Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit31-1.htm |

| EX-23.3 - EXHIBIT 23.3 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit23-3.htm |

| EX-23.2 - EXHIBIT 23.2 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit23-2.htm |

| EX-32.1 - EXHIBIT 32.1 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit32-2.htm |

| EX-23.1 - EXHIBIT 23.1 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2016

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE EXCHANGE ACT

For the transition period from _________ to __________________

000-54416

(Commission File Number)

SCANDIUM INTERNATIONAL MINING

CORP.

(Exact name of registrant as specified in its

charter)

| British Columbia, Canada | 98-1009717 |

| (State or other jurisdiction | (IRS Employer |

| of incorporation or organization) | Identification No.) |

| 1430 Greg Street, Suite 501, Sparks, Nevada | 89431 |

| (Address of principal executive offices) | (Zip Code) |

(775) 355-9500

(Registrant’s telephone

number, including area code)

N/A

(Former name, former address and

former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) filed all

reports required to be filed by sections 13 or 15(d) of the Securities and

Exchange Act of 1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filed [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell

company, as defined in Rule 12b-2 of the Exchange Act.

Yes [

] No [X]

Indicate the number of shares outstanding of each of the

registrant’s classes of common stock, as of the latest practicable date:

As of May 10, 2016, the registrant’s outstanding common stock

consisted of 225,047,200 shares.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

THREE MONTHS ENDED MARCH 31, 2016

| Scandium International Mining Corp. |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Expressed in US Dollars) (Unaudited) |

As at: |

March 31, 2016 | December 31, 2015 | ||||

|

||||||

ASSETS |

||||||

|

||||||

Current |

||||||

Cash |

$ | 1,331,731 | $ | 2,249,676 | ||

Prepaid expenses and receivables |

123,205 | 107,529 | ||||

|

||||||

Total Current Assets |

1,454,936 | 2,357,205 | ||||

|

||||||

Equipment (Note 3) |

4,704 | 2,611 | ||||

Mineral property interests (Note 4) |

942,723 | 942,723 | ||||

|

||||||

Total Assets |

$ | 2,402,363 | $ | 3,302,539 | ||

|

||||||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||

|

||||||

Current |

||||||

Accounts payable and accrued liabilities |

$ | 74,359 | $ | 196,322 | ||

Accounts payable with related parties |

17,239 | 11,009 | ||||

|

||||||

Total Liabilities |

91,598 | 207,331 | ||||

|

||||||

Stockholders’ Equity |

||||||

Capital stock (Note 6)

(Authorized: Unlimited number of common shares; |

91,142,335 | 91,142,335 | ||||

Treasury stock (Note 7) (1,033,333 common shares) |

(1,264,194 | ) | (1,264,194 | ) | ||

Additional paid in capital (Note 6) |

6,771,050 | 6,375,237 | ||||

Accumulated other comprehensive loss |

(853,400 | ) | (853,400 | ) | ||

Deficit |

(92,419,278 | ) | (91,338,182 | ) | ||

|

||||||

Total Stockholders’ Equity |

3,376,513 | 4,061,796 | ||||

|

||||||

Non-controlling Interest in a Subsidiary (Note 10) |

(1,065,748 | ) | (966,588 | ) | ||

|

||||||

Total Equity |

2,310,765 | 3,095,208 | ||||

|

||||||

Total Liabilities and Equity |

$ | 2,402,363 | $ | 3,302,539 |

Nature and continuance of operations (Note 1)

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

| Scandium International Mining Corp. |

| CONDENSED CONSOLIDATED STATEMENTS OF |

| OPERATIONS AND COMPREHENSIVE LOSS |

| (Expressed in US Dollars) (Unaudited) |

|

March 31, 2016 | March 31, 2015 | ||||

3 month period ended |

||||||

|

||||||

|

||||||

EXPENSES |

||||||

Amortization (Note 3) |

$ | 1,064 | $ | 958 | ||

Consulting |

25,500 | 28,000 | ||||

Exploration |

512,289 | 133,606 | ||||

General and administrative |

78,986 | 54,688 | ||||

Insurance |

8,551 | (2,226 | ) | |||

Professional fees |

26,269 | 42,808 | ||||

Salaries and benefits |

115,924 | 116,416 | ||||

Stock-based compensation (Note 6) |

395,813 | 14,314 | ||||

Travel and entertainment |

15,997 | 15,935 | ||||

|

||||||

Loss from operations before other items |

(1,180,393 | ) | (404,499 | ) | ||

|

||||||

|

||||||

OTHER ITEMS |

||||||

Foreign exchange gain (loss) |

137 | (10,463 | ) | |||

Interest expense |

- | (55,692 | ) | |||

|

||||||

|

137 | (66,155 | ) | |||

|

||||||

Loss and comprehensive loss for the period |

(1,180,256 | ) | (470,654 | ) | ||

|

||||||

Costs allocable to non-controlling interest in a subsidiary |

99,160 | - | ||||

|

||||||

Loss and comprehensive loss for the period attributable |

$ | (1,081,096 | ) | $ | (470,654 | ) |

|

||||||

Basic and diluted loss and comprehensive loss per |

$ | 0.01 | $ | 0.00 | ||

|

||||||

Weighted average number of common shares outstanding |

225,047,200 | 198,604,790 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

| Scandium International Mining Corp. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Expressed in US Dollars) (Unaudited) |

3-month period ended |

March 31, 2016 | March 31, 2015 | ||||

|

||||||

|

||||||

CASH FLOWS FROM OPERATING ACTIVITIES |

||||||

Loss for the period |

$ | (1,180,256 | ) | $ | (470,654 | ) |

Items not affecting cash: |

||||||

Amortization |

1,064 | 958 | ||||

Stock-based compensation |

395,813 | 14,314 | ||||

|

||||||

Changes in non-cash working capital items: |

||||||

Decrease (increase) in prepaids and receivables |

(15,676 | ) | 21,725 | |||

Increase (decrease) in accounts payable, accrued liabilities and accounts |

(115,733 | ) | 181,492 | |||

|

(914,788 | ) | (252,165 | ) | ||

CASH FLOWS FROM INVESTING ACTIVITIES |

||||||

Additions to fixed assets |

(3,157 | ) | - | |||

|

(3,157 | ) | - | |||

|

||||||

Change in cash during the period |

(917,945 | ) | (252,165 | ) | ||

Cash, beginning of period |

2,249,676 | 417,386 | ||||

|

||||||

Cash, end of period |

$ | 1,331,731 | $ | 165,221 |

Supplemental disclosure with respect to cash flows (Note 9)

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

| Scandium International Mining Corp. |

| CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN |

| EQUITY |

| (Expressed in US Dollars) (Unaudited) |

|

Accumulated | Total | Non- | ||||||||||||||||||||||||

|

Additional | Treasury | Other | Stockholders’ | controlling | ||||||||||||||||||||||

|

Number of | Paid in | Stock | Comprehensive | Deficit | Equity | Interest in a | ||||||||||||||||||||

|

Shares | Capital Stock | Capital | Loss | Subsidiary | Total Equity | |||||||||||||||||||||

|

|||||||||||||||||||||||||||

Balance, December 31, 2014 |

198,604,790 | $ | 89,186,471 | $ | 2,419,615 | $ | (1,264,194 | ) | $ | (853,400 | ) | $ | (88,567,751 | ) | $ | 920,741 | $ | - | $ | 920,741 | |||||||

Private placements |

23,654,930 | 1,812,047 | - | - | - | - | 1,812,047 | - | 1,812,047 | ||||||||||||||||||

Shares issued in settlement of debt |

2,237,480 | 169,262 | - | - | - | - | 169,262 | - | 169,262 | ||||||||||||||||||

Share issue costs |

- | (60,000 | ) | - | - | - | - | (60,000 | ) | - | (60,000 | ) | |||||||||||||||

Stock options exercised |

550,000 | 34,555 | (10,717 | ) | - | - | - | 23,838 | - | 23,838 | |||||||||||||||||

Stock-based compensation |

- | - | 673,224 | - | - | - | 673,224 | - | 673,224 | ||||||||||||||||||

Sale of 20% of Australian subsidiary |

- | - | 3,293,115 | - | - | - | 3,293,115 | (793,115 | ) | 2,500,000 | |||||||||||||||||

Loss for the year |

- | - | - | - | - | (2,770,431 | ) | (2,770,431 | ) | (173,473 | ) | (2,943,904 | ) | ||||||||||||||

Balance, December 31, 2015 |

225,047,200 | 91,142,335 | 6,375,237 | (1,264,194 | ) | (853,400 | ) | (91,338,182 | ) | 4,061,796 | (966,588 | ) | 3,095,208 | ||||||||||||||

Stock-based compensation |

- | - | 395,813 | - | - | - | 395,813 | - | 395,813 | ||||||||||||||||||

Loss for the period |

- | - | - | - | - | (1,081,096 | ) | (1,081,096 | ) | (99,160 | ) | (1,180,256 | ) | ||||||||||||||

Balance, March 31, 2016 |

225,047,200 | $ | 91,142,335 | $ | 6,771,050 | $ | (1,264,194 | ) | $ | (853,400 | ) | $ | (92,419,278 | ) | $ | 3,376,513 | $ | (1,065,748 | ) | $ | 2,310,765 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

| Scandium International Mining Corp. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| March 31, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 1. | NATURE AND CONTINUANCE OF OPERATIONS |

Scandium International Mining Corp. (the “Company”) is a specialty metals and alloys company focusing on scandium and other specialty metals.

The Company was incorporated under the laws of the Province of British Columbia, Canada in 2006. The Company currently trades on the Toronto Stock Exchange under the symbol “SCY”.

The Company’s focus is on the exploration and evaluation of its specialty metals assets, specifically the Nyngan scandium deposit located in New South Wales, Australia and the Tørdal scandium/rare earth minerals deposit in Norway. In June 2014, the Company made the final installment payment to acquire the Nyngan property. The Company is an exploration stage company and anticipates incurring significant additional expenditures prior to production at any and all of its properties.

In fiscal 2015, the Company settled a $2,500,000 promissory note payable in exchange for a 20% interest in its Australian subsidiary which holds the Nyngan and Honeybugle properties. Accordingly, the Company holds an 80% interest in its Australian subsidiary as at period end.

These condensed consolidated financial statements have been prepared on a going concern basis that contemplates the realization of assets and discharge of liabilities at their carrying values in the normal course of business for the foreseeable future. These financial statements do not reflect any adjustments that may be necessary if the Company is unable to continue as a going concern.

The Company currently earns no operating revenues and will require additional capital in order to advance both the Nyngan and Tørdal properties. The Company’s ability to continue as a going concern is uncertain and is dependent upon the generation of profits from mineral properties, obtaining additional financing and maintaining continued support from its shareholders and creditors. These are material uncertainties that raise substantial doubt about the Company’s ability to continue as a going concern. In the event that additional financial support is not received or operating profits are not generated, the carrying values of the Company’s assets may be adversely affected.

| 2. | BASIS OF PRESENTATION |

Basis of presentation

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”). The interim condensed consolidated financial statements include the consolidated accounts of the Company and its wholly-owned subsidiaries with all significant intercompany transactions eliminated. In the opinion of management, all adjustments necessary for a fair statement of the consolidated financial position, results of operations and cash flows for the interim periods have been made. Certain information and footnote disclosures normally included in the consolidated financial statements prepared in accordance with generally accepted accounting principles of the United States of America (“US GAAP”) have been condensed or omitted pursuant to such SEC rules and regulations. These interim condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2015 and with our Annual Report on Form 10-K filed with the SEC on March 15, 2016. Operating results for the three-month period ended March 31, 2016 may not necessarily be indicative of the results for the year ending December 31, 2016.

These unaudited condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, EMC Metals USA Inc., Wolfram Jack Mining Corp., and The Technology Store, Inc. Non-controlling interest represents the minority shareholders’ 20% proportionate share of the net assets and results of the Company’s majority-owned Australian subsidiary, EMC Metals Australia Pty Ltd., from the date the 20% interest was disposed by the Company (Note 4). All significant intercompany accounts and transactions have been eliminated on consolidation.

Use of estimates

The preparation of unaudited interim condensed consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the deferred income tax asset valuations, asset impairment, stock-based compensation and loss contingencies. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between estimates and the actual results, future results of operations will be affected.

Fair value of financial assets and liabilities

The Company measures the fair value of financial assets and liabilities based on US GAAP guidance which defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements.

The Company classifies financial assets and liabilities as held-for-trading, available-for-sale, held-to-maturity, loans and receivables or other financial liabilities depending on their nature. Financial assets and financial liabilities are recognized at fair value on their initial

6

| Scandium International Mining Corp. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| March 31, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 2. | BASIS OF PRESENTATION (cont’d…) |

recognition, except for those arising from certain related party transactions which are accounted for at the transferor’s carrying amount or exchange amount.

Financial assets and liabilities classified as held-for-trading are measured at fair value, with gains and losses recognized in net income. Financial assets classified as held-to-maturity, loans and receivables, and financial liabilities other than those classified as held-for-trading are measured at amortized cost, using the effective interest method of amortization. Financial assets classified as available-for-sale are measured at fair value, with unrealized gains and losses being recognized as other comprehensive income until realized, or if an unrealized loss is considered other than temporary, the unrealized loss is recorded in income.

Financial instruments, including receivables, accounts payable and accrued liabilities, and accounts payable with related parties are carried at amortized cost, which management believes approximates fair value due to the short term nature of these instruments.

The following table presents information about the assets that are measured at fair value on a recurring basis as at March 31, 2016, and indicates the fair value hierarchy of the valuation techniques the Company utilized to determine such fair value. In general, fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets. Fair values determined by Level 2 inputs utilize data points that are observable such as quoted prices, interest rates and yield curves. Fair values determined by Level 3 inputs are unobservable data points for the asset or liability, and included situations where there is little, if any, market activity for the asset:

|

Quoted Prices | Significant Other | Significant | ||||||||||

|

March 31, | in Active Markets | Observable Inputs | Unobservable Inputs | |||||||||

|

2016 | (Level 1) | (Level 2) | (Level 3) | |||||||||

Assets: |

|||||||||||||

Cash |

$ | 1,331,731 | $ | 1,331,731 | $ | — | $ | — | |||||

|

|||||||||||||

Total |

$ | 1,331,731 | $ | 1,331,731 | $ | — | $ | — |

The carrying value of receivables, accounts payable and accrued liabilities, and accounts payable with related parties approximate their fair value due to their short-term nature.

The fair value of cash are determined through market, observable and corroborated sources.

Recently Adopted and Recently Issued Accounting Standards

Accounting Standards Update 2016-01 – Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. This accounting pronouncement, which goes into effect December 12, 2017, is far reaching and covers several presentation areas dealing with measurement, impairment, assumptions used in estimating fair value and several other areas. The Company is reviewing this update to determine the impact it may have on its financial statements.

Accounting Standards Update 2015-17 – Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes. This accounting pronouncement requires that deferred tax liabilities and assets be classified as noncurrent in a classified statement of financial position. Currently deferred tax liabilities and assets must be presented as current and noncurrent. The policy is effective December 16, 2016. The Company is evaluating this guidance and believes it will have little impact on the presentation of its financial statements.

Accounting Standards Update 2015-02 - Consolidation (Topic 810) - Amendments to the Consolidation Analysis. This update provides guidance with respect to the analysis that a reporting entity must perform to determine whether it should consolidate certain types of legal entities. The amendments in this Update are effective for public business entities for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2015. The Company has adopted this standard which has little impact on the presentation of its financial statements.

Accounting Standards Update 2015-01 - Income Statement—Extraordinary and Unusual Items (Subtopic 225-20). This Update is part of an initiative to reduce complexity in accounting standards (the Simplification Initiative). This Update eliminates from GAAP the concept of extraordinary items. The amendments in this Update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. The Company has adopted this standard which will only have an impact on its presentation of its financial statements should an extraordinary or unusual event take place.

Accounting Standards Update 2014-15 – Presentation of Financial Statements – Going Concern (Subtopic 205-40). This accounting pronouncement provides guidance in GAAP about management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to provide related footnote disclosures. In doing so, the amendments should reduce diversity in the timing and content of footnote disclosures. The policy is effective December 15, 2016. The Company is evaluating this guidance and believes it will have little impact on the presentation of its financial statements.

7

| Scandium International Mining Corp. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| March 31, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 3. | EQUIPMENT |

|

December 31, | Additions | |||||||||||

|

2015 Net Book | (disposals) | March 31, 2016 | ||||||||||

|

Value | (write-offs) | Amortization | Net Book Value | |||||||||

Computer equipment |

$ | 1,017 | $ | 3,157 | $ | (275 | ) | $ | 3,899 | ||||

Office equipment |

1,594 | - | (789 | ) | 805 | ||||||||

|

|||||||||||||

| $ | 2,611 | $ | 3,157 | $ | (1,064 | ) | $ | 4,704 |

|

December 31, | Additions | December 31, | ||||||||||

|

2014 Net Book | (disposals) | 2015 Net Book | ||||||||||

|

Value | (write-offs) | Amortization | Value | |||||||||

Computer equipment |

$ | 1,696 | $ | - | $ | (679 | ) | $ | 1,017 | ||||

Office equipment |

4,748 | (3,154 | ) | 1,594 | |||||||||

| $ | 6,444 | $ | - | $ | $ (3,833 |

) | $ | 2,611 |

| 4. | MINERAL PROPERTY INTERESTS |

|

Scandium and | |||

March 31, 2016 |

other | |||

|

||||

Acquisition costs |

||||

|

||||

Balance, December 31, 2015 |

$ | 942,723 | ||

Additions |

- | |||

Balance March 31, 2016 |

$ | 942,723 |

|

Scandium and | |||

December 31, 2015 |

other | |||

|

||||

Acquisition costs |

||||

|

||||

Balance, December 31, 2014 |

$ | 3,012,723 | ||

Sale of net smelter royalty |

(2,070,000 | ) | ||

Balance December 31, 2015 |

$ | 942,723 |

Title to mineral property interests involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyancing history characteristic of many mineral property interests. The Company has investigated title to all of its mineral property interests and, to the best of its knowledge, title to all of its properties is in good standing.

On October 13, 2015, the Company received US$2.07M from a private investor in return for the granting of a 0.7% royalty on gross mineral sales from both the Nyngan property and the Honeybugle property. The amount received in return for the royalty interest was deducted from the value of the mineral interests of Nyngan and Honeybugle.

SCANDIUM PROPERTIES

Nyngan, New South Wales Property

On February 6, 2013, the Company announced that it had acquired 100% of the Nyngan property, in return for AUD$2.6 million cash payments and a percentage royalty payable to its previous partner on sales of product from the project.

During fiscal 2015, the Company settled a $2,500,000 promissory note payable in exchange for a 20% interest in its Australian subsidiary which holds title to both the Nyngan and Honeybugle properties.

Royalties attached to the Nyngan property include a 1.5% Net Profits Interest royalty to private parties involved with the early exploration on the property, and a 1.7% Net Smelter Returns royalty payable to Jervois for 12 years after production commences,

8

| Scandium International Mining Corp. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| March 31, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 4. | MINERAL PROPERTY INTERESTS (cont’d…) |

subject to terms in the settlement agreement. Another revenue royalty is payable to private interests of 0.2%, subject to a $370,000 cap. A New South Wales minerals royalty will also be levied on the project, subject to negotiation, currently 4% on revenue.

Honeybugle property, Australia

In April of 2014 the Company also acquired an exploration license referred to as the Honeybugle property, a prospective scandium exploration property located 24 kilometers from the Nyngan Project. As described in the previous Nyngan Property section, during fiscal 2015, the Company settled its $2,500,000 promissory note payable in exchange for a 20% interest in its Australian subsidiary which holds title to both the Nyngan and Honeybugle properties.

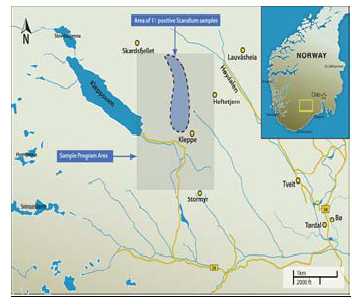

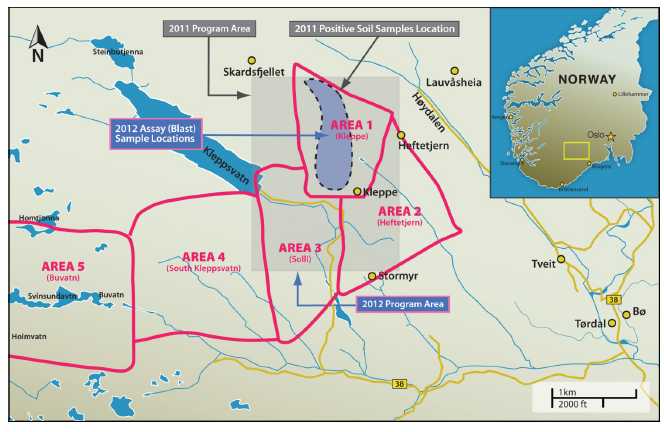

Tørdal and Evje-Iveland properties, Norway

During 2012 the Company entered into an option agreement with REE Mining AS (“REE”) to earn up to a 100% interest in the Tørdal and Evje-Iveland properties pursuant to which the Company paid $130,000 and issued 1,000,000 common shares valued at $40,000. The Company subsequently renegotiated the payments required to earn the interest and the Evje-Iveland property was removed from the option agreement. Pursuant to the amendment, the Company earned a 100% interest in the Tørdal property by paying an additional $35,000 and granting a 1% Net Smelter Return (“NSR”) payable to REE.

| 5. | RELATED PARTY TRANSACTIONS |

During the 3-month period ended March 31, 2016, the Company expensed $301,363 for stock-based compensation for stock options issued to Company directors. During the 3-month period ended March 31, 2015, the Company expensed $Nil for stock-based compensation for stock options issued to Company directors.

During the 3-month period ended March 31, 2016, the Company paid a consulting fee of $25,500 for one of its directors. During the 3-month period ended March 31, 2015, the Company paid a consulting fee of $25,500 for one of its directors.

| 6. | CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL |

On September 1, 2015, the Company issued 1,982,850 common shares at a value of C$0.10 per common share for total proceeds of C$198,285 ($150,000).

On August 31, 2015, the Company issued 2,237,480 common shares at a value of C$0.10 per common share in settlement of interest payable on the promissory note with a fair value of C$223,748 ($169,262).

On August 24, 2015, the Company issued 21,672,080 common shares at a value of C$0.10 per common share for total proceeds of C$2,167,208 ($1,662,047). The Company paid $60,000 in share issuance costs with regard to this common share issue.

Stock Options and Warrants

The Company established a stock option plan (the “Plan”) under which it is authorized to grant options to executive officers and directors, employees and consultants and the number of options granted under the Plan shall not exceed 15% of the shares outstanding. Under the Plan, the exercise period of the options may not exceed ten years from the date of grant and vesting is determined by the Board of Directors.

9

| Scandium International Mining Corp. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| March 31, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 6. | CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL (cont’d…) |

Stock option transactions are summarized as follows:

|

Stock Options | ||||||

|

|||||||

|

Weighted average | ||||||

|

Number | exercise price in Canadian $ | |||||

|

|||||||

|

|||||||

Outstanding, December 31, 2014 |

15,378,750 | $ | 0.11 | ||||

Granted |

5,350,000 | 0.14 | |||||

Cancelled |

(2,568,750 | ) | 0.16 | ||||

Exercised |

(550,000 | ) | 0.05 | ||||

|

|||||||

Outstanding, December 31, 2015 |

17,610,000 | 0.12 | |||||

Granted |

4,860,000 | 0.13 | |||||

Cancelled |

- | - | |||||

Exercised |

- | - | |||||

|

|||||||

Outstanding, March 31, 2016 |

22,470,000 | $ | 0.12 | ||||

|

|||||||

Number currently exercisable |

21,357,000 | $ | 0.12 | ||||

As at March 31, 2016, incentive stock options were outstanding as follows:

|

Exercise | ||||||

Number of |

Price in | ||||||

options |

Canadian $ | Expiry Date |

|||||

|

|||||||

Options |

|||||||

4,300,000 |

0.100 | November 5, 2020* |

|||||

250,000 |

0.315 | May 4, 2016** |

|||||

500,000 |

0.250 | May 16, 2016 |

|||||

300,000 |

0.155 | September 15, 2016 |

|||||

2,285,000 |

0.080 | April 24, 2017 |

|||||

150,000 |

0.120 | July 25, 2017 |

|||||

1,400,000 |

0.070 | August 8, 2017 |

|||||

1,000,000 |

0.100 | May 9, 2018 |

|||||

3,375,000 |

0.120 | July 25, 2019 |

|||||

200,000 |

0.100 | December 30, 2019 |

|||||

3,450,000 |

0.140 | April 17, 2020 |

|||||

400,000 |

0.115 | August 28, 2020 |

|||||

4,860,000 |

0.130 | February 8, 2021 |

|||||

|

|||||||

22,470,000 |

* These options were extended by the Company shareholder’s at the Company’s annual meeting in October 2015. The Company recognized an additional expense of $281,962 related to this extension during the year ended December 31, 2015. Black-Scholes option pricing model assumptions used were a risk-free interest rate of 1.49%, expected life of 5 years, with a 0.00% forfeiture and dividend rate as well as a volatility rate of 145.92% . ** These options expired unexercised on May 4, 2016.

As at March 31, 2016 the Company’s outstanding and exercisable stock options have an aggregate intrinsic value of $1,168,470 (2015 - $305,291).

As at March 31, 2016, and December 31, 2015, there were no warrants outstanding.

Stock-based compensation

During the 3-month period ended March 31, 2016, the Company recognized stock-based compensation of $1,168,470 (March 31, 2015 - $305,291) in the statement of operations and comprehensive loss as a result of incentive stock options granted, vested and extended in the current period. There were 4,860,000 stock options issued during the 3-month period ended March 31, 2016 (March 31, 2015 – Nil).

The weighted average fair value of the options granted in the quarter was C$0.13 (2015 - Nil).

10

| Scandium International Mining Corp. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| March 31, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 6. | CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL (cont’d…) |

The fair value of all compensatory options granted is estimated on grant date using the Black-Scholes option pricing model. The weighted average assumptions used in calculating the fair values are as follows:

|

2016 | 2015 | |||||

|

|||||||

Risk-free interest rate |

1.14% | N/A | |||||

Expected life |

5 years | N/A | |||||

Volatility |

141.21% | N/A | |||||

Forfeiture rate |

0.00% | N/A | |||||

Dividend rate |

0.00% | N/A |

| 7. | TREASURY STOCK |

|

|||||||

|

Number | Amount | |||||

|

|||||||

Treasury shares, March 31, 2016 and December 31 2015 |

1,033,333 | $ | 1,264,194 | ||||

|

|||||||

|

1,033,333 | $ | 1,264,194 |

Treasury shares comprise shares of the Company which cannot be sold without the prior approval of the TSX.

| 8. | SEGMENTED INFORMATION |

The Company’s mineral properties are located in Norway and Australia. The Company’s capital assets’ geographic information is as follows:

March 31, 2016 |

Norway | Australia | United States | Total | |||||||||

|

|||||||||||||

Equipment |

$ | - | $ | - | $ | 4,704 | $ | 4,704 | |||||

Mineral property interests |

238,670 | 704,053 | - | 942,723 | |||||||||

|

|||||||||||||

|

$ | 238,670 | $ | 704,053 | $ | 4,704 | $ | 947,427 |

December 31, 2015 |

Norway | Australia | United States | Total | |||||||||

|

|||||||||||||

Equipment |

$ | - | $ | - | $ | 2,611 | $ | 2,611 | |||||

Mineral property interests |

238,670 | 704,053 | - | 942,723 | |||||||||

|

|||||||||||||

|

$ | 238,670 | $ | 704,053 | $ | 2,611 | $ | 945,334 |

11

| Scandium International Mining Corp. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| March 31, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 9. | SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS |

|

|||||||

|

2016 | 2015 | |||||

|

|||||||

Cash paid during the 3-month period for interest |

$ | - | $ | 56,250 | |||

|

|||||||

Cash paid during the 3-month period for income taxes |

$ | - | $ | - |

| 10. | EMC METALS AUSTRALIA PTY LTD |

On August 24, 2015 the Company’s $2,500,000 promissory note payable converted into a 20% ownership interest in EMC Metals Australia Pty Ltd (“EMC Australia”), with the Company holding an 80% ownership interest. EMC Australia holds the Company’s interests in the Nyngan Scandium Project and Honeybugle Scandium property. Upon conversion of the promissory note payable, EMC Australia is now operated as a joint venture between Scandium Investments LLC (“SIL”) and the Company. SIL holds a carried interest in the Nyngan Scandium Project and is not required to contribute cash for the operation of EMC Australia until the Company meets two development milestones: (1) filing a feasibility study on SEDAR, and (2) receiving a mining license on either joint venture property. At such time as the two development milestones are met, SIL becomes fully participating on project costs thereafter.

Completion of the development milestones by the Company, as described above, activates a second one-time, limited period option for SIL to elect to convert the fair market value of its 20% joint venture interest in the Nyngan Scandium Project and Honeybugle Scandium property into an equivalent value of the Company’s common shares, at then prevailing market prices, rather than continue with ownership at the project level.

EMC Australia is consolidated in the Company’s Consolidated Financial Statements for the 3-month period ended March 31, 2016 as a non-controlling interest.

| 11. | SUBSEQUENT EVENTS |

A technical report on the feasibility study entitled “Feasibility Study – Nyngan Scandium Project, Bogan Shire, NSW, Australia” dated May 4, 2016 was compiled pursuant to the requirements of NI 43-101. The report was filed on May 6, 2016 and is available on SEDAR (www.sedar.com) and on the Company’s website (www.scandiummining.com).

12

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of the operating results, corporate activities and financial condition of Scandium International Mining Corp. (hereinafter referred to as “we”, “us”, “Scandium International”, “SCY”, or the “Company”) and its subsidiaries provides an analysis of the operating and financial results between December 31, 2015 and March 31, 2016 and a comparison of the material changes in our results of operations and financial condition between the three-month period ended March 31, 2015 and the three-month period ended March 31, 2016. This discussion should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the year ended December 31, 2015.

This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including, but not limited to, those set forth under the heading “Risk Factors and Uncertainties” in our Annual Report on Form 10-K for the year ended December 31, 2015, and elsewhere in this Quarterly Report on Form 10-Q.

The interim statements have been prepared in accordance with US Generally Accepted Accounting Principles (“US GAAP”) as required under U.S. federal securities laws applicable to the Company, and as permitted under applicable Canadian securities laws. The Company is a reporting company under applicable securities laws in Canada and the United States. The reporting currency used in our financial statements is the United States Dollar.

The information contained within this report is current as of May 10, 2016 unless otherwise noted. Additional information relevant to the Company’s activities can be found on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Technical information in this MD&A has been reviewed and approved by Willem Duyvesteyn, a Qualified Person as defined by Canadian National Instrument 43-101 (“NI 43-101”). Mr. Duyvesteyn is a director and consultant of Scandium International.

Cautionary Note to U.S. Investors Regarding Reserve and Resource Estimates

The Company uses Canadian Institute of Mining, Metallurgy and Petroleum definitions for the terms “proven reserves”, “probable reserves”, “measured resources” and “indicated resources”. U.S. investors are cautioned that while these terms are recognized and required by Canadian regulations, including National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), the U.S. Securities and Exchange Commission (“SEC”) does not recognize them. Canadian mining disclosure standards differ from the requirements of the SEC under SEC Industry Guide 7, and reserve and resource information referenced in this Form 10-Q may not be comparable to similar information disclosed by companies reporting under U.S. standards. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve”. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources” or “indicated mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. Disclosure of “contained ounces” in a resource estimate is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves in compliance with NI 43-101 may not qualify as “reserves” under SEC standards.

Cautionary Note Regarding Forward-Looking Statements

Certain statements made in this Quarterly Report on Form 10-Q may constitute “forward-looking statements about the Company and its business. Forward looking statements are statements that are not historical facts and include, but are not limited to, reserve and resource estimates, estimated value of the project, projected investment returns, anticipated mining and processing methods for the project, the estimated economics of the project, anticipated Scandium recoveries, production rates, Scandium grades, estimated capital costs, operating cash costs and total production costs, planned additional processing work and environmental permitting. The forward-looking statements in this report are subject to various risks, uncertainties and other factors that could cause the Company's actual results or achievements to differ materially from those expressed in or implied by forward looking statements. These risks, uncertainties and other factors include, without limitation risks related to uncertainty in the demand for Scandium and pricing assumptions; uncertainties related to raising sufficient financing to fund the project in a timely manner and on acceptable terms; changes in planned work resulting from logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company's properties; uncertainties involved in the estimation of Scandium reserves and resources; the possibility that required permits may not be obtained on a timely manner or at all; the possibility that capital and operating costs may be higher than currently estimated and may preclude commercial development or render operations uneconomic; the possibility that the estimated recovery rates may not be achieved; risk of accidents, equipment breakdowns and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; risks related to projected project economics, recovery rates, and estimated NPV and anticipated IRR and other factors identified in the Company's SEC filings and its filings with Canadian securities regulatory authorities. Forward-looking statements are based on the beliefs, opinions and expectations of the Company's management at the time they are made, and other than as required by applicable securities laws, the Company does not assume any obligation to update its forward-looking statements if those beliefs, opinions or expectations, or other circumstances, should change.

Scandium International Corporate Overview

Scandium International is a specialty metals and alloys company focusing on scandium and other specialty metals. The Company intends to utilize its knowhow and, in certain instances, patented technologies to maximize opportunities in scandium and other specialty metals.

The Company was formed in 2006, under the name Golden Predator Mines Inc. As part of a reorganization and spin-out of the Company’s precious metals portfolio in March 2009, the Company changed its name to EMC Metals Corp. In order to reflect our emphasis on mining for scandium minerals, effective November 19, 2014, we changed our name to Scandium International Mining Corp. The Company currently trades on the Toronto Stock Exchange (the “TSX”) under the symbol “SCY”.

Our focus of operations is the exploration and development of the Nyngan scandium deposit located in New South Wales (“NSW”), Australia (“Nyngan” or the “Nyngan Scandium Project”). We also hold an exploration stage property in Norway, known as the Tørdal scandium/rare earth minerals property.

We acquired a 100% interest in the Nyngan Scandium Project in June of 2014 pursuant to the terms of a settlement agreement with Jervois Mining Ltd. of Melbourne, Australia. The project is held through our Australian subsidiary, EMC Metals Australia Pty Ltd.

During Q3 of 2015, the Company converted a $2,500,000 loan into a 20% minority interest in its Australian subsidiary which holds the Nyngan and Honeybugle scandium properties. The Company currently holds an 80% equity interest in its Australian subsidiary.

During the first quarter of 2016, we focused on Nyngan Scandium Project activities including scandium marketing arrangements, and completion of a definitive feasibility study (“DFS”) and an environmental impact statement (“EIS”).

Principal Properties Review

Nyngan Scandium Project (NSW, Australia)

On February 5, 2010, SCY entered into the JV Agreement with Jervois to co-develop Nyngan. The JV Agreement gave SCY the right to earn a 50% interest in a joint venture with Jervois for the purpose of holding and developing Nyngan, provided SCY met certain technical and financial milestones. SCY met all financial requirements and delivered evidence of technical milestone achievement to Jervois on February 24, 2012.

On February 27, 2012, Jervois formally rejected SCY’s claim to have met the earn-in conditions specified in the JV. The parties discussed and successfully reached an agreed settlement in February 2013 that resolved all issues in dispute. The terms of the binding settlement provided for the transfer of 100% ownership and control of Nyngan, including the relevant exploration tenements and surface (freehold) land holdings, to the Company, in return for A$2.6 million in future cash payments. The settlement agreement also applied a production royalty on the Nyngan Scandium Project of 1.7% of sales for products produced from the site, payable to Jervois. The royalty has a 12-year term from first production date, and a minimum royalty calculated on the basis of sales in that year of 10 tonnes of scandium oxide.

In June of 2014, the Company completed the second of two settlement payments required under its agreement with Jervois. Formal transfer of the Nyngan exploration licenses to SCY’s Australian subsidiary has been completed.

With regard to the payoff of Jervois settlement payments, on June 24, 2014, SCY entered into a $2.5 million loan facility with Scandium Investments LLC (“SIL”), a company owned by a US private investor group (the “2014 Loan”). The proceeds of the 2014 Loan were applied to pay the A$1.3 million final payment to Jervois in order for SCY to acquire a 100% interest in Nyngan (pursuant to the terms of a settlement agreement with Jervois entered into in February of 2013). The balance of the proceeds of the 2014 Loan was applied to repay $1.2 million in maturing debt. The 2014 Loan had a maturity date of December 24, 2015.

In accordance with the terms of the 2014 Loan, the outstanding principal and interest automatically converted into an effective 20% joint venture interest in both our Nyngan Scandium Project and our exploration license, referred to as the Honeybugle Scandium property at the time the Company meets a funding milestone (defined as raising $3.0 million in equity). The funding milestone was met on August 24, 2015 and the 2014 Loan has converted into a 20% ownership interest in EMC Metals Australia Pty Ltd (EMC Australia”), with SCY holding an 80% ownership interest. EMC Australia holds our interest in the Nyngan Scandium Project and the Honeybugle Scandium property. Under the terms of the 2014 Loan, upon conversion of the loan EMC Australia will be operated as a joint venture between SIL and SCY with SIL holding a carried interest in the Nyngan Scandium Project until the Company meets two development milestones: (1) filing a feasibility study on SEDAR, and (2) receiving a mining license on either joint venture property. At such time as the two development milestones are met, SIL becomes fully participating on project costs thereafter.

Completion of the development milestones by the Company, as described above, will activate a second one-time, limited period option for the joint venture partner to elect to convert the fair market value of its 20% joint venture interest in the Nyngan Scandium Project and Honeybugle Scandium property into an equivalent value of the Company’s common shares, at then prevailing market prices, rather than continue with ownership at the project level.

Substantial Nyngan project metallurgical test work has been completed, and additional process optimization work in this area is planned for 2016. The Company has engaged the engineering firm Lycopodium Minerals Pty Ltd, of Brisbane, QLD, Australia (“Lycopodium”), to lead a feasibility study (“Feasibility Study” or “DFS”) on the Nyngan Scandium Project. Key findings from the DFS have been reported in a news release dated April 18, 2016 and the full Feasibility Study wascompleted during May 2016. Additional detail regarding the Feasibility Study is contained in the following section titled “Nyngan Feasibility Study”.

Nyngan Property Description and Location

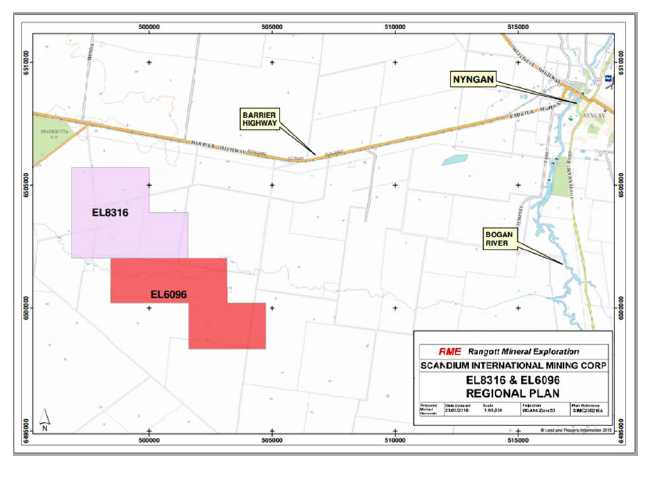

The Nyngan Scandium Project site is located approximately 450 kilometres northwest of Sydney, NSW, Australia and approximately 20 kilometres due west of the town of Nyngan, a rural town of approximately 2900 people. The deposit is located 5 kilometres south of Miandetta, off the Barrier Highway that connects the town of Nyngan to the town of Cobar. The license area can be reached via the paved Barrier Highway, which allows year-round access, but final access to the site itself will be reached by clay farm tracks. The general area can be characterized as flat countryside and is classified as agricultural land, used predominantly for wheat farming and livestock grazing. Infrastructure in the area is good, with available water and electric power in close proximity to the property boundaries.

The Nyngan property is classified as an Australia Property for purposes of financial statement segment information.

The scandium resource is hosted within the lateritic zone of the Gilgai Intrusion, one of several Alaskan-type mafic and ultramafic bodies that intrude Cambrian-Ordovician metasediments collectively called the Girilambone Group. The laterite zone, locally up to 40 meters thick, is layered with hematitic clay at the surface followed by limonitic clay, saprolitic clay, weathered bedrock and finally fresh bedrock. The scandium mineralization is concentrated within the hematitic, limonitic, and saprolitic zones with values up to 350 ppm scandium.

The specific location of the exploration licenses that we may earn an interest in are provided in Figure 2 below.

Figure 1: Location of Nyngan Project

Figure 2: Location of the Exploration Licenses

Metallurgy Development

The Company has invested in and developed methodology for extracting scandium from the Nyngan property resource since 2010. A portion of the work done over this period has been superseded by work that followed, but subsequent test programs universally benefitted from prior efforts. In summary, the programs have been as follows:

| • |

2010 – The Company inherited work done on Nyngan from Jervois, and applied that work to a quick flowsheet and capital estimate prepared for management by Roberts & Schaefer of Salt Lake City, Utah; | |

| • |

2011 - The Company employed Hazen Research, Inc., of Golden, Colorado, USA (“Hazen”) to test acid baking techniques and solvent extraction (“SX”) processes with Nyngan resource material. The Company also employed SGS-Lakefield (Ontario) to test pressure acid leach techniques on Nyngan resource, as a replacement for or an enhancement to acid bake techniques done earlier in the year by Hazen; | |

| • |

2012 – The Company engaged SNC-Lavalin to do an economic study for management, utilizing an acid bake flowsheet and SX work from the Hazen test program; | |

| • |

2014 - The Company published a preliminary economic assessment (“PEA”) entitled NI 43- 101F1 Technical Report on the Feasibility of the Nyngan Scandium Project, authored by Larpro Pty Ltd, utilizing both Hazen and SGS-Lakefield testwork results; and | |

| • |

2015 – The Company amended and refiled the 2014 PEA Report as the “Amended Technical Report and Preliminary Economic Analysis on the Nyngan Scandium Project, NSW, Australia”. |

In February of 2011, we announced results of a series of laboratory-scale tests investigating the production of scandium-aluminum (“Sc-Al”) alloys directly from aluminum oxide and scandium oxide feed materials, prepared by the CSIRO. The overall objective of this research was to demonstrate and commercialize the production of Sc-Al master alloy using impure scandium oxide as the scandium source, potentially significantly improving the economics of scandium aluminum master alloy production.

Nyngan Feasibility Study

On April 18, 2016 the Company announced the results of a feasibility study on the Nyngan Scandium Project. Lycopodium led the Feasibility Study from their Brisbane, Australia office with supporting input from Mining One consultants of Melbourne, Australia, Knight Piésold Pty Ltd of South Brisbane, Australia, Altrius Engineering Services of Brisbane, Australia, and Rangott Mineral Exploration Pty Ltd of Orange, Australia.

The feasibility study concluded that the Nyngan Scandium Project has the potential to produce an average of 37,690 kilograms of scandium oxide (scandia) per year, at grades of 98.0% -99.9%, generating an after tax cumulative cash flow over a 20 year Project life of US$629 million, with an NPV10% of US$177 million. The average process plant feed grade over the 20 year Project life is 409ppm of scandium.

The financial results of the feasibility study are based on a conventional flow sheet, employing continuous HPAL and SX techniques. The flow sheet was modeled and validated from METSIM modeling and considerable bench scale/pilot scale metallurgical test work utilising Nyngan resource material. A number of the key elements of this flowsheet work have been protected by the Company under US Patent Applications.

The Feasibility Study has been developed and compiled to an accuracy level of +15%/-5%, by a globally recognized engineering firm that has considerable expertise in laterite deposits and process facilities, as well as in smaller mining and processing projects, and has excellent familiarity with the Nyngan Scandium Project location and environment.

NI 43-101 Technical Report

A technical report on the feasibility study entitled “Feasibility Study – Nyngan Scandium Project, Bogan Shire, NSW, Australia” dated May 4, 2016 was compiled by Lycopodium pursuant to the requirements of NI 43-101. The report was filed on May 6, 2016 and is available on SEDAR (www.sedar.com) and on the Company’s website (www.scandiummining.com).

Nyngan Scandium Project Financial Highlights and Key Assumptions

The Feasibility Study found that the Nyngan Scandium Project has the potential for attractive economics, based on a capital estimate supported by conventional process designs and direct vendor pricing. The Feasibility Study is expressed in US dollar (US$) currency, unless otherwise noted. A foreign exchange rate of US$0.70 (1A$=US$0.70) was applied in all conversions. No escalation for inflation was assumed in cash flows. All cash flows and discounted cash flows (NPVs and IRRs) in this news release are shown on an after-tax basis, based on a 30% Australian corporate tax rate.

Financial highlights are as follows:

Table 1. Nyngan Scandium Project - Feasibility Study Financial Highlights

| Summary | NI 43-101 |

| Nyngan Scandium Project | DFS |

| Key Project Parameters | Result |

| Capital Cost Estimate (US$ M) | $87.1 |

| Average Plant Feed Grade (ppm Sc) | 409 |

| Resource Processed (tpy) | 71,820 |

| Mill Recovery (%) | 83.7% |

| Oxide Production (kg per year) | 37,690 |

| Scandium Oxide (Scandia) Product Grade | 98-99.9% |

| Annual Cash Operating Cost (US$ M) | $21.0 |

| Unit Cash Cost (US$/kg Oxide) | $557 |

| Oxide Price Assumption (US$/kg) | $2,000 |

| Annual Revenue (US$ millions) | $75.4 |

| Annual EBITDA (US$ millions) | $49.5 |

| NPV (10%i) (After Tax) | $177.5 |

| NPV (8%i) (After Tax) | $225.4 |

| IRR (%) (After Tax) | 33.1% |

| Payback (years) | 3.3 |

Mineral Resource Estimate

We advise U.S. investors that while the terms “measured resources,” and “indicated resources” are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize these terms. U.S. investors are cautioned not to assume that any part or all of the material in these categories will be converted into reserves.

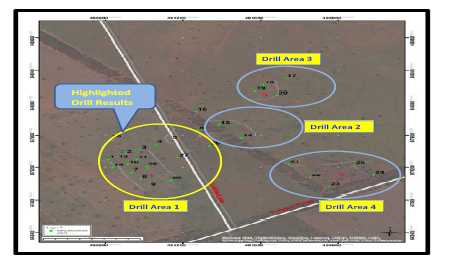

The Feasibility Study includes a revised and updated resource estimate for the Nyngan Scandium Project, originally established in 2010. The revised NI 43-101 Measured and Indicated scandium resource now totals 16.9 million tonnes at an average grade of 235ppm scandium, from all scandium-bearing sources including hematite, limonite, saprolite and some bedrock resource material. The updated resource retains the same economic cut-off value of 100ppm as was used in the earlier resource estimate. The new resource was established using Gemcom’s SURPAC Block Model software and applied Ordinary Kriging techniques for estimation.

The Feasibility Study production plan is based on a portion of the new limonite-only resource, and provides a 20 year mining program consisting of two production pits, sufficient to supply the processing plant at a (nameplate) rate of 75,000 tpy and an average grade of 409ppm scandium over the life of the Nyngan Scandium Project. Both the new resource estimate and the 20 year mining pit design are based on assay and lithology data from a property total of 141 drill holes, including assay and lithology data from recent (2014-2015) drilling work.

The updated and original Nyngan Scandium Project scandium mineral resources are as follows:

Table 2. Nyngan Scandium Resource

| Revised Resource (1)(2) | Previous Resource (1) | |||

| Nyngan Project | (effective date: April 15, 2016) | (effective date: Feb. 9, 2010) | ||

| Resource Summary | Resource | Grade | Resource | Grade |

| (100ppm Sc cut-off) | Tonnes | (ppm Sc) | Tonnes | (ppm Sc) |

| Measured Resource | 5,690,000 | 256 | 2,718,000 | 274 |

| Indicated Resource | 11,230,000 | 225 | 9,294,000 | 258 |

| Total Resource | 16,920,000 | 235 | 12,012,000 | 261 |

| NOTE: (1) Mineral resources that are not mineral reserves do not have demonstrated viability | ||||

| (2) Mineral Resources are inclusive of Mineral Reserves | ||||

Mineral Reserve Estimate

The Feasibility Study includes the first established Reserve on a portion of the resource, associated specifically with that portion of the limonite resource on which economic viability has been established by the engineering and project development work in the Feasibility Study. The feasibility study utilizes 1.34 million tonnes of limonite resource over 20 years, almost all in the Measured Resource category, and that portion of the overall resource has generated the Reserve figure, as shown below:

Table 3. Nyngan Scandium Reserve

| Mineral Reserve | ||

| Nyngan Project | (effective date: April 15, 2016) | |

| Reserve Summary | Reserve | Grade |

| Tonnes | (ppm Sc) | |

| Proven Reserve | 794,514 | 394 |

| Probable Reserve | 641,915 | 429 |

| Total Reserve | 1,436,429 | 409 |

| NOTE: Reserve strip ratio is 3.42 (waste/reserve tonnes) | ||

Mining and Processing Summary

The mining element of the Nyngan Scandium Project represents a relatively minor part, although a critical part, of the overall Nyngan Scandium Project activity. The Feasibility Study mine plan is based on a plant feed of 240 tonnes/day (tpd) or 75,000 tonnes per year requirement. Mine production is based on conventional open pit methods with an average strip ratio of 2.1:1 (overburden/resource). The mine will be worked in campaigns, likely 3 one-month production periods per year, avoiding the wet months, in which a contract miner will be employed to extract and deliver material to a run-of-mine plant stockpile adjacent to the processing facility. The processing plant will run continuously, fed from plant stockpiles of previously mined resource, covered against moisture and weather.

The processing plant operations will size the input material, and then initially apply an HPAL system, using a continuous autoclave pressure-fed with pre-heated ore, dosed with sulfuric acid. Subsequent circuits will then recover the liberated scandium using SX, oxalate precipitation and calcination, to generate a finished scandium oxide product. Once at nameplate capacity, the processing plant is forecast to produce between 36,600 and 42,000 kilograms of scandium oxide product per year, averaging 37,690 kilograms/year over the 20 year feasibility study production period. Oxide product will be produced on-site at grades between 98% and 99.9%, as Sc2O3, and will be offered at grades that meet various customer requirements, suitably packaged for direct sales to end users.

Plant tailings will be neutralized with lime to pH 8.5, dewatered, and stored in a Residue Storage Facility (tailings pond) meeting the environmental requirements of mining permits and NSW State regulators.

Capital Cost Detail

Total capital costs for the Nyngan Scandium Project are estimated at US$87.1 million, and include a 10.5% contingency, allocated on a line item basis varying from 5% to 15%, depending on estimation method, vendor quotation details, and Lycopodium’s risk assessment for the capital cost area. The majority (87%) of the capital cost in the Feasibility Study was Australian-sourced, and consequently initially priced in Australian dollars (A$). The capital cost estimate is established at a +15%/-5% level of accuracy, consistent with industry standards for a Definitive Feasibility Study.

The initial capital cost is spread over a number of areas, but the high pressure autoclave systems, leaching and neutralization circuits contained in the processing plant are the most significant capital items, totaling US$41M or 47% of total costs, including contingencies. Sustaining plant and operations capital is provided as an annual expensed cost, and totals US$3.6M over the life of the project. Sustaining tailings pond capital is similarly provided for and expensed annually to operating costs, and totals US$22.4M, over the life of the project. These costs are treated as cash unit production costs, where those figures are provided.

The cash flow model includes US$5.2M in costs for tailings pond closure, expensed one year after the final year of operation, which is 2038. The pond will likely have reached its optimal size at this time, and would need to be rehabilitated in any event. The model does not include any costs for demolition of facilities, or recovery of value for equipment or facilities in the form of salvage. The Feasibility Study authors did not undertake detailed investigations of alternate site uses for the project facility after 20 years, because the Measured and Indicated scandium resource is considerably larger than the current project would consume, allowing for either expansions of capacity, extensions of the 20-year initial time period of operation, or both.

Table 4. Feasibility Study Capital Cost Detail

| Nyngan Project | Initial Project |

| Capital Cost Summary | Capital Cost |

| (millions) | (US$M) |

| Mining Capital | |

| Pre-Stripping Cost | $1.72 |

| Vehicles/Site Equipment | $1.26 |

| Mining Subtotal | $2.98 |

| Processing Plant Capital | |

| Process Plant Mechanicals | $40.96 |

| Site Infrastructure | $25.95 |

| Construction Costs | $3.91 |

| EPCM Costs | $10.41 |

| Owners Costs | $2.93 |

| Process Plant Subtotal | $84.16 |

| Total Project Capital Cost | $87.14 |

Operating Costs Detail

Operating costs were estimated based on metallurgical test work results and METSIM modelling quantities and requirements. The single most significant cost item in operating costs is reagent cost, with the single largest component in this category being sulfuric acid. The acid price used was A$270/tonne, as quoted by a sulfuric acid broker, delivered to site. The second most significant cost is staff/labor, where the feasibility study assumes a staffing level of 73 full time personnel. The level of accuracy on the operating component was estimated at +15%/- 15%.

Operating cost details in the Feasibility Study, as to total average annual cash costs, and also unit costs on an annual average ore tonnage throughput basis and a kilogram oxide basis, are as follows:

Table 5. Feasibility Study Operating Costs, and Unit Costs Per kg Oxide

| Nyngan Project | Average | Unit Cost/ | Unit Cost/ |

| OpEx Mine/Process Expense | Annual Cost | Processed Tonne | Oxide kg |

| US$ M | US$/tonne | US$/kg | |

| Mining Costs | |||

| Stripping Cost | $0.5 | $7.49 | $14.27 |

| Mining Costs | $0.8 | $10.96 | $20.88 |

| Total Mining Costs | $1.3 | $18.45 | $35.15 |

| Processing Cost | |||

| Labor Cost | $5.9 | $82.19 | $156.60 |

| Utilities Costs | $2.2 | $29.99 | $57.15 |

| Reagents | $7.1 | $98.24 | $187.19 |

| Consumables | $0.6 | $8.02 | $15.29 |

| Maintenance | $1.6 | $22.80 | $43.44 |

| General | $0.16 | $2.23 | $4.24 |

| Total Processing Costs | $17.5 | $243.48 | $463.92 |

| General Costs | |||

| Tailings Pond Costs | $1.1 | $15.60 | $29.72 |

| Site G&A Costs | $0.6 | $7.82 | $14.90 |

| Consultants & Marketing | $0.5 | $6.76 | $12.88 |

| Total General Costs | $2.2 | $30.18 | $57.50 |

| Annual Cash Operating Cost | $21.0 | $292.10 | $556.57 |

The Nyngan Scandium Project plan has provided for a gradual ramp-up to full (nameplate) capacity in the first two years of operation. The ramp-up provides for 35% of nameplate throughput (26,250 tonnes) in production year 1 (2018) and 80% of nameplate throughput (60,000 tonnes) in production year 2 (2019). The respective scandium oxide product output estimate during those years is 13,300kg and 30,900kg, respectively. This 2 year ramp-up to nameplate capacity was determined based on the commissioning experience of other HPAL plants of similar general design, built and brought online in the last 15 years. All of these benchmarking examples were nickel plants processing lateritic ores, all but one were initial installations, and all were of much bigger size than the Nyngan processing plant.

Pricing Assumptions

The price assumption in the Feasibility Study is US$2,000 per kilogram (kg) of scandium oxide product, as an average price covering all product sold, over various product grades. Current market pricing, such as that can be established, is substantially above these levels based on small unit quantities and varying grades. In order to encourage a viable, over-subscribed and vigorous scandium market, across numerous applications, product suppliers, like us, will need to provide for adequate supply of quality product, available from trusted jurisdictions, at prices lower than products trade for today.

In addition to limited publically available price quotes for scandium oxide, the Feasibility Study notes two other reference points on the US$2,000/kg price assumption. The Company has an offtake agreement in place, for 7,500 kg/year (3 years), with pricing being supportive of the pricing assumption in the Feasibility Study. The customer is a knowledgeable alloy group, with longstanding interest in aluminum-scandium alloys. The Feasibility Study price assumption is also supported by a recent, independent marketing report that examined the 10 year scandium supply/demand outlook, and includes scenario-based 10 year price forecasts. The details and contents of this market outlook report will remain confidential, but select information will be included in the feasibility study. Both of these reference points support that the scandium value proposition for customers/consumers is valid at this price level.

Sensitivities

The Nyngan Scandium Project is most sensitive to changes in the value of the Australian dollar relative to the US dollar, along with changes in the product price. The Project is somewhat less sensitive to either operating or capital cost changes. Sensitivities to various parameters are shown below.

Table 6. Sensitivity to Product Price

| Project | Constant Dollar

(after Tax) Project NPV at Various Discount Rates and Various Oxide Product Prices (US$) | |||||

| Financial Sensitivity | ||||||

| to Product Price | ||||||

| Product Price (US$/kg) | $1,200 | $1,500 | $2,000 | $2,500 | $3,000 | $3,500 |

| Constant Dollar | ||||||

| Net Present Value (US$ M) | ||||||

| 6% Discount | $82.4 | $159.7 | $287.6 | $414.9 | $542.2 | $669.4 |

| 8% Discount | $55.1 | $119.3 | $225.3 | $330.9 | $436.3 | $541.7 |

| 10% Discount | $34.3 | $88.3 | $177.5 | $266.1 | $354.7 | $443.1 |

| Internal Rate of Return (IRR) | 15.2% | 22.4% | 33.1% | 42.8% | 52.0% | 60.6% |

Table 7. Profitability Sensitivities to Changes in Key Financial Assumptions

| Sensitivity to | NPV (10%i) | |

| Financial Parameters | US$ M | IRR (%) |

| DFS Result | $177.5 | 33.1% |

| Operating Cost Sensitivity | ||

| Cost Increase (10%) | $166.3 | 31.6% |

| Cost Decrease (10%) | $188.7 | 34.5% |

| Price Sensitivity | ||

| Lower Realized Oxide Price (10%) | $142.0 | 29.0% |

| Higher Realized Oxide Price (10%) | $212.9 | 37.0% |

| Capital Cost Sensitivity | ||

| Higher Capital Cost (10%) | $169.6 | 30.4% |

| Lower Capital Cost (10%) | $185.4 | 36.2% |

| Fx Sensitivity ($0.70) | ||

| US$/A$ @ $0.80 | $150.3 | 27.6% |

| US$/A$ @ $0.75 | $163.9 | 30.2% |

| US$/A$ @ $0.65 | $191.3 | 36.4% |

General Assumptions

The Feasibility Study is presented on a 100% ownership basis. The Company effectively owns 80% of the Nyngan Scandium Project through EMC Australia. The remaining 20% of EMC Australia is owned by SIL, a Nevada corporation owned by private interests.

All cash flows and financial analyses have been presented on a 100% equity basis. No debt leverage has been assumed in providing capital for development. No inflation factors have been applied to future cash flows, making the discounted cash flow performance measures constant dollar figures.

The Nyngan Scandium Project schedule identifies 2017 as the initial year in the cash flow, with construction initiated and completed in that year. Some commissioning is scheduled for Q4 2017. Further wet commissioning and start-up is scheduled for Q1 2018. First production is planned for March 2018, which is year 1 of 20 (calendar) years of production, completing in 2037. Reclamation of the Residue Storage Facility is scheduled for 2038. The supply and delivery estimate on the specialist autoclave and flash vessels is setting the timeframe for first production in Q1 2018.

DFS Conclusions and Recommendations

The production assumptions in the Feasibility Study are backed by solid independent flow sheet test work on the planned process for scandium recovery. The DFS consolidates a significant amount of metallurgical test work and prior study on the Nyngan Scandium Project, including important test work results completed since the PEA was generated in 2014. The entire body of work demonstrates a viable, conventional process flow sheet utilizing a continuous-system HPAL leaching process, and good metallurgical recoveries of scandium from the resource. The metallurgical assumptions are supported by various bench and pilot scale independent test work programs that are consistent with known outcomes in other laterite resources. The continuous autoclave configuration, as opposed to batch systems explored in previous flow sheets, is also a more conventional and current design choice.

The level of accuracy established in the Feasibility Study substantially reduces the uncertainty levels inherent in earlier studies, specifically the PEA. The greater confidence intervals around the DFS were achieved by reliance on significant project engineering work, a capital and operating cost estimate supported by detailed requirements and vendor pricing, plus one offtake agreement and an independent marketing assessment, both supportive of the marketing assumptions on the business.

The Feasibility Study delivered a positive result on the Nyngan Scandium Project, and recommends the Nyngan Scandium Project owners seek finance and proceed to construction. Recommendations were made therein for additional immediate work, notably to win additional offtake agreements with customers, complete some optimizing flow sheet studies, and to initiate as early as possible detailed engineering required on certain long-lead capital items.

Environmental Permitting

On May 2, 2016 the Company announced the filing of an Environmental Impact Statement (“EIS”) with the New South Wales, Australia, Department of Planning and Environment, (the “Department”) in support of the planned development of the Nyngan Scandium Project. The EIS was prepared by R.W. Corkery & Co. Pty. Limited, on behalf of the Company’s 80% owned subsidiary, EMC Australia to support an application for Development Consent for the Nyngan Scandium Project. The EIS is a complete document, including a Specialist Consultants Study Compendium, and was submitted to the Department on Friday, April 29, 2016. The full document will first receive a compulsory adequacy review by Department staff before being formally accepted and placed on public exhibition.

EIS Highlights:

| • | The EIS finds residual environmental impacts represent negligible risk. | |

| • | The proposed development design achieves sustainable environmental outcomes. |

| • |

The EIS finds net-positive social and economic outcomes for the community. | |

| • |

Nine independent environmental consulting groups conducted analysis over five years, and contributed report findings to the EIS. | |

| • |

The Nyngan Project development is estimated to contribute A$12.4M to the local and regional economies, and A$39M to the State and Federal economies, annually | |

| • |

The EIS is fully aligned with the DFS and with a NSW Mining License Application for the Nyngan Project. |

Conclusion statement in the EIS:

“In light of the conclusions included throughout this Environmental Impact Statement, it is assessed that the Proposal could be constructed and operated in a manner that would satisfy all relevant statutory goals and criteria, environmental objectives and reasonable community expectations.”

EIS Discussion:

The EIS is the foundation document submitted by a developer intending to build a mine facility in Australia. The Nyngan Scandium Project is considered a State Significant Project, in that capital cost exceeds A$30million, which means State agencies are designated to manage the investigation and approval process for granting a Development Consent, from the Minister of Planning and Environment. This Department will manage the review of the Proposal through a number of State and local governmental agencies.

The EIS is a self-contained set of documents used to seek a Development Consent. It is however, supported in many ways by the recently completed feasibility study.

Once the Development Consent is granted, there are a number of operating licenses that are required from various regulatory agencies to construct and operate a mining operation in NSW.

The key license approvals are:

| • |

An Environment Protection Licence, | |

| • |

A Mining Lease, | |

| • |

Water Supply Works and Use Approval and Water Access Licence, | |

| • |

A Section 138 Permit issued by the Bogan Shire Council, for construction of the intersection of the Site Access Road and Gilgai Road, | |

| • |

An approval from the NSW Dams Safety Committee for the design and construction of the Residue Storage Facility, and | |

| • |

A high voltage connection agreement with Essential Energy. |

The EIS represents the cornerstone of all of these approvals and licenses, along with the multi-interagency review that will precede the approval authorization for a Development Consent. The timeframe for completion of these reviews and granting of licenses is not fixed, and is dependent on the quality of the EIS, the extent of the questions that may arise from the project review, and the available resources in government to address the review itself. General estimates range from 6-9 months, with some proposals taking longer, particularly larger proposals, or proposals with more community and environmental impacts to consider.

The Company intends to follow and support the progress of governmental agency reviews in coming months, and will be conducting a Town Hall meeting with residents of the Nyngan community, soon after the EIS goes on public exhibition, expected sometime in May 2016.

Patent Application Filings