Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Medtronic plc | exhibit991-fy16q4earningsr.htm |

| 8-K - 8-K - Medtronic plc | fy16q4earningsrelease.htm |

MEDTRONIC PLC Q4 FY16 EARNINGS PRESENTATION MAY 31, 2016 • CONSOLIDATED RESULTS & GROUP REVENUE HIGHLIGHTS • EPS GUIDANCE, REVENUE OUTLOOK, & OTHER ASSUMPTIONS • FY17 REVENUE REPORTING CHANGES Exhibit 99.2

Q4 FY16 Earnings Results | May 31, 2016 | 2 FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements which provide current expectations or forecasts, including those relating to market and sales growth, growth strategies, financial results, use of free cash flow, product development and introduction, partnerships, regulatory matters, restructuring initiatives, mergers/acquisitions/divestitures and related effects, accounting estimates, financing activities, working capital adequacy, competitive strengths and sales efforts. They are based on current assumptions and expectations that involve uncertainties or risks. These uncertainties and risks include, but are not limited to, those described in our periodic reports on file with the U.S. Securities and Exchange Commission (SEC). Actual results may differ materially from anticipated results. Forward-looking statements are made as of today's date, and we undertake no duty to update them or any of the information contained in this presentation. Financial Data Certain information in this presentation includes calculations or figures that have been prepared internally and have not been reviewed or audited by our independent registered public accounting firm. Use of different methods for preparing, calculating or presenting information may lead to differences and such differences may be material. This presentation also contains non-GAAP financial measures such as free cash flow and historical revenue on a comparable constant currency basis, which sums historical data of Medtronic and Covidien, aligns Covidien’s prior year monthly revenue to Medtronic’s fiscal quarters and adjusts for the impact of foreign currency translation. We believe these measures provide a useful way to evaluate our underlying performance. Detail concerning how all non-GAAP measures are calculated, including all GAAP to non-GAAP reconciliations, are provided on our website and can be accessed using this link.

CONSOLIDATED RESULTS & GROUP REVENUE HIGHLIGHTS

Q4 FY16 Earnings Results | May 31, 2016 | 4 Strong 6% revenue growth; continuing to outperform the market • Upper end of our MSD goal, and ahead of Q4 outlook • Solid performances in Diabetes, CVG, and MITG, more than offset challenges in certain RTG businesses • Executing on three revenue growth vectors: • Therapy Innovation: 390 bps – exceeded goal of 150 to 350 bps • Emerging Markets: 185 bps – at the high end of 150 to 200 bps goal • Services & Solutions: 25 bps – below 40 to 60 bps goal • Foreign currency translation had a negative $179M impact on revenue • Acquisitions & divestitures contributed a net 60 bps to Q4 revenue growth Delivered robust leverage: EPS lev. 1,210 bps1, Operating lev. 740 bps1 • Non-GAAP OM of 31.0% after adjusting for unplanned GM items (see slide 7) • Stable pricing: ASP declines in line with previous quarters • SG&A: strong 180 bps1 improvement Y/Y • Delivered on our Covidien cost synergy commitments • 260 bps improvement in OM1 Y/Y after adjusting for unplanned items (see slide 7) • Offset unplanned negative impacts to EPS through financial levers Capital allocation: numerous strategic & disciplined actions • Returned $1.1B to shareholders: $529M net share repurchases; $531 dividends • Executing on untrapped ~$10B in cash (result of FY16 intercompany transaction): • Incremental share repurchases • Prepaid $2.7B debt via tender • M&A: acquired Bellco, a pioneer in hemodialysis treatment solutions MDT Q4 FY16 HIGHLIGHTS 1 Figures represent comparison to Q4 FY15 on constant currency basis 2 Diluted EPS STRONG Q4 PERFORMANCE Revenue: Other Financial Highlights: U.S. 56% Non- U.S. Dev 31% EM 13% 1 Revenue $M As Rep Y/Y % CC1 Y/Y % CVG 2,736 5 8 MITG 2,460 3 6 RTG 1,875 1 3 Diabetes 496 6 10 Total $7,567 4% 6% U.S. 4,217 4 4 Non-U.S. Dev 2,393 3 6 EM 957 4 15 Total $7,567 4% 6% EPS2 Y/Y Y/Y CC1 GAAP $0.78 NC NC Non-GAAP $1.27 9% 18% Cash Flow from Ops $1.3B Adj. Free Cash Flow $1.4B CVG 36% MITG 32% RTG 25% DIAB 7%

Q4 FY16 Earnings Results | May 31, 2016 | 5 MDT Q4 FY16 GAAP SELECT FINANCIAL INFORMATION Q4 FY16 Q4 FY15 Y/Y Growth / Y/Y Change Net Sales ($M) 7,567 7,304 4% Gross Margin 68.8% 59.8% 900 bps SG&A ($M) 2,360 2,404 2% % of Sales 31.2% 32.9% 170 bps R&D ($M) 575 528 (9%) % of Sales 7.6% 7.2% (40 bps) Other Income, Net ($M) (21) (20) 0% Operating Profit 1,506 373 304% Operating Margin 19.9% 5.1% 1,480 bps EPS1 ($) 0.78 0.00 NC 1 Diluted EPS

Q4 FY16 Earnings Results | May 31, 2016 | 6 MDT Q4 FY16 NON-GAAP SELECT FINANCIAL INFORMATION Q4 FY16 Q4 FY15 Y/Y Growth / Y/Y Change FX Impact $M / Change CC Adjusted1 CC Growth / Change1 Net Sales ($M) 7,567 7,304 4% (179) -- 6% Gross Margin1 68.8% 69.6% (80 bps) (100 bps) 69.8% 20 bps SG&A ($M) 2,360 2,404 2% 52 -- 0% % of Sales 31.2% 32.9% 170 bps (10 bps) 31.1% 180 bps R&D ($M) 575 528 (9%) 2 -- (9%) % of Sales 7.6% 7.2% (40 bps) (20 bps) 7.4% (20 bps) Other Income, Net ($M) (21) (20) 5% (25) -- 130% Operating Profit1 2,290 2,170 6% (171) -- 13% Operating Margin 1 30.3% 29.7% 60 bps (150 bps) 31.8% 210 bps Diluted EPS1 ($) 1.27 1.16 9% (0.10) -- 18% 1 See FY16 Fourth Quarter Financial Schedules & Non-GAAP Reconciliations tables for additional information on reconciliations of non-GAAP information Operating Leverage +740 bps EPS Leverage +1,210 bps

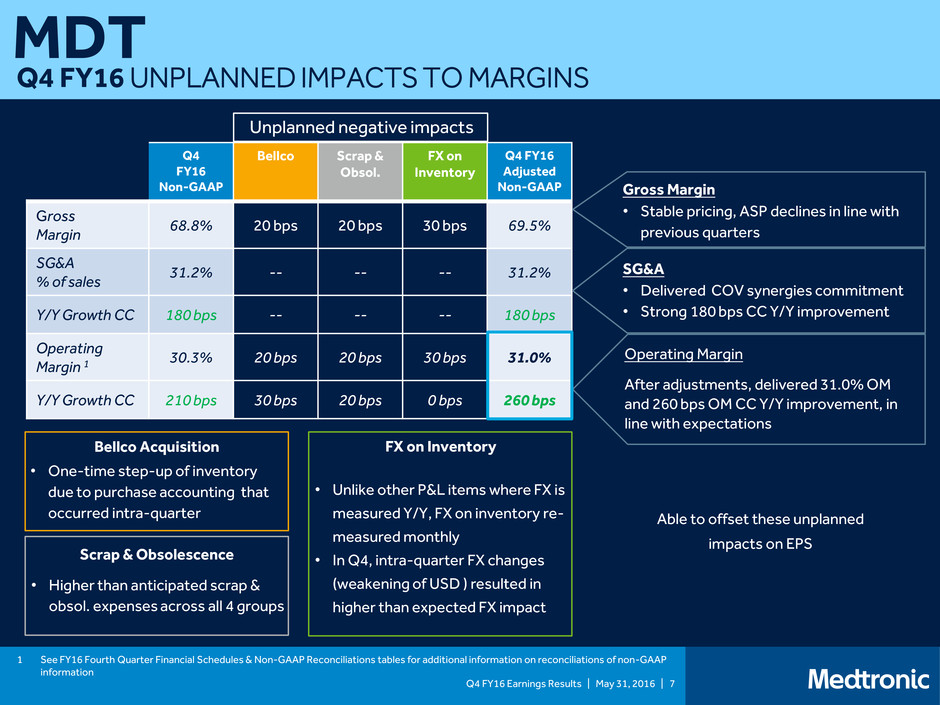

Q4 FY16 Earnings Results | May 31, 2016 | 7 MDT Q4 FY16 UNPLANNED IMPACTS TO MARGINS Q4 FY16 Non-GAAP Bellco Scrap & Obsol. FX on Inventory Q4 FY16 Adjusted Non-GAAP Gross Margin 68.8% 20 bps 20 bps 30 bps 69.5% SG&A % of sales 31.2% -- -- -- 31.2% Y/Y Growth CC 180 bps -- -- -- 180 bps Operating Margin 1 30.3% 20 bps 20 bps 30 bps 31.0% Y/Y Growth CC 210 bps 30 bps 20 bps 0 bps 260 bps Unplanned negative impacts Gross Margin • Stable pricing, ASP declines in line with previous quarters SG&A • Delivered COV synergies commitment • Strong 180 bps CC Y/Y improvement Operating Margin After adjustments, delivered 31.0% OM and 260 bps OM CC Y/Y improvement, in line with expectations • One-time step-up of inventory due to purchase accounting that occurred intra-quarter Bellco Acquisition FX on Inventory • Unlike other P&L items where FX is measured Y/Y, FX on inventory re- measured monthly • In Q4, intra-quarter FX changes (weakening of USD ) resulted in higher than expected FX impact • Higher than anticipated scrap & obsol. expenses across all 4 groups Scrap & Obsolescence 1 See FY16 Fourth Quarter Financial Schedules & Non-GAAP Reconciliations tables for additional information on reconciliations of non-GAAP information Able to offset these unplanned impacts on EPS

Q4 FY16 Earnings Results | May 31, 2016 | 8 MDT Q4 FY16 Y/Y MARGIN CHANGES 58.0% 63.0% 68.0% 73.0% Q4 FY15, GAAP Non-GAAP Adjustments Q4 FY15, Non-GAAP Performance Q4 FY16, CC FX Q4 FY16, Non-GAAP Non-GAAP Adjustments Q4 FY16, GAAP 69.8% (1.0%) 68.8% 0.0% 10.0% 20.0% 30.0% Q4 FY15, GAAP Non-GAAP Adjustments Q4 FY15, Non-GAAP Performance Q4 FY16 CC FX Q4 FY16, Non-GAAP Non-GAAP Adjustments Q4 FY16, GAAP Relatively Stable Y/Y Strong 210 bps Operational Improvement Gross Margin Operating Margin 59.8% 9.8% 68.8% 5.1% 24.6% 29.7% 2.1% 31.8% (1.5%) 30.3% (10.4%) 19.9% 69.6% 0.2% Note: See FY16 Fourth Quarter Financial Schedules & Non-GAAP Reconciliations tables for additional information on reconciliations of non-GAAP information.

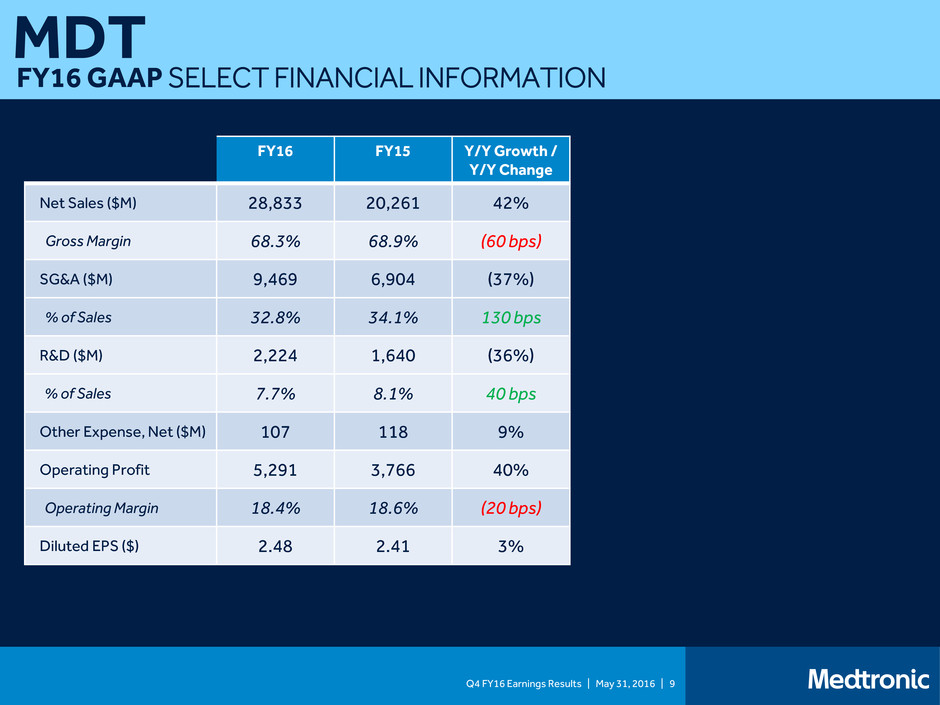

Q4 FY16 Earnings Results | May 31, 2016 | 9 MDT FY16 GAAP SELECT FINANCIAL INFORMATION FY16 FY15 Y/Y Growth / Y/Y Change Net Sales ($M) 28,833 20,261 42% Gross Margin 68.3% 68.9% (60 bps) SG&A ($M) 9,469 6,904 (37%) % of Sales 32.8% 34.1% 130 bps R&D ($M) 2,224 1,640 (36%) % of Sales 7.7% 8.1% 40 bps Other Expense, Net ($M) 107 118 9% Operating Profit 5,291 3,766 40% Operating Margin 18.4% 18.6% (20 bps) Diluted EPS ($) 2.48 2.41 3% 1 1

Q4 FY16 Earnings Results | May 31, 2016 | 10 MDT FY16 NON-GAAP SELECT FINANCIAL INFORMATION FY162 FY153 Y/Y Growth / Y/Y Change FX Impact $M / Change CC Adjusted CC Growth / Change1 Net Sales ($M) 28,833 28,242 2% (1,502) -- 7% Gross Margin1 69.1% 70.3% (120 bps) (120 bps) 70.3% 0 bps SG&A ($M) 9,469 9,580 1% 451 -- (4%) % of Sales 32.8% 33.9% 110 bps (10 bps) 32.7% 120 bps R&D ($M) 2,224 2,064 (8%) 27 -- (9%) % of Sales 7.7% 7.3% (40 bps) (30 bps) 7.4% (10 bps) Other Expense, Net ($M) 107 196 45% 114 -- (13%) Operating Profit1 8,126 8,028 1% (797) -- 11% Operating Margin1 28.2% 28.4% (20 bps) (120 bps) 29.4% 100 bps Diluted EPS1 ($) 4.37 4.20 4% (0.47) -- 15% 1 See FY16 Q4 Financial Schedules & Non-GAAP Reconciliations tables for additional information on reconciliations of non-GAAP information 2 Includes extra week of sales in Q1 FY16 3 Comparable basis (includes both legacy Medtronic and legacy Covidien) Operating Leverage +370 bps EPS Leverage +780 bps

Q4 FY16 Earnings Results | May 31, 2016 | 11 MDT FY16 Y/Y MARGIN CHANGES 60.0% 65.0% 70.0% 75.0% FY15, GAAP Non-GAAP Adjustments To Align MDT & COV FY15, Non-GAAP Combined MDT & COV Performance FY16, CC FX FY16, Non-GAAP Non-GAAP Adjustments FY16, GAAP 70.3% 70.3% - (1.2%) 69.1% 15.0% 20.0% 25.0% 30.0% 35.0% FY15, GAAP Non-GAAP Adjustments To Align MDT & COV FY15, Non-GAAP Combined MDT & COV Performance FY16 CC FX FY16, Non-GAAP Non-GAAP Adjustments FY16, GAAP Relatively Stable Y/Y 100 bps Operational Improvement Gross Margin Operating Margin 68.9% 3.5% 68.3% (0.8) 18.6% 11.0% 28.4% 1.0% 29.4% (1.2%) 28.2% (9.8%) 18.4% (2.1%) (1.2%) Note: See FY16 Fourth Quarter Financial Schedules & Non-GAAP Reconciliations tables for additional information on reconciliations of non-GAAP information.

Q4 FY16 Earnings Results | May 31, 2016 | 12 CVG Q4 FY16 HIGHLIGHTS CRHF 54% CSH 30% APV 16% U.S. 52% Non- U.S. Dev 33% EM 15% Cardiac Rhythm & Heart Failure (CRHF) KEY PERFORMANCE DRIVERS1 High Power – MSD • Highest US share since Q4FY10 • ICDs: MSD growth – US Evera MRI™, • Visia AF™ single-chamber ICD: FDA approval (launch early summer) • CRT-D: HSD growth – US MRI launch • TYRX: Mid 50’s growth Low Power – MSD • US Pacing – MSD; Market – LSD decline • Estimated gained ~300 bps share • Advisa SR MRI™ single chamber • Reveal LINQ™ pull-through • FDA approval of Micra TPS • Diagnostics – HSD: Reveal LINQ™ Coronary & Structural Heart (CSH) Aortic & Peripheral Vascular (APV) AF Solutions – Mid 30’s • Fire & Ice presented at ACC; in NEJM Services & Sol. – Mid 40’s Heart Valve Therapies – DD • TCV – High 20’s WW; ~20% US • US share stable Q/Q after losing some share in large valves last quarter • WW TAVR market growing mid-30’s • Europe: continue to gain share • Japan: strong CoreValve® launch • SURTAVI: enrollment complete • Started clinical for Evolut™ R XL & Evolut™ PRO, and enrollment for US Low Risk Coronary – LSD • DES – Flat; maintaining global share • OUS – LSD: Resolute Onyx™ share gains on new sizes; completed DFS CE Mark trial enrollment • US – Lower-single digits decline • Balloons – LDD: Euphora™ PTCA Aortic – MSD • US: HSD growth; Endurant IIs AAA • OUS: MSD growth; driven by dissection in EU, and market share gains in Japan • Heli-FX ® EndoAnchor ® : continuing to gain momentum; competitive account conversion & device pull-through Peripheral – HSD • DCB: US & WW market share leader • IN.PACT ® Admiral DCB • Aligned salesforce to CVG • Exceptional clin. & economic data Strong, Balanced Growth Across all Three Divisions Extracorp. Therapies – MSD • Continued success of next gen Bio- Medicus® cannula launch endoVenous – Mid Teens • VenaSeal™ launch gaining traction Evera MRI™ SureScan® ICD CoreValve® Evolut® R Resolute Onyx ® IN.PACT Admiral ® WW implantables market: LSD; MDT taking share Y/Y and Q/Q Heli-FX ® EndoAnchor Revenue $M As Rep Y/Y % CC1 Y/Y % CRHF 1,492 7 9 CSH 816 3 7 APV 428 5 8 Total $2,736 5% 8% U.S. 1,411 8 8 Non-U.S. Dev 905 Flat 3 EM 420 7 18 Total $2,736 5% 8% Growth Outlook: MSD 1 Figures represent comparison to Q4 FY15 on a constant currency basis Arctic Front Advance®

Q4 FY16 Earnings Results | May 31, 2016 | 13 MITG Q4 FY16 HIGHLIGHTS Surgical Solutions KEY PERFORMANCE DRIVERS1 Above Market Growth in Surgical Solutions; LSD PMR Growth Patient Monitoring & Recovery (PMR) Advanced Surgical – LDD • Focused on sustainable, long-term surgical market leadership, by improving open surgeries, transitioning open surgeries to MIS, and advancing MIS technologies • DD growth across Endo Stapling and Vessel Sealing driven by strong adoption of new products including LigaSureTM Maryland, Reinforced Reload, and ValleyLabTM FT10 • Estimate US surgical volume growth posted a slight uptick to ~3% Early Technologies – LDD • Strong mid-teens growth in Gastrointestinal Solutions driven by Given® PillCam® and Barrx® • Balanced growth in US and Non- US Developed markets General Surgical – MSD • Benefitted from RF Surgical acquisition, which closed in Q2 and core Instruments & Access business in the US and EMEA Nursing Care – LSD Decline • Impacted by timing of distributor ordering patterns and softness in Incontinence and WoundCare offset by strength in Enteral Feeding Patient Care & Safety – LSD • Strength in electrode sales, particularly in US Endo GIA™ Kendall™ Electrodes Renal Care Solutions • Formed new business unit following acquisition of Bellco, which contributed to Q4 revenue Revenue $M As Rep Y/Y % CC1 Y/Y % Surg. Sol. 1,358 5 9 PMR 1,102 1 3 Total $2,460 3% 6% U.S. 1,252 2 2 Non-U.S. Dev 901 5 9 EM 307 2 15 Total $2,460 3% 6% Growth Outlook: MSD 1 Figures represent comparison to Q4 FY15 on a constant currency basis Endo GIA™ LigaSure™ ValleyLab™ PMR 45% Surg. Sol. 55% U.S. 51% Non- U.S. Dev 37% EM 12% Respiratory & Patient Monitoring – Flat • LSD Patient Monitoring growth driven by Capnography / Respiratory Compromise offset by ongoing quality challenges • PB 980 and Capnostream had a combined impact of ~$25M on Q4 revenue; expect to have both of these issues resolved this summer

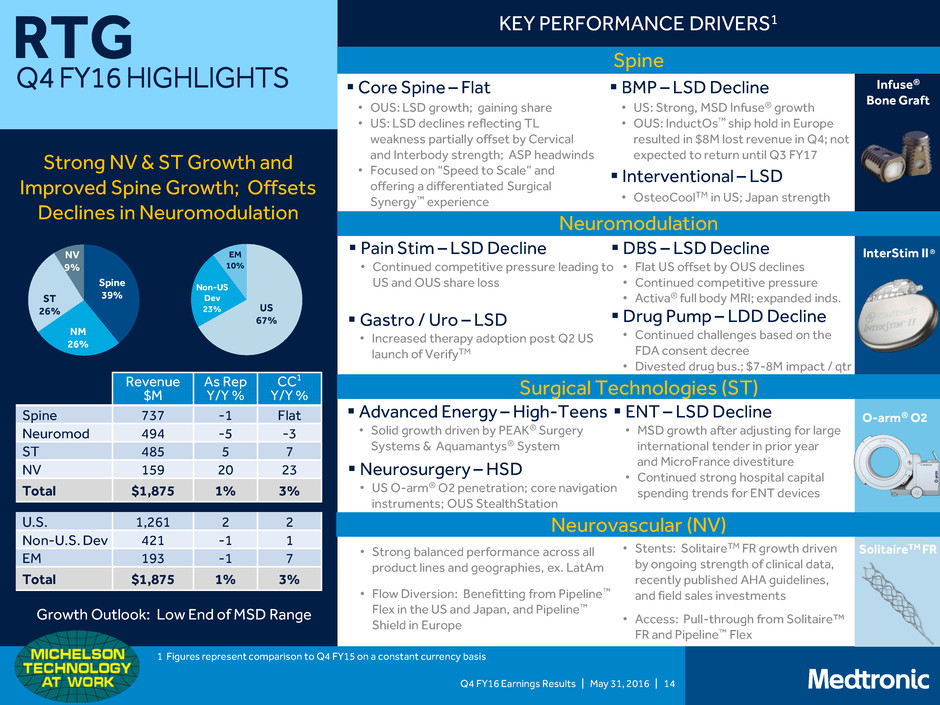

Q4 FY16 Earnings Results | May 31, 2016 | 14 RTG Q4 FY16 HIGHLIGHTS Spine 39% NM 26% ST 26% NV 9% US 67% Non-US Dev 23% EM 10% KEY PERFORMANCE DRIVERS1 Strong NV & ST Growth and Improved Spine Growth; Offsets Declines in Neuromodulation Drug Pump – LDD Decline • Continued challenges based on the FDA consent decree • Divested drug bus.; $7-8M impact / qtr Core Spine – Flat • OUS: LSD growth; gaining share • US: LSD declines reflecting TL weakness partially offset by Cervical and Interbody strength; ASP headwinds • Focused on “Speed to Scale” and offering a differentiated Surgical Synergy™ experience BMP – LSD Decline • US: Strong, MSD Infuse® growth • OUS: InductOs™ ship hold in Europe resulted in $8M lost revenue in Q4; not expected to return until Q3 FY17 DBS – LSD Decline • Flat US offset by OUS declines • Continued competitive pressure • Activa® full body MRI; expanded inds. Advanced Energy – High-Teens • Solid growth driven by PEAK® Surgery Systems & Aquamantys® System ENT – LSD Decline • MSD growth after adjusting for large international tender in prior year and MicroFrance divestiture • Continued strong hospital capital spending trends for ENT devices InterStim II ® O-arm® O2 SolitaireTM FR Infuse® Bone Graft Spine Neuromodulation Surgical Technologies (ST) Neurovascular (NV) Gastro / Uro – LSD • Increased therapy adoption post Q2 US launch of VerifyTM Pain Stim – LSD Decline • Continued competitive pressure leading to US and OUS share loss Neurosurgery – HSD • US O-arm® O2 penetration; core navigation instruments; OUS StealthStation • Strong balanced performance across all product lines and geographies, ex. LatAm • Flow Diversion: Benefitting from Pipeline™ Flex in the US and Japan, and Pipeline™ Shield in Europe • Stents: SolitaireTM FR growth driven by ongoing strength of clinical data, recently published AHA guidelines, and field sales investments • Access: Pull-through from Solitaire™ FR and Pipeline™ Flex Interventional – LSD Revenue $M As Rep Y/Y % CC1 Y/Y % Spine 737 -1 Flat Neuromod 494 -5 -3 ST 485 5 7 NV 159 20 23 Total $1,875 1% 3% U.S. 1,261 2 2 Non-U.S. Dev 421 -1 1 EM 193 -1 7 Total $1,875 1% 3% Growth Outlook: Low End of MSD Range 1 Figures represent comparison to Q4 FY15 on a constant currency basis • OsteoCoolTM in US; Japan strength

Q4 FY16 Earnings Results | May 31, 2016 | 15 DIABETES Q4 FY16 HIGHLIGHTS US 59% Non-US Dev 34% EM 7% KEY PERFORMANCE DRIVERS1 Intensive Insulin Management (IIM) Strong, Broad-Based Performance Across All Three Divisions MiniMed ® 530G MiniMed® Connect 15 Total Group Revenue $496M Revenue $M As Rep Y/Y % CC1 Y/Y % IIM ND MSD HSD NDT ND >200 >225 DSS ND MSD HSD Total $496 6% 10% U.S. 293 Flat Flat Non-U.S. Dev 166 19 27 EM 37 6 23 Total $496 6% 10% Growth Outlook: HSD to Low DD MiniMed® 640G Non-Intensive Diabetes Therapies (NDT) iPro®2 CGM w/ Pattern Snapshot Diabetes Service & Solutions (DSS) 1 Figures represent comparison to Q4 FY15 on constant currency basis • Robust OUS results driven by excellent performance of MiniMed® 640G System with Enhanced Enlite™ CGM sensor in Europe & APAC; US market remains competitive • US pivotal trial enrollment for MiniMed® 670G complete; On track to submit PMA to FDA before end of June 2016 • ~80% of patients enrolled in 670G US clinical trial also opted-in to the FDA’s continued access program • UnitedHealthcare partnership establishes MDT as preferred in-network provider of insulin pumps ages 18+ years, giving members access to the company’s advanced diabetes technology and comprehensive support services • Worked closely with Chengdu authorities to operationalize agreement announced in January 2016, laying the groundwork for greater therapy access in China in FY17 • 3rd consecutive quarter NDT has doubled revenue growth, reflecting strong sales of iPro®2 CGM technology in the US, Latin America, Europe, and Russia • Progress on Henry Schein distribution agreement - US sales reps trained during quarter; Continued strong feedback on Pattern Snapshot for iPro®2 CGM analytics • Collaboration with Qualcomm Life to jointly develop a future generation CGM system with a new sensor and smaller design for people with type 2 diabetes • Continued strong growth in consumables, Diabeter service revenue, and MiniMed® Connect • MiniMed® Connect uptake and user feedback remains extremely positive • Android version of the glucose monitoring app expected to launch in Q2 FY17 • Partnerships remain on track to transform diabetes care through innovative solutions • IBM Watson applying cognitive computing to support diabetes management • On track to bring our stand-alone sensor product, Guardian® Connect, to EU in early FY17; in US, PMA application submitted to FDA during Q4 FY16, approval expected H2 FY17

FY17 EPS GUIDANCE, REVENUE OUTLOOK, & OTHER ASSUMPTIONS

Q4 FY16 Earnings Results | May 31, 2016 | 17 MDT FY17 EPS GUIDANCE, REVENUE OUTLOOK & OTHER ASSUMPTIONS FY17 Q1 FY17 Revenue Growth Outlook – CC1 5% - 6% Lower half of annual range Revenue Growth – Reported2 3% - 4.5% Currency Impact -$25 to -$75M -$25 to -$75M CVG MSD MITG MSD RTG Low-end of MSD Diabetes HSD to Low DD COV Synergies ~$225-250M Cash EPS Guidance $4.60 - $4.70 Currency Impact on EPS -$0.20 to -$0.25 -$0.06 to -$0.08 Cash EPS Growth – CC1 12% - 16% Upper-end of annual range Free Cash Flow $6.5 - $7.0B Guidance does not include any charges or gains that would be recorded as non-GAAP adjustments to earnings during the fiscal year 1 Excludes the impact of the Q1FY16 extra week 2 Includes the impact of the Q1FY16 extra week

FY17 REVENUE REPORTING CHANGES

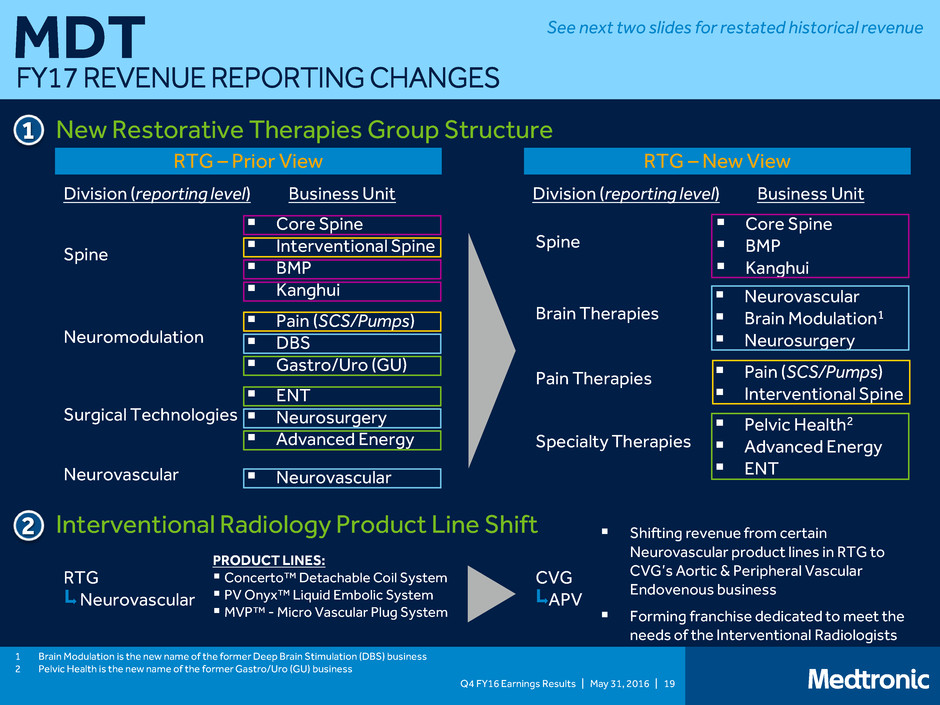

Q4 FY16 Earnings Results | May 31, 2016 | 19 MDT FY17 REVENUE REPORTING CHANGES RTG – Prior View Neuromodulation Surgical Technologies Spine Neurovascular Core Spine Interventional Spine BMP Kanghui Pain (SCS/Pumps) DBS Gastro/Uro (GU) ENT Neurosurgery Advanced Energy Neurovascular Division (reporting level) Business Unit RTG – New View Division (reporting level) Business Unit Brain Therapies Pain Therapies Spine Specialty Therapies Core Spine BMP Kanghui Neurovascular Brain Modulation1 Neurosurgery Pain (SCS/Pumps) Interventional Spine Pelvic Health2 Advanced Energy ENT New Restorative Therapies Group Structure 1 2 Interventional Radiology Product Line Shift PRODUCT LINES: Concerto™ Detachable Coil System PV Onyx™ Liquid Embolic System MVP™ - Micro Vascular Plug System Shifting revenue from certain Neurovascular product lines in RTG to CVG’s Aortic & Peripheral Vascular Endovenous business Forming franchise dedicated to meet the needs of the Interventional Radiologists 1 Brain Modulation is the new name of the former Deep Brain Stimulation (DBS) business 2 Pelvic Health is the new name of the former Gastro/Uro (GU) business RTG Neurovascular CVG APV See next two slides for restated historical revenue

Q4 FY16 Earnings Results | May 31, 2016 | 20 MDT REPORTING CHANGES: RESTATED HISTORICAL REVENUE Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY16 FY16 Restorative Therapies Group 1,802 1,764 1,753 1,869 7,188 Spine 685 649 636 659 2,629 Brain Therapies 462 475 483 538 1,958 Pain Therapies 309 293 279 301 1,182 Specialty Therapies 346 347 355 371 1,419 Cardiac & Vascular Group 2,571 2,488 2,417 2,742 10,218 Aortic & Peripheral Vascular 414 410 402 434 1,660 Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY16 FY16 Restorative Therapies Group 1,220 1,215 1,209 1,255 4,899 Spine 462 454 457 463 1,836 Brain Therapies 264 272 274 294 1,104 Pain Therapies 230 222 207 215 874 Specialty Therapies 264 267 271 283 1,085 Cardiac & Vascular Group 1,356 1,340 1,256 1,417 5,369 Aortic & Peripheral Vascular 242 249 236 252 979 World Wide U.S.

Q4 FY16 Earnings Results | May 31, 2016 | 21 APPENDIX ACRONYMS / ABBREVIATIONS 1 Growth DD Double Digits HSD High-Single Digit LDD Low-Double Digits LSD Low-Single Digit MSD Mid-Single Digit Other ASP Average Selling Price Bps Basis Points CC Constant Currency Dev Developed EM Emerging Markets EMEA Europe, Middle East & Africa EPS Earnings per Share FX Foreign Exchange FY Fiscal Year H1 / H2 First Half / Second Half NC Not Comparable ND Not Disclosed Ops Operations OM Operating Margins OUS Outside the United States Q/Q Quarter-over-Quarter Rep Reported WW Worldwide Y/Y Year-over-Year Business Specific ACC American College of Cardiology MDT Medtronic AF Atrial Fibrillation MITG Minimally Invasive Therapies Group AHA American Heart Association MIS Minimally Invasive Surgery APV Aortic & Peripheral Vascular NDT Non-Intensive Diabetes Therapies BMP Bone Morphogenetic Protein NEJM New England Journal of Medicine CGM Continuous Glucose Monitoring Neuromod Neuromodulation CRHF Cardiac Rhythm & Heart Failure NV Neurovascular CRT-D Cardiac Resynchronization Therapy – Defibrillator Obsol Obsolescence CSH Coronary & Structural Heart PB980 Puritan Bennett™ 980 CVG Cardiac & Vascular Group PMR Patient Monitoring & Recovery DBS Deep Brain Stimulation RTG Restorative Therapies Group DCB Drug Coated Balloon Sol Solutions DES Drug Eluting Stent SURTAVI Surgical Replacement & Transcatheter Aortic Valve Implantation DSS Diabetes Services & Solutions ST Surgical Technologies ENT Ear, Nose, & Throat TAVR Transcatheter Aortic Valve Replacement Extracorp Extracorporeal TCV Transcatheter Valves ICD Implantable Cardioverter Defibrillator TPS Transcatheter Pacing System IIM Intensive Insulin Management