Attached files

| file | filename |

|---|---|

| 8-K - INTRAWEST RESORTS HOLDINGS, INC 8-K 5-5-2016 - Intrawest Resorts Holdings, Inc. | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Intrawest Resorts Holdings, Inc. | ex99_1.htm |

Exhibit 99.2

Intrawest Resorts Holdings, Inc.Fiscal 2016 Third Quarter Earnings Call PresentationMay 5, 2016

Important Information 2 This document contains forward-looking statements. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which Intrawest operates as well as the Company’s beliefs and assumptions regarding our operations and financial performance, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, industry results or market trends to differ materially from those expressed or implied by such forward-looking statements. Therefore any statements contained herein that are not statements of historical fact may be forward-looking statements and should be evaluated as such. Without limiting the foregoing, words such as “Expects”, “Anticipates”, “Should”, “Intends”, “Plans”, “Believes”, “Seeks”, “Estimates”, “Projects”, and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict, including those described in Part I - Item 1A, ‘‘Risk Factors’’ in our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 filed with the Securities and Exchange Commission (“SEC”) on September 9, 2015, as may be revised in subsequent SEC filings. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The actual performance of Intrawest may differ from the budget, projections and returns set forth herein and may differ materially.Certain information contained herein has been obtained from published and non-published sources. Such information has not been independently verified by Intrawest. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.This presentation is part of the fiscal 2016 third quarter earnings call dated May 5, 2016, and includes certain non-GAAP financial measures, including Adjusted EBITDA (“Adj. EBITDA”). Non-GAAP financial measures such as Adj. EBITDA should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Please refer to our Current Report on Form 10-Q filed May 5, 2016, with the SEC for a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP.We use Adj. EBITDA as a measure of our operating performance. Adj. EBITDA is a supplemental non-GAAP financial measure.Our board of directors and management team focus on Adj. EBITDA as a key performance and compensation measure. Adj. EBITDA assists us in comparing our performance over various reporting periods because it removes from our operating results the impact of items that our management believes do not reflect our core operating performance. The compensation committee of our board of directors will determine the annual variable compensation for

certain members of our management team, based in part, on Adj. EBITDA. Adj. EBITDA is not a substitute for net income (loss), income (loss) from continuing operations, cash flows from operating activities or any other measure prescribed by GAAP. There are limitations to using non-GAAP measures such as Adj. EBITDA. Although we believe that Adj. EBITDA can make an evaluation of our operating performance more consistent because it removes items that do not reflect our core operations, other companies in our industry may define Adj. EBITDA differently than we do. As a result, it may be difficult to use Adj. EBITDA to compare the performance of those companies to our performance. Adj. EBITDA should not be considered as a measure of the income generated by our business or discretionary cash available to us to invest in the growth of our business. Our management compensates for these limitations by reference to our GAAP results and using Adj. EBITDA as a supplemental measure.

Fiscal 2016 Third Quarter Overview 2 Completed the sale of IRCG to Diamond Resorts on January 29, 2016. Outstanding growth at our Colorado resorts and CMH more than offset the record-setting warmth in the EastAdjusted EBITDA grew by more than 8% excluding the impact of the weakened Canadian dollar and Intrawest Resort Club Group (“IRCG”)1Launched season pass sales for 2016/2017 ski season, with the Kids Ski Free program in Colorado and 25 resorts on the M.A.X. passCompleted $50 million share repurchase and amended credit agreement in conjunction with $25 million debt prepayment

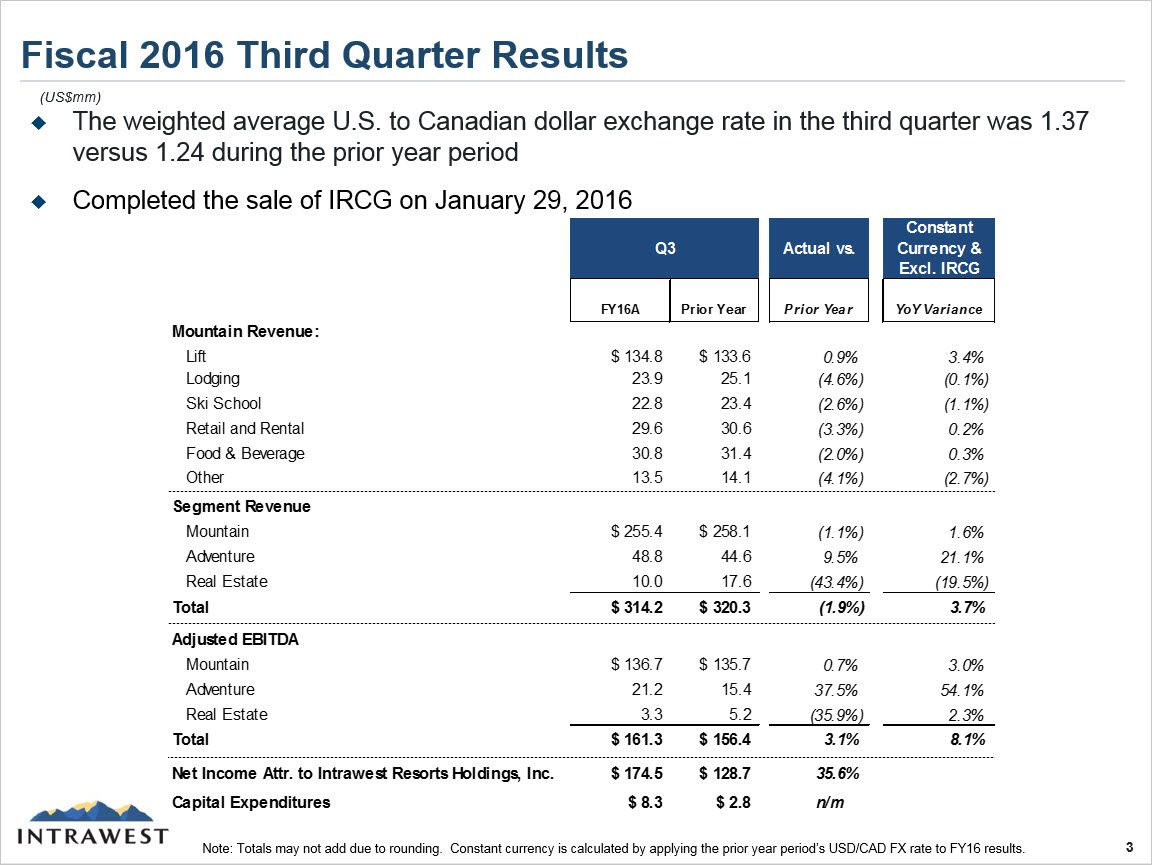

Fiscal 2016 Third Quarter Results 4 (US$mm) Note: Totals may not add due to rounding. Constant currency is calculated by applying the prior year period’s USD/CAD FX rate to FY16 results. The weighted average U.S. to Canadian dollar exchange rate in the third quarter was 1.37 versus 1.24 during the prior year periodCompleted the sale of IRCG on January 29, 2016

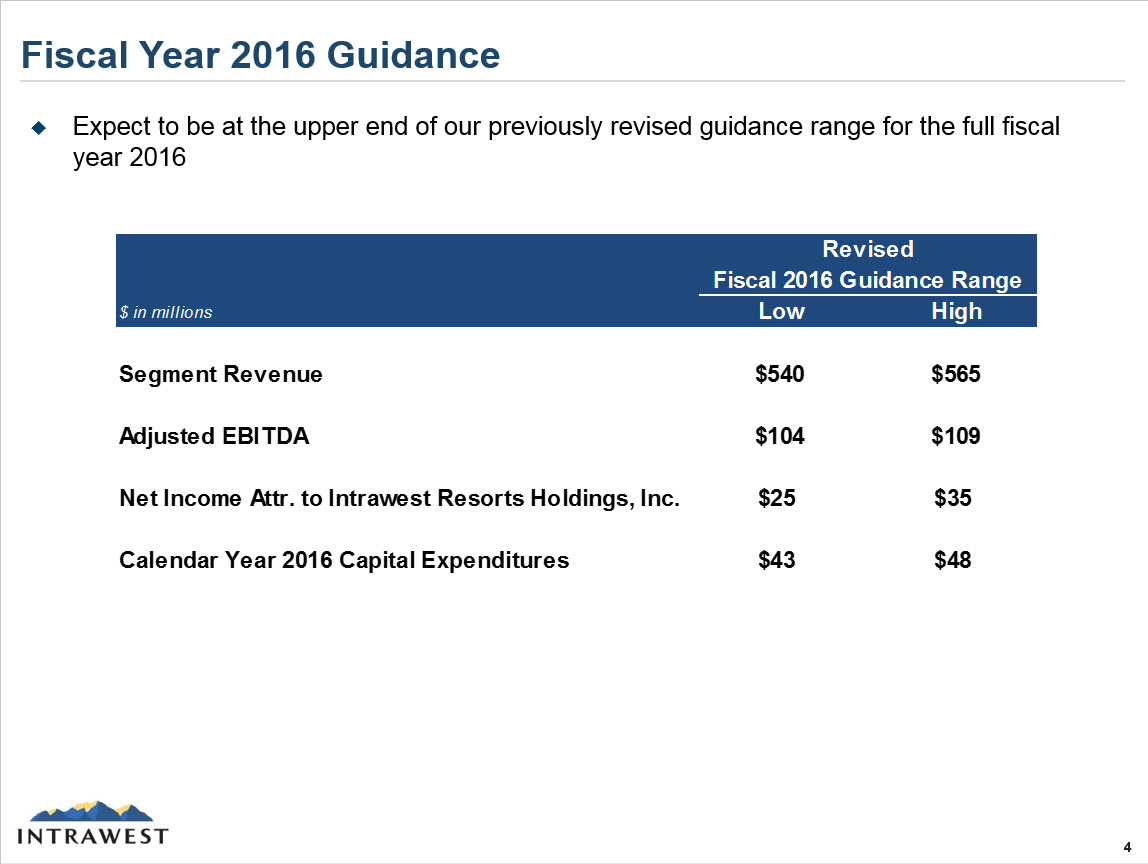

Fiscal Year 2016 Guidance 5 Expect to be at the upper end of our previously revised guidance range for the full fiscal year 2016

Conclusion 6 CMH has Breakout QuarterAdventure Revenue + 21.1% and Adventure Adj. EBITDA + 54.1% in constant currency $50mm Buyback + $34mm1 of Debt Prepayment Accretive share repurchase and continued deleveraging Expect FY16 to be within High End of Guidance RangeDriven by strong Q3 results and outlook for remainder of year Colorado & CMH Overcome Unprecedented Warmth in East Adjusted EBITDA +8.1% in constant currency after removing IRCG 1) Includes $9mm from January ECF prepayment and $25mm from voluntary prepayment made in conjunction with Fourth Amendment to credit agreement.