Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - RealPage, Inc. | form8-kaxnwpfinancials.htm |

| EX-99.2 - EXHIBIT 99.2 - RealPage, Inc. | ex992nwpproforma.htm |

| EX-23.1 - EXHIBIT 23.1 - RealPage, Inc. | ex231-eyconsentx02.htm |

C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S NWP Services Corporation and Subsidiaries Years Ended December 31, 2015 and 2014 With Report of Independent Auditors Exhibit 99.1

NWP Services Corporation and Subsidiaries Consolidated Financial Statements Years Ended December 31, 2015 and 2014 Contents Report of Independent Auditors.....................................................................................1 Consolidated Financial Statements Consolidated Balance Sheets .........................................................................................3 Consolidated Statements of Operations and Comprehensive Loss................................4 Consolidated Statements of Convertible Preferred Stock and Stockholders’ Deficit....5 Consolidated Statements of Cash Flows ........................................................................6 Notes to Consolidated Financial Statements..................................................................7

A member firm of Ernst & Young Global Limited 1 Ernst & Young LLP Suite 1700 18101 Von Karman Avenue Irvine, CA 92612 Tel: +1 949 794 2300 Fax: +1 949 437 0590 ey.com Report of Independent Auditors The Board of Directors and Stockholders NWP Services Corporation and Subsidiaries We have audited the accompanying consolidated financial statements of NWP Services Corporation and Subsidiaries (the “Company”), which comprise the consolidated balance sheets as of December 31, 2015 and 2014, and the related consolidated statements of operations and comprehensive loss, convertible preferred stock and stockholders’ deficit, and cash flows for the years then ended, and the related notes to the consolidated financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in conformity with U.S. generally accepted accounting principles; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Company’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

2 Opinion In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of NWP Services Corporation and Subsidiaries at December 31, 2015 and 2014, and the consolidated results of their operations and their cash flows for the years then ended in conformity with U.S. generally accepted accounting principles. April 29, 2016

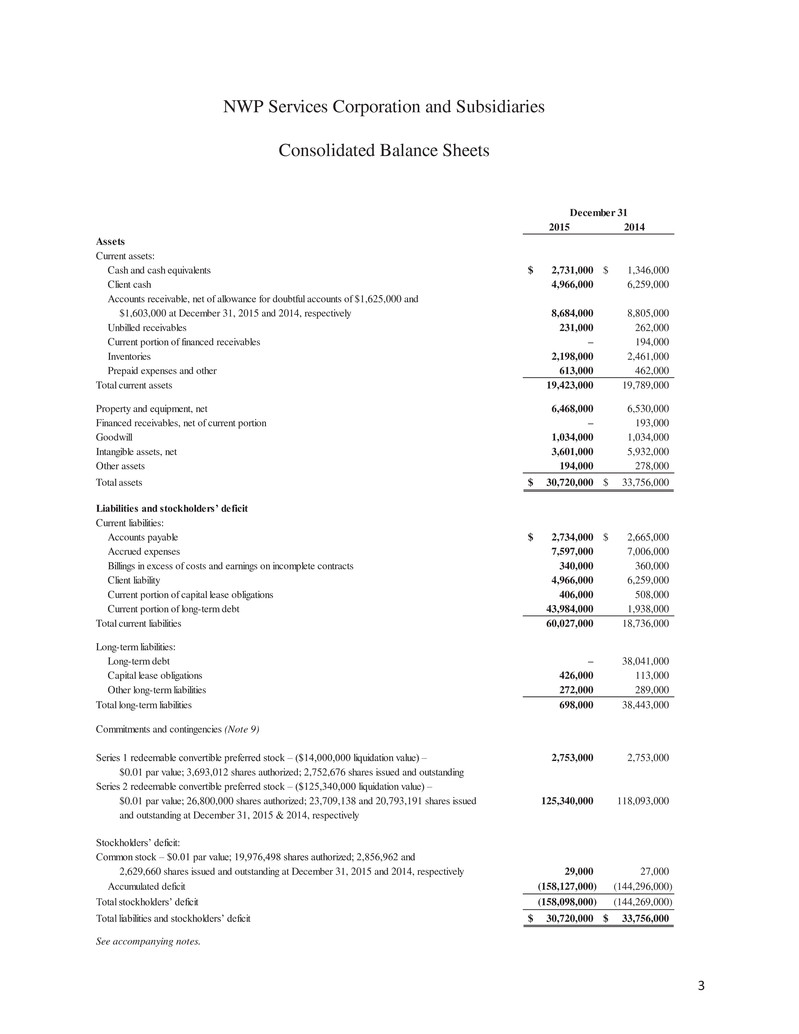

3 2015 2014 Assets Current assets: Cash and cash equivalents 2,731,000$ 1,346,000$ Client cash 4,966,000 6,259,000 Accounts receivable, net of allowance for doubtful accounts of $1,625,000 and $1,603,000 at December 31, 2015 and 2014, respectively 8,684,000 8,805,000 Unbilled receivables 231,000 262,000 Current portion of financed receivables – 194,000 Inventories 2,198,000 2,461,000 Prepaid expenses and other 613,000 462,000 Total current assets 19,423,000 19,789,000 Property and equipment, net 6,468,000 6,530,000 Financed receivables, net of current portion – 193,000 Goodwill 1,034,000 1,034,000 Intangible assets, net 3,601,000 5,932,000 Other assets 194,000 278,000 Total assets 30,720,000$ 33,756,000$ Liabilities and stockholders’ deficit Current liabilities: Accounts payable 2,734,000$ 2,665,000$ Accrued expenses 7,597,000 7,006,000 Billings in excess of costs and earnings on incomplete contracts 340,000 360,000 Client liability 4,966,000 6,259,000 Current portion of capital lease obligations 406,000 508,000 Current portion of long-term debt 43,984,000 1,938,000 Total current liabilities 60,027,000 18,736,000 Long-term liabilities: Long-term debt – 38,041,000 Capital lease obligations 426,000 113,000 Other long-term liabilities 272,000 289,000 Total long-term liabilities 698,000 38,443,000 Commitments and contingencies (Note 9) Series 1 redeemable convertible preferred stock – ($14,000,000 liquidation value) – 2,753,000 2,753,000 $0.01 par value; 3,693,012 shares authorized; 2,752,676 shares issued and outstanding Series 2 redeemable convertible preferred stock – ($125,340,000 liquidation value) – $0.01 par value; 26,800,000 shares authorized; 23,709,138 and 20,793,191 shares issued 125,340,000 118,093,000 and outstanding at December 31, 2015 & 2014, respectively Stockholders’ deficit: Common stock – $0.01 par value; 19,976,498 shares authorized; 2,856,962 and 2,629,660 shares issued and outstanding at December 31, 2015 and 2014, respectively 29,000 27,000 Accumulated deficit (158,127,000) (144,296,000) Total stockholders’ deficit (158,098,000) (144,269,000) Total liabilities and stockholders’ deficit 30,720,000$ 33,756,000$ See accompanying notes. NWP Services Corporation and Subsidiaries Consolidated Balance Sheets December 31

4 2015 2014 Revenue: Monitoring and billing 43,488,000$ 42,567,000$ Meters 9,748,000 9,141,000 SmartSource 5,196,000 4,136,000 Total revenue 58,432,000 55,844,000 Cost of revenue: Monitoring and billing 20,142,000 19,308,000 Meters 9,602,000 9,360,000 SmartSource 4,759,000 3,685,000 Total cost of revenue 34,503,000 32,353,000 Gross profit 23,929,000 23,491,000 Operating expenses: Product and technology 3,176,000 2,836,000 Sales and marketing 8,497,000 7,831,000 General and administrative 12,481,000 12,187,000 Total operating expenses 24,154,000 22,854,000 Income (loss) from operations (225,000) 637,000 Interest expense (6,298,000) (6,247,000) Other income 18,000 19,000 Loss before benefit (provision) for income taxes (6,505,000) (5,591,000) (Provision) benefit for income taxes (79,000) 32,000 Net loss and comprehensive loss (6,584,000)$ (5,559,000)$ See accompanying notes. Year Ended December 31 Consolidated Statements of Operations and Comprehensive Loss NWP Services Corporation and Subsidiaries

5 Total Accumulated Stockholders’ Shares Amount Shares Amount Shares Amount Deficit Deficit Balance at December 31, 2013 2,752,676 2,753,000 20,793,191 111,266,000 2,214,133 22,000 (131,910,000) (131,888,000) Issuance of common stock – – – – 415,527 5,000 – 5,000 Accrued dividends on series 2 preferred stock – – – 6,827,000 – – (6,827,000) (6,827,000) Net loss and comprehensive loss – – – – – – (5,559,000) (5,559,000) Balance at December 31, 2014 2,752,676 2,753,000$ 20,793,191 118,093,000$ 2,629,660 27,000$ (144,296,000)$ (144,269,000)$ Issuance of common stock – – – – 227,302 2,000 – 2,000 Issuance of series 2 preferred stock – – 2,915,947 – – – – – Accrued dividends on series 2 – preferred stock – – – 7,247,000 – – (7,247,000) (7,247,000) Net loss and comprehensive loss – – – – – – (6,584,000) (6,584,000) Balance at December 31, 2015 2,752,676 2,753,000$ 23,709,138 125,340,000$ 2,856,962 29,000$ (158,127,000)$ (158,098,000)$ See accompanying notes. Common StockPreferred Stock, Series 1 Preferred Stock, Series 2 NWP Services Corporation and Subsidiaries Redeemable Convertible Redeemable Convertible Consolidated Statements of Convertible Preferred Stock and Stockholders’ Deficit

6 2015 2014 Operating activities Net loss and comprehensive loss (6,584,000)$ (5,559,000)$ Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 3,460,000 3,019,000 Amortization of intangible assets 2,351,000 2,410,000 Provision for doubtful accounts 395,000 213,000 Change in fair value of earnout liability – 13,000 Change in fair value of interest-rate swaps (14,000) 28,000 Amortization of loan origination fee 83,000 117,000 Interest paid-in-kind 5,331,000 5,442,000 Gain on sale of property and equipment (22,000) – Changes in operating assets and liabilities: Client cash 1,293,000 254,000 Accounts receivable and unbilled receivables 59,000 (2,978,000) Financed receivables 85,000 375,000 Inventories 263,000 (534,000) Prepaid expenses and other assets (151,000) (14,000) Accounts payable, accrued expenses, and other liabilities 655,000 1,529,000 Client liability (1,293,000) (254,000) Earnout liability – (222,000) Billings in excess of costs and earnings on incomplete contracts (20,000) 168,000 Net cash provided by operating activities 5,891,000 4,007,000 Investing activities Purchases of property and equipment (2,505,000) (2,639,000) Proceeds from sale of equipment 22,000 – Acquisition of intangible asset (20,000) – Net cash used in investing activities (2,503,000) (2,639,000) Financing activities Principal payments on long-term debt (1,875,000) (42,358,000) Principal payments on capital lease obligations (680,000) (495,000) Proceeds from long-term debt 550,000 39,453,000 Proceeds from the issuance of common stock 2,000 4,000 Net cash used in financing activities (2,003,000) (3,396,000) Net increase/(decrease) in cash and cash equivalents 1,385,000 (2,028,000) Cash and cash equivalents at beginning of year 1,346,000 3,374,000 Cash and cash equivalents at end of year 2,731,000$ 1,346,000$ Supplemental disclosure of cash flow information Cash paid for interest 875,000$ 639,000$ Cash paid for income taxes 76,000$ 91,000$ Supplemental disclosure of non-cash flow investing and financing activities Capital expenditures funded by capital lease obligations 891,000$ 437,000$ Series 2 preferred stock dividends accrued 7,247,000$ 6,827,000$ See accompanying notes. Year Ended December 31 NWP Services Corporation and Subsidiaries Consolidated Statements of Cash Flows

7 NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 1. Description of Business Description of Business NWP Services Corporation and Subsidiaries (the “Company”), a Delaware corporation, was founded in 1995 and is headquartered in Costa Mesa, California, with offices in Texas, Michigan, Minnesota, and Florida. The Company is a national provider that offers financial transaction processing solutions for multifamily housing professionals. The Company provides billing, financial payment processing, and utility management solutions to multi-housing owners and managers. The Company’s product family includes Utility Logic, Utility Smart, Utility Genius, SmartSource, and NWP Submeter. • Utility Logic provides the requirements to initiate and manage a utility cost recovery program to help maximize utility recovery dollars for properties. Services include (1) resident billing specific to property needs through Utility Billing, Convergent Billing, Read Bill and Remit, (2) electronic payments through ePay, (3) automated data exchange between NWP systems and property management systems, (4) regulatory compliance assistance, (5) flexible analytics and reporting tools, (6) superior service for properties and residents, (7) online training for NWP solutions, and (8) comprehensive reporting. • Utility Smart provides a collection of features and enabling technologies which help optimize utility spend. With a unique collection of intelligent features and enabling technologies, Utility Smart helps to optimize a property’s utility spend with greater precision, saving multifamily owners costs annually. These solutions focus on reduction of overall utility consumption and expenses while providing an analysis of cost and consumption for immediate visibility and insight into key utility data. Services include (1) utility invoice processing and payment, (2) vacant cost recovery, (3) vacant management, ( 4 ) utility consumption alerts, ( 5 ) advanced analytics and reporting, and (6) Utility Smart training. • Utility Genius advances utility cost recovery and energy management programs to the next level. Utility and energy consultative service offerings provide specialized support complimenting other NWP solutions. Utility Genius services are available individually to focus on the areas which will most benefit specific needs at the property and portfolio level. Services include (1) utility action desk analysis services, (2) recovery optimization and risk mitigation services, (3) energy procurement, rate audits and tax services, (4) waste expert, and (5) green and LEED certification and training services.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 8 1. Description of Business (continued) • SmartSource is the complete full-service, back-office solution for real estate owners and managers seeking to boost profitability and enhance performance. Services include (1) property accounting, (2) accounts payable, (3) IT network hosting, (4) PC and application support, and (5) training. • NWP Submeter services provide owners and managers an open platform whether installing new meters or retrofitting existing communities. Other services include repairs, upgrades, and maintenance services for existing meters systems. Basis of Presentation The accompanying consolidated financial statements, which include NWP Services Corporation, NWP Installation Company and Open-c Solutions, Inc., a dormant company, have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) as contained within the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”). All intercompany transactions and balances have been eliminated in consolidation. Subsequent Events The Company has evaluated subsequent events through April 29, 2016, which is the date the December 31, 2015, financial statements were available to be issued. Use of Estimates The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Estimates are used in several areas including: determination of accounts receivable allowances, sales tax accruals, warranty reserves, impairment of goodwill, intangible assets, and long-lived assets, valuation of the Company’s common stock, stock options, warrants, interest rate swaps and income tax contingencies. Actual results could differ from those estimates.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 9 2. Summary of Significant Accounting Policies Liquidity and Capital Resources As of December 31, 2015, the Company has cash and cash equivalents of $2.7 million and availability under its revolving line of credit facility of $2.9 million. Net cash provided by operating activities was $5.9 million and $4.0 million during the years ended December 31, 2015 and 2014, respectively. Given the Company’s leveraged liquidity position, any significant down-turn in its operating earnings or cash flows could impair its ability to comply with the financial covenants of its existing credit facilities. As of December 31, 2015, the Company was in compliance with the covenant requirements of its existing credit facilities. Amounts outstanding under the Company’s credit facilities were paid in full in connection with the acquisition of the Company by RealPage, Inc. on March 4, 2016 (See Note 15). Cash and Cash Equivalents Cash equivalents are highly liquid investments purchased with original maturities of three months or less. Fair Value of Financial Instruments Financial assets and liabilities with carrying amounts approximating fair value include cash and cash equivalents, client cash, accounts receivable, accounts payable, client liabilities, accrued liabilities, and income taxes payable. The carrying amount of these financial assets and liabilities approximates fair value because of their short maturities.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 10 2. Summary of Significant Accounting Policies (continued) Concentrations of Credit Risk and Significant Customers The Company processes service bills, financial transactions and utility management throughout the United States of America. Revenue to recurring and nonrecurring customers is generally made on open account. Allowances are maintained for potential losses, and such losses historically have not been significant and have been within management’s expectations. The Company is exposed to credit loss for the amount of cash deposits with financial institutions in excess of federally insured limits. The Company invests in certificate of deposits and money market accounts with financial institutions. At times, such cash deposits are in excess of the Federal Deposit Insurance Corporation limits. The Company has not experienced any losses in such accounts. Financial instruments which potentially subject the Company to concentrations of credit risk consist principally of cash, cash equivalents, accounts receivable, unbilled receivables, and financed receivables. Revenue from significant customers, those representing 10% or more of total revenue for the respective periods, and their corresponding accounts receivable balance as a percent of total Accounts Receivable are summarized as follows: Revenue Accounts Receivable 2015 2014 2015 2014 Customer A 16% 12% 13% 10% Customer B 10 10 12 13 Client Cash Client cash represents amounts held in a separate designated depository account that are collected from residents for monitoring and billing services and are remittable to property owners and managers. Client cash amounts are remitted to customers monthly and are included in current assets in the accompanying consolidated balance sheets.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 11 2. Summary of Significant Accounting Policies (continued) Accounts Receivable and Allowance for Doubtful Accounts Accounts receivable consist of trade receivables recorded upon recognition of revenue for monitoring and billing and installation revenue, reduced by reserves for estimated uncollectible amounts that are recorded to bad debt expense. Trade accounts receivable are recorded at the invoiced amount and do not bear interest. The allowance for doubtful accounts is determined based on historical write-off experience, current customer information and other relevant factors, including specific identification of past due accounts, based on the age of the receivable in excess of the contemplated due date as well as the general state of the economy. Accounts are charged off against the allowance when the Company believes they are uncollectible. The following table summarizes the activity in the allowance for doubtful accounts as of December 31: 2015 2014 Balance at beginning of year $ 1,603,000 $ 1,408,000 Charged to cost and expenses 93,000 213,000 Charge-offs, net of recoveries (71,000) (18,000) Balance at end of year $ 1,625,000 $ 1,603,000 Financed Receivables Financed receivables consist of promissory notes acquired by the Company in conjunction with prior business combinations and represent financing of meter installation projects previously performed by acquirees. The receivables have varying original maturities, do not bear interest, and are secured by the installed equipment. The Company’s financed receivables are recorded at amortized cost, net of allowance for doubtful accounts (if any), and evaluated for impairment at each balance sheet date. Purchase discounts are recognized as income over the life of the receivable as cash is collected. The amortized cost of a financed receivable is the outstanding unpaid principal balance, net of unamortized purchase discounts associated with the acquisition of the financed receivable.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 12 2. Summary of Significant Accounting Policies (continued) The allowance for uncollectible financed receivables is a valuation allowance that reflects management’s estimate of loan losses inherent in the receivables portfolio as of the balance sheet date. The allowance for doubtful accounts is determined based on historical write-off experience, current customer information and other relevant factors, including specific identification of past due accounts, based on the age of the financed receivable in excess of the contemplated extended payment terms as well as the general state of the economy. Financed receivables are charged off against the allowance when the Company believes they are uncollectible. As of December 31, 2015 and 2014, the Company had recorded an allowance of $302,000 and $0 for doubtful accounts as it relates to financed receivables. Financed receivables consist of the following as of December 31: 2015 2014 Financed receivables $ 302,000 $ 387,000 Allowance for doubtful accounts (302,000) – Financed receivables, net $ – $ 387,000 Inventories Inventories are stated at the lower of cost (first-in, first-out) or market. Inventories consist almost entirely of meters and subcontract labor costs incurred on contracts in progress. The Company establishes inventory allowances for estimated obsolescence or unmarketable inventory equal to the difference between the cost of inventory and the estimated realizable values based on assumptions about forecasted demand, open purchase commitments and market conditions. Inventories consist of the following as of December 31: 2015 2014 Finished goods $ 1,846,000 $ 1,874,000 Construction in process 352,000 587,000 Inventories $ 2,198,000 $ 2,461,000

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 13 2. Summary of Significant Accounting Policies (continued) Property and Equipment Property and equipment are stated at cost. Depreciation is calculated using the straight-line method over the following estimated useful lives: three years for computer equipment and five years for office furniture and equipment. Leasehold improvements are depreciated over the lesser of the term of the lease or the estimated useful lives ranging from five to seven years. When assets are sold, or otherwise disposed of, the cost and related accumulated depreciation are removed from the Company’s records, and any gain or loss is recognized at the time of disposal. The costs incurred in the preliminary stages of development of software for internal use related to research, project planning, training, maintenance and general and administrative activities, and overhead costs are expensed as incurred. The costs of relatively minor upgrades, maintenance and enhancements to the software are also expensed as incurred. Once an application has reached the development stage, internal and external costs incurred in the performance of application development stage activities, including materials, services and payroll-related costs for employees are capitalized, if direct and incremental, until the software is substantially complete and ready for its intended use. Capitalization ceases upon completion of all substantial testing. We also capitalize costs related to specific upgrades and enhancements when it is probable the expenditures will result in additional functionality. Capitalized costs are recorded as part of property and equipment. Internal use software is amortized on a straight-line basis over its estimated useful life, generally three years. The Company capitalized $1,485,000 and $1,872,000 of product development costs during the years ended December 31, 2015 and 2014, respectively, and recognized amortization expense of $1,674,000 and $1,388,000 during the years ended December 31, 2015 and 2014, respectively. Unamortized product development cost was $3,500,000 and $3,700,000 at December 31, 2015 and 2014, respectively. Management evaluates the useful lives of these assets on an annual basis and tests for impairment whenever events or changes in circumstances occur that could impact the recoverability of these assets. There were no impairments to internal use software during the years ended December 31, 2015 and 2014.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 14 2. Summary of Significant Accounting Policies (continued) Long-Lived Assets Including Goodwill and Other Acquired Intangible Assets The Company reviews property and equipment and certain identifiable intangibles for impairment. Long-lived assets, including other acquired intangible assets, require impairment losses to be recorded in operations when it is determined that the carrying value of a long-lived asset may not be recoverable. The Company assesses potential impairments of its long-lived assets whenever events or changes in circumstances indicate that the asset’s carrying value may not be recoverable. An impairment loss is recognized when the carrying amount of a long-lived asset or asset group is not recoverable. Recoverability of these assets is measured by comparison of its carrying amount to future undiscounted cash flows the assets are expected to generate. If property and equipment and certain identifiable intangibles are considered to be impaired, the impairment to be recognized equals the amount of by which the carrying value of the assets exceeds its fair market value. There were no indicators of impairment of long-lived assets at December 31, 2015 and 2014. The Company does not amortize goodwill. Rather, such assets are required to be tested for impairment at least annually or sooner, whenever events or changes in circumstances indicate that the assets may be impaired. The Company performs a qualitative assessment on its goodwill and intangible asset impairment tests on December 31 of each year. The Company did not recognize any goodwill or intangible asset impairment charges in 2015 and 2014. The Company amortizes its intangible assets with definite lives over their estimated useful lives and reviews these assets for impairment annually. The Company is currently amortizing its acquired intangible assets with definite lives over periods ranging from five to seven years.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 15 2. Summary of Significant Accounting Policies (continued) Derivative Instruments To mitigate the risk of interest-rate fluctuations associated with the Company’s variable rate long- term debt, the Company utilizes interest-rate swaps to modify the market risk exposures in connection with the variable rate debt to achieve primarily fixed rate interest expense. Interest-rate swap transactions generally involve the exchange of floating or fixed interest payments. On May 23, 2014, the Company entered into a two-year floating-to-fixed interest-rate swap, with an effective start date of May 23, 2014, that is based on a one-month LIBOR rate versus a 0.84% fixed rate and had a notional value of $6,187,500 and $7,125,000 as of December 31, 2015 and 2014, respectively. The interest-rate swap was not designated for hedge accounting and, accordingly, changes in fair value of the swap were included in interest expense within the Company’s consolidated statements of operations and comprehensive loss. See Note 6, Fair Value Measurements, for further details. Taxes Collected From Customers and Remitted to Governmental Authorities The Company presents taxes collected from customers and remitted to governmental authorities in revenue on a net basis.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 16 2. Summary of Significant Accounting Policies (continued) Revenue Recognition The Company derives revenue from three primary sources: Monitoring and Billing services, Meter services, and SmartSource services. The Company recognizes revenue based on the four criteria that must exist for revenue to be recognized: (1) persuasive evidence that an arrangement exists, (2) delivery has occurred or services have been rendered, (3) the seller’s price to the buyer is fixed or determinable, and ( 4 ) collectability is reasonably assured. The Company assesses whether it acts as a principal in the transaction or as an agent acting on behalf of others. Where the Company is the principal in the transaction and has the risks and rewards of ownership, the transactions are recorded gross in the consolidated statements of operations and comprehensive loss. To date the Company has been the principal in all such transactions. Monitoring and Billing Services Revenue related to monthly monitoring and billing services is recognized in the period in which the services are performed, which is generally when the service bills are generated. Meters Services The Company performs its meter installation services under short-term contracts generally not exceeding six months. Meter installation revenue is recognized using the percentage of completion method, whereby contract revenue is recognized based on units completed and installed in relation to total contracted units. The cumulative effects of revisions of estimated total contract revenues and costs are recorded in the period such revisions are determined. A provision for estimated losses on uncompleted contracts, if any, is recorded in the period in which losses become determinable. Claims and change orders are reflected at estimated recoverable amounts. There were no estimated losses as of December 31, 2015 and 2014. Materials costs incurred on contracts in progress for which revenues have not yet been recognized are included in inventories in the accompanying consolidated balance sheets and totaled $352,000 and $587,000 at December 31, 2015 and 2014, respectively.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 17 2. Summary of Significant Accounting Policies (continued) SmartSource Services Revenues related to SmartSource services are primarily comprised of cost plus contracts. These services are charged to customers based on cost plus an agreed-upon markup percentage; revenues are recognized as costs are incurred and the other revenue recognition criteria have been met. Cost of Revenue Monitoring and Billing Costs Monitoring and billing cost of revenue consists primarily of personnel costs related to the Company’s operations, support services, training and initial billing services and expenses related to third-party service providers. Personnel costs include salaries, bonuses, and employee benefits. Cost of revenue also includes an allocation of facility and overhead costs. The Company allocates facilities costs and overhead costs based on headcount. Meters Costs Meters cost of revenue consists primarily of inventory, personnel costs and third-party subcontractor’s labor costs. Personnel costs include salaries, bonuses and employee benefits. Cost of revenue also includes an allocation of facility and overhead costs. The Company allocates facility and overhead costs based on headcount. The cumulative effects of revisions of estimated total costs are recorded in the period such revisions are determined. A provision for estimated losses on uncompleted contracts, if any, is recorded in the period in which losses become determinable. Claims and change orders are reflected at estimated recoverable amounts. SmartSource Costs SmartSource cost of revenue consists primarily of personnel costs related to the Company’s back-office financial management and IT services, Personnel costs include salaries, bonuses, and employee benefits. Cost of revenue also includes an allocation of facility and overhead costs. The Company allocates facilities costs and overhead costs based on headcount.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 18 2. Summary of Significant Accounting Policies (continued) Warranty Costs Warranty costs associated with meter installation contracts are estimated and provided for in the period in which the related revenue are recognized based on historical experience with warranty claims. Warranty costs are not material for the years ended December 31, 2015 and 2014. Shipping and Handling Costs All shipping and handling costs are expensed as incurred and are recorded as a component of cost of revenue. Charges for shipping and handling are included as a component of meter installations. Product and Technology Product and technology consist of product management and development and engineering. Product and technology expenses consist primarily of payroll-related expenses, facility costs and outside services for the Company’s product management and research and development groups. Product and technology costs are expensed as incurred unless they meet certain criteria for capitalization. Advertising Costs Advertising costs are expensed as incurred. These costs are included in sales and marketing expenses in the accompanying consolidated statements of operations and comprehensive loss. Advertising costs for the years ended December 31, 2015 and 2014, were $78,000 and $77,000, respectively. Income Taxes Current income tax expense is the amount of income taxes expected to be payable for the current year. A deferred income tax asset or liability is established for the expected future consequences resulting from temporary differences in the financial reporting and tax bases of assets and liabilities. Deferred income tax expense (benefit) is the net change during the year in the deferred income tax asset or liability. The Company provides a valuation allowance for its deferred tax assets when management believes it is more likely than not that these assets will not be realized.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 19 2. Summary of Significant Accounting Policies (continued) Stock-Based Compensation The Company accounts for stock-based compensation by estimating the fair-value of stock-based payment awards at the grant date using an option pricing model, and the portion that is ultimately expected to vest is recognized as compensation expense over the requisite service period. The Company uses the Black-Scholes option-pricing model to estimate fair-value of the stock-based awards. Calculating stock-based compensation expense requires the input of highly subjective assumptions, including the stock price on the date of grant, the expected term of the stock-based awards, stock price volatility, and pre-vesting forfeitures. The estimate of the expected term of options granted was determined by the simplified method. Since the Company is a private entity with no historical data on volatility of its stock, the expected volatility is based on the volatility of similar entities (referred to as “guideline companies”). In evaluating similarity, the Company considered factors such as industry, stage of life cycle, size and financial leverage. The assumptions used in calculating the fair value of stock-based awards represent the Company’s best estimates, but these estimates involve inherent uncertainties and the application of management judgment. As a result, if factors change and the Company uses different assumptions, stock-based compensation expense could be materially different in the future. In addition, the Company is required to estimate the expected forfeiture rate and only recognize expense for those shares expected to vest. The Company estimates the forfeiture rate based on historical experience of its stock-based awards that are granted, exercised, and cancelled. If its actual forfeiture rate is materially different from its estimate, stock-based compensation expense could be significantly different from what has been recorded in the current period. The risk-free rate for periods within the contractual life of the option is based on United States treasury yield for a term consistent with the expected life of the stock option in effect at the time of grant. The Company has never declared or paid any cash dividends and does not presently plan to pay cash dividends in the foreseeable future. The Company has elected to recognize stock-based compensation expense on a straight-line basis (net of estimated forfeitures) over the employee service vesting period. Shares of common stock issued upon exercise of stock options will be from previously unissued shares.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 20 2. Summary of Significant Accounting Policies (continued) Recent Accounting Standards In November 2015, the FASB issued ASU No. 2015-17, Income Taxes (Topic 740)—Balance Sheet Classification of Deferred Taxes, which requires that deferred tax liabilities and assets be classified as noncurrent in a classified balance sheet. Prior to the issuance of this guidance, deferred tax liabilities and assets were required to be separately classified into a current amount and a noncurrent amount in the balance sheet. The new accounting guidance represents a change in accounting principle and the standard is effective for fiscal years beginning after December 15, 2017 for non-public entities. The amendments in this ASU should be applied either prospectively or retrospectively. The Company has adopted the application of ASU No. 2015-17 on 2015 financial statements and all deferred taxes are reclassified to noncurrent on its consolidated balance sheet. This application and reclassification does not have material impact on the Company’s consolidated financial statements. In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842), which requires lessees to recognize on the balance sheet assets and liabilities for leases with lease terms of more than 12 months. Consistent with current accounting principles generally accepted in the United States of America (“GAAP”), the recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee primarily will depend on its classification as a finance or operating lease. However, unlike current GAAP—which requires only capital leases to be recognized on the balance sheet—the new ASU will require both types of leases to be recognized on the balance sheet. The ASU will take effect for non-public entities for fiscal years beginning after December 15, 2019. This ASU shall be applied at the beginning of the earliest period presented using the modified retrospective approach, which includes a number of practical expedients that an entity may elect to apply. Early application of ASU No. 2016-02 is permitted. The Company is evaluating the adoption of this ASU and the potential effects on the consolidated financial statements. In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (Topic 606), which includes amendments that create Topic 606 and supersede the revenue recognition requirements in Topic 605, Revenue Recognition, including most industry-specific revenue recognition guidance throughout the Industry Topics of the Codification. In addition, the amendments supersede the cost guidance in Subtopic 605-35, Revenue Recognition—Construction-Type and Production-Type Contracts, and create new Subtopic 340-40, Other Assets and Deferred Costs— Contracts with Customers. In summary, the core principle of Topic 606 is that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 21 2. Summary of Significant Accounting Policies (continued) Recent Accounting Standards The amendments in ASU No. 2014-09 were originally effective for annual reporting periods beginning after December 15, 2017 for non-public entities. On July 9, 2015, the FASB decided to defer for one year the effective date of ASU No. 2014-09, while also deciding to permit early application. With these changes, ASU No. 2014-09 will become effective for annual reporting periods beginning after December 15, 2018 for non-public entities. The Company is evaluating the future impact of the issuance of ASU No. 2014-09, as well as the deferral decisions reached by the FASB. In April 2015, the FASB issued ASU No. 2015-03, Interest—Imputation of Interest (Subtopic 835- 30) – Simplifying the Presentation of Debt Issuance Costs, which requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. This ASU requires retrospective adoption and is effective for fiscal years beginning after December 15, 2015. In August 2015, the FASB issued ASU No. 2015-15, Interest—Imputation of Interest (Subtopic 835- 30) – Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of- Credit Arrangements—Amendments to SEC Paragraphs Pursuant to Staff Announcement at June 18, 2015 EITF Meeting, which amends Subtopic 835-30 to add Securities and Exchange Commission paragraphs relative to the presentation and subsequent measurement of debt issuance costs associated with line-of-credit arrangements. The effective date of ASU No. 2015-03 was unaffected by the issuance of ASU No. 2015-15. The Company is evaluating the adoption of ASU No. 2015-03 and ASU No. 2015-15 and the potential effects on the consolidated financial statements. In July 2015, the FASB issued ASU No. 2015-11, Inventory (Topic 330)—Simplifying the Measurement of Inventory, which requires all inventory, other than inventory measured at last-in, first-out or the retail inventory method, to be measured at the lower of cost and net realizable value. Net realizable value represents the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal and transportation. This ASU is effective for fiscal years beginning after December 15, 2016. The amendments in this ASU should be applied prospectively. When adopted, ASU No. 2015-11 is not expected to have a material impact on the Company’s consolidated financial statements.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 22 3. Goodwill and Intangible Assets Intangible assets acquired in conjunction with two acquisitions in 2010, consist of trade names, customer contracts and non-compete agreements. Goodwill of approximately $1.0 million was recognized in relation to the transactions. All of the amounts recorded to goodwill are expected to be deductible for tax purposes. Goodwill and intangible assets at December 31, 2015 and 2014, were as follows: 2015 2014 Weighted- Average Useful Lives (In Years) Gross Carrying Amount Accumulated Amortization Net Book Value Weighted- Average Useful Lives (In Years) Gross Carrying Amount Accumulated Amortization Net Book Value Customer contracts 7 $16,302,000 $12,769,000 $3,533,000 7 $ 16,302,000 $ 10,479,000 $ 5,823,000 Goodwill – 1,034,000 – 1,034,000 – 1,034,000 – 1,034,000 Non-compete agreements 5-7 221,000 215,000 6,000 5–7 221,000 183,000 38,000 Trade name 7 191,000 148,000 43,000 7 191,000 120,000 71,000 Broadview Network 10 20,000 1,000 19,000 – – – Amortization expense on intangibles was $2,351,000 and $2,410,000 for the year ended December 31, 2015 and 2014, respectively. Based on intangible assets recorded, and assuming no subsequent additions or impairment of the underlying assets, the remaining estimated future annual amortization expense related to the intangible assets as of December 31, 2015, is expected to be as follows: Year ending December 31: 2016 $2,222,000 2017 1,364,000 2018 & Thereafter 15,000 $3,601,000

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 23 4. Property and Equipment Property and equipment consist of the following as of December 31: 2015 2014 Office furniture and equipment $ 5,983,000 $ 10,811,000 Computer software 11,252,000 18,954,000 Leasehold improvements 1,637,000 1,745,000 18,872,000 31,510,000 Accumulated depreciation and amortization (12,404,000) (24,980,000) Property and equipment, net $ 6,468,000 $ 6,530,000 Depreciation and amortization expense for the years ended December 31, 2015 and 2014, was $3,460,000 and $3,019,000, respectively. Depreciation and amortization expense are included in general and administrative expenses in the accompanying statement of operations and comprehensive loss. 5. Long-Term Debt In May 2010, the Company entered into a loan and security agreement with an unaffiliated third- party financial institution (“Senior Lender”) which provided for a term loan of $7,000,000 (“Senior Debt”) and a $5,000,000 revolving line of credit (“Revolver”). Proceeds were used to refinance existing debt, and fund acquisitions. The Senior Debt was to mature on June 1, 2015, with payments of principal and interest due monthly such that the loan is fully repaid by the maturity date. In May 2010, the Company entered into a term loan security agreement with Strome Mezzanine Fund, LP, (the “Subordinated Lender”) which provided for borrowings of up to $30,000,000 (“Subordinated Debt”). The Subordinate Lender is a Director and significant stockholder of the Company. Proceeds from the Subordinated Debt was used to fund acquisitions. During 2010, the Company executed subordinated secured promissory notes under the Subordinated Debt agreement of $9,000,000 and $9,250,000, which were to mature on May 24, 2015 and September 27, 2015, respectively. In July 2012, the Company and Senior Lender entered into an additional loan and security agreement which provided for an additional $700,000 equipment line (“Equipment Line”).

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 24 5. Long-Term Debt (continued) Proceeds were used to finance the purchase of equipment. The Equipment Line was to mature on January 1, 2016, with payments of principal and interest due monthly such that the loan is fully repaid by the maturity date. In May 2014, the Company modified its loan agreement with the Senior Lender to increase the amount available under the Senior Debt to $15,000,000 and renewed the $5,000,000 Revolver for an additional two years, subject to a borrowing formula. Proceeds were used to refinance existing Senior Debt, the Equipment Line and Subordinated Debt. The Senior Debt now matures on September 30, 2016, with payments of principal and interest due monthly. The aggregate principal payments on the term loan will equal 10.00% of the term loan from the closing date through the first anniversary of the closing date (“the First Anniversary”), 15.00% of the term loan from the First Anniversary date through the second anniversary of the closing date (the “Second Anniversary”), 20.00% of the term loan from the Second Anniversary date through September 1, 2016, and on the term loan maturity date, the remaining amount owed under the term loan. Interest on the Senior Debt is calculated as Prime or LIBOR plus 1.75% to 2.5% or 4.00% to 4.75%, respectively, based upon our senior leverage ratio, however the Prime-base rate shall never be less than 2.50%. The Revolver maturing on July 24, 2014, was renewed for two more years. The Revolver, after the renewal, matures on May 23, 2016, with payments of interest due monthly. Interest on the Revolver is calculated as Prime or LIBOR plus 1.00% or 3.00%, respectively, as selected by the Company from time to time, however the Prime-based rate and the LIBOR based rate shall never be less than 2.50% or 2.00%, respectively. The Senior Debt and Revolver are secured by all the personal property of the Company. As of December 31, 2015 and 2014, the Senior Debt had an outstanding balance of $12,250,000 and $14,125,000, respectively, and the Revolver had an outstanding balance of $2,105,000 and $1,600,000, respectively. As of December 31, 2015, availability under the Revolver approximated $2,900,000. In conjunction with the Senior Debt modification the Company entered into an interest rate swap to fix the interest rate on $7,500,000 of the principal amount of the term loan at 0.84% plus applicable spread through September 2016. This interest rate swap was being carried at fair market value on the Company’s consolidated balance sheets, with changes in fair value included in interest expense.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 25 5. Long-Term Debt (continued) In May 2014, the Company modified its term loan security agreement with the Subordinated Lender. Proceeds from the Senior Debt and Revolver were used to reduce the Subordinated Debt balance to $21,547,000, which matures on December 31, 2016. The Subordinate Lender is a significant stockholder of the Company. Interest on the note is calculated monthly based on an annual rate of 20%. The Company can elect to pay monthly interest payments in (i) cash, or (ii) by increasing the principal amount of the note. All PIK Interest is compounded into the principal. The Subordinated Debt is secured by all the personal property of the Company, subject to an inter- creditor agreement with the Senior Lender. As of December 31, 2015 and 2014, Subordinated Debt outstanding totaled $29,629,000 and $24,298,000, respectively, including PIK Interest of $5,331,000 and $2,751,000, respectively. As of December 31, 2015, approximately $371,000 of financing remains available under the Subordinated Debt agreement. In connection with the debt modification described above (1) the unamortized original deferred financing costs of $161,000 and (2) capitalization of new deferred financing cost of $41,000 are collectively reflected as original deferred financing costs to be amortized over the life of the loan using the straight-lined method. During the years ended December 31, 2015 and 2014, the Company incurred $6,298,000 and $6,247,000 of interest expense, respectively. Of these amounts, $42,000 and $39,000 were payable as of December 31, 2015 and 2014, respectively. Included in interest expense is the amortization of deferred financing costs of $83,000 and $117,000 for the years ended December 31, 2015 and 2014, respectively and PIK Interest of $5,331,000 and $5,442,000 for the years ended December 31, 2015 and 2014, respectively. Also included in interest expense is changes in fair value of interest-rate swaps of ($14,000) and $28,000 as of December 31, 2015 and 2014, respectively. As of December 31, 2015 and 2014, the Company’s deferred financing costs were $74,000 and $157,000, respectively, net of amortization.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 26 5. Long-Term Debt (continued) Both the Senior Debt and Subordinated Debt require monthly compliance with a minimum fixed charge coverage ratio, a maximum senior debt to EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio, and a maximum total indebtedness to EBITDA ratio. The Company was in compliance with all of its debt covenants as of December 31, 2015. Future principal payments under the Company’s long-term debt are as follow: Year ending December 31: 2016 $ 43,984,000 6. Fair Value Measurements The accounting guidance for fair value measurements establishes a framework for measuring fair value that includes a hierarchy used to classify the inputs used in determining fair value. The hierarchy prioritizes the inputs to valuation techniques used to measure fair value into three levels. The level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level of input that is significant to the fair value measurement. Fair value is defined as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The fair value is calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific to the entity. Level 1: Quoted market prices in active markets for identical assets or liabilities. Level 2: Observable market based inputs or unobservable inputs that are corroborated by market data. Level 3: Unobservable inputs that are not corroborated by market data.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 27 6. Fair Value Measurements (continued) Assets and liabilities measured at fair value are based on one or more of the valuation techniques. The valuation techniques are described below. Market approach: The market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities. Cost approach: The cost approach is based on the amount that currently would be required to replace the service capacity of an asset (current replacement cost). Income approach: The income approach uses valuation techniques to convert future amounts to a single present amount. The Company maximizes the use of observable inputs and minimizes the use of unobservable inputs when measuring fair value. Accordingly, when available, the Company measures fair value using Level 1 inputs because they generally provide the most reliable evidence of fair value. If market data is not readily available, fair value is based upon other significant unobservable inputs such as inputs that reflect the Company’s own assumptions about the inputs market participants would use in valuing the investments. Investments valued using unobservable inputs are classified to the lowest level of any input that is most significant to the valuation. Thus, a valuation may be classified in Level 3 even though the valuation may include significant inputs that are readily observable.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 28 6. Fair Value Measurements (continued) Fair Value Measurements at December 31, 2015 and 2014, respectively: Level 1 Level 2 Level 3 Balance as of December 31, 2015 Liabilities Interest-rate swap – 14,000 – 14,000 $ $ 14,000 $ $ 14,000 Level 1 Level 2 Level 3 Balance as of December 31, 2014 Liabilities Warrant liability $ – $ 2,000 $ – $ 2,000 Interest-rate swap – 28,000 – 28,000 $ – $ 30,000 $ – $ 30,000

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 29 6. Fair Value Measurements (continued) The following are descriptions of the valuation methodologies and key inputs used to measure financial assets and liabilities recorded at fair value on a recurring basis: Warrants: The valuation of the warrant liability uses the Black-Scholes valuation model with unobservable Level 2 inputs. The changes in the fair value of the warrant liability are recorded in other income (expense) on the statement of operations and comprehensive loss. The Company used the following assumptions to estimate the fair value of the warrant liability at December 31, 2015 and 2014: Expected Volatility Expected Dividend Yield Expected Term Risk-Free Interest Rate Description Warrant liability at December 31, 2015 29.2% 6.00% 0.08 1.28% Warrant liability at December 31, 2014 29.4% 6.00% 1.08 1.06% Interest-rate swaps: The fair value of the interest-rate swaps is determined using the income approach and is predominately based on Level 2 observable interest rates and yield curves. There were no changes in the valuation techniques during the years ended December 31, 2015 and 2014. The changes in the fair value of the interest-rate swaps are recorded in the interest expense on the statement of operations and comprehensive loss. 7. Related-Party Transactions During the years ended December 31, 2015 and 2014, the Company recognized revenue of approximately $2,136,000 and $3,262,000, respectively, which was derived from customers who are existing stockholders. As of December 31, 2015 and 2014, accounts receivable and accounts payable from/to related parties were $254,000 and $355,000, respectively, and $92,000 and $85,000, respectively. The related parties have an equity interest of less than 2% in the Company on a fully diluted basis as of December 31, 2015 and 2014.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 30 7. Related-Party Transactions (continued) During 2010, the Company entered into a term loan security agreement with a Director and significant stockholder of the Company. On May 23, 2014, the Company modified the term loan and security agreement, which included, an extension of the maturity date and the modification of the interest rate. As of December 31, 2015 and 2014, debt outstanding totaled $29,629,000 and $24,298,000, respectively. See Note 5, Long-Term Debt, for further details. During 2011, the Company entered into a service agreement with a software provider, an entity with relations to a Director of the Company. Payments made to the software provider during 2015 and 2014, totaled $6,000 and $14,800, respectively. During 2012, the Company entered into a service agreement with a consulting firm, an entity with relations to a Director of the Company. Payments made to the consulting firm during 2015 and 2014, totaled $0 and $30,000, respectively. 8. Income Taxes Deferred income tax assets and liabilities are comprised of the following at December 31: 2015 2014 Reserves $ 1,479,000 $ 1,267,000 Deferred Interest 3,236,000 3,436,000 Accrued compensation 664,000 716,000 Depreciation and amortization 3,682,000 2,703,000 Indefinite lived intangibles (58,000) (61,000) Net operating loss carryforwards 22,251,000 21,409,000 Other deferred tax adjustments 221,000 (359,000) 31,475,000 29,111,000 Less valuation allowance 31,533,000 29,172,000 $ (58,000) $ (61,000)

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 31 8. Income Taxes (continued) The benefit (provision) for income taxes differs from the amount of income tax determined by applying the applicable U.S. statutory income tax rate to loss before provision for income tax as a result of the following differences for the years ended December 31: 2015 2014 Federal tax computed at statutory rate 34.0% 34.0% State taxes, net of federal benefit 2.8 4.2 Permanent differences (0.8) (1.1) Other deferred tax adjustments (1.0) (7.4) Deferred interest - (10.3) Change in valuation allowance (36.3) (18.7) Total provision for current state income taxes (1.2)% 0.7% The Company has established a full valuation allowance for its deferred tax assets due to uncertainties that preclude it from determining that it is more likely than not that the Company will be able to generate sufficient taxable income to realize such assets with exception to uncertain tax positions arising from recognition criterion under ASC 740. The Company monitors positive and negative factors that may arise in the future as it assesses the need for a valuation allowance against its deferred tax assets. During the years ended December 31, 2015 and 2014, the Company increased the valuation allowance by $2,361,000 and $1,078,000, respectively. As of December 31, 2015, the Company’s net operating loss (“NOL”) carryforwards for federal and state purposes are approximately $84,142,000 and $21,914,000, respectively. The federal and state NOL carryforwards as of December 31, 2015, begin to expire in 2018 and 2016, respectively. Given the Company’s historical net operating losses, a full valuation allowance has been established on the Company’s net deferred tax assets. The Company has generated additional deferred tax liabilities related to its tax amortization of certain acquired indefinite lived intangible assets because these assets are not amortized for book purposes. The tax amortization in current and future years gives rise to a deferred tax liability which will only reverse at the time of ultimate sale or book impairment. Due to the uncertain timing of this reversal, the temporary differences associated with indefinite lived intangibles cannot be considered a source of future taxable income for purposes of determining a valuation allowance. As such, the deferred tax liability cannot be used to support an equal amount of the deferred tax asset related to the NOL carry forward (“naked credit”). This resulted in recognizing deferred tax liability of $58,000 and $61,000 for the years ended December 31, 2015 and 2014, respectively.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 32 8. Income Taxes (continued) Pursuant to Internal Revenue Code (the “Code”) Section 382, use of the Company’s NOL and credit carryforwards may be limited if the Company experiences a cumulative change in ownership of greater than 50% in a moving three-year period. Ownership changes could impact the Company’s ability to utilize NOL and credit carryforwards remaining at an ownership change date. On June 18, 1998, the Company experienced an “ownership change” under Section 382 of the Internal Revenue Code as a result of an increase in the percentage of the Company’s stock value held by certain persons of more than 50.00% during the previous three-year period. Subsequent to an ownership change, the Company’s annual use of its NOLs is generally limited to the value of the Company’s equity immediately before the ownership change multiplied by the long-term tax exempt rate, which for June 1998, was 5.15%. Additional ownership changes may have occurred subsequent to June 18, 1998 through May 22, 2003. If an ownership change has occurred, it would further limit the Company’s use of NOLs remaining at the ownership change date in a manner identical to the limitation that occurred in June 1998, which could result in a substantial limitation that would result in NOLs expiring unused. The Company is currently in the process of completing its analysis of ownership changes during this time period. From May 23, 2003 to December 31, 2015, the Company did not experience an ownership change. As such, the Company’s federal tax NOLs incurred during this time period are available for utilization without limitation under Section 382. Uncertain Tax Positions On January 1, 2009, the Company adopted Accounting for Uncertain Tax Positions pursuant to ASC 740. The Company’s policy is to recognize interest expense and penalties related to income tax matters as a component of income tax expense. The Company recorded no uncertain tax benefits, interest, or penalties at adoption. As of December 31, 2015, the Company’s liability for uncertain tax positions was $7,600,000 in relation to tax deductions taken for the applicable high yield discount obligation and bonuses that are not more likely than not to be sustained. The Company has recorded no interest or penalties on this liability during the year ended December 31, 2015, as the Company would be able to offset the exposure with net operating losses. The Company is required to analyze all open tax years, as defined by the statutes of limitations, for all major jurisdictions, which includes federal and certain states. Open tax years are those that are open for examination by taxing authorities. As of December 31, 2015, the Company’s open statutes of limitations for significant tax jurisdictions are as follows: federal for 2012 through 2015, and state for 2011 through 2015.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 33 8. Income Taxes (continued) It is reasonably possible that the amount of the liability for unrecognized tax benefits may change within the next 12 months due to subsequent filing positions. However, an estimate of the range of possible change cannot be made at this time due to the uncertainty of the Company’s future net operating losses. 9. Commitments and Contingencies Leases The Company leases its facilities under noncancelable operating lease agreements. The leases have remaining terms which range from a period of one to five years. Most leases contain renewal options which are generally exercisable at increased rates. Some of the leases provide for increases in the rental rates at specified times during the lease terms, prior to the expiration dates. Rent expense is calculated on the straight-line basis over the term of each respective lease, resulting in deferred rent. At December 31, 2015 and 2014, deferred rent of $523,000 and $607,000, respectively, is included in accrued expenses in the accompanying consolidated balance sheets and will be amortized to rent expense over the life of the lease. Rent expense for the years ended December 31, 2015 and 2014, totaled $1,033,000, and $873,000, respectively.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 34 9. Commitments and Contingencies (continued) Future minimum lease payments are as follows: Capital Lease Operating Lease Year ending December 31: 2016 $ 430,000 $ 1,061,000 2017 313,000 1,094,000 2018 124,000 1,009,000 2019 - 533,000 2020 - 116,000 Thereafter - - Total minimum lease payments $ 867,000 $ 3,813,000 Less amounts representing interest (35,000) Less current portion (406,000) $ 426,000 Capital lease assets consist of the following at December 31: 2015 2014 Capital leases $ 3,166,000 $ 3,155,000 Accumulated amortization (1,966,000) (2,310,000) Total capital lease assets $ 1,200,000 $ 845,000 The Company’s capital leases are for software and hardware.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 35 9. Commitments and Contingencies (continued) Litigation The Company is involved in various legal proceedings and claims arising in the ordinary course of business. In the opinion of the Company, the ultimate resolution of these matters will not have a material adverse effect on the consolidated financial position, results of operations or cash flow of the Company. One of the Company’s customers filed a lawsuit against NWP in 2015. The case was settled in March 2016. The cost of the settlement is included in Accrued Expenses in the accompanying financial statements as of December 31, 2015. Other Contingent Contractual Obligations During its normal course of business, the Company has made certain indemnities, commitments, and guarantees under which it may be required to make payments in relation to certain transactions. These include (i) intellectual property indemnities to the Company’s customers and licensees in connection with the use, sale and/or license of Company products, (ii) indemnities to various lessors in connection with facility leases for certain claims arising from such facilities or leases, (iii) indemnities to vendors and service providers pertaining to claims based on the negligence or willful misconduct of the Company, (iv) indemnities to Accenture LLP, the purchaser of assets of the Company’s Open-c subsidiary, and (v) indemnities involving the accuracy of representations and warranties in certain contracts. The duration of these indemnities, commitments and guarantees varies and, in certain cases, may be indefinite. The majority of these indemnities, commitments, and guarantees do not provide for any limitation on the maximum amount of future payments the Company could be obligated to make. Historically, costs incurred to settle claims related to indemnities have not been material to the Company’s consolidated financial position, results of operations or cash flows. In addition, the Company believes the likelihood is remote that material payments will be required under the commitments and guarantees described above. The fair value of indemnities, commitments, and guarantees that the Company issued during the years ended December 31, 2015 and 2014, was not material to the Company’s consolidated financial position, results of operations or cash flows.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 36 10. Preferred Stock Series 2 Preferred Stock Accretion As disclosed below, dividends on Series 2 Preferred Stock are cumulative. The Company accrued dividends of $7,247,000 and $6,827,000 for the years ended December 31, 2015 and 2014, respectively. The Company issued Series 2 Preferred Stock Dividends of 2,915,947 shares and 0 shares during 2015 and 2014, respectively. Dividends declared, accrued, and not issued as of December 31, 2015 and 2014, aggregate $4,423,000 and $12,048,000, respectively. Summary of Rights, Preferences, and Privileges of Series 2 Preferred Stock and Series 1 Preferred Stock The following table summarizes certain of the material rights, preferences, and privileges of the Series 1 and 2 Preferred Stock of the Company: Rights, Preferences and Privileges Summary Dividends Series 2 Preferred Stock – Dividends on the Series 2 Preferred Stock accrue at an annual rate of 6% compounded quarterly on $5.10 per share, the accreted value. Accumulated dividends on Series 2 Preferred Stock must be paid before any dividends on other classes of capital stock are paid. Dividends on Series 2 Preferred Stock will be declared annually and paid, in cash or issued in shares of Series 2 Preferred Stock, at the Company’s election. Series 1 Preferred Stock – The Series 1 Preferred Stockholders will not be entitled to any accrual of dividends. They will, however, be entitled to the same dividends as the common stock receives, if and when they are declared.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 37 10. Preferred Stock (continued) Rights, Preferences and Privileges Summary Liquidation preferences Series 2 Preferred Stock – In case of a Liquidation Event, the holders of Series 2 Preferred Stock will be entitled to receive, in preference to the holders of other classes of capital stock, twice the original purchase price for each share of Series 2 Preferred Stock, plus any accrued or unpaid dividends. This liquidation preference, will, however, terminate upon the effective date of a qualified initial public offering. Series 1 Preferred Stock – In case of a Liquidation Event, after payment of the Series 2 Preferred Stock liquidation preferences and any distribution pursuant to the Company’s Management Retention Plan, the Series 1 Preferred Stock will be entitled to up to an aggregate of $14,000,000, which amount will be shared ratably amongst the holders of Series 1 Preferred Stock based on the number of shares of Series 1 Preferred Stock owned. This liquidation preference will, however, terminate upon the effective date of a qualified initial public offering.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 38 10. Preferred Stock (continued) Rights, Preferences and Privileges Summary Redemption rights Series 2 Preferred Stock – Upon a vote by the holders of a majority of the outstanding shares of Series 2 Preferred Stock after May 23, 2007, each holder of Series 2 Preferred Stock will have the right to require the Company to repurchase all of such holder’s shares of Series 2 Preferred Stock. Such redemption right has not been exercised and continues to be in force. Upon a vote of 75% of the outstanding shares of Series 2 Preferred Stock, all shares of Series 2 Preferred Stock will be redeemed. The redemption price will be equal to twice the original purchase price for each share of Series 2 Preferred Stock, plus any accrued or unpaid dividends. The redemption price will be payable in six equal semiannual installments, the first installment being paid 90 days after the vote of the Series 2 preferred Shareholders vote to redeem such shares. If legally available funds for redemption of shares on any redemption installment date are insufficient to redeem the applicable shares, those funds that are legally available will be used to redeem the maximum possible number of shares pro rata among the shares of Series 2 Preferred Stock to be redeemed. The shares not redeemed will be redeemed when legally available funds become available. Additionally, at time of redemption, the Company will, for every two shares of Series 2 Preferred Stock redeemed, issue one warrant exercisable for common stock at an exercise price of $5.10 per share. Since the redemption feature is not certain to occur but is out of the control of management, the Company has presented the series 2 preferred stocks in the mezzanine section of the consolidated balance sheet. Redemption rights Series 1 Preferred Stock – The Series 1 Preferred Stock will be redeemable at the election of the individual holder of Series 1 Preferred Stock. However, no shares of Series 1 Preferred Stock may be redeemed until all issued and outstanding shares of Series 2 Preferred Stock elected to be redeemed are redeemed, including the full payment of any redemption price in connection with the redemption of Series 2 Preferred Stock. The redemption price for the Series 1 Preferred Stock will be in an amount equal to $1.00 per share of Series 1 Preferred Stock. Since the redemption feature is not certain to occur but is out of the control of management, the Company has presented the series 1 preferred stocks in the mezzanine section of the consolidated balance sheet.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 39 10. Preferred Stock (continued) Rights, Preferences and Privileges Summary Voting rights Series 1 and 2 Preferred Stock – The holders of each share of Preferred Stock will have the right to one vote for each share of Common Stock into which such Preferred Stock could then be converted, and with respect to such vote, such holder will have full voting rights and powers equal to the voting rights and powers of the holders of Common Stock.

NWP Services Corporation and Subsidiaries Notes to Consolidated Financial Statements (continued) 40 10. Preferred Stock (continued) Rights, Preferences and Privileges Summary Conversion feature Series 1 and 2 Preferred Stock – The holders of each share of Preferred Stock will have the following rights with respect to the conversion of Preferred Stock into share of Common Stock: (1) Option Conversion whereby each holder of any share(s) of Preferred Stock who elects to convert any share(s) of Preferred Stock into share(s) of Common Stock must surrender the certificate(s) for such share(s) of Preferred Stock or (2) each outstanding share of Preferred Stock will be converted automatically into fully paid and nonassessable shares of Common Stock: (i) immediately before the closing of an underwritten public offering pursuant to an effective registration statement filed under the Securities Act covering the offer and sale of Common Stock for the account of the Company in which (a) if such offering occurs before December 31, 2004, the per share offering price to the public is at least two and a half times the then current Conversion Price for Series 2 Preferred Stock, and the net cash proceeds to the Company (after underwriting discounts, commissions and fees) are at least $25.0 million; or (b) if such offering occurs after December 31, 2004, the per share price to the public is at least three times the then current conversion price for the Series 2 Preferred Stock, and the net cash proceeds to the Company (after underwriting discounts, commissions and fees) are at least $30.0 million; or (ii) upon the Company’s receipt of the written consent of the holders of not less than a majority of the then outstanding shares of Series 2 Preferred Stock, which consent must include the consent of Crosslink Capital; provided that Crosslink Capital continues to own at least 50% of the Series 2 Preferred Stock that it purchased. Each share of Preferred Stock will be convertible into the number of shares of Common Stock that results from dividing (i) the Original Issue Price for such shares of Preferred Stock by (ii) the conversion price for such shares of Preferred Stock that is in effect at the time of conversion.