Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ION GEOPHYSICAL CORP | a8k-2016xq1xearnings.htm |

| EX-99.1 - EXHIBIT 99.1 - ION GEOPHYSICAL CORP | ex991earningsrelease2016-q1.htm |

ION Earnings Call – Q1 2016 Earnings Call Presentation May 5, 2016

Corporate Participants and Contact Information CONTACT INFORMATION If you have technical problems during the call, please contact DENNARD–LASCAR Associates at 713 529 6600. If you would like to view a replay of today's call, it will be available via webcast in the Investor Relations section of the Company's website at www.iongeo.com for approximately 12 months. BRIAN HANSON President and Chief Executive Officer STEVE BATE Executive Vice President and Chief Financial Officer 2

Forward-Looking Statements The information included herein contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Actual results may vary fundamentally from those described in these forward-looking statements. All forward-looking statements reflect numerous assumptions and involve a number of risks and uncertainties. These risks and uncertainties include risk factors that are disclosed by ION from time to time in its filings with the Securities and Exchange Commission. 3

ION Q1 16 Overview Q1 net loss of $35 million, $(3.30) per share, on revenues of $23 million Used $8 million in cash, versus $29 million in Q1 15 Generated $2.5 million cash from operations, versus $(6.7) million in Q1 15 Implemented additional cost reduction initiatives in Q2, reducing workforce by over 12% Additional reductions should yield additional $15 million in annualized savings 4 Ocean Bottom Services – Mobilizing crew for survey offshore Nigeria Solutions – Expect revenues to be stronger in 2H Systems & Software – Revenues indicative of low capacity utilization among installed base – Acquired Global Dynamics Inc. SailWing technology Financial Highlights Segment Highlights Financial Restructuring Completed bond exchange offer, retiring $26 million in principal value of $175 million high yield bonds Issued $121 million of new bonds maturing 12/15/21 with 1% interest rate increase to 9.125% 84% participation rate

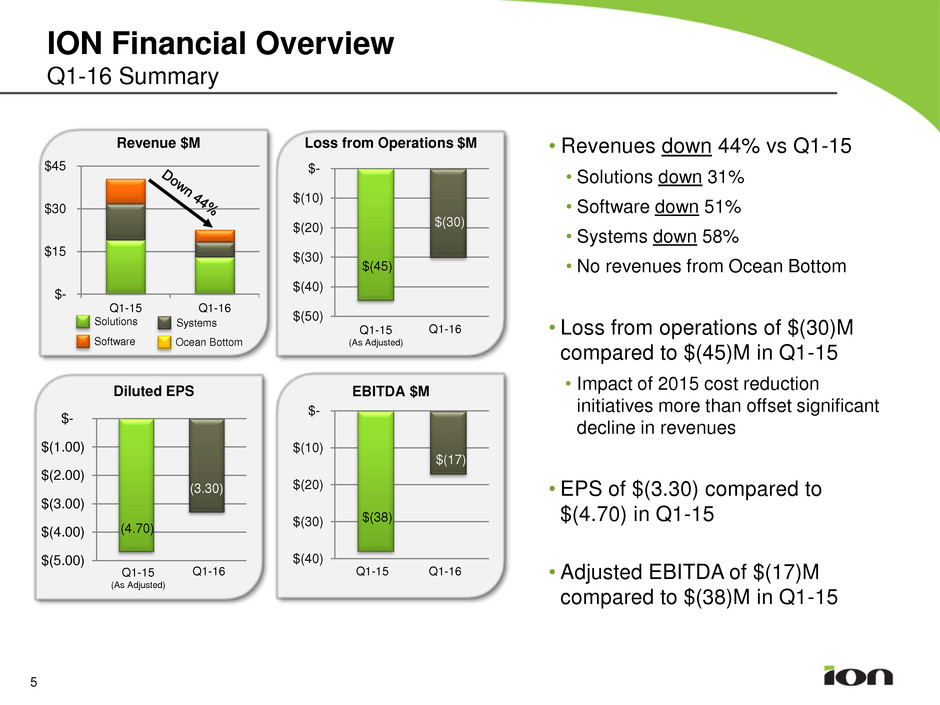

(4.70) (3.30) $(5.00) $(4.00) $(3.00) $(2.00) $(1.00) $- Diluted EPS Q1-15 (As Adjusted) 5 ION Financial Overview Q1-16 Summary $- $15 $30 $45 Q1-15 Q1-16 Software Systems Solutions Revenue $M $(38) $(17) $(40) $(30) $(20) $(10) $- Q1-15 Q1-16 • Revenues down 44% vs Q1-15 • Solutions down 31% • Software down 51% • Systems down 58% • No revenues from Ocean Bottom • Loss from operations of $(30)M compared to $(45)M in Q1-15 • Impact of 2015 cost reduction initiatives more than offset significant decline in revenues • EPS of $(3.30) compared to $(4.70) in Q1-15 • Adjusted EBITDA of $(17)M compared to $(38)M in Q1-15 Ocean Bottom Q1-16 EBITDA $M $(45) $(30) $(50) $(40) $(30) $(20) $(10) $- Q1-16 Loss from Operations $M Q1-15 (As Adjusted)

ION Financial Overview Cash Flow 6 SUMMARIZED CASH FLOW $ Millions Q1-15 Q1-16 Net loss (55.5)$ (35.0)$ Non-cash adjust. (DD&A, stock comp) 13.3 13.6 Working capital 35.5 23.9 Cash from operations (6.7) 2.5 Multi-client investment (9.1) (6.3) PP&E capital expenditures (12.0) (0.3) Other investing activities 0.3 - Net cash from investing activities (20.8) (6.6) Repurchase of common stock - (1.0) Payments of debt (2.1) (2.2) ther financing activities - (1.3) Net cash from financing activities (2.1) (4.5) Effect of change in f/x 0.4 0.3 Net Change in Cash (29.2) (8.2) Cash & Cash Equiv. (Beg. Of Period) 173.6 84.9 Cash & Cash Equiv. (End Of Period) 144.4$ 76.7$ • Used $8M in cash, compared to $29M Q1-15 • Total liquidity of $103M at March 2016 • $77M of cash • $26M availability under revolver • No borrowings on revolver, decline in eligible receivables included in borrowing base calculation •Completed bond exchange offer in April • Retired $26M debt, using $15M cash • Extended maturity to Dec. 2021 on $121M

Summary Slow start in tough operating environment OBS crew mobilizing for project offshore Nigeria Completed financial restructurings Reduced cost commensurate with revenues Expect second half of year to be stronger Positioned to weather the storm 7

8 Q&A