Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Energy Future Intermediate Holding CO LLC | d130130d8k.htm |

| EX-99.1 - EX-99.1 - Energy Future Intermediate Holding CO LLC | d130130dex991.htm |

Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| ) | ||||

| In re: | ) | Chapter 11 | ||

| ) | ||||

| ENERGY FUTURE HOLDINGS CORP., et al.,1 | ) | Case No. 14-10979 (CSS) | ||

| ) | ||||

| Debtors. |

) | (Jointly Administered) | ||

| ) |

DISCLOSURE STATEMENT FOR THE AMENDED JOINT PLAN OF

REORGANIZATION OF ENERGY FUTURE HOLDINGS CORP., ET AL.,

PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE

| KIRKLAND & ELLIS LLP | RICHARDS, LAYTON & FINGER, P.A. | |

| 601 Lexington Avenue | 920 North King Street | |

| New York, New York 10022 | Wilmington, Delaware 19801 | |

| Telephone: (212) 446-4800 | Telephone: (302) 651-7700 | |

| Facsimile: (212) 446-4900

—and—

300 North LaSalle Chicago, Illinois 60654 Telephone: (312) 862-2000 Facsimile: (312) 862-2200 |

Facsimile: (302) 651-7701 |

Counsel to the Debtors and Debtors in Possession

—and—

| PROSKAUER ROSE LLP | BIELLI & KLAUDER LLC | |

| Three First National Plaza 70 W. Madison Street, Suite 3800 Chicago, Illinois 60602 |

1204 North King Street Wilmington, Delaware 19801 Telephone: (302) 803-4600 | |

| Telephone: (312) 962-3550 | Facsimile: (302) 397-2557 | |

| Facsimile: (312) 962-3551 |

Co-Counsel to the Debtor Energy Future Holdings Corp.

—and—

| 1 | The last four digits of Energy Future Holdings Corp.’s tax identification number are 8810. The location of the debtors’ service address is 1601 Bryan Street, Dallas, Texas 75201. Due to the large number of debtors in the Chapter 11 Cases, which are being jointly administered, a complete list of the debtors and the last four digits of their federal tax identification numbers is not provided herein. A complete list of such information may be obtained on the website of the debtors’ claims and noticing agent at http://www.efhcaseinfo.com. |

| CRAVATH, SWAINE AND MOORE LLP | STEVENS & LEE, P.C. | |

| Worldwide Plaza 825 Eighth Avenue New York, New York 10019 |

1105 North Market Street, Suite 700 Wilmington, Delaware 19801 Telephone: (302) 425-3310 | |

| Telephone: (212) 474-1978 | Facsimile: (610) 371-7927 | |

| Facsimile: (212) 474-3700 | ||

|

JENNER & BLOCK LLP 919 Third Avenue New York, New York 10022 Telephone: (212) 891-1600 Facsimile: (212) 891-1699 |

Co-Counsel to the Debtor Energy Future Intermediate Holding

Company LLC

—and—

| MUNGER, TOLLES & OLSON LLP | MCELROY, DEUTSCH, MULVANEY & CARPENTER, LLP | |

| 355 South Grand Avenue, 35th Floor Los Angeles, California 90071 Telephone: (213) 683-9100 |

300 Delaware Avenue, Suite 770 Wilmington, Delaware 19801 Telephone: (302) 300-4515 | |

| Facsimile: (213) 683-4022 | Facsimile: (302) 654-4031 |

Co-Counsel to the TCEH Debtors

THIS IS NOT A SOLICITATION OF AN ACCEPTANCE OR REJECTION OF THE PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ACCEPTANCES OR REJECTIONS OF THE PLAN MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THIS DRAFT DISCLOSURE STATEMENT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT.2

Dated: May 10, 2016

| 2 | This Disclosure Statement for the Amended Joint Plan of Reorganization of Energy Future Holdings Corp. et al., Pursuant to Chapter 11 of the Bankruptcy Code amends, modifies, and supersedes the disclosure statement that was filed with the Court on April 14, 2015 at Docket No. 4143, without prejudice to the Debtors’ ability to file further amended versions in the future. |

IMPORTANT INFORMATION REGARDING THIS DISCLOSURE STATEMENT, DATED MAY 10, 2016

SOLICITATION OF VOTES

ON THE AMENDED JOINT PLAN OF REORGANIZATION OF

ENERGY FUTURE HOLDINGS CORP., ET AL.,

PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE

From the Holders of Outstanding:

| Voting Class |

Name of Class Under the Plan | |

| Class A4 | EFH Legacy Note Claims | |

| Class A5 | EFH Unexchanged Note Claims | |

| Class A6 | EFH LBO Note Primary Claims | |

| Class A7 | EFH Swap Claims | |

| Class A8 | EFH Non-Qualified Benefit Claims | |

| Class A9 | General Unsecured Claims Against EFH Corp. | |

| Class A10 | General Unsecured Claims Against the EFH Debtors Other Than EFH Corp. | |

| Class A11 | Tex-La Guaranty Claims | |

| Class A12 | TCEH Settlement Claim | |

| Class B4 | EFIH Second Lien Note Claims | |

| Class B5 | EFH LBO Note Guaranty Claims | |

| Class B6 | General Unsecured Claims Against the EFIH Debtors | |

| Class B9 | Interests in EFIH | |

| Class C3 | TCEH First Lien Secured Claims | |

| Class C4 | TCEH Unsecured Debt Claims | |

| Class C5 | General Unsecured Claims Against the TCEH Debtors Other Than EFCH | |

IF YOU ARE IN ONE OF THESE CLASSES, YOU ARE RECEIVING THIS DOCUMENT AND THE ACCOMPANYING MATERIALS BECAUSE YOU ARE ENTITLED TO VOTE ON THE PLAN.

RECOMMENDATION BY THE DEBTORS

THE BOARD OF MANAGERS OR DIRECTORS (AS APPLICABLE) OR THE SOLE MEMBER OF EACH OF THE DEBTORS HAS APPROVED THE TRANSACTIONS CONTEMPLATED BY THE PLAN AND DESCRIBED IN THIS DISCLOSURE STATEMENT AND RECOMMEND THAT ALL HOLDERS OF CLAIMS OR INTERESTS WHOSE VOTES ARE BEING SOLICITED SUBMIT BALLOTS TO ACCEPT THE PLAN.

DELIVERY OF BALLOTS

BALLOTS AND MASTER BALLOTS, AS APPLICABLE, MUST BE ACTUALLY RECEIVED BY THE

SOLICITATION AGENT BY THE VOTING DEADLINE, WHICH IS 4:00 P.M. (PREVAILING

EASTERN TIME) ON [JULY 22, 2016] AT THE FOLLOWING ADDRESSES:

FOR ALL BALLOTS OTHER THAN MASTER BALLOTS

VIA FIRST CLASS MAIL:

EFH BALLOT PROCESSING

C/O EPIQ BANKRUPTCY SOLUTIONS, LLC

P.O. BOX 4422

BEAVERTON, OREGON 97076-4422

VIA OVERNIGHT COURIER OR HAND DELIVERY:

EFH BALLOT PROCESSING

C/O EPIQ BANKRUPTCY SOLUTIONS, LLC

10300 SW ALLEN BOULEVARD

BEAVERTON, OREGON 97005

FOR MASTER BALLOTS

VIA FIRST CLASS MAIL, OVERNIGHT COURIER, OR HAND DELIVERY:

EFH BALLOT PROCESSING

C/O EPIQ BANKRUPTCY SOLUTIONS, LLC

777 THIRD AVENUE, 12TH FLOOR

NEW YORK, NEW YORK 10017

IF YOU RECEIVED AN ENVELOPE ADDRESSED TO YOUR NOMINEE, PLEASE ALLOW ENOUGH

TIME WHEN YOU RETURN YOUR BALLOT FOR YOUR NOMINEE TO CAST YOUR VOTE ON A

MASTER BALLOT BEFORE THE VOTING DEADLINE.

BALLOTS RECEIVED VIA EMAIL OR FACSIMILE WILL NOT BE COUNTED.

IF YOU HAVE ANY QUESTIONS ON THE PROCEDURE FOR VOTING ON THE PLAN, PLEASE

CALL THE DEBTORS’ RESTRUCTURING HOTLINE AT:

(877) 276-7311

READERS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE AND ARE URGED TO CONSULT WITH THEIR OWN ADVISORS BEFORE CASTING A VOTE WITH RESPECT TO THE PLAN.

THE SECURITIES TO BE ISSUED PURSUANT TO THE PLAN HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 (THE “SECURITIES ACT”) OR SIMILAR STATE SECURITIES OR “BLUE SKY” LAWS.

THE SECURITIES TO BE ISSUED IN CONNECTION WITH THE PLAN HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) OR BY ANY STATE SECURITIES COMMISSION OR SIMILAR PUBLIC, GOVERNMENTAL, OR REGULATORY AUTHORITY, AND NEITHER THE SEC NOR ANY SUCH AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN.

SEE SECTION IX OF THE DISCLOSURE STATEMENT FOR IMPORTANT SECURITIES LAW DISCLOSURES.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING PROJECTED FINANCIAL INFORMATION AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. FORWARD-LOOKING STATEMENTS ARE PROVIDED IN THIS DISCLOSURE STATEMENT PURSUANT TO THE SAFE HARBOR ESTABLISHED UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND SHOULD BE EVALUATED IN THE CONTEXT OF THE ESTIMATES, ASSUMPTIONS, UNCERTAINTIES, AND RISKS DESCRIBED IN THIS DISCLOSURE STATEMENT.

FURTHER, READERS ARE CAUTIONED THAT ANY FORWARD-LOOKING STATEMENTS IN THIS DISCLOSURE STATEMENT ARE BASED ON ASSUMPTIONS THAT ARE BELIEVED TO BE REASONABLE, BUT ARE SUBJECT TO A WIDE RANGE OF RISKS, INCLUDING RISKS ASSOCIATED WITH THE FOLLOWING: (I) FUTURE FINANCIAL RESULTS AND LIQUIDITY, INCLUDING THE ABILITY TO FINANCE OPERATIONS IN THE ORDINARY COURSE OF BUSINESS; (II) VARIOUS FACTORS THAT MAY AFFECT THE VALUE OF THE SECURITIES TO BE ISSUED UNDER THE PLAN; (III) THE RELATIONSHIPS WITH AND PAYMENT TERMS PROVIDED BY TRADE CREDITORS; (IV) ADDITIONAL FINANCING REQUIREMENTS POST-RESTRUCTURING; (V) FUTURE DISPOSITIONS AND ACQUISITIONS; (VI) THE EFFECT OF COMPETITIVE PRODUCTS, SERVICES, OR PROCURING BY COMPETITORS; (VII) CHANGES TO THE COSTS OF COMMODITIES AND RAW MATERIALS; (VIII) THE PROPOSED RESTRUCTURING AND COSTS ASSOCIATED THEREWITH; (IX) THE EFFECT OF CONDITIONS IN THE ENERGY MARKET ON THE DEBTORS; (X) THE CONFIRMATION AND CONSUMMATION OF THE PLAN; (XI) CHANGES IN LAWS AND REGULATIONS FROM GOVERNMENT AGENCIES; AND (XII) EACH OF THE OTHER RISKS IDENTIFIED IN THIS DISCLOSURE STATEMENT. DUE TO THESE UNCERTAINTIES, READERS CANNOT BE ASSURED THAT ANY FORWARD-LOOKING STATEMENTS WILL PROVE TO BE CORRECT. THE DEBTORS ARE UNDER NO OBLIGATION TO (AND EXPRESSLY DISCLAIM ANY OBLIGATION TO) UPDATE OR ALTER ANY FORWARD-LOOKING STATEMENTS WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE, UNLESS INSTRUCTED TO DO SO BY THE BANKRUPTCY COURT.

THE TERMS OF THE PLAN GOVERN IN THE EVENT OF ANY INCONSISTENCY BETWEEN THE PLAN AND THE SUMMARIES CONTAINED IN THIS DISCLOSURE STATEMENT.

THE INFORMATION IN THIS DISCLOSURE STATEMENT IS BEING PROVIDED SOLELY FOR THE PURPOSES OF VOTING TO ACCEPT OR REJECT THE PLAN OR OBJECTING TO CONFIRMATION. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE USED BY ANY PARTY FOR ANY OTHER PURPOSE.

ALL EXHIBITS TO THE DISCLOSURE STATEMENT, ALONG WITH ALL OTHER DOCUMENTS FILED WITH THE SEC BY THE DEBTORS AND THEIR AFFILIATES, ARE INCORPORATED INTO AND ARE A PART OF THIS DISCLOSURE STATEMENT AS IF SET FORTH IN FULL IN THIS DISCLOSURE STATEMENT. THE DOCUMENTS FILED WITH THE SEC BY THE DEBTORS AND

THEIR AFFILIATES ARE AVAILABLE FREE OF CHARGE ONLINE AT THE DEBTORS’ WEBPAGE, HTTP://WWW.ENERGYFUTUREHOLDINGS.COM/FINANCIAL/DEFAULT.ASPX, AT THE DEBTORS’ RESTRUCTURING WEBPAGE, WWW.EFHCASEINFO.COM, AND AT THE SEC’S WEBPAGE, HTTP://WWW.SEC.GOV/EDGAR.SHTML.

TABLE OF CONTENTS

| Page | ||||||||

| I. | Executive Summary |

1 | ||||||

| A. |

Purpose of this Disclosure Statement and the Plan |

1 | ||||||

| B. |

Overview of EFH |

3 | ||||||

| C. |

Overview of the Plan |

5 | ||||||

| D. |

Makewhole and Postpetition Interest Claims Discussion |

11 | ||||||

| E. |

Settlement and Release of Debtor Claims |

13 | ||||||

| F. |

Summary of Treatment of Claims and Interests and Description of Recoveries Under the Plan |

14 | ||||||

| G. |

Voting on the Plan |

21 | ||||||

| H. |

Effect of Failure of Conditions |

22 | ||||||

| I. |

Certain IRS Matters |

22 | ||||||

| J. |

Confirmation Process |

24 | ||||||

| K. |

The Plan Supplement |

24 | ||||||

| II. | EFH’s Business Operations and Capital Structure |

27 | ||||||

| A. |

Overview of EFH’s Corporate Structure |

27 | ||||||

| B. |

EFH’s Business Operations |

28 | ||||||

| C. |

EFH’s Capital Structure |

38 | ||||||

| D. |

Statement of the EFIH First Lien Notes Trustee and the EFIH Second Lien Notes Trustee |

51 | ||||||

| III. | The Events Leading to the Debtors’ Financial Difficulties |

53 | ||||||

| A. |

History of EFH Corp. |

53 | ||||||

| B. |

The 2007 Acquisition |

53 | ||||||

| C. |

EFH Following the 2007 Acquisition |

53 | ||||||

| D. |

The Result of Low Natural Gas Prices on EFH’s Financial Performance Following the 2007 Acquisition |

57 | ||||||

| E. |

Other Market Conditions Affecting TCEH’s Performance |

63 | ||||||

| F. |

EFH’s Financial Outlook and Business Strategy Going Forward |

64 | ||||||

| G. |

EFH’s Reorganization Efforts |

64 | ||||||

| IV. | Material Events in the Chapter 11 Cases |

69 | ||||||

| A. |

Venue |

69 | ||||||

| B. |

Appointment of Official Committees |

69 | ||||||

| C. |

First and Second Day Motions |

70 | ||||||

| D. |

Protocol for Certain Case Matters |

76 | ||||||

| F. |

Retention of Professionals |

76 | ||||||

| G. |

Motions Related to the Restructuring Support Agreement |

77 | ||||||

| H. |

Exploring the EFH/EFIH Transaction |

80 | ||||||

| I. |

Retention of Conflicts Matter Advisors |

83 | ||||||

| K. |

Legacy Discovery |

83 | ||||||

| L. |

TCEH First Lien Investigation |

84 | ||||||

| M. |

Makewhole Litigation |

85 | ||||||

| N. |

EFIH Second Lien Partial Repayment Motion |

89 | ||||||

| O. |

Original Confirmed Plan Confirmation Settlements |

90 | ||||||

| P. |

Other Ongoing Litigation Items |

91 | ||||||

| Q. |

Exclusivity |

92 | ||||||

| R. |

Other Bankruptcy Motions, Applications, and Filings |

93 | ||||||

| V. | Summary of the Plan |

98 | ||||||

| A. |

Sources of Consideration for Plan Distributions |

99 | ||||||

| B. |

Restructuring Transactions |

101 | ||||||

| C. |

Administrative Claims, Priority Tax Claims, DIP Claims, and Statutory Fees |

104 | ||||||

i

| D. |

Classification of Claims and Interests |

109 | ||||||

| E. |

Treatment of Classified Claims and Interests |

111 | ||||||

| F. |

Other Selected Provisions of the Plan |

124 | ||||||

| G. |

Effect of Confirmation |

132 | ||||||

| H. |

Settlement, Release, Injunction, and Related Provisions |

134 | ||||||

| VI. | Confirmation of the Plan |

154 | ||||||

| A. |

The Confirmation Hearing |

154 | ||||||

| B. |

Requirements for Confirmation |

154 | ||||||

| C. |

Conditions Precedent to Confirmation of the Plan |

157 | ||||||

| D. |

Conditions Precedent to Confirmation of a Plan as to the EFH Debtors and EFIH Debtors |

158 | ||||||

| E. |

Conditions Precedent to the TCEH Effective Date |

159 | ||||||

| F. |

Conditions Precedent to the EFH Effective Date |

162 | ||||||

| G. |

Waiver of Conditions |

163 | ||||||

| H. |

Effect of Failure of Conditions |

163 | ||||||

| I. |

Certain IRS Matters |

163 | ||||||

| VII. | Voting Instructions |

164 | ||||||

| A. |

Overview |

164 | ||||||

| B. |

Holders of Claims and Interests Entitled to Vote on the Plan |

164 | ||||||

| C. |

Voting Record Date |

164 | ||||||

| D. |

Voting on the Plan |

164 | ||||||

| E. |

Ballots Not Counted |

165 | ||||||

| VIII. | Risk Factors |

167 | ||||||

| A. |

Risks Related to the Restructuring |

167 | ||||||

| B. |

Risks Related to Confirmation and Consummation of the Plan |

174 | ||||||

| C. |

Risks Related to Recoveries Under the Plan |

176 | ||||||

| D. |

Risk Factors Related to the Business Operations of the Debtors, the Reorganized Debtors, and Oncor Electric |

179 | ||||||

| E. |

Miscellaneous Risk Factors and Disclaimers |

196 | ||||||

| IX. | Important Securities Laws Disclosures |

202 | ||||||

| A. |

Section 1145 of the Bankruptcy Code |

202 | ||||||

| B. |

Subsequent Transfers of Securities Not Covered by the Section 1145(a) Exemption |

203 | ||||||

| X. | Certain U.S. Federal Income Tax Consequences of the Plan |

205 | ||||||

| A. |

Introduction |

205 | ||||||

| B. |

Certain U.S. Federal Income Tax Consequences of the Plan to the Debtors |

206 | ||||||

| C. |

Certain U.S. Federal Income Tax Consequences of the Plan to Holders of Allowed Claims in Classes Entitled to Vote on the Plan |

210 | ||||||

| D. |

Withholding and Reporting |

217 | ||||||

| XI. | Recommendation of the Debtors |

219 | ||||||

ii

EXHIBITS

| Exhibit A | List of EFH Debtors | |

| Exhibit B | List of TCEH Debtors | |

| Exhibit C | Plan of Reorganization | |

| Exhibit D | Corporate Structure of the Debtors and Certain Non-Debtor Affiliates | |

| Exhibit E | Reorganized TCEH Financial Projections | |

| Exhibit F | Reorganized EFH-EFIH Financial Projections | |

| Exhibit G | Reorganized TCEH Valuation Analysis | |

| Exhibit H | Oncor Valuation Analysis | |

| Exhibit I | Liquidation Analysis | |

| Exhibit J | Disclosure Statement Order | |

THE DEBTORS HEREBY ADOPT AND INCORPORATE EACH EXHIBIT ATTACHED TO THIS

DISCLOSURE STATEMENT BY REFERENCE AS THOUGH FULLY SET FORTH HEREIN.

iii

I. Executive Summary

| A. | Purpose of this Disclosure Statement and the Plan. |

Energy Future Holdings Corp. (“EFH Corp.” and, together with certain of its direct and indirect subsidiaries listed on Exhibit A attached hereto, the “EFH Debtors”), the ultimate parent company of each of the entities that comprise the EFH corporate group (collectively, “EFH”); Texas Competitive Electric Holdings Company LLC (“TCEH” and, together with its direct parent company, Energy Future Competitive Holdings Company LLC (“EFCH”) and certain of TCEH’s direct and indirect subsidiaries as listed on Exhibit B attached hereto, the “TCEH Debtors”); and Energy Future Intermediate Holding Company LLC (“EFIH” and, together with EFIH Finance, Inc., the “EFIH Debtors” and the EFH Debtors, the TCEH Debtors, and the EFIH Debtors collectively, the “Debtors”) are providing you with the information in this second amended disclosure statement (the “Disclosure Statement”) on the date hereof (the “Solicitation Date”) pursuant to section 1125 of chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in connection with the chapter 11 cases (the “Chapter 11 Cases”) commenced by the Debtors on April 29, 2014 (the “Petition Date”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”).

The Debtors seek to confirm the Amended Joint Plan of Reorganization of Energy Future Holdings Corp., et al., Pursuant to Chapter 11 of the Bankruptcy Code (the “Plan”), filed contemporaneously herewith3 including the Plan Supplement, to effect a comprehensive restructuring of their respective balance sheets (the “Restructuring”). The Bankruptcy Court approved this Disclosure Statement, authorized solicitation of votes to accept or reject the Plan, and scheduled the hearing to confirm the Plan (the “Confirmation Hearing”) to begin at [ ] (prevailing Eastern Time) on [ ]. It is important that Holders of Claims and Interests carefully read this Disclosure Statement and all of the materials attached to this Disclosure Statement and incorporated into this Disclosure Statement by reference to fully understand the business operations of all of the Debtors and their non-Debtor affiliates.

As described in this Disclosure Statement, the Debtors believe that the Plan provides for a comprehensive restructuring and recapitalization of the Debtors’ pre-bankruptcy obligations and corporate form, preserves the going-concern value of the Debtors’ businesses, maximizes recoveries available to all constituents, provides for an equitable distribution to the Debtors’ stakeholders, protects the jobs of employees, and ensures continued provision of electricity in Texas to the TCEH Debtors’ approximately 1.7 million retail customers and the smooth delivery of electricity to the entire state through the TCEH Debtors’ generation activities.

A bankruptcy court’s confirmation of a plan of reorganization binds the debtor, any entity or person acquiring property under the plan, any creditor of or interest holder in a debtor, and any other entities and persons as may be ordered by the bankruptcy court to the terms of the confirmed plan, whether or not such creditor or interest holder is impaired under or has voted to accept the plan or receives or retains any property under the plan, through an order confirming the plan (as defined in the Plan, the “Confirmation Order”). Among other things (subject to certain limited exceptions and except as otherwise provided in the Plan or the Confirmation Order), the Confirmation Order will discharge the Debtors from any Claim (as that term is defined in the Plan) arising before the Effective Date and substitute the obligations set forth in the Plan for those pre-bankruptcy Claims. Under the Plan, Claims and Interests are divided into groups called “Classes” according to their relative priority and other criteria.

| 3 | The Plan is attached hereto as Exhibit C and incorporated into this Disclosure Statement by reference. Capitalized terms used but not otherwise defined in this Disclosure Statement have the meanings ascribed to such terms in the Plan, and capitalized terms used but not otherwise defined in this Executive Summary have the meanings ascribed to them in the remainder of this Disclosure Statement or the Plan. Additionally, this Disclosure Statement incorporates the rules of interpretation set forth in Article I.B of the Plan. The summaries provided in this Disclosure Statement of any documents attached to this Disclosure Statement, including the Plan, the exhibits, and the other materials referenced in the Plan, the Plan Supplement, and any other documents referenced or summarized herein, are qualified in their entirety by reference to the applicable document. In the event of any inconsistency between the discussion in this Disclosure Statement and the documents referenced or summarized herein, the applicable document being referenced or summarized shall govern. In the event of any inconsistencies between any document and the Plan, the Plan shall govern. |

Each of the Debtors is a proponent of the Plan within the meaning of section 1129 of the Bankruptcy Code. The Plan does not contemplate the substantive consolidation of the Debtors’ estates. Except to the extent that a Holder of an Allowed Claim agrees to a less favorable treatment of such Claim, in full and final satisfaction, settlement, release, and discharge of and in exchange for such Claim, each Holder of an Allowed Claim or Allowed Interest with regard to each of the Debtors will receive the same recovery (if any) provided to other Holders of Allowed Claims or Allowed Interests in the applicable Class according to the respective Debtor against which they hold a Claim or Interest, and will be entitled to their Pro Rata share of consideration available for distribution to such Class (if any).

The Debtors believe that their businesses and assets have significant value that would not be realized under any alternative reorganization option or in a liquidation. Consistent with the valuation, liquidation, and other analyses prepared by the Debtors with the assistance of their advisors, the going concern value of the Debtors is substantially greater than their liquidation value. The Debtors believe that all alternative transactions that have been presented to the Debtors to date would result in significant delays, litigation, and additional risks and costs, and could negatively affect the Debtors’ value by, among other things, increasing administrative costs and causing unnecessary uncertainty with the Debtors’ key customers, employees, trading counterparties, and supplier constituencies, which could ultimately lower the recoveries for all Holders of Allowed Claims and Allowed Interests.

Notwithstanding any other provision in the Disclosure Statement or Disclosure Statement Order, the Court makes no finding or ruling in the Disclosure Statement Order, other than with respect to the adequacy of the Disclosure Statement pursuant to Section 1125 of the Bankruptcy Code, with respect to (a) the negotiations, reasonableness, business purpose, or good faith of the Plan, or as to the terms of the Plan (or the treatment of any class of claims thereunder and whether those claims are or are not impaired) for any purpose, (b) whether the Plan satisfies any of the requirements for confirmation under section 1129 of the Bankruptcy Code, or (c) the standard of review or any factor required for approval of the Confirmation of the Plan. Any objections or requests served in connection with the Plan are hereby reserved and not waived by entry of the Disclosure Statement Order; provided, however, that nothing in the Disclosure Statement or the Disclosure Statement Order shall preclude the Debtors or any other party in interest that is the subject of such objection or discovery requests from seeking to overrule such objections or limit or otherwise overrule such discovery requests.

Any rights of (s) Computershare Trust Company, N.A., and Computershare Trust Company of Canada, in their capacity as indenture trustee for the EFIH second lien notes, and an ad hoc group of EFIH second lien noteholders, (t) Delaware Trust Company, as indenture trustee for the EFIH first lien notes and an ad hoc group of EFIH first lien noteholders, (u) the Office of the United States Trustee, (v) the official committee of unsecured creditors of EFH Corp., EFIH, EFIH Finance Inc., and EECI, Inc., (w) The Bank of New York Mellon, in its capacity as the PCRB Trustee, (x) The Bank of New York Mellon Trust Company, in its capacity as the EFCH 2037 Notes Trustee, (y) American Stock Transfer & Trust Company, LLC, in its capacity as successor trustee for notes issued by EFH Corp., or (z) UMB Bank, N.A., in its capacity as indenture trustee for the unsecured 11.25%/12.25% Senior Toggle Notes due 2018 and the 9.75% Senior Notes due 2019, to object to confirmation of the Plan are hereby fully reserved and not waived.

Prior to voting on the Plan, you are encouraged to read this Disclosure Statement and all documents attached to this Disclosure Statement in their entirety, as well as the various reports and other filings filed with the SEC by the Debtors and their Affiliates (collectively, the “EFH Public Filings”). The EFH Public Filings include those reports filed by EFH Corp., EFIH, and EFCH, as well as those filed by the non-Debtor Entity Oncor Electric Delivery Company LLC (“Oncor Electric”) and Oncor Electric Delivery Transition Bond Company LLC (“Oncor BondCo”). The EFH Public Filings are available free of charge online at http://www.energyfutureholdings.com/financial/default.aspx, http://www.sec.gov/edgar.shtml, and www.efhcaseinfo.com. This Disclosure Statement expressly incorporates the EFH Public Filings by reference. As reflected in the EFH Public Filings and this Disclosure Statement, there are risks, uncertainties, and other important factors that could cause the Debtors’ actual performance or achievements to be materially different from those they may project, and the Debtors undertake no obligation to update any such statement. Certain of these risks, uncertainties, and factors are described in Section VIII of this Disclosure Statement, entitled “Risk Factors,” which begins on page 167.

2

| B. | Overview of EFH. |

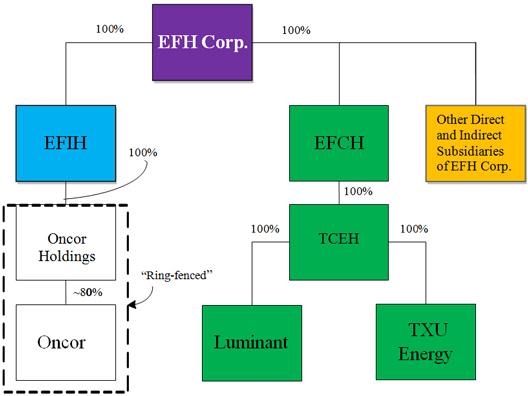

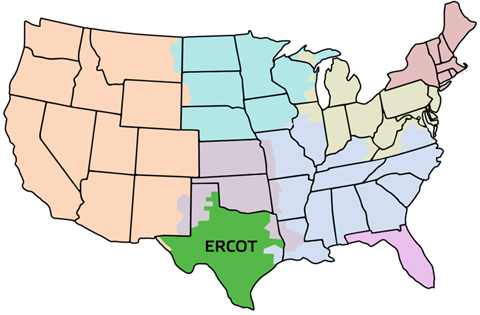

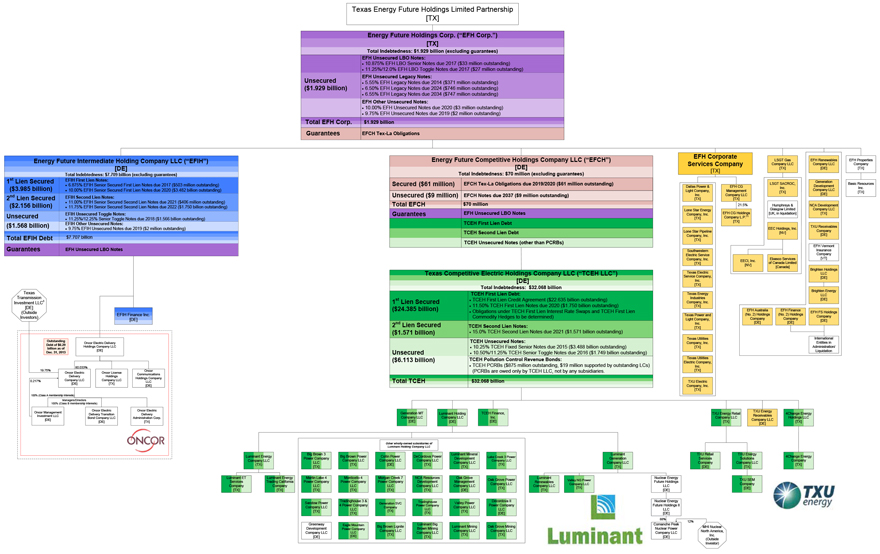

EFH’s businesses include the largest generator, distributor, and certified retail provider of electricity (or “REP”) in Texas.4 EFH conducts substantially all of its business operations in the electricity market overseen by the Electric Reliability Council of Texas (“ERCOT”), which covers the majority of Texas. The Texas electricity market, in turn, is subject to oversight and regulation by the Public Utility Commission of Texas (the “PUCT”). As of December 31, 2015, EFH had approximately 8,860 employees, approximately 5,300 of whom are employed by the Debtors and the remainder of which are employed by the non-Debtor, Oncor Electric. EFH has three distinct business units:

| • | EFH’s competitive electricity generation, mining, wholesale electricity sales, and commodity risk management and trading activities, conducted by the TCEH Debtors composing “Luminant”; |

| • | EFH’s competitive retail electricity sales and related operations, mainly conducted by the TCEH Debtors composing “TXU Energy”;5 and |

| • | EFH’s rate-regulated electricity transmission and distribution operations, conducted by the non-Debtor Oncor Electric Delivery Company LLC (“Oncor Electric”). EFIH, which is 100% owned by EFH Corp., indirectly owns approximately 80% of Oncor Electric. As described below, Oncor Holdings and Oncor Electric are not Debtors in the Chapter 11 Cases. |

EFH and its management team have significant experience as leaders in the electricity industry.

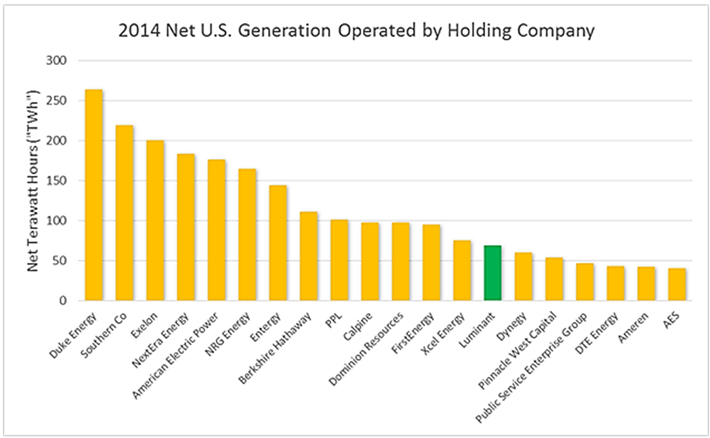

With the addition of two natural gas combined cycle gas turbine (CCGT) plants acquired in April of 2016, Luminant currently owns and operates 15 power plants comprising 50 electricity generation units.6 Luminant’s total electricity generation of 16,760 megawatts (“MW”) accounts for approximately 19% of the generation capacity in the ERCOT market. Luminant sells approximately 66% of its electricity generation output to TXU Energy, and sells the remainder through bilateral sales to third parties or through sales directly to ERCOT. Luminant also owns and operates 12 surface lignite coal mines in Texas that supply coal to Luminant’s lignite/coal-fueled units.7 Luminant is the largest coal miner in Texas and the ninth-largest coal miner in the United States.8

TXU Energy sells electricity to approximately 1.7 million residential and business customers, and is the single largest REP by customer count in Texas. TXU Energy serves approximately 25% of the residential customers and approximately 17% of the business customers in the areas of the ERCOT market that are open to competition. TXU Energy generally purchases all of its electricity requirements from Luminant. TXU Energy maintains a strong position in the highly competitive ERCOT retail electricity market due to its industry-leading customer care performance and technological innovation.

Oncor Electric is engaged in rate-regulated electricity transmission and distribution activities in Texas. Oncor Electric provides these services at rates approved by the PUCT to REPs (including TXU Energy) that sell electricity to

| 4 | For financial reporting under Generally Accepted Accounting Principles (“US GAAP”), EFH Corp. reports information for two segments: the Competitive Electric and Regulated Delivery business segments. The Competitive Electric segment includes both Luminant and TXU Energy. The Regulated Delivery segment is composed of Oncor. The Competitive Electric segment is essentially engaged in the production of electricity and the sale of electricity in wholesale and retail channels. |

| 5 | The Debtors also conduct a relatively small amount of retail electricity operations through their 4Change Energy brand and another entity, Luminant ET Services Company, which provides retail electricity service to one municipality and to some of Luminant’s mining operations, and a small amount of retail gas operations through Luminant Energy Company LLC. |

| 6 | Of those units, 49 units are in active year-round operation, and one unit is subject to seasonal operation. |

| 7 | Of these mines, eight are active, two are in development, and two are currently idle. |

| 8 | Based on tons of coal mined in 2013. |

3

residential and business customers, as well as to electricity distribution companies, cooperatives, and municipalities. Oncor Electric operates the largest transmission and distribution system in Texas, delivering electricity to more than 3.3 million homes and businesses and operating more than 121,000 miles of transmission and distribution lines. Oncor Electric has the largest geographic service territory of any transmission and distribution utility within the ERCOT market, covering 91 counties and over 400 incorporated municipalities. Importantly, however, Oncor Electric is “ring-fenced” from the Debtors: it has an independent board of directors, and it is operated, financed, and managed independently. As a result, its financial results of operation are not consolidated into EFH Corp.’s financial statements. A significant portion of Oncor Electric’s revenues are attributable to TXU Energy, which is Oncor Electric’s largest customer. Oncor Holdings, Oncor Electric, and their ring-fenced subsidiaries are not Debtors in the Chapter 11 Cases.

EFH largely adopted its current organizational structure, and issued a significant portion of the debt that composes its capital structure, in October 2007, as a result of the private acquisition of a public company, TXU Corp. (the “2007 Acquisition”). At the time, investment funds affiliated with Kohlberg Kravis Roberts & Co. L.P. (“KKR”), TPG Capital, L.P. (“TPG”) and Goldman, Sachs & Co. (“Goldman Sachs”) (together with KKR and TPG, the “Sponsor Group”), together with certain co-investors, contributed approximately $8.3 billion of equity capital into EFH through Texas Energy Future Holdings Limited Partnership (“Texas Holdings”). And, like many other private acquisitions, EFH issued significant new debt and assumed existing debt and liabilities in connection with the 2007 Acquisition. Immediately following the 2007 Acquisition, the Debtors’ total funded indebtedness was approximately $36.13 billion, comprised of approximately $28.8 billion at TCEH, $128 million at EFCH, and $7.2 billion at EFH Corp.

As of the Petition Date, the principal amount of the Debtors’ total funded indebtedness was nearly $42 billion, including:

| • | approximately $24.385 billion of TCEH First Lien Debt (excluding amounts due under canceled TCEH First Lien Interest Rate Swaps and TCEH First Lien Commodity Hedges, which the TCEH Debtors estimate total approximately $1.235 billion), $1.571 billion of TCEH Second Lien Notes, $5.237 billion of TCEH Unsecured Notes, and $875 million of Pollution Control Revenue Bonds; |

| • | approximately $61 million of Tex-La Obligations that are obligations of EFCH, which are guaranteed by EFH Corp., and secured by an interest in certain assets owned by the TCEH Debtors and Oncor, and approximately $9 million of EFCH 2037 Notes; |

| • | approximately $1.929 billion of EFH Unsecured Notes (including $1.282 billion of EFH Legacy Notes held by EFIH); and |

| • | approximately $3.985 billion of EFIH First Lien Notes, $2.156 billion of EFIH Second Lien Notes, and $1.568 billion of EFIH Unsecured Notes. |

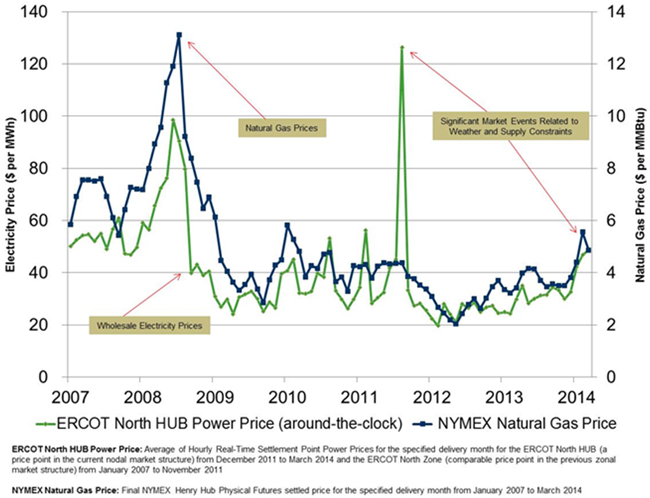

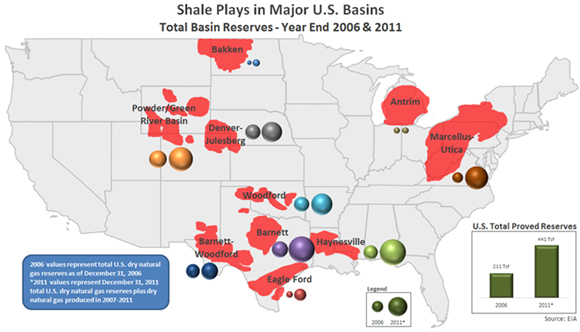

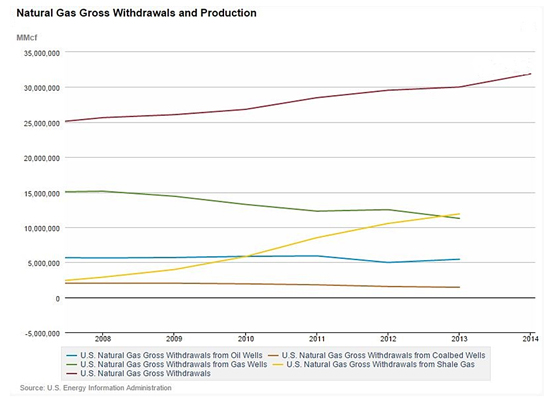

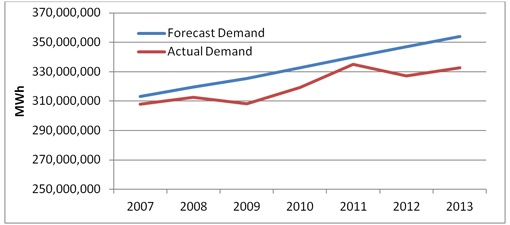

Although the Debtors’ core business operations are strong, and TCEH and EFIH have historically been and will continue to be cash flow positive before debt service, low wholesale electricity prices in the Texas electricity market have made it impossible for the TCEH Debtors to support their current debt load. In October 2007, the main ingredients for EFH’s financial success were robust. Since 2007, however, overall economic growth was reduced because of the economic recession in 2008 and 2009 and wholesale electricity prices have significantly declined. The material and unexpected reduction in wholesale electricity prices was caused, in large part, by an increase in the supply of natural gas caused by the rise of hydraulic fracturing (known as “fracking”) and advances in directional drilling techniques. This increase in the supply of natural gas caused a significant decline in natural gas prices, and because the wholesale price of electricity in the ERCOT market is closely tied to the price of natural gas, the wholesale price of electricity in the ERCOT market has significantly declined since 2007. As a result of this significant decline in wholesale electricity prices in ERCOT coupled with higher fuel and environmental compliance costs, the profitability of the TCEH Debtors’ generation assets has substantially declined.

Separately, EFIH and EFH Corp. have significant funded indebtedness and had insufficient cash flows to service those obligations. Before the Petition Date, EFIH—which is a holding company that has no independent business operations—relied on dividend distributions from Oncor Electric and intercompany interest payments (relating to debt issued by EFH Corp. and the TCEH Debtors that EFIH acquired in exchange offers) to satisfy its

4

funded debt obligations. These sources of cash, however, were not sufficient to service EFIH’s obligations. EFH Corp. also has minimal cash flow. As a result, both EFIH and EFH Corp. faced significant liquidity constraints that prompted their chapter 11 filings.

| C. | Overview of the Plan. |

| 1. | Events Leading Up to the Plan. |

| A. | The Restructuring Support Agreement and Bidding Procedures. |

The Debtors commenced their Chapter 11 Cases on April 29, 2014, after signing a restructuring support agreement (the “Restructuring Support Agreement”) with certain of their significant stakeholders. The Restructuring Support Agreement was the product of arm’s-length negotiations with the Debtors’ stakeholders and more than two years of efforts to evaluate available restructuring alternatives. At the time the Debtors signed the Restructuring Support Agreement, the Restructuring Support Agreement represented the best available, value-maximizing restructuring alternative. The Restructuring Support Agreement contemplated, among other things, an EFIH Second Lien DIP Facility, under which certain Holders of EFIH Unsecured Notes would have become the majority owners of Reorganized EFH. After the Debtors filed the Chapter 11 Cases, however, the Debtors received competing offers to acquire EFH Corp.’s economic ownership interest in Oncor Electric, including from third party strategic buyers. These bids offered new alternatives to maximize the value of the Debtors’ estates, and the Debtors opted to terminate the Restructuring Support Agreement in July 2014 to pursue these potential offers, consistent with their fiduciary duties.

After terminating the Restructuring Support Agreement, the Debtors then worked diligently with their advisors and stakeholders to develop a process to maximize estate recoveries resulting from the market interest in EFH Corp.’s indirect economic ownership interest in Oncor Electric (the “Bidding Procedures”). The Bankruptcy Court entered an order approving the Bidding Procedures and related auction process for the selection of the highest or otherwise best bid (the “Bidding Procedures Order”). As described in Section IV.G., entitled “Exploring the EFH/EFIH Transaction,” which begins on page 69, following entry of the Bidding Procedures Order, the Debtors received Round 1 Bids and Round 2 Bids (each as defined herein) from various strategic and third-party bidders, engaged in extensive diligence sessions with interested bidders, and exchanged drafts of proposed definitive documentation. Ultimately, however, the Debtors did not receive an actionable and value-maximizing proposal in connection with the auction process.

| B. | The Disinterested Director Settlement. |

At the same time, the Debtors and their advisors took a number of key steps to advance plan negotiations and set the stage for the negotiations and settlements that led to the filing of Joint Plan of Reorganization of Energy Future Holdings Corp. et al., Pursuant to Chapter 11 of the Bankruptcy Code filed on April 14, 2015 [D.I. 4142] and accompanying disclosure statement (the “Original Confirmed Plan” and Sixth Disclosure Statement,” respectively).

In November 2014, each of EFH Corp., EFIH, and EFCH/TCEH, retained counsel and financial advisors (together, the “Conflicts Matter Advisors”) to advise and represent them in reviewing and analyzing actual conflicts matters among those Debtors’ estates, including potential intercompany Claims among the Debtors, at the direction of the disinterested directors and managers at each of EFH, EFIH, and EFCH/TCEH, respectively.9

Additionally, to allow the disinterested directors or managers and the Conflicts Matter Advisors to fully engage in restructuring discussions on actual conflict matters, the Debtors expended significant efforts to provide the Conflicts Matter Advisors with diligence regarding potential conflicts matters and actual conflicts matters. This included frequent telephonic and in-person diligence sessions, and involved the Debtors or their advisors providing materials or presentations that helped inform the Conflicts Matter Advisors on key factual and legal issues and the Debtors’ historical transactions.

| 9 | The EFH Notes Indenture Trustee asserts that the disinterested directors and managers at each of EFH, EFIH, and EFCH/TCEH are not disinterested with respect to the Plan because such disinterested directors and managers are Released Parties and Exculpated Parties. The Debtors disagree with such assertions and believe that the burden is on the challenging party to create reasonable doubt that a director is not disinterested. See, e.g., Beam v. Stewart, 845 A.2d 1040, 1049 (Del. 2004). Consequently, the Debtors and the EFH Notes Indenture Trustee reserve all rights in connection with these issues. |

5

The Debtors’ co-chief restructuring officers (“co-CROs”) led the development of a plan term sheet that was based on proposals and feedback received from the Debtors’ creditors following numerous meetings and telephone conferences the Debtors and their advisors participated in with their stakeholders where the parties discussed various plan of reorganization concepts and issues. Numerous stakeholders made their own proposals, which the Debtors closely reviewed and analyzed.

Following nearly a month of discussions and negotiations with their stakeholders about the plan term sheet and alternative proposals, on March 9, 2015, the Debtors circulated to the same stakeholder groups a revised draft of the plan term sheet and a revised proposed confirmation timeline that set forth preliminary illustrative settlement numbers based on feedback the co-CRO’s had received from stakeholders. The substantive content of the plan term sheet and confirmation timeline were approved by the co-CROs and the numbers were intended to strike a preliminary but appropriate balance among the various interests reflected in the various proposals that had been discussed. As had been the case with the term sheet circulated on February 11, 2015, while the Debtors had not sought and received approval from their boards of the substantive content of the revised plan term sheet, the circulation of the revised plan term sheet and confirmation timeline was supported by each of the Debtors’ boards, including the disinterested directors and managers in consultation with their respective Conflicts Matter Advisors.

Following the engagement of the Conflicts Matter Advisors and while all of the above was taking place, the Debtors’ disinterested directors and managers undertook a comprehensive process to prepare for and participate in negotiations with each other regarding the various inter-Debtor issues and claims that would necessarily affect any plan of reorganization. This included in-person and telephonic discussions and negotiation sessions over the course of multiple weeks and culminated in a settlement among the Debtors’ disinterested directors and managers (the “Disinterested Director Settlement”). This settlement is based on independent analyses and diligence conducted by the Debtors’ disinterested directors and managers after consultation with the Conflicts Matter Advisors and was the product of significant and deliberate negotiations among the Debtors’ disinterested directors and managers.

In sum, the co-CROs led the formulation and the negotiation of the Original Confirmed Plan as a whole, subject to the Debtors’ disinterested directors’ and managers’ formulation and negotiation of the Plan with respect to actual conflict matters.

| C. | The “Standalone Plan” and Convergence on the Merger Transaction. |

Approximately one year after the Petition Date, and following months of discussions with their stakeholders and following good faith, arm’s length negotiations among the Debtors’ disinterested directors and managers, the Debtors filed initial versions of the Original Confirmed Plan and Sixth Amended Disclosure Statement on April 14, 2015 in a continued effort to negotiate a consensual, value-maximizing Plan.

The versions of the Original Confirmed Plan and Sixth Amended Disclosure Statement filed on April 14, 2015 provided for a Spin-Off and one of three forms of transaction for Reorganized EFH: a merger, an equity investment, or a standalone reorganization (such contemplated transactions, the “EFH/EFIH Transaction”). As described in Section IV.H., entitled “Exploring the EFH/EFIH Transaction” which begins on page 80, following the filing of the initial versions of the Original Confirmed Plan and the Sixth Amended Disclosure Statement, the Debtors continued to evaluate the possibility of executing a potential EFH/EFIH Transaction through the formal auction process governed by the Bidding Procedures Order. Ultimately, the Debtors determined that they were not prepared to enter into a definitive agreement for any of the Round 2 Bids they received in connection with the auction.

At the same time the Debtors explored potential bids in connection with the formal auction process, the Debtors continued to engage in discussions with their various creditor constituencies regarding the possibility of converting EFIH’s interest in Oncor Electric into a real estate investment trust under the Internal Revenue Code of 1986, as amended (a “REIT” and the transactions and commercial arrangements necessary to implement a REIT structure for EFH, Reorganized EFH, EFIH, Reorganized EFIH, and/or any direct or indirect subsidiary of EFIH or Reorganized EFIH (or a successor of any of these entities), the “REIT Reorganization”), a possibility that has long been known to the Debtors and their creditors as a potential option for unlocking significant value for the EFIH Debtors but which requires certain rulings from, among others, the Internal Revenue Service (“IRS”) and the PUCT.

6

Based on these discussions, the Debtors and various of their constituencies discussed several potential paths forward, described in greater detail in Section IV.G. entitled “Exploring the EFH/EFIH Transaction,” which begins on page 73. Ultimately, the Debtors determined to pursue two aspects of the EFH/EFIH Transaction alternatives provided for in the versions of the Original Confirmed Plan and Sixth Amended Disclosure Statement filed on April 14, 2015: (a) a merger and investment structure, in which certain investors (including, potentially, existing creditor constituencies) would provide a new-money contribution that would be used to provide a full recovery to Allowed Claims against EFH and EFIH, in cash (excluding Makewhole Claims) and (b) the Spin-Off. As a condition to effectiveness of the Merger (as described below and in the Original Confirmed Plan), Reorganized EFH (or a successor entity) would be required to successfully obtain certain approvals and rulings, including PUCT approvals and IRS rulings, necessary for the REIT Reorganization.

Ultimately, the Debtors, certain plan sponsors, which included existing and strategic investors, the TCEH Supporting First Lien Creditors, the TCEH First Lien Agent, the TCEH Supporting Second Lien Creditors, the TCEH Committee, and the TCEH Unsecured Ad Hoc Group, executed a plan support agreement, dated as of August 9, 2015 (as amended on September 11, 2015 and as may be amended, supplemented, or otherwise modified from time to time in accordance therewith, including all exhibits and schedules attached thereto, the “Plan Support Agreement”) which required, among other things, that the parties to the Plan Support Agreement support the Original Confirmed Plan and seek prompt confirmation and consummation of the Restructuring Transactions contemplated therein, and subject to the conditions set forth therein. The Plan Support Agreement also contained certain provisions agreed to by the parties to the Plan Support Agreement in the event the Debtors had to pursue an alternative restructuring other than that contemplated by the Original Confirmed Plan (as defined in the Plan Support Agreement, the “Alternative Restructuring”).

Among other terms, the Alternative Restructuring contemplates the TCEH Cash Payment. The TCEH Cash Payment (as defined in the Plan Support Agreement) is the $550 million in Cash, payable to the Holders of Allowed TCEH First Lien Deficiency Claims, Allowed TCEH Unsecured Note Claims, Allowed TCEH Second Lien Note Claims, Allowed PCRB Claims, and Allowed General Unsecured Claims Against the TCEH Debtors Other Than EFCH, and subject to certain reductions (including as a result of the EFH Settlement, as described herein).

Additionally, the Original Confirmed Plan contemplated a merger (the “Merger”) pursuant to that certain Purchase Agreement and Plan of Merger, dated as of August 9, 2015, as may be amended, supplemented, or otherwise modified from time to time in accordance therewith, including all exhibits attached thereto (the “Merger and Purchase Agreement”) by and among EFH Corp., EFIH, and two acquisition vehicles controlled by certain purchasers on the Effective Date of Reorganized EFH with and into New EFH in a transaction intended to qualify as a tax-free reorganization, under section 368(a) of the Internal Revenue Code, with New EFH continuing as the surviving corporation. The Merger would be funded through equity investments made pursuant to an equity commitment letter, rights offering, and backstop agreement (collectively, the “Equity Investment”), each of which would be used to fund certain distributions under the Plan.

The Bankruptcy Court approved the Debtors’ entry into the Plan Support Agreement on September 18, 2015 [D.I. 6097]. The Bankruptcy Court confirmed the Original Confirmed Plan on December 9, 2015 [D.I. 7285]. The Bankruptcy Court also authorized the Debtors to enter into the Merger and Purchase Agreement and the related equity commitments.

| D. | Issues Related to Closing of the Merger. |

The Effective Date of the Original Confirmed Plan and consummation of the Merger and Purchase Agreement included various conditions precedent to consummation of the transactions contemplated thereby, including a condition that certain approvals and rulings be obtained, including from the PUCT and the IRS.

Under the terms of the Plan Support Agreement, the parties’ obligations to support the Original Confirmed Plan and the transactions contemplated therein could terminate on April 30, 2016 (the “Plan Support Outside Date”) unless (a) all required approvals from the Public Utility Commission of Texas (the “PUCT”) with respect to consummation of the Original Confirmed Plan and the transactions contemplated by the Merger and Purchase Agreement have been obtained by such date, in which case the April 30, 2016 date would be automatically extended by 60 days or (b) all such required approvals have not been obtained, but the investors party to the Merger and Purchase Agreement could submit a written request by April 30, 2016 to extend such date by 30 days in exchange for a $50 million reduction of the TCEH Cash Payment.

7

Following confirmation of the Original Confirmed Plan, the Debtors and the purchasers under the Merger and Purchase Agreement diligently worked to effectuate the Original Confirmed Plan.

On March 24, 2016, the Public Utilities Commission of Texas (the “PUCT”), entered an order related to the proposed transfer of control of Oncor and the related REIT Reorganization contemplated by the Merger and Purchase Agreement (the “PUCT Order”). The PUCT Order did not include all of the approvals required from the PUCT with respect to consummation of the Original Confirmed Plan and the Merger and Purchase Agreement, including with respect to the terms of the initial lease between Oncor AssetCo and OEDC (requiring a separate proceeding for such approval). See, e.g., PUCT Order, ¶ 191-92.

Because the PUCT Order did not include all of the approvals required for consummation of the Original Confirmed Plan and the Merger and Purchase Agreement, the Plan Support Outside Date was not automatically extended. On April 30, 2016, the investor parties that are party to the Plan Support Agreement indicated that they would not elect to extend the Plan Support Outside Date. As a result, the Ad Hoc TCEH First Lien Committee delivered a Plan Support Termination Notice (as defined in the Plan Support Agreement) to the Debtors and the Required Investor Parties (as defined in the Plan Support Agreement), which caused the Original Confirmed Plan to be null and void.

Importantly, the occurrence of a Plan Support Termination Event (as defined in the Plan Support Agreement), does not terminate the Plan Support Agreement, but rather only terminates the parties’ obligations with respect to the Original Confirmed Plan. In other words, the Plan Support Agreement continues to bind the parties to the Plan Support Agreement with respect to certain key terms that would be set forth in any Alternative Restructuring (including as contemplated by the Plan).

Contemporaneously herewith, the Debtors filed the Plan, which includes the Alternative Restructuring Terms including the TCEH Cash Payment.

The Debtors may withdraw the Plan at any time if the Debtors determine that pursuing Confirmation or Consummation of the Plan would be inconsistent with any Debtor’s fiduciary duties.

| 2. | Plan Structure. |

The Plan constitutes a separate plan of reorganization for each of the Debtors. The Plan provides that (i) confirmation of the Plan with respect to the TCEH Debtors may occur separate from, and independent of, confirmation of the Plan with respect to the EFH Debtors and EFIH Debtors (subject to the applicable conditions precedent to confirmation) and (ii) the TCEH Effective Date for the Plan with respect to the TCEH Debtors may occur separate from, and independent of, the EFH Effective Date for the Plan with respect to the EFH Debtors and EFIH Debtors (subject to the applicable conditions precedent to each Effective Date).

Additionally, the Plan provides for the following key transactions and recoveries for each of the TCEH Debtors, EFH Debtors, and EFIH Debtors.

| • | TCEH and the TCEH Debtors. |

| • | The Plan provides for two potential restructurings for the TCEH Debtors. |

| • | If the Spin-Off Condition is satisfied, the stock of Reorganized TCEH, the New Reorganized TCEH Debt (or the net proceeds thereof), the net cash proceeds of the Spin-Off Preferred Stock Sale, the Spin-Off TRA Rights (if any), and the proceeds of the TCEH Settlement Claim less any TCEH Settlement Claim Turnover Distributions will be distributed to Holders of TCEH First Lien Claims in a transaction intended to qualify as a tax-free reorganization under section 368(a)(1)(G) of the IRC. |

8

| • | Additionally, if the Spin-Off Condition is satisfied, certain of the TCEH Debtors’ assets will be transferred to the Preferred Stock Entity pursuant to the Spin-Off Preferred Stock Sale in a transaction intended to qualify as a taxable sale exchange under section 1001 of the IRC. |

| • | Under the Spin-Off, TCEH will spin off from the Debtors to form a standalone reorganized entity, Reorganized TCEH, and certain tax attributes of the EFH Group will be substantially used to provide Reorganized TCEH with a partial step-up in tax basis in certain of its assets, valued at approximately $1.0 billion. |

| • | In general, the overall tax basis of Reorganized TCEH’s assets will be higher if the Spin-Off Condition is satisfied. |

| • | If the Spin-Off Condition is not satisfied, then the assets of the TCEH Debtors will be transferred to Reorganized TCEH in a transaction or transactions intended to qualify as a taxable sale or exchange under section 1001. |

| • | Class C3: TCEH First Lien Secured Claims. As set forth in the Plan, the treatment of the Class C3 TCEH First Lien Secured Claims depends on whether the Spin-Off is effectuated or whether the Taxable Separation is effectuated, in each case pursuant to the terms and conditions set forth in the Plan. |

| • | Class C4: TCEH Unsecured Debt Claims and Class C5: General Unsecured Claims Against the TCEH Debtors Other Than EFCH. Each Holder of a Class C4 and Class C5 Allowed Claim shall receive its Pro Rata share of the TCEH Cash Payment. |

| • | TCEH will receive an allowed, unsecured settlement claim against EFH Corp. (the “TCEH Settlement Claim”) (as described below in Section 3, entitled “Settlement and Release of Debtor Claims,” which begins on page 12), in the amount of $700 million, which shall receive the same treatment as the other Impaired Classes with Claims against the EFH Debtors, subject to certain conditions. |

| • | EFH Debtors and EFIH Debtors. |

| • | Investment Scenario. In the Investment Scenario, certain investors (including, potentially, existing creditor constituencies) would provide a new-money contribution at the Investment Plan Value, that may be used, at the option of the applicable Debtor(s), to provide a recovery to Allowed Claims against EFH Corp. and EFIH in the form of Cash or Reorganized EFH Common Stock. The Investment Plan Value means the value as of the EFH Effective Date of the Reorganized EFH Common Stock under the Plan in an amount to be disclosed in advance of the Confirmation Hearing. |

| • | Standalone Scenario. The Standalone Scenario contemplates either no new-money contribution or a new-money contribution at the Standalone Plan Value. The Standalone Plan Value means, solely with respect to the Standalone Scenario, the value as of the EFH Effective Date of the Reorganized EFH Common Stock under the Plan in an amount to be disclosed in advance of the Confirmation Hearing. |

| • | Certain of the Claims asserted against the EFH Debtors may constitute EFH Beneficiary Claims (specifically, the Allowed EFH Non-Qualified Benefit Claims, the Allowed EFH Unexchanged Note Claims, and the Allowed General Unsecured Claims Against EFH Corp.) if the Class comprising each of such Claims fails to vote to accept or reject the Plan consistent with the Voting Condition (set forth in the EFH Settlement, described herein). |

| • | Holders of EFH Beneficiary Claims are entitled to receive, in addition to their other recoveries as Allowed EFH Corp. Claims, their Pro Rata share of the TCEH Settlement Claim |

9

| Turnover Distribution in an aggregate amount not to exceed $37.8 million. The TCEH Settlement Claim Turnover Distribution is a distribution of the recovery, proceeds, or distributions, if any, that TCEH receives on account of the TCEH Settlement Claim that it is required to assign to Holders of EFH Beneficiary Claims under the EFH Settlement. Recovery pursuant to the TCEH Settlement Claim Distribution. |

| • | The EFH Debtors also reserve their right to assert that any Holder of an Allowed Claim against the EFH Debtors who receives its Pro Rata share of the EFH Creditor Recovery Pool is Unimpaired if such recovery satisfies such Holder’s Allowed Claim in full. |

| • | The REIT Reorganization is not a condition to consummation of the Plan with respect to the EFH Debtors and EFIH Debtors. |

In exchange for the value provided and the compromises contained in the Plan and the Settlement Agreement, the Plan provides for the mutual release of Claims among all Debtors and consenting Holders of Claims and Interests and third-party releases of direct and indirect Holders of Interests in EFH Corp. and its affiliates.

Other significant aspects of the Plan are summarized below.

| (a) | TCEH Spin-Off. |

If applicable, the TCEH Debtors will undertake the Spin-Off, as follows:

| i. | TCEH formed Reorganized TCEH prior to the TCEH Effective Date; |

| ii. | on the TCEH Effective Date, except for liabilities assumed by Reorganized TCEH pursuant to the Plan, all other Claims against the TCEH Debtors will be canceled, and each Holder of an Allowed Claim against a TCEH Debtor will have the right to receive its recovery in accordance with the terms of the Plan; and TCEH shall assume the obligations of its subsidiaries that are TCEH Debtors to make distributions pursuant to and in accordance with the Plan that are to be made after the TCEH Effective Date; |

| iii. | immediately following such cancelation, pursuant to the Separation Agreement, TCEH and the EFH Debtors will make the Contribution to Reorganized TCEH, in exchange for which TCEH shall receive 100% of the (i) Reorganized TCEH membership interests and (ii) the net Cash proceeds of the New Reorganized TCEH Debt (or, at the TCEH Supporting First Lien Creditors’ election, with the consent of the Debtors, all or a portion of such New Reorganized TCEH Debt); |

| iv. | immediately following the Contribution, TCEH and Reorganized TCEH shall effectuate the Spin-Off Preferred Stock Sale, including the distribution of the proceeds thereof to TCEH; |

| v. | immediately following the Spin-Off Preferred Stock Sale, Reorganized TCEH shall undertake the Reorganized TCEH Conversion; and |

| vi. | immediately following the Reorganized TCEH Conversion, TCEH will make the Distribution. |

10

| (b) | TCEH Step-Up in Tax Basis. |

If the Spin-Off is effectuated pursuant to the terms and conditions set forth in Article IV.B.2 of the Plan, pursuant to the Spin-Off Preferred Stock Sale, gain will be triggered in an amount not in excess of, and in order to achieve, a partial step-up in tax basis in certain of the EFH Group’s assets (as defined in the Plan, the “Basis Step-Up”).

For more information on the Basis Step-Up and the Spin-Off Preferred Stock Sale, refer to Section X.A of this Disclosure Statement, entitled “Introduction” which begins on page 205.

| (c) | New Debt |

The Plan also contemplates new senior secured debt or equity securities to be issued by Reorganized EFIH (on the EFH Effective Date) and new long-term debt to be issued by Reorganized TCEH (on the TCEH Effective Date but prior to the Reorganized TCEH Conversion) (as defined in the Plan, the New Reorganized EFIH Debt and the New Reorganized TCEH Debt). As reflected in the Plan filed contemporaneously herewith, the New Reorganized EFIH Debt is currently contemplated to be issued in an aggregate amount of up to $4.7 billion, although the final principal amount of New Reorganized EFIH Debt to be issued on the EFH Effective Date is still the subject of ongoing discussions and negotiations.

| (i) | Private Letter Ruling. |

The Spin-Off is conditioned upon the Debtors’ receipt of the Private Letter Ruling (as defined below) that includes certain rulings (such rulings, as defined in the Plan, the “Fundamental Rulings”). EFH filed a written request with the IRS dated June 10, 2014 (the “Original Ruling Request”) that the IRS issue a private letter ruling (the “Private Letter Ruling”) to EFH addressing the qualification of the Contribution, the Reorganized TCEH Conversion, and the Distribution as a “reorganization” within the meaning of Sections 368(a)(1)(G), 355, and 356 of the Internal Revenue Code of 1986 (as amended, the “IRC”), as well as addressing certain other matters. The Debtors have subsequently provided supplemental information to the IRS, including a supplemental written request with the IRS dated September 3, 2015 (the “Supplemental Ruling Request” and, together with the Original Ruling Request, the “Ruling Request”) that seeks certain additional rulings (including certain of the Fundamental Rulings) and addresses the structural changes to the Plan that have occurred since the Original Ruling Request was submitted, including the REIT Reorganization.

| D. | Makewhole and Postpetition Interest Claims Discussion. |

| 1. | Postpetition Interest Claims. |

The Plan provides for payment of postpetition interest at the Federal Judgment Rate with respect to unsecured claims arising from EFH Corp. and EFIH funded indebtedness (“Postpetition Interest Claims”), and provides that claims for postpetition interest interest in excess of the Federal Judgment Rate shall be disallowed in their entirety.

| a. | Plan Treatment of Postpetition Interest Claims. |

With respect to Postpetition Interest Claims, the Plan contemplates treating claims for postpetition interest as Allowed Claims equal to the following amounts (the following, the “Allowed Postpetition Interest Claims”):

| • | EFIH First Lien Notes: Accrued but unpaid postpetition interest (including any Additional Interest and interest on interest) on outstanding principal as of the Petition Date at the non-default contract rate as set forth in the EFIH First Lien Indenture through the closing date of the EFIH First Lien DIP Facility. |

| • | EFIH Second Lien Note Claims: Accrued but unpaid postpetition interest (including any Additional Interest and interest on interest) on outstanding principal as of the Petition Date at the non-default contract rate set forth in the EFIH Second Lien Indenture through the EFH Effective Date. |

11

| • | General Unsecured Claims Against the EFIH Debtors: Accrued postpetition interest on outstanding principal as of the Petition Date at the Federal Judgment Rate (which, for the avoidance of doubt, excludes Additional Interest). |

| • | EFH LBO Note Primary Claims: Accrued postpetition interest on outstanding principal as of the Petition Date at the Federal Judgment Rate (which, for the avoidance of doubt, excludes Additional Interest). |

| • | EFH LBO Note Guaranty Claims: Accrued postpetition interest on outstanding principal as of the Petition Date at the Federal Judgment Rate (which, for the avoidance of doubt, excludes Additional Interest). |

| • | EFH Unexchanged Note Claims: Accrued postpetition interest on outstanding principal as of the Petition Date at the Federal Judgment Rate (which, for the avoidance of doubt, excludes Additional Interest). |

| • | EFH Legacy Note Claims: Accrued postpetition interest on outstanding principal as of the Petition Date at the Federal Judgment Rate (which, for the avoidance of doubt, excludes Additional Interest). |

| 2. | Distributions on Account of Makewhole Claims. |

| a. | Objections to Makewhole Claims. |

The Plan contemplates, and effectiveness of the Plan is conditioned on, all alleged Claims under certain series of EFH Corp. and EFIH funded indebtedness regarding the entitlement to optional redemption premiums or similar “makewhole” payments asserted in connection with the repayment or satisfaction of such indebtedness during the Chapter 11 Cases or under the Plan (“Makewhole Claims”) being Disallowed Makewhole Claims as of the Effective Date.

As of the date hereof, the EFH Debtors and the EFIH Debtors, as applicable, have objected to or otherwise challenged (or will object or otherwise challenge) Makewhole Claims asserted by Holders of: (a) the EFH Legacy Note Claims, as set forth in the EFH Legacy Note Objection; (b) the EFH Unexchanged Note Claims, the EFH LBO Note Primary Claims, and the EFH LBO Note Guaranty Claims, all as set forth in the Non-Legacy Note EFH Unsecured Objection, (c) the EFIH First Lien Note Claims [Adversary D.I. 33], (d) the EFIH Second Lien Note Claims [Adversary D.I. 39] (the “EFIH Second Lien Challenge”), and (e) Claims under the EFIH Toggle Notes, as set forth in the EFIH PIK Objection (collectively, the “Makewhole Challenges”). As of the date hereof, the Bankruptcy Court has disallowed the Makewhole Claims under the EFIH First Lien Notes and the EFIH Second Lien Notes (but such disallowance is the subject of a pending appeal) and, as described further in Section IV.K., entitled “Makewhole Litigation,” beginning on page 86, the EFH Debtors and EFIH Debtors (as applicable) and the remaining Holders of Makewhole Claims are engaged in proceedings regarding the Makewhole Challenges.

With respect to the EFH Legacy Note Claims, the EFH Notes Trustee has asserted that the EFH Legacy Notes are distinguishable from the Bankruptcy Court’s earlier ruling that the automatic acceleration of the EFIH First Lien Notes prevented the EFIH First Lien Notes from being entitled to a Makewhole Claim because of the variance in the language of the EFH Legacy Note Indentures and because none of the EFH Legacy Notes have been accelerated. The Debtors disagree with such assertions and reserve all rights with respect to such assertions, and nothing in this Disclosure Statement shall affect the Debtors’ rights with respect to the EFH Legacy Note Objection.

| b. | Treatment of Makewhole Claims. |

To the extent such Makewhole Claims are not disallowed by the Bankruptcy Court, a condition to the Effective Date will be unable to be satisfied. Such condition can, however, be waived by the Debtors, with the consent of the Plan Sponsors, the TCEH Supporting First Lien Creditors, and, subject to and through the Plan Support Termination Date, the TCEH Supporting Second Lien Creditors and the TCEH Committee (in each case such consent not to be unreasonably withheld). Otherwise, the Plan may be withdrawn because of the Debtors’ inability to satisfy this condition. Nothing in the Plan, the Disclosure Statement, or the Confirmation Order affects, modifies, or alters any Holder’s rights to appeal the Confirmation Order or any other order of the Bankruptcy Court.

12

The Debtors, such Holders of Makewhole Claims, and all other applicable parties in interest, reserve all rights with respect to arguments that may be raised in connection with any such appeals, including any arguments as to whether such appeals are equitably moot. In addition, any such Holder may be entitled to file a motion for a stay pending appeal of the Confirmation Order under Fed. R. Bankr. Proc. 8007. The Debtors intend to object to any such motion and, in any event, believe that any such stay would require any such Holder to post a supersedeas bond in an amount up to the full purchase price consideration under the Restructuring Transactions. If such Holders obtain relief on appeal, such Holders may seek to enforce such relief against Reorganized EFH or Reorganized EFIH (and each of their successors, including New EFH) and may assert that unless such Makewhole Claims are satisfied in full, in Cash, such Holders are Impaired under the Plan and thus would have been entitled to vote on the Plan. The Debtors disagree with such assertions and reserve all rights in connection with such assertions.

Certain of the Indenture Trustees have taken the position that the Plan must provide for payment in full of their respective Makewhole Claims as, and to the extent, such Claims are Allowed (including after the Effective Date), and that following the Effective Date, such Claims may be enforced against New EFH and any other successor to the EFIH Debtors, as applicable, under the Plan and/or against distributions received under the Plan by Holders of other Claims against any of the Debtors. See Section II.D beginning on page 57 for a detailed description of the EFIH First Lien Notes Trustee’s position and the EFIH Second Lien Trustee’s position with respect to the foregoing. The Debtors disagree with such assertions and reserve their rights with respect to such assertions.

For more information on these and other Claim and Interest Holder recoveries, including the forms of distributions, refer to Section V.E of this Disclosure Statement, entitled “Treatment of Classified Claims and Interests,” which begins on page 111.

| E. | Settlement and Release of Debtor Claims. |

The Plan includes a proposed settlement of numerous claims belonging to the Debtors, including claims against creditors, other Debtors, and third parties. During the Chapter 11 Cases a number of parties have asserted that there are potential litigation claims that could be asserted on behalf of EFCH, TCEH, and certain of EFCH’s and TCEH’s direct and indirect subsidiaries related to various pre-petition transactions. Motions seeking standing to prosecute and settle certain claims against Holders of TCEH First Lien Secured Claims were filed by (a) the TCEH Committee [D.I. 3593]; (b) the EFH Committee [D.I. 3605]; and (c) the TCEH Unsecured Ad Hoc Group [D.I. 3603]. Additional information regarding these motions is included in Section IV.J. of this Disclosure Statement, entitled “TCEH First Lien Investigation” which begins on page 75.

The transactions underlying these claims have been the subject of significant investigation by the Debtors (including their respective disinterested directors and managers and together with their respective Conflicts Matter Advisors), the Creditors’ Committees, and various creditor groups. In addition to informal diligence, in August 2014, the Debtors negotiated entry of an order establishing formal discovery procedures governing a wide breadth of prepetition issues and transactions for a broad time period, in some cases more than 15 years prepetition. This extensive discovery effort, referred to as Legacy Discovery, resulted in the Debtors’ production of more than 806,000 documents (comprising over 5.6 million pages). The Sponsor Group and other parties also made significant document productions. Further discussion of Legacy Discovery is provided in Section IV.J of this Disclosure Statement, entitled “Legacy Discovery,” which begins on page 2.

The release provisions of the Plan contemplate, among other things, the release of any and all Causes of Action, including any derivative claims, asserted on behalf of the Debtors, that each Debtor would have been legally entitled to assert (whether individually or collectively). In particular, the Plan contemplates the settlement of all Intercompany Claims. The settlement terms incorporated into the Plan were approved by the Bankruptcy Court on December 7, 2016 pursuant to the Settlement Order, and released substantially all Intercompany Claims through December 7, 2015, released all claims against the TCEH First Lien Creditors, and released all claims against the Sponsor Group. The Plan provides similar releases for all such claims through the Effective Date.

Other than a $700 million Allowed Claim and distribution right of TCEH in the EFH estate as described above, there will not be any allowed prepetition claims between any of EFH, EFIH, and TCEH or any of their subsidiaries, including Oncor Electric Distribution Holdings Company LLC and its subsidiary.

13

A summary of the alleged claims settled pursuant to the Plan can be found in Section V.H.3 of this Disclosure Statement, entitled “Summary and Discussion of Material Potential Claims Subject to Plan Settlement.”

| F. | Summary of Treatment of Claims and Interests and Description of Recoveries Under the Plan. |

The Plan organizes the Debtors’ creditor and equity constituencies into Classes. For each Class, the Plan describes: (1) the underlying Claim or Interest; (2) the recovery available to the Holders of Claims or Interests in that Class under the Plan; (3) whether the Class is Impaired under the Plan; and (4) the form of consideration, if any, that such Holders will receive on account of their respective Claims or Interests.

Although the Chapter 11 Cases are being jointly administered pursuant to an order of the Bankruptcy Court, the Debtors are not proposing the substantive consolidation of their respective bankruptcy estates.

The proposed distributions and classifications under the Plan are based upon a number of factors. The valuation of Reorganized TCEH as a going concern is based upon the value of TCEH’s assets and liabilities as of an assumed Effective Date of [ ], 2016 and incorporates various assumptions and estimates, as discussed in detail in the Valuation Analysis of Reorganized TCEH, attached hereto as Exhibit G. The valuation of Reorganized EFH and Reorganized EFIH (including Oncor Electric) will be filed in advance of the hearing to consider approval of the Disclosure Statement.

The table below provides a summary of the classification, description, and treatment of Claims and Interests under the Plan. This information is provided in summary form below for illustrative purposes only and is qualified in its entirety by reference to the provisions of the Plan. For a more detailed description of the treatment of Claims and Interests under the Plan and the sources of satisfaction for Claims, including the treatment of certain types of Claims that are not separately classified under the Plan, see Section V of this Disclosure Statement, entitled “Summary of the Plan,” which begins on page 98.

| Class |

Name of Class Under the Plan |

Description of Class |

Estimated Percentage Recovery Under the Plan |

Plan Treatment and Voting Rights | ||||

| Unclassified Non-Voting Claims Against the Debtors | ||||||||

| N/A |

TCEH DIP Claims | Holders of Claims under the TCEH DIP Facility. | 100% | Each Holder shall receive payment in full in Cash. | ||||

| N/A |

EFIH First Lien DIP Claims | Holders of Claims under the EFIH First Lien DIP Facility including any Claims asserted by the EFIH First Lien DIP Agent. | 100% | Each Holder shall receive payment in full in Cash. | ||||

| N/A |

Administrative Claims | Holders of Allowed Administrative Claims against any Debtor. | 100% | Each Holder shall receive payment in full in Cash. | ||||

| N/A |

Priority Tax Claims | Holders of any Priority Tax Claim against any Debtor. | 100% | Each Holder shall receive payment in Cash in a manner consistent with section 1129(a)(9)(C) of the Bankruptcy Code. | ||||

| Classified Claims and Interests of the EFH Debtors (EFH Corp. and each of EFH Corp.’s direct and indirect subsidiaries other than (a) EFIH and its direct and indirect subsidiaries and (b) EFCH and its direct and indirect subsidiaries) | ||||||||

| A1 |