Attached files

| file | filename |

|---|---|

| EX-95 - EX-95 - NOV Inc. | d168353dex95.htm |

| EX-31.1 - EX-31.1 - NOV Inc. | d168353dex311.htm |

| EX-32.2 - EX-32.2 - NOV Inc. | d168353dex322.htm |

| EX-31.2 - EX-31.2 - NOV Inc. | d168353dex312.htm |

| EX-32.1 - EX-32.1 - NOV Inc. | d168353dex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2016

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-12317

NATIONAL OILWELL VARCO, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 76-0475815 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

7909 Parkwood Circle Drive

Houston, Texas

77036-6565

(Address of principal executive offices)

(713) 346-7500

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | þ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of April 28, 2016 the registrant had 377,060,946 shares of common stock, par value $0.01 per share, outstanding.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

NATIONAL OILWELL VARCO, INC.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(In millions, except share data)

| March 31, 2016 |

December 31, 2015 |

|||||||

| ASSETS |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 1,759 | $ | 2,080 | ||||

| Receivables, net |

2,212 | 2,926 | ||||||

| Inventories, net |

4,534 | 4,678 | ||||||

| Costs in excess of billings |

1,040 | 1,250 | ||||||

| Prepaid and other current assets |

503 | 491 | ||||||

|

|

|

|

|

|||||

| Total current assets |

10,048 | 11,425 | ||||||

| Property, plant and equipment, net |

3,303 | 3,124 | ||||||

| Deferred income taxes |

144 | 130 | ||||||

| Goodwill |

7,003 | 6,980 | ||||||

| Intangibles, net |

3,800 | 3,849 | ||||||

| Investment in unconsolidated affiliates |

324 | 327 | ||||||

| Other assets |

132 | 135 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 24,754 | $ | 25,970 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 467 | $ | 623 | ||||

| Accrued liabilities |

2,058 | 2,284 | ||||||

| Billings in excess of costs |

704 | 785 | ||||||

| Current portion of long-term debt and short-term borrowings |

7 | 2 | ||||||

| Accrued income taxes |

199 | 264 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

3,435 | 3,958 | ||||||

| Long-term debt |

3,372 | 3,907 | ||||||

| Deferred income taxes |

1,239 | 1,362 | ||||||

| Other liabilities |

275 | 283 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

8,321 | 9,510 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies |

||||||||

| Stockholders’ equity: |

||||||||

| Common stock - par value $.01; 1 billion shares authorized; 377,066,012 and 375,764,794 shares issued and outstanding at March 31, 2016 and December 31, 2015 |

4 | 4 | ||||||

| Additional paid-in capital |

8,024 | 8,005 | ||||||

| Accumulated other comprehensive loss |

(1,308 | ) | (1,553 | ) | ||||

| Retained earnings |

9,635 | 9,927 | ||||||

|

|

|

|

|

|||||

| Total Company stockholders’ equity |

16,355 | 16,383 | ||||||

| Noncontrolling interests |

78 | 77 | ||||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

16,433 | 16,460 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 24,754 | $ | 25,970 | ||||

|

|

|

|

|

|||||

See notes to unaudited consolidated financial statements.

2

NATIONAL OILWELL VARCO, INC.

CONSOLIDATED STATEMENTS OF INCOME (LOSS) (UNAUDITED)

(In millions, except per share data)

| Three Months Ended March 31, |

||||||||

| 2016 | 2015 | |||||||

| Revenue |

$ | 2,189 | $ | 4,820 | ||||

| Cost of revenue |

1,945 | 3,643 | ||||||

|

|

|

|

|

|||||

| Gross profit |

244 | 1,177 | ||||||

| Selling, general and administrative |

433 | 607 | ||||||

|

|

|

|

|

|||||

| Operating profit (loss) |

(189 | ) | 570 | |||||

| Interest and financial costs |

(25 | ) | (26 | ) | ||||

| Interest income |

5 | 5 | ||||||

| Equity income (loss) in unconsolidated affiliates |

(6 | ) | 9 | |||||

| Other income (expense), net |

(21 | ) | (56 | ) | ||||

|

|

|

|

|

|||||

| Income (loss) before income taxes |

(236 | ) | 502 | |||||

| Provision for income taxes |

(118 | ) | 189 | |||||

|

|

|

|

|

|||||

| Net income (loss) |

(118 | ) | 313 | |||||

| Net income attributable to noncontrolling interests |

1 | 3 | ||||||

|

|

|

|

|

|||||

| Net income (loss) attributable to Company |

$ | (119 | ) | $ | 310 | |||

|

|

|

|

|

|||||

| Net income (loss) attributable to Company per share: |

||||||||

| Basic |

$ | (0.32 | ) | $ | 0.76 | |||

|

|

|

|

|

|||||

| Diluted |

$ | (0.32 | ) | $ | 0.76 | |||

|

|

|

|

|

|||||

| Cash dividends per share |

$ | 0.46 | $ | 0.46 | ||||

|

|

|

|

|

|||||

| Weighted average shares outstanding: |

||||||||

| Basic |

375 | 407 | ||||||

|

|

|

|

|

|||||

| Diluted |

375 | 409 | ||||||

|

|

|

|

|

|||||

See notes to unaudited consolidated financial statements.

3

NATIONAL OILWELL VARCO, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

(In millions)

| Three Months Ended March 31, |

||||||||

| 2016 | 2015 | |||||||

| Net income (loss) |

$ | (118 | ) | $ | 313 | |||

| Currency translation adjustments |

143 | (418 | ) | |||||

| Changes in derivative financial instruments, net of tax |

102 | (66 | ) | |||||

|

|

|

|

|

|||||

| Comprehensive income (loss) |

127 | (171 | ) | |||||

| Comprehensive income attributable to noncontrolling interest |

1 | 3 | ||||||

|

|

|

|

|

|||||

| Comprehensive income (loss) attributable to Company |

$ | 126 | $ | (174 | ) | |||

|

|

|

|

|

|||||

See notes to unaudited consolidated financial statements.

4

NATIONAL OILWELL VARCO, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(In millions)

| Three Months Ended March 31, |

||||||||

| 2016 | 2015 | |||||||

| Cash flows from operating activities: |

||||||||

| Net income (loss) |

$ | (118 | ) | $ | 313 | |||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

175 | 190 | ||||||

| Deferred income taxes |

(135 | ) | (7 | ) | ||||

| Equity (income) loss in unconsolidated affiliates |

6 | (9 | ) | |||||

| Other, net |

83 | 91 | ||||||

| Change in operating assets and liabilities, net of acquisitions: |

||||||||

| Receivables |

706 | 369 | ||||||

| Inventories |

112 | (126 | ) | |||||

| Costs in excess of billings |

210 | (47 | ) | |||||

| Prepaid and other current assets |

(11 | ) | 34 | |||||

| Accounts payable |

(157 | ) | (201 | ) | ||||

| Accrued liabilities |

(231 | ) | (224 | ) | ||||

| Billings in excess of costs |

(81 | ) | (278 | ) | ||||

| Income taxes payable |

(65 | ) | 1 | |||||

| Other assets/liabilities, net |

127 | 8 | ||||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

621 | 114 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchases of property, plant and equipment |

(84 | ) | (130 | ) | ||||

| Business acquisitions, net of cash acquired |

(21 | ) | (23 | ) | ||||

| Other |

2 | 4 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(103 | ) | (149 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Borrowings against lines of credit and other debt |

2,368 | 1,871 | ||||||

| Payments against lines of credit and other debt |

(3,052 | ) | (792 | ) | ||||

| Cash dividends paid |

(173 | ) | (185 | ) | ||||

| Share repurchases |

— | (1,330 | ) | |||||

| Proceeds from stock options exercised |

1 | 3 | ||||||

| Other |

(5 | ) | (3 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(861 | ) | (436 | ) | ||||

| Effect of exchange rates on cash |

22 | (41 | ) | |||||

|

|

|

|

|

|||||

| Increase (decrease) in cash and cash equivalents |

(321 | ) | (512 | ) | ||||

| Cash and cash equivalents, beginning of period |

2,080 | 3,536 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 1,759 | $ | 3,024 | ||||

|

|

|

|

|

|||||

| Supplemental disclosures of cash flow information: |

||||||||

| Cash payments (receipts) during the period for: |

||||||||

| Interest |

$ | 3 | $ | 6 | ||||

| Income taxes |

$ | (32 | ) | $ | 96 | |||

See notes to unaudited consolidated financial statements.

5

NATIONAL OILWELL VARCO, INC.

Notes to Consolidated Financial Statements (Unaudited)

1. Basis of Presentation

The preparation of financial statements in conformity with generally accepted accounting principles (“GAAP”) in the United States requires management to make estimates and assumptions that affect reported and contingent amounts of assets and liabilities as of the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The accompanying unaudited consolidated financial statements of National Oilwell Varco, Inc. (“NOV” or the “Company”) present information in accordance with GAAP in the United States for interim financial information and the instructions to Form 10-Q and applicable rules of Regulation S-X. They do not include all information or footnotes required by GAAP in the United States for complete consolidated financial statements and should be read in conjunction with our 2015 Annual Report on Form 10-K.

In our opinion, the consolidated financial statements include all adjustments, which are of a normal recurring nature, unless otherwise disclosed, necessary for a fair presentation of the results for the interim periods. Certain reclassifications have been made to the prior year financial statements in order for them to conform with the 2016 presentation. The results of operations for the three months ended March 31, 2016 are not necessarily indicative of the results to be expected for the full year.

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, receivables, and payables approximated fair value because of the relatively short maturity of these instruments. Cash equivalents include only those investments having a maturity date of three months or less at the time of purchase. See Note 7 for the fair value of long-term debt and Note 10 for the fair value of derivative financial instruments.

2. Inventories, net

Inventories consist of (in millions):

| March 31, 2016 |

December 31, 2015 |

|||||||

| Raw materials and supplies |

$ | 1,040 | $ | 1,069 | ||||

| Work in process |

595 | 632 | ||||||

| Finished goods and purchased products |

2,899 | 2,977 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 4,534 | $ | 4,678 | ||||

|

|

|

|

|

|||||

6

3. Accrued Liabilities

Accrued liabilities consist of (in millions):

| March 31, 2016 |

December 31, 2015 |

|||||||

| Accrued vendor costs |

$ | 432 | $ | 449 | ||||

| Customer prepayments and billings |

389 | 426 | ||||||

| Compensation |

249 | 241 | ||||||

| Warranty |

226 | 244 | ||||||

| Fair value of derivative financial instruments |

132 | 261 | ||||||

| Taxes (non-income) |

127 | 175 | ||||||

| Insurance |

115 | 113 | ||||||

| Accrued commissions |

68 | 73 | ||||||

| Interest |

29 | 8 | ||||||

| Other |

291 | 294 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 2,058 | $ | 2,284 | ||||

|

|

|

|

|

|||||

Service and Product Warranties

The Company provides service and warranty policies on certain of its products. The Company accrues liabilities under service and warranty policies based upon specific claims and a review of historical warranty and service claim experience in accordance with Accounting Standards Codification (“ASC”) Topic 450 “Contingencies”. Adjustments are made to accruals as claim data and historical experience change. In addition, the Company incurs discretionary costs to service its products in connection with product performance issues and accrues for them when they are encountered.

The changes in the carrying amount of service and product warranties are as follows (in millions):

| Balance at December 31, 2015 |

$ | 244 | ||

|

|

|

|||

| Net provisions for warranties issued during the year |

18 | |||

| Amounts incurred |

(37 | ) | ||

| Currency translation adjustments and other |

1 | |||

|

|

|

|||

| Balance at March 31, 2016 |

$ | 226 | ||

|

|

|

4. Costs and Estimated Earnings on Uncompleted Contracts

Costs and estimated earnings on uncompleted contracts consist of (in millions):

| March 31, 2016 |

December 31, 2015 |

|||||||

| Costs incurred on uncompleted contracts |

$ | 9,139 | $ | 9,082 | ||||

| Estimated earnings |

4,164 | 4,080 | ||||||

|

|

|

|

|

|||||

| 13,303 | 13,162 | |||||||

| Less: Billings to date |

12,967 | 12,697 | ||||||

|

|

|

|

|

|||||

| $ | 336 | $ | 465 | |||||

|

|

|

|

|

|||||

| Costs and estimated earnings in excess of billings on uncompleted contracts |

$ | 1,040 | $ | 1,250 | ||||

| Billings in excess of costs and estimated earnings on uncompleted contracts |

(704 | ) | (785 | ) | ||||

|

|

|

|

|

|||||

| $ | 336 | $ | 465 | |||||

|

|

|

|

|

|||||

7

5. Accumulated Other Comprehensive Income (Loss)

The components of accumulated other comprehensive income (loss) are as follows (in millions):

| Currency Translation Adjustments |

Derivative Financial Instruments, Net of Tax |

Defined Benefit Plans, Net of Tax |

Total | |||||||||||||

| Balance at December 31, 2015 |

$ | (1,279 | ) | $ | (205 | ) | $ | (69 | ) | $ | (1,553 | ) | ||||

| Accumulated other comprehensive income (loss) before reclassifications |

143 | 50 | — | 193 | ||||||||||||

| Amounts reclassified from accumulated other comprehensive income (loss) |

— | 52 | — | 52 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at March 31, 2016 |

$ | (1,136 | ) | $ | (103 | ) | $ | (69 | ) | $ | (1,308 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

The components of amounts reclassified from accumulated other comprehensive income (loss) are as follows (in millions):

| Three Months Ended March 31, | ||||||||||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||||||||||

| Currency Translation Adjustments |

Derivative Financial Instruments |

Defined Benefit Plans |

Total | Currency Translation Adjustments |

Derivative Financial Instruments |

Defined Benefit Plans |

Total | |||||||||||||||||||||||||

| Revenue |

$ | — | $ | (1 | ) | $ | — | $ | (1 | ) | $ | — | $ | 65 | $ | — | $ | 65 | ||||||||||||||

| Cost of revenue |

— | 76 | — | 76 | — | (1 | ) | — | (1 | ) | ||||||||||||||||||||||

| Tax effect |

— | (23 | ) | — | (23 | ) | — | (18 | ) | — | (18 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | — | $ | 52 | $ | — | $ | 52 | $ | — | $ | 46 | $ | — | $ | 46 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

The Company’s reporting currency is the U.S. dollar. A majority of the Company’s international entities in which there is a substantial investment have the local currency as their functional currency. As a result, currency translation adjustments resulting from the process of translating the entities’ financial statements into the reporting currency are reported in other comprehensive income or loss in accordance with ASC Topic 830 “Foreign Currency Matters” (“ASC Topic 830”). For the three months ended March 31, 2016, a majority of these local currencies strengthened against the U.S. dollar resulting in net other comprehensive income of $143 million upon the translation from local currencies to the U.S. dollar. For the three months ended March 31, 2015, a majority of these local currencies weakened against the U.S. dollar resulting in net other comprehensive loss of $418 million upon the translation from local currencies to the U.S. dollar.

The effect of changes in the fair values of derivatives designated as cash flow hedges are accumulated in other comprehensive income or loss, net of tax, until the underlying transactions to which they are designed to hedge are realized. The movement in other comprehensive income or loss from period to period will be the result of the combination of changes in fair value for open derivatives and the outflow of other comprehensive income or loss related to cumulative changes in the fair value of derivatives that have settled in the current or prior periods. The accumulated effect was other comprehensive income of $102 million (net of tax of $40 million) for the three months ended March 31, 2016 and other comprehensive loss of $66 million (net of tax of $21 million) for the three months ended March 31, 2015.

8

6. Business Segments

Operating results by segment are as follows (in millions):

| Three Months Ended March 31, |

||||||||

| 2016 | 2015 | |||||||

| Revenue: |

||||||||

| Rig Systems |

$ | 926 | $ | 2,523 | ||||

| Rig Aftermarket |

391 | 719 | ||||||

| Wellbore Technologies |

631 | 1,171 | ||||||

| Completion & Production Solutions |

558 | 948 | ||||||

| Eliminations |

(317 | ) | (541 | ) | ||||

|

|

|

|

|

|||||

| Total revenue |

$ | 2,189 | $ | 4,820 | ||||

|

|

|

|

|

|||||

| Operating profit (loss): |

||||||||

| Rig Systems |

$ | 67 | $ | 477 | ||||

| Rig Aftermarket |

69 | 204 | ||||||

| Wellbore Technologies |

(91 | ) | 95 | |||||

| Completion & Production Solutions |

(38 | ) | 88 | |||||

| Eliminations and corporate costs |

(196 | ) | (294 | ) | ||||

|

|

|

|

|

|||||

| Total operating profit (loss) |

$ | (189 | ) | $ | 570 | |||

|

|

|

|

|

|||||

| Operating profit (loss)%: |

||||||||

| Rig Systems |

7.2 | % | 18.9 | % | ||||

| Rig Aftermarket |

17.6 | % | 28.4 | % | ||||

| Wellbore Technologies |

(14.4 | %) | 8.1 | % | ||||

| Completion & Production Solutions |

(6.8 | %) | 9.3 | % | ||||

| Total operating profit (loss) % |

(8.6 | %) | 11.8 | % | ||||

On January 1, 2016, to provide a clearer measurement of segment performance, the Company will no longer allocate certain corporate overhead costs to its segments and is now capturing those costs in “Eliminations and corporate costs.” Prior period amounts have been reclassified to make the segment performance comparable. For the three months ended March 31, 2016 and 2015, the corporate costs were $50 million and $67 million, respectively.

Sales from one segment to another generally are priced at estimated equivalent commercial selling prices; however, segments originating an external sale are credited with the full profit to the Company. Eliminations include intercompany transactions conducted between the four reporting segments that are eliminated in consolidation. Intercompany transactions within each reporting segment are eliminated within each reporting segment.

Included in operating profit are certain restructuring and other items primarily related to costs associated with Voluntary Early Retirement Plans (“VERP”) established by the Company during the first quarters of 2016 and 2015. In 2016 and 2015, VERP costs included $45 million and $58 million in severance, respectively, $35 million and $45 million in postretirement medical benefits, respectively, and $5 million and $18 million related to stock-based compensation, respectively. Severance payments related to the VERP were made during the quarter in which the Company established the plan. As of March 31, 2016, the Company had approximately $73 million accrued for the VERP postretirement medical benefits. Other costs incurred of $56 million in 2016 related primarily to severance and facility closures. Other items by segment are as follows (in millions):

| Three Months Ended March 31, |

||||||||

| 2016 | 2015 | |||||||

| Other items: |

||||||||

| Rig Systems |

$ | 52 | $ | 40 | ||||

| Rig Aftermarket |

8 | 8 | ||||||

| Wellbore Technologies |

38 | 45 | ||||||

| Completion & Production Solutions |

34 | 29 | ||||||

| Eliminations and corporate costs |

9 | — | ||||||

|

|

|

|

|

|||||

| Total other items |

$ | 141 | $ | 122 | ||||

|

|

|

|

|

|||||

9

7. Debt

Debt consists of (in millions):

| March 31, 2016 |

December 31, 2015 |

|||||||

| Senior Notes, interest at 1.35% payable semiannually, principal due on December 1, 2017 |

$ | 499 | $ | 498 | ||||

| Senior Notes, interest at 2.60% payable semiannually, principal due on December 1, 2022 |

1,390 | 1,389 | ||||||

| Senior Notes, interest at 3.95% payable semiannually, principal due on December 1, 2042 |

1,087 | 1,087 | ||||||

| Commercial paper |

207 | 890 | ||||||

| Other |

196 | 45 | ||||||

|

|

|

|

|

|||||

| Total debt |

3,379 | 3,909 | ||||||

| Less current portion |

7 | 2 | ||||||

|

|

|

|

|

|||||

| Long-term debt |

$ | 3,372 | $ | 3,907 | ||||

|

|

|

|

|

|||||

On January 1, 2016, the Company adopted Accounting Standards Update (“ASU”) No. 2015-03 “Simplifying the Presentation of Debt Issuance Costs.” This ASU requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. We have applied the change retrospectively for prior period balances of unamortized debt issuance costs, resulting in a $21 million reduction in other assets and long-term debt on our consolidated balance sheet as of December 31, 2015. The table above now presents our debt liability net of the related debt discount and debt issuance costs.

The Company has a $4.5 billion, five-year credit facility which expires September 28, 2018. The Company also has a commercial paper program under which borrowings are classified as long-term since the program is supported by the $4.5 billion, five-year credit facility. At March 31, 2016, there were $210 million in commercial paper borrowings (gross of debt issuance costs), and there were no outstanding letters of credit issued under the credit facility, resulting in $4,290 million of funds available under this credit facility. Interest under this multicurrency facility is based upon LIBOR, NIBOR or EURIBOR plus 1.125% subject to a ratings-based grid, or the U.S. prime rate. The credit facility contains a financial covenant regarding maximum debt-to-capitalization ratio of 60%. As of March 31, 2016, the Company was in compliance with a debt-to-capitalization ratio of 17.1%.

The Company also had $1,887 million of additional outstanding letters of credit at March 31, 2016 that are under various bilateral letter of credit facilities. Other letters of credit are issued as bid bonds, advanced payment bonds and performance bonds.

The fair value of the Company’s debt is estimated using Level 2 inputs in the fair value hierarchy and is based on quoted prices for those or similar instruments. At March 31, 2016 and December 31, 2015, the fair value of the Company’s unsecured Senior Notes approximated $2,463 million and $2,551 million, respectively. At March 31, 2016 and December 31, 2015, the carrying value of the Company’s unsecured Senior Notes approximated $2,976 million and $2,974 million, respectively. The carrying value of the Company’s variable rate borrowings approximates fair value.

10

8. Tax

The effective tax rate for the three months ended March 31, 2016 was 50.0%, compared to 37.6% for the same period in 2015. Compared to the U.S. statutory rate, the effective tax rate was positively impacted in the periods by the effect of lower tax rates on income earned in foreign jurisdictions, foreign exchange losses for tax reporting in Norway, and a reduction in tax reserves due to audit settlements and the expiration of the statute of limitations on open tax years. The effective tax rate was negatively impacted by foreign dividends net of foreign tax credits, nondeductible expenses, and an increase in valuation allowance on deferred taxes.

The difference between the effective tax rate reflected in the provision for income taxes and the U.S. federal statutory rate of 35% was as follows (in millions):

| Three Months Ended March 31, |

||||||||

| 2016 | 2015 | |||||||

| Federal income tax at U.S. federal statutory rate |

$ | (83 | ) | $ | 176 | |||

| Foreign income tax rate differential |

(27 | ) | (46 | ) | ||||

| State income tax, net of federal benefit |

(4 | ) | 4 | |||||

| Nondeductible expenses |

12 | 5 | ||||||

| Tax benefit of manufacturing deduction |

— | (10 | ) | |||||

| Foreign dividends, net of foreign tax credits |

5 | 7 | ||||||

| Tax impact of foreign exchange |

(8 | ) | 1 | |||||

| Change in valuation allowance |

10 | — | ||||||

| Tax rate change on temporary differences |

2 | (4 | ) | |||||

| Change in tax reserves |

(25 | ) | 69 | |||||

| Other |

— | (13 | ) | |||||

|

|

|

|

|

|||||

| Provision for income taxes |

$ | (118 | ) | $ | 189 | |||

|

|

|

|

|

|||||

The balance of unrecognized tax benefits at March 31, 2016 was $24 million. The Company does not anticipate its total unrecognized tax benefits at March 31, 2016 to significantly change due to the settlement of audits or the expiration of statutes of limitation within 12 months of this reporting date.

The Company is subject to taxation in the U.S., various states and foreign jurisdictions. The Company has significant operations in the United States, Canada, the United Kingdom, the Netherlands and Norway. Tax years that remain subject to examination by major tax jurisdiction vary by legal entity, but are generally open in the U.S. for tax years after 2012 and outside the U.S. for tax years after 2008.

To the extent penalties and interest would be assessed on any underpayment of income tax, such accrued amounts have been classified as a component of income tax expense in the financial statements.

For the three-month period ended March 31, 2016, the Company is utilizing the discrete-period method to compute its interim tax provision due to significant variations in the relationship between income tax expense and pre-tax accounting income or loss; consequently, the actual effective rate for the interim period is being reported. The discrete-period method is applied when the application of the estimated annual effective tax rate is impractical because it is not possible to reliably estimate the annual effective tax rate.

For the three-month period ended March 31, 2015, the Company utilized the estimated annual effective tax rate method in computing its interim tax provisions. The relationship between pre-tax accounting income and income tax for these periods allowed the Company to estimate the annual effective tax rate to be applied to year-to-date income in those periods.

On January 1, 2016, the Company adopted FASB ASU No. 2015-17, “Balance Sheet Classification of Deferred Taxes” on a retrospective basis. Rather than classify deferred tax assets and liabilities as current and non-current, this update requires that deferred tax assets and liabilities be classified as non-current in the Consolidated Balance Sheet. Adoption of this ASU resulted in a reclassification of our current deferred tax assets and liabilities to non-current deferred tax assets and liabilities in our Consolidated Balance Sheet as of March 31, 2016. Prior periods have been retrospectively adjusted. At December 31, 2015, $376 million of current deferred tax assets have been reclassified to non-current deferred tax liabilities, $358 million of non-current deferred tax assets have been reclassified to non-current deferred tax liabilities, and $291 million of current deferred tax liabilities have been reclassified to non-current deferred tax liabilities.

11

9. Stock-Based Compensation

The Company has a stock-based compensation plan known as the National Oilwell Varco, Inc. Long-Term Incentive Plan (the “Plan”). The Plan provides for the granting of stock options, performance-based share awards, restricted stock, phantom shares, stock payments and stock appreciation rights. The number of shares authorized under the Plan is 39.5 million. At March 31, 2016, 1,054,009 shares remain available for future grants under the Plan, all of which are available for grants of stock options, performance-based share awards, restricted stock awards, phantom shares, stock payments and stock appreciation rights.

On February 24, 2016, the Company granted 3,672,411 stock options with a fair value of $6.44 per share and an exercise price of $28.24 per share; 1,732,095 shares of restricted stock and restricted stock units with a fair value of $28.24 per share; performance share awards to senior management employees with potential payouts varying from zero to 341,780 shares; and 4,618,400 stock appreciation rights (“SARs”) with an exercise price of $28.24 and a fair value of $6.44 per SAR. The stock options vest over a three-year period from the grant date while the restricted stock and restricted stock units vest on the third anniversary of the date of grant. The performance share awards can be earned based on performance against established goals over a three-year performance period. The performance share awards are based entirely on a TSR (total shareholder return) goal. Performance against the TSR goal is determined by comparing the performance of the Company’s TSR with the TSR performance of the members of the OSX index for the three year performance period. The SARs are cash-settled awards and vest over a three-year period from the grant date. Upon exercise of the SARs, the employee is entitled to receive cash payment for the appreciation in the value of our common stock over the exercise price. We account for the cash-settled SARs as liability awards, which require the awards to be revalued at each reporting period.

Total stock-based compensation for all stock-based compensation arrangements under the Plan was $29 million and $40 million for the three months ended March 31, 2016 and 2015, respectively. Included in stock-based compensation for the three months ended March 31, 2016 and 2015 is $5 million and $18 million, respectively, related to the Voluntary Early Retirement Plan established by the Company in the first quarter of each year. The total income tax benefit recognized in the Consolidated Statements of Income for all stock-based compensation arrangements under the Plan was $7 million for both the three months ended March 31, 2016 and 2015, respectively.

12

10. Derivative Financial Instruments

ASC Topic 815, “Derivatives and Hedging” requires a company to recognize all of its derivative instruments as either assets or liabilities in the Consolidated Balance Sheet at fair value. The accounting for changes in the fair value (i.e., gains or losses) of a derivative instrument depends on whether it has been designated and qualifies as part of a hedging relationship and further, on the type of hedging relationship. For those derivative instruments that are designated and qualify as hedging instruments, a company must designate the hedging instrument, based upon the exposure being hedged, as a fair value hedge, cash flow hedge, or a hedge of a net investment in a foreign operation.

The Company is exposed to certain risks relating to its ongoing business operations. The primary risk managed by using derivative instruments is foreign currency exchange rate risk. Forward contracts against various foreign currencies are entered into to manage the foreign currency exchange rate risk on forecasted revenues and expenses denominated in currencies other than the functional currency of the operating unit (cash flow hedge). In addition, the Company will enter into non-designated forward contracts against various foreign currencies to manage the foreign currency exchange rate risk on recognized nonfunctional currency monetary accounts (non-designated hedge).

The Company records all derivative financial instruments at their fair value in its Consolidated Balance Sheet. Except for certain non-designated hedges discussed below, all derivative financial instruments that the Company holds are designated as cash flow hedges and are highly effective in offsetting movements in the underlying risks. Such arrangements typically have terms between 2 and 24 months, but may have longer terms depending on the underlying cash flows being hedged, typically related to the projects in our backlog. The Company may also use interest rate contracts to mitigate its exposure to changes in interest rates on anticipated long-term debt issuances.

At March 31, 2016, the Company has determined that the fair value of its derivative financial instruments representing assets of $36 million and liabilities of $137 million (primarily currency related derivatives) are determined using level 2 inputs (inputs other than quoted prices in active markets for identical assets and liabilities that are observable either directly or indirectly for substantially the full term of the asset or liability) in the fair value hierarchy as the fair value is based on publicly available foreign exchange and interest rates at each financial reporting date. At March 31, 2016, the net fair value of the Company’s foreign currency forward contracts totaled a net liability of $101 million.

At March 31, 2016, the Company did not have any interest rate swaps and its financial instruments do not contain any credit-risk-related or other contingent features that could cause accelerated payments when the Company’s financial instruments are in net liability positions. We do not use derivative financial instruments for trading or speculative purposes.

Cash Flow Hedging Strategy

To protect against the volatility of forecasted foreign currency cash flows resulting from forecasted revenues and expenses, the Company has instituted a cash flow hedging program. The Company hedges portions of its forecasted revenues and expenses denominated in nonfunctional currencies with forward contracts. When the U.S. dollar strengthens or weakens against the foreign currencies, the change in present value of future foreign currency revenues and expenses is offset by changes in the fair value of the forward contracts designated as hedges.

For derivative instruments that are designated and qualify as a cash flow hedge (i.e., hedging the exposure to variability in expected future cash flows that is subject to a particular currency risk), the effective portion of the gain or loss on the derivative instrument is reported as a component of other comprehensive income (loss) and reclassified into earnings in the same line item associated with the forecasted transaction and in the same period or periods during which the hedged transaction affects earnings (e.g., in “revenues” when the hedged transactions are cash flows associated with forecasted revenues). The remaining gain or loss on the derivative instrument in excess of the cumulative change in the present value of future cash flows of the hedged item, if any (i.e., the ineffective portion), or hedge components excluded from the assessment of effectiveness, is recognized in the Consolidated Statements of Income during the current period.

For the three months ended March 31, 2016, the Company recognized losses of $16 million as a result of the discontinuance of certain cash flow hedges when it became probable that the original forecasted transactions would not occur by the end of the originally specified time period. At March 31, 2016, there were $137 million in pre-tax losses recorded in accumulated other comprehensive income (loss). Significant changes in forecasted operating levels or delays in large capital construction projects, whereby certain hedged transactions associated with these projects are no longer probable of occurring by the end of the originally specified time period, could result in additional losses due to the de-designation of existing hedge contracts.

13

The Company had the following outstanding foreign currency forward contracts that were entered into to hedge nonfunctional currency cash flows from forecasted revenues and expenses (in millions):

| Currency Denomination | ||||||||

| Foreign Currency |

March 31, 2016 |

December 31, 2015 |

||||||

| Norwegian Krone |

NOK | 8,376 | NOK | 9,655 | ||||

| U.S. Dollar |

USD | 211 | USD | 321 | ||||

| Euro |

EUR | 69 | EUR | 78 | ||||

| Danish Krone |

DKK | 35 | DKK | 57 | ||||

| Singapore Dollar |

SGD | 12 | SGD | 14 | ||||

| British Pound Sterling |

GBP | 2 | GBP | 4 | ||||

| Canadian Dollar |

CAD | 1 | CAD | 2 | ||||

Non-designated Hedging Strategy

The Company enters into forward exchange contracts to hedge certain nonfunctional currency monetary accounts. The purpose of the Company’s foreign currency hedging activities is to protect the Company from risk that the eventual U.S. dollar equivalent cash flows from the nonfunctional currency monetary accounts will be adversely affected by changes in the exchange rates.

For derivative instruments that are non-designated, the gain or loss on the derivative instrument subject to the hedged risk (i.e., nonfunctional currency monetary accounts) is recognized in other income (expense), net in current earnings.

The Company had the following outstanding foreign currency forward contracts that hedge the fair value of nonfunctional currency monetary accounts (in millions):

| Currency Denomination | ||||||||

| Foreign Currency |

March 31, 2016 |

December 31, 2015 |

||||||

| Norwegian Krone |

NOK | 2,474 | NOK | 2,265 | ||||

| Russian Ruble |

RUB | 2,097 | RUB | 2,164 | ||||

| U.S. Dollar |

USD | 496 | USD | 515 | ||||

| Euro |

EUR | 223 | EUR | 371 | ||||

| Danish Krone |

DKK | 221 | DKK | 153 | ||||

| British Pound Sterling |

GBP | 16 | GBP | 11 | ||||

| Canadian Dollar |

CAD | 11 | CAD | 7 | ||||

| Singapore Dollar |

SGD | 2 | SGD | 5 | ||||

14

The Company has the following gross fair values of its derivative instruments and their balance sheet classifications:

| Asset Derivatives |

Liability Derivatives |

|||||||||||||||||||

| Fair Value | Fair Value | |||||||||||||||||||

| Balance Sheet Location |

March 31, 2016 |

December 31, 2015 |

Balance Sheet Location |

March 31, 2016 |

December 31, 2015 |

|||||||||||||||

| Derivatives designated as hedging instruments under ASC Topic 815 |

||||||||||||||||||||

| Foreign exchange contracts |

Prepaid and other current assets | $ | 5 | $ | 5 | Accrued liabilities | $ | 107 | $ | 212 | ||||||||||

| Foreign exchange contracts |

Other Assets | 2 | — | Other liabilities | 5 | 25 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total derivatives designated as hedging instruments under ASC Topic 815 |

$ | 7 | $ | 5 | $ | 112 | $ | 237 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Derivatives not designated as hedging instruments under ASC Topic 815 |

||||||||||||||||||||

| Foreign exchange contracts |

Prepaid and other current assets | $ | 29 | $ | 21 | Accrued liabilities | $ | 25 | $ | 49 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total derivatives not designated as hedging instruments under ASC Topic 815 |

$ | 29 | $ | 21 | $ | 25 | $ | 49 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total derivatives |

$ | 36 | $ | 26 | $ | 137 | $ | 286 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| The Effect of Derivative Instruments on the Consolidated Statements of Income | ||||||||||||||||||||||||||||

| ($ in millions) | ||||||||||||||||||||||||||||

|

Derivatives in ASC Topic 815 |

Amount of Gain (Loss) Recognized in OCI on Derivative (Effective Portion) (a) |

Location of Gain (Loss) Accumulated OCI into Income |

Amount of Gain (Loss) Reclassified from Accumulated OCI into Income (Effective Portion) |

Location of Gain (Loss) Derivative (Ineffective Portion and Amount Excluded from Effectiveness Testing) |

Amount of Gain (Loss) Recognized in Income on Derivative (Ineffective Portion and Amount Excluded from Effectiveness Testing) (b) |

|||||||||||||||||||||||

| Three Months Ended March 31, |

Three Months Ended March 31, |

Three Months Ended March 31, |

||||||||||||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | |||||||||||||||||||||||

| Revenue | 1 | (65) | Cost of revenue | (16) | — | |||||||||||||||||||||||

| Foreign exchange contracts |

66 | (152 | ) | Cost of revenue | (60 | ) | 1 | Other income (expense), net | (1 | ) | (1 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

66 | (152) | (59) | (64) | (17) | (1) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Derivatives Not Designated as Hedging Instruments under ASC Topic 815 |

Location of Gain (Loss) Recognized in Income on Derivative |

Amount of Gain (Loss) Recognized in Income on Derivative | ||||

| Three Months Ended March 31, | ||||||

| 2016 | 2015 | |||||

| Foreign exchange contracts |

Other income (expense), net | 14 | (76) | |||

|

|

| |||||

| Total |

14 | (76) | ||||

|

|

| |||||

| (a) | The Company expects that $(124) million of the Accumulated Other Comprehensive Income (Loss) will be reclassified into earnings within the next twelve months with an offset by gains from the underlying transactions resulting in no impact to earnings or cash flow. |

| (b) | The amount of gain (loss) recognized in income represents $(16) million and nil related to the ineffective portion of the hedging relationships for each of the three months ended March 31, 2016 and 2015, respectively, and $(1) million related to the amount excluded from the assessment of the hedge effectiveness for each of the three months ended March 31, 2016 and 2015. |

15

11. Net Income (Loss) Attributable to Company Per Share

The following table sets forth the computation of weighted average basic and diluted shares outstanding (in millions, except per share data):

| Three Months Ended March 31, |

||||||||

| 2016 | 2015 | |||||||

| Numerator: |

||||||||

| Net income (loss) attributable to Company |

$ | (119 | ) | $ | 310 | |||

|

|

|

|

|

|||||

| Denominator: |

||||||||

| Basic—weighted average common shares outstanding |

375 | 407 | ||||||

| Dilutive effect of employee stock options and other unvested stock awards |

— | 2 | ||||||

|

|

|

|

|

|||||

| Diluted outstanding shares |

375 | 409 | ||||||

|

|

|

|

|

|||||

| Net income (loss) attributable to Company per share: |

||||||||

| Basic |

$ | (0.32 | ) | $ | 0.76 | |||

|

|

|

|

|

|||||

| Diluted |

$ | (0.32 | ) | $ | 0.76 | |||

|

|

|

|

|

|||||

| Cash dividends per share |

$ | 0.46 | $ | 0.46 | ||||

|

|

|

|

|

|||||

ASC Topic 260, “Earnings Per Share” requires companies with unvested participating securities to utilize a two-class method for the computation of net income attributable to Company per share. The two-class method requires a portion of net income attributable to Company to be allocated to participating securities, which are unvested awards of share-based payments with non-forfeitable rights to receive dividends or dividend equivalents, if declared. Net income attributable to Company allocated to these participating securities was immaterial for the three months ended March 31, 2016 and therefore not excluded from net income attributable to Company per share calculation.

The Company had stock options outstanding that were anti-dilutive totaling 15 million and 14 million shares for the three months ended March 31, 2016 and 2015, respectively.

12. Cash Dividends

On February 25, 2016, the Company’s Board of Directors approved a cash dividend of $0.46 per share. The cash dividend was paid on March 25, 2016, to each stockholder of record on March 11, 2016. Cash dividends were $173 million and $185 million for the three months ended March 31, 2016 and 2015, respectively. On April 11, 2016, the Company’s Board of Directors approved a plan to reduce the Company’s quarterly dividend to $0.05 per share. The declaration and payment of future dividends is at the discretion of the Company’s Board of Directors and will be dependent upon the Company’s results of operations, financial condition, capital requirements and other factors deemed relevant by the Company’s Board of Directors.

16

13. Commitments and Contingencies

In 2008, we received U.S. federal grand jury subpoenas and subsequent inquiries from U.S. governmental agencies requesting records related to our compliance with U.S. export trade laws and regulations. We have cooperated fully with agents from the U.S. Department of Justice, the Department of Commerce Bureau of Industry and Security, the United States Department of Treasury, Office of Foreign Assets Control, and U.S. Immigration and Customs Enforcement in responding to the inquiries. We have also cooperated with an informal inquiry from the Securities and Exchange Commission in connection with the inquiries previously made by the aforementioned federal agencies. We have conducted our own internal review of this matter. At the conclusion of our internal review in the fourth quarter of 2009, we identified possible areas of concern and discussed these areas of concern with the relevant agencies. We are currently negotiating a potential resolution with the agencies involved related to these matters. We currently anticipate that any administrative fine or penalty agreed to as part of a resolution would be within established accruals, and would not have a material effect on our financial position or results of operations. To the extent a resolution is not negotiated, we cannot predict the timing or effect that any resulting government actions may have on our financial position or results of operations.

In addition, we are involved in various other claims, internal investigations, regulatory agency audits and pending or threatened legal actions involving a variety of matters. As of March 31, 2016, the Company recorded an immaterial amount for contingent liabilities representing all contingencies believed to be probable. The Company has also assessed the potential for additional losses above the amounts accrued as well as potential losses for matters that are not probable but are reasonably possible. The total potential loss on these matters cannot be determined; however, in our opinion, any ultimate liability, to the extent not otherwise provided for and except for the specific cases referred to above, will not materially affect our financial position, cash flow or results of operations. As it relates to the specific cases referred to above we currently anticipate that any administrative fine or penalty agreed to as part of a resolution would be within established accruals, and would not have a material effect on our financial position or results of operations. To the extent a resolution is not negotiated as anticipated, we cannot predict the timing or effect that any resulting government actions may have on our financial position, cash flow or results of operations. These estimated liabilities are based on the Company’s assessment of the nature of these matters, their progress toward resolution, the advice of legal counsel and outside experts as well as management’s intention and experience.

Our business is affected both directly and indirectly by governmental laws and regulations relating to the oilfield service industry in general, as well as by environmental and safety regulations that specifically apply to our business. Although we have not incurred material costs in connection with our compliance with such laws, there can be no assurance that other developments, such as new environmental laws, regulations and enforcement policies hereunder may not result in additional, presently unquantifiable, costs or liabilities to us.

Further, in some instances, direct or indirect consumers of our products and services, entities providing financing for purchases of our products and services or members of the supply chain for our products and services may become involved in governmental investigations, internal investigations, political or other enforcement matters. In such circumstances, such investigations may adversely impact the ability of consumers of our products, entities providing financial support to such consumers or entities in the supply chain to timely perform their business plans or to timely perform under agreements with us. For example, the on-going, publicly disclosed investigations in Brazil have adversely impacted our shipyard customers, their customers, entities providing financing for our shipyard customers and/or entities in the supply chain. The investigations in Brazil have led to, and are expected to continue to lead to, delays in deliveries to our shipyard customers in Brazil, along with temporary suspension of performance under our supply contracts, and could result in attempted cancellation or other breaches of our contracts by our shipyard customers.

In other jurisdictions, our shipyard customers’ customers in some instances have, and may in the future, sought suspension, delay or cancellation of the contracts or payment due between our shipyard customers and their customers. To the extent our shipyard customers and their customers become engaged in disputes or litigation related to any such suspensions, delays or cancellations, we may also become involved, either directly or indirectly, in such disputes or litigation, as we enforce the terms of our contracts with our shipyard customers. Further, customers in other markets may seek delay or suspension of deliveries, extending delivery into future periods, or may attempt cancellations. While we manage deliveries and collection of payment to achieve milestone payments that mitigate our financial risk, such delays, suspensions, attempted cancellations, breaches of contract or other similar circumstances, could adversely affect our operating results, collections of accounts receivable and financial condition and could reduce our backlog.

17

14. Recently Issued Accounting Standards

In April 2015, the FASB issued Accounting Standard Update No. 2015-03 “Simplifying the Presentation of Debt Issuance Costs” (ASU 2015-03) to simplify the presentation of debt issuance costs. This update requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts, as opposed to current presentation of an asset on the balance sheet. ASU No. 2015-03 is effective for fiscal years beginning after December 15, 2015, and for interim periods within those fiscal years. The Company adopted this update on January 1, 2016, and has applied the change retrospectively to prior periods for unamortized debt issuance costs. See Note 7 for further information on the presentation of debt issuance costs.

In November 2015, the FASB issued Accounting Standard Update No. 2015-17 “Balance Sheet Classification of Deferred Taxes” (ASU 2015-17). This update requires companies to classify all deferred tax assets and liabilities as non-current on its consolidated financial position. The Company has early adopted ASU 2015-17 on a retrospective basis, resulting in a reclassification of current deferred tax assets and liabilities to non-current deferred tax assets and liabilities. The ASU adoption is effective January 1, 2016, and prior periods have been retrospectively adjusted. See Note 8 for further information on the presentation of deferred taxes.

In March 2016, the FASB issued Accounting Standard Update No. 2016-09, “Improvements to Employee Share-Based Payment Accounting” (ASU 2016-09). This update requires that entities record all of the tax effects related to share-based payments at settlement (or expiration) through the income statement. ASU No. 2016-09 is effective for fiscal years beginning after December 15, 2016, and for interim periods within those fiscal years. The Company is currently assessing the impact of the adoption of ASU No. 2016-09 on its consolidated financial position and results of operations.

In February 2016, the FASB issued Accounting Standard Update No. 2016-02 “Leases” (ASU No. 2016-02), which supersedes the lease requirements in Accounting Standard Codification Topic No. 840 “Leases” and most industry-specific guidance. This update increases transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. ASU No. 2016-02 is effective for fiscal years beginning after December 15, 2018, and for interim periods within those fiscal years. The Company is currently assessing the impact of the adoption of ASU No. 2016-02 on its consolidated financial position and results of operations.

In May 2014, the FASB issued Accounting Standard Update No. 2014-09 “Revenue from Contracts with Customers” (ASU No. 2014-09), which supersedes the revenue recognition requirements in Accounting Standard Codification Topic No. 605 “Revenue Recognition” and most industry-specific guidance. This update requires that entities recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which a company expects to be entitled in exchange for those goods or services. ASU No. 2014-09 is effective for fiscal years beginning after December 15, 2017, and for interim periods within those fiscal years. The Company is currently assessing the impact of the adoption of ASU No. 2014-09 on its consolidated financial position and results of operations.

18

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Introduction

National Oilwell Varco, Inc. (the “Company”) is a worldwide leader in the design, manufacture and sale of equipment and components used in oil and gas drilling, completion and production operations, and the provision of oilfield services to the upstream oil and gas industry.

Unless indicated otherwise, results of operations data are presented in accordance with accounting principles generally accepted in the United States (“GAAP”). In an effort to provide investors with additional information regarding our results of operations, certain non-GAAP financial measures, including operating profit excluding other items, operating profit percentage excluding other items and operating (non-GAAP) earnings per share, are provided. See Non-GAAP Financial Measures and Reconciliations in Results of Operations for an explanation of our use of non-GAAP financial measures and reconciliations to their corresponding measures calculated in accordance with GAAP.

Rig Systems

The Company’s Rig Systems segment makes and supports the capital equipment and integrated systems needed to drill oil and gas wells on land and offshore. The segment designs, manufactures and sells land rigs, offshore drilling equipment packages, including installation and commissioning services, and drilling rig components that mechanize and automate the drilling process and rig functionality.

Equipment and technologies in Rig Systems include: substructures, derricks, and masts; cranes; pipe lifting, racking, rotating, and assembly systems; fluid transfer technologies, such as mud pumps; pressure control equipment, including blowout preventers; power transmission systems, including drives and generators; and rig instrumentation and control systems.

Rig Systems supports land and offshore drillers. Demand for the segment’s products depends on drilling contractors’ and oil and gas companies’ capital spending plans, specifically capital expenditures on rig construction and refurbishment.

Rig Aftermarket

The Company’s Rig Aftermarket segment provides comprehensive aftermarket products and services to support land and offshore rigs, and drilling rig components manufactured by the Company’s Rig Systems segment.

The segment provides spare parts, repair, and rentals as well as technical support, field service and first well support, field engineering, and customer training through a network of aftermarket service and repair facilities strategically located in major areas of drilling operations.

Rig Aftermarket supports land and offshore drillers. Demand for the segment’s products and services depends on overall levels of oilfield drilling activity, which drives demand for spare parts, service, and repair for Rig Systems’ large installed base of equipment; and secondarily on drilling contractors’ and oil and gas companies’ capital spending plans, specifically capital expenditures on rig refurbishment and re-certification.

Wellbore Technologies

The Company’s Wellbore Technologies segment designs, manufactures, rents, and sells a variety of equipment and technologies used to perform drilling operations, and offers services that optimize their performance, including: solids control and waste management equipment and services; drilling fluids; portable power generation; premium drill pipe; wired pipe; drilling optimization and automation services; tubular inspection, repair and coating services; rope access inspection; instrumentation; measuring and monitoring; downhole and fishing tools; steerable technologies; hole openers; and drill bits.

Wellbore Technologies focuses on oil and gas companies and supports drilling contractors, oilfield service companies, and oilfield equipment rental companies. Demand for the segment’s products and services depends on the level of oilfield drilling activity by oil and gas companies, drilling contractors, and oilfield service companies.

19

Completion & Production Solutions

The Company’s Completion & Production Solutions segment integrates technologies for well completions and oil and gas production. The segment designs, manufactures, and sells equipment and technologies needed for hydraulic fracture stimulation, including pressure pumping trucks, blenders, sanders, hydration units, injection units, flowline, manifolds and wellheads; well intervention, including coiled tubing units, coiled tubing, and wireline units and tools; onshore production, including composite pipe, surface transfer and progressive cavity pumps, and artificial lift systems; and, offshore production, including floating production systems and subsea production technologies.

Completion & Production Solutions supports service companies and oil and gas companies. Demand for the segment’s products depends on the level of oilfield completions and workover activity by oilfield service companies and drilling contractors, and capital spending plans by oil and gas companies and oilfield service companies.

Critical Accounting Policies and Estimates

In our annual report on Form 10-K for the year ended December 31, 2015, we identified our most critical accounting policies. In preparing the financial statements, we make assumptions, estimates and judgments that affect the amounts reported. We periodically evaluate our estimates and judgments that are most critical in nature which are related to revenue recognition under long-term construction contracts; allowance for doubtful accounts; inventory reserves; impairment of long-lived assets (excluding goodwill and other indefinite-lived intangible assets); goodwill and other indefinite-lived intangible assets; purchase price allocation of acquisitions; service and product warranties; and income taxes. Our estimates are based on historical experience and on our future expectations that we believe are reasonable. The combination of these factors forms the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results are likely to differ from our current estimates and those differences may be material.

20

EXECUTIVE SUMMARY

For its first quarter ended March 31, 2016, the Company had a $119 million net loss, or $0.32 per fully diluted share, on $2.2 billion in revenue. Compared to the fourth quarter of 2015, revenue decreased $533 million or 20% and net loss decreased $1.4 billion or 92%. Compared to the first quarter of 2015, revenue decreased $2.6 billion or 55%, and net income decreased $429 million or 138%.

Operating loss excluding other items was $48 million or (2.2)% of sales in the first quarter of 2016, compared to operating profit of $141 million or 5.2% of sales in the fourth quarter of 2015, and $692 million or 14.4% of sales in the first quarter of 2015.

During the first quarter of 2016, fourth quarter of 2015, and first quarter of 2015, pre-tax other items included in operating profit (loss) were $141 million, $1,773 million and $122 million, respectively. Excluding other items charges from all periods, first quarter 2016 operating (non-GAAP) losses were $(0.06) per fully diluted share, compared to earnings of $0.23 per fully diluted share in the fourth quarter of 2015 and $1.14 per fully diluted share in the first quarter of 2015.

Oil & Gas Equipment and Services Market

Over the past decade, technological advancements in the oilfield equipment and service space unlocked production from formations that were previously deemed uneconomic, especially in North America. According to the Rystad Energy DCube, from 2004 to 2014 global oil and liquids supply increased by 9.9 million barrels per day, 5.8 million barrels per day from U.S. unconventional resources, 1.7 million barrels per day from deep-water (defined as water depths greater than 400 feet) resources and 2.4 million barrels per day from other sources. The advances in technology combined with relatively high commodity prices caused by growing demand enabled and sustained an increase in global drilling activity. In recent years, global supply started to catch up to demand, and in the latter half of 2014, demand growth in areas such as Asia, Europe and the U.S. weakened while drilling activity remained strong and production continued to grow. As a result, the first signs of an oversupply-related imbalance appeared and prices began to decline. Unlike previous cycles, when the Organization of the Petroleum Exporting Countries (OPEC) curtailed production levels to defend pricing, certain members of OPEC increased production in an effort to increase market share and financially stress higher cost producers, most notably those operating in the North American shale market. As a result, the price of oil declined significantly during early 2015, remained depressed throughout the year, and underwent another major reduction toward the end of 2015. In early 2016, the market witnessed oil trading in the high $20 per barrel range, a price range not seen since 2003.

In response to rapidly deteriorating market conditions, operators adjusted accordingly by acutely reducing both operating and capital expenditures. Orders for our equipment and services slowed and rig counts declined rapidly. The average U.S. land rig count fell 27% sequentially, exiting the quarter at 450 rigs, the lowest count since the 1940s. For the first quarter of 2016, the average number of active rigs drilling worldwide decreased 41% year-over-year, with a 57% decline in the North American market alone.

Segment Performance

The Rig Systems segment generated $926 million in revenues and $67 million in operating profit or 7.2% of sales in the first quarter of 2016. Compared to the prior quarter, revenues decreased $89 million or 9%, and operating profit decreased $79 million or 54%. Compared to the first quarter of 2015, segment revenues decreased $1.6 billion or 63%, and operating profit decreased $410 million or 86%. First quarter 2016 revenue out of backlog for the Rig Systems segment decreased 9% sequentially and 66% year-over-year on fewer shipments of land rigs and postponed delivery dates of some offshore projects. During the first quarter of 2016, the segment received $97 million in new orders, composed entirely of discrete capital equipment including cranes, pressure control, and jacking systems. In light of the recent vote by the shareholders of SETE Brasil Participacoes SA to authorize Sete to file for bankruptcy, and a further decline in drilling activity during the quarter to record lows and the resulting effect on certain other customers, the Company removed $2.1 billion of orders from its backlog. Contracts for these orders remain in place and are enforceable. If these customers obtain funding to continue their projects, the Company will pursue resumption of construction and update the backlog accordingly. With this reduction, backlog for capital equipment orders for the Rig Systems segment at March 31, 2016 was $3.31 billion.

The Rig Aftermarket segment generated $391 million in revenues and $69 million in operating profit or 17.6% of sales in the first quarter of 2016. Compared to the prior quarter, revenues decreased $178 million or 31%, and operating profit decreased $69 million or 50%. Compared to the first quarter of 2015, segment revenues decreased $328 million or 46%, and operating profit decreased $135 million or 66%. Revenue decreased year-over-year as drilling contractors reduced spending and depleted existing spares inventories rather than purchase new, and deferred repair and maintenance work on their rig fleets when possible.

The Wellbore Technologies segment generated $631 million in revenue and a $91 million operating loss, or (14.4)% of sales, for the first quarter of 2016. Compared to the prior quarter, revenue decreased $126 million or 17%, and operating loss decreased $1.6 billion or 95%. Compared to the first quarter of 2015, revenues decreased $540 million or 46%, and operating profit decreased $186 million or 196%. Revenue decreased in correlation with lower levels of worldwide drilling activity, which required and consumed less of the segment’s services and product offerings. Sequential operating margins increased due to a $1,634 million impairment charge related to goodwill and a certain indefinite-lived trade name, which negatively impacted operating margins during the fourth quarter of 2015. Year-over-year operating margins declined on lower volumes and a market decline that outpaced cost reduction efforts.

21

The Completion & Production Solutions segment generated $558 million in revenue and $38 million in operating loss or (6.8)% of sales during the first quarter of 2016. Compared to the prior quarter, revenue decreased $188 million or 25%, and operating profit decreased $42 million. Compared to the first quarter of 2015, revenues decreased $390 million or 41%, and operating profit decreased $126 million or 143%. Revenue and operating profit decreased sequentially and year-over-year on lower levels of worldwide activity and pricing pressures.

Outlook

The persistent supply and demand imbalance has led to low commodity prices and significantly reduced activity by exploration and production companies. The reduced activity has created an oversupply of service capacity and capital equipment resulting in increasingly challenging prospects for many of our customers in the form of reduced volumes and pricing pressures. Consequently, we are cautious in our outlook for the remainder of 2016, and anticipate that our customers will minimize capital expenditures until they see the early signs of a recovery in commodity prices and overall activity levels. We also expect them to minimize parts purchases and postpone maintenance using existing stocks of spares and cannibalizing idle equipment whenever possible.

In the current environment, contractors are hesitant to invest in older equipment which can be far less productive and competitive. As a result, we anticipate that the industry will retire a significant portion of the current base of capital equipment during this cyclical downturn, which could result in newbuild orders when commodity prices recover and activity increases. However, a meaningful increase in drilling activity is not expected in 2016 as commodity prices remain at decade lows. As a result, our near-term outlook remains cautious and visibility beyond the middle of 2016 remains limited as the duration of the current market downturn is uncertain.

We expect the slope and timing of revenue decline, stabilization and recovery will be different across our four business segments. Likewise, our global customer base includes national oil companies, international oil companies, onshore and offshore drilling contractors and others whose strategies and reactions to low commodity prices vary. Our Completion & Production Solutions segment is expected to see an increase in activity when decisions are made to complete and produce the inventory of already drilled wells. Our Wellbore Technologies and Rig Aftermarket segments are expected to see stronger recovery as drilling of new wells increases, while orders for newbuild rigs in our Rig Systems segment may come later in the cycle.

Throughout 2016, we will continue to focus on what we can control, in the form of sizing our operations with anticipated levels of activity while continuing to advance our longer term strategic goals. The Company has a history of implementing cost-controls measures and downsizing in response to depressed market conditions and has a track record of executing strategic acquisitions and developing new products and technologies. The Company remains optimistic regarding longer-term market fundamentals as existing oil and gas fields continue to deplete and numerous major projects to replenish supply are deferred or canceled while global demand continues to grow.

22

Operating Environment Overview

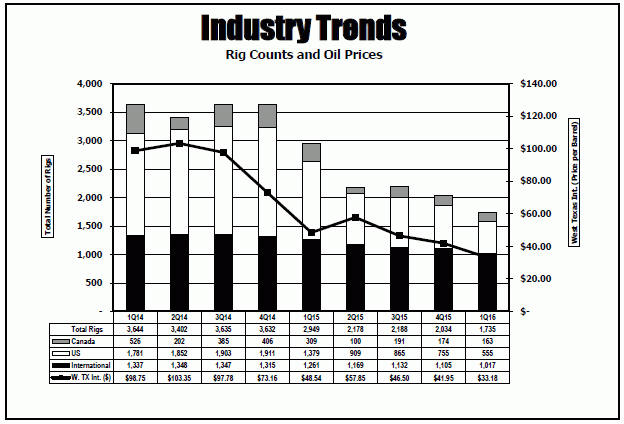

The Company’s results are dependent on, among other things, the level of worldwide oil and gas drilling, well remediation activity, the prices of crude oil and natural gas, capital spending by other oilfield service companies and drilling contractors, and worldwide oil and gas inventory levels. Key industry indicators for the first quarter of 2016 and 2015, and the fourth quarter of 2015 include the following:

| 1Q16* | 1Q15* | 4Q15* | % 1Q16 1Q15 |

% 1Q16 4Q15 |

||||||||||||||||

| Active Drilling Rigs: |

||||||||||||||||||||

| U.S. |

555 | 1,379 | 755 | (59.8 | %) | (26.5 | %) | |||||||||||||

| Canada |

163 | 309 | 174 | (47.2 | %) | (6.3 | %) | |||||||||||||

| International |

1,017 | 1,261 | 1,105 | (19.3 | %) | (8.0 | %) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Worldwide |

1,735 | 2,949 | 2,034 | (41.2 | %) | (14.7 | %) | |||||||||||||

| West Texas Intermediate Crude Prices (per barrel) |

$ | 33.18 | $ | 48.54 | $ | 41.95 | (31.6 | %) | (20.9 | %) | ||||||||||

| Natural Gas Prices ($/mmbtu) |

$ | 1.98 | $ | 2.87 | $ | 2.11 | (31.0 | %) | (6.2 | %) | ||||||||||

| * | Averages for the quarters indicated. See sources below. |

The following table details the U.S., Canadian, and international rig activity and West Texas Intermediate Crude Oil prices for the past nine quarters ended March 31, 2016, on a quarterly basis:

Source: Rig count: Baker Hughes, Inc. (www.bakerhughes.com); West Texas Intermediate Crude Oil and Natural Gas Prices: Department of Energy, Energy Information Administration (www.eia.doe.gov).

23