Attached files

| file | filename |

|---|---|

| EX-32.A - SECTION 906 CEO CERTIFICATIONS - WINDSTREAM HOLDINGS, INC. | a10qexhibit32a1q16.htm |

| EX-32.B - SECTION 906 CFO CERTIFICATIONS - WINDSTREAM HOLDINGS, INC. | a10qexhibit32b1q16.htm |

| EX-31.A - SECTION 302 CEO CERTIFICATIONS - WINDSTREAM HOLDINGS, INC. | a10qexhibit31a1q16.htm |

| EX-31.B - SECTION 302 CFO CERTIFICATIONS - WINDSTREAM HOLDINGS, INC. | a10qexhibit31b1q16.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2016

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Exact name of registrant as specified in its charter | State or other jurisdiction of incorporation or organization | Commission File Number | I.R.S. Employer Identification No. | |||

Windstream Holdings, Inc. | Delaware | 001-32422 | 46-2847717 | |||

Windstream Services, LLC | Delaware | 001-36093 | 20-0792300 | |||

4001 Rodney Parham Road | ||||

Little Rock, Arkansas | 72212 | |||

(Address of principal executive offices) | (Zip Code) | |||

(501) 748-7000 | ||||

(Registrants’ telephone number, including area code) | ||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Windstream Holdings, Inc. | ý YES ¨ NO | |||

Windstream Services, LLC | ý YES ¨ NO | |||

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Windstream Holdings, Inc. | ý YES ¨ NO | |||

Windstream Services, LLC | ý YES ¨ NO | |||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Windstream Holdings, Inc. | Large accelerated filer ý | Accelerated filer ¨ | ||

Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

Windstream Services, LLC | Large accelerated filer ¨ | Accelerated filer ¨ | ||

Non-accelerated filer ý | Smaller reporting company ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act).

Windstream Holdings, Inc. | ¨ YES ý NO | |||

Windstream Services, LLC | ¨ YES ý NO | |||

As of April 29, 2016, 96,310,037 shares of common stock of Windstream Holdings, Inc.were outstanding. Windstream Holdings, Inc. holds a 100 percent interest in Windstream Services, LLC.

This Form 10-Q is a combined quarterly report being filed separately by two registrants: Windstream Holdings, Inc. and Windstream Services, LLC. Windstream Services, LLC is a direct, wholly-owned subsidiary of Windstream Holdings, Inc. Accordingly, Windstream Services, LLC meets the conditions set forth in general instruction H(1)(a) and (b) of Form 10-Q and is therefore filing this form with the reduced disclosure format. Unless the context indicates otherwise, the use of the terms “Windstream,” “we,” “us” or “our” shall refer to Windstream Holdings, Inc. and its subsidiaries, including Windstream Services, LLC, and the term “Windstream Services” shall refer to Windstream Services, LLC and its subsidiaries.

The Exhibit Index is located on page 68. | ||

WINDSTREAM HOLDINGS, INC.

WINDSTREAM SERVICES, LLC

FORM 10-Q

TABLE OF CONTENTS

Page No. | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | Defaults Upon Senior Securities | * |

Item 4. | Mine Safety Disclosures | * |

Item 5. | Other Information | * |

Item 6. | ||

_____________

* | No reportable information under this item. |

1

WINDSTREAM HOLDINGS, INC.

WINDSTREAM SERVICES, LLC

FORM 10-Q

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

Three Months Ended March 31, | ||||||||||||

(Millions, except per share amounts) | 2016 | 2015 | ||||||||||

Revenues and sales: | ||||||||||||

Service revenues | $ | 1,340.6 | $ | 1,381.8 | ||||||||

Product sales | 32.8 | 36.8 | ||||||||||

Total revenues and sales | 1,373.4 | 1,418.6 | ||||||||||

Costs and expenses: | ||||||||||||

Cost of services (exclusive of depreciation and amortization included below) | 668.8 | 680.0 | ||||||||||

Cost of products sold | 28.9 | 31.9 | ||||||||||

Selling, general and administrative | 203.8 | 225.0 | ||||||||||

Depreciation and amortization | 304.8 | 340.7 | ||||||||||

Merger and integration costs | 5.0 | 14.1 | ||||||||||

Restructuring charges | 4.4 | 7.0 | ||||||||||

Total costs and expenses | 1,215.7 | 1,298.7 | ||||||||||

Operating income | 157.7 | 119.9 | ||||||||||

Dividend income on CS&L common stock | 17.6 | — | ||||||||||

Other expense, net | (1.2 | ) | (1.2 | ) | ||||||||

Net loss on early extinguishment of debt | (35.4 | ) | — | |||||||||

Other-than-temporary impairment loss on investment in CS&L common stock | (181.9 | ) | — | |||||||||

Interest expense | (219.7 | ) | (141.1 | ) | ||||||||

Loss before income taxes | (262.9 | ) | (22.4 | ) | ||||||||

Income tax benefit | (31.0 | ) | (27.7 | ) | ||||||||

Net (loss) income | $ | (231.9 | ) | $ | 5.3 | |||||||

Basic and diluted (loss) earnings per share: | ||||||||||||

Net (loss) income | ($2.52 | ) | $.05 | |||||||||

See the accompanying notes to the unaudited interim consolidated financial statements.

2

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

Three Months Ended March 31, | ||||||||||||

(Millions) | 2016 | 2015 | ||||||||||

Net (loss) income | $ | (231.9 | ) | $ | 5.3 | |||||||

Other comprehensive income (loss): | ||||||||||||

Available-for-sale securities: | ||||||||||||

Unrealized holding gain arising during the period | 104.6 | — | ||||||||||

Other-than-temporary impairment loss recognized in the period | 181.9 | — | ||||||||||

Change in available-for-sale securities | 286.5 | — | ||||||||||

Interest rate swaps: | ||||||||||||

Unrealized loss on designated interest rate swaps | (8.3 | ) | (8.6 | ) | ||||||||

Amortization of unrealized losses on de-designated interest rate swaps | 1.2 | 3.4 | ||||||||||

Income tax benefit | 2.7 | 2.0 | ||||||||||

Change in interest rate swaps | (4.4 | ) | (3.2 | ) | ||||||||

Postretirement and pension plans: | ||||||||||||

Plan curtailment | (5.5 | ) | — | |||||||||

Amounts included in net periodic benefit cost: | ||||||||||||

Amortization of net actuarial loss | 0.1 | 0.2 | ||||||||||

Amortization of prior service credits | (0.5 | ) | (1.3 | ) | ||||||||

Income tax benefit | 2.3 | 0.2 | ||||||||||

Change in postretirement and pension plans | (3.6 | ) | (0.9 | ) | ||||||||

Other comprehensive income (loss) | 278.5 | (4.1 | ) | |||||||||

Comprehensive income | $ | 46.6 | $ | 1.2 | ||||||||

See the accompanying notes to the unaudited interim consolidated financial statements.

3

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Millions, except par value) | March 31, 2016 | December 31, 2015 | ||||||

Assets | ||||||||

Current Assets: | ||||||||

Cash and cash equivalents | $ | 74.6 | $ | 31.3 | ||||

Accounts receivable (less allowance for doubtful | ||||||||

accounts of $30.6 and $33.1, respectively) | 636.1 | 643.9 | ||||||

Inventories | 79.4 | 79.5 | ||||||

Prepaid expenses and other | 149.9 | 120.6 | ||||||

Total current assets | 940.0 | 875.3 | ||||||

Goodwill | 4,213.6 | 4,213.6 | ||||||

Other intangibles, net | 1,457.2 | 1,504.7 | ||||||

Net property, plant and equipment | 5,255.7 | 5,279.8 | ||||||

Investment in CS&L common stock | 653.8 | 549.2 | ||||||

Other assets | 90.9 | 95.5 | ||||||

Total Assets | $ | 12,611.2 | $ | 12,518.1 | ||||

Liabilities and Shareholders’ Equity | ||||||||

Current Liabilities: | ||||||||

Current maturities of long-term debt | $ | 11.9 | $ | 5.9 | ||||

Current portion of long-term lease obligations | 156.6 | 152.7 | ||||||

Accounts payable | 323.6 | 430.1 | ||||||

Advance payments and customer deposits | 193.9 | 193.9 | ||||||

Accrued taxes | 71.6 | 84.1 | ||||||

Accrued interest | 118.1 | 78.4 | ||||||

Other current liabilities | 273.9 | 322.0 | ||||||

Total current liabilities | 1,149.6 | 1,267.1 | ||||||

Long-term debt | 5,433.1 | 5,164.6 | ||||||

Long-term lease obligations | 4,959.8 | 5,000.4 | ||||||

Deferred income taxes | 254.9 | 287.4 | ||||||

Other liabilities | 476.1 | 492.2 | ||||||

Total liabilities | 12,273.5 | 12,211.7 | ||||||

Commitments and Contingencies (See Note 13) | ||||||||

Shareholders’ Equity: | ||||||||

Common stock, $.0001 par value, 166.7 shares authorized, | ||||||||

96.3 and 96.7 shares issued and outstanding, respectively | — | — | ||||||

Additional paid-in capital | 587.6 | 602.9 | ||||||

Accumulated other comprehensive loss | (5.9 | ) | (284.4 | ) | ||||

Accumulated deficit | (244.0 | ) | (12.1 | ) | ||||

Total shareholders’ equity | 337.7 | 306.4 | ||||||

Total Liabilities and Shareholders’ Equity | $ | 12,611.2 | $ | 12,518.1 | ||||

See the accompanying notes to the unaudited interim consolidated financial statements.

4

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

Three Months Ended March 31, | ||||||||

(Millions) | 2016 | 2015 | ||||||

Cash Flows from Operating Activities: | ||||||||

Net (loss) income | $ | (231.9 | ) | $ | 5.3 | |||

Adjustments to reconcile net (loss) income to net cash provided from operations: | ||||||||

Depreciation and amortization | 304.8 | 340.7 | ||||||

Provision for doubtful accounts | 9.7 | 10.3 | ||||||

Share-based compensation expense | 13.7 | 14.8 | ||||||

Deferred income taxes | (27.5 | ) | (33.8 | ) | ||||

Other-than-temporary impairment loss on investment in CS&L common stock | 181.9 | — | ||||||

Noncash portion of net loss on early extinguishment of debt | (7.4 | ) | — | |||||

Amortization of unrealized losses on de-designated interest rate swaps | 1.2 | 3.4 | ||||||

Plan curtailment | (5.5 | ) | — | |||||

Other, net | (15.3 | ) | 6.9 | |||||

Changes in operating assets and liabilities, net | ||||||||

Accounts receivable | (2.0 | ) | (33.3 | ) | ||||

Prepaid income taxes | (5.8 | ) | 7.8 | |||||

Prepaid expenses and other | (6.0 | ) | (24.8 | ) | ||||

Accounts payable | (100.2 | ) | (64.2 | ) | ||||

Accrued interest | 39.8 | 67.4 | ||||||

Accrued taxes | (12.5 | ) | (10.9 | ) | ||||

Other current liabilities | 4.2 | (43.2 | ) | |||||

Other liabilities | (10.0 | ) | (2.6 | ) | ||||

Other, net | (4.0 | ) | — | |||||

Net cash provided from operating activities | 127.2 | 243.8 | ||||||

Cash Flows from Investing Activities: | ||||||||

Additions to property, plant and equipment | (263.8 | ) | (189.3 | ) | ||||

Proceeds from the sale of property | 6.2 | — | ||||||

Grant funds received for broadband stimulus projects | — | 7.4 | ||||||

Network expansion funded by Connect America Fund - Phase I | — | (8.3 | ) | |||||

Change in restricted cash | — | (0.4 | ) | |||||

Other, net | — | (2.1 | ) | |||||

Net cash used in investing activities | (257.6 | ) | (192.7 | ) | ||||

Cash Flows from Financing Activities: | ||||||||

Dividends paid to shareholders | (14.9 | ) | (151.5 | ) | ||||

Repayments of debt and swaps | (985.3 | ) | (325.4 | ) | ||||

Proceeds of debt issuance | 1,278.0 | 490.0 | ||||||

Debt issuance costs | (10.7 | ) | — | |||||

Stock repurchases | (28.9 | ) | — | |||||

Payments under long-term lease obligations | (36.8 | ) | — | |||||

Payments under capital lease obligations | (19.8 | ) | (11.2 | ) | ||||

Other, net | (7.9 | ) | (6.8 | ) | ||||

Net cash provided from (used in) financing activities | 173.7 | (4.9 | ) | |||||

Increase in cash and cash equivalents | 43.3 | 46.2 | ||||||

Cash and Cash Equivalents: | ||||||||

Beginning of period | 31.3 | 27.8 | ||||||

End of period | $ | 74.6 | $ | 74.0 | ||||

Supplemental Cash Flow Disclosures: | ||||||||

Interest paid | $ | 178.6 | $ | 74.7 | ||||

Income taxes paid (refunded), net | $ | 6.5 | $ | (1.2 | ) | |||

See the accompanying notes to the unaudited interim consolidated financial statements.

5

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY (UNAUDITED)

(Millions, except per share amounts) | Common Stock and Additional Paid-In Capital | Accumulated Other Comprehensive Loss | Accumulated Deficit | Total | ||||||||||||

Balance at December 31, 2015 | $ | 602.9 | $ | (284.4 | ) | $ | (12.1 | ) | $ | 306.4 | ||||||

Net loss | — | — | (231.9 | ) | (231.9 | ) | ||||||||||

Other comprehensive income (loss), net of tax: | ||||||||||||||||

Change in available-for-sale securities | — | 286.5 | — | 286.5 | ||||||||||||

Change in postretirement and pension plans | — | (3.6 | ) | — | (3.6 | ) | ||||||||||

Amortization of unrealized losses on de-designated interest rate swaps | — | 0.7 | — | 0.7 | ||||||||||||

Change in designated interest rate swaps | — | (5.1 | ) | — | (5.1 | ) | ||||||||||

Comprehensive income (loss) | — | 278.5 | (231.9 | ) | 46.6 | |||||||||||

Share-based compensation expense (See Note 6) | 6.6 | — | — | 6.6 | ||||||||||||

Stock options exercised | 0.4 | — | — | 0.4 | ||||||||||||

Stock issued for management incentive compensation plans (See Note 6) | 5.5 | — | — | 5.5 | ||||||||||||

Stock issued to employee savings plan (See Note 5) | 24.0 | — | — | 24.0 | ||||||||||||

Stock repurchases | (28.9 | ) | — | — | (28.9 | ) | ||||||||||

Taxes withheld on vested restricted stock and other | (8.3 | ) | — | — | (8.3 | ) | ||||||||||

Dividends of $.15 per share declared to shareholders | (14.6 | ) | — | — | (14.6 | ) | ||||||||||

Balance at March 31, 2016 | $ | 587.6 | $ | (5.9 | ) | $ | (244.0 | ) | $ | 337.7 | ||||||

See the accompanying notes to the unaudited interim consolidated financial statements.

6

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

Three Months Ended March 31, | ||||||||||||

(Millions) | 2016 | 2015 | ||||||||||

Revenues and sales: | ||||||||||||

Service revenues | $ | 1,340.6 | $ | 1,381.8 | ||||||||

Product sales | 32.8 | 36.8 | ||||||||||

Total revenues and sales | 1,373.4 | 1,418.6 | ||||||||||

Costs and expenses: | ||||||||||||

Cost of services (exclusive of depreciation and amortization included below) | 668.8 | 680.0 | ||||||||||

Cost of products sold | 28.9 | 31.9 | ||||||||||

Selling, general and administrative | 203.3 | 224.4 | ||||||||||

Depreciation and amortization | 304.8 | 340.7 | ||||||||||

Merger and integration costs | 5.0 | 14.1 | ||||||||||

Restructuring charges | 4.4 | 7.0 | ||||||||||

Total costs and expenses | 1,215.2 | 1,298.1 | ||||||||||

Operating income | 158.2 | 120.5 | ||||||||||

Dividend income on CS&L common stock | 17.6 | — | ||||||||||

Other expense, net | (1.2 | ) | (1.2 | ) | ||||||||

Net loss on early extinguishment of debt | (35.4 | ) | — | |||||||||

Other-than-temporary impairment loss on investment in CS&L common stock | (181.9 | ) | — | |||||||||

Interest expense | (219.7 | ) | (141.1 | ) | ||||||||

Loss before income taxes | (262.4 | ) | (21.8 | ) | ||||||||

Income tax benefit | (30.8 | ) | (27.4 | ) | ||||||||

Net (loss) income | $ | (231.6 | ) | $ | 5.6 | |||||||

See the accompanying notes to the unaudited interim consolidated financial statements.

7

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

Three Months Ended March 31, | ||||||||||||

(Millions) | 2016 | 2015 | ||||||||||

Net (loss) income | $ | (231.6 | ) | $ | 5.6 | |||||||

Other comprehensive income (loss): | ||||||||||||

Available-for-sale securities: | ||||||||||||

Unrealized holding gain arising during the period | 104.6 | — | ||||||||||

Other-than-temporary impairment loss recognized in the period | 181.9 | — | ||||||||||

Change in available-for-sale securities | 286.5 | — | ||||||||||

Interest rate swaps: | ||||||||||||

Unrealized loss on designated interest rate swaps | (8.3 | ) | (8.6 | ) | ||||||||

Amortization of unrealized losses on de-designated interest rate swaps | 1.2 | 3.4 | ||||||||||

Income tax benefit | 2.7 | 2.0 | ||||||||||

Change in interest rate swaps | (4.4 | ) | (3.2 | ) | ||||||||

Postretirement and pension plans: | ||||||||||||

Plan curtailment | (5.5 | ) | — | |||||||||

Amounts included in net periodic benefit cost: | ||||||||||||

Amortization of net actuarial loss | 0.1 | 0.2 | ||||||||||

Amortization of prior service credits | (0.5 | ) | (1.3 | ) | ||||||||

Income tax benefit | 2.3 | 0.2 | ||||||||||

Change in postretirement and pension plans | (3.6 | ) | (0.9 | ) | ||||||||

Other comprehensive income (loss) | 278.5 | (4.1 | ) | |||||||||

Comprehensive income | $ | 46.9 | $ | 1.5 | ||||||||

See the accompanying notes to the unaudited interim consolidated financial statements.

8

WINDSTREAM SERVICES, LLC

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Millions, except number of shares) | March 31, 2016 | December 31, 2015 | ||||||

Assets | ||||||||

Current Assets: | ||||||||

Cash and cash equivalents | $ | 74.6 | $ | 31.3 | ||||

Accounts receivable (less allowance for doubtful | ||||||||

accounts of $30.6 and $33.1, respectively) | 636.1 | 643.9 | ||||||

Inventories | 79.4 | 79.5 | ||||||

Prepaid expenses and other | 149.9 | 120.6 | ||||||

Total current assets | 940.0 | 875.3 | ||||||

Goodwill | 4,213.6 | 4,213.6 | ||||||

Other intangibles, net | 1,457.2 | 1,504.7 | ||||||

Net property, plant and equipment | 5,255.7 | 5,279.8 | ||||||

Investment in CS&L common stock | 653.8 | 549.2 | ||||||

Other assets | 90.9 | 95.5 | ||||||

Total Assets | $ | 12,611.2 | $ | 12,518.1 | ||||

Liabilities and Member Equity | ||||||||

Current Liabilities: | ||||||||

Current maturities of long-term debt | $ | 11.9 | $ | 5.9 | ||||

Current portion of long-term lease obligations | 156.6 | 152.7 | ||||||

Accounts payable | 323.6 | 430.1 | ||||||

Advance payments and customer deposits | 193.9 | 193.9 | ||||||

Payable to Windstream Holdings, Inc. | 14.9 | 15.1 | ||||||

Accrued taxes | 71.6 | 84.1 | ||||||

Accrued interest | 118.1 | 78.4 | ||||||

Other current liabilities | 259.0 | 306.9 | ||||||

Total current liabilities | 1,149.6 | 1,267.1 | ||||||

Long-term debt | 5,433.1 | 5,164.6 | ||||||

Long-term lease obligations | 4,959.8 | 5,000.4 | ||||||

Deferred income taxes | 254.9 | 287.4 | ||||||

Other liabilities | 476.1 | 492.2 | ||||||

Total liabilities | 12,273.5 | 12,211.7 | ||||||

Commitments and Contingencies (See Note 13) | ||||||||

Member Equity: | ||||||||

Additional paid-in capital | 584.7 | 600.3 | ||||||

Accumulated other comprehensive loss | (5.9 | ) | (284.4 | ) | ||||

Accumulated deficit | (241.1 | ) | (9.5 | ) | ||||

Total member equity | 337.7 | 306.4 | ||||||

Total Liabilities and Member Equity | $ | 12,611.2 | $ | 12,518.1 | ||||

See the accompanying notes to the unaudited interim consolidated financial statements.

9

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

Three Months Ended March 31, | ||||||||

(Millions) | 2016 | 2015 | ||||||

Cash Flows from Operating Activities: | ||||||||

Net (loss) income | $ | (231.6 | ) | $ | 5.6 | |||

Adjustments to reconcile net (loss) income to net cash provided from operations: | ||||||||

Depreciation and amortization | 304.8 | 340.7 | ||||||

Provision for doubtful accounts | 9.7 | 10.3 | ||||||

Share-based compensation expense | 13.7 | 14.8 | ||||||

Deferred income taxes | (27.5 | ) | (33.8 | ) | ||||

Other-than-temporary impairment loss on investment in CS&L common stock | 181.9 | — | ||||||

Noncash portion of net loss on early extinguishment of debt | (7.4 | ) | — | |||||

Amortization of unrealized losses on de-designated interest rate swaps | 1.2 | 3.4 | ||||||

Plan curtailment | (5.5 | ) | — | |||||

Other, net | (15.3 | ) | 6.9 | |||||

Changes in operating assets and liabilities, net | ||||||||

Accounts receivable | (2.0 | ) | (33.3 | ) | ||||

Prepaid income taxes | (5.8 | ) | 7.8 | |||||

Prepaid expenses and other | (6.0 | ) | (24.8 | ) | ||||

Accounts payable | (100.2 | ) | (64.2 | ) | ||||

Accrued interest | 39.8 | 67.4 | ||||||

Accrued taxes | (12.5 | ) | (10.9 | ) | ||||

Other current liabilities | 4.2 | (43.2 | ) | |||||

Other liabilities | (10.0 | ) | (2.6 | ) | ||||

Other, net | (4.0 | ) | — | |||||

Net cash provided from operating activities | 127.5 | 244.1 | ||||||

Cash Flows from Investing Activities: | ||||||||

Additions to property, plant and equipment | (263.8 | ) | (189.3 | ) | ||||

Proceeds from the sale of property | 6.2 | — | ||||||

Grant funds received for broadband stimulus projects | — | 7.4 | ||||||

Network expansion funded by Connect America Fund - Phase I | — | (8.3 | ) | |||||

Change in restricted cash | — | (0.4 | ) | |||||

Other, net | — | (2.1 | ) | |||||

Net cash used in investing activities | (257.6 | ) | (192.7 | ) | ||||

Cash Flows from Financing Activities: | ||||||||

Distributions to Windstream Holdings, Inc. | (44.1 | ) | (151.8 | ) | ||||

Repayments of debt and swaps | (985.3 | ) | (325.4 | ) | ||||

Proceeds of debt issuance | 1,278.0 | 490.0 | ||||||

Debt issuance costs | (10.7 | ) | — | |||||

Payments under long-term lease obligations | (36.8 | ) | — | |||||

Payments under capital lease obligations | (19.8 | ) | (11.2 | ) | ||||

Other, net | (7.9 | ) | (6.8 | ) | ||||

Net cash provided from (used in) financing activities | 173.4 | (5.2 | ) | |||||

Increase in cash and cash equivalents | 43.3 | 46.2 | ||||||

Cash and Cash Equivalents: | ||||||||

Beginning of period | 31.3 | 27.8 | ||||||

End of period | $ | 74.6 | $ | 74.0 | ||||

Supplemental Cash Flow Disclosures: | ||||||||

Interest paid | $ | 178.6 | $ | 74.7 | ||||

Income taxes paid (refunded), net | $ | 6.5 | $ | (1.2 | ) | |||

See the accompanying notes to the unaudited interim consolidated financial statements.

10

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENT OF MEMBER EQUITY (UNAUDITED)

(Millions) | Additional Paid-In Capital | Accumulated Other Comprehensive Loss | Accumulated Deficit | Total | ||||||||||||

Balance at December 31, 2015 | $ | 600.3 | $ | (284.4 | ) | $ | (9.5 | ) | $ | 306.4 | ||||||

Net loss | — | — | (231.6 | ) | (231.6 | ) | ||||||||||

Other comprehensive income (loss), net of tax: | ||||||||||||||||

Change in available-for-sale securities | — | 286.5 | — | 286.5 | ||||||||||||

Change in postretirement and pension plans | — | (3.6 | ) | — | (3.6 | ) | ||||||||||

Amortization of unrealized losses on de-designated interest rate swaps | — | 0.7 | — | 0.7 | ||||||||||||

Change in designated interest rate swaps | — | (5.1 | ) | — | (5.1 | ) | ||||||||||

Comprehensive income (loss) | — | 278.5 | (231.6 | ) | 46.9 | |||||||||||

Share-based compensation expense (See Note 6) | 6.6 | — | — | 6.6 | ||||||||||||

Stock options exercised | 0.4 | — | — | 0.4 | ||||||||||||

Stock issued for management incentive compensation plans (See Note 6) | 5.5 | — | — | 5.5 | ||||||||||||

Stock issued to employee savings plan (See Note 5) | 24.0 | — | — | 24.0 | ||||||||||||

Taxes withheld on vested restricted stock and other | (8.3 | ) | — | — | (8.3 | ) | ||||||||||

Distributions payable to Windstream Holdings, Inc. | (43.8 | ) | — | — | (43.8 | ) | ||||||||||

Balance at March 31, 2016 | $ | 584.7 | $ | (5.9 | ) | $ | (241.1 | ) | $ | 337.7 | ||||||

See the accompanying notes to the unaudited interim consolidated financial statements.

11

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

1. Preparation of Interim Financial Statements:

In these consolidated financial statements, unless the context requires otherwise, the use of the terms “Windstream,” “we,” “us” or “our” shall refer to Windstream Holdings, Inc. and its subsidiaries, including Windstream Services, LLC, and the term “Windstream Services” shall refer to Windstream Services, LLC and its subsidiaries.

Organizational Structure –Windstream Holdings, Inc. (“Windstream Holdings”) is a publicly traded holding company and the parent of Windstream Services, LLC (“Windstream Services”). Windstream Holdings common stock trades on the NASDAQ Global Select Market (“NASDAQ”) under the ticker symbol “WIN”. Windstream Holdings owns a 100 percent interest in Windstream Services. Windstream Services and its guarantor subsidiaries are the sole obligors of all outstanding debt obligations and, as a result also file periodic reports with the Securities and Exchange Commission (“SEC”). Windstream Holdings is not a guarantor of nor subject to the restrictive covenants included in any of Windstream Services’ debt agreements. The Windstream Holdings board of directors and officers oversee both companies.

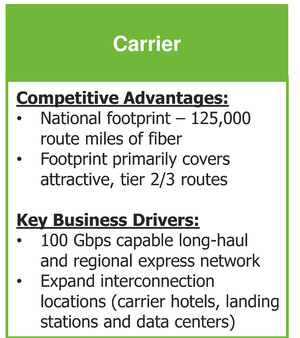

Description of Business – We are a leading provider of advanced network communications and technology solutions for consumers, businesses, enterprise organizations and carrier partners across the United States. We offer bundled services, including broadband, security solutions, voice and digital television to consumers. We also provide data, cloud solutions, unified communications and managed services to business and enterprise clients. We supply core transport solutions on a local and long-haul fiber-optic network spanning approximately 125,000 miles.

Enterprise service revenues include revenues from integrated voice and data services, advanced data, traditional voice and long-distance services provided to enterprise customers. Consumer service revenues are generated from the provisioning of high-speed Internet, voice and video services to consumers. Small business service revenues include revenues from integrated voice and data services, advanced data and traditional voice and long-distance services provided to small business customers. Carrier revenues include revenues from other carriers for special access circuits and fiber connections as well as voice and data services sold on a wholesale basis. Regulatory revenues include switched access revenues, federal and state Universal Service Fund (“USF”) revenues and amounts received from Connect America Fund - Phase II. Other service revenues include USF surcharge revenues, other miscellaneous services and consumer revenues generated in markets where we lease the connection to the customer premise.

Basis of Presentation – The accompanying unaudited consolidated financial statements have been prepared based upon SEC rules that permit reduced disclosure for interim periods. Certain information and footnote disclosures have been condensed or omitted in accordance with those rules and regulations. The accompanying consolidated balance sheet as of December 31, 2015, was derived from audited financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States. In our opinion, these financial statements reflect all adjustments that are necessary for a fair presentation of results of operations and financial condition for the interim periods shown including normal recurring accruals and other items. The results for the interim periods are not necessarily indicative of results for the full year. For a more complete discussion of significant accounting policies and certain other information, this report should be read in conjunction with the consolidated financial statements and accompanying notes included in our Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the SEC on February 25, 2016.

Windstream Holdings and its domestic subsidiaries, including Windstream Services, file a consolidated federal income tax return. As such, Windstream Services and its subsidiaries are not separate taxable entities for federal and certain state income tax purposes. In instances when Windstream Services does not file a separate return, income taxes as presented within the accompanying consolidated financial statements attribute current and deferred income taxes of Windstream Holdings to Windstream Services and its subsidiaries in a manner that is systematic, rational and consistent with the asset and liability method. Income tax provisions presented for Windstream Services and its subsidiaries are prepared under the “separate return method.” The separate return method represents a hypothetical computation assuming that the reported revenue and expenses of Windstream Services and its subsidiaries were incurred by separate taxable entities.

The preparation of financial statements, in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”), requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and disclosure of contingent assets and liabilities. The estimates and assumptions used in the accompanying consolidated financial statements are based upon management’s evaluation of the relevant facts and circumstances as of the date of the consolidated financial statements. Actual results may differ from the estimates and assumptions used in preparing the accompanying consolidated financial statements, and such differences could be material.

12

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

1. Preparation of Interim Financial Statements, Continued:

There are no significant differences between the consolidated results of operations, financial condition, and cash flows of Windstream Holdings and those of Windstream Services other than for certain expenses incurred directly by Windstream Holdings principally consisting of audit, legal and board of director fees, NASDAQ listing fees, other shareholder-related costs, income taxes, common stock activity, and payables from Windstream Services to Windstream Holdings. Earnings per share data has not been presented for Windstream Services, because that entity has not issued publicly held common stock as defined in accordance with U.S. GAAP. Unless otherwise indicated, the note disclosures included herein pertain to both Windstream Holdings and Windstream Services.

Certain prior year amounts have been reclassified to conform to the current year financial statement presentation. These changes and reclassifications did not impact net (loss) income or comprehensive income.

Recently Issued Authoritative Guidance

Revenue Recognition – In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers. The standard outlines a single comprehensive revenue recognition model for entities to follow in accounting for revenue from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. The core principle of the revenue model is that an entity should recognize revenue for the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled to receive for those goods or services. ASU 2014-09 also includes new accounting principles related to the deferral and amortization of contract acquisition and fulfillment costs. ASU 2014-09 may be adopted by applying the provisions of the new standard on a retrospective basis to all periods presented in the financial statements or on a modified retrospective basis which would result in the recognition of a cumulative effect adjustment in the year of adoption. When issued, ASU 2014-09 was to be effective for annual periods beginning after December 15, 2016 and interim periods within those annual periods. Early adoption was not permitted.

In July 2015, the FASB deferred the effective date of ASU 2014-09 by one year to December 15, 2017 for annual reporting periods beginning after that date, or January 1, 2018, for calendar companies like Windstream. Entities are permitted to early adopt the standard, but not before the original effective date of December 15, 2016. We are in the process of determining the method of adoption and assessing the impact the new standard will have on our consolidated financial statements. We expect to adopt this standard effective January 1, 2018.

In March 2016, FASB issued ASU 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net). The amendments are intended to improve the operability and understandability of the implementation guidance on principal versus agent considerations. The effective date for this ASU is the same as the effective date for ASU 2014-09. In conjunction with our assessment of ASU 2014-09, we are currently evaluating the impacts of this new guidance.

Fair Value Measurement Disclosures – In May 2015, the FASB issued ASU No. 2015-07, Disclosures for Investments in Certain Entities That Calculate Net Asset Value Per Share (or Its Equivalent), which amends certain fair value measurement disclosures. The standard removes the requirement to categorize within the fair value hierarchy investments for which fair value is measured using the net asset value per share practical expedient and also removes certain related disclosure requirements. ASU 2015-07 is effective retrospectively for fiscal years, and interim periods within those years, beginning after December 31, 2015, with early adoption permitted.

Pension Plan Investment Disclosures – In July 2015, the FASB issued ASU No. 2015-12, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965). This standard eliminates the requirement to measure the fair value of fully benefit-responsive investment contracts and provide the related fair value disclosures. Under the new guidance, fully benefit-responsive investment contracts will be measured and disclosed only at contract value. The standard also eliminates certain disclosure requirements related to an employee benefit plan’s investments presented in the plan’s standalone financial statements. ASU 2015-12 is effective retrospectively for fiscal years beginning after December 31, 2015, with early adoption permitted. Adoption of ASU 2015-07 and 2015-12 will impact certain annual disclosures related to our qualified pension plan assets, but otherwise is not expected to have a material impact on our consolidated financial statements.

13

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

1. Preparation of Interim Financial Statements, Continued:

Valuation of Inventory – In July 2015, the FASB issued ASU No. 2015-11, Simplifying the Measurement of Inventory. The updated guidance requires that an entity should measure inventory valued using a first-in, first-out or average cost method at the lower of cost and net realizable value. Net realizable value is defined as the estimated selling price in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. ASU 2015-11 should be applied on a prospective basis and is effective for fiscal years, and interim periods within those years, beginning after December 15, 2016, with early adoption permitted. We are currently assessing the timing of adoption of ASU 2015-11, however, we do not expect it to have a material impact to our consolidated results of operations, financial position or cash flows.

Leases – In February 2016, the FASB issued ASU 2016-02, Leases, which will require that virtually all lease arrangements that do not meet the criteria of a short-term lease be presented on the lessee’s balance sheet by recording a right-of-use asset and a lease liability equal to the present value of the related future lease payments. The income statement impacts of the leases will depend on the nature of the leasing arrangement and will be similar to existing accounting for operating and capital leases. The new standard does not substantially change the accounting for lessors. The new standard will also require additional disclosures regarding an entity’s leasing arrangements and will be effective for the first interim reporting period within annual periods beginning after December 15, 2018, although early adoption is permitted. Lessees and lessors will be required to apply the new standard at the beginning of the earliest period presented in the financial statements in which they first apply the new guidance, using a modified retrospective transition method. We are currently assessing the timing of adoption and the impact the new standard will have on our consolidated financial statements.

Derivatives and Hedging – In March 2016, the FASB issued ASU 2016-05, Derivatives and Hedging (Topic 815): Effect of Derivative Contract Novations on Existing Hedge Accounting Relationships (a consensus of the Emerging Issues Task Force). ASU 2016-05 clarifies that a change in the counterparty to a derivative instrument that has been designated as the hedging instrument does not, in and of itself, require de-designation of that hedging relationship provided that all other hedge accounting criteria continue to be met. ASU 2016-05 is effective for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years. Early adoption is permitted. We do not expect that the adoption of ASU 2016-05 will have a material impact on our consolidated financial statements.

Employee Share-Based Payment Accounting – In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share-Based Payment Accounting, which simplifies several aspects of the accounting for employee share-based payment transactions, including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the statement of cash flows. Under the new guidance all excess tax benefits and tax deficiencies, including tax benefits of dividends on share-based payment awards, should be recognized as income tax expense or benefit in the income statement, eliminating the notion of the APIC pool. The excess tax benefits will be classified as operating activities along with other income tax cash flows rather than financing activities in the statement of cash flows. The tax effects of exercised or vested awards should be treated as discrete items in the reporting period in which they occur. ASU 2016-19 also allows entities to elect to either estimate the total number of awards that are expected to vest or account for forfeitures when they occur. Additionally, ASU 2016-09 clarifies that cash payments to tax authorities in connection with shares withheld to meet statutory tax withholding requirements should be presented as a financing activity in the statement of cash flows. ASU 2016-09 is effective for annual reporting periods beginning after December 15, 2016, including interim periods within those annual reporting periods. Early adoption is permitted. We are currently assessing the timing of adoption and the impact the new standard will have on our consolidated financial statements.

14

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

2. Long-term Debt:

Windstream Holdings has no debt obligations. All debt, including the senior secured credit facility described below, have been incurred by Windstream Services and its subsidiaries. Windstream Holdings is neither a guarantor of nor subject to the restrictive covenants imposed by such debt.

Long-term debt was as follows at:

(Millions) | March 31, 2016 | December 31, 2015 | ||||||

Issued by Windstream Services: | ||||||||

Senior secured credit facility, Tranche B5 – variable rates, due August 8, 2019 | $ | 576.7 | $ | 578.2 | ||||

Senior secured credit facility, Tranche B6 – variable rates, due March 29, 2021 (a) | 600.0 | — | ||||||

Senior secured credit facility, Revolving line of credit – variable rates, due April 24, 2020 | 588.0 | 300.0 | ||||||

Debentures and notes, without collateral: | ||||||||

2017 Notes – 7.875%, due November 1, 2017 | 369.5 | 904.1 | ||||||

2020 Notes – 7.750%, due October 15, 2020 | 700.0 | 700.0 | ||||||

2021 Notes – 7.750%, due October 1, 2021 | 887.3 | 920.4 | ||||||

2022 Notes – 7.500%, due June 1, 2022 | 468.9 | 485.9 | ||||||

2023 Notes – 7.500%, due April 1, 2023 | 529.5 | 540.1 | ||||||

2023 Notes – 6.375%, due August 1, 2023 | 700.0 | 700.0 | ||||||

Issued by subsidiaries of Windstream Services: | ||||||||

Windstream Holdings of the Midwest, Inc. – 6.75%, due April 1, 2028 | 100.0 | 100.0 | ||||||

(Discount) premium on long-term debt, net (b) | (8.7 | ) | 4.6 | |||||

Unamortized debt issuance costs (b) | (66.2 | ) | (62.8 | ) | ||||

5,445.0 | 5,170.5 | |||||||

Less current maturities | (11.9 | ) | (5.9 | ) | ||||

Total long-term debt | $ | 5,433.1 | $ | 5,164.6 | ||||

(a) | If the maturity of the revolving line of credit is not extended prior to April 24, 2020, the maturity date of the Tranche B6 term loan will be April 24, 2020; provided further, if the 2020 Notes have not been repaid or refinanced prior to July 15, 2020 with indebtedness having a maturity date no earlier than March 29, 2021, the maturity date of the Tranche B6 term loan will be July 15, 2020. |

(b) | The net (discount) premium balance and unamortized debt issuance costs are amortized using the interest method over the life of the related debt instrument. |

Senior Secured Credit Facility - On March 29, 2016, Windstream Services executed an incremental amendment to its existing senior secured credit facility to provide for the issuance of an aggregate principal amount $600.0 million term loan under Tranche B6 due March 29, 2021, the proceeds of which were used to repurchase $441.1 million of outstanding 7.875 percent notes due November 1, 2017 (the “2017 Notes”) pursuant to a tender offer and to repay other debt obligations of Windstream Services along with related fees and expenses. The Tranche B6 term loan was issued at a discount of $15.0 million. Debt issuance costs associated with the Tranche B6 borrowings were $10.7 million which were capitalized and will be amortized over the life of the term loan.

On April 24, 2015, Windstream Services had amended its existing senior secured credit facility which includes a revolving line of credit in an aggregate principal amount of $1,250.0 million and Tranche B5 term loan. The amended credit facility provides that Windstream Services may seek to obtain incremental revolving or term loans in an unlimited amount subject to maintaining a maximum secured leverage ratio and other customary conditions, including obtaining commitments and pro forma compliance with financial maintenance covenants consisting of a maximum debt to consolidated earnings before interest, taxes, depreciation and amortization (“EBITDA”) ratio and a minimum interest coverage ratio. In addition, Windstream Services may request extensions of the maturity date under any of its existing revolving or term loan facilities.

15

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

2. Long-term Debt, Continued:

Interest rates applicable to the Tranche B5 term loan are, at Windstream Services’ option, equal to either a base rate plus a margin of 1.75 percent per annum or London Interbank Offered Rate (“LIBOR”) plus a margin of 2.75 percent per annum. LIBOR and the base rate for the Tranche B5 term loan shall at no time be less than 0.75 percent and 1.75 percent, respectively. Interest rates applicable to the Tranche B6 are, at Windstream Services’ option, equal to either a base rate plus a margin of 4.00 percent per annum or LIBOR plus a margin of 5.00 percent per annum. LIBOR and the base rate for the Tranche B6 term loan shall at no time be less than 0.75 percent and 4.00 percent, respectively. Tranche B5 and B6 term loans made under the credit facility are subject to quarterly amortization payments in an aggregate amount equal to 0.25 percent of the initial principal amount of such term loans, with the remaining balance payable on August 8, 2019 and March 29, 2021, respectively. The senior secured credit facility is guaranteed, jointly and severally, by certain of Windstream Services’ wholly owned subsidiaries.

Revolving line of credit - As a result of the April 24, 2015 amendment to the credit facility, the maturity date of the revolving line of credit was extended to April 24, 2020. Windstream Services may obtain revolving loans and may issue up to $30.0 million of letters of credit, which upon issuance reduce the amount available for other extensions of credit. Accordingly, the total amount outstanding under the letters of credit and the indebtedness incurred under the revolving line of credit may not exceed $1,250.0 million. Borrowings under the revolving line of credit may be used for permitted acquisitions, working capital and other general corporate purposes of Windstream Services and its subsidiaries. Windstream Services will pay a commitment fee on the unused portion of the commitments under the revolving credit facility that will range from 0.40 percent to 0.50 percent per annum, depending on the debt to consolidated EBITDA ratio of Windstream Services and its subsidiaries. Revolving loans made under the credit facility are not subject to interim amortization and such loans are not required to be repaid prior to April 24, 2020, other than to the extent the outstanding borrowings exceed the aggregate commitments under the revolving credit facility. Interest rates applicable to loans under the revolving line of credit are, at Windstream Services’ option, equal to either a base rate plus a margin ranging from 0.25 percent to 1.00 percent per annum or LIBOR plus a margin ranging from 1.25 percent to 2.00 percent per annum, based on the debt to consolidated EBITDA ratio of Windstream Services and its subsidiaries.

During the first three months of 2016, Windstream Services borrowed $693.0 million under the revolving line of credit in its senior secured credit facility and repaid $405.0 million of these borrowings through March 31, 2016. Considering letters of credit of $23.1 million, the amount available for borrowing under the revolving line of credit was $638.9 million at March 31, 2016.

During the first three months of 2016, the variable interest rate on the revolving line of credit ranged from 2.25 percent to 4.50 percent, and the weighted average rate on amounts outstanding was 2.52 percent during the period. Comparatively, the variable interest rate ranged from 2.41 percent to 4.50 percent during the first three months of 2015, with a weighted average rate on amounts outstanding during the period of 2.52 percent.

Debentures and Notes Repaid in 2016

Partial Repurchase of Senior Notes - Pursuant to a debt repurchase program authorized by Windstream Services’ board of directors, during the first quarter of 2016, Windstream Services repurchased in the open market $154.2 million aggregate principal amount of its senior unsecured notes consisting of the following:

• | $93.5 million aggregate principal amount of 7.875 percent senior unsecured notes due November 1, 2017, (the “2017 Notes”) at a repurchase price of $97.8 million, including accrued and unpaid interest; |

• | $33.1 million aggregate principal amount of 7.750 percent senior unsecured notes due October 1, 2021, (the “2021 Notes”), at a repurchase price of $26.0 million, including accrued and unpaid interest; |

• | $17.0 million aggregate principal amount of 7.500 percent senior unsecured notes due June 1, 2022, (the “2022 Notes”), at a repurchase price of $13.1 million, including accrued and unpaid interest; and |

• | $10.6 million aggregate principal amount of 7.500 percent senior unsecured notes due April 1, 2023, (the “2023 Notes”) at a repurchase price of $8.0 million, including accrued and unpaid interest. |

At the time of repurchase, there was $9.4 million in unamortized net discount and debt issuance costs related to the repurchased notes. The repurchases were funded utilizing available borrowings under the amended revolving line of credit.

16

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

2. Long-term Debt, Continued:

Tender Offer for 2017 Notes - On March 29, 2016, Windstream Services repurchased $441.1 million aggregate principal amount of the 2017 Notes for total consideration of $477.5 million, plus accrued interest, pursuant to a cash tender offer announced on March 14, 2016. Under the tender offer, Windstream Services paid total consideration of $1,082.50 per $1,000 principal amount of the 2017 Notes, which included a $30 early tender payment, plus accrued and unpaid interest. Windstream Services had accepted for payment the maximum principal amount of 2017 Notes contemplated under the tender offer, and as a result, no additional notes were repurchased under the tender offer which expired on April 11, 2016.

Net Loss on Early Extinguishment of Debt

The net loss on early extinguishment of debt was as follows for the three month period ended March 31, 2016:

(Millions) | ||||||||

Partial repurchases of 2017 Notes: | ||||||||

Premium on repurchases | $ | (40.6 | ) | |||||

Third-party fees for repurchases | (2.2 | ) | ||||||

Unamortized net discount on original issuance | (2.0 | ) | ||||||

Unamortized debt issuance costs on original issuance | (3.7 | ) | ||||||

Loss on early extinguishment from partial repurchases of 2017 Notes | (48.5 | ) | ||||||

Partial repurchases of 2021, 2022 and 2023 Notes: | ||||||||

Discount on repurchases | 13.6 | |||||||

Unamortized net premium on original issuance | 0.3 | |||||||

Unamortized debt issuance costs on original issuance | (0.8 | ) | ||||||

Gain on early extinguishment from partial repurchases of 2021, 2022 and 2023 Notes | 13.1 | |||||||

Net loss on early extinguishment of debt | $ | (35.4 | ) | |||||

Windstream Services repurchased a portion of its 2017 Notes during the first quarter of 2016. The partial repurchase was accounted for as an extinguishment, and accordingly, Windstream Services recognized a pre-tax loss of $(48.5) million.

Windstream Services repurchased in the open market certain of its senior unsecured notes representing an aggregate principal amount of $154.2 million. The partial repurchase was accounted for under the extinguishment method of accounting, and as a result, Windstream Services recognized a pretax gain of $13.1 million.

Maturities for long-term debt outstanding as of March 31, 2016, excluding $(8.7) million of unamortized net discount and $66.2 million of unamortized debt issuance costs, were as follows:

Twelve month period ended: | (Millions) | ||

March 31, 2017 | $ | 11.9 | |

March 31, 2018 | 381.4 | ||

March 31, 2019 | 11.9 | ||

March 31, 2020 | 565.0 | ||

March 31, 2021 | 1,864.0 | ||

Thereafter | 2,685.7 | ||

Total | $ | 5,519.9 | |

17

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

2. Long-term Debt, Continued:

Interest Expense

Interest expense was as follows for the three month periods ended March 31:

(Millions) | 2016 | 2015 | |||||||||||

Interest expense - long-term debt | $ | 91.5 | $ | 133.6 | |||||||||

Interest expense - long-term lease obligations: | |||||||||||||

Telecommunications network assets | 126.9 | — | |||||||||||

Real estate contributed to pension plan | 1.5 | 1.7 | |||||||||||

Impact of interest rate swaps | 2.8 | 6.6 | |||||||||||

Interest on capital leases and other | 0.6 | 0.7 | |||||||||||

Less capitalized interest expense | (3.6 | ) | (1.5 | ) | |||||||||

Total interest expense | $ | 219.7 | $ | 141.1 | |||||||||

Debt Compliance

The terms of Windstream Services’ credit facility and indentures include customary covenants that, among other things, require maintenance of certain financial ratios and restrict Windstream Services’ ability to incur additional indebtedness. These financial ratios include a maximum leverage ratio of 4.5 to 1.0 and a minimum interest coverage ratio of 2.75 to 1.0. In addition, the covenants include restrictions on dividend and certain other types of payments. As of March 31, 2016, Windstream Services was in compliance with all of these covenants.

In addition, certain of Windstream Services’ debt agreements contain various covenants and restrictions specific to the subsidiary that is the legal counterparty to the agreement. Under Windstream Services’ long-term debt agreements, acceleration of principal payments would occur upon payment default, violation of debt covenants not cured within 30 days, a change in control including a person or group obtaining 50 percent or more ownership interest in Windstream Services, or breach of certain other conditions set forth in the borrowing agreements. Windstream Services and its subsidiaries were in compliance with these covenants as of March 31, 2016.

3. Derivatives:

Windstream Services enters into interest rate swap agreements to mitigate the interest rate risk inherent in its variable rate senior secured credit facility. Derivative instruments are accounted for in accordance with authoritative guidance for recognition, measurement and disclosures about derivative instruments and hedging activities, including when a derivative or other financial instrument can be designated as a hedge. This guidance requires recognition of all derivative instruments at fair value, and accounting for the changes in fair value depends on whether the derivative has been designated as, qualifies as and is effective as a hedge. Changes in fair value of the effective portions of cash flow hedges are recorded as a component of other comprehensive income (loss) in the current period. Any ineffective portion of the hedges is recognized in earnings in the current period.

As of March 31, 2016 and December 31, 2015, Windstream Services was party to three pay fixed, receive variable interest rate swap agreements to serve as cash flow hedges of the interest rate risk inherent in its senior secured credit facility. The swaps have a notional value of $675.0 million and are scheduled to mature on October 17, 2019. The average fixed interest rate paid is 3.604 percent and includes a component which serves to settle the liability existing on Windstream Services swaps at the time of the transaction. The variable rate received resets on the seventeenth day of each month to the one-month London Interbank Offered Rate (“LIBOR”). The swaps are hedging probable variable cash flows which extend up to one year beyond the maturity of certain components of Windstream Services’ variable rate debt. Consistent with past practice, Windstream Services expects to extend or otherwise replace these components of its debt with variable rate debt. The swaps are off-market swaps, meaning they contain an embedded financing element, which the swap counterparties recover through an incremental charge in the fixed rate over what would be charged for an at-market swap. As such, a portion of the cash payment on the swaps represents the rate that Windstream Services would pay on a hypothetical at-market interest rate swap and is recognized in interest expense. The remaining portion represents the repayment of the embedded financing element and reduces the initial swap liability.

18

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

3. Derivatives, Continued:

As a result of refinancing transactions completed in 2013 and April 2015, Windstream Services de-designated certain interest rate swaps and froze the accumulated net gains and losses in accumulated other comprehensive loss related to these swaps. The frozen balance is amortized from accumulated other comprehensive loss to interest expense over the remaining life of the original swaps. All derivative instruments are recognized at fair value in the accompanying consolidated balance sheets as either assets or liabilities, depending on the rights or obligations under the related contracts.

Set forth below is information related to interest rate swap agreements:

(Millions, except for percentages) | March 31, 2016 | December 31, 2015 | ||||||

Designated portion, measured at fair value: | ||||||||

Other current liabilities | $ | 18.5 | $ | 18.3 | ||||

Other non-current liabilities | $ | 38.6 | $ | 33.4 | ||||

Accumulated other comprehensive loss | $ | (9.2 | ) | $ | (0.9 | ) | ||

De-designated portion, unamortized value: | ||||||||

Accumulated other comprehensive income (loss) | $ | 0.9 | $ | (0.2 | ) | |||

Weighted average fixed rate paid | 2.96 | % | 2.99 | % | ||||

Variable rate received | 0.44 | % | 0.35 | % | ||||

Derivatives are assessed for effectiveness each quarter and any ineffectiveness is recognized in other expense, net in our consolidated statements of operations. Ineffectiveness recognized on the cash flow hedges was $(0.5) million and $(2.3) million for the three month periods ended March 31, 2016 and 2015, respectively.

All or a portion of the change in fair value of Windstream Services’ interest rate swap agreements recorded in accumulated other comprehensive loss may be recognized in earnings in certain situations. If Windstream Services extinguishes all of its variable rate debt, or a portion of its variable rate debt such that the variable rate interest received on the swaps exceeds the variable rate interest paid on its debt, all or a portion of the change in fair value of the swaps may be recognized in earnings. In addition, the change in fair value of the swaps may be recognized in earnings if Windstream Services determines it is no longer probable that it will have future variable rate cash flows to hedge against or if a swap agreement is terminated prior to maturity. Windstream Services has assessed the counterparty risk and determined that no substantial risk of default exists as of March 31, 2016. Each counterparty is a bank with a current credit rating at or above A, as determined by Moody’s Investors Service, Standard & Poor’s Corporation and Fitch Ratings.

Windstream Services expects to recognize losses of $(7.0) million, net of taxes, in interest expense in the next twelve months related to the unamortized value of the de-designated portion of interest rate swap agreements and the interest settlements for the three remaining interest swap agreements at March 31, 2016. Payments on the swaps are presented in the financing activities section of the accompanying consolidated statements of cash flows due to the embedded financing element discussed above.

Changes in the value of these derivative instruments were as follows for the three month periods ended March 31:

(Millions) | 2016 | 2015 | ||||||

Changes in fair value of effective portion, net of tax (a) | $ | (5.1 | ) | $ | (5.2 | ) | ||

Amortization of unrealized losses on de-designated interest rate swaps, net of tax (a) | $ | 0.7 | $ | 2.0 | ||||

(a) | Included as a component of other comprehensive income (loss) and will be reclassified into earnings as the hedged transaction affects earnings. |

The agreements with each of the derivative counterparties contain cross-default provisions, whereby if Windstream Services were to default on certain indebtedness, it could also be declared in default on its derivative obligations and may be required to net settle any outstanding derivative liability positions with its counterparties at the swap termination value of $61.7 million including accrued interest and excluding the credit valuation adjustment to measure non-performance risk. In addition, certain of the agreements with the counterparties contain provisions where if a specified event or condition, such as a merger, occurs that materially changes Windstream Services’ creditworthiness in an adverse manner, Windstream Services may be required to fully collateralize its derivative obligations. At March 31, 2016, Windstream Services had not posted any collateral related to its interest rate swap agreements.

19

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

3. Derivatives, Continued:

Balance Sheet Offsetting

Windstream Services is party to master netting arrangements, which are designed to reduce credit risk by permitting net settlement of transactions with counterparties. For financial statement presentation purposes, Windstream Services does not offset assets and liabilities under these arrangements.

The following table presents the liabilities subject to an enforceable master netting arrangement as of March 31, 2016 and December 31, 2015. As of March 31, 2016 and December 31, 2015, all swap agreements with counterparties were in a liability position and, accordingly, there were no assets to be recognized in the accompanying consolidated balance sheets as of those dates.

Information pertaining to derivative liabilities was as follows:

Gross Amounts Not Offset in the Consolidated Balance Sheets | |||||||||||||||||||

(Millions) | Gross Amount of Recognized Liabilities | Net Amount of Liabilities Presented in the Consolidated Balance Sheets | Financial Instruments | Cash Collateral Received | Net Amount | ||||||||||||||

March 31, 2016: | |||||||||||||||||||

Interest rate swaps | $ | 57.1 | $ | 57.1 | $ | — | $ | — | $ | 57.1 | |||||||||

December 31, 2015: | |||||||||||||||||||

Interest rate swaps | $ | 51.7 | $ | 51.7 | $ | — | $ | — | $ | 51.7 | |||||||||

4. Fair Value Measurements:

Fair value of financial and non-financial assets and liabilities is defined as an exit price, representing the amount that would be received to sell an asset or transfer a liability in an orderly transaction between market participants. Authoritative guidance defines the following three tier hierarchy for assessing the inputs used in fair value measurements:

Level 1 – Quoted prices in active markets for identical assets or liabilities

Level 2 – Observable inputs other than quoted prices in active markets for identical assets or liabilities

Level 3 – Unobservable inputs

The highest priority is given to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurement) and the lowest priority is given to unobservable inputs (level 3 measurement). Assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Our assessment of the significance of a particular input to the fair value measurement requires judgment and may affect the valuation of fair value assets and liabilities and their placement within the fair value hierarchy levels.

Our non-financial assets and liabilities, including property, plant and equipment, goodwill, intangible assets and asset retirement obligations, are measured at fair value on a non-recurring basis. No event occurred during the three month period ended March 31, 2016 requiring these non-financial assets and liabilities to be subsequently recognized at fair value. Our financial instruments consist primarily of cash and cash equivalents, accounts receivable, investment in CS&L common stock, accounts payable, long-term debt and interest rate swaps. The carrying amount of cash, accounts receivable and accounts payable was estimated by management to approximate fair value due to the relatively short period of time to maturity for those instruments. Cash equivalents, investment in CS&L common stock, long-term debt and interest rate swaps are measured at fair value on a recurring basis. Cash equivalents were not significant as of March 31, 2016 or December 31, 2015.

20

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

4. Fair Value Measurements, Continued:

The fair values of the investment in CS&L common stock, interest rate swaps and long-term debt were determined using the following inputs at:

(Millions) | March 31, 2016 | December 31, 2015 | ||||||

Recorded at Fair Value in the Financial Statements: | ||||||||

Investment in CS&L common stock - Level 1 | $ | 653.8 | $ | 549.2 | ||||

Derivatives - Interest rate swap liabilities - Level 2 | $ | 57.1 | $ | 51.7 | ||||

Not Recorded at Fair Value in the Financial Statements: (a) | ||||||||

Long-term debt, including current maturities - Level 2 | $ | 4,797.5 | $ | 4,452.7 | ||||

(a) | Recognized at carrying value of $5,511.2 million and $5,233.3 million in long-term debt, including current maturities, and excluding unamortized debt issuance costs, in the accompanying consolidated balance sheets as of March 31, 2016 and December 31, 2015, respectively. |

The fair value of CS&L common stock is based on the quoted market price of the shares on the last day of the reporting period. The CS&L common stock trades on NASDAQ.

The fair values of interest rate swaps are determined based on the present value of expected future cash flows using observable, quoted LIBOR swap rates for the full term of the swaps and also incorporate credit valuation adjustments to appropriately reflect both Windstream Services’ own non-performance risk and non-performance risk of the respective counterparties. As of March 31, 2016 and December 31, 2015, the fair values of the interest rate swaps were reduced by $3.7 million and $2.9 million, respectively, to reflect non-performance risk.

In calculating the fair value of Windstream Services’ long-term debt, the fair value of the debentures and notes was calculated based on quoted market prices of the specific issuances in an active market when available. The fair value of the other debt obligations was estimated based on appropriate market interest rates applied to the debt instruments. In calculating the fair value of the Windstream Holdings of the Midwest, Inc. notes, an appropriate market price of similar instruments in an active market considering credit quality, nonperformance risk and maturity of the instrument was used.

We do not have any assets or liabilities measured for purposes of the fair value hierarchy at fair value using significant unobservable inputs (Level 3). We recognize transfers between levels of the fair value hierarchy as of the end of the reporting period. There were no transfers within the fair value hierarchy during the three month period ended March 31, 2016.

5. Employee Benefit Plans and Postretirement Benefits:

We maintain a non-contributory qualified defined benefit pension plan. Future benefit accruals for all eligible nonbargaining employees covered by the pension plan have ceased. We also maintain supplemental executive retirement plans that provide unfunded, non-qualified supplemental retirement benefits to a select group of management employees. Additionally, we provide postretirement healthcare and life insurance benefits for eligible employees. Employees share in, and we fund, the costs of these plans as benefits are paid.

The components of pension benefit income (including provision for executive retirement agreements) were as follows for the three month periods ended March 31:

(Millions) | 2016 | 2015 | ||||||||||

Benefits earned during the period | $ | 2.2 | $ | 2.4 | ||||||||

Interest cost on benefit obligation | 13.8 | 13.4 | ||||||||||

Amortization of prior service credit | (0.1 | ) | — | |||||||||

Expected return on plan assets | (16.2 | ) | (17.6 | ) | ||||||||

Net periodic benefit income | $ | (0.3 | ) | $ | (1.8 | ) | ||||||

21

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

5. Employee Benefit Plans and Postretirement Benefits, Continued:

The components of postretirement benefits income were as follows for the three month periods ended March 31:

(Millions) | 2016 | 2015 | ||||||||||

Interest cost on benefit obligation | $ | 0.3 | $ | 0.3 | ||||||||

Amortization of net actuarial loss | 0.1 | 0.2 | ||||||||||

Amortization of prior service credit | (0.4 | ) | (1.3 | ) | ||||||||

Plan curtailment | (5.5 | ) | — | |||||||||

Net periodic benefit income | $ | (5.5 | ) | $ | (0.8 | ) | ||||||

During the first quarter of 2016, we made changes to our postretirement medical plan, eliminating medical and prescription drug subsidies primarily for certain active participants effective March 14, 2016. As a result, we remeasured the plan and recognized curtailment gains totaling $5.5 million, which was recognized in cost of services and selling, general and administrative expenses, with the offsetting effect recorded as a reduction in accumulated other comprehensive loss.

We contributed $0.5 million to the postretirement plan during the three month period ended March 31, 2016, and expect to contribute an additional $1.6 million for postretirement benefits throughout the remainder of 2016, excluding amounts that will be funded by participant contributions to the plan. In 2016, we expect to make in cash employer contributions for pension benefits of $1.0 million to the qualified pension plan to meet our 2016 funding requirements and $0.9 million necessary to fund the expected benefit payments of our unfunded supplemental executive retirement pension plans to avoid certain benefit restrictions. The amount and timing of future contributions to our qualified pension plan are based on a myriad of factors including investment performance, changes in future discount rates and changes in the demographics of the population participating in the plan.

We also sponsor an employee savings plan under section 401(k) of the Internal Revenue Code, which covers substantially all salaried employees and certain bargaining unit employees. Windstream matches on an annual basis up to a maximum of 4.0 percent of employee pre-tax contributions to the plan for employees contributing up to 5.0 percent of their eligible pre-tax compensation. We recorded expenses of $6.5 million in the three month period ended March 31, 2016, as compared to $5.6 million for the same period in 2015 related to our matching contribution under the employee savings plan, which was included in cost of services and selling, general and administrative expenses in our consolidated statements of operations. Expense related to our 2016 matching contribution expected to be made in Windstream Holdings common stock is included in share-based compensation expense in the accompanying consolidated statements of cash flow. Additionally, we contributed 3.2 million shares of our common stock to the plan for the 2015 annual matching contribution during the three month period ended March 31, 2016. At the time of our contribution, the shares had a fair value of approximately $24.0 million as determined by the plan trustee. During 2015, we contributed 2.7 million shares of our common stock to the plan for the 2014 annual matching contribution. At the time of this contribution, the shares had a fair value of approximately $21.6 million as determined by the plan trustee.

6. Share-Based Compensation Plans:

Under the Amended and Restated 2006 Equity Incentive Plan (the “Incentive Plan”), we may issue a maximum of 24.3 million equity stock awards in the form of restricted stock, restricted stock units, stock appreciation rights or stock options. As of March 31, 2016, the Incentive Plan had remaining capacity of approximately 5.9 million awards. As of March 31, 2016, we had additional remaining capacity of approximately 0.1 million awards from a similar equity incentive plan assumed in a prior acquisition.

Our Board of Directors approves grants of restricted stock and restricted stock units to officers, executives, non-employee directors and certain management employees. These grants include the standard annual grants to these employee and director groups as a key component of their annual incentive compensation plan and one-time grants may include time-based and performance-based awards. Time-based awards generally vest over a service period of two or three years. Each recipient of the performance-based restricted stock units may vest in a number of shares from zero to 150.0 percent of their award based on attainment of certain operating targets, some of which are indexed to the performance of Standard & Poor’s 500 Stock Index, over a three-year period. The 2016 operating targets for these performance based restricted stock units were approved by the Board of Directors in February 2016. The standard annual grants to employees and directors were made in the first quarter of 2016.

22

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

6. Share-Based Compensation Plans, Continued:

The vesting periods and grant date fair value for restricted stock and restricted stock units issued was as follows for the three month period ended March 31, 2016:

(Number of shares in thousands, dollars in millions) | ||||

Vest ratably over a three-year service period | 1,293.3 | |||

Vest two years from date of grant, service based | 53.2 | |||

Vest contingently at the end of a three-year performance period | 1,293.3 | |||

Vest one year from date of grant, service based - granted to non-employee directors | 106.0 | |||

Total granted | 2,745.8 | |||

Grant date fair value | $ | 14.8 | ||

Restricted stock and restricted stock unit activity for the three month period ended March 31, 2016 was as follows:

(Thousands) Underlying Number of Shares | Per Share Weighted Average Fair Value | ||||||

Non-vested at December 31, 2015 | 3,553.1 | $ | 15.29 | ||||

Granted | 2,745.8 | $ | 5.38 | ||||

Vested | (1,128.9 | ) | $ | 18.38 | |||

Forfeited | (85.1 | ) | $ | 15.24 | |||

Non-vested at March 31, 2016 | 5,084.9 | $ | 9.42 | ||||

At March 31, 2016, unrecognized compensation expense totaled $37.8 million and is expected to be recognized over the weighted average vesting period of 1.6 years. Unrecognized compensation expense is included in additional paid-in capital in the accompanying consolidated balance sheets and statements of shareholders’ and member equity. Share-based compensation expense for restricted stock and restricted stock units was $6.6 million for the three month period ended March 31, 2016, as compared to $5.0 million for the same period in 2015.

In addition to including amounts related to restricted stock and restricted units, share-based compensation expense presented in the accompanying consolidated statements of cash flow also includes amounts related to certain executive and management incentive compensation plans and the matching contribution to the employee savings plan for which payments to eligible participants are expected to be made in Windstream Holdings common stock. A summary of share-based compensation expense was as follows for the three month periods ended March 31:

(Millions) | 2016 | 2015 | ||||||||||

Restricted stock and restricted units | $ | 6.6 | $ | 5.0 | ||||||||

Employee savings plan (See Note 5) | 6.5 | 5.6 | ||||||||||

Executive and management incentive compensation plans | 0.6 | 4.2 | ||||||||||

Share-based compensation expense | $ | 13.7 | $ | 14.8 | ||||||||

23

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

7. Merger, Integration and Restructuring Charges: