Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - REGAL BELOIT CORP | a1q2016earningsannouncement.htm |

| 8-K - 8-K - REGAL BELOIT CORP | form8-k1q2016earningsrelea.htm |

Regal Beloit Corporation First Quarter 2016 Earnings Conference Call May 10, 2016 Mark Gliebe Chairman and Chief Executive Officer Jon Schlemmer Chief Operating Officer Chuck Hinrichs Vice President Chief Financial Officer Robert Cherry Vice President Investor Relations

Safe Harbor Statement This presentation contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements represent our management’s judgment regarding future events. In many cases, you can identify forward-looking statements by terminology such as “may,” “will,” “plan,” “expect,” “anticipate,” “estimate,” “believe,” or “continue” or the negative of these terms or other similar words. Actual results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors, including: uncertainties regarding our ability to execute our restructuring plans within expected costs and timing; increases in our overall debt levels as a result of the acquisition of the Power Transmission Solutions (“PTS”) business from Emerson Electric Co., or otherwise and our ability to repay principal and interest on our outstanding debt; actions taken by our competitors and our ability to effectively compete in the increasingly competitive global electric motor, power generation and mechanical motion control industries; our ability to develop new products based on technological innovation and the marketplace acceptance of new and existing products; fluctuations in commodity prices and raw material costs; our dependence on significant customers; issues and costs arising from the integration of acquired companies and businesses such as the PTS acquisition, including the timing and impact of purchase accounting adjustments; unanticipated costs or expenses we may incur related to product warranty issues; our dependence on key suppliers and the potential effects of supply disruptions; infringement of our intellectual property by third parties, challenges to our intellectual property, and claims of infringement by us of third party technologies; product liability and other litigation, or the failure of our products to perform as anticipated, particularly in high volume applications; economic changes in global markets where we do business, such as reduced demand for the products we sell, currency exchange rates, inflation rates, interest rates, recession, foreign government policies and other external factors that we cannot control; unanticipated liabilities of acquired businesses; affect on earnings of any significant impairment of goodwill or intangible assets; cyclical downturns affecting the global market for capital goods; difficulties associated with managing foreign operations; and other risks and uncertainties including but not limited to those described in Item 1A-Risk Factors of the Company’s Annual Report on Form 10-K filed on March 2, 2016 and from time to time in our reports filed with U.S. Securities and Exchange Commission. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. The forward-looking statements included in this presentation are made only as of their respective dates, and we undertake no obligation to update these statements to reflect subsequent events or circumstances. p 2

Non-GAAP Financial Measures p 3 We prepare financial statements in accordance with accounting principles generally accepted in the United States (“GAAP”). We also periodically disclose certain financial measures in our quarterly earnings releases, on investor conference calls, and in investor presentations and similar events that may be considered “non-GAAP” financial measures. We believe that these non-GAAP financial measures are useful measures for providing investors with additional information regarding our results of operations and for helping investors understand and compare our operating results across accounting periods and compared to our peers. In addition, since our management often uses these non-GAAP financial measures to manage and evaluate our business, make operating decisions, and forecast our future results, we believe disclosing these measures helps investors evaluate our business in the same manner as management. This additional information is not meant to be considered in isolation or as a substitute for our results of operations prepared and presented in accordance with GAAP. In this earnings release, we disclose the following non-GAAP financial measures, and we reconcile these measures in the tables below to the most directly comparable GAAP financial measures: adjusted diluted earnings per share (both historical and projected), adjusted operating profit, adjusted operating profit margin, free cash flow, and free cash flow as a percentage of net income. In addition to these non-GAAP measures, we also use the term “organic sales” to refer to GAAP sales from existing operations excluding sales from acquired businesses recorded prior to the first anniversary of the acquisition less the amount of sales attributable to any divested businesses (“acquisition sales”), and the impact of foreign currency translation. The impact of foreign currency translation is determined by translating the respective period’s sales (excluding acquisition sales) using the same currency exchange rates that were in effect during the prior year periods. We use the term “organic sales growth” to refer to the increase in our sales between periods that is attributable to organic sales. We use the term “acquisition growth” to refer to the increase in our sales between periods that is attributable to acquisition sales.

Agenda Opening Comments Mark Gliebe Financial Update Chuck Hinrichs Segment Update Jon Schlemmer Summary Mark Gliebe Q&A All p 4

Opening Comments 1st Quarter Results 1st Quarter Sales Headwinds > Oil & Gas and Power Generation End Markets > North America/China Industrial End Markets > Middle East HVAC and North American Resi HVAC and Water Heater Markets > Contractual Two-Way Material Price Formulas p 5 $912 $818 $36 ($12) Prior Year FX Acquisition Organic Current Year ($118) ($40) Oil & Gas / Power Gen ($40) NA/China Industrial ($25) Resi HVAC/Water Heater ($12) Two-Way MPFs

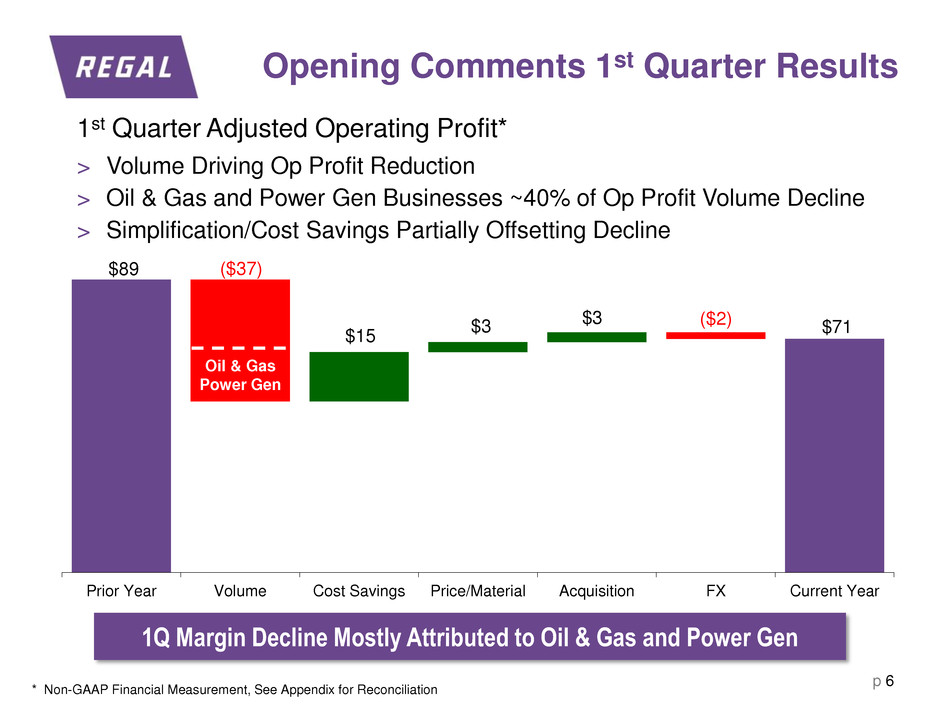

$89 $71 ($37) ($2) Prior Year Volume Cost Savings Price/Material Acquisition FX Current Year Opening Comments 1st Quarter Results 1st Quarter Adjusted Operating Profit* > Volume Driving Op Profit Reduction > Oil & Gas and Power Gen Businesses ~40% of Op Profit Volume Decline > Simplification/Cost Savings Partially Offsetting Decline * Non-GAAP Financial Measurement, See Appendix for Reconciliation p 6 1Q Margin Decline Mostly Attributed to Oil & Gas and Power Gen Oil & Gas Power Gen $3 $3 $15

> Accelerated Simplification and Cost Savings Plans Numerous Simplification Programs Underway Aggressively Right-sizing our Oil & Gas Businesses Reducing SG&A Costs > Portfolio Update Agreed to Sell Non-Core Mastergear Business with $22 Million in Sales Exited $20 Million in Sales of Low Margin Business Total of ~$65 Million in Sales of Exited Businesses Since 2014 Investor Day Purchased Remaining Shares from European JV Partner in Commercial Refrigeration Space > Cash Improved Cash Cycle by 8 Days and Reduced Inventory $18 Million Delivered 104% Free Cash Flow* to Net Income Paid Down $17 Million in Debt Opening Comments 1st Quarter Results p 7 * Non-GAAP Financial Measurement, See Appendix for Reconciliation

> 2016 Outlook – Sales Modest Improvement in Global Industrial Demand Easier Comparisons in the Second Half Especially in Oil & Gas More Typical Heating Season in the Second Half > Second Half – Operating Margin Simplification and Synergies Improved Mix in Climate Solutions Segment > Reducing SG&A, while Investing in Sales and Engineering Teams to Generate Long-Term Growth p 8 Simplification Initiative Positions Regal to Perform in Difficult Markets Looking Forward

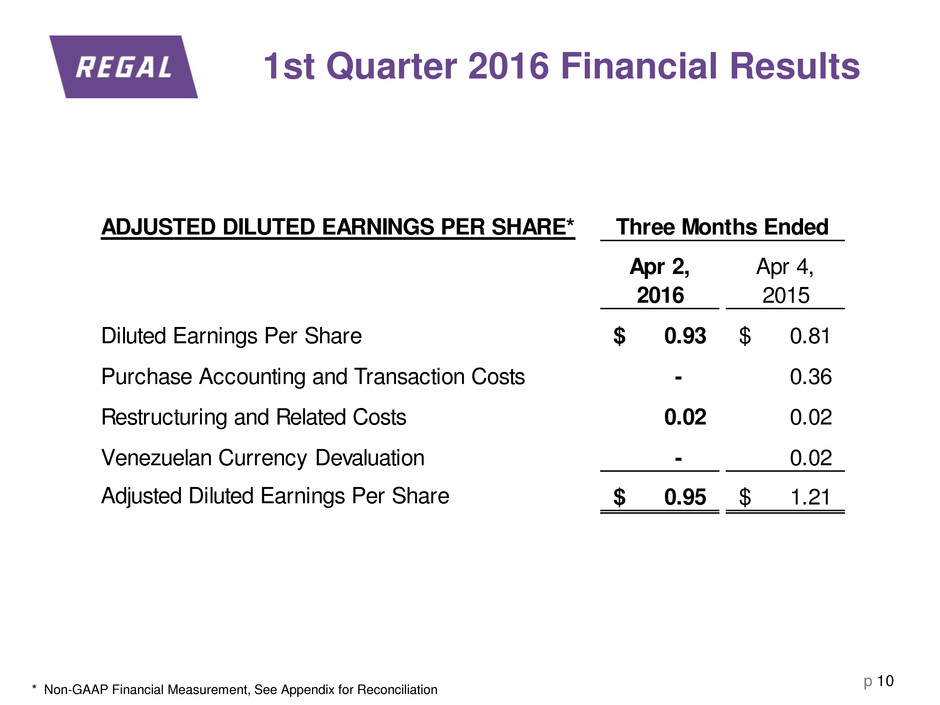

> Sales of $818 Million, Down 10.3% – Net Acquisition Growth of 3.9% – Foreign Currency Translation of (1.3%) – Organic Sales of (12.9%) > Adjusted Operating Profit Margin* of 8.6%, Down 120 Basis Points from Prior Year > Lower Sales Volume Pressured Margins > Contribution of Simplification Initiative Benefits and Cost Controls Partially Offset Effect of Sales Volume Decline 1st Quarter 2016 Financial Results p 9 * Non-GAAP Financial Measurement, See Appendix for Reconciliation

1st Quarter 2016 Financial Results p 10 * Non-GAAP Financial Measurement, See Appendix for Reconciliation ADJUSTED DILUTED EARNINGS PER SHARE* Apr 2, 2016 Apr 4, 2015 Diluted Earnings Per Share 0.93$ 0.81$ Purchase Accounting and Transaction Costs - 0.36 Restructuring and Related Costs 0.02 0.02 Venezuelan Currency Devaluation - 0.02 Adjusted Diluted Earnings Per Share 0.95$ 1.21$ Three Months Ended

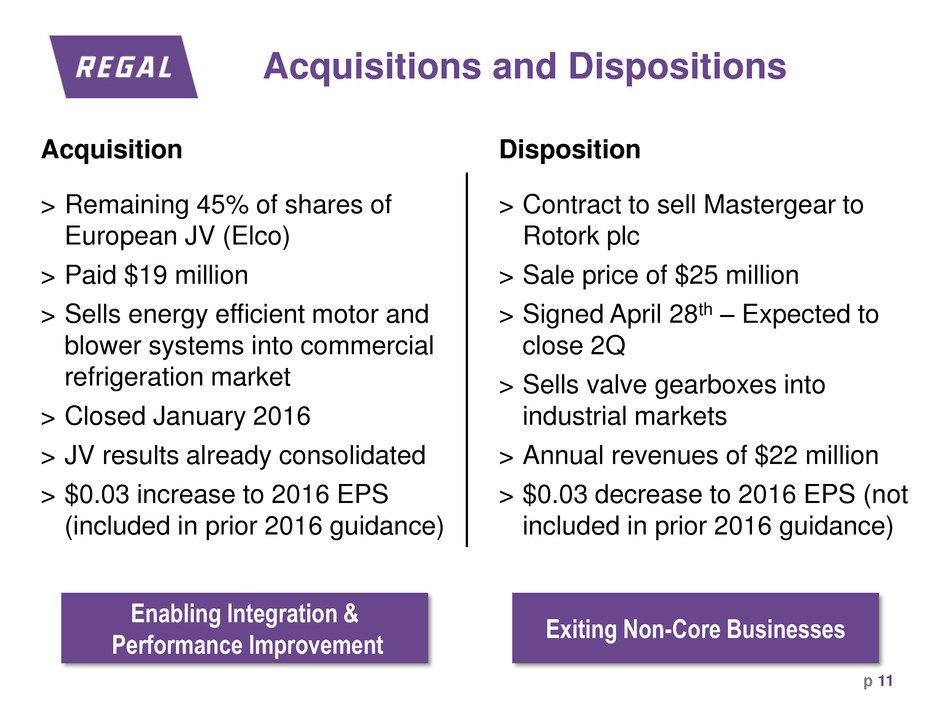

Acquisitions and Dispositions p 11 Acquisition > Remaining 45% of shares of European JV (Elco) > Paid $19 million > Sells energy efficient motor and blower systems into commercial refrigeration market > Closed January 2016 > JV results already consolidated > $0.03 increase to 2016 EPS (included in prior 2016 guidance) Disposition > Contract to sell Mastergear to Rotork plc > Sale price of $25 million > Signed April 28th – Expected to close 2Q > Sells valve gearboxes into industrial markets > Annual revenues of $22 million > $0.03 decrease to 2016 EPS (not included in prior 2016 guidance) Enabling Integration & Performance Improvement Exiting Non-Core Businesses

Capital Expenditures > $15 Million in 1Q 2016 > $85 Million Expected in FY 2016 Effective Tax Rate (ETR) Balance Sheet at April 2, 2016 > Total Debt of $1,675 Million > Net Debt of $1,426 Million > 1Q 2016 Debt Reduction of $17 Million > Reduced Total Debt by $230 Million Since the PTS Acquisition 1st Quarter 2016 Key Financial Metrics Free Cash Flow* > $43 Million in 1Q 2016 > 104% of Net Income in 1Q 2016 > Improved Working Capital p 12 > 23% ETR in 1Q 2016 > Expect 23% ETR for FY 2016 * Non-GAAP Financial Measurement, See Appendix for Reconciliation

2016 Full Year Guidance > 2H Expected to be Stronger than 1H > FX Estimated to Be a 1%-2% Headwind on 2016 Sales > 2016 Restructuring and Related Expenses Estimated at $14 Million > Full Year 2016 GAAP EPS Guidance of $4.38 to $4.78 > Full Year 2016 Adjusted EPS* Guidance of $4.40 to $4.80 Addition of Restructuring and Related Expenses of $0.20 Subtraction of Estimated Gain on Sale of Mastergear of $0.18 p 13 * Non-GAAP Financial Measurement, See Appendix for Reconciliation

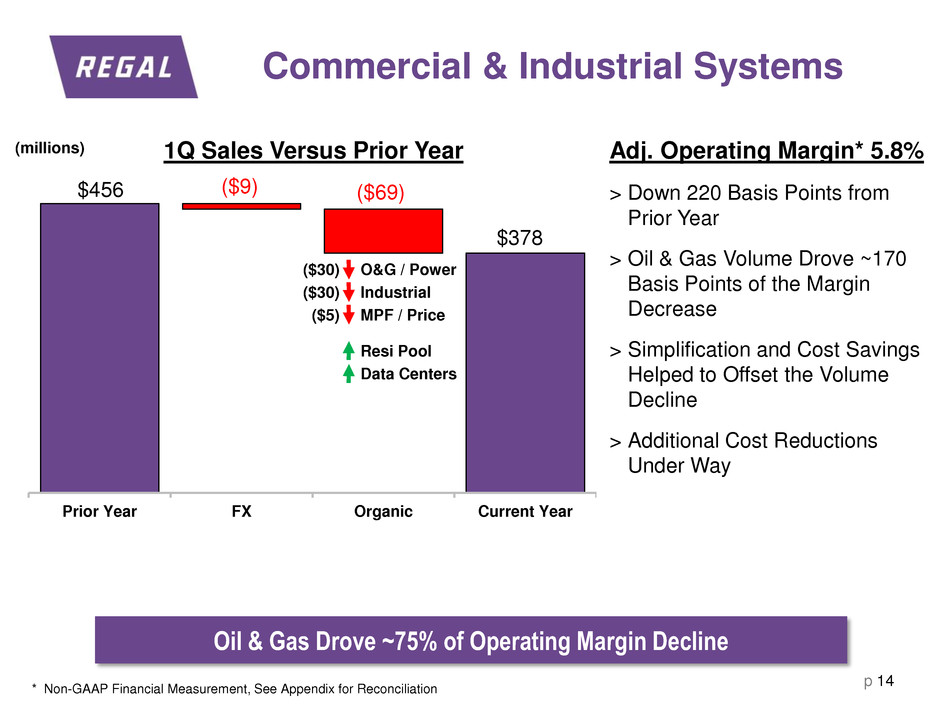

$456 $378 ($9) ($69) Prior Year FX Organic Current Year O&G / Power Industrial MPF / Price Resi Pool Data Centers Commercial & Industrial Systems p 14 * Non-GAAP Financial Measurement, See Appendix for Reconciliation (millions) Oil & Gas Drove ~75% of Operating Margin Decline ($30) ($30) ($5) 1Q Sales Versus Prior Year Adj. Operating Margin* 5.8% > Down 220 Basis Points from Prior Year > Oil & Gas Volume Drove ~170 Basis Points of the Margin Decrease > Simplification and Cost Savings Helped to Offset the Volume Decline > Additional Cost Reductions Under Way

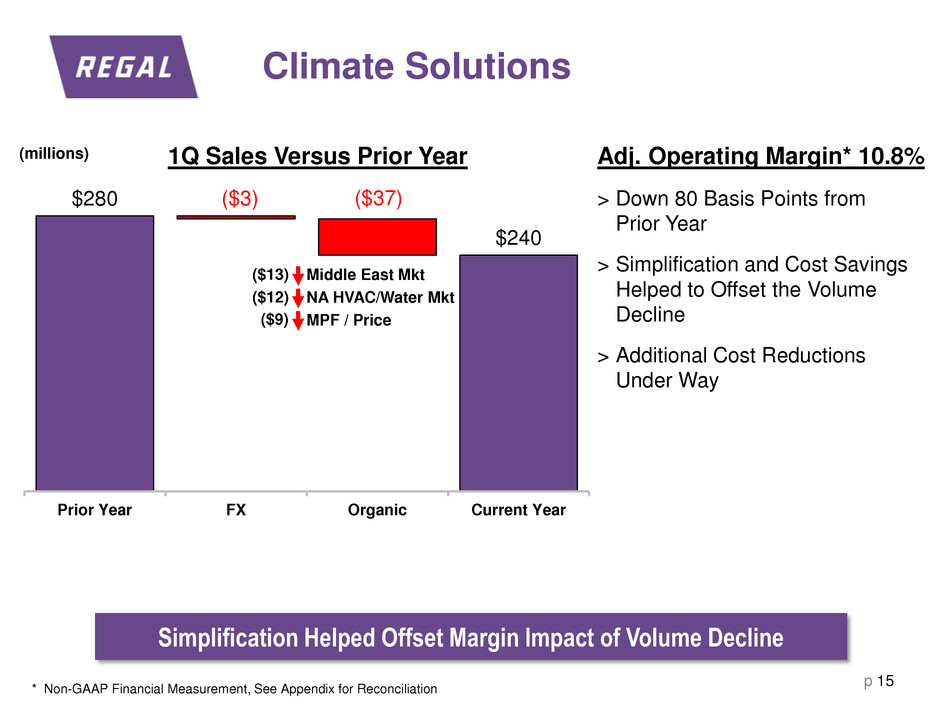

$280 $240 ($3) ($37) Prior Year FX Organic Current Year Middle East Mkt NA HVAC/Water Mkt MPF / Price Climate Solutions p 15 (millions) Simplification Helped Offset Margin Impact of Volume Decline 1Q Sales Versus Prior Year Adj. Operating Margin* 10.8% > Down 80 Basis Points from Prior Year > Simplification and Cost Savings Helped to Offset the Volume Decline > Additional Cost Reductions Under Way ($13) * Non-GAAP Financial Measurement, See Appendix for Reconciliation ($12) ($9)

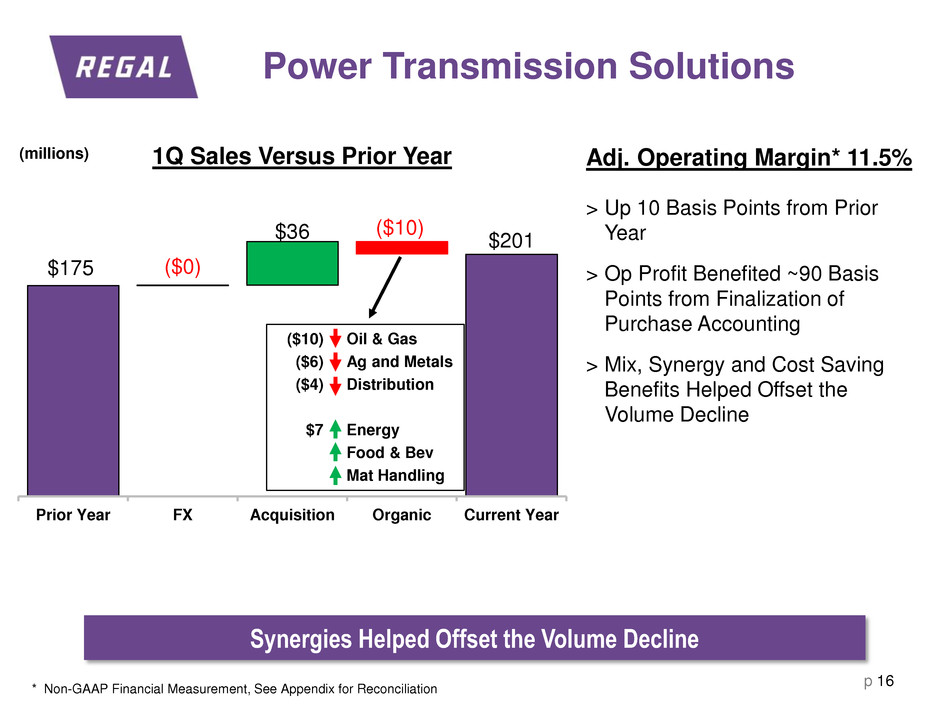

Adj. Operating Margin* 11.5% > Up 10 Basis Points from Prior Year > Op Profit Benefited ~90 Basis Points from Finalization of Purchase Accounting > Mix, Synergy and Cost Saving Benefits Helped Offset the Volume Decline Power Transmission Solutions p 16 (millions) Synergies Helped Offset the Volume Decline 1Q Sales Versus Prior Year $175 $201 $36 ($0) Prior Year FX Acquisition Organic Current Year * Non-GAAP Financial Measurement, See Appendix for Reconciliation ($10) ($10) Oil & Gas ($6) Ag and Metals ($4) Distribution $7 Energy Food & Bev Mat Handling

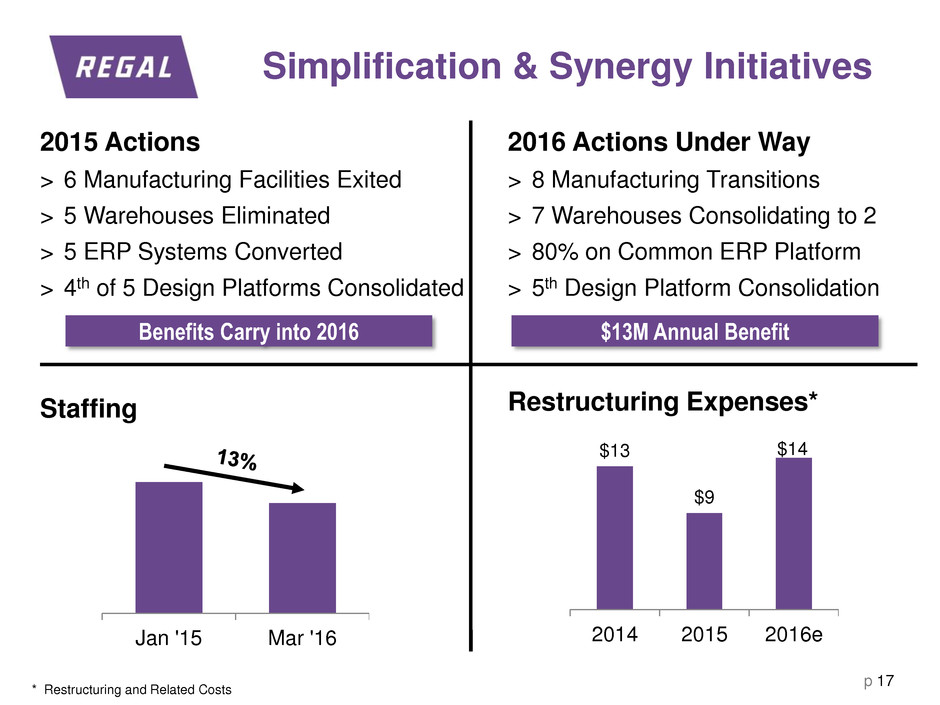

2015 Actions > 6 Manufacturing Facilities Exited > 5 Warehouses Eliminated > 5 ERP Systems Converted > 4th of 5 Design Platforms Consolidated Staffing Restructuring Expenses* p 17 * Restructuring and Related Costs Simplification & Synergy Initiatives Jan '15 Mar '16 $13 $9 $14 2014 2015 2016e Benefits Carry into 2016 $13M Annual Benefit 2016 Actions Under Way > 8 Manufacturing Transitions > 7 Warehouses Consolidating to 2 > 80% on Common ERP Platform > 5th Design Platform Consolidation

1st Quarter Summary > Sales Impacted by: Oil & Gas and Power Generation Markets North American and China Industrial Markets > Margin Decline Mainly Driven by Oil & Gas and Power Generation > Weaker Volume Impact on Margin Partially Offset by Simplification > In Execution Mode on Simplification and Cost Savings Programs > Improved Working Capital Management Drove Free Cash Flow Performance Enabling Debt Reduction > Guidance Reflects Stronger Second Half Simplification and Cost Savings – Especially Oil & Gas Impact Normal Heating Season and Improved Mix in Climate Solutions Modest Global Industrial Improvement as De-stocking Slows p 18

Questions and Answers p 19

p 20 Appendix Non-GAAP Reconciliations ADJUSTED DILUTED EARNINGS PER SHARE Apr 2, 2016 Apr 4, 2015 Diluted Earnings Per Share 0.93$ 0.81$ Purchase Accounting and Transaction Costs —$ 0.36$ Restructuring and Related Costs 0.02$ 0.02$ Venezuelan Currency Devaluation —$ 0.02$ Adjusted Diluted Earnings Per Share 0.95$ 1.21$ Three Months Ended

p 21 Appendix Non-GAAP Reconciliations RECONCILIATION OF 2016 ADJUSTED ANNUAL GUIDANCE Minimum Maximum 2016 EPS Annual Guidance 4.38$ 4.78$ Restructuring and Related Costs 0.20 0.20 Gain on Sale of Business (0.18) (0.18) 2016 Adjusted EPS Annual Guidance 4.40$ 4.80$

p 22 Appendix Non-GAAP Reconciliations ADJUSTED OPERATING INCOME Apr 2, 2016 Apr 4, 2015 Apr 2, 2016 Apr 4, 2015 Apr 2, 2016 Apr 4, 2015 Apr 2, 2016 Apr 4, 2015 Income from Operations 21.7 33.3 24.6 33.4 23.0 (3.1) 69.3 63.6 Purchase Accounting and Transaction Costs — — — — — 22.7 — 22.7 Restructuring nd Related Costs 0.1 1.9 1.3 (1.0) — 0.3 1.4 1.2 Venezuelan Currency Devaluation — 1.5 — — — — — 1.5 Adjusted Income from Operations 21.8$ 36.7$ 25.9$ 32.4$ 23.0$ 19.9$ 70.7$ 89.0$ GAAP Operating Margin % 5.7 % 7.3 % 10.3 % 11.9 % 11.5 % (1.8)% 8.5 % 7.0 % Adjusted Operating Margin % 5.8 % 8.0 % 10.8 % 11.6 % 11.5 % 11.4 % 8.6 % 9.8 % Total Regal Three Months Ended Commercial & Industrial Systems Climate Solutions Power Transmission Solutions

p 23 Appendix Non-GAAP Reconciliations FREE CASH FLOW RECONCILIATION Apr 2, 2016 Apr 4, 2015 Net Cash rovided by Operating Activities 58.2 17.5$ Additions to Property Plant and Equipment (14.9) (21.2) Free Cash Flow 43.3$ (3.7)$ Free Cash Flow as a Percentage of Net Income Attributable to Regal Beloit Corporation 104.1 % Three Months Ended

p 24 Appendix Non-GAAP Reconciliations ORGANIC GROWTH Three Months Ended Apr 2, 2016 Net Sales 818.2$ Net Sales from Businesses Acquired (35.9) Impact from Foreign Currency Exchange Rates 11.9 Adjusted Net Sales 794.2$ Net Sales Three Months Ended April 4, 2015 911.7$ Organic Growth % (12.9)%

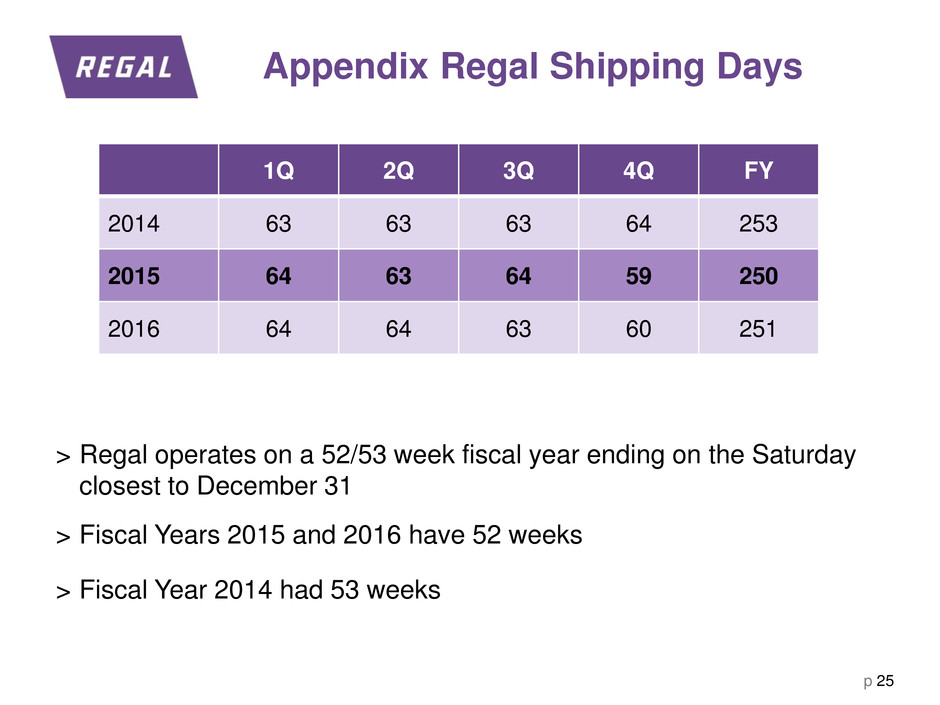

Appendix Regal Shipping Days p 25 1Q 2Q 3Q 4Q FY 2014 63 63 63 64 253 2015 64 63 64 59 250 2016 64 64 63 60 251 > Regal operates on a 52/53 week fiscal year ending on the Saturday closest to December 31 > Fiscal Years 2015 and 2016 have 52 weeks > Fiscal Year 2014 had 53 weeks