Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ESTERLINE TECHNOLOGIES CORP | d103748d8k.htm |

| EX-99.1 - EX-99.1 - ESTERLINE TECHNOLOGIES CORP | d103748dex991.htm |

Q2 2016 Supplemental Financial Information May 5, 2016 Exhibit 99.2

This presentation may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “should” or “will,” or the negative of such terms, or other comparable terminology. These forward-looking statements are only predictions based on the current intent and expectations of the management of Esterline, are not guarantees of future performance or actions, and involve risks and uncertainties that are difficult to predict and may cause Esterline’s or its industry’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Esterline's actual results and the timing and outcome of events may differ materially from those expressed in or implied by the forward-looking statements due to risks detailed in Esterline's public filings with the Securities and Exchange Commission including its most recent Transition Report on Form 10-K. This presentation also contains references to non-GAAP financial information subject to Regulation G. The reconciliations of each non-GAAP financial measure to its comparable GAAP measure as well as further information on management’s use of non-GAAP financial measures are included in Esterline’s press release dated May 5, 2016, included as Exhibit 99.1 to Form 8-K filed with the SEC on the same date, as well as in this presentation.

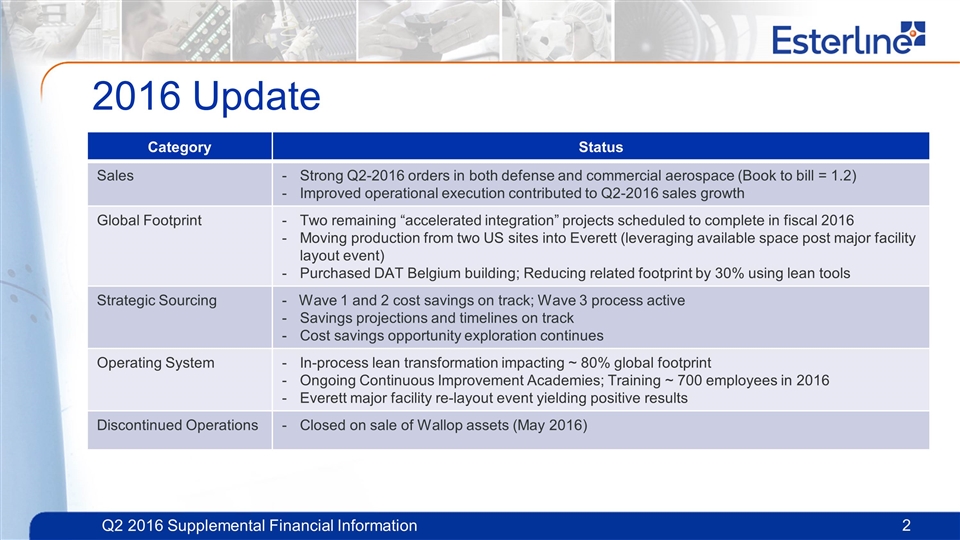

Category Status Sales Strong Q2-2016 orders in both defense and commercial aerospace (Book to bill = 1.2) Improved operational execution contributed to Q2-2016 sales growth Global Footprint Two remaining “accelerated integration” projects scheduled to complete in fiscal 2016 Moving production from two US sites into Everett (leveraging available space post major facility layout event) Purchased DAT Belgium building; Reducing related footprint by 30% using lean tools Strategic Sourcing - Wave 1 and 2 cost savings on track; Wave 3 process active Savings projections and timelines on track Cost savings opportunity exploration continues Operating System In-process lean transformation impacting ~ 80% global footprint Ongoing Continuous Improvement Academies; Training ~ 700 employees in 2016 Everett major facility re-layout event yielding positive results Discontinued Operations Closed on sale of Wallop assets (May 2016) 2016 Update

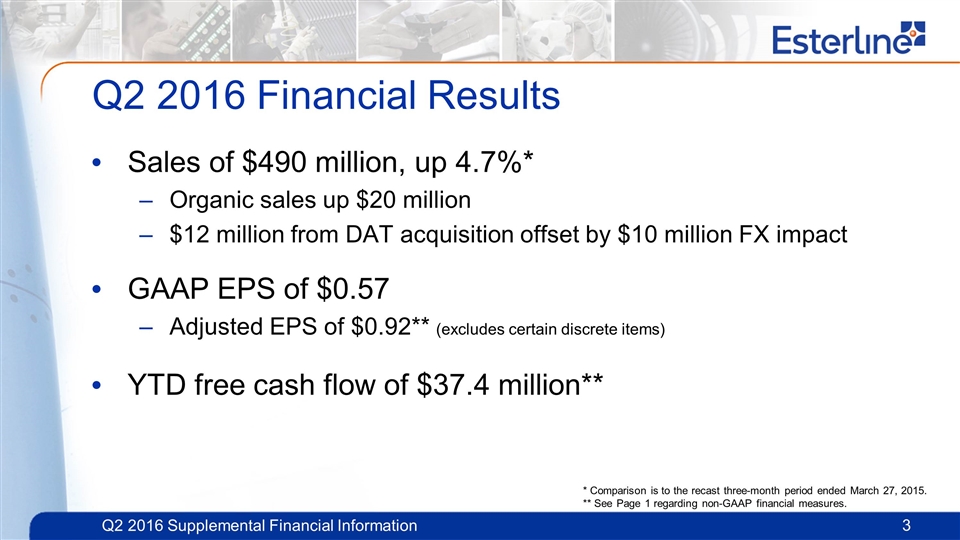

Q2 2016 Financial Results Sales of $490 million, up 4.7%* Organic sales up $20 million $12 million from DAT acquisition offset by $10 million FX impact GAAP EPS of $0.57 Adjusted EPS of $0.92** (excludes certain discrete items) YTD free cash flow of $37.4 million** * Comparison is to the recast three-month period ended March 27, 2015. ** See Page 1 regarding non-GAAP financial measures.

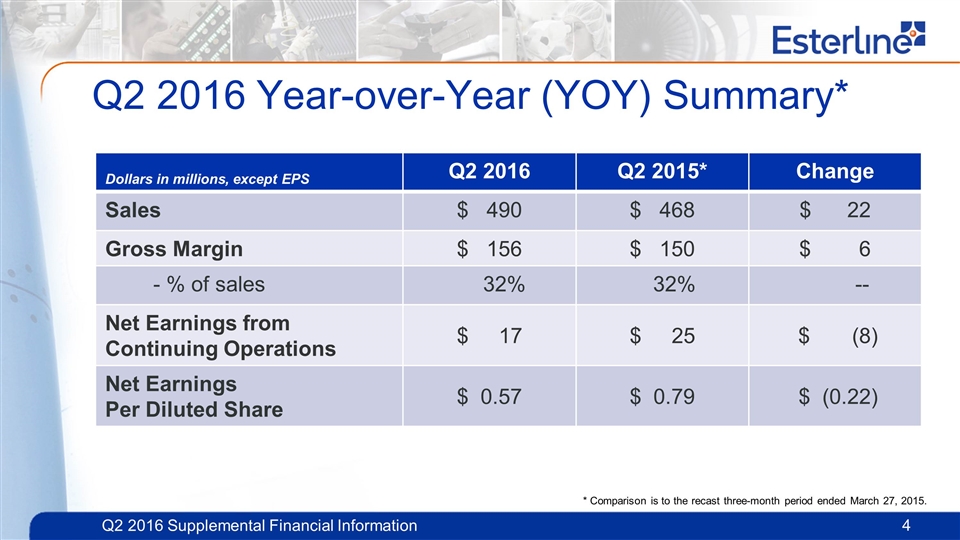

Q2 2016 Year-over-Year (YOY) Summary* Dollars in millions, except EPS Q2 2016 Q2 2015* Change Sales $ 490 $ 468 $ 22 Gross Margin $ 156 $ 150 $ 6 - % of sales 32% 32% -- Net Earnings from Continuing Operations $ 17 $ 25 $ (8) Net Earnings Per Diluted Share $ 0.57 $ 0.79 $ (0.22) * Comparison is to the recast three-month period ended March 27, 2015.

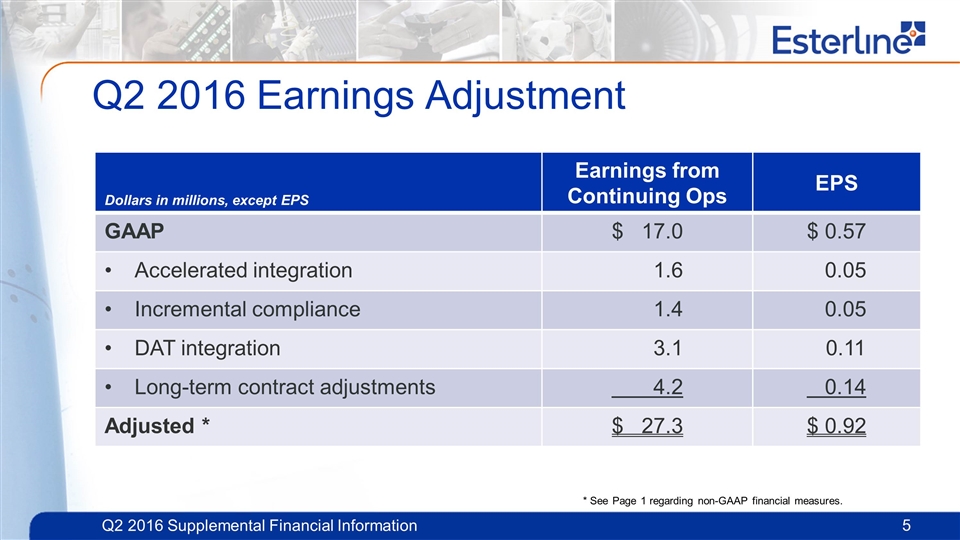

Q2 2016 Earnings Adjustment Dollars in millions, except EPS Earnings from Continuing Ops EPS GAAP $ 17.0 $ 0.57 Accelerated integration 1.6 0.05 Incremental compliance 1.4 0.05 DAT integration 3.1 0.11 Long-term contract adjustments 4.2 0.14 Adjusted * $ 27.3 $ 0.92 * See Page 1 regarding non-GAAP financial measures.

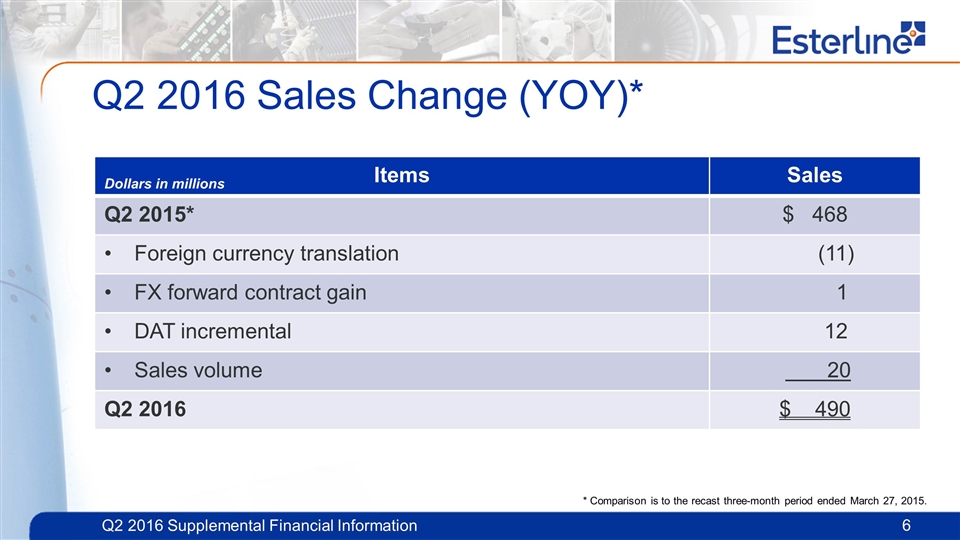

Q2 2016 Sales Change (YOY)* Items Sales Q2 2015* $ 468 Foreign currency translation (11) FX forward contract gain 1 DAT incremental 12 Sales volume 20 Q2 2016 $ 490 Dollars in millions * Comparison is to the recast three-month period ended March 27, 2015.

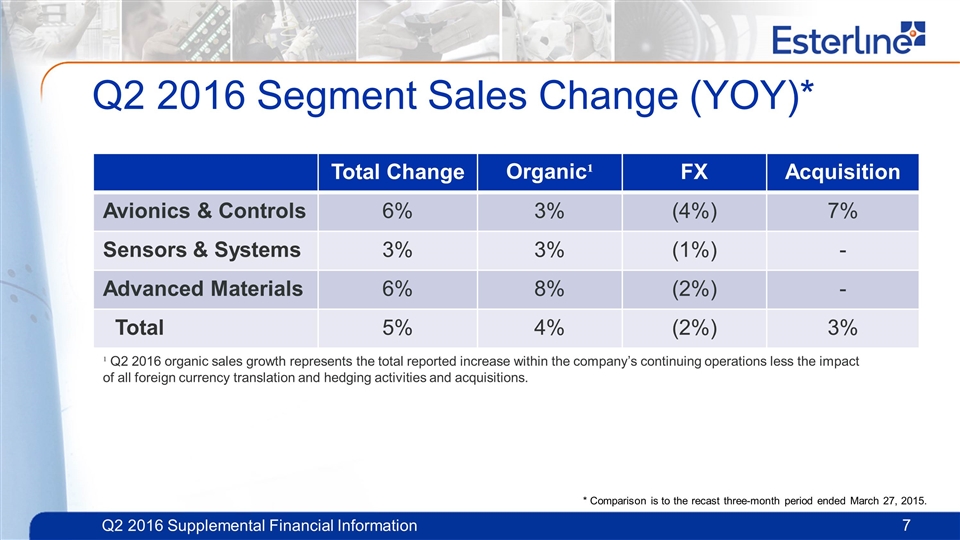

Q2 2016 Segment Sales Change (YOY)* Total Change Organic¹ FX Acquisition Avionics & Controls 6% 3% (4%) 7% Sensors & Systems 3% 3% (1%) - Advanced Materials 6% 8% (2%) - Total 5% 4% (2%) 3% ¹ Q2 2016 organic sales growth represents the total reported increase within the company’s continuing operations less the impact of all foreign currency translation and hedging activities and acquisitions. * Comparison is to the recast three-month period ended March 27, 2015.

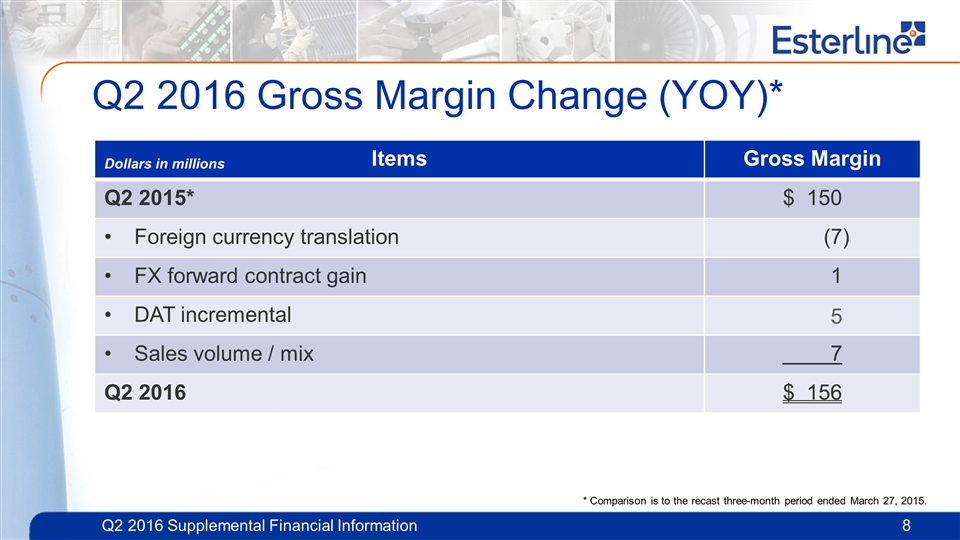

Q2 2016 Gross Margin Change (YOY)* Items Gross Margin Q2 2015* $ 150 Foreign currency translation (7) FX forward contract gain 1 DAT incremental 5 Sales volume / mix 7 Q2 2016 $ 156 Dollars in millions * Comparison is to the recast three-month period ended March 27, 2015.

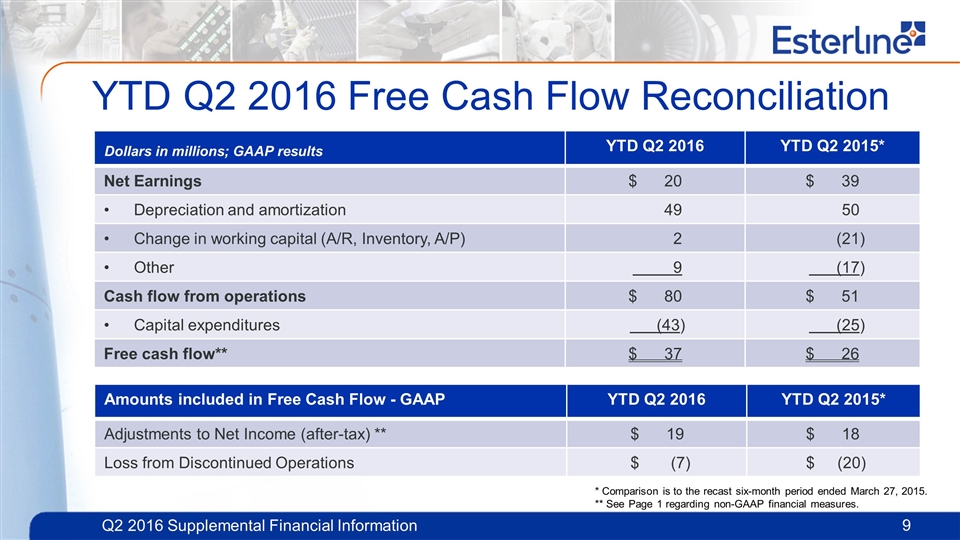

YTD Q2 2016 Free Cash Flow Reconciliation * Comparison is to the recast six-month period ended March 27, 2015. ** See Page 1 regarding non-GAAP financial measures. YTD Q2 2016 YTD Q2 2015* Net Earnings $ 20 $ 39 Depreciation and amortization 49 50 Change in working capital (A/R, Inventory, A/P) 2 (21) Other 9 (17) Cash flow from operations $ 80 $ 51 Capital expenditures (43) (25) Free cash flow** $ 37 $ 26 Dollars in millions; GAAP results Amounts included in Free Cash Flow - GAAP YTD Q2 2016 YTD Q2 2015* Adjustments to Net Income (after-tax) ** $ 19 $ 18 Loss from Discontinued Operations $ (7) $ (20)

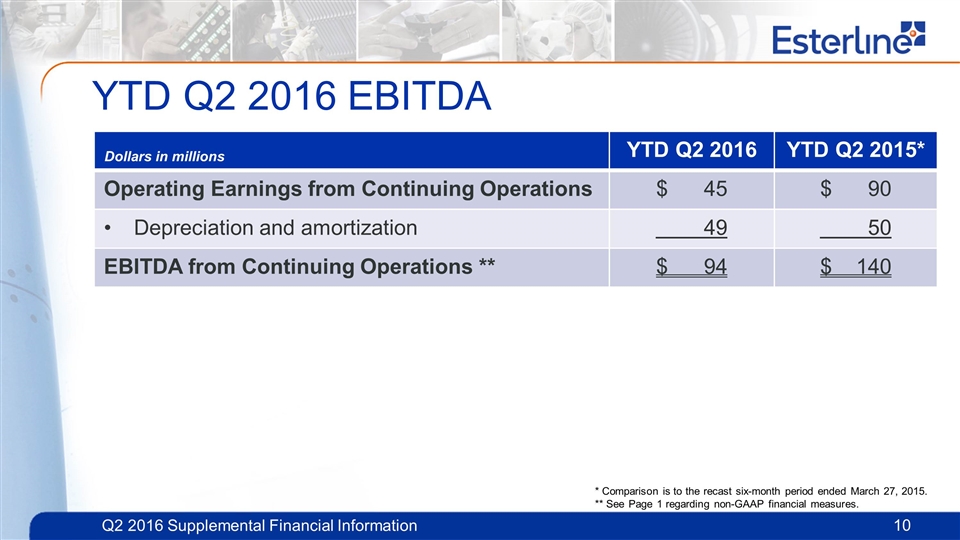

YTD Q2 2016 EBITDA * Comparison is to the recast six-month period ended March 27, 2015. ** See Page 1 regarding non-GAAP financial measures. YTD Q2 2016 YTD Q2 2015* Operating Earnings from Continuing Operations $ 45 $ 90 Depreciation and amortization 49 50 EBITDA from Continuing Operations ** $ 94 $ 140 Dollars in millions

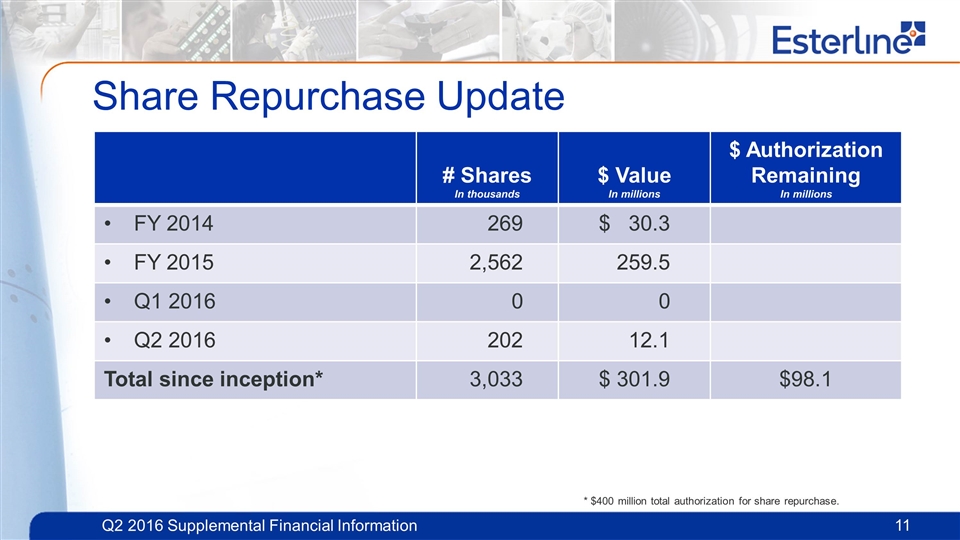

Share Repurchase Update # Shares In thousands $ Value In millions $ Authorization Remaining In millions FY 2014 269 $ 30.3 FY 2015 2,562 259.5 Q1 2016 0 0 Q2 2016 202 12.1 Total since inception* 3,033 $ 301.9 $98.1 * $400 million total authorization for share repurchase.

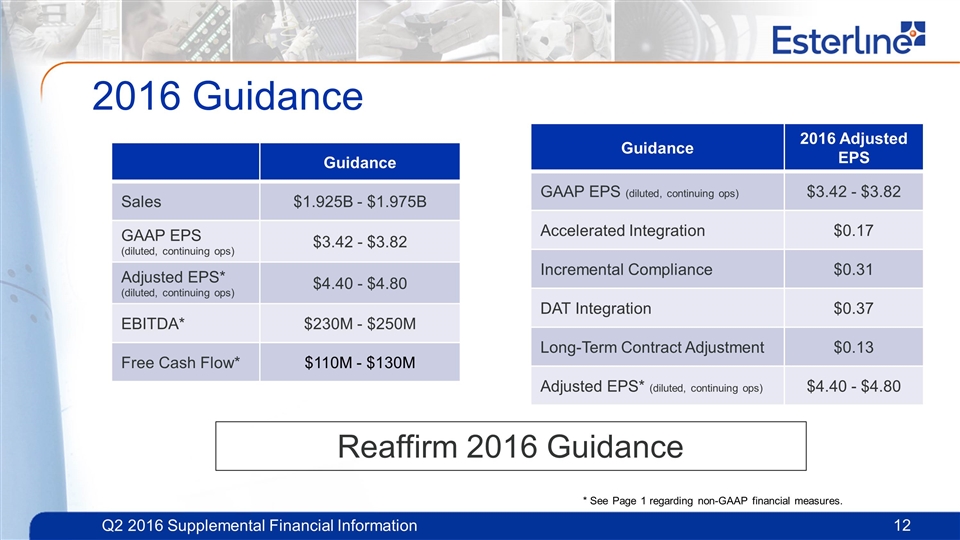

2016 Guidance Guidance Sales $1.925B - $1.975B GAAP EPS (diluted, continuing ops) $3.42 - $3.82 Adjusted EPS* (diluted, continuing ops) $4.40 - $4.80 EBITDA* $230M - $250M Free Cash Flow* $110M - $130M Guidance 2016 Adjusted EPS GAAP EPS (diluted, continuing ops) $3.42 - $3.82 Accelerated Integration $0.17 Incremental Compliance $0.31 DAT Integration $0.37 Long-Term Contract Adjustment $0.13 Adjusted EPS* (diluted, continuing ops) $4.40 - $4.80 Reaffirm 2016 Guidance * See Page 1 regarding non-GAAP financial measures.

Appendix

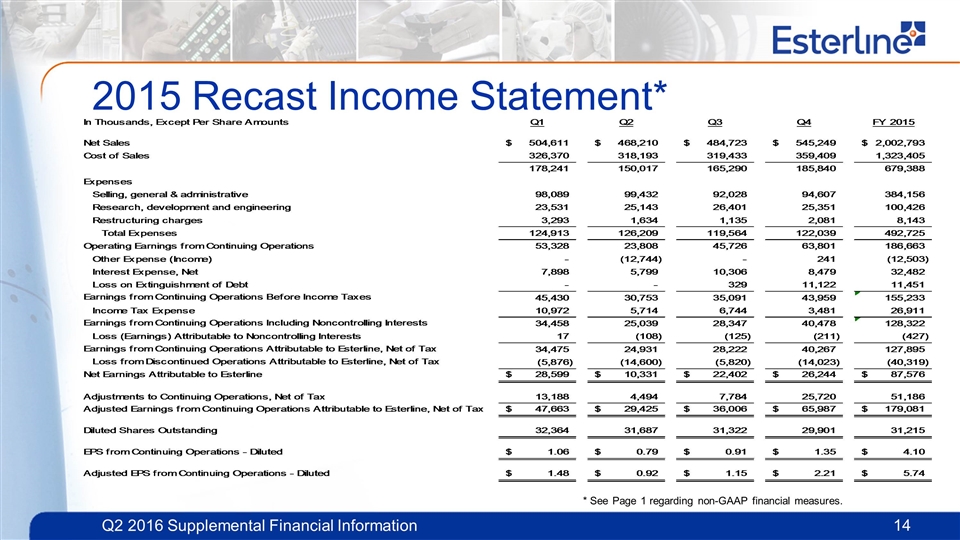

2015 Recast Income Statement* * See Page 1 regarding non-GAAP financial measures.

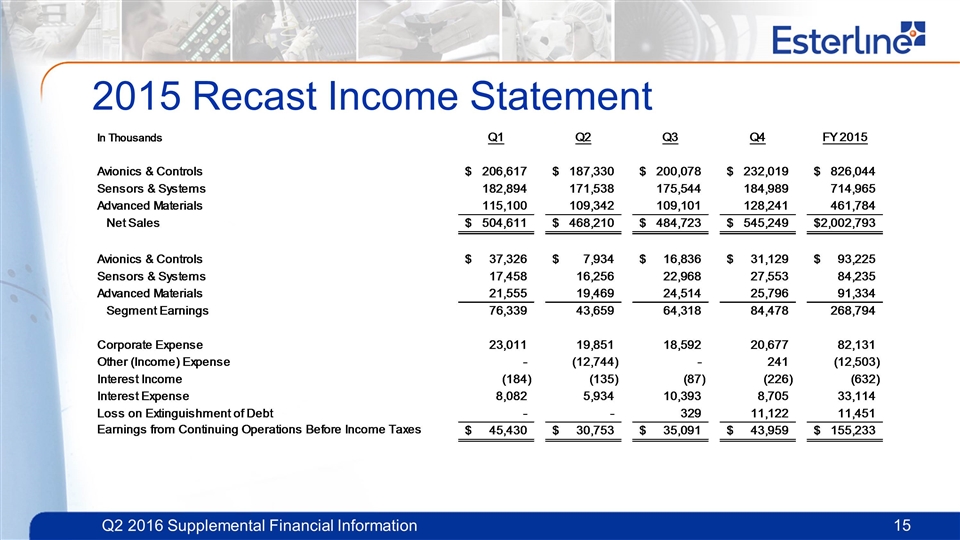

2015 Recast Income Statement

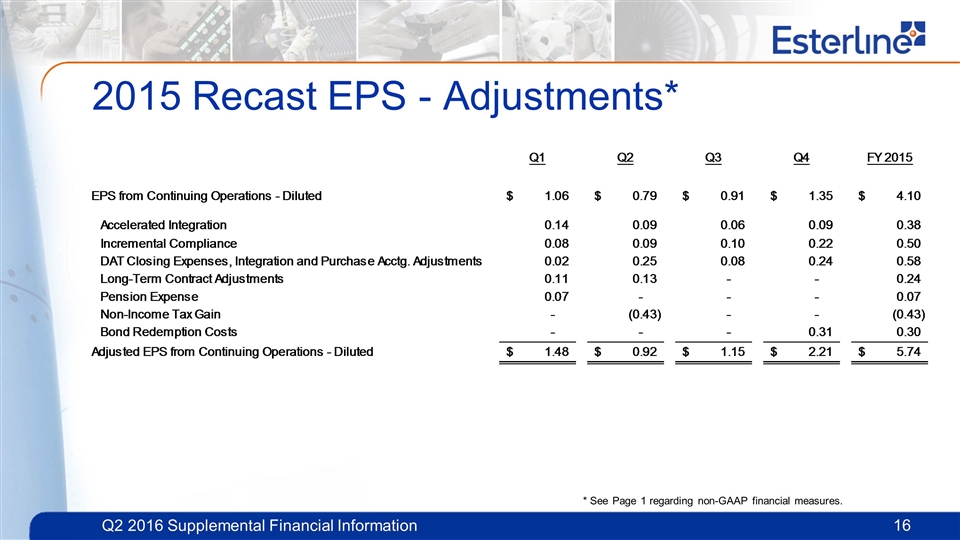

2015 Recast EPS - Adjustments* * See Page 1 regarding non-GAAP financial measures.

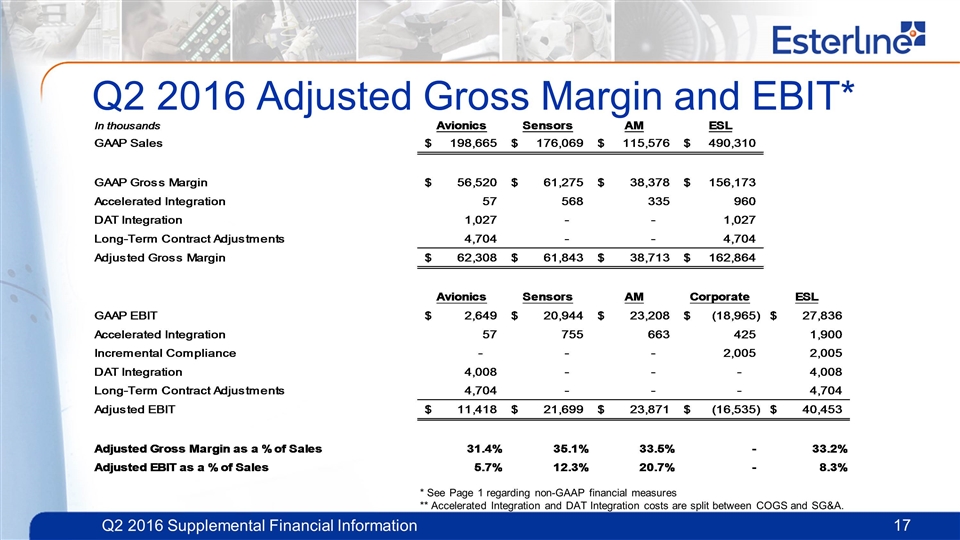

Q2 2016 Adjusted Gross Margin and EBIT* * See Page 1 regarding non-GAAP financial measures ** Accelerated Integration and DAT Integration costs are split between COGS and SG&A.

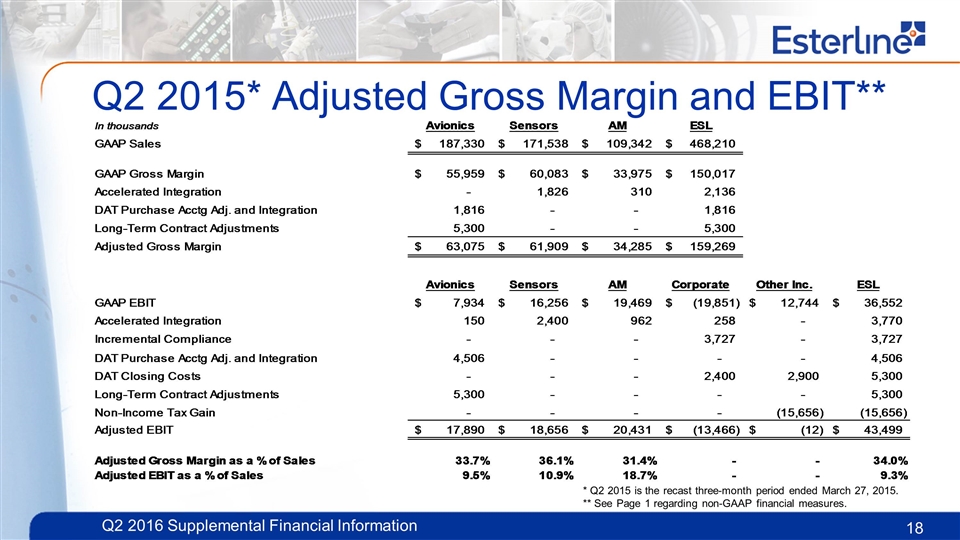

Q2 2015* Adjusted Gross Margin and EBIT** 18 * Q2 2015 is the recast three-month period ended March 27, 2015. ** See Page 1 regarding non-GAAP financial measures.

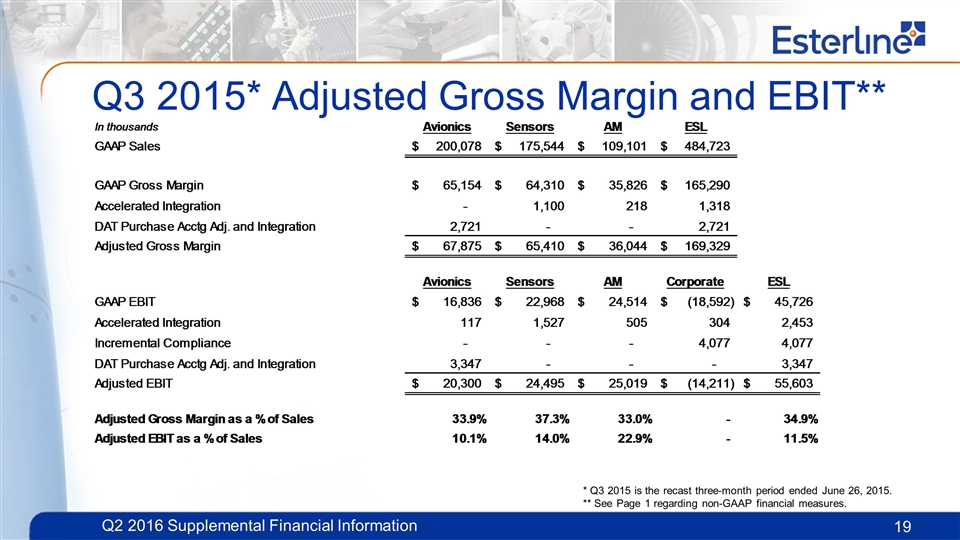

Q3 2015* Adjusted Gross Margin and EBIT** 19 * Q3 2015 is the recast three-month period ended June 26, 2015. ** See Page 1 regarding non-GAAP financial measures.

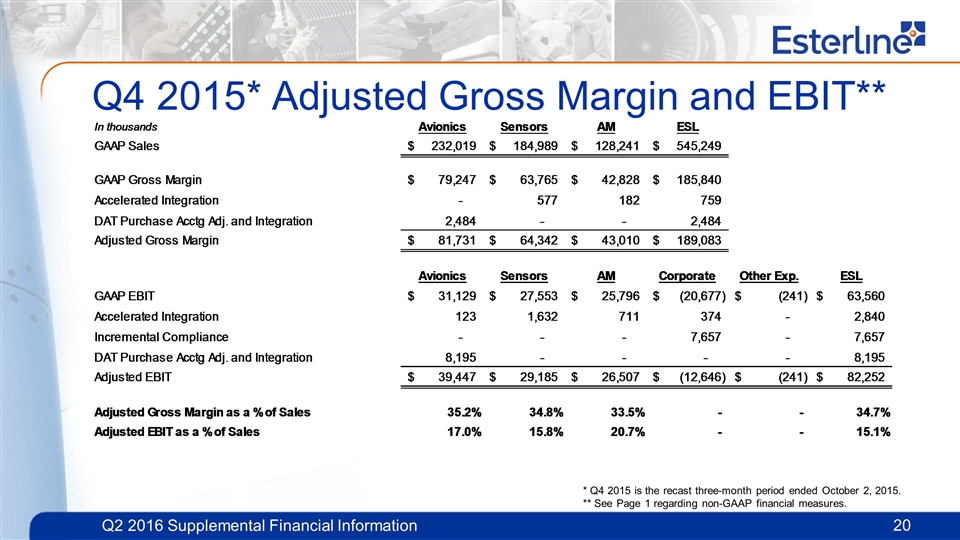

Q4 2015* Adjusted Gross Margin and EBIT** * Q4 2015 is the recast three-month period ended October 2, 2015. ** See Page 1 regarding non-GAAP financial measures.