Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K FBC - FIRST BUSEY CORP /NV/ | form8k_fbc.htm |

2016 :

•Balance Sheet Strength

•Maintain Organic Growth

•Entry Into St. Louis - Pulaski

•Build Out Indianapolis

•Continue Culture Enhancements

Busey Summary

- Founded in 1868 - Same Name, Same Charter

- Built on Numerous Acquisitions in Central Illinois

- Two Banks - Busey Bank and Pulaski Bank

- Busey Bank - $3.9 Billion

- 28 Illinois Branches, 1 Indianapolis, 6 Southwest Florida

- Pulaski Bank - $1.6 Billion

- Acquired April 30, 2016

- 13 Branches in St. Louis MSA

- Wealth Management - $5.0 Billion Assets Under Care

- Busey Wealth Management - Illinois Based Wealth Management

- Trevett Capital Partners - Boutique High Net Worth

- Busey Ag Management - 90,000+ Acres

- FirsTech - A Remittance Processing Company

- Shortening and Automating Cash Collections for Large Companies

- Delivers Customized Solutions to the Middle Market

Balance Sheet Strength

- Balance Sheet Strength, Profitability and Growth . . . In that Order

- Asset Quality Solid - Q1 2016

- ALL to Loans - 1.75%

- ALL to NPLs - 253.5%

- Classified Assets Ratio - 15.5%

- NPL Largely Consist of Three Credits

- Strong Capital Base - Q1 2016

- Redeemed SBLF Q4 2015 - $72.3 million

- 9+% Tangible Common Equity, Ample Room for Growth

- Strong Dividend Yield at 3.2% based upon $21.00 BUSE

54%

5Y Total Return of

BUSE1

BUSE1

1 SNL May 6, 2016

70%

3Y Total Return of

BUSE1

BUSE1

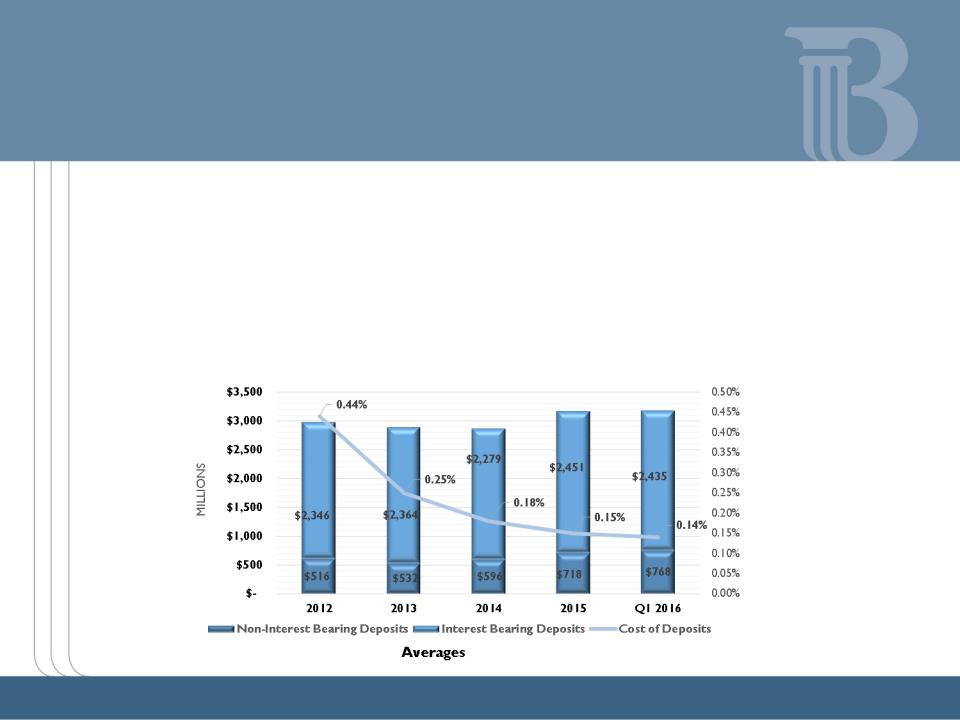

Balance Sheet Strength

- Balance Sheet Strength, Profitability and Growth . . . In that Order

- Solid Core Funding Base

-Q1 Cost of Deposits - 14 bps

-24% Non-interest Bearing Deposits

Loan Growth

- Strategic Investment in 2011 and 2012 into Commercial Organic Growth

- Compounded Annual Growth Rate YE 2011 to YE 2015 - 5.6%

- Ex-Q1 2015 Herget Acquisition

- Herget All Cash Acquisition, Contributed ~$90 million in Loans

- Seasonal Q1 Annual Decline - Typically 1.5%-2.0% Loan Balances

- Q1 2016 Down 2% vs. December 31, 2015

Non-Interest Income

- 36.1% of Total Revenue is Non-Interest Income1

- 14.2% Revenues from Wealth Management

- 6.7% Revenues from FirsTech

- Busey Wealth Management2

- $23.9 Million Revenue

- $7.9 Million Pre-tax Margin

- FirsTech2

- $11.4 Million Revenue3

- $2.9 Million Pre-tax Margin

1 - At March 31, 2016, Excludes Security Gains/ Losses

2 - Graph and Data - Full year 2015

5 Year Earnings Growth

Expands into Saint Louis

Transaction Rationale

Strategically

Compelling

Compelling

Financially

Attractive

Attractive

Low Risk

q Comprehensive due diligence process and thorough loan review completed

q PULB has an experienced and deep management team to assist in post merger operations,

integration, and market expansion

integration, and market expansion

q PULB has a similar culture which will facilitate a successful integration process

q Creates a $5.5 billion asset Midwest community bank with greater scale, operating

efficiency, along with geographic and balance sheet diversification

efficiency, along with geographic and balance sheet diversification

q Franchise expansion into attractive St. Louis market

q Significant transaction with top-tier institution

q Provides strong St. Louis commercial banking platform with cross-sale opportunities for

BUSE wealth management and complimentary mortgage strategies

BUSE wealth management and complimentary mortgage strategies

q Clayton, MO is hub for FirsTech, BUSE’s payment processing subsidiary - natural market

expansion because of BUSE’s presence in the St. Louis market

expansion because of BUSE’s presence in the St. Louis market

q Significant accretion to core earnings

q Tangible book value dilution earn back of approximately 3 years

q Robust internal rate of return

q Pricing multiples in line with other recent transactions for banks similar in size and

geography to PULB

geography to PULB

q Leverages excess capital of BUSE

Transaction Pro Forma Financial Implications

|

Earnings Accretion 1st Full Year of Operations

|

10% - 12%

|

|

Tangible Book Value Dilution at Close

|

3.8%

|

|

Tangible Book Value Per Share Earn Back at Close

|

~3 years

|

|

8.2%

|

|

|

Pro Forma Tier 1 Common Ratio

|

10.5%

|

|

Pro Forma Total Risk Based Capital Ratio

|

13.3%

|

Pro Forma TCE Ratio

Earnings, Tangible Book Value and Capital Ratios

Transaction Meets All M&A Disciplines

|

Key Attributes

|

PULB

|

Rationale1

|

|

Franchise:

|

||

|

q High-density metro market with growth

opportunities in commercial & wealth

management |

Significant entry in the attractive St. Louis

market, Midwest’s 4th largest MSA |

|

|

q Mature franchise with an attractive deposit base

|

ü

|

More than $1.1 billion deposits, 79% core,

overall cost of deposits 39 bps, 93 year old institution |

|

q Strong commercial lending platform

|

ü

|

43% of PULB loans in C&I and Comm. RE, significant

cross selling opportunities for BUSE wealth management product line |

|

q Complimentary mortgage strategies

|

ü

|

Ability to enhance value of PULB’s strong

mortgage originations through cross selling BUSE retail and wealth management products |

|

q Complementary culture

|

ü

|

Similar culture, efficient transition

|

|

q Attractive TBV earn back period

|

Approximately 3 years

|

|

Key Attributes

PULB

Rationale1

Franchise:

ü

q Complementary culture

ü

Similar culture, efficient transition

Financial:

q Accretive to EPS

ü

Immediately accretive to earnings excluding transaction costs,

first full year accretion approximately 10% - 12%

first full year accretion approximately 10% - 12%

q Attractive TBV earn back period

ü

Approximately 3 years

q Conservative credit marks and reasonable cost

saves

saves

ü

2.3% of total loans and over 100% of NPAs; 25%

cost savings

cost savings

1 As of September 30, 2015

Indianapolis

14

- Presence in Indianapolis for Over 20 Years

- $210MM + In Loans

- $40MM Deposits

- Hired Experienced Market President April 2016

- First Full Service Location January 2017

Continued Culture Enhancements

- Associates

- Full Training Program for Vast Majority of Associates

- Wellness Program with over 75% Adoption

- 4.15 of 5 Associate Engagement Score (Gallup), Up 0.3% from Prior Year

- Customers

- Net Promoter Score - Widely Used Customer Promoter Score

- Results and Trends are Positive

- Internal Service Scores

- Communities

- Financial - $1MM + by Busey and Associates

- Human - 13,000 + Hours by 700+ Associates

- Social - Leaders at the Table