Attached files

| file | filename |

|---|---|

| 8-K - COTTONWOOD CORPORATE CENTER PSA 8-K - HINES GLOBAL INCOME TRUST, INC. | hgriicottonwoodpsa8-k.htm |

Exhibit 10.1

SALE, PURCHASE AND ESCROW AGREEMENT

BETWEEN

NOP COTTONWOOD HOLDINGS, LLC (Seller)

AND

HGREIT II COTTONWOOD CENTER LLC (Purchaser)

AND

COMMONWEALTH LAND TITLE INSURANCE COMPANY (Escrow Agent)

TABLE OF CONTENTS

ARTICLE 1 SALE OF PROPERTY | 1 | |||

1.1 | Real Property | 1 | ||

1.2 | Personal Property | 1 | ||

1.3 | Other Property Rights | 1 | ||

ARTICLE 2 PURCHASE PRICE AND DEPOSIT | 2 | |||

2.1 | Purchase Price | 2 | ||

2.2 | Independent Consideration | 3 | ||

ARTICLE 3 TITLE MATTERS | 3 | |||

3.1 | Title to Real Property | 3 | ||

3.2 | Title and Survey | 3 | ||

ARTICLE 4 PURCHASER’S DUE DILIGENCE | 5 | |||

4.1 | Due Diligence Period | 5 | ||

4.2 | Access to Property | 5 | ||

4.3 | Due Diligence Materials To Be Delivered | 8 | ||

4.4 | Due Diligence Materials To Be Made Available | 8 | ||

4.5 | Assignment/Termination of Contracts | 8 | ||

4.6 | Tenant Estoppel Certificates | 9 | ||

4.7 | Return of Due Diligence Materials | 9 | ||

ARTICLE 5 ADJUSTMENTS AND PRORATIONS | 10 | |||

5.1 | Prorations | 10 | ||

5.2 | Real Estate Taxes and Assessments | 10 | ||

5.3 | Operating Expenses | 11 | ||

5.4 | Lease Expenses | 11 | ||

5.5 | Purchase Price Credit | 11 | ||

5.6 | Extra Space Shuttle | 11 | ||

5.7 | Security Deposits | 12 | ||

5.8 | Apportionment Credit | 12 | ||

5.9 | Closing Costs | 12 | ||

5.10 | Delayed Adjustment | 13 | ||

5.11 | Survival | 13 | ||

ARTICLE 6 CLOSING | 13 | |||

6.1 | Closing Date | 13 | ||

6.2 | Seller’s Closing Deliveries | 13 | ||

6.3 | Purchaser Closing Deliveries | 14 | ||

6.4 | Seller’s Post‑Closing Deliveries and Cooperation | 15 | ||

ARTICLE 7 CONDITIONS TO CLOSING | 15 | |||

7.1 | Seller’s Obligations | 15 | ||

7.2 | Purchaser’s Obligations | 16 | ||

7.3 | Waiver of Failure of Conditions Precedent | 16 | ||

ARTICLE 8 REPRESENTATIONS AND WARRANTIES | 17 | |||

8.1 | Purchaser’s Representations | 17 | ||

8.2 | Seller’s Representations | 19 | ||

8.3 | General Provisions | 21 | ||

ARTICLE 9 COVENANTS | 23 | |||

9.1 | Maintenance of Property | 23 | ||

9.2 | Contracts | 23 | ||

9.3 | Negative Covenants | 24 | ||

9.4 | Confidentiality | 24 | ||

9.5 | Tax Contests, Refunds and Credits | 25 | ||

ARTICLE 10 DEFAULTS | 25 | |||

10.1 | Default by Purchaser | 25 | ||

10.2 | Default by Seller | 26 | ||

10.3 | Waiver of Right to Record Lis Pendens | 27 | ||

10.4 | Survival | 27 | ||

ARTICLE 11 DAMAGE, DESTRUCTION AND CONDEMNATION | 27 | |||

11.1 | Destruction or Damage | 27 | ||

11.2 | Condemnation | 28 | ||

11.3 | Waiver | 29 | ||

ARTICLE 12 ESCROW | 29 | |||

12.1 | General | 29 | ||

12.2 | Investment | 29 | ||

12.3 | Supplementary Escrow Instructions | 29 | ||

12.4 | Limitation on Liability | 30 | ||

12.5 | Disputes between Parties | 30 | ||

12.6 | Taxes Payable on Interest | 30 | ||

12.7 | Receipt and Disbursement of Deposits | 30 | ||

12.8 | Designation Agreement | 31 | ||

12.9 | Survival | 31 | ||

ARTICLE 13 LEASING MATTERS | 31 | |||

13.1 | New Leases | 31 | ||

13.2 | Lease Expenses | 32 | ||

13.3 | Lease Enforcement | 32 | ||

13.4 | Survival | 33 | ||

ARTICLE 14 DISCLAIMER, WAIVER, RELEASE | 33 | |||

14.1 | Disclaimer | 33 | ||

14.2 | Waiver and Release | 35 | ||

14.3 | Definitions | 35 | ||

14.4 | Survival | 36 | ||

ARTICLE 15 MISCELLANEOUS | 36 | |||

15.1 | Assignment | 36 | ||

15.2 | Brokers | 36 | ||

15.3 | Notices | 37 | ||

15.4 | Calculation of Time Periods | 39 | ||

15.5 | Survival/Merger | 39 | ||

15.6 | Termination of Agreement | 39 | ||

15.7 | Integration; Waiver | 39 | ||

15.8 | Governing Law | 39 | ||

15.9 | Waiver by Jury/Venue | 39 | ||

15.10 | Recovery by Prevailing Party | 39 | ||

15.11 | Construction | 40 | ||

15.12 | Binding Effect | 40 | ||

15.13 | Severability | 40 | ||

15.14 | Proper Execution | 40 | ||

15.15 | No Marketability | 41 | ||

15.16 | No Third Party Beneficiary | 41 | ||

15.17 | No Recordation | 41 | ||

15.18 | Time of Essence | 41 | ||

15.19 | Deleted | 41 | ||

15.20 | Independent Responsibility/No Alter Ego | 41 | ||

15.21 | Further Assurances | 42 | ||

15.22 | Limited Liability | 42 | ||

15.23 | Counterparts | 42 | ||

15.24 | Cooperation With Purchaser's Auditors And SEC Filing Requirements | 42 | ||

EXHIBITS

Exhibit A – | Legal Description | |

Exhibit B-1 – | Leases | |

Exhibit B-2 – | Security Deposits | |

Exhibit B-3 – | Tenant Arrearages | |

Exhibit B-4 – | Contracts | |

Exhibit B-5 – | Mandatory Contracts | |

Exhibit B-6 – | Litigation | |

Exhibit C – | Form of Tenant Estoppel Certificate | |

Exhibit D – | Deed | |

Exhibit E – | Bill of Sale | |

Exhibit F – | Assignment of Leases | |

Exhibit G – | General Assignment | |

Exhibit H – | Certification of Non‑Foreign Status | |

Exhibit I – | Notice to Tenants | |

Exhibit J – | ERISA Letter | |

Exhibit K – | Lease Expenses | |

Exhibit L – | Form Assignment and Assumption of Manager’s Rights | |

Exhibit M – | Purchase Price Credit Amounts | |

SALE, PURCHASE AND ESCROW AGREEMENT

THIS SALE, PURCHASE AND ESCROW AGREEMENT (“Agreement”) is made as of May 13, 2016, (the “Effective Date”) by and between NOP COTTONWOOD HOLDINGS, LLC, a Delaware limited liability company (“Seller”), and HGREIT II COTTONWOOD CENTER LLC, a Delaware limited liability company (“Purchaser”).

W I T N E S S E T H:

NOW, THEREFORE, for and in consideration of Ten Dollars ($10.00) paid by Purchaser to Seller, the mutual covenants and agreements contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller and Purchaser hereby agree as follows:

ARTICLE 1

SALE OF PROPERTY

Seller agrees to sell, transfer and assign to Purchaser, and Purchaser agrees to purchase and accept from Seller, subject to the terms and conditions set forth in this Agreement, the following (herein collectively referred to as the “Property”):

1.1 Real Property. That certain parcel of real estate located in Salt Lake County, Utah, and more particularly described in Exhibit A attached hereto, together with all of Seller’s right, title and interest in and to all improvements and fixtures located thereon and all rights, privileges and appurtenances pertaining thereto, including all rights, easements, privileges, appurtenances and privileges belonging or appertaining thereto (collectively, the “Real Property”); and

1.2 Personal Property. All of Seller’s right, title and interest in and to all tangible personal property owned by Seller (excluding any computer or computer equipment and software owned by Seller or Seller’s property manager, but including all computers and software owned by Seller necessary to operate the improvements), located on the Real Property and used in the ownership, operation and maintenance of the Real Property and all books, records and files relating to the Real Property and in Seller’s possession or control, including all equipment, tools, machinery, artwork, and furnishings; but specifically excluding Proprietary Documents (as defined below), any items of personal property owned by Tenants at or on the Real Property, other items not related to the Real Property, any items of personal property leased to Seller (herein collectively referred to as the “Personal Property”). The term “Proprietary Documents” means all materials and information which are proprietary or confidential, including, without limitation, income tax returns, loan and financial documents, internal corporate or organizational governance materials and documents, appraisals, budgets, strategic plans for the Property, internal analyses, marketing information regarding the Property, attorney work product, privileged attorney client communications and accountant work product.

1.3 Other Property Rights. All of Seller’s right, title and interest in and to (a) all leases, licenses and other agreements for the use and/or occupancy of the Real Property to which Seller is a party (excluding easements and similar agreements recorded among public records against the Real Property which run with the land) and all guaranties relating thereto (collectively, the “Leases”), in effect at the Closing (as defined in Section 6.1 below); (b) to the extent assignable by Seller, all service, supply, maintenance, utility and commission agreements, equipment leases, warranties, and other contracts, subcontracts and agreements described in Exhibit B-4 attached hereto (collectively, the “Contracts”), to the extent in effect at the Closing and which Purchaser has elected to assume in accordance with Section 4.5; (c) to the extent assignable by Seller without expense to Seller, all licenses, permits and other written authorizations for the use, operation or ownership of the Real Property, to the extent in affect at the Closing; (d) to the extent assignable by Seller without expense to Seller, any trade names, trademarks, logos, service marks, photographs and other identifying material, Property name, plans and specifications, warranties and guarantees pertaining to the Real Property and any improvements; and (e) all of the rights and obligations of Seller as Manager under the that certain Declaration of Easements, Covenants and Restrictions [Cottonwood Corporate Center] dated as of January 8, 1996 by COTNET Investments, L.C., (f/k/a Wallnet Investments, L.C.) a Utah limited liability company, recorded January 17, 1996, as Instrument No.

6259074 of the Official Records of Salt Lake County, Utah (as amended, modified and supplemented, the “Declaration”) (the rights and interests of Seller described in clauses (b), (c), (d) and (e) hereinabove being herein collectively referred to as the “Other Property Rights”); provided, however, the Other Property Rights shall not include: (1) any management or leasing agreements or any obligations thereunder or insurance policy for all or any portion of the Property; and (2) any defenses, claims or causes of action Seller may have against third parties with respect to matters arising or accruing prior to the Closing.

ARTICLE 2

PURCHASE PRICE AND DEPOSIT

2.1 Purchase Price. The purchase price to be paid by Purchaser for the Property is the sum of One Hundred Forty Million and 00/100 DOLLARS ($140,000,000.00) (the “Purchase Price”). The Purchase Price shall be paid in the following manner:

2.1.1 Deposit. Within two (2) business days after the full execution and delivery of this Agreement by Purchaser and Seller, Purchaser shall deposit the sum of Two Million and 00/100 Dollars ($2,000,000.00) in immediately available funds (the “Deposit”) with Commonwealth Land Title Insurance Company (“Escrow Agent” or “Title Company”). The Deposit shall be held and delivered by Escrow Agent in accordance with the provisions of this Agreement. Any interest earned on the Deposit shall be considered part of the Deposit. Except as expressly otherwise set forth herein, at the Closing, the Deposit shall be delivered to Seller and applied against the Purchase Price. The Deposit may be increased in accordance with Section 6.1. If Purchaser fails to timely deposit any portion of the Deposit within the time period required, Seller may terminate this Agreement by notice to Purchaser and the parties hereto shall have no further rights or obligations hereunder, except for rights and obligations which, by their terms, survive the termination of this Agreement.

2.1.2 Funds at Closing. On the Closing Date, Purchaser shall deposit with the Escrow Agent for payment to Seller the Purchase Price, plus or minus the prorations and adjustments set forth in Article 5 including the Deposit, plus any other amounts required to be paid by Purchaser at the Closing, in immediately available funds.

2.2 Independent Consideration. Seller and Purchaser hereby acknowledge that One Hundred Dollars ($100.00) of the Deposit is independent consideration for this Agreement (the “Independent Consideration”). The parties have bargained for such amount as consideration for Purchaser’s exclusive option to purchase the Property pursuant to the terms of this Agreement and for Seller’s execution of this Agreement, in addition to other consideration described in this Agreement. The Independent Consideration is not refundable and, upon Closing or upon any termination of this Agreement for any reason, Escrow Agent shall disburse a portion of the Deposit equal to the Independent Consideration to Seller. If Escrow Agent returns the Deposit to Purchaser in accordance with this Agreement for any reason, Escrow Agent shall deliver a portion of the Deposit equal to the Independent Consideration to Seller notwithstanding any other provision of this Agreement.

ARTICLE 3

TITLE MATTERS

3.1 Title to Real Property. Seller shall convey to Purchaser and Purchaser shall accept from Seller fee simple title to the Real Property subject to the following (collectively, the “Permitted Exceptions”): (i) all matters of title relative to the Real Property, except as otherwise provided in Section 3.2 below; (ii) all matters disclosed on the Survey or any update to the Survey, except as otherwise provided in Section 3.2 below; (iii) the lien of taxes and assessments not yet due and payable, subject to prorations as provided in this Agreement; (iv) all matters caused by Purchaser or any of Purchaser’s Representative (as defined in Section 8.3.1); (vi) all matters approved or deemed approved by Purchaser; and (vii) the Leases.

3.2 Title and Survey.

3.2.1 Seller has provided to Purchaser that certain American Land Title Association (“ALTA”) Commitment for Title Insurance issued by the Title Company under Order Number: 47421B, covering the Real Property, with an effective date of March 29, 2016 (the “Title Commitment”), together with legible copies or access to electronic copies of all documents identified in the Title Commitment which either create or evidence an exception to title. Purchaser acknowledges receipt from Seller of a survey for the Real Property prepared by American Surveying and Mapping, Inc., dated May 2, 2014 and last updated on March 17, 2016, under Project No. 1602333 (the “Survey”). The cost of the initial draft of the Survey shall be Seller’s responsibility, and Purchaser shall be responsible for any additional Survey costs attributable to any updates to such Survey.

3.2.2 During the Due Diligence Period, Purchaser shall review title to the Property as disclosed by the Title Commitment and the Survey (and any update to the Survey, if any), and satisfy itself as to the availability from the Title Company of the ALTA owner’s policy of title insurance (including any required endorsements) required by Purchaser at Closing (the “Title Policy”). During the Due Diligence Period, if Purchaser has any objections to title exceptions or matters of survey, it shall so notify Seller thereof, and subject to the provisions of Section 3.2.3 below, Seller shall within five (5) business days thereafter, notify Purchaser whether or not it elects to cause each such objection to be removed or cured; the failure of Seller to notify Purchaser of its intention to cause an objection to be removed or cured shall be deemed to be an election by Seller not to cause such objection to be removed or cured, provided Seller shall in all events, whether or not Purchaser objects thereto, remove all Must-Cure Matters as provided in Section 3.2.3 below. In the event that Seller elects, or is deemed to have elected, not to remove or cure any objection which it is not required to remove or cure, Purchaser’s sole remedy shall be to terminate this Agreement by written notice to Seller prior to the expiration of the Due Diligence Period, in which event the Deposit shall be returned to Purchaser and neither party shall have any rights, obligations or liabilities hereunder except for those which are expressly stated herein to survive the termination of this Agreement.

3.2.3 Seller shall have no obligation to remove or cure (x) any matters of Survey, or (y) unless Seller has agreed to cure such objection pursuant to Section 3.2.2, any title objections; provided that, whether or not Purchaser makes any objection thereto, Seller shall be obligated, at its sole cost and expense, to remove at or prior to the Closing (i) the liens of any financing obtained at any time by Seller which are secured by the Property, any mechanic’s or materialmen’s liens

relating to work commissioned by (expressly excluding any mechanics’ or materialmen’s liens relating to work commission by any Tenant), and any other liens placed on the Property by or through Seller, which can be satisfied or discharged upon the payment of money, and (ii) any exceptions or encumbrances to title which are created by Seller after the date of this Agreement in violation of this Agreement without Purchaser’s consent (“Must-Cure Matters”). Seller shall have the right to use the Purchase Price, or the portion thereof paid to Seller, to cure any Must-Cure Matters which can be satisfied concurrently with the Closing without causing any such Must-Cure Matter to remain in effect upon transfer of the Property to Purchaser. If Seller is unable to remove or cure any title objection which it is required to remove or cure as provided in Section 3.2.3 prior to the Closing Date, Seller shall have the right to extend the Closing Date for up to ten (10) days by delivering written notice thereof to Purchaser.

3.2.4 Purchaser may terminate this Agreement and receive a refund of the Deposit if Seller fails to remove or cure any title objection which it is required to remove or cure as provided in Section 3.2.3 on or before the Closing Date. If the Title Company revises the Title Commitment after the expiration of the Due Diligence Period to add any exception not previously disclosed in the Title Commitment, Purchaser may object to such exception in writing to Seller within three (3) business days after Purchaser’s receipt of such revised Title Commitment (but in no event later than the Closing Date). If Purchaser fails to timely object to any such exception, such exception shall be deemed to be a Permitted Exception. If Purchaser timely objects to any such exception, then, subject to the provisions of Section 3.2.3 above, Seller shall within three (3) business days thereafter, notify Purchaser whether or not it elects to cause each such objection to be removed or cured; the failure of Seller to notify Purchaser of its intention to cause any such objection to be removed or cured shall be deemed to be an election by Seller not to cause such objection to be removed or cured, provided Seller shall in all events, whether or not Purchaser objects thereto, remove all Must-Cure Matters as provided in Section 3.2.3 above. In the event that Seller elects, or is deemed to have elected, not to remove or cure any such objection which it is not required to remove or cure, Purchaser’s sole remedy shall be to terminate this Agreement by written notice to Seller within three (3) business days of such election or deemed election by Seller, in which event the Deposit shall be returned to Purchaser and neither party shall have any rights, obligations or liabilities hereunder except for those which are expressly stated herein to survive the termination of this Agreement. Seller shall have the right to extend the Closing Date for up to ten (10) days to attempt remove any such exception by delivering written notice thereof to Purchaser.

3.2.5 All matters of survey or exceptions to title in the Title Commitment which are not required to be removed by Seller in accordance with Section 3.2.2, Section 3.2.3 and/or Section 3.2.4 shall, if Purchaser does not elect to terminate this Agreement, be deemed to be Permitted Exceptions.

ARTICLE 4

PURCHASER’S DUE DILIGENCE

4.1 Due Diligence Period. During the period beginning on the Effective Date and ending at Closing, Purchaser shall have the right to conduct examinations, inspections, testing, studies and/or investigations of the Property (the “Due Diligence”), subject to the terms of Section 4.2 and the other terms of this Agreement. If Purchaser is not satisfied with the results of its Due Diligence,

in its sole discretion, for any reason or no reason, Purchaser may terminate this Agreement by delivering notice to Seller prior to 5:00 p.m. (Pacific Time) on May 13, 2016 (the period from the Effective Date through 5:00 p.m. (Pacific Time) on May 13, 2016, the “Due Diligence Period”). In the event Purchaser elects to terminate this Agreement in accordance with the foregoing, the Deposit shall be returned to Purchaser and neither party shall have any rights, obligations or liabilities hereunder except for those which are expressly stated herein to survive the termination of this Agreement. In the event Purchaser fails to timely deliver to Seller notice of Purchaser’s election to either waive its termination right under this Section 4.1 or terminate this Agreement pursuant to the foregoing, Purchaser shall be deemed to have elected to terminate this Agreement, in which event the Deposit shall be returned to Purchaser and neither party shall have any rights, obligations or liabilities hereunder except for those which are expressly stated herein to survive the termination of this Agreement.

4.2 Access to Property. Prior to Closing, Seller shall allow Purchaser and Purchaser’s Representatives (as defined in Section 8.3.1 below) access to the Real Property at reasonable times, upon not less than twenty-four (24) hours prior notice to Seller and upon appropriate notice to Tenants (if applicable) as permitted or required under the Leases, for the purpose of conducting reasonable inspections and tests, including surveys and architectural, engineering and geotechnical inspections and tests and an ASTM standard Phase I environmental site assessment. Purchaser’s rights described above are subject to the following terms and conditions. Seller shall have the right to be present during any visit to the Real Property by Purchaser and/or any of Purchaser’s Representatives.

4.2.1 Purchaser shall deliver to Seller at least one (1) business day prior notice of the date proposed for any such inspection or test. WITH RESPECT TO ANY INTRUSIVE INSPECTION OR TEST (INCLUDING, WITHOUT LIMITATION, COLLECTION OF BUILDING MATERIAL SAMPLES OR SOIL CORES OR ANY TEST DESIGNED TO IDENTIFY THE PRESENCE OF HAZARDOUS MATERIALS) PURCHASER SHALL OBTAIN SELLER’S PRIOR WRITTEN CONSENT, WHICH CONSENT MAY BE GIVEN, WITHHELD OR CONDITIONED IN SELLER’S SOLE DISCRETION, INCLUDING, WITHOUT LIMITATION, CONSENT TO THE TIMING AND SCOPE OF THE WORK TO BE PERFORMED. SELLER SHALL HAVE THE RIGHT TO TAKE SPLIT OR DUPLICATE SAMPLES FROM ANY SUCH INTRUSIVE INSPECTION OR TEST FOR PURPOSES OF CONDUCTING, AT SELLER’S SOLE COST, ITS OWN INSPECTION OR TEST THEREOF.

4.2.2 Purchaser agrees that neither it nor any of Purchaser’s Representatives shall interfere with the operation of the Real Property or the rights of any person or entity leasing or occupying space in the Real Property pursuant to a Lease (collectively, the “Tenants”) or any parties to any reciprocal easement agreements. Purchaser shall notify Seller at least one (1) business day in advance of Purchaser’s intended communication with any Tenant and allow Seller the opportunity to participate in such communication if Seller desires. As used in this Section 4.2, “communicate” and “communication” shall include the initiation of, response to, or sharing or exchange of information, knowledge or messages, whether by oral, written or electronic methods or media or by any other means.

4.2.3 For the period beginning on the Effective Date through the date upon which this Agreement is terminated or Closing occurs, Purchaser shall maintain comprehensive general liability insurance covering the insured against claims of bodily injury, personal injury and property damage arising out of Purchaser’s entry onto the Real Property, including a Broad Plan Contractual Liability endorsement and a Broad Form Comprehensive General Liability endorsement covering the insuring provisions of this Agreement and the performance by Purchaser of its indemnification obligations under this Agreement, for limits of liability not less than Two Million Dollars ($2,000,000) for bodily injury, personal injury, death and property damage. Such insurance policies shall: (a) name Seller and all other persons designated by Seller, as additional insureds; (b) be issued by an insurance company having a rating of not less than A‑X in Best’s Insurance Guide and licensed to do business in the jurisdiction in which the Real Property is located; (c) be primary insurance as to all claims thereunder and provide that any insurance carrier by Seller or any other party is excess and is non‑contributing with the subject insurance coverage; (d) contain a cost‑liability endorsement or severability of interest clause acceptable to Seller; (e) provide that any act or omission of one of the insureds or additional insureds thereunder which would void or otherwise reduce coverage, shall not void or reduce coverage as to the other insureds or additional insureds; (f) provide that the insurer thereunder waives any right of recovery by way of subrogation against Seller or any other additional insured in connection with any loss or damage covered by such insurance policy, Purchaser and Seller each hereby waiving its right of action and recovery against and releasing the other and the other additional insureds under such insurance policy from and against all liabilities, damages, losses, claims and expenses for which they may be liable to the extent the other is covered by insurance actually carried or required to be carried by it under this Agreement; (g) not contain the deductible in excess of Ten Thousand Dollars ($10,000.00); and (h) initially be for a term of at least six (6) months and shall contain an endorsement prohibiting cancellation, modification or reduction of coverage without first giving Seller at least thirty (30) days prior notice of such proposed action. Prior to its entry onto the Property, Purchaser shall deliver to Seller a certificate of insurance for the insurance coverage described above, which certificate of insurance shall be in form satisfactory to Seller. Under no circumstances shall Purchaser have any right pursuant to this Section or otherwise to enter the Real Property prior to its procurement of the above‑referenced insurance and delivery of the corresponding certificate of insurance to Seller, or at any time thereafter during which Purchaser fails to maintain the insurance coverage described above.

4.2.4 Purchaser agrees to indemnify, protect, defend (with counsel satisfactory to Seller) and hold harmless Seller, Seller’s affiliates, shareholders, partners and members, and their respective directors, officers, shareholders, partners, members, agents, contractors and employees (collectively, the “Seller Parties”), from and against any and all claims, damages, losses, liabilities, costs and expenses, including, without limitation, reasonable expenses of investigation and reasonable attorneys’ fees and disbursements (hereinafter collectively, “Indemnified Claims”) against Seller, Seller Parties or any of them, arising in connection with or incident to the entry and/or the conduct of activities upon the Real Property by Purchaser and/or Purchaser’s Representative (as defined in Section 8.3.1), including, without limitation, in any way connected with or arising out of Purchaser’s Work; provided, however, such indemnity shall not extend to protect Seller or any other Seller Party from any liabilities for (i) pre-existing conditions merely discovered by Purchaser (e.g., latent environmental contamination) so long as no action by Purchaser or any

Purchaser’s Representative aggravates such pre-existing condition, or (ii) Seller’s or any Seller Parties’ gross negligence or willful acts.

4.2.5 Purchaser covenants and agrees to: (i) pay in full for all materials joined or affixed to the Real Property in connection with any environmental, engineering, soil, feasibility or other studies or activities that are procured or undertaken by or on behalf of Purchaser (herein, “Purchaser’s Work”); (ii) pay in full all persons who perform labor on the Real Property with respect to Purchaser’s Work; and (iii) not permit or suffer any mechanic’s, materialmen’s or other lien of any kind or nature to be enforced against the Real Property for any of Purchaser’s Work. Purchaser shall be responsible for the costs and expenses of all reports and studies commissioned by Purchaser with respect to the Property.

4.2.6 Purchaser shall, as soon as possible and at Purchaser’s sole cost and expense, restore the Real Property where Purchaser or Purchaser’s Representatives have performed any of Purchaser’s Work to substantially the same condition that existed prior to such Purchaser’s Work, failing which Seller may perform the work of restoration and Purchaser shall reimburse Seller for all costs incurred by Seller in connection therewith upon rendition of bills paid for by Seller; provided, however, that prior to the commencement of any work of restoration by Seller pursuant to this Subsection, Seller shall provide Purchaser with at least three (3) business days prior notice of Purchaser’s failure to perform the work of restoration described in this Subsection and Purchaser shall have failed to commence the work of restoration within such three (3) business day period and thereafter diligently proceed to complete the same.

4.2.7 Purchaser may communicate with any governmental authority for the sole purpose of gathering information regarding then-current zoning and building code compliance of the Real Property and the then-current entitlements with respect to the Real Property in connection with the transaction contemplated by this Agreement and searching publicly available databases regarding the Real Property. With respect to any other communications with governmental authorities, Purchaser shall deliver to Seller at least one (1) business day prior notice to inform Seller of Purchaser’s intended communication with any governmental authority and shall obtain Seller’s consent with respect thereto. Purchaser shall allow Seller the opportunity to participate in such communication if Seller desires.

4.2.8 This Section 4.2 shall survive the termination of this Agreement and the Closing.

4.3 Due Diligence Materials To Be Delivered. Seller shall deliver, cause to be delivered, or make available via an electronic data room within five (5) days after the Effective Date, to Purchaser the following:

4.3.1 Title Commitment and Survey. Seller’s most current Title Commitment and the Survey.

4.3.2 Leases. The Leases;

4.3.3 Contracts. The Contracts;

4.3.4 Tax Statements. Ad valorem tax statements for the Real Property for the current tax period and the previous two (2) tax years;

4.3.5 Financial Information. Operating statements pertaining to the Real Property for the 24 months preceding the date of this Agreement or such lesser period as Seller has owned the Real Property; and

4.3.6 Rent Roll. Seller’s most current rent roll for the Property.

4.4 Due Diligence Materials To Be Made Available. To the extent such items are in Seller’s possession, except for Proprietary Documents, Seller shall make available to Purchaser for Purchaser’s review, at Seller’s option at Seller’s office, at the office of Seller’s property manager, at the Real Property, or via an electronic data room, the following items and information, and Purchaser at its expense shall have the right to make copies of the same:

4.4.1 Licenses, Permits and Certificates of Occupancy. Licenses, permits and certificates of occupancy relating to the Real Property;

4.4.2 Plans, Specifications and Reports. Building plans and specifications relating to the Real Property, and all architectural and engineering reports and the most recent environmental and property condition reports in Seller’s possession which are not Proprietary Documents;

4.4.3 Capital Expenditures, Maintenance Records and Warranties. Capital expenditures and maintenance work orders for the 24 months preceding the date of this Agreement or such lesser period as Seller has owned the Real Property, and warranties, if any, for elements of the Real Property;

4.4.4 Lease Correspondence. Written correspondence files related to the Leases; and

4.4.5 Additional Documents. Any additional documents, reports or information related to the Property and reasonably requested by Purchaser which are not Proprietary Documents.

4.5 Assignment/Termination of Contracts. Seller agrees to terminate, by written notice to the other parties thereto delivered on or before the Closing, any of the Contracts that Purchaser, pursuant to written notice to Seller prior to the expiration of the Due Diligence Period, requests Seller to terminate, but only if such Contracts (x) may be lawfully terminated without any monetary penalty to Seller, or (y) Purchaser pays any termination fee or other cost or charge associated with the termination of such Contract; provided, however, Seller shall not be obligated to terminate and Purchaser shall be obligated to assume at Closing, the Contracts identified on Exhibit B-5 attached hereto (the “Mandatory Contracts”). Seller shall deliver to Purchaser copies of all notices of termination given by Seller hereunder. At the Closing, Seller shall assign to Purchaser and Purchaser shall assume from Seller (for the period after Closing), all of the Contracts other than those Contracts which Seller terminates in accordance with the provisions of this Section 4.5. Purchaser acknowledges that the assignment or termination of certain of the Contracts may require the prior approval of the particular contractor. Seller shall endeavor to obtain such approval; provided,

however, that failure to obtain such approval shall not be a default by Seller hereunder. Notwithstanding the foregoing, Purchaser shall not be obligated to assume any management or leasing agreements or any obligations thereunder, including any so-called “tail” obligations.

4.6 Tenant Estoppel Certificates. Seller shall use commercially reasonable efforts to obtain and deliver to Purchaser prior to the Closing Date, estoppel certificates in the form of Exhibit C attached hereto or such other form as is attached to or prescribed by a Lease (collectively, the “Tenant Estoppel Certificates”) executed by Tenants collectively leasing at least seventy percent (70%) of the rentable footage rented in the Real Property (the “Estoppel Percentage”). Seller shall not be obligated to expend funds or institute legal proceedings to obtain such Tenant Estoppel Certificates. It shall be a condition to Purchaser’s obligation to close the Transaction (as hereinafter defined) that the following conditions have been satisfied (collectively, the “Estoppel Condition”): (i) the Estoppel Percentage shall have been satisfied, and (ii) that each of the following Tenants (each, a “Major Tenant”) shall have delivered an executed Tenant Estoppel Certificate to Purchaser, which is not a Non-Complying Estoppel Certificate: (1) SanDisk Corporation, (2) Extra Space Storage, (3) Kern River Gas, (4) Dyno Nobel, and (5) Raytheon Company. If the Estoppel Condition is not satisfied on or before the Closing Date, Seller and Purchaser each shall have the right to extend the Closing Date by not more than fifteen (15) days to attempt to obtain Tenant Estoppel Certificates to satisfy the Estoppel Condition. A Tenant Estoppel Certificate shall count towards the Estoppel Condition unless it is a Non-Complying Estoppel Certificate. As used herein, “Non-Complying Estoppel Certificate” means a Tenant Estoppel Certificate that (a) discloses a rental amount or any other material adverse economic term of the applicable Lease that was not disclosed to Purchaser (whether in the applicable Lease, this Agreement or any other document), (b) alleges a material default of Seller (as landlord) or Tenant under the applicable Lease, (c) discloses a material dispute between the landlord and a Tenant in connection with the applicable Lease, or (d) is otherwise not substantially in the form of the Tenant Estoppel Certificate. “Material” for purposes of this Section 4.6 means, with respect to any Tenant, a default, adverse economic term or dispute disclosed in a Tenant Estoppel Certificate executed by such tenant which, together with all defaults, adverse economic terms and disputes disclosed in Tenant Estoppel Certificates executed by all other Tenants, is in excess of $100,000.

4.7 Return of Due Diligence Materials. If this Agreement is terminated pursuant to Section 4.1 or for any other reason, Purchaser shall deliver to Seller within three (3) business days after such termination, copies of all surveys, engineering, environmental and other reports relative to the Property prepared by third parties for Purchaser, and all documents previously delivered by Seller to Purchaser, but Purchaser shall not be obligated to provide Seller with Purchaser’s or Purchaser’s attorneys’ internal analysis or work product.

ARTICLE 5

ADJUSTMENTS AND PRORATIONS

5.1 Prorations.

5.1.1 General. The following items of income and expense with respect to the Property and payable to or by the owner of the Property shall be prorated as of 11:59 p.m. (Pacific Time) the day prior to the Closing: (i) all real property taxes and assessments as provided in Section

5.2; (ii) rents and other tenant payments and tenant reimbursements including payments of estimated operating expenses and taxes (collectively, “Tenant Payments”) if any, received under the Leases; (iii) charges for water, sewer, electricity, gas, fuel and other utility charges, all of which shall be read promptly before Closing, unless Seller elects to close its own applicable account, in which event Purchaser shall open its own account and the respective charges shall not be prorated; (iv) amounts prepaid and amounts accrued but unpaid on service contracts which are to be assumed by Purchaser; and (v) periodic fees for licenses, permits or other authorizations with respect to the Property.

5.1.2 Adjustments. Delinquent Tenant Payments for the period prior to Closing, if any, shall not be prorated and all rights thereto shall be retained by Seller, who reserves the right to collect and retain such delinquent Tenant Payments, and Purchaser agrees to cooperate (at no expense to Purchaser) with Seller in Seller’s efforts to collect such Tenant Payments; provided, however, that Seller shall not be entitled to file or commence any disposition or eviction proceeding against the delinquent tenant. For a period of six (6) months after the Closing, Purchaser shall (at no cost or expense to Purchaser) bill and use reasonable efforts to collect all delinquent Tenant Payments. If at any time after the Closing Purchaser shall receive any such delinquent Tenant Payments, Purchaser shall immediately remit such Tenant Payments to Seller, provided that any monies received by Purchaser from a delinquent Tenant shall be applied first to current rents then due and payable and then to delinquent rents in the inverse order in which they became due and payable.

5.2 Real Estate Taxes and Assessments. Real estate taxes and assessments for the calendar year in which Closing occurs shall be prorated as of 11:59 p.m. (Pacific Time) on the day prior to the Closing. Seller shall pay all such taxes and assessments attributable to any period prior to the date upon which the Closing occurs, and Purchaser shall pay all such taxes attributable to any period beginning on or after the date upon which the Closing occurs. If the real estate tax rate and/or assessments have not been set for the fiscal year in which the Closing occurs, then the proration of such taxes shall be based upon the rate and assessments for the preceding fiscal year, and such proration shall be adjusted between Seller and Purchaser upon presentation of evidence that the actual taxes for the fiscal year in which the Closing occurs differ from the amounts used at the Closing. Seller shall pay all installments of special assessments due and payable prior to the date upon which the Closing occurs and Purchaser shall pay all installments of special assessments due and payable on and after the date upon which the Closing occurs. After the Closing, Purchaser shall pay all amounts for which Purchaser receives credit under this Section and shall indemnify, protect, defend and hold harmless Seller from and against all liabilities, losses, damages, costs and expenses (including reasonable attorneys’ fees and disbursements) suffered or incurred by it with respect thereto, which obligation shall survive the Closing. Any refunds of real estate, personal property and/or other taxes made received by Purchaser after the Closing shall be held in trust by Purchaser and shall first be then paid to any Tenants who are entitled to the same, and the balance, if any, shall be paid to Seller to the extent allocable to the period prior to Closing and to Purchaser to the extent allocable to the period commencing on and after the Closing).

5.3 Operating Expenses. Operating expenses for the Property (including, without limitation, (i) utility charges, and (ii) expenses prepaid by Seller) shall be prorated as of 11:59 p.m.

(Pacific Time) of the day prior to the Closing. Seller shall pay all such operating expenses (including utility charges) attributable to any period prior to the date upon which the Closing occurs, and Purchaser shall pay all operating expenses attributable to any period beginning on or after the date upon which the Closing occurs. To the extent that the amount of actual consumption of any utility services is not determined prior to the Closing, a proration shall be made at the Closing based on the last available reading, and post‑Closing adjustments between Purchaser and Seller shall be made within twenty (20) days of the date that actual consumption for such pre‑Closing period is determined. As to utility charges, Seller may elect to pay one or more of said items accrued to the date hereinabove fixed for apportionment directly to the person or entity entitled thereto, and to the extent Seller so elects and such utility service is terminated as of Closing, such item shall not be apportioned hereunder and Seller’s obligation to pay such item directly shall survive the Closing, and Seller shall indemnify, protect, defend and hold harmless Purchaser from and against all liability, losses, damage, costs and expenses (including reasonable attorneys’ fees and disbursements) suffered or incurred by Purchaser with respect thereto. After the Closing, Purchaser shall pay all amounts for which Purchaser receives credit under this Section and shall indemnify, protect, defend and hold harmless Seller from and against all liabilities, losses, damages, costs and expenses (including reasonable attorneys’ fees and disbursements) suffered or incurred by Seller with respect thereto, which obligation shall survive the Closing.

5.4 Lease Expenses. At the Closing, Purchaser shall reimburse Seller for the Lease Expenses (as defined in Section 13.2) and Seller shall credit against the Purchase Price the Lease Expenses to the extent required by the terms of Section 13.2.

5.5 Purchase Price Credit. At the Closing, Seller shall provide to Purchaser a credit against the Purchase Price for tax purposes (the “Purchase Price Credit”) in an amount equal to the sum of the amounts set forth on Exhibit M attached hereto for the applicable periods set forth on Exhibit M which are from and after the Closing Date, as prorated for the month in which the Closing Date occurs if the Closing Date is not the first day of a calendar month. The following is a hypothetical illustration of the Purchase Price Credit: If the Closing Date is June 10, 2016, the Purchase Price Credit shall be equal to $430,829.69 ($38,418.77 for the period from June 10,2016 through June 30, 2016, plus $392,410.92 for the period from July 1, 2016 through January 31, 2017).

5.6 Extra Space Shuttle Obligations. Seller shall retain, and Purchaser shall not assume, the obligation of the landlord under Section 31 of that certain Lease Agreement dated December 22, 2015 by and between Seller, as landlord, and Extra Space Storage, Inc. (“Extra Space”), as tenant, as amended (as in effect as of the date of this Agreement, the “Extra Space Lease”), to pay to Extra Space an amount not to exceed $50,000 for the purchase of the Tenant Shuttle (as defined in the Extra Space Lease). Seller shall, at Seller's election, either (x) make such payment at or prior to Closing, or (y) prior to, and as a condition to, Closing, obtain an acknowledgement from Extra Space that Seller, and not Purchaser, will be solely responsible for such payment. Following the Closing, Purchaser shall (i) promptly deliver to Seller all notices received or given by Purchaser with respect to Section 31 of the Extra Space Lease and (ii) reasonably cooperate with Seller in connection with Seller’s performance of Seller’s obligations under this Section 5.6.

5.7 Security Deposits. At the Closing, Seller shall, at Seller’s option, either deliver to Purchaser, or give Purchaser a credit against the Purchase Price for, the aggregate amount of the unapplied cash security deposits then held by Seller under the Leases and required to be held by Seller under the Leases, plus any interest accrued thereon and payable to Tenants pursuant to Leases. With respect to any security deposits which are letters of credit delivered to Seller by Tenants, Seller shall (i) deliver to Purchaser at the Closing such letters of credit, (ii) execute and deliver such other instruments as the issuers of such letters of credit shall reasonably require for the transfer or re-issue of such letter of credit without additional liability or expense to Seller, (iii) cooperate with Purchaser to change the named beneficiary under such letters of credit to Purchaser or re-issue such letter of credit to Purchaser, and (iv) pay all transfer fees not paid by the applicable Tenant. At the Closing, Purchaser shall pay to Seller all refundable cash and other deposits posted with utility companies serving the Real Property if such utility contracts remain in place and are assigned to Purchaser, or, at Seller’s option, Seller shall be entitled to receive and retain such refundable cash and other deposits. Purchaser and Seller shall take all steps necessary to effectuate the transfer of all utilities to its name as of the Closing Date.

5.8 Apportionment Credit. Any apportionments and prorations which are not expressly provided for in this Article shall be made in accordance with the customary practice in the local jurisdictions in which the Real Property is located. Purchaser and Seller agree to prepare a schedule of tentative adjustments at least three (3) business days prior to the Closing Date. In the event the prorations to be made at the Closing result in a credit (i) to Purchaser, such amount shall be paid at the Closing by giving Purchaser a credit against the Purchase Price in the amount of such credit, or (ii) to Seller, Purchaser shall pay the amount thereof to Seller at the Closing by an increase to the Purchase Price.

5.9 Closing Costs. Purchaser shall pay (i) the additional cost, if any, of extended coverage and all charges for endorsements to the Title Policy; (ii) the cost of any updates to the Survey (above those costs for the initial preparation of the Survey); (iii) all recording and filing charges in connection with the instruments by which Seller conveys the Property; (iv) one-half (1/2) of all escrow or closing charges; and (v) all costs of Purchaser’s Due Diligence. Seller shall pay (i) the base premium for the Title Policy, exclusive of the cost of endorsements and extended coverage; (ii) the initial cost of the Survey; (iii) all recording and filing charges in connection with any instruments required to release any Must-Cure Matters; and (iv) one-half (1/2) of all escrow or closing charges. Purchaser and Seller shall each pay all legal and professional fees of the attorneys and consultants engaged by them respectively. All other costs of the Closing shall be paid in accordance with the custom of the jurisdiction in which the Real Property is located.

5.10 Delayed Adjustment. Following the Closing, Seller and Purchaser shall reasonably cooperate with each other in order to calculate and determine the correct amount of all prorations required to made pursuant to this Article. If at any time following the Closing, the amount of an item listed in this Article shall prove to be incorrect (whether as a result of an error in calculation or a lack of complete and accurate information as of the Closing), the party in whose favor the error was made shall pay to the other party the sum necessary to correct such error within thirty (30) days after receipt of proof of such error. Any amounts not paid within such thirty (30) day period shall bear interest from the date the payor received proof of the error until paid at the rate of ten percent

(10%) per annum. Upon request of Purchaser or Seller, the other party shall provide a detailed and accurate written statement signed by such party certifying as to the payments received by such party from Tenants from and after Closing and to the manner in which such payments were applied, and shall make their books and records available for inspection by the other party during ordinary business hours upon reasonable advance notice. Notwithstanding anything herein to the contrary, the final reconciliation for adjustment of any prorations under this Article shall occur within six (6) months after the Closing.

5.11 Survival. The terms of this Article shall survive the Closing.

ARTICLE 6

CLOSING

Purchaser and Seller hereby agree that the transaction contemplated by this Agreement (the “Transaction”) shall be consummated as follows:

6.1 Closing Date. Consummation of the Transaction (the “Closing”) shall occur through an escrow with Escrow Agent on June 10, 2016 (the “Closing Date”), subject to Seller’s and Purchaser’s right to extend the Closing as provided elsewhere in this Agreement; provided, however, that Purchaser shall have a one-time right to extend the Closing Date by up to thirty (30) days by, on or before the date which is three (3) business days prior to the scheduled Closing Date, (a) delivering written notice to Seller of such extension and (b) depositing with Escrow Agent an additional $2,000,000 which shall be added to and become part of the Deposit. All funds must be received by Seller by no later than 3:00 p.m. (Pacific Time) on the Closing Date. Purchaser and Seller shall conduct a “pre‑Closing” on the last business day prior to the Closing Date.

6.2 Seller’s Closing Deliveries. At the Closing, Seller shall deliver or cause to be delivered to Purchaser the following:

(a) Deed. A Deed in the form of Exhibit D attached hereto, executed and acknowledged by Seller (the “Deed”).

(b) Bill of Sale. A Bill of Sale in the form of Exhibit E attached hereto, executed by Seller (the “Bill of Sale”).

(c) Assignment of Leases. An Assignment of Leases in the form of Exhibit F attached hereto, executed by Seller (the “Assignment of Leases”).

(d) General Assignment. A General Assignment in the form of Exhibit G attached hereto, executed by Seller (the “General Assignment”).

(e) Assignment and Assumption of Manager’s Rights. An Assignment and Assumption of Manager’s Rights in the form of Exhibit L attached hereto (the “Assignment of Manager’s Rights”), executed by Seller.

(f) Closing Statement. A Closing Statement for the Transaction executed by Seller and reflecting the Purchase Price, prorations required to made in accordance

with this Agreement, and other amounts payable by Purchaser and Seller at the Closing (the “Closing Statement”).

(g) Non‑Foreign Status Affidavit. A non‑foreign status affidavit in the form of Exhibit H attached hereto, executed by Seller, certifying that Seller is not a “foreign person” as that term is defined in Section 1445 of the Internal Revenue Code.

(h) Notice to Tenants. A single letter in the form of Exhibit I attached hereto, executed by Seller, for delivery to the Tenants, notifying them of the sale of the Property to Purchaser, the assignment of the applicable security deposit to Purchaser and advising them that all future payments of rent and other payments due under the Leases are to be made to Purchaser at an address designated by Purchaser.

(i) Title Affidavits. Title affidavits and gap indemnities customarily required by the Title Company in order to allow the Title Company to limit any exceptions for parties in possession to the Tenants under the Leases, and not to take any exceptions for mechanics’ liens.

(j) Other Documents. Evidence of authority and any additional documents which Escrow Agent or the Title Company may reasonably require for the proper consummation of the Transaction; provided, however, no such additional document shall expand any obligation, covenant, representation or warranty of Seller or result in any new or additional obligation, covenant, representation or warranty of Seller under this Agreement beyond those expressly set forth in this Agreement.

(k) Real Property. Possession of the Real Property, subject to the Permitted Exceptions.

(l) State Law Disclosures. Such disclosures and reports as are required by applicable state and local law in connection with the conveyance of the Property.

6.3 Purchaser Closing Deliveries. At the Closing, Purchaser shall deliver or cause to be delivered to Seller the following:

(a) Purchase Price. The Purchase Price as adjusted for apportionments and other adjustments required under this Agreement, plus any other amounts required to be paid by Purchaser at the Closing.

(b) Bill of Sale. The Bill of Sale executed by Purchaser.

(c) Assignment of Leases. The Assignment of Leases executed by Purchaser.

(d) General Assignment. The General Assignment executed by Purchaser.

(e) Assignment of Manager’s Rights. The Assignment of Manager’s Rights executed by Purchaser.

(f) Closing Statement. The Closing Statement executed by Purchaser.

(g) ERISA Letter. A letter to Seller in the form of Exhibit J attached hereto, duly executed by Purchaser confirming the warranty set forth in Section 8.1(c).

(h) Additional Documents. Evidence of authority and any additional documents which Seller, Escrow Agent or the Title Company may reasonably require for the proper consummation of the Transaction; provided, however, no such additional document shall expand any obligation, covenant, representation or warranty of Purchaser or result in any new or additional obligation, covenant, representation or warranty of Purchaser under this Agreement beyond those expressly set forth in this Agreement.

6.4 Seller’s Post‑Closing Deliveries and Cooperation. Immediately after the Closing, Seller shall make the Personal Property, Leases, Contracts, the Other Property Rights, and all other elements of the Property available at the Real Property or at the offices of the property manager for the Property. After the Closing, Seller shall have the right to inspect the books and records relative to the Property at reasonable times during normal business hours and after reasonable prior notice to Purchaser to verify that Purchaser is remitting to Seller all amounts required to be remitted to Seller in accordance with the terms of this Agreement, and for any other purpose related to Seller’s prior ownership of the Property, including, without limitation, Seller’s response to any legal requirement, tax audit, tax return preparation or litigation threatened or brought against Seller. The terms of this Section shall survive the Closing.

ARTICLE 7

CONDITIONS TO CLOSING

7.1 Seller’s Obligations. Seller’s obligation to close the Transaction is conditioned on all of the following, any or all of which may be expressly waived by Seller, at its sole option:

(a) Purchaser’s Representations True. All representations and warranties made by Purchaser in this Agreement shall be true and correct in all material respects on and as of the Closing, as if made on and as of the Closing, except to the extent they expressly relate to an earlier date.

(b) Purchaser’s Deliveries and Performance Complete. Purchaser shall have delivered the funds required hereunder and all of the documents and other items required to be executed and delivered by Purchaser pursuant to Section 6.3.

7.2 Purchaser’s Obligations. Purchaser’s obligation to close the Transaction is conditioned on all of the following, any or all of which may be expressly waived by Purchaser, at its sole option:

(a) Seller’s Representations True. Subject to the provisions of Section 8.3, all representations and warranties made by Seller in this Agreement, as the same may be modified

as provided in Section 8.3, shall be true and correct in all material respects on and as of the Closing, as if made on and as of such date.

(b) Seller’s Deliveries and Performance Complete. Seller shall have delivered all of the documents, funds and other items required to be delivered by Seller pursuant to Section 6.2.

(c) Tenant Estoppel Certificates. Purchaser shall have received Tenant Estoppel Certificates to satisfy the Estoppel Condition.

(d) Title. The Title Company is unconditionally bound to issue the Title Policy, subject only to the Permitted Exceptions, in accordance with Article 3 hereof; provided, however, that if the Title Company will not issue the Title Policy, subject only to the Permitted Exceptions, in accordance with Article 3 hereof at the Closing, Seller may elect to cause an alternate title company (which may be First American Title Insurance Company, Chicago Title Insurance Company, Fidelity National Title Insurance Company, Old Republic Title, Stewart Title or such other title company acceptable to Purchaser in Purchaser’s sole discretion) to issue the Title Policy and Seller shall have the right to extend the Closing Date for up to ten (10) days to cause the issuance of such Title Policy.

(e) Leases. As of the Closing Date, no Major Tenants shall (i) be subject to a bankruptcy, insolvency, reorganization, liquidation, dissolution or similar proceeding, (ii) have terminated its Lease in writing or (iii) be in material default under its Lease. “Material” for purposes of this Section 7.2(e) means, with respect to the applicable Tenant, an amount in excess of the monthly rental amount due by such Tenant under its Lease.

7.3 Waiver of Failure of Conditions Precedent. At any time or times on or before the date specified for the satisfaction of any condition, Purchaser or Seller may elect to waive the benefit of any such condition set forth in Sections 7.1 or 7.2, respectively. In the event any of the conditions set forth in Sections 7.1 or 7.2 are neither waived nor fulfilled, the party for whose benefit the condition exists may terminate this Agreement by delivering notice to the other whereupon the Deposit shall be returned to Purchaser and neither party shall have any further rights, obligations or liabilities under this Agreement except for those which expressly survive the termination of this Agreement; provided, however, if the failure of a condition set forth in this Agreement for the benefit of a party is not satisfied due to a default of the other party, then the terms of Article 10 shall govern.

ARTICLE 8

REPRESENTATIONS AND WARRANTIES

8.1 Purchaser’s Representations. Purchaser represents and warrants to Seller as follows as of the date of the Agreement through the Closing:

(a) Each of Purchaser and its general partners or managing members, if any, (i) is duly organized (or formed), validly existing and in good standing under the laws of their respective state or commonwealth of organization, and (ii) has all necessary power to execute and deliver this Agreement and all documents contemplated hereunder to be executed by them, respectively, and to perform all of their respective obligations hereunder and thereunder. This

Agreement and all documents contemplated hereunder to be executed by Purchaser (1) have been duly authorized by all requisite partnership, corporate or other action on the part of Purchaser and its general partners or managing members, if any, and (2) are the valid and legally binding obligation of Purchaser, enforceable in accordance with their respective terms. Neither the execution and delivery of this Agreement or any document contemplated hereunder to be executed by Purchaser, nor the performance of the obligations of Purchaser hereunder or thereunder will result in the violation of any law or any provision of the partnership agreement, articles of incorporation, by‑laws or other organizational or governing documents of Purchaser, or conflict with any order or decree of any court or governmental authority by which Purchaser is bound.

(b) Neither Purchaser nor any of its general partners or managing members, if any, (i) has applied for, consented to, acquiesced to, or is subject to the appointment of a receiver, trustee, custodian, liquidator or other similar official for itself or for all or a substantial part of its assets; (ii) is subject to a bankruptcy, insolvency, reorganization, liquidation, dissolution or similar proceeding, or has admitted in writing its inability to pay its debts as they become due; (iii) has made an assignment for the benefit of creditors; (iv) has filed a petition or an answer seeking, consenting to, or acquiescing in a reorganization or an arrangement with creditors, or sought to take advantage of any bankruptcy law, insolvency law or other law for the benefit of debtors; or (v) has filed an answer admitting the material obligations of a petition filed against it in any bankruptcy, insolvency, reorganization, liquidation, dissolution or similar proceeding.

(c) Neither Purchaser’s assets, nor the assets to be used by Purchaser to acquire the Property, constitute “plan assets” within the meaning of 29 C.F.R. Section 2510.3‑101, as modified by Section 3(42) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). Purchaser is not a “governmental plan” within the meaning of Section 3(32) of ERISA and, to Purchaser’s knowledge, the execution of this Agreement and the purchase of the Property by Purchaser is not subject to state statutes regulating investments of, and fiduciary obligations with respect to, governmental plans.

(d) There is no agreement to which Purchaser is a party or to Purchaser’s knowledge binding on Purchaser which is in conflict with this Agreement. There is no action or proceeding pending or, to Purchaser’s knowledge, threatened against Purchaser which challenges or impairs Purchaser’s ability to execute or perform its obligations under this Agreement.

(e) Purchaser represents and warrants to Seller that neither Purchaser nor, to Purchaser’s knowledge, any Person who owns a controlling direct or indirect interest in Purchaser (collectively, a “Purchaser Party”), is now nor shall be at any time until the Closing under this Agreement an individual, corporation, partnership, joint venture, association, joint stock company, trust, trustee, estate, limited liability company, unincorporated organization, real estate investment trust, government authority or any other form of entity (collectively, a “Person”) with whom a United States citizen, entity organized under the laws of the United States or its territories or entity having its principal place of business within the United States or any of its territories (collectively, a “U.S. Person”), including a United States Financial Institution as defined in 31 U.S.C. 5312, as periodically amended (“Financial Institution”), is prohibited from transacting business of the type contemplated by this Agreement, whether such prohibition arises under United

States law, regulation, executive orders and lists published by the Office of Foreign Assets Control, Department of the Treasury (“OFAC”) (including those executive orders and lists published by OFAC with respect to Persons that have been designated by executive order or by the sanction regulations of OFAC as Persons with whom U.S. Persons may not transact business or shall limit their interactions to types approved by OFAC (“Specially Designated Nationals and Blocked Persons”) or otherwise. Neither Purchaser nor, to Purchaser’s knowledge, any Purchaser Party, nor any Person providing funds to Purchaser in connection with the transaction contemplated hereby (a) is under investigation by any governmental authority for, or has been charged with, or convicted of, money laundering, drug trafficking, terrorist related activities, any crimes which in the United States would be predicate crimes to money laundering, or any violation of any Anti-Money Laundering Laws; (b) has been assessed civil or criminal penalties under any Anti-Money Laundering Laws (as hereinafter defined); or (c) has had any of its funds seized or forfeited in any action under any Anti-Money Laundering Laws. For purposes of this Subsection, the term “Anti-Money Laundering Laws” shall mean laws, regulations and sanctions, state and federal, criminal and civil, that (1) limit the use of and/or seek the forfeiture of proceeds from illegal transactions; (2) limit commercial transactions with designated countries or individuals believed to be terrorists, narcotics dealers or otherwise engaged in activities contrary to the interests of the United States; (3) require identification and documentation of the parties with whom a Financial Institution conducts business; or (4) are designed to disrupt the flow of funds to terrorist organizations. Such laws, regulations and sanctions shall be deemed to include the USA PATRIOT Act of 2001, Pub. L. No. 107-56 (the “Patriot Act”), the Bank Secrecy Act, 31 U.S.C. Section 5311 et seq., the Trading with the Enemy Act, 50 U.S.C. Section 1701 et seq., and the sanction regulations promulgated pursuant thereto by the OFAC, as well as laws relating to prevention and detection of money laundering in 18 U.S.C. Sections 1956 and 1957. For purposes of this Section, the term “Purchaser Party” does not include any Person to the extent such Persons’ interest is in or through an entity whose securities are listed on a national securities exchange or quoted on an automated quotation system in the U.S. or a wholly-owned subsidiary of such an entity.

If Purchaser obtains knowledge that Purchaser or any owner of a controlling interest in Purchaser becomes identified on any List or is indicted, arraigned, or custodially detained on charges involving money laundering or predicate crimes to money laundering, then (1) Purchaser shall immediately notify Seller of the same in writing, (2) Purchaser shall not be in default of this Agreement, but Seller shall have the right to terminate this Agreement, in which event the Deposit shall be returned to Purchaser. Purchaser agrees to indemnify, protect, defend (with counsel satisfactory to Seller) and hold harmless Seller Parties from and against any and all claims, damages, losses, liabilities, costs and expenses, including, without limitation, reasonable expenses of investigation and reasonable attorneys’ fees and disbursements arising out of any breach by Purchaser of the representations and warranties in this Section 8.1, and such obligations shall survive Closing or termination of this Agreement.

8.2 Seller’s Representations. Seller represents and warrants to Purchaser as follows as of the date of this Agreement through the Closing:

(a) Each of Seller and its general partners or managing members, if any (i) is duly organized (or formed), validly existing and in good standing under the laws of their

respective state or commonwealth of organization, and (ii) has all necessary power to execute and deliver this Agreement and all documents contemplated hereunder to be executed by them respectively and to perform their respective obligations hereunder and thereunder. This Agreement and all documents contemplated hereunder to be executed by Seller and/or its general partners or managing members, if any, (1) have been duly authorized by all requisite partnership, corporate or other action on the part of Seller and its general partners or managing members, if any, and (2) are the valid and legally binding obligation of Seller and its general partners or managing members, if any, as the case may be, enforceable in accordance with their respective terms. Neither the execution and delivery of this Agreement or any document contemplated hereunder to be executed by Seller or its general partners or managing members, if any, nor the performance of the obligations of Seller or its general partners or managing members, if any, hereunder or thereunder will result in the violation of any law or any provision of the partnership agreement, articles of incorporation, by‑laws or other organizational or governing documents of Seller or its general partners or managing members, if any, nor will conflict with any order or decree of any court or governmental authority by which Seller or its general partners or managing members, if any, are bound.

(b) Neither Seller nor any of its general partners or managing members, if any, (i) has applied for, consented to, acquiesced to, or is subject to the appointment of a receiver, trustee, custodian, liquidator or other similar official for itself or for all or a substantial part of its assets; (ii) is subject to a bankruptcy, insolvency, reorganization, liquidation, dissolution or similar proceeding, or has admitted in writing its inability to pay its debts as they become due; (iii) has made an assignment for the benefit of creditors; (iv) has filed a petition or an answer seeking, consenting to, or acquiescing in a reorganization or an arrangement with creditors, or sought to take advantage of any bankruptcy law, insolvency law or other law for the benefit of debtors; or (v) has filed an answer admitting the material obligations of a petition filed against it in any bankruptcy, insolvency, reorganization, liquidation, dissolution or similar proceeding.

(c) To Seller’s knowledge, there is no agreement to which Seller is a party or binding on Seller which is in conflict with this Agreement. To Seller’s knowledge, there is no action or proceeding pending or threatened against Seller which challenges or impairs Seller’s ability to execute or perform its obligations under this Agreement.

(d) Seller represents and warrants to Purchaser that neither Seller nor, to Seller’s knowledge, any Person who owns a direct or indirect interest in Seller (collectively, a “Seller Party”), is now nor shall be at any time until the Closing under this Agreement a Person with whom a U.S. Person, including a Financial Institution, is prohibited from transacting business of the type contemplated by this Agreement, whether such prohibition arises under United States law, regulation, executive orders and lists published by OFAC (including those executive orders and lists published by OFAC with respect to Specially Designated Nationals and Blocked Persons) or otherwise. Neither Seller nor, to Seller’s knowledge, any Seller Party, nor any Person providing funds to Seller in connection with the transaction contemplated hereby (a) is under investigation by any governmental authority for, or has been charged with, or convicted of, money laundering, drug trafficking, terrorist related activities, any crimes which in the United States would be predicate crimes to money laundering, or any violation of any Anti-Money Laundering Laws; (b) has been

assessed civil or criminal penalties under any Anti-Money Laundering Laws; or (c) has had any of its funds seized or forfeited in any action under any Anti-Money Laundering Laws.

If Seller obtains knowledge that Seller or any owner of a controlling interest in Seller becomes identified on any List or is indicted, arraigned, or custodially detained on charges involving money laundering or predicate crimes to money laundering, then (1) Seller shall immediately notify Purchaser of the same in writing, and (2) Seller shall not be in default of this Agreement, but Purchaser shall have the right to terminate this Agreement, in which event the Deposit shall be returned to Purchaser. Seller agrees to indemnify, protect, defend (with counsel satisfactory to Purchaser) and hold harmless Purchaser Parties from and against any and all claims, damages, losses, liabilities, costs and expenses, including, without limitation, reasonable expenses of investigation and reasonable attorneys’ fees and disbursements arising out of any breach by Seller of the representations and warranties in this Section 8.2, and such obligations shall survive Closing or termination of this Agreement.

(e) Exhibit B-1 attached hereto is a true, accurate and complete list of the Leases (including amendments) in effect as of the date of this Agreement. As of the date of this Agreement, Seller has neither received nor delivered any written notices from or to any of the Tenants under the Leases asserting that either Seller or any such Tenant is in monetary default or non-monetary default in any material respect under any of the respective Leases (other than defaults that have been cured in all material respects) except as disclosed on Exhibit B-1 attached hereto. As of the Effective Date, there are no leases or occupancy agreements affecting the Property by which Seller is bound other than the Leases listed on Exhibit B-1. The copies of the Leases that have been provided or made available to Purchaser are true, correct and complete in all material respects. Without limiting Purchaser’s rights under Section 7.2(e), it is expressly acknowledged and agreed that Seller does not represent or warrant that any particular Lease will be in force and effect on the Closing Date or that the Tenants will have performed their obligations thereunder.

(f) Exhibit B-2 attached hereto is a complete list of the security deposits held by Seller under the Leases as of the date of this Agreement.

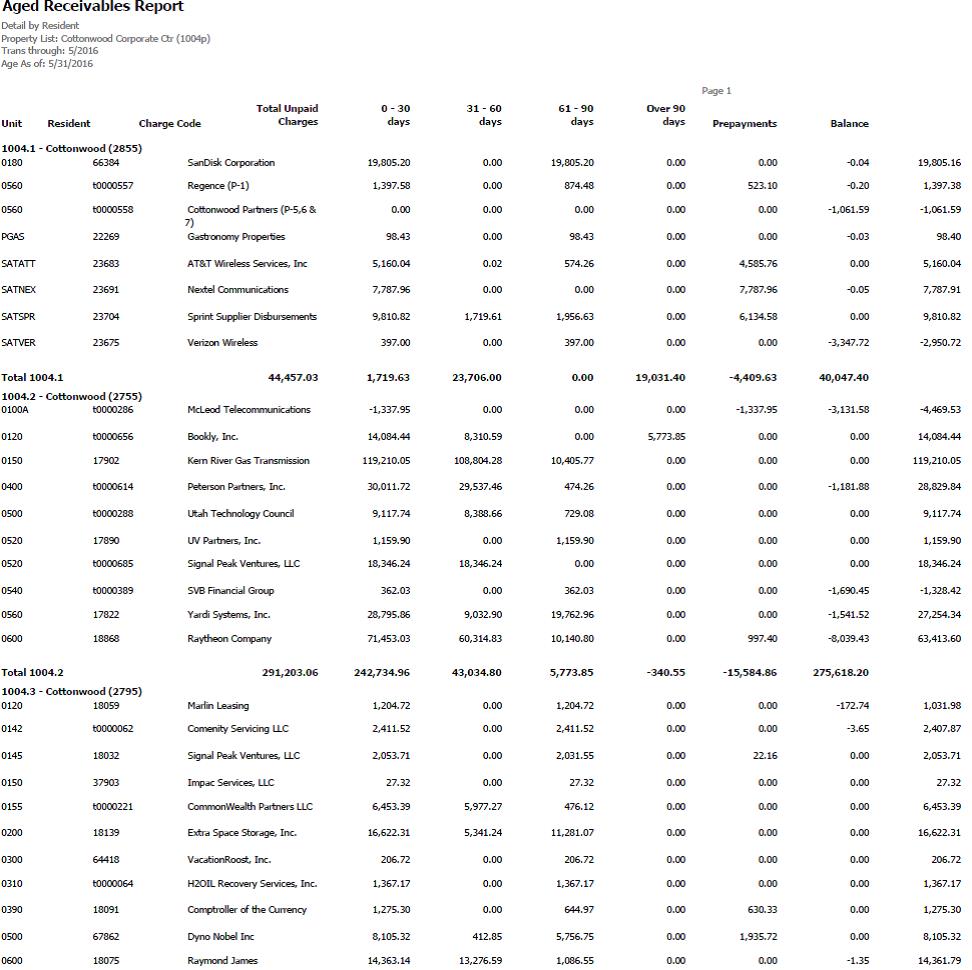

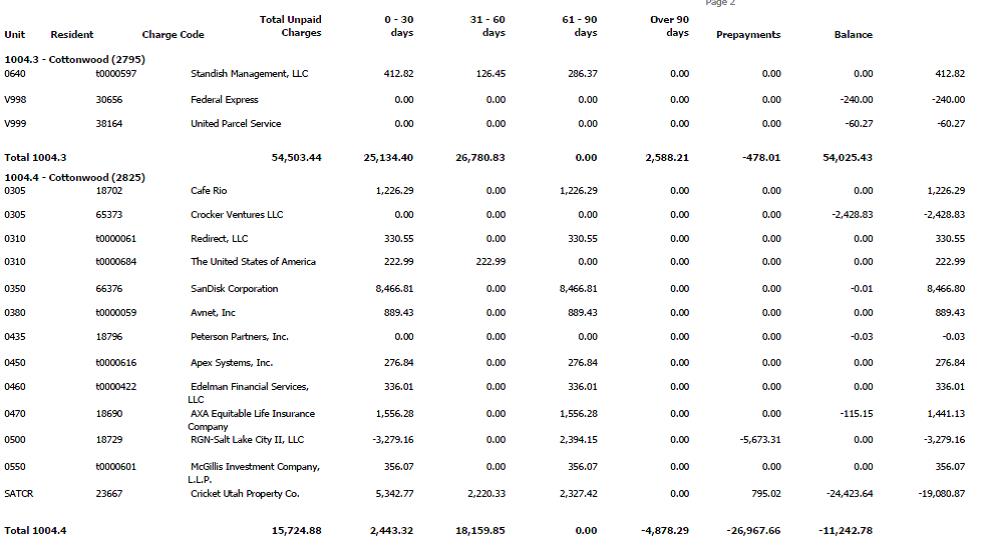

(g) To Seller’s knowledge, Exhibit B-3 attached hereto is a Tenant arrearage schedule which is true, correct and complete in all material respects as of the date set forth thereon.

(h) Exhibit B-4 attached hereto is a complete list of the Contracts in effect as of the date of this Agreement which, subject to Section 4.5, are not intended to be terminated as of the Closing. Seller has neither received nor delivered any written notices from or to any party to any of the Contracts asserting that either Seller or any such party is in material default in any material respect under any of the respective Contracts (other than defaults that have been cured in all material respects). As of the Effective Date, Exhibit B-4 is a true and correct list of all Contracts in effect as of the date hereof and Seller has delivered or made available to Purchaser for review, true and complete copies of all Contracts, as set forth on Exhibit B-4.

(i) As of the date of this Agreement, except for the matters set forth on Exhibit B-6 attached hereto, there is no pending action, suit, litigation, hearing or administrative

proceeding as to which Seller has received written notice with respect to all or any portion of the Property which is not or would not be covered by insurance and which would have a material adverse effect on the use or operation of the Property.

(j) As of the date of this Agreement, there are no pending or threatened condemnation or eminent domain proceedings against the Property with respect to which Seller has received written notice.

(k) Seller is not a “foreign person” or “foreign corporation” as those terms are defined in Section 1445 of the Internal Revenue Code and the regulations promulgated thereunder.

(l) Except as set forth on Exhibit K attached hereto, there are no unpaid Leasing Expenses currently owed with respect to any Lease.

(m) Seller has no employees at the Property.

8.3 General Provisions.

8.3.1 Seller’s Representations Deemed Modified. To the extent Purchaser knows or is deemed to know prior to the Closing that any of Seller’s representations or warranties are inaccurate, untrue or incorrect in any way, Purchaser shall have the rights set forth in Section 8.3.2. For purposes of this Agreement, Purchaser shall be “deemed to know” that a representation or warranty of Seller was untrue, inaccurate or incorrect to the extent that (i) this Agreement, the Title Commitment, the Survey, the documents and other instruments comprising the Personal Property, any document and other information delivered or made available to Purchaser by Seller or any of its representatives, agents or advisors, any estoppel certificate delivered to Purchaser, or any studies, tests, reports or analyses prepared by or for Purchaser or any of its investors, owners, employees, agents, advisors, representatives or consultants (all of the foregoing being herein collectively referred to as “Purchaser’s Representatives”) or otherwise obtained by Purchaser or Purchaser’s Representatives contains information which directly contradicts such representation or warranty; or (ii) information which directly conflicts with such representation or warranty is otherwise disclosed to or becomes known to Purchaser or any of Purchaser’s Representatives prior to the Closing.