc.

Consolidated Balance Sheets

(Unaudited)

| March 31, |

|

| September 30, |

| |||

|

| 2016 |

|

| 2015 |

| ||

ASSETS | ||||||||

Current Assets |

|

|

|

|

|

| ||

Cash and Cash Equivalents |

| $ | 31,083 |

|

| $ | 25,966 |

|

Accounts Receivable |

|

| 8,214 |

|

|

| 11,546 |

|

Prepaid Expense |

|

| 2,068 |

|

|

| 5,000 |

|

Total current assets |

|

| 41,365 |

|

|

| 42,512 |

|

Property, Plant and Equipment |

|

|

|

|

|

|

|

|

Property, Plant and Equipment |

|

| 169,902 |

|

|

| 159,034 |

|

Accumulated Depreciation and Ammortization |

|

| (44,318 | ) |

|

| (26,994 | ) |

Property, Plant and Equipment, net |

|

| 125,584 |

|

|

| 132,040 |

|

Other Assets |

|

|

|

|

|

|

|

|

Cost Basis Investment |

|

| 40,000 |

|

|

| 40,000 |

|

Security Deposit |

|

| 6,476 |

|

|

| - |

|

Intangible Assets (net of amortization of $6,743 and $nil) |

|

| 60,685 |

|

|

| 67,428 |

|

Goodwill |

|

| 446,743 |

|

|

| 446,743 |

|

Total Other Assets |

|

| 553,904 |

|

|

| 554,171 |

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

| $ | 720,853 |

|

| $ | 728,723 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) |

| |||||||

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

Accounts Payable |

| $ | 104,466 |

|

| $ | 46,324 |

|

Accounts Payable - Related Party |

|

| 12,000 |

|

|

| - |

|

Accrued Liabilities |

|

| 18,995 |

|

|

| 11,659 |

|

Current Portion - Notes Payable - Related Party |

|

| 139,096 |

|

|

| 133,507 |

|

Convertible Loan (net of unamortized discount of $46,446 and $64,062) |

|

| 143,644 |

|

|

| 38,438 |

|

Interest Expense Payable |

|

| 4,786 |

|

|

| - |

|

Loan Payable |

|

| 28,058 |

|

|

| - |

|

Derivative Liability |

|

| 264,997 |

|

|

| 200,460 |

|

Total Current Liabilities |

|

| 716,042 |

|

|

| 430,388 |

|

Notes Payable - Related Party, less Current Portion |

|

| 6,378 |

|

|

| 13,047 |

|

Total Liabilities |

|

| 722,420 |

|

|

| 443,435 |

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity (Deficit) |

|

|

|

|

|

|

|

|

Class A Preferrred Stock, Par Value $.0001, 1,850,000 authorized, 1,840,000 issued and outstanding |

| $ | 184 |

|

| $ | 184 |

|

Class B Preferrred Stock, Par Value $.0001, 5,000,000 authorized, 5,000,000 issued and outstanding |

|

| 500 |

|

|

| 500 |

|

Common Stock, Par Value $.0001, 750,000,000 authorized, 415,717,063 and 398,645,595 issued and outstanding, respectively |

|

| 41,572 |

|

|

| 39,865 |

|

Additional Paid In Capital |

|

| 1,776,139 |

|

|

| 1,654,597 |

|

Accumulated Deficit |

|

| (1,907,341 | ) |

|

| (1,506,975 | ) |

Total Stockholders' Equity (Deficit) |

|

| (88,946 | ) |

|

| 188,171 |

|

Non-controlling Interests |

|

| 87,379 |

|

|

| 97,117 |

|

Total Equity (Deficit) |

|

| (1,567 | ) |

|

| 285,288 |

|

Total Liabilities and Stockholders' Equity (Deficit) |

| $ | 720,853 |

|

| $ | 728,723 |

|

The accompanying notes are an integral part of these unaudited interim financial statements

| 3 |

Signal Bay, Inc.

Consolidated Statements of Operations

(Unaudited)

|

| Three months ended |

|

| Six months ended |

| ||||||||||

|

| March 31, |

| March 31, |

| |||||||||||

|

| 2016 |

|

| 2015 |

|

| 2016 |

|

| 2015 |

| ||||

Revenues |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Testing Services |

| $ | 40,019 |

|

| $ | - |

|

| $ | 79,657 |

|

| $ | - |

|

Consulting Services |

|

| 64,587 |

|

|

| 5,600 |

|

|

| 195,673 |

|

|

| 10,412 |

|

Total Revenue |

|

| 104,606 |

|

|

| 5,600 |

|

|

| 275,330 |

|

|

| 10,412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

| 222,998 |

|

|

| 775,299 |

|

|

| 485,237 |

|

|

| 805,487 |

|

Depreciation and Amortization |

|

| 12,130 |

|

|

| 5,067 |

|

|

| 24,160 |

|

|

| 5,067 |

|

Total Operating Expense |

|

| 235,128 |

|

|

| 780,366 |

|

|

| 509,397 |

|

|

| 810,554 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from Operations |

|

| (130,522 | ) |

|

| (774,766 | ) |

|

| (234,067 | ) |

|

| (800,142 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

| 89,222 |

|

|

| - |

|

|

| 140,975 |

|

|

| - |

|

Loss on disposal of assets |

|

| 1 |

|

|

| - |

|

|

| 720 |

|

|

| - |

|

Loss on derivatives |

|

| 120,755 |

|

|

| - |

|

|

| 34,342 |

|

|

| - |

|

Total other expense |

|

| 209,978 |

|

|

| - |

|

|

| 176,037 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

| $ | (340,500 | ) |

| $ | (774,766 | ) |

| $ | (410,104 | ) |

| $ | (800,142 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Loss attributable to non-controlling interests |

|

| (5,017 | ) |

|

|

|

|

|

| (9,738 | ) |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss attributable to Signal Bay, Inc. |

| $ | (335,483 | ) |

| $ | (774,766 | ) |

| $ | (400,366 | ) |

| $ | (800,142 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Net Loss Per Share |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Share Outstanding Basic and Diluted |

|

| 406,064,579 |

|

|

| 327,581,025 |

|

|

| 403,886,812 |

|

|

| 309,322,948 |

|

The accompanying notes are an integral part of these unaudited interim financial statements

| 4 |

Signal Bay, Inc.

Consolidated Statements of Cash Flows

(Unaudited)

|

| Six months ended |

| |||||

|

| March 31, |

| |||||

|

| 2016 |

|

| 2015 |

| ||

Cash flows from operating activities |

|

|

|

|

|

| ||

Net loss |

| $ | (410,104 | ) |

| $ | (800,142 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

Loss on disposal of asset |

|

| 720 |

|

|

| - |

|

Default penalty on convertible debenture |

|

| 51,229 |

|

|

|

|

|

Stock based compensation |

|

| 83,444 |

|

|

| 740,189 |

|

Depreciation and amortization expense |

|

| 24,160 |

|

|

| 5,067 |

|

Amortization of debt discount |

|

| 67,616 |

|

|

| - |

|

Derivative expense |

|

| 34,342 |

|

|

| - |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

| 3,332 |

|

|

| (10,413 | ) |

Security deposit |

|

| (6,476 | ) |

|

| - |

|

Prepaid expenses and other current assets |

|

| 2,932 |

|

|

| - |

|

Accounts payable |

|

| 58,142 |

|

|

| (2,986 | ) |

Accounts payable - related party |

|

| 12,000 |

|

|

| - |

|

Accrued expenses |

|

| 14,844 |

|

|

| - |

|

Net cash used in operating activities |

|

| (63,819 | ) |

|

| (68,285 | ) |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

Hardware and Equipment Purchased |

|

| (11,681 | ) |

|

| (2,194 | ) |

Domain, Website and Customer List Acquisition |

|

| - |

|

|

| (3,500 | ) |

Net cash used in investing activities |

|

| (11,681 | ) |

|

| (5,694 | ) |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

| - |

|

|

| 59,500 |

|

Original Issue Discount on convertible notes |

|

| - |

|

|

| - |

|

Proceeds from convertible notes |

|

| 53,639 |

|

|

| - |

|

Proceeds from loan payable |

|

| 39,150 |

|

|

| - |

|

Payments on notes payable |

|

| (11,092 | ) |

|

| - |

|

Payments on notes payable - related party |

|

| (9,080 | ) |

|

| - |

|

Proceeds from notes payable - related party |

|

| 8,000 |

|

|

| 30,000 |

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

| 80,617 |

|

|

| 89,500 |

|

|

|

|

|

|

|

|

|

|

Net change in cash |

|

| 5,117 |

|

|

| 15,521 |

|

Cash balance, beginning of period |

|

| 25,966 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

Cash balance, end of period |

| $ | 31,083 |

|

| $ | 15,521 |

|

|

|

|

|

|

|

|

|

|

Cash paid for: |

|

|

|

|

|

|

|

|

Interest |

| $ | 12,098 |

|

| $ | - |

|

Accrued income taxes |

| $ | - |

|

| $ | - |

|

|

|

|

|

|

|

|

|

|

Noncash investing and financing activities: |

|

|

|

|

|

|

|

|

Software purchased with common stock |

| $ | - |

|

| $ | 58,333 |

|

Conversion of convertible note into common stock |

| $ | 20,000 |

|

| $ | - |

|

Reclassifcation of related party debt from short-term to long-term |

| $ | 6,378 |

|

| $ | - |

|

Reclassification of derivative liability to APIC |

| $ | 19,805 |

|

| $ | - |

|

Domain, websites, and social media accounts purchased with common stock |

| $ | - |

|

| $ | 31,250 |

|

The accompanying notes are an integral part of these unaudited interim financial statements

| 5 |

SIGNAL BAY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2016

(Unaudited)

NOTE 1 – NATURE OF ACTIVITIES AND CONTINUANCE OF BUSINESS

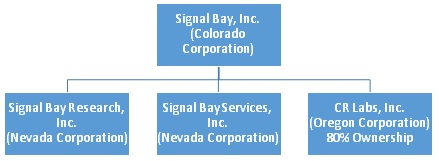

Signal Bay, Inc., a Colorado corporation and its subsidiaries provide advisory, management and analytical testing services to the emerging legalized cannabis industry. Signal Bay, Inc. was originally incorporated in the State of New York, December 12, 1977 under the name 3171 Holding Corporation. On February 22, 1979 the name was changed to Electronomic Industries Corp. and on February 23, 1983 the name was changed to Quantech Electronics Corp. The Company was reincorporated in the State of Colorado on December 15, 2003. On August 29, 2014, the Company completed a reverse merger with Signal Bay Research, Inc., a Nevada Corporation, and took over its operations. In September 2014, the Company changed its name from Quantech Electronics Corp. to Signal Bay, Inc. The Company has selected September 30 as its fiscal year end. Signal Bay, Inc. is domiciled in the State of Colorado, and its corporate headquarters are located in Bend, Oregon.

As a part of and prior to the consummation of the reverse merger, William Waldrop and Lori Glauser, principals of Signal Bay Research, Inc., purchased 28,811,933 shares of the Company (80% of the issued and outstanding common stock) from WB Partners. The merger between the Company and Signal Bay Research was finalized and closed contemporaneously with the share purchase. As part of this share purchase, Mr. Waldrop and Ms. Glauser became the officers and directors of the Company. Signal Bay Research was acquired through the issuance of 254,188,067 shares of common stock and 5,000,000 shares of Series B Preferred Stock to Mr. Waldrop and Ms. Glauser, pro rata. After the reverse merger, William Waldrop and Lori Glauser individually each own 127,500,000 shares of common stock and 2,500,000 shares of Series B Preferred stock in the Company. Immediately prior to the reverse merger, neither William Waldrop nor Lori Glauser had any interest in the Company. Immediately after to the reverse, WB Partners owned less than 5% of the common stock. The company filed a Form 10-12G on November 25, 2014, and was determined to be a shell company by the SEC as per the Form 10-12G/A which went effective on January 24, 2015. As of January 29, 2015, the company filed an 8K stating it entered into a material agreement and was no longer a shell company.

After the reverse merger, Signal Bay Research, Inc. continues to operate as a wholly owned subsidiary capturing the research and advisory services for Signal Bay, Inc.

Signal Bay Services was formed on January 25, 2015, as the management services division of Signal Bay. Currently, Signal Bay Services has one contract with Libra Wellness Services, LLC with anticipated engagement commencing in August 2016.

On September 17, 2015, Signal Bay entered into a share exchange agreement with CR Labs, Inc., an Oregon Corporation, pursuant to which the company issued 40,000,000 shares of the Company's common stock resulting in exchange for 80% of the outstanding common stock of CR Labs, Inc.

The Company currently has executed memorandum of understandings to acquire Oregon Analytical Services, LLC in Eugene, OR and Smith Scientific Industries, Inc. d/b/a Kenevir Research in Medford, OR.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation:

The accompanying unaudited interim consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission, and should be read in conjunction with the audited financial statements and notes thereto contained in the Company's most recent Annual Financial Statements filed with the SEC on Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim period presented have been reflected herein. The results of operations for the interim period are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements which would substantially duplicate the disclosures contained in the audited consolidated financial statements for the most recent fiscal period, as reported in the Form 10-K, have been omitted.

| 6 |

Principles of Consolidation:

The Company prepares its financial statements on the accrual basis of accounting. The accompanying consolidated financial statements include the accounts of the Company and its wholly and partially owned subsidiaries, all of which have a fiscal year end of September 30. All significant intercompany accounts, balances and transactions have been eliminated in the consolidation.

The Company consolidates its subsidiaries in accordance with ASC 810, and specifically ASC 810-10-15-8 which states, the usual condition for a controlling financial interest is ownership of a majority voting interest, and, therefore, as a general rule ownership by one reporting entity, directly or indirectly, or over 50% of the outstanding voting shares of another entity is a condition pointing toward consolidation."

Use of Estimates

The preparation of financial statements in accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. A change in managements' estimates or assumptions could have a material impact on Signal Bay, Inc. financial condition and results of operations during the period in which such changes occurred. Actual results could differ from those estimates. Signal Bay, Inc. financial statements reflect all adjustments that management believes are necessary for the fair presentation of their financial condition and results of operations for the periods presented.

Financial Instruments

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities. Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data. Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

Level 1 - Level 2 - Level 3 -

The Company's financial instruments consist principally of cash, accounts payable, and accrued liabilities. Pursuant to ASC 820 and 825, the fair value of cash is determined based on "Level 1" inputs, which consist of quoted prices in active markets for identical assets. The recorded values of all other financial instruments approximate their current fair values because of their nature and respective maturity dates or durations.

The following table sets forth by level with the fair value hierarchy the Company's financial assets and liabilities measured at fair value on March 31, 2016:

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| ||||

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Derivative financial instruments |

| $ | - |

|

| $ | - |

|

| $ | 264,997 |

|

| $ | 264,997 |

|

Recently Issued Accounting Pronouncements

Management believes recently issued accounting pronouncements will have no impact on the financial statements of the Company.

| 7 |

NOTE 3 – ACQUISITIONS

On September 17, 2015 the Company performed a share exchange for 80% ownership of CR Labs, Inc., from its founders. CR Labs is an Oregon company engaged in providing analytical testing services for the medical marijuana industry in compliance with the Oregon Health Authority. The costs related to the transaction were $42,193 and were expensed during 2015.

The Company applied the acquisition method to the business combination and valued each of the assets acquired (cash, accounts receivable, and property, plant and equipment) and liabilities assumed (accounts payable) at fair value as of the acquisition date. The cash, accounts receivable and accounts payable were deemed to be recorded at fair value as of the acquisition date. The Company determined the fair value of property, plant and equipment to be historical book value. The preliminary allocation of the purchase price was based on estimates of the fair value of the assets and liabilities assumed. Under the purchase agreement, the Company issued 40,000,000 shares of common stock. These shares had an acquisition date fair value of $400,000. The following table shows the estimated fair values of the assets acquired and liabilities assumed at the date of acquisition:

ASSETS ACQUIRED: |

|

|

| |

CASH |

| $ | 2,970 |

|

ACCOUNT RECEIVABLE |

|

| 3,550 |

|

PROPERTY PLANT AND EQUIPMENT |

|

| 43,360 |

|

INTANGIBLE ASSETS |

|

| 67,428 |

|

GOODWILL |

|

| 446,743 |

|

TOTAL ASSETS ACQUIRED |

|

| 564,051 |

|

|

|

|

|

|

LESS LIABILITIES ASSUMED |

|

|

|

|

ACCOUNTS PAYABLE AND ACCRUED LIABILITIES |

|

| (36,421 | ) |

NOTES PAYABLE |

|

| (27,630 | ) |

TOTAL LIABILITIES ASSUMED |

|

| (64,051 | ) |

|

|

|

|

|

LESS NON-CONTROLLING INTEREST |

|

| (100,000 | ) |

|

|

|

|

|

NET ASSETS ACQUIRED FROM CR LABS ACQUISITION |

| $ | 400,000 |

|

| 8 |

The following unaudited information is provided to present a summary of the combined results of the Company's operations with CR Labs, Inc. as if the acquisition had been completed as of the beginning of the reporting period. Adjustments were made to eliminate any inter-company transactions in the periods presented.

SIGNAL BAY, INC. | ||||||||

STATEMENTS OF OPERATIONS | ||||||||

(Unaudited) | ||||||||

|

|

|

|

| ||||

|

| Three months ended |

|

| Six months ended |

| ||

|

| March 31, 2015 |

|

| March 31, 2015 |

| ||

|

| (Pro Forma) |

|

| (Pro Forma) |

| ||

Revenues |

|

|

|

|

|

| ||

Testing Services |

| $ | 19,593 |

|

| $ | 44,783 |

|

Consulting Services |

|

| 5,600 |

|

|

| 10,412 |

|

Total Revenue |

|

| 25,193 |

|

|

| 55,195 |

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

SG&A |

|

| 783,447 |

|

|

| 822,670 |

|

Depreciation and Amortization |

|

| 5,067 |

|

|

| 5,067 |

|

Total Operating Expense |

|

| 788,514 |

|

|

| 827,737 |

|

|

|

|

|

|

|

|

|

|

(Loss) From Operations |

|

| (763,321 | ) |

|

| (772,542 | ) |

|

|

|

|

|

|

|

|

|

Other expense |

|

|

|

|

|

|

|

|

Interest expense |

|

| 0 |

|

|

| 0 |

|

Loss on disposal of assets |

|

| 0 |

|

|

| 0 |

|

Gain on derivatives |

|

| 0 |

|

|

| 0 |

|

Total other expense |

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) |

| $ | (763,321 | ) |

| $ | (772,542 | ) |

|

|

|

|

|

|

|

|

|

Basic and Diluted Net Loss Per Share |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

|

|

|

|

|

|

|

|

|

Weighted Average Share Outstanding Basic and Diluted |

|

| 327,581,025 |

|

|

| 309,322,948 |

|

| 9 |

NOTE 4 – GOING CONCERN

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company has negative working capital, recurring losses, and does not have an established source of revenues sufficient to cover its operating costs. These factors raise substantial doubt about the Company's ability to continue as a going concern.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plan described in the preceding paragraph and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that may be necessary if the Company is unable to continue as a going concern.

In the coming year, the Company's foreseeable cash requirements will relate to continual development of the operations of its business, maintaining its good standing and making the requisite filings with the Securities and Exchange Commission, and the payment of expenses associated with operations and business developments. The Company may experience a cash shortfall and be required to raise additional capital.

Historically, it has mostly relied upon internally generated funds such as shareholder loans and advances to finance its operations and growth. Management may raise additional capital by retaining net earnings or through future public or private offerings of the Company's stock or through loans from private investors, although there can be no assurance that it will be able to obtain such financing. The Company's failure to do so could have a material and adverse effect upon it and its shareholders.

NOTE 5 – RELATED PARTY TRANSACTIONS

During the six months ended March 31, 2016, the Company borrowed $8,000 and paid $2,500 from Lori Glauser, our COO, for working capital. The total amount owed is $85,500 and $80,000 as of March 31, 2016 and September 30, 2015, respectively. The loan is at 0% interest and is to be repaid by September 30, 2016.

During the six months ended, March 31, 2016, $34,006 was paid to Newport Commercials Advisors (NCA) for management consulting services, a company which is owned 100% by William Waldrop, our CEO.

On June 22, 2015, the Company purchased a 4% ownership of Libra Wellness Center, LLC from Lori J Glauser, our COO for $40,000. The $40,000 is to be paid in one installment due no later than July 1, 2016. The total amount owed is $40,000 as of March 31, 2016 and September 30, 2015. This transaction has been recorded as a cost basis investment since neither Signal Bay, William Waldrop or Lori Glauser has any additional ownership and do not have any control over Libra Wellness Center, LLC. Libra Wellness Center, LLC has subsequently obtained additional financing resulting in our ownership being diluted to 1.5%.

During the six months ended March 31, 2016, the Company repaid to Eric Ezrine, CR Labs, President, $6,580. The total amount owed is $19,974 and $26,554 as of March 31, 2016 and September 30, 2015, respectively.

As of March 31, 2016, the company has accrued payroll due to Eric Ezrine, CR Labs President $6,000.

As of March 31, 2016, the company has accrued payroll due to Carlos Cummings, CR Labs Vice President $6,000.

Through March 31, 2016, our executive, administrative and operating offices are located at 2996 Panorama Ridge Dr. Henderson, NV 89052. The office space is being provided by one of our Directors.

On November 1, 2015, Signal Bay, Inc majority owned subsidiary CR Labs, Inc. executed a facility lease for a new building in Bend, OR to provide sufficient space for additional analytical equipment. This lease was guaranteed by the Signal Bay, Inc. to entice the landlord to enter the agreement.

| 10 |

NOTE 6 – EQUITY TRANSACTIONS

Preferred Stock Designation

Series A Preferred Stock

The Company designated 1,850,000 shares of Series A Convertible Preferred Stock with a par value of $0.0001 per share. Dividends: Initially, there will be no dividends due or payable on the Series A Preferred Stock. Any future terms with respect to dividends shall be determined by the Board consistent with the Corporation's Certificate of Incorporation. Any and all such future terms concerning dividends shall be reflected in an amendment to this Certificate, which the Board shall promptly file or cause to be filed.

All shares of the Series A Preferred Stock shall rank (i) senior to the Corporation's Common Stock and any other class or series of capital stock of the Corporation hereafter created, (ii) pari passu with any class or series of capital stock of the Corporation hereafter created and specifically ranking, by its terms, on par with the Series A Preferred Stock and (iii) junior to any class or series of capital stock of the Corporation hereafter created specifically ranking, by its terms, senior to the Series A Preferred Stock, in each case as to distribution of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary.

The Series A Preferred shall have no liquidation preference over any other class of stock.

Except as otherwise required by law, holders of Series A Preferred Stock shall have no special voting rights and their consent shall not be required (except to the extent they are entitled to vote with holders of Common Stock or any other class or series of preferred stock) for the taking of any corporate action.

Conversion at the Option of the Holder. From 12 months from the date of issuance, each holder of shares of Series A Preferred Stock may, at any time and from time to time, convert (an "Optional Conversion") each of its shares of Series A Preferred Stock into fully paid and nonassessable shares of Common Stock at a rate equal to 4.9% of the Common Stock.

AntiDilution. For a period of 18 months after the Preferred is convertible, the conversion price of the Series A Preferred will be subject to adjustment to prevent dilution in the event that the Company issues additional shares at a purchase price less than the applicable conversion price. The conversion price will be subject to adjustment on a weighted basis that takes into account issuances of additional shares. At the expiration of the antidilution period, the conversion rate in Section VI (A) above shall be equal to a conversion rate equal to 4.9% on the Common Stock. For example, if on the date of expiration of the antidilution clause there are 500,000,000 shares of Common Stock issued and outstanding then each Series A Preferred Stock shall convert at a rate of 13.24 common shares for each 1 Series Preferred Share.

The company has evaluated the Series A Preferred Stock in accordance with ASC 815 and has determined their conversion options were for equity and ASC 815 does not apply.

The company has evaluated the Series A Preferred Stock in accordance with FASB ASC Subtopic 47020, and has determined that there is no beneficial conversion feature that must be accounted.

| 11 |

Series B Convertible Preferred Stock

The Company designated 5,000,000 shares of Series B Convertible Preferred Stock with a par value of $0.0001 per share.

Initially, there will be no dividends due or payable on the Series B Preferred Stock. Any future terms with respect to dividends shall be determined by the Board consistent with the Corporation's Certificate of Incorporation. Any and all such future terms concerning dividends shall be reflected in an amendment to this Certificate, which the Board shall promptly file or cause to be filed.

All shares of the Series B Preferred Stock shall rank (i) senior to the Corporation's Common Stock and any other class or series of capital stock of the Corporation hereafter created, (ii) pari passu with any class or series of capital stock of the Corporation hereafter created and specifically ranking, by its terms, on par with the Series B Preferred Stock and (iii) junior to any class or series of capital stock of the Corporation hereafter created specifically ranking, by its terms, senior to the Series B Preferred Stock, in each case as to distribution of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary.

The Series B Preferred shall have no liquidation preference over any other class of stock.

Each holder of outstanding shares of Series B Preferred Stock shall be entitled to the number of votes equal to equal to one hundred (100) Common Shares. Except as provided by law, or by the provisions establishing any other series of Preferred Stock, holders of Series B Preferred Stock and of any other outstanding series of Preferred Stock shall vote together with the holders of Common Stock as a single class.

Each holder of shares of Series B Preferred Stock may, at any time and from time to time, convert (an "Optional Conversion") each of its shares of Series B Preferred Stock into a 100 of fully paid and nonassessable shares of Common Stock; provided, however, that any Optional Conversion must involve the issuance of at least 100 shares of Common Stock.

In the event of a reverse split the conversion ratio shall not be change. However, in the event a forward split shall occur then the conversion ratio shall be modified to be increased by the same ratio as the forward split.

The company has evaluated the Series B Preferred Stock in accordance with ASC 815 and has determined their conversion options were for equity and ASC 815 does not apply.

The company has evaluated the Series B Preferred Stock in accordance with FASB ASC Subtopic 47020, and has determined that there is no beneficial conversion feature that must be accounted.

On January 27, 2015, we issued 4,000,000 shares to Electrum Partners for advisory service under the Company's Equity Incentive Plan for 2015 which vested ratably throughout 2016. The Company recognizes compensation expense ratably over the vesting periods. For the six months ended March 31, 2016 and 2015, the Company recorded compensation expense related to this transaction of $7,963 and $25,312, respectively. As of March 31, 2016, 2,625,000 shares were fully vested.

On April 1, 2015, we issued 1,000,000 shares to Connie Richter for advisory service under the Company's Equity Incentive Plan for 2015 which vested ratably throughout 2016. The Company recognizes compensation expense ratably over the vesting periods. For the six months ended March 31, 2016 and 2015, the Company recorded compensation expense related to this transaction of $1,991 and $0, respectively. As of March 31, 2016, 593,750 shares were fully vested.

| 12 |

On June 17, 2015, we issued 500,000 shares to Casey Houlihan for advisory services under the Company's Equity Incentive Plan for 2015 which vested ratably throughout 2016. The Company recognizes compensation expense ratably over the vesting periods. For the six months ended March 31, 2016 and 2015, the Company recorded compensation expense related to this transaction of $2,389 and $0, respectively. As of March 31, 2016, 387,500 shares were fully vested.

On July 1, 2015, we issued 1,000,000 shares to Jim Fitzpatrick as an independent consultant for management consulting services under the Company's Equity Incentive Plan for 2015 which vested ratably throughout 2016. The Company recognizes compensation expense ratably over the vesting periods. For the six months ended March 31, 2016 and 2015, the Company recorded compensation expense related to this transaction of $2,595 and $0, respectively. As of March 31, 2016, 1,000,000 shares were fully vested.

On September 17, 2015, we issued 1,250,000 shares to Eric Ezrine for his role as President of CR Labs under the Company's Equity Incentive Plan for 2015 which vests 25% per year annually on the grant date. The Company recognizes compensation expense ratably over the vesting periods. For the six months ended March 31, 2016 and 2015, the Company recorded compensation expense related to this transaction of $0 and $0, respectively. As of March 31, 2016, 0 shares were fully vested.

On September 17, 2015, we issued 1,000,000 shares to Carlos Cummings for his role as Vice President of CR Labs under the Company's Equity Incentive Plan for 2015 which vests 25% per year annually on the grant date. The Company recognizes compensation expense ratably over the vesting periods. For the six months ended March 31, 2016 and 2015, the Company recorded compensation expense related to this transaction of $0 and $0, respectively. As of March 31, 2016, 0 shares were fully vested.

On October 13, 2015, we issued 1,000,000 shares to Anthony Smith for advisory services under the Company's Equity Incentive Plan for 2015. These shares will vest ratably over 24 months. The Company recognizes compensation expense ratably over the vesting periods. For the six months ended March 31, 2016 and 2015, the Company recorded compensation expense related to this transaction of $2,595 and $0, respectively. As of March 31, 2016, 250,000 shares were fully vested.

On December 31, 2015, we issued 4,000,000 shares to Zachary Puznak for advisory services valued at $40,000.

On January 1, 2016, we issued 3,000,000 shares to Andrew Hunzicker for advisory services under the Company's Equity Incentive Plan for 2015. These shares will vest ratably over 3 months. The Company recognizes compensation expense ratably over the vesting periods. For the six months ended March 31, 2016 and 2015, the Company recorded compensation expense related to this transaction of $22,256 and $0, respectively. As of March 31, 2016, 3,000,000 shares were fully vested.

On February 2, 2016, we issued 3,448,276 shares of common stock for the conversion of convertible notes with principal and accrued interest of $20,000.

On March 31, 2016, we issued 4,807,692 shares, valued at $6,250, to an advisor for consulting services rendered and expensed $6,250 related to this transaction.

| 13 |

NOTE 7 – CONVERTIBLE DEBT

On July 23, 2015, Signal Bay, Inc. (the "Company") executed a convertible promissory note with a principal amount of $102,500 (the "Note") to St. George Investments, LLC. ("Lender"). The Note was funded on July 23, 2015 (Purchase Date). The Company may repay this note at any time. This note shall be deemed paid in full if Company pays to Lender (a) the sum of $91,250 (meaning Borrower would receive a $11,250 discount) on or before the date that is ninety (90) days from the Purchase Price Date, or (b) the sum of $97,500 (meaning Borrower would receive a $5,000 discount) on any date after the date that is ninety (90) days from the Purchase Price Date but on or before the date that is one hundred thirty-five (135) days from the Purchase Price Date (the "Prepayment Opportunity Date"). If Borrower does not repay the entire Outstanding Balance of this Note on or before the Prepayment Opportunity Date, it shall receive no prepayment discount and must pay the entire Outstanding Balance of this Note in full on or before the Maturity Date. Lender has the right at any time following an Event of Default, at its election, to convert (each instance of conversion is referred to herein as a "Conversion") all or any part of the Outstanding Balance into shares ("Conversion Shares") of fully paid and non-assessable common stock, $0.0001 par value per share ("Common Stock"), of Borrower as per the following conversion formula: the number of Conversion Shares equals the amount being converted (the "Conversion Amount") divided by the Conversion Price. The conversion price (the "Conversion Price") for each Conversion (as defined below) shall be equal to the product of 70% (the "Conversion Factor") multiplied by the average of the three (3) lowest Closing Bid Prices in the twenty (20) Trading Days immediately preceding the applicable Conversion. Debt discount of $102,500 was recorded and during the six months ended March 31, 2016, there was amortization of debt discount of $64,062. The unamortized debt discount at March 31, 2016 is $0. On March 31, 2016, Tangiers Global LLC Purchased $115,019 of the note from St. George Investments. Upon the close, St. George still retained a $25,000 portion of the note.

On February 19, 2016, the Company closed a Securities Purchase Agreement with Adar Bays, LLC ("Adar Bays") providing for the purchase of two Convertible Redeemable Notes (the "AB Notes") in the aggregate principal amount of $50,000. The front-end AB Note was funded on February 25, 2016 with the Company receiving $23,000 of net proceeds after $2,000 in legal fees. The back-end AB Note will be funded upon payment of the first. The AB Note matures on February 19, 2017, accrues interest at 8% per annum and is convertible into shares of common stock at a conversion price equal to 50% of the lowest trading price as quoted on a national exchange for the twenty prior trading days including the date on which the Notice of Conversion is received by the Company. In no event shall Adar Bays effect a conversion if such conversion results in Adar Bays beneficially owning in excess of 9.9% of the outstanding common stock of the Company. Accrued interest shall be paid in shares of common stock at any time at the discretion of Adar Bays pursuant to the conversion terms above. The AB Note may be prepaid with the following penalties: (i) if the AB Note is prepaid within 90 days of the issuance date, then 130% of the face amount plus any accrued interest; (ii) if the AB Note is prepaid within 180 days of the issuance date, then 150% of the face amount plus any accrued interest. The AB Note may not be prepaid after the 180th day. The AB Note also contains certain representations, warranties, covenants and events of default, and increases in the amount of the principal and interest rate under the AB Note in the event of such defaults. Debt discount of $25,000 was recorded and during the six months ended March 31, 2016, there was amortization of debt discount of $2,801. The unamortized debt discount at March 31, 2016 is $22,199.

On March 21, 2015, the Company executed a 10% convertible promissory note with a principal amount of $27,500 (the "Note") with Tangiers Global, LLC. The Note was funded on March 31, 2016 (Purchase Date). The Note may be prepaid by the Company, whole or in part, according to the following schedule:

Days Since Effective Date | Prepayment Amount | |

Under 30 | 100% of Principal Amount | |

31-60 | 110% of Principal Amount | |

61-90 | 120% of Principal Amount | |

91-120 | 130% of Principal Amount | |

121-150 | 140% of Principal Amount | |

151-180 | 150% of Principal Amount |

| 14 |

If Borrower does not repay the entire Outstanding Balance of this Note on or before the Prepayment Opportunity Date, it shall receive no prepayment discount and must pay the entire Outstanding Balance of this Note in full on or before the Maturity Date. Lender has the right at any time following an Event of Default, at its election, to convert (each instance of conversion is referred to herein as a "Conversion") all or any part of the Outstanding Balance into shares ("Conversion Shares") of fully paid and non-assessable common stock, $0.0001 par value per share ("Common Stock"), of Borrower as per the following conversion formula: the number of Conversion Shares equals the amount being converted (the "Conversion Amount") divided by the Conversion Price. The conversion price (the "Conversion Price") for each Conversion (as defined below) shall be equal to the product of 50% (the "Conversion Factor") multiplied by the average of the lowest trading price of the Company's common stock during the 25 consecutive trading days prior to the date the holder elects to all or part of the Note. Debt discount of $25,000 was recorded and during the six months ended March 31, 2016, there was amortization of debt discount of $753. The unamortized debt discount at March 31, 2016 is $26,747.

On March 21, 2015, the Company executed a 0% convertible exchange promissory note with a principal amount of $115,019 (the "Note") with Tangiers Global, LLC. The Note was funded on March 31, 2016 (Purchase Date) in a direct purchase from St. George Investments. Lender has the right at any time, at its election, to convert (each instance of conversion is referred to herein as a "Conversion") all or any part of the Outstanding Balance into shares ("Conversion Shares") of fully paid and non-assessable common stock, $0.0001 par value per share ("Common Stock"), of Borrower as per the following conversion formula: the number of Conversion Shares equals the amount being converted (the "Conversion Amount") divided by the Conversion Price. The conversion price (the "Conversion Price") for each Conversion (as defined below) shall be equal to the product of 50% (the "Conversion Factor") multiplied by the average of the lowest trading price of the Company's common stock during the 20 consecutive trading days prior to the date the holder elects to all or part of the Note.

NOTE 8 – DERIVATIVE LIABILITY

The Company analyzed the conversion option for derivative accounting consideration under ASC 815, Derivatives and Hedging, and determined that the instrument should be classified as a liability since the conversion option becomes effective at issuance resulting in there being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options.

The following table summarizes the derivative liability activity from September 30, 2015 through March 31, 2016.

Description |

| Derivative Liability |

| |

Deriviative liabilities September 30, 2015 |

| $ | 200,460 |

|

Day one loss due to derivatives on convertible debt |

|

| 74,377 |

|

Debt discount |

|

| 50,000 |

|

Derivative liability written off to APIC |

|

| (19,805 | ) |

Change in fair value of the derivative |

|

| (40,035 | ) |

Balance at March 31, 2016 |

|

| 264,997 |

|

| 15 |

The following table summarizes the loss on derivative liability included in the income statement for the financial periods ended March 31, 2016 and 2015, respectively.

|

| Six months ended |

| |||||

|

| 2016 |

|

| 2015 |

| ||

|

|

|

|

|

|

| ||

Day one loss due to derivatives on convertible debt |

| $ | 74,377 |

|

| $ | - |

|

Change in fair value of the derivative |

|

| (40,035 | ) |

|

| - |

|

Derivative expense |

| $ | 34,342 |

|

| $ | - |

|

The table below shows the Black-Scholes option-pricing model inputs used by the Company to value the derivative liability, as well as the determined value of the option liability at each measurement date:

|

| 03/31/16 |

| |

Assumptions |

| Convertible Debt |

| |

Dividend yield |

|

| 0.00 | % |

Market price |

| $ | 0.0013 |

|

Risk-free rate for term |

| 0.21% - 0.59 | % | |

Volatility |

| 259.47% - 321.80 | % | |

Remaining life |

| 0.312 - 0.973 |

| |

NOTE 9 – INDUSTRY SEGMENTS

This summary reflects the Company's current segments, as described below.

Signal Bay Consulting (SBC)

SBC provides advisory, licensing and compliance services to the cannabis industry. SBC clients are located in states that have state managed medical and/or recreational programs. SBC assists these companies with license applications, business planning, state compliance and ongoing operational support. At the current time all of Signal Bay corporate resources are used to support SBC.

CR Labs, Inc (CRLB)

| 16 |

CR Labs, Inc. provides analytical testing services to the cannabis industry. CRLB clients are located in Oregon and consist of growers, processors and dispensaries. Operating under the rules of the Oregon Health Authority, CRLB certifies products have been tested and are free from pesticides and other containments before resale to patients and consumer in the State of Oregon.

Six Months Ended March 31, 2016 SBC CRLB Total Consolidated Revenue Segment loss from operations Total assets Capital expenditures Depreciation and amortization Six Months Ended March 31, 2015 SBC CRLB Total Consolidated Revenue Segment loss from operations Total assets Capital expenditures Depreciation Three Months Ended March 31, 2016 SBC CRLB Total Consolidated Revenue Segment loss from operations Total assets Capital expenditures Depreciation Three Months Ended March 31, 2015 SBC CRLB Total Consolidated Revenue Segment loss from operations Total assets Capital expenditures Depreciation

$ 195,673 $ 79,657 $ 275,330 (172,450 ) (61,617 ) (234,067 ) 662,162 58,691 720,853 - 11,681 11,681 18,586 5,574 24,160

$ 10,412 $ - $ 10,412 (800,142 ) - (800,142 ) 116,144 - 116,144 5,694 - 5,694 5,067 - 5,067

$ 64,587 $ 40,019 $ 104,606 (91,380 ) (39,142 ) (130,522 ) 662,162 58,691 720,853 - 2,429 2,429 5,922 2,837 8,759

$ 5,600 $ - $ 5,600 (774,766 ) - (774,766 ) 116,144 - 116,144 2,194 - 2,194 5,067 - 5,067

| 17 |

NOTE 10 – SUBSEQUENT EVENTS

Subsequent to March 31, 2016, the Company issued 108,989,795 shares of common stock for conversion of convertible notes with principal and accrued interest of $55,356.

On April 1, 2016, we issued 231,250 shares that vested to members of our advisory committee under the Company's Equity Incentive Plan.

On May 1, 2016, we issued 231,250 shares that vested to members of our advisory committee under the Company's Equity Incentive Plan.

On May 19, 2016, Signal Bay, Inc. (the "Company") entered into an 8% convertible promissory note (the "Note") with Tangiers Global, LLC. ("Lender") in the amount of $76,650. Of this amount $6,650 was an original issue discount ("OID"). The company received $70,000 and it was funded on May 19, 2016 (Purchase Date).

The company can prepay the note based on the following schedule.

Days Since Effective Date | Prepayment Amount | |

0-90 | 115% of Principal Amount | |

91-180 | 135% of Principal Amount |

Lender has the right at any time following an Event of Default, at its election, to convert (each instance of conversion is referred to herein as a "Conversion") all or any part of the Outstanding Balance into shares ("Conversion Shares") of fully paid and non-assessable common stock, $0.0001 par value per share ("Common Stock"), of Borrower as per the following conversion formula: the number of Conversion Shares equals the amount being converted (the "Conversion Amount") divided by the Conversion Price. The conversion shall be equal to (a) 55% of the lowest trading price of the Company's common stock during the 20 consecutive trading days prior to the date on which Holder elects to convert all or part of the Note.

On May 19, 2016, Signal Bay, Inc. (the "Company") entered into an 8% convertible promissory note (the "Note") with LG Capital Funding, LLC. ("Lender") in the amount of $76,650. Of this amount $3,650 was an original issue discount ("OID") and $3,000 was expensed on legal fees. The company received $70,000 and it was funded on May 19, 2016 (Purchase Date).

The company can prepay the note based on the following schedule.

Days Since Effective Date | Prepayment Amount | |

0-90 | 115% of Principal Amount | |

91-180 | 135% of Principal Amount |

| 18 |

Lender has the right at any time following an Event of Default, at its election, to convert (each instance of conversion is referred to herein as a "Conversion") all or any part of the Outstanding Balance into shares ("Conversion Shares") of fully paid and non-assessable common stock, $0.0001 par value per share ("Common Stock"), of Borrower as per the following conversion formula: the number of Conversion Shares equals the amount being converted (the "Conversion Amount") divided by the Conversion Price. The conversion shall be equal to (a) 55% of the lowest trading price of the Company's common stock during the 20 consecutive trading days prior to the date on which Holder elects to convert all or part of the Note.

On May 24, 2016, we acquired Oregon Analytical Services, LLC via and asset purchase. In conjunction with the purchase, the company issued 200,000 shares of Series "C" preferred stock, and executed a promissory note for $700,000, paid $12,500 cash down payment and assumed loans and other obligations for $87,500.

On May 24, 2016, we issued 2,000,000 shares to an advisor for due diligence associated with the acquisition of Oregon Analytical Services.

On June 1, 2016, we issued 231,250 shares that vested to members of our advisory committee under the Company's Equity Incentive Plan.

On June 1, 2016, the Company entered into a Stock Purchase Agreement with Anthony R Smith to purchase 80% of the ownership of Smith Scientific Industries, Inc. for 300,000 shares of Series "C" preferred stock, $236,000 promissory note, with a down payment of $100,000. $25,000 was paid in cash at closing with the remaining balance to be paid within six months.

1) The Company's wholly owned subsidiary EVIO Inc. has executed executive employment agreement with Anthony R. Smith PhD. to become the Chief Science Officer overseeing all of EVIO Labs facilities.

2) Anthony R. Smith PhD has been appointed to the Board of Directors of Signal Bay, inc.

3) William Waldrop and Lori Glauser have been appointed to the Board of Directors and Managers of Smith Scientific Industries, Inc.

| 19 |

ITEM 2 – MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed herein are forward-looking statements. Such forward-looking statements contained herein involve risks and uncertainties, including statements as to:

· | our future operating results; | |

· | our business prospects; | |

· | our contractual arrangements and relationships with third parties; | |

· | the dependence of our future success on the general economy; | |

· | our possible financings; and | |

· | the adequacy of our cash resources and working capital. |

These forward-looking statements can generally be identified as such because the context of the statement will include words such as we "believe," "anticipate," "expect," "estimate" or words of similar meaning. Similarly, statements that describe our future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which are described in close proximity to such statements and which could cause actual results to differ materially from those anticipated as of the date of this report. Shareholders, potential investors and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included herein are only made as of the date of this report, and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion of our financial condition and results of operations in conjunction with the financial statements and the notes thereto, included elsewhere in this report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to those differences include those discussed below and elsewhere in this report, particularly in the "Risk Factors" section.

| 20 |

Critical Accounting Policies and Estimates.

Our Management's Discussion and Analysis of Financial Condition and Results of Operations section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to revenue recognition, accrued expenses, financing operations, and contingencies and litigation. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the appropriate carrying value of certain assets and liabilities which are not readily apparent from other sources.

Business of Registrant

Signal Bay, Inc., a Colorado corporation and its subsidiaries ("Signal Bay", the "Company", the "Registrant", "we", "our", or "us") provide advisory, management and analytical testing services to the emerging legalized cannabis industry. Our three business units are described below:

Signal Bay, Inc. was originally incorporated in the State of New York, December 12, 1977 under the name 3171 Holding Corporation. On February 22, 1979 the name was changed to Electronomic Industries Corp. and on February 23, 1983 the name was changed to Quantech Electronics Corp. The Company was reincorporated in the State of Colorado on December 15, 2003. On August 29, 2014, the Company completed a reverse merger with Signal Bay Research, Inc., a Nevada Corporation, and took over its operations. In September 2014, the Company changed its name from Quantech Electronics Corp. to Signal Bay, Inc. The Company has selected September 30 as its fiscal year end. Signal Bay, Inc. is domiciled in the State of Colorado, and its corporate headquarters are located in Las Vegas, Nevada.

Signal Bay Research provides industry research, business and market intelligence, and consulting services. We provide advisory and consulting services to cannabis companies including license application support, regulatory compliance, market forecasts, and operational insights. We also publish industry information via online media, research reports, and publications. Our media properties include CANNAiQ.com, a business to business information portal and MarijuanaMath.com a general interest informational website for the cannabis industry. Signal Bay is also the home of the Cannabis Consultant Marketplace (CCM). The CCM is an outsourcing freelancing matching platform enabling cannabis companies to post projects and hire consultants.

Signal Bay Services provides operating services for licensed cannabis businesses. Signal Bay Services has been engaged in Management Services Agreement with Libra Wellness Center, LLC, a licensed cannabis production and processing establishment, to operate their marijuana processing facility in North Las Vegas, Nevada. We will provide the staff and operational support to Libra Wellness to produce processed cannabis and infused products for licensed dispensaries throughout Southern Nevada.

| 21 |

CR Labs d.b.a. CannAlytical Research is the analytical laboratory division of Signal Bay. Signal Bay owns 80% of the issued and outstanding shares in CR Labs. CR Labs provides compliance testing services in accordance with the Oregon Health Authority. Tests include residual solvent analysis, pesticide screening, microbiological screening, terpene analysis, and cannabinoid potency profiling of cannabis and cannabis infused products. CR Labs also provides consulting services CR Labs is located in Bend Oregon, and tests cannabis for both medicinal and adult use. We are currently evaluating additional legal cannabis markets to provide our analytical testing services.

RESULTS OF OPERATIONS

Three months ended March 31, 2016 compared to three months ended March 31, 2015:

SIGNAL BAY, INC.

STATEMENTS OF OPERATIONS

(Unaudited)

|

| Three months ended |

| |||||

|

| March 31, |

| |||||

|

| 2016 |

|

| 2015 |

| ||

Revenues |

|

|

|

|

|

| ||

Testing Services |

| $ | 40,019 |

|

| $ | - |

|

Consulting Services |

|

| 64,587 |

|

|

| 5,600 |

|

Total Revenue |

|

| 104,606 |

|

|

| 5,600 |

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

| 222,998 |

|

|

| 775,299 |

|

Depreciation and Amortization |

|

| 12,130 |

|

|

| 5,067 |

|

Total Operating Expense |

|

| 235,128 |

|

|

| 780,366 |

|

|

|

|

|

|

|

|

|

|

Loss from Operations |

|

| (130,522 | ) |

|

| (774,766 | ) |

|

|

|

|

|

|

|

|

|

Other expense |

|

|

|

|

|

|

|

|

Interest expense |

|

| 89,222 |

|

|

| - |

|

Loss on disposal of assets |

|

| 1 |

|

|

| - |

|

Loss on derivatives |

|

| 120,755 |

|

|

| - |

|

Total other expense |

|

| 209,978 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

Net Loss |

| $ | (340,500 | ) |

| $ | (774,766 | ) |

|

|

|

|

|

|

|

|

|

Less: Loss attributable to non-controlling interests |

|

| (5,017 | ) |

|

| - |

|

|

|

|

|

|

|

|

|

|

Net Loss attributable to Signal Bay, Inc. |

| $ | (335,482 | ) |

| $ | (774,766 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Net Loss Per Share |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Share Outstanding Basic and Diluted |

|

| 408,518,372 |

|

|

| 327,581,025 |

|

| 22 |

Revenue

The Company generated $104,606 in revenue for the three months ended March 31, 2016 as compared to $5,600 for the three months ended March 31, 2015. A majority of the increase, $58,988, was a direct result of the consulting services provided to clients assisting with licensing and compliance services. $40,019 was attributed to the acquisition of CR Labs.

Operating Expenses

Operating expenses decreased for the three months ended March 31, 2016 as compared to the same period in 2015. During the period ended March 31, 2016, the company realized increased operating expenses associated with providing the consulting services and the expansion of the laboratory testing services and relocation. This was off-set by a substantial reduction in expenses associated with the 2015 Equity Incentive Plan that occurred in the Quarter ending March 31, 2015.

During the period ended March 31, 2016, we incurred general and administrative expenses of $222,998 compared to $775,299 incurred during the period ended March 31, 2015. The reduction was primarily the result of reduced professional fees associated with the early stages of the company's development.

Six months ended March 31, 2016 compared to six months ended March 31, 2015:

SIGNAL BAY, INC.

STATEMENTS OF OPERATIONS

(Unaudited)

|

| Six months ended |

| |||||

|

| March 31, |

| |||||

|

| 2016 |

|

| 2015 |

| ||

Revenues |

|

|

|

|

|

| ||

Testing Services |

| $ | 79,657 |

|

| $ | - |

|

Consulting Services |

|

| 195,673 |

|

|

| 10,412 |

|

Total Revenue |

|

| 275,330 |

|

|

| 10,412 |

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

| 485,237 |

|

|

| 805,487 |

|

Depreciation and Amortization |

|

| 24,160 |

|

|

| 5,067 |

|

Total Operating Expense |

|

| 509,397 |

|

|

| 810,554 |

|

|

|

|

|

|

|

|

|

|

Loss from Operations |

|

| (234,067 | ) |

|

| (800,142 | ) |

|

|

|

|

|

|

|

|

|

Other expense |

|

|

|

|

|

|

|

|

Interest expense |

|

| 140,975 |

|

|

| - |

|

Loss on disposal of assets |

|

| 720 |

|

|

| - |

|

Loss on derivatives |

|

| 34,342 |

|

|

| - |

|

Total other expense |

|

| 176,037 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

Net Loss |

| $ | (410,104 | ) |

| $ | (800,142 | ) |

|

|

|

|

|

|

|

|

|

Less: Loss attributable to non-controlling interests |

|

| (9,738 | ) |

|

| - |

|

|

|

|

|

|

|

|

|

|

Net Loss attributable to Signal Bay, Inc. |

| $ | (400,366 | ) |

| $ | (800,142 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Net Loss Per Share |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

|

|

|

|

|

|

|

|

|

Weighted Average Share Outstanding Basic and Diluted |

|

| 404,291,170 |

|

|

| 309,322,948 |

|

The Company generated $275,330 in revenue for the six months ended March 31, 2016 as compared to $10,412 for the six months ended March 31, 2015. A majority of the increase, $185,260, was a direct result of the consulting services provided to clients assisting with licensing and compliance services. $79,657 was attributed to the acquisition of CR Labs.

| 23 |

Operating Expenses

Operating expenses decreased for the six months ended March 31, 2016 as compared to the same period in 2015. During the period ended March 31, 2016, the company realized increased operating expenses associated with providing the consulting services and the expansion of the laboratory testing services and relocation. This was off-set by a substantial reduction in expenses associated with the 2015 Equity Incentive Plan that occurred in the Quarter ending March 31, 2015.

During the period ended March 31, 2016, we incurred general and administrative expenses of $485,237 compared to $805,487 incurred during the period ended March 31, 2015. The reduction was primarily the result of reduced professional fees associated with the early stages of the company's development.

Liquidity and Capital Resources |

|

|

|

|

|

|

|

|

| |||

Balance Sheet Date |

| March 31 |

|

| September 30 |

|

|

|

| |||

|

| 2016 |

|

| 2015 |

|

| Change |

| |||

|

|

|

|

|

|

|

|

|

| |||

Cash |

| $ | 31,083 |

|

| $ | 25,966 |

|

| $ | 5,117 |

|

Total Assets |

| $ | 720,853 |

|

| $ | 728,723 |

|

| $ | (7,870 | ) |

Total Liabilities |

| $ | 722,420 |

|

| $ | 443,435 |

|

| $ | 278,985 |

|

Stockholders' Equity (Deficit) |

| $ | (88,946 | ) |

| $ | 188,171 |

|

| $ | (277,117 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| March 31 |

|

| September 30 |

|

|

|

| |||

|

| 2016 |

|

| 2015 |

|

| Change |

| |||

Current Assets |

| $ | 41,365 |

|

| $ | 42,512 |

|

| $ | (1,147 | ) |

Current Liabilities |

| $ | 716,042 |

|

| $ | 430,388 |

|

| $ | 285,654 |

|

Working Capital Deficiency |

| $ | (674,677 | ) |

| $ | (387,876 | ) |

| $ | (286,801 | ) |

| 24 |

As of March 31, 2016 the Company had $31,083 in cash, and $125,584 in equipment net of depreciation and a total of $720,853 in assets. In management's opinion, the Company's cash position is insufficient to maintain its operations at the current level for the next 12 months. Any expansion may cause the Company to require additional capital until such expansion began generating revenue. It is anticipated that the raise of additional funds will principally be through the sales of our securities. As of the date of this report, additional funding has been secured, however, we will require additional funding and no assurance may be given that we will be able to raise additional funds.