Attached files

| file | filename |

|---|---|

| EX-5 - EXHIBIT 5.1 - KinerjaPay Corp. | exh5_1.htm |

| EX-23 - EXHIBIT 23 - KinerjaPay Corp. | exh_23.htm |

| XML - IDEA: XBRL DOCUMENT - KinerjaPay Corp. | R9999.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KinerjaPay Corp.

(Exact Name of

Registrant as Specified in its Charter)

| Delaware | 3674 | 42-1771817 |

| (State or other Jurisdiction of Incorporation) | (Primary Standard Industrial Classification Code) | (IRS Employer Identification No.) |

Jl. Multatuli, No.8A, Medan, 20151 Indonesia,

Phone: +62-819-6016-168

(Address and Telephone Number of Registrant's Principal

Executive Offices and Principal Place of Business)

| Delaware Intercorp., 113 Barksdale Professional Center, Newark, DE 19711 | |

| (Agent for Service) | |

| Copies to: | |

| Thomas J.

Craft, Jr., Esq. P.O. Box 4143 Tequesta, FL 33469 (561) 317-7036 |

Office of Richard Rubin 40 Wall Street, 28th Floor New York, NY 10005 (212) 400-7198 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

xIf this Form is filed to register additional securities for an Offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same Offering.

¨If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same Offering.

¨If delivery of the Prospectus is expected to be made pursuant to Rule 434, please check the following box.

¨Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| Calculation of Registration Fee | ||||

| Title of Securities To Be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price(2) | Registration Fee(3) |

| Common Stock, $0.0001 per share | 1,450,000 | $0.77 | $1,116,500 | $112.43 |

| (1) This Registration Statement covers the resale by our Selling Shareholders of up to 1,450,000 shares of Common Stock previously issued to such Selling Shareholders. | ||||

| (2) The Offering price has been estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) of the Securities Act and is based upon the closing price of $0.77 per share of the Registrant's Common Stock on the OTCQB Market on May 11, 2016. | ||||

| (3) Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate Offering price. | ||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this Prospectus is not complete and may be changed.

We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission becomes effective. This Prospectus is not an offer to

sell these securities and we are not soliciting offers to buy these securities in any

state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION ON MAY __, 2016

KINERJAPAY CORP.

1,450,000 SHARES OF COMMON STOCK

The selling shareholders (the "Selling Security Holders") named in this prospectus (the "Prospectus") are offering all of the shares of common stock (the "Common Stock") of KinerjaPay Corp. f/k/a Solarflex Corp., a Delaware corporation ("Kinerjapay," the "Company" or the "Registrant") offered through this Prospectus. We are filing the registration statement (the "Registration Statement"), of which this Prospectus forms a part, in order to permit the Selling Security Holders to sell their restricted shares of Common Stock, and restricted shares underlying warrants issued in by the Registrant in a series of transactions exempt from registration under the Securities Act of 1933, as amended (the "Act") pursuant to the provisions of Regulation D and Regulation S promulgated by the United States Securities and Exchange Commission (the "SEC") under the Act. The Common Stock to be sold by the Selling Security Holders as provided in the "Selling Security Holders section of this Prospectus have already been issued.

Reference is made to the disclosure under "Selling Security Holders" and "Description of Securities to be Registered" below. The outstanding shares of Common Stock described above were previously issued in private placement transactions, including unit offerings, under Regulation D and Regulation S completed prior to the filing of the Registration Statement of which this Prospectus forms a part. We will not receive any proceeds from the sale of the Common Stock covered by this Prospectus in connection with the offering (the "Offering").

Our Common Stock is subject to quotation on OTCQB Market under the symbol KPAY. On May 11, 2016, the reported sales price for our Common Stock was $0.77 per share. We urge prospective purchasers of our Common Stock to obtain current information about the market prices of our Common Stock. The prices at which the Selling Security Holders may sell the shares of Common Stock in this Offering will be determined by the prevailing market price for the shares of Common Stock or in negotiated transactions.

Our independent registered public accounting firm has expressed substantial doubt as to our ability to continue as a going concern.

Investing in our Common Stock involves a high degree of risk. See "Risk Factors" to read about factors you should consider before buying shares of our Common Stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus is: May __, 2016

Please read this Prospectus carefully and in its entirety. This Prospectus contains disclosure regarding our business, our financial condition and results of operations and risk factors related to our business and our Common Stock, among other material disclosure items. We have prepared this Prospectus so that you will have the information necessary to make an informed investment decision.

You should rely only on information contained in this Prospectus. We have not authorized any other person to provide you with different information. This Prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this Prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

The Registration Statement containing this Prospectus, including the exhibits to the Registration Statement, provides additional information about our Company and the Common Stock offered under this Prospectus. The Registration Statement, including the exhibits and the documents incorporated herein by reference, can be read on the Securities and Exchange Commission website or at the Securities and Exchange Commission offices mentioned under the heading "Where You Can Find More Information."

This summary highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information that you should consider before investing in the Common Stock. You should carefully read the entire Prospectus, including "Risk Factors", "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the Financial Statements, before making an investment decision. In this Prospectus, the terms "KinerjaPay" "Company," "Registrant," "we," "us" and "our" refer to KinerjaPay Corp., a Delaware corporation.

Business Plan

The Company was incorporated in Delaware on February 12, 2010 under the name Solarflex Corp. for the purpose of developing, manufacturing and selling a solar photovoltaic element, a device that converts light into electrical flow (also known as a photovoltaic cell) based on certain proprietary technology to improve solar energy conversion and provide energy at a lower cost.

We did not generate any revenues from the sale of any solar photovoltaic element, nor did we successfully manufacturer or construct a working prototype, either on our own or through third-party manufacturers. We determined during the 4th quarter of 2015 to evaluate potential business opportunities.

On December 1, 2015, the Company entered into a license agreement (the "License Agreement") with PT Kinerja Indonesia, an entity organized under the laws of Indonesia and controlled by Mr. Ng ("PT Kinerja"), for an exclusive, world-wide license to use and commercially exploit certain technology and intellectual property (the "KinerjaPay IP") and its website, KinerjaPay.com. Pursuant to the License Agreement, the Company was granted the exclusive, world-wide rights to the KinerjaPay IP, an e-commerce portal.

In connection with the License Agreement, we agreed to: (i) change the name of the Company from Solarflex Corp to KinerjaPay Corp.; (ii) implement a reverse split of our common stock on a one-for-thirty (1:30) basis; and raise equity capital in the minimum offering amount of $500,000 and the maximum offering amount of $2,500,000 through the offering of units at a price of $0.50, each Unit, each consisting of 1 share of common stock (post-reverse) and 1 class A warrant exercisable for a period of 24 months to purchase 1 additional share of common stock (post-reverse) at $1.00. The Unit Offering was made only to "accredited investors" who are not U.S. Persons in reliance upon Regulation S promulgated by the SEC under the Securities Act of 1933, as amended (the "Act"). On January 20, 2016, the Company closed the Minimum Offering after it received subscription proceeds in excess of $500,000. To date, we have raised $725,000 under the Unit Offering, while the Unit Offering is continuing.

As of March 10, 2016, the Company's name change to KinerjaPay Corp. and its one-for-thirty (1:30) reverse stock split became effective. The Company's shares of common stock are subject to quotation on the OTCQB market under the symbol "KPAY."

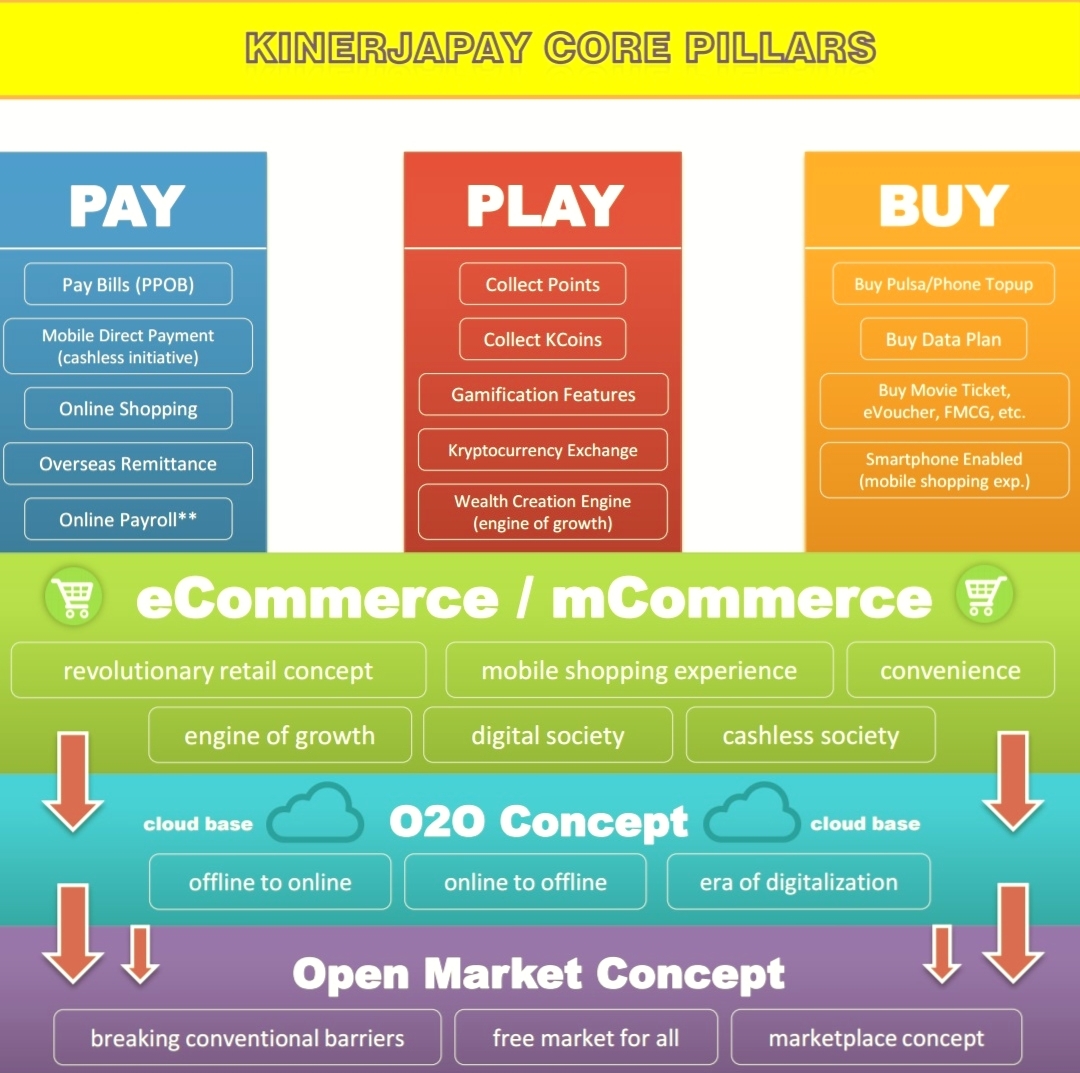

Our principal products and services are: (i) our electronic payment service (the "EPS"); and (ii) our virtual marketplace (the "Marketplace") both of which are available on our portal under the domain name KinerjaPay.com (the "Portal"). Our Android-based mobile app not only serves as an extension of desktop or laptop access to our website, but has additional in-app services that cater to mobile users, such as social engagement and digital entertainment (the "Mobile App"). We believe that in combining our EPS function ("PAY") with the ability to buy and sell products via our virtual marketplace ("Buy") enhanced by a gamification component ("Play") our customers and merchants are enticed to return more often and increase their loyalty to our services.

Indonesia, the world's fourth most-populous country, having a population estimated to be 255 million people, is rapidly becoming the major economic power in the Southeast Asia region. Over 50% of its population is below the age of 30, and as a result, we believe that the young Indonesian population is highly adaptive to new technology. The rise of cheap Smartphones and tablets that sell for less than US$100 is rapidly broadening internet access and pushing the nascent Indonesian e-commerce market toward a critical point in terms of scale and profitability, in spite of significant challenges due to poor infrastructure and payment systems. The number of internet users is excepted to double to 125 million by 2017 and Smartphone ownership is to rise from 20 per cent to 52 per cent in the same period, the highest percentage compared to other Southeast Asian countries, according to Redwing, an advisory group.

Our Kinerja.com platform was launched in February 2015 but has already achieve significant market acceptance evidenced by more than 13,000 users/customers and more than 78,000 e-commerce transactions during 2015.

Page 4

Notwithstanding our belief that our Portal represents a significant advance as compared to other Indonesian portals, there are a number of potential difficulties that we might face, including the following:

Ÿ Competitors may develop

alternatives that render our Portal services redundant or

unnecessary;

Ÿ We may not obtain and maintain sufficient protection of

our intellectual property;

Ÿ Our

proprietary technology may be shown to have characteristics that may render

it insufficient for our business;

Ÿ Our

Portal may not become widely accepted by consumers and merchants; and

Ÿ

Strict, new government regulations and inappropriate e-commerce policies,

especially in an emerging economy such as Indonesia, may hinder the growth

of the e-commerce market; and

Ÿ We may not be able to raise sufficient additional funds

to fully implement our business plan and grow our business.

To date, we have raised $725,000 in equity under the Unit Offering and we may be expected to require up to an additional $2.5 million in capital during the next 12 months to fully implement our business plan and fund our operations.

Summary of Risk Factors

This offering involves substantial risk. Our ability to execute our business strategy is also subject to certain risks. The risks described under the heading "Risk Factors" included elsewhere in this prospectus may cause us not to realize the full benefits of our business plan and strategy or may cause us to be unable to successfully execute all or part of our strategy. Some of the most significant challenges and risks include the following:

Ÿ Our

Auditor has expressed substantial

doubt as to our ability to continue as a going concern.

Ÿ

Our limited operating history does not afford investors a sufficient history

on which to base an investment decision.

Ÿ

Our revenues will be dependent upon acceptance of our Portal by consumers

and merchants.

The failure of such acceptance will cause us to curtail or cease operations.

Ÿ

We face substantial and increasing competition in the Indonesian e-commerce

market.

Ÿ We cannot be certain that we

will obtain patents for our proprietary technology or that such patents will

protect us.

Ÿ

The availability of a large number of authorized but unissued shares of

Common Stock may, upon their issuance, lead to dilution of existing

stockholders.

Ÿ Our stock is

thinly traded, sale of your holding may take a considerable amount of time.

Before you invest in our common stock, you should carefully consider all the information in this prospectus, including matters set forth under the heading "Risk Factors."

Where You Can Find Us

The Company's principal executive office and mailing address is at Jl. Multatuli, No.8A, Medan, 20151; Indonesia, Phone: +62-819-6016-168

Our Filing Status as a "Smaller Reporting Company"

We are a "smaller reporting company," meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. As a "smaller reporting company," the disclosure we will be required to provide in our SEC filings are less than it would be if we were not considered a "smaller reporting company." Specifically, "smaller reporting companies" are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act of 2002 requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings occurring on or after January 21, 2013; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being permitted to provide two years of audited financial statements in annual reports rather than three years. Decreased disclosures in our SEC filings due to our status as a "smaller reporting company" may make it harder for investors to analyze the Company's results of operations and financial prospects.

Page 5

The Offering

Common Stock offered by Selling Shareholders |

We are registering 1,450,000 shares of Common Stock. |

| Common stock outstanding before and after the Offering | 7,467,013 shares of Common Stock before and after the offering |

| Terms of the Offering | The Selling Security Holders will determine when and how they will sell the Common Stock offered in this Prospectus. The prices at which the Selling Security Holders may sell the shares of Common Stock in this Offering will be determined by the prevailing market price for the shares of Common Stock or in negotiated transactions. |

| Termination of the Offering | The Offering will conclude upon such time as all of the Common Stock has been sold pursuant to the Registration Statement. |

| Trading Market | Our Common Stock is subject to quotation on the OTCQB Market under the symbol "KPAY". |

| Use of proceeds | The Company is not selling any shares of the Common Stock covered by this Prospectus. As such, we will not receive any of the Offering proceeds from the registration of the shares of Common Stock covered by this Prospectus. |

Risk Factors |

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of his/her/its entire investment. See "Risk Factors". |

Page 6

SUMMARY OF FINANCIAL INFORMATION

The following summary financial data should be read in conjunction with "Management's Discussion and Analysis," "Plan of Operation" and the Financial Statements and Notes thereto, included elsewhere in this Prospectus. The balance sheet and the statement of operations data are derived from our unaudited interim financial statements for the years ended December 31, 2015 and 2014.

Statement of Operations Data:

| For the Year | For the Year | |||

| Ended December 31, 2015 | December 31, 2014 | |||

| Revenues | $ | - | $ | - |

| Total general and administrative expenses | 44,932 | 108,240 | ||

| Total operating expenses | (44,932) | (108,240) | ||

| Interest expense | (11,809) | (9,161) | ||

| Amortization expense | 37,058 | - | ||

| Loss on extinguishment of debt | (199,305) | - | ||

| Net loss | $ | (293,104) | $ | (188,265) |

| Net Loss Per Share – Basic and Diluted | $ | (0.00) | $ | (0.00) |

| Weighted Average Number of Shares Outstanding - Basic and Diluted | 136,275,147 | 135,183,552 |

Balance Sheet Data:

| December 31, 2015 | ||

| Cash and restricted cash | $ | 250,194 |

| Total assets | 250,194 | |

| Total current liabilities | 274,467 | |

| Total liabilities | 274,467 | |

| Total stockholders' deficit | $ | (24,273) |

| Total liabilities and shareholders' deficit | $ | 250,194 |

Special Note Regarding Forward-Looking Statements

The information contained in this Prospectus, including in the documents incorporated by reference into this Prospectus, includes some statements that are not purely historical and that are "forward-looking statements." Such forward-looking statements include, but are not limited to, statements regarding our management's expectations, hopes, beliefs, intentions and/or strategies regarding the future, including our financial condition and results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words "anticipates," "believes," "continue," "could," "estimates," "expects," "intends," "may," "might," "plans," "possible," "potential," "predicts," "projects," "seeks," "should," "would" and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Prospectus are based on current expectations and beliefs concerning future developments and the potential effects on the parties and the transaction. There can be no assurance that future developments actually affecting us will be those anticipated. These that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following forward-looking statements involve a number of risks, uncertainties (some of which are beyond the parties' control) or other assumptions.

Page 7

The shares of our Common Stock being offered for resale by the Selling Shareholders are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose their entire amount invested in the Common Stock. Accordingly, prospective investors should carefully consider, along with other matters referred to herein, the following risk factors in evaluating our business before purchasing any shares of Common Stocks. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, you may lose all or part of your investment. You should carefully consider the risks described below and the other information in this Prospectus before investing in our Common Stock.

Risks Associated With Our Business

Our Independent Registered Public Accounting Firm has expressed substantial doubt as to our ability to continue as a going concern.

The audited financial statements have been prepared assuming that we will continue as a going concern and do not include any adjustments that might result if we cease to continue as a going concern. We believe that in order to continue as a going concern, including the costs of being a public company, we will need approximately $30,000 per year simply to cover the administrative, legal and accounting fees. We plan to fund these expenses primarily through cash flow, the sale of restricted shares of our Common Stock, and the issuance of convertible notes.

Based on our financial statements for the years ended December 31, 2015 and 2014, our independent registered public accounting firm has expressed substantial doubt as to our ability to continue as a going concern. To date we have not generated any revenue.

Notwithstanding our success in raising over $725,000 from the private sale of equity securities in 2016 and our expectation that we will be successful in raising up to an additional $2.5 million during 2016, there can be no assurance that we will continue to be successful in raising equity capital and have adequate capital resources to fund our operations or that any additional funds will be available to us when needed or at all, or, if available, will be available on favorable terms or in amounts required by us. If we are unable to obtain adequate capital resources to fund operations, we may be required to delay, scale back or eliminate some or all of our plan of operations, which may have a material adverse effect on our business, results of operations and ability to operate as a going concern.

Our limited operating history does not afford investors a sufficient history on which to base an investment decision.

On December 1, 2015, we were granted an exclusive, world-wide license by PT Kinerja Indonesia, our licensor, to KinerjaPay IP and its website, KinerjaPay.com, an e-commerce platform that provides users with the convenience of EPS for bill transfer and our Marketplace. Our Portal was first launched by PT Kinerja Indonesia in February 2015 and only has a limited operating history. See the disclosure under "Description of Business" and in Risk Factors below. As a result of our limited operating history, we may not become profitable in the near future, if at all. If we are unable to reach profitability, our stock price would decline and our ability to continue to raise capital, either equity or debt, may be adversely effected. The long-term revenue and income prospects of our business and the market for electronic online payments have not been proven. We will encounter risks and difficulties commonly faced by early-stage companies in new and rapidly evolving markets.

We plan to make significant investments using our recently raised equity capital in our newly-organized Indonesian subsidiary, PT Kinerja Pay Indonesia, which entity will conduct all of our business activities related to out Portal. Notwithstanding our ability to having raised equity capital to date and our expectation to be able to raise up to an additional $2.5 million during 2016, we may not be able to achieve profitability in the foreseeable future, if at all. Our ability to achieve profitability will depend on, among other things, market acceptance of our Portal and our ability to compete effectively with other e-commerce businesses operating in Indonesia and potentially in the wider Southeast Asian market. We cannot assure you that the relatively new market for our EPS and our Marketplace will remain viable in Indonesia. We expect to invest substantial amounts to:

Ÿ Drive consumer and merchant awareness

to our EPS and Marketplace;

Ÿ Persuade consumers and merchants to sign up for and use our

EPS product and use our Marketplace;

Ÿ Improve our system infrastructure to handle seamless

processing of transactions;

Ÿ Continue to develop our

Portal;

Ÿ Expand into international markets; and

Ÿ Broaden our customer base.

We may fail to implement successfully these objectives. This would adversely impact our revenues. There can be no assurance at this time that we will be able to operate profitably or that we will have adequate working capital to meet our obligations as they become due. Investors must consider the risks and difficulties frequently encountered by early stage companies, particularly in rapidly evolving markets. Such risks include the following:

Ÿ competition;

Ÿ need for acceptance of our Portal;

Ÿ ability to

develop a brand identity;

Ÿ ability to anticipate and adapt to a

competitive market;

Ÿ ability to effectively manage rapidly expanding

operations;

Ÿ amount and timing of operating costs and capital

expenditures relating to expansion of our business, operations, and

infrastructure; and

Ÿ dependence upon key personnel to market our product

and the loss of one of our key managers may adversely affect the marketing

of our product.

We cannot be certain that our business strategy will be successful or that we will successfully address these risks. In the event that we do not successfully address these risks, our business, prospects, financial condition, and results of operations could be materially and adversely effected.

Page 8

Our revenues will be dependent upon acceptance of our Portal by the Indonesian Consumers. The failure of such acceptance will cause us to curtail or cease operations.

Uncertainty exists as to whether our Portal will be accepted by the Indonesian consumer. A number of factors may limit the market acceptance of our Portal, including the availability of alternative electronic payment portals and the fees for our services relative to alternative electronic payment services and other virtual marketplaces. There is a risk that potential customers and merchants will be encouraged to continue to use other portals and/or electronic payment services instead. We are assuming that, notwithstanding the fact that our Portal is new in the Indonesian market, potential customers will elect to use our Portal.

Our revenues are expected to come from the sale of our Portal services. As a result, we will continue to incur operating losses until such time as our revenues reach a mature level and we are able to generate sufficient cash flow to meet our operating expenses. There can be no assurance that the market will adopt our Portal. In the event that we are not able to successfully market and significantly increase the number of Portal users, or if we are unable to charge the necessary fees, our financial condition and results of operations will be materially and adversely affected.

Software failures, breakdowns in the operations of the servers and communications systems upon which we must rely or glitches or malfunctions in our Portal technology could hurt our reputation, revenues and profitability.

Our success depends on the efficient and uninterrupted operation of the servers and communications systems owned and operated by PT Kinerja Indonesia, an entity controlled by our controlling shareholder and CEO, Mr. Ng. We have entered into an agreement with PT Kinerja Indonesia to operate all of the servers, as well as provide hosting and maintenance services and the infrastructure systems, upon which we rely. A failure of these systems and services could impede our business by delays in processing of data, delivery of databases and services, client data and day-to-day management of our business. While all of our operations will have disaster recovery plans in place, they might not adequately protect us. Despite any precautions we take and PT Kinerja Indonesia already has in place, damage from fire, floods, hurricanes, power loss, telecommunications failures, computer viruses, break-ins and similar events at their computer facilities could result in interruptions in the flow of data to our customers. In addition, any failure by the computer environment to provide our required data communications capacity could result in interruptions in our service. In the event of a server failure, we could be required to transfer our client/customer data operations to an alternative provider of server hosting services. Such a transfer could result in delays in our ability to deliver our services to our customers.

To the extent that glitches or errors cause our Portal to malfunction and our customers' use of our Portal is interrupted, our reputation could suffer and our potential revenues could decline or be delayed until such glitches or errors are remedied, which will not be within our control. We may also be subject to liability for the glitches and malfunctions. There can be no assurance that, despite the expertise of PT Kinerja Indonesia, glitches and/or errors in our service or new releases or upgrades will not occur, resulting in loss of future revenues or delay in market acceptance, diversion of development resources, damage to our reputation, potential litigation, or increased service costs, any of which would have a material adverse effect upon our business, operating results and financial condition.

Long-term disruptions in the Portal infrastructure provided by PT Kinerja Indonesia caused by events such as natural disasters, the outbreak of war, the escalation of hostilities and acts of terrorism, particularly involving locations in Indonesia for which we will have no control, could adversely effect our e-commerce business. Although, we plan to carry property and business interruption insurance for our business operations, our coverage might not be adequate to compensate us for all losses that may occur.

We face risks related to the storage of customers' confidential and proprietary information.

Our Portal, which is maintained by PT Kinerja Indonesia, is designed to maintain the confidentiality and security of our customers' confidential and proprietary data that are stored on their server systems, which may include sensitive personal data. However, any accidental or willful security breaches or other unauthorized access to these data could expose us to liability for the loss of such information, time-consuming and expensive litigation and other possible liabilities as well as negative publicity which may be expected to adversely effect our business and operations. Techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are difficult to recognize and react to. We rely on PT Kinerja Indonesia, which may be unable to anticipate these techniques or implement adequate preventative or reactionary measures.

We might incur substantial expense to further develop and commercially exploit our Portal which may never become sufficiently successful.

Our growth strategy requires the successful expansions of our e-commerce business. Although management will take every precaution to ensure that our Portal will, with a high degree of likelihood, achieve market acceptance and therefore commercial success, there can be no assurance that this will be the case. The causes for commercial failure can be numerous, including:

Ÿ market demand for our

EPS and Marketplace proves to be

smaller than we expect;

Ÿ competitive e-commerce providers, either

presently operating in the Indonesian market or who are to join our market may have superior

features, more competitive prices and/or fees, better performance and, as a result, greater market

acceptance;

Ÿ further Portal development turns out to be more costly

than anticipated or takes longer;

Ÿ our Portal requires significant

adjustment to changing market conditions, rendering the Portal uneconomic or

extending considerably the likely investment return period;

Ÿ additional

regulatory requirements are imposed which increase the overall costs of

running our Portal;

Ÿ Customers may be unwilling to adopt and/or use our

Portal.

Page 9

Card association rules may change or certain practices could negatively affect our business and, if we do not comply with these rules, could result in our inability to accept credit cards. If we are unable to accept credit cards, our competitive position would be critically damaged.

We are not a bank and as a result we are barred from belonging to and directly access the credit card associations or the bank payment network. We must therefore rely on banks and their service providers to process our transactions. We must comply with the operating rules of the credit card associations and bank payment networks as they apply to merchants. The associations' member banks set these rules, and the associations interpret the rules. Some of those member banks compete with us. Credit card associations could adopt new operating rules or interpretations of existing rules which we may find difficult or even impossible to comply with, in which case we could lose our ability to give customers the option of using credit cards to support their payments. If we were unable to accept credit cards our competitive position would be critically damaged.

We face considerable risks of loss due to fraud and/or disputes between senders and recipients. If we are unable to deal effectively with losses from fraudulent transactions, our losses from fraud would increase, and our business would be materially adversely effected.

We face significant risks of loss due to fraud and disputes between senders and recipients, including:

Ÿ unauthorized use of credit cards and bank account information and

identity theft;

Ÿ merchant fraud and other disputes;

Ÿ system security

breaches;

Ÿ fraud by employees; and

Ÿ use of our system for illegal

purposes.

When a sender pays a merchant for goods or services through our Portal using a credit card and the cardholder is defrauded or otherwise disputes the charge, the full amount of the disputed transaction gets charged back to us and our credit card processor levies additional fees against us, unless we can successfully challenge the chargeback. Chargebacks may arise from the unauthorized use of a cardholder's card number or from a cardholder's claim that a merchant failed to perform. If our chargeback rate becomes excessive, credit card associations also can require us to pay fines and could terminate our ability to accept their cards for payments. We cannot assure you that chargebacks will not arise in the future.

We have taken measures to detect and reduce the risk of fraud, but we cannot assure you of these measures' effectiveness. If these measures do not succeed, our business will be adversely effected.

We may incur chargebacks and other losses from merchant fraud, payment disputes and insufficient funds, and our liability from these items could have a material adverse effect on our business and result in our losing the right to accept credit cards for payment as a result of which our ability to compete could be impaired, and our business would suffer.

While we did not incur any chargebacks during 2015 and during the three months ended March 31, 2016, we may incur losses from merchant fraud, including claims from customers that merchants have not performed, that their goods or services do not match the merchant's description or that the customer did not authorize the purchase. Our liability for such items could have a material adverse effect on our business, and if they become excessive, could result in our losing the right to accept credit cards for payment.

Unauthorized use of credit cards and bank accounts could expose us to substantial losses. If we are unable to detect and prevent unauthorized use of cards and bank accounts, our business would suffer.

The highly automated nature of our Portal makes us an attractive target for fraud. In configuring our Portal technology, we face an inherent trade-off between customer convenience and security. We believe that several of our current and former competitors in the electronic payments business have gone out of business or significantly restricted their businesses largely due to losses from this type of fraud. We expect that technically knowledgeable criminals will continue to attempt to circumvent our anti-fraud systems. During 2015 and during the three months ended March 31, 2016, we did not incur any chargebacks but there can be no assurance that we will not incur chargebacks in the future.

Security and privacy breaches in our Portal may expose us to additional liability and result in the loss of customers, either of which events could harm our business and cause our stock price to decline.

Our inability, or the inability of PT Kinerja Indonesia, as the case may be, to protect the security and privacy of our electronic transactions could have a material adverse effect on our profitability. A security or privacy breach could:

Ÿ expose us to additional liability;

Ÿ increase our expenses relating

to resolution of these breaches; and

Ÿ discourage customers from using

our product.

The type and scale of electronic payments that we handle for our customers makes us vulnerable to employee fraud or other internal security breaches and, as a result, our business would suffer. We cannot assure you that our internal security systems will prevent material losses from employee fraud and that our system applications designed for data security will effectively counter evolving security risks or address the security and privacy concerns of existing and potential customers. Any failures in our security and privacy measures could have a material adverse effect on our business, financial condition and results of operations.

Page 10

Our Portal might be used for illegal or improper purposes, which could expose us to additional liability and harm our business.

Despite measures we have taken to detect and prevent identify theft, unauthorized uses of credit cards and similar misconduct, our electronic online payment portal remains susceptible to potentially illegal or improper uses. These may include illegal online gaming, fraudulent sales of goods or services, illicit sales of prescription medications or controlled substances, software and other intellectual property piracy, money laundering, bank fraud, child pornography trafficking, prohibited sales of alcoholic beverages and tobacco products and online securities fraud. Despite measures we have taken to detect and lessen the risk of this kind of conduct, we cannot assure you that these measures will succeed. Our business could suffer if customers use our system for illegal or improper purposes.

In addition, we classify merchants who historically have experienced significant chargeback rates as higher risk. The legal status of many of these higher risk accounts is uncertain, and if these merchants are prohibited or restricted from operating in the future, our revenue from fees generated from these accounts would decline. Proposed legislation has been introduced in Indonesia that operation of an Internet gaming business, sales of alcoholic beverages and other activities violates Indonesian law, and to prohibit payment processors such as us from processing payments for those activities. If merchants accept these illegal activities, we could be subject to civil and criminal lawsuits, administrative action and prosecution for, among other things, money laundering or for aiding and abetting violations of law. We would lose the revenues associated with these accounts and could be subject to material penalties and fines, both of which would seriously harm our business.

We face substantial and increasing competition in the Indonesian e-commerce market.

The market in which we operate is intensely competitive. We currently and potentially compete with a wide variety of electronic payment providers and online and offline companies marketplaces providing goods and services to consumers and merchants . The Internet and mobile networks provide new, rapidly evolving and intensely competitive channels for electronic payment services and marketplaces to sell all types of goods and services. We compete in two-sided markets, and must attract both buyers and sellers to use our Marketplace. Consumers who purchase or sell goods through our Marketplace have more and more alternatives, and merchants have more channels to reach consumers. We expect competition to continue to intensify. Online and offline businesses increasingly are competing with each other and our competitors include a number of online and offline retailers with significant resources, large user communities and well-established brands. Moreover, the barriers to entry into these channels can be low, and businesses easily can launch online sites or mobile platforms and applications at nominal cost by using commercially available software or partnering with any of a number of successful e-commerce companies. As we respond to changes in the competitive environment, we may, from time to time, make pricing, service or marketing decisions or acquisitions that may be controversial with and lead to dissatisfaction among users, which could reduce activity on our Portal and harm our profitability.

Some of our competitors are well known, more established and better capitalized than we are and we may be unable to establish market share. As such, they may have at their disposal greater marketing strength and economies of scale and, as they may have additional products and/or services at more competitive price. They may also have more resources to expend to create more innovative payment processing products in competition with ours. Accordingly, we may not be successful in competing effectively for market share.

The market we operate in emerging, intensely competitive and characterized by rapid technological change. We compete with existing electronic payment services and virtual marketplaces, including, among others:

Ÿ Tokopedia

Ÿ Bukalapak

Ÿ Lazada

Ÿ Zalora

Ÿ OLX

Ÿ Blibli

Ÿ Payment

processors such as Doku and Veritrans

Our competitors may respond to new or emerging technologies and changes in customer requirements faster and more effectively than we can. These competitors have offered, and may continue to offer, their services for free in order to gain market share and we may be forced to lower our prices in response.

Our status under certain Indonesian and international financial services regulation is unclear. Violation of or compliance with present or future regulation could be costly, expose us to substantial liability, force us to change our business practices or force us to cease offering our current product.

We operate in an industry subject to government regulation. We currently are subject to Indonesian regulations in our role as money transfer agent and are therefore subject to Indonesian electronic fund transfer and money laundering regulations. In the future, we might be subjected to:

Ÿ banking regulations;

Ÿ additional money transmitter regulations and

money laundering regulations;

Ÿ international banking or financial

services regulations or laws governing other regulated industries; or

Ÿ

U.S. and international regulation of Internet transactions.

If we are

found to be in violation of any current or future regulations, we could be:

Ÿ exposed to financial liability, including substantial fines which could be

imposed on a per transaction basis and disgorgement of our profits;

Ÿ

forced to change our business practices; or

Ÿ forced to cease doing

business altogether or with the residents of one or more states or

countries.

Page 11

However, we cannot assure you that the steps we have taken to address any regulatory concerns will be effective. If we are found to be engaged in an unauthorized banking business, we might be subject to monetary penalties and adverse publicity and might be required to cease doing business. Even if the steps we have taken to resolve any concerns are deemed sufficient by the regulatory authorities, we could be subject to fines and penalties for our prior activities. The need to comply with laws prohibiting unauthorized banking activities could also limit our ability to enhance our services in the future.

Our financial success will remain highly sensitive to changes in the rate at which our customers fund payments using credit cards rather than bank account transfers. Our profitability could be harmed if the rate at which customers fund using credit cards goes up.

We pay significant transaction fees when senders fund payment transactions using credit cards, nominal fees when customers fund payment transactions by electronic transfer of funds from bank accounts and no fees when customers fund payment transactions from an existing account balance with us. Senders may resist funding payments by electronic transfer from bank accounts because of the greater protection offered by credit cards, including the ability to dispute and reverse merchant charges, because of frequent flier miles or other incentives offered by credit cards or because of generalized fears regarding privacy or loss of control in surrendering bank account information to a third party.

We rely on financial institutions to process our payment transactions. Should any of these institutions decide to stop processing our payment transactions, our business could suffer.

Not being a bank, we cannot belong to and directly access the credit card associations or the bank payment network. As a result, we must rely on banks or their independent service operators to process our transactions. Bank Central Asia ("BCA") currently processes our bank transactions and our credit card transactions. BCA also provides payment processing services to some of our competitor and offers credit card processing services directly to online merchants. If we could not obtain processing services on acceptable terms, and if we could not switch to another processor quickly and smoothly, our business could suffer materially.

Increases in credit card processing fees could increase our costs, affect our profitability, or otherwise limit our operations.

From time to time, credit card associations increase the interchange fees that they charge for each transaction using their cards. Our credit card processors have the right to pass any increases in interchange fees on to us. Any such increased fees could increase our operating costs and reduce our profit margins. Furthermore, our credit card processors require us to pledge cash as collateral with respect to our acceptance of certain credit cards and the amount of cash that we are required to pledge could be increased at any time.

Customer complaints or negative publicity about our product and customer service could affect use of our product adversely and, as a result, our business could suffer.

Customer complaints or negative publicity about our Portal could diminish consumer confidence in and use of our EPS and Marketplace. Breaches of our customers' privacy and our security measures could have the same effect. Measures we sometimes take to combat risks of fraud and breaches of privacy and security, such as freezing customer funds, can damage relations with our customers. These measures heighten the need for prompt and accurate customer service to resolve irregularities and disputes. We may receive negative media coverage, as well as public criticism regarding customer disputes. Effective customer service requires significant personnel expense, and this expense, if not managed properly, could impact our profitability significantly. The number of customer service and sales representatives that PT Kinerja Indonesia employees is expected to increase from currently 5 throughout 2016. Any inability by us to manage or train our customer service representatives properly could compromise our ability to handle customer complaints effectively. If we do not handle customer complaints effectively, our reputation may suffer and we may lose our customers' confidence.

We have limited experience in managing and accounting accurately for large amounts of customer funds. Our failure to manage these funds properly would harm our business.

Our ability to manage customer funds requires a high level of internal controls. We have neither an established operating history nor proven management experience in maintaining, over a long term, these internal controls. As our business continues to grow, we must strengthen our internal controls accordingly. Our success requires customer's confidence in our ability to handle large and growing transaction volumes and amounts of customer funds. Any failure to maintain controls or to manage customer funds could diminish customer use of our Portal severely.

Compliance with changing regulations concerning corporate governance and public disclosure may result in additional expenses.

In recent years, there have been several changes in laws, rules, regulations and standards relating to corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), the Sarbanes-Oxley Act of 2002 ("Sarbanes-Oxley") and various other new regulations promulgated by the SEC and rules promulgated by the national securities exchanges.

The Dodd-Frank Act, enacted in July 2010, expands federal regulation of corporate governance matters and imposes requirements on publicly-held companies, including us, to, among other things, provide stockholders with a periodic advisory vote on executive compensation and also adds compensation committee reforms and enhanced pay-for-performance disclosures. While some provisions of the Dodd-Frank Act were effective upon enactment, others will be implemented upon the SEC's adoption of related rules and regulations. The scope and timing of the adoption of such rules and regulations is uncertain and accordingly, the cost of compliance with the Dodd-Frank Act is also uncertain.

In addition, Sarbanes-Oxley specifically requires, among other things, that we maintain effective internal control over financial reporting and disclosure of controls and procedures. In particular, we must perform system and process evaluation and testing of our internal control over financial reporting to allow management to report on the effectiveness of our internal control over financial reporting, as required by Section 404 of Sarbanes-Oxley Act ("Section 404"), and our independent registered public accounting firm is required to attest to our internal control over financial reporting.

Page 12

Our testing, or the subsequent testing by our independent registered public accounting firm may reveal deficiencies in our internal control over financial reporting that are deemed to be material weaknesses. Our compliance with Section 404 will require that we incur substantial accounting expenses and expend significant management efforts. We currently have limited internal audit capabilities and will need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. Moreover, if we are not able to comply with the requirements of Section 404 in a timely manner, or if we or our independent registered public accounting firm identifies deficiencies in our internal control over financial reporting that are deemed to be material weaknesses, the market price of our stock could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

These and other new or changed laws, rules, regulations and standards are, or will be, subject to varying interpretations in many cases due to their lack of specificity. As a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. Our efforts to comply with evolving laws, regulations and standards are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. Further, compliance with new and existing laws, rules, regulations and standards may make it more difficult and expensive for us to maintain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. Members of our board of directors and our principal executive officer and principal financial officer could face an increased risk of personal liability in connection with the performance of their duties. As a result, we may have difficulty attracting and retaining qualified directors and executive officers, which could harm our business. We continually evaluate and monitor regulatory developments and cannot estimate the timing or magnitude of additional costs we may incur as a result.

Online payment processing liability is inherent in the industry and insurance is expensive and difficult to obtain, we may be exposed to large lawsuits.

Our business exposes us to potential liability risks, which are inherent in the e-commerce business. While we will take precautions we deem to be appropriate to avoid potential liability suits against us, there can be no assurance that we will be able to avoid significant liability exposure. Liability insurance for electronic payment processing industry is generally expensive. We plan to obtain liability professional indemnity insurance coverage for our Portal services. There can be no assurance that we will be able to obtain such coverage on acceptable terms, or that any insurance policy will provide adequate protection against potential claims. A successful liability claim brought against us may exceed any insurance coverage secured by us and could have a material adverse effect on our results or ability to continue our Portal.

We may need to raise additional capital to fund continuing operations and an inability to raise the necessary capital or to do so on acceptable terms could threaten the success of our business.

We currently anticipate that our available capital resources will be sufficient to meet our expected working capital and capital expenditure requirements for the six-month ended June 30, 2016. We anticipate that we may require an additional funding during 2016. However, such resources may not be sufficient to fund the long-term growth of our business. If we determine that it is necessary to raise additional funds, we may choose to do so through strategic collaborations, licensing arrangements, public or private equity or debt financing, a bank line of credit, or other arrangements.

We cannot be sure that any additional funding will be available on terms favorable to us or at all. Any additional equity financing may be dilutive to our stockholders, new equity securities may have rights, preferences or privileges senior to those of existing holders of our shares of common stock. Debt or equity financing may subject us to restrictive covenants and significant interest costs. If we obtain funding through a strategic collaboration or licensing arrangement, we may be required to relinquish our rights to our product or marketing territories. If we are unable to obtain the financing necessary to support our operations, we may be required to defer, reduce or eliminate certain planned expenditures or significantly curtail our operations.

We may need to increase the size of our organization, and may experience difficulties in managing growth.

At present, we are a small company. We expect to experience a period of expansion in headcount, infrastructure and overhead and anticipate that further expansion will be required to address potential growth and market opportunities. Future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain and integrate new managers. Our future financial performance and its ability to compete effectively will depend, in part, on its ability to manage any future growth effectively.

The loss of key personnel could adversely affect our business. We may not be able to hire and retain qualified personnel to support our growth.

Our success depends to a significant extent upon the efforts of Mr. Edwin Ng, our Chairman and controlling shareholder, and other key personnel that we expect to join us during the remainder of 2016. The loss of the services of such personnel and the inability to hire and retain of such personnel could adversely affect our business and our ability to implement our growth plan. We cannot assure you that the services of the members of our management team will continue to be available to us, or that we will be able to find a suitable replacement for any of them. We do not have key man insurance on any members of our management team. If any member of our management team were to die and we are unable to replace them for a prolonged period of time, we may be unable to carry out our long term business plan and our future prospect for growth, and our business, may be harmed.

Our success is dependent upon our ability to attract, train, manage and retain qualified personnel. There is substantial competition for qualified personnel, and an inability to recruit or retain qualified personnel may impact our ability to implement our strategy to grow our business.

We plan to grant stock options or other forms of equity awards in the future as a method of attracting and retaining employees, motivating performance and aligning the interests of employees with those of our stockholders. There are currently no options and/or equity awards outstanding. If we are unable to adopt, implement and maintain equity compensation arrangements that provide sufficient incentives, we may be unable to retain our existing employees and attract additional qualified candidates. If we are unable to retain our existing employees, including qualified technical personnel, and attract additional qualified candidates, our business and results of operations could be adversely effected.

Page 13

We may not be able to successfully expand our business through acquisitions.

We review corporate and product acquisitions as a part of our growth strategy. If we decided to undertake an acquisition, we may not be able to successfully integrate it in order to realize the full benefit of such acquisition. Factors which may affect our ability to grow successfully through acquisitions include:

Ÿ inability to identify suitable targets given the relatively narrow

scope of our business;

Ÿ inability to obtain acquisition or additional

working capital financing due to our financial condition;

Ÿ difficulties

and expenses in connection with integrating the acquired companies and

achieving the expected benefits;

Ÿ diversion of management's attention

from current operations;

Ÿ the possibility that we may be adversely

affected by risk factors facing the acquired companies;

Ÿ acquisitions

could be dilutive to earnings, or in the event of acquisitions made through

the issuance of our common shares to the shareholders of the acquired

company, dilutive to our existing shareholders;

Ÿ potential losses

resulting from undiscovered liabilities of acquired companies not covered by

the indemnification we may obtain from the seller; and

Ÿ loss of key

employees of the acquired companies.

We have limited experience competing in international markets, where we hope to compete, beyond Indonesia. Our international expansion plans will expose us to greater political, intellectual property, regulatory, exchange rate fluctuation and other risks, which could harm our business.

We intend to expand use of our EPS and Marketplace in selected international markets, initially in the Southeast Asian region. If we are unable to execute our expansion into international markets, our business could suffer. Accordingly, we anticipate devoting significant resources and management attention to expanding international opportunities. Expanding internationally subjects us to a number of risks, including:

Ÿ greater difficulty in managing foreign operations;

Ÿ expenses

associated with localizing our products, including offering customers the

ability to transact business in major currencies in addition to the

Indonesian Rupiah;

Ÿ laws and business practices that favor local

competitors;

Ÿ multiple and changing laws, tax regimes and government

regulations;

Ÿ foreign currency restrictions and exchange rate

fluctuations;

Ÿ changes in a specific country's or region's political or

economic conditions; and

Ÿ differing intellectual property laws.

Risks Related to Our Common Stock

We are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We have offered and sold our Common Stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act of 1933, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We have not received a legal opinion to the effect that any of our prior offerings were exempt from registration under any federal or state law. Instead, we have relied upon the operative facts as the basis for such exemptions, including information provided by investors themselves.

If any prior offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption from the registration or qualification provisions of such state statutes. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which it has relied, we may become subject to significant fines and penalties imposed by the SEC and state securities agencies.

Edwin Ng, our Control Shareholder and Chairman owns approximately 40% of our common stock and may be able to influence the outcome of stockholder votes and their interests may differ from other stockholders.

As of May 11, 2016, our control shareholder, executive officer and director beneficially owns 3,000,000 shares of our Common Stock representing approximately 40% of our outstanding Shares, excluding Shares underlying options and warrants. Subject to any fiduciary duties owed to our other stockholders under Delaware law, these stockholders may be able to exercise significant influence over matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, and will have some control over our management and policies. Some of these persons may have interests that are different from yours. For example, these stockholders may support proposals and actions with which you may disagree. The concentration of ownership could delay or prevent a change in control of the Company or otherwise discourage a potential acquirer from attempting to obtain control of the Company, which in turn could reduce the price of our stock. In addition, these stockholders could use their voting influence to maintain our existing management and directors in office, delay or prevent changes in control of the Company, or support or reject other management and board proposals that are subject to stockholder approval, such as amendments to our employee stock plans and approvals of significant financing transactions.

Page 14

The availability of a large number of authorized but unissued shares of Common Stock may, upon their issuance, lead to dilution of existing stockholders.

We are authorized to issue 500,000,000 shares of Common Stock, $0.0001 par value per share. We have approximately 492,533,00 shares of Common Stock available for issuance. Additional shares may be issued by our board of directors without further stockholder approval. The issuance of large numbers of shares, possibly at below market prices, is likely to result in substantial dilution to the interests of other stockholders. In addition, issuances of large numbers of shares may adversely affect the market price of our Common Stock.

Our Certificate of Incorporation, as amended, authorizes 10,000,000 shares of preferred stock, $0.0001 par value per share none of which are issued and outstanding as of the date of this registration statement. The board of directors is authorized to provide for the issuance of these unissued shares of preferred stock in one or more series, and to fix the number of shares and to determine the rights, preferences and privileges thereof. Accordingly, the board of directors may issue preferred stock which may convert into large numbers of shares of Common Stock and consequently lead to further dilution of other shareholders.

We have never paid cash dividends and do not anticipate doing so in the foreseeable future.

We have never declared or paid cash dividends on our common shares. We currently plan to retain any earnings to finance the growth of our business rather than to pay cash dividends. Payments of any cash dividends in the future will depend on our financial condition, results of operations and capital requirements, as well as other factors deemed relevant by our board of directors.

Our Common Stock is subject to the "Penny Stock" rules of the SEC and the trading market in our stock is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

Ÿ That a broker or dealer approve a person's account for transactions in

penny stocks; and

Ÿ The broker or dealer receives a

written agreement to the transaction, setting forth the identity and

quantity of the penny stock to be purchased.

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

Ÿ Obtain financial information and investment experience objectives of

the person; and

Ÿ Make a reasonable determination that the transactions

in penny stocks are suitable for that person and the person has sufficient

knowledge and experience in financial matters to be capable of evaluating

the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

Ÿ Sets forth the basis on which the broker or dealer made the suitability

determination; and

Ÿ That the broker or dealer received a signed, written

agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our Common Stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Financial Industry Regulatory Authority, Inc. ("FINRA") sales practice requirements may limit a shareholder's ability to trade our Common Stock.

In addition to the "penny stock" rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our Common Stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Our stock is thinly traded, sale of your holding may take a considerable amount of time.

The shares of our Common Stock are thinly-traded on the OTCQB Market, meaning that the number of persons interested in purchasing our Common Stock at or near bid prices may be relatively small or non-existent. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our Common Stock will develop or be sustained, or that current trading levels will be sustained. Due to these conditions, we can give you no assurance that you will be able to sell your shares at or near bid prices or at all if you need money or otherwise desire to liquidate your shares.

Page 15

Shares eligible for future sale may adversely affect the market.

From time to time, certain of our stockholders may be eligible to sell all or some of their shares of Common Stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144 promulgated under the Securities Act, subject to certain limitations. In general, pursuant to amended Rule 144, non-affiliate stockholders may sell freely after six months subject only to the current public information requirement. Affiliates may sell after six months subject to the Rule 144 volume, manner of sale (for equity securities), current public information and notice requirements. Any substantial sales of our Common Stock pursuant to Rule 144 may have a material adverse effect on the market price of our Common Stock.

If we fail to maintain effective internal controls over financial reporting, the price of our Common Stock may be adversely affected.

Our internal control over financial reporting may have weaknesses and conditions that could require correction or remediation, the disclosure of which may have an adverse impact on the price of our Common Stock. We are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely affect our public disclosures regarding our business, prospects, financial condition or results of operations. In addition, management's assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed in our internal controls over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting or disclosure of management's assessment of our internal controls over financial reporting may have an adverse impact on the price of our Common Stock.

We are required to comply with certain provisions of Section 404 of the Sarbanes-Oxley Act of 2002 and if we fail to comply in a timely manner, our business could be harmed and our stock price could decline.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require an annual assessment of internal controls over financial reporting, and for certain issuers an attestation of this assessment by the issuer's independent registered public accounting firm. The standards that must be met for management to assess the internal controls over financial reporting as effective are evolving and complex, and require significant documentation, testing, and possible remediation to meet the detailed standards.

We expect to incur expenses and to devote resources to Section 404 compliance on an ongoing basis. It is difficult for us to predict how long it will take or costly it will be to complete the assessment of the effectiveness of our internal control over financial reporting for each year and to remediate any deficiencies in our internal control over financial reporting. As a result, we may not be able to complete the assessment and remediation process on a timely basis. In addition, although attestation requirements by our independent registered public accounting firm are not presently applicable to us, we could become subject to these requirements in the future and we may encounter problems or delays in completing the implementation of any resulting changes to internal controls over financial reporting. In the event that our Chief Executive Officer or Chief Financial Officer determine that our internal control over financial reporting is not effective as defined under Section 404, we cannot predict how the market prices of our shares will be affected; however, we believe that there is a risk that investor confidence and share value may be negatively affected.

Our share price could be volatile and our trading volume may fluctuate substantially.

The price of our Common Shares has been and may in the future continue to be extremely volatile, with the sale price fluctuating from a low of $0.02 to a high of $1.20 since 2013. Many factors could have a significant impact on the future price of our common shares, including:

Ÿ our inability to raise additional capital to fund our operations;

Ÿ our failure to successfully implement our business objectives and

strategic growth plans;

Ÿ compliance with ongoing regulatory

requirements;

Ÿ market acceptance of our product;

Ÿ changes in

government regulations;

Ÿ general economic conditions and other

external factors; and

Ÿ actual or anticipated fluctuations in our